Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

National Disability Insurance Scheme - Management of Transition of the Disability Services Market

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness to date of the management of the approach to transition the disability services market to the National Disability Insurance Scheme (NDIS) market arrangements.

Summary and recommendations

Background

1. The National Disability Insurance Scheme (NDIS or the Scheme) is a shared reform agenda to replace current Commonwealth, state and territory disability support systems with a nationally consistent approach that gives people with disability, their families and carers more choice and control. When fully implemented, it is estimated that the Scheme will benefit approximately 460 000 Australians with a disability, at a cost of around $22 billion in 2019–20.

2. Implementation of the NDIS is intended to drive changes in the disability services market over time. The disability services market is expected to grow significantly to meet increased demand for goods and services. New and different forms of suppliers are anticipated to enter the market, bringing with them ‘diversity, competition and innovation.’1 Estimates suggest that the disability care workforce will need to more than double in size between 2013 and 2019–20.

3. The NDIS will also transform the way in which the disability services market operates. Consumer choice and control is a central pillar of the NDIS, which will change the nature of the relationship between consumers and service providers. Many service providers will also need to adapt their systems and processes to manage the shift from block funding (in advance) to fee-for-service arrangements. Due to the scale of the reform, the maturing of the new NDIS disability services market is expected to take up to ten years, and perhaps longer in some market segments.

Audit objective and criteria

4. Recognising that a well-functioning and responsive disability services market is fundamental to the successful implementation of the NDIS, the audit focused on the management of the transition of the disability services market by the Australian Government entities with responsibility for the NDIS—the Department of Social Services (DSS or the department) and the National Disability Insurance Agency (the NDIA or the Agency).

5. The objective of the audit was to assess the effectiveness to date of the management of the approach to transitioning the disability services market to the NDIS market arrangements. To form a conclusion against the audit objective, the ANAO adopted the following high-level criteria:

- the approach by the department and the NDIA to transition the disability services market has been informed by lessons learnt from the trial sites and other relevant market transformations;

- the department and the NDIA have effectively considered implementation issues in their management of the approach to transitioning the disability services market;

- the Sector Development Fund has been used strategically to support and inform the transition of the disability services market; and

- the department and the NDIA have effective mechanisms to continue to adjust and refine their approach to transitioning the disability services market.

Conclusion

6. By mid-2016 the department and the NDIA had established, or had taken steps to establish, the key building blocks for a successful transition of the disability services market to the new NDIS arrangements, but many risks and some gaps remain.

7. Within NDIS’ intergovernmental governance arrangements, the processes and timeframes for collective decision-making have been inconsistent with the timeframes for the rollout of the Scheme. This, along with a lack of clarity over roles and responsibilities, has contributed to delays, risk and complexity.

8. There is limited evidence of a strategic approach to the use of the Commonwealth’s $146 million Sector Development Fund, in the first three years of the Fund’s administration.

9. Both the department and the NDIA have captured, analysed and used lessons from the trial sites to develop market policy and operational settings in response to feedback and experience.

10. While the department did not have a clearly documented work program to implement its disability workforce development responsibilities, the Agency documented a program of activities to operationalise its market transition responsibilities. However there was no published overall work plan which sets out timeframes and deliverables.

11. There is a high degree of executive oversight of NDIS risks within both DSS and the NDIA but opportunities remain to enhance both intergovernmental and Commonwealth risk management.

12. Both the department and the NDIA have recently changed their organisational arrangements to improve their ability to meet their responsibilities. In October 2016, DSS developed a draft NDIS Transition Program Plan to support its market oversight role in the NDIS market transition. The NDIA’s transition planning provides for continued collection of data, and mechanisms are in place, or under development, to improve data collection.

13. Finalising the national NDIS Quality and Safeguarding Framework and its supporting infrastructure and implementation arrangements needs to be a priority to improve regulatory certainty and address market transition risks. The deployment of a new NDIS ICT system from July 2016 experienced significant problems. Timely and accurate communication is essential in such circumstances.

14. Going forward, the NDIS is a complex social and economic reform. The magnitude of the growth and change required to the disability services market cannot be underestimated, and the transition to full Scheme elevates an already high risk environment. This requires ongoing monitoring and active management. Within this context, both DSS and the NDIA need to invest in their capability to identify and resolve emerging market concerns for many years to come.

Supporting findings

Planning the market transition

15. In the early design and transition phases of the NDIS, the governance arrangements were necessarily complex but fit-for-purpose given the Scheme is a shared responsibility between the Commonwealth and states and territories. In this regard, key market design and policy elements required agreement by all governments. In practice, the timeframes associated with this collective decision-making arrangement have been inconsistent with the implementation timeframes set by governments. This has increased the NDIS’ operational complexity and elevated risks for the market transition.

16. During the NDIS trial period there was a lack of clarity over the roles and accountabilities of government entities for managing the market transition. In September 2016 the Disability Reform Council agreed market-related roles and responsibilities for the Commonwealth, states and territories, and the NDIA. It would be useful for DSS and the NDIA to publish statements defining their respective ‘market oversight’ and ‘market stewardship’ roles, to improve transparency and support accountability for these responsibilities.

17. Over time, governments have considered a number of elements of the Scheme’s market design, but key gaps towards establishing a well-functioning NDIS market remain. Certain regulatory arrangements—in particular on safety and quality—have progressed, but significant work remains. There is no evidence that the conflict of interest in the NDIA being both a price regulator and purchaser (on behalf of governments) has been considered.

18. In June 2015, an Integrated Market, Sector and Workforce Strategy was published—two years after the original trial sites commenced. This Strategy describes a vision for the disability services market under the NDIS, and high-level transitional supports, but does not commit jurisdictions to specific deliverables, accountabilities and milestones.

19. The approach to the NDIS market transition, including the Integrated Market, Sector and Workforce Strategy, was informed by learnings from the trial sites and other market transitions. There was no formal consultation with external stakeholders. There is benefit to be gained from consulting key non-government stakeholders in the context of any future iteration of the Strategy.

20. There is limited evidence of the Commonwealth adopting a strategic approach to disbursements from the $146 million Sector Development Fund in the first three years of the Fund’s administration. Around one third of the Fund was committed prior to the publication of the Integrated Market, Sector and Workforce Strategy in 2015. The ANAO’s review of projects supported through the Fund to December 2015 indicates that a more strategic approach is warranted, informed by learnings identified through evaluation of funded projects. Publication of an Investment Strategy or similar document would increase transparency and inform stakeholders of the outcomes sought from projects assisted through the Fund.

Implementing the market transition

21. In October 2016 the department developed a draft NDIS Transition Program Plan that documents a program of work to support its broader market oversight role during transition to full Scheme. However, the department did not have a clearly documented program of work to operationalise its disability workforce development responsibilities, although priorities for investment in workforce development are now documented in a Sector Development Fund Investment Strategy. There are common issues and linkages between the quality and supply of the disability, aged care, health and child care workforces. An Interdepartmental Committee is examining how entities can work together to use mainstream policy settings and programs to support an adequate labour supply. The disability care workforce is a major risk to the NDIS rollout, which needs to be carefully monitored and managed. Workforce development initiatives would be strengthened by the department developing and publishing a targeted action plan.

22. The NDIA has a documented program of work to operationalise key areas of activity and projects to support the market transition. Information about aspects of the Agency’s market readiness work is also public. There is no published overall work plan relating to the transition of the disability services market which sets out specific timeframes and deliverables. Publishing information on the Agency’s market stewardship role and its approach to steering the disability services market towards the desired end state would be beneficial.

23. Both the department and the NDIA have captured, analysed and used lessons from the NDIS trial sites to develop market policy and operational settings in response to feedback and experience. At the operational level, the NDIA has used learnings from the trial sites to support the market transition. The ANAO’s review of Agency records and consultation with stakeholders indicated that, in response to trial site experience, the Agency had implemented measures to better support both participants and service providers to transition to the NDIS market.

24. The ANAO’s consultations with entities and review of entity records indicate that there is now a high degree of executive oversight of NDIS risks within both DSS and the NDIA. A framework for the identification, management and reporting of risks has been developed which reflects that the NDIS is a shared intergovernmental responsibility. A May 2016 Independent Review of the Readiness of NDIS for Transition to Full Scheme made a number of recommendations aimed at enhancing collective risk identification and management, including: changes to decision-making structures to facilitate timely resolution of critical system-wide strategic and implementation issues; joint scenario planning to strengthen risk mitigation and contingency plans; and scheduling of structured reflection points. Implementation of these recommendations would strengthen collective risk management and responsiveness, as well as the department’s own risk management.

25. The NDIS Commonwealth Board plays a key role in oversighting NDIS risk to the Commonwealth. The Commonwealth Board has increased its risk focus since May 2015. Documenting accountabilities and timeframes (where applicable) for mitigation strategies—in the NDIS Transition Dashboard Reports provided to the Commonwealth Board by the department—and reporting progress in implementing mitigation strategies would allow increased transparency and accountability for risk management.

Meeting future market challenges

26. Both the department and the NDIA have recently implemented revised organisational arrangements and structures to support their respective market oversight and stewardship roles. As the NDIS market develops over time, both entities will need to continue to invest in their organisational capabilities to enable the Government to maintain its ability to oversee the impacts of the NDIS on stakeholders.

27. DSS has developed a draft NDIS Transition Program Plan aligned to its market-related roles and responsibilities for the NDIS market transition phase, including setting out its plans to establish the capability to collect, analyse and monitor key data to inform its lead ‘market oversight’ role.

28. In planning for the transition to full Scheme, the NDIA—supported by the Scheme Actuary—has established mechanisms to collect and analyse data and other information to: monitor the emerging markets to support its operational and market stewardship responsibilities; and inform governments and market participants. The Agency is continuing to build its data analytics capacity.

29. The Agency is implementing measures to address identified barriers to a successful market transition. This includes improving the availability of market information and investing in initiatives to build participant capacity to act as informed consumers. The NDIA is developing an improved evidence base to inform its responsibilities for pricing decisions, and intends to establish clear market review cycles to underpin decision-making in respect of Scheme pricing.

30. The national NDIS Quality and Safeguarding Framework is still to be considered by the Council of Australian Governments. The Framework and its supporting regulatory infrastructure and implementation arrangements need to be settled as a matter of priority.

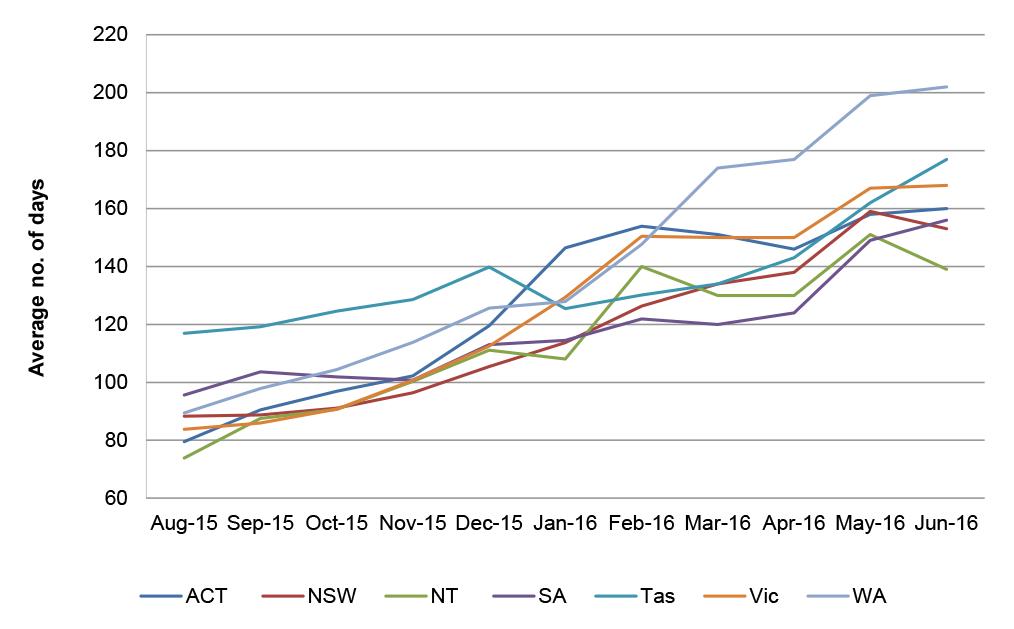

31. Existing quality and safeguarding arrangements will continue to operate during transition but there are concerns about the capacity of existing regulatory systems to respond effectively as the NDIS market expands. Delays in the registration of providers have emerged in the lead up to transition, and provider registration may remain a pressure point for the Agency during the transition. Ongoing monitoring and reporting of performance against benchmarks should be considered.

32. The introduction of a new ICT system for the NDIS on 1 July 2016 was expected to provide enhanced functionality for Scheme participants and new and existing service providers. However, the rollout of this new system experienced significant problems. During periods of uncertainty and change in particular, timely and accurate communication is essential to build understanding and reduce frustrations.

Recommendation

|

Recommendation No. 1 Paragraph 3.7 |

The Department of Social Services should produce and publish a disability care workforce action plan as soon as practicable, which includes specific actions, timeframes, accountabilities, and monitoring arrangements for implementation. DSS’ response: Agreed. DSS agrees with this recommendation and recognises that workforce action plans that take into account the individual characteristics of geographic and cohort markets will be valuable during the transition period. Work at the bilateral level, in particular, will be critical to ensure that the workforce responses in each jurisdiction are matched to the specific characteristics and needs of the local market. DSS is currently working with State and Territory Governments and the NDIA to operationalise Bilateral Agreements to Transition to a full scheme NDIS. Each Bilateral Agreement includes a System and Sector Readiness Schedule, which sets out agreed activities to prepare the market and workforce, and respond to any sector or system readiness issues in each state or territory. This work will assist DSS in capturing workforce issues and risks that are jurisdiction-specific, and together with the relevant jurisdiction, develop effective strategies to mitigate these problems. |

Summary of entity responses

Department of Social Services

The Department acknowledges the findings of the report and agrees with the recommendation. The recommendation reflects the direction the Department is already taking in its ongoing role as lead policy agency with responsibility for the National Disability Insurance Scheme (NDIS). The Department will also continue to work closely with the National Disability Insurance Agency (NDIA), and its state and territory counterparts to develop, implement and publish, as appropriate, policy directions and activities which go towards achieving an efficient and effective disability services market and workforce.

The Department notes that we are still in the early stages of transition to the full scheme NDIS. As the audit report notes, we do not yet have a mature market, and consequently any workforce shortages are not national or entrenched, as there is not yet a critical mass of participants with plans in place outside trial sites. It will be critical for the Department, the NDIA and the states and territories to maintain close monitoring of local and systemic issues in the nascent market to ensure a comprehensive and timely response.

The ‘learn and build’ approach has been a key pillar of the approach to the NDIS. While we have made efforts to be aware of cautionary experiences emerging from other market transitions, the NDIS is a ground-breaking reform to offer life-long, multi-service support to people with disability, which does not lend itself easily to comparisons with other reforms. Similarly, while it was critical to capture the learnings from the trial sites to inform development of strategies and approaches, the information derived from the trials is limited to geographic areas or participant cohorts and does not provide a sound basis for forming judgements about the wider market. The Department considers that a stronger basis for intervention in the market is likely to emerge in the later part of the transition to full scheme.

National Disability Insurance Agency

The National Disability Insurance Agency (NDIA) acknowledges and agrees with the findings in the audit report. The audit process was a valuable exercise and the feedback provided by the ANAO will assist NDIA in its current and future market transition activities.

1. Background

Introduction

1.1 The National Disability Insurance Scheme (NDIS or the Scheme) will replace current Commonwealth, state and territory disability support systems with a nationally consistent approach aimed at giving people with disability, their families and carers more choice and control over the support they receive. It will provide funded packages of support to eligible individuals with disability and, when fully implemented, it is estimated that the Scheme will benefit approximately 460 000 Australians with a disability, at a total cost of around $22 billion in 2019–20.2

1.2 Existing disability systems are predominantly funded, and in some case operated, by governments.3 Access to, and choice of, services can be limited. People with disability generally have to accept the services on offer rather than being able to tailor supports to their particular needs. This has resulted in short term planning, higher long term support needs and system costs, and adverse personal outcomes for some people with disability and their carers.

1.3 The NDIS instead adopts a lifetime cost of care model, consistent with insurance principles, which seeks to invest over the life of a person. Eligible participants will develop a plan that identifies their individual goals and aspirations and the ‘reasonable and necessary’ supports4 required to help them work towards these. Participants with an approved plan of support may then purchase these supports from service providers of their choice. Governments will also significantly increase their funding for disability services and equipment, from an estimated $14.9 billion in 2012 to around $22 billion in 2019–20. The transition to the NDIS will involve the phased transfer of eligible people with disability from existing disability systems into the Scheme. New entrants will also join the NDIS during the transition. In addition, the NDIS is expected to assist people with disability, including those who do not meet the eligibility criteria for the Scheme, by providing information, linkages and referrals to connect them with appropriate disability, community and mainstream supports.

Background to the NDIS

1.4 In 2010, the Australian Government asked the Productivity Commission to conduct an inquiry into a ‘National Disability Long-term Care and Support Scheme.’ The Productivity Commission reported in July 2011 and concluded that existing disability support arrangements ‘are inequitable, underfunded, fragmented, and inefficient and give people with disability little choice.’5 In order to address these concerns, the Productivity Commission recommended the establishment of two schemes—a NDIS and a National Injury Insurance Scheme.6

Consideration by the Council of Australian Governments

1.5 In April 2012, COAG agreed a set of high-level principles to guide consideration of the Productivity Commission’s recommendations. These principles included that reforms should take a social insurance approach, supported by actuarial modelling. COAG also required the Select Council on Disability Reform to ‘reflect and give effect to’ design principles that addressed:

- the provision of individualised care and support based on need, supported by a number of ‘foundation reforms’, which included the development of the disability services sector, workforce and capacity as well as reforms to promote client choice and control;

- transparent and sustainable resourcing arrangements that would provide funding certainty and support a social insurance approach;

- transparent and accountable governance arrangements that would provide for ongoing involvement of all jurisdictions in determining governance, policy settings and Scheme management; and

- accelerated progress in the delivery of ‘foundation reforms’, to run in parallel with the resolution of governance and funding issues.7

Intergovernmental Agreement

1.6 In December 2012, the Commonwealth and all states and territories entered into an Intergovernmental Agreement for the launch of the NDIS. The Intergovernmental Agreement was to provide ‘the foundations for governments to work together to develop and implement the first stage of an NDIS … [and a] framework for progressing to a full Scheme’.8 Among other things, the Intergovernmental Agreement sets out the objectives for the first stage of the NDIS and the roles and responsibilities of parties to the Agreement. In respect of the Commonwealth, these responsibilities included: developing legislation to support the Scheme; and funding the establishment, administrative and system supports for the launch, including for a National Disability Insurance Agency9 (NDIA or the Agency) and sector and workforce development.

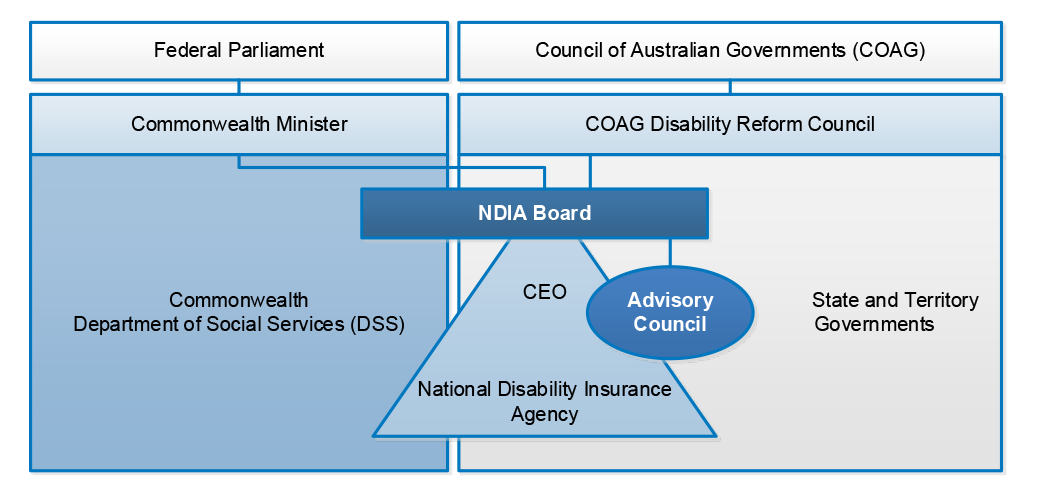

1.7 Part 7 of the Intergovernmental Agreement provided for the establishment of a Standing Council on Disability Reform (Ministerial Council) with responsibility for NDIS policy.10 The Ministerial Council comprises the Treasurers and Ministers with responsibility for disability reform from each jurisdiction, and is supported by a number of officials’ forums. The Intergovernmental Agreement also provides that the Board of the NDIA will report to the Ministerial Council ‘to give all jurisdictions visibility of the Agency’s service delivery and fiscal outcomes’11 (see Figure 1.1).

Figure 1.1: NDIS governance arrangements

*Note: These are intergovernmental groups.

Source: Department of Social Services, as at September 2015.

Legislation

1.8 In March 2013, the National Disability Insurance Scheme Act 2013 (the Act) was enacted. Among other things, the Act establishes the NDIA as a corporate Commonwealth entity12 and defines its functions, governance and reporting requirements. The Act is supplemented by a number of NDIS Rules, which address the more detailed operational aspects of the Scheme.

Commonwealth administrative arrangements

1.9 In 2011–12, a cross-portfolio Task Force was established within the Department of Families, Housing, Community Services and Indigenous Affairs to support the development of the NDIS and establishment of the NDIA. Following the launch of the Scheme, the Task Force’s policy functions were incorporated within the Department of Social Services (DSS or the department).13

1.10 The NDIA is responsible for implementing the NDIS. The Agency is governed by the NDIA Board, which is responsible under the Act for: ensuring the proper, efficient and effective performance of the Agency’s functions; and determining objectives, strategies and policies to be followed by the Agency. In performing its functions, the Board must have regard to relevant actuarial analysis and advice and is also supported by an Independent Advisory Council (see Figure 1.2). Board appointments are made by the Commonwealth Minister with the agreement of all states and territories.

Figure 1.2: National Disability Insurance Agency governance arrangements

Source: Adapted from NDIA website available at <https://myplace.ndis.gov.au/ndisstorefront/about-us/governance.html> [accessed 28 August 2016].

NDIS Commonwealth Board

1.11 To provide oversight of the development and implementation of the NDIS from a Commonwealth perspective, the Australian Government established the NDIS Commonwealth Board (Commonwealth Board). Presently, the Commonwealth Board comprises high-level representation from the Australian Government departments of: Prime Minister and Cabinet; Treasury; Finance; and Veterans’ Affairs and is chaired by the Secretary of the Department of Social Services.14 The Chief Executive Officer of the Agency is an ex-officio member of the Board. The Commonwealth Board is a forum for senior officials to: contribute to a whole-of-government perspective on the implementation of the NDIS; assess, prioritise and progress issues relating to cost and sustainability; and develop whole-of-government positions on NDIS policy.

Implementation of the NDIS

1.12 The Intergovernmental Agreement signed by all jurisdictions on 7 December 2012 sets out key arrangements for the launch of the NDIS in a number of trial sites, commencing from 1 July 2013. In the NDIS trial period—1 July 2013 to 30 June 2016—approximately 34 350 people with disability became NDIS participants across nine operational NDIS sites (seven trial sites and two early transition sites). At full Scheme15 (2019–20) it is anticipated that there will be around 420 000 NDIS participants nationally, excluding Western Australia.16

1.13 Bilateral Agreements for the Transition to a NDIS set out the timeframes for transition in each jurisdiction and document how people with disability will move into the NDIS, which is generally by age, by cohort, by geographical region, or a combination of these factors. While the timeframes for transitioning to full Scheme differ between jurisdictions, it is intended that the Scheme will be fully implemented by July 2019 in all jurisdictions that have indicated their intent to progress to full Scheme. This timeframe has been described as ambitious given the magnitude of reform required to implement the Scheme.17 Appendix 2 provides an overview of planned transition arrangements by jurisdiction, along with key NDIS data.

Disability services market

1.14 Implementation of the NDIS is intended to drive changes in the disability services market18 over time. The department and the NDIA advised the ANAO that, due to the unprecedented scale and nature of reform, the maturing of a new disability services market under the NDIS is expected to take up to ten years, and perhaps longer in some market segments. Further, some markets may require more active and careful intervention and risk management over several years to aid the transition.

1.15 The disability services market is expected to grow significantly to meet increased demand for goods and services under the NDIS. That is, in 2012–13, around 313 000 people with disability accessed services provided under the National Disability Agreement.19 By the time the NDIS is fully implemented in 2019–20, it is estimated that the number of Scheme participants will be around 460 000.20 Funding for disability services is also expected to increase from an estimated $14.9 billion in 2012 to around $22 billion in 2019–20.21 It is anticipated that new and different forms of suppliers will enter the market to meet this demand, bringing with them ‘diversity, competition and innovation.’22 It is also estimated that the disability care workforce will need to more than double in size between 2013 and 2019–20.23

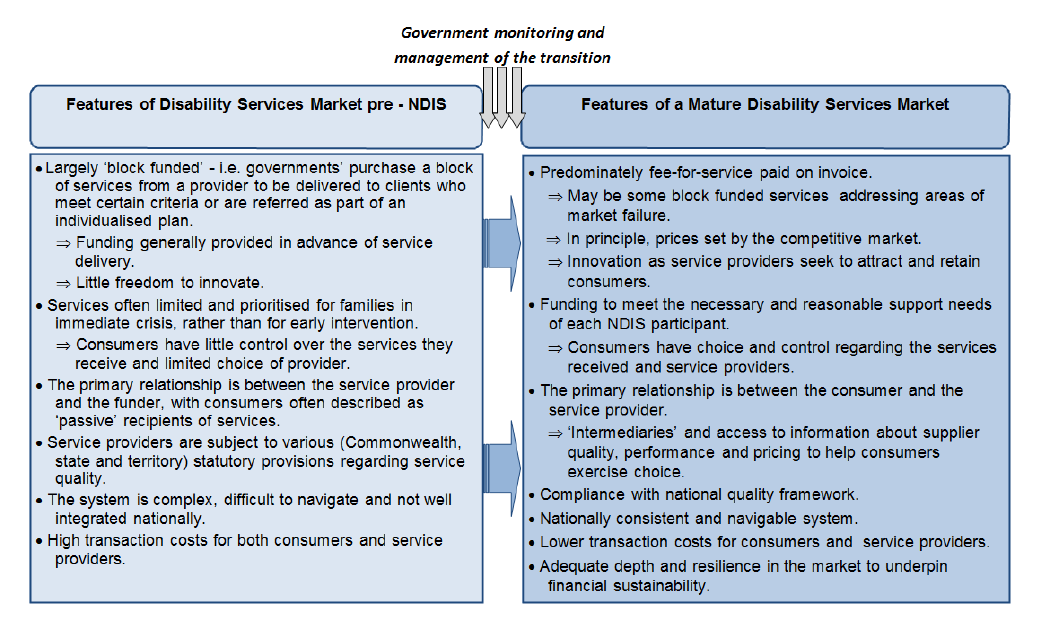

1.16 The NDIS is expected to transform the way in which the disability services market operates. Key features of the current disability services market as compared to a competitive and mature NDIS market are listed at Figure 1.3. Notably, the primary relationship under NDIS arrangements will be between service providers and NDIS participants rather than between service providers and government funding bodies.

Figure 1.3: Key features of the disability services market pre and post NDIS

Source: Based on ANAO analysis of: the Productivity Commission report on Disability Care and Support; the Integrated Market, Sector and Workforce Strategy; and NDIA presentations on the market transition.

1.17 Participant choice and control is a central pillar of the NDIS. New market exchange relationships between participants and providers are expected to empower participants. As Scheme participants develop confidence, gain access to more information about the types of supports that may be available to help them achieve their goals, and start to exercise greater choice and control, the nature of their relationship with service providers is anticipated to change. For example, there is expected to be a greater focus on the participant’s experience, service innovation and on effective marketing of goods and services to participants.24

1.18 Similarly, the type and mix of supports that participants demand may change as they start to choose what supports they receive and as participants’ goals and aspirations change. The emergence of intermediary services to assist NDIS participants to connect and/or coordinate the supports provided in their plan, or to assist with the financial management of these supports, is also expected to be a feature of disability markets under the NDIS.

1.19 The operational environment is expected to be markedly different under the NDIS. Many service providers will need to adapt their administrative systems and processes to manage the shift from block funding (in advance) to fee-for-service arrangements.

1.20 The effective growth, transition and management of the disability services market is considered to be central to the successful implementation of the NDIS. Without market adjustment there is a risk that the demand generated by the NDIS will outstrip supply, creating inflationary and quality pressures in the market. Such pressures have the potential to adversely impact access by NDIS participants to quality services and supports and to undermine the Scheme’s sustainability.

Audit approach

1.21 This audit is the first in a series that the ANAO plans to conduct into the NDIS. Recognising that a well-functioning market is fundamental to the successful implementation of the NDIS, this audit is focused on the management of the transition of the disability services market. Noting that management of the market transition is a shared responsibility between the Commonwealth and the states and territories, this audit examines the Australian Government entities with responsibility for the NDIS—DSS and the NDIA.

1.22 The objective of this audit is to assess the effectiveness to date of the management of the approach to transition the disability services market to the NDIS market arrangements. To form a conclusion against the audit objective, the ANAO adopted the following high level criteria:

- the approach by DSS and the Agency to transition the disability services market has been informed by lessons learnt from the trial sites and other relevant market transformations.

- the department and the Agency have effectively considered implementation issues in their management of the approach to transitioning the disability services market.

- the Sector Development Fund has been used strategically to support and inform the transition of the disability services market.

- the department and the Agency have effective mechanisms to continue to adjust and refine their approach to transitioning the disability services market.

1.23 The audit focused on the department’s and the Agency’s policy and operational development work around market design, implementation and transition within a multi-jurisdictional framework. The audit did not examine the initial market design and transition by the Productivity Commission or other aspects of the NDIS such as: scaling up for roll-out to the full Scheme; intergovernmental negotiations other than where these have impacted on the department’s and the Agency’s management of the market transition; the financial sustainability of the NDIS; or the interaction with mainstream services.

1.24 Previous ANAO audits of significant, demand-driven programs with exacting implementation timeframes25, and recent key reviews and guides relating to Commonwealth administration were also considered, including: Learning from Failure by Professor Peter Shergold AC26; and Successful Implementation of Policy Initiatives, by the Department of the Prime Minister and Cabinet and the ANAO.27

1.25 The audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of approximately $913 860.

2. Planning the market transition

Areas examined

This chapter examines whether management of the transition of the disability services market was underpinned by: effective governance arrangements; clear roles and accountabilities; and a strategic approach to market regulation and transition. It also examines if there are processes in place to monitor implementation and whether the Sector Development Fund was used strategically to support the market transition.

Conclusions

Within NDIS’ intergovernmental governance arrangements, the processes and timeframes for collective decision-making have been inconsistent with the timeframes for the rollout of the Scheme. This, along with a lack of clarity over roles and responsibilities, has contributed to delays, risk and complexity.

There is limited evidence of a strategic approach to the use of the Commonwealth’s $146 million Sector Development Fund, in the first three years of the Fund’s administration.

Areas for improvement

It would be useful for the Department of Social Services and the National Disability Insurance Agency to publish statements defining their ‘market oversight’ and ‘market stewardship’ roles, respectively, to improve transparency and accountability.

There would be benefit in the 2017 Productivity Commission review to also examine regulatory responsibility for price setting.

Publication of an investment strategy for the Sector Development Fund would increase transparency and inform stakeholders of the outcomes sought.

Do governance arrangements support the effective management of the market transition?

In the early design and transition phases of the NDIS, the governance arrangements were necessarily complex but fit-for-purpose given the Scheme is a shared responsibility between the Commonwealth and states and territories. In this regard, key market design and policy elements required agreement by all governments. In practice, the timeframes associated with this collective decision-making arrangement have been inconsistent with the implementation timeframes set by governments. This has increased the NDIS’ operational complexity and elevated risks for the market transition.

2.1 The National Disability Insurance Scheme (NDIS or the Scheme) is a shared responsibility between the Commonwealth and states and territories and this is reflected in multi-jurisdictional and multi-layered governance arrangements (see Figure 1.1). The Scheme is being jointly designed by the Commonwealth, states and territories and implemented by the National Disability Insurance Agency (NDIA or the Agency). The Department of Social Services (DSS or the department) advised the ANAO that ‘all major policy decisions and documents are based on extensive consultation with the states, territories and the NDIA, and to go forward must be agreed by these same stakeholders.’ This approach seeks to draw on expertise across jurisdictions to create a shared policy vision, and allow for adjustments based on experience.

2.2 Given the shared responsibilities for the NDIS, the governance arrangements that were established for the early market design and transition phases of the Scheme were fit-for-purpose. However, the processes and timeframes for collective decision-making have proved to be inconsistent with the implementation timeframes set by governments. The impacts of these arrangements has increased the NDIS’ operational complexity and elevated risks for the market transition.

2.3 For example, the January 2015 Capability Health Check of the National Disability Insurance Agency noted that ideally ‘participants, existing providers, new entrants to the market and the NDIA would be given at least 12 months [that is by 1 July 2015] advance notice of the agreed details of transition to the full scheme …’ in order to make necessary preparations. The report further noted that delays would impact the development of detailed implementation and operational plans; ICT system development and the provision of information to the market place about the location and timeframes for likely increases in demand. Yet, the Bilateral Agreements for transition to full Scheme were not signed until between September 2015 and May 2016.

2.4 Similarly, the May 2016 Independent Review of the Readiness of NDIS for Transition to Full Scheme noted that:

Interviewees highlighted concerns about constrained timelines on the finalisation of key policy decisions and settings ‘down to the wire’ as having potentially negative impact on scheme implementation. In some cases goodwill was being lost when the time needed to put the necessary focus on implementation was not available given the later than expected delivery of policy frameworks. In reality, this has meant that there has not always been sufficient time to adjust implementation and resolve any implications, including in areas such as ICT.

2.5 The department advised the ANAO that it ‘considers that the complexity of the governance arrangements, while cumbersome, is necessary, given the shared undertaking that the NDIS represents.’

2.6 The Independent Review of the Readiness of NDIS for Transition to Full Scheme also recommended changes to decision-making structures to facilitate timely resolution of critical system-wide strategic and implementation issues. At their 2 September 2016 meeting, the Disability Reform Council (Ministerial Council) discussed a number of changes to ensure a streamlined, flexible and agile governance structure for the NDIS to enable governments to respond and implement solutions quickly as issues arise over transition. These will be the focus of further negotiation.28

Are the roles and accountabilities of parties responsible for the market transition clear?

During the NDIS trial period there was a lack of clarity over the roles and accountabilities of government entities for managing the market transition. In September 2016 the Disability Reform Council agreed market-related roles and responsibilities for the Commonwealth, states and territories, and the NDIA. It would be useful for DSS and the NDIA to publish statements defining their respective ‘market oversight’ and ‘market stewardship’ roles, to improve transparency and support accountability for these responsibilities.

Defining roles and responsibilities for the market transition

2.7 The ANAO has previously identified that program implementation is more likely to succeed if it receives strong executive‐level support, and there is a sound governance framework in place to oversight progress and respond, as appropriate, to any unexpected variations in performance. Governance arrangements need to be tailored to the requirements of the program with clearly defined roles and responsibilities, including decision‐making responsibilities. This is important for allowing appropriate mobilisation of resources and addressing emerging problems in a timely and effective manner.29

2.8 DSS advised the ANAO that ‘the necessary complexity of the NDIS governance arrangements is a notable feature of the Scheme that means that DSS, or indeed the NDIA and DSS, have limited options for unilateral policy and program activity’. DSS further advised that ‘states and territories hold many of the levers for successful market transition, over which the Commonwealth has little influence or control’. In this regard, the ANAO notes that shared decision-making was a known—and necessary—part of the NDIS’ governance from the outset.

2.9 The roles and responsibilities of the Commonwealth, states and territories, and the Agency during the launch phase of the NDIS are set out in the Intergovernmental Agreement for the National Disability Insurance Scheme (NDIS) Launch30 (Intergovernmental Agreement). Under the Intergovernmental Agreement, jurisdictions share responsibility for policy development to support the design and implementation of the NDIS launch. In respect of the market transition, responsibility for funding sector and workforce development rests with the Commonwealth.31 Responsibility for supporting transition arrangements for existing providers rests with both the Commonwealth and the responsible state or territory, depending on the provider.32

2.10 Under the Intergovernmental Agreement, the Agency has responsibility for delivery and management of the NDIS, consistent with its enabling legislation.33 The relevant market transition functions of the Agency are set out in section 118 of the Act, and include to:

(i) support the independence, and social and economic participation, of people with disability; and

(ii) enable people with disability to exercise choice and control in the pursuit of their goals and the planning and delivery of their supports; and

(iii) ensure that the decisions and preferences of people with disability are respected and given appropriate priority; and

(iv) promote the provision of high quality and innovative supports that enable people with disability to maximise independent lifestyles and inclusion in the mainstream community; and

(v) ensure that a reasonable balance is achieved between safety and the right of people with disability to choose to participate in activities involving risk.

2.11 The ANAO’s review of documentation and stakeholder consultations indicates that there had been a lack of clarity over responsibility for different aspects of the market transition. There was evidence of officials from the Commonwealth, states and territories repeatedly discussing the need to clarify roles and responsibilities for both the development of the Strategy and market transition arrangements more broadly. During audit fieldwork, roles and responsibilities for the market transition were also not considered settled by all parties consulted by the ANAO. A number of state and territory officials raised issues regarding the authorising environment for the Agency’s market work and where responsibility lies for matters that are not within the control of the Agency, for example industrial relations.

2.12 This lack of clarity resulted in the Agency receiving mixed messages from government stakeholders and delays in the work program for developing the (market transition) Strategy. For example:

- despite responsibility for the development of a market strategy resting with intergovernmental officials, in September 2014 the Disability Reform Council (Ministerial Council) wrote to the NDIA Board seeking a report back on strategies to develop the necessary market conditions to support the NDIS;

- the Market Readiness Working Group established by the Disability Policy Group in June 2014 did not meet for the first time until November 2014 and DSS advised the ANAO that confusion about who was responsible for taking forward the market transition work contributed to these delays.

2.13 The unclear authorising environment in which the Agency was operating was identified as an issue in a number of external reviews since 2014. These include: KPMG’s July 2014 ‘Interim report: Review of the optimal approach to transition to the full NDIS’34; the January 2015 ‘Health Check’ of the NDIA, which identified role clarity as an ongoing issue; and a 2016 Independent Review of the Readiness of NDIS for Transition to Full Scheme that ‘heard repeatedly there was a lack of clarity in the roles and responsibilities of all parties in relation to the market and providers.’

2.14 The Agency advised the ANAO that while roles and responsibilities for the market transition have not always been clear, this was to be expected given the magnitude of reform, and the number of players involved. The Agency further advised that roles and processes have been evolving and adapting as the Agency learns from experience and this fluidity was not viewed by the Agency as a negative. The ANAO notes that while organisational agility and flexibility is important it does not negate the need for clear roles and responsibilities. Rather, role clarity in such circumstances is essential to mitigate risk and ensure accountability.

2.15 On 2 September 2016 the Ministerial Council agreed market-related roles and responsibilities of the Commonwealth, state and territory governments and the NDIA.35 In this regard, during transition to full Scheme:

- the department has the lead ‘market oversight’ role, including in respect of national issues relating to the market, sector and workforce; and

- the NDIA is expected to take an active ‘market stewardship’ role to ensure that participants will be able to access services, manage Scheme sustainability, and embed the insurance principles of the Scheme. The Ministerial Council also noted that the NDIA’s role and responsibilities are expected to evolve over time.

2.16 Ministerial agreement to these clarified roles and responsibilities during the transition to full Scheme is a positive step. This development recognised that the NDIA and other parties need greater clarity about their market-related roles and responsibilities going forward. It would also be useful for both DSS and the NDIA to publish a clear statement outlining their ‘market oversight’ and ‘market stewardship’ roles, respectively, to provide greater definition, transparency and support accountability for these responsibilities. It is also likely that in practice there will still be some areas of ambiguity that will need to be resolved, bilaterally or multilaterally, from time to time. Given the pace of reform, it will be important for this to occur in a timely and responsive manner, informed by both policy and operational experience.36

2.17 The Agency advised the ANAO that it plans to document and publish its market stewardship role, including levers it may use during the transition to full Scheme, in a Statement of Opportunities and Intent.

Is there a transition strategy that defines the market end state and transition pathway?

Over time, governments have considered a number of elements of the Scheme’s market design, but key gaps towards establishing a well-functioning NDIS market remain. Certain regulatory arrangements—in particular on safety and quality—have progressed, but significant work remains. There is no evidence that the conflict of interest in the NDIA being both a price regulator and purchaser (on behalf of governments) has been considered.

In June 2015, an Integrated Market, Sector and Workforce Strategy was published—two years after the original trial sites commenced. This Strategy describes a vision for the disability services market under the NDIS, and high-level transitional supports, but does not commit jurisdictions to specific deliverables, accountabilities and milestones.

2.18 From the early days of the Scheme’s development, building the capacity of the disability workforce and sector and assisting existing providers to transition to the NDIS environment were recognised by governments as priorities.37 Other proposed elements of the Scheme’s market design regularly considered by governments in the early planning phases included:

- regulatory arrangements, chiefly focused on a national approach to safety and quality;

- supply and demand side strategies; and

- transition arrangements, including for existing participants and providers.

2.19 In April 2012, the Prime Minister announced that the NDIS would commence in up to four trial sites from 1 July 2013, a year earlier than originally proposed by the Productivity Commission. In this context, officials and Ministers focused on agreeing those design aspects of the Scheme that needed to be in place prior to the trials commencing. Market structure and workforce development were identified as ‘policy threshold issues to be resolved following launch.’

Structures for market regulation

2.20 Markets generally comprise regulators (who set/administer the market’s rules), suppliers (such as existing disability service providers as well as new entrants) and purchasers (such as participants at the individual level, as well as the NDIA as the system-wide purchaser on behalf of governments). Markets require clear information and certainty on the regulatory framework, including pricing arrangements, to make informed investment decisions. Clear information on regulation and pricing also supports participants’ ability to operate effectively in the market.

National Quality and Safeguarding Framework

2.21 The National Quality and Safeguarding Framework is the responsibility of the Commonwealth and state and territory governments, through the Ministerial Council. A key challenge for the National Quality and Safeguarding Framework will be to effectively regulate diverse service providers, who differ in size, level of experience, and in the risk profile of the services on offer.38

2.22 Consultations on a National Quality and Safeguarding Framework closed on 30 April 2015, and it was intended that the Ministerial Council would consider the draft framework by the end of 2015. This timeframe was not met, and an agreed framework was not available at the commencement of transition to full Scheme on 1 July 2016. The draft NDIS Quality and Safeguarding Framework was subsequently considered by the Ministerial Council in September 2016, with COAG to consider its agreement to the framework by the end of 2016.

2.23 Regulatory structures proposed include:

- an NDIS Complaints Commissioner who will receive and support the resolution of complaints about providers of NDIS-funded supports, receive and investigate serious incident reports, and investigate potential breaches of the NDIS Code of Conduct;

- an NDIS Registrar who will have responsibility for registering providers, managing the NDIS Practice Standards and certification scheme, monitoring provider compliance, and taking action as required;

- a Commonwealth Senior Practitioner who will oversee approved behaviour support practitioners and providers; provide best practice advice; receive, review and report on provider reports on use of restrictive practices; and follow-up on serious incidents that suggest unmet behaviour support needs. The states and territories will be responsible for approval processes to include restrictive practices in a behaviour plan; and

- worker screening, with the Commonwealth responsible for national policy and standards, while state and territory government will have responsibility for screening workers before they enter the workforce and for continuing to monitor whether workers are safe to support people with disability.

2.24 The draft Framework proposes that not all risks associated with the NDIS need to be addressed directly by the Framework. For example, complaints about the NDIA, or NDIA-funded Local Area Coordinators, could be addressed through existing regulation, such as the Administrative Appeals Tribunal and the Commonwealth Ombudsman. The draft Framework also sets out links with existing universal protections, such as police, fair trading bodies, consumer protections (e.g. under the Australian Consumer Law39), and other regulatory and complaints systems.

2.25 The draft Framework should be settled as a matter of priority and released to the market. This Framework is intended to be operational by July 2018. The Framework, once agreed by COAG, is also a high-level strategy, and much work remains to agree the operational level details and establish the proposed regulatory functions within this timeframe.

Other regulatory elements

2.26 Regulation (or otherwise) of prices also has a significant impact on the function of markets, affordability of goods and services (and the Scheme, as a whole), and decisions by both existing and potential providers and participants. Consistent with the Productivity Commission’s 2010 report, the NDIA’s role includes determining the ‘efficient price’ for NDIS services.40 The Scheme’s legislation also sets out the Agency’s role including ‘managing the financial sustainability of the Scheme’ and making decisions on ‘reasonable and necessary supports’.41

2.27 The Agency advised the ANAO that in a mature NDIS market, the price of disability services and supports is expected to be set by the market. While the disability services market is in transition, the Agency sets a maximum price that registered service providers may charge for funded supports included in participants’ plans. These maximum prices are currently above the ‘efficient price’ identified by the Agency, in recognition that it may take some time for providers to adapt to the new arrangements. The NDIA has also indicated that it will consider moves to deregulate prices as the market matures.

2.28 The ANAO’s interviews with service providers identified that NDIS pricing is a contentious issue. National Disability Services42 advised the ANAO that:

Growth in the current market may be restricted by the collapse of existing services as some NDIS prices are too low. A reasonable margin for funded supports is needed so that organisations can build a balance sheet and invest in service innovation that responds to changing demand. Organisations need to know what prices will be charged to enable planning.

2.29 Governments (and the Agency) are actively monitoring risks to the Scheme’s financial sustainability. However, the NDIA’s dual roles in the market as both a funder or ‘purchaser’ on behalf of governments, and as a price ‘regulator’ presents a conflict of interest which needs to be transparently managed. In other (largely public-provided) sector transformations such as the establishment of the national energy market, governments have progressively taken steps to establish independent pricing regulators, for all or part of the market’s operations where public interest concerns remain. In a similar human service delivery market, the Aged Care Financing Authority provides independent advice to government on funding and financing matters.

2.30 In the context of entities’ analysis of NDIS market arrangements, and advice to governments’ on the NDIS market design, the ANAO could find no evidence that the implications of these dual market roles for the NDIA had been actively examined.

2.31 By July 2017, the Ministerial Council is expected to set out terms of reference for a Productivity Commission review of Scheme costs, with a report due by end December 2017. The review is expected to examine, amongst other things, the sustainability of Scheme costs, jurisdictional capacity, costs pressures, efficiencies that have been achieved, and levers to manage potential cost overruns. This review could also usefully re-examine the appropriateness of the NDIA continuing to exercise a role in NDIS price setting, or whether this key regulatory role (if it is to continue beyond the transition phase) should reside elsewhere.

Integrated Market, Sector and Workforce Strategy

2.32 While Commonwealth, state and territory officials, as well as the NDIA, met regularly to progress elements of the Scheme design and market transition, it was not until April 2015 that the Ministerial Council agreed an Integrated Market, Sector and Workforce Strategy (the Strategy). This Strategy was published in June 2015—some two years after the original trial sites commenced. Prior to the release of the Strategy there was no nationally agreed framework to inform market development activities undertaken by jurisdictions and the Agency in NDIS trial sites or more broadly.

2.33 The Strategy’s vision for the NDIS market is that ‘people with disability exercise choice and control and have access to a full range of quality services and supports.’43 It also lists the ‘essential characteristics of a responsive and effective market structure’44 as a means of depicting the desired end state for the NDIS disability services market. These characteristics include:

- informed and capable consumers who have access to information about supplier quality, performance and pricing;

- providers of goods and services take a holistic view of the person with disability and generate a diverse, vibrant, sustainable, competitive and fair market place;

- transaction costs are minimised, allowing consumers to readily move between service providers; and

- market regulation achieves a balance between providing protection, supporting choice, and understanding risk.

Transition pathway

2.34 Bilateral Agreements for the Transition to a NDIS set out the timeframes for transition in each jurisdiction and document how people with disability will move into the NDIS. These transitional pathways vary by jurisdiction, although arrangements are generally by age, by cohort, by geographical region, or a combination of these factors.45

2.35 In terms of the market transition, the Strategy outlines that in a responsive and effective market structure:

- existing providers of goods and services are supported to make the transition to the Scheme and to ensure that social capital and skilled and experienced workers are retained within the sector;

- there is adequate support for people with disability to influence the design of supports, facilitating new ways of engaging support, including assessing levels of risk for the individual; and

- transitional arrangements are in place where there are supply gaps.46

2.36 While establishing a national approach to the market transition, the Strategy does not provide a clear basis for coordinated actions, as it does not commit jurisdictions to specific deliverables, with agreed timeframes, accountabilities and milestones. DSS advised the ANAO that ‘detailed timeframes and accountabilities will likely be captured in a bilateral context going forward, recognising the unique characteristics in each jurisdiction in terms of the market and workforce.’

2.37 A number of the service providers interviewed by the ANAO advised that they were reluctant to invest in revised systems and processes, or make decisions regarding service delivery offerings, because the future was too opaque. They further advised that they were eager for more information about a range of issues, including: NDIS pricing policy and when pricing would be deregulated; and timeframes for state and territory withdrawal from direct service delivery.47 The peak body for non-government disability service organisations, National Disability Services, has stated that service providers need ‘… a clear map of the terrain ahead.’ National Disability Services advised the ANAO:

Several strategies have been published (Assistive Technology, Rural and Remote, Market and Workforce). They provide directions but are light on implementation detail. For these strategies to inform the planning and investment decisions of service providers, they need to be underpinned by clear publicly-available plans.

2.38 Further detail about how the Strategy is to be operationalised, including specific actions and timeframes, would assist stakeholders, particularly service providers who need to make investment decisions. In July 2016, DSS advised the ANAO that it intends to develop a Strategy ‘action plan’ for 2016–17 and into the future. Publishing this action plan, including key priorities and initiatives, timeframes and milestones, may help to address stakeholder concerns.

Have lessons from other relevant experiences been considered?

The approach to the NDIS market transition, including the Integrated Market, Sector and Workforce Strategy, was informed by learnings from the trial sites and other market transitions. There was no formal consultation with external stakeholders. There is benefit to be gained from consulting key non-government stakeholders in the context of any future iteration of the Strategy.

Learning from other market transitions

2.39 When implementing new programs, the ANAO has observed that entities should consider whether there is any international or interstate experience that would beneficially inform their consideration of program design and implementation.48

2.40 In May 2014 the Disability Policy Group49 considered analysis from other market transitions, in particular: early childhood education and care; aged care; Job Services Australia; and Out of Home Care NSW. Officials also reviewed analysis of issues affecting the viability of non-government and government service providers operating in contestable environments. In that context, the transition of foster care services to non-government organisations in NSW (the Out of Home Care program) was examined as a case study.

2.41 In February 2015, the NDIS Market Readiness Working Group50 considered a draft Strategy that was informed by lessons from other major market transitions in Australia and internationally; and from other market transitions to individualised funding.51

2.42 During the course of the audit, the ANAO noted that officials continued to engage in learning and analysis. For example, in March 2016 Commonwealth, state and territory officials held a workshop on risks and challenges in the new NDIS market. The workshop considered, among other matters, a presentation from the Victorian Department of Education on the vocational education and training reforms and the challenge of regulating the VET-FEE Help market.

Learning from operational and stakeholder experience

2.43 The Agency regularly contributes its own experiences and analysis to inform governments’ market policy considerations through the intergovernmental Market, Sector and Workforce Working Group.52 The ANAO’s analysis indicates that the Strategy was also informed by the operational experience of the Agency.

2.44 The Strategy was not directly informed by consultations with key non-government stakeholders. However, the Market, Sector and Workforce Working Group did consider several reports formulated with input from stakeholders:

- the Roadmap to a Sustainable Workforce which was prepared by the peak body, National Disability Services, following interviews with key informants in NDIS trial sites and broader consultation with sector experts and stakeholders, including consumer advocates, service providers and peak bodies; and

- reports53 commissioned by DSS on the sustainability of the disability workforce and disability sector which were informed by consultation with disability service providers, state government agencies, consumer groups and people with a disability.

2.45 Successive reviews of government administration have emphasised the importance of engaging with a range of stakeholders and experts in formulating policy and program development.54 NDIS participants and service providers have key roles in the successful transition of the disability services market and workforce. There would be particular benefit in consulting key non-government stakeholders in the context of any future iteration of the Strategy.

Has the Sector Development Fund been used to support and inform the market transition?

There is limited evidence of the Commonwealth adopting a strategic approach to disbursements from the $146 million Sector Development Fund in the first three years of the Fund’s administration. Around one third of the Fund was committed prior to the publication of the Integrated Market, Sector and Workforce Strategy in 2015.

The ANAO’s review of projects supported through the Fund to December 2015 indicates that a more strategic approach is warranted, informed by learnings identified through evaluation of funded projects. Publication of an Investment Strategy or similar document would increase transparency and inform stakeholders of the outcomes sought from projects assisted through the Fund.

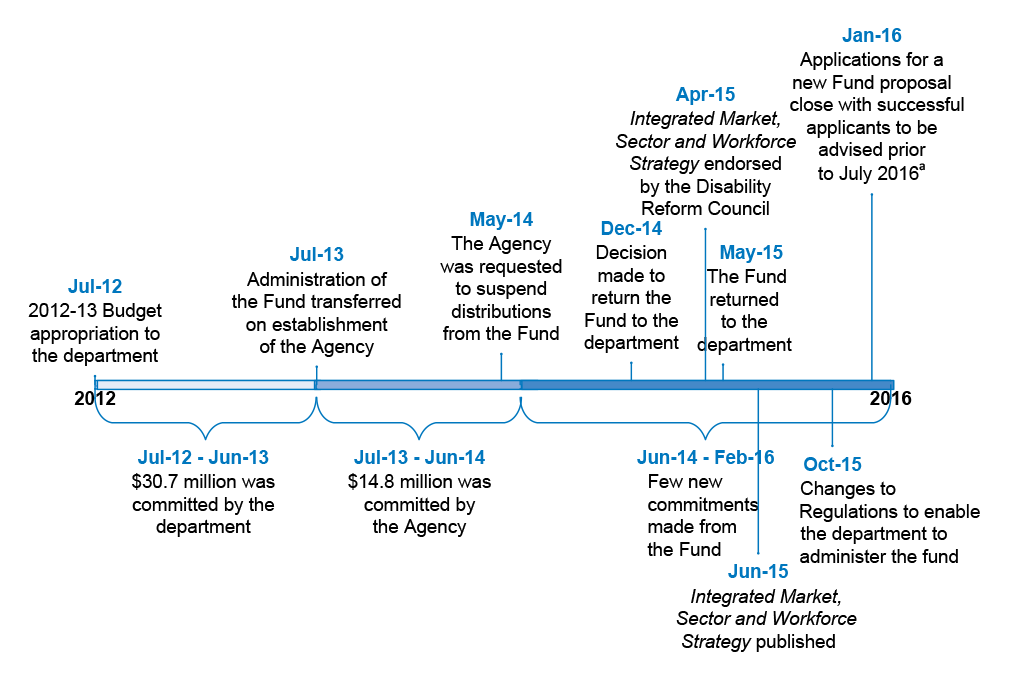

2.46 The Sector Development Fund (the Fund) provides $146 million (from 2012–13 to 2017–18) to support the NDIS market transition. As at December 2015, approximately $80 million of the Fund remained uncommitted. The ANAO’s review indicates that almost one third ($45.5 million) of the Fund was committed by DSS and the Agency prior to finalising the Integrated Market, Sector and Workforce Strategy in April 2015.55

2.47 Documentation provided by the department to the ANAO states that, as at December 2015, approximately $65.8 million of the Fund was expended, committed or set aside for a range of projects (see Table 2.1). Within this amount, DSS records indicate that, as at December 2015, there were sixteen current SDF project commitments totalling $26.4 million. This included $10 million set aside for a Specialist Disability Accommodation Initiative from 2015–16 to 2016–17.56

Fund purpose and administration

2.48 Budget Paper No. 1 (2012–13) stated that the purpose of the Fund was:

to increase the capacity of the disability services sector to deliver NDIS services and supports. The disability support workforce will undergo a fundamental change and will expand significantly under the NDIS. This funding will assist the sector to make the transition.

2.49 This general statement was expanded in the Sector Development Fund: Strategy and operational guidelines57 (Fund Guidelines). The Fund Guidelines state that the Fund:

aims to support the market, sector and workforce to transition to the new NDIS operational environment of full scheme by funding activities that assist individuals and organisations so:

- there is an efficient, responsive and innovative market that meets the diverse needs of people with disability and their families

- people with disability are able to effectively exercise choice and control to shape the nature of the market.

2.50 As illustrated in Figure 2.1, between 2012–13 and 2015–16, the Fund’s administration has moved between DSS and the Agency. In 2012–13 the Fund was administered by the NDIS Taskforce located in the department.58 The Fund Guidelines indicate that the department established initial outcomes and priorities for the Fund in consultation with state and territory governments although no evidence of this consultation was provided to the ANAO. During 2012–13, the NDIS Taskforce committed $30.7 million from the Fund, of which $19.5 million was allocated to state and territory governments, including $16.1 million to the ACT Government for sector development and Tier 2 projects.59 The remaining $11.2 million of Fund monies committed by the NDIS Taskforce was allocated to a range of sector development projects. The ANAO found no evidence that the allocation of the Funds’ monies during this period was underpinned by a documented strategy or process.

Figure 2.1: Administrative responsibility for the Sector Development Fund (2012–13 to 2015–16)

Note a: As at 14 September 2016, the results of the January 2016 funding round were not publicly available online.

Source: ANAO analysis of DSS documentation.

2.51 Following the transfer of Fund administration to the Agency in July 2013, the NDIA Board considered several iterations of a strategy to underpin allocations from the Fund. This work was overtaken by the Ministerial Council’s decision to develop the Integrated Market Sector and Workforce Strategy. Notwithstanding the absence of an agreed Strategy, the Agency published Fund guidelines (in February 2014 and November 2014) and committed a further $14.8 million to a range of projects. In May 2014, under authority from the Assistant Minister for Social Services, DSS (verbally) asked the Chair of the NDIA Board for the NDIA to suspend making further commitments from the Fund while the department and Agency ‘liaise to develop a strategic approach for the remaining unspent funds’. There was a pause in the commitment of Fund monies from that time.

2.52 The Fund’s administration was transferred back to DSS on 1 May 2015. The department was not able to commit any Fund monies until October 2015, when amendments to Schedule 1AB of the Financial Framework (Supplementary Powers) Regulations 1997 were approved. The department advised the ANAO that these amendments were necessary to provide legal authority for the department to administer the Fund.

Projects

2.53 As noted in paragraph 2.46 the majority of current and completed projects supported by the Sector Development Fund were funded before the Integrated Market, Sector and Workforce Strategy was agreed in April 2015. The Strategy notes that Fund activities to that date had been aligned with one of four outcome areas: building participant capacity for choice and control; developing the market; workforce growth and development; and research and data. Table 2.1 outlines Fund projects by outcome area (as at December 2015).

Table 2.1: Sector Development Fund projects by outcome area (as at December 2015)

|

Sector outcomes |

No. of projects |

Funds committed or set aside ($) million |

Proportion of total funds committed (%)a |

|

Building participant capacity for choice and control |

21 |

$17.0m |

26 |

|

Developing the market |

32 |

$30.6m |

46 |

|

Workforce growth and development |

8 |

$10.0m |

15 |

|

Research and data |

5 |

$8.2m |

12 |

|

Total |

66 |

$65.8m |

100 |

Note a: Figures have been rounded, and may not total 100%,

Source: ANAO analysis of DSS documentation.

2.54 The ANAO’s review indicated that funding allocations were largely consistent with the four outcome areas identified in the Strategy and that a number of projects were funded in order to develop an evidence-base to inform future policy and strategy development or to support national approaches to known areas of need. But the review indicated that there remains scope for a more strategic approach in order to identify lessons learned through evaluation and linking activity. In particular the review identified:

- a number of similar projects were funded either directly through the Fund, or through Fund allocations to the states and territories. The ANAO found no evidence that there was coordination or linking across similar projects, nor was there a mechanism in place to analyse and capture thematic learning from these projects to inform future investment; and

- limited evidence of evaluation of some higher cost projects, including projects implemented by some jurisdictions with Fund monies, for effectiveness and national applicability.

2.55 In October 2016, the department advised the ANAO that it was further developing its Sector Development Fund performance reporting to reflect thematic outcomes from projects and issues or areas for further work. The department further advised that this will inform the next range of projects commissioned through the Sector Development Fund.

2.56 The ANAO’s review also identified a number of instances where funds were committed for purposes inconsistent with the stated purpose of the Fund. For example: $3.3 million to conduct the NDIS evaluation; and approximately $4.4 million for the ongoing conduct and extension of the Australian Institute of Health and Welfare’s Survey of Disability, Ageing and Carers, neither of which directly related to the Fund’s aim at the time that the funds were committed. This represents approximately 12 per cent of Fund commitments to December 2015.

Fund Guidelines and Investment Strategy

2.57 The Fund Guidelines60 set out five outcome areas and two secondary outcomes, which are broadly consistent with the outcome areas identified in the Integrated Market, Sector and Workforce Strategy. Part 2 of the Fund Guidelines states that it ‘is not envisaged that open selections will be used to formulate project proposals.’61 Rather, the Guidelines state that proposals will primarily come from the: Integrated Market, Sector and Workforce Strategy; Quality and safety (sic) strategy; disability sector; state and territory governments; and the NDIA. The Guidelines do not provide advice on how projects identified in these strategies are to be prioritised, or the mechanism by which proponents can bring forward a proposal for consideration. DSS advised the ANAO that it intends to publish information on the NDIS Sector Development Fund webpage informing mainstream and disability sector organisations how they may apply for grants under the Sector Development Fund.62

2.58 In April 2016, DSS developed a Sector Development Fund Investment Strategy as an ‘internal planning document’ that sets out DSS priorities for the Fund. The Investment Strategy proposes to allocate approximately $43 million (around 55 per cent of the remaining uncommitted monies) to a range of projects targeting provider readiness and workforce development. The Investment Strategy indicates that the balance of Fund monies—approximately $35.7 million—will be available for emerging priorities in 2016–17 and 2017–18.

2.59 The Investment Strategy was not informed by an evaluation of outcomes from previously funded projects, although the department advised ANAO that it drew on learnings from past projects. Publication of the Investment Strategy or similar document would increase transparency and inform stakeholders of the outcomes sought from projects assisted through the Fund.

3. Implementing the market transition

Areas examined

This chapter examines whether the Department of Social Services (DSS or the department) and the National Disability Insurance Agency (NDIA or the Agency) have in place a program of work to transition the market. It also examines how lessons learned from the NDIS trials were used to inform NDIS policy and implementation, and whether risk management arrangements are in place to identify and mitigate risks associated with the market transition.

Conclusion

Both the department and the NDIA have captured, analysed and used lessons from the trial sites to develop market policy and operational settings in response to feedback and experience.

While the department did not have a clearly documented work program to implement its disability workforce development responsibilities, the Agency documented a program of activities to operationalise its market transition responsibilities. However there was no published overall work plan which sets out timeframes and deliverables.

There is a high degree of executive oversight of NDIS risks within both DSS and the NDIA but opportunities remain to enhance both intergovernmental and Commonwealth risk management.

Area for improvement

The ANAO has recommended that the Department of Social Services produce and publish a disability care workforce action plan as soon as practicable.

Do the Agency and the department have in place a program of work to implement their market transition responsibilities?

In October 2016 the department developed a draft NDIS Transition Program Plan that documents a program of work to support its broader market oversight role during transition to full Scheme. However, the department did not have a clearly documented program of work to operationalise its disability workforce development responsibilities, although priorities for investment in workforce development are now documented in a Sector Development Fund Investment Strategy. There are common issues and linkages between the quality and supply of the disability, aged care, health and child care workforces. An Interdepartmental Committee is examining how entities can work together to use mainstream policy settings and programs to support an adequate labour supply.

The disability care workforce is a major risk to the NDIS rollout, which needs to be carefully monitored and managed. Workforce development initiatives would be strengthened by the department developing and publishing a targeted action plan.