Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Procurement of the Southern Positioning Augmentation Network

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Southern Positioning Augmentation Network (SouthPAN) will deliver high integrity positioning capability.

- The economic benefit of this is linked to automation solutions across a range of sectors and when fully implemented in 2028, is expected to also deliver safety-critical capability.

- The audit assessed if the procurement process undertaken by Geoscience Australia was compliant with the Commonwealth Procurement Rules (CPRs) and has secured a service that is likely to deliver value for money.

Key facts

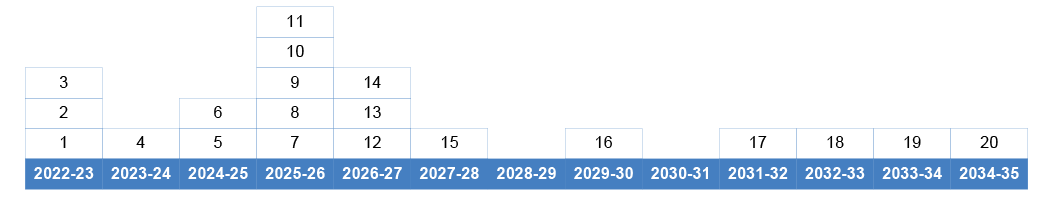

- A procurement process was undertaken between March 2020 and September 2022.

- On 16 September 2022 the Australian Government announced a $1.18 billion contract over 19 years with Lockheed Martin Australia Pty Ltd to deliver SouthPAN.

What did we find?

- Geoscience Australia’s procurement for SouthPAN was largely effective.

- The procurement process was largely compliant with the CPRs. Demonstrating value for money over the life of the contract will be challenging.

- There is a fit-for-purpose contract management framework in place.

- The performance framework for the measurement of outcomes is not effective.

What did we recommend?

- The Auditor-General made three recommendations related to: improving the administration of future procurement processes; implementing a clear complaints process for end-users; and improved verification over the accuracy of the services provided.

- Geoscience Australia agreed to the recommendations.

$6.2bn

Estimate of the value of SouthPAN services to the Australian economy over the next 30 years

2

Number of compliant tenders

$1.18bn

Value of the 19 year contract to deliver SouthPAN from 2022 to 2041

Summary and recommendations

Background

1. The Southern Positioning Augmentation Network (SouthPAN) is a Satellite-Based Augmentation System that will deliver international open standard signals for positioning. SouthPAN will support end-user services provided as signals, each with an internet service. Any person who has access to a device that is enabled for this technology (such as a mobile phone) will be able to receive the signals.

2. On 16 September 2022 the Australian Government announced a $1.18 billion contract over 19 years with Lockheed Martin Australia Pty Ltd (Lockheed Martin Australia) to deliver SouthPAN. In 2019, it was estimated the services SouthPAN delivers would be worth $6.2 billion to the Australian economy over the next 30 years.

Rationale for undertaking the audit

3. Officials from non-corporate Commonwealth entities are required to undertake procurements in accordance with the Commonwealth Procurement Rules (CPRs) and, in particular, achieve value for money. This performance audit was conducted to provide assurance to the Parliament that Geoscience Australia undertook an effective procurement that was compliant with the CPRs and has resulted in the potential to achieve value for money over the life of the contract.

Audit objective and criteria

4. The objective of the audit was to assess the effectiveness of Geoscience Australia’s 2020 to 2022 procurement of SouthPAN.

5. To form a conclusion against the objective, the following high-level criteria were adopted.

- Did Geoscience Australia deliver a compliant procurement process that will achieve value for money?

- Did Geoscience Australia put in place fit-for-purpose arrangements to effectively manage the SouthPAN contract?

- Did Geoscience Australia put in place fit-for-purpose arrangements to effectively assess the performance of SouthPAN?

Conclusion

6. Geoscience Australia’s 2020 to 2022 procurement of location positioning services with decimetre accuracy and high integrity capability was largely effective. It will be challenging for Geoscience Australia to demonstrate achievement of value for money over the life of the contract.

7. Geoscience Australia undertook an open and competitive procurement process. It complied with five and partly complied with two of the CPRs. Value for money was evaluated however the inconsistencies in the process and assessment meant it could not be determined if the procurement achieved value for money. Geoscience Australia did not effectively manage the perceived conflict of interest in relation to an incumbent provider tendering for a new contract. Due to the limitations in the study that estimated economic benefits of $6.2 billion over the next 30 years, Geoscience Australia will find it challenging to demonstrate value for money over the life of the contract.

8. Geoscience Australia has a fit-for-purpose contract management framework in place and is managing the contract effectively.

9. The contract performance management framework is fit-for-purpose, however, the performance framework for Geoscience Australia to demonstrate that the implementation of SouthPAN will generate benefits and achieve the outcomes of the contract is not effective.

Supporting findings

The 2020 to 2022 procurement

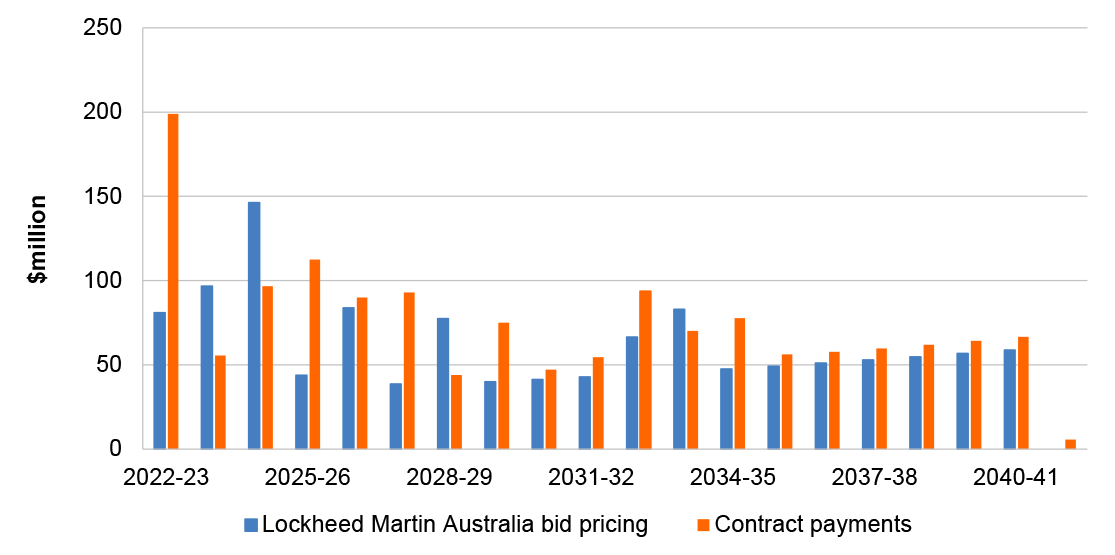

10. Geoscience Australia had fit-for-purpose governance structures in place for the procurement. Geoscience Australia complied with five of the seven CPR rule groups assessed. The value for money assessment did not align with the approved framework or the framework that was used. In relation to price and risk, the Tender Evaluation Report did not facilitate ease of comparison between the two tenderers. Two individuals with declared conflicts of interest were members of the evaluation panel. The internal probity officer was in the reporting line of the evaluation panel. (See paragraphs 2.1 to 2.82)

11. The contract negotiations resulted in Geoscience Australia achieving its minimum fall-back position, paying $32 million more and transferring non-insurable liability to the Commonwealth. In seeking funding from the Australian Government, Geoscience Australia stated that the expected outcome would be $6.2 billion in benefits to the Australian economy. Due to the limitations in the study supporting this statement, Geoscience Australia will find it challenging to demonstrate value for money over the life of the contract. (See paragraphs 2.83 to 2.102)

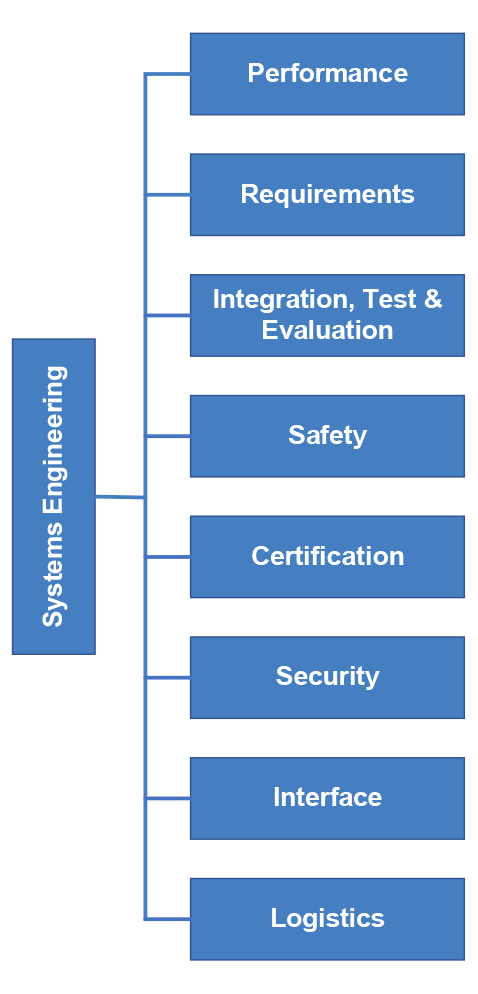

Contract management

12. The contract management framework in place aligns with the contract. Risk management is documented and there are governance arrangements in place for escalation to resolve matters that arise. The contract specifies 15cm 2 sigma precision, which facilitates accuracy down to 10cm. The contract clearly outlines the relationships between the contractor and sub-contractors. (See paragraphs 3.2 to 3.23)

13. Geoscience Australia has fit-for-purpose administrative arrangements in place to manage the contract. Reporting and meetings are occurring and Geoscience Australia is proactively engaging with Lockheed Martin Australia and the subcontractors. The Contract Management Plan reflects the requirements of the contract. As at 30 June 2023, the contractor is being paid correctly and milestone deliverables are on track. (See paragraphs 3.24 to 3.51)

Performance management

14. Geoscience Australia has controls in place to assess the outputs performance of SouthPAN. Geoscience Australia is using an adapted methodology from the SBAS Trial Economic Benefits Analysis Report to estimate the potential economic benefits to the Australian economy and therefore, the performance outcome of SouthPAN. This will not be effective for this purpose. (See paragraphs 4.2 to 4.16)

15. Geoscience Australia is responsible for managing complaints from end-users of SouthPAN services but is currently not effectively monitoring, reporting or evaluating this. There is an Engagement and Communications Strategy (and implementation plan), however three of the seven data sources for assessing uptake of the services will not be effective. SouthPAN is included in Geoscience Australia’s corporate reporting however the reporting is outputs based. There is limited verification over the accuracy of the SouthPAN signals and Geoscience Australia currently has no strategy or plan in place to effectively evaluate the impact of the services that will be delivered. (See paragraphs 4.17 to 4.42)

Recommendations

Recommendation no. 1

Paragraph 2.59

Geoscience Australia improve its future procurement processes by:

- clearly linking procurement objectives with evaluation criteria and sub-criteria, with a clear and transparent assessment methodology;

- greater adherence to the Department of Finance’s guidance on assessing value for money; and

- putting in place improved arrangements to ensure procurement decision-makers are assured of consistency in tender evaluations.

Geoscience Australia response: Agreed.

Recommendation no. 2

Paragraph 4.20

Geoscience Australia strengthen its complaints process to specifically capture issues relating to SouthPAN and improve its recording of the nature of contact, so that complaints can be effectively identified and the resolution action assessed for effectiveness.

Geoscience Australia response: Agreed.

Recommendation no. 3

Paragraph 4.43

Geoscience Australia assess the feasibility of attaining improved verification over the delivery of the accuracy of the SouthPAN signals across Australia and its maritime regions; and develop a corporate performance measure in line with this.

Geoscience Australia response: Agreed.

Summary of entity response

16. The proposed final report was provided to Geoscience Australia. The summary response to the report is provided below and the full response is at Appendix 1.

Geoscience Australia

Geoscience Australia (GA) welcomes the findings of the audit into the Southern Positioning Augmentation Network (SouthPAN) procurement. We appreciate the effort by the Australian National Audit Office (ANAO) to review the complex and technical procurement of the first Satellite-Based Augmentation System in the southern hemisphere.

Participating in the audit was a valuable opportunity for GA to reflect on what we could have been done better. We accept all of the ANAO’s recommendations; we particularly agree that improved consistency in the documentation of our decisions would have enabled us better to demonstrate the steps we took to comply with the Commonwealth Procurement Rules.

The world class technology being delivered through the SouthPAN program will be transformational for the citizens and economies of Australia and New Zealand. SouthPAN early Open Services have been available for over a year and are already being accessed by diverse industry sectors. GA is confident that value for money will be realised for SouthPAN over the life of the system, even though there will be challenges to quantify the economic benefits realised empirically, given that SouthPAN services are an open broadcast service.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Procurement

Performance and impact measurement

1. Background

Introduction

1.1 Geoscience Australia is a non-corporate Commonwealth entity within the Industry, Science and Resources portfolio. The Chief Executive Officer is the accountable authority.

1.2 The purpose of Geoscience Australia is to inform government, industry and community decisions on the economic, social and environmental management of the nation’s natural resources through enabling access to geoscientific and spatial information.1

1.3 In Geoscience Australia’s 2023–24 Corporate Plan, the Southern Positioning Augmentation Network (SouthPAN) is part of the broader Positioning Australia initiative that is part of the ‘creating a location-enabled Australia’ strategic priority. The relevant objective of the priority is to deliver ‘an accurate and reliable national positioning capability’, including ‘access to precise positioning services across Australia and its maritime zones’.

The Southern Positioning Augmentation Network

1.4 A Satellite-Based Augmentation System (SBAS) is a technology that delivers augmented Global Navigation Satellite System (GNSS) positioning. There are two user categories — aviation and non-aviation.

1.5 SBAS for aviation is an International Civil Aviation Organization certified safety-critical system2 that provides wide coverage of enhanced GNSS by transmitting augmentation information from geostationary satellites.3 The purpose is to improve the accuracy, integrity, availability and continuity of GNSS signals for aircraft navigation.4 SBAS for non-aviation supports a range of GNSS applications that focus on high-accuracy positioning solutions primarily for industry.

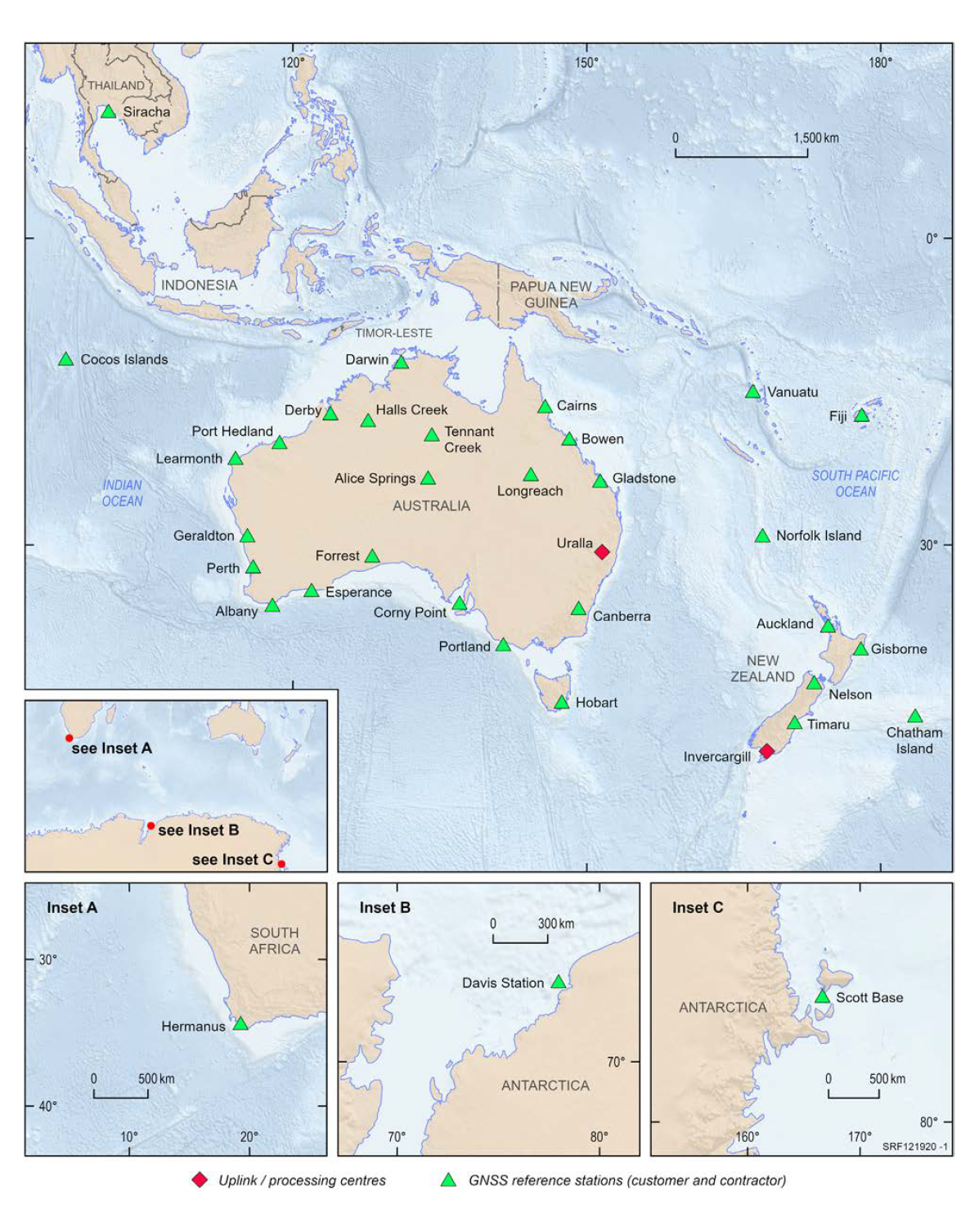

1.6 SouthPAN is an SBAS that will deliver international open standard signals for positioning. This will be achieved by combining and correcting data from the European Galileo GNSS, the USA’s Global Positioning System (GPS) and dedicated GNSS reference stations5 across Australia, New Zealand, the Pacific, Antarctica, Asia and Africa which will be uploaded as signals to a geostationary satellite for transmission to end-users.

1.7 SouthPAN will support three end-user services provided as signals6, each with an internet service. It has been stated publicly that these services will provide access to real-time location data to an accuracy of 10cm across Australia and its maritime regions. Any person who has access to a device that is SBAS enabled, such as a mobile phone, will be able to receive the signals.

1.8 The economic benefit of this satellite technology is linked to innovation in automation solutions across a range of sectors and when fully operational in 2028, is expected to also deliver safety-critical capability.

The SBAS trial and procurement for SouthPAN

1.9 A national network for positioning, navigation and timing (PNT) data is regarded by Geoscience Australia as ‘critical to Australia maintaining its competitive advantage’ for industries that use this data. A market solution has not emerged in Australia, a trend mirrored internationally with countries investing in a range of government funded PNT infrastructure since the 1990s.

1.10 The satellite technology of an SBAS can deliver positioning accuracy to 10cm without the need for mobile phone coverage, making it a solution for regional and remote Australia and instances when mobile coverage is not available. Australia’s position on the globe also affords an advantage over other countries in relation to observing global PNT data. This provides greater commercial and research opportunities for Australia.

1.11 Following a conversation at a conference in 2016 between a Geoscience Australia official and a representative from Lockheed Martin Space Corporation, Geoscience Australia received an offer by letter in July 2016 to test an SBAS in the Asia-Pacific region. The offer (which expired on 31 December 2016) was for an international consortium led by Lockheed Martin Space Corporation to absorb just under half the expected costs by waiving $10 million for access to a satellite payload.7 In October 2016, a different technology company advised its stakeholders by email (including the same Geoscience Australia official) that it had won the contract for a South Korean SBAS and that it remained ‘committed to the campaign to bring SBAS to Australia and New Zealand’.

1.12 In the Mid-Year Economic and Fiscal Outlook in December 2016, funding of $12 million over three years was provided to take up the Lockheed Martin Space Corporation offer to trial the benefits of high-accuracy satellite positioning technology for Australian industry. The New Zealand Government joined the project, providing an additional $2 million to extend the trial to New Zealand.

1.13 The SBAS trial or test-bed8 was delivered by the three commercial organisations that comprised the international consortium through contracts that were entered into in January 2017. The test-bed was delivered through: Lockheed Martin Space Corporation’s (LMC) uplink station9; GMV Innovating Solutions’ (GMV) software; Inmarsat’s 4F1 satellite; and Geoscience Australia’s existing Continuously Operating Reference Stations. No public procurement process was undertaken.

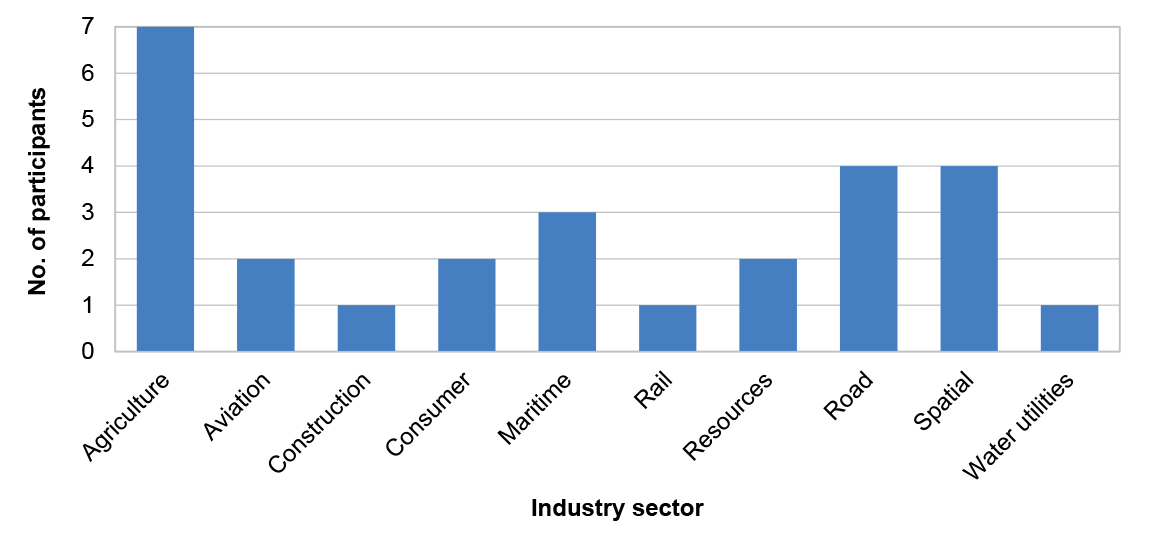

1.14 The SBAS trial, commencing in October 2017, involved 27 demonstrator projects across 10 industry sectors. During the SBAS trial, Geoscience Australia released four approaches to market (between 26 February 2018 and 27 August 2019) that sought information in relation to ‘identified areas of program risk’ for delivering an SBAS for Australia and New Zealand.

1.15 The decision to proceed with the SBAS was announced in the Federal Budget on 8 May 2018. The National Positioning Infrastructure Capability (NPIC) and the SBAS programs were announced as part of the Australian Government’s Australian Technology and Science Growth Plan with funding provided through the then National Digital Economy Strategy. The NPIC program was established with $64 million over four years and $11.7 million ongoing with the SBAS program receiving $160.9 million over four years and $39.2 million ongoing from 2022–23 for the purpose of building world leading positioning capability.

1.16 At the end of the demonstrator projects in January 2019, an economic benefits study based on the test-bed results was undertaken. This report of the study along with a test-bed overview and technical report were published in August 2019.10 11 12 In February 2019, the contract with Inmarsat was extended to 31 January 2024 at a cost of $19.6 million.13

1.17 The SBAS project (now called SouthPAN) is led by a partnership between Geoscience Australia and Toitū Te Whenua Land Information New Zealand (LINZ). The partnership between the countries was announced following the annual Australia-New Zealand Leaders’ Meeting on 28 February 2020, by the Prime Ministers of Australia and New Zealand under the Agreement Relating to Science, Research and Innovation Cooperation.14 Under a Joint Procurement Agreement, the parties agreed that Geoscience Australia would be responsible for undertaking the procurement with LINZ retaining a decision-making role. New Zealand also made a financial contribution to the procurement process and the contract.

1.18 The procurement commenced in March 2020 and was designed as an open and competitive tender, with a single approach to market for products and services to establish and maintain SouthPAN as a service. The transmission of the three test signals continued until the contracts with LMC and GMV ended on 31 July 2020. Due to the bids from the tenderers exceeding the available funding, between November 2020 and March 2021 Geoscience Australia undertook an ‘offer definition and improvement’ process followed by a ‘best and final offer’ process against a reduced scope for the request for tender. The bids again exceeded the available funding.

1.19 In October 2021 contract negotiations commenced with the preferred tenderer, Lockheed Martin Australia Pty Ltd (Lockheed Martin Australia). In the Mid-Year Economic and Fiscal Outlook in December 2021, additional funding of $521.8 million over 20 years from 2021–22 was provided towards the procurement to deliver the Australian Government’s publicly announced commitment to provide 10cm accuracy through SouthPAN across Australia and its maritime zones. On 13 September 2022 the contract for $1.18 billion was signed. On 26 September 2022, the test-bed was reactivated and early open services became available. The services that SouthPAN is expected to deliver are to become progressively available with a fully operational and certified safety-critical system expected to be in place by 2028.

Rationale for undertaking the audit

1.20 On 16 September 2022 the Australian Government announced a $1.18 billion contract over 19 years with Lockheed Martin Australia Pty Ltd to deliver SouthPAN. In 2019, it was estimated the services SouthPAN delivers would be worth $6.2 billion to the Australian economy over the next 30 years.

1.21 The audit provides assurance to the Parliament whether Geoscience Australia undertook an effective procurement that was compliant with the Commonwealth Procurement Rules and has resulted in the potential to achieve value for money over the life of the contract.

Audit approach

Audit objective, criteria and scope

1.22 The audit objective was to assess the effectiveness of Geoscience Australia’s 2020 to 2022 procurement of SouthPAN.

1.23 To form a conclusion against the objective, the ANAO examined:

- Did Geoscience Australia deliver a compliant procurement process that will achieve value for money?

- Did Geoscience Australia put in place fit-for-purpose arrangements to effectively manage the SouthPAN contract?

- Did Geoscience Australia put in place fit-for-purpose arrangements to effectively assess the performance of SouthPAN?

1.24 The audit assessed whether the 2020 to 2022 procurement process complied with Commonwealth Procurement Rules (CPRs) and has the potential to deliver value for money over the life of the contract. It also assessed the effectiveness of Geoscience Australia’s contract and performance management of Lockheed Martin Australia to deliver SouthPAN. The audit scope did not include:

- the procurement of various satellite payload/navigation services;

- the expression of interest process from landowners to host GNSS reference station sites;

- an analysis of the services provided through SouthPAN;

- the quality or technical support of the services provided through SouthPAN;

- user satisfaction with the services; or

- the direct arrangements that exist between Lockheed Martin Australia and its subcontractors, beyond how Geoscience Australia maintains control of such arrangements.

Audit methodology

1.25 The audit involved:

- examining Geoscience Australia’s records;

- conducting system walkthroughs; and

- meetings with relevant staff and contractors.

1.26 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $399,689.

1.27 The team members for this audit were Rowena Thomson, Sean Brindle, Ben Thomson, Caitlin Williams, Renina Boyd and Michelle Page.

2. The 2020 to 2022 procurement

Areas examined

The ANAO examined whether an open and competitive procurement process was conducted that complied with the Commonwealth Procurement Rules (CPRs) and demonstrated achievement of value for money.

Conclusion

Geoscience Australia undertook an open and competitive procurement process. It complied with five and partly complied with two of the CPRs. Value for money was evaluated however the inconsistencies in the process and assessment meant it could not be determined if the procurement achieved value for money. Geoscience Australia did not effectively manage the perceived conflict of interest in relation to an incumbent provider tendering for a new contract. Due to the limitations in the study that estimated economic benefits of $6.2 billion over the next 30 years, Geoscience Australia will find it challenging to demonstrate value for money over the life of the contract.

Areas for improvement

The ANAO made one recommendation aimed at improving the consistency and transparency of future procurement processes.

The ANAO also suggested that Geoscience Australia consider: improved probity in relation to managing conflicts of interest and the selection of internal probity officers; and ensuring administrative processes address the requirements for liability provisions in contracts with third parties.

2.1 Following a trial of Satellite-Based Augmentation System (SBAS) services, Geoscience Australia commenced a procurement process in 2020 to deliver positioning services with decimetre accuracy and high integrity positioning data.15 Officials from non-corporate Commonwealth entities are required to undertake procurements in accordance with the CPRs and, in particular, achieve value for money.

Did the 2020 to 2022 SouthPAN procurement comply with the CPRs?

Geoscience Australia had fit-for-purpose governance structures in place for the procurement. Geoscience Australia complied with five of the seven CPR rule groups assessed. The value for money assessment did not align with the approved framework or the framework that was used. In relation to price and risk, the Tender Evaluation Report did not facilitate ease of comparison between the two tenderers. Two individuals with declared conflicts of interest were members of the evaluation panel. The internal probity officer was in the reporting line of the evaluation panel.

Governance arrangements for the procurement

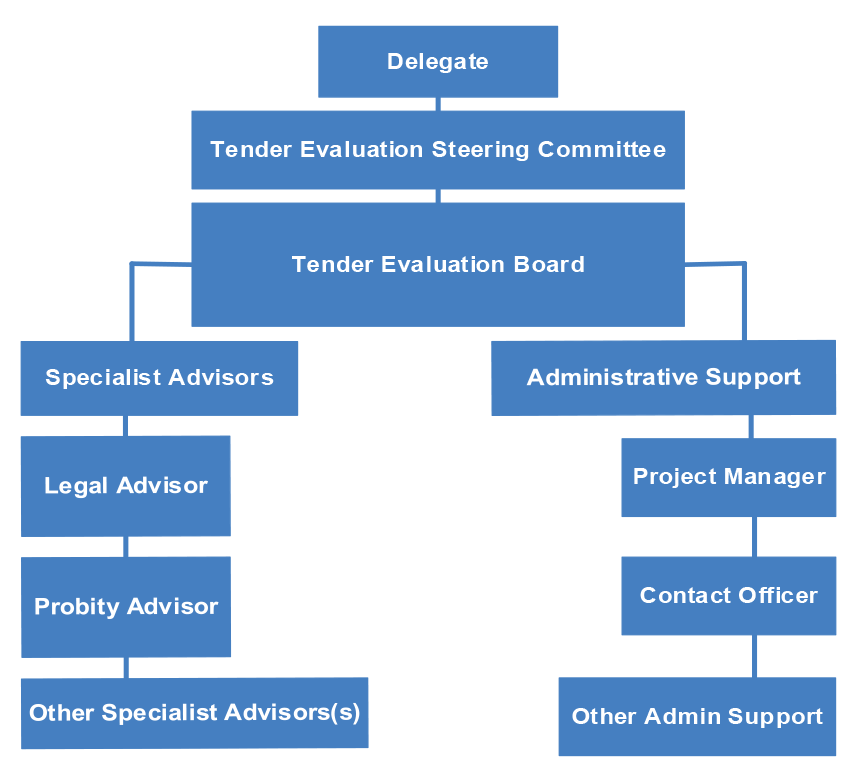

2.2 The Tender Evaluation Plan for the procurement was approved by the Chief Executive Officer (CEO) of Geoscience Australia on 21 July 2020. The Tender Evaluation Plan outlined the roles and responsibilities of the delegate (the CEO), the Tender Evaluation Steering Committee and the Tender Evaluation Board. The governance structure is provided in Figure 2.1.

Figure 2.1: Governance structure for the SouthPAN procurement

Source: Geoscience Australia’s Tender Evaluation Plan.

2.3 The role of the Tender Evaluation Steering Committee was to oversee the governance of the request for tender process. It comprised four senior executive service officers — two from Geoscience Australia and two from Toitū Te Whenua Land Information New Zealand (LINZ). An additional member from the Department of Defence joined the committee in October 2021. Substantive changes to the Tender Evaluation Plan, such as changes to the board or steering committee membership, required approval by the CEO. This occurred on 20 October 2021.

2.4 The role of the Tender Evaluation Board was to prepare a draft Tender Evaluation Report for endorsement by the Tender Evaluation Steering Committee and then prepare a final Tender Evaluation Report for decision by the CEO. It comprised the Chair (Geoscience Australia), a Deputy Chair (LINZ) and two evaluators (Geoscience Australia and LINZ), all of whom were executive level officers. The Tender Evaluation Board was supported by probity, legal, commercial, cyber security, technical and project management advisers as required.

2.5 There were two other governance groups outside the procurement process — the Joint Governance Board of Management and the Positioning Program Board.

- The Joint Board of Management was established in November 2019 to coordinate the planning and scheduling of the implementation of SouthPAN between Australia and New Zealand. In September 2022 it was replaced by the Joint Governance Board of Management. It is responsible for: developing bilateral agreements; endorsing technical requirements; agreeing cost sharing arrangements; the communication and implementation strategies; major procurement recommendations; changes to scope, cost or timing; monitoring program risk and the realisation of program benefits; and providing program assurance. There are currently five members — one each from Geoscience Australia and LINZ, and three independent members.16 The chair position alternates between Australia and New Zealand. The Geoscience Australia and LINZ members report to the head of their respective agencies.

- The Positioning Program Board provided (and continues to provide) strategic guidance, advice and oversight of Geoscience Australia’s Positioning Program17 within the context of Geoscience Australia’s National Positioning Infrastructure Branch activities. It also provides direction on management of high or extreme risks and decision making, as well as endorsing or not endorsing suggested resolutions, that may affect progress of the Positioning Program.

2.6 The members of the Tender Evaluation Board were different to those of the Tender Evaluation Steering Committee. The Chair of the Tender Evaluation Board reported to the CEO through the Tender Evaluation Steering Committee. During the planning of the procurement and up until the Tender Evaluation Plan, the Chair of the Tender Evaluation Board was also a member of the Joint Board of Management. Two members of the Tender Evaluation Steering Committee (including the Chair) were also members of the Joint Board of Management throughout the procurement.

The procurement process

2.7 Prior to the request for tender, there were four requests for information released on 26 February 2018, 17 January 2019, 3 May 2019, and 27 August 2019. Based on the information received from these, the request for tender invited suppliers to build, operate and maintain SouthPAN.

2.8 Before identifying whether a single stage open tender was appropriate, a range of options for the procurement were assessed by Geoscience Australia, including: a panel arrangement or multi-use list through an open tender; leveraging a whole-of-government arrangement or an existing government contract; a limited tender; funded prototypes developed by short-listed tenderers to be coordinated by Geoscience Australia; and a multi-stage open tender.

2.9 The Senior Responsible Officer, who was also the Chair of the Positioning Program Board (see paragraph 2.5), approved the Procurement Strategy on 1 August 2019, noting that: ‘The option of single stage Open Tender for seeking a proven technical solution delivered by a service provider with a proven track record of establishing and sustaining similar capabilities in recent years is recommended as the preferred option’.

Requests for information

2.10 Geoscience Australia undertook the requests for information to ‘reduce the risk of failing to fully understand what needs to be done or how it will be done’. The goal was to enter into a contract arrangement with a single service provider ‘to deliver and sustain a turn-key solution as an end-to-end managed service — “SBAS as a service”’. It was regarded by Geoscience Australia as a complex system that was required to be ‘designed to meet global performance requirements under Australia and New Zealand’s unique service area and space weather conditions’.

2.11 On 27 August 2019, Geoscience Australia published a fourth request for information. It closed on 5 November 2019 and the resulting Market Analysis Report was approved on 19 December 2019. It outlined that the market analysis validated the single stage open tender approach as the ‘most effective way of achieving value for money for Geoscience Australia and Land Information New Zealand’.

2.12 Potential suppliers gave feedback on: potential solutions and services; service delivery performance; service delivery timelines; contractual arrangements; and refined indicative pricing with seven potential suppliers giving presentations to Geoscience Australia. Geoscience Australia assessed that four of the seven potential suppliers proposed solutions that closely aligned with the project requirements. Geoscience Australia concluded that there was a competitive market sector with the capacity to deliver an SBAS and maintain it. At the same time, Geoscience Australia noted that while the four potential suppliers that proposed closely aligned solutions had established and built an SBAS, and two others were able to provide satellite payload services, none had yet run an ongoing SBAS service.

2.13 The Market Analysis Report documented that the potential suppliers identified additional risk associated with: a lack of clarity around software integration; the tight timeframe to deliver set by Geoscience Australia; and the challenges associated with certifying an SBAS service for aviation. One potential supplier also raised the concern that another supplier of SBAS products had an advantage over the others, due to a small number of project requirements and ‘emphasised the importance of making requirements supplier/technology agnostic’. This feedback was considered by Geoscience Australia in reviewing the requirements.

The request for tender

2.14 On 11 March 2020 the CEO approved the request for tender for release. In the email to the CEO requesting approval, the Joint Board of Management advised that the request for tender built on the test-bed ‘to specify a full operational SBAS’ and that ‘this experience has proved highly valuable in the development of system requirements’. It also noted that feedback to the SBAS Function and Performance Specification request for information had been incorporated into ‘very mature system specifications’ which had ‘substantially reduced the implementation risk of the program’.

2.15 On 13 March 2020, Geoscience Australia published a request for tender on AusTender for the Southern Positioning Augmentation Network (SouthPAN). Between 25 March 2020 and 19 July 2020, fourteen addendums were issued that provided more information to tenderers. At the closing date of 22 July 202018, responses were received from Lockheed Martin Australia Pty Ltd (Lockheed Martin Australia) and two others.

2.16 The request for tender documentation outlined that the purpose of the procurement was to develop and maintain a positioning augmentation network to improve the capability of the positioning already provided by the GPS and Galileo satellite constellations. The expectation was for improved positioning capability to benefit user applications in the agriculture, construction, resources and utilities as well as decimetre accuracy (with a 40 minute convergence time), and sub-metre level accuracy (in real time) for the aviation and road transport sectors. Services to be delivered included: open, internet and safety-of-life.19

2.17 The Tender Evaluation Plan outlined the five stages of the evaluation:

- Stage 1 — compliance screening;

- Stage 2 — detailed evaluation against the evaluation criteria;

- Stage 3 — risk assessment and verification activities (which could also be conducted as part of other evaluation stages);

- Stage 4 — value for money assessment; and

- Stage 5 — the Tender Evaluation Report.

2.18 The report on the compliance screening included: the tenders received; details of any late tenders; the completeness of the tenders; compliance of the tenders with the minimum content and format requirements or conditions for participation; and any recommendations regarding tenders assessed as non-compliant. The report recommended that Lockheed Martin Australia and another tenderer progress to Stage 2, which the Tender Evaluation Steering Committee approved on 5 August 2020. The third tenderer was not recommended to progress as the tender was not compliant.

2.19 The nine evaluation criteria for the procurement and the weightings for each are outlined in Table 2.1. Geoscience Australia advised that there were ‘several workshops during the week of 2 March 2020 to finalise the weightings for the evaluation criteria, attended by the Director, Project Manager, Senior Engineer, and Procurement Officer who used their professional experience and judgement — including comparing alternate models — to establish the weightings’.

2.20 For the weighted criteria, the methodology was a comparative qualitative rating on a scale out of 100.20 For criteria six to nine an order of merit was established. Pricing was assessed against four ratings: unacceptable; not favourable; acceptable; and favourable. Ten categories21 of risk were assessed against a likelihood scale of five (rare to almost certain) and degree of impact, also on a scale of five (minor to catastrophic), to produce an overall level of risk. Under the approved Tender Evaluation Plan each member of the Evaluation Tender Board was required to make an individual qualitative assessment against the criteria. Agreement by consensus followed in relation to an overall assessment for each evaluation criteria for each tenderer.

Table 2.1: The weighted and non-weighted evaluation criteria

|

Criteria number |

Evaluation criteria |

Weighting |

Description |

|

1 |

Project management |

40% |

Demonstrated understanding, and ability to provide project management. |

|

2 |

Service management |

25% |

Demonstrated understanding and ability to provide service management. |

|

3 |

Functional and performance specification |

20% |

Demonstrated understanding and suitable approach to delivering the functional and performance specifications. |

|

4 |

Demonstrated experience |

5% |

Demonstrate a strong and consistent capacity through relevant experience. |

|

5 |

Resource management and personnel |

10% |

Suitability of key personnel and subcontractors and their roles, including relevant qualifications and experience. |

|

6 |

Indigenous participation plan (IPP) |

Nil |

Past performance, including history of compliance with minimum mandatory requirements (MMR), and extent to meeting IPP MMRs for this tender. |

|

7 |

Economic benefit |

Nil |

Economic benefit to the Australian economy. |

|

8 |

Price |

Nil |

Tenderer’s costs and pricing in meeting the obligations set out in the draft contract and their contribution to value for money for Australian Government. |

|

9 |

Risk |

Nil |

Risks not assessed in relation to the above criteria including, but not limited to:

|

Source: ANAO analysis of the Request for Tender documentation.

2.21 Geoscience Australia had an evaluation template for the Tender Evaluation Board members to assess the tenderers. A colour-code rating was applied with green for ‘outstanding’, ‘very good’, or ‘good’; amber for ‘fair’, ‘acceptable’, or ‘marginal’; and red for ‘poor’, ‘very poor’, or ‘unacceptable’. There were also free text fields for each evaluator to identify the strengths, weaknesses and risks.

2.22 Grey Advantage Consulting reviewed the criteria evaluation templates for Geoscience Australia and noted as at 18 June 2020 that the templates were ‘overly detailed and not easily linked to the procurement objectives described in the Procurement Plan or to the high level evaluation criteria. This will make scoring of the high level evaluation criteria extremely difficult. There is a risk that the audit trail provided by the Tender Responses to the Requirements will not be sufficient to evidence achievement of the procurement objectives and demonstrate value for money. Neither the requirements or the evaluation criteria have been mapped to the procurement objectives.’

The best and final offer process

2.23 At the end of October 2020, evaluation on pricing commenced. Both tenderers that progressed to Stage 2 were in excess of the approved budget. This resulted in Geoscience Australia moving to an offer definition and improvement process22, followed by inviting the tenderers to submit their best and final offers in December 2020. The requirement for the provision of government-owned ground uplink stations was removed in an effort to reduce costs.

- The original SBAS model assumed the Global Navigation Satellite Systems (GNSS) ground reference stations and the uplink stations would be owned by the Commonwealth. The uplink stations generate navigation signals and transmit those signals to the satellite payload. To receive and verify the data for the signal, uplink stations house central processing facilities23, antennas (satellite dishes) and network (telecommunications) infrastructure.24 Geoscience Australia advised the Australian Government that the alternative of leasing industry owned uplink stations would result in a saving of $105.2 million over 15 years and minimise delays.

2.24 Prior to the offer definition and improvement process, Lockheed Martin Australia proposed that two of the five major system technical reviews that would form part of the eventual contract be conducted prior to the awarding of the contract. Geoscience Australia sought legal advice from MinterEllison, which stated in an email dated 17 December 2020: ‘We understand that the tenderer has proposed that by undertaking early works, it will be better placed to meet the proposed timetable for delivery of the operating system into service and it can reduce the contingency in its price accordingly’. Geoscience Australia did not seek advice from the other participant in the offer definition and improvement process as to whether it would like to put forward a similar proposal.

- Geoscience Australia undertook a risk review in relation to the Lockheed Martin Australia proposal. SHOAL Group identified that the risks included: a perceived bias towards the tenderer; the criteria and requirements for the system technical reviews were not yet agreed; and it may result in a significant price increase (or withdrawal) due to unexpected project risks being identified. Following Lockheed Martin Australia being selected as the preferred tenderer, an agreement was executed on 7 December 2021.25 The mitigation was for a number of contract documents to be agreed between the parties before the system reviews were undertaken.

2.25 In the letter inviting tenderers to provide their ‘best and final offer’ the amount available was identified as $750 million. The tenderers were requested to split the pricing of their best and final offers into separate capabilities so Geoscience Australia could better understand the service component costs. The best and final offers, while less than the original bids, were still 52.9 per cent above the available budget.26

- The satellite payload component of both the original bids was deemed by Geoscience Australia to be excessively expensive27 so in July 2021, the CEO approved removing the two payloads28 from the procurement and undertaking separate procurement processes for these. This approach was identified by Geoscience Australia to potentially save an estimated $100 million.

2.26 The best and final offer period closed on 15 March 2021 and the CEO was briefed that despite the removal of the two satellite payloads, both bids were again significantly above the allocated budget and proceeding to contract award was not possible. This resulted in the CEO approving continuation of the request for tender while Geoscience Australia made a submission to the Australian Government in the December 2021 Mid-Year Economic and Fiscal Outlook for additional funding of $521.8 million, which was received.

- The separate procurement for the first satellite payload was released to the market between 1 October 2021 and 17 December 2021. There were no respondents. Geoscience Australia briefed the CEO about the need for revisions to the requirements following engagement with the market and the preferred tenderer29 for SouthPAN. An amendment to the request for tender was released and the procurement resulted in Inmarsat being awarded the contract on 1 May 2023. The procurement for the second payload is expected to be completed in 2024. The expected saving of $100 million for separating these procurements from the SouthPAN procurement is unlikely to be achieved.

Compliance with the CPRs

2.27 The procurement commenced in March 2020 and the ANAO assessment of the procurement was against the April 2019 version of the CPRs in the period up to the release of updated CPRs in December 2020. For procurement activities that occurred after December 2020, the updated CPRs were applied. Table 2.2 summarises Geoscience Australia’s compliance.

Table 2.2: Procurement of SouthPAN CPRs compliance

|

CPR group assesseda |

Assessment results |

|

Value for money (Part 4) |

▲ |

|

Encouraging competition (Part 5) |

◆ |

|

Efficient, effective, economic and ethical (Part 6)b |

▲ |

|

Accountability and transparency (Part 7) |

◆ |

|

Procurement risk (Part 8) |

◆ |

|

Procurement method (Part 9) |

◆ |

|

Additional rules (Part 10)c |

◆ |

Key: ◆ Geoscience Australia’s SouthPAN procurement complied with the CPRs

● Geoscience Australia’s SouthPAN procurement largely complied with the CPRs

▲ Geoscience Australia’s SouthPAN procurement partly complied with the CPRs

■ Geoscience Australia’s SouthPAN procurement did not comply with the CPRs

Note a: Depending on the timing of procurement activities, assessment was against the April 2019 or December 2020 CPRs.

Note b: Ethical behaviour in this context includes conflicts of interest, equitable treatment of potential suppliers and tenderers, probity advice, gifts or benefits, use of public resources, complying with relevant legislation and the handling of complaints.

Note c: The additional rules in Division 2 relate to conditions for limited tender, request documentation, specifications, conditions for participation, minimum time limits, late submissions, receipt and opening of submissions and awarding of contracts. ‘Minimum time limits’ in this context refers to the timeframes published on AusTender relating to applicant submissions and responses to the various stages of the procurement.

Source: ANAO analysis of CPRs compliance.

Value for money

The value for money framework

2.28 The CEO approved Tender Evaluation Plans30 set out that the value for money assessment would consider, including but not limited to:

- the quality and fitness for purpose of the proposal (technical worth against the scored and weighted evaluation criteria);

- financial assessment of the pricing information;

- the extent to which the proposed Indigenous Participation Plan met the mandatory minimum requirements;

- the extent to which potential benefit to the Australian economy may be achieved;

- the extent to which the proposal met the broader outcomes of works and services undertaken in NZ; and

- any other risks that the entity considers relevant.

2.29 The Tender Evaluation Report states that the Tender Evaluation Board undertook a value for money assessment which considered:

- the objectives of the procurement;

- the scores for each of the five weighted evaluation criteria;

- the orders of merit for the IPP and Economic Benefit evaluation criteria;

- the price, including the schedule of payments and abatement regime;

- the risk profile;

- non-contract costs, including consideration of all costs, fees, allowances and charges associated with the implementation and completion of the obligations set out in the Draft Contract; and

- the combination of Contract and non-contract costs referred to as the Total Cost of Ownership.

2.30 Geoscience Australia advised that that reference in the Tender Evaluation Report to consideration being given to the objectives of the procurement was ‘an editorial inconsistency in the production of the report’. Geoscience Australia stated ‘at no stage were the “objectives of the procurement” used to evaluate tenders’ and that ‘the evaluation described in the Tender Evaluation Report fully meets the intent of the Tender Evaluation Plan’. The variances in the approach between what was planned and what was in the report warranted the Tender Evaluation Plan being updated by the CEO as the approving officer (see paragraph 2.3). This did not occur.

2.31 A presentation to the Tender Evaluation Steering Committee in July 2021 provided an overview of the Tender Evaluation Board’s value for money assessment for both tenderers and their recommendation. The value for money slides simply described the weighted criteria and the non-weighted criteria assessments (without explicit reference to the value for money assessment) as did the value for money section in the Tender Evaluation Report. The briefing and the Tender Evaluation Report were not clear or transparent as to how the value for money assessment linked to the procurement objectives.

Table 2.3: Tender Evaluation Board value for money overview presented to the Tender Evaluation Steering Committee

|

|

Weighting |

Lockheed Martin Australia |

The other tenderer |

|

Project Management |

40% |

85 |

73 |

|

Service Management |

25% |

87 |

72 |

|

Function and Performance Specification |

20% |

79 |

69 |

|

Demonstrated Experience |

5% |

78 |

90 |

|

Resource Management and Personnel |

10% |

85 |

73 |

|

Total |

100% |

84 |

73 |

|

Lockheed Martin Australia |

The other tenderer |

||

|

Indigenous Participation |

1 |

2 |

|

|

Economic Benefit |

1 |

2 |

|

|

Pricing |

2 |

1 |

|

|

Riska |

- |

- |

|

|

Order of Merit |

1 |

2 |

|

Note a: A rating for risk was not documented in numerical form.

Source: ANAO analysis of Geoscience Australia Tender Evaluation Steering Committee briefing.

The value for money assessment

2.32 The value for money assessment (Stage 4) was conducted on 22 July 2021 after the best and final offer process at a meeting of the Tender Evaluation Board. The purpose was for the Board to reach consensus on all the criteria and decide if any additional narrative was required for the 31 March 2021 draft of the Tender Evaluation Report. The minutes recorded that the assessment of Lockheed Martin Australia and the other tenderer was discussed in the context of the best and final offer submissions. The final Tender Evaluation Report (approved by the CEO on 16 September 2021) and the Tender Evaluation Board’s assessment were reviewed to determine how the value for money assessment was documented.

2.33 Two of the weighted criteria ratings were varied following the best and final offer process: Criterion 3 — Functional and Performance Specification; and Criterion 4 — Demonstrated Experience.

2.34 The other tenderer was reduced by five points for Criterion 3 as Lockheed Martin Australia:

- had a more compact site footprint;

- addressed the durability of stations in the hot and remote locations;

- included improved redundancies of uplink facilities and provided more information and data supported claims around achievable system performance; and

- the site architecture supported better system performance (accuracy and availability provided by long-distance sites in Thailand and South Africa).

It was also noted that the other tenderer ‘had some compliance issues with the minimum service area requirement, particularly in relation to northern New Zealand and northwest Australia’.

2.35 For Criterion 4, Lockheed Martin Australia was reduced by two points as: ‘[Lockheed Martin Australia] brings significant experienced staff meeting the minimum requirement but does not have organisational experience with certifying SBAS’ while the other tenderer had ‘significant and current experience in developing other SBAS and the certification process’.

2.36 Following the request for tender, the other tenderer was ranked ahead on Criterion 6 (Indigenous Participation Plan). Lockheed Martin Australia requested an exemption for this criterion, which it did not receive. In its best and final offer submission, Lockheed Martin Australia updated its tender to include a plan to recruit and train at least two Indigenous personnel to work at its Uralla uplink facility. The Tender Evaluation Board meeting minutes stated that ‘both the tenderers are equivalent’. The Tender Evaluation Board stated that Lockheed Martin Australia had ‘a detailed plan’ compared to the other tenderer which had ‘a generic plan’ to attain at least four per cent full-time equivalent Indigenous employees or sub-contractors through the capital works set-up and maintenance phases.31

2.37 As both tenderers proposed undertaking much of the work outside Australia, the Tender Evaluation Report noted that this necessarily limited the economic benefits to infrastructure development, operation and maintenance for both tenderers. The primary reason given for Lockheed Martin Australia ranking ahead of the other tenderer for Criterion 7 (Economic Benefit) was because it had a ‘superior plan for the commercial exploitation of the system outside of Australia and New Zealand when compared to [the other tenderer]’.32 The minutes from the meeting on 16 July 2021 note that a LINZ member of the Tender Evaluation Board queried whether a tied order of merit was acceptable if there was no clear basis on which to separate the tenderers. The Chair said that while the other tenderer had improved on the ability to on-sell the services during the offer and definition improvement process, that the Chair ‘was comfortable that [Lockheed Martin Australia] provided a greater degree of confidence that they would create a business opportunity and this would produce an economic benefit’. The summary for these sections in the Tender Evaluation Report stated that Lockheed Martin Australia had a ‘well thought out plan’ compared to ‘a plan’ for the other tenderer.

2.38 Despite the value for money framework stating the Tender Evaluation Board would consider the order of merit for the Indigenous Participation Plan and Economic Benefit evaluation criteria (see paragraph 2.29), in the value for money section of the Tender Evaluation Report it was stated: ‘Whilst the Tender Evaluation Board considered each Tenderer’s response to the non-weighted Indigenous Participation Plan and Economic Benefit Evaluation Criteria, it ultimately concluded they did not affect the overall value-for-money’.

2.39 A Deloitte Australia draft pricing analysis33 dated 9 April 2021 informed the Tender Evaluation Board’s evaluation of the pricing schedules submitted in response to the best and final offer process. The pricing analysis stated that the other tenderer’s bid had a variance of 73 per cent more than Lockheed Martin Australia for the first year. In relation to Lockheed Martin Australia, the Tender Evaluation Report stated it was a strength that the pricing schedule ‘ramps up over the first three years of the contract so expenditure is deferred until late in the establishment phase’. The other tenderer’s proposal included greater up-front costs in the first year, with these decreasing over time. This was identified as a weakness in the Tender Evaluation Report. Geoscience Australia advised that the guidance to tenderers was to price according to effort each year.

2.40 In the pricing analysis, the other tenderer’s bid was significantly less than Lockheed Martin Australia’s: ‘[Lockheed Martin Australia’s] total project cost is consistently around 5%-15% more expensive than that of [the other tenderer] across the incremental option and all proposed alternatives, with an average variance of $82.94m or 9.54%’. This was identified in the analysis as a weakness for Lockheed Martin Australia but was not included in the Tender Evaluation Report. The pricing analysis also stated that the other tenderer’s ‘pricing alternatives are less transparent compared to [Lockheed Martin Australia’s] alternatives options’ and that it was ‘noticeably harder to comprehend [the other tenderer’s] set of assumptions’.

2.41 The meeting minutes record for Criterion 8 (Price) state that the Tender Evaluation Board ‘agreed that price is not a differentiating factor’ as both ‘proposed solutions were favourable and the price difference was negligible over the life of the project’, both were ‘within budget and within five per cent of each other’ and that the other tender had provided ‘the slighter cheaper solution’. The Tender Evaluation Report included a comparison on Total Cost of Ownership (the combined contract and non-contract costs) resulting in the bids being within 4.3 per cent of each other.

2.42 The other tenderer ranked first against pricing, which was Criterion 8, with a total cost projection less than Lockheed Martin Australia. The other tenderer also had no ‘tender validity extension’ cost, whereas Lockheed Martin Australia specified that the price would increase by $19.26 million if the contract was awarded after 1 January 2022. The Tender Evaluation Report stated: ‘the Tender Evaluation Board presumes this cost to be sunk and is included in [Lockheed Martin Australia’s] price’, but this was not stated to be a weakness.

2.43 Lockheed Martin Australia was deemed to have an overall lower risk profile (Criterion 9), however, both tenderers were described in the Tender Evaluation Report as having an acceptable level of risk. Of the 10 categories, Lockheed Martin Australia was rated as having low risk for three and very low risk for seven. The other tenderer was rated as having medium risk for three, low risk for two and very low risk for five.

2.44 In determining the risk profiles of the tenderers, the Tender Evaluation Board included the following considerations.

- It was likely a contract ‘…could be negotiated more quickly with Lockheed Martin Australia when compared to [the other tenderer] due to the significance of non-compliances with the contract and technical requirements’ (see paragraphs 2.46 to 2.50).34

- Negotiation with the other tenderer would likely result in an increase in the Total Cost of Ownership35, due to an increase in the contract price due to invalid assumptions by the other tenderer, or an increase in non-contract costs should the scope of the procurement be reduced to make the assumptions valid (see paragraph 2.51 to 2.54).

- Provision of an additional contingency amount of $44.695 million was needed against the establishment phase of the contract to clarify scope and mitigate risk for the other tenderer. The statement in the Tender Evaluation Report was that scope clarification and risk mitigation would result in a) an increase in price following negotiations; b) contract changes following contract award; c) organisational effort from Geoscience Australia and LINZ to deliver the full scope of the project; or d) a combination of the above (see paragraphs 2.55 to 2.56).

2.45 These three considerations were assessed against the supporting evidence in the Tender Evaluation Report.

The significance of non-compliances with the contract and technical requirements

2.46 The Tender Evaluation Report states that in relation to comparing the contract non-compliance between the two tenderers they were both rated good and that ‘Overall, [Lockheed Martin Australia’s] Tender is marginally more compliant and shifts less risk to Geoscience Australia but the differential between the Tenders remains small’. For commercial compliance, there were no ‘overt commercial risks or concerns’ for either tenderer. For legal compliance, non-compliances were grouped by significance. Table 2.4 outlines the assessment.

Table 2.4: Legal non-compliance assessment

|

Significance of non-compliance |

Lockheed Martin Australia |

The other tenderer |

|

Fundamental shift of risk from the tenderer to Geoscience Australia regarding a material contract principle |

0 |

0 |

|

Very material shift of risk from the tenderer to Geoscience Australia regarding a material contract principle |

5 |

5 |

|

Significant shift of risk from the tenderer to Geoscience Australia regarding a principle |

115 |

112 |

|

Lower level significance shift of risk from the tenderer to Geoscience Australia regarding a principle but which is more than an immaterial drafting issue |

73 |

87 |

|

Minor drafting proposed by tenderer which has little if any substantive effect |

23 |

15 |

Source: ANAO analysis of the Tender Evaluation Report.

2.47 The details of the non-compliances were grouped into 24 themes (which reflected terms in the contract) and assessed. Table 2.5 outlines the risk ratings against these.

Table 2.5: Legal non-compliance risk rating

|

Risk rating |

Lockheed Martin Australia |

The other tenderer |

|

Medium |

8 |

10 |

|

Low |

15 |

14 |

|

No ratinga |

1 |

0 |

Note a: For one theme, the other tenderer received a risk rating, there was no risk identified for this theme for Lockheed Martin Australia.

Source: ANAO analysis of the Tender Evaluation Report.

2.48 For the technical compliance assessment, Lockheed Martin Australia was assessed as being 95.8 per cent compliant with the Statement of Requirements and the other tenderer was found to be 99.6 per cent compliant. For the function and performance specifications Lockheed Martin Australia was 73.3 per cent compliant and the other tenderer was 96 per cent compliant. Table 2.6 outlines the percentages of compliance, partial compliance and non-compliance for the technical assessment.

Table 2.6: Technical compliance assessment

|

Technical compliance assessment |

Lockheed Martin Australia |

The other tenderer |

|

Statement of Requirements — compliance |

||

|

Compliant |

95.8% |

99.6% |

|

Partially compliant |

2.7% |

0.3% |

|

Non-compliant |

1.5% |

0.1% |

|

Function and Performance specifications — compliance |

||

|

Compliant |

73.3% |

96% |

|

Partially compliant |

26.7% |

4% |

|

Non-compliant |

0% |

0% |

Source: ANAO analysis of the Tender Evaluation Report.

2.49 Table 2.7 provides the risk rating associated with the technical compliance assessment.

Table 2.7: Technical compliance risk rating

|

Risk rating |

Lockheed Martin Australia |

The other tenderer |

|

Statement of Requirements - compliance |

||

|

High |

0 |

2 |

|

Medium |

3 |

0 |

|

Low |

2 |

0 |

|

Function and Performance specifications – compliance |

||

|

High |

0 |

1 |

|

Medium |

1 |

1 |

|

Low |

4 |

0 |

Source: ANAO analysis of the Tender Evaluation Report.

2.50 The information relating to contract non-compliance and technical compliance, as laid-out in the Tender Evaluation Report, did not facilitate ease of comparison between the two tenderers. It also did not document how the compliance and non-compliance related to the risk categorisation (see paragraph 2.20)

An increase in the Total Cost of Ownership due to invalid assumptions

2.51 The pricing section in the Tender Evaluation Report in relation to the other tenderer stated ‘The Tenderer has provided a long list of pricing assumptions that are relatively complex and it is therefore difficult to interpret to gain a clear understanding of what is included and excluded from the price.’ Table 2.8 outlines the assumptions documented in the Deloitte Australia draft pricing analysis. Lockheed Martin Australia had a total of 41 assumptions and the other tenderer had a total of 42. These were categorised into three assumption types: timing related; pricing related but unrelated to timing; and technical.

Table 2.8: Number of tenderer pricing assumptions by category

|

Assumption category |

Lockheed Martin Australia |

The other tenderer |

|

Timing related |

14 |

8 |

|

Pricing related but unrelated to project timing |

19 |

19 |

|

Technical |

8 |

15 |

|

Total assumptions |

41 |

42 |

Source: ANAO analysis of the draft external pricing analysis.

2.52 Key assumptions that were identified by Deloitte Australia for the other tenderer were:

- assumptions that directly affected price required Geoscience Australia and LINZ to confirm which aspects of the solution would be relevant in the first 1–2 years of the project;

- assumptions for the full project and sustainment costs were relevant for the whole project, but determining which capabilities would be exercised by Geoscience Australia and LINZ would determine the scope of the sustainment phase;

- the offer was valid for three months longer than Lockheed Martin Australia’s offer;

- assumptions presumed cost and timeline would be borne by Geoscience Australia and LINZ if GNSS references sites were not available at least four months before the site acceptance date;

- assumptions were linear and relied on assumptions preceding it, therefore choosing a subset of capabilities was more difficult to plan compared to Lockheed Martin Australia’s offer; and

- the assumptions were more numerous and complex overall.

2.53 On 12 April 2021 Deloitte Australia advised Geoscience Australia that it did not include any of the technical assumptions in its analysis as it did not have the engineering expertise to assess the cost implications of them. It stated that ‘…the [Tender Evaluation Board] might be able to flag any technical assumptions that directly drive pricing…’ and ‘If none are found to materially impact pricing, then no update would be needed’. The Deloitte Australia draft analysis was not finalised. Geoscience Australia advised that the document was in draft form as ‘Given the importance of the content, [Geoscience Australia] worked directly in face-to-face discussions with [the contractor] to ensure the Tender Evaluation Board understood the advice.’

2.54 The value for money section in the Tender Evaluation Report stated ‘Lockheed Martin Australia had a lower level of technical risk by demonstrating a better understanding of the scope of works, and by making less assumptions about the delineation of scope between the contractor and customer’. This statement is made in the context of risk, not price (or Total Cost of Ownership). Further, while the value for money section summarises that Lockheed Martin Australia was assessed ahead of the other tenderer on project management (Criterion 1), service management (Criterion 2), function and performance (Criterion 3) resource management and personnel (Criterion 5) in the context of assumptions, it did not state how this assessment was connected to the total cost of ownership outcome or the risk assessment.36

Provision of an additional contingency amount of $44.695 million

2.55 The Tender Evaluation Board applied a contingency amount of $44.695 million37 as risk mitigation against the other tenderer’s assumptions. As there was no information in the Tender Evaluation Report other than that the contingency had been applied (see paragraph 2.44), information was sought on how the amount of $44.695 million increase to the establishment phase of the contract for the other tenderer was quantified. Geoscience Australia advised ‘The aggregated risks informed the [Tender Evaluation Board’s] decision to apply the risk adjustment of $44.695m’ and ‘The figure of $44.695m was not proposed as an increase to [the other tenderer’s] tendered price, it was an internal contingency adjustment reflecting the scope uncertainty and higher risk assessed on the other tender. The contingency adjustment was to ensure that an adequate budget was available on a total cost of ownership basis. It did not affect the ranking of the tenders on price or the overall outcome.’

2.56 This amount was included as part of the other tenderer’s total costs in the Tender Evaluation Report, which reduced the price differential between the tenderers. The minutes of the Tender Evaluation Board meeting on 22 July 2021 recorded that the purpose of putting a price on the potential cost of incorrect assumptions made by the other tenderer was to ‘inform management’. While the inclusion of Lockheed Martin Australia’s tender validity extension cost of $19.26 million in the total cost had a footnote to the relevant table in the Tender Evaluation Report, the contingency amount of $44.695 million against the other tenderer did not.

Demonstrating achievement of value for money

2.57 Part 6 of the CPRs relates to efficient, effective, economical and ethical procurement. Ethical is described as having a range of characteristics including consistency. Part 4 of the CPRs relates to value for money. Achieving value for money is the core rule of the CPRs. Procurements should facilitate accountable and transparent decision making.

2.58 Geoscience Australia had a framework for undertaking a value for money assessment and undertook the assessment. However, the inconsistencies in both the process and the reporting of it meant it was unable to be determined if Geoscience Australia correctly identified that Lockheed Martin Australia’s tender was better value for money than the other tenderer, or that either of them would deliver value for money.

Recommendation no.1

2.59 Geoscience Australia improve its future procurement processes by:

- clearly linking procurement objectives with evaluation criteria and sub-criteria, with a clear and transparent assessment methodology;

- greater adherence to the Department of Finance’s guidance on assessing value for money in future procurement processes; and

- putting in place improved arrangements to ensure procurement decision-makers are assured of consistency in tender evaluations.

Geoscience Australia response: Agreed.

2.60 Geoscience Australia agrees to the recommendation to strengthen future procurement processes in line with the Department of Finance’s guidance. Since the SouthPAN procurement, Geoscience Australia has been taking steps to improve the documentation for our procurement processes. These include the development of procurement templates, improved capability training on procurement for Geoscience Australia officers, and improvements in the recording of the evidence and rationale for procurement decisions.

Efficient, effective, economic and ethical

Probity matters

2.61 In March 2019, Geoscience Australia contracted Maddocks, a commercial law firm, to act as the external probity advisor for the procurement. Maddocks developed a probity framework for the procurement which detailed that all project personnel must complete conflict of interest and confidentiality documentation. The probity framework included a form for Australian Public Service (APS) employees and non-APS employees to declare conflict of interests and forms for APS employees to acknowledge their obligations regarding confidentiality, and for non-APS employees to complete a confidentiality undertaking via deed poll.

2.62 Geoscience Australia appointed an internal probity officer (referred to as the Contact Officer) who was an APS officer in the reporting line (for the purposes of the procurement) to the Tender Evaluation Board (see Figure 2.1).38 The template for the conflict of interest declaration form in the Probity Framework stated that the person making the declaration was to immediately notify the Chair of the Tender Evaluation Board (in their usual role in the Positioning Australia branch) and the internal probity officer regarding any conflict of interest that may arise during the procurement.

2.63 Geoscience Australia created and maintained a probity register which contained conflict of interest and confidentiality registers for procurement personnel from both Australia and New Zealand. The probity register contained 332 conflict of interest declarations and 321 confidentiality acknowledgement/undertakings. Sixteen of the conflict of interest declarations were related to other procurements. Of the remaining 316 conflict of interest forms, 36 contained declarations of a potential conflict relating to 30 people. Five of those did not document mitigating action by Geoscience Australia’s probity officer, who was required under the probity framework to take action to avoid or manage any identified actual, apparent or potential conflict of interest that arose.

2.64 ANAO analysis of the register sought to match the names in both the conflict of interest and confidentiality sections. The results identified 28 names in the confidentiality register not recorded in the conflict of interest register and eight names in the conflict of interest register not recorded in the confidentiality register. An analysis of the individual forms for the members of the governance arrangements (Figure 2.1) found one of Geoscience Australia’s staff had submitted signed, but not witnessed, confidentiality forms.

|

Opportunity for improvement |

|

2.65 Geoscience Australia could consider putting processes in place to ensure fully completed conflict of interest and confidentiality declarations and acknowledgements be received (and recorded correctly) from all personnel involved in procurement activities. |

2.66 The Chair of the Tender Evaluation Board initially declared nil conflicts in August 2019. In October 2019, Geoscience Australia outlined in an email to Maddocks that LINZ had raised the issue of the impartiality of the Chair of the Tender Evaluation Board. In an email LINZ stated the Chair should ‘be a commercial advisor who can lead moderations and not be unduly influenced by past experience with suppliers, as is the norm in evaluation panels’ and ‘The Chair needs to be someone who is impartial to the outcome, and not had any previous involvement with suppliers, and be able to Chair moderations and not have their own view/bias’.

2.67 Maddocks responded to Geoscience Australia stating ‘We understand that LINZ is (or was) concerned that there may be a perception that [the individual] has a conflict of interest in circumstances where [they have] pre-existing relationships with some potential suppliers. This is not an unreasonable concern. There is likely to be an at least perceived conflict of interest as tenderers, external scrutineers and the public more broadly may consider that [the individual’s] experience and relationships may influence [their] ability to assess some potential suppliers’ tenders impartially’. The email also stated ‘We understand that since your email [Geoscience Australia] no longer proposes having [the individual] as the Evaluation Panel Chair’.

2.68 The individual advised that they believed they should be the Chair as they had the technical knowledge for the procurement. In the same email (October 2019) from Maddocks it was noted that ‘it would have been acceptable, from a probity perspective, for [the individual] to be appointed as the Chair’ provided the person ‘was fully aware of, and complied with, [their] obligations as set out in the SBAS Probity Framework; and [Geoscience Australia] took appropriate measures to address any potential or perceived conflict of interest on [the individual’s] part’. The individual was agreed as Chair by the CEO when the Tender Evaluation Plan was approved (see paragraph 2.2).

2.69 In the same email Maddocks had further stated ‘it is not possible to completely ‘remove’ a perception risk. However, it is possible to address the perception risks stemming from [the individual’s] perceived conflict of interest in the following ways…’. This included probity briefings, robust documentation of decisions to withstand scrutiny, independent monitoring/observation of all Tender Evaluation Board meetings and assessments by Maddocks (as the external probity advisor), having at least five members of the Tender Evaluation Board and the Chair not being the delegate, as ways to address this perception risk.

2.70 On receipt of the tender responses, the Chair of the Tender Evaluation Board declared their status from 2009 to 2017 as the Positioning Program Manager at the Cooperative Research Centre for Spatial Information (CRCSI) which became Frontier SI in 2018 (see paragraph 2.92). Geoscience Australia advised the ANAO that this role supported the CEO of Geoscience Australia as the Chair of the CRCSI Program Board. The declaration of the Chair of the Tender Evaluation Board also included their interactions with tendering organisations as project manager of the test bed, and then as project manager, in the early stages of the SouthPAN procurement. The Deputy Chair of the Tender Evaluation Board who was a LINZ employee did so at the same time, declaring a business relationship with Lockheed Martin, GMV, and Zeta Associates due to the SBAS trial (see Table 3.1) and that they had been ‘taken out for dinner by Lockheed Martin/GMV/Zeta on several occasions at conferences in 2018’. Maddocks was contacted by the internal probity officer for advice regarding this declaration and was advised that ‘any attempts by organisations (but particularly Tenderers) to communicate with [the individual] need to be declined, file noted and referred to you as the Contact Officer’. It was noted in the register ‘Maddocks notified of declaration and agreed that it’s of no concern. [The individual] has been made aware of their obligations under the Probity Framework, no further action required.’

2.71 The Compliance Screening Report (Stage 1 of the evaluation process, see paragraph 2.17) noted the inherent conflict of interest issues related to the existing relationship between the international consortium members delivering the SBAS trial and Geoscience Australia staff responsible for the procurement. The mitigation strategy outlined in the Compliance Screening Report, which was approved by the Tender Steering Committee on 5 August 2020, stated that all correspondence between Lockheed Martin Corporation and the Chair of Tender Evaluation Board had been lodged with Geoscience Australia’s internal probity officer. It also stated that information sessions held prior to the procurement which were chaired by [the Chair of the Tender Evaluation Board] had been conducted ‘under the direct supervision of a [Geoscience Australia] probity officer at all times’.

2.72 The identification of potential, perceived or actual conflict of interest should, in the first instance, lead agencies to seek to eliminate the conflict of interest. When this is not possible the Department of Finance recommends effective management strategies be implemented.39