Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Qualifying for the Disability Support Pension

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the Department of Social Services and the Department of Human Services’ administration of Disability Support Pension eligibility and review processes.

Summary

Background

1. The Disability Support Pension (DSP) provides financial support to working age Australians who are permanently blind or have a permanent physical, intellectual or psychiatric impairment that prevents or limits their capacity to work. Over 800 000 Australians with disability were in receipt of DSP at the end of June 2014—equal to around 5 per cent of the working age population—and a further 100 000 people with disability (with partial capacity to work) were receiving unemployment benefits such as Newstart Allowance.1

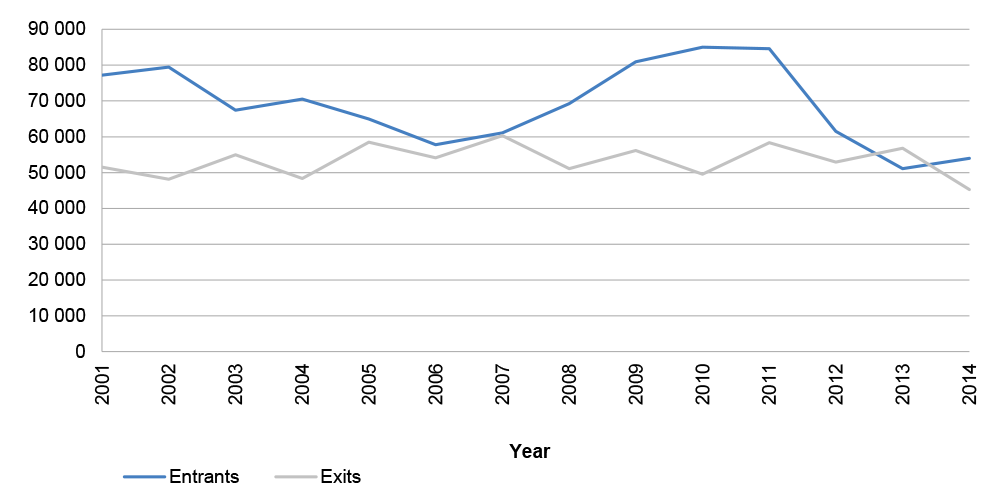

2. Expenditure on DSP is significant—over $16.5 billion in 2014–15. The number of DSP recipients has grown at an average annual rate of 4.2 per cent over the past four decades. Successive governments have made efforts to curb DSP expenditure growth. Recent efforts include revisions to the impairment tables, which underpin Job Capacity Assessments, introduced in January 2012. These changes aimed to taper DSP growth and reduce new grants2 of the pension by approximately 6500 per year. There has been a reduction in the percentage of DSP claimants being granted the pension since then, and slight fluctuation3 in the overall numbers of DSP recipients year on year, reflecting DSP in and outflows and other factors, such as changes to age eligibility for women on the Age Pension.

3. The Social Security Act 1991 (the Act), and related legislative instruments, provide the legislative basis for DSP, including the rules of eligibility and the rates payable to DSP recipients. The Department of Social Services (DSS) is responsible for overall administration of the legislative framework, policy and the management of the financial appropriation for DSP. The Department of Human Services (Human Services) is responsible for the day-to-day operations of DSP, including conducting assessments of claims, making payments, reviewing continued eligibility and handling appeals.

4. Claimants for DSP are required to provide medical evidence about their condition. While some claimants (around five per cent) are granted DSP outright—manifest grant4—on the basis of the severity of their condition, most others are required to undergo a Job Capacity Assessment of their medical condition(s) and ability to work. The assessments are conducted by health or allied health professionals employed by Human Services.

Audit objective and criteria

5. The objective of the audit was to assess DSS’s and Human Services’ administration of DSP eligibility processes. Four high-level criteria were examined to form an opinion against this objective:

- qualification processes—including how impairment and work capacity were determined and whether Job Capacity Assessments appropriately assessed applicants’ eligibility for DSP;

- appeals processes—whether processes were effective, efficient and timely;

- reviews of recipients’ continued eligibility for DSP and whether these reviews were appropriately targeted; and

- performance and assessment processes—whether as a program DSP was effectively measured, monitored and reported.

6. The audit focused on the administration of the reforms to the impairment tables and Job Capacity Assessment processes introduced on 1 January 2012.

Conclusion

7. Changes to the DSP eligibility assessment processes introduced in January 2012 aimed to taper DSP growth and reduce new grants. The proportion of DSP claims granted by Human Services since has decreased from around 53 per cent in July 2011 (six months before the changes came into effect) to 39 per cent of total claims in June 2014 (leading to an increase in the number of requests for reviews and appeals of decisions). The ANAO has found that, to date, DSS has not undertaken any formal review or evaluation of the eligibility changes. A focus on evaluation of the efficiency and effectiveness of the changes would provide assurance of whether the current results are in keeping with legislation. It would also assist in informing government about the cost/benefit of the eligibility processes and the likely impact of any further changes to the impairment tables.

8. The ANAO also found that, at a day-to-day level, while the eligibility processes for DSP applied by Human Services were in keeping with legislation, eligibility decisions could be better documented. There was also a risk that the vast majority of DSP recipients will remain on DSP for long periods without any review of continued entitlement. While reviewing the entire stock of DSP recipients would be expensive and ineffective for some groups, Human Services could improve the level and targeting of medical review activity for DSP recipients (not covered by the 2014–15 Budget measure for under 35 year olds5), including through drawing on medical and impairment risks identified during the claims processes.

Supporting findings

9. The eligibility processes to qualify for DSP are complex, requiring assessment of the level of functional impact of a person’s impairment and their continuing inability to work. While Human Services’ assessment of new claimants’ eligibility was in keeping with underpinning legislation, policy and guidance, some aspects of the assessment process and its oversight could be improved. In particular, there is scope for Human Services to improve:

- the documentation of assessment decisions; and

- advice about program of support requirements and the potential referral of certain claimants to employment or other support services, consistent with current policy.

10. Each year Human Services receives a large number of requests for internal review of rejected DSP claims. Review processes take time. Around 20 per cent of internal review decisions are appealed to the Social Security Appeals Tribunal (SSAT).6 Of these, around 20 per cent of decisions were subsequently appealed to the Administrative Appeals Tribunal.7 There is the potential for reviews and appeals activity to be reduced by improving communication with customers. In particular, by:

- improving the appeals data to enable Human Services and DSS to better understand the reasons for successful appeals and assist in improving the application processes and quality control frameworks; and

- Human Services more clearly explaining the basis for rejecting a claim so that claimants can make an informed decision on whether or not they should submit an appeal.

11. Human Services undertakes a range of compliance and non-compliance review activities for income support payments. The ANAO found that the level of review activity (to confirm recipients’ ongoing eligibility for DSP) varied in volume and effectiveness across each review type and from year to year. The overall level of activity undertaken each year is significant—over 67 000 recipients were reviewed in 2013–14 and 79 151 in 2014–15. However, the possibility of a recipient being required to undergo a medical assessment as part of a review was low—only 3841 (five per cent) of DSP recipients who were reviewed in 2013–14. Human Services reduced medical review activity levels (as part of compliance reviews) in 2014–15 to just 721 reviews. In 2014–15 a Budget measure was introduced to fund 28 000 reviews of DSP recipients under 35 years of age. As a result, recipients who fall outside the Budget measure criteria are unlikely to be reviewed and may continue receiving DSP even though their medical conditions no longer justify it.

12. While reviewing the entire stock of DSP recipients would be expensive and ineffective for some groups, Human Services could improve targeting of medical reviews for compliance activities, including by drawing on medical and impairment risks identified during the claims process. This approach would be consistent with the view of the Productivity Commission that DSP reassessments need to be sufficiently frequent so that they reflect the foreseeable needs of individuals.

13. The audit found that scope exists for the provision of more complete and meaningful performance measures and reporting for DSP:

- DSS reports DSP performance against a range of population characteristics and volume data and provides commentary on factors which influence program performance in its annual reports. The 2013–14 report attributed a fall in DSP growth over the past five years to changes in DSP assessment processes. However, supporting evidence is limited and timing indicates that other factors are also likely to have impacted on flows into DSP across the period; and

- DSS reports little information about the efficiency, effectiveness and economy of the program or its service delivery. Human Services only reports total volumes of Job Capacity Assessments conducted in a financial year. A stronger focus on measuring the quality of decision making for DSP claims would better position DSS to evaluate operational efficiency and identify potential service improvements.

14. An advisory committee report produced prior to the implementation of the revised impairment tables recommended that the tables be reviewed and evaluated. However, at the time of the audit, DSS had not yet undertaken any review or evaluation activity around the tables. Such activity would provide for policy adjustment or alignment and would provide assurance of whether the current results are in keeping with legislation. It would assist in informing government about the cost/benefit of the eligibility processes and the likely impact of any further tightening of the impairment tables.

15. The ANAO has made four recommendations to assist in improving the administration of DSP eligibility processes.

Summary of entity responses

16. The proposed audit report was provided to DSS and Human Services.8 Their formal responses are as follows:

Department of Social Services

17. The Department of Social Services (the Department) acknowledges the findings of the report and agrees with the recommendations. The Department welcomes the report’s findings that recent policy initiatives have strengthened targeting of the DSP and controlled population growth. These changes have resulted in a reduction in the DSP population during 2014-15, in terms of absolute numbers and as a proportion of the Australian working age population. The Department will continue to work with the Department of Human Services to ensure that assessment processes for new claims and reviews of qualification for existing recipients continue to be undertaken to a high standard, and in keeping with legislation and policy.

Department of Human Services

18. The Department of Human Services (the department) welcomes this report and the ANAO’s conclusion that the department’s processing of new claims for Disability Pension Support (DSP) is in accordance with legislation, policy and guidance.

19. As the audit report acknowledges, the eligibility processes to qualify for DSP are complex. In 2014–15, the department assessed over 110,000 new claims for DSP. In addition, the department successfully delivered a number of Budget measures such as the medical eligibility reviews of certain DSP recipients aged 35 years and under, and the introduction of Disability Medical Assessments by Government-contracted doctors.

20. The audit found the department’s assessment of new claimants’ eligibility was in keeping with underpinning legislation, policy and guidance. Given the size and complexity of the programme, the audit does suggest some areas for improvement. In that regard, the department agrees with the audit recommendations, which align well with work in progress. The department considers that implementation of the recommendations will further enhance the department’s administration of the Disability Support Pension.

Recommendations

|

Recommendation No.1 Paragraph 2.19 |

To provide full documentation of eligibility decisions, the ANAO recommends that Human Services:

Response from audited entities: Agreed. |

|

Recommendation No.2 Paragraph 4.22 |

To improve the efficiency and effectiveness of the current review process, the ANAO recommends that Human Services, in cooperation with DSS, include options in its risk profiling to better identify recipients whose medical conditions have a greater prospect of improvement. Response from audited entities: Agreed. |

|

Recommendation No.3 Paragraph 5.16 |

The ANAO recommends that DSS and Human Services:

Response from audited entities: Agreed. |

|

Recommendation No.4 Paragraph 5.23 |

To help identify further opportunities for improvement in the administration of DSP, the ANAO recommends that DSS, in cooperation with Human Services:

Response from audited entities: Agreed. |

1. Background and context

1.1 The Disability Support Pension (DSP) is Australia’s key welfare payment for people who are unable to work due to a permanent disability and are otherwise unable to maintain a basic acceptable standard of living. Over 820 000 Australians with disability, around 5 per cent of the working age population, were in receipt of DSP at the end of June 2014.9 In addition, more than 100 000 people with a partial capacity to work were receiving unemployment benefits such as Newstart Allowance.10

1.2 Strong financial incentives exist for individuals to test their eligibility for DSP. The basic fortnightly rate of payment for DSP is significantly higher (more than $250) than the basic rate for Newstart Allowance.11 Further, although there are financial incentives12 and other support services to assist DSP recipients into work, the rate of work participation is low, with only around 8 per cent reporting income from employment in 2013–14.13

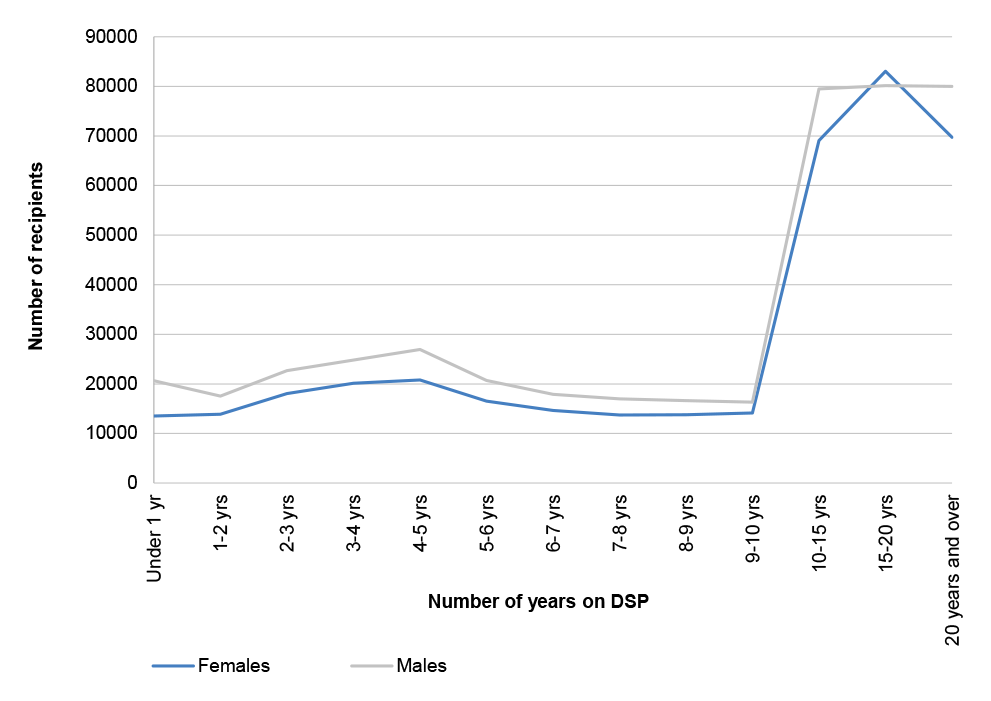

1.3 Around half of all DSP recipients granted14 DSP transfer from another income support payment and once on the payment tend to remain on it for many years. As at 30 June 2014, DSP recipients had on average spent more than 13 years on DSP. Of those who left the payment, 15 per cent were no longer on income support, while 54 per cent had transferred to the Age Pension and 28 per cent died. The source (and destination) of flows in and out of DSP are shown in Figure 1.1.

Figure 1.1: DSP recipient inflows and outflows in 2013–14

Source: Department of Social Services, Characteristics of Disability Support Pension Recipients, June 2014.

1.4 The Social Security Act 1991 (the Act), and related legislative instruments, provide the legislative basis for DSP, including the rules of eligibility and the rates payable to recipients. Section 3.6 of the Guide to Social Security Law (the Guide) contains information on the qualification requirements and the assessment process which apply to DSP. The Department of Social Services (DSS) is responsible for setting the policy parameters of DSP, managing the financial appropriation and maintaining the Guide. The Department of Human Services (Human Services) is responsible for administering payments to recipients.

DSP expenditure

1.5 DSP expenditure is significant, estimated to exceed $16.9 billion in 2015–16. Table 1.1 shows the expected increase in expenditure over the forward estimate years, reflecting projected changes in the economy, customer trends, indexation parameters15 and the impact of policy initiatives.

Table 1.1: Income support expenses for people with disability

|

|

2014–15 Actual |

2015–16 Budget |

2016–17 Forward estimate |

2017–18 Forward estimate |

2018–19 Forward estimate |

|

|

$’000 |

$’000 |

$’000 |

$’000 |

$’000 |

|

Special Appropriations: Social Security (Administration) Act 1999 |

|||||

|

Disability Support Pension |

16 536 886 |

16 907 236 |

17 357 547 |

17 826 798 |

18 434 942 |

Source: Australian Government, Portfolio Budget Statements 2015–16 Budget Related Paper No.1.15A Social Services Portfolio, Commonwealth of Australia, Canberra, 2015, p. 67.

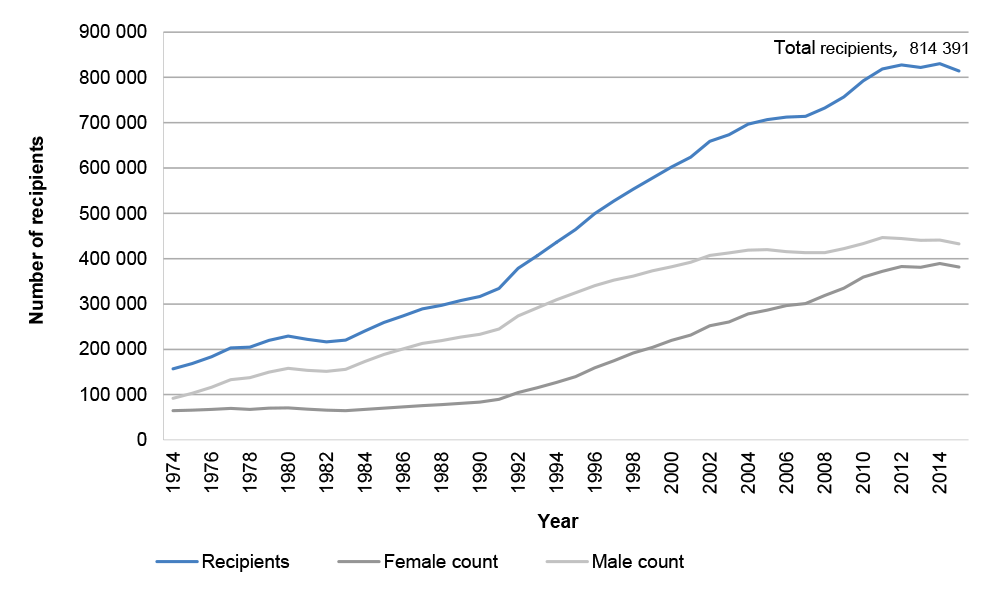

1.6 While successive governments have made efforts to reduce DSP expenditure, the number of recipients has grown at an average annual rate of 4.2 per cent over the past four decades (see Figure 1.2).

Figure 1.2: Growth in DSP recipient numbers, June 1994 to June 2015

Note: As at 30 June 2015, there were 814 391 DSP recipients (432 744 male and 381 647 female recipients). Over half (56.8 per cent) of all DSP recipients at this date were over 50 years old, of whom 5.1 per cent were aged over 65 years (either because they did not meet the 10 years residency requirement for Age Pension or because they have chosen to remain on DSP).

Source: Department of Social Services, Characteristics of Disability Support Pension Recipients June 2014, p. 8 and advice from DSS.

Reforms to the Disability Support Pension

1.7 Significant reforms to DSP include Welfare to Work (2006)16 which tightened the work capacity eligibility criteria for DSP to persons with work capacities of less than 15 hours17 per week. To give effect to this change in eligibility, more complex assessments of work capacity—Job Capacity Assessments—were introduced.18 The change in eligibility was expected to curb DSP growth. However, from 2007 recipient numbers continued to grow due a range of factors, including:

- lower than expected flow to the Newstart Allowance partial capacity to work category;

- a shift of recipients from Parenting Payment19; and

- the gradual increase in the Age Pension age for women—in the period from 2004–05 to 2009–10, DSP numbers increased by around 96 000, around 85 per cent of this represented growing numbers of female recipients.20

1.8 A number of changes to DSP eligibility and assessment process have been introduced since 2007. Revised impairment tables which underpin Job Capacity Assessments, were introduced from January 2012.21 These tables, reflecting contemporary medical and rehabilitation practice, aimed to taper DSP growth and reduce new grants of DSP by approximately 6 500 per year. A summary of relevant DSP Budget measures is at Appendix 3.

1.9 The Government is currently considering a report (February 2015) by the Reference Group on Welfare Reform chaired by Patrick McClure AO, which recommends further reforms to DSP.22 The group’s report proposes a simpler system of income support with a greater focus on employment. A Supported Living Pension is also proposed and would be available for people with disability and an assessed work capacity of less than eight hours a week for at least the next five years. At the time of finalising the report on this audit the Government was yet to respond to the group’s report.

Qualifying for the Disability Support Pension

1.10 To qualify for DSP, the recipient must:

- be aged between 16 years and the Age Pension age; meet the residency requirements; and meet the income and assets test for their situation23; and

- have a permanent physical, intellectual or psychiatric condition and be assessed as having a total of 20 points or more under the impairment tables that are used to assess a person’s ability to work; and

- have a ‘continuing inability to work’; or

- be permanently blind.

1.11 A person may be determined to meet the medical and continuing inability to work criteria for DSP if they have a condition which can be granted as ‘manifest’.24 When a person does not meet the manifest criteria, they are required to undergo a Job Capacity Assessment. A Job Capacity Assessment is a comprehensive assessment of a person’s medical condition and ability to work. The assessments are conducted by health or allied health professionals, employed by Human Services.

1.12 A ‘continuing inability to work’ is defined at Section 94(2) of the Social Security Act, which is shown at paragraph 2 of Appendix 4. In summary, if a person has a severe impairment, the impairment must of itself be sufficient to prevent the person from doing any work25 independent of a program of support (that is, a program provided by a designated provider to help address barriers to their employment and other needs as a result of their impairment26) within the next two years.27

DSP reviews

1.13 Human Services undertakes eligibility reviews of DSP recipients each year to confirm their ongoing eligibility for DSP. The 2014–15 Budget supplemented this review activity with a measure requiring the review of certain DSP recipients, aged 35 years and under. To complete this measure, DSS estimates that up to 28 000 recipients aged under 35 will be reviewed between 1 July 2014 and 31 December 2015. Approximately five per cent of recipients reviewed are expected to no longer qualify for DSP.

Audit objective, criteria and scope

1.14 The audit objective was to assess DSS’s and Human Services’ administration of DSP eligibility and review processes.

1.15 Four high-level criteria were used to form an opinion against this objective. These criteria examined:

- the qualification processes—including how impairment and work capacity were assessed and whether Job Capacity Assessments appropriately supported claimants’ eligibility for DSP. This criterion included an assessment of whether Job Capacity Assessments were: aligned with relevant policy and legislative requirements; and conducted by appropriately qualified assessors;

- the appeal processes—whether processes were effective, efficient and timely;

- reviews of recipients to re-assess eligibility for DSP—whether they were appropriately targeted, including the basis for selecting recipients for review and the extent to which results of reviews were used to inform adjustments to the assessment process; and

- how effectively the performance of DSP, in particular Job Capacity Assessments, was measured, monitored and reported—including appropriateness of performance measures and the extent to which information on performance is useful in informing government policy decisions.

1.16 The audit focused on the administration of DSP claims—that required a Job Capacity Assessment as part of the eligibility determination process—since the introduction in 2012 of reforms to the impairment tables and Job Capacity Assessment processes.

Audit methodology

1.17 Fieldwork was conducted in DSS and Human Services between December 2014 and April 2015, and involved:

- interviews with relevant DSS and Human Services staff and other stakeholders with an interest in DSP28;

- reviewing relevant DSS and Human Services documentation, including examining a total of 506 Human Services customer records who had claimed DSP (450 grants and 56 rejections of DSP) and the records of a further 100 customers whose continued eligibility for DSP had been reviewed by Human Services. This examination included reviewing the approval processes and controls; and

- analysis of DSP data and information, including to gain insight into the numbers and trends in assessments, approval, rejection and appeal rates.

1.18 The audit was undertaken in accordance with the ANAO’s auditing standards, at a cost of approximately $631,340.

Report structure

1.19 The structure of the report is outlined in Table 1.2.

Table 1.2: Structure of the report

|

Chapter |

Overview |

|

2. Assessment of eligibility for DSP |

This chapter examines the processes for assessing the eligibility of individuals for DSP, including the conduct of Job Capacity Assessments. The qualifications and support provided to assessors and Human Services quality assurance processes are also examined. |

|

3. Reviews and Appeals of Rejected Claims for DSP |

This chapter examines Human Services’ handling of internal reviews and appeals of decisions to reject claims for DSP. |

|

4. Reviewing Ongoing DSP Recipient Eligibility |

This chapter examines the processes for reviews of DSP recipients to confirm their ongoing eligibility for the payment. |

|

5. Performance Monitoring and Reporting |

This chapter examines the effectiveness of DSP processes that have been established by DSS and Human Services to provide effective oversight of the delivery of DSP and high quality Job Capacity Assessments. |

2. Assessment of eligibility for the Disability Support Pension

Areas examined

This chapter examines the processes for assessing the eligibility of individuals for the Disability Support Pension (DSP)—including determination of impairment and work capacity and whether Job Capacity Assessments have appropriately assessed applicants’ eligibility for DSP.

Conclusion

The ANAO found that the eligibility assessment process to qualify for DSP is complex. While Human Services’ assessment of new claimants’ eligibility was in keeping with underpinning legislation, policy and guidance, some aspects of the process and its oversight could be improved. In particular there is scope for Human Services to improve:

- the documentation of assessment decisions; and

- advice about program of support requirements and the potential referral of certain claimants to employment or other support services, consistent with current policy.

Area for improvement

The ANAO has one recommendation aimed at the documentation of decisions to grant DSP.

Introduction

2.1 The process for qualifying for the DSP (for individuals who do not meet the manifest criteria as noted in paragraph 1.11) requires Human Services to assess and rate the level of functional impact of a person’s impairment and their continuing inability to work. The person must be unable, because of the impairment, to do any work of at least 15 hours per week (independent of a program of support), in the next two years. To meet the continuing inability to work requirements, a person whose impairment is not severe, must have also participated in a program of support. An overview of the DSP assessment process is shown at Figure 2.1.

Figure 2.1: DSP claim assessment process

Note: The assessment process shown in this diagram does not include the changes mentioned at Appendix 3 and which take full effect from 1 July 2015.

Source: ANAO analysis of Human Services information.

2.2 Human Services processed 141 747 new claims for DSP in 2013–14 and around 110 000 claims were referred to a Job Capacity Assessment as part of the DSP claim process. There were 57 918 claims granted or around 42 per cent of total claims received in that year.29 Of rejected claims, nearly 80 per cent were rejected on medical grounds, with the reasons for rejection including:

- conditions not fully diagnosed, treated and stabilised (35.8 per cent);

- conditions attract less than 20 points on the impairment tables (34.0 per cent);

- failed to supply requested information (14.6 per cent); and

- did not meet program of support requirements (3.9 per cent).

2.3 The ANAO examined a sample of 450 grants of DSP to determine whether Human Services had conducted the Job Capacity Assessments in keeping with the legislation, policy and guidance which underpins DSP. The results of the ANAO’s assessment are outlined below.

Has Human Services conducted eligibility assessments consistent with the legislation, policy and guidance?

The ANAO found that Job Capacity Assessments conducted by Human Services to: assess the permanence of medical conditions; rate impairments (against the impairment tables); and assess continuing ability to work, were conducted in keeping with the underpinning legislation and policy (and guidance). Assessments were in almost all cases supported by medical evidence. However, not all decisions or changes to Job Capacity Assessments by delgates were well documented against the requirements of the impairment tables. Documentation of decisions made at each step should be improved.

The requirement for certain people to participate in a program of support should be better communicated to those persons whose claims for DSP are rejected. Similarly persons who are granted DSP should be advised of any recommendations for possible future employment support that have been made by a Job Capacity assessor and, consistent with current policy, appropriate referrals made.

One recommendation is made in respect of these findings.

Assessment of the permanence of medical conditions

2.4 Each DSP claim referred for a Job Capacity Assessment requires the assessor (within Human Services) to make an assessment of whether the person’s medical condition is ‘permanent’ as prescribed in the Social Security (Tables for the Assessment of Work-related Impairment for Disability Support Pension) Determination 2011 (Section 6) and supporting guidance. 30

2.5 The ANAO found that assessors informed their assessment on the permanence of a claimant’s medical condition using both medical reports31 and information provided by the claimant during interview. Assessor recommendations were mostly well supported by evidence. For the 450 grants of DSP examined, sufficient evidence was available for the assessment of 437 grants (97 per cent)32, which is consistent with Human Services’ benchmark for 95 per cent of assessment reports to receive a quality rating of ‘satisfactory or better’. Evidence was not apparent or recommendations not supported in a small number of cases.

2.6 In some instances, the Job Capacity Assessment report did not fully document the assessment with respect to conditions being fully diagnosed, treated and stabilised (because the reports did not indicate that the condition would persist for over two years). While the ANAO was satisfied that the medical reports supported the assessments satisfactorily, the supporting guidance to the Determination requires that decisions (which consider verbal information provided by claimants or medical practitioners) be documented.

2.7 The ANAO also observed that in practice Job Capacity Assessors use the term ‘permanent’ to distinguish a medical condition where the functional impacts are expected to persist for at least two years, from a temporary medical condition. Under the Determination a condition is only ‘permanent’ if it has been ‘fully diagnosed, treated and stabilised’ by an appropriately qualified medical practitioner. There would be merit in Human Services using terminology in Job Capacity Assessment reports that is consistent with the Determination. 33

Assessment of impairments

2.8 Job Capacity Assessments aim to identify a person’s level of functional impairment resulting from medical conditions assessed as permanent.34 Where assessors consider that a person’s condition has been fully diagnosed, treated and stabilised, they rate the impairment using the points system in the impairment tables (Table 2.1). Assessors must take into account the functional impacts of the claimant’s impairment and must consider all potential work opportunities in the open labour market35 in Australia, and not just those in the location of the claimant.36

Table 2.1: Impairment ratings

|

Impairment rating |

Description |

|

0 |

No functional impacts on activities under the table. |

|

5 |

There is a mild functional impact on activities under the table. |

|

10 |

There is a moderate functional impact on activities under the table. |

|

20 |

There is a severe functional impact on activities under the table. |

|

30 |

There is an extreme functional impact on activities under the table. |

Source: Social Security (Tables for the Assessment of Work-related Impairment for Disability Support Pension) Determination 2011.

2.9 The ANAO found that Human Services’ assessments of impairments for the sample of grants were conducted in keeping with the Determination (and Guidance) using available medical evidence and information provided by claimants at interviews. Of the grants sampled:

- 423 grants (94 per cent) were assessed as having ‘severe’ impairments (an impairment rating of 20 or more points on a single table);

- two claims (0.4 per cent) were granted as manifest on review after initially being rejected; and

- 25 grants (5.6 per cent) were assessed as not having severe impairments (impairment ratings of 20 points, but not on a single table).

2.10 For almost all grants sampled by the ANAO:

- suitable tables were used (99.6 per cent or 448 grants);37

- the tables were applied correctly (96.7 per cent of grants (433 grants)) to determine impairment ratings;38 and

- sufficient evidence (in the form of medical reports) was available (97 per cent) to support the assessment. This result was consistent with Human Services’ benchmark for 95 per cent of assessment reports to receive a quality rating of ‘satisfactory or better’.

2.11 The impairment tables list specific requirements that must be met for each impairment rating and assessment reports should demonstrate that these requirements have been met. In practice, the ANAO observed that there was some inconsistency in the way that assessors justified their impairment ratings:

- in 75 per cent of the assessment reports reviewed by the ANAO, impairment ratings decisions made against the requirements of the impairment tables were fully documented; and

- in the remaining 25 per cent of reports, the documentation of decisions could have been improved, for example, reports stated that the requirements for an impairment rating had been met, without reference to the impairment tables.

Assessment of Continuing Inability to Work

2.12 In assessing a person’s continuing inability to work, an assessor must take into account the functional impacts of the claimant’s medical conditions assessed as permanent. The assessment of a person’s continuing inability to work requires judgement and experience to assess whether a person could, with support, increase their work capacity to 15 hours a week or more, within two years.39 Assessors must take into account the functional impacts of the medical conditions, (using hourly bandwidths)40 on work capacity at both the time of assessment (baseline) and within two years, with employment assistance and other interventions, and independent of an ongoing program of support.

2.13 Documenting the reasons for assessment decisions provides an assurance that decision making is in keeping with requirements set out in the legislation and guidelines. The ANAO found that most assessors provided a reasonable level of documentation to support their assessments. However, in around 13 per cent of reports41, assessments could have been better documented. They simply stated that, because of the person’s medical conditions, the person did not have a capacity to work or that the assessor believed that the claimant would not attain the ability to work at least 15 hours per week within the next two years.

Assessment of program of support obligations

2.14 As part of the continuing inability to work test, people claiming DSP from 3 September 2011 who are not manifestly granted and who do not have a severe impairment, have needed to show that they have actively participated in a program of support. Active participation in a program of support is specified in the Determination and is taken to mean participation of at least 18 months within the past three years.42

2.15 In 2013–14, 2840 persons granted DSP did not have a severe impairment (4.93 per cent of all grants). Of these, most (2763 or 97.3 per cent) had undertaken a program of support and 61 (2.1 per cent) had been exempted from participation in the workforce. In that year a further 3309 (3.9 per cent) claims were rejected because a person had failed to meet the program of support requirement.

2.16 In the sample of grants examined by ANAO, most individuals (425 or 94.4 per cent) were not required to have participated in a program of support because they had a severe impairment or were granted manifestly. A small number (22 or 4.9 per cent) had participated in a program of support and three (0.7 per cent) were exempt under the legislative Determination.43 Of the grants where the person had participated in a program of support, in a small number of cases (three of the 22 grants) the assessor had inaccurately calculated the claimants’ level of participation in the program of support. In 11 other cases the ANAO observed that the assessment reports did not detail how program of support requirements were met and simply stated that examination of the Employment Services System indicated that the requirement had been met.

Decisions of the delegate

2.17 While Job Capacity Assessors consider the severity of a person’s medical conditions and the impact of those conditions on their ability to work, they do not decide whether a person should be granted DSP. Assessment reports provide an input to the decision making process and the assessor’s recommendations can be varied by the Human Services delegate where appropriate. A small number of assessment reports in the ANAO sample (13 reports) included the following paragraph:

In determining eligibility for income support, Centrelink exercises delegations under the Social Security Act. Having regard to a range of information including the Employment Services Assessment and Job Capacity Assessment Report, the Centrelink delegate has varied the client’s impairment rating or work capacity for this purpose. The Centrelink delegate has discussed this decision with the Job Capacity Assessor.

2.18 While acknowledging that changes have been made to the assessment report by the delegate, this wording does not indicate what changes were made to the impairment rating or work capacity of the client or the reasons for the changes. To provide clarity of the decision in such situations and to provide a better base for administrative review, there would be merit in clearly specifying the changes to the assessment report and the reasons for the changes.44

Recommendation No.1

2.19 To provide full documentation of eligibility decisions, the ANAO recommends that Human Services:

- review the guidance it provides to assessors on the level of detail to be included in Job Capacity Assessment reports, particularly for assessments of impairment ratings, a person’s inability to work and program of support obligations; and

- require delegates to clearly specify any changes they make to the Job Capacity Assessment reports.

Entity response: Department of Social Services

2.20 The Department of Social Services agrees with this recommendation. The Department supports strengthening the documentation that underlies decision making for qualification of DSP, noting that the audit finds that DHS is undertaking assessments in keeping with legislation.

Entity response: Department of Human Services

2.21 The department agrees with this recommendation.

2.22 The department notes the audit found Human Services’ assessment of new claimants’ eligibility was in keeping with underpinning legislation, policy and guidance, and identified some areas where it could be improved. Importantly, the department notes the audit finding ‘… the ANAO was satisfied that the medical reports supported the assessments satisfactorily…’, which supports that correct eligibility decisions were made by delegates.

2.23 The department regularly reviews and, where necessary, updates its guidance for staff. Given the complexity of the DSP assessment process, different aspects can be documented on different parts of a customer’s record and work is underway to improve the central visibility of this information.

2.24 The department has in place processes for delegates to request changes to Job Capacity Assessment reports. The ability to edit reports after they are finalised is limited by the department’s legacy information, communications and technology (ICT) systems. The department will take opportunities provided by changes to the ICT system to improve the level of detail recorded.

Referrals to program of support and employment services

2.25 Where a person’s claim is rejected for reasons unrelated to non-participation in a program of support (for example, residency or where a medical condition is not fully diagnosed, treated or stabilised), Human Services advises the person of the reason for the rejection of the claim.45 However, the ANAO found no evidence that Human Services advised unsuccessful claimants of the possible need to participate in a program of support, despite guidance that they should do so. Where individuals are not advised of the requirements, it can have negative consequences on any subsequent claims for DSP. The Social Security Appeals Tribunal indicated to the ANAO that Human Services could do more to increase awareness of program of support requirements.46 It is therefore important that Human Services make persons whose claims have been rejected aware of the program of support requirements.

2.26 When conducting assessments, Job Capacity Assessors consider and make recommendations on available support to improve a claimant’s future employment prospects.47 However, except for some persons under 35 years of age, DSP recipients are not required to accept a referral to a support provider. In some cases, assessors will facilitate a referral to an employment services provider directly. However, in cases where assessors recommended that future support be provided, the ANAO found no evidence that referrals had been made. Recognising also that, without intervention, a person is likely to remain on DSP for a long period, there would be merit in Human Services having arrangements in place to assure that referrals are made to employment service providers where this is recommended by the assessor as having the potential to assist in the claimant’s return to the workforce.

Did Human Services have adequate arrangements in place to quality assure Job Capacity Assessments?

The ANAO found that Human Services’ quality control framework for Job Capacity Assessments focuses on the capability of assessors, guidance and quality review.

Job Capacity Assessors’ qualifications mostly aligned with the impairment tables relevant to a claimant’s primary medical condition and/or contributing assessors were used. The ANAO observed a small number of instances where this was not the case and the decision was subsequently overturned on appeal, raising the possibility that, if a contributory assessor had been involved, the appeal might have been avoided.

2.27 Effective internal controls to assure the quality of decision making and arrangements to identify changes in payment recipients’ circumstances help ensure people receive correct payments. The quality control framework for Job Capacity Assessments has three main components focusing on capability of assessors, guidance and quality review, as summarised at Table 2.2.48

Table 2.2: Quality control framework for Job Capacity Assessments

|

Element |

Description |

|

Capability |

Human Services uses suitably qualified and experienced assessors to perform assessments, with specialist advice provided by health professionals. |

|

Guidance, training and support |

The provision of guidance and support to staff and Job Capacity Assessors to help them to process claims for DSP efficiently and effectively. |

|

Quality assurance reviews of Job Capacity Assessment reports |

The quality assurance reviews of assessment reports are undertaken by the team managers (and also by directors and a quality panel) of the assessors using a standard set of questions in a quality control tool. |

Source: ANAO analysis of Human Services documentation.

Capability of Job Capacity Assessors

2.28 Section 1.1.J.70 of the Guide to Social Security Law states that an assessor’s qualifications will generally align with the impairment table(s) relevant to a claimant’s primary medical condition.49 Where they do not align, a secondary contributing assessor holding a professional qualification that aligns with the relevant table(s) is expected to review the medical evidence and use of the impairment tables by the primary assessor and confirm the conclusions drawn by the primary assessor, in particular, the status of medical conditions, impairment ratings, work capacity and onward referrals.

2.29 As at 28 February 2015, Human Services employed 646 Job Capacity Assessors. The ANAO found that assessors mostly held relevant qualifications or a contributing assessor was employed to assist in the assessment. In the sample of 450 grants examined, assessments were conducted for 437 grants,50 contributing assessors were employed in 51 per cent of claims and, in 14 instances (three per cent) of the grants sample, it was doubtful or unclear whether a suitable assessor had been engaged in the assessment. While contributing assessor requirements were being met in all but a few cases, where the requirement was not met, it potentially had negative consequences on claimants and may have resulted in unnecessary review action.

Drawing on specialist advice

2.30 Assessors can obtain advice on complex cases or arrange for a specialist medical assessment where it is essential for completion of the report. The Health Professional Advisory Unit (the Unit) is a team of health professionals (including medical practitioners) in Human Services51 who provide advice, interpretation and clarification to assessors and other Human Services staff on a person’s medical conditions and the impact of these conditions on their work capacity. In 2014–15, 621 referrals were made to the Unit in respect of new claims for DSP and 2993 for DSP related issues (see Table 2.3). The ANAO observed that Health Professional Advisory Unit staff primarily reviewed assessments on whether a medical condition was fully diagnosed, treated and stabilised and impairment ratings. In providing advice, Unit staff focused on the functional aspects of claimants’ medical conditions, having regard to the available medical evidence.

Table 2.3: DSP Referrals to the Health Professional Advisory Unit, 2011–12 to 2014–15

|

Referral reason |

Year |

|||

|

|

2011–12 |

2012–13 |

2013–14 |

2014–15 |

|

DSP referrals |

|

|

|

|

|

DSP new claims |

1754 |

685 |

705 |

621 |

|

Assessments in progress |

108 |

49 |

50 |

61 |

|

Appeals |

1462 |

1444 |

1281 |

1084 |

|

DSP cancellations |

324 |

778 |

773 |

540 |

|

DSP medical reviews in progress |

66 |

59 |

134 |

108 |

|

DSP under 35 reviews |

- |

- |

- |

579 |

|

Total DSP referrals |

3714 |

3015 |

2943 |

2993 |

Source: Human Services.

2.31 Assessors can also request specialist medical assessments. In 2013–14, of the around 110 000 assessments in that year, 2938 referrals were made to specialist medical assessors (2751 to Human Services internal specialist assessors, not necessarily in the Unit, and 187 to external specialists). Of these referrals, 2007 (or 68 per cent) related to the intellectual functioning or specific learning disabilities of a claimant.

2.32 The involvement of contributing assessors and the Health Professional Advisory Unit on more complex issues provided assurance that the correct assessments were being made. However, the ANAO found a small number of instances (seven) in the grants sample where Job Capacity Assessors had rejected claims on the basis of the medical condition, without consulting the Unit or contributing assessor, and the claims were subsequently successfully appealed.

|

Case study 1. Supporting advice not sought |

|

The claimant’s impairment was optic nerve atrophy. The assessor for this claimant was an Accredited Exercise Physiologist, who recommended the claimant was not medically eligible, without consulting a contributing assessor or the Health Professional Advisory Unit. The claimant’s agent requested information under Freedom of Information, which was granted, and an internal review by a subject matter expert changed the decision to grant the claim as manifest after additional medical information, which supported the original medical information, was provided. The original rejection decision may have avoided the need for a review, had there been a contributing assessor or had advice been provided by the Health Professional Advisory Unit. |

Source: ANAO examination of DSP claims assessments.

Guidance, training and support

2.33 Policy guidance is provided to Human Services staff through the Guide to Social Security Law (managed by DSS), and through other documents, such as the guidelines on the use of the impairment tables. Human Services has developed a range of training products on assessment procedures, including training on DSP for access staff, the use of the impairment tables for Job Capacity Assessors and awareness training on disabilities such as mental health.

2.34 Human Services advised that assessors are expected to undertake annual refresher training and that all assessors have received training over the last year. Completion of training is monitored through the department’s Learning Management System and as part of individual performance agreements. Assessors are also expected to comply with continuing professional development required to maintain their professional registration.

Quality assurance reviews of Job Capacity Assessment reports

2.35 Job Capacity Assessments are the primary mechanism for informing decisions on non-manifest grants of DSP. Quality reviews of assessment reports that focus on ‘continuous improvement in quality processes and quality outcomes’52 are conducted for assessment reports and interviews. A total of 2724 such reviews were completed in 2013–14, representing a review rate of all assessments of 2.27 per cent.

2.36 Human Services’ quality control findings indicated that, in 2013–14, 66 per cent of quality reviews (1793 out of a total of 2724 quality reviews) achieved a quality rating of excellent and 97 per cent (2636 reviews) achieved a quality rating of satisfactory or better. In one per cent of cases (28 reviews), the incorrect application of the assessment procedures adversely impacted on the accuracy of the assessment for income support purposes. Although this is a small percentage, the number is still sizeable in absolute terms because of the large number of claims received each year.

2.37 A key issue in determining the accuracy of assessments is whether a different assessor considering the same evidence would reach the same conclusion. At the time of the audit fieldwork, team leaders reviewed the assessments of their own staff. Following the fieldwork, Human Services advised that, to help assure the consistency of quality assurance reviews, it had implemented an impartial, independent quality review team that comprises a rotating panel of assessors.

3. Internal Reviews and Appeals of Rejected Claims for the Disability Support Pension

Areas examined

This chapter examines Human Services’ handling of internal reviews and appeals of decisions to reject claims for the Disability Support Pension (DSP).

Conclusion

Around 20 per cent of Human Service decisions to reject DSP claims are reviewed. Human Services’ key performance indicator for internal reviews in was to complete 70 per cent of the reviews within 49 days. In this regard the ANAO found that in 2014–15:

- the target was not met (58 per cent of reviews were conducted within 49 days);

- the average time taken to complete reviews was 70 days; and

- some reviews had taken up to 12 months to complete.

Many decisions were subsequently appealed to the former Social Security Appeals Tribunal and the Administrative Appeals Tribunal. There is the potential for reviews and appeals activity to be reduced by improving communication with appellants. In particular, by clearly explaining the basis for rejecting a claim initially so that applicants can make an informed decision on whether or not they should submit an appeal. Improving the appeals and review data captured by Human Services could enable Human Services and DSS to better understand the main reasons for successful appeals and could assist in improving the application processes and quality control frameworks.

Introduction

3.1 Where a claimant believes a decision to reject their claim for DSP was unfair or unlawful, they may in the first instance seek an internal review of the decision under the Social Security (Administration) Act 199953. Until 30 June 2015, if claimants remained dissatisfied, they could then apply to the Social Security Appeals Tribunal54 for a review of the decision and, depending on the outcome, may further appeal to the Administrative Appeals Tribunal.55

3.2 Reviews and appeals provide Human Services and DSS with an opportunity to continuously improve administrative arrangements and inform policy deliberations.

Are applications for review of DSP decisions managed in an effective, efficient and timely manner?

In 2013-14, Human Services finalised 23 898 internal reviews of a DSP decision. Review officers changed a total of 5645 (23.7 per cent) of the original decisions. Around 23 per cent of decisions were subsequently appealed to the Social Security Appeals Tribunal and the Administration Appeals Tribunal.

Review processes take time and may cause uncertainty for claimants. Human Services’ key performance indicator for internal reviews in 2014–15 was to complete 70 per cent of the reviews within 49 days. This target was not met (58 per cent of reviews met the target). The average time taken to complete reviews was 70 days and some reviews took up to 12 months to complete. The ANAO observed in a sample of reviews selected across 2012 to 2014, that around 60 per cent were completed within 90 days and, on average, reviews took 111 days to complete.

Human Services advised during the course of the audit that it had implemented revised arrangements to improve timeliness and reduce the number of applications for internal review on hand. Human Services reported that their efforts in this regard had significantly reduced the number of outstanding reviews during 2014–15.

3.3 In 2013−14, 83 829 DSP claims were rejected (76 per cent on medical grounds) and, of these, 22.5 per cent were appealed. When an appeal is lodged, it is first examined by a subject matter expert and, subject to the outcome of that examination, a formal internal review may then be undertaken. In some cases, the subject matter expert may ask for a new Job Capacity Assessment to review any significant new evidence not taken into account in the original assessment, before a formal internal review of a claim is undertaken.

3.4 Formal internal reviews are undertaken by authorised review officers, who are senior and experienced officers, independent of the original decision to reject the claim. When conducting an internal review, authorised review officers consider the evidence on hand at the time the claim was rejected. The authorised review officers are not health professionals, but are trained in utilising internal resources, such as policy and legislation relating to the review types being undertaken, along with other resources such as those in the Health Professional Advisory Unit. As a part of the review process, the authorised review officers may also contact external health professionals (including treating doctors and psychologists) involved in the initial decision making process for clarification of medical evidence or the provision of additional medical evidence.

Outcomes of authorised review officer reviews

3.5 In 2013-14, Human Services finalised 23 898 internal reviews of a DSP decision.56 Authorised review officers decided 19 531 reviews, (the remaining reviews being determined by the subject matter experts mentioned in the previous paragraph) and affirmed the original decision in 12 957 (63 per cent) of these reviews. The original decision was set aside in 3501 (18 per cent) reviews and in the remaining reviews were either withdrawn, varied or dismissed due to lack of jurisdiction. Human Services advised that a primary reason for this was the provision of new information or evidence. This suggests that there is scope for Human Services to take steps to ensure that claimants are aware of the information that they need to provide to establish a DSP claim.57

3.6 For reviews undertaken by authorised review officers, a similar proportion of decisions were upheld on appeal to the Social Security Appeals Tribunal. In the 2014–15 Annual Report Human Services reported that, in the three years 2011–12 to 2013–14, the Tribunal had changed an average of 2625 (24 per cent) authorised review officer review decisions annually across all payment types. There is a range of reasons why adverse decisions may have been changed by the Tribunal. One reason advised by the Tribunal for DSP was that:

Some [authorised review officers] wrongly conclude that no current medication or treatment by a specialist for a physical, intellectual or psychiatric condition means that the condition is not permanent even though it is long-standing and the general practitioner has said that no further treatment is planned.

3.7 At the time of the field work, Human Services did not undertake quality assurance assessments of authorised review officer reviews. However, the department has advised that, from July 2015, it implemented arrangements to review the decisions of authorised review officers. It has also advised that it has since required authorised review officers to consult assessors before changing decisions and to refer claimants for a Disability Medical Assessment before completion of the review, where the review officer is considering setting aside a decision to reject a claim on medical grounds.

Efficiency and timeliness of internal reviews

3.8 Review processes can take time and cause uncertainty for claimants. External stakeholders58 consulted during the course of the audit reported that the timeliness of authorised review officer reviews presented difficulties for claimants. The Social Security Appeals Tribunal noted that the longer the delay in conducting an internal review, the more adverse the potential implications of not referring an applicant to a program of support, should they need to do so to qualify for DSP. The 2014 report of the Commonwealth Ombudsman into complaints about Human Services also identified delays in the completion of authorised review officer reviews as a particular source of complaints.59

3.9 Human Services’ key performance indicator for internal reviews in 2014–15 was to complete 70 per cent of the reviews within 49 days.60 In this regard, 58 per cent of reviews across all income support types met the Human Services target in 2014–15. However, the average time taken to complete reviews was 70 days and some reviews had taken up to 12 months to complete, with the longest review in 2014–15 lasting over 350 days.61 The ANAO observed, in a sample of DSP reviews selected from the period 1 January 2012 to 31 October 2014, that around 60 per cent were completed within 90 days and, on average, reviews had taken 111 days to complete.

3.10 Human Services advised during the course of the audit that it had implemented revised arrangements to improve timeliness and reduce the number of applications for review on hand. Improvements included: introducing a more flexible resource model to enable reviewers to transfer between teams and share the workload nationally; training additional subject matter experts and authorised review officers to undertake reviews; and developing standard operating procedures and upgrading systems to better automate workflow.62

3.11 Human Services has also advised that it is considering further options to improve the timeliness of internal reviews in the light of a trial conducted in 2014. As part of the trial, an internal review by an authorised review officer did not commence until after the decision was fully examined, checked for correctness and the reasoning for the decision had been fully explained to the claimant by a designated member of the business area. The trial led to a reduction in the number of referrals to authorised review officers for formal reviews (31 per cent compared to the 67 per cent referral rate in 2013–14).63 The results of this trial also indicated that there was scope for Human Services officers to better explain decisions to claimants.

Appeals to the Social Security Appeals Tribunal and Administrative Appeals Tribunal

3.12 A claimant who is not satisfied with the decision of an internal Human Services review has the option to appeal to the Social Security Appeals Tribunal and, if required, further appeal to the Administrative Appeals Tribunal64. DSP-related appeals represent the highest proportions of social security-related appeals to both Tribunals. Social Security Appeals Tribunal data show a significant increase in the number of DSP decisions reviewed over the past four years. This increase may be the result of the measures to tighten DSP eligibility and assessment process. However, it may also be the result of the growing gap in payments rates for DSP recipient’s as other working age payments.

3.13 In 2014–15, the Social Security Appeals Tribunal: reviewed 5651 decisions; affirmed 4100 (73 per cent) of the decisions made by Human Services; set aside 849 decisions (15 per cent); and varied 31 decisions (0.5 per cent). The remaining decisions were not reviewable, withdrawn or dismissed. Reviews of DSP decisions accounted for approximately 47 per cent of the decisions reviewed by the Tribunal for all income support payments (12 989) in 2014–15.65 Across all income support payments, the key reasons for making changes to decisions included: new information being available (44 per cent of the changes in decisions), errors of fact (31 per cent) and errors of law (11 per cent).66 A summary of the results of appeals to the Social Security Appeals Tribunal over the past five years is provided at Table 3.1.

Table 3.1: Outcomes of DSP decisions to the Social Security Appeals Tribunal, to 2014–15

|

|

2010–11 |

2011–12 |

2012–13 |

2013–14 |

2014–15 |

|

Applications received |

2951 |

3446 |

4404 |

4437 |

6139 |

|

Decisions reviewed |

2974 |

3315 |

4449 |

4613 |

5651 |

|

Decisions affirmed |

1853 |

2070 |

3164 |

3320 |

4100 |

|

Percentage of Human Services reviewed decisions affirmed |

62% |

62% |

71% |

72% |

67% |

Source: Social Security Appeals Tribunal annual reports.

3.14 In 2014–15 the Administrative Appeals Tribunal finalised 2129 appeals of Human Services’ decisions across all income support payments, or 32 per cent of all finalised appeals (6748). Of the 2129 finalised appeals, 1108 (52 per cent) were DSP appeals.67 DSP appeals are the largest source of income support appeals to the Administrative Appeals Tribunal.

Does Human Services seek to improve the delivery of the Disability Support Pension through monitoring review and appeal activities?

Human Services has advised that it captures information on major appeals reasons and outcomes and shares these with staff in its network. More detailed data on the reasons for the changes in decisions from the internal review and appeal processes could improve the claims application process and quality control framework. It could also enable Human Services and DSS to better understand the main reasons for successful appeals.

There is also the potential for reviews and appeals activity to be reduced by improving communication with appellants, in particular, by more clearly explaining the basis for rejecting a claim initially so that appellants can make an informed decision on whether or not they should submit an appeal.

Monitoring of internal reviews and appeal outcomes

3.15 Human Services advised the ANAO (20 March 2015) that its Appeals Branch shares the outcomes of Social Security Appeals Tribunal decisions with the authorised review officer network. It has also recently started to upload decisions against customer records for ease of access/analysis for the original decision maker and front-of-house staff. In addition, Human Services is conducting further work to expand the communication of trends and/or reasons for stays and variations arising from Social Security Appeals Tribunal decisions, and it intends to develop a reporting tool to collect this information and provide intelligence to inform the business.

3.16 More detailed data on the reasons for the changes in decisions from the internal review and appeal processes (such as whether additional medical evidence was provided or whether the authorised review officer or Tribunal came to a different conclusion on the available evidence and, if so, why) would have the potential to provide valuable feedback to improve the claims process and quality control framework.

Using appeals information to improve the delivery of the Disability Support Pension

3.17 Reviews and appeals provide an opportunity to continuously improve administrative arrangements for DSP. Human Services advised that many internal review applications were being lodged unnecessarily. In many cases staff had not provided claimants with clear and concise reasons for the rejection of their claims. Subsequently, claimants lodged appeals against the decisions. Internal reviews had also been lodged automatically by staff in response to claimants who had indicated that they were unhappy about their claim rejection, and some claimants were unaware that their claim was under internal review. In response, Human Services was at the time of the audit implementing strategies to encourage staff to better explain rejection reasons, before moving the case into the review waiting list.

3.18 To improve communication to claimants and reduce unnecessary applications for review or appeal, it is important that Human Services clearly explain the basis for the rejection of an income support claim. A 2014 investigation by the Commonwealth Ombudsman into service delivery complaints about Human Services indicated that customers had ‘expressed frustration at receiving confusing, sometimes contradictory letters from Centrelink’.68 In this regard, while Human Services has regularly reviewed its letters and provided oral feedback to claimants on the outcome of their claims, the audit observed that there remained scope to improve the clarity of grant and rejection letters. Better explanations could also be provided about the reasons for rejected claims.

4. Reviewing Ongoing Disability Support Pension Recipient Eligibility

Areas examined

This chapter examines the processes for reviews of DSP recipients to confirm ongoing eligibility and whether these reviews were appropriately targeted.

Conclusion

Human Services undertakes a range of review activities for income support payments including risk based compliance reviews and serious non-compliance reviews and investigations, and Random Sample Survey Reviews. The ANAO found that the level of review activity varied in volume and effectiveness across each review type and from year to year.

The overall level of activity undertaken each year to confirm ongoing eligibility of DSP is significant—79 151 reviews were undertaken in 2014–15. However, the number of cancellations and payment reductions arising from this activity is relatively low. Further, the possibility of a DSP recipient being required to undergo a medical assessment as part of a compliance review was also low—just 3841 medical reviews (5 per cent) of DSP recipients reviewed in 2013–14, falling to 721 reviews in 2014–15. In 2014-15 a Budget measure was introduced to fund 28 000 reviews of DSP recipients under-35 years of age. As a result, recipients who fall outside the Budget measure criteria are unlikely to be reviewed and may continue receiving DSP even though their medical conditions no longer justify it.

While reviewing the entire stock of DSP recipients would be expensive and ineffective for some groups, Human Services could improve targeting of medical reviews for compliance activities, including by drawing on medical and impairment risks identified during the claims processes. This approach would be consistent with the view of the Productivity Commission that DSP reassessments need to be sufficiently frequent that they reflect the foreseeable needs of individuals.

Areas for improvement

The ANAO has two recommendations aimed at restoring the level of medical review activity within compliance reviews and targeting of activity towards recipients identified as having a reasonable prospect that their medical conditions may become less severe after two years.

Introduction

4.1 Human Services undertakes a significant level of review of payment eligibility and compliance across all income support types. Each year around 68 000 DSP recipients have their eligibility for payment reviewed and as a result around 6600 individuals have their payments reduced or cancelled. These reviews can include a review of an individual’s medical conditions. In addition, from 1 July 2014 certain DSP recipients aged less than 35 (and granted DSP between 2008 and 2011 with working capacity of eight hours or more) were required to have their eligibility and payments reviewed under the new impairment tables that came into effect on 1 January 2012.69

4.2 To complement the review activity, Human Services has early intervention and prevention practices in place. These practices help to ensure that DSP recipients receive their correct entitlements and meet their obligations and responsibilities and do not incur unnecessary debts. Practices include targeted education strategies and involve early contact with recipients through letters and SMS messages to remind them of their obligations and to prompt self-correction. Human Services also works with recipients to resolve compliance issues due to genuine mistakes and to prevent debt accumulation. When there is deliberate fraud, offenders may be prosecuted.70

How many DSP recipients are identified for continuing eligibility review and how effective are these reviews?

The ANAO found that each year Human Services conducts a large number of reviews of continuing eligibility for DSP through the conduct of risk based compliance reviews, serious non-compliance reviews and random sample survey reviews. The effectiveness of this review activity varies across each review type and from year to year.

However, even though medical grounds are the most likely reason (76 per cent) for an individual having their claim for DSP rejected, only 5 per cent of DSP recipients who were reviewed in 2013–14 had their medical conditions reviewed. Human Services reduced medical review activity (as part of compliance reviews) to just 721 reviews in 2014–15. In 2014-15 a Budget measure was introduced to fund 28 000 reviews of DSP recipients under-35 years of age. As a result, recipients who fall outside the Budget measure criteria are unlikely to be reviewed and may continue receiving DSP even though their medical conditions no longer justify continued receipt of the payment.

4.3 Human Services’ review framework for income support payments, including DSP, consists of risk-based reviews (compliance reviews and service update reviews), serious non-compliance investigations and random sample survey reviews. Risk-based reviews are targeted at income support recipients who are at greater risk of no longer meeting eligibility requirements for their payment, including due to increased income or assets or increased hours of employment.71 Two types of risk based review are conducted—compliance reviews (which are part of Human Services’ formal compliance program) and service update reviews (which are not part of the formal compliance program, but are triggered by service profiling and actioned by processing staff). By contrast, serious non-compliance investigations arise when a recipient is found to have failed to fully declare their circumstances and random sample surveys provide checks on the correctness of payments across all income support types.

4.4 In 2014–15 Human Services reviewed around ten per cent of the DSP population for compliance and payment correctness. The type and number of reviews conducted are shown at Table 4.1.

Table 4.1: Reviews undertaken of total Disability Support Pension population 2013–14 and 2014–15

|

Review type |

2013–14 |

2014–15 |

||

|

|

Number conducted |

Percentage of population |

Number conducted |

Percentage of population |

|

Compliance reviews |

58 247 |

7.1 % |

64 913 |

7.8% |

|

Service update reviews |

5 832 |

0.7 % |

11 240 |

1.4% |

|

Serious non-compliance reviews |

976 |

0.1 % |

703 |

0.1% |

|

Random Sample Survey reviews |

2 757 |

0.3 % |

2 295 |

0.3% |

|

Total annual reviews |

67 812 |

8.2 % |

79 151 |

9.5% |

Source: ANAO

Risk based compliance reviews

4.5 Compliance reviews72 undertaken in 2014–15 for DSP resulted in the cancellation of 1658 recipients’ payments (2.6 per cent) and a reduction in payment for 5115 recipients (7.9 per cent). A total of $39 528 393 in debts was raised through 10 667 (16.4 per cent) reviews—an average debt of $3791 per person. In comparing the result with the three previous years, the ANAO found that, although the volume of compliance reviews had almost doubled, the number of payment cancelations declined from 1881 to 1658 and the percentage of reviews resulting in payment reductions declined from 14 per cent to 7.9 per cent on 2011−12 levels. The results of the compliance reviews for the years to 2014–15 are outlined in Table 4.2.

Table 4.2: Outcome of Disability Support Pension compliance reviews completed—2010–11 to 2014–15

|

Year |

Reviews completed |

Cancellations |

Payment reductions |

Debts raised |

|||

|

|

Number |

Number |

Value $ |

Number |

Value $ |

Number |

Value $ |

|

2010–11 |

39 489 |

1 267 |

805 684 |

4 956 |

1 928 121 |

16 379 |

39 218 312 |

|

2011–12 |

32 468 |

1 881 |

1 274 658 |

4 563 |

2 226 523 |

9 647 |

31 119 441 |

|

2012–13 |

67 304 |

1 799 |

1 242 446 |

5 896 |

2 301 263 |

9 638 |

25 744 310 |

|

2013–14 |

58 247 |

1 659 |

1 203 511 |

5 394 |

2 355 859 |

10 445 |

39 597 827 |

|

2014–15 |

64 913 |

1 658 |

1 245 151 |

5 115 |

2 516 872 |

10 667 |

39 528 393 |

Source: Human Services.

Service update reviews

4.6 Over the four years 2011–12 to 2014–15, the effectiveness of the service update reviews has varied. The number of service update reviews conducted has declined significantly since 2011–12 (see Table 4.3), with only 20 cancellations and 33 debts raised in 2014–15. The outcomes (numbers of cancellations, payment reductions and debts raised) appear low and suggest that Human Services could review its risk targeting and allocation of resources to determine if an improved result could be achieved.

Table 4.3: Service update review results, 2011–12 to 2014–15

|

Year |

Reviews completed |

Cancellations |

Payment reductions |

Debts raised |

|||

|

|

Number |

Number |

Value $ |

Number |

Value $ |

Number |

Value $ |

|

2011–12 |

29 489 |

234 |

154 977 |

2 498 |

460 867 |

3 724 |

2 704 566 |

|

2012–13 |

11 419 |

200 |

132 714 |

894 |

274 335 |

851 |

954 560 |

|

2013–14 |

5 832 |

75 |

54 147 |

286 |

134 825 |

135 |

292 926 |

|

2014–15 |

11 240 |

20 |

16 117 |

193 |

79 379 |

33 |

11 468 |

Note: These data show results of all service profiling reviews undertaken as a part of both the compliance program and as a part of Human Services’ daily management activities.

Source: Human Services.

Serious non-compliance investigations and reviews

4.7 The Productivity Commission’s 2011 inquiry report, Disability Care and Support73, noted that, while Human Services had implemented increasingly sophisticated measures for detecting fraud and undisclosed changes of circumstances for all welfare benefits, there were relatively few cases of convictions for fraud involving DSP. It concluded that the reason for this was that most people on DSP had impairments that genuinely adversely affect their employment prospects.

4.8 Serious non-compliance investigations and reviews arise when a DSP recipient is found to have failed to fully declare their circumstances or have provided false or misleading statements to Human Services or to treating medical professionals.74 Recipients are selected for an investigation when a high likelihood of criminal conduct has been identified.75 Investigations may arise from the application of proactive targeting methodologies, and the assessment of available third party data and public information tipoffs.

4.9 In 2014–15 Human Services undertook 703 serious non-compliance investigations and reviews. The results of these reviews for the years to 2014–15 are outlined in Table 4.4.

Table 4.4: Outcome of serious non-compliance investigations and reviews completed—2011–12 to 2014–15

|

Year |

Completed |

Cancellations |

Payment reductions |

Debts raised |

|||

|

|