Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

National Disability Insurance Scheme Fraud Control Program

Please direct enquiries through our contact page.

The objective of this audit was to examine the effectiveness of the National Disability Insurance Agency’s (NDIA) fraud control program and its compliance with the Commonwealth Fraud Control Framework.

Summary and recommendations

Background

1. The National Disability Insurance Scheme (NDIS/the Scheme) is being rolled out nationally over three years from 2016 to 2019. Once fully implemented, the NDIS will provide about 460,000 Australians aged under 65, who have permanent and significant disability, with funding for supports and services.1 The National Disability Insurance Agency (NDIA) is an independent statutory agency responsible for implementing the NDIS.2

2. The NDIA has a Fraud Strategy Statement3 which states that:

The NDIA has strengthened its fraud control arrangements to protect the Scheme and the Agency from exploitation through fraud. The NDIA and Commonwealth Government will not tolerate fraud or the misuse of funds intended to support people with disability.

3. The Commonwealth Fraud Control Framework4 is designed to manage the risks of fraud against Commonwealth entities. Under Section 10 of the Public Governance and Accountability Rule 2014, the NDIA (as a corporate entity) must comply with the Fraud Rule. However, the other elements of the Fraud Control Framework, the Fraud Policy and the Fraud Guidance, are not binding for NDIA.

4. The Commonwealth Government is aware of the need to enhance its response to fraud, noting that the 2019–20 Budget included ‘$16.4 million over two years for a targeted approach to tackling fraud’.5

Rationale for undertaking the audit

5. Australian National Audit Office (ANAO) performance audits have shown that schemes similar to the NDIS have posed fraud risks and implementation challenges.6 The ANAO’s financial auditing of the NDIA has identified specific fraud risks relating to third party providers.7 There is also a risk that people committing fraud can move between government programs, for example from the family day care sector.8 In developing its fraud control program the NDIA must comply with the Fraud Rule, however, as a corporate entity, the Commonwealth’s Fraud Policy and Fraud Guidance are not mandatory for it as they are for non-corporate entities. This is despite the NDIA receiving public funds for a public purpose.

6. These risks, along with the scale of the NDIA, which will receive an estimated $20.209 billion in 2019–20, led to the prioritisation of an audit of the NDIA’s fraud control program. The ANAO has an ongoing performance audit program covering the NDIS, with the previous audits focused on participant access decision making controls and the management of the transition of the disability services market.

Audit objective and criteria

7. The objective of this audit was to examine the effectiveness of the NDIA’s fraud control program and its compliance with the Commonwealth Fraud Rule. To form a conclusion against the audit objective, the ANAO adopted the following high-level audit criteria:

- Has the NDIA implemented effective strategies to prevent fraud?

- Does the NDIA effectively detect and respond to fraud?

- Has the NDIA implemented effective arrangements to oversight, monitor and report on its fraud control arrangements?

Conclusion

8. The NDIA is largely compliant with the requirements of the Commonwealth Fraud Rule and is undertaking work which has the potential to make its fraud control program effective.

9. The NDIA Risk Appetite Statement states that fraud is unacceptable. The NDIA has developed strategies to prevent fraud, although after controls were implemented, two residual risk ratings remained high. The NDIA’s Fraud Control Plan is aligned with better practice and it has processes in place to assess fraud risks and raise fraud awareness. Further work is needed to reassess fraud risk, consolidate fraud controls, and prioritise and deliver future enhancements.

10. The NDIA has largely appropriate fraud detection and response mechanisms, except data analytics and data matching capabilities are being progressively implemented and it is developing a case management system that more effectively supports investigations.

11. The NDIA has implemented largely effective oversight, monitoring and reporting of its fraud control arrangements, with improvements made over 2018 and planned for 2019. The NDIA engages effectively with other government entities on fraud control, although fraud related governance should be improved via enhanced project management and reporting.

Supporting findings

Preventing fraud

12. The NDIA’s assessment of fraud risk was largely comprehensive, except that some risks were not adequately considered at the time of the risk assessment, including: self-managed participants; third party provision of the NDIA’s ICT services; and the upcoming transition of provider registration to the NDIS Quality and Safeguards Commission.

13. In 2018, the NDIA established an appropriate Fraud Control Plan that contains all of the elements listed in the Commonwealth’s better practice guidance.

14. The NDIA’s policy is that fraud is ‘unacceptable’ and high risk ratings are ‘typically undesirable’. The NDIA has identified fraud controls, except many of the ‘controls’ are not active controls. The control effectiveness rating for many fraud risk types is ‘poor’ and the Risk Register rates two risk types as having a high residual risk. The Risk Register should be updated so it is comprehensive and records control weaknesses and prioritised future actions.

15. The NDIA has developed appropriate training and activities to raise awareness of fraud amongst all agency and partner staff, except the completion rates of the training should be improved. It is mandatory for NDIA staff to complete the fraud training annually. Forty seven per cent of NDIA staff are up-to-date with the training, 35 per cent need to recomplete the training and 18 per cent have not completed the training. Fraud control officials and investigation staff are sufficiently qualified and experienced for their roles and the NDIA has received assurance that seconded staff and contractors on the Fraud Taskforce have the required qualifications.

16. The NDIA has published appropriate resources to raise awareness of fraud amongst external stakeholders. The NDIA records attendance and collects feedback for face-to-face provider training but does not monitor providers’ usage of online materials.

Detecting and responding to fraud

17. The NDIA has implemented appropriate processes for NDIA staff, providers, participants and members of the public to report fraud. The NDIA has established procedures to manage the confidentiality of the reports, however adherence to these procedures should be improved. During the course of the audit the NDIA updated guidance documentation, trained staff and commenced the procurement of a new case management system that may enhance compliance with the procedures.

18. The NDIA has implemented appropriate measures to detect potential fraud, except the important detection methods, data analytics and data matching, are being progressively implemented. Other detection methods include budget variance analysis, participant plan sampling and review, internal audit, and referral pathways with the NDIS Quality and Safeguards Commission. The NDIA redesigned the fraud control data analytics profiles and applied three profiles in March 2019, with an additional nine profiles planned. The NDIA is working to improve its data capability through the recent development of standardised frameworks, draft methodologies, and enhanced data sharing arrangements with other entities.

19. Processes for investigating and taking action against suspected fraud are largely appropriate. In December 2018, NDIA developed policies and procedures for investigations which are compliant with the Australian Government Investigations Standards (AGIS) 2011. The NDIA is undertaking investigations in line with these policies and has established an appropriate triaging, escalation, and oversight model. The NDIA also established the NDIS Fraud Taskforce in July 2018, which is a key enhancement to the practical capacity to respond to fraud.

20. The NDIA’s fraud response management is not fully compliant with investigations policies or the AGIS. The electronic case management system does not centrally record investigation activities or assist with the preparation of briefs of evidence. The NDIA has not established key performance indicators for investigations or undertaken assurance activities to confirm that investigations are being conducted in line with these policies and procedures. The NDIA is taking action to improve compliance in these areas.

Oversight, monitoring and reporting

21. The NDIA works effectively with other entities to mitigate fraud. Of note are:

- the NDIA’s membership of the Fraud and Anti-Corruption Centre;

- the July 2018 establishment of the NDIS Fraud Taskforce which draws in the expertise of the Australian Federal Police and Department of Human Services;

- the NDIA reviews Department of Education and Training data on providers who have defrauded family day care; and

- active engagement with the NDIS Quality and Safeguards Commission.

22. The NDIA is undertaking several projects to improve its fraud controls including delivery of a Fraud and Compliance Roadmap. The NDIA has completed risk assessments for its major fraud related projects. However, it has not provided evidence that risk assessments, which consider fraud risk, have been conducted for all NDIA projects. The NDIA should review its projects to identify how these will close the gaps between fraud risks and controls. This would assist in updating the Risk Register.

23. The NDIA has enhanced its governance and internal reporting of fraud control activities over 2018. The Board, Audit Committee, Risk Committee and the Executive Leadership Team have considered different aspects of the NDIA’s fraud control program including fraud risks, ICT fraud security, the Fraud Control Plan and fraud investigations. Fraud control governance and reporting would be more effective if the Board and the Executive Leadership Team were regularly updated on the status of fraud controls in response to fraud risks.

24. The NDIA responds to the annual Australian Institute of Criminology (AIC) questionnaire on fraud. Under the Fraud Control Framework, given the NDIA is a corporate entity, this reporting is better practice rather than being mandatory. There is scope for NDIA to enhance future reports given improvements in its fraud control activities.

Recommendations

Recommendation no. 1

Paragraph 2.31

That, to gain a better understanding of the overall fraud control strategies and to prioritise and track future control enhancements, the NDIA:

- remove any non-controls from the Risk Register;

- assess if key individual controls are implemented and effective; and

- regularly update the Risk Register with planned controls, the delivery date and the project or activity under which the control will be developed and implemented.

National Disability Insurance Agency response: Agreed.

Recommendation no. 2

Paragraph 3.26

That the NDIA improve its active fraud detection methods by implementing the planned data analytics and data matching activity as a matter of priority, and on a continuing basis.

National Disability Insurance Agency response: Agreed.

Recommendation no. 3

Paragraph 3.49

The NDIA improve compliance with investigations policies by:

- ensuring the new case management system has the functionality identified in pre-procurement planning documents;

- establishing performance measures for its investigative functions that align with organisational goals for fraud investigation; and

- undertaking quality assurance reviews of recent investigations to gain assurance that the NDIA Investigations Manual is being consistently applied.

National Disability Insurance Agency response: Agreed.

Recommendation no. 4

Paragraph 4.18

That the NDIA undertake a review of its project management of fraud control. This review should:

- map all projects and activities with fraud control dimensions, including their status, linkages, relative priority and resourcing;

- determine whether additional projects or activities are required to close any gaps between the fraud risks and the implemented and planned fraud controls within projects; and

- support updating the Fraud and Corruption Risk Register (Recommendation 1).

National Disability Insurance Agency response: Agreed.

Recommendation no. 5

Paragraph 4.43

That, to ensure visibility of the fraud control environment, NDIA provide regular reports to the Executive Leadership Team and the Board containing a summary of the status of the Fraud and Corruption Risk Register including:

- the untreated risk rating and the residual overall impact after controls are applied for each of the 17 fraud risk types;

- the controls effectiveness rating for each of the 17 fraud risk types; and

- the actions required on controls, with implementation dates.

National Disability Insurance Agency response: Agreed.

Recommendation no. 6

Paragraph 4.57

That, in making improvements to its fraud control processes and systems, the NDIA ensures that it is able to record and report more detailed fraud control data, including for the Australian Institute of Criminology Annual Reporting Census.

National Disability Insurance Agency response: Agreed.

Summary of entity response

25. The National Disability Insurance Agency (the Agency) welcomes the ANAO’s audit report into the NDIS Fraud Control Program. The Agency is committed to preventing, detecting and responding to fraud against the National Disability Insurance Scheme (the Scheme) to ensure we continue to support the independence and social and economic participation of people with a disability.

26. The Agency has strengthened its fraud control arrangements to protect the Scheme and the Agency from exploitation through fraud. Recent media regarding the Agency addressing serious fraud is an example of our efforts to detect and respond to fraud against the NDIS appropriately.

27. In addition to the audit finding that the Agency is compliant with the requirements of the Commonwealth Fraud Rule, the Agency is pleased the audit acknowledges that our investigation policies and procedures are compliant with best practice standards outlined in the Australian Government Investigation Standards and our investigations are undertaken in accordance with these policies.

28. The Agency accepts the six recommendations and is pleased to advise steps have already been taken to address a number of the recommendations and findings in the report.

29. The Agency is well progressed in delivering a strategic multi-year program to strengthen our management of fraud and compliance risks. The Agency is pleased to advise that since the audit we have procured a new case management system, continued to invest and mature our data analytics capability so fraud can be detected and responded to quickly, and introduced a rolling program to update the fraud risk assessment and fraud risk mitigation measures.

30. As noted in the report, the NDIA Board has recently endorsed an updated Fraud and Corruption Risk Register. This register includes an updated fraud risk profile as well as a comprehensive view of controls to ensure the Agency is well positioned to protect the Scheme and the Agency from exploitation through fraud. (Also refer to Appendix 1 for the entity response.)

Key learnings for all Australian Government entities

Below is a summary of key learnings, including instances of good practice, which have been identified in this audit that may be relevant for other Commonwealth entities.

Governance and risk management

Policy/program implementation

1. Background

Introduction

1.1 The Australian Government describes fraud as ‘dishonestly obtaining a benefit, or causing a loss, by deception or other means’. Additionally, fraud requires intent. It requires more than carelessness, accident or error which may be non-compliance not fraud.9

1.2 The Australian Institute of Criminology (AIC) has reported that10 in 2015–16 the estimated value of Commonwealth fraud investigations commenced was $503.5 million, with an estimated $25.7 million lost under finalised investigations in 2015–16.11 The majority of alleged fraud incidents and confirmed fraud involved parties external to the entity.

1.3 Detecting all fraud can pose challenges, with the UK Cabinet Office stating:

The government can deal with the [fraud] problem that is known, as the loss associated with this is self-evident. Dealing with the problem that we do not know about is more complex, as the loss is not self-evident. The challenge is to shine a light on those areas where information is poor or non-existent.

Fraud is a hidden and evolving crime; fraudsters make themselves hard to find and adjust and improve their tactics for evading detection when organisations take preventative action.12

The Commonwealth Fraud Control Framework

1.4 The Public Governance Performance and Accountability Act 2013 (PGPA Act) is the key piece of legislation underpinning the Australian Government’s financial framework. The PGPA Act, the Public Governance Performance and Accountability Rule 2014 (PGPA Rule)13 and associated policies and guidance set out the regulatory framework for the proper use and management of public resources by Commonwealth entities.

1.5 The Commonwealth’s requirements for managing the risk of fraud are outlined in the Commonwealth Fraud Control Framework 2017 (the Framework).14 The Framework requires government entities to put in place a comprehensive fraud control program that covers prevention, detection, investigation and reporting strategies. The three key elements in the Framework are the:

- Fraud Rule: From section 10 of the PGPA Rule, the Fraud Rule is a legislative instrument that binds all Commonwealth entities and sets out the key requirements of managing fraud;

- Commonwealth Fraud Control Policy: The Fraud Control Policy sets out procedural requirements for specific areas of fraud management; and

- Resource Management Guide No. 201 — Preventing, detecting and dealing with fraud: (Fraud Guidance): outlines better practice guidance, setting out the government’s expectations for fraud management arrangements within Commonwealth entities.

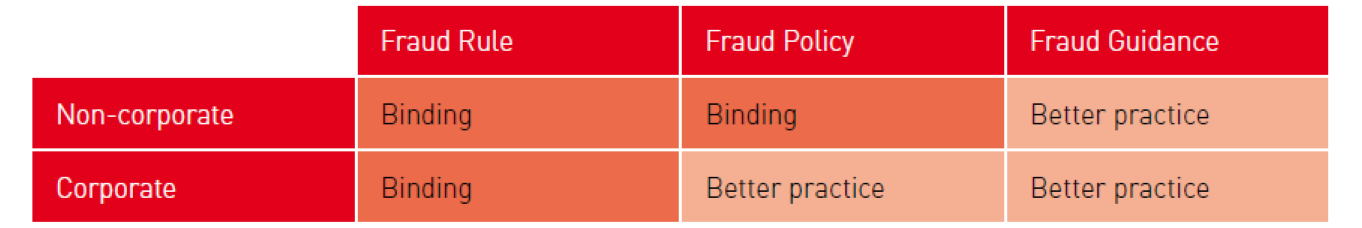

1.6 Each of these elements has a different binding effect on corporate and non-corporate entities (Figure 1.1)15

Figure 1.1: Binding effects of the Commonwealth Fraud Control Framework

Source: Attorney-General’s Department, Commonwealth Fraud Control Framework 2017.

1.7 The National Disability Insurance Agency (NDIA or the Agency) is a corporate entity, and must comply with the requirements in the Fraud Rule. Although it distributes $20 billion of funds annually which poses a fraud risk, NDIA can choose to align its processes with the Fraud Policy and Fraud Guidance as a matter of better practice.

1.8 The Fraud Rule contains the following mandatory requirements for all Commonwealth corporate and non-corporate entities:

The accountable authority of a Commonwealth entity must take all reasonable measures to prevent, detect and deal with fraud relating to the entity, including by:

- conducting fraud risk assessments regularly and when there is a substantial change in the structure, functions or activities of the entity; and

- developing and implementing a fraud control plan that deals with identified risks as soon as practicable after conducting a risk assessment; and

- having an appropriate mechanism for preventing fraud, including by ensuring that:

- officials in the entity are made aware of what constitutes fraud; and

- the risk of fraud is taken into account in planning and conducting the activities of the entity; and

- having an appropriate mechanism for detecting incidents of fraud or suspected fraud, including a process for officials of the entity and other persons to report suspected fraud confidentially; and

- having an appropriate mechanism for investigating or otherwise dealing with incidents of fraud or suspected fraud; and

- having an appropriate mechanism for recording and reporting incidents of fraud or suspected fraud.

The National Disability Insurance Agency

1.9 The National Disability Insurance Scheme (NDIS or the Scheme) replaces existing Commonwealth, state and territory disability support systems with a nationally consistent scheme aimed at providing Australians under the age of 65, who have a permanent and significant disability, ‘with the reasonable and necessary supports they need to live an ordinary life’.16

1.10 The NDIA was established on 1 July 2013 as a corporate Commonwealth entity under the National Disability Insurance Scheme Act 2013 (the Act), to deliver the NDIS and manage, advise and report on its financial sustainability. Table 1.1 provides an overview of NDIA staff, participants, and funding.

Table 1.1: The NDIA — entity overview

|

Category |

Type of resource |

Number |

|

Number of staff (as at 30 June 2018) |

APS employees |

2634 |

|

Contractors and secondees |

1799 |

|

|

Partners in the Communitya |

3439 |

|

|

Number of Scheme participants (as at 31 March 2019) |

277,155b |

|

|

Estimated actual total net resourcing to the NDIA 2018–19 |

$15.718 billion |

|

|

Estimated total net resourcing to the NDIA 2019–20 |

$20.209 billion |

|

Note a: NDIS Partners in the Community are qualified and experienced organisations chosen by the NDIA for their strong local knowledge and understanding of people with disability or developmental delay. Partners in the Community provide two key services:

- Delivering Early Childhood Early Intervention services for children aged 0–6 years; and

- Assisting NDIS participants to understand and access the NDIA, develop and refine their plans, and link them to community and mainstream services.

Note b: COAG Disability Reform Council Quarterly Report 31 March 2019, [Internet], available at: <https://www.ndis. gov.au/about-us/publications/quarterly-reports> [accessed 6 June 2019].

Source: 2017–18 NDIA Annual Report and page 134, 2019–20 Social Services Portfolio Budget Statements.

1.11 For 2019–20, the estimated total net resourcing to NDIA is $20.209 billion, which includes funds from state and territory governments.17 This is about one per cent of the Australian GDP.18 The Commonwealth Government’s contribution to NDIS, including to the Quality and Safeguards Commission, is forecast to rise from $8.459 billion in 2019–20 to $13.161 billion in 2022–23 (a 55.6 per cent increase). At full implementation (460,000 participants), the average payment to participants is estimated at $45,000 per year.

1.12 The NDIA Corporate Plan 2018–22 notes that it has a conservative risk appetite,19 and its Risk Appetite Statement states that any type or amount of fraud is unacceptable. As the Scheme grows, potential fraud risk from participants, providers, partners in the community, NDIA staff and other external parties may also increase.

1.13 In July 2018, the Government established the national NDIS Fraud Taskforce (the Taskforce) to tackle potential fraud against the NDIA. The Taskforce is a partnership between the NDIA, the Department of Human Services and the Australian Federal Police.20 Chapter 3 has further detail on the establishment of the Taskforce and its investigation work.

Rationale for undertaking the audit

1.14 ANAO performance audits have shown that schemes similar to the NDIS have posed fraud risks and implementation challenges.21 The ANAO’s financial auditing of the NDIA has identified specific fraud risks relating to third party providers.22 There is also a risk that people committing fraud can move between government programs, for example from the family day care sector.23 In developing its fraud control program the NDIA must comply with the Fraud Rule, however, as a corporate entity, the Commonwealth’s Fraud Policy and Fraud Guidance are not mandatory for it as they are for non-corporate entities. This is despite the NDIA receiving public funds for a public purpose.

1.15 These risks, along with the scale of the NDIA which will receive an estimated $20.209 billion in 2019–20, led to the prioritisation of an audit of the NDIA Fraud control program. The ANAO has an ongoing performance audit program covering the NDIS, with the previous audits focused on participant access decision making controls and the management of transition of the disability services market.

Audit approach

Audit objective, criteria and scope

1.16 The objective of this audit was to examine the effectiveness of the NDIA’s fraud control program and its compliance with the Commonwealth Fraud Control Framework. To form a conclusion against the audit objective, the ANAO adopted the following high-level audit criteria:

- Has the NDIA implemented effective strategies to prevent fraud?

- Does the NDIA effectively detect and respond to fraud?

- Has the NDIA implemented effective arrangements to oversight, monitor and report on its fraud control arrangements?

1.17 The audit originally commenced in November 2017. In February 2018 the Auditor-General paused the audit as the NDIA was undertaking an overhaul of its fraud control program. The audit recommenced in October 2018.

Audit methodology

1.18 In addition to reviewing key policy, procedural, governance and risk management documentation, the audit methodology included:

- interviewing relevant officers (of the NDIA, Department of Human Services, Australian Federal Police and the NDIS Quality and Safeguards Commission);

- examining guidance and training available to NDIA staff, including fraud and prevention officers;

- examining information available to providers and participants to assist them to meet their obligations;

- reviewing whether fraud controls and strategies reflect identified fraud risks and testing whether a selection of planned controls were implemented;

- examining fraud detection and investigation approaches; and

- examining fraud governance, project management and reporting arrangements.

1.19 The audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of $586,305.

1.20 The team members for this audit were Kate Lawrence-Haynes, Deanne Allan, Joel Smith, Sam Painting and David Brunoro.

2. Preventing fraud

Areas examined

This chapter examines whether the National Disability Insurance Agency has implemented effective strategies to prevent fraud. The Agency’s fraud risk assessment process, the fraud control plan, the fraud and corruption risk register and selected controls have been reviewed. Internal fraud awareness training and external fraud awareness-raising activities were also reviewed.

Conclusion

The NDIA Risk Appetite Statement states that fraud is unacceptable. The NDIA has developed strategies to prevent fraud, although after controls were implemented, two residual risk ratings remained high. The NDIA’s Fraud Control Plan is aligned with better practice and it has processes in place to assess fraud risks and raise fraud awareness. Further work is needed to reassess fraud risk, consolidate fraud controls, and prioritise and deliver future enhancements.

Areas for improvement

ANAO made one recommendation to enhance the comprehensiveness of fraud risk assessments and update the risk register to reflect all controls.

Summary of compliance with the Framework

2.1 Table 2.1 outlines the National Disability Insurance Agency’s (NDIA or the Agency) compliance with the mandatory requirements of Commonwealth Fraud Rule in relation to strategies to prevent fraud. The detailed analysis supporting these conclusions is included in the following sections of this Chapter, as well as analysis of whether the NDIA is meeting the requirements of its internal fraud policies.

Table 2.1: The NDIA’s compliance with mandatory fraud prevention requirementsa

Note a: These are mandatory requirements under the Commonwealth Fraud Control Framework, Fraud Rule, parts (a), (b), (c) (i).

Note b: The Fraud Control Plan deals with identified risks at a high level only.

Source: ANAO.

2.2 Figure 2.1 shows how the NDIA’s fraud risk processes and documents fit together. It has:

- undertaken a fraud risk assessment;

- created a Fraud and Corruption Risk Register (the Risk Register) with risks and fraud controls;

- developed a Fraud Control Plan informed by the Risk Register; and

- released a public Fraud Strategy Statement.

Figure 2.1: Summary of the NDIA’s fraud risk assessment and documents

Source: ANAO summary of NDIA activities and documents.

Did the NDIA comprehensively assess fraud risks and establish an appropriate Fraud Control Plan?

The NDIA’s assessment of fraud risk was largely comprehensive, except that some risks were not adequately considered at the time of the risk assessment, including: self-managed participants; third party provision of the NDIA’s ICT services; and the upcoming transition of provider registration to the NDIS Quality and Safeguards Commission.

In 2018, the NDIA established an appropriate Fraud Control Plan that contains all of the elements listed in the Commonwealth’s better practice guidance.

2.3 As a corporate Commonwealth entity, the NDIA must comply with section 10 of the Public Governance Performance and Accountability Rule 2014 (Fraud Rule) which states:

The accountable authority of a Commonwealth entity must take all reasonable measures to prevent, detect and deal with fraud relating to the entity, including by:

- Conducting fraud risk assessments regularly and when there is a substantial change in the structure, functions or activities of the entity; and

- Developing and implementing a fraud control plan that deals with identified risks as soon as practicable after conducting a risk assessment.24

2.4 The ANAO assessed the NDIA’s fraud risk assessment process, including the comprehensiveness of the assessment, and whether the NDIA developed an appropriate Fraud Control Plan.

The NDIA’s fraud risk assessments

2.5 The NDIA has complied with the Fraud Rule and conducted regular fraud risk assessments.25 Since 2015, the NDIA has conducted three fraud risk assessments, completed in March 2015, May 2016, and February 2018.

2.6 The NDIA’s 2018 fraud risk assessment included twenty three fraud risk workshops and discussions with both executive and non-executive NDIA staff from all states and territories. The fraud risk assessment activities engaged staff from multiple branches and divisions within the Agency, with a particular focus on service delivery areas. Consultation for the 2018 risk assessment was internal and did not involve consultation with external stakeholders who have expertise in fraud risk (for example the Australian Federal Police or the Department of Human Services).26

2.7 The workshops covered general information on fraud, the NDIA’s 17 fraud risk types (see paragraph 2.25 for example risk types) and the agency’s fraud-specific responsibilities. In January 2018 a workshop was held with senior staff to determine the risk ratings for the 17 risk types using the Agency’s Risk Assessment Criteria to assess likelihood and Scheme consequences. In March 2018, the NDIA finalised the NDIA Fraud and Corruption Risk Register (the Risk Register). The Risk Register was updated in November 2018 to reflect fraud control changes in response to an alleged fraud.

2.8 The Fraud Rule requires the NDIA to conduct a new fraud risk assessment when a substantial change in the structure, function or activities of the Agency has occurred. The NDIS Quality and Safeguards Commission (QSC) was established in July 2018 to improve the registration and regulation of NDIS providers. From 1 July 2018, the QSC became responsible for registering providers in New South Wales and South Australia and will progressively assume this responsibility in all states and territories by 1 July 2020. The NDIA continues to be responsible for registering providers in states and territories where the QSC is not yet operating.

2.9 Both entities have established referral pathways between each other in relation to Fraud (see Chapter 4, paragraph 4.9).

2.10 During March and April 2019, the NDIS ran 23 fraud risk assessment group workshops and 12 individual consultations to underpin updating of the Risk Register. The NDIA advised that the Department of Human Services and the QSC were consulted during the process, with the Australian Federal Police providing input via the Risk Register held by the NDIS Taskforce.

The comprehensiveness of the NDIA’s 2018 fraud risk assessment

2.11 The Commonwealth Fraud Control Framework, Fraud Guidance (Fraud Guidance)27 lists 18 areas where fraud vulnerabilities can arise. Seventeen of the areas are applicable to the NDIA’s operating environment (Table 2.2).

Table 2.2: NDIA fraud vulnerabilities relevance and assessment

|

|

Is this vulnerability relevant to the NDIA? |

Has the NDIA comprehensively assess the vulnerability? |

|

Common areas where fraud vulnerabilities can arise |

||

|

A) Policy/program design |

✔ |

✔ |

|

B) Procurement (including tendering and managing supplier interfaces) |

✔ |

✔ |

|

C) Revenue collection and administering payments to the public |

✔ |

✘ |

|

D) Service delivery to the public, including program and contract management |

✔ |

✔ |

|

E) Provision of grant and funding arrangements |

✔ |

✔ |

|

F) Exercising regulatory authority |

✔ |

✘ |

|

G) Provision of identification documentsa |

✘ |

N/A |

|

H) Internal governance arrangements |

✔ |

✔ |

|

I) Changes in the activities or functions of an entity |

✔ |

✘ |

|

Factors that may lead to fraud vulnerabilities |

||

|

J) Systems managed across different government portfolios, service providers and/or jurisdictions |

✔ |

✘ |

|

K) Opportunities for exploitation by professional facilitators |

✔ |

✘ |

|

L) Programs creating new opportunities for unregulated industries |

✔ |

✔ |

|

M) Programs significantly expanding a regulated industry to new organisations |

✔ |

✘ |

|

N) Programs requiring verification/authentication of identity, particularly online |

✔ |

✔ |

|

O) Programs involving electronic claims, submissions, assessments, verification and/or payments |

✔ |

✔ |

|

P) Programs providing assistance to vulnerable people |

✔ |

✔ |

|

Q) Programs with low verification thresholds |

✔ |

✘ |

|

R) Programs needing to be delivered quickly |

✔ |

✔ |

Note a: The NDIA does not provide identification documents, as such that vulnerability is not relevant to the NDIA.

Source: ANAO analysis using two tables from the Commonwealth Fraud Control Framework, Risk Management Guide 201, pages C9 and C12.

2.12 The NDIA comprehensively assessed the fraud vulnerabilities involved in 10 out of the 17 relevant areas. The key fraud vulnerabilities that were not adequately considered and reflected in the risk register are:

- self-managed participants, for example, use of unregistered providers and low verification thresholds for payments to self-managed participants (see rows C and Q in Table 2.2);

- risks associated with having an IT system provided by a third party (the Department of Human Services), for example, limitations on NDIA’s ability to manage the provision of services given the lack of an enforceable contract (see row J in Table 2.2);

- possible risks given the forthcoming split of responsibilities between the NDIA and the QSC for provider registration (see rows F, I and J in Table 2.2); and

- risks that could arise due to the rapidly expanding Scheme, for example, Fraud and Compliance Branch resourcing may not align with the expansion of the Scheme and the expanded risk of exploitation by professional facilitators (see rows K and M in Table 2.2).

2.13 The NDIA identified nine points in the NDIS process where assurance activities should be conducted. The Risk Register records risks at these points except for reviewable decision reviews.

NDIA’s Fraud Control Plan

2.14 Sub-section 10 (b) of the Fraud Rule requires the NDIA to develop and implement ‘a fraud control plan that deals with identified risks as soon as practicable after conducting a risk assessment’.

2.15 The NDIA’s 2018 Fraud Control Plan (FCP) was considered by the Board in May 2018 and finalised in August 2018. The FCP was uploaded to the NDIA intranet in October 2018 alongside a publicly available NDIA Fraud Strategy Statement (see paragraph 2.50).

2.16 The Commonwealth’s Fraud Guidance outlines the content that may be included in fraud control plans, such as: a summary of fraud risks and vulnerabilities; treatment strategies and controls; training approaches; and internal management mechanisms, protocols, roles and responsibilities. The NDIA’s 2018 FCP contains all of the elements listed in these better practice guidelines. This is an improvement on the Agency’s 2016 FCP, which did not include most of the recommended content, and did not list any of the identified risks.

Has the NDIA identified and implemented controls to reduce the risk of fraud?

The NDIA’s policy is that fraud is ‘unacceptable’ and high risk ratings are ‘typically undesirable’. The NDIA has identified fraud controls, except many of the ‘controls’ are not active controls. The control effectiveness rating for many fraud risk types is ‘poor’ and the Risk Register rates two risk types as having a high residual risk. The Risk Register should be updated so it is comprehensive and records control weaknesses and prioritised future actions.

The NDIA’s Fraud Risk Register

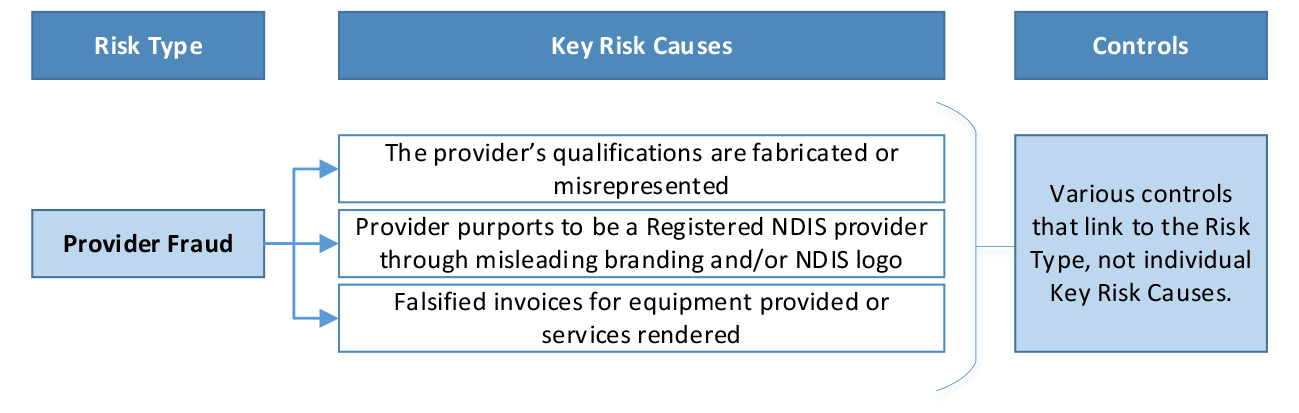

2.17 NDIA has advised the ANAO that its Fraud and Corruption Risk Register (the Risk Register) should be the single source of truth on fraud risks and controls.28 Acting on the findings from the fraud risk workshops in 2017–18, in March 201829 the NDIA created a new Risk Register. In the Risk Register, each of the 17 risk types has a range of ‘key risk causes’ which outline how the risk could materialise and associated controls (an example is at Figure 2.2).

Figure 2.2: Items in the Fraud Risk Register — example

Source: ANAO reproduction of the NDIA Fraud and Corruption Risk Register.

2.18 The ‘Key Risk Causes’ column in the Risk Register demonstrates that the NDIA has given consideration to how fraud risks could occur. The key risk causes are accompanied by a large list of controls in place to mitigate the overall risk. The controls cannot be directly linked to the key risk causes, but the controls do relate to the broad risk type. The Risk Register lists 338 current controls in place to help mitigate the consequence and likelihood of each fraud risk type.

2.19 The Australian Standard AS 8001-2008 Fraud and Corruption Control30 defines a control as ‘an existing process, policy, device, practice or other action that acts to minimise negative risks or enhance positive opportunities.’ A more recent New South Wales Audit Office publication has a stricter definition that a control is a process that should be actioned, rather than a reference to policy or legislation.31 Controls can be preventive, detective or corrective.

2.20 Of the 338 controls listed in the Risk Register, 185 (55 per cent) are not active ‘controls’, as they are:

- acts/legislation;

- internal audits;

- NDIA guidance/policy documents; or

- not yet operational.

2.21 Some controls are listed against more than one risk type if they are generic and relevant to different fraud risks, for example, fraud training and the fraud reporting hotline.

2.22 In order to assess the implementation of the NDIA’s fraud risk controls, the ANAO randomly selected and tested 10 controls from the Risk Register.32 Seven of the 10 selected controls have been implemented.33

The NDIA’s assessment of fraud controls

2.23 The NDIA policy is that any amount of fraud is ‘unacceptable’ within the context of an entity level ‘conservative’ risk appetite. In addition, the NDIA’s Risk Assessment Guide states that controls rated as ‘poor’ should have improvements scheduled within three months, and for those rated as ‘adequate’ within six months. It also notes that high risk ratings are ‘typically undesirable’.

2.24 The Risk Register identifies the NDIA’s 17 fraud and corruption risk types and lists the untreated and residual impact of each of the fraud risk types (see Table 2.3).

Table 2.3: NDIA’s assessment of identified fraud and corruption risks, November 2018

|

Risk type |

Impact (Untreated) |

Impact (Residual) |

|

1. |

Medium |

Medium |

|

2. |

Medium |

Medium |

|

3. |

High |

High |

|

4. |

Medium |

Low |

|

5. |

Medium |

Medium |

|

6. |

High |

High |

|

7. |

Medium |

Medium |

|

8.1. |

Medium |

Medium |

|

8.2. |

High |

Medium |

|

9. |

High |

Medium |

|

10. |

Medium |

Low |

|

11. |

Medium |

Medium |

|

12. |

Medium |

Low |

|

13. |

Medium |

Low |

|

14. |

Medium |

Medium |

|

15. |

Medium |

Medium |

|

16. |

Medium |

Low |

|

17. |

High |

Medium |

Notes: For the November 2018 version of the Risk Register, when considering the impact of the controls, the NDIA first considered the consequence and likelihood of a risk occurring — the ‘untreated’ risk rating. Then, once consideration of the controls effectiveness was complete, the NDIA re-assessed the consequence and likelihood of each risk occurring — the ‘residual’ risk rating. The June 2019 version of the Risk Register, which is not reflected in this Table, includes updated risk types.

Source: ANAO reproduction of the NDIA Fraud and Corruption Risk Register.

2.25 Table 2.3 does not show the specific risk types but these include participant fraud, provider fraud, cyber/IT fraud, identity fraud, procurement and grant funding fraud, and payroll and leave entitlement fraud. The NDIA identified two fraud risk types that have a high residual risk impact and 11 risk types with a medium residual impact.

2.26 The NDIA assessed that 10 out of 17 of its fraud risk types have ‘poor’ controls. Four of the controls rated as ‘poor’ and three of those rated as ‘adequate’ do not have any associated improvements scheduled. In addition, for three fraud risk types, the residual risk rating was lower than the untreated risk rating, despite the control effectiveness being rated as poor.

2.27 In 2018 the NDIA developed a Fraud and Compliance Roadmap to strengthen its management of fraud and compliance risks. The Roadmap is supported by a two year program of work with over 280 deliverables. There was no clear link between the Risk Register and the deliverables in the Fraud and Compliance Strategic Roadmap.

2.28 In April 2019, the NDIA mapped the 280 deliverables in the Fraud and Compliance Roadmap to the 17 risk types in the Fraud Risk Assessment. This showed that at least 70 of the deliverables could be linked directly to the fraud risk types and would strengthen the controls for these risks.

2.29 The NDIA should improve its management of fraud risk by using the Risk Register to record and prioritise work to improve fraud controls, linked to the Fraud and Compliance Roadmap.

2.30 In April 2019, the NDIA provided the ANAO with an incomplete draft of an updated Risk Register. A new Risk Register was approved by the Board Risk Committee in early June 2019. NDIA has provided details of the fraud risk implications of this new Risk Register in its response this Audit (paragraph 30 and paragraphs 2.32–2.36). The ANAO has not assessed the June 2019 version of the Risk Register.

Recommendation no.1

2.31 That, to gain a better understanding of the overall fraud control strategies and to prioritise and track future control enhancements, the NDIA:

- remove any non-controls from the Risk Register;

- assess if key individual controls are implemented and effective; and

- regularly update the Risk Register with planned controls, the delivery date and the project or activity under which the control will be developed and implemented.

National Disability Insurance Agency response: Agreed.

2.32 The NDIA undertook a comprehensive review of the Fraud and Corruption Risk Register in March 2019. This review included more than 20 group workshops and 12 individual sessions, with representatives from 60 different stakeholders groups involving almost 200 individuals. The finalised version of Fraud and Corruption Risk Register was endorsed by the NDIA Board in June 2019.

2.33 Through the update process the risk types listed in the Fraud and Corruption Risk Register were rationalised and re-categorised, to better consider the range and scope of fraud risks faced by the NDIA, changes in structure and the increased role of the NDIS Quality and Safeguards Commission. The Fraud and Corruption Risk Register has been updated for risks regarding self-managed participants, shared services agreements and arrangements with the NDIS Quality and Safeguards Commission. NDIA has not included the impacts of planned controls when assessing residual risk for each risk type, as until implemented the residual risk remains based on the controls actually implemented.

2.34 The updated Fraud and Corruption Risk Register identifies key controls, no longer includes non-controls, and assesses the implementation and effectiveness of individual controls and preventative measures. For proposed controls where timeframes have not been set at the time of writing, the Fraud & Compliance Branch, in partnership with Line 1 Risk Resources, will support business to set timeframes and deliver the controls.

2.35 In order to ensure the ongoing and contemporary assessment of NDIA’s fraud risk, a program of ongoing review of fraud risks faced by the NDIA was endorsed by the Board.

2.36 As noted in the audit report, the NDIA is undertaking several programs of work to improve our fraud controls. Activities within the Fraud and Compliance Roadmap which will develop, review and support the implementation of controls for fraud risk, to strengthen NDIA’s management of fraud and compliance risks, have been reflected in the updated Fraud and Corruption Risk Register. This will be supported by the work of our Project Management Office is undertaking in response to ANAO’s Recommendation 4.

Has the NDIA implemented appropriate fraud training for all officials in the entity, including those with fraud-specific responsibilities?

The NDIA has developed appropriate training and activities to raise awareness of fraud amongst all agency and partner staff, except the completion rates of the training should be improved. It is mandatory for NDIA staff to complete the fraud training annually. Forty seven per cent of NDIA staff are up-to-date with the training, 35 per cent need to recomplete the training and 18 per cent have not completed the training. Fraud control officials and investigation staff are sufficiently qualified and experienced for their roles and the NDIA has received assurance that seconded staff and contractors on the Fraud Taskforce have the required qualifications

2.37 The Fraud Rule states that:

The accountable authority of a Commonwealth entity must take all reasonable measures to prevent, detect and deal with fraud relating to the entity, including by:

- Having an appropriate mechanism for preventing fraud, including by ensuring that:

- Officials in the entity are made aware of what constitutes fraud.

Awareness-raising and training

2.38 The NDIA updated its mandatory ‘Fraud Awareness’ eLearning in January 2019, with a policy that the training be completed by all NDIA and Partners in the Community staff within three months of commencing employment, and recompleted once a year. The content of the module includes a definition of fraud, the difference between fraud and error, and examples of fraud. Chapter 3 outlines further details on reporting suspected fraud.

2.39 As of 31 January 2019, 47 per cent of all NDIA staff have completed the mandatory eLearning module within the last year (see Figure 2.3). A further 35 per cent of NDIA staff have completed the training more than one year ago and need to recomplete the training. The NDIA advised that, where applicable, email reminders are given to staff twice before the due date for the mandatory training and one week after, and that a monthly report records outstanding mandatory training. The NDIA also advised that from May 2019 all Branch Managers will be given a report on outstanding mandatory training for their staff and from 1 July 2019 the SES performance framework will include training compliance.

Figure 2.3: ‘Fraud Awareness at NDIA’ completion rates, as at 31 January 2019

Source: ANAO analysis of NDIA eLearning completion data.

2.40 In addition to the eLearning, the NDIA also runs ‘Payment Integrity’ face-to-face training.34 The training includes information on: the impact of poor payment integrity; specific examples of how staff should respond to suspected fraud; and some of the warning signs of fraud and misuse. NDIA has advised that the payment integrity training is one of 18 modules in the New Starter Program and is mandatory for planners and local area coordinators. It further advised that 223 Australian Public Service planners commenced within NDIA between January and March 2019, with 91 per cent of them having completed the New Starter Program. NDIA records completion rates for local area coordinators but these may not be accurate as this is based on data from manual attendance records provided by Partners in the Community.

2.41 The NDIA also raises internal awareness of fraud on its intranet. During 2018, six notices relating to fraud were posted on the Intranet. The fraud reporting page on the intranet provides information on: how to report suspected fraud; what information to include in a report; and the actions that will be taken by the Fraud and Compliance Branch when the report is received.

Training and qualifications for fraud and compliance staff

2.42 The 2017 Commonwealth Fraud Control Framework Fraud Policy (Fraud Policy)35 states:

Entities must ensure officials primarily engaged in fraud control activities possess or attain relevant qualifications or training to effectively carry out their duties; and

Fraud investigations must be carried out by appropriately qualified personnel as set out in AGIS.

2.43 The Fraud Guidance recommends:

- Qualifications for investigators in line with the Australian Government Investigation Standards 2011 (AGIS),36 which recommends:

- Certificate IV in Government (Investigation) or its equivalent — for staff primarily engaged as an investigator; or

- Diploma of Government (Investigation), or equivalent — for staff primarily engaged in the coordination and supervision of investigations;

- The following qualifications for fraud control officials:

- Certificate IV in Government (Fraud Control) or equivalent qualification for officials implementing fraud control; or

- Diploma in Government (Fraud Control) or equivalent qualification for officials managing fraud control.

- Training within 12 months for officials entering these roles without the relevant experience.

2.44 The Fraud and Compliance Branch has an Attainment of Fraud Qualifications Policy which was approved on 4 January 2019. The policy references and is closely aligned with the 2017 Commonwealth Fraud Control Framework and AGIS requirements. The NDIA’s position descriptions for investigators list the required qualifications.

2.45 The Fraud and Compliance Branch maintains a qualifications register, verifies the qualifications of staff, and holds certified copies on file. The register identifies 28 staff and contractors, consisting of eight fraud control officials and 20 fraud investigators. 37 Of the staff identified as investigators or fraud control officials, most hold the recommended qualification. The NDIA has outlined equivalent experience and qualifications for those who do not hold the recommended qualifications (for example, significant police experience), except one investigator is to obtain a qualification by December 2019. As at June 2019, the NDIA was in the process of verifying the qualifications of five investigators who have police backgrounds.

2.46 The NDIA has 15 Department of Human Services and Australian Federal Police officers supporting the NDIS Fraud Taskforce. These staff are involved in NDIA fraud investigations but are not listed on the qualifications register. The NDIA has advised that it has received assurance from the relevant entity that these staff hold the required qualifications.

2.47 The NDIA Fraud and Compliance Branch has taken proactive steps to upskill staff in investigation and fraud control positions. In 2018, five qualifications were obtained by four individuals who entered their roles at the NDIA without the recommended qualifications. Two of these staff attained their qualifications through the recognition of prior learning process.

2.48 Staff in the Fraud and Compliance Branch have undertaken additional investigation training. The Fraud and Anti-Corruption Centre runs a Commonwealth Agency Investigations Workshop. Four staff from the NDIA investigations team participated in the workshops in 2017 and 2018. In March 2018, the investigations team also engaged an external facilitator to run training sessions. The sessions focused on interview training, including interviewing vulnerable people and taking witness statements.

Has the NDIA appropriately raised fraud awareness among external stakeholders?

The NDIA has published appropriate resources to raise awareness of fraud amongst external stakeholders. The NDIA records attendance and collects feedback for face-to-face provider training but does not monitor providers’ usage of online materials.

2.49 There are no mandatory requirements for the NDIA to help raise awareness amongst external stakeholders. However, the Fraud Guidance states the following:

Paragraph 49. Having effective outreach programs can help entities prevent fraud. Outreach activities include entities clearly explaining their integrity policies and programs, and position on fraud to clients and service providers, and where appropriate, to members of the public.

Paragraph 50. It is beneficial for awareness-raising programs for third-party providers to take into account the work they do directly for entities and the services they deliver on behalf of the entity. These programs can be extended to provide clients and providers information about their rights and obligations, including information on their fraud control responsibilities.

The Fraud Strategy Statement

2.50 The Fraud Guidance states that ‘a widely distributed fraud strategy statement can assist in raising awareness’. The NDIA Fraud Strategy Statement was posted to the intranet on 12 October 2018 and made publically available on the NDIS website.38 It includes all of the recommended content in the Fraud Guidance including the definition of fraud, a summary of the consequences of fraud, an assurance that allegations of fraud will be handled confidentially and advice on where to obtain further information.

Awareness raising for the public

2.51 The NDIS website contains publicly available resources to raise awareness of fraud:

- the ‘Reporting suspected fraud’ page (provides examples of fraudulent behaviour and explains how to report suspected fraud); and39

- the NDIS 2017–18 Annual Report has information on how NDIA is managing fraud risk.40

2.52 The topic of fraud within the NDIS attracts a large amount of media attention. Widespread media coverage can assist in raising awareness and the Commonwealth Director of Public Prosecutions acknowledges that increased publicity of prosecution can have a deterrent effect.41 The NDIA Engagement and Communications Strategy (October 2018) recognises awareness raising as a priority in external communications.

2.53 On 24 July 2018, the NDIA posted a media release on the NDIS website for the announcement of the Fraud Taskforce.42 Further media releases were posted in September 2018 regarding on-going investigations43 and in October 2018 regarding the Taskforce’s first arrest.44

Awareness raising for providers

2.54 The NDIA publishes monthly e-Newsletters to which all registered providers are automatically subscribed. Any party can also subscribe via the NDIS website. The July 2018 e-Newsletter mentioned the establishment of the NDIS Fraud Taskforce.

2.55 The NDIA has an online Provider Toolkit45 with resources for NDIS providers. These include eLearning activities including ‘payment integrity responsibilities for providers’ and ‘warning signs and how to report fraud’. The training explains the provider’s responsibility in upholding Scheme integrity and details how to detect and report suspected fraud.

2.56 There is also training material advising providers how to comply with the NDIS Terms of Business. The Terms of Business outline mandatory requirements and the proper conduct for payments and pricing. If a provider is found to not comply with the Terms of Business registration can be revoked and legal action can be taken on fraudulent claims.

2.57 Over 2018 the NDIA ran face-to-face payment integrity sessions for providers. For instance, in early 2018, the NDIA ran payment integrity provider sessions as a part of the National Provider Forum in each state and territory. Sessions were also held at regional sites where there was demand due to difficulties in travelling to capital cities.

2.58 The NDIA records attendance and collects feedback forms from the payment integrity sessions. Across both the National Provider Forum and the individual sessions, an estimated 1187 provider staff attended payment integrity sessions in 2018. The NDIA has advised that it does not track which providers have completed the online activities, which limits oversight of the impact and utility of these resources.

3. Detecting and responding to fraud

Areas examined

This chapter examines whether the National Disability Insurance Agency (NDIA) effectively detects and responds to fraud. Methods for receiving reports of suspected fraud, fraud detection capability and responses to instances of suspected fraud were reviewed.

Conclusion

The NDIA has largely appropriate fraud detection and response mechanisms, except data analytics and data matching capabilities are being progressively implemented and it is developing a case management system that more effectively supports investigations.

Areas for improvement

The ANAO made two recommendations to:

- implement planned data analytics and data matching activities; and

- increase compliance with investigations policies by implementing: a compliant case management system; relevant performance indicators; and a quality assurance for investigations.

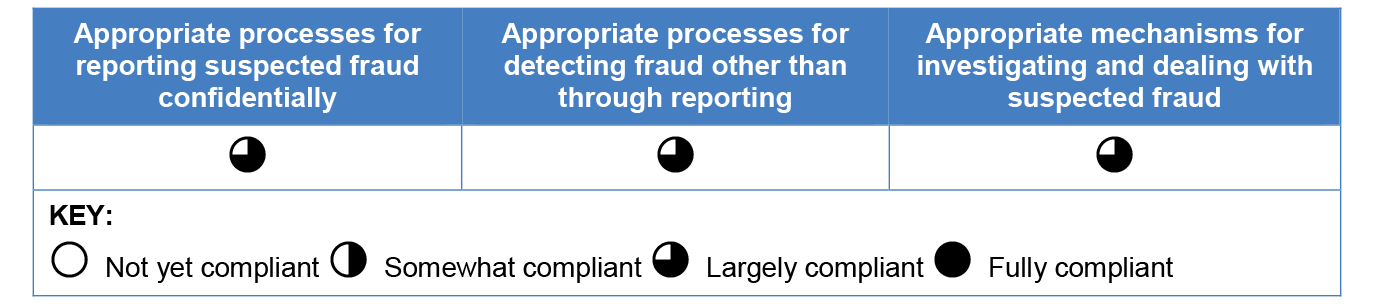

Summary of Compliance with the Framework

3.1 Table 3.1 outlines the NDIA’s overall compliance with the mandatory requirements outlined in the Attorney-General’s Commonwealth Fraud Control Framework in relation to detecting and responding to fraud. The two relevant requirements are:

- having an appropriate mechanism for detecting incidents of fraud or suspected fraud, including a process for officials of the entity and other persons to report suspected fraud confidentially; and

- having an appropriate mechanism for investigating or otherwise dealing with incidents of fraud or suspected fraud.

3.2 For the purposes of this assessment, the first requirement has been separated into two sub-tests, with the first focusing on implementing confidential reporting channels and the second focusing on other mechanisms for detecting fraud. The detailed analysis supporting the conclusions in Table 3.1 is included in the following sections of this Chapter.

Table 3.1: NDIA’s compliance for fraud detection and response

Note: These are mandatory requirements under the Commonwealth Fraud Control Framework Fraud Rule parts (d) and (e).

Source: ANAO.

Has the NDIA put in place appropriate processes for suspected fraud to be confidentially reported?

The NDIA has implemented appropriate processes for NDIA staff, providers, participants and members of the public to report fraud. The NDIA has established procedures to manage the confidentiality of the reports, however adherence to these procedures should be improved. During the course of the audit the NDIA updated guidance documentation, trained staff and commenced the procurement of a new case management system that may enhance compliance with the procedures.

3.3 The 2017 Commonwealth Fraud Control Framework Fraud Rule (Fraud Rule)46 states:

The accountable authority of a Commonwealth entity must take all reasonable measures to prevent, detect and deal with fraud relating to the entity, including by:

a process for officials of the entity and other persons to report suspected fraud confidentially.

3.4 The 2017 Commonwealth Fraud Control Framework Fraud Guidance (Fraud Guidance), although non-mandatory for the NDIA, states that it is important for entities to appropriately publicise fraud reporting mechanisms. It also encourages entities to establish measures to protect those making reports from adverse consequences.47

Channels to report fraud

3.5 The NDIA has implemented a number of channels for suspected fraud to be reported. The channels are advertised on the NDIA’s intranet and internet pages and include:

- the fraud reporting hotline, a telephone service for reporting fraud;

- the fraud reporting email address; and

- an online contact form.48

3.6 The NDIA’s intranet page contains relevant information on fraud tip-offs and reminders are posted to internal noticeboards. These tip-off channels are also listed in the NDIA’s Fraud Control Plan, in updates to staff groups, and in the NDIA’s mandatory fraud awareness training.

3.7 There has been an increase in tip-offs since July 2017, and a marked increase since the NDIS Fraud Taskforce was established in July 2018 (Figure 3.1).

Figure 3.1: Tip-offs about suspected fraud to the NDIA, July 2017 to February 2019

Source: ANAO analysis of NDIA tip-off data.

3.8 The majority of tip-offs to the NDIA in the 2017–18 financial year were received through the fraud reporting email address and hotline. A small number were received by letter or in person (Figure 3.2).

Figure 3.2: Source of tip-offs to the NDIA, 2017–18 financial year

Source: ANAO analysis of NDIA tip-off data.

3.9 Public Interest Disclosures are disclosures made by a public official to a government entity, persons not in government, or to a legal practitioner which may relate to fraud. The NDIA has developed policies for managing Public Interest Disclosures, appointed authorised officers to whom NDIA officials may make disclosures, published guidance on making a disclosure, and referenced disclosures in its fraud awareness training. The guidance also outlines the rights that officials have under the Public Interest Disclosures Act 2013.

Managing the confidentiality of reports

3.10 The NDIA’s website notes that people reporting fraud can request to have their details remain confidential, and that the NDIA has established procedures to assist with managing confidentiality. These procedures require the Intake and Assessment Team who receive the reports to ask whether the informant would like their details to remain confidential. If so, the Intake and Assessment Team must ensure there are no identifying details on the intake record such as names and phone numbers. As part of this process officers are prompted by the IT system to review the description of the case before saving the record to ensure it does not include identifying information.

3.11 The ANAO reviewed tip-offs received by the Intake and Assessment Team in December 2018 to check if the confidentiality procedures had been implemented. Figure 3.3 shows that in December 2018, 160 reports were recorded and confidentiality was requested by 32 informants. The request for confidentiality was not correctly handled in 15 per cent of sampled cases, as identifying information was recorded in five instances.

Figure 3.3: NDIA’s compliance with confidentiality procedures for tip-offs received in December 2018

Source: ANAO analysis of NDIA files.

3.12 Where the confidentiality procedure was not followed, the identifying information was removed before the case was referred outside the Intakes and Assessment Team.

3.13 Following the ANAO’s assessment of this process, Intake and Assessments staff undertook additional training, and relevant guidance documentation was updated with the aim of ensuring staff do not record information when confidentiality is requested. In addition, the NDIA is in the process of procuring a new case management system (see paragraphs 3.41–3.45). Documentation outlining the case management system requirements specifies IT system controls and business rules to further enhance compliance with this procedure.

Does the NDIA have appropriate methods to detect potential fraud other than via reports from staff and external parties?

The NDIA has implemented appropriate measures to detect potential fraud, except the important detection methods, data analytics and data matching, are being progressively implemented. Other detection methods include budget variance analysis, participant plan sampling and review, internal audit, and referral pathways with the NDIS Quality and Safeguards Commission. The NDIA redesigned the fraud control data analytics profiles and applied three profiles in March 2019, with an additional nine profiles planned. The NDIA is working to improve its data capability through the recent development of standardised frameworks, draft methodologies, and enhanced data sharing arrangements with other entities.

3.14 The Fraud Rule49 states:

The accountable authority of a Commonwealth entity must take all reasonable measures to prevent, detect and deal with fraud relating to the entity, including by:

d) having an appropriate mechanism for detecting incidents of fraud or suspected fraud…

3.15 The 2017 Commonwealth Fraud Control Framework Fraud Policy (Fraud Policy)50 states that ‘Entities must maintain appropriately documented instructions and procedures to assist officials [to] … detect … fraud’.

3.16 The Australian Institute of Criminology’s Commonwealth Fraud Investigations 2015–16 report identifies ten ways fraud is usually detected in the Commonwealth, based on a census of Commonwealth entities. Each of these methods are listed and discussed in Table 3.2.

Table 3.2: The NDIA’s implementation of mechanisms to detect fraud

|

Detection method |

NDIA implementation |

ANAO comment |

|

External tip-offs, internal tip-offs, self-reporting, accidental detection, reporting by law enforcementa (five methods). |

✔ |

These five detection methods occur through the tip-offs mechanism, outlined in paragraphs 3.5–3.9. Accidental detection is not separately recorded by the NDIA but it has occurred. |

|

Management review and document examination (two methods). |

✔ |

The Risk Register has management review and document examination as controls. Management reviews include reconciliations and variance analysis of expenditure against budgets. Document examinations include selecting a sample of finalised participant plans to analyse potential fraud. Both of these processes have been implemented, with documentation examination having led to identification of suspected fraud. |

|

Internal Audit |

✔ |

The NDIA has established a procedure for the internal audit area to report any suspected fraud it identifies but it has not yet reported any instances of suspected fraud. A 2018 internal audit had a fraud focus (see Chapter 4, paragraph 4.30). |

|

Reporting by financial institution |

✔ |

NDIA currently uses information from financial institutions to assist with its intelligence function. |

|

Data analytics |

In progress |

The NDIA is progressively implementing its data analytics and data matching capability. See paragraphs 3.18–3.25. This work is part of the Fraud and Compliance Roadmap work (see paragraphs 4.24–4.26). NDIA has advised that it sees data analytics as an iterative tool with adjustments to be made as a result of learnings from fraud cases. |

KEY: ✔ Implemented ✘ Not implemented

Note a: Engagement with law enforcement is further explored in Chapter 4.

Source: ANAO analysis.

3.17 Some mechanisms to detect fraud are included in the NDIA’s Fraud and Corruption Risk Register. However, as outlined in Chapter 2, paragraphs 2.27 the Risk Register does not record all current and planned fraud controls, which may include other detection methods.

Data analytics for fraud detection

3.18 The Association of Certified Fraud Examiners has observed ‘proactive data monitoring and analysis are among the most effective anti-fraud controls. Organisations which undertake proactive data analysis techniques experience frauds that are 54 per cent less costly’.51 As such, data analytics and data matching could be a critical tool for the NDIA.

3.19 The NDIA had developed actuarial profiles that used NDIA data to identify instances of suspicious activity such as patterns of fund utilisation, claims above pricing caps or claims above a participant’s budget.52 Reports against these profiles were provided to the Fraud and Compliance Branch (the Branch) on an ad-hoc basis until May 2018.

3.20 In May 2018, the Branch undertook a review of 15 of the 17 actuarial profiles.53 The review examined a sample of cases created from each profile to identify whether the reports were useful to the Branch. In summary, the assessment found that:

- three profiles were acceptable in their current form;

- three profiles were acceptable if better data was captured;

- five profiles would need more significant changes before they could be accepted;

- two profiles were likely useful to another business area; and

- two profiles were no longer required.

3.21 Responsibility for fraud risk profiles was transitioned to the Branch in July 2018. In December 2018 the Branch obtained access to a data analytics platform and began drafting a Fraud Risk Profile Development Framework, and made changes to work practice documentation. After refining data analytics, including the profile outputs and business rules, the Branch began running its own reports in March 2019. Although no reports were run after May 2018, three profile reports were generated in March 2019 and the outputs were backdated to July 2017.54 The reports generated are improved versions of the three determined as acceptable in May 2018. NDIA has advised that a further three reports will be tested and implemented by 30 September 2019 and that an additional six profiles have been identified for implementation by the end of 2019.

3.22 The NDIA expects to finalise its Fraud Risk Profile Development Framework in June 2019. This framework is intended to be a standardised methodology for the design, development, testing and production of risk profiles.

Data matching for fraud detection

3.23 Data-matching involves bringing together data from different sources and analysing it to identify individuals or organisations for further investigation or action.

3.24 The NDIA began conducting the following data matching activities in 2018:

- Payment Integrity: The NDIA’s actuarial team routinely undertakes a payment integrity activity where it matches participant data with state and territory data. This is to ensure that the correct government entity is paying supports.

- Family Day Care provider matching: The NDIA receives information from the Department of Education Child Care Enforcement Action register regarding Family Day Care providers that have been sanctioned. The NDIA matches this data to its own providers and investigates as required. As at February 2019, the NDIA had engaged with 38 NDIA providers following this data matching activity, and is in the process of de-registering 25 providers. The NDIA has identified that providers with sanctions against them in the Department of Education Child Care Enforcement Action register have made $3.6 million in service bookings and have received payments totalling $2.3 million from the NDIA. The NDIA advised the ANAO that it is in the process of implementing this check as a pre-registration step, at which time the data-matching will become a ‘business as usual’ activity.

3.25 The NDIA continues to invest in building its data matching capability. In February 2019, the NDIA Risk Committee noted the NDIA’s new Identity Management Framework. This aims to strengthen identity controls for participants seeking access to the Scheme by accessing and using third party data sets. This includes matching data from government and non-government organisations. As an example, the NDIA received its first set of ‘fact of death’ data in March 2019 and compared it with participant information to identify discrepancies.55

Recommendation no.2

3.26 That the NDIA improve its active fraud detection methods by implementing the planned data analytics and data matching activity as a matter of priority, and on a continuing basis.

National Disability Insurance Agency response: Agreed.

3.27 As part of the Fraud and Compliance Roadmap, the NDIA has prioritised investment in data analytics and matching, infrastructure and data analysts. This has enabled the NDIA to stand up both data analytics and matching capabilities to proactively detected fraud and non-compliance. The NDIA continues to invest in and strengthen our data analytics and data matching capability.

3.28 The NDIA has implemented three fraud detection profiles. A further three fraud detection profiles have been developed and are undergoing refinement prior to operationalisation. These profiles have been prioritised as they act as key controls for identified fraud risks. An additional six profiles have been identified for future development.

3.29 As noted in the audit, the NDIA commenced data matching activities in 2018. As part of the Fraud and Compliance Roadmap, the NDIA has acquired the data storage and analytical tools to necessary to progress its data matching strategy. The NDIA has already entered into formal arrangements with six government and non-government organisations to acquire data with further arrangements currently being negotiated or planned.

Are there appropriate processes in place for investigating suspected fraud and taking appropriate action?

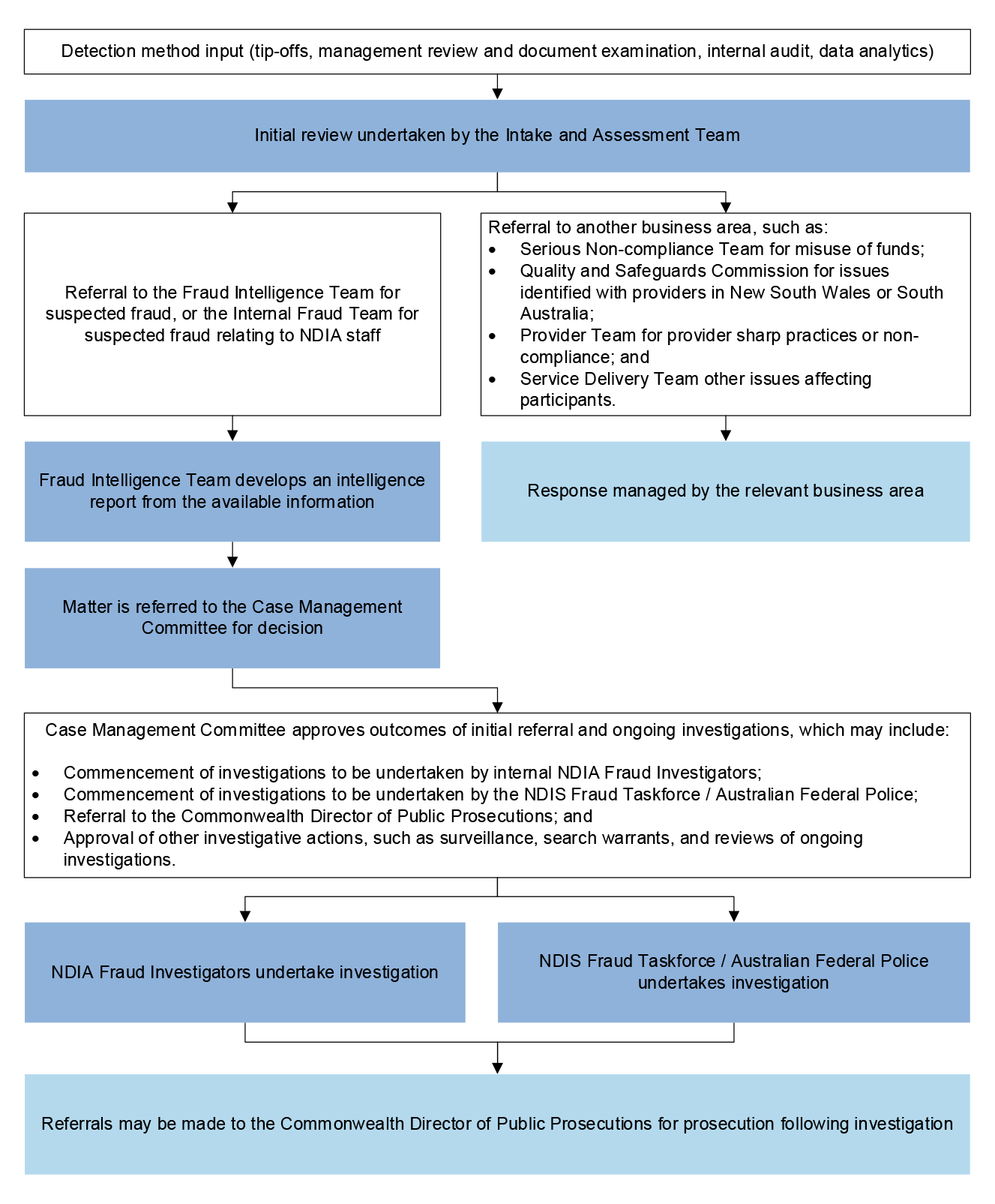

Processes for investigating and taking action against suspected fraud are largely appropriate. In December 2018, NDIA developed policies and procedures for investigations which are compliant with the Australian Government Investigations Standards (AGIS) 2011. The NDIA is undertaking investigations in line with these policies and has established an appropriate triaging, escalation, and oversight model. The NDIA also established the NDIS Fraud Taskforce in July 2018, which is a key enhancement to the practical capacity to respond to fraud.

The NDIA’s fraud response management is not fully compliant with investigations policies or the AGIS. The electronic case management system does not centrally record investigation activities or assist with the preparation of briefs of evidence. The NDIA has not established key performance indicators for investigations or undertaken assurance activities to confirm that investigations are being conducted in line with these policies and procedures. The NDIA is taking action to improve compliance in these areas.

3.30 The Fraud Rule56 states:

The accountable authority of a Commonwealth entity must take all reasonable measures to prevent, detect and deal with fraud relating to the entity, including by:

- having an appropriate mechanism for investigating or otherwise dealing with incidents of fraud or suspected fraud; and

- Commonwealth entities must have an appropriate mechanism for recording and reporting incidents of fraud or suspected fraud.

3.31 The Fraud Policy57 provides further guidance on investigations and states that entities must have investigation processes and procedures that are consistent with the Australian Government Investigations Standards (AGIS) 2011. While the Fraud Policy is not binding for the NDIA, the NDIA’s Fraud Control Plan states that investigations undertaken within the Agency will comply with the AGIS.

The NDIS Fraud Taskforce