Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of the Search and Rescue Aircraft Contract

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Cobham contract is AMSA's largest contract.

- Any failures to deliver the contracted services could have public safety impacts.

Key facts

- The contract was signed in October 2014, to commence operation in late 2016 and to run for 12 years with an option to extend for a further three years.

- At time of signature, the contract was budgeted to cost $640 million for the initial 12 year term.

- Search and rescue units have been established at three bases in Cairns, Perth and Essendon.

What did we find?

- Management of the contract has been fully effective.

- The contract is being delivered in accordance with the planned cost, scope and delivery timeframe.

- Following initial delays, all search and rescue assets have been provided and accepted into service. AMSA managed those initial delays through the contractual framework.

- The contracted services are being provided. The contractual framework established clear performance requirements and linked a substantial proportion of contract payments to them. AMSA has effectively monitored and managed contractor performance against the contracted performance requirements.

$640 million

budgeted to be spent over 12 years.

24%

below budgeted cost up to 30 June 2020.

97%

of maximum standing charge paid in 2019–20 showing the contractor is meeting the contracted KPIs.

Summary

Background

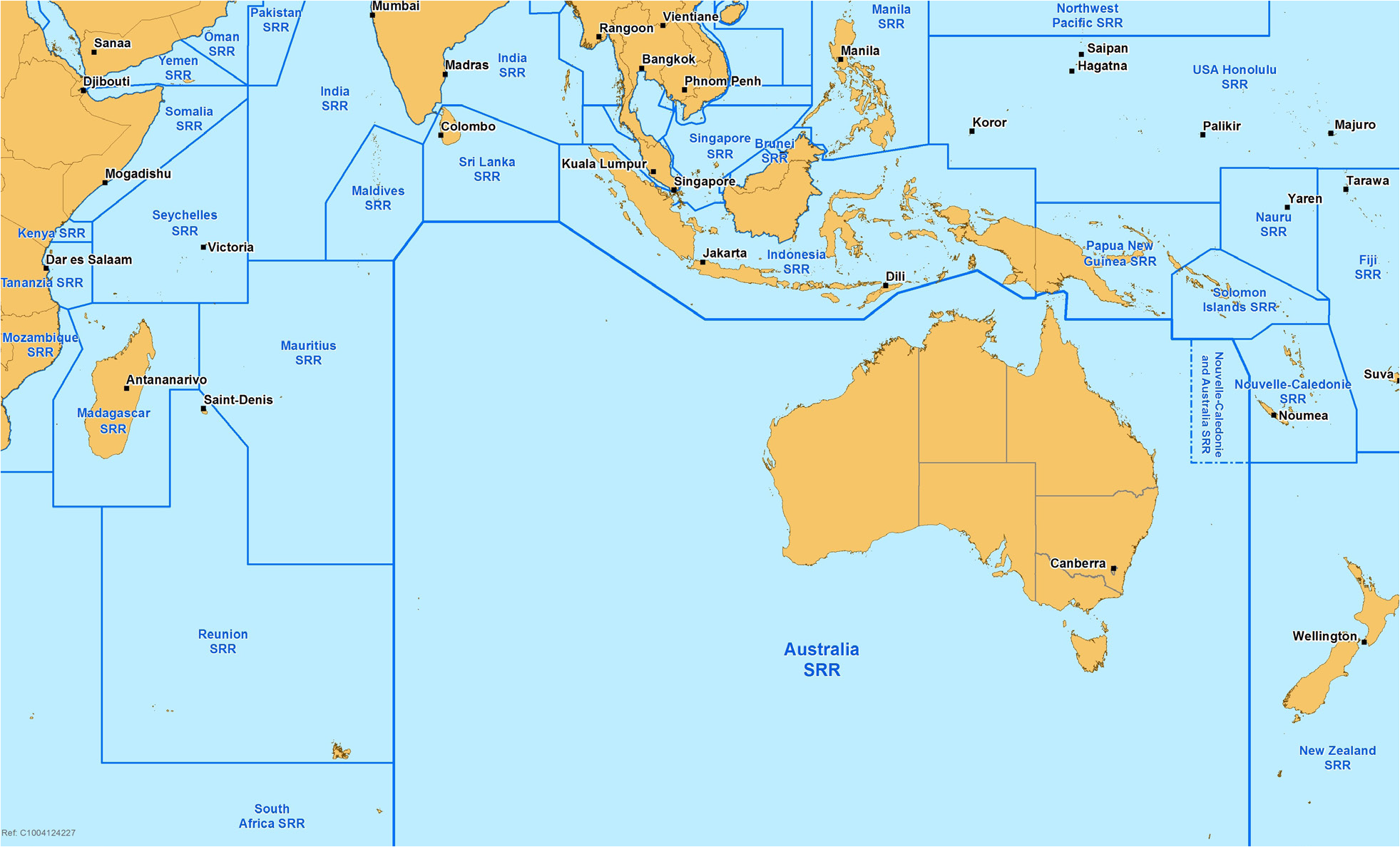

1. Australia’s search and rescue region covers the Australian continent and large areas of the Indian, Pacific and Southern Oceans as well as the Australian Antarctic territories. The region is nearly 53 million square kilometres (one tenth of the earth’s surface) and borders the search and rescue regions of 10 other countries. AMSA is Australia’s national maritime regulator and is also responsible for maintaining national search and rescue (SAR) services for the maritime and aviation sectors.

2. AMSA engaged a single service provider to provide a dedicated airborne SAR capability and has a range of contracts in place with other providers on an opportunity basis to ensure that there are aircraft available for SAR 24 hours a day, seven days per week. This capability allows AMSA to task aviation assets to SAR incidents in a timely manner within the Australian SAR region.1 The Commonwealth Procurement Rules (CPRs) apply to AMSA’s procurement activities.2

3. In preparation for the end of the previous contract, commencing in November 2011, AMSA undertook market testing. Ten companies provided input which assisted in the development of the request for tender (RFT), which also incorporated lessons learned by AMSA from the extant contract. Further industry consultation occurred in early-2013, with a RFT released in August 2013. The successful tenderer would be required to bring together the hardware, software, and the trained crew. Five companies responded and provided proposals.

4. Cobham SAR Services (Cobham) was awarded the $640 million contract on 20 October 2014, to commence operation in late 2016, for the provision of the dedicated airborne SAR capability. Cobham is responsible for acquiring, modifying, operating and maintaining four Bombardier Challenger CL-604 special mission jet aircraft for the life of the contract (12 years with an option to extend for an additional three years). Expenditure under the contract to date is $153.3 million.

Rationale for undertaking the audit

5. The Cobham contract is AMSA’s largest contract. This audit was undertaken four years into the 12 year contract to provide transparency over the services that have been provided under the contract to date, and also provide independent assurance to the Parliament as to whether AMSA is managing the operation of search and rescue contracted services effectively, as any failures to deliver the contracted services would have public safety impacts.

6. This audit was undertaken in a similar timeframe to a separate audit of the Management of Civil Maritime Surveillance Services Contract audit in the Home Affairs portfolio, which provided an opportunity to compare and contrast two aircraft service contracts (and its management) with contractors that are subsidiaries of the same parent company, Cobham Ltd.3 The audit in the Home Affairs portfolio is expected to table in the first quarter of 2021–22.

Audit objective and criteria

7. The audit objective was to assess whether AMSA is effectively managing the Search and Rescue Aircraft contract.

8. To form a conclusion against the objective, the following high level criteria were adopted:

- Has the contract delivered against the planned cost, scope and delivery timeframe?

- Have the specified search and rescue assets been provided?

- Have the search and rescue services been provided?

Conclusion

9. AMSA’s management of the search and rescue aircraft contract has been fully effective.

10. The contract is being delivered in accordance with the planned cost, scope and delivery timeframe. While there was a delay with the commencement of services being provided in full, the contract end date has not been extended. Standing charge payments for each base and air operating charges for missions that have been flown are tracking 24 per cent below the amount AMSA had budgeted to have paid by 30 June 2020. Under the well-designed contractual framework, costs tracking below budget initially reflected delays in each base commencing full operations. For the last three financial years, the major factors resulting in costs being lower than budgeted have been inflation being less than budgeted (charges and rates are indexed in the contract) and fewer flying hours being required than was budgeted.

11. Following initial delays, search and rescue assets have been provided and accepted into service. AMSA managed those initial delays through the contractual framework, including by not paying the standing charge for the bases and aircraft until they had been accepted into service and, once it started paying the charge, paying at a reduced rate until the remaining deficiencies had been addressed.

12. The contracted search and rescue services are being provided. The contractual framework established clear performance requirements and linked a substantial proportion of contract payments to those requirements. AMSA has effectively monitored and managed contractor performance against the contracted performance requirements. Performance reporting under the contract shows that base availability has increased over time and that bases have been responsive to calls for missions to be flown.

Supporting findings

Contract delivery against planned cost, scope and timeframe

13. At an expected cost of $640 million, AMSA contracted Cobham in October 2016 for the delivery of search and rescue services out to December 2028, with an option to extend for a further three years. The services are contracted to be delivered at three bases with crews to be available 24 hours a day, seven days a week.

14. There have been ten variations to the contract. The most common reason for variations, related to delays in the commencement of services being provided when transitioning to the new provider. Those delays did not result in an extension of the contract end date and, accordingly, the expected cost of the contract to AMSA has been reduced by an estimated $11.1 million.

15. AMSA’s contract managers are experienced and have received appropriate training.

Search and Rescue assets

16. As required by the contract, search and rescue units have been established at three bases in Cairns, Perth and Essendon.

17. There was an initial delay in the provision of the contracted search and rescue units including the acceptance into service of the aircraft. AMSA managed those delays through the contractual framework. Of note was that AMSA did not pay the standing charge for the bases and aircraft until they had been accepted into service and, once it started paying the charge, paid at a reduced rate until the remaining deficiencies had been addressed. Overall, there was a net reduction of $15.2 million in cost to AMSA as a result of these delays.

Contracted search and rescue services

18. The contracted search and rescue services are being provided with an average of 20 missions per month being flown in the three financial years to 30 June 2020.

19. Once initial issues with crewing were resolved, the contracted crewing requirements have been consistently met.

20. Performance reporting under the contract shows that availability of the three bases has improved over time such that it has become increasingly common for the contracted base availability key performance indicator to be met. Similarly, there has been a positive trend in the frequency with which each base has been meeting the contracted timeframes for responding to calls for missions to be flown.

21. AMSA has managed performance against the key performance indicators by applying the contracted framework to adjust the amounts it has paid. The contract also includes service credits and liquidated damages provisions and these have been employed on a number of occasions.

Australian Maritime Safety Authority summary response

22. AMSA’s summary response to the report is provided below and its full response is at Appendix 1.

Providing a search and rescue function to the community is one of the most challenging and rewarding functions undertaken by the Australian Maritime Safety Authority. The aircraft contract provides dedicated response assets to deliver that vital public safety role. We are pleased to note that management of the contract was considered fully effective, and there were no recommendations for our attention.

Key messages from this audit for all Australian Government entities

23. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Procurement

Contract management

1. Background

Introduction

1.1 Australia’s search and rescue region covers the Australian continent and large areas of the Indian, Pacific and Southern Oceans as well as the Australian Antarctic territories. The region is nearly 53 million square kilometres (one tenth of the earth’s surface) and borders the search and rescue regions of 10 other countries. Figure 1.1 below outlines Australia’s search and rescue region.

Figure 1.1: Australia’s search and rescue region (SRR)

Source: Australian Maritime Safety Authority.

1.2 The Australian Maritime Safety Authority (AMSA) is a Corporate Commonwealth entity established under the Australian Maritime Safety Authority Act 1990 (AMSA Act). It is the national agency responsible for maritime safety; protection of the marine environment; and maritime and aviation search and rescue (SAR).

1.3 To fulfil Australia’s international obligations, AMSA’s Joint Rescue Coordination Centre (JRCC) was established to coordinate SAR for aviation and maritime incidents. The JRCC provides SAR coordination services for maritime, aviation and assists police with land-based incidents, and is located in AMSA’s Canberra office. The JRCC responds to approximately 7000 incidents per year.

1.4 AMSA engaged a single service provider to provide a dedicated airborne SAR capability and has a range of contracts in place with other providers on an opportunity basis to ensure that there are aircraft available for SAR 24 hours a day, seven days per week. This capability allows AMSA to task aviation assets to SAR incidents in a timely manner within the Australian SAR region.4 The Commonwealth Procurement Rules (CPRs) apply to AMSA’s procurement activities.5

Search and Rescue Aircraft contract

1.5 Under a contract signed in 2005, AeroRescue provided SAR modified and equipped Dornier 328-120 turboprop aircraft from five locations around Australia.6 The contract ceased in a phased manner between August 2016 and February 2017.7

1.6 In preparation for the end of the previous contract, commencing in November 2011 AMSA undertook market testing. Ten companies provided input which assisted in the development of the request for tender (RFT), which also incorporated lessons learned by AMSA from the extant contract. Further industry consultation occurred in early-2013, with a RFT released in August 2013. The RFT specified the performance AMSA sought from the service and left industry to determine the most appropriate aircraft, sensors and crewing solution to achieve this. AMSA sought a single service provider to acquire, modify, commission, operate and maintain the SAR service, and to provide aircraft that would be available for search and rescue tasking at short notice, 24 hours a day, seven days a week. The RFT specification outlined key minimum requirements of the service, including the number and distribution of aircraft bases, range requirements and provided historical data on search locations from 2010 to 2012. The RFT also provided a desired budget limit for the monthly standing charge, and invited tenderers to propose aircraft type and numbers, location of bases and to calculate the resultant average time to reach historical incidents. The service provider was required to bring together the hardware, software, and the trained crew.

1.7 Five companies responded and provided proposals. Cobham SAR Service (Cobham) was the successful tenderer. AMSA signed a contract with Cobham on 20 October 2014, to commence operation in 2016, for the provision of the dedicated aerial SAR capability. The contract specifies the following key performance indicators (KPIs):

- KPI 1 — Base availability — service provider must ensure that availability for a base in respect of a month must not be less than 95 per cent.8

- KPI 2 — Base responsiveness — service provider must ensure that:

- for day response time, 30 minutes from SAR alert call to calling for aircraft taxi clearance; and

- for night response time, 60 minutes from SAR alert call to calling for aircraft taxi clearance.9

- KPI 3 — Management — service provider must provide all reports and other deliverable items required in a month by the contract in accordance with the timeframes and procedures as set out in the contract. Each late submission will incur liquidated damages of $500 per event.

1.8 During 2016–17, AMSA developed a bespoke system, SARweb, to provide an interface for the organisations that work with Australian search and rescue. The system is linked to AMSA’s incident management software which provides visibility of search areas and the task for each asset. Aircraft may also have tracking equipment which allows the JRCC to have visibility of each assets current location and the search area covered.

1.9 SARweb is also used as a performance management tool for the administration of the contract. Status reports from each base detailing aircraft location and availability are uploaded and visible in the JRCC search and rescue incident management system. Aircraft detail information is directly fed from Cobham’s internal system, which includes crewing and maintenance data.

1.10 KPIs are captured and reports are provided directly from SARweb to Cobham and the contract administrators at AMSA.

1.11 As provided by the terms of the contract, AMSA conducts audits of service delivery. Audits are carried out at each base on at least a quarterly basis, in line with its quarterly meetings with Cobham. Since commencement of the SAR service, AMSA has undertaken 13 audits of the Cairns base; nine at the Perth base and 11 at Essendon.

1.12 AMSA also conducts visits to the bases, which can involve ground activities to ascertain crew knowledge on various aspects of the service. Where non-compliance or deficiencies are identified, AMSA provides notices to Cobham with specified timeframes to address the deficiencies.

Rationale for undertaking the audit

1.13 The Cobham contract is AMSA’s largest contract. This audit was undertaken four years into the 12 year contract to provide transparency over the services that have been provided under the contract to date, and also provide independent assurance to the Parliament as to whether AMSA is managing the operation of search and rescue contracted services effectively, as any failures to deliver the contracted services could have public safety impacts.

1.14 This audit was undertaken in a similar timeframe to a separate audit of the Management of Civil Maritime Surveillance Services Contract audit in the Home Affairs portfolio, which provided an opportunity to compare and contrast two aircraft service contracts (and its management) with contractors that are subsidiaries of the same parent company, Cobham Ltd.10 The audit in the Home Affairs portfolio is expected to table in the first quarter of 2021–22.

Audit approach

Audit objective, criteria and scope

1.15 The objective was to assess whether AMSA is effectively managing the Search and Rescue Aircraft contract.

1.16 To form a conclusion against the objective, the following high level criteria were adopted:

- Has the contract delivered against the planned cost, scope and delivery timeframe?

- Have the specified search and rescue assets been provided?

- Have the search and rescue services been provided?

1.17 The audit scope covered the period from contract execution.

Audit methodology

1.18 The audit methodology included:

- examination and analysis of AMSA records;

- interviews with relevant AMSA staff; and

- interviews with Cobham SAR Services.

1.19 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $370,000.

1.20 The team members for this audit were Michelle Mant, Sean Neubeck, Josh Carruthers, Kasia Hill and Brian Boyd.

2. Has the contract delivered against the planned cost, scope and delivery timeframe?

Areas examined

ANAO examined whether the contract has delivered against the cost, scope and delivery timeframe as envisaged when the contract commenced.

Conclusion

The contract is being delivered in accordance with the planned cost, scope and delivery timeframe. While there was a delay with the commencement of services being provided in full, the contract end date has not been extended. Standing charge payments for each base and air operating charges for missions that have been flown are tracking 24 per cent below the amount AMSA had budgeted to have paid by 30 June 2020. Under the well-designed contractual framework, costs tracking below budget initially reflected delays in each base commencing full operations. For the last three financial years, the major factors resulting in costs being lower than budgeted have been inflation being less than budgeted (charges and rates are indexed in the contract) and fewer flying hours being required than was budgeted.

2.1 To assess whether the contract has delivered against the cost, scope and delivery timeframe envisaged when it commenced in 2016, the ANAO examined:

- how payments are tracking against AMSA's budgeted expenditure for the contract over its duration;

- the number and effect of variations that have been made to the contract, with a focus on any changes made to the scope and delivery timeframe;

- the training and experience of those officers responsible for contract management.

What was the expected cost, scope and timeframe when the contract was entered into?

At an expected cost of $640 million, AMSA contracted Cobham in October 2014 for the delivery of search and rescue services out to December 2028, with an option to extend for a further three years. The services are contracted to be delivered at three bases with crews to be available 24 hours a day seven days a week.

2.2 Under the contract, Cobham is responsible for acquiring, modifying, operating and maintaining four jet aircraft for the life of the contract at each of the three bases and to provide aircraft crew available to conduct SAR operations over land or sea on a 24 hour, seven day per week basis.

2.3 The original timeframe for commencement of the service was staged to align with the transition-out of the prior SAR service provider. Original commencement dates were:

- Perth — 8 August 2016

- Cairns — 10 October 2016

- Essendon — 12 December 2016.11

2.4 The contract also provided for a phase out of the current service from the different bases:

- Perth — 7 August 2028

- Cairns — 9 October 2028

- Essendon — 11 December 2028.

2.5 The contract includes an option that permits AMSA to extend the contract in respect to one or more bases for any period on one or more occasions up to a maximum of three years after 11 December 2028.

2.6 The CPRs require that key details of contracts that have been awarded be reported on AusTender within 42 days of the contract being entered into or amended. This was met by AMSA. On 27 October 2014, AMSA reported that a $640 million contract with Cobham had been entered into covering the period 8 August 201612 to 11 December 2028.

2.7 The reported $640 million cost of the contract represented the estimated cost to AMSA over the 12 year term of search and rescue services. The contract payments cover a standing charge for each base, an air operating charge reflecting the number of hours flown each month, defined categories of miscellaneous charges and reimbursement of expenses in circumstances where aircraft are tasked by AMSA to operate away from their base. The $640 million figure included an estimate for indexation over the contract term (the contract provides for indexation of the monthly standing charge and the hourly flying rate).

2.8 In the event that AMSA exercised the option to extend the contract for three years, AMSA estimated that the contract would cost $837.8 million. This comprised $692.1 million for the standing charge and $145.7 million for air operation charges over 15 years. Contract costs are tracking below budget.13

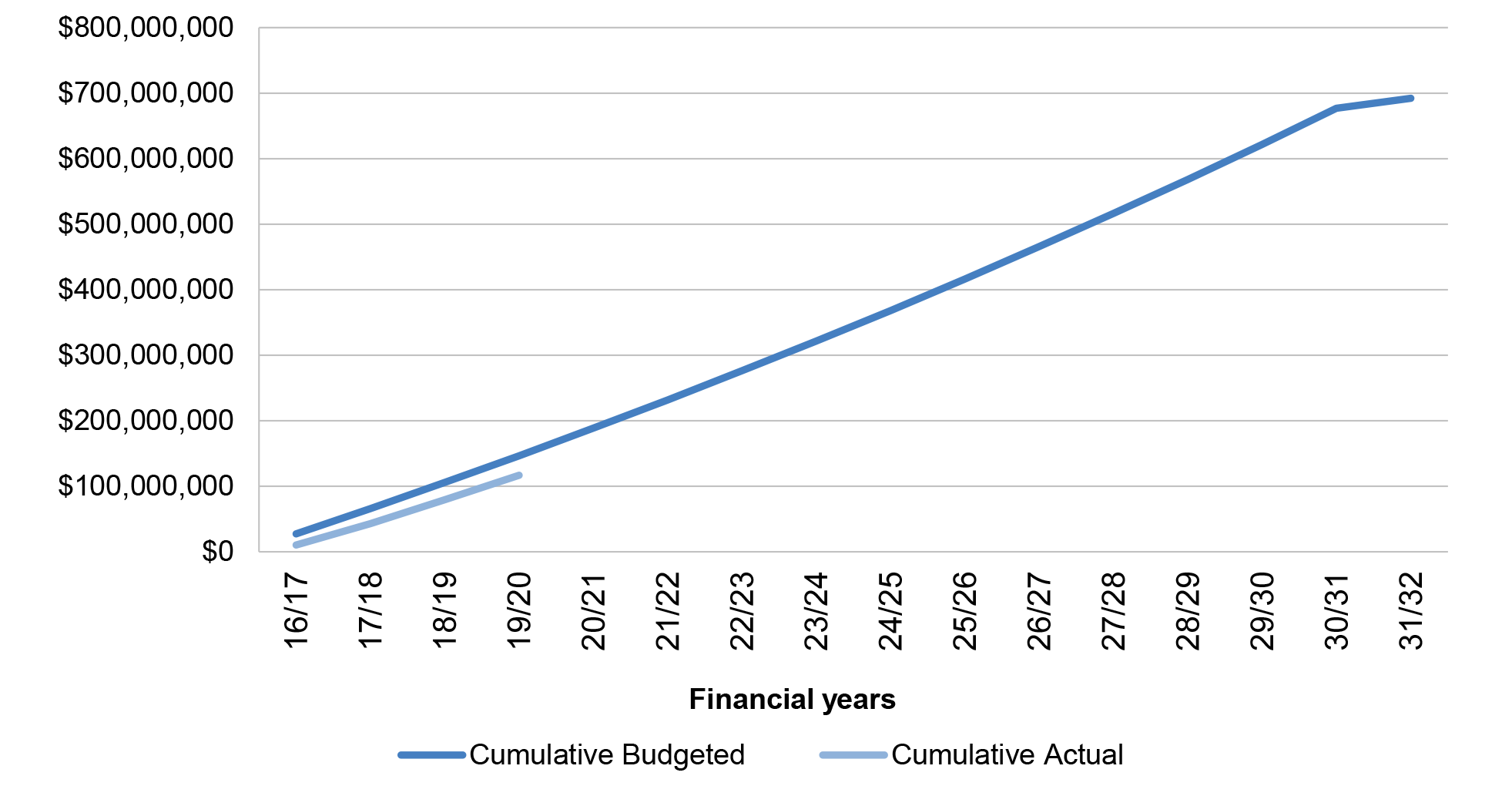

2.9 By 30 June 2020, cumulative payments of the standing charge totalled $116.8 million which was $30 million (20.4 per cent) below the amount of $146.8 million AMSA had budgeted to have spent by that date (see Figure 2.2 below). Key factors that have contributed to this position were:

- in the first financial year of the contract, payments for the standing charge were $17 million or 62.1 per cent below budget. This reflected the delays in bases and aircraft being accepted into service (see further at paragraphs 3.2 to 3.13); and

- costs were also less than budgeted in the three subsequent years (by 15.4 per cent, 9.3 per cent and 8.2 per cent respectively) reflecting:

- the operation of the contractual KPI framework. AMSA budgeted paying 100 per cent of the standing charge whereas the contract calculates the amount payable from a starting point of 90 per cent (see paragraph 4.14) of the maximum which, depending on performance against the contracted KPIs, can be increased (with a cap of 100 per cent) or reduced (with a floor of 80 per cent); and

- inflation has been lower than was expected at the time the contract was entered into meaning that the indexation of the standing charge as provided for by the contract has been lower than budgeted.

Figure 2.1: Standing charge payments compared with budget, 2016–17 to 2031–32

Source: ANAO analysis of AMSA data.

2.10 By 30 June 2020, air operation charges, which are calculated under the contract according to the aircraft operating hours flown on missions each month (with a different rate for each base), totalling $15 million had been paid by AMSA, which was $13 million (or 46.4 per cent) below the amount of $27.9 million AMSA had budgeted to have spent by that date (see Figure 2.3 below). This has been the result of:

- less demand for missions to be flown such that, to 30 June 2020, cumulative mission hours for the three bases for the three financial years to 30 June 202014 were 29.8 per cent less than budgeted (see further at paragraph 4.5); and

- lower than budgeted inflation meaning that the indexation of the air operating charge for each base15 has been less than expected such that, by 30 June 2020, the charge for each base was between 28 per cent and 32 per cent below budget.

Figure 2.2: Air operation charge payments compared with budget, 2016–17 to 2031–32

Source: ANAO analysis of AMSA data.

To what extent has the original contract been varied?

There have been ten variations to the contract. The most common reason for variations related to delays in the commencement of services being provided when transitioning to the new provider. Those delays did not result in an extension of the contract end date and, accordingly, the expected cost of the contract to AMSA has been reduced by an estimated $11.1 million.

2.11 ASMA has signed ten contract variations since the contract was executed in October 2014 (see Table 2.1).

Table 2.1: Contract variations

|

Variation No. |

Date of Execution |

Summary and effect of variation |

|

1 |

16 September 2015 |

Minor editorial corrections. Revised Schedule 6 to introduce the automation of some reports, and improve content of reporting. |

|

2 |

19 July 2016 |

Delay to service commencement dates. Dates for service changed to:

Delay to AMSA's obligation to pay monthly standing charge. |

|

3 |

24 October 2016 |

Delay to service commencement dates. Dates for service changed to:

Delay to AMSA's obligation to pay monthly standing charge. |

|

4 |

18 November 2016 |

Change to order of base acceptance. Bases were changed to:

Introduction of a capability build-up plan for the aircraft's Mission Management System (MMS) on and from the commencement of services. Flexibility for AMSA to nominate two standard fuel loads. |

|

5 |

6 January 2017 |

Change to Capability Date to reflect acceptance of Cairns base on 16 December 2016. Delay to commencement dates and order of acceptance of second and third bases. Dates for service changed to:

Delay to AMSA's obligation to pay monthly standing charge for second and third bases. |

|

6 |

6 June 2017 |

Provide the service provider with use of the substitute aircraft for services other than those specified in the contract (fisheries surveillance).a |

|

7 |

24 November 2017 |

Removal of the effect of the Performance Score for Base Availability during the period approved by AMSA for the Service Provider's crew availability remediation plan. |

|

8 |

20 March 2018 |

Update to Flight Management System (FMS) provisions, reflecting change to the 'interim capability' and extending FMS/MMS interface delivery date to 30 June 2018. |

|

9 |

9 July 2018 |

|

|

10 |

27 March 2020 |

Increase to response times and corresponding adjustment to KPI score factors to allow crew to work from home as a result of coronavirus pandemic, for as long as is necessary to deal with the pandemic. |

Note a: The operations as outlined in Variation 6 did not proceed.

Source: ANAO analysis of AMSA documentation.

2.12 As illustrated by Table 2.1, half of the variations were signed during the initial implementation phase, due to delays with the initial commencement of the service. Of particular significance, variations two, three and five all relate to the delays to the commencement of services.16 AMSA agreed to postpone the commencement dates rather than accept a partial service on the original dates and thereby retain the contractual tools to manage further slippage. This included the contract permitting AMSA to bring the contract to an end should the agreed commencement dates not be achieved. As the contract tied payments to the bases coming into service, AMSA was not required to make any payments to Cobham until the bases were accepted into service.

2.13 In July 2016, Cobham formally advised AMSA that it could not meet the entry into service commencement dates specified in the contract. While Cobham confirmed that the modified aircraft and full crew would arrive at each base on the expected dates, delays would occur as training of crews would not be complete. Cobham advised AMSA that it had anticipated it would undertake the aircraft conversion using a less onerous approvals process that had previously been used to convert its existing fleet of special mission aircraft and requested relief from its obligations to complete transition-in activities. AMSA did not agree to the request, highlighting that gaining regulatory approval for this operation was an identified risk and it had sought assurances from tenderers that they had a viable plan, and that this risk was also the subject of detailed consideration during contract negotiations.

2.14 The delays in service commencement resulted in the expected cost of the contract reducing by $11.1 million17 as delays to the commencement of the service also reduced the 12 year term of the contract. The staggered end of the previous SAR contract helped to mitigate the impact on AMSA of the delays with commencement of service.18 In addition, AMSA engaged other aviation providers to fill specific geographical gaps, which AMSA advised the ANAO in October 2020 cost $1.6 million.19

2.15 The other significant variation (variation seven) related to crewing issues. In November 2017, Cobham identified that the current crew establishment was not sufficient to deliver the contracted requirements on a reliable basis. Cobham requested short term KPI relief during a period of 'crew investment' where Cobham would increase the number of crews at each base to seven, two more than the contracted number of five. AMSA agreed to remove the extra 10 per cent deduction on crew availability, while Cobham implemented the crew availability remediation plan.

Are contract managers appropriately trained and experienced?

AMSA's contract managers are experienced and have received appropriate training.

2.16 AMSA has a team of six individuals in the Response Branch that are actively involved in the management of its aviation response contracts, reporting to a Responsibility Centre (RC) manager. The RC is responsible for all major contracts including marine aids to navigation; emergency towage vessels, response communications and aviation assets, in particular Cobham SAR service. The RC is also the budget holder for the Cobham contract.

2.17 The Principal Advisor, Aviation Assets is responsible for the day-to-day management with the team, for all of the AMSA aviation contracts. This includes negotiating agreements with state and territory governments to use their assets, and with commercial aircraft engaged on an opportunity basis. Cobham is AMSA's only dedicated aviation response service. This team also manages AMSA's inventory of deployable search and rescue equipment, and trains volunteer air search observers.

2.18 The Response team also includes a supervisor co-located with the JRCC, and three aviation auditors who are regionally located (Cairns, Perth and Melbourne). The team is responsible for auditing and training for all search and rescue units (SRUs) both rotary and fixed wing as well as the Air Search Observers provided by the state and territory emergency services.

2.19 Staff responsible for managing the contract have upwards of 20 years' experience managing large scale service contracts. Staff also have aviation industry knowledge and experience with aviation law.

2.20 AMSA has retained important contract-specific knowledge as a result of some key personnel responsible for the ongoing management of the contract having been involved since the development of the RFT. Members of the contract management team were involved in drafting and agreeing the KPIs.

2.21 AMSA staff responsible for managing the Cobham contract have had access to a range of documentation to assist them. In particular, the contract management toolbox is provided as reference material to aid in defining roles and responsibilities, skillsets required and assistance with planning the management of AMSA contracts. The toolbox includes the contract management guidelines; procedures; skills checklist; roles and responsibilities; contract management plan template; and sample risks and risk treatments.

2.22 In relation to training:

- two of the staff currently involved in the management of the contract undertook negotiation training as part of the tender process;

- the team has completed safety and lead auditor's courses, with team members attaining competency in management systems auditing, auditing quality management systems and leading management system audit teams;

- AMSA developed additional guidance and training materials in 2019–20 in response to an internal audit to provide a base level competency in procurement and contract management for all AMSA staff.20 This included a mandatory procurement training package and updates for the contract management toolbox. All of the staff involved in the management of the Cobham contract have undertaken this training21; and

- a Contract Management Improvement Program is also available to staff, with an e-learning training package developed to identify and address high-level contract management issues using a lessons learned approach, providing practical ASMA examples for staff. This module has been developed and was shared with the ANAO prior to its final release. This training was made available through AMSA's e-learning system on 3 September 2020, and will be required for staff involved in managing contracts of any size. A total of 31 people across AMSA have completed the training to date.

3. Have the specified search and rescue assets been provided?

Areas examined

This chapter examines whether the specified search and rescue assets contracted with Cobham have been provided and how AMSA managed any shortfalls for the provision of these services.

Conclusion

Search and rescue assets have been provided and accepted into service. AMSA managed initial delays through the contractual framework, including by not paying the standing charge for the bases and aircraft until they had been accepted into service and, once it started paying the charge, paying at a reduced rate until the remaining deficiencies had been addressed.

3.1 To assess whether the contracted assets have been provided, the ANAO examined:

- whether search and rescue units have been established at the three base locations specified in the contract; and

- any shortfalls or delays in the bases being accepted into service, and how those delays were managed.

Have the specified assets been provided?

As required by the contract, search and rescue units have been established at three bases in Cairns, Perth and Essendon.

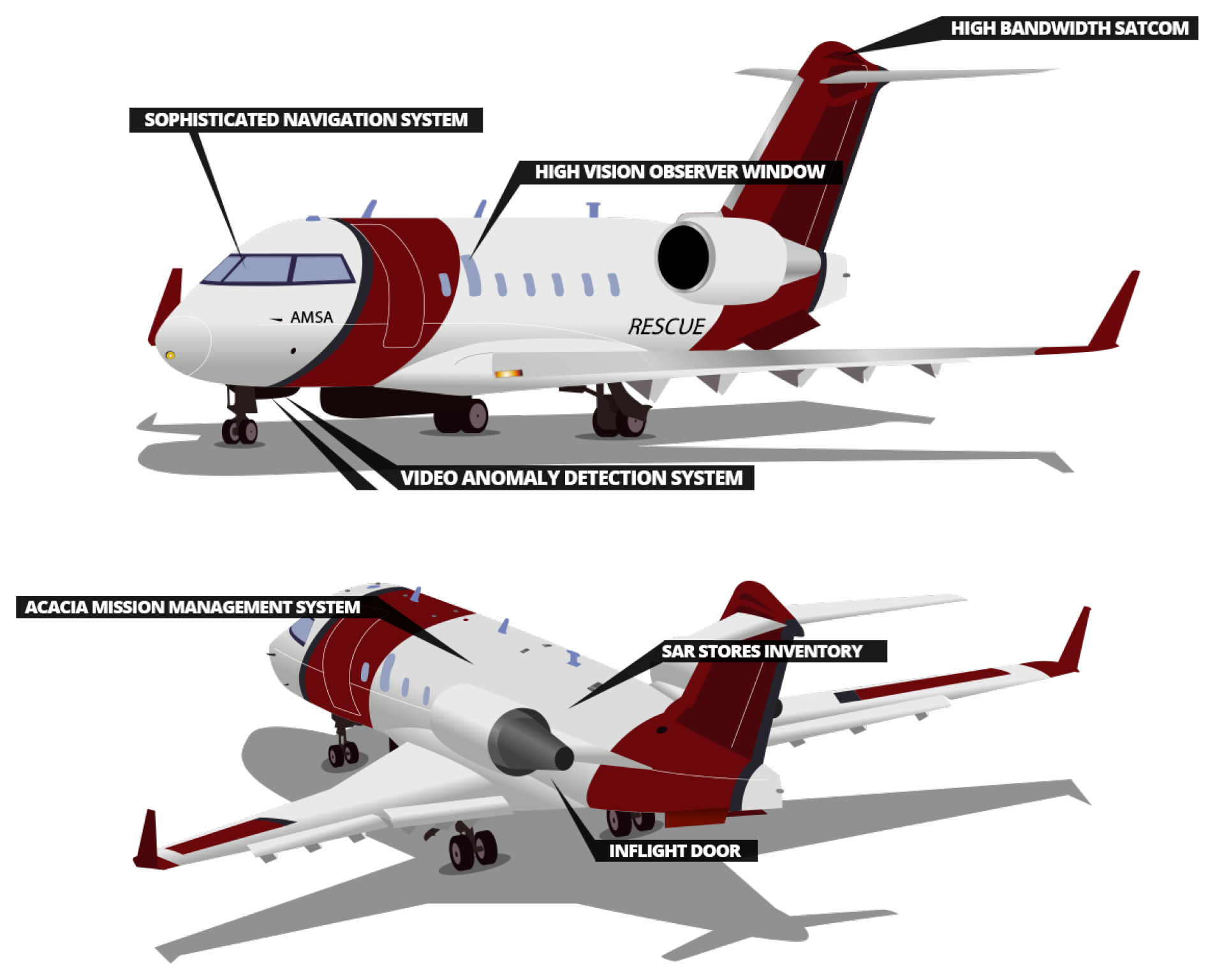

3.2 The contract requires that search and rescue units (SRUs) be established at three bases (Cairns, Perth and Essendon) involving four Bombardier Challenger CL-604 special mission jet aircraft (see Figure 3.1) and that a specified number of trained crew be able to conduct search and rescue and associated operations over land or sea on a 24 hour, seven day per week basis. The aircraft are required to be fitted with a variety of speciality radars and sensors, and able to deliver life-sustaining stores.22 One aircraft is required to be located at each of the three bases. The fourth jet is designated as a maintenance spare, capable of deployment to any base to maintain the SAR service, and is also to be used for training purposes.

Figure 3.1: AMSA Search and Rescue Challenger Jet

Source: AMSA.

3.3 The contract requires that the search and rescue units be established progressively between August and December 2016 (see paragraph 2.3) with the entry into service dates for the aircraft at each base aligning with those dates. The fourth (spare) aircraft had an entry into service date of 1 March 2017.

3.4 The four aircraft were purchased progressively from December 2014 through to January 2016. Following the purchase and acceptance of the aircraft by Cobham, the aircraft were ferried to the paint facility for paint and livery application in accordance with the contractual requirements. Modifications to the aircraft were then conducted in two stages:

- Stage 1 modifications were completed in Toronto, Canada and included the installation of an air operable door, enlarged panoramic observer windows, and appropriate seating for the crew; and

- Stage 2 modifications were completed in Adelaide and involved the interior fit out of the aircraft, as well as the integration of role equipment and the Mission Management System (MMS).

3.5 While Cobham was responsible for the acquisition and acceptance of the aircraft and equipment, AMSA had an ongoing involvement in the process. AMSA received regular project status reports from Cobham throughout the implementation period and discussed the master schedule with Cobham at monthly meetings.

3.6 Under the contract AMSA has the right to satisfy itself that the service was safe to commence and that the search and rescue functions could be performed to an acceptable standard. AMSA undertook a number of pre-acceptance activities including:

- review and approval of management plans including a Master Test Plan which detailed the approach and activities for acceptance testing of deliverables from subcontractors;

- oversight of the development of crew training material and attendance at some of the crew training sessions to provide feedback to improve subsequent courses;

- observing the development of the stores delivery system (this involved a series of trials in smaller aircraft prior to trials in the Challenger, and attendance at a number of workshops and discussions); and

- cooperating in the development of Joint Standard Operating Procedures (JSOPs) that set out the day to day requirements around tasking and reporting for the aircraft when in service.

3.7 Prior to formal acceptance of the bases, AMSA standards officers boarded a number of training flights in Perth during which crews were undergoing proficiency checks.23 During those flights, mission equipment was used and the competencies set out in the contract for each crew position on the aircraft were demonstrated. In addition, for the formal acceptance, AMSA planned scenarios to be flown by Cobham as if they were live SAR tasks. The flights were designed to test the full system across a range of activities including day SAR activities, night SAR activities and a marine pollution patrol flight.

3.8 The culmination of formal acceptance activities was a final scenario, designed to be a full system test of the base, aircraft, sensors, crew and skills. The final scenario for the Cairns base occurred on 15 December 2016 over three flights. The observations from those flights were discussed with Cobham and contributed to AMSA accepting the Cairns base into service on 16 December 2016.

3.9 This was followed by the Perth base and aircraft being accepted into service on 15 February 2017 and the Essendon base and aircraft on 18 April 2017. The fourth aircraft arrived at the Essendon base on 18 July 2017.

3.10 One deliverable, the mobile phone direction finding capability, while provided has not been able to be used. This is the first time this capability was to be used in search and rescue in Australia. Cobham acquired hardware to install into the aircraft and commenced the process to integrate and obtain the required approvals. As the mobile spectrums are licenced to the telephone providers, the Australian Communications and Media Authority (ACMA) required the providers’ consent, and then proposed a public consultation process. AMSA advised the ANAO that in the lead up to this process, other Australian Government agencies became aware of the technology and hardware to be used, raising potential regulatory, privacy and national security issues and requested that AMSA seek an alternative solution.

How has AMSA managed any shortfalls in the provision of contracted search and rescue assets?

There was an initial delay in the provision of the contracted search and rescue units including the acceptance into service of the aircraft. AMSA managed those delays through the contractual framework. AMSA did not pay the standing charge for the bases and aircraft until they had been accepted into service and, once it started paying the charge, paid at a reduced rate until the remaining deficiencies had been addressed. Overall, there was a net reduction of $15.2 million in cost to AMSA as a result of these delays.

3.11 By mid-July 2017 the contracted search and rescue units including the required aircraft had been provided. As outlined at paragraphs 3.2 to 3.10, there had been delays in the commencement date for each of the search and rescue units.

3.12 AMSA clearly communicated its concerns with the delays and the impact to Cobham through meetings and in correspondence. AMSA highlighted that delays were resulting in a capability gap in search and rescue services, which was exacerbated by the progressive withdrawal of the existing aircraft. AMSA informed Cobham that the reasons for the delay did not satisfy the criteria for granting relief under the contract, identified that the delays could result in AMSA issuing a default notice, negotiated revised delivery dates and highlighted that further delays could lead to contract termination.

3.13 Amending the contracted delivery dates rather than accepting partial delivery and without extending the contracted completion dates meant that AMSA did not start paying the contracted monthly standing charge for the aircraft until each base and aircraft had been accepted into service. The amount involved totalled $11.1 million comprising $3.9 million for the delay with Cairns, $3.5 million for the delay with Perth and $3.7 million for the delay with Essendon. The risk of gaps in capability were addressed through the transition arrangements with the existing provider as well as AMSA engaging other providers to fill specific geographic gaps (at a cost of $1.6 million — see paragraph 2.14).

3.14 At acceptance into service of each base, AMSA identified contractual non-compliances and deficiencies in relation to the aircraft capability and crewing. The monthly standing charges that were paid were reduced for each base for periods until the non-compliances and deficiencies were remediated to AMSA’s satisfaction, following which performance would be managed through the KPI regime detailed in Chapter 1, paragraph 1.7.

3.15 Cobham had also not delivered all of the required capability by the agreed timeframe as part of the capability build-up plan. Those elements of the capability build-up that were not delivered by their due date were managed through the KPI regime. Effectively all three bases, after transitioning to the KPI regime, were considered to be ‘base limited’ until 1 April 2018 and this meant that the maximum monthly standing charge available was restricted to 91 per cent across all three bases.

3.16 Table 3.1 below outlines key dates relating to the commencement of services at each of the three bases, and the periods in which the standing charge paid was reduced and KPI restrictions were applied. It also shows the associated estimated cost to Cobham as a result of not being on the full KPI regime during those periods.

Table 3.1: Key commencement timeframes and associated impact on contract payments

|

|

Cairns |

Perth |

Essendon |

|

Original Contracted commencement date |

10 Oct 2016 |

8 Aug 2016 |

12 Dec 2016 |

|

Actual commencement date |

16 Dec 2016 |

15 Feb 2017 |

18 Apr 2017 |

|

Period standing charge was reduced by 30 per cent |

16 Dec 2016 to 12 Jan 2017 |

15 Feb 2017 to 17 July 2017 |

18 Apr 2017 to 17 July 2017 |

|

Estimated cost ($000) |

251.5 |

1,276.3 |

677.6 |

|

Period standing charge was reduced by 20 per centa |

NA |

18 Jul 2017 to 25 Oct 2017 |

NA |

|

Estimated cost ($000) |

NA |

775.2 |

NA |

|

Period the KPI Regime — restriction to ‘Base Limited’b applied |

13 Jan 2017 to 1 Apr 2018 |

26 Oct 2017 to 1 Apr 2018 |

18 July 2017 to 1 Apr 2018 |

|

Estimated cost ($000) |

1,915.5 |

435.8 |

1,190.4 |

Note a: The standing charge for Perth was reduced by 20 per cent between 18 July 2017 and 25 October 2017 due to crewing shortfalls.

Note b: While restricted to ‘Base Limited’ the maximum standing charge available for a base is 91 per cent; further KPI deductions are applicable.

Source: ANAO analysis of AMSA data.

4. Have the contracted search and rescue services been provided?

Areas examined

This chapter examines whether AMSA has received the search and rescue services as required under the contract, and whether these services have been provided to the contracted level of performance.

Conclusion

The contracted search and rescue services are being provided. The contractual framework established clear performance requirements and linked a substantial proportion of contract payments to those requirements. AMSA has effectively monitored and managed contractor performance against the contracted performance requirements. Performance reporting under the contract shows that base availability has increased over time and that bases have been responsive to calls for missions to be flown.

4.1 To assess whether the contracted search and rescue services have been received by AMSA, the ANAO examined:

- the missions that have been flown out of each base;

- whether aircrew requirements have been met;

- the extent to which service key performance indicators specified in the contract have been met; and

- how AMSA has managed any shortfalls in the services that have been provided.

Have the search and rescue services been provided?

The contracted search and rescue services are being provided with an average of 20 missions per month being flown in the three financial years to 30 June 2020.

4.2 Following some initial delays as set out in paragraphs 3.2 to 3.13, by mid-July 2017 the contracted search and rescue units including the required aircraft had been provided and the bases had been accepted into service by AMSA.

4.3 Figure 4.1 illustrates that, over the three financial years to 30 June 2020, there have been 722 live SAR missions flown with an average of 20 missions per month across the three bases. While there has been significant variation over the period, Cairns has typically been the busiest of the bases with 45 per cent of missions flown out of that base followed by Essendon with 31 per cent and Perth with 24 per cent.

Figure 4.1: Missions flown per base per month: July 2017 to June 2020

Source: ANAO analysis of AMSA data.

4.4 Of the 722 live SAR missions, over the three financial years to 30 June 2020, 512 of these were day missions and 210 were conducted as night missions. Figure 4.2 provides the breakdown of live SAR missions, over the three financial years to 30 June 2020, by day of the week and time of the day indicating that the service does operate 24 hours a day, seven days a week.

Figure 4.2: Breakdown of live SAR mission by day of the week and time of the day July 2017 to June 2020

Source: Analysis of AMSA data.

4.5 The contract states that Cobham may only be tasked to perform up to 24,000 aircraft operating hours over the 12 year term of the contract. For budgeting purposes, AMSA had estimated 1500 operating hours per annum (equivalent to 18,000 hours over the term of the contract). The number of mission hours required has been consistently tracking well below that budgeted such that, to 30 June 2020, cumulative mission hours for the three bases for the three financial years to 30 June 202024 were 29.8 per cent less than budgeted. Since Cobham began flying missions, Cairns has been the busiest base, with 1850 hours flown to 30 June 2020 and has been the only base where 500 hours or more has been flown in any one year (502 hours in 2019–20). Significantly fewer mission hours have been flown out of Perth (888 hours to 30 June 2020) and Essendon (946 hours to 30 June 2020).

Have aircrew requirements been met?

Once initial issues with crewing were resolved, the contracted crewing requirements have been consistently met.

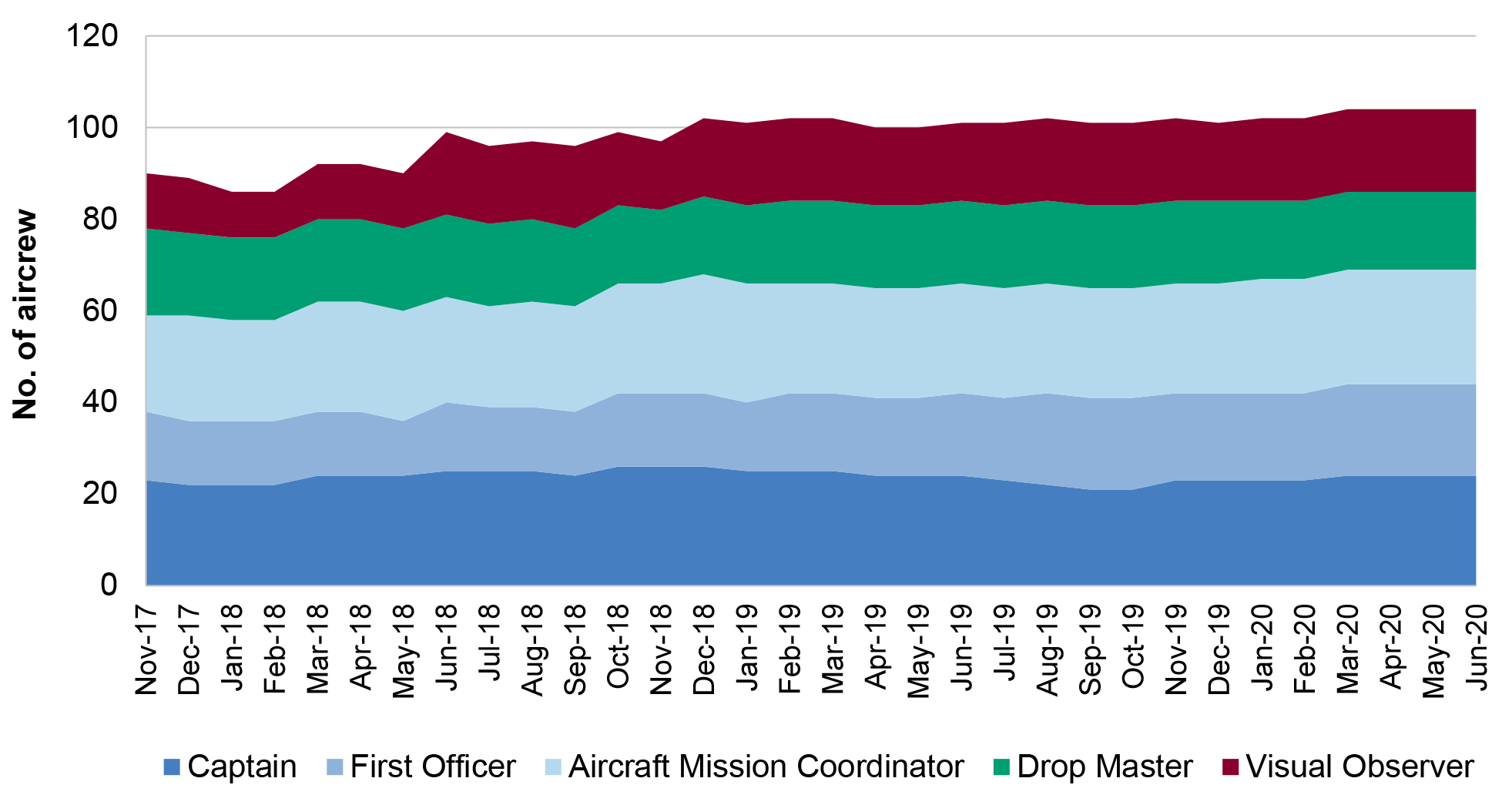

4.6 The contract included requirements addressing the number and training of aircrew. The contract requires a minimum of 17 crews across the three bases, with a minimum of five full crews per base. Crews consist of the following personnel:

- Captain;

- First Officer (who may be a Captain but authorised to act as a First Officer);

- Aircraft Mission Co-ordinator;

- Drop Master; and

- Visual Observer.

4.7 Each base is required to have three rostered crew shifts per day comprising two six-hour shifts during the day and a single twelve-hour shift overnight. At any time during the 24 hour period at each base a crew can be called out to conduct a mission of at least eight hours duration.

4.8 Initially the required number of trained crews was not provided and this was reflected in a variation to the contract as well as delays with bases being accepted into service, which in turn led to reduced contract payments being made by AMSA (see paragraph 2.14). Once the initial issues with crewing were resolved, the contracted crewing requirements have been consistently met.

4.9 Figure 4.3 illustrates the total crew numbers across the three bases by category since November 2017 (excluding crew that have been reported as having been secured but that have not yet commenced employment). The number of aircrew has been stable across each base for some with:

- 33 to 34 total crew at Perth, including six or seven captains, since August 2019;

- 33 to 35 total crew at Cairns since July 2018 with nine or 10 captains for much of this period; and

- 33 to 36 total crew at Essendon since October 2018, with no fewer than seven captains in any month.

Figure 4.3: Air crew by category, November 2017 to June 2020

Source: ANAO analysis of AMSA data.

4.10 As illustrated by Figure 4.3 above and Figure 4.4 below, once the initial issues with crewing were resolved, there have been few instances where there have been significant shortfalls in available crew. This has been reflected in the last adjustment to assessed performance against the base availability indicator due to crew shortages for Perth and Essendon was in October 2017. An adjustment was made in March 2020 in relation to Cairns25, which was the first such deduction for that base since December 2017.

Figure 4.4: Assessment of performance against the base availability indicator July 2017 to June 2020

Source: ANAO analysis of AMSA data.

4.11 The contract includes minimum requirements for training of individual crew, with Cobham required to provide the necessary training over the term of the contract to ensure that the competency standards of the crew are maintained to satisfactorily perform their SAR functions. All training, certification and competency requirements are regulated by CASA26 and are also addressed in AMSA’s audits of the contractor.

Have performance thresholds been met?

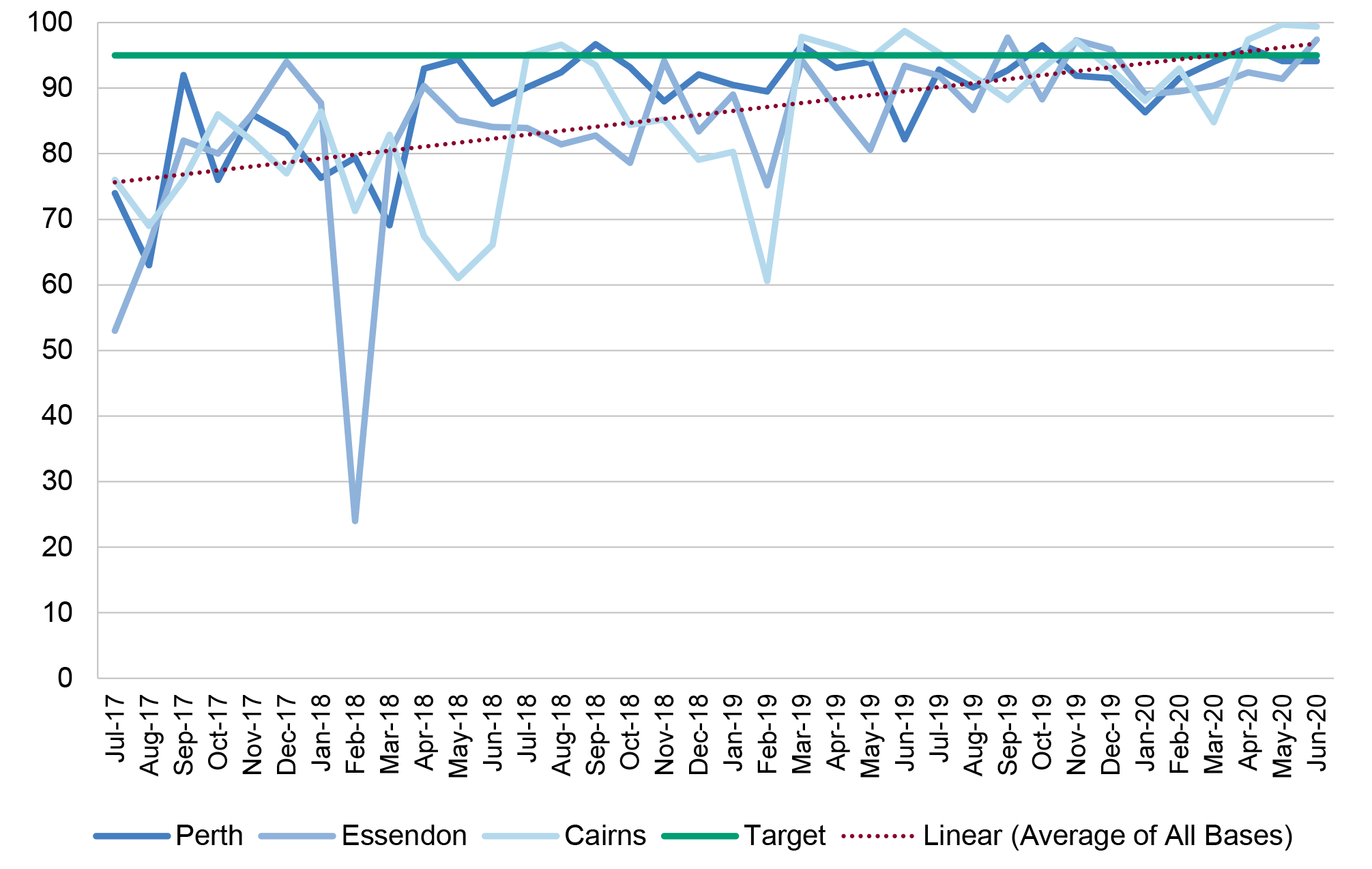

Performance reporting under the contract shows that availability of the three bases has improved over time such that it has become increasingly common for the contracted base availability key performance indicator to be met. Similarly, there has been a positive trend in the frequency with which each base has been meeting the contracted timeframes for responding to calls for missions to be flown.

4.12 A base is considered available when: an aircraft is in the standard SAR configuration; all equipment and systems are operational and capable of performing the services in accordance with the contract; and there is a sufficient crew roster to allow for three flights per day to the nominated endurance of the aircraft. Base availability links to the first key performance indicator under the contract (see paragraph 1.7), where the service provider must ensure that availability for a base in respect of a month is not be less than 95 per cent.

4.13 As illustrated by Figure 4.5, performance reporting under the contract shows that base availability has been improving since July 2017. Compared to the contracted target of 95 per cent, in 2019–20:

- Perth averaged 93 per cent and achieved the KPI in four27 months. October 2020 advice from AMSA to the ANAO was that the January 2020 reduction for Perth related to serviceability issues with the aircraft;

- Essendon averaged 92 per cent and achieved the KPI in four months; and

- Cairns averaged 93 per cent and achieved the KPI in five months. The significant reduction in base availability evident in March 2020 was due to pilot illness (see footnote 25).

Figure 4.5: Base availability, July 2017 to June 2020

Source: ANAO analysis of AMSA data.

4.14 An important factor initially affecting base availability related to delays with the delivery of the contracted automated interface between the Flight Management System (FMS) and the Mission Management System (MMS). This resulted in the bases being ‘base limited’ until AMSA agreed to a revised delivery date in February 2018.

4.15 Time is critical for SAR missions and AMSA advised the ANAO that this necessitates setting an exacting standard for responsiveness. Consistent with this, a key aspect of contractual performance relates to how quickly aircraft respond to calls for a mission to be flown, with the contract specifying performance standards under the second key performance indicator (see paragraph 1.7). Responsiveness combines with the base availability percentage (and derived performance score) to determine the monthly standing charge payment amount.

4.16 As illustrated by Figure 4.6, there has been a positive trend in the frequency with which each base has been meeting the contracted timeframes for responding to calls for missions to be flown. For example, Cairns (the base that has been required to fly the highest number of missions) achieved an average responsiveness against contracted timeframes of 93 per cent for the 102 missions flown in 2019–20, and fully met expectations for five months of the year (when 43 missions were flown).

Figure 4.6: Base responsiveness to mission call outs, July 2017 to June 2020

Source: ANAO analysis of AMSA data.

4.17 Figure 4.6 highlights the volatility in the frequency of SAR missions, in that if there are only two SAR missions for a base in a month and both missions are delayed, even by a short time, assessed performance against the responsiveness indicator is significantly impacted. Reflecting this, the two significant responsiveness shortfalls in 2019–20 related to:

- Perth in July 2019, as a result of both SAR missions being delayed (Captain on home standby due to a double shift and refueller delayed); and

- Essendon in July 2020, as a result of pilot delays outside of the allowable 30 minutes due to COVID-19 for one SAR mission (only three missions for the month).

How has AMSA managed any shortfalls in the provision of contracted search and rescue services?

AMSA has managed performance against the key performance indicators by applying the contracted framework to adjust the amounts it has paid. The contract also includes service credits and liquidated damages provisions and these have been employed on a number of occasions.

4.18 In the three financial years to 30 June 2020, there have been 722 live SAR missions flown, with 274 flown in the most recently completed year (2019–20). For 2019–20, AMSA reported28 that it responded to 390 incidents and that 199 people were rescued and 90 medical evacuations were coordinated from merchant and cruise ships.

4.19 There have also been no instances of a mission not being completed. For the period July 2017 to June 2020, 19 per cent of missions have been conducted outside the contracted responsiveness standards, with an average delay of 24 minutes. Delays were most common at Perth and least common at Essendon, with the delays longest on average from Essendon and shortest from Cairns.

4.20 In November 2020, AMSA advised the ANAO that there have been fewer than five occasions over the course of the contract where an aircraft has been declared unserviceable after the crew at a base has begun to respond. In those cases, other aircraft in the SAR system are likely to be tasked to respond. The longest delay experienced to date was 138 minutes after the required taxi time which was a result of some required aircraft lighting requiring repair before departure could occur.

4.21 The quantum of the monthly standing charge that is paid is determined by performance against the contracted KPIs (see paragraph 1.7). The amount payable can be as low as 80 per cent of the contracted maximum. The major determinant of the amount paid each month is base availability, with the contract providing that AMSA will pay 90 per cent of the standing charge adjusted as follows:

- against the availability KPI:

- performance of 91.1 per cent and above results in increments in the amount of the standing charge payable, to a maximum of 99 per cent of the standing charge; and

- performance of 90 per cent and below results in the amount of the standing charge being reduced, to a minimum of 80 per cent for performance against the KPI of 86 per cent or less; and

- performance of 94.1 per cent and above against the responsiveness KPI will add one per cent to the proportion of the standing charge that is paid.

4.22 As illustrated by Figure 4.7, since January 2018 there has been only one month in which the amount of the standing charge paid in respect to a base has been below 90 per cent of the contracted maximum. Over 2019–20, the amount paid has averaged more than 97 per cent of the maximum. In March 2020, Cairns dropped to 86 per cent of the monthly standing charge. This was mainly related to pilot illness (see footnote 25). Cairns received the full monthly standing charge three times in September 2019, May 2020 and June 2020; Essendon twice in November and December 2019 and Perth once in April 2020. In aggregate, over the period to June 2020, AMSA has paid $106.4 million (or 94 per cent) of the maximum of $113.7 million provided for by the contract for that period.

Figure 4.7: Percentage of monthly standing charge paid, July 2017 to June 2020

Source: ANAO analysis of AMSA data.

4.23 Service credit incentives are applied if Cobham reaches 95 per cent or more. These credits can be used to increase the overall performance score for a base in a month where the minimum 95 per cent has not been met. These credits must be used within 12 months from the month they were earned. Service credits cannot be used once base availability for a base in a month falls below 86 per cent. Overall, throughout the three financial years examined:

- Cairns — earned credit points on 11 occasions for superior performance and has redeemed these points on six occasions to increase the overall score and therefore the percentage of the monthly standing charge paid;

- Perth — earned credit points on seven occasions for superior performance and has redeemed these points on five occasions to increase the overall score and therefore the percentage of the monthly standing charge paid; and

- Essendon — earned credit points on six occasions for superior performance and has redeemed points on two occasions to increase the overall score and the percentage of the monthly standing charge paid.

4.24 The contract specifies that all required reports be provided in accordance with specified timeframes and procedures with late submission to incur liquidated damages of $500 per event, but not more than $5000 within a month. There have been a total of 32 late lodgement of debriefs since the bases have been on the full KPI regime, at a cost to Cobham of $16,000.

Appendices

Appendix 1 Australian Maritime Safety Authority response

Footnotes

1 AMSA has access to a range of pre-authorised aviation resources for use in SAR incidents. These are both rotary and fixed wing aircraft located across Australia that AMSA can call upon to request a response to search and rescue incidents. Some of these have specialist equipment and training — for example rotary-wing rescue — winch-equipped helicopters and crew for rescue, homing to distress beacons, visual search and limited supply dropping.

2 Under section 30 of the Public Governance, Performance and Accountability Rule 2014. As outlined in Auditor-General Report No.27 2019–20 Australian Government Procurement Contract Reporting Update, the CPRs do not apply to all CCEs (see pp. 12–14).

3 Cobham Ltd. is a UK-based company. The company was sold in late-2019 to a US company — Advent.

4 AMSA has access to a range of pre-authorised aviation resources for use in SAR incidents. These are both rotary and fixed wing aircraft located across Australia that AMSA can call upon to request a response to search and rescue incidents. Some of these have specialist equipment and training — for example rotary-wing rescue — winch-equipped helicopters and crew for rescue, homing to distress beacons, visual search and limited supply dropping.

5 Under section 30 of the Public Governance, Performance and Accountability Rule 2014. As outlined in Auditor-General Report No.27 2019–20 Australian Government Procurement Contract Reporting Update, the CPRs do not apply to all CCEs (see pp. 12–14).

6 AeroRescue operated from five bases: Darwin, Perth, Brisbane, Cairns and Essendon.

7 AeroRescue Pty, Ltd. is a subsidiary of the Paspaley Group.

8 There are service credit incentives applied if the service provider reaches 96 per cent or more. These credits can be used to increase its performance score for a base in a month where the minimum 95 per cent has not been met. These credits must be used within 12 months from the month they were earned. Service credits cannot be used once base availability for a base in a month falls below 86 per cent.

9 Due to COVID-19 restrictions, Variation 10 (27 March 2020) was put in place to allow crew to work from home rather than be on base. This varied the response time from 30 minutes to 60 minutes.

10 Cobham Ltd. is a UK-based company. This was sold in late 2019 to a US company — Advent.

11 As is outlined below, the original commencement dates were amended through various variations to the contract. See Table 2.1 below.

12 The contract states that it was made on 20 October 2014.

13 Payments to 30 June 2020 for reimbursable costs as permitted under the contract were $693,595. AMSA did not separately budget for reimbursable costs.

14 This analysis excludes 2016–17 as the contract did not commence at the start of the year and there were delays in the bases being accepted into service.

15 The contract specifies different rates for each base.

16 These delays are discussed further in Chapter 3.

17 AMSA has not reported any amendments to the contract on AusTender. This means that the AusTender contract notice does not reflect the reductions in the estimated total cost of the contract as a result of delays in the service commencement.

18 As part of the RFT process, AMSA sought to incorporate lessons learned into the current contract. As such, this contract was designed to overlap with the prior SAR contract as part of the transition plan.

19 AMSA further advised the ANAO that some of this cost was planned and would have been incurred in any event as the existing contract for delivery of services out of Darwin had expired on 31 January 2015.

20 AMSA staff can undertake Certificate IV in Government Contracts/Procurement. The Certificate IV is not a pre-requisite to manage contracts at AMSA, because people involved with the contract were recruited based on their experience and qualifications. None of the current staff actively involved in the management of this contract have completed this training.

21 At the time of the audit, 96 per cent of all AMSA staff had completed the procurement awareness training.

22 Stores are a range of survival and communication aids delivered to people in distress, typically dropped under parachute.

23 As the Perth base was originally contracted to enter into service first, the aircraft had been located there since August 2016 to undertake training flights.

24 This analysis excludes 2016–17 as the contract did not commence at the start of the year and there were delays in the bases being accepted into service.

25 In October 2020, AMSA advised the ANAO that the crewing issue for Cairns in March 2020 was ‘mostly due to pilot illness’ involving a combination of captains and first officers over 12 shifts.

26 Civil Aviation Regulation 1988, 217 imposes requirement for training and assessment. AMSA does not repeat audit activity that is the responsibility of the aviation regulator.

27 The contract provides that if the contractor’s performance against a KPI is calculated to a number that is not a whole number then the calculated level of performance is rounded up to the nearest whole number. For example, base availability calculated at 94.1 per cent is rounded up to 95 per cent and therefore considered to meet the target. This was the case for May and June 2020 availability at the Perth base.

28 AMSA Annual Report 2019–20, p. 43.