Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

National Broadband Network — Transition from Construction to Operation

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- NBN Co Limited (NBN Co) is a government business enterprise (GBE).

- The board has ultimate responsibility for the strategies and performance of the company and is accountable to shareholder ministers.

- The nature of the NBN Co transition is one of a shift in the balance of its two core functions of ‘building’ and ‘operating’ the national broadband network.

- The performance audit assesses whether the board had strategies and arrangements in place to oversee and manage the transition.

Key facts

- In December 2020 the Minister for Communications declared that the national broadband network be treated as built and fully operational.

What did we find?

- Strategies and arrangements to oversee and manage the transition from building to operating the national broadband network were largely effective.

- Communication with, and reporting to, shareholder ministers fell short of mandatory and other requirements.

What did we recommend?

- There were three recommendations to NBN Co aimed at ensuring specific requests from shareholder ministers were adequately responded to, the Australian Government’s expectations were reflected in strategy and performance monitoring and mandatory requirements were met.

- NBN Co agreed to all recommendations.

7

number of GBEs which are Commonwealth companies, including NBN Co

$51.4bn

funding committed by the Australian Government to NBN Co since 2011

0

number of corporate plans during the transition period which met all mandatory requirements

Summary and recommendations

Background

1. NBN Co Limited (NBN Co) is a Commonwealth company under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), and is a Government Business Enterprise (GBE). A GBE is a commercially focused government owned business that is established to fulfil a Commonwealth Government purpose. The Commonwealth Government establishes GBEs to implement government policy, where intervention is appropriate such as where there are high barriers to entry, market failure or no market at all and/or infrastructure investments with lower rates of return. There are seven GBEs which are Commonwealth companies, including NBN Co.1

2. The purpose of NBN Co is to provide fast, reliable and affordable connectivity to enable Australia to seize the economic opportunities before it and service the best interests of consumers. NBN Co is accountable to the Australian Government as its sole shareholder. The Commonwealth’s ownership interest is represented by two shareholder ministers, the Minister for Communications and the Minister for Finance. The Australian Government has made a commitment that it will keep NBN Co in public hands for the foreseeable future to provide the company with the certainty needed to continue delivering improvements to the network while keeping prices affordable.

3. The board is the accountable authority under finance law.2 The conduct of the board is subject to the provisions of the PGPA Act, the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule), the Corporations Act 2001, the National Broadband Network Companies Act 2011 (NBN Act) and common law. The board has ultimate responsibility for the performance of the company, and the board is accountable to the shareholder ministers.

4. In July 2020 the board commenced oversight of changes to NBN Co’s governance, strategies, initiatives, processes and reporting to facilitate the transition of the company to be ‘a customer-led, trusted critical national infrastructure provider’ by 2023–24. The nature of the NBN Co transition is one of a shift in the balance of its two core functions of ‘building’ and ‘operating’ the national broadband network. NBN Co will continue both types of activities after completion of the transition. The transition reflects the shift in focus to being primarily on the operation of the network while continuing to build and upgrade the infrastructure supporting the network.

5. The governance arrangements and processes undertaken by NBN Co between July 2020 and December 2023 have been examined in this performance audit as the ‘transition period’ in which most of its activities to move the entity from completing the initial build of the national broadband network to being a fully operational wholesaler occurred. Key areas of focus during this period included the company’s organisational structure, financing, risk management, compliance and assurance.

Rationale for undertaking the audit

6. NBN Co is accountable to the Australian Government as its sole shareholder. NBN Co was established in 2009. In June 2011, the Australian Government and NBN Co entered into an Equity Funding Agreement, whereby equity funding of $29.5 billion was provided. In addition, in 2016–17 the Australian Government entered into a loan agreement with NBN Co for $19.5 billion which is required to be repaid by 30 June 2024.3 In 2022–23 the Australian Government and NBN Co entered into an Equity Funding Agreement for an additional $2.4 billion in equity funding to expand full-fibre access to an additional 1.5 million premises by December 2025.4

7. The performance audit will provide assurance that NBN Co has strategies and arrangements in place to oversee its transition from building to operating the national broadband network.

8. Under the Auditor-General Act 1997, as a GBE, performance audits of NBN Co can be undertaken at the request of the Joint Committee of Public Accounts and Audit (JCPAA). A request from the JCPAA was received on 3 August 2023 following an approach from the Auditor-General for such a request.

Audit objective and criteria

9. The objective of the audit was to assess the effectiveness of NBN Co’s strategies to manage its transition from building to operating the national broadband network.

10. To form a conclusion against the objective, the following high-level criteria were adopted:

- Did NBN Co have a fit-for-purpose and risk-based transition plan and strategies in place to transition the business from building to operating the national broadband network?

- Were the arrangements for oversight of the transition effectively managed?

- Does NBN Co’s monitoring and reporting demonstrate that it has effectively transitioned its business to support its focus on operating and enhancing the network?

11. The performance audit examined the changes in governance, processes and reporting from July 2020 to December 2023 to support the transition activities. The focus of the audit was to evaluate the oversight of the transition by the board as the accountable authority. The audit considered the board’s operation and reporting to shareholders based on information provided to the board by management.

Conclusion

12. Strategies and arrangements to oversee and manage the transition from building to operating the national broadband network were largely effective. Communication with, and reporting to, shareholder ministers fell short of mandatory and other requirements.

13. NBN Co had largely fit-for-purpose and risk-based transition plans and strategies except for failing to address all mandatory requirements. The approach to the transition made the achievement of timelines and key milestones less transparent to the board. There is no timeline for completion of the transition. It was not transparent that ministers’ statements of expectations were reflected in NBN Co’s transition plans and strategies.

14. Arrangements for the oversight of transition were largely effective. Communication with, and reporting to, shareholder ministers fell short of mandatory requirements. Requests from shareholder ministers that NBN Co comply with mandatory requirements made between September 2020 and September 2023 were not addressed until early 2024. Until improvements were implemented in February 2023, transition risk information was not complete or accurate and did not consistently reflect the board’s risk appetite. NBN Co’s identification and monitoring of its finance law obligations was incomplete. NBN Co’s assurance and fraud control arrangements supported the transition.

15. NBN Co’s monitoring and reporting demonstrates that it has been largely effective in transitioning its business to support a focus on operating and enhancing the national broadband network. NBN Co’s performance monitoring and reporting did not meet the content requirements of a GBE. NBN Co has demonstrated that its activities and performance expectations have adapted over time to reflect transition performance and outcomes.

Supporting findings

Transition plans and strategies

16. For the transition period NBN Co corporate plans fell short of mandatory requirements related to providing information about purposes, performance, and capability. The most recent corporate plan (2024–27) demonstrated improved compliance except for information about performance. The approach to corporate planning adopted by NBN Co diminishes the transparency of achievement of NBN Co’s strategy and purposes. NBN Co’s management of the transition and consequently the board’s monitoring of transition activities changed over the transition period. Planning for, and reporting of, the transition was incorporated into business-as-usual activities and monitored by the executive committee. This reduced the transparency of the timelines, expectations, and achievements of the transition to the accountable authority and shareholder ministers. (See paragraphs 2.2 to 2.31).

17. NBN Co did not assure itself that transition plans and strategies reflected the priorities, objectives and approach required by the Australian Government as outlined in the statements of expectations. Other external and internal considerations were incorporated into strategy development and monitoring. (See paragraphs 2.32 to 2.45).

18. The initial transition horizon identified in board papers was four years to June 2024. Transition plans were prepared in July 2020. Since March 2022 the board has not received specific information about transition timelines and key milestones. Until December 2023, the board and shareholder ministers did not receive information about how the company’s planned performance measures would contribute to the achievement of its purposes. (See paragraphs 2.46 to 2.54).

Transition oversight arrangements

19. Governance arrangements supported transition requirements and changes in business operations. Governance arrangements did not fully comply with the PGPA Act or reflect changes to the board’s role outlined in the shareholder ministers’ statements of expectations. NBN Co management did not provide complete or accurate information to the board or shareholder ministers about risks and risk management during the transition. The board’s risk appetite was not consistently applied during the transition. NBN Co’s oversight arrangements did not provide for complete identification and monitoring of its compliance with finance law obligations. (See paragraphs 3.5 to 3.68).

20. NBN Co has not met its obligations for communication with, and reporting to, shareholder ministers. During the transition quarterly progress reports did not include all mandatory content and were provided to shareholder ministers by management rather than the board chair as required by Resource Management Guide No. 126: Commonwealth Government Business Enterprises – Governance and Oversight Guidelines (RMG 126 – GBE Guidelines). This was rectified early in 2024 but only after three written requests from shareholder ministers. Information requirements of the Shareholder Information Deed have not been met. (See paragraphs 3.69 to 3.89).

Monitoring and reporting

21. The board received reports and information about NBN Co’s performance during the transition. NBN Co’s performance monitoring and reporting did not meet the content requirements of a government business enterprise. (See paragraphs 4.2 to 4.14).

22. NBN Co has demonstrated that its activities and performance expectations have adapted over time to reflect transition performance and outcomes. NBN Co does not have a single framework or approach for capturing, considering and monitoring the implementation of lessons learnt. (See paragraphs 4.15 to 4.19).

Recommendations

Recommendation no. 1

Paragraph 2.16

NBN Co ensures corporate plans meet the needs of shareholder ministers, the Parliament and the public and meet all requirements of the Public Governance, Performance and Accountability Act 2013 and Resource Management Guide No. 126: Commonwealth Government Business Enterprises – Governance and Oversight Guidelines.

NBN Co Limited response: Agreed.

Recommendation no. 2

Paragraph 2.38

NBN Co establishes processes to assure itself that statement of expectations’ requirements have been sufficiently incorporated into corporate plans and strategies.

NBN Co Limited response: Agreed.

Recommendation no. 3

Paragraph 3.46

NBN Co ensures information provided to shareholder ministers responds to specific requests.

NBN Co Limited response: Agreed.

Summary of entity response

We welcome the positive conclusions that have been made in the Report in respect of NBN Co’s transition from a construction focused company to a fully operational broadband wholesaler.

We are particularly pleased that on an overall basis the ANAO has assessed that NBN Co was largely effective in transitioning to an operating company and that the following observations were recognised in your conclusion in the Report:

- Strategies and arrangements to oversee and manage the transition from building to operating the national broadband network were largely effective.

- NBN Co had largely fit-for-purpose and risk-based transition plans and strategies.

- Arrangements for the oversight of transition were largely effective.

- NBN Co’s monitoring and reporting demonstrates that is has been largely effective in transitioning its business to support a focus on operating and enhancing the national broadband network.

- NBN Co has demonstrated that its activities and performance expectations have adapted over time to reflect transition performance and outcomes.

We note that the Report includes the observation that the approach to the transition made the achievement of timelines and key milestones less transparent to the Board and that there was no timeline for completion of the transition. This reflects management and the Board’s decision to embed the delivery of transition activities within its general operational strategies. As such there is no definitive end date to the transition and achievement of these objectives is replaced by the next stage of transition and optimisation of the Company as it strives to deliver its purpose. This was a conscious decision and was made to ensure that the necessary changes as part of the transition could be best managed alongside the day-to-day operations of the Company.

NBN Co will also work to address each of the three recommendations included in the Report.

Key messages from this audit for all Australian Government entities

23. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Performance and impact measurement

1. Background

Introduction

1.1 NBN Co Limited (NBN Co) is a Commonwealth company under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), and is a Government Business Enterprise (GBE). A GBE is a Commonwealth entity or company as defined by section 8 of the PGPA Act and prescribed by section 5 of the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). A GBE is a commercially focused government owned business that is established to fulfil a Commonwealth Government purpose. The Commonwealth Government establishes GBEs to implement government policy, where intervention is appropriate such as where there are high barriers to entry, market failure or no market at all and/or infrastructure investments with lower rates of return. There are seven GBEs which are Commonwealth companies, including NBN Co.5

1.2 A GBE as a government-owned entity has high levels of scrutiny, sensitivity and accountability.

Effective governance and stewardship frameworks are essential to ensure that GBEs make a positive contribution to economic efficiency, sector competitiveness and the delivery of services to the community.

The Board of Directors provides stewardship, strategic leadership, governance and oversight of GBEs, while also acting as a bridge between Commonwealth policy-making and operational implementation by GBEs.

The Board of Directors of a GBE has ultimate fiduciary responsibility for the performance of the GBE, and are fully accountable to Shareholder Ministers.6

1.3 The purpose of NBN Co is to provide fast, reliable and affordable connectivity to enable Australia to seize the economic opportunities before it and service the best interests of consumers. The Australian Government has made a commitment that it ‘will keep NBN Co in public hands for the foreseeable future to provide the entity with the certainty needed to continue delivering improvements to the national broadband network while keeping prices affordable’.7

1.4 NBN Co is to enhance Australia’s digital capability by delivering services to meet the current and future needs of households, communities and businesses, and to promote digital inclusion and equitable access to affordable and reliable broadband services. NBN Co is required to operate on a commercial basis, drive a culture of efficiency and innovation that yields results, and meet the highest standards of transparency, governance and accountability.8

1.5 NBN Co is accountable to the Australian Government as its sole shareholder. The Commonwealth’s ownership interest is represented by two shareholder ministers. The shareholder ministers are the Minister for Communications and the Minister for Finance. The ministers are supported by their respective departments. The shareholder ministers and shareholder departments have distinct expectations and information requirements of NBN Co. These requirements are set out in the Statement of Expectations, Resource Management Guide No. 126: Commonwealth Government Business Enterprises – Governance and Oversight Guidelines (RMG 126 – GBE Guidelines) and the Shareholder Information Deed. In the Statement of Expectations the shareholder ministers set out information to guide NBN Co’s strategic direction and approach. RMG 126 – GBE Guidelines outlines mandatory compliance obligations for accountable authorities of GBEs and non-mandatory suggested better practice governance approaches which can be considered for implementation by GBEs where relevant. The Shareholder Information Deed, which is an agreement between the Commonwealth of Australia and NBN Co, outlines a range of information and meetings to be undertaken between NBN Co and shareholder departments to assist in the monitoring and management of the Commonwealth’s financial interests and risks.

1.6 The board of NBN Co is the accountable authority under finance law.9 The conduct of the board is subject to the provisions of the PGPA Act, the PGPA Rule, the Corporations Act 2001, the National Broadband Network Companies Act 2011 (NBN Act) and common law. The board has ultimate responsibility for the performance of the company, and the board is accountable to the shareholder ministers. The board has established four sub-committees to assist it in achieving its objectives: the financing committee; the audit and risk committee; the nominations committee; and the people and remuneration committee.

1.7 Pursuant to rule 5.4.1 of the Constitution of NBN Co Limited, the board is to comprise a minimum of three and a maximum of nine directors. At December 2023 the board comprised eight non-executive directors and one managing director who was the chief executive officer. The board chair was appointed with effect from January 2022 with a current term to December 2024.10 Since July 2020 there have been five new non-executive directors appointed to the board. The chief executive officer was appointed with effect from September 2018 and reappointed in 2023 for an additional term of three years.

1.8 The Constitution of NBN Co Limited outlines the role of the chief executive officer. In addition the board charter states that ‘the chief executive officer is responsible for implementing strategic objectives, policies, the corporate plan and budget of the company approved by the board’. The board may delegate some of its powers to the chief executive officer.

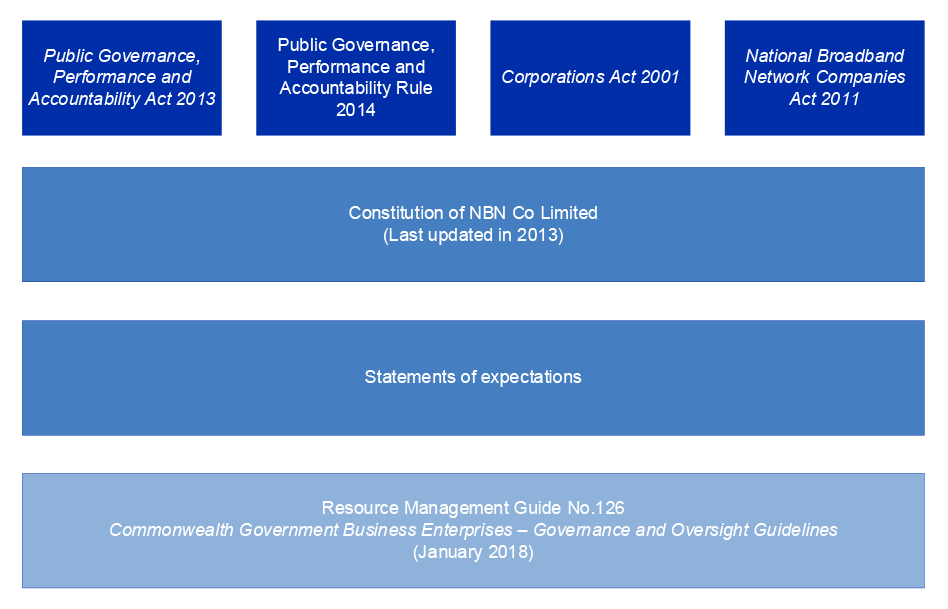

1.9 The legislative and regulatory framework of NBN Co examined as part of this performance audit is illustrated in Figure 1.1. The application of these documents to NBN Co is described and assessed in the body of this report.

Figure 1.1: NBN Co’s legislative and regulatory framework examined as part of this performance audit

Source: ANAO analysis of NBN Co’s legislative and regulatory framework.

1.10 At 30 June 2023 NBN Co had 4,760 employees and recorded revenue of $5.3 billion. In terms of delivering the national broadband network, in its Annual Report 2023 NBN Co reported there were 12.29 million premises ‘ready to connect’; 6.90 million premises able to access nbn Home Ultrafast speed tier plans and 12,790 new wireless cells added to the Fixed Wireless network.

Transition from construction to operation

1.11 The nature of the NBN Co transition is one of a shift in the balance of its two core functions of ‘building’ and ‘operating’ the national broadband network. NBN Co will continue both types of activities after completion of the transition. The transition reflects the shift in focus to being primarily on the operation of the network while continuing to build and upgrade the infrastructure supporting the network.

1.12 In July 2020 the board commenced oversight of changes to NBN Co’s governance, strategies, initiatives, processes and reporting to facilitate the transition of the company to be ‘a customer-led, trusted critical national infrastructure provider’ by 2023–24. The governance arrangements and processes undertaken by NBN Co between July 2020 and December 2023 have been examined in this performance audit as the ‘transition period’ in which most of its transition activities to move the entity from completing the initial build of the national broadband network to being a fully operational wholesaler occurred. Key areas of focus during this period included the company’s organisational structure, financing, risk management, compliance and assurance.

1.13 In December 2020 the Minister for Communications declared that the national broadband network be treated as built and fully operational.11 This declaration is one of the steps that must occur under the NBN Act before NBN Co can be privatised, but does not necessarily trigger any further steps.

Rationale for undertaking the audit

1.14 NBN Co is accountable to the Australian Government as its sole shareholder. NBN Co was established in 2009. In June 2011, the Australian Government and NBN Co entered into an Equity Funding Agreement, whereby equity funding of $29.5 billion was provided. In addition, in 2016–17 the Australian Government entered into a loan agreement with NBN Co for $19.5 billion which is required to be repaid by 30 June 2024. In 2022–23 the Australian Government and NBN Co entered into an Equity Funding Agreement for an additional $2.4 billion in equity funding to expand full-fibre access to an additional 1.5 million premises by December 2025.12

1.15 The performance audit will provide assurance that NBN Co has strategies and arrangements in place to oversight its transition from building to operating the national broadband network.

1.16 Under the Auditor-General Act 1997, as a GBE, performance audits of NBN Co can be undertaken at the request of the Joint Committee of Public Accounts and Audit (JCPAA). A request from the JCPAA was received on 3 August 2023 following an approach from the Auditor-General for such a request.

Audit approach

Audit objective, criteria and scope

1.17 The objective of the audit was to assess the effectiveness of NBN Co’s strategies to manage its transition from building to operating the national broadband network.

1.18 To form a conclusion against the objective, the following high-level criteria were adopted:

- Did NBN Co have a fit-for-purpose and risk-based transition plan and strategies in place to transition the business from building to operating the national broadband network?

- Were the arrangements for oversight of the transition effectively managed?

- Does NBN Co’s monitoring and reporting demonstrate that it has effectively transitioned its business to support its focus on operating and enhancing the network?

1.19 The performance audit examined the changes in governance, processes and reporting from July 2020 to December 2023 to support the transition activities. The focus of the audit was to evaluate the oversight of the transition by the board as the accountable authority. The audit considered the board’s operation and reporting to shareholders based on information provided to the board by management.

Audit methodology

1.20 The audit methodology included:

- examination of documentation held by NBN Co including strategies, policies, procedures, frameworks, guidelines, internal reporting and meeting minutes;

- meetings with the board chair, executive and staff;

- observation of part of one board meeting; and

- consideration of one public submission to the audit.

1.21 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $499,500.

1.22 The team members for this audit were Michelle Page, Susan Ryan and Peter Bell.

2. Transition plans and strategies

Areas examined

This chapter examines whether NBN Co had fit-for-purpose and risk-based transition plans and strategies in place to transition its business from building to operating the national broadband network.

Conclusion

NBN Co had largely fit-for-purpose and risk-based transition plans and strategies except for failing to address all mandatory requirements. The approach to the transition made the achievement of timelines and key milestones less transparent to the board. There is no timeline for completion of the transition. It was not transparent that ministers’ statements of expectations were reflected in NBN Co’s transition plans and strategies.

Areas for improvement

The ANAO made two recommendations aimed at ensuring NBN Co corporate plans meet the needs of shareholder ministers, the Parliament and the public and meet mandatory requirements; and assuring itself that statement of expectations requirements have been sufficiently incorporated into corporate plans and strategies.

2.1 Fit-for-purpose transition plans and strategies are those which comply with Commonwealth legislation and policy requirements and are consistent with any standards and better practice that have been adopted by the entity. Risk-based plans are those which evaluate options, risks of chosen strategies and implications, both now and into the foreseeable future. Plans and strategies should consider timing, performance and resources. Strategies should be directed towards achieving the Australian Government stated purposes for the Government Business Enterprise (GBE).

Did NBN Co transition plans and strategies reflect appropriate consideration of options, risks and financial implications?

For the transition period NBN Co corporate plans fell short of mandatory requirements related to providing information about purposes, performance, and capability. The most recent corporate plan (2024–27) demonstrated improved compliance except for information about performance. The approach to corporate planning adopted by NBN Co diminishes the transparency of achievement of NBN Co’s strategy and purposes.

NBN Co’s management of the transition and consequently the board’s monitoring of transition activities changed over the transition period. Planning for, and reporting of, the transition was incorporated into business-as-usual activities and monitored by the executive committee. This reduced the transparency of the timelines, expectations, and achievements of the transition to the accountable authority and shareholder ministers.

Corporate planning

2.2 Section 95 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and subsection 27(A) of the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) set out the planning and reporting requirements for Commonwealth companies. Resource Management Guide No. 126: Commonwealth Government Business Enterprises – Governance and Oversight Guidelines (RMG 126 – GBE Guidelines) also outlines the mandatory compliance obligations for accountable authorities of a GBE. Mandatory corporate planning compliance obligations are intended to ensure effective accountability and transparency to the Parliament and the public. The mandatory corporate planning compliance obligations are also focused on the delivery of high-quality strategies, planning, and performance information.

2.3 The directors of a Commonwealth company must prepare a corporate plan at least once for each reporting period and give the corporate plan to the shareholder ministers in accordance with the prescribed rules. The corporate plan must set out how the activities of the company will contribute to achieving those priorities and objectives stated by the Australian Government in the Statement of Expectations.13 Corporate plans must cover a period of at least four years and include, for each reporting period covered by the plan, a summary of how the company will achieve its purposes and how the company’s performance in achieving the purposes will be measured and assessed. Corporate plans must include any performance measures and targets that will be used in the measurement and assessment.14 Corporate plans are also expected to include financial results for the year immediately prior as a comparison.

2.4 In recognition that a GBE may wish to include information in corporate plans about strategies and performance measures and targets that may be confidential or contain commercially sensitive information, the accountable authority may agree to prepare both a public (redacted) version of the corporate plan and a confidential (unredacted) corporate plan, or statement of corporate intent, that is provided to shareholder ministers. The public version of the corporate plan must address the requirements of the corporate plan as prescribed by the PGPA Rule and include sufficient non-confidential or non-commercially sensitive information to inform how the GBE plans to deliver on its purposes, and measure its performance, over the reporting period.15

2.5 To assess whether the board had established strategies that reflected appropriate consideration of options, risks and financial implications, the ANAO examined the content of the five corporate plans prepared for the period 2020–23 to 2024–27 and assessed compliance with requirements. As required by RMG 126 – GBE Guidelines, each of the corporate plans covers a four-year period and includes the financial year in which it is prepared. For example, corporate plan 2020–23 covers the period from 1 July 2019 to 30 June 2023.

2.6 An assessment of whether public and confidential corporate plans were prepared and provided by NBN Co to shareholder ministers during the transition period is summarised in Table 2.1.

Table 2.1: NBN Co corporate plans provided to shareholder ministers over the transition period

|

|

Corporate Plan 2020–23 |

Corporate Plan 2021–24 |

Corporate Plan 2022–25 |

Corporate Plan 2023–26 |

Corporate Plan 2024–27 |

|

Public version |

Yes |

Yes |

Yes |

Yesa |

Yes |

|

Confidential version |

No |

No |

Nob |

No |

Yesc |

Note a: A Statement of Corporate Intent 2023–26 was publicly released in August 2022. To reflect the provision of a new Statement of Expectations in December 2022 and entering into an Equity Funding Agreement with the Australian Government for an additional $2.4 billion, a full corporate plan for 2023–26 was publicly released in December 2022.

Note b: A single confidential page was provided to shareholder ministers which outlined the financial and operating forecast targets for each of the four-year periods covered by the corporate plan.

Note c: An analysis of the information contained in the NBN Co integrated operating plan was provided to shareholder ministers in lieu of a confidential corporate plan in May 2023. In August 2023 shareholder ministers requested that a confidential version of the corporate plan, which met requirements, be provided ‘as soon as possible’. On 15 December 2023, a confidential version of the Corporate Plan 2024–27 was provided to shareholder ministers. RMG 126 – GBE Guidelines paragraph 3.7 states that ‘Corporate Plans should be provided to Shareholder Ministers with sufficient time for Shareholder Ministers to provide comments if they wish to do so’. The contents of this confidential corporate plan have been further analysed at paragraphs 2.14 to 2.15.

Source: ANAO analysis of NBN Co corporate plans.

2.7 For the corporate plans since 2022–25, the board decided not to include in corporate plans financial or operational performance measures and targets for more than a twelve-month period. The rationale for this was ‘since commencing activity in local and global debt capital markets, the Company has come under a new suite of obligations and limitations. This means NBN Co must ensure it complies with certain regulatory requirements and guidelines in respect to market disclosures.’ At the time of approving this change to corporate plan information, there was no evidence that the board considered the impact of this change on meeting the corporate plan requirements outlined in the PGPA Act, PGPA Rule or RMG 126 – GBE Guidelines. NBN Co provided a range of planning and performance information to shareholder departments to support the development of corporate plans. This information was not provided to shareholder ministers for the purposes of meeting the requirements of a confidential corporate plan under the PGPA Act, PGPA Rule or RMG 126 – GBE Guidelines.

2.8 Table 2.2 summarises the ANAO’s assessment of NBN Co’s corporate plans against requirements.16 The assessment was made based on an analysis of the public and confidential versions of the corporate plans provided to shareholder ministers.

Table 2.2: Analysis of NBN Co’s compliance with corporate plan requirements

|

RMG 126 – GBE Guidelines component |

Requirement |

2020–23 |

2021–24 |

2022–25 |

2023–26 |

2024–27a |

|

Period corporate plan must cover |

A corporate plan must cover at least four reporting periods: the reporting period for which the plan is prepared and at least the following three reporting periods. |

◆ |

◆ |

◆ |

■ |

◆ |

|

A statement that the corporate plan has been prepared for paragraph 95(1) of the PGPA Act, reporting period for which the corporate plan is prepared and the reporting periods covered by the corporate plan. Reference to any other legislation applicable to the preparation of the corporate plan. |

◆ |

◆ |

◆ |

◆ |

◆ |

|

The purposes of the Government Business Enterprise (GBE), including:

|

▲ |

▲ |

▲ |

▲ |

◆ |

|

|

◆ |

◆ |

◆ |

◆ |

◆ |

|

|

■ |

■ |

■ |

■ |

▲ |

|

The key strategies and plans for each reporting period covered by the corporate plan to achieve the GBE’s purpose, including human resource strategies and industrial relations strategies. |

▲ |

▲ |

▲ |

▲ |

◆ |

|

A summary of the risk oversight and management systems, including an analysis of key risks in the GBE’s environment and how these risks will shape the activities to be undertaken to fulfil the GBE’s purpose and meet financial targets, accountabilities for managing risk, mitigation strategies and their alignment to the objectives and plans of the GBE, consistent with the intent of the Commonwealth Risk Management Policy. |

◆ |

◆ |

◆ |

◆ |

◆ |

Key: ◆ Fully compliant ▲ Partially compliant ■ Not compliant

Note a: On 15 December 2023, a confidential version of the Corporate Plan 2024–27 was provided to shareholder ministers. RMG 126 – GBE Guidelines paragraph 3.7 states that ‘Corporate Plans should be provided to Shareholder Ministers with sufficient time for Shareholder Ministers to provide comments if they wish to do so’. The contents of this confidential corporate plan have been assessed at paragraph 2.14 to 2.15.

Source: ANAO analysis of NBN Co’s corporate plans.

2.9 In relation to the ‘period corporate plan must cover’ requirements, the 2023–26 corporate plan was assessed as ‘non-compliant’ as performance measures and targets beyond a twelve-month planning horizon were not included in the public corporate plan and no confidential information, which covered a four year reporting period, was prepared.

2.10 In relation to the ‘purposes’ and ‘capability’ requirements, although the corporate plans include information on the purposes and objectives of the company, the six strategic pillars which underpin its strategy did not change over the five corporate plans prepared during a period of significant change associated with the transition. The detailed strategies and initiatives which are described in the body of the public corporate plans to support the achievement of purposes were not linked to the strategic pillars or the ‘value creation outcomes’ described in the corporate plans.17 The narrative information in corporate plans does not provide sufficient or clear information on how the strategies and initiatives planned by the entity change over the corporate plan four-year reporting period, how they will be measured over each of the reporting periods or how these strategies contribute to achieving the entity’s, or the Australian Government’s, purposes for the company. In addition, until 2024–27 strategies related to human resources and industrial relations in the corporate plans provided limited insight into NBN Co’s structure and approach to these areas as it moved from construction to operational activities. The 2024–27 confidential corporate plan provided additional information on how strategies linked to key outcomes and performance measures over each of the reporting periods.

2.11 In terms of the ‘performance’ requirement, until 2024–27, the corporate plans did not provide all mandatory information on how NBN Co would achieve its purposes and how this would be measured and assessed. RMG 126 – GBE Guidelines Table 4 outlines 21 minimum key performance measures for corporate plans, including specific indicators and how these should be defined and calculated. These minimum financial and non-financial measures were not included in NBN Co’s corporate plans until 2024–27.

2.12 NBN Co prepares integrated operating plans to ‘support the development of the Corporate Plan and Capital Management Strategy’. The integrated operating plans are detailed documents which outline initiatives and financing, as well as financial and non-financial performance metrics, to support the direction of the company. The integrated operating plans include over 60 performance metrics. An assessment of whether the RMG 126 – GBE Guidelines minimum financial and non-financial measures of performance had been considered by NBN Co when developing corporate plans is provided in Table 2.3. In this table an assessment of ‘partially complaint’ was recorded where the components of the performance indicator were included in the integrated operating plan but the indicator itself was not. This means that the performance indicator could be calculated using existing information but would require effort to locate the relevant information and calculate the required ratio. The assessment was also recorded as ‘partially compliant’ where the performance indicator was not provided for the entire reporting period.

Table 2.3: Analysis of NBN Co’s compliance with RMG 126 Table 4 minimum key performance indicators in corporate planning information

|

Measure |

Key performance indicator required |

2020–23 to 2023–26 |

2024–27 |

|

Financial performance |

Total shareholder return |

◆ |

◆ |

|

Dividend yielda |

◆ |

◆ |

|

|

Dividend payout ratioa |

◆ |

◆ |

|

|

Earnings before interest and taxes (EBIT) |

■ |

◆ |

|

|

Earnings before interest, taxes, depreciation and amortisation (EBITDA) |

◆ |

◆ |

|

|

Return on equity (RoE) |

◆ |

◆ |

|

|

Net profit after tax (NPAT) |

▲ |

◆ |

|

|

Underlying net profit after tax |

▲ |

◆ |

|

|

Business efficiency |

Operating margin |

▲ |

◆ |

|

Return on capital employed |

▲ |

◆ |

|

|

Debtors age (days) |

■ |

◆ |

|

|

Leverage and solvency |

Gearing ratio |

▲ |

◆ |

|

Interest cover |

▲ |

◆ |

|

|

Current ratio |

■ |

◆ |

|

|

Liquidity ratio |

▲ |

◆ |

|

|

Customers and stakeholders |

Customer satisfaction |

■ |

▲ |

|

Meeting CSOs |

N/A |

N/A |

|

|

Staff |

Staff retention and turnover rates |

▲ |

▲ |

|

Staff satisfaction |

■ |

▲ |

|

|

Lost time injury frequency rates and OHS incident rate |

▲ |

▲ |

|

|

Wages expense ratio |

▲ |

◆ |

|

Key: ◆ Fully compliant ▲ Partially compliant ■ Not compliant

Note a: Dividend yield and payout ratios are assessed as fully compliant as the corporate plans include information that no dividend is yet due and payable.

Source: ANAO analysis of NBN Co corporate plans and integrated operating plans.

2.13 Table 2.3 highlights that the majority of the minimum key performance indicators for corporate plans had not been prepared and reported by NBN Co until 2024–27.

2.14 The confidential corporate plan for 2024–27 included the RMG 126 Table 4 minimum key performance indicators and 77 other performance metrics, that included some duplication.18 The other performance metrics are those used by NBN Co management to assess its performance against the integrated operating plan. The inclusion of management performance indicators in corporate plans diminishes the transparency of the achievement of NBN Co’s strategy and purposes.

2.15 The ANAO considered the approach adopted by NBN Co for the development of the 2024–27 confidential corporate plan. As discussed in paragraph 2.4, RMG 126 – GBE Guidelines envisages that corporate planning requirements are met through a single corporate plan that may be redacted for the public to remove any confidential or commercially sensitive information. In addition, shareholder ministers have requested on three occasions that NBN Co provide a confidential corporate plan (refer to Table 3.3). The approach adopted by NBN Co for 2024–27 corporate planning was to prepare a public corporate plan comprising 60 pages.19 In addition, it provided shareholder ministers with a ‘confidential corporate plan’ that comprised an additional four documents totalling 128 pages much of which was management information and reports.20 In total the 2024–27 corporate planning information provided by NBN Co to shareholder ministers comprised 188 pages. A corporate plan is the primary planning document used by shareholder ministers, the Parliament and the public to understand the purposes of the entity, its objectives, and functions. It should set out how the entity undertakes its key activities and role and how it will measure performance in achieving its purposes. To provide transparency and accountability the information in corporate plans needs to meet requirements and be sufficiently summarised so that stakeholders can readily assess entity purposes, strategy and performance.

Recommendation no.1

2.16 NBN Co ensures corporate plans meet the needs of shareholder ministers, the Parliament and the public and meet all requirements of the Public Governance, Performance and Accountability Act 2013 and Resource Management Guide No. 126: Commonwealth Government Business Enterprises – Governance and Oversight Guidelines.

NBN Co Limited response: Agreed.

2.17 We acknowledge that the Corporate Plans prepared over the audit review period fell short of meeting all mandatory requirements as outlined in the GBE Guidelines. However, we would like to highlight that NBN Co performs a detailed corporate planning and forecasting process each year in support of its corporate plan and budgeting obligations. This Integrated Operating Plan (IOP) spans a 4-year forecast period and NBN Co actively engages with the Shareholder Departments throughout this process, providing supplementary briefings and information to the Departments upon request. In response to Shareholder Minister communication in respect of the Corporate Plan, NBN Co took steps to improve the compliance of Corporate Plan 2024-27 with GBE Guidelines. Moving forward, NBN Co is currently in planning discussions with the Shareholder Departments over the content of the Corporate Plan 2025-28 to ensure that all requirements of the GBE Guidelines are met in full.

Transition plan options and risk exposures

2.18 In July 2020 the board commenced oversight of changes to NBN Co’s governance, strategies, initiatives, processes and reporting to facilitate the transition of the company to be ‘a customer-led, trusted critical national infrastructure provider’ by 2023–24. Although the corporate plan and the integrated operating plan for 2021–24 included information on the operations, initiatives and financing for the company, a Continuous Transformation Plan was noted in July 2020 by the board to complement this information and to assist in providing a greater focus on the ‘operational elements where transformational change is necessary’ over the next four years.

2.19 The Continuous Transformation Plan identified initiatives for 2020–21 and future years to provide a multi-year program of work which focused on building critical strategic capability, simplifying operations, augmenting technology, meeting retail service providers’ needs for simplification, and cost effectiveness. The Continuous Transformation Plan was also intended to facilitate continuous collaboration across relevant business units. The Continuous Transformation Plan included a ‘traffic light’ approach to tracking initiatives to be delivered and was to include a scorecard review on the implementation of initiatives to be reviewed by the board on a quarterly basis. The Continuous Transformation Plan was monitored by the board until February 2021.

2.20 In March 2021 the board noted a document titled Vision2025 which was developed by the Executive Committee21 to provide the organisation with ‘further clarity of direction at a time when the organisation was changing from building a subscriber base to becoming a lean wholesaler’. Vision2025 proposed that NBN Co would be ‘radically different by 2025’. The Executive Committee stated that it would use this new vision to assist in prioritising the transition initiatives to be undertaken.

2.21 In August 2021, in the transition update to the board, management identified that the transition activities from July 2020 to January 2021 focused on the reduction in scale build activity and the accompanying organisational restructure, substantial workforce change (total staffing levels, including contractors, were reduced by around 2,000 people), together with operating cost reductions and process efficiency. Management stated that it was in the process of determining its ‘50 Top Priorities’ to be implemented over 2021–22 to 2024–25 to assist with the transformation. In December 2021 the board noted the top priority initiatives were continuing to be refined and prioritised by management. Ten ‘priority tiers’ had been identified and were to be tracked by management.

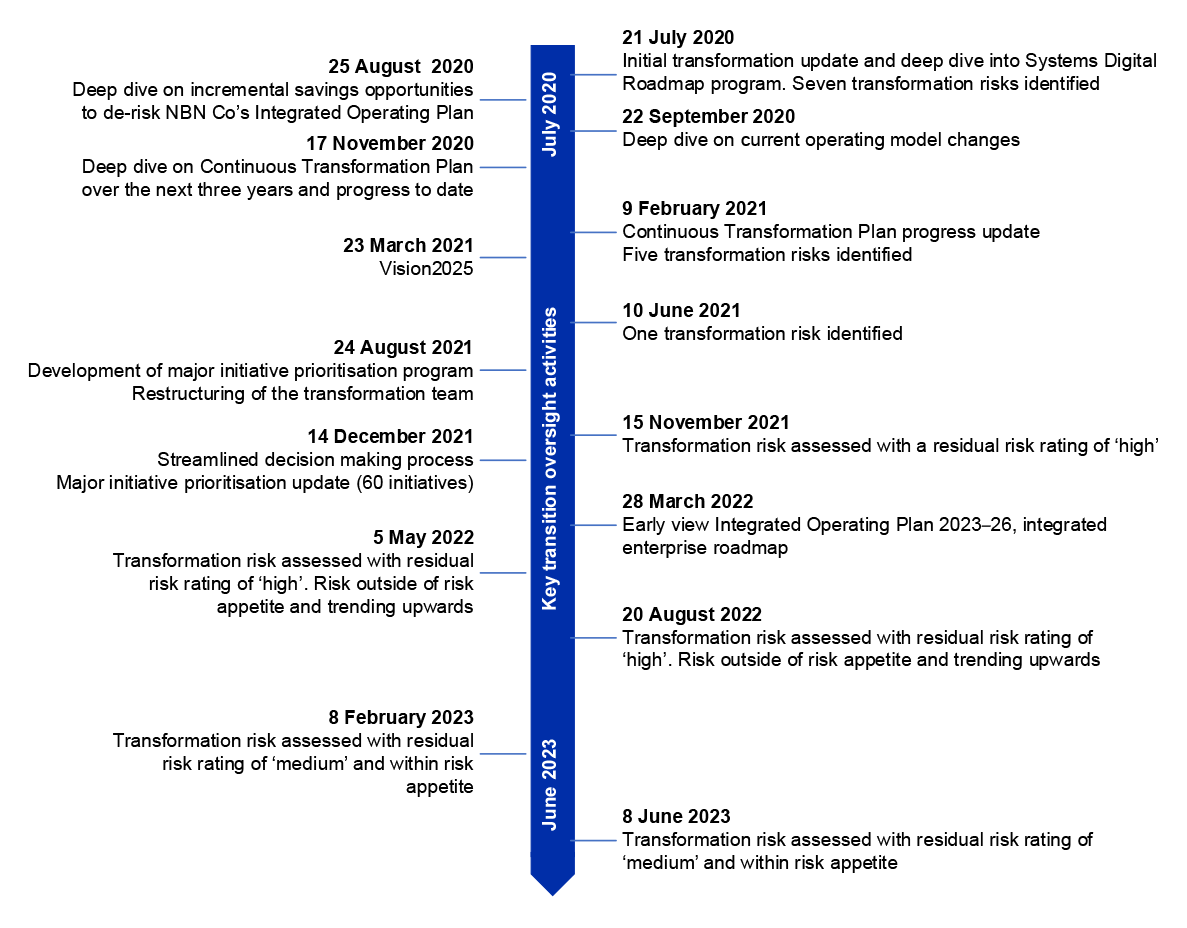

2.22 In its March 2022 transition update to the board, management identified that it would focus on the prioritisation of initiatives which would be included in the 2023–26 integrated operating plan development process and corporate plan. From March 2022, there was no specific transition update provided to the board, initiatives would be incorporated into and monitored as general entity performance. The board ‘noted’ the approach taken by management and the early view of the Integrated Operating Plan 2023–26. The board ‘reviewed and noted’ the draft Integrated Operating Plan 2023–26 in March 2022 and ‘approved’ the Integrated Operating Plan 2023–26 in September 2022. A timeline of the key transition oversight activities by the board during 2020–21 to 2022–23 is illustrated in Figure 2.1.

Figure 2.1: Key transition oversight activities related to plans, options and risks for 2020–21 to 2022–23

Source: ANAO analysis of board and audit and risk committee papers.

2.23 In summary, between July 2020 and February 2021 the board received information about how the organisation was transforming. Over the next ten months to December 2021 transition initiatives were monitored by the board through general performance reporting and management provided updates on how it was reprioritising initiatives and decision making. After this time, the transition was solely monitored through the delivery of the integrated operating plans and performance reporting information provided to the board (described and examined in paragraph 4.4). The integrated operating plans do not set out a date at which NBN Co will be fully transformed into ‘a customer-led, trusted critical national infrastructure provider’. The internal vision for NBN Co to be ‘a brilliant wholesaler, enabling Australia’s digital future’ by 2025 was included in the Integrated Operating Plan 2022–25. This internal vision was also included in the integrated operating plans for 2023–26 and 2024–27. NBN Co management advised that monitoring of the transition was carried out by the executive committee rather than the accountable authority. It is the board, as the accountable authority, that is responsible for the performance of the GBE and for demonstrating the achievement of performance to the shareholder ministers.

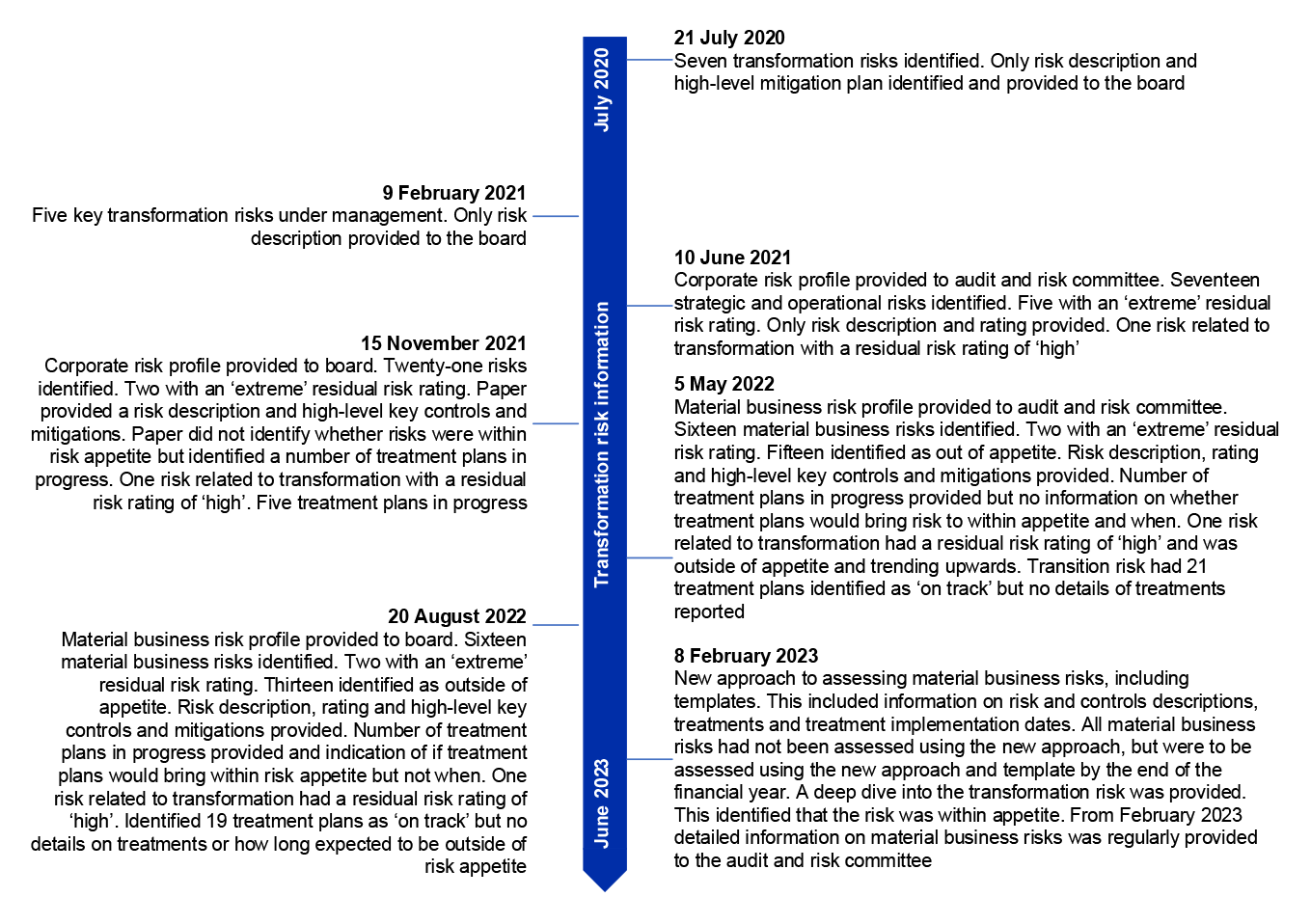

2.24 In July 2020 and February 2021 the board was provided with a list of between five and seven transformation risks. These risks were to complement the risks managed by individual business units as part of business-as-usual activities. These risks were not assessed in accordance with NBN Co’s risk management policy (e.g. there was no assessment of impact and no identification of controls or risk treatment plans).

2.25 From June 2021 NBN Co changed how the strategic risks22 for the company were worded and rated. One strategic risk related to the transition was identified:

Transformation: ability to appropriately govern, resource, synchronise, and develop capabilities to meet nbn’s vision.

2.26 This risk was rated as ‘high’ and ‘trending upwards’. There was no underlying assessment of the controls for this risk, and no treatment plans were identified to bring the risk within the board’s risk appetite of ‘medium’ residual risk. There was also no documentation to indicate how long management expected the risk to be outside of risk appetite. Six monthly updates on the entity risk profile, including information on material business risks were provided to the board (described and examined in paragraphs 3.40 and 3.41). A detailed risk assessment, including information on controls, treatments and ratings for the transformation risk was first provided to the board in February 2023. This was the first time that the transformation risk was assessed to be within risk appetite. A timeline of the key transition updates for 2020–21 to 2022–23 is included at Figure 2.1.

Financial planning

Funding

2.27 In June 2011, the Australian Government and NBN Co entered into an Equity Funding Agreement, whereby equity funding of $29.5 billion was provided. In 2016–17 the Australian Government entered into a loan agreement with NBN Co for $19.5 billion. This loan is required to be repaid by 30 June 2024.23 As NBN Co transitioned from building to a customer-led operating business it was required to diversify its sources of funding in order to finance the repayment of the Commonwealth loan by the due date and to secure financing for future operations. In 2020 the Australian Government agreed to allow NBN Co to acquire private sector long-term debt. Since 2020 NBN Co has raised external funding in excess of $25 billion.

2.28 A Treasury Policy was initially developed and approved by the board in May 2020. The Treasury Policy sets out NBN Co’s approach to managing financial risk and capital planning, including key financial strategies and assumptions. In November 2020 the board established a Financing Committee to consider and approve matters relating to funding arrangements and debt capital markets.24 The Financing Committee regularly updated the board on its activities. The Treasury Policy also outlines the role of the centrally managed treasury function to develop and recommend treasury policies and strategies to the board, to negotiate and manage short and long term funding from financial institutions and capital markets, and to allow central management of NBN Co’s surplus cash position and financial market exposures.

2.29 In August 2020 the board approved the initial refinancing plan which was provided to the Commonwealth of Australia represented by the Department of Communications and the Department of Finance (the departments). The refinancing plan was prepared based on the requirements outlined in the loan agreement. The refinancing plan outlined the approach taken to generate funds to ensure the Commonwealth loan would be repaid by the agreed due date. The document stated that it aligned to the Integrated Operating Plan 2021–24 and information included in capital management plans. Quarterly refinancing plan updates are provided to the departments. The board or its sub-committees do not receive copies of these quarterly reports. At each board meeting the chief financial officer’s performance report is tabled and noted. This document provides information on key financial performance metrics, financial position and financial commentary. It also includes capital expenditure, debt funding and cash flow information. A treasury dashboard is also provided to the board which includes treasury policy compliance information. The board receives regular updates from the Financing Committee on transactions that have been approved and correspondence with shareholder ministers related to financing transaction approvals.

Monitoring

2.30 In March 2019 a Shareholder Information Deed was executed. This was an agreement between the shareholder (Commonwealth of Australia represented by the Department of Communications) and NBN Co. The Shareholder Information Deed outlined a range of information and a series of meetings to be undertaken between NBN Co and shareholder departments to assist the Commonwealth of Australia in monitoring and managing its financial interests and risks as the shareholder in NBN Co. The Shareholder Information Deed was amended in March 2020, November 2020 and April 2022.

2.31 The deed includes the requirement to submit a capital management plan annually, to prepare an annual integrated operating plan and to provide long range financial outlook information. During the transition period, long-term financial planning did not extend to the time horizon required by the Shareholder Information Deed but did support corporate plan and integrated operating plan development and timelines.

Did NBN Co transition plans and strategies reflect the build and operate requirements of the Statement of Expectations and other external and internal considerations?

NBN Co did not assure itself that transition plans and strategies reflected the priorities, objectives and approach required by the Australian Government as outlined in the statements of expectations. Other external and internal considerations were incorporated into strategy development and monitoring.

2.32 NBN Co operates in a commercial environment which is influenced not only by government expectations, which are expressed by the shareholder ministers, but also external and internal factors. External factors, such as the competitive environment, technology changes and the economy can influence how NBN Co is able to deliver on its strategies and can influence internal decision making. The ANAO assessed whether government expectations and external and internal factors were appropriately considered by the board when developing transition plans and strategies.

Statement of Expectations

2.33 A Statement of Expectations may be issued by the responsible minister(s) to Commonwealth entities. A Statement of Expectations provides greater clarity about the government’s policies and objectives relevant to the entity and the priorities the minister expects the entity to observe in conducting its operations. A Statement of Expectations is generally refreshed with every change in minister, where there are changes in Commonwealth policy or every two years. The Statement of Expectations can include information on the strategic direction of the entity and how the entity should engage with business, the community and other government entities. The Statement of Expectations usually includes an expectation for the Commonwealth entity to meet the highest standards of transparency, governance and accountability. The Statement of Expectations usually includes a request for the Commonwealth entity to include information in corporate plans and annual reports on how it intends to, and has, discharged its responsibilities under the Statement of Expectations during the reporting period.

2.34 Following receipt of a Statement of Expectations, the accountable authority of a Commonwealth entity can (although it is not required) respond to the minister(s) with a Statement of Intent which outlines how the entity intends to meet those expectations, including how it will demonstrate progress. The Statement of Intent may be broader in scope than the expectations set out in the Statement of Expectations, and offers an avenue to highlight any emerging risks or operational issues relevant to the delivery of the entity functions. The Statement of Intent usually includes information describing internal initiatives or structures, changes in systems or governance, and efforts to build staff capability and to foster an organisation culture that supports best practice. Generally, both the Statement of Expectations and Statement of Intent are made available on the Commonwealth entity’s website.

2.35 Three statements of expectations from shareholder ministers to NBN Co were in effect during the transition period. Each statement replaced the previous one. The content of each of the statements of expectations is summarised in Table 2.4 indicating changes in the Australian Government’s expectations of NBN Co over the transition period. The 2016 Statement of Expectations focused on the roll out of a network in a cost-effective way. The 2021 Statement of Expectations was issued after the national broadband network was declared that it should be treated as built and fully operational, and focused on the commercial viability of NBN Co, and the company’s priority for complying with PGPA Act and GBE requirements as the entity transitioned to its fully operational phase. The 2022 Statement of Expectations continued the emphasis on transparency, governance and accountability including outlining the specific roles of the board.

Table 2.4: Analysis of key information included in the statements of expectations

|

Statement of Expectations issue date |

Analysis of key content |

|

24 August 2016 |

The statement provided NBN Co the flexibility and discretion in operational, technology and network design decisions, within the constraints of the Equity Funding Agreement with the Commonwealth, and the Government’s broadband policy objectives. It stated that NBN Co should roll out a multi-technology mix network and build the network in a cost-effective way using the technology best matched to each area of Australia. In terms of transparency, accountability and planning, the statement specified that in operating its business NBN Co should be mindful of the principles of public transparency, communicating and managing risk and business planning in accordance with NBN Co’s obligations as a Government Business Enterprise. |

|

26 August 2021 |

This statement was issued following the declaration in December 2020 that the national broadband network should be treated as ‘built and fully operational’.a The statement guides NBN Co’s transition to its fully operational phase while ensuring its strategic direction remains aligned with the government’s objectives for the national broadband network. The statement included the government’s objectives (which had been broadened to support the goal for Australia to be a ‘leading digital economy and society by 2030’) and outlined specific service expectations. These service expectations included regional and remote requirements, and how the organisation would foster competitive and efficient markets. The statement had a greater emphasis on operating commercially and operating efficiently within NBN Co’s capital constraints. Governance and accountability requirements also became more specific including that NBN Co should adopt, as far as practicable, the ASX Corporate Governance Principles and Recommendations and ensure ongoing compliance with RMG 126 – GBE Guidelines and PGPA requirements, including for corporate planning and associated key performance indicators. The statement emphasised that the board is fully accountable to shareholder ministers for the achievement of the objects and purposes of the entity. The statement also suggested that the board should have access to a company secretary to whom the board members can raise matters confidentially and to seek advice as a governance expert.b |

|

19 December 2022 |

The statement articulated the government objectives and the purpose and objectives of NBN Co. The statement outlined the role and responsibilities of NBN Co including that the board has ultimate responsibility for the performance of the company and is accountable to the Government as its sole shareholder. It stated that NBN Co should observe the principles and obligations set out in RMG 126 – GBE Guidelines. More detailed and specific ‘initiative’ requirements were identified such as digital capability and productivity, equitable access e.g., connecting first nations Australians, and regional and remote expectations. Specific metrics and deadlines for these initiatives were provided or requested to be developed. |

Note a: Declaration that the NBN should be treated as built and fully operational, available from https://www.infrastructure.gov.au/sites/default/files/declaration-that-the-nbn-should-be-treated-as-built-and-fully-operational.pdf [accessed 20 February 2024].

Note b: NBN Co has had a company secretary since June 2010.

Source: ANAO analysis of NBN Co’s statements of expectations.

2.36 NBN Co has not prepared or published a Statement of Intent or any other response to any of the statements of expectations received. The board did not formally acknowledge the receipt of the statements of expectations except for their mention in the published corporate plans and annual reports. NBN Co does not have a process to confirm that statement of expectations’ requirements have been sufficiently incorporated into corporate plans and strategies or governance structures.

2.37 In February 2021 the board minutes included an action that ‘Management will align the content of the next version of the Statement of Expectations (SOE) to the Corporate Plan and highlight any gaps between the two documents when it next reports to the Board on the progress of the SOE’. No gap analysis was provided to the board and the action was closed by the board in July 2021.

Recommendation no.2

2.38 NBN Co establishes processes to assure itself that statement of expectations’ requirements have been sufficiently incorporated into corporate plans and strategies.

NBN Co Limited response: Agreed.

2.39 While NBN Co accepts the recommendation above, we note that NBN Co believes that the Statement of Expectations have been sufficiently incorporated into its operating strategies and corporate plans. This is reflected in the approval of corporate plans by the Board and the Shareholder Ministers. However, we acknowledge that there is no formal process to demonstrate this alignment. We therefore accept the ANAO recommendation that a formal process should be established by NBN Co to assure itself that Statement of Expectations requirements have been sufficiently incorporated into corporate plans and strategies.

External and internal considerations

2.40 The board holds annual strategic planning meetings with the NBN Co executive to assist with the development of integrated operating plans and corporate plans. Board strategy days were held on 15 December 2020, 16 November 2021, 15 November 2022 and 14 November 2023. Detailed agenda and papers were prepared and discussed during these meetings. The agendas included discussion and consideration of customer, technology and market trends, the competitive landscape and emerging risks. The strategic planning days included consideration of external and internal factors impacting on the development and achievement of company purposes and directions.

2.41 No meeting minutes or action items resulting from the board strategic planning meetings were prepared for strategy days held on 15 December 2020 or 16 November 2021. Meeting minutes and outcomes were documented for the strategy meetings held on 15 November 2022 and 14 November 2023. NBN Co management advised the ANAO in January 2024 that board strategic planning meetings were ‘not formal board meetings (which have protocols around minute taking) but rather set up as opportunities to hear and discuss the company strategy as well as what was happening in the market and hence conducted in a less formal setting consistent with the agenda’s at that time.’ Not keeping records diminishes the opportunity for the board to keep shareholder ministers informed, including in the event that shareholder ministers are not invited to or attend the strategic meeting (as required by RMG 126 – GBE Guidelines).

2.42 An integrated operating plan and corporate plan development process is undertaken by NBN Co. This commences with the board strategic planning day and the preparation of both draft and final integrated operating plans and corporate plans by management. These documents are discussed by the board. Shareholder departments provide comments on the draft integrated operating plans, and shareholder ministers may provide comment on the draft corporate plans. The board approves the final integrated operating plans and corporate plans. Shareholder ministers confirm the public release of corporate plans.

2.43 Over the transition period board meetings included a range of guest speakers to provide ongoing insight into the market, competition and future trends. The board received information related to internal and external factors which could impact material business risks and the achievement of key outcomes. Since June 2021, the board received, as part of the analysis of the six-monthly strategic risk profile, a paper outlining the ‘emerging risk profile’. This paper outlines risks and trends on the horizon which are not yet fully understood, unfamiliar or difficult to predict and quantify. This information is captured and analysed by management to identify how emerging issues may become strategic or operational risks or change the trajectory or velocity of NBN Co’s current risks.

2.44 Since February 2023 the board has received a paper on each of the 12 key outcomes of the company. A selection of outcomes are discussed at each meeting (i.e. rotated through each of the 12 outcomes on a cyclical basis). The papers prepared on each outcome included information on key challenges and opportunities, roadmaps for achievement (up to three years), competition and external factors, metrics and progress to date. This included analysis of internal and external factors impacting on the operations of the company.

2.45 At each board meeting the chief executive officer and the chief financial officer provide performance reports which include monitoring of a selection of financial and operational performance metrics. Commentary is included to explain variances including those which could be a result of emerging internal or external factors.

Did NBN Co transition plans and strategies incorporate detailed timelines and performance targets to meet the changing circumstances and needs of transition?

The initial transition horizon identified in board papers was four years to June 2024. Transition plans were prepared in July 2020. Since March 2022 the board has not received specific information about transition timelines and key milestones.

Until December 2023, the board and shareholder ministers did not receive information about how the company’s planned performance measures would contribute to the achievement of its purposes.

2.46 A principal objective of a GBE is that it adds to its shareholder value. RMG 126 – GBE Guidelines states that to achieve this mandate a GBE is expected to: operate efficiently, that is, at a minimum cost for a given scale and quality of outputs; price efficiently; and earn at least a commercial rate of return.25 In addition to setting a principal financial target, shareholder ministers may set other financial and non-financial targets in consultation with the GBE.26

Timelines

2.47 As discussed in paragraph 2.18, the board noted the Continuous Transformation Plan in July 2020. This Continuous Transformation Plan outlined timelines and key milestones which were separate from business-as-usual activities included in the integrated operating plan. When presenting the Continuous Transformation Plan to the board, management stated that ‘the planned transformation brings to life the IOP 21–24 focused on nbn’s six strategic pillars, using a mix of inflight programs and new transformation initiatives to achieve IOP targets’. Oversight of the Continuous Transformation Plan by the board was undertaken until February 2021. From this time, no distinction was made between transition and business-as-usual activities in documents presented to the board. Integrated operating plans, corporate plans or board reporting did not identify when transition would be completed. NBN Co management advised the ANAO in January 2024 that ‘notwithstanding the initial approach of monitoring the transition within a fixed timeline, that under the current approach the transition had been migrated into operations and was recognised as an on-going endeavour’. As discussed in paragraph 2.23, the incorporation of transition activities into the integrated operating plans creates a risk that the board is unable to see the completion of transition against timelines and key milestones.

Initiatives and performance metrics

2.48 The Integrated Operating Plan 2021–24 identified key activities to be undertaken against commitments in the plan. It did not provide information about how these activities were linked to the strategies and outcomes identified in the corporate plan or financial and non-financial performance metrics. From September 2020 the chief executive officer performance report tabled in board meetings included a ‘RAG assessment of enterprise-level key initiatives’.27 This document linked the initiatives being undertaken by the entity to the strategies included in the corporate plan. A tracking status of the initiatives was provided as either: red – initiative is off track and needs attention; amber – initiative has significant challenges with plan in place; or green – initiative is on track. The RAG assessment results for the end of 2020–21 were that of the 19 initiatives still in progress, four were identified as ‘amber’ and one was identified as ‘red’.

2.49 The Integrated Operating Plan 2022–25 identified nine key outcomes to be achieved but did not provide a link between these outcomes and the key strategies and value outcomes identified in the corporate plan or financial and non-financial performance metrics.

2.50 The Integrated Operating Plan 2023–26 identified twelve key outcomes to be achieved. These key outcomes were not linked to the strategies and outcomes included in the corporate plan but were linked to a series of 66 financial and non-financial metrics to be monitored by management. The Integrated Operating Plan 2024–27 included the same twelve key outcomes and also did not link these outcomes to the strategies and value outcomes included in the corporate plan. Sixty-nine financial and non-financial performance metrics were linked to the twelve key outcomes and were to be monitored by management.

2.51 None of the integrated operating plans examined included information on the milestones, cost or resourcing of the key activities, initiatives or outcomes. Information about cost and resourcing was included in the integrated operating plans at the entity level rather than the initiative or outcome level.

2.52 Board reporting on financial and non-financial measures is included in the chief executive officer and chief financial officer’s performance reports. Only a selection of metrics determined by management were included in these documents during the transition period. Progress against all performance metrics included in corporate plans and integrated operating plans was not provided comprehensively, or progressively to the board or shareholder ministers.

2.53 Since February 2023 the board has received papers that address the 12 key outcomes of the company (refer to paragraph 2.44).

2.54 As a GBE, NBN Co is required to provide confidential quarterly progress reports to shareholder ministers. The requirements of the progress reports include provision of an analysis of the GBE’s quarterly and year-to-date performance against corporate plan forecasts and analysis of performance against its broader corporate plan objectives, such as its key performance indicators and operational performance targets and forecasts. The quarterly progress report should also include major achievements during the period along with explanations for any changes to strategies.28 Quarterly progress reports prepared during the audit period included a selection of financial and non-financial performance targets and did not provide commentary or an analysis of performance against the entity’s broader corporate plan objectives.

3. Transition oversight arrangements

Areas examined

This chapter examines whether NBN Co’s oversight of transition arrangements was effective. It examines the implementation of arrangements for governance, risk management, compliance, assurance and stakeholder engagement.

Conclusion

Arrangements for the oversight of transition were largely effective. Communication with, and reporting to, shareholder ministers fell short of mandatory requirements. Requests from shareholder ministers that NBN Co comply with mandatory requirements made between September 2020 and September 2023 were not addressed until early 2024.

Until improvements were implemented in February 2023, transition risk information was not complete or accurate and did not consistently reflect the board’s risk appetite. NBN Co’s identification and monitoring of its finance law obligations was incomplete. NBN Co’s assurance and fraud control arrangements supported the transition.

Areas for improvement

The ANAO made one recommendation aimed at ensuring NBN Co responds to specific requests from shareholder ministers.

The ANAO identified two opportunities for improvement aimed at ensuring board and committee charters reflect PGPA Act requirements and ensuring compliance with both mandatory requirements and Shareholder Information Deed obligations.

3.1 The nature of the NBN Co Limited (NBN Co) transition is one of a shift in the balance of its two core functions of ‘building’ and ‘operating’ the national broadband network. NBN Co will continue both types of activities after completion of the transition. The transition reflects the shift in focus to being primarily on the operation of the network while continuing to build and upgrade the infrastructure supporting the network.

3.2 As discussed in paragraph 2.22 NBN Co’s oversight of the transition was mainly through regular monitoring of the integrated operating plan performance. This included the application of NBN Co’s existing governance and management approaches to facilitate oversight of how the organisation was transitioning.