Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Quality and Integrity of the Department of Veterans' Affairs Income Support Records

The objective of the audit was to examine the quality and integrity of DVA's income support records and to report on the effectiveness of the department's management of the data and how it impacts on service delivery.

Summary

Introduction

The Repatriation Commission was officially established on 1 July 1920 with the passing of the Australian Soldiers' Repatriation Act 1920, to provide support for veterans, widows and their families.1 This Act was replaced by the Veterans' Entitlements Act 1986 (the Act), which retained the functions of the Repatriation Commission. Under the Act, the Commission delegates its powers to the Department of Veterans' Affairs (DVA) to grant pensions and other benefits to veterans and their dependants, and certain other eligible people.

The service pension provides regular income support for people with limited means of income and is broadly equivalent to the Centrelink age and disability pensions. However, it is payable five years earlier than the age pension in recognition of the effects of war. The two critical criteria required of claimants in the Act are to be a veteran and have rendered qualifying service. Age and residency requirements are also mandatory for some pensions. There are rules related to assets and income that also affect pension eligibility and pension amount.

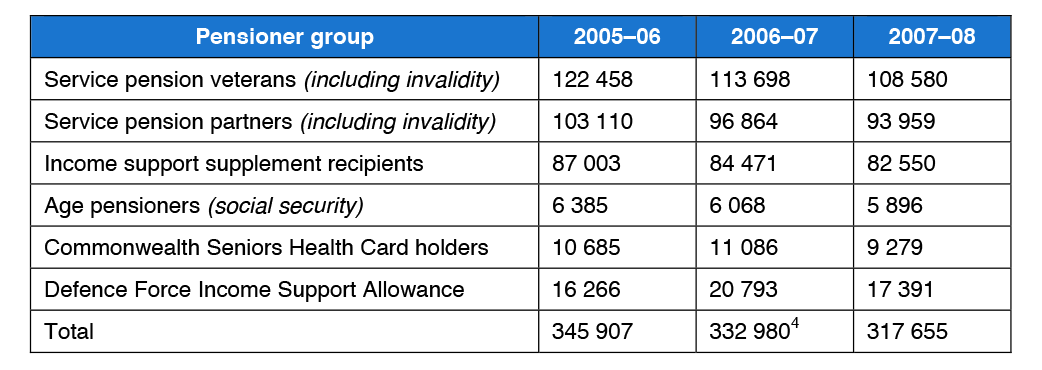

The total appropriation to deliver this output in 2007–08 was $44 744 000.2 Table 1 below provides a list of income support groups under the Act.

DVA's client population has declined over the past three financial years as illustrated in Table 1. At 30 June 2008, the income support pensioner population was 4.6 per cent less than was reported in the previous financial year. There has been a corresponding downwards trend in the department's workload. 3

Table 1: Income support beneficiary population

Source: DVA's Annual Reports 2005–06 (p. 56), 2006–07(p. 59) and 2007–08 (p. 60).

Note: DVA's annual reports also outline five forms of income support paid under DVA's Output 1.1: Income support under the Veterans' Entitlements Act 1986. These are the: age service and invalidity service pensions; partner service pension; income support supplement; social security age pension (which is paid to eligible disability pensioners and their partners); and Defence Force Income Support Allowance (DFISA). 5

Restructure of DVA

In order to better manage the services provided to Australia's declining population of war veterans and the expected decrease in its workload and funding, DVA undertook a major restructure in 2005–06. This restructure, known as oneDVA, was the foundation for a new approach to the way DVA delivers its services to veterans. The reorganisation involved a move away from variable State-based practices and the expansion of geographically dispersed teams resourced along national business lines. The department's strategy to standardise its operations across all service areas was complemented by the introduction of the first phase of a new ‘oneVoice' telephone service environment, the Veterans Service Centre (VSC).

Modernisation of DVA's information technology

In parallel with DVA's restructure, the department also recognised the need to modernise its IT and reduce its expenditure on maintenance of heritage systems.6 As part of this initiative, the department purchased Cúram, an off-the-shelf, integrated IT application framework designed for service delivery environments. This IT-enabled business change offers the potential for better functionality of DVA's IT systems based on up-to-date business rules, more reliable information underpinning decision-making and reporting, and increased convenience for veterans.

DVA is taking a phased approach to implementing Cúram, with data migration (from the department's heritage IT systems into Cúram) scheduled over a number of years. The initial phase of the department's modernisation of its IT systems occurred in 2006, when several projects were implemented. This involved the migration of over 1.5 million records containing client personal information from heritage databases into the new Cúram environment. Despite DVA's considerable project planning, data testing and cleansing to prepare the heritage data for transfer into Cúram, unanticipated data incompatibility and integration issues emerged during the migration of the data. To enable the transfer of the data into Cúram, heritage records with blank date of birth fields were populated by DVA with ‘dummy' data.7

The department has a major initiative to clean up data integrity errors. This is the Data Integrity Cleanup Exercise (DICE) project which predominantly revolves around correcting:

- data errors that were transferred from heritage systems into Cúram; and

- newly created problems that arose as a result of incompatibility issues between heritage and Cúram systems during data migration.

The department also has an ongoing program for data cleanup – the Data Integrity Problems (DIPs) work. DIPs activity is directed to correcting complex data errors unable to be resolved directly via the existing applications.

The cost of implementing Cúram was to be offset by ongoing savings in administration and program costs arising from the improved IT framework and de-commissioning of relevant heritage systems.8

Audit scope and objective

The objective of the audit was to examine the quality and integrity of DVA's income support records and to report on the effectiveness of the department's management of the data and how it impacts on service delivery. The audit included an examination of:

- DVA's management of the data including the quality of data stored on its client databases, the processing of claims and payment processing;

- the accuracy, completeness and reliability of DVA's electronic income support records; and

- the impacts the quality of data has on service delivery, and related issues of customer support and feedback.

The audit focused on data integrity issues associated with the various types of service pension, income support supplement, the social security age pension and other related allowances. The accuracy and completeness of records of selected mandatory fields and other key fields that underpin the integrity of DVA's income support records were examined.

The ANAO's data extraction and analysis encompassed 1 580 546 records in DVA's production environment which included the records of 264 248 income support clients who were in payment.9 While the audit did not directly examine the accuracy of individual payments, it examined underlying data integrity issues that can impact on the accuracy of payments, such as the current status of client asset and income information.

The audit also included a limited number of reviews of paper files and consideration of documentation associated with DVA's IT governance, particularly in relation to data management.

Conclusion

The Department of Veterans' Affairs (DVA) has been undergoing significant change since 2005–06. Following a review of its service delivery arrangements, DVA adopted a new business and information technology (IT) strategy, in recognition of the declining population of war veterans and expected 30–50 per cent decrease in the department's workload over the next 10 years. A key element of DVA's IT strategy is to reduce expenditure on the maintenance of IT systems over time, by eventually decommissioning its heritage systems. The purchase of Cúram, an off-the-shelf IT product designed for social welfare environments, was a key part of this strategy. DVA identified Cúram as an enabler for its new model of business operation, known as oneDVA.

A challenge for DVA in this environment is balancing the resources required to maintain its heritage IT systems relative to its investment in new IT capability with its greater functionality. While Cúram is designed to be the ‘source of truth' for client personal data and to provide a platform to better manage DVA's data in the future, it is still in the early stages of implementation. Income support data is not yet scheduled for migration into Cúram, and DVA continues to be dependant on the integrity of the data stored in heritage systems for administering income support payments. In this environment, the department relies heavily upon the corporate knowledge held by a few key staff about its IT systems and business processes.

Overall, the poor quality of the data in DVA's electronic databases is affecting the efficiency and reliability of the department's decision-making, and its internal and external reporting. While in most cases there was sufficient evidence in DVA's multiple systems and the hard copy customer records examined to support its clients' eligibility for income support benefits, the audit revealed:

- the department's management of electronic data and data integrity issues was not effective;

- key fields in many electronic records were not accurate, complete or reliable; and

- inaccurate recording and reporting of complaints and compliments in the department's Feedback Management System.

Management of data and data integrity issues

Data integrity problems highlighted during this audit included: the number of DVA clients with more than one Unique Identification Number (UIN) continuing to increase since the previous audit of DVA's administration of Repatriation Health Cards in 2003–04; DVA not having a complete electronic record of the qualifying service details for 41 per cent of veterans eligible for the age service pension; exempt assets of clients being disregarded beyond the legislated exemption period for the purpose of the assets test; fragmentation of client information across multiple records; and cases of pension misclassification, requiring DVA to further analyse the raw data to ensure the information reported was meaningful and reliable. These and other data integrity issues identified by the audit increase the risk of DVA providing untimely advice and incorrect payments, and reduce the department's capacity to provide assurance that the right person is receiving their correct entitlement. To mitigate this risk, the department has a range of administrative processes and checks in place. However, these add to the costs of administering the program. This situation also limits the ability of the department to garnish the dividends of oneDVA.

The quality of DVA's data would be substantially improved through the development and deployment of an organisation-wide data integrity improvement strategy, underpinned by stronger governance arrangements. In recent years, DVA has reviewed both its IT governance and committee structure and identified similar issues to those reported by the ANAO in this audit, including a need for greater clarity across the department for the authority, ownership and control of data management and data integrity issues. Strengthening oversight arrangements would assist DVA to monitor the progress of the strategy, as well as align elements with the roll out of Cúram and recognise the interdependencies within the oneDVA initiative. DVA's progress would also be facilitated by setting targets and timeframes for reviewing records, and better utilising the opportunities presented by client and department initiated contacts, including compliance and review work, to improve data integrity.

Accuracy, completeness and reliability of key fields in client records

DVA's policy and procedural controls for new claims processing and updating of client records would benefit from review and consolidation. In particular, data entry controls and support materials should be standardised across the department's State offices and the Veterans Service Centres (VSC), consistent with the oneDVA strategy. This would help to reduce data input errors and support consistency in decision-making and client records management generally. Additional assurance would be gained from a greater focus on data input standards and controls, and procedural compliance around claims processing and updating of client records.

Veterans/clients receiving the maximum pension or receiving a part pension (and considered by DVA to be low risk), are generally not reviewed through DVA's review program measures unless pensioners notify of a change in their circumstances. This has potential service delivery impacts when cases are not reviewed for a number of years as clients could incur unexpected debts or be underpaid for a significant period. Retrospective adjustments applied to pensions over a number of years does create higher administrative costs for DVA, when having to account for multiple changes to a pensioner's circumstances.

In 2004, DVA introduced its Enhanced Compliance Program (ECP) in order to manage the risk of pensioner non-compliance.10 The ECP targets cases profiled by DVA as high risk with no recent review activity, or cases with potentially volatile income and assets. As well as achieving higher than expected benefit payment savings, the ECP has been successful in updating the current status of a client's circumstances. However, this program, coupled with the program of two-yearly reviews of pensioners receiving less than the maximum pension rate, reviews less than seven per cent of the total income support population. Overall, more than 70 per cent of clients have not had a review that updates all of their previously submitted asset information, for eight years or more.

DVA has a range of IT controls and assurance programs, including the ECP and client contact activities, which present an opportunity to improve data integrity. These compliance activities and other direct contacts with clients provide opportunities to implement cost-effective arrangements to validate or correct client information. Improved data integrity would provide greater assurance that DVA's clients are receiving their correct income support entitlement and associated services.

Management of feedback data and service delivery impacts

The unreliability of DVA's client feedback data limits the department's capacity to effectively utilise the intelligence gathered from complaints and compliments to assist in setting client service priorities and to systematically monitor and generate reliable public reports. DVA's proposed new feedback management system is in the early planning stages, with the projected timetable and resources yet to be defined. DVA has advised that, in the meantime, its existing Feedback Management System (FMS) will continue to be used with its known data quality shortcomings.

In the interim, it would be prudent for DVA to raise departmental staff awareness of the need for all feedback to be recorded in the existing FMS and to ensure compliance with the department's Procedural Policy–Handling Feedback from the Veteran Community. In doing so, a focus should be on awareness raising and highlighting the value DVA places on client feedback and the intelligence gathered from complaints, as a driver of improvements to business and service quality. This would assist in ensuring that client feedback is accurately recorded and appropriately managed day-to-day and ensure its availability for long term business and service delivery improvement purposes.

The ANAO has made four recommendations designed to strengthen the quality and integrity of DVA's income support information by: clarifying oversight arrangements for the authority, ownership and control of data management and data integrity issues; documenting a controls framework for income support and evaluating the department's IT controls and assurance activities to determine which elements are most effective in improving data integrity and refocus the activities accordingly; implementing standard procedures for data entry and the management of client records and correcting key data fields of active records; and raising awareness of the value of client feedback and the need for all complaints and compliments to be recorded.

Summary of agency's response

The Department of Veterans' Affairs (DVA) agrees with the recommendations of the ANAO report. The ANAO report highlights the significant organisational changes occurring within DVA, both in terms of Information Technology and Communications, and internal structures to effectively manage the declining population of veterans and their dependants. The department acknowledges the requirement to continue to address data integrity issues and to ensure staff understand the importance of accurate data entry. The department has commissioned several reviews to ensure the current controls and governance arrangements are effectively supporting the department's operations and enabling quality decision making.

Key findings by chapter

Chapter 2—Income Support Controls Framework

The ANAO reviewed DVA's controls framework to assess whether the department had: included risks associated with data integrity in its broader risk management framework; appropriate oversight arrangements for IT; and a documented IT controls framework.

Risks associated with data integrity

DVA's Risk Management Framework identifies internal and external risks. Major internal risks include: agency capability; agency information communication and technology (ICT) capability; and agency financial capability. A key challenge for DVA is managing the risks associated with maintaining the department's heritage IT systems, while developing new system capabilities. In July 2008, this issue was referred to DVA's Information Committee, which is responsible for overseeing the direction of strategic ICT in DVA. The department advised that the committee is redefining the department's ICT capability to appropriately prioritise maintenance and support of heritage databases, relative to development and support of other systems.11'12

Governance arrangements

DVA established a new governance committee structure in 2005–06 to support the oneDVA model, which continues to be refined. While the ANAO identified a number of issues at the corporate level, DVA's governance committees' roles and responsibilities are defined and articulated. In recent years, DVA has reviewed both its IT governance and internal committee structure. DVA's most recent formal review of its IT governance was in 2003–04. While some of the better practice suggestions and recommendations have been implemented, several remain outstanding that are relevant to the findings of this audit. In particular; development of a formal IT Governance Framework; formally documenting and regularly updating the interdependencies between application databases; and revision of DVA's data management framework to better address data integrity issues.

In 2007–08, DVA conducted an internal review of its governance committee structure. The progress report to the Executive Management Group (EMG) in March 2008 focused on internal governance processes introduced as part of the move to oneDVA and cites similar issues to those subsequently identified by the ANAO, including:

- staff not understanding the different roles of the committees, and there is considerable overlap;

- the lack of clarity of the lines of authority of committees and the committee hierarchy; and

- IT projects considered by committees outside their charter or without reference to the more senior decision-making governance committee.13

The new Data Integrity Sub-Committee (DISC) was established in 2007–08. DISC is tasked with enhancing the integrity of data held in DVA's client databases and resolving issues related to data ownership. However, the authority of the DISC is unclear in DVA's overall governance structure. The department advised that the DISC is scheduled to meet and report to the Operations Committee every six weeks. However, at August 2008, the DISC had met once in the previous 12 months.14 Clarification of the status of the DISC will assist the development of an agency-wide strategy, assigning responsibilities and timelines to business areas to address DVA's data integrity issues. Improvements to the integrity of DVA's data will improve the department's reporting capability.

Documented IT controls framework

The department's administration of income support involves a combination of complex heritage and new IT systems. In this environment, documentation of the IT controls framework is important, as are formal systems documentation such as a comprehensive data dictionary and system specifications or business rules. DVA does not have in place formal documentation of its IT controls framework or systems. Furthermore, specialist knowledge of the strengths and weaknesses of the department's IT systems and the use of business logic by individual officers is also required to turn the raw data into meaningful and reliable information.15

Integral to strengthening DVA's IT controls is documentation of the existing systems. This would help to establish an evidentiary link between the electronic records of clients receiving an income support benefit and the key legislated and policy requirements. It would also assist the users of DVA systems and data to assess: the strengths and weaknesses of particular IT systems; the significance and suitability of the data to answer specific queries; and the risks associated with using raw data without additional corroborating evidence.

Data entry controls

DVA's IT systems contain few documented data entry controls and the ANAO identified a considerable number of errors made during data entry. DVA advised that Cúram has functions that should allow for improved data entry validations. Two Cúram controls for data input are the name search function and Information Quality Rapid (IQ Rapid) function. The name search function provides a control to reduce the likelihood of the creation of multiple records when DVA registers a new client. However, this control measure can be by-passed during the registration process and multiple records continue to be created. IQ Rapid is a control used in DVA's systems at the point of entering Australian addresses. While staff can override the IQ Rapid function, around 80 per cent of the records examined by the ANAO complied with DVA's policy, suggesting the control is effective.

Chapter 3—Income Support Eligibility

The ANAO extracted in payment client records to determine whether DVA's income support records met the key legislated and policy eligibility requirements for veterans, partners and widows/widowers. The ANAO used a data analysis interrogation tool to examine all of DVA's 1 580 546 client records, of which 264 248 were in payment. The results of the ANAO's data analysis include:

- of 99 079 veterans eligible for the age service pension, 40 306 veterans (41 per cent) did not have a complete electronic record of service details. The ANAO inspected a sample of 40 service pensioners' paper files associated with incomplete electronic service details records. Of these, 39 files contained sufficient evidence of the veteran's military history and service details to prove their qualifying service eligibility;16

- of 126 891 age service pensioners, the records for 4774 pensioners indicated that they did not meet the age requirements. However, further analysis revealed these records are most likely female non veteran clients receiving the partner service pension, incorrectly classified as age service pensioners. The system control to correctly classify these pensioners is not consistently used by the department; and

- many income support clients are incorrectly classified in DVA's client databases. For example, of 50 246 invalidity service pensioners, the records of 18 787 pensioners indicated that the clients did not meet the requirement to receive the invalidity service pension. Rather, the age of the pension recipients revealed that they should have been receiving the age service pension (while the age service pension and invalidity pension are the same pension amount, once a pensioner reaches the social security pension age, their pension is assessable income for taxation purposes). The ANAO could not determine from the data extracted using DVA's Ad Hoc Inquiry System 2000 (AIS), whether the misclassified invalidity client records (that had reached social security pension age) had their income support identified as subject to income tax. Upon further investigation of a sample of these records using the Veterans Information Enquiry Window (VIEW) application, the ANAO determined that the records were identified as assessable for tax purposes.17

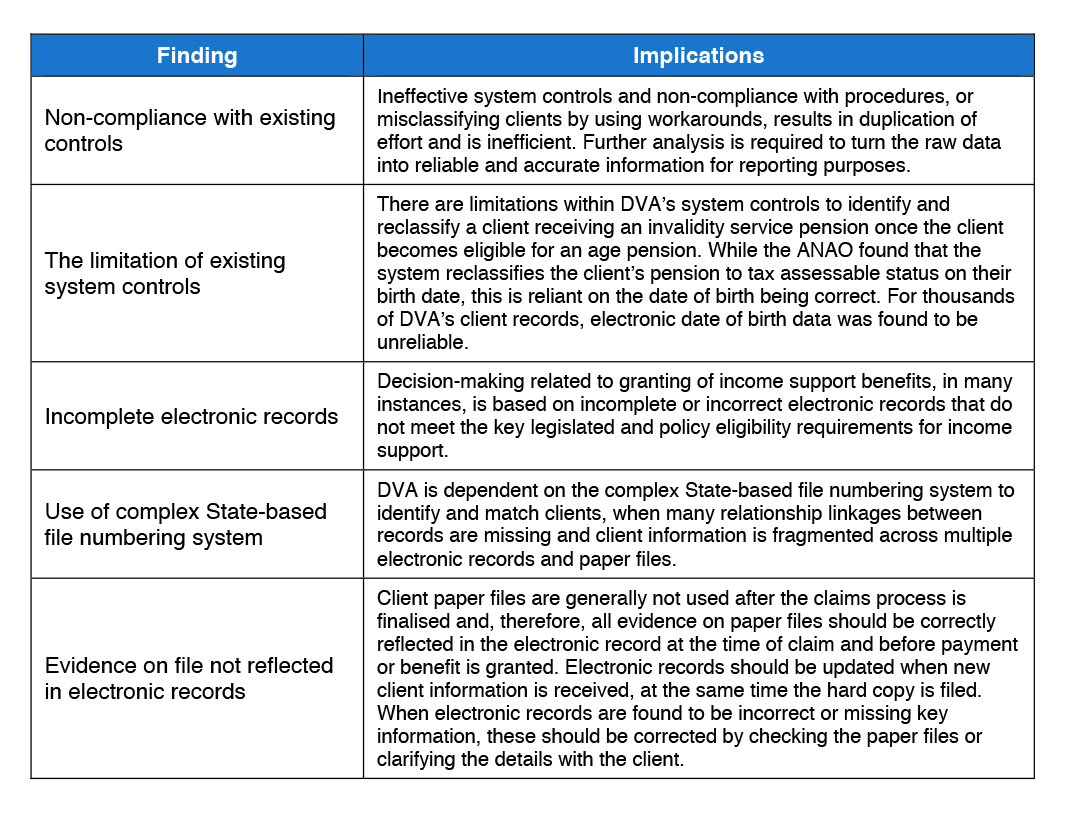

The ANAO tested the 5638 records of social security age pension clients in payment and found that the electronic records indicated that all of these clients were the correct age to receive the social security age pension. Consistent with the legislation, none of these clients were in receipt of both the social security and age service pensions.18 The key implications of the above findings for DVA's data integrity are summarised in Table 2 below.

Table 2: Implications of the ANAO’s data analysis

Source: ANAO analysis.

Chapter 4—Asset and Income Records

The income support pension is calculated using two separate tests—the income test and the asset test. The amount of pension a veteran or spouse can receive depends on their income and value of their assets. The ANAO reviewed DVA's: quality assurance (QA) program; measures to ensure timely updating of asset and income records; and programs to review higher risk categories of assets and income. DVA's compliance activities rely on underlying data integrity but also provide an opportunity to update client information during the course of the department's interaction with its clients.

National Income Support Quality Assurance Program

DVA's National Income Support Quality Assurance Program is designed to provide assurance of high risk cases, reviews and new income support claims. The quality assurance program reviews a random sample of five per cent of these types of cases selected each fortnight. DVA QA processes involve checking for data input and other errors in new claims decisions and checks that the outcome accurately reflects the evidence on file.

The main trends identified in income support claims processing in DVA's 2005–06 QA trends analysis workshop report were: increasing complexity of business income tax returns; evidence not being taken into account; lack of attention to detail; and the date-of-effect of a change to a client's circumstances, while recorded, being overlooked by the claims officer. The increasing complexity of client financial circumstances and associated staff workload were also reported to be contributing factors to some of the error trends in claims processing. Implementation of standard data entry procedural controls for all DVA staff registering clients, processing claims or updating client records would improve the quality of DVA's income support data generally.

Timely updating of asset and income records

Pensioners receiving a reduced rate of pension are provided with a full listing of their previously submitted income and asset position every two years, for confirmation or update. Around 40 per cent of DVA clients in payment are receiving less than the maximum rate of pension. The ANAO analysed the 264 248 client records in payment and found 7810 clients received a reduced pension as a result of the application of the asset test representing approximately three per cent of the total income support population. Further analysis found more than 70 per cent of clients' asset records have not undergone a review that updates all of their previously submitted asset information, for eight years or more. While DVA's record of these assets is below the asset threshold, some asset values such as investment properties, would have fluctuated over the years, in such a way as to affect entitlements.

In contrast to the asset review strategy, the ANAO noted that over 50 per cent of the income tested records of service pensioners had been reviewed or updated since 2007. Income support pensioners earning casual wages undergo regular three-monthly reviews by DVA. The data matching program with external agencies such as Centrelink and the Australian Taxation Office also identifies undeclared income and incorrect payments.

Program to review high-risk cases, especially categories of assets

DVA's program of reviews of selected cases provides an avenue to improve the integrity of client payments. The Enhanced Compliance Program (ECP) includes reviews of new claims, assets and regular income reviews and cases profiled as high-risk by DVA. Reviews can be initiated by the department or by pensioners. The ECP is achieving substantially higher than expected savings in pension payments, and provides the opportunity to update invalid or changed client details that may not have undergone review for several years. However, the target of 10 000 additional reviews each year is less than four per cent of the income support population. These reviews, coupled with the two-yearly request to those receiving less than the maximum pension rate, reviews approximately seven per cent of the entire income support population.

Chapter 5—Data Integrity

At 30 June 2007, DVA's databases held 1 580 546 client records. At the time, the income support client population was 332 980 and the population of client's with repatriation health cards was 293 620—a combined total of 626 600. Therefore, approximately 60 per cent of the client records held in DVA's production environment are inactive; that is, these clients are not receiving any entitlement or benefit. This is consistent with DVA's analysis of the client records transferred from heritage systems into Cúram. An ANAO audit of the Management of Repatriation Health Cards in 2003–04 found that around 50 per cent of the production environment databases contained inactive client records, indicating a significant increase in four years.

The ANAO identified 832 000 client records in the production environment with no active links/relationships to other records (indicating no surviving partners or dependents)19 and sometimes with a date of death recorded many decades in the past. The ANAO considers there is no business reason for DVA to maintain inactive redundant records in the production environment.

DVA's inactive records relate to clients who are not in payment and do not receive a health card or any other entitlement. Many of these records relate to veterans who lodged some type of claim with DVA in the past but whose claim was rejected, or contain redundant data where no activity has occurred for many years. This information remains in DVA's production environment. Other records relate to deceased clients. For greater efficiency, the production environment databases should primarily contain information relating to DVA's active client populations. Inactive records could be archived or relocated outside the production environment after a specified period, with the potential to be reintroduced into the production environment, if and when required. While acknowledging cost and system re-engineering issues, the benefits associated with improved system performance and data integrity are more likely to be realised.

During the audit, DVA committed to undertake technical work to establish approximately 6500 missing relationship links between records in Cúram, as 2500 of these are in payment. Once this work is completed, the ANAO suggests that the department consider the benefits of identifying and archiving or relocating the inactive redundant records outside the production environment. DVA's investment in this strategy, where there is no business reason to maintain these records, will substantially improve the currency and integrity of its data in the production environment.

Initiatives to clean up inaccurate data

DVA's Data Integrity Cleanup Exercise (DICE) was an initiative undertaken as part of the Australian Government's former Access Card project. Many of the data integrity issues that were identified by DICE are consistent with the ANAO's findings in this audit and that of the previous ANAO audit in 2003–04. Issues identified by DICE included:

- 28 630 clients in DVA's production environment with a dummy date of birth that was bulk-loaded during previous data cleanup exercises;

- the recording of false dates of birth at the time of registration; and

- the need to educate all staff about the importance of correct data for all cases.

The DICE project had not met its objectives when the Access Card project was discontinued in November 2007. DVA's End of Project DICE Report states:

The lack of project management rigour meant that the project had less visibility to the Executive, no clear plan and hence, insufficient resources. The (project) objective was not achieved.20

DVA's Resources Committee endorsed a new business proposal in June 2008 known as DICE 2, which has been referred to the Cúram Project Board for consideration in relation to other IT priorities. If agreed, final endorsement by the Information Committee is required for the project to proceed.

Chapter 6—Integrity of Feedback Data

Management of stakeholder feedback

DVA has a national Feedback Management System (FMS) supported by documented procedures entitled Procedural Policy-Handling Feedback from the Veteran Community. The procedural policy requires compliance by all DVA staff when handling stakeholder feedback, such as complaints and compliments.

During fieldwork, the ANAO observed a low level of awareness of FMS and the department's national feedback policy procedures among departmental staff. The Veterans Service Centre's (VSC) ‘oneVoice' telephone service receives customer feedback. Complaints are managed locally by team leaders or referred to business areas and are not recorded in FMS by VSC staff. DVA advised that its official policy is for all stakeholder feedback to be entered into FMS but acknowledged that the national policy procedures are not widely used by departmental staff. DVA also advised that until a new system is implemented, feedback data recorded and reported (using the current system) will continue to be inaccurate.

In DVA's Annual Report 2006–07, the department reports a high level of veteran overall satisfaction with its services. During this period DVA reported 227 compliments, almost half the 440 reported in the previous financial year. The Annual Report also states that 372 complaints were recorded by DVA in 2006–07, compared with 198 in the previous financial year. In 2006–07, 51 per cent of clients were satisfied with DVA's handling of their complaints, compared with 73 per cent the previous year. This was the lowest recorded satisfaction level over the previous six financial years. DVA advised that client satisfaction levels with complaints handling is an unreliable indicator owing to the department's data recording issues. This position inhibits the opportunities available to the department to fully utilise feedback information for monitoring and improving its service delivery.

DVA was unable to electronically reproduce the complaint figures reported in its Annual Reports for 2005–06 and 2006–07 and the complaints recorded in the department's FMS. DVA acknowledged the inaccuracies of its complaints data and indicated that complaint numbers would be closer to 2000 or 3000 per year if the department's feedback management system was more reliable.

Footnotes

1 Department of Veterans' Affairs, Department of Veterans' Affairs Annual Report 2007–08, p. 20.

2 Department of Veterans' Affairs (Defence Portfolio), Portfolio Budget Statements 2007–08: Budget Related Paper No. 1.4B, May 2007, p. 49.

3 From time to time this trend in the workload may reverse in response to legislated or policy changes but this does not affect the overall systemic downwards trend. For example, in September 2007, a change to the taper rate of the assets test generated around 4800 additional claims over a short period, with workloads returning to the pre-1 July 2007 levels early in 2008–09.

4 The income support population in Table 1 for 2006–07 was reproduced from DVA's Annual Report 2006–07. However, the population figure for the 2006–07 financial year reported in DVA's Annual Report 2007–08 is less by 4732. DVA has not explained this discrepancy.

5 Department of Veterans' Affairs, Department of Veterans' Affairs Annual Report 2007–08, p. 58.

6 The replacement of old systems hardware to reduce maintenance costs is not limited to DVA. The recent independent Review of the Australian Government's Use of Information and Communication Technology by Sir Peter Gershon, August 2008, illustrates the commonality of the issue both across agencies and internationally. Recommendations include agencies: strengthening governance around improving ICT capability; reducing expenditure on heritage systems without impairing service delivery; and increasing internal ICT capabilities.

7 Dummy data is a dummy variable that does not contain any useful data but it does reserve space for a real variable.

8 The department's expenditure on Cúram application development over the previous three financial years 2005–06 to

2007–08 is estimated to be $38 million. See Table 2.1 for a breakdown of the figures.

9 This refers to clients who were receiving any kind of DVA payment at the time of the data extraction.

10 DVA's review of the ECP states: ‘compliance reviews are the most effective and resource intensive review types as they update all aspects of a person's pension assessment. All other review types only update one or two assessment items.

11 ICT concerns all of DVA's communication and information technology of which IT hardware and software is a major component. The Information Management Unit (IMU) is responsible for managing the department's investment in ICT and works with business areas to improve outcomes and services through the provision and management of appropriate IT services.

12 On 12 March 2009, DVA advised that the Information Committee met in February 2009 and endorsed a two phased approach for a select tender to conduct a review of the department's current and future ICT requirements. As part of this review an implementation approach for the establishment of a formal prioritisation process will be determined.

13 DVA minute – progress report to the EMG on the internal governance review, dated 17 March 2008.

14 Department of Veterans' Affairs, Data integrity Strategy Overview v1 0, 25 July 2008.

15 On 12 March 2009, DVA advised that the department's IT systems have been certified to the ISO 9001 standard.

16 Prior to the implementation of the Generic Update Interface for DVA Entitlement (GUIDE) application in June 2002, there was no capacity to record qualifying service details on DVA's electronic systems. DVA advised that since 2003, veteran service pension cannot be granted without electronically recording qualifying service details. However, many of DVA's records are missing critical information such as war code.

17 Age service pension is granted five years earlier than social security age pension. Invalidity service pensioners can be eligible for age service pension (which is tax assessable) but the advantage of staying on invalidity pension until social security pension age is reached, is that invalidity service pension is not subject to income tax. Once invalidity recipients reach social security pension age, their pension becomes tax assessable and they should be classified in the system as age service pensioners.

18 Social Security age pension and age service pension are different pension types, with different eligibility criteria. Pensioners cannot be in receipt of both pension types.

19 A related issue involves more than 6500 relationships that were unable to be loaded into Cúram from heritage systems. Of these, around 2500 clients are receiving a payment. The Data integrity Cleanup Exercise 2 identifies cases of missing relationships/linkages as a priority, where clients are receiving payment but the relationships/links between records are incorrect or missing.

20 Department of Veterans' Affairs, End of Project Report for ADV II Data Integrity Cleanup Exercise (DICE), undated and unsigned.

21 As at 12 March 2009, DVA had not yet made a decision to proceed with this project.

22 On 12 March 2009, DVA advised that the overall satisfaction with DVA in its recent 2008 satisfaction survey of its general client group was 92 per cent.

23 DVA explained the inaccuracies in the report figures as due to either complaints received for a financial year and recorded in FMS after 30 June of that year and 50 complaints from one complainant that were not recorded in FMS.

24 Department of Veterans' Affairs meeting with the ANAO, 4 August 2008.