Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Staff Leave in the Australian Public Service

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- As of 30 June 2021, leave and other entitlements represented $3.0 billion (5.5 per cent) of Australian Government employee benefit expenses ($54.8 billion) and $11.1 billion (2.5 per cent) of Australian Government employee benefit liabilities ($447.5 billion).

- This audit seeks to assess compliance in the management of staff leave at 10 entities that collectively employ 37 per cent of the Australian Public Service workforce and represent a cross-section of agencies of different sizes and functions.

Key facts

- 56,588 personnel (average staffing level) were employed by the 10 entities in the 2020–21 financial year.

- $751 million employee leave benefit expenses reported by the 10 entities in the 2020–21 financial year.

- $2.073 billion employee leave provision liabilities reported by the 10 entities in the 2020–21 financial year.

What did we find?

- All 10 entities were compliant or largely compliant with annual, long service, parental/maternity, personal, and flexible leave obligations and entitlements.

- All entities except Aboriginal Hostels Ltd have established policies for the administration of leave that align with relevant legislative, award and enterprise agreement requirements.

What did we recommend?

- There were four recommendations covering human resource management information systems, controls and policy development and alignment.

- One recommendation was to Aboriginal Hostels Ltd, one recommendation was to four entities, and two recommendations were to all 10 entities.

- All entities agreed to relevant recommendations.

5,822 (8%)

Employees across all 10 entities exceeding annual leave balance thresholds in enterprise agreements.

11%–53%

Rate of schedulable leave (annual, purchased, long-service, maternity and parental) approved after the commencement of leave.

3%–15%

Rate of flexible leave maximum credit/debit balances exceeding requirements.

Summary and recommendations

Background

1. Leave entitlements and obligations for Australian Government employees and employers are established in workplace relations legislation including the: Fair Work Act 2009 (Fair Work Act); Long Service Leave (Commonwealth Employees) Act 1976; Maternity Leave (Commonwealth Employees) Act 1973; Paid Parental Leave Act 2010; and related regulations.

2. Employee benefits (including wages and salaries, superannuation, leave, separation and redundancies) represent the highest value departmental expenditure for most Australian Government entities, and the inputs and estimates that contribute to the measurement of the associated liability are subject to management judgement. In 2020–21, leave and other entitlements represented $3.0 billion (5.5 per cent) of Australian Government employee benefits expenses ($54.8 billion), and $11.1 billion (2.5 per cent) of Australian Government employee benefits liabilities ($447.5 billion) as at 30 June 2021.

Rationale for undertaking the audit

3. In response to an increase in findings relating to human resource management and administration across Australian Government entities during the period from 2015–16 to 2018–19, the ANAO undertook procedures relating to the management of staff leave as part of the 2019–20 financial statement audits of the Department of Home Affairs, the Department of the Prime Minister and Cabinet and the Department of the Treasury.

4. The analysis identified weaknesses in processes relating to staff leave and associated monitoring controls. It was also identified that entities did not have appropriate and fit for purpose human resources management information systems (HRMIS) and processes to facilitate the identification of rates of non-compliance with entity policies, patterns of attendance and leave that, if identified and addressed, may have resulted in higher levels of attendance.

5. This audit seeks to further assess compliance in the management of staff leave at 10 entities with combined average staffing levels of 56,588 or more than a third of the Australian Public Service (APS) workforce in 2020–21. This audit will provide assurance to the Parliament about the extent to which entities are complying with legislative, award, enterprise agreement, and policy requirements relating to staff leave.

Audit objective and criteria

6. The objective of the audit was to assess the compliance by selected Australian Public Service entities with legislation and other relevant requirements relating to staff leave.

7. To form a conclusion against the audit objective, the ANAO adopted the following high-level criteria:

- Have the entities established policies for the administration of leave types that align with the relevant legislation, award and enterprise agreement provisions?

- Did the entities comply with the legislative, award, enterprise agreement, and policy requirements in the administration of leave types?

Conclusion

8. All 10 entities largely complied with requirements for the management of staff leave. Aboriginal Hostels Ltd (AHL) has not developed policies to support the management of staff leave.

Supporting findings

9. Supporting findings for each of the 10 entities have been summarised in Table S.1.

Annual and purchased leave

10. All entities except Aboriginal Hostels Ltd (AHL) have established policies for the administration of annual and purchased leave that align with relevant legislation, award and enterprise agreement provisions.

11. All 10 entities complied with legislative, award, enterprise agreement, and policy requirements in the administration of annual and purchased leave, except for the following instances of material non-compliance:

- annual leave commencing prior to approval — non-compliance for all six entities with a requirement, Australian Taxation Office (ATO), Clean Energy Regulator (CER), Department of Finance (Finance), Murray Darling Basin Authority (MDBA), National Disability Insurance Agency (NDIA) and National Indigenous Australians Agency (NIAA) ranging from 19.5 per cent at the ATO to 27.8 per cent at NIAA;

- annual leave balances exceeding thresholds — non-compliance for all four entities with a requirement (AHL, Finance, MDBA and NIAA) ranging from 15 per cent at AHL to 21 per cent at Finance; and

- approval of purchased leave inconsistent with enterprise agreement requirements — non-compliance at Finance (eight per cent) and Department of Industry, Science, Energy and Resources (DISER) (24 per cent).

Long service leave

12. All entities except AHL have established policies for the administration of long service leave that align with relevant legislation and enterprise agreement provisions.

13. All 10 entities complied with legislative, enterprise agreement and policy requirements in the administration of long service leave, except for the following instances of material non-compliance:

- long service leave approved without delegation — non-compliance of 8 per cent at NDIA;

- long service leave commencing prior to approval — non-compliance for all six entities with a requirement at ATO, CER, Finance, MDBA, NDIA and NIAA ranging from 11 per cent at Finance to 36.6 per cent at NIAA;

- long service leave broken by leave type not permitted — non-compliance at ACIC, ATO, CER, DISER, Finance, MDBA, NDIA, NIAA and Services Australia ranging from 1.5 per cent at Services Australia to 11 per cent at DISER; and

- long service leave granted without qualifying service — non-compliance at Services Australia (one employee).

Personal (and carer’s) leave

14. All entities except AHL have developed appropriate policies for administering personal (and carer’s) leave that align with relevant legislation, award and enterprise agreement provisions.

15. All 10 entities complied with legislative, award, enterprise agreement and policy requirements in the administration of personal (and carer’s) leave, except for the following instances of material non-compliance:

- personal leave without evidence exceeding consecutive day limit — non-compliance at AHL, CER, DISER, Finance, NDIA and NIAA ranging from 1.9 per cent at DISER to 11.3 per cent at NIAA;

- personal leave without evidence exceeding annual limit — non-compliance at ACIC, CER, DISER, Finance, MDBA, NDIA and Services Australia ranging from less than one per cent at NDIA and Services Australia to 25.4 per cent at MDBA; and

- leave not supported by documentary evidence — 12 per cent non-compliance at Finance.

Maternity and parental leave

16. All entities except AHL have developed appropriate policies for administering maternity and parental leave that align with relevant legislation, award and enterprise agreement provisions.

17. All 10 entities complied with legislative, award, enterprise agreement, and policy requirements in the administration of maternity and parental leave, except for the following instances of material non-compliance:

- paid maternity leave granted above entitlement — non-compliance at ATO, DISER, MDBA and NIAA ranging from less than one per cent at ATO and DISER to 12.5 per cent (one instance) at MDBA;

- maternity leave granted above entitlement — non-compliance at ATO and DISER ranging from two per cent at ATO to nine per cent at DISER;

- documentation supporting fitness to work not on file — non-compliance at ATO and Finance ranging from eight per cent at ATO to 14 per cent at Finance;

- maternity leave counting as service exceeding entitlement — non-compliance at AHL, ATO, DISER, MDBA, NIAA and Services Australia ranging from less than one per cent at Services Australia and DISER to 12.5 per cent at MDBA;

- documentary evidence supporting maternity leave — non-compliance at Services Australia (12 per cent) and Finance (20 per cent); and

- documentary evidence supporting parental leave not on file — non-compliance at DISER, Finance, NIAA and Services Australia ranging from eight per cent at Services Australia to 100 per cent at NIAA.

Flexible leave and time off in lieu

18. All entities except AHL have developed appropriate policies for administering flexible leave and time off in lieu leave that align with award and enterprise agreement provisions.

19. No entity was compliant with award, enterprise agreement and policy requirements in the administration of APS level flexible leave. Two entities, ACIC and AHL have not established flexible leave functionality in existing human resource management information systems. The ANAO identified the following among the remaining entities:

- flexible leave credit or debit balances exceeding maximum threshold — ATO, CER, DISER, Finance, MDBA, NDIA, NIAA and Services Australia ranging from 3.4 per cent of APS level employees at Services Australia to 15.4 per cent at MDBA; and

- settlement clause requirements — non-compliance at ATO, CER, Finance, MDBA, NDIA and Services Australia ranging from 2.6 per cent of flexible leave records at Services Australia to 13.8 per cent at MDBA.

20. Five entities (ATO, Finance, NDIA, NIAA and Services Australia) advised that leave days taken using Executive Level time off in lieu (TOIL) are administered using existing human resource management information systems.

21. Finance is the only entity that has established systems to record additional hours worked by Executive Level employees to support its administration of accrual and use of TOIL.

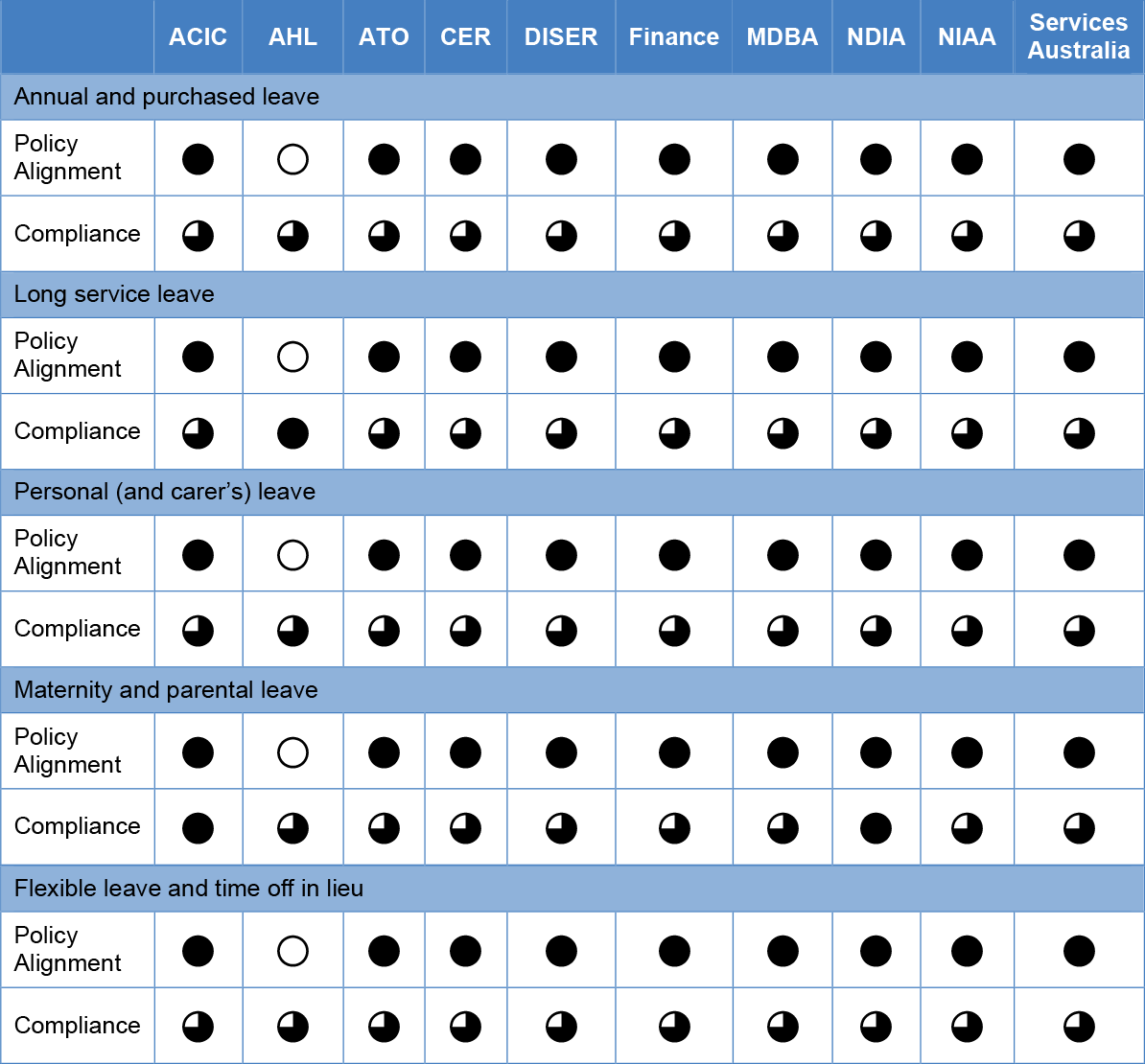

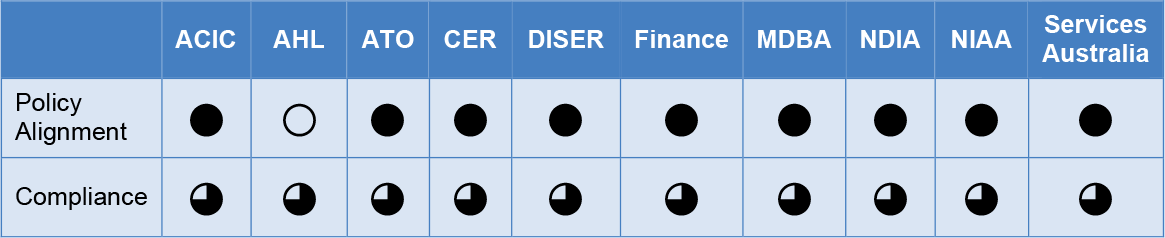

Table S.1. Summary of findings — policy alignment and compliance with legislative, award, enterprise agreement, and policy requirements.

Key: ![]() Entity has not established policies (Policy Alignment) / Widespread non-compliance was identified with legislative, award, enterprise agreement, and policy requirements for the leave type (Compliance).

Entity has not established policies (Policy Alignment) / Widespread non-compliance was identified with legislative, award, enterprise agreement, and policy requirements for the leave type (Compliance).

![]() Entity policies have been developed but are not aligned with legislative, award, and enterprise agreement provisions (Policy Alignment) / Multiple instances of non-compliance were identified with legislative, award, enterprise agreement, and policy requirements for the leave type (Compliance).

Entity policies have been developed but are not aligned with legislative, award, and enterprise agreement provisions (Policy Alignment) / Multiple instances of non-compliance were identified with legislative, award, enterprise agreement, and policy requirements for the leave type (Compliance).

![]() Entity policies are largely aligned with some immaterial exceptions (Policy Alignment) / Small number of instances of non-compliance were identified with legislative, award, enterprise agreement, and policy requirements for the leave type (Compliance).

Entity policies are largely aligned with some immaterial exceptions (Policy Alignment) / Small number of instances of non-compliance were identified with legislative, award, enterprise agreement, and policy requirements for the leave type (Compliance).

![]() Entity has policies aligned with requirements (Policy Alignment) / No instances of non-compliance were identified with legislative, award, enterprise agreement, and policy requirements for the leave type (Compliance).

Entity has policies aligned with requirements (Policy Alignment) / No instances of non-compliance were identified with legislative, award, enterprise agreement, and policy requirements for the leave type (Compliance).

Source: ANAO analysis.

Recommendations

Recommendation no. 1

Paragraph 2.8

Aboriginal Hostels Limited develop and implement policies for the administration of all leave types that align with legislative, award and enterprise agreement provisions.

Aboriginal Hostels Limited response: Agreed

Recommendation no. 2

Paragraph 3.24

All entities establish appropriate controls to ensure the use of long service leave complies with legislative, award, enterprise agreement and policy requirements, including controls that ensure long service leave is only broken by permitted types of leave.

Aboriginal Hostels Limited response: Agreed

Australian Criminal Intelligence Commission response: Agreed

Australian Taxation Office response: Agreed

Clean Energy Regulator response: Agreed

Department of Finance response: Agreed

Department of Industry, Science, Energy and Resources response: Agreed

Murray Darling Basin Authority response: Agreed

National Disability Insurance Agency response: Agreed

National Indigenous Australians Agency response: Agreed

Services Australia response: Agreed

Recommendation no. 3

Paragraph 5.22

Department of Finance; Department of Industry, Science, Energy and Resources; National Indigenous Australians Agency; and Services Australia establish appropriate controls to ensure the use of maternity and parental leave complies with legislative, award, enterprise agreement and policy requirements, including controls that ensure documentary evidence has been sighted by the approver or recorded in the system.

Department of Finance response: Agreed

Department of Industry, Science, Energy and Resources response: Agreed

National Indigenous Australians Agency response: Agreed

Services Australia response: Agreed

Recommendation no. 4

Paragraph 6.19

All entities establish or refine information systems and/or other procedural controls to support the consistent management of flexible leave provisions established in enterprise agreements and determinations.

Aboriginal Hostels Limited response: Agreed

Australian Criminal Intelligence Commission response: Agreed

Australian Taxation Office response: Agreed

Clean Energy Regulator response: Agreed

Department of Finance response: Agreed

Department of Industry, Science, Energy and Resources response: Agreed

Murray Darling Basin Authority response: Agreed

National Disability Insurance Agency response: Agreed

National Indigenous Australians Agency response: Agreed

Services Australia response: Agreed

Summary of entity responses

Aboriginal Hostels Limited

Aboriginal Hostels Limited (AHL) welcomes any constructive review and external scrutiny of its processes and procedures and acknowledges the findings and recommendations as set out in the s19 report. AHL welcomes the findings and agrees to the implementation of the recommendations as detailed in our responses.

AHL has recently developed a business case, which recommends the implementation of a new HRMIS with enhanced functionality, including the automation of a range of existing manual processes. Once implemented, it is expected that the new HRMIS would also support the strengthening of leave management and associated governance processes.

We would like to acknowledge the efforts of the ANAO team and the collaborative approach in undertaking this audit. AHL looks forward to a continuing positive working relationship with the ANAO.

Australian Criminal Intelligence Commission

The ACIC welcomes the audit into the management of staff leave in the Australian Public Service, and is committed to continually improving how it manages and administers staff leave across the agency. It was particularly pleasing that the audit recognised the sound governance the agency has in place, though the ACIC acknowledges there is still room for improvement.

Recognising the importance of a fit-for-purpose human resource information management system, the ACIC had already began implementing a number of enhancements to its systems at the commencement of the audit, in accordance with the Government Enterprise Resource Planning (GovERP) project. This includes upgrades to user experience, and additional automated controls to ensure leave is taken in accordance with employee entitlements.

The audit has highlighted the shared responsibility that employees and managers have in ensuring leave is taken appropriately and in accordance with entitlements. To support this, the ACIC has reviewed the education and guidance provided to employees and managers, with a new training package under development and leave policies under review. Once finalised, these resources will better support staff across the agency to effectively manage leave.

Australian Taxation Office

The ATO welcomes this review and the report finding that the ATO is largely compliant with requirements for the management of staff leave. The review has also found the ATO to have appropriate policies for administering leave that align with relevant legislation, award and enterprise agreement provisions.

We recognise the audit findings identified some opportunities to further enhance our management of staff leave. We also note the period within which the audit was conducted was one that saw the ATO operating in an environment that required the rapid implementation of Government stimulus measures arising from the COVID-19 pandemic. This required unprecedented workloads to support the community in a time of great uncertainty and impacted on the usual operation of and access to leave.

The ATO does have concerns with the data presented in scatterplots visuals in figures 2.2 and 4.1. We believe they do not appropriately represent the performance of ATO managers in approving the tens-of-thousands of leave events that occurred in the audit period, nor accurately represent the distribution of elapsed time taken to approve leave.

Noting the above, the ATO agrees with the two recommendations relevant to it and will continue to refine and improve processes in the management of staff leave.

ANAO comment on Australian Taxation Office summary response

22. The ANAO observed 29,497 instances of annual leave being approved following the commencement of that leave and 149,074 instances of personal leave (which are ordinarily approved upon return to work). Figure 2.2 and Figure 4.1 are intended to demonstrate the distribution of days taken to approve annual and personal leave following either the commencement of annual leave or return to work for personal leave. The ANAO has included footnotes to these figures to Appendix 8 where the number of instances, mean and median for each entity are provided to ensure appropriate context is available to readers. The ANAO has also acknowledged that there may be some instances where it may be appropriate for scheduled leave to be approved following commencement of leave (see paragraphs 2.23 and 2.24).

Clean Energy Regulator

CER accepts the audit findings and overall, the agency is compliant with the policy and legislation. The CER will continue to focus efforts on employee and management behaviour to improve compliance with leave approval in the HR information system prior to commencing leave and for unscheduled leave to be approved as soon as the employee returns from leave. Monthly management leave reports sent to section managers and senior management will be used as a direct monitoring report and followed up with email communication to employees and managers to address excess leave balances or debits.

Department of Finance

The Department of Finance (Department) welcomes the findings of the Australian National Audit Office (ANAO) report titled Management of Staff Leave in the Australian Public Service.

The Department agrees with the audit recommendations and will implement actions to address areas identified for improvement, including system and process enhancements and providing enhanced guidance for managers and staff.

The COVID-19 pandemic required the Department to support the Australian Government to deliver on measures, leading to a sustained high workload, including during the period that the audit took place. This sustained workload had an impact on the management of staff leave balances within the limits of our Enterprise Agreement and relevant policies.

The Department will continue to monitor key workforce indicators and is implementing strategies to actively manage staff leave where it exceeds Enterprise Agreement provisions.

Department of Industry, Science, Energy and Resources

The Department of Industry, Science, Energy and Resources (the department) acknowledges the Australian National Audit Office’s (ANAO) proposed audit report on Management of Staff Leave in the Australian Public Service.

The department accepts the recommendations, as they relate to the department and will work collaboratively to investigate and implement these recommendations.

The department notes the ANAO’s conclusion that all departmental policies were found to align with requirements and our overall results were broadly the same as other entities included in the audit.

The department thanks the ANAO for its proposed audit report and commits to working collaboratively to explores options for addressing the recommendations made in the report.

Murray Darling Basin Authority

The Murray-Darling Basin Authority (MDBA) is committed to appropriate and timely implementation of agreed recommendations from the Management of Staff Leave in the Australian Public Service.

Of the four recommendations in this report, two are applicable to the MDBA.

The MDBA acknowledges that whilst largely compliant, there is some work to be done to strengthen the controls around the management of long service leave and to refine information systems and/or other procedural controls to support the consistent management of flexible leave provisions. The MDBA supports strengthening controls as identified by the ANAO.

National Disability Insurance Agency

The NDIA acknowledges the findings of the report and supports the recommendations and opportunities for improvement they provide in managing staff leave entitlements. The NDIA appreciates the ANAO’s conclusion that the NDIA has established policies for the administration of leave types that align with the relevant legislation and enterprise agreement provision, and the NDIA is largely compliant with legislation and other relevant requirements relating to staff leave.

The NDIA agrees to implement recommendations 2 and 4 and is committed to the improvement of application of leave requirements including minimum and maximum entitlements, and timeliness of submission and approval of leave requests. We will seek to expand our data analytics to support compliance with related leave conditions. This will complement existing communication and education activities and is in addition to Human Resource (HR) management reporting which informs management action.

As recognised by the ANAO in this audit report, the NDIA is the recipient of a shared service arrangement from Services Australia, including provision of a human resource management information system (HRMIS). The NDIA will continue to explore enhancements to these systems and processes, where required, in partnership with Services Australia. It is important to recognise that the current COVID pandemic including Government restrictions on movement, has impacted staff leave plans and led to an accumulation of leave holdings. The NDIA has initiated various strategies to address maximum leave entitlements, as part of our employee wellbeing focus. These activities will form part of the broader action plan to address findings from this audit.

National Indigenous Australians Agency

The National Indigenous Australians Agency (NIAA) is committed to best practice human resource management and administration. The NIAA is currently reviewing its Leave Policy to ensure it aligns with the new Enterprise Agreement 2021-24. Following extensive staff consultation, the Leave Policy is anticipated to be published in August 2022.

The NIAA is working closely with the Department of Prime Minister and Cabinet (PM&C) as the NIAA’s shared service provider for its human resource information management systems (Aurion) and payroll processing, to implement a number of changes in relation to the management of leave entitlements. These changes will support employees and managers to better understand leave requirements and approval responsibilities.

The NIAA will supplement the system changes with a full review of intranet content relating to leave procedures to ensure the content aligns with the new leave policy and all information is clear and easy to access. This will support employees to better understand their rights and responsibilities in relation to leave entitlements.

The NIAA agrees with all recommendations relevant to the NIAA and notes actions undertaken and underway.

Services Australia

Services Australia welcomes this report, and is pleased with the high compliance results across the various staff leave examined, particularly in the context of the agency having the highest average staffing level from the ten entities examined. Health and wellbeing are important to maintaining the endurance and resilience of the workforce. Leave supports employees to balance their individual circumstances and life events, and to be well at work. Managers and staff seek to balance leave needs and preferences with business requirements, sometimes during periods of unprecedented demand for assistance. Considering the work that is underway to deliver the Government Enterprise Resource Planning (GovERP) system, the agency will undertake education and communication campaigns, and continue to train staff and monitor compliance, to further strengthen the compliance rate with the management of employee leave.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Policy implementation

Governance and risk management

Records management

1. Background

Introduction

1.1 Leave entitlements and obligations for Australian Government employees and employers are established in workplace relations legislation including the: Fair Work Act 2009 (Fair Work Act); Long Service Leave (Commonwealth Employees) Act 1976; Maternity Leave (Commonwealth Employees) Act 1973; Paid Parental Leave Act 2010; and related regulations.

1.2 The Australian Public Service Enterprise Award 2015, entity specific enterprise agreements established under Part 2-4 of the Fair Work Act, and entity policies provide additional obligations on Australian Public Service (APS) employers and employees in relation to leave.1 2

1.3 Human resource financial processes encompass the day-to-day management and administration of employee benefits including payroll and other entitlements, such as leave.

1.4 Employee benefits (including wages and salaries, superannuation, leave, separation and redundancies) represent the highest value departmental expenditure for most Australian Government entities, and the inputs and estimates that contribute to the measurement of the associated liability are subject to management judgement. In 2020–21, leave and other entitlements represented $3.0 billion (5.5 per cent) of Australian Government employee benefits expenses ($54.8 billion), and $11.1 billion (2.5 per cent) of Australian Government employee benefits liabilities ($447.5 billion) as at 30 June 2021.

1.5 The Public Governance, Performance and Accountability Act 2013 (PGPA Act) sets out that the accountable authority must govern the entity in a way that ‘promotes the proper use and management of public resources for which the authority is responsible’3 and that accountable authorities must establish and maintain appropriate systems of risk oversight and management, and appropriate systems of internal control.

1.6 The PGPA Act also states that the accountable authority must act in a way that is ‘not inconsistent with the policies of the Australian Government’. The government’s workplace bargaining policy states that entities are responsible for ensuring that workplace arrangements are consistent with the policy, meet all legislative obligations, and that entities are responsible for ensuring that their workplace relations policies and practices are consistent with the policy.

1.7 The establishment and implementation of policies that align with legislative, award and enterprise agreement requirements support good practice in the administration of staff leave and assist entities to communicate entitlements and obligations to employees and delegates.

Selected entities

1.8 Entities were selected from those that engage employees under the Public Service Act 1999 and provide a broad cross-section of government entities based on size (small, medium and large) and function (policy, service delivery and regulation). Table 1.1 includes employee and financial statistics for each entity and sets out a combined average staffing level of 56,588 employees across all 10 entities, accounting for 37 per cent of the total APS workforce in 2020–21.

Table 1.1: Audit entities average staffing levels and employee leave benefits and provisions

|

Entity |

2020–21 Average staffing level |

2020–21 Employee benefits expenses (leave) ($,000) |

2020–21 Employee benefits liabilities (leave) ($,000) |

|

Aboriginal Hostels Ltd (AHL) |

331 |

2,308 |

7,762 |

|

Australian Criminal Intelligence Commission (ACIC) |

702 |

10,911 |

30,559 |

|

Australian Tax Office (ATO) |

18,131 |

227,632 |

778,616 |

|

Clean Energy Regulatory (CER) |

318 |

4,737 |

13,245 |

|

Department of Finance (Finance) |

1,262 |

32,131a |

116,306a |

|

Department of Industry, Science, Energy and Resources (DISER) |

2,549 |

43,336 |

125,546 |

|

Murray-Darling Basin Authority (MDBA) |

266 |

4,773 |

12,120 |

|

National Disability Insurance Agency (NDIA) |

3,979 |

41,798 |

92,109 |

|

National Indigenous Australians Agency (NIAA) |

1,154 |

15,257 |

53,069 |

|

Services Australia |

27,896 |

368,547 |

844,632 |

Note a: Finance reporting includes both departmental ($14.7 million employee benefits expense and $65.8 million employee provisions) and administered ($17.4 million employee benefits expense and $50.5 million employee provisions) elements. Administered employee benefits and provisions relate to employees engaged under the Members of Parliament (Staff) Act 1984.

Source: Entity annual reports and portfolio budget statements.

Rationale for undertaking the audit

1.9 The increase in findings relating to human resource management and administration across Australian Government entities during the period from 2015–16 to 2018–19, and the significance of these as a proportion of all financial statements audit findings prompted the ANAO to undertake procedures relating to the management of staff leave in three entities. This was performed as part of the 2019–20 financial statements audits of the Department of Home Affairs, the Department of Prime Minister and Cabinet and the Department of the Treasury.

1.10 Analysis in these three financial statements audits identified weaknesses in processes relating to staff leave and associated monitoring controls. The reporting on the three entities indicated their systems did not facilitate the identification of: rates of non-compliance with entity policies; weaknesses in monitoring controls and reporting; and patterns of attendance and leave that, if identified and addressed, may result in higher levels of attendance. This resulted in poor outcomes for the three entities from that intended by the related policies.

1.11 This audit will provide assurance to the Parliament about the extent to which entities are complying with legislative, award, enterprise agreement and policy requirements relating to staff leave.

Audit approach

Audit objective, criteria and scope

1.12 The objective of the audit was to assess the compliance by selected Australian Public Service entities with legislation and other relevant requirements relating to staff leave.

1.13 To form a conclusion against the audit objective, the ANAO adopted the following high-level criteria:

- Have the entities established policies for the administration of leave types that align with the relevant legislation, award and enterprise agreement provisions?

- Did the entities comply with the legislation, award, enterprise agreement, and policy requirements in the administration of leave types?

Audit methodology

1.14 The audit methodology included:

- examination of relevant legislation, awards, enterprise agreements and entity policies relating to the administration of the following leave entitlements:

- annual and purchased leave;

- long service leave;

- maternity and parental leave;

- personal (and carer’s) leave; and

- APS level flexible leave and Executive Level time off in lieu.

- meetings with entity staff responsible for the administration of staff leave;

- analysis of entity data and sample testing of individual leave balances and transactions including leave approvals and supporting documentation; and

- testing of entity information system controls used for the administration of leave.

Data integrity

1.15 The Australian Government’s information management standard sets out requirements for the maintenance of government business information including that entities create, save or capture business information into systems with sufficient functionality to satisfy operational and other stakeholder needs for reliable and trusted information.

1.16 The ANAO tested the reliability and completeness of entity data for all types of leave within the scope of this audit and found that for eight of 10 entities leave data was reliable and complete. Issues were identified with missing records and incomplete approval date fields provided to the ANAO by Finance; and incomplete data for AHL for all types of leave, where 26% of leave transactions had no approval data available.

1.17 Services Australia is the provider of a number of services for NDIA, including a shared human resources management information system (HRMIS). For the purpose of determining timeliness of leave approvals, the ANAO requested the system field that identifies the date an instance of leave was approved. The configuration of Services Australia and NDIA’s HRMIS resulted in the ANAO being unable to obtain detailed approval data for some leave transactions as their HRMIS records the date a leave transaction was last actioned and substitutes for the approval date where subsequent adjustments occur. This limits the ability to accurately monitor compliance with leave requirements through systems based reporting, where the date of approval is a necessary data point for analysis.

1.18 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $660,000.

1.19 The team members for the audit were Pooja Bajaj, Alexander Aird, Michael Commens, Benjamin Webb and Colin Bienke.

2. Compliance with annual and purchased leave provisions in relevant legislation, awards, enterprise agreements, and policies

Areas examined

This chapter examines entities’ policies and compliance with legislative, award, enterprise agreement, and policy provisions in the administration of employee annual and purchased leave.

Conclusion

All entities except AHL have established policies for the administration of annual and purchased leave that align with relevant legislation, award and enterprise agreement provisions.

All 10 entities complied with legislative, award, enterprise agreement, and policy requirements in the administration of annual and purchased leave, except for the following instances of material non-compliance:

- annual leave commencing prior to approval — non-compliance for all six entities with a requirement (ATO, CER, Finance, MDBA, NDIA and NIAA) ranging from 19.5 per cent at the ATO to 27.8 per cent at NIAA;

- annual leave balances exceeding thresholds — non-compliance for all four entities with a requirement (AHL, Finance, MDBA and NIAA) ranging from 15 per cent at AHL to 21 per cent at Finance; and

- approval of purchased leave inconsistent with enterprise agreement requirements — non-compliance at Finance (eight per cent) and DISER (24 per cent).

Note: The key explaining symbols used for summarising compliance findings is provided in summary Table S.1.

Areas for improvement

The ANAO made one recommendation to AHL relating to the development and implementation of leave policies. The ANAO also made suggestions for improvement relating to leave approvals, monitoring and assurance and management reporting.

2.1 Workplace relations legislation, the Australian Public Service Enterprise Award 2015 (the award) and entity enterprise agreements establish annual and purchased leave entitlements and obligations for Australian Government public service employers and employees under the Public Service Act 1999.

2.2 To assess entity compliance with annual and purchased leave provisions the ANAO examined whether entities:

- developed and implemented policies for the administration of annual and purchased leave that align with legislative, award and enterprise agreement provisions;

- complied with legislative, award, enterprise agreement, and policy requirements in the administration of annual and purchased leave; and

- established appropriate management reporting on the use and administration of staff leave.

Have entities established policies for the administration of annual and purchased leave that align with relevant legislation, award and enterprise agreement provisions?

Nine entities established policies for the administration of annual and purchased leave that align with legislation, award, and entity enterprise agreement provisions. AHL has not established policies to support the administration of annual and purchased leave entitlements.

2.3 Section 87 of the Fair Work Act 2009 and section 16 of the Australian Public Service Enterprise Award 2015 establish annual leave entitlements. As provided for by the National Employment Standards (NES), which are defined within the Fair Work Act 2009, an employee (other than an irregular or intermittent employee) is entitled to four weeks of paid annual leave for each year of service. An employee on annual leave will, for the period of the annual leave, be paid at the employee’s ordinary hourly rate.

2.4 Enterprise agreements and determinations covering all entities include an entitlement to four weeks of paid annual leave consistent with the award and NES. End of year shutdown leave, encompassing the period between 25 December and 1 January, is granted to employees in eight entities and specified in agreements and determinations.4 The number of days granted for the end of year shutdown is not specified in agreements, however this is three business days. Services Australia’s employees covered by the agreement are entitled to an additional three days of annual leave in lieu of end of year shutdown leave.

2.5 Enterprise agreements also specify annual leave balances and purchased leave entitlements as shown in Table 2.1.

Policies, and procedures for administering annual leave entitlements

2.6 Entities should establish fit-for-purpose policies for the administration of leave entitlements that support compliance with legislation, relevant awards, entity enterprise agreements, and the government’s information management standards.5

2.7 Nine entities developed policies for the administration of annual leave consistent with legislation, award and enterprise agreement requirements. AHL has not established policies for the management of staff leave. Table 2.1 sets out annual and purchased leave entitlements, and obligations relating to the approval of leave for all 10 entities.

Table 2.1: Entity annual and purchase leave entitlements and administrative arrangements

|

Entity |

Annual leave entitlementa |

Annual leave thresholdb |

Purchased leave (maximum) |

Requirement to approve annual leave in advance |

Requirement to approve purchased leave in advance |

|

ACIC |

20 days |

40 days |

4 weeks |

No |

No |

|

AHL |

20 days |

40 days |

4 weeks |

No |

No |

|

ATO |

20 days |

50 days |

8 weeks |

Yes |

Yes |

|

CER |

20 days |

40 days |

4 weeks |

Yes |

Yes |

|

DISER |

20 days |

40 days |

10 weeks |

No |

Yes |

|

Finance |

20 days |

40 days |

4 weeks |

Yes |

Yes |

|

MDBA |

20 days |

40 days |

8 weeks |

Yes |

No |

|

NDIA |

20 days |

40 days |

8 weeks |

Yes |

Yes |

|

NIAA |

20 days |

40 days |

8 weeks |

Yes |

Yes |

|

Services Australia |

23 days |

46 days |

4 weeks |

No |

No |

Note a: Annual leave entitlement is for full-time equivalent staff. Pro-rata entitlements exist for part-time employees.

Note b: Leave plans for managing employee leave where annual leave balances exceed the threshold are to be agreed prior to the balance exceeding the threshold. Leave plan requirements are set out in entity policies for all entities except for AHL.

Source: ANAO analysis of entity enterprise agreements and leave policies between 1 July 2020 and 31 October 2021.

Recommendation no.1

2.8 Aboriginal Hostels Limited develop and implement policies for the administration of all leave types that align with legislative, award and enterprise agreement provisions.

Aboriginal Hostels Limited response: Agreed

2.9 AHL will establish a comprehensive leave policy that will align with relevant legislative award and enterprise agreement provisions. As recommended by the ANAO, the policy will include a requirement for the prior approval of schedulable leave and also detail the requirement for unscheduled leave and associated documentation to be submitted within appropriate and measurable timeframes.

2.10 Work to develop the leave policy has commenced and will be finalised once bargaining for AHL’s new enterprise agreement is completed. As the proposed new enterprise agreement includes significant changes, once approved, AHL will ensure that the new policy will fully align with relevant provisions.

Did entities comply with legislative, award, enterprise agreement, and policy requirements in the administration of annual and purchased leave?

All 10 entities complied with legislative, award, enterprise agreement, and policy requirements in the administration of annual and purchased leave, except for the following instances of material non-compliance:

- annual leave commencing prior to approval — non-compliance for all six entities with a requirement (ATO, CER, Finance, MDBA, NDIA and NIAA) ranging from 19.5 per cent at the ATO to 27.8 per cent at NIAA;

- annual leave balances exceeding thresholds — non-compliance for all four entities with a requirement (AHL, Finance, MDBA and NIAA) ranging from 15 per cent at AHL to 21 per cent at Finance; and

- approval of purchased leave inconsistent with enterprise agreement requirements — non-compliance at Finance (eight per cent) and DISER (24 per cent).

Annual leave accruals and balances

2.11 Section 16 of the Australian Public Service Enterprise Award 2015 and entity enterprise agreements set out that annual leave accrues at the rate of 20 days each year for all entities except Services Australia with its enterprise agreement stating that ‘A full time employee will accrue 23 days (172.5 hours) of annual leave for each full year of service’.6

2.12 The ANAO has obtained assurance over the accurate accrual and financial reporting of annual leave balances through:

- IT general and application controls testing that is complemented by employee benefits controls and substantive testing for the eight entities where this is the related financial statements audit approach; and

- substantive testing of employee benefits transactions and balances for the remaining two entities, ACIC and AHL.

2.13 Results of the 2020–21 financial statement audits of the 10 entities concluded that there were no material adverse audit findings relating to employee leave transactions and balances, including annual leave.

2.14 As shown in Table 2.1, employees at all 10 entities have entitlements to accrue annual leave and obligations to manage annual leave balances in accordance with enterprise agreements. Four entities (AHL, Finance, MDBA and NIAA) have explicit clauses requiring the employee and employer to manage annual leave balances exceeding thresholds.7

2.15 The ANAO analysed all employee annual leave balances between 1 July 2020 and 31 October 2021 to determine the number of employees exceeding the annual leave threshold specified in entity enterprise agreements. ANAO observed that all 10 entities had employees that exceeded enterprise agreement thresholds for annual leave. The rate of employees exceeding the threshold at the four entities with an explicit compliance requirement ranged from 15 per cent at AHL to 21 per cent at Finance.8 Additional detail is included in Appendix 3.

2.16 Figure 2.1 shows the rate of employees at each entity exceeding the annual leave threshold set out in enterprise agreements.

Figure 2.1: Percentage of employees exceeding entity annual leave threshold

Note: Percentage of employee leave balances exceeding the threshold calculated using the total number of employees for each entity

Source: ANAO analysis of entity leave data between 1 July 2020 and 31 October 2021.

2.17 All entities except AHL have enterprise agreement clauses and/or policies for the management of excess annual leave balances. These typically require entities to develop plans in consultation with employees to manage excessive annual leave balances. For example, Finance’s annual leave policy states that when accrued annual leave exceeds 40 days, a manager must work with the employee to develop an agreed strategy to reduce the leave to 40 days or below within a 12-month period.

2.18 The ANAO observed that a combined 223 employees across all entities had leave balances greater than 75 days with the highest annual leave balance observed in entity data equivalent to 241 days of annual leave or more than six times the annual leave balance specified in the entity’s enterprise agreement.

2.19 Some entities advised that the COVID-19 pandemic impacted the management of excessive leave balances including the development of staff leave plans. For example, MDBA advised the ANAO that between 28 July 2020 and 9 December 2021, MDBA did not direct staff with leave balances greater than 40 days to take leave.

Timeliness of approval of annual and purchased leave taken

2.20 The Australian Public Service Commission defines scheduled leave by detailing the leave types that comprise unscheduled absences. Personal, carers and miscellaneous leave (bereavement, compassionate and emergency leave) are identified as unscheduled absences.

2.21 To facilitate appropriate resourcing of operational requirements and the efficient use of resources, entity policies should require that annual and purchased leave is approved in advance of being taken, and the circumstances where there may be exceptions to this. This is consistent with the Australian Public Service Commission’s classification of these types of leave as schedulable.

2.22 As shown in Table 2.1, six of 10 entities have requirements in enterprise agreements and/or policy which requires the prior approval of annual leave, for example:

- ATO’s enterprise agreement states that ‘where leave is planned, approval must be gained prior to the employee’s absence’ from duty;

- MDBA’s enterprise agreement states that annual leave requires prior approval except in exceptional circumstances9;

- NDIA’s enterprise agreement states that generally, you must obtain prior approval for annual, purchased, long service or flex leave or give notice of the taking of unplanned leave, as soon as practicable, including notice of the duration, or expected duration, of the leave; and

- NIAA’s leave policy states employees must obtain prior approval for all leave through the relevant approval process before the leave is taken.

2.23 There may be instances where it would be appropriate for annual and other scheduled/planned leave to be approved following commencement. These include when:

- an employee accesses annual leave in lieu of personal leave, where personal leave entitlements have been exhausted;

- employees or managers move to another role, breaking reporting lines prior to the approval of leave; or

- an approver goes on unplanned leave prior to approving employee leave.

2.24 Existing system limitations may also result in the loss of original approval data where leave applications are amended after approval for personal leave taken during periods of leave.

2.25 The ANAO applied a threshold of 10 per cent to its analysis of leave commencing prior to approval. Only Services Australia (see Table 2.3) has a rate of annual leave commencing prior to approval below 10 per cent. The ANAO’s analysis of entity records identified rates of non-compliance for all six entities with explicit requirements to have annual and purchased leave approved prior to commencement.

Table 2.2: Entity rates of non-compliance with annual and purchased leave approval requirements

|

Entity |

Annual leave commenced before evidence of approval obtaineda |

Purchased leave commenced before evidence of approval obtaineda |

|

Entities where there is a requirement for prior approval of leave |

||

|

ATO |

19.5% |

21.4% |

|

CER |

24.9% |

14.9% |

|

Finance |

25.3% |

30.8% |

|

MDBAb |

23.2% |

17.4% |

|

NDIA |

20.8% |

28.5% |

|

NIAA |

27.8% |

23.3% |

Note a: Figures indicate the percentage of total leave transactions approved after commencement of leave. Rates of non-compliance set out in the table are the rates observed in entity data. The ANAO has not applied the 10% threshold discussed at paragraph 2.25 to its calculation.

Note b: MDBA does not have a requirement in its enterprise agreement or policy for the prior approval of purchased leave.

Source: ANAO analysis of entity leave approval data between 1 July 2020 and 31 October 2021.

2.26 The ANAO also analysed leave approval records for the four entities without an explicit requirement for prior approval of annual and purchased leave. ANAO analysis of entity leave approval data between 1 July 2020 and 31 October 2021 is included in Table 2.3.

Table 2.3: Entities without an explicit requirement for the prior approval of annual and purchased leave

|

Entity |

Annual leave commenced before evidence of approval obtaineda |

Purchased leave commenced before evidence of approval obtaineda |

|

ACIC |

26.0% |

33.3% |

|

AHL |

53.9% |

0% |

|

DISER |

22.2% |

40.5% |

|

Services Australia |

9.1% |

13.0% |

Note a: Figures indicate the percentage of total leave transactions approved after commencement of leave.

Source: ANAO analysis of entity leave approval data between 1 July 2020 and 31 October 2021.

2.27 Figure 2.2 shows the distribution in days taken to approve annual leave following the commencement of that leave. The figure indicates that even for entities with a clear policy requirement, there are many instances of long delays in approving annual leave. Mean and median days taken to approve annual leave following commencement for all entities included in Appendix 8.

Figure 2.2: Entity’s distribution of days taken to approve annual leave following commencement

Note: Days taken to approve leave calculated from the date of the commencement of leave to the date of approval.

Note: Population, mean and median figures for each entity is included in Appendix 8, Table A.6.

Note: The configuration of Services Australia and NDIA’s HRMIS resulted in the ANAO being unable to obtain all leave transaction approval records (see paragraph 1.17). Accordingly, Figure 2.2 includes transactions where the date of last action was recorded instead of the leave approval date for Services Australia and NDIA.

Source: ANAO analysis of entity leave data between 1 July 2020 and 31 October 2021.

|

Opportunities for improvement |

|

2.28 Entities should ensure that there is sufficient oversight and monitoring of employee leave approval processes to provide assurance to management that the administration of employee leave complies with legal and enterprise agreement obligations. To support the monitoring of compliance with relevant enterprise agreement requirements, entities should also ensure that the original approval of annual and other scheduled leave is retained in entity records where subsequent adjustments to this leave is made. |

Annual leave payments

2.29 Section 16 of the Australian Public Service Enterprise Award 2015 states that annual leave is to be paid at the ordinary hourly rate of pay, except where applicants use annual leave at half pay in accordance with enterprise agreements.

2.30 In assessing the accurate payment of annual leave, the ANAO relied on the assurance obtained over automated system controls for four entities where these have been tested as part of the financial statements audits and complemented this with substantive sample testing as part of this audit. These automated system controls have been established to support the accurate payment of annual leave entitlements consistent with legislative, award and enterprise agreement requirements. ANAO analysis found that entities have established effective systems controls to support the accurate payment of annual leave where this was tested as part of the financial statements audits.

2.31 The ANAO undertook sample testing for annual leave transactions for the six entities where financial statements audits have not obtained assurance over automated controls for the payment of annual leave due to the selection of alternative audit approaches. 10 ANAO sample testing of leave transactions at these entities demonstrated the accurate payment of annual leave.

Purchased leave maximum threshold and approvals

2.32 As shown above in Table 2.1 entity enterprise agreements include entitlements for purchased leave ranging from four to 10 weeks. For example, Finance’s enterprise agreement states that ‘Where approved by the delegate, employees may purchase from one to four weeks additional leave each year.’

2.33 The ANAO undertook data analysis of purchased leave transactions to determine compliance with enterprise agreement provisions. The analysis indicates that two entities (Services Australia and NIAA) were not compliant with purchased leave maximum entitlement requirements. A total of six employees or less than one per cent of employees accessing purchased leave at Services Australia purchased more leave than the annual four-week entitlement. Two employees or 1.5 per cent of employees accessing purchased leave at NIAA were granted purchased leave exceeding the enterprise agreement entitlement shown in Table 2.1.11

2.34 The ANAO also reviewed samples of purchased leave transactions to determine whether appropriate approvals were obtained and conditions relating to existing annual leave balances were not exceeded. The ANAO found that eight of 10 entities complied with purchased leave approval requirements. Twenty-four per cent of samples at DISER and eight per cent of samples tested at Finance were not compliant with approval requirements. Non-compliance at DISER was because the approval was provided by an officer without the requisite delegation, and the non-compliance at Finance was that there was no record of the approval.

2.35 See Appendix 3 for additional results on purchased leave.

|

Opportunity for improvement |

|

2.36 Entities should ensure that there is sufficient oversight and monitoring of employee leave to provide assurance to management that where required, sufficient documentation is maintained and readily accessible, and that the administration of employee leave complies with legal and enterprise agreement obligations. |

Existence of purchased leave with annual leave exceeding threshold

2.37 As a control to prevent further significant balances of leave being accumulated, some entities have established policies that either prohibit or limit the approval of purchased leave when the enterprise agreement threshold for annual leave has been exceeded.

2.38 MDBA and ACIC have established policy requirements that specify purchased leave will only be approved for employees who have not exceeded the annual leave threshold set out in enterprise agreements and policies. For example, ACIC’s employment policy states:

Employees are ordinarily expected to utilise their Annual Leave prior to taking Purchased Leave. In any event, an application for Purchased Leave will not be approved if the employee holds an Annual Leave credit equivalent to four (4) weeks, except in extenuating circumstances such as future leave requirements to undertake an extended holiday.

2.39 The ANAO tested for the interaction of purchased leave use with annual leave balances for MDBA and ACIC as these were the only two entities with a relevant clause and found no instances of non-compliance.

Management reporting and assurance

2.40 Regular reporting to management on the status of employee leave and compliance with legislative, award and enterprise agreement requirements assists entities to identify trends in the use of employee leave and supports management to respond to instances of non-compliance.

Assurance arrangements

2.41 AHL and Finance have not established effective standardised systems generated reporting which would support the effective monitoring of compliance. The ANAO also observed inconsistencies in data, such as inconsistent date fields used to record the approval date of leave. There were also delays in obtaining sufficient assurance over the completeness of leave data provided.

Management reporting

2.42 Entities advised that they manage employee leave balances through system notifications and reminders when leave balances approach or exceed thresholds and dashboard reporting on human resources metrics for line managers and business areas.

2.43 All entities except ACIC and AHL have established reporting to senior management that include trends and statistics relating to the administration of employee leave. The following arrangements are in place for the eight entities that have established management reporting:

- ATO provides reporting on leave use trends and mitigation strategies for unscheduled leave to business groups and provides group level workforce reporting that includes leave statistics, trends and analysis, and commentary.

- CER has monthly reporting that is provided to managers and executives at branch and division level. Reports includes employees who are approaching or over enterprise agreement limits.

- DISER senior executives have access to point-in-time dashboards which include statistics on leave balances, absentee rates, and other relevant human resource metrics. Group level flexible leave reports are also provided.

- Finance provides monthly workforce reporting to all senior leaders. The reports provided include employee leave balances and highlight anomalies such as excess annual, APS level flexible leave and Executive Level time off in lieu balances.

- MDBA provides monthly reporting to program and portfolio managers on recommendations and actions relating to: unapproved flex sheets; excess annual and flexible leave balances; low personal leave balances; absenteeism; and forecast leave.

- NDIA provides monthly reporting to business areas and senior management that highlight key trends relating to the use of leave, raise awareness of leave arrangements, and support the consistent processing of leave applications.

- NIAA provides statistics on annual leave, flexible leave, and unscheduled absences each quarter for its Chief Operating Officer and as part of its internal reporting to the NIAA Executive Board. Senior executive managers also have access to point in time dashboards.

- Services Australia produces monthly reports for its executive that include trend analysis of annual leave use and annual leave balances, workforce composition, attrition and separation rates, and workforce capability and diversity statistics.

2.44 For the two entities with limited or no reporting to the senior executive the following reporting arrangements are in place:

- AHL has not implemented reporting at any level relating to compliance with employee leave provisions.

- ACIC provides quarterly reporting on excess annual leave balances to employees and line managers and a twice-yearly report to its executive committee on annual leave. ACIC does not provide reporting on compliance activities undertaken or statistics and trend analysis for other types of leave.

|

Opportunity for improvement |

|

2.45 Entities could improve management reporting by ensuring that reporting to their executive includes analysis of compliance trends and work undertaken to detect and prevent non-compliance with leave entitlements and administrative requirements. |

3. Compliance with long service leave provisions in relevant legislation, enterprise agreements and policies

Areas examined

This chapter examines entities’ policies and compliance with legislative, enterprise agreement and policy provisions in the administration of long service leave.

Conclusion

All entities except AHL have established policies for the administration of long service leave that align with relevant legislation and enterprise agreement provisions.

All 10 entities complied with legislative, enterprise agreement and policy requirements in the administration of long service leave, except for the following instances of material non-compliance:

- long service leave approved without delegation — non-compliance of 8 per cent at NDIA;

- long service leave commenced prior to approval — non-compliance for all six entities with a requirement at ATO, CER, Finance, MDBA, NDIA and NIAA ranging from 11 per cent at Finance to 36.6 per cent at NIAA;

- long service leave broken by leave type not permitted — non-compliance at ACIC, ATO, CER, DISER, Finance, MDBA, NDIA, NIAA and Services Australia ranging from 1.5 per cent at Services Australia to 11 per cent at DISER; and

- long service leave granted without qualifying service — non-compliance at Services Australia (one employee).

Note: Key explaining symbols used for summarising compliance findings is provided in summary Table S.1.

Areas for improvement

The ANAO made one recommendation relating to the implementation of systems controls to ensure the use of long service leave complies with legislative requirements. The ANAO also made one suggestion for improvement relating to communicating long service leave requirements to leave approvers.

3.1 The Long Service Leave (Commonwealth Employees) Act 1976 establishes long service leave entitlements and obligations for Australian Government public service employees and Australian Government public service employers. To assess entity compliance with long service leave provisions the ANAO examined whether entities:

- developed and implemented policies for the administration of long service leave that align with legislative and enterprise agreement provisions; and

- complied with legislative, enterprise agreement and policy requirements in the administration of long service leave.

Have entities established policies for the administration of long service leave that align with relevant legislation and enterprise agreement provisions?

All entities except AHL have established policies for the administration of long service leave that align with relevant legislation and enterprise agreement provisions.

3.2 Australian Government public service employees accrue an entitlement of 0.3 months long service leave for each year of continuous service and become eligible to use this following the completion of 10 years continuous service in accordance with sections 11, 12, 16 and 18 of the Long Service Leave (Commonwealth Employees) Act 1976. Long service leave for particular officers of the MDBA is administered under the Long Service Leave Act 1976 (ACT) with leave accruing at a rate of 6.5 working days each year, with leave accessible following seven years continuous service. 12

3.3 Entity enterprise agreements also include provisions for long service leave consistent with the Long Service Leave (Commonwealth Employees) Act 1976. Agreements for nine entities state the minimum amount of long service leave that can be taken is seven calendar days (14 calendar days at half pay) and that long service leave can be broken only by attendance at work, maternity and parental leave, or otherwise provided by conditions of the enterprise agreement. Some officers at MDBA, who were previously employed at the Murray-Darling Basin Commission (MDBC) can access long service leave in blocks of a minimum five working days (10 days at half pay). These employees were not Commonwealth employees at the time of their engagement at MDBC, as such their long service leave is administered in accordance with the Long Service Leave Act 1976 (ACT).

Policies and procedures for administering long service leave entitlements

3.4 Nine entities developed policies for the administration of long service leave (LSL) consistent with legislative and enterprise agreement requirements. AHL has no policies in place for the management of staff leave.

3.5 Table 3.1 sets out entity long service leave entitlements and obligations established in legislation, enterprise agreements and entity policies.

Table 3.1: Entity long service leave entitlements and administrative arrangements

|

Entity |

Annual entitlement for each year of continuous service |

Continuous service requirement |

Minimum LSL days with each period of leave |

LSL requires prior approval |

|

ACIC |

0.3 months |

10 years |

7 days (14 days half-pay) |

No |

|

AHL |

0.3 months |

10 years |

7 days (14 days half-pay) |

No |

|

ATO |

0.3 months |

10 years |

7 days (14 days half-pay) |

Yes |

|

CER |

0.3 months |

10 years |

7 days (14 days half-pay) |

Yes |

|

DISER |

0.3 months |

10 years |

7 days (14 days half-pay) |

No |

|

Finance |

0.3 months |

10 years |

7 days (14 days half-pay) |

Yes |

|

MDBAa |

0.3 months |

10 years |

7 days (14 days half-pay) |

Yes |

|

NDIA |

0.3 months |

10 years |

7 days (14 days half-pay) |

Yes |

|

NIAA |

0.3 months |

10 years |

7 days (14 days half-pay) |

Yes |

|

Services Australia |

0.3 months |

10 years |

7 days (14 days half-pay) |

No |

Note a: Some employees at MDBA who had previously been employed at the Murray-Darling Basin Commission accrue long service leave at a rate of 6.5 working days for each year of eligible service. Those employees previously employed at MDBC are able to take long services leave in five day blocks at full-pay and 10 day blocks at half-pay.

Source: ANAO analysis of entity enterprise agreements, leave policies and procedures.

Did entities comply with legislative, enterprise agreement and policy requirements in the administration of long service leave?

All 10 entities complied with legislative, enterprise agreement and policy requirements in the administration of long service leave, except for the following instances of material non-compliance:

- long service leave approved without delegation — non-compliance of 8 per cent at NDIA;

- long service leave commenced prior to approval — non-compliance for all six entities with a requirement at ATO, CER, Finance, MDBA, NDIA and NIAA ranging from 11 per cent at Finance to 36.6 per cent at NIAA;

- long service leave broken by leave type not permitted — non-compliance at ACIC, ATO, CER, DISER, Finance, MDBA, NDIA, NIAA and Services Australia ranging from 1.5 per cent at Services Australia to 11 per cent at DISER; and

- long service leave granted without qualifying service — non-compliance at Services Australia (one employee).

Long service leave balances (including accruals)

3.6 Long service leave for full-time employees accrues at a rate of 0.3 months leave for each year of continuous service as stated in the long service leave formula set out in section 18 of the Long Service Leave (Commonwealth Employees) Act 1976. 13

3.7 Assurance has been obtained over the accurate accrual and financial reporting of long service leave balances through:

- IT general and application controls testing that is complemented by employee benefits controls and substantive testing for the eight entities where this is the related financial statements audit approach; and

- substantive testing of employee benefits transactions and balances for the remaining two entities, ACIC and AHL.

3.8 Results of the 2020–21 financial statement audits of the 10 entities concluded that there were no material adverse findings relating to employee leave transactions and balances, including long service leave.

Recognition of prior service (including approvals), entitlement to long service leave and continuity of service

3.9 Section 11 of the Long Service Leave (Commonwealth Employees) Act 1976 and regulations 6–9 and 11 of the Long Service Leave (Commonwealth Employees) Regulations state that Australian Government employees are required to achieve 10 years qualifying service to become eligible for long service leave.14

3.10 ANAO analysed entity data to determine whether entities had granted long service leave to only those employees who had met qualifying service requirements. Analysis shows that all entities except Services Australia were compliant, granting long service leave to only those employees meeting minimum qualifying service requirements. There was one employee (less than one per cent) at Services Australia who was granted long service leave without meeting the minimum 10 year qualifying service requirements. This occurred because the employee had a break in service greater than 12 months.

3.11 Section 12 of the Long Service Leave (Commonwealth Employees) Act 1976 establishes continuity of service requirements that prohibit breaks in service of longer than 12 months. Sample testing found that all entities were compliant with continuity of service obligations.

3.12 Detailed results are included at Appendix 4.

Timeliness of approval of long service leave

3.13 To facilitate appropriate resourcing of operational requirements and efficient use of resources, some entity policies and/or enterprise agreements require that long service leave is approved in advance of being taken. For example, NDIA’s enterprise agreement has a general leave provision which states that:

Generally, you must obtain prior approval for annual, purchased, long service or flex leave or give notice of the taking of unplanned leave, as soon as practicable, including notice of the duration, or expected duration, of the leave.

3.14 As stated at paragraph 2.23, there may be instances where the commencement of annual and other schedulable types of leave before approval may be explained. As stated at paragraphs 2.23 and 2.24, to account for these instances the ANAO has applied a threshold of 10 per cent to its analysis. Only Services Australia (see Figure 3.1) has a rate of long service leave commencing prior to approval below 10 per cent.

3.15 Six entities (ATO, CER, Finance, MDBA, NDIA and NIAA) have established enterprise agreement provisions or policy requirements that long service leave be approved before the commencement of this leave as detailed in Figure 3.1 shows the rates of leave being approved following commencement for entities with and without an explicit requirement for prior approval of long service leave.

Figure 3.1: Entity rates of long service leave commencing prior to leave being approved

Source: ANAO analysis of entity leave data between 1 July 2020 and 31 October 2021.

Use and payments of long service leave

3.16 Analysis of long service leave data relating to minimum long service leave usage requirements in enterprise agreements and entity policies indicates that AHL, CER, Finance, MDBA and NIAA were compliant with relevant provisions between 1 July 2020 to 31 October 2021. A small number of instances (between one and eight) at ACIC, ATO, DISER, NDIA, and Services Australia where employees accessed long service leave for a period of less than seven days at full pay or 14 days at half pay. For these entities the rate of non-compliance was one per cent or less.

3.17 Section 16 of the Long Service Leave (Commonwealth Employees) Act 1976 sets out the requirement for long service leave to be granted to employees by the approving authority and for payments in lieu of unused long service leave credits upon cessation of employment. ANAO undertook sample testing of the granting of long service leave and the payment in lieu of long service leave and found two instances (8 per cent) of non-compliance at NDIA, where the approver did not have the required delegation.

3.18 Detailed results are included at Appendix 4.

Inappropriate use of long service leave

3.19 Enterprise agreements and entity policies set out that periods of long service leave can only be broken by attendance at work except where provided for by legislation such as the Maternity Leave (Commonwealth Employees) Act 1973, parental leave or where specified in enterprise agreements. For example, ATO’s enterprise agreement states:

The minimum period during which Long Service Leave can be taken is seven calendar days (at full pay, or 14 days at half pay). Except as otherwise provided by legislation or this Agreement, Long Service Leave can only be broken by attendance at work.

3.20 All entities except AHL have also established policies regarding the use of long service leave. This incorporates consideration for the use of long service leave in a manner consistent with the accrued entitlement — being based on calendar days as opposed to business days.

3.21 ANAO testing of long service leave transactions identified that only AHL was compliant with requirements that leave be broken only by types of leave allowed in legislation, enterprise agreements and/or leave policies. Nine entities had at least one instance of long service leave not in compliance with this requirement. The rate of long service leave being broken by leave in a manner not consistent with its enterprise agreement and relevant policy ranges from 1.5 per cent of all long service leave transactions at Services Australia to 11 per cent at DISER.

3.22 Detailed results are included at Appendix 4.

|

Opportunity for improvement |

|