Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of the Manufacture and Supply of Domestic Fractionated Blood Plasma Products

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- A reliable supply of blood and blood products is an integral component of Australia’s medical system.

- The National Fractionation Agreement for Australia (NaFAA) is the National Blood Authority’s (NBA) second largest contract, worth $3.4 billion over nine years.

- The NaFAA was established via a limited tender procurement in a sole provider market, and was exempt from some requirements of the Commonwealth Procurement Rules (CPRs).

Key facts

- The NaFAA is a contract from January 2018 to December 2026 between the NBA and CSL Behring (CSL) for the manufacture and supply of domestic fractionated blood plasma products.

- CSL is Australia’s sole domestic fractionator.

- Fractionation is a process that separates, purifies and concentrates different types of proteins found in blood plasma into therapeutic doses.

What did we find?

- The NBA has been largely effective at managing the manufacture and supply of domestic fractionated blood plasma products.

- The NBA conducted largely appropriate strategic procurement planning, including considering strategic supply objectives. Enterprise level risk management processes monitored and mitigated risks to the supply of blood products.

- The NaFAA procurement process largely supported the achievement of value for money, but the NBA did not demonstrate full compliance with the CPRs.

- Contract management arrangements including performance monitoring and risk management were largely effective.

- The NBA did not comply with various internal requirements throughout the procurement and contract management processes.

What did we recommend?

- The Auditor-General made three recommendations to the NBA. One recommendation was in relation to performance reporting, one related to contract risk management, and the third related to updating internal policies.

$811.9m

in total NaFAA expenditure from January 2018 to December 2020

$171.8m to $244.0m

is the range of potential savings expected from the NaFAA relative to the previous contract

4.738g

is the average amount of immunoglobulin produced by CSL per kg of starting plasma

Summary and recommendations

Background

1. A reliable supply of blood and blood products is an integral component of Australia’s medical system. Blood and blood products are critical in a wide range of medical uses, including for cancer patients, victims of traumatic accidents, people undergoing surgery, and those with blood disorders such as haemophilia. Governments in Australia spend over $1 billion a year on the supply of blood and blood products.

2. The National Blood Authority (NBA) was established in 2003 under the National Blood Authority Act 2003 following the signing of the National Blood Agreement by the Australian, state and territory governments. As the central purchasing agency for blood and blood products, the NBA establishes contracts with suppliers to meet the needs of patients, within the resources and policy parameters set by Australian, state and territory governments.

3. The National Fractionation Agreement for Australia (NaFAA) is a $3.4 billion nine-year contract with CSL Behring (CSL).1 Under the NaFAA, plasma donated by Australian donors is processed by CSL using a process called fractionation. CSL is the sole national plasma fractionator in Australia.

Rationale for undertaking the audit

4. The NaFAA was selected for audit because of the materiality of the services delivered under the contract, its relationship to the core functions and purpose of the NBA, and the limited market in which the services are procured. In addition, at $3.4 billion, the cost of this procurement is a significant use of public funds. A key challenge for the NBA is achieving value for money in a market with a sole provider, in accordance with the Australian Government procurement framework and in line with the policy objectives of the National Blood Agreement including to promote national self-sufficiency.

Audit objective and criteria

5. The audit objective was to assess the effectiveness of NBA’s management of the manufacture and supply of domestic fractionated blood plasma products. To form a conclusion against the objective, the following high-level criteria were adopted:

- Was there appropriate planning in place to support strategic procurement for the manufacture and supply of domestic fractionated blood plasma products?

- Did the procurement process support the achievement of value for money?

- Were effective contract management and monitoring arrangements established to ensure the delivery of the NaFAA?

Conclusion

6. The NBA has been largely effective at managing the manufacture and supply of domestic fractionated blood plasma products.

7. The NBA conducted largely appropriate planning that supported the strategic procurement for the manufacture and supply of domestic fractionated blood plasma products through the NaFAA. The NBA considered strategic supply objectives throughout the NaFAA procurement phase through preparation of the National Supply Plan and Budget, and enterprise- level risk management processes monitored and mitigated risks to the supply of blood products. The NBA did not document procurement planning in accordance with internal policies.

8. The processes undertaken for the procurement of the NaFAA largely supported the achievement of value for money. The NBA conducted benchmarking activities, modelling, and forecasting to assess CSL’s proposal for the NaFAA, and negotiated rates and conditions to support the achievement of value for money. The NBA did not comply with all mandatory requirements of the Commonwealth Procurement Rules (CPRs), including not fully implementing internal policies.

9. The NBA established contract management arrangements for the NaFAA that have been largely effective; however, they were not always implemented fully in accordance with the requirements of NBA internal policy.

Supporting findings

Planning to support strategic procurement

10. The NBA had an approved National Supply Plan and Budget in place at the time of planning for the NaFAA. The NaFAA costings and the 2018–19 National Supply Plan and Budget were developed concurrently, with both processes informing the proposed total contract price.

11. Strategic objectives were considered during the NaFAA procurement phase, through discussions and information provided by the NBA to the Jurisdictional Blood Committee (JBC) and the NBA Board. The NBA did not document procurement planning for the NaFAA in accordance with internal policies.

12. The NBA had in place organisational-level risk activities to monitor and mitigate risks to the supply of blood products, including for products delivered under the NaFAA.

Supporting the achievement of value for money

13. The NBA did not demonstrate that it complied with ethical behaviour requirements in the CPRs and relevant internal policies, as it did not document its consideration of probity risks nor develop a probity plan, and conflict of interest declarations were not completed by NBA staff covering the NaFAA procurement period. The NBA did not retain complete records of conversation for key negotiation meetings held with CSL, which would have provided additional transparency over the decision-making process.

14. NBA benchmarking activities, modelling, and forecasting formed a sound basis for demonstrating value for money in the NaFAA.

15. The NBA effectively negotiated proposed rates and conditions between the two proposals submitted by CSL by leveraging CSL’s preference for a longer contract period, negotiating a price reduction and the retention of indexation arrangements from the previous contract, and integrating conditions in the contract that provided greater flexibility with additional assurance over risk.

Contract management and monitoring arrangements

16. The NBA’s monitoring and management of CSL’s performance has been largely effective. The NBA monitors CSL’s performance against the NaFAA key performance indicators, and has enforced financial penalties and provided bonuses largely in accordance with the contract. Assurance processes for the NaFAA have been established but not consistently completed.

17. The NBA’s risk management for the NaFAA has been largely effective but has not been conducted fully in accordance with internal requirements. The NBA has focused primarily on managing supply and product risks. The NBA has been responsive to issues identified throughout the NaFAA and both parties have complied with key risk requirements under the contract.

18. The NBA’s approach to the design and management of the NaFAA was based on the previous contract with CSL. Review activities and proposals for improvement were undertaken although not through the established internal process.

Recommendations

Recommendation no. 1

Paragraph 4.22

The National Blood Authority review the reporting of CSL Behring’s performance against the NaFAA key performance indicators in the annual report, to ensure it accurately reflects the performance target and the result achieved. Results presented should provide the reader with a clear indication of performance against the targets.

National Blood Authority response: Agreed.

Recommendation no. 2

Paragraph 4.43

The National Blood Authority conduct risk management activities for the NaFAA in line with internal requirements, including:

- conducting an assessment of supplier and contract risks;

- establishing a NaFAA risk management plan to document the approach to risk management; and

- developing a timeline of risk management activities, including a review cycle for risk management activities.

National Blood Authority response: Agreed.

Recommendation no. 3

Paragraph 4.71

The National Blood Authority review and update its suite of internal policies and guidance for procurement and contract management. Internal policy should be consistent with current Australian Government legislative and policy requirements, be commensurate with business needs, and reflect the operating environment of the National Blood Authority. Procurement and contract management processes should be conducted in accordance with the updated internal policy requirements.

National Blood Authority response: Agreed.

Summary of National Blood Authority response

19. The NBA’s summary response to the report is provided below and its full response is at Appendix 1.

The National Blood Authority (NBA) thanks the ANAO for auditing the NBA’s performance in managing the manufacture and supply of domestic fractionated blood plasma products through the major contract negotiated and managed by the NBA with CSL Behring, and for the three recommendations made and agreed to improve the NBA’s future procurement and reporting processes.

The NBA notes that this and preceding contracts have delivered the effective and uninterrupted supply of a range of plasma derived products to Australian patients since 2003. The current contract is a long-term, high value contract of national significance that has delivered good outcomes for patients, governments, Australian industry and community. The audit findings that the NBA has been largely effective with its strategic procurement planning and contract management are welcomed as are the findings that the NBA’s benchmarking activities, modelling, and forecasting have formed a sound basis for demonstrating the contract’s value for money.

The NBA acknowledges that improvements can continue to be made to processes and it will respond to the audit recommendations accordingly.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Procurement

Contract management

1. Background

Introduction

1.1 A reliable supply of blood and blood products is an integral component of Australia’s medical system. Blood and blood products are critical in a wide range of medical uses, including for cancer patients, victims of traumatic accidents, people undergoing surgery, and those with blood disorders such as haemophilia. Governments in Australia spend over $1 billion a year on the supply of blood and blood products. Blood products are provided free of charge to patients requiring treatment through health providers. Types of blood products are set out in Table 1.1.

Table 1.1: Blood product categories

|

Category |

Definition |

|

Fresh blood components |

Components of whole blood (red blood cells, platelets and fresh frozen plasma) are referred to as fresh blood components. The majority of these fresh components are collected by centrifuging the whole blood. The centrifugation process separates the whole blood into red blood cells, platelets and plasma. Platelets and plasma can also be collected by apheresis (a process where whole blood is removed from a donor and the required component(s) retained, while the remainder of the blood components are returned to the donor). |

|

Plasma-derived products |

These are products derived from plasma, using various techniques such as chromatography and Cohn cold-ethanol fractionation.a Proteins are isolated from the plasma and processed into a range of plasma-derived products, such as albumin, immunoglobulin, and coagulation factors (including factors VIII, IX and XI). |

|

Recombinant products |

Recombinant products are genetically engineered forms of plasma proteins and are not sourced from blood, but from host cells that contain an inserted copy of a human gene that produces the protein. |

Note a: Fractionation is a process in which different types of proteins found in blood plasma are separated, purified and concentrated into therapeutic doses. Further detail on fractionation is outlined from paragraph 1.12 below.

Source: National Blood Authority, National Blood Supply Contingency Plan July 2019, p.16.

1.2 The National Blood Authority (NBA) was established in 2003 under the National Blood Authority Act 2003 (NBA Act, or the Act) following the signing of the National Blood Agreement by the Australian, state and territory governments. The NBA is a non-corporate Commonwealth entity operating under the NBA Act, the Public Governance, Performance and Accountability Act 2013 (PGPA Act), and the Public Service Act 1999.

1.3 The National Blood Agreement lists Australian, state and territory governments’ policy objectives for the blood sector. The primary policy objectives are to:

- provide an adequate, safe, secure and affordable supply of blood products, blood related products and blood related services in Australia; and

- promote safe, high quality management and use of blood products, blood related products and blood related services in Australia.

1.4 These primary policy objectives are underpinned by secondary policy aims, including to promote national self-sufficiency.

1.5 As the central purchasing agency for blood and blood products, the NBA establishes contracts with suppliers to meet the needs of patients, within the resources and policy parameters set by Australian, state and territory governments.

Governance arrangements for the Australian blood sector

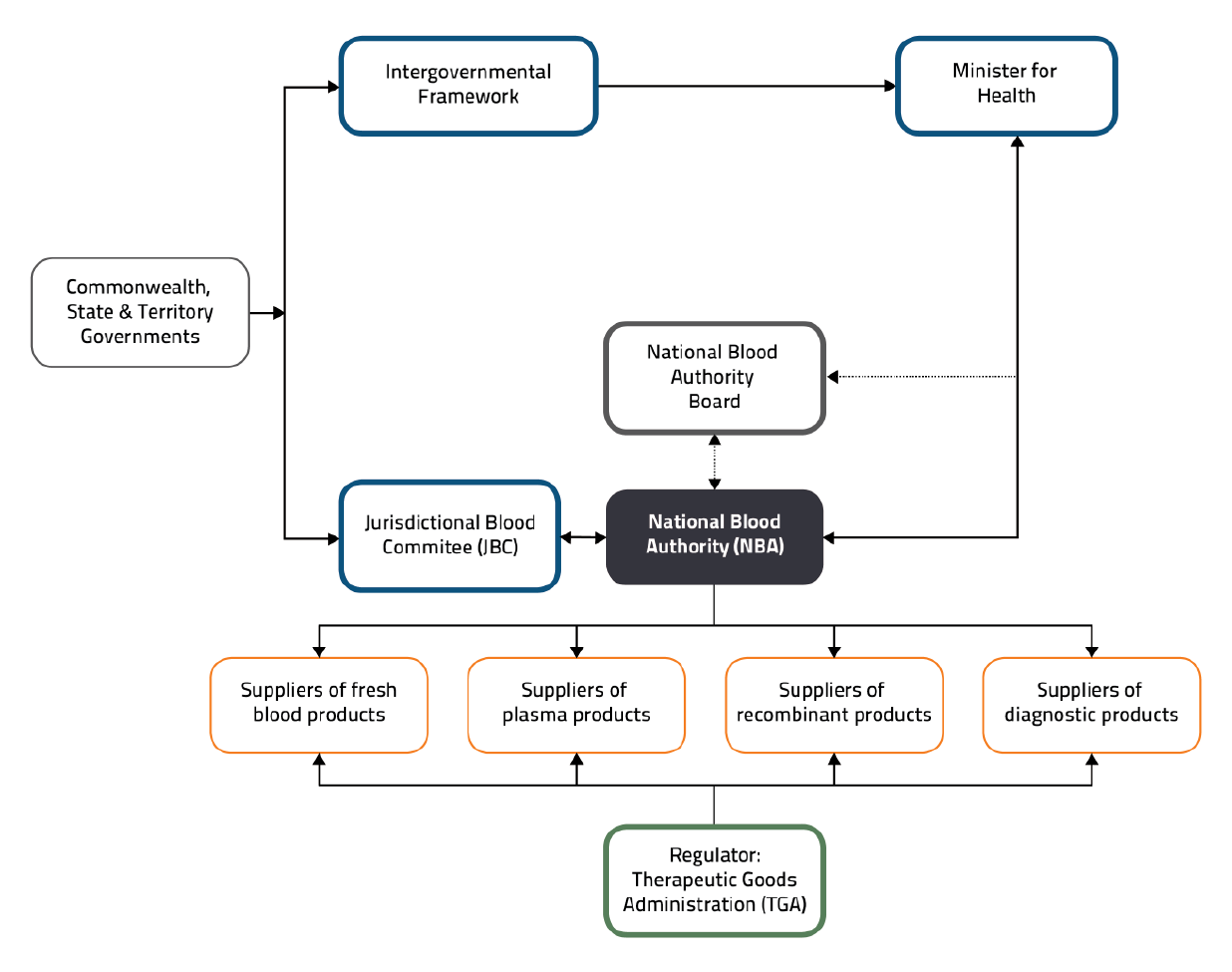

1.6 Governance arrangements for the Australian blood sector are set out in the National Blood Agreement and the NBA Act, and are depicted in Figure 1.1.

Figure 1.1: Governance arrangements for the Australian blood sector

Source: National Blood Authority, Corporate Plan 2020–21 to 2023–24, p.7.

1.7 The Jurisdictional Blood Committee (JBC) — established in 2003 by the National Blood Agreement — is a committee of senior government officials who represent the Australian, state and territory governments. The JBC is responsible for all jurisdictional issues relating to the national blood supply, including: considering advice from, and providing advice to, the NBA on matters related to the national blood supply; and overseeing the NBA’s role in relation to the collection, production and distribution of products.2

1.8 The NBA Board was established under the NBA Act. The Board’s functions, set out in section 13 of the Act, include providing advice to the General Manager (now titled the Chief Executive) about the performance of the NBA’s functions.3 The Board is not a decision-making body but performs an advisory role, considering key strategic issues facing the NBA. The Chief Executive is the accountable authority of the NBA.

1.9 Under the National Blood Agreement, the Australian Government provides 63 per cent of the funding for the national blood supply and the NBA’s operating costs. State and territory governments collectively provide funding for the remaining 37 per cent on a price-volume basis according to products supplied to each state and territory. In 2019–20, total purchases of blood and blood products was $1.26 billion, with plasma products accounting for 48.2 per cent. Funding for 2020–21 is budgeted at $1.36 billion.

1.10 Domestic manufacturing of plasma and recombinant products in Australia is undertaken solely by CSL Behring (CSL) under a contract entered into with the NBA — the National Fractionation Agreement for Australia (NaFAA, or the contract).4

The National Fractionation Agreement for Australia

1.11 The NaFAA is a $3.4 billion nine-year contract with CSL in place from January 2018 to December 2026, subject to a review in 2022. The aim of the NaFAA is to ensure the manufacture and supply of domestic fractionated blood plasma products. The NaFAA aims to provide a safe, secure and affordable supply of plasma products while ensuring value for money for Australian, state and territory governments.

Figure 1.2: Purchaser-provider arrangements for the blood sector

Source: ANAO.

1.12 As illustrated in Figure 1.2, plasma donated by Australian donors and collected by Australian Red Cross Lifeblood is provided to CSL for fractionation under the NaFAA. Fractionation is a process that separates, purifies and concentrates different types of proteins found in blood plasma into therapeutic doses.5 Products manufactured through fractionation include:

- immunoglobulin (Ig) products — used to provide additional immunoglobulins to support patients’ immune systems and to support patients with auto-immune disorders;

- albumin — used to increase plasma volume and retain fluid in the blood stream; and

- clotting factors — used to treat patients with haemophilia and other bleeding disorders, including from surgery.

1.13 Specific blood plasma products manufactured by CSL under the NaFAA are set out in Appendix 2.

1.14 The NaFAA represents the NBA’s second largest contract in total value, with the NBA reporting expenditure of $273.3 million in 2019–20.6 A total of 802.6 tonnes of Australian plasma was pooled for fractionation under the NaFAA in 2019–20.

1.15 The NBA has reported that the NaFAA delivered savings of $7.4 million in 2018–19, and $4.26 million in 2019–20 for domestic Ig products.7 The NaFAA is expected to deliver savings of more than $200 million over the term of the contact, relative to the previous contract with CSL. These savings are partly a result of plans for improved manufacturing processes and efficiencies, referred to by CSL as ‘process migration’.

1.16 CSL is the sole fractionator for Australia and through the NaFAA, remains Australia’s national plasma fractionator — a role held since 1953. As set out in Figure 1.3, the Commonwealth has entered into three previous contracts with CSL for fractionation services since CSL was privatised in 1994.

Figure 1.3: Timeline of fractionation contracts between the Commonwealth and CSL

Source: ANAO analysis.

Government procurement

1.17 The Commonwealth Procurement Rules (CPRs), issued by the Finance Minister under subsection 105(b) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), set out the Australian Government’s procurement policy framework and establish principles that apply to all procurement processes.

1.18 In addition to the requirements of the CPRs, section 20A of the PGPA Act authorises accountable authorities to give instructions (Accountable Authority Instructions) to officials in their entities on any matter necessary or convenient for carrying out or giving effect to the PGPA Act. These are legally binding instructions relating to the financial administration of entities. Accountable Authority Instructions extend to entities’ procurement policies, which may be supplemented by more detailed guidance covering the various phases of the procurement cycle in the context of entities’ particular business environment.

1.19 The CPRs promote the use of sound and transparent procurement practices that seek to achieve value for money and encourage competition in government procurement.8 The CPRs include mandatory requirements that entities must follow. The extent to which all rules of the CPRs apply depends on the value of the procurement and is set out in the two divisions of the CPRs:

- Division 1 — rules applying to all procurements regardless of value. Officials must comply with the rules of Division 1 when conducting procurements; and

- Division 2 — additional rules that apply to all procurements valued at or above the relevant procurement thresholds, unless exempted under Appendix A.

1.20 Appendix A of the CPRs allows for the procurement of blood plasma products or plasma fractionation services to be exempt from Division 2, which sets out additional requirements for limited tender procurements.

1.21 In order to secure an adequate supply of blood products, the NBA manages a number of contracts for the supply of domestic and imported blood products.9 The NBA operates within a unique environment with a limited pool of companies manufacturing blood products.

Rationale for undertaking the audit

1.22 The NaFAA was selected for audit because of the materiality of the services delivered under the contract, its relationship to the core functions and purpose of the NBA, and the limited market in which the services are procured. In addition, at $3.4 billion, the cost of this procurement is a significant use of public funds. A key challenge for the NBA is achieving value for money in a market with a sole provider, in accordance with the Australian Government procurement framework and in line with the policy objectives of the National Blood Agreement including to promote national self-sufficiency.

Previous audit coverage

1.23 The ANAO conducted an audit of the NBA in 2011 (Auditor-General Report No.8 2011–12 The National Blood Authority’s Management of the National Blood Supply), focused primarily on the NBA’s Deed of Agreement with the then Australian Red Cross Blood Service (now Australian Red Cross Lifeblood). The audit scope included the NBA’s governance and administrative systems, contract management practices, and performance monitoring. The previous contract with CSL was excluded from the scope of the 2011 audit.

Audit approach

Audit objective, criteria and scope

1.24 The audit objective was to assess the effectiveness of NBA’s management of the manufacture and supply of domestic fractionated blood plasma products. To form a conclusion against the objective, the following high-level criteria were adopted:

- Was there appropriate planning in place to support strategic procurement for the manufacture and supply of domestic fractionated blood plasma products?

- Did the procurement process support the achievement of value for money?

- Were effective contract management and monitoring arrangements established to ensure the delivery of the NaFAA?

Audit methodology

1.25 The audit methodology included:

- examining and analysing entity documentation; and

- interviews with NBA staff.

1.26 The audit also sought public submissions via the ANAO website.

1.27 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $393,000.

1.28 The team members for this audit were Freya Mathie, Hayley Pennock, Jennifer Zierk, Samuel Painting, and Peta Martyn.

2. Planning to support strategic procurement

Areas examined

This chapter examines whether the National Blood Authority (NBA) undertook appropriate planning for the National Fractionation Agreement of Australia (NaFAA) to support strategic procurement for the manufacture and supply of domestic fractionated blood plasma products.

Conclusion

The NBA conducted largely appropriate planning that supported the strategic procurement for the manufacture and supply of domestic fractionated blood plasma products through the NaFAA. The NBA considered strategic supply objectives throughout the NaFAA procurement phase through preparation of the National Supply Plan and Budget, and enterprise-level risk management processes monitored and mitigated risks to the supply of blood products. The NBA did not document procurement planning in accordance with internal policies.

2.1 As one of two major contracts managed by the NBA, it is important that the NaFAA aligns with the NBA’s broader strategic planning and budgeting process. To determine whether the NBA’s planning for the strategic procurement of the manufacture and supply of domestic blood plasma products was appropriate, the ANAO examined whether:

- the NBA’s annual supply planning and budgeting process informed the procurement for the manufacture and supply of domestic fractionated blood plasma products;

- the procurement planning supported the achievement of an affordable, safe, secure and adequate supply of domestic fractionated blood products; and

- the procurement planning addressed identified risks to the supply of domestic fractionated blood products.

2.2 The planning phase of the NaFAA commenced in April 2015 when the NBA first presented to the Board its plans for the next fractionation agreement, and continued throughout the procurement until the contract was signed in December 2017.

Did the National Supply Plan and Budget inform the procurement?

The NBA had an approved National Supply Plan and Budget in place at the time of planning for the NaFAA. The NaFAA costings and the 2018–19 National Supply Plan and Budget were developed concurrently, with both processes informing the proposed total contract price.

2.3 The NBA is required to undertake an annual supply planning and budgeting process under paragraph 25(b) of the National Blood Agreement and paragraph 8(1)(b) of the National Blood Authority Act 2003 (NBA Act, or the Act). The process results in the National Supply Plan and Budget, which forms a key part of the NBA’s management of the blood supply and achievement of its primary objectives.10 The National Supply Plan and Budget consists of a spreadsheet of forecasted volumes and costs of blood products over four years. It includes all fresh, plasma, recombinant and imported blood products, and any additional payments agreed by jurisdictions.

2.4 The National Supply Plan and Budget process begins in July each year for the following financial year. As set out in the NBA’s key business processes documentation, the process begins with modelling using the NBA’s contract management system, followed by consultation with states and territories (or jurisdictions), and suppliers, including CSL Behring (CSL) and the Australian Red Cross Lifeblood, to confirm volume estimates. Forecasts are then discussed with representatives from jurisdictions (often including key clinical representatives), with the refined forecasted volumes then used by the NBA to produce cost estimates based on contract values or estimated prices.

2.5 The spreadsheet outlining the forecasted volumes and costs of blood products is accompanied by a summary of the total NBA budget (administered and departmental) for each forecasted year, and the National Product Price List, which outlines products supplied under the National Blood Agreement.

2.6 Following a final review by jurisdictional representatives, the full National Supply Plan and Budget is provided to the Jurisdictional Blood Committee (JBC) for approval in December. The JBC approves the National Supply Plan and Budget for submission to the Clinical Principal Committee, Australian Health Ministers’ Advisory Council, and Health Council.

2.7 The NBA is responsible for the implementation and ongoing management and monitoring of blood product supply and demand against the approved National Supply Plan and Budget, including quarterly reporting to the JBC. The NBA conducts a mid-year review of the National Supply Plan and Budget to address emerging trends identified since the budget was approved, and adjustments are made if required. Jurisdictions are charged for the products they are issued during the year, not according to forecasted volumes, following a reconciliation process completed by NBA at the end of the financial year.

2.8 Throughout the procurement phase for the NaFAA, the NBA had three National Supply Plan and Budgets in place for 2016–17 to 2018–19, approved by the JBC in December 2015, December 2016 and December 2017 respectively. The 2018–19 National Supply Plan and Budget process ran concurrently with the finalisation of the NaFAA. As NaFAA negotiations reached their conclusion, proposed contract prices in the NaFAA informed the forecasted budget. The NBA used the proposed contract prices and National Supply Plan and Budget volume forecasts to estimate the total cost of the NaFAA, which was then used in the spending proposal minute approved by the NBA Chief Executive to finalise the NaFAA. This is consistent with the NBA process for the development of the National Supply Plan and Budget, which uses known contract prices where possible to produce a budget estimate.

2.9 The 2018–19 National Supply Plan and Budget was agreed in principle by the JBC on 1 December 2017, just prior to the NaFAA finalisation on 6 December 2017. The costings used to calculate the total figure for the NaFAA, as set out in the NBA’s spending proposal for the contract, were largely consistent with the 2018–19 National Supply Plan and Budget. Volumes set out under the NaFAA costing calculations matched the volumes set out in the 2018–19 National Supply Plan and Budget, and costings used for NaFAA calculations generally matched, with two exceptions that impacted on the NaFAA costings and the final amount included in the spending proposal:

- A formula error was identified in the NaFAA costings for three products.11 The formula relied on a calculation of product volume multiplied by product price, where the error resulted in the use of incorrect product prices. This resulted in the NaFAA calculations being $1.75 million lower than the National Supply Plan and Budget for these products over a five year period. The total spending proposal amount for the NaFAA was $2.02 million lower than if the correct prices had been used.

- An additional formula error was identified in the method used to split the NaFAA costings for the 2021–22 prices. Correct pricing was applied but the formula used resulted in only 11 months of the annual product volumes being counted. This error affected all products for 2021–22, and resulted in the spending proposal being $25.11 million lower than if the entire annual volume was counted.

2.10 The formula errors in the NaFAA costings resulted in the approved spending proposal being $27.13 million lower than if correct formulas were used, representing 0.9 per cent of the total NaFAA value.

2.11 In audits of other entities, the ANAO has previously noted the weaknesses of using spreadsheets as a primary tool for managing business information.12 Spreadsheets lack formalised change/version control and reporting, increasing the risk of error. This can make spreadsheets unreliable corporate data handling tools, as accidental or deliberate changes can be made to formulae and data, without there being a record of when, by whom, and what changes were made.

Did procurement planning support the achievement of strategic objectives?

Strategic objectives were considered during the NaFAA procurement phase, through discussions and information provided by the NBA to the JBC and the NBA Board. The NBA did not document procurement planning for the NaFAA in accordance with internal policies.

2.12 As set out in Chapter 1, one of the two primary policy objectives for the Australian blood sector is ‘to provide an adequate, safe, secure and affordable supply of blood products, blood related products and blood related services in Australia’.13 The NBA’s Outcome 1 is to provide:

Access to a secure supply of safe and affordable blood products, including through national supply arrangements and coordination of best practice standards within agreed funding policies under the national blood arrangements.14

2.13 The primary policy objectives are underpinned by secondary policy aims, including self-sufficiency. The JBC has noted the tensions between the primary policy objectives and the secondary policy aims of domestic self-sufficiency and reliance on voluntary, non-remunerated donations. The NBA is required to balance the policy of self-sufficiency with affordability and supply security.

2.14 The NBA’s website states:

The NBA relies on regulation by the Therapeutic Goods Administration to address the major policy aim of safety. The policy aim of affordability is addressed through various procurement mechanisms such as competitive tendering, price benchmarking and other specific negotiation approaches. The policy aims of adequacy and security of supply are addressed through a range of measures such as primary and contingency supply arrangements, inventory and inventory reserve requirements, and an integrated regime of supply and contract risk protections.15

2.15 In papers to the JBC, the NBA advised and sought approval from the committee in relation to: prices and costs; the negotiation approach for the NaFAA; and the supply arrangements through the National Supply Plan and Budget. The NaFAA sets out minimum inventory requirements linked to the key performance indicators (KPIs) for the contract, demonstrating NBA’s management mechanisms for the security of supply.

2.16 The NBA also stated on its website that preparations for tender processes include: gathering information on the global market; reviewing the current arrangements to identify where improvements might be gained (for example security of supply, safety and value for money); and using knowledge of normal supply chain and commercial arrangements to design arrangements that are achievable and sustainable.16 The NBA presented to the JBC and the Board ‘horizon scanning’ papers, which documented the NBA’s monitoring of international developments related to the management of blood and blood products.

2.17 In planning for the NaFAA procurement, in 2015 the NBA drafted a two-page procurement plan that sets out activities to be undertaken during the planning phase of the procurement. Activities outlined in the plan included: identifying issues with the then current contract with CSL — the CSL Australian Fractionation Agreement (CAFA); identifying issues that may impact on the term of the next contract; developing policy parameters for developing the next contract; seeking agreement from Government on the policy parameters; and developing project timeframes and resourcing requirements. The draft procurement plan was not finalised.

2.18 NBA internal procurement policy requires minimum documentation of a procurement strategy, project plan, risk management plan and project schedule. The NBA did not document procurement planning in accordance with internal policies. However, there was evidence of the NBA executing the activities identified in the draft procurement plan in papers provided by the NBA to the JBC and the NBA Board.

2.19 In addition to the JBC and Board papers, the NBA’s strategic goals, as set out in corporate plans, have consistently referenced the four primary policy objectives (affordable, safe, secure and adequate) over the planning period for the NaFAA. The final spending proposal for the NaFAA noted that ‘entering into this arrangement assists the NBA to achieve its purposes under the NBA Act particularly to carry out national blood arrangements to ensure that there is a safe, secure, sufficient and affordable supply of plasma blood products in all the States and covered Territories in Australia’.

Did procurement planning appropriately address identified risks to the supply of domestic fractionated blood plasma products?

The NBA had in place organisational-level risk activities to monitor and mitigate risks to the supply of blood products, including for products delivered under the NaFAA.

2.20 Under the National Blood Agreement and the NBA Act, the NBA is responsible for managing risks to the national blood supply, including risk mitigation and contingency measures.

2.21 Although a risk assessment and risk management plan was not completed for the NaFAA procurement (see from paragraph 3.28), the NBA conducted organisational-level risk activities that contributed to the monitoring and mitigation of blood supply risks. These included supply risks for products, including products supplied under the NaFAA. These risk processes were conducted on an annual basis and were in place at the time of planning for the NaFAA.

2.22 The Supply Risk and Risk Mitigation Update process, conducted annually, involves stakeholder consultation (including with suppliers) and review of international events that may impact on product supply. On completion of the process, a brief is submitted to the NBA’s Chief Executive accompanied by a product-level risk register, which outlines key risks and treatments for each blood product type, and a document outlining mitigation strategies and detailed information for each product.

2.23 Several risks were common across most product types: contamination of supply; unexpected increases in demand; and issues with distribution or supply leading to product losses. Treatments for common product supply risks in the product-level risk register often consist of contract mechanisms such as requirements for suppliers to maintain minimum levels of product stock and clauses outlining options for the supply of alternative products. These treatments stem from the NBA’s findings from the original Supply Risk and Risk Mitigation Project in 2004–05, which identified contract mechanisms to ensure national reserves and minimum product levels as some of the most effective in mitigating risk.

2.24 Another key organisational-level risk assessment activity conducted by the NBA in parallel with planning for the NaFAA was an activity the NBA terms ‘horizon scanning’. The National Blood Agreement requires the NBA to monitor the national and international environment in which the Australian Blood Sector operates for new technological, clinical, risk or other developments that may impact on the national blood supply and requires the NBA to maintain a systematic approach to identifying new developments. Horizon scanning reports were submitted to the JBC quarterly as a standing agenda item throughout the NaFAA procurement period from May 2015 to December 2017.

2.25 Common treatments cited in the Supply Risk and Risk Mitigation Update process from 2015–16 have been included in the NaFAA. These treatments were also included in the NBA’s previous fractionation agreement with CSL, the CAFA. The NaFAA includes requirements for CSL to hold a minimum level of starting plasma (which is plasma supplied to CSL by the NBA) and each manufactured product at all times, except for under scenarios outlined in the contract. CSL must also maintain a separate National Reserve of products under the NaFAA.

2.26 In addition, two of the five KPIs in the NaFAA reiterate these mechanisms and are stated to directly address supply risks by ensuring the maintenance of minimum inventory levels and the National Reserve, and that products in the National Reserve have sufficient shelf life remaining. KPIs are discussed further in Chapter 4. Although these clauses and KPIs were rolled over from the CAFA to form the basis of the NaFAA, risks were considered by the NBA during the planning phase of the NaFAA through entity level risk assessment processes outlined above.

3. Supporting the achievement of value for money

Areas examined

This chapter examines whether the National Blood Authority’s (NBA) procurement process for the National Fractionation Agreement for Australia (NaFAA) supported the achievement of value for money.

Conclusion

The processes undertaken for the procurement of the NaFAA largely supported the achievement of value for money. The NBA conducted benchmarking activities, modelling, and forecasting to assess CSL Behring’s (CSL) proposal for the NaFAA, and negotiated rates and conditions to support the achievement of value for money. The NBA did not comply with all mandatory requirements of the Commonwealth Procurement Rules (CPRs), including not fully implementing internal policies.

Areas for improvement

The ANAO made a suggestion that the NBA maintains records of negotiations of procurements to provide transparency over the decision-making process and ensure that information captured is accurate, complete, and corporate knowledge is retained.

3.1 The NaFAA was established following a limited tender process. Limited tender procurements generally reduce competition and therefore, under the CPRs, may only be undertaken in specific circumstances for high value procurements17; however, an entity must still demonstrate that the procurement achieves value for money. To determine whether the procurement undertaken by the NBA for the NaFAA supported the achievement of value for money, the ANAO examined whether:

- the procurement process was consistent with the July 2014 and March 2017 CPRs in force over the procurement period18;

- the basis for assessing the proposed rates as value for money was sound; and

- the proposed rates and conditions were effectively negotiated.

Was the procurement process consistent with the Commonwealth Procurement Rules?

The NBA did not demonstrate that it complied with ethical behaviour requirements in the CPRs and relevant internal policies, as it did not document its consideration of probity risks nor develop a probity plan, and conflict of interest declarations were not completed by NBA staff covering the NaFAA procurement period. The NBA did not retain complete records of conversation for key negotiation meetings held with CSL, which would have provided additional transparency over the decision-making process.

3.2 In undertaking procurements, officials from relevant entities are required to adhere to the CPRs.19 The CPRs establish procurement rules that apply to all procurement processes, and promote value for money as the core rule of the Australian Government’s procurement policy framework. Value for money is enhanced and complemented by other key rules—encouraging competition; efficient, effective, economical and ethical use of resources; and accountability and transparency in decision making.20 Value for money is achieved through proper procurement planning to support the selection of an appropriate procurement method that encourages fair and open competition commensurate with the size, scale and risk of the procurement.21

3.3 The NBA conducted the NaFAA as a limited tender, using exemption 12 under Appendix A of the March 2017 CPRs for the procurement of blood plasma products or plasma fractionation services.22 Using this exemption required the NBA to follow the rules outlined in Division 1 of the CPRs; however, the NBA was not required to comply with the additional Division 2 requirements for procurements above the relevant procurement threshold.23

3.4 The CPRs set out the mandatory requirements with which officials must comply when undertaking procurements. The CPRs have been designed to provide flexibility in developing and implementing procurement processes relevant to an entity’s needs that reflect the size, scope and risk of the procurement. More broadly, the CPRs also indicate good practice.24

3.5 The CPRs state that they provide a necessary framework for accountable authorities when issuing Accountable Authority Instructions and operational requirements in relation to procurement. The CPRs further set out that in the area of procurement, an accountable authority should provide a mechanism to:

- apply the principles and requirements of the resource management and procurement frameworks, focusing on the relevant entity’s operations; and

- provide primary operational instructions to relevant entity officials in carrying out their duties related to procurement, in a way that is tailored to a relevant entity’s particular circumstances and needs.25

3.6 Three NBA internal policies — or key business processes (KBP) — applied to the NaFAA procurement:

- KBP3 — Tendering and Contract Negotiation-Blood Products and Services, dated June 2015;

- KBP7 — Risk Management Framework, dated December 2013 and last updated in February 2016; and

- Management Instruction 17 — Disclosure and Management of Conflicts of Interest by NBA Staff, dated July 2008.

3.7 The NBA Accountable Authority Instructions specify that all KBPs must be followed by NBA employees. KBP3 outlines that procurement officers must follow the process, unless they receive clearance from the NBA Chief Executive or Deputy General Manager (now titled the Deputy Chief Executive).26 NBA staff working on the NaFAA procurement included the Chief Executive and Deputy Chief Executive, with the Chief Executive being the delegate to enter into the contract with CSL. The NBA advised that KBP3 was designed for an open tender process, and that some requirements did not apply for the NaFAA procurement. There was no evidence of a sign off by the Chief Executive or Deputy Chief Executive to vary internal policies or process for the NaFAA procurement.

3.8 The NBA’s NaFAA spending proposal provided advice to the Chief Executive that the NBA’s Accountable Authority Instructions and KBPs were followed during the procurement.

Achieving value for money

3.9 The core rule of the CPRs is achieving value for money. The CPRs state that ‘Officials responsible for a procurement must be satisfied, after reasonable enquires, that the procurement achieves a value for money outcome’.27 The CPRs also state that ‘an official must consider the relevant financial and non-financial costs and benefits of each submission.’ To meet the accountability and transparency requirements of the CPRs, it is important that entities select the best value for money proposals and document the reasons and process by which they arrived at their decision.

3.10 The NBA engaged KordaMentha Corporate (KordaMentha) to conduct assessment and modelling of potential NaFAA savings, and provide advice on the value of the contract and negotiation tactics.28 KordaMentha concluded that the final contract offer, against a baseline of the prior contract, could deliver savings between $171.8 and $244.0 million (dependent on the plasma growth assumptions and volumes) with the terms and conditions offering flexibility and additional protections. KordaMentha advised the NBA that the proposed terms negotiated with CSL over an extended period of time represented fair value. The terms and conditions negotiated to assist in delivering value for money from the NaFAA are discussed from paragraph 3.53 below.

3.11 The NBA Chief Executive approved a spending proposal minute on 6 December 2017 that documented the procurement strategy and approach for the NaFAA. The spending proposal justified value for money by setting out that CSL is the sole provider of fractionation services and that the previous contract was used as the baseline to assess savings achieved through the negotiation process. The spending proposal also noted that the NaFAA represented best value for money available within the current policy arrangements.

Ethical behaviour

3.12 The CPRs state that ‘Ethical relates to honesty, integrity, probity, diligence, fairness and consistency’.29 The CPRs further state that:

Officials undertaking procurement must act ethically throughout the procurement. Ethical behaviour includes:

a. recognising and dealing with actual, potential and perceived conflicts of interest;

b. dealing with potential suppliers, tenderers and suppliers equitably, including by

i. seeking appropriate internal or external advice when probity issues arise, and

ii. not accepting inappropriate gifts or hospitality;

c. carefully considering the use of public resources; and

d. complying with all directions, including relevant entity requirements, in relation to gifts or hospitality, the Australian Privacy Principles of the Privacy Act 1988 and the security provisions of the Crimes Act 1914.

3.13 In addition to the requirements of the CPRs, subsection 13(7) of the Code of Conduct contained in the Public Service Act 1999 requires an employee to take reasonable steps to avoid any conflict of interest (real or apparent) in connection with the employee’s employment, and disclose details of any material personal interest of the employee in connection with the employee’s employment. Agency heads and senior executive service employees of the Australian Public Service are required to declare in writing, at least annually, their own and their immediate family’s financial and other interests that could cause a real or apparent conflict of interest.30

3.14 Entity accountable authorities must promote the ethical management of public resources and establish and maintain appropriate systems relating to risk management, oversight and internal controls, including policies and procedures regarding the management of conflicts of interest.31

3.15 NBA Management Instruction 17 — Disclosure and Management of Conflicts of Interest by NBA Staff, sets out that the possible areas of conflict of interest that NBA staff members should be particularly aware of are in relation to current or potential future suppliers to the NBA, including both suppliers of blood and blood products. The management instruction requires that all NBA staff complete an annual conflict of interest disclosure and includes a declaration template. The management instruction also recognises that work on a project involving tendering or similar procurement activity is a common situation where it is appropriate to consider conflict of interest issues and states that staff may be asked to make a conflict of interest disclosure in these circumstances.

3.16 The NBA provided an annual conflict of interest disclosure for the Chief Executive that was completed in October 2016.32 A private interests declaration was completed by the Deputy Chief Executive in January 2016, when they were acting in the role of Chief Executive. These annual declarations were completed on a single occasion within the procurement period from April 2015 to December 2017, and no conflicts were declared. The NBA also provided annual conflict of interest declarations, with no conflicts of interest being declared, that were completed outside the NaFAA procurement period:

- Deputy Chief Executive: for January and December 2014; and

- Executive Director: for December 2013, and January and December 2014.

3.17 No conflict of interest disclosures were completed by NBA staff specifically for the purpose of working on the NaFAA procurement.

3.18 A probity plan provides the framework for ensuring that probity and transparency are maintained throughout a procurement process.33 In planning a procurement, the NBA’s KBP3 states that officials are required to apply and comply with probity principles and practices throughout all stages of every procurement. KBP3 also sets out that in addition to the minimum documentation required (procurement strategy, project plan, risk management plan and project schedule), officials should consider whether additional documentation, including a probity plan, is warranted.

3.19 Additional NBA guidance notes that the need for probity measures is typically as a result of a task or risk analysis indicating a need to obtain independent verification of the integrity of procurement or procurement related processes. This guidance outlines that probity measures typically include a probity plan and regular reporting to confirm compliance with probity requirements. There was no evidence of the NBA’s consideration of the need for a probity plan and it was therefore unclear how the NBA considered probity issues, either perceived, actual, or potential.

3.20 The NBA advised that probity risks were mitigated by generally ensuring that more than one NBA staff member was present at negotiation meetings held with CSL. The NBA provided evidence of 11 meetings between the NBA and CSL from 24 March 2017 to 27 November 2017. Multiple attendees were identified as attending 10 of the 11 meetings. One meeting was held between only the NBA Chief Executive and CSL General Manager. Talking points for the meeting were drafted with input from the Deputy Chief Executive and KordaMentha, and a summary of the content and result from the meeting was included in papers to the NBA Board in August 2017. KordaMentha also attended two meetings with the NBA and CSL.

3.21 Given that the NaFAA represents the NBA’s second largest contract in monetary value, and the close ongoing relationship between the NBA and CSL, there would have been merit in the NBA developing a probity plan for the NaFAA procurement.

3.22 Entities should also ensure that policies on conflict of interest management are consistent with policies relating to gifts and benefits.34 The NBA maintained a Gifts and Hospitality Register that did not include any declaration of gifts received by NBA officials from CSL during the procurement period for the NaFAA (April 2015 to December 2017).

Accountability and transparency

3.23 Mandatory requirements of the CPRs relevant to a sole source tender include:

- Officials must maintain for each procurement a level of documentation commensurate with the scale, scope and risk of the procurement.

- Relevant entities must have access to evidence of agreements with suppliers, in the form of one or a combination of the following documents: a written contract, a purchase order, an invoice or a receipt.

- In order to draw the market’s early attention to potential procurement opportunities, each relevant entity must maintain on AusTender a current procurement plan containing a short strategic procurement outlook.

- Relevant entities must report contracts and amendments on AusTender within 42 days of entering into (or amending) a contract if they are valued at or above the reporting threshold.35

3.24 Decisions regarding the contract and negotiation were documented in a summary form within papers that were provided to the NBA Board and the Jurisdictional Blood Committee (JBC). The NBA advised the ANAO that papers presented to the Board and the JBC were considered to be the records of the procurement.

3.25 The CPRs require a level of documentation to be kept which is commensurate with scale, scope and risk of the procurement. The NBA’s internal policy, KBP3, sets out that minutes of the negotiation process are key documents in conducting a procurement. The NBA did not maintain complete records of conversation from negotiation meetings with CSL. Maintaining complete records of discussions, including the attendees and agreed outcomes of negotiation meetings, would have provided additional transparency over the decision-making process and ensure that information captured is accurate, complete and corporate knowledge is retained to inform future procurements.

3.26 The NBA’s spending proposal minute documented financial approval from the Chief Executive. The NBA maintained records of agreements with CSL in the form of the executed contract and invoices.

3.27 The procurement was not included in the NBA’s annual procurement plan for 2016–17. The NBA reported the NaFAA on AusTender, within the required 42 days.

Procurement risk

3.28 The CPRs state that ‘Relevant entities must establish processes for the identification, analysis, allocation and treatment of risk when conducting a procurement’.36

3.29 The NBA’s risk management policy statement and internal risk management framework policy — KBP7 — requires each level of the organisation to undertake a five step process of risk management including identification, analysis, evaluation, treatment, monitoring and review. KBP7 includes a requirement for the use of a risk matrix relating to the consequence and likelihood of the risk occurring.

3.30 There was no evidence of the NBA conducting a risk process for the NaFAA procurement in line with its internal policies. The NBA’s 2015 draft procurement plan identified some procurement risks, including project timeliness, potential poor identification of issues, poorly developed terms of reference, and non-identification of potential consultancies. However, the plan was not used by the NBA as a basis for identifying, analysing, allocating and treating risk throughout the procurement.

3.31 In April 2015, the NBA provided a paper to the Board on the development of a strategy and approach for the CSL fractionation agreement. The paper identified key issues relating to the procurement, including that the environment in which CSL approaches the negotiations had changed since the contract preceding the NaFAA, and the need to explore potential risks of the new global production capacity at Broadmeadows.37

3.32 A paper that was presented to the JBC in April 2016, prior to NBA’s commencement of contract negotiations with CSL, demonstrated the NBA’s consideration of broader strategic issues, including CSL’s desire to make capital investment dependent on the next contract, related blood product transition implications and annual plasma volumes. These issues were raised in a letter to CSL in April 2016, and continued to be discussed throughout the negotiation. No mitigations or risk treatments were developed for these issues prior to negotiation.

Was the basis for assessing value for money sound?

NBA benchmarking activities, modelling, and forecasting formed a sound basis for demonstrating value for money in the NaFAA.

3.33 The market for fractionation services in Australia is a local monopoly, in a global industry that the NBA identifies as oligopolistic and having limited market transparency. In this type of market, value for money cannot be assessed through the usual evaluation of competitive tenders.38 Auditor-General Report No.48 2014–15 Limited Tender Procurement noted that it is generally more difficult for entities conducting a limited tender to demonstrate value for money, and identified activities that entities may undertake in addition to obtaining multiple quotes to increase the likelihood of achieving value for money, including:

- benchmarking costs for similar services procured previously; and

- negotiating strongly for discounted pricing or additional services rather than accepting initial quotes provided.39

Benchmarking from the previous contract

3.34 In May 2014, the NBA completed a mid-term review of the previous contract with CSL — the CSL Australian Fractionation Agreement (CAFA) — as required by the terms of the contract to determine the expiry date. The assessment was based on CSL’s achievement against key performance indicators (KPIs), the suitability of the range of products manufactured, and whether product prices remained competitive. Outcomes of the review determined whether the contract continued to the full term.

3.35 The CAFA set out a benchmarking methodology to be applied in the mid-term review to ensure that the prices under the contract remained competitive in comparison to other comparable markets, and relative or better in percentage terms to the pricing position as at 1 January 2010. The methodology considered whether prices remained competitive through a series of price benchmarking approaches:

- the NBA contingent intravenous immunoglobulin (IVIg) price (that is, the NBA price for imported IVIg);

- other plasma-derived product prices obtained by the NBA for comparable products (if any);

- pricing, trends and industry intelligence from publicly available data;

- price data for a comparable selection of countries from IMS (an international subscription service which collects and reports price/volume information)40; and

- published United States price data from the Centre for Medicare and Medicaid Services.

3.36 The methodology noted that prices considered must exclude all taxes, duties, wholesale margins, distribution costs and the cost of plasma. Pricing was affected by foreign exchange rates, with the CAFA determining that an accepted exchange rate to convert the average selling price into Australian dollars was the 12 month average historical exchange rate for the period immediately prior to the date of commencement of the review, for the relevant currency.

3.37 The CAFA required CSL to purchase additional commercial data, and conduct the benchmarking, which was completed in February 2014. In completing the benchmarking analysis, CSL made several assumptions and adjustments to the methodology. In the mid-term review report the NBA noted that CSL used:

- a plasma cost sourced from publicly quoted sources identifying small volume market trading in plasma, which were not representative of the efficiency of vertically integrated plasma collections undertaken by major global fractionation companies such as CSL itself;

- a mean reverting exchange rate rather than the 12 month average historical exchange rate in the CAFA41;

- prices from comparator countries weighted by volume to arrive at a price for each product in each of the reference countries; and

- average product prices derived from three different data sources, for comparator countries.

3.38 CSL’s analysis asserted that prices under the CAFA at the time of review:

- remained, on average, five per cent lower than comparator prices from the selection of reference countries;

- the average price of IVIg had remained flat in nominal terms since the commencement of the CAFA, and had fallen by eight per cent in real terms as a result of the reducing average price as volumes of IVIg supplied increased; and

- prices of all products supplied under the CAFA had declined in real terms consistent with the indexation provisions that allowed for unit price increases of one per cent less than the annual inflation rate.

3.39 The NBA re-performed CSL’s benchmarking analysis, with two differing key assumptions:

- plasma cost of US$111 per litre, which was a reported cost for CSL’s global collections, against a cost of US$122 used in the CSL analysis; and

- 12 month historical average exchange rate.

3.40 The NBA’s analysis noted that, dependant on the underlying assumptions, prices under the CAFA could be between 10 to 16 per cent higher than average. The NBA noted in the mid-term review report that the differences in the approach and findings:

…primarily serve to show that the process of relying directly on a figure derived from an international price benchmarking process is highly unreliable, given that this process relies on a methodology where the correct approach is debatable in a number of key respects, and source information which is not readily available or comparable on a basis which would represent the operation of a fully functioning and economically efficient marketplace.

3.41 The report noted scope for improvement of prices for a number of key blood products. The NBA decided against seeking revised prices from CSL on these products, on advice from the Board. Whilst the NBA did not pursue revised prices for these products at the time of review, NBA Board papers in February 2017 recorded that:

- in November 2014, at the request of the JBC, the NBA sought an efficiency dividend on the commercial pricing formula under the CAFA following the JBC’s endorsement of the Four Year Plasma Plan in 2014; and

- in April 2016, the NBA confirmed an efficiency mechanism with prices indexed by an amount of Consumer Price Index (CPI) minus three and a half per cent, rather than CPI minus one per cent.

3.42 The NBA’s CAFA mid-term review concluded that CSL had satisfactorily performed its obligations under the agreement, the range of products were generally equivalent to international products with a competitive yield for immunoglobulin (Ig), and product pricing was useful for budget management processes as the price of Ig products declined with volume and the prices of all products remained behind CPI increases.

Benchmarking for the NaFAA

3.43 The NBA did not re-perform international benchmarking activities in 2016–17 for the NaFAA procurement, with CSL’s first proposal for the NaFAA noting that re-performing the benchmarking methodology for the new agreement would cost approximately $150,000. Instead, the NBA engaged KordaMentha in June 2017 to provide financial modelling and assessment of CSL’s proposals, was provided a report commissioned by CSL from KPMG on value for money in the global fractionation market, and considered commercial intelligence analytics reports prepared by a financial services company.

3.44 In March 2017, CSL provided a first proposal for the new contract which referenced the benchmarking from the CAFA as the basis for value for money and included updated data from the KPMG commissioned report that evaluated price competitiveness.

3.45 The finalised KPMG report was provided to the NBA in June 2017 and did not follow the same benchmarking methodology set out in the CAFA. KPMG analysis found that when excluding the cost of plasma collection, the fractionation fee for plasma products supplied to Australia under the CAFA appeared to be in line with average commercial price benchmark against the USA, Germany, Japan, France, Italy, Canada, Sweden and Switzerland. KPMG caveated that price comparisons were sensitive to differences in plasma supply fractionation models, which were difficult to accurately adjust due to:

- the range of products supplied, which may impact cost recovery by allocating fixed costs across more or less products derived per litre of plasma;

- obligations and regulatory constraints under which suppliers operate, with costs typically increasing with an increase in obligations and constraints;

- differences in demand for products derived from the same litre of plasma; and

- length of contracts.

3.46 The NBA provided KordaMentha with a copy of the KPMG report in July 2017 and the commercial intelligence analytics reports on CSL prepared by a financial services company. The NBA advised that KordaMentha completed a reconciliation of KPMG’s report against its own modelling that had been based on assumptions and information agreed with the NBA. While the NBA considered that the KPMG report provided analysis and arguments that supported CSL’s negotiation position, the NBA advised that the matters presented in the report did not become the direct subject of negotiations.

3.47 KordaMentha conducted market analysis and investigation of CSL’s business, including assessments of return on equity, return on assets, and earnings. In an interim report to the NBA, KordaMentha confirmed that CSL was financially in line with competitors, and globally was not profiting more than its competitors. The report also noted that the imported blood product prices paid by the NBA were lower than CAFA prices, and that this may have been due to the contracted prices for imported Ig not being at market rates. In comparison to imported blood product prices, Ig costs under the CAFA and the first proposal were approximately 22 per cent higher inclusive of the yield bonus, block fee and national reserve fee, excluding the cost of plasma.42

3.48 As noted in paragraph 3.33, benchmarking costs for similar services procured previously may increase the likelihood of achieving value for money. The CAFA was used as the basis to demonstrate savings for the NaFAA as a comparison to previous supply costs. KordaMentha conducted financial modelling and analysis of CSL’s two proposals, which included:

- rolling forward the existing CAFA assuming all of the pricing and indexation formulas were in place for the duration of the new contract for each of the products as a baseline;

- using the four-year national blood plan to determine the volume of products to be provided, and average growth rate across the four years, to forecast the growth in forward years;

- adopting an inflation rate of two per cent from CSL’s first proposal. Modelling for the second proposal including an agreed indexation arrangement for Ig products (see discussion from paragraph 3.65); and

- scenario analysis for plasma growth.

3.49 KordaMentha modelled three scenarios for plasma growth for each proposal to determine the range of potential savings. This modelling is shown in Figure 3.1.

Figure 3.1: KordaMentha scenario analysis — NaFAA and CAFA cost comparisons

Source: NBA documentation.

Were proposed rates and conditions effectively negotiated?

The NBA effectively negotiated proposed rates and conditions between the two proposals submitted by CSL by leveraging CSL’s preference for a longer contract period, negotiating a price reduction and the retention of indexation arrangements from the previous contract, and integrating conditions in the contract that provided greater flexibility with additional assurance over risk.

3.50 On 15 February 2016, CSL wrote to the NBA to request a letter of intent to negotiate the next contract after the CAFA. CSL noted that the letter of intent would allow CSL to proceed with investing in the initial design of new facilities at its existing site in Broadmeadows, Victoria, to progress a manufacturing upgrade referred to as process migration.43 CSL presented information about the process migration project to the NBA Board in February 2016, with a subsequent presentation to the JBC in September 2016.

3.51 CSL’s letter to the NBA noted that potential for a longer term agreement would provide CSL with greater surety to move from the design phase into the construction phase for the process migration project. Efficiencies to be realised by process migration informed savings in CSL’s first proposal with the project expected to be fully realised by September 2021.

3.52 The NBA presented a paper to the JBC in April 2016 to agree to a response to CSL, resulting in a letter of intent. The letter of intent stated that the NBA anticipated the negotiation of a second agreement; however Australian, state and territory governments were still in the early stage of discussion on the contract term and conditions. The letter also sought clarification on outstanding issues regarding process migration, including:

- price benefits for key blood products, including products in the CAFA and potential new products with commercial KPIs or guarantees;

- yield, purity and quality improvements for IVIg and other key products; and

- clinical, supply planning, management or logistical implications of moving from current blood products to global blood products, which may not have been identified in the proposal.

3.53 The NBA and CSL held preliminary conversations in October and November 2016. NBA documentation following the meetings identified that issues of contract length would be critical for CSL, with a preference for an eight to ten year contract term. Substantive negotiations began on 24 March 2017. A timeline for the negotiation phase of the NaFAA procurement is set out at Figure 3.2. The NBA’s internal procurement policy KBP3 requires procurements to have an approved negotiation strategy. The NBA did not have an approved negotiation strategy for the NaFAA procurement, documentation of the negotiation approach was set out in papers to the NBA Board, and the JBC.

Figure 3.2: Timeline of contract negotiations

Source: ANAO analysis of NBA documentation.

3.54 Outcomes from the NBA’s initial negotiation meeting with CSL were reported to the JBC on 7 April 2017, noting that:

- the NBA would seek best possible value for money, with a preference for a shorter term agreement of two to four years that took into account uncertainties regarding process migration and potential government policy changes; and

- CSL indicated a continuing preference for a longer term agreement of preferably eight to ten years, and an interest in a potential opportunity for the commercial sale of surplus Australian albumin.

3.55 CSL’s first proposal identified approximately $110 million worth of savings over an eight year fixed term, compared to prices under the CAFA at 31 December 2017. This was based on 2017–18 plasma and product supply estimates and an annual CPI of two per cent. The proposal stated that savings would grow in excess of $150 million if the volume of plasma and Ig products were to grow by at least five per cent per year over the eight year period. CSL’s proposal stated that ‘the price offer is inextricably linked to the contract terms and should be considered a holistic package’.

3.56 The proposal also stated that the costs of process migration would be partly amortised by the contract. Savings were generated from a combination of:

- price reduction for Ig products of $2.20 per gram at commencement of the new contract, with all other products remaining at CAFA exit prices;

- an efficiency dividend through changing indexation to CPI minus 1 per cent for Ig products in any year where plasma and product volume growth of five per cent or greater is achieved;

- effective July 2019, all product prices and fees subject to annual indexation at CPI, removing indexation agreements made under the CAFA;

- from September 2021, a price reduction for Ig products by a further $2.00 per gram, with additional reductions for Albumin; and

- reduction of the block fee in 2021.

3.57 CSL’s offer included additional changes to CAFA contract conditions including:

- changes to manufacturing processes for five existing products and an addition of nine new products following process migration;

- maintaining the NBA’s step-in rights only until the introduction of process migration;

- establishing a Joint Operational Team to review and simplify relevant operational and administrative processes;

- minimum annual starting plasma volume of 650 tonnes;

- changes to KPI2 to express yield as the percentage of Ig recovered from starting plasma, as opposed to the grams of Ig produced per kilogram; and

- post-process migration, the replacement of one product with an imported alternative at a lower cost.44

3.58 On 29 June 2017, the NBA wrote to CSL advising that preliminary analysis of CSL’s proposal had been completed and had identified that the first proposal did not provide a significant improvement in value for money, when compared to the CAFA, to warrant a longer term contract. Key issues outlined by the NBA included:

- prices and fees across various elements of the contract;

- removal of discounts from indexation arrangements under the CAFA;

- production yield issues; and

- contractual performance and measurement.

3.59 As shown in in Figure 3.1, KordaMentha modelled several scenarios focused on plasma growth, measured against the costs of the CAFA, rolled forward eight years including indexation arrangements under the CAFA.

3.60 Initial modelling and analysis undertaken by KordaMentha was provided to the NBA in an interim report on 13 July 2017. The report suggested that the savings presented in CSL’s first proposal varied between $74 million and $119 million, with the majority of savings to be realised from September 2021, following expected process migration completion. The interim report sought additional clarification from CSL on price parameters and assumptions for modelling, process migration risks, justification for increased minimum plasma volume, and contract term length.

3.61 The NBA conducted five additional meetings with CSL until August 2017, when CSL submitted a second proposal, a ‘best and final offer’ on 9 August 2017. Meeting minutes were not maintained for these conversations — outcomes were primarily documented through papers to the JBC and NBA Board, some email exchanges, and draft internal NBA documents.

3.62 The NBA’s paper to the JBC in September 2017 reiterated that the first proposal was complex, with numerous interrelated elements for prices and fees. The NBA noted that the first proposal did not appear to provide a significant improvement on value for money from the CAFA and that the proposed term of eight years was inconsistent with the NBA’s preference for a two to four year contract. The analysis also identified that the potential implications and benefits of process migration were unclear.

3.63 Variations between the first and second proposals from CSL indicate the NBA’s ability to negotiate against issues identified during the procurement. Modelling undertaken by KordaMentha estimated final savings against the CAFA in the range of $171.8 to $244.0 million over nine years. These savings demonstrated a $38.6 million improvement over the first proposal45, more evenly spread across the agreement, rather than back-loading savings post process migration. The second offer included changes in a number of areas of the agreement, as outlined in the sections below.

Pricing and indexation