Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Selected Fraud Prevention and Compliance Budget Measures

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the Department of Human Services' and the Department of Social Services’ management of selected fraud prevention and compliance Budget measures.

Summary and recommendations

Background

1. The Department of Social Services is the Australian Government entity responsible for income security and support policies and programs, including the Administered appropriations from which income support payments are made. The Department of Human Services is responsible for service delivery policy and also administers a wide range of social, health and other payments and services, including on behalf of other entities such as the Department of Social Services. To assist in protecting the integrity of government outlays that it administers, the Department of Human Services conducts a range of compliance-related activities as part of its ongoing operations. The Department of Human Services also regularly receives additional Budget funding to supplement its existing compliance activities and to address specific risks.

2. From 2012–13 to 2015–16, the Government announced seven Centrelink-related fraud prevention and compliance Budget measures to address new and existing fraud and compliance risks affecting the integrity of the social security system. As part of these measures, the Department of Human Services received $290.5 million in additional departmental funding, and in return committed to deliver Budget (Administered) savings totalling $2.1 billion in fiscal balance terms, and $1.4 billion in underlying cash balance terms over the relevant measure periods.1

Audit objective and criteria

3. The objective of the audit was to assess the Department of Human Services’ and the Department of Social Services’ management of selected fraud prevention and compliance Budget measures. To form a conclusion against the audit objective, the ANAO adopted the following high level audit criteria:

- Have sound processes and practices been established to support the design and implementation of specific Budget-funded compliance measures?

- Is there effective monitoring of the implementation and achievement of the measures?

- Have expected savings and other benefits from the measures been achieved?

4. The audit focussed on seven Centrelink-related compliance measures announced in the relevant Budgets and implemented from 2012–13 to 2015–16 (see Appendix 2). In examining the Strengthening the Integrity of Welfare Payments measure, the audit focussed on two specific initiatives that had identified savings for 2015–16—that is, the Employment Income Matching initiative and the AUSTRAC initiative. The audit’s scope did not consider any compliance measures announced following the 2015–16 Budget. Further, the audit scope did not examine the Department of Human Services’ management of its broader Centrelink compliance program.

Conclusion

5. The Department of Human Services’ management of the seven selected compliance measures resulted in:

- three measures not being effectively implemented;

- two measures’ implementation being partially effective—with one measure achieving the expected savings but not the expected level of compliance activity and the other measure achieving the expected level of compliance activity but not the expected savings; and

- two measures being effectively implemented.

6. As a consequence, most of the compliance measures examined did not fully achieve their expected outcomes, including savings and addressing the risks to payment integrity, as agreed.

7. Shortcomings were also identified in the Department of Human Services’ approach to monitoring and reporting for all measures examined. As the entity responsible for the Administered appropriations against which savings were to be delivered, the Department of Social Services’ oversight of the achievements of the measures was not effective. Improvements are warranted to both the bilateral and the internal monitoring arrangements presently in place, to support both entities’ capacity to track progress against the Government’s expected outcomes, including savings targets.

8. The Department of Social Services used an agreed methodology to calculate the savings expected from the compliance measures and the Department of Human Services developed useful implementation plans to support the delivery of the measures. There are opportunities to improve both the methodology and plans.

9. The monitoring and oversight arrangements for the compliance measures, set out under the Bilateral Management Arrangement between the Department of Social Services and the Department of Human Services, have not been effective as they were not followed. The Department of Social Services as the relevant policy entity did not take responsibility for monitoring outcomes, including impacts and actual savings, achieved from the measures.

10. The Department of Human Services’ internal and external monitoring and reporting for compliance measures could be improved. While the Department of Human Services has well established monitoring and reporting arrangements, these mechanisms did not consistently provide clear and accurate advice on whether the compliance measures were achieving the desired outcomes, including savings and planned levels of activity.

Supporting findings

Designing and planning compliance measures

11. The Department of Social Services established and used a methodology, agreed with the Department of Finance, to support the design of the compliance measures, including for calculating projected savings. There would be benefit in regularly reviewing this methodology to improve assurance on the accuracy of the projected savings from compliance measures. In addition, documenting the underpinning evidence for the key assumptions used in calculating the expected savings from the measures would improve transparency and the repeatability of the use of this evidence.

12. The Department of Human Services developed useful project plans for all of the compliance measures. There is scope to include information on how the key outcomes for each compliance measure will be measured. Using these plans consistently over the life of the measure would also assist in maintaining clarity on the expected outcomes and deliverables.

Monitoring and reporting on compliance measures

13. Monitoring and oversight arrangements in place between the Department of Human Services and the Department of Social Services for the compliance measures were not effective. Requirements set out under the Bilateral Management Arrangement between the two entities were not met. In addition, the Department of Social Services as the relevant policy entity did not take responsibility for monitoring the achievements of the measures.

14. The Department of Human Services’ monitoring of savings and expenses associated with compliance measures could be improved. In the Department of Human Services’ advice to its Minister on implementation progress, the department used a methodology that did not provide reliable advice on the (gross fiscal balance) savings achieved from the measures. The Department of Human Services also does not have the systems or processes in place to provide advice on the underlying cash savings realised, including debts recovered from the majority of the compliance measures—a key outcome expected from the measures.

15. The Department of Human Services’ approach to monitoring compliance measure expenses considers whether the benefits outweigh the costs of monitoring. Developing and implementing a method to estimate the costs of compliance measures would allow the Department of Human Services to better inform its external reporting and evaluations of its compliance activities.

16. The Department of Human Services has well developed project monitoring mechanisms for reporting to its Executive. However, this monitoring system relies on accurate and consistent reporting by the responsible business areas. In this regard, the regular internal reporting on the progress of the measures has not provided a consistent and reliable indication of whether key performance outcomes, including expected savings and planned levels of activity, were on track, nor whether key risks were being effectively managed.

17. While the Department of Human Services has documented a process for its public reporting against its key performance indicators, the underlying systems and processes require greater maturity to support an accurate assessment. In this context, it is uncertain whether the Department of Human Services’ public reporting against its key performance indicator is accurate.

18. The Department of Human Services’ reporting to its Minister has been ad hoc. Following the lapsing of the previously required reporting arrangements due to the change of government in September 2013, the Department of Human Services has not reported to Government on the 2012–13 measures. The Department of Human Services also did not report annually to the Department of Finance on the outcomes realised, as it committed to do in place of reporting to Government.

Achieving compliance measure outcomes

19. The savings and other outcomes—including addressing risks to payment and business integrity—expected from the compliance measures have not been fully realised. Achievements against the expected levels of compliance activities, including business-as-usual activity agreed in the Budget, were mixed with four of the measures not achieving expected activity levels. The ANAO’s analysis indicated that the delivery against the expected savings was also mixed—four of the measures did not achieve their savings targets. Where achievements are likely to be significantly lower than commitments, the relevant minister should be promptly advised, to allow for a timely decision on whether the continued implementation of the relevant measure is the most efficient and effective use of public resources in the circumstances.

20. The Department of Human Services has project management processes in place to conduct reviews both at post implementation phase and at project closure and has completed three post implementation reviews and four closure reports for the compliance measures. The post implementation reviews could be improved by including a risk assessment of the broader implications of any issues identified and their potential impacts on the project’s overall objectives. The information reported in the closure reports could be improved by including more analysis regarding costs and effort expended on the measures, and the business-as-usual impacts.

Recommendations

Recommendation No.1

Paragraph 2.15

That in developing Budget-related compliance measures:

- the Department of Social Services establishes a process to regularly review the inputs used to calculate expected savings for Budget-related compliance measures; and

- the Department of Social Services and the Department of Human Services document the basis for assumptions and inputs used, including related data sources.

Department of Human Services response: Agreed.

Department of Social Services response: Agreed.

Recommendation No.2

Paragraph 3.52

That the Department of Human Services:

- in consultation with the Department of Social Services, develops and implements a method to estimate and monitor the amount of debt recovered from compliance measures;

- consistently reports internally on its progress and achievements for compliance measures against key performance targets and outcomes; and

- develops and implements a method to estimate the costs of compliance measures, to provide improved assurance over its external reporting, and to better inform evaluations of its compliance activities.

Department of Human Services response: Agreed with qualifications.

Recommendation No.3

Paragraph 4.24

That the Department of Human Services’ assessment of the outcomes and achievements of compliance Budget measures includes a complete assessment against expected additional activity levels (where agreed) as well as the expected additional savings.

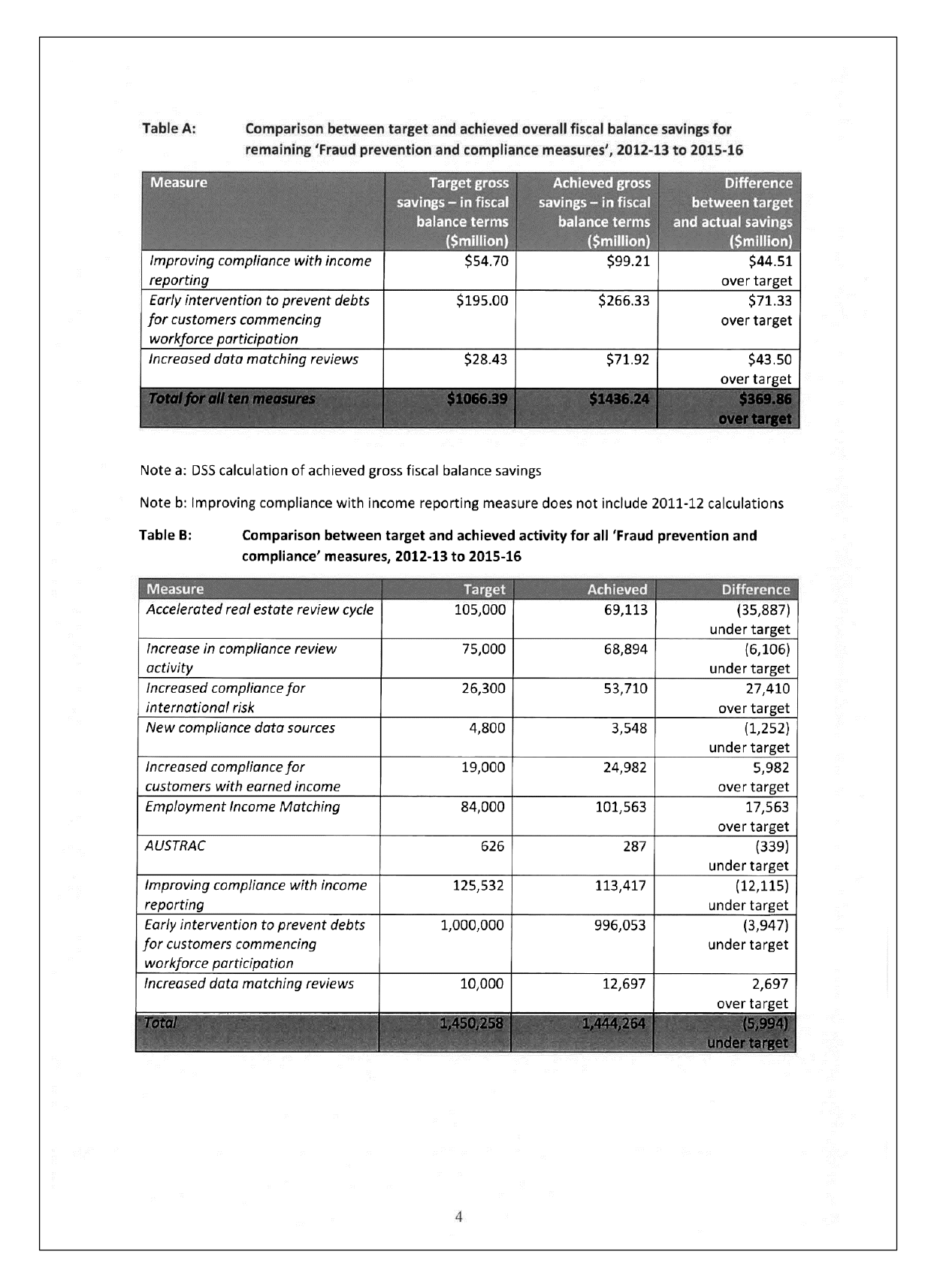

Department of Human Services response: The Department already undertakes these assessments as demonstrated by the tables in Appendix 1 of our response.

Summary of entity responses

21. The Department of Human Services’ and the Department of Social Services’ summary responses to the report are provided below. Full responses are at Appendix 1.

Department of Human Services

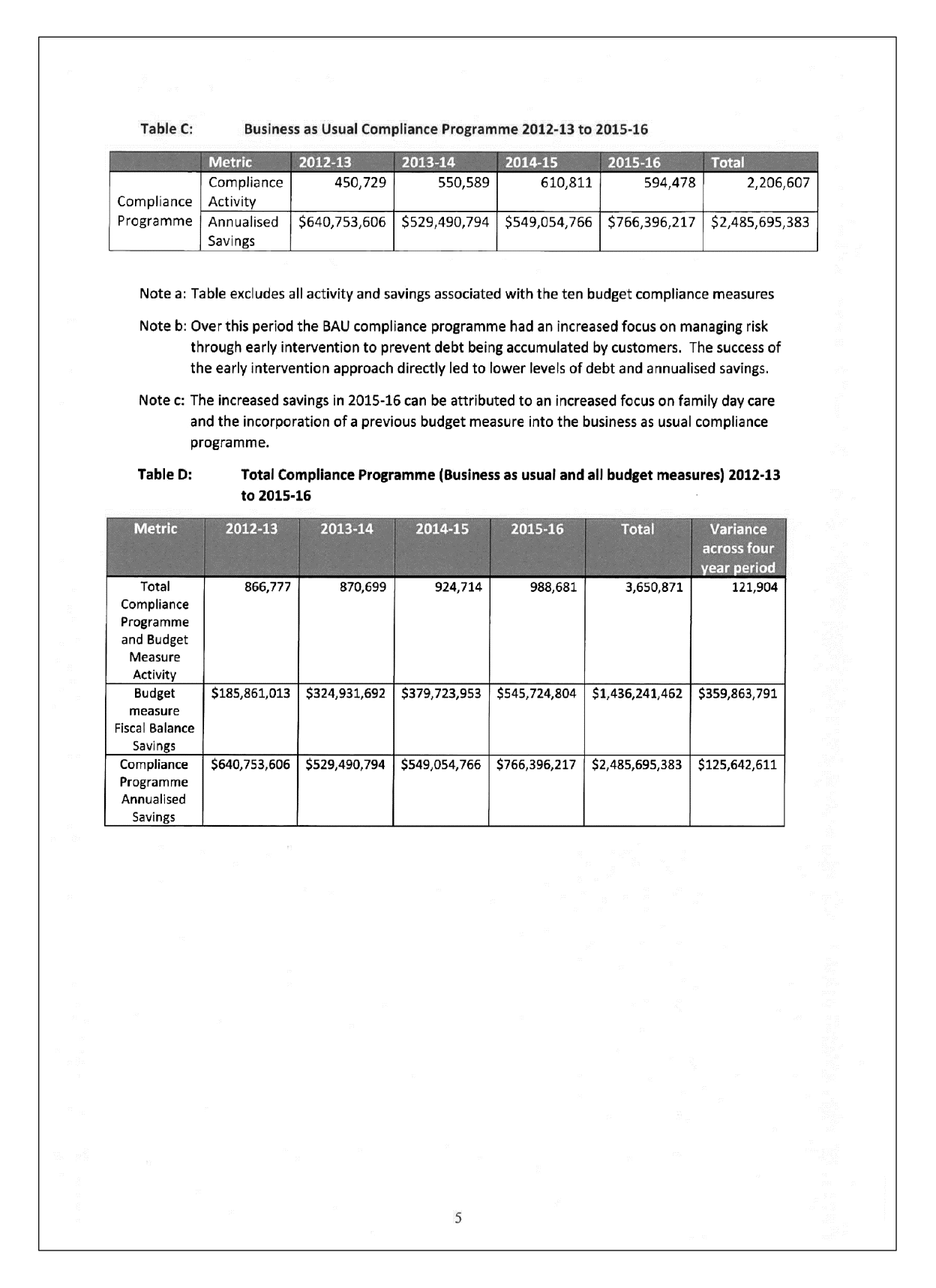

The department has delivered savings of $1.436 billion against a target of $1.066 billion–a variance of $367.7 million or 34.7% for all compliance budget measures. For the seven measures examined by the ANAO the department delivered savings of $998 million in relation to a target of $788 million, an excess of $210 million or 26.7%.

Since 2012–13, the department has realised total annualised savings from its business as usual (BAU) compliance activity of $2,485.7 million over four years. It has also increased the volume of compliance activity delivered as part of its Compliance Programme by 32%.

The department does not accept the key conclusion in the report that most of the compliance measures examined were not effectively implemented and the expected outcomes were not fully achieved, including savings.

In contrast to the report, the evidence demonstrates the department:

- exceeded expected outcomes from new measures;

- was effective in the implementation of the Compliance Programme; and

- provided clear and accurate reporting on progress of these measures in both public reporting and briefing to Ministers.

Consistent with the evidence provided to the ANAO, the department also cannot agree with Tables 3.2, 4.1, 4.3, 4.4 and 4.6 in the report or the suggestion that Ministers were briefed in an ad hoc manner. Tables that reflect the evidence provided to the ANAO during the audit are attached at Appendix 1.

The department has actively managed all compliance measures in a manner consistent with the Public Governance, Performance and Accountability Act 2013. The department does not agree with the input based methodology used in the report which does not take into account the requirement to use BAU resources efficiently and effectively to respond to emerging pressures and risks. The department considers that input based activity level targets are not necessarily an appropriate measure of performance. For this reason, the department’s current outcomes approach to measuring the performance of compliance measures is considered appropriate.

The department notes that the ANAO has not made any recommendations which directly address its main conclusions and findings. The Department of Human Services agrees with Recommendation 1, and agrees with qualifications to Recommendation 2, and notes with respect to Recommendation 3 the department already undertakes these assessments as demonstrated by the tables in Appendix 1.

ANAO comments on the Department of Human Services’ response

The evidence and supporting data used in both the ANAO’s analysis and the Department of Human Services’ response are largely the same, with the differences in the tables due primarily to the differing methodologies:

- The ANAO’s methodology is set out in paragraphs 4.3, 4.12, 4.14 to 4.16 and 4.21, with further detail in Appendix 4 to the report.

- The Department of Human Services’ response to the ANAO’s methodology is set out in paragraphs 4.5, 4.8 and 4.13.

Department of Social Services

The Department of Social Services (the Department) agrees to the first recommendation for which it has responsibility.

The Department will undertake an internal review of the costing model and inputs used to calculate expected savings of compliance measures. The Department will work with DHS to establish a register of assumptions and inputs.

The Department notes the view that the oversight of the achievement of the measures could be improved. The Department is currently working with DHS to review and implement revised arrangements under the Bilateral Management Arrangement between the two departments. This will include considering the most appropriate arrangements for the monitoring of fraud prevention and compliance Budget measures, noting that DHS is a separate Department of State accountable to its Minister for performance, and working arrangements and protocols between DSS and DHS need to reflect this.

1. Background

Introduction

1.1 The Department of Social Services (DSS) is the policy department responsible for income security and support policies and programs, including the Administered appropriations from which income support payments are made. The Department of Human Services (Human Services) is responsible for the development of service delivery policy and administers a range of social, health and other payments and services.

1.2 As part of its ongoing operations, Human Services undertakes compliance activities aimed at protecting the integrity of the government outlays it administers, including for payments and services under the Centrelink program. Human Services’ compliance model (Figure 1.1) shows a continuum of customer attitudes towards compliance and illustrates the strategies the department uses to respond. The model recognises that most people want to provide correct and up-to-date information, with the department’s fraud control processes designed to focus intelligence and investigation activity on the most serious cases of non-compliance rather than on those people making honest mistakes.

Figure 1.1: Human Services compliance model

Source: Human Services.

1.3 Table 1.1 summarises key departmental statistics for Human Services’ Centrelink compliance program for the period 2012–13 to 2015–16.

Table 1.1: Human Services’ Centrelink compliance program activities, costs and staffing levels from 2012–13 to 2015–16

|

|

2012–13 |

2013–14 |

2014–15 |

2015–16 |

|

Compliance activities completeda |

866 597 |

869 082 |

923 462 |

987 895 |

|

Departmental direct costs ($million)b |

$234.8 |

$232.0 |

$224.5 |

$255.3 |

|

Direct staffing levelsc |

2349 |

1807 |

1996 |

2317 |

Note a: These figures show the compliance activities completed as reported in Human Services’ Annual Reports from 2012–13 to 2015–16. The figures reported are specific to targeted compliance interventions only and do not include activities relating to serious non-compliance and fraud.

Note b: Human Services advised the ANAO that these costs are the direct compliance costs relating to: serious non-compliance; compliance review activities; payment integrity activities; customer-centric activities; debt management; strategic management; project management; and divisional support.

Note c: Full-time equivalent staffing levels as at 30 June in each year.

Source: Human Services documentation.

Fraud prevention and compliance related Budget measures

1.4 From 2012–13 to 2015–16, the Government announced seven Centrelink-related fraud prevention and compliance Budget measures2 to address new and existing fraud and compliance risks affecting the integrity of the social security system.3 As part of these measures, Human Services received $290.5 million in additional departmental funding, and committed to return to the Budget savings totalling $2.1 billion in fiscal balance terms and $1.4 billion in underlying cash balance terms over the relevant measure periods.4 These projected savings are then set out in the Administered expenses of the relevant policy entity.5 Table 1.2 outlines the funding provided to Human Services and the expected savings to be returned to the Budget for the seven compliance measures in the scope of this audit. Further information on the measures is provided at Appendix 2.

Table 1.2: Selected fraud prevention and compliance Budget measures from 2012–13 to 2015–16

|

Budget measure |

Funding provided to Human Servicesa ($million) |

Projected gross savings—in fiscal balance terms ($million) |

Projected gross savings—in underlying cash terms ($million) |

|

2012–13 Budget |

|||

|

Fraud prevention and compliance—Accelerated real estate review cycle |

$13.1 |

$63.1 |

$61.0 |

|

Fraud prevention and compliance—Increase in compliance review activity |

$40.7 |

$161.5 |

$110.5 |

|

Fraud prevention and compliance—Increased compliance for international risk |

$8.3 |

$100.4 |

$83.6 |

|

Fraud prevention and compliance—Increased recovery of high value non-current customer debt |

$5.9 |

$0.0 |

$20.1 |

|

Fraud prevention and compliance—New compliance data sources |

$8.9 |

$65.9 |

$40.2 |

|

2013–14 Budget |

|||

|

Fraud prevention and compliance—Increase compliance for customers with earned income |

$8.8 |

$67.5 |

$46.9 |

|

2015–16 Budget |

|||

|

Strengthening the Integrity of Welfare Paymentsb |

$204.8 |

$1663.4 |

$1075.2 |

|

Total funding and gross savings |

$290.5 |

$2121.8 |

$1437.5 |

Note a: Human Services is responsible for implementing the measures and an immaterial proportion of the funding was allocated to relevant policy entities.

Note b: The audit focussed on two particular initiatives under the Strengthening the Integrity of Welfare Payments measure that had identified savings for 2015–16: the Employment Income Matching initiative and the AUSTRAC initiative. The audit only assessed outcomes for these two initiatives for the 2015–16 financial year.

Source: ANAO analysis of Budget documentation.

1.5 Savings from compliance activities generally arise when a recipient’s circumstances do not match the entitlement rules for a payment or benefit and the compliance activity results in:

- changes to a payment—either a payment cancellation or a reduction in the payment rate—due to a change to the recipient’s circumstances; and/or

- a debt being raised against the recipient—for recovery of monies previously paid to which the recipient was not eligible.

Compliance measures announced since the 2015–16 Budget

1.6 In the 2015–16 Mid-Year Economic and Fiscal Outlook, the Government announced three further social security related compliance measures—one being an extension to the 2015–16 Strengthening the Integrity of Welfare Payments measure. For these three measures, Human Services received $153 million, with projected net fiscal balance savings of $1.9 billion to be delivered over the forward estimates.

1.7 In July 2016, the Government announced five new welfare integrity initiatives as part of the Coalition’s election commitments. Three of these initiatives build on the 2015–16 Strengthening the Integrity of Welfare Payments measure. On 19 December 2016, as part of the 2016–17 Mid-Year Economic and Fiscal Outlook, the Government announced the Better Management of the Social Welfare System measure to deliver on its election commitments. From this measure, Human Services receives $498 million to expand its fraud prevention and debt recovery capability. In return, the Government expects to achieve net savings of $3.7 billion in fiscal balance terms and $2.1 billion in underlying cash terms from 2016–17 to 2019–20.

Administrative arrangements for social security related compliance measures

1.8 The business relationship between DSS and Human Services is governed by a Bilateral Management Arrangement (BMA) between the two departments.6 The BMA Head Agreement is supported by a number of protocols, which outline the agreed processes, frameworks and guidelines to support operational arrangements. The New Work and Changed Business Protocol governs the administrative relationship between DSS and Human Services for delivery of Budget measures.

1.9 Human Services is responsible for the implementation of the compliance program and related Budget measures. For Budget costing purposes, DSS is responsible for income support policy, including payment policies, and for calculating the estimated savings to be realised from the delivery of additional compliance activities.7

Audit approach

1.10 The objective of the audit was to assess Human Services’ and DSS’ management of selected fraud prevention and compliance Budget measures.

1.11 To form a conclusion against the audit objective, the ANAO adopted the following high-level audit criteria:

- Have sound processes and practices been established to support the design and implementation of specific Budget-funded compliance measures?

- Is there effective monitoring of the implementation and achievement of the measures?

- Have expected savings and other benefits from the measures been achieved?

1.12 The audit focussed on seven Centrelink-related compliance measures announced in the relevant Budgets from 2012–13 to 2015–16 (see Appendix 2). In examining the Strengthening the Integrity of Welfare Payments measure, the audit focussed on two specific initiatives that had identified savings for 2015–16—that is, the Employment Income Matching initiative and the AUSTRAC initiative. The audit scope covered the 2012–13 to 2015–16 financial years and did not include the Mid-Year Economic and Fiscal Outlook and Election commitment measures announced since the 2015–16 Budget. Further, the audit scope did not examine Human Services’ broader Centrelink compliance program.

1.13 The audit methodology included:

- interviews with Human Services and DSS staff;

- interviews with the Department of Finance and the Department of the Prime Minister and Cabinet;

- examination and analysis of documentation relating to the development and implementation of the seven compliance measures in the scope of this audit; and

- an analysis of the extent to which expected savings had been monitored, reported on and achieved.

1.14 The performance audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of approximately $567 000.

2. Designing and planning compliance measures

Areas examined

This chapter examines the processes and practices established to support the design and implementation of the relevant Budget-funded compliance measures.

Conclusion

The Department of Social Services (DSS) used an agreed methodology to calculate the savings expected from the compliance measures and the Department of Human Services (Human Services) developed useful implementation plans to support the delivery of the measures. There are opportunities to improve both the methodology and plans.

Areas for improvement

The ANAO recommends establishing a process to regularly review DSS’ savings methodology for compliance measures, and documenting the evidence underpinning key assumptions in calculating expected savings.

The ANAO also suggests that Human Services includes in the implementation plans for the compliance measures an explanation for how key outcomes would be measured.

Have sound processes been established to support the design and implementation of the compliance measures?

DSS established and used a methodology, agreed with the Department of Finance, to support the design of the compliance measures, including for calculating projected savings. There would be benefit in regularly reviewing this methodology to provide better assurance on the accuracy of the projected savings from compliance measures. In addition, documenting the underpinning evidence for the key assumptions used in calculating the expected savings from the measures would improve transparency and the repeatability of the use of this evidence.

Human Services developed useful project plans for all of the compliance measures. There is scope to include information on how the key outcomes for each compliance measure will be measured. Using these plans consistently over the life of the measure would also assist in maintaining clarity on the expected outcomes and deliverables.

2.1 The policy cases for the measures were developed to address compliance risks identified by Human Services, and government priorities at the time. In broad terms, the measures aimed to address risks and deliver savings to the Budget by:

- increasing the number of compliance activities for a particular area of risk;

- addressing gaps in the compliance program; and/or

- expanding on current capabilities and activities through implementing new processes.

2.2 Human Services advised the ANAO that a range of information informed the development of the compliance measures, including:

- past experience—in particular, earlier measures informed the development of the Strengthening the Integrity of Welfare Payments measure;

- data relating to key risk areas from prior compliance work undertaken; and

- pilot activity undertaken.

Modelling savings estimates for compliance measures

2.3 Compliance reviews are designed to test whether an income support recipient’s payment amount is accurate. Where a recipient’s circumstances have changed or do not meet the entitlement rules, the compliance review can result in a change to the recipient’s payment. This change can be a cancellation of payment or a variation to the fortnightly payment amount and may relate to a historical or current pay period, or both. A debt is raised where an income support recipient has received payment in excess of their entitlement.

2.4 Relevant policy entities were responsible for calculating expected savings for the compliance measures during the Budget process, using key assumptions, generally supplied by Human Services, and a methodology agreed with the Department of Finance.8

Key compliance activity assumptions

2.5 Calculating the expected savings for the measures is dependent upon key assumptions made about the relevant compliance activity.9 Human Services developed the key assumptions for the majority of compliance measures in the audit scope.10 These assumptions included:

- the number of compliance reviews to be conducted;

- the percentage of reviews expected to result in a cancellation, and the average fortnightly dollar value of cancellations;

- the percentage of reviews expected to result in a downward variation to the fortnightly payment rate, and the average dollar value of the variation; and

- the percentage of reviews expected to result in a debt being raised, and the average dollar value of the debt.

2.6 Human Services and DSS advised the ANAO that the assumptions for the compliance measures were based on the analysis of historical data; however, with a few exceptions, neither department was able to provide the underpinning evidence relating to the basis of the key assumptions.11

2.7 There would be merit in Human Services and DSS setting out the basis for the assumptions used in these calculations and maintaining a register of such assumptions (to provide a record of their source). Documenting the evidence underpinning these assumptions would aid transparency and repeatability, and should also reduce the time taken to prepare savings estimates. It would also help to align expected savings calculations with outcomes realised from similar recent compliance activities. This record could include the last date of review, the owner of the assumption and, where the measure is an extension of a previous measure, the reasons for any changes to previous assumptions.

Expected savings over the forward estimates

2.8 The compliance activity assumptions (see paragraph 2.5) are used by DSS to calculate the expected savings over the forward estimates from: fortnightly payment reductions; debts raised; and debts that will be recovered. The methodology used by DSS determines both the fiscal balance and underlying cash savings, with the total fiscal balance savings derived from summing the calculated payment reductions and debts raised, and the total underlying cash savings derived from summing the calculated payment reductions and debts recovered.12

2.9 There are a number of complexities in calculating expected savings to be generated from compliance activities. Key issues can include13:

- diminishing rates of return over time from some compliance activities;

- differences in estimating savings achieved from fortnightly payment reductions;

- time lags in collecting debts that have been raised; and

- differences between the debt amounts initially assessed and the amounts that are actually collected.14

2.10 In calculating savings from payment reductions, DSS assumed that the incorrect payment would have continued for a defined number of fortnights into the future, had the compliance review not been conducted. The number of fortnights used by DSS to calculate future payment reductions differs by payment. DSS also applied indexation to payment reductions, and calculated the expected overall savings based on the measure’s implementation date.15 Savings from payment reductions were apportioned between the year in which the planned compliance activity would take place and the following year/s. This is to account for compliance activities being undertaken at different times throughout a given year. In calculating the value of debts expected to be recovered, DSS excluded a proportion—which varies by payment type—of the debt raised as ‘doubtful debt’ that will not be recoverable over the measure period. The recoverable debt amount was then apportioned over the relevant forward estimates’ period.

2.11 DSS advised the ANAO that the methodology and key inputs used to calculate expected savings for the compliance measures were developed ‘around eight to ten years ago’ in consultation with actuaries. DSS was unable to provide the ANAO with any documentation relating to the development of the methodology or relevant inputs, and DSS further advised the ANAO that:

Notwithstanding that the documentation is not available, the methodology has been agreed with the Department of Finance, and has been in place since the time the agreement was reached.

The basis for calculating the projection of variations was based on the duration of debts detected by the Random Sample [Survey] and the overall debt levels, whilst the recovery projections were based on the amounts recovered for debts raised in a given year. The methodology is monitored for exceptions regularly and has remained consistent over time. As our overall monitoring of Social Security debt has not shown major exceptions over the past years we are satisfied that the cancellation/variation projection methodology also remains sound.

2.12 In addition, DSS advised the ANAO that although the overall methodology has not had a major review for some time, individual assumptions/inputs for any new measures are reviewed with the Department of Finance, including for the measures in the scope of this audit.

2.13 However, the ANAO was not provided with documentation relating to reviews of the two key inputs into DSS’ methodology—which vary by payment type:

- the estimated number of fortnights that a particular type of payment may have continued for, had the compliance review not been conducted; and

- the estimated proportion of debt recovered over four years for particular payments.

2.14 There would be merit in DSS establishing a process to regularly review its model to provide better assurance on the relevancy of the key inputs used to calculate expected savings for compliance measures.

Recommendation No.1

2.15 That in developing Budget-related compliance measures:

- the Department of Social Services establishes a process to regularly review the inputs used to calculate expected savings for Budget-related compliance measures; and

- the Department of Social Services and the Department of Human Services document the basis for assumptions and inputs used, including related data sources.

Department of Human Services response: Agreed.

2.16 The department will work with the Department of Social Services to document the underlying evidence that support assumptions and inputs used to develop new compliance budget measures.

Department of Social Services response: Agreed.

2.17 DSS will undertake an internal review of the costing model used to calculate expected savings of compliance measures, including reviewing the inputs and assumptions used. DSS will work with the DHS to establish a register of assumptions and inputs used in costings and will ensure that each assumption is reviewed at least once every three years to ensure they remain relevant.

Project plans for compliance measures

2.18 Human Services developed project plans for all of the compliance measures within the scope of this audit. These project plans aim to provide a single source of reference for the project, and to support its implementation and management.

2.19 The ANAO’s analysis indicates that:

- the project plans for each of the measures were mostly consistent with the originating policy case;

- the project plans provided a useful summary of the purpose of the measure; and

- the majority of project plans contained key information, including key outcomes and expected benefits such as targets for compliance activities and savings to be achieved each year, to support the implementation of the measures.16

2.20 The ANAO also identified some shortcomings with the information included in the project plans for some of the measures, as discussed below.

2.21 The project plans did not provide a clear explanation of the methodology Human Services intended to use to monitor the achievement of savings from the measures. Including an explanation of how key outcomes would be measured—such as the methodology to be used to calculate savings for a measure—would be beneficial to help ensure that the approach to measuring outcomes was consistent and clear (see also paragraphs 3.8 to 3.13).

2.22 The savings targets identified in project plans for the New compliance data sources and Increase in compliance review activity measures were for the net savings targets only, rather than the gross or total savings target. In this regard, the savings targets in these plans did not account for Human Services’ costs of delivering the measures. For the Increased compliance for international risk measure, the project plan cited a lower target number of review activities (26 300 reviews) compared to the target outlined in the policy case agreed to by government (33 800 reviews).

2.23 While the purpose of the project plan was to be a single source of reference to support a measure’s management, the project plans were not always actively used over the life of the measures. For example, during the early implementation phase for the Increased recovery of high value non-current customer debt measure, project documentation identified some departmental confusion as to the correct savings target for the measure, despite the relevant project plan setting out the correct savings target. Further, the evaluation report for the Accelerated real estate review cycle measure outlined the need to identify a key risk early; however, this risk had already been set out in the relevant project plan. Using the project plans to inform the ongoing implementation of the measures would also provide relevant project teams with clarity around expected outcomes and deliverables.

3. Monitoring and reporting on compliance measures

Areas examined

This chapter examines the effectiveness of the Department of Human Services’ (Human Services’) and the Department of Social Services’ (DSS’) arrangements for monitoring and reporting on compliance measures.

Conclusion

The monitoring and oversight arrangements for the compliance measures, set out under the Bilateral Management Arrangement between DSS and Human Services, have not been effective as they were not followed. DSS as the relevant policy entity did not take responsibility for monitoring outcomes, including impacts and actual savings, achieved from the measures.

Human Services’ internal and external monitoring and reporting for compliance measures could be improved. While Human Services has well-established monitoring and reporting arrangements, these mechanisms did not consistently provide clear and accurate advice on whether the compliance measures were achieving the desired outcomes, including savings and planned levels of activity.

Areas for improvement

The ANAO has recommended that Human Services consistently track and report key outcomes achieved from compliance measures as part of its established project monitoring arrangements, and develops and implements a method to estimate both its actual costs and debt recoveries from compliance measures.

The ANAO has also suggested that Human Services adopt a methodology consistent with the approach used in Budget processes to calculate the actual savings achieved for compliance measures.

Were the monitoring and oversight arrangements in place between Human Services and the Department of Social Services effective?

Monitoring and oversight arrangements in place between Human Services and DSS for the compliance measures were not effective. Requirements set out under the Bilateral Management Arrangement between the two entities were not met. In addition, DSS as the relevant policy entity did not take responsibility for monitoring the achievements of the measures.

3.1 During the course of the audit, DSS and Human Services commenced a broad review of the Bilateral Management Arrangement (BMA). Under the BMA in place at the time of the audit, arrangements for undertaking new work—including Budget measures—are set out in the New Work and Changed Business Protocol. These arrangements include the following in relation to the delivery of Budget measures:

Where projects are established to implement Budget Measures or New Work in either department, the project management team responsible for delivery is required to report progress on the delivery of the Budget Measure or New Work to the other department via their project-based communications and stakeholder engagement plan.

Project teams are required to report progress toward implementation of Budget Measures or New Work until such time as the project transitions to Business as Usual (BAU) and its monitoring for assurance to executives and government is encompassed under the BMA governance and reporting arrangements.

3.2 For each of the compliance measures, Human Services outlined their proposed stakeholder engagement in Stakeholder Engagement and Communication Plans or (where separate plans were not developed) in the relevant Project Management Plans. The proposed approach to stakeholder engagement with policy entities for the compliance measures was not consistent across the compliance measures:

- for three out of the seven plans, the relevant policy entities were not identified as stakeholders; and

- for the four plans that did include policy entities, the communication channels and frequency of communications with the relevant policy entities varied between projects, from emails and phone calls as required to monthly project status reports.

3.3 Human Services was unable to provide any evidence confirming that its plans to engage with the identified policy entities had been implemented, as set out in its Stakeholder Engagement and Communications Plans or Project Management Plans, where relevant.

3.4 Separately, as part of its regular reporting to policy entities, Human Services provided quarterly Agency Reports throughout the measure periods. These reports set out information on the outcome of fraud and compliance activities for Human Services’ compliance program as a whole; however, the progress and achievements realised (to date) of individual measures was not reported.

3.5 Until the ANAO’s audit, DSS and Human Services had not cooperated to calculate the actual savings realised from the measures (actual savings achieved are discussed in Chapter 4). As the policy entity responsible for the Administered outlays against which the savings are accrued, DSS should have taken more responsibility for monitoring expected achievements from the measures.

Did Human Services effectively monitor savings and expenses associated with compliance measures?

Human Services’ monitoring of savings and expenses associated with compliance measures could be improved. In Human Services’ advice to its Minister on implementation progress, the department used a methodology that did not provide reliable advice on the (gross fiscal balance) savings achieved from the measures. Human Services also does not have the systems or processes in place to provide advice on the underlying cash savings realised, including debts recovered from the majority of the compliance measures—a key outcome expected from the measures.

Human Services’ approach to monitoring compliance measure expenses considers whether the benefits outweigh the costs of monitoring. Developing and implementing a method to estimate the costs of compliance measures would allow Human Services to better inform its external reporting and evaluations of its compliance activities.

Monitoring savings achieved from compliance measures

3.6 For the measures examined in this audit, the relevant Government decisions set out the expected savings to be delivered by the measures in both fiscal balance and underlying cash balance terms.17 Savings from the compliance measures were expected to derive from the following:

- fortnightly payment reductions—that is, savings from compliance and review activities that result in a reduction to, or cancellation of, a payment rate (expressed as both expected fiscal balance and underlying cash balance savings);

- debts raised—that is, liabilities owing to the Government from compliance review or investigation activities (expressed as expected fiscal balance savings); and

- debts recovered (expressed as expected underlying cash balance savings).18

Fortnightly reductions and debts raised

3.7 In estimating the gross fiscal balance savings achieved from the measures, Human Services summed the savings from fortnightly payment reductions and the savings attributed from debts raised, consistent with the methodology outlined in paragraph 2.8. Human Services attributed compliance savings (from fortnightly payment reductions and debts raised) to individual compliance measures through the use of pre-defined business rules that allow data relating to specific measure activities to be extracted from its systems.

3.8 Human Services used two methods to determine estimates of savings achieved from fortnightly payment reductions:

- multiplying fortnightly payment reductions by a factor of 26, to ‘annualise’ the fortnightly payment reduction amount; or

- using savings calculators, provided by the relevant policy entities, chiefly DSS.19

3.9 The first methodology was used by Human Services to advise its Minister on savings achieved from the measures.20 However, there are limitations on the accuracy of this methodology, as any savings from payment reductions are fully attributed to the year in which the compliance activity took place, rather than being apportioned across future years. As such, any savings from payment reductions are calculated as having a full year impact, irrespective of whether the activity may have occurred in the beginning or end of a given financial year—an approach inconsistent with the methodology used by DSS in the Budget process (see paragraph 2.10).

3.10 This approach could lead to incorrect assessments being made—including by the Minister for Human Services—of progress and achievements from the compliance measures. For example, in June 2016, in a report to its Minister, Human Services advised that:

- the Accelerated real estate review cycle measure achieved $41.7 million in gross fiscal balance savings—31 per cent or $9.8 million above DSS calculations for the same period; and

- the Increased compliance for international risk measure achieved $37.7 million gross fiscal balance savings—34 per cent or $19.8 million below DSS calculations for the same period.

3.11 The second methodology outlined in paragraph 3.8(b) is generally used to provide the relevant project team with an indication of progress against the relevant savings targets for the measures. Human Services advised the ANAO that in using these savings calculators, Human Services can estimate the savings achieved by the measures using a methodology aligned to that used by DSS in the Budget costing process. Human Services also advised that the savings estimations using this methodology provide a ‘useful indicative view’ of measure performance; however, Human Services considers the savings estimations are not appropriate for external reporting as, according to Human Services, DSS is responsible for calculating actual savings achieved from the measures.

3.12 In September 2016, during the course of the audit, DSS separately calculated the savings achieved from the compliance measures. The methodology used by DSS was aligned to the methodology used to determine projected savings, and distributed savings from any fortnightly reductions across the forward financial years, based on relevant implementation dates and different payment factors. The ANAO’s analysis indicates that the savings calculations derived by Human Services from the use of the policy entities’ savings calculators (the second methodology) were more reliable and aligned to the calculations supplied by DSS, than those derived from ‘annualising’ the savings (the first methodology).

3.13 For more reliable monitoring and reporting of actual savings achieved from compliance measures, and in cooperation with DSS, Human Services should use both a consistent approach throughout the measure reporting period, as well as use the methodology agreed during the Budget process, particularly in reporting to its Minister.

Debts recovered

3.14 One of the key indicators of the success of a measure is the extent to which Human Services achieves the projected debt recovery targets—as reflected in the Government’s targets for underlying cash savings for the compliance measures.21

3.15 However, for the majority of measures, Human Services did not monitor its progress against the Government’s underlying cash savings targets during the period 2012–13 to 2015–16.22

3.16 Human Services advised the ANAO that the department did not have mechanisms in place to report the total value of debts recovered by measure. However, debts recovered could be measured via separate tracking, or they could be modelled using more contemporary or actual performance estimates (for example, through using average debt recovery rates for the relevant financial year), whichever is the most cost-effective.

Monitoring expenses incurred on compliance measures

3.17 As part of the Budget process for the 2012–13 compliance measures, Human Services was required to report annually to Government on its actual expenditure for all fraud and compliance programs, including individual measures, in the Minister for Human Services’ Strategic Fraud and Non-Compliance (SFNC) Performance Report.23

3.18 Despite these reporting requirements and the department’s own key performance indicators (KPIs)—which include assessing whether the measures are delivered ‘on budget’ (see paragraph 3.31)—the department’s actual expenses for implementing the 2012–13 and 2013–14 compliance measures were not tracked or reported as they were classified by Human Services as ‘financially simplified’ projects.24 For the Strengthening the Integrity of Welfare Payments measure, only a proportion of the measure’s funding was tracked; funding relating to its operational work and corporate overheads was not accounted for. In this regard, from the 2015–16 financial year appropriation of $71.4 million, Human Services monitored and reported (both internally and externally) against its project management allocation of $27.3 million (38 per cent of the measure’s Budget appropriation for that year).

3.19 Although Human Services did not track the compliance expenses or effort spent on the measures, the department provided the ANAO with some information relating to the expenses for four of the 2012–13 and 2013–14 compliance measures, as outlined in Table 3.1. Note, Human Services’ attribution of expenses and activities to the compliance measures differs to the ANAO’s attribution as outlined in Chapter 4.

Table 3.1: Human Services’ estimated expenses for four 2012–13 and 2013–14 compliance measures

|

|

2012–13 ($) |

2013–14 ($) |

2014–15 ($) |

2015–16 ($) |

Total ($) |

|

|

Increase in compliance review activity |

||||||

|

Budgeted expensea |

8 774 500 |

8 774 500 |

4 387 300 |

|

21 936 300 |

|

|

Actual expenseb,c |

8 282 307 |

9 586 945 |

10 103 045 |

|

27 972 297 |

|

|

Difference |

492 193 |

(812 445) |

(5 715 745) |

|

( 6 035 997) |

|

|

Increased compliance for international risk |

||||||

|

Budgeted expensea |

1 656 300 |

456 000 |

549 300 |

463 100 |

3 124 700 |

|

|

Actual expenseb |

6 149 174 |

2 610 567 |

560 811 |

4 586d |

9 325 138 |

|

|

Difference |

(4 492 874) |

(2 154 567) |

(11 511) |

458 514 |

(6 200 438) |

|

|

Increased recovery of high value non-current customer debt |

||||||

|

Budgeted expense |

1 759 961 |

1 715 694 |

1 726 776 |

1 743 586 |

6 946 017 |

|

|

Actual expense |

1 333 841 |

1 512 038 |

1 957 359 |

1 273 300 |

6 076 538 |

|

|

Difference |

426 120 |

203 656 |

(230 583) |

470 286 |

869 479 |

|

|

Increase compliance for customers with earned income |

||||||

|

Budgeted expensea |

|

4 723 370 |

|

|

4 723 370 |

|

|

Actual expenseb,e |

|

3 289 444 |

|

|

3 289 444 |

|

|

Difference |

|

1 433 926 |

|

|

1 433 926 |

|

|

Total difference between budgeted and actual expenses |

(9 933 030) |

|||||

Note a: Human Services advised the ANAO that the ‘Budgeted expense’ figures outlined differ from the total departmental funding allocated to the department through the Budget process. Human Services advised the ‘Budget expense’ figures includes only the funding internally allocated to the particular business area undertaking the compliance activities for these measures. The remainder of the departmental funding allocated to Human Services through the Budget process is internally allocated to other business areas within the department to cover the cost of corporate overheads and other flow on activities (such as appeals or debt management). These business areas do not distinguish between the expenses associated with Budget measure activity and the expenses associated with business-as-usual activity.

Note b: Human Services advised that the ‘Actual expense’ data relates only to the direct compliance activity expenses. The ‘Actual expense’ data does not include expenses for corporate overheads or other flow-on activities (such as appeals or debt management) as the responsible business areas do not distinguish between the expenses associated with Budget measure activity and the expenses associated with business-as-usual activity.

Note c: Human Services advised the ANAO that because the Increase in compliance review activity measure activity is an increase on yearly compliance activity, expenses for the measure could be interpreted as the difference between the 2011–12 (pre-measure) costs of $8.98 million and the total activity expenses for the 2012–13 to 2014–15 years.

Note d: ‘Actual expense’ as at 2 June 2016. Human Services was unable to provide data for the full 2015–16 financial year.

Note e: Human Services advised the ANAO that because the Increase compliance for customers with earned income measure activity is an increase on yearly compliance activity, expenses for the measure could be interpreted as the difference between the 2012–13 (pre-measure) costs of $27.89 million and the total activity expenses for 2013–14.

Source: ANAO analysis of Human Services’ data.

3.20 As shown in Table 3.1, for the four compliance measures for which Human Services provided indicative expenditure, the department’s estimated total actual expenses exceeded the budgeted expenses by $9.9 million (or 27 per cent). For example, for the Increased compliance for international risk measure the department allocated significantly more staff to implement the measures than were estimated during its original planning. Human Services advised the ANAO that in implementing these measures, it took a number of actions including: approved overtime for current staff; undertook temporary recruitment internal to the department; and/or realigned compliance staff from other activities. In this regard, the actual costs of these measures were significantly greater than originally estimated.

3.21 Establishing a practical and cost-effective mechanism to separately track or estimate the actual cost of some measures (for example, through using the average cost of the relevant compliance activity that is the focus of a measure or the level of full-time equivalent (FTE) staffing25) would:

- provide enhanced assurance when reporting on the achievements of measures against the department’s KPIs (see discussion from paragraph 3.31);

- provide a more complete and accurate summary of the performance of a measure, for example to calculate the net savings realised; and

- enable the cost-effectiveness and efficiency of those compliance activities to be evaluated26, including to inform the development of new measures.

Has Human Services’ internal monitoring and reporting on the compliance measures been effective?

Human Services has well-developed project monitoring mechanisms for reporting to its Executive. However, this monitoring system relies on accurate and consistent reporting by the responsible business areas. In this regard, the regular internal reporting on the progress of the measures has not provided a consistent and reliable indication of whether key performance outcomes, including expected savings and planned levels of activity, were on track, nor whether key risks were being effectively managed.

Arrangements for monitoring compliance measures

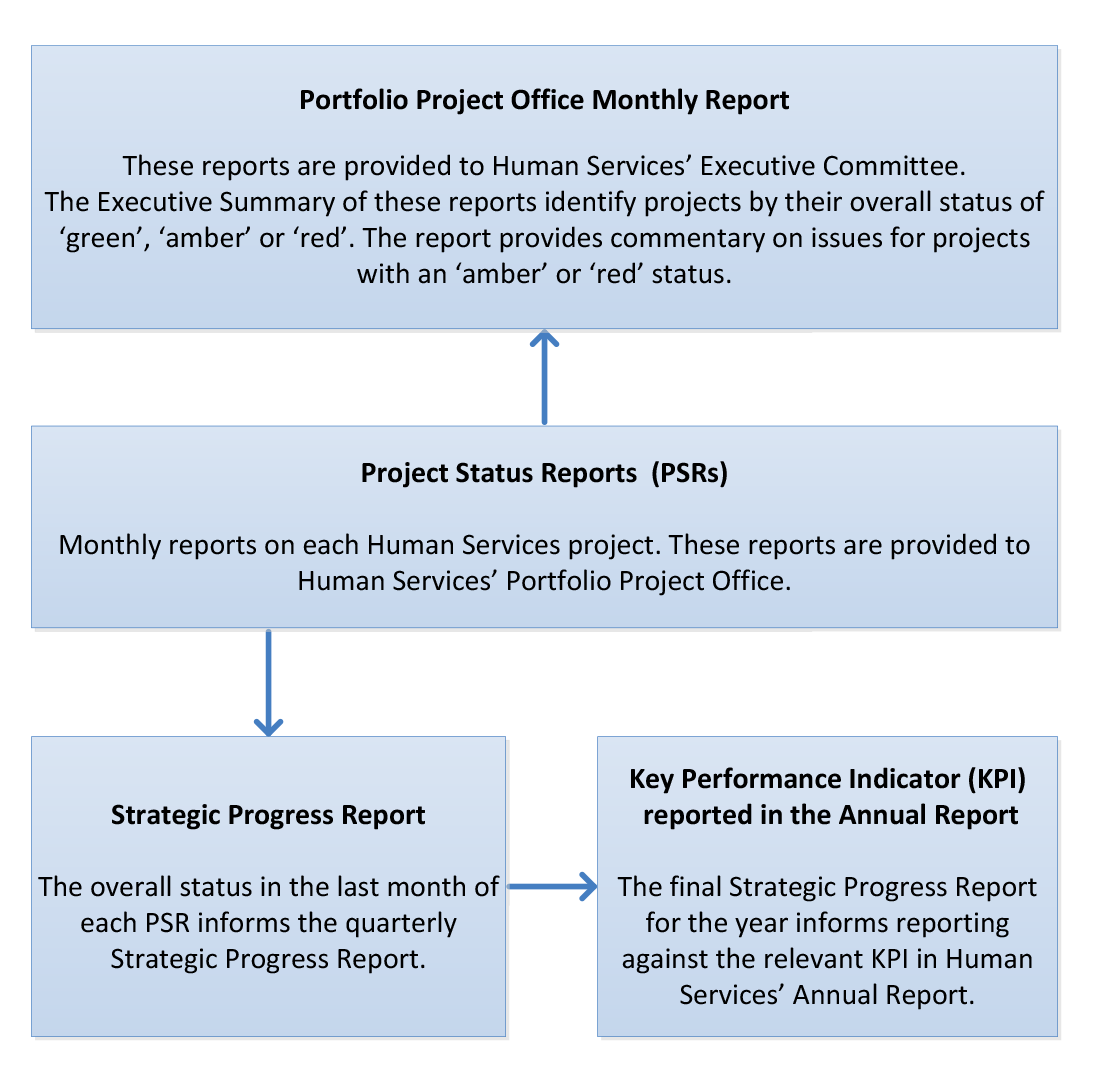

3.22 Human Services’ monitoring of its compliance measures includes weekly or fortnightly reporting at the project level, as well as monthly reporting to its departmental Executive. Under Human Services’ Programme and Project Management Framework, monthly Project Status Reports (PSRs) are to be completed for all programs and projects. The aim of these reports is to provide the Project Board27 and other team members with up-to-date information on project risks, issues, scope, budget, schedule, tasks and activities delivered and forecasted into the future. PSRs had been completed for each compliance measure since the outset.

3.23 Figure 3.1 shows the reporting structure for compliance measures, and how the PSRs contribute to broader reporting arrangements within the department.

Figure 3.1: Human Services’ internal reporting structure for compliance measures

Source: ANAO analysis of Human Services documentation.

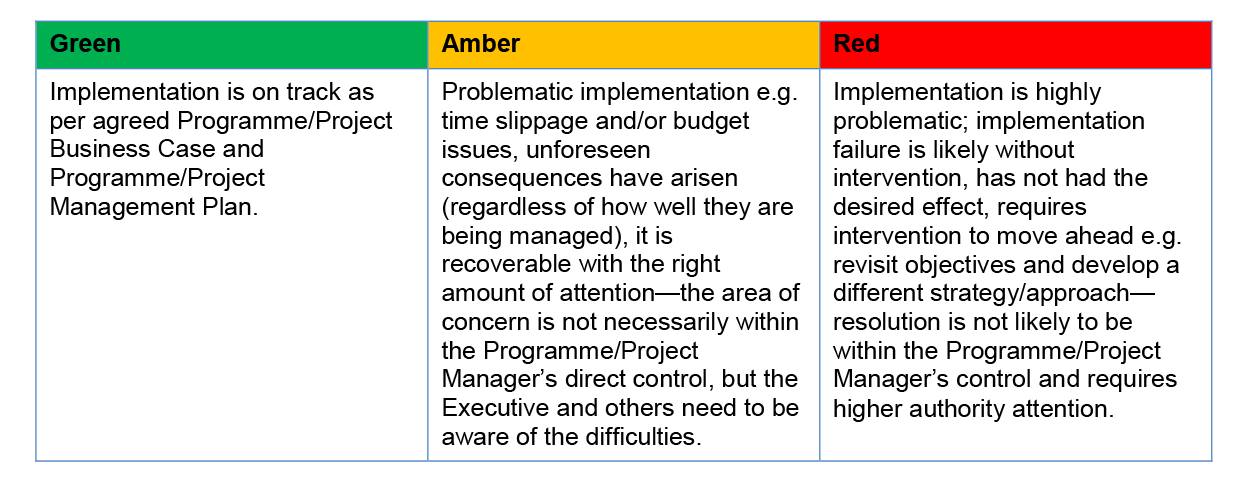

3.24 Human Services uses departmental project tolerances to report project performance within PSRs using a traffic light rating system.28 Figure 3.2 shows the department’s project tolerances for the overall project status in place during the implementation of the measures.

Figure 3.2: Human Services’ project tolerances for overall project statusa

Note a: These tolerances were outlined in Human Services’ Project Management Framework in place at the time of the audit and the implementation periods for measures in the scope of this audit (Human Services’ Project Management Framework was updated in July 2016).

Source: Human Services documentation.

3.25 The ANAO reviewed a sample of 22 PSRs for the compliance measures29 and reviewed the overall project status contained in these reports compared to the achievement of key outcomes—savings30 and activity levels (see Table 3.2). The ANAO identified:

- the overall project status reported at the end of each financial year did not always reflect the department’s overall project status tolerance levels in place at the time; and

- there were inconsistencies in the information reported, both within and across measures. In particular, key outcomes—number of activities completed and savings achieved—were not consistently reported.

Table 3.2: Comparison between Human Services’ assessment of activity level and savings achievements and the reported overall status in the June Project Status Reports

Note a: Where achievements were not reported in the PSRs, other Human Services documentation, including weekly project reports, were used to assess the achievement.

Note b: Where Human Services had assessed the measure was in the ‘close phase’ of the project management framework, the overall status against project tolerance was not stated; instead the PSR status was ‘closing’.

Note c: The last PSR for the Increase in compliance review activity measure was completed in September 2014 because the project was closed in October 2014. The closure of this measure is discussed further in paragraph 4.36.

Note d: For the Increased recovery of high value non-current customer debt measure, Human Services did not report through the PSR on the number of activities undertaken; however, Human Services’ information shows that over the measure period the four year target was achieved (see Appendix 3, Table A.9 and Table A.10 ).

Source: ANAO analysis of Human Services documentation and data.

3.26 The two key outcomes for the majority of the measures were targets for savings and activity levels. In the sample of reports reviewed, the ANAO identified six reports where the overall project status was ‘green’ even though the savings target (as determined by Human Services) had not been achieved. For one of these reports, the activity level target had also not been met.

3.27 Based on Human Services’ documentation, the Increased compliance for international risk measure did not achieve its savings target for any of the four years of the measure; however, its overall PSR status remained ‘green’ from July 2012 until January 2016, when the status turned to ‘amber’.

3.28 The Accelerated real estate review cycle measure’s overall PSR status remained ‘green’ from July 2012 until January 2015, when the status changed to ‘amber’. It did not achieve its savings target for any of the first three financial years of the measure. In addition, there were two other significant issues that affected implementation of this measure: the closure of the Australian Valuation Office (AVO) in 201431; and the introduction of a new risk-based real estate model by Human Services in July 2014, which superseded the Accelerated real estate review cycle measure. There was some commentary about these issues in the PSRs during 2014. Human Services advised the ANAO that ‘the project reported green through to December 2014 on the basis the required volume of activity could still be delivered in the second half of the financial year.’ Human Services’ project tolerance descriptions for a project’s overall status (see Figure 3.2) are that where a project’s implementation is problematic, its overall status should be reported as ‘amber’ or ‘red’.

3.29 Human Services advised the ANAO that: the PSR template in use at this time indicated that where a project was on track, there was no requirement to report on specific deliverables; three or more criteria with a changed status were required to change the overall status of the project; and this indicates that partial achievement is an acceptable justification to report a status of ‘green’. Human Services further advised that the PSRs for the measures clearly stated that where there was an underachievement of savings, the over achievement of other measures within the overall suite of measures offset this discrepancy.

3.30 In reporting on compliance measures through the PSRs, Human Services should consistently report on all key performance targets and include performance against these key targets in assessing a project’s overall status. This would provide the department’s Executive with a more reliable snapshot of progress, as well as allow the PSRs to serve as a more accurate and accountable basis for determining achievements of the measures—including against the department’s public KPIs.

Has Human Services’ external reporting on the outcomes of the compliance measures been accurate and timely?

While Human Services has documented a process for its public reporting against its KPIs, the underlying systems and processes require greater maturity to support an accurate assessment. In this context, it is uncertain whether Human Services’ public reporting against its KPI is accurate.

Human Services’ reporting to its Minister has been ad hoc. Following the lapsing of the previously required reporting arrangements due to the change of government in September 2013, Human Services did not report to Government on the 2012–13 measures. Human Services also did not report annually to the Department of Finance on the outcomes realised, as it committed to do in place of reporting to Government.

Public reporting against key performance indicators

3.31 Human Services reported publicly on the performance of the compliance measures through two KPIs, as outlined in successive Human Services Portfolio Budget Statements since 2012–13:

- Fraud Prevention and Compliance Budget measures: Key initiatives delivered within timeframes and on budget and outcomes are achieved (2012–13 to 2014–15); and

- Strengthening the Integrity of Welfare Payments Budget measure: Key initiatives delivered as agreed within timeframes and on budget (2015–16 and 2016–17).

3.32 The target for both KPIs was ‘Achieved’, with results reported in Human Services’ Annual Reports. Table 3.3 outlines Human Services’ reported achievements against the performance targets for both KPIs from 2012–13 to 2015–16.

Table 3.3: Human Services’ assessment against its public key performance indicators for compliance measures from 2012–13 to 2015–16

|

Financial Year |

Fraud Prevention and Compliance Budget measures Key initiatives delivered within timeframes and on budget and outcomes are achieved a |

Strengthening the Integrity of Welfare Payments Budget measure Key initiatives delivered as agreed within timeframes and on budget a |

||

|

|

Target |

Actual |

Targetb |

Actual |

|

2012–13 |

Achieved |

Achieved |

|

|

|

2013–14 |

Achieved |

Achieved |

|

|

|

2014–15 |

Achieved |

Achieved |

|

|

|

2015–16 |

|

|

Achieved |

Achieved |

Note a: Human Services’ Portfolio Budget Statements from 2012–13 to 2015–16 note that ‘the list of key initiatives is determined by government priorities each financial year’.

Note b: This performance measure has a target of ‘achieved’ until 2017–18, as outlined in Human Services’ 2016–17 Portfolio Budget Statements.

Source: Human Services documentation.

3.33 Accurate reporting on its public KPIs for compliance Budget measures involves Human Services:

- establishing a reliable mechanism to support this reporting requirement;

- defining the key initiatives (Budget measures) that contribute to the KPIs; and

- assessing whether the relevant key measures were delivered within the agreed timeframes, according to the agreed budget, and whether expected outcomes were achieved.

Establishing a mechanism for public reporting

3.34 Human Services has established a process for the department’s public KPI reporting. The methodology, calculation and reporting procedures for the public KPIs are formally approved by Human Services’ Executive at the commencement of the financial year and documented in KPI Measure Records. Human Services advised the ANAO that these KPI Measure Records are reviewed on a quarterly basis. Internally, the progress against relevant targets is reported quarterly to Human Services’ Executive through the Strategic Progress Report.

3.35 For the public KPIs listed in Table 3.3, Human Services’ preparation of the Strategic Progress Reports for its Executive relied on the quarterly results and commentary from the compliance measure’s most recent PSR. However, as set out in Table 3.2, the ANAO’s analysis indicates that the overall project status reported in some of these PSRs is not always accurate or reliable. Further, the ANAO’s analysis identified that for the Employment Income Matching initiative under the Strengthening the Integrity of Welfare Payments measure, there was a different overall project status recorded in the Strategic Progress Reports and the PSRs. The second to fourth quarter PSRs recorded the overall project status as ‘amber’, yet reporting for the Strategic Progress Reports during the same period showed the overall project status as ‘green’.

Defining relevant ‘key initiatives’

3.36 It is not clear which ‘Fraud Prevention and Compliance’ measures were included in the department’s public reporting against the KPI from 2012–13 to 2014–1532:

- Human Services was unable to advise the ANAO which compliance measures were included in its reporting against the KPI for the 2012–13 and 2013–14 financial years.

- In 2014–15, the number of compliance measures included in Human Services’ internal quarterly reporting against the KPI varied throughout the financial year, as the department did not define which compliance measures were to be included.

- The 2014–15 Strategic Progress Report for the fourth quarter aggregated the result reported for three measures, whereas Human Services advised the ANAO that nine compliance measures contributed to the performance indicator for that quarter.

3.37 Additionally, for Human Services’ reporting against the KPI for the Strengthening the Integrity of Welfare Payments measure, ANAO analysis showed that the 2015–16 Strategic Progress Reports included two additional initiatives: the 2012–13 Improve billing practices within public hospitals measure (included in the first quarter) and Increased recovery of high value customer debt (included in the first and second quarters). These two compliance measures were not included in the KPI Measure Records for the 2015–16 KPI and were individual measures separate to the Strengthening the Integrity of Welfare Payments measure.

Assessing whether timeframes, budget and outcomes were achieved

3.38 As part of its broader project monitoring arrangements, Human Services has established mechanisms for regular reporting on implementation progress, including key timing/milestones for relevant measures. However, these mechanisms are also reliant on the quality and consistency of the reporting of key deliverables and outcomes in the PSRs. As Table 3.2 indicates, this PSR reporting has not been consistent over the relevant periods for the measures.

3.39 As discussed at paragraph 3.18, Human Services does not monitor or report on the costs of ‘financially simplified’ compliance measures, and does not monitor the operational compliance costs relating to the Strengthening the Integrity of Welfare Payments measure. In the absence of tracking its own costs, it is not clear how Human Services determined that the measures were ‘on budget’, as publicly reported in Human Services’ 2012–13 to 2015–16 Annual Reports.

3.40 Human Services advised the ANAO that, although individual costs were not tracked for the compliance measures, the compliance division did not exceed its overall internal budget from 2012–13 to 2015–16. Using the overall divisional budget (which includes Human Services’ business-as-usual funding) as a basis for determining whether individual measures were ‘on budget’ has limitations, as it cannot demonstrate whether the funds provided for individual measures were expended as planned.

3.41 As shown in Table 3.3, Human Services’ public reporting in its Annual Reports from 2012–13 to 2015–16 show that the relevant KPIs had been ‘achieved’. In Human Services’ reporting against its single KPI from 2012–13 to 2014–15, Human Services aggregated the department’s internal calculations of the gross fiscal balance savings achieved for all the compliance measures included in the KPI33, but did not track its debt recovery achievements (underlying cash savings) for the relevant measures. Similarly, the debt recovery achievements were not tracked for the 2015–16 KPI.

3.42 Human Services’ public reporting of ‘achieved’ was also assessed in isolation of the department’s commitment that activities for certain measures would be additional to the department’s business-as-usual activities (see paragraphs 4.2 to 4.10).

3.43 Overall, there is no clarity and transparency in Human Services’ public reporting on the performance of the compliance measures from 2012–13 to 2015–16. While the department has documented a process for its public reporting against its KPIs, the underlying systems and processes require greater maturity to support an accurate assessment to be made.

Reporting back to Government

3.44 The Minister for Human Services has responsibility for the delivery of, and reporting on, fraud and compliance activities to the Government. The stakeholder engagement and communication plans for five of the seven compliance measures noted that the Minister would be provided with quarterly reports on the progress of the measures—including information on the achievement of goals and delivery of benefits.

3.45 The ANAO’s analysis shows that Human Services’ advice to its Minister on the implementation and achievement of the compliance measures had been ad hoc and not consistent with the stakeholder engagement and communication plans developed at those times. Towards the end of 2015, following the early implementation stage of the Strengthening the Integrity of Welfare Payments measure in 2015–16, the department provided its Minister with more information than in previous years.

3.46 During the course of the audit, Human Services developed a report on compliance and debt activity within the department, with a plan for this report to be submitted to the Minister on a monthly basis. The first report was provided to the Minister in early May 2016.34 The report provides information on the proportion of targeted activities completed and estimated gross fiscal savings achieved35 (current financial year and the whole period of the measure) for nine selected compliance measures, five within the scope of this audit.36

Strategic Fraud and Non-Compliance Performance Report

3.47 As part of the 2012–13 Budget, Human Services was required to report annually to the Government on the success of the 2012–13 measures37, including savings realised, through the SFNC Performance Report.38

3.48 Following the change of government (in September 2013) Human Services advised the ANAO that the SFNC submission and performance report did not continue as these reporting mechanisms were an initiative of the previous government. Consequently, the department completed its last SFNC report in 2011–12.

3.49 Following a change of government, the Minister for Human Services would have had to seek authority for the SFNC performance report to continue. In these circumstances, the ANAO would have expected that Human Services would have provided advice to its Minister outlining the earlier reporting requirements, and seeking the Minister’s views on whether to continue with the requirements—this did not occur.

3.50 Instead, in March 2014, Human Services’ Executive decided not to continue with the SFNC submission and the Strategic Partnership Interdepartmental Committee which oversighted that process. The department advised relevant policy entities39 of its decision, and in its place the department committed to continue to report to the Department of Finance on the performance of the compliance measures.

3.51 Since the 2012–13 Budget, Human Services had not reported to either the Government or the Department of Finance on its performance and relative achievements in implementing the compliance measures.40

Recommendation No.2

3.52 That the Department of Human Services:

- in consultation with the Department of Social Services, develops and implements a method to estimate and monitor the amount of debt recovered from compliance measures;

- consistently reports internally on its progress and achievements for compliance measures against key performance targets and outcomes; and

- develops and implements a method to estimate the costs of compliance measures, to provide improved assurance over its external reporting, and to better inform evaluations of its compliance activities.

Department of Human Services response: Agreed with qualifications.

3.53 The department recognises that there are opportunities for improving monitoring and reporting arrangements for its compliance measures. Recommendations 2(a) and (c) are considered long term goals that will be considered as part of the Welfare Payment Infrastructure Transformation Programme, which will deliver enhanced capability. These system improvements are expected to provide the department with better management information to support improved program management and monitoring.