Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of the Australian War Memorial’s Development Project

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Australian War Memorial (the Memorial) was allocated $498.7 million in 2018 to deliver the Development Project. A further $50 million was allocated in 2022 and $8.8 million unspent from the business case funding was redirected to the project.

- This audit provides assurance to Parliament on the delivery of a nationally significant project, including procurement, contract management and project management.

Key facts

- As at October 2023, there were 221 contracts for project management, design, engineering, construction and specialist advice for the Development Project.

- The Memorial remains open to the public throughout construction (completing quarter 4 2025) and gallery development (completing quarter 4 2027), with the project due for final completion in June 2028.

What did we find?

- Management of the Development Project has been largely effective.

- Procurement policies, governance and project management arrangements were largely effective.

- Procurement activities were largely conducted in compliance with the Commonwealth Procurement Rules through open and competitive processes.

- Contract management was largely effective.

- There were deficiencies in record keeping, management of conflicts of interest, documenting value for money assessments and in the quality of advice to the minister.

What did we recommend?

- The Auditor-General made five recommendations to the Memorial to improve policies, record keeping, probity, conflicts of interest and contract management.

- There was one recommendation to the Department of Finance (Finance) to update guidance on AusTender reporting.

- The Memorial and Finance agreed to the recommendations.

13

tenderers responded to the 2021 Request for Expression of Interest for the first three Main Works Packages.

$454.6m

(GST inclusive) value of contracts for the Development Project as at October 2023.

73%

of initial contracts (prior to variations) reported on AusTender within required 42 days.

Summary and recommendations

Background

1. The Australian War Memorial (the Memorial) is a corporate Commonwealth entity (CCE) established by the Australian Memorial Act 1980 (the Memorial Act). Its purpose is ‘to commemorate the sacrifice of those Australians who have died in war or on operational service and those who have served our nation in times of conflict.’

2. In November 2018, the Australian government announced funding of $498.7 million for the Development Project to 2028; ‘to display more of their collection and proudly tell the stories from recent years in Afghanistan, Iraq, the Solomon Islands and East Timor.’1 A further $50 million was allocated in March 2022 for a total of $548.7 million (GST exclusive).

3. Under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), an entity’s accountable authority has a duty to promote the proper (efficient, effective, economical and ethical) use and management of public resources. The Memorial is a CCE prescribed under section 30 of the Public Governance, Performance and Accountability Rule 2014 to follow the Commonwealth Procurement Rules (CPRs). The CPRs govern how entities buy goods and services and are designed to ensure the achievement of value for money.

Rationale for undertaking the audit

4. The Memorial is a nationally significant cultural institution which manages assets valued at $1.5 billion. The funding of $548.7 million for the Development Project represents a significant increase in the Memorial’s project management and procurement activity.

5. This audit provides assurance to the Parliament about the effectiveness of the Memorial’s procurement and project management arrangements. This includes whether the Memorial complied with CPRs and established effective governance and contract management arrangements to deliver the project.

Audit objective and criteria

6. The audit objective was to assess whether the Australian War Memorial is effectively managing the development project.

7. To form a conclusion against the objective, the following high-level criteria were adopted.

- Has the Australian War Memorial (the Memorial) established effective procurement and project management frameworks?

- Were procurement activities conducted in accordance with Commonwealth Procurement Rules?

- Has the Memorial established effective contract management arrangements to support project delivery?

Conclusion

8. The Memorial’s management of the Development Project was largely effective. Shortcomings in the management of probity risks would have been improved with full implementation of internal policies and procedures.

9. Procurement policies, governance and project management arrangements were largely effective. The Director’s Instructions are not supported by a delegation from the Council as the accountable authority. Procurement policies were revised in 2020, after the award of funding to the Development Project in 2018, to ensure alignment with the Commonwealth Procurement Rules and Public Governance, Performance and Accountability Act 2013. Additional governance structures and project management arrangements were established appropriate and proportionate to the project scale and risk, with a focus on safety, risk management and cost control. Record keeping practices did not follow approved processes.

10. Procurement activities were largely conducted in compliance with the CPRs. Higher value procurements were conducted through open and competitive processes and assessments were appropriately documented in tender evaluation reports. Value for money assessments were not adequately documented for the variation in price between tender responses and executed contracts or for lower value procurements. Management of ethical and probity risks was partly effective. Engagement with the external probity advisor was insufficient for the scale and risk of the procurements. Conflicts of interest were not adequately documented and declared or known conflicts were not adequately managed. Incumbency risks related to the procurement for ongoing project management services were not adequately managed and steps were taken to avoid seeking ministerial approval for the entering into contracts on two occasions. Minister’s briefs were insufficiently detailed to support the minister to meet their obligations under section 71 of the Public Governance, Performance and Accountability Act 2013.

11. Largely effective contract management arrangements have been established. The Development Project contracts include clearly documented requirements. There are appropriate systems to monitor contractor performance and performance has been managed largely effectively to achieve value for money and deliver the Development Project objectives. The documentation of assessment of value for money considerations for contract variations was insufficient. Ministerial briefs lacked sufficient detail of value for money assessments. In one instance, the signed contract variation exceeded the value approved by the Minister for Veterans’ Affairs and the value of the variation was incorrectly stated in the subsequent ministerial brief.

Supporting findings

Has the Memorial established effective procurement, governance, and project management arrangements?

12. Largely fit-for-purpose procurement policies were developed which align with the Commonwealth Procurement Rules (CPRs) and the Public Governance, Performance and Accountability Act 2013 (PGPA Act). These policies include template forms and clear guidance on the responsibilities of officials when conducting a procurement. The Director’s Instructions were not supported by a delegation of authority from the Council. (See paragraphs 2.2 to 2.17)

13. Specific governance arrangements were established to manage the budget, deliverables and the increased risk associated with the scale and complexity of the Development Project. Governance arrangements have clearly defined organisational structure and reporting responsibilities which support the Council and Director maintaining appropriate oversight. A suite of project-specific policies was developed to support procurement, contract management and project delivery, which are reviewed annually. Record keeping practices did not follow approved processes. The Development Project has not been subject to a Gateway Review under the Australian Government Assurance Reviews Framework. (See paragraphs 2.18 to 2.46)

Were procurement activities conducted in accordance with Commonwealth Procurement Rules?

14. Open tenders and multiple quotes from panel arrangements for tenders were used to maximise competition for higher value procurements. Evaluation criteria for each procurement stage were not published at the beginning of multistage procurements. Lower value procurements were not adequately documented. Seventy-three per cent of contracts were reported on AusTender within the required 42 days. Incumbency risks were not appropriately managed for the project management services procurement. (See paragraphs 3.3 to 3.25)

15. Activity specific conflict of interest declarations were not obtained for all delegates, members of evaluation committees and advisors involved in procurements. Key personnel did not declare their prior employment with tenderers. Management plans were not consistently developed for declared or known conflicts. Engagement with probity advisors was insufficient for the scale and risk of the procurements. (See paragraphs 3.26 to 3.51)

16. Tender evaluation reports for 13 of 18 procurements reviewed appropriately documented and demonstrated how value for money was assessed. Value for money assessments were largely not undertaken where the negotiated final contract price varied the price approved in the tender evaluation report. (See paragraphs 3.52 to 3.63)

17. Tender evaluation reports for high value procurements set out the assessment process and demonstrated how value for money was considered and risks were assessed. Subsequent documentation of the outcome of contract negotiations or rationale for the award of contract with a different value than previously approved was insufficient. Ministerial approval was obtained to enter into contracts over $1 million. Advice to the minister was insufficiently detailed to support the minister in carrying out their duties, including those under section 71 of the PGPA Act. In two instances contracts were split to not exceed the $1 million threshold for ministerial approval. (See paragraphs 3.64 to 3.76)

Has the Memorial established effective contract management arrangements to support project delivery?

18. Development Project contracts include clearly documented requirements for delivery. Construction contracts for Main Works Packages include detailed design drawings of works to be delivered to specified timeframes and quality to an agreed lump sum. The Memorial implemented peer reviews, monthly site visits and a suite of reporting requirements to monitor contractor performance. (See paragraphs 4.3 to 4.16)

19. Contract management processes at the whole of project level are largely aligned to the better practice principles of the Contract Management Guide. The Memorial tracks construction progress against set timelines and maintains oversight of completion dates. Cost control and risk management arrangements have been implemented. (See paragraphs 4.17 to 4.35)

20. Policies and procedures for contract variations are documented, however, records of contract variations are not consistently supported by value for money assessments. Ministerial briefs lack transparency, accuracy and the rationale for statements about value for money assessments. One contract variation was executed for an amount higher than that approved by the minister and the ministerial brief relating to a subsequent variation contained the incorrect value of the executed variation. (See paragraphs 4.36 to 4.60)

Recommendations

21. This report makes five recommendations to the Australian War Memorial relating to updating policies, management of conflicts of interest, record keeping and contract management. The report makes one recommendation to the Department of Finance to update procurement guidance on AusTender reporting.

Recommendation no. 1

Paragraph 2.6

The Australian War Memorial strengthen controls by issuing Accountable Authority Instructions (AAIs) consistent with RMG206 Model AAIs for corporate Commonwealth entities and ensuring that it documents any of its powers that have been delegated to the Director.

Australian War Memorial response: Agreed.

Recommendation no. 2

Paragraph 2.37

The Australian War Memorial update its records management policies to ensure that electronic record keeping systems are defined and approved, and implement quality assurance controls to ensure records are maintained in accordance with its policy and the requirements of the Archives Act 1983.

Australian War Memorial response: Agreed.

Recommendation no. 3

Paragraph 3.50

The Australian War Memorial strengthens the ethical conduct of its procurement activity consistent with its obligations under the Public Governance, Performance and Accountability Act 2013 and Commonwealth Procurement Rules:

- Ensuring all officials, contractors and advisors involved in procurement activities, in any capacity, complete activity specific conflict of interest declarations, on the basis of ‘if in doubt, declare the interest’; and

- Actively engaging probity advice to assist with the management of ethical and probity risks for higher value and/or higher risk procurements.

Australian War Memorial response: Agreed.

Recommendation no. 4

Paragraph 3.76

The Australian War Memorial ensure that appropriate records are created and maintained that clearly document how value for money has been considered and will be achieved, including:

- in decision briefs to delegates, including for subsequent approval where contracts are to be executed for more than the approved tendered price;

- in briefs to the Minister for Veterans’ Affairs seeking approval to enter into contracts;

- for limited tenders and procurements under the Commonwealth Procurement Rules thresholds; and

- for contract variations.

Australian War Memorial response: Agreed.

Recommendation no. 5

Paragraph 4.21

The Australian War Memorial revise its whole of project Construction Management Plan to ensure it adequately captures requirements of the Memorial’s procurement policy and alignment with the better practice principles of the Australian Government Contract Management Guide. This should include consideration of implementing individual contract management plans for higher value procurements to manage contractor specific risks and compliance with legislative and policy requirements.

Australian War Memorial response: Agreed.

Recommendation no. 6

Paragraph 4.52

The Department of Finance should further strengthen Commonwealth Procurement Rules by updating Resource Management Guide 423 Procurement and Reporting Obligations to require entities to report all contracts and amendments where the total contract value is above the relevant threshold.

Department of Finance response: Agreed in principle.

Summary of entity response

22. The proposed audit report was provided to the Memorial and an extract of the proposed report was provided to the Department of Finance (Finance). The Memorial’s summary response is reproduced below, no summary response was provided by the Finance. The full responses from both entities are at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed in Appendix 2.

Australian War Memorial

As the Report itself highlights the Memorial’s Development Project is a project of national significance. The Report also notes project delivery has faced the unique challenge of keeping the Memorial open as the centre of national commemoration and that it has had to adapt to the simultaneous impacts of COVID-19 and record high construction inflation.

The Memorial therefore welcomes the primary findings of the Report that it has established ‘largely effective’ frameworks for project management, procurement and contract management within that context.

The Memorial accepts the five recommendations made within the Report identified in areas of record keeping, probity management and corporate policy. As noted in Appendix 2 Improvements observed by the ANAO the Memorial has addressed many of these issues already and is working to close out final recommendations.

The Memorial believes the Report will provide Government with assurance that, through clearly documented strategic planning, innovative solutions and constant improvement, is it successfully managing the continued challenges facing any major project at this time in order to deliver high quality outcomes for veterans, their families and all Australians.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Procurement

Records management

1. Background

Introduction

1.1 The Australian War Memorial (the Memorial) opened in 1941 and is a corporate Commonwealth entity established by the Australian Memorial Act 1980 (the Memorial Act). The Memorial Act defines the Memorial’s purpose ‘to commemorate the sacrifice of those Australians who have died in war or on operational service and those who have served our nation in times of conflict’. The Memorial Act sets out the functions and powers of the Memorial, including its ministerial oversight, and the roles and functions of the Memorial Council and the Memorial Director.

1.2 The Memorial’s Council (the Council) is the Accountable Authority responsible for the conduct and control of the affairs of the Memorial. Council members are appointed by the Governor-General and include, ex-officio, the heads of Army, Navy and Air Force. The day-to-day operation of the Memorial is administered by the Director, who is appointed by the Governor-General for a term of up to seven years.2

The Memorial’s Development Project

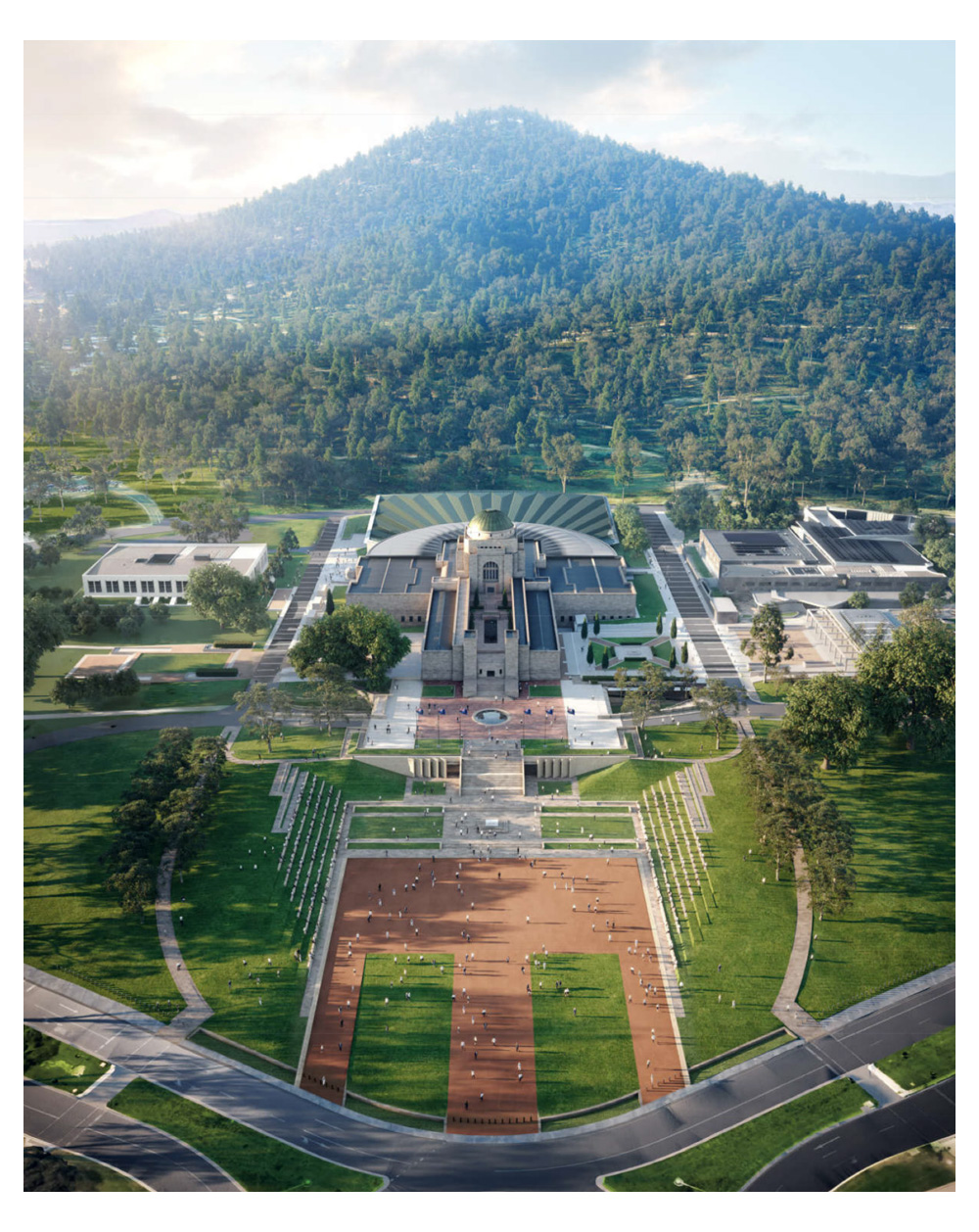

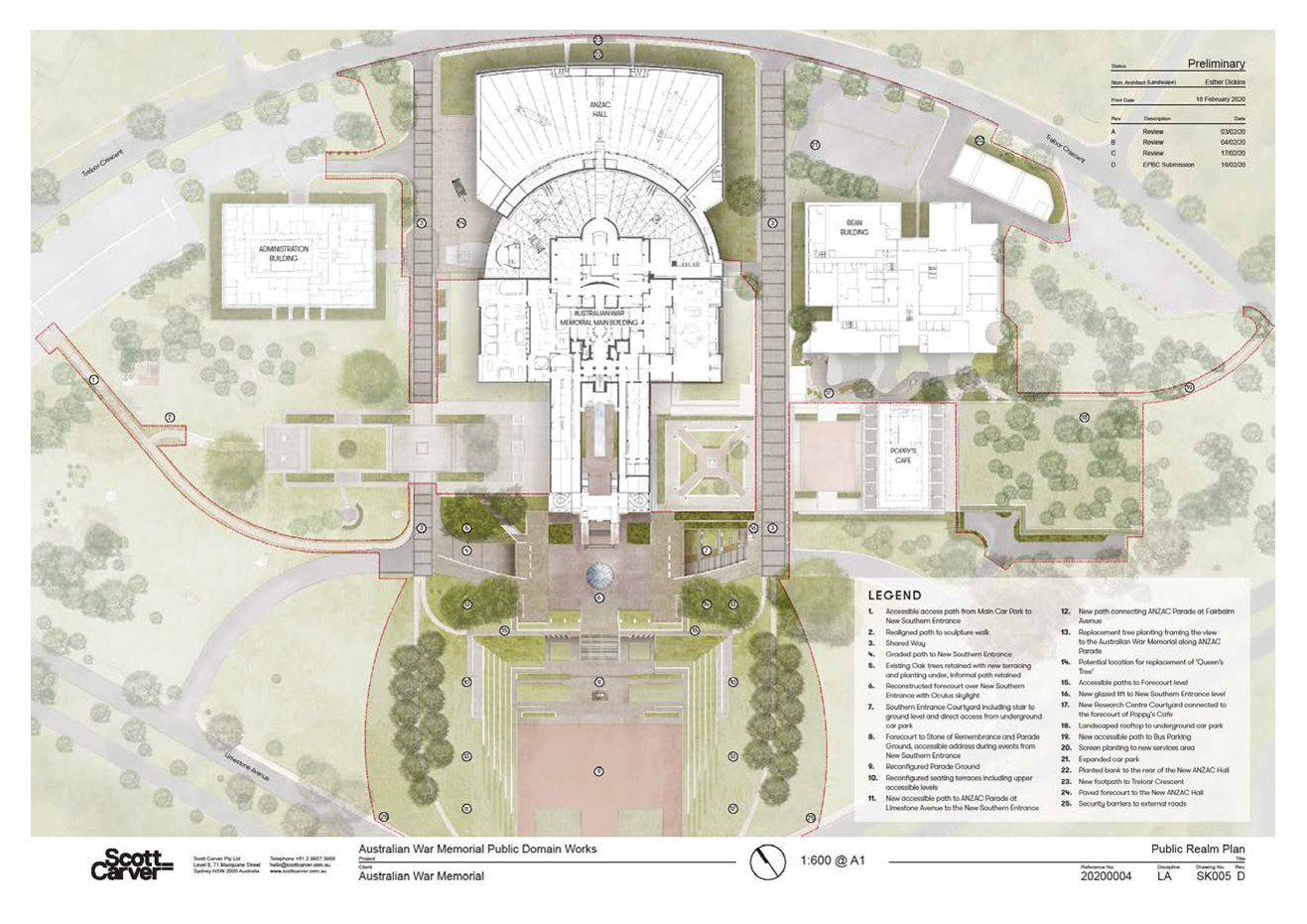

1.3 The Development Project includes a new southern entrance and parade ground at the front of the existing main building, an extension to the CEW Bean Building, a new Anzac Hall and glazed link at the rear of the main building, refurbishment of the main building, gallery fit outs and works in the public realm. These were separated into different packages including:

- Early and Enabling Works;

- Main Works Package 1 (MWP1) New Southern Entrance;

- Main Works Package 2 (MWP2) CEW Bean Building and Central Energy Plant;

- Main Works Package 3 (MWP3) Anzac Hall and Glazed Link;

- Main Works Package 4 (MWP4) Main Memorial Building Refurbishment;

- Gallery fit outs; and

- Public realm works (landscaping).

1.4 The Memorial published plans, renders and video of the Development Project on its website.3 Appendix 6 includes a selection of Development Project images.

1.5 The requirement for additional gallery space was identified in the 2016 Functional Efficiency Review of the Australian War Memorial. The Memorial’s 2020 evidence to the Parliamentary Standing Committee on Public Works (Public Works Committee) identified four issues that the project would address:4

- spatial constraints that prevent (i) the telling of the stories of recent conflicts and operations at a level of detail consistent with earlier conflicts, and (ii) the Memorial properly recognising the service of those who served in recent conflicts and operations;

- the lack of capacity to include large technology objects such as planes, helicopters and armoured vehicles within galleries, as these objects are critical to telling the stories of recent conflicts and operations;

- circulation challenges caused by the numbers of visitors being well in excess of what the building was designed for, and which has now been in excess of one million per year for the last five years; and

- the lack of compliance with the Federal Disability Discrimination Act 1992 to ensure the facility is accessible for all Australians, regardless of physical capacity.

1.6 The Memorial also advised the Public Works Committee that a key objective for the Development Project was to remain open to the public during the construction phase.

Funding for the Development Project

1.7 The Memorial’s Development Project was subject to Australian Government funding approval under the Two Stage Capital Works Approval Process:

- First stage: develop Initial Business Case (IBC) including Whole-of-Life Costs (WoLC) estimate to a 50 per cent confidence interval to support a New Policy Proposal (NPP) seeking government approval to proceed to second stage, including funding for a Detailed Business Case (DBC).

- Second stage: develop Detailed Business Case (DBC) including WoLC estimate to 80 per cent confidence interval and NPP seeking project approval.5

1.8 The government allocated $5 million to the Memorial in the 9 May 2017 budget for an IBC, with the Memorial awarding the contract for the IBC to GHD Pty Ltd to a value of $216,260.55. Following delivery of the IBC in October 2017, a further $11.4 million was allocated in the Mid-Year Economic and Fiscal Outlook (MYEFO) 2017–18 for the DBC. GHD Pty Ltd was contracted to develop the DBC by 21 December 2018.6

1.9 On 17 October 2018, the Australian Government approved $498.7 million (GST exclusive) capital expenditure for the Development Project. This approval was based on a ‘Project Status Update report September 2018’ that calculated funding costs to a 75 per cent confidence interval and did not include WoLC.

1.10 The Development Project was announced by the Prime Minister on 1 November 2018.7

1.11 The DBC was finalised on 21 December 2018, after the decision was made and announced, with a proposed budget that matched the approved amount ($498.7 million GST exclusive), calculated to an 80 per cent confidence interval. The DBC included additional information on delivery approach, governance, risk and WoLC. The Memorial advised the ANAO that the DBC was hand delivered to the Department of Veterans’ Affairs on 21 December 2018.

1.12 The Australian Government response to the Parliamentary Standing Committee on Public Works Report 1/2021 advised Parliament that8:

The resulting DBC was closely examined by the Department of Veterans’ Affairs, Department of Finance and Cabinet before being approved for funding in November 2018.

1.13 There was no evidence that the DBC was considered by government.

1.14 On 23 August 2018, the Minister for Finance agreed that $7 million unspent from the IBC and DBC could be redirected to the Development Project budget. The unspent funds redirected to the project were $8,813,029.

1.15 On 13 January 2021 the Memorial commenced a multistage tender process for the first three Main Works Packages (MWPs); MWP1 Southern Entrance, MWP2 CEW Bean Building and MWP3 Anzac Hall and Glazed Link. The Memorial identified from mid-2021 a high risk for potential price escalation, which was realised from 2 November 2021 following receipt of tender responses for MWP2.

1.16 The Memorial advised the ANAO that the Director verbally briefed the Minister for Veterans’ Affairs on the price escalation in January 2022. There was no evidence of a written brief or minutes of that meeting.

1.17 On 11 March 2022, the Council met out of session to consider a project budget update:

Based on market responses to these tenders there is an estimated funding shortfall of $65-70m across all construction and Gallery fit out works due to COVID 10 [sic], supply chain disruptions and materiel and labour availability.

1.18 The Council agreed on 11 March 2022 to seek an additional $50 million from the Australian Government. By this time, the Tender Evaluation Report for MWP2 was signed by the delegate (23 January 2022), the Treasurer had written to the Prime Minister seeking agreement to an additional $50 million (24 February 2022) and the Prime Minister signed a letter approving the additional $50 million (4 March 2022). On 4 July 2022, the Director confirmed in a media statement the additional funding of $50 million was allocated by the Australian Government in March 2022.9

1.19 In October 2022, the Memorial submitted a Project Budget Update to the Parliamentary Standing Committee on Public Works, setting out a rationale for the additional funding.10

1.20 During the Development Project, the Memorial has elected to complete additional works funded by Memorial cash reserves. These include the geothermal heat exchange (Case Study 1) and business as usual maintenance items completed alongside development works, such as security and ICT infrastructure. As of July 2023, the total program budget is $582,782,260 (GST exclusive). This is in addition to the IBC and DBC Detailed Business Case expenditure totalling $7.6 million.

1.21 Table 4.4 in Chapter 4 shows the budget breakdown and changes to 31 October 2023.

Timeline for the Development Project

1.22 The 2018 DBC established a timeline for the completion of the Development Project by February 2028. In July 2019, the Memorial created baseline milestones using updated information from architectural concept designs and gallery plans. Table 1.1 shows the changes in the key milestones over time as reported in the Memorial’s Project Delays Summary.

Table 1.1: Development Project key milestones

|

Milestone |

Baseline at July 2019 |

Revised October 2020 |

Revised January 2023 |

|

Enabling works begin |

2019 |

Commenced Quarter 4 (Q4) 2019 |

Complete |

|

New Anzac Hall works commence (Main Works Package 3 (MWP3) |

2020 |

Q1 2021 |

Commenced Q3 2021 |

|

New Southern Entrance works begin (MWP1) |

2021 |

Q2 2021 |

Commenced Q3 2021 |

|

CEW Bean Building and Research Centre works begin (MWP2) |

2021 |

Q3 2021 |

Commenced Q3 2021 |

|

New Southern Entrance external works (parade ground) complete (MWP1) |

2022 |

Q2 2024 |

Q2 2024 |

|

New Southern Entrance & Main Building Lower (central circulation) opens to public (MWP1) |

2022 |

Q4 2024 |

Q1 2025 |

|

CEW Bean Building and Research Centre complete (MWP2) |

2023 |

Q2 2024 |

Q4 2024 |

|

Anzac Hall and Glazed Link Base Build complete (MWP3) |

2023 |

Q2 2024 |

Q4 2024 |

|

Anzac Hall Galleries open |

2024 |

Q4 2024 |

Q4 2025 |

|

Main Building refurbishment beginsa |

2024 |

Q3 2021 |

Commenced Q4 2021 |

|

Main Building refurbishment works complete (MWP4)a |

2027 |

Q2 2024 |

Q3 2025a |

|

Main Building Galleries installation complete |

2027 |

Q4 2027 |

Q4 2027 |

|

Public Realm works complete |

2027 |

Q4 2027 |

Q4 2027 |

|

Project completion |

30 June 2028 |

30 June 2028 |

30 June 2028 |

Note: Milestone dates are calendar year. Project timelines adjustments are discussed further from paragraphs 4.23.

Note a: Refurbishment of lower Main Building brought forward to deliver concurrent with MWP1. MWP4 completion date is to be confirmed through final contract negotiations occurring quarter 1 2024.

Source: Memorial documentation.

Procurement and contract management activities

1.23 The Memorial is a prescribed corporate Commonwealth entity (CCE) under section 30 of the Public Governance, Performance and Accountability Rule 2014, and is subject to the Commonwealth Procurement Rules (CPRs). The Memorial11:

must comply with the ‘rules for all procurements’ listed in Division 1 and the ‘additional rules’ listed in Division 2 when the expected value of the procurement is at or above the relevant procurement threshold

1.24 The procurement thresholds for prescribed CCEs are $400,000 for non-construction procurements or $7.5 million for construction services. Additionally, under subsection 35(b) of the Australian War Memorial Act 1980, the Memorial must obtain the approval of the Minister for Veterans’ Affairs before entering into a contract under which the Memorial is to pay or receive more than $1 million.12

1.25 Managing procurements effectively requires attention across the procurement lifecycle: commencing in the procurement phase with effective planning, tender evaluation and contract negotiation, and progressing to active management of contractors’ performance and compliance in the contract management phase.

Rationale for undertaking the audit

1.26 The Memorial is a nationally significant cultural institution which manages assets valued at $1.5 billion. The funding of $548.7 million for the Development Project represents a significant increase in the Memorial’s project management and procurement activity.

1.27 This audit provides assurance to the Parliament about the effectiveness of the Memorial’s procurement and project management arrangements. This includes whether the Memorial complied with Commonwealth Procurement Rules and established effective governance and contract management arrangements to deliver the Development Project.

Audit approach

Audit objective, criteria and scope

1.28 The audit objective was to assess whether the Australian War Memorial is effectively managing the development project.

1.29 To form a conclusion against the objective, the following high-level criteria were adopted.

- Has the Australian War Memorial established effective procurement and project management frameworks?

- Were procurement activities conducted in accordance with Commonwealth Procurement Rules?

- Has the Memorial established effective contract management arrangements to support project delivery?

Audit methodology

1.30 The audit involved:

- examining Memorial documentation, including policy documents, minutes of meetings, procurement records and contract management records;

- reviewing AusTender data;

- meetings with Memorial officials and contracted personnel involved in the Development Project;

- conducting site visits of construction for the first three Main Works Packages: Southern Entrance, CEW Bean Building, and Anzac Hall and Glazed Link;

- meeting with the Memorial’s contracted probity advisor; and

- reviewing five citizen contributions received for this audit.

1.31 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $609,000.

1.32 The team members for this audit were Jason Millward, Shelley Yin, James Carrington, Rory Tredinnick, Angelo Dimitropoulos and Alexandra Collins.

2. Has the Memorial established effective procurement, governance, and project management arrangements?

Areas examined

This chapter examines whether the Australian War Memorial (the Memorial) has established effective procurement policies, governance, and project management arrangements.

Conclusion

Procurement policies, governance and project management arrangements were largely effective. The Director’s Instructions are not supported by a delegation from the Council as the accountable authority.

Procurement policies were revised in 2020, after the award of funding to the Development Project in 2018, to ensure alignment with the Commonwealth Procurement Rules and Public Governance, Performance and Accountability Act 2013.

Additional governance structures and project management arrangements were established appropriate and proportionate to the project scale and risk, with a focus on safety, risk management and cost control. Record keeping practices did not follow approved processes.

Areas for improvement

The ANAO made two recommendations for the Memorial to issue Accountable Authority Instructions and update record keeping policies. There were two opportunities for improvement for the Memorial relating to improving policy documents and distributing minutes of the Interdepartmental Advisory Committee. There was one opportunity for improvement made for the Department of Finance to extend the scope of Resource Management Guide 106 Australian Government Assurance Reviews to include corporate Commonwealth entities.

2.1 This chapter examines whether the Australian War Memorial (the Memorial) has established effective procurement policies, governance, and project management arrangements to support management of the Development Project.13 Policies may include procurement instructions, policies and guidance and be supported by governance, oversight, and probity arrangements. A sound framework helps ensure that: procurements are undertaken effectively, ethically and in compliance with relevant rules and legislation; entities properly use and manage public resources; and procurements achieve their objectives and value for money outcomes.

Has the Memorial developed a fit-for-purpose procurement framework?

Largely fit-for-purpose procurement policies were developed which align with the Commonwealth Procurement Rules (CPRs) and the Public Governance, Performance and Accountability Act 2013 (PGPA Act). These policies include template forms and clear guidance on the responsibilities of officials when conducting a procurement. The Director’s Instructions were not supported by a delegation of authority from the Council.

Memorial procurement policies and guidance

2.2 The Memorial is a corporate Commonwealth entity (CCE), subject to the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and prescribed by section 30 of the Public Governance, Performance and Accountability Rules 2014 (PGPA Rules) to comply with the Commonwealth Procurement Rules (CPRs).14

2.3 Section 20A of the PGPA Act states:

The accountable authority of a Commonwealth entity may, by written instrument, give instructions to an official of the entity about any matter relating to the finance law.

2.4 The Department of Finance (Finance) provides further guidance in its Resource Management Guide (RMG) 206 on Accountable Authority Instructions (AAIs).15 This guidance includes model AAI templates covering procurement, risk management and disclosure of interests.16

2.5 The accountable authority for the Memorial is the Council and the Director is the Chief Executive Officer who ‘subject to and in accordance with the general directions of the Council, manage[s] the affairs of the Memorial’.17 The Director has issued Director’s Instructions covering financial and administrative management of the Memorial, including delegations. The Council has not made Accountable Authority Instructions. There was no evidence that the Council had delegated authority to the Director to issue instructions.

Recommendation no.1

2.6 The Australian War Memorial strengthen controls by issuing Accountable Authority Instructions (AAIs) consistent with RMG206 Model AAIs for corporate Commonwealth entities and ensuring that it documents any of its powers that have been delegated to the Director.

Australian War Memorial’s response: Agreed.

2.7 The Council of the Australian War Memorial delegated the authority to make and approve AAIs to the Director of the Australian War Memorial, consistent with RMG206, at Meeting 184 (March 2024).

2.8 Paragraph 8.2 of the CPRs states:

Relevant entities must establish processes to identify, analyse, allocate and treat risk when conducting a procurement. The effort directed to risk assessment and management should be commensurate with the scale, scope and risk of the procurement. Relevant entities should consider risks and their potential impact when making decisions relating to value for money assessments, approvals of proposals to spend relevant money and the terms of the contract.

2.9 Policies, procedures and guidance materials have been established regarding procurement, which align with the PGPA Act and CPRs.

2.10 The Memorial’s 2016 Procurement Manual was replaced in June 2020 by new policies informed by a 2019 internal audit. The internal audit noted the existing policy was largely consistent with the CPRs, but could be improved by updated guidance on conflict of interest and use of AusTender. The procurement policies introduced in 2020 and updated in 2022 include

- Procurement Framework — outlines procurement policies and relevant legislation applicable to Memorial procurements.

- Procurement Guidance — provides detailed guidance on procurement processes, including requirements of the CPRs and the best practice principles of the Australian Contract Management Guide.

2.11 The Memorial’s Probity Guidelines issued in September 2019 and updated in 2022 include guidance for managing conflict of interest, including:

- requirement to complete a deed of confidentiality and declaration of conflict of interest ‘prior to any involvement in the RFT process’;

- declaring any existing business or personal relationships with tenderers or potential tenderers; and

- specific steps to ensure incumbent suppliers do not obtain an unfair advantage.

2.12 The procurement and probity policies set out how probity advice can support ethical procurement but did not specify if or when this was required. The Memorial’s Procurement Guidance stated, ‘Consideration, particularly for high value procurements, should be given as to whether appointing a legal or probity adviser is necessary.’ Probity plans are mentioned once in this document, with no direction of when they must be developed.

2.13 The procurement approach for the Development Project is set out in the Contracting Strategy and Procurement Schedule (Project Strategy). The Project Strategy was approved in 2019 by the Executive Project Director (EPD) and updated in March 2023. This included specific references to probity arrangements, including the engagement of a dedicated probity advisor for major design and construction works and ‘individual probity plans where necessary’. The Memorial’s oversight and assurance could be improved with Memorial Development Committee approval of the Project Strategy and other key governance documents.

2.14 The Memorial developed procurement templates that are ‘not mandatory but is strongly recommended to ensure that minimum documentation and policy requirements are met’. Table 2.1 sets out the ANAO assessment of these templates and where these were used for the Development Project.

Table 2.1: The Memorial’s procurement templates

|

Memorial template |

ANAO assessment |

Used for the Development Project |

|

Approval to Proceed (procurement plan) |

Incorporates CPR requirements for estimate of procurement value, risk assessment, procurement method and how value for money assesseda |

Since November 2023 |

|

Request for Tender |

Consistent with CPRs |

Yes (see paragraph 3.64) |

|

Tender Evaluation Plan |

Consistent with CPRs |

Yes (see paragraph 3.64) |

|

Tender Evaluation Report |

Consistent with CPRs |

Yes (see paragraph 3.64) |

|

Deed of Confidentiality and Conflict of Interest Declaration |

Consistent with CPRs activity specific, includes version for employees and contracted personnel |

Yes, for tender evaluation committee members Since October 2023 for delegate and other tender advisors |

|

Contract Management Plan |

Consistent with CPRs and contract management guide |

No (see paragraph 4.17) |

|

Probity Plan |

Consistent with CPRs |

No (see paragraph 3.27) |

Note a: Commonwealth Procurement Rules.18

Source: ANAO assessment of Memorial documentation.

2.15 The Memorial has a centralised procurement team that supports staff with all stages of the procurement process. The Memorial’s policies, guidance and procurement templates were aligned with the CPRs and available to staff on the Memorial intranet.

2.16 The Project Strategy is a key document that articulates how all procurement and contract activities for the Development Project are managed at the whole of project level to meet core objectives of quality, built outcomes and timeliness. The Integrated Management Team (IMT) was established in May 2019 to implement the Project Strategy.

|

Opportunity for improvement |

|

2.17 The Memorial could improve the clarity of its frameworks and policy documents by specifying mandatory documentation requirements which ‘must’ be adhered to rather than ‘should’ be used. |

Does the Memorial have effective governance and project management arrangements?

Specific governance arrangements were established to manage the budget, deliverables and the increased risk associated with the scale and complexity of the Development Project. Governance arrangements have clearly defined organisational structure and reporting responsibilities which support the Council and Director maintaining appropriate oversight. A suite of project-specific policies was developed to support procurement, contract management and project delivery, which are reviewed annually. Record keeping practices did not follow approved processes. The Development Project was not subject to a Gateway Review under the Australian Government Assurance Reviews Framework.

Governance arrangements

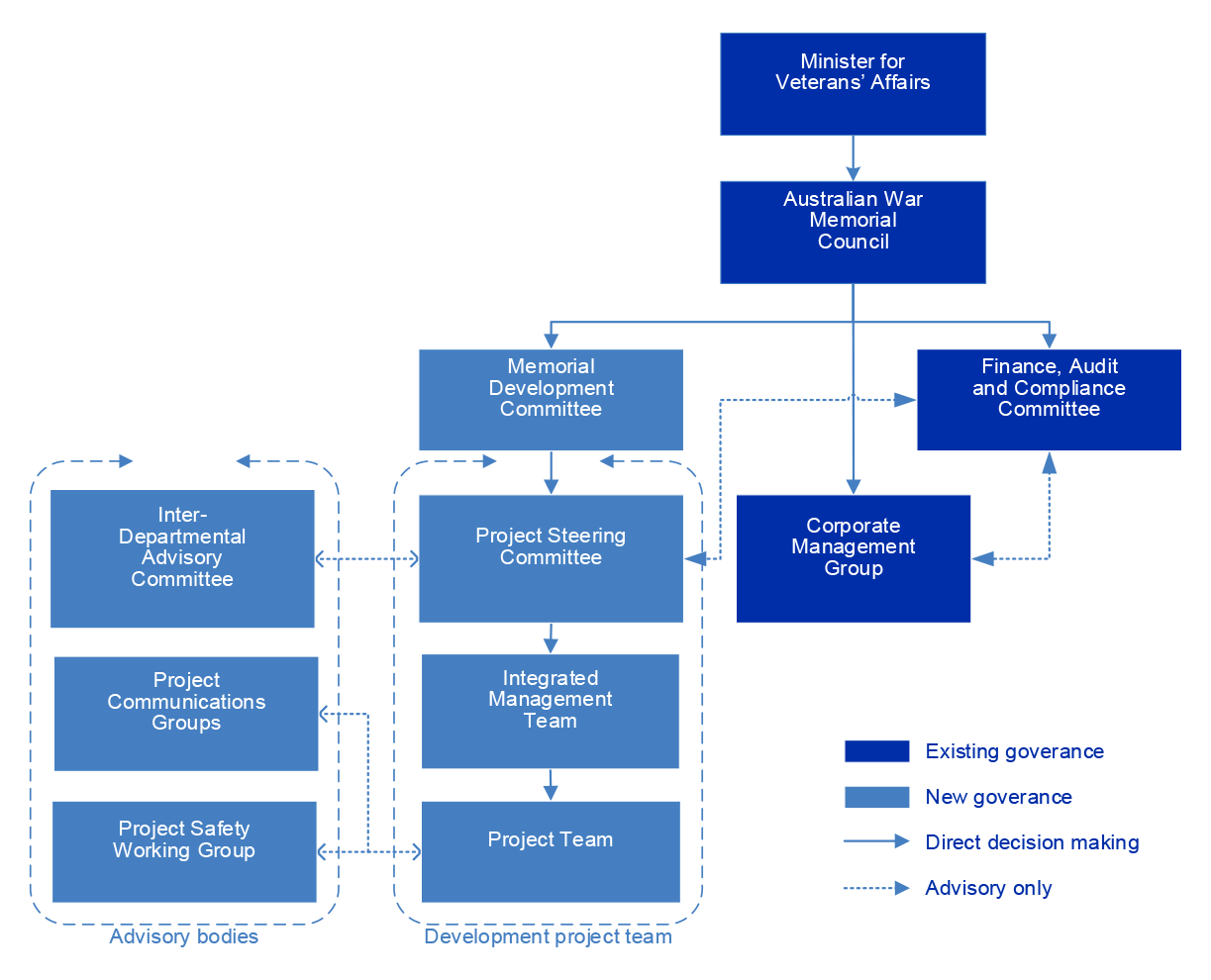

2.18 The initial appropriation of $498.7 million19 for the Development Project represented a significant increase in the Memorial’s usual construction-related procurement activity. The Council established new governance structures for the Development Project and integrated these with the existing governance functions of the Memorial. The arrangements were informed by the proposed governance and delivery approach outlined in the 2018 Detailed Business Case (DBC). Figure 2.1 summarises the governance structure.

Figure 2.1: Memorial governance structure

Note: The new governance arrangements were implemented from early 2019.

Source: ANAO analysis of Memorial’s governance arrangements for the Development Project.

2.19 The Memorial Director is the designated Senior Responsible Officer for the Development Project and reports to Council.

2.20 The 2018 DBC proposed the establishment of an Executive Project Director (EPD), ‘responsible for delivering the overall project objectives, including the day-to-day management of time, cost and quality risks.’

2.21 The Memorial established the position of the EPD as proposed and the occupant of the role is the decision maker for all operational decisions and provides weekly updates to the Director on Development Project progress.

2.22 The key governance mechanisms for the Development Project are summarised in Table 2.2. There is clear delineation of roles and responsibilities.

Table 2.2: Governance of the Memorial’s Development Project

|

Forum |

Purpose |

Planned meeting frequency |

|

Council |

The Accountable Authority, responsible for the overall conduct and control of the affairs of the Memorial in accordance with the Australian War Memorial Act 1980. |

Quarterly, or as often as determined by the Chair |

|

Finance, Audit and Compliance Committee (FACC) |

A committee of the Council per section 45 of the PGPA Acta that provides independent advice and assurance on the Memorial’s financial and performance reporting, systems of risk oversight and management, and internal control systems. Includes one independent external member. |

Quarterly |

|

Memorial Development Committee (MDC) |

A committee of the Council that provides assurance and advice on the Development Project’s governance, program of works, management control, risk and value for money. Includes members of the Council, two external advisors, independent audit member (from FACC) and a former Council Chair. |

Quarterly |

|

Project Steering Committee (PSC) |

Provides oversight and endorsement of decisions by the EPD, in the delivery of all aspects of the Development Project. Membership is the Memorial Director (chair), the three Assistant Directors, and the EPD. |

Quarterly; more frequent during early or critical stages of the project |

|

Corporate Management Group (CMG) |

Responsible for strategic oversight and day-to-day operations of the Memorial, including the Development Project’s impacts on business-as-usual operations. |

Weekly |

|

Inter-Departmental Advisory Committee (IDAC) |

Established to review project progress, risk and compliance with government policy. Includes Memorial Director and members from the departments of Prime Minister and Cabinet, Finance, Treasury, Veterans’ Affairs, Defence and the National Capital Authority. |

Quarterly |

|

Project Communications Group(s) |

Established to maintain communications between Integrated Management Team and the Memorial’s other business areas. Group was split in June 2021 into separate groups for Precinct (construction) and Gallery Development (fitout and collection installation). |

Every two months |

|

Integrated Management Team (IMT) |

Established to provide integration between the governance and operational areas involved in the Development Project. The IMT includes both Memorial staff and management and technical consultants. |

Weekly |

Note a: Section 45 of PGPA Act sets out the requirement for a Commonwealth entity to have an audit committee.

Source: ANAO analysis of governance arrangements.

2.23 The Council maintains oversight of the Development Project through quarterly reports on risk, project progress and budget management from the Memorial Development Committee (MDC) and the Director, both of which are standing agenda items for Council meetings. Minutes of key meetings reflect consideration of advice provided by supporting committees, except that consideration of IDAC advice by Council, MDC or FACC was not recorded.

|

Opportunity for improvement |

|

2.24 To enhance the transparency of the governance arrangements for the Development Project, the Memorial could provide the Inter-Departmental Advisory Committee (IDAC) minutes to the Memorial Development Committee (MDC) and Finance, Audit and Compliance Committee (FACC). Any actions or decisions arising out of the consideration of the IDAC could then be reported to the Council via the committee’s usual reporting processes. |

2.25 The Memorial’s governance structures were appropriate to manage risk and support delivery of the Development Project. There was sufficient engagement by the Council and representation of senior executive and operational staff across relevant groups to provide oversight and inform strategic direction of the project.

2.26 In addition to the 2019 internal audit of procurement policies (paragraph 2.10), a 2020 internal audit reviewed the Memorial’s management of work health and safety (WHS) governance for the Development Project. This audit found WHS governance arrangements were appropriate. As at January 2024, there were no other internal audits completed for the Development Project. The Memorial’s oversight and assurance could be improved with additional internal audits.

Memorial Development Committee

2.27 The Memorial Development Committee (MDC) was established in August 2019 to ‘provide independent assurance and advice to Council on matters relating to the Memorial’s Development Project.’ The MDC operates as a committee of Council with membership drawn from Council, two external advisors (initially two construction experts and, from 2023, one construction and one design expert), an external audit advisor (the independent member from the Finance, Audit and Compliance Committee), and a former Council chair as a further advisor. MDC meets quarterly ahead of the Council’s meetings and reports on progress, risk, safety, and budget.

Project Steering Committee

2.28 The Project Steering Committee (PSC) provides oversight of key areas of the Development Project, including progress, quality, safety, and cost. Case Study 1 below provides an example of how the decision to include the Geothermal Heat Exchange (GHX) was considered by the PSC, MDC and the Council.20

|

Case Study 1 Decision making for inclusion of Geothermal Heat Exchange |

|

At the 15 June 2022 Memorial Development Committee (MDC) meeting, management highlighted ‘the need to re-examine the previously discarded option of geothermal energy’ due to expected future higher gas costs. MDC considered the full proposal for $10 million for complete de-gasification of the Central Energy Plant and other options to partially degasify the site and prepare for full geothermal use in future. MDC agreed for management to develop options for a $10 million scope reduction on the Development Project to potentially fund the Geothermal Heat Exchange (GHX) within the existing funding allocation from the Australian government. The report for the 22 July 2022 PSC meeting highlighted the possible inclusion of GHX in design as a new risk that had the potential to impact time and budget of the Development Project. At the 18 August 2022 meeting, MDC recommended to Council not to proceed with the proposed GHX technology as no additional funding had been secured and proceeding would likely lead to reduction in project scope. The MDC’s recommendation was considered at the 19 August 2022 Council meeting. Council decided to proceed with the installation of GHX technology on the basis of long-term environmental and economic benefits. The Minister for Veteran’s Affairs announced on 29 September 2022 that ‘the Geothermal Heat Exchange (GHX) will be funded within the War Memorial’s existing development package’.21 |

Integrated management team

2.29 The Memorial established an Integrated Management Team (IMT) with internal and external expertise, to manage operational delivery of the Development Project, including project management, procurement, and contract management. The IMT is led by the EPD and includes 42 Memorial staff and nine consultants (six from TSA Management and three labour hire). Each of the Main Works Packages (MWP), discussed in paragraph 1.3, have a dedicated project manager within the IMT. The Memorial maintains a responsibility matrix that provides clear roles and responsibilities for all members of the IMT.

2.30 The EPD maintains oversight over all elements of the project through reporting from the Director for Procurement and Design, Director for Gallery Development, and the Construction Operations Manager.

2.31 The IMT members are involved in 25 committees or working group meetings related to the Development Project. Weekly meetings occur within the IMT and between the IMT and other business areas across the Memorial to share information and coordinate activities. Key IMT meetings are summarised in Table 2.3.

Table 2.3: Key integrated management team (IMT) operational meetings

|

Meeting name |

Purpose |

Planned frequency |

|

IMT Team Meetings |

Team updates |

Weekly |

|

3 Week Look Ahead (Operational Impacts) |

IMT and AWM Operational teams to coordinate activities |

Weekly |

|

Notices of Disruption/Logistics Meeting |

IMT and head contractor meeting for logistic coordination |

Weekly |

|

Project Management Group |

IMT management meeting |

Weekly |

|

Head Contractor Project Control Group (PCGa) |

Coordination of medium–long term objectives between IMT and AWM operational areas |

Monthly |

|

Gallery Development PCGa |

Coordination between IMT and AWM operational areas |

Monthly |

|

Project Coordination Groupsb MWP1, 2, 3 and 4 |

IMT and MWP head contractor |

Monthly |

|

Cost Control Meetingsc |

Review of financial progress |

Every six weeks |

Note a: In July 2021 the Project Communications Group (PCG) split into Precinct (construction) and Gallery Development groups.

Note b: There are four MWP Project Coordination Groups, one for each of the four Main Works Packages.

Note c: Cost control meetings occur once every six weeks for every main works package and for gallery design.

Source: ANAO analysis.

Record keeping

2.32 Paragraphs 7.2 to 7.5 of the CPRs state:

7.2 Officials must maintain for each procurement a level of documentation commensurate with the scale, scope and risk of the procurement.

7.3 Documentation should provide accurate and concise information on: a. the requirement for the procurement; b. the process that was followed; c. how value for money was considered and achieved; d. relevant approvals; and e. relevant decisions and the basis of those decisions.

7.4 Relevant entities must have access to evidence of agreements with suppliers […].

7.5 Documentation must be retained in accordance with the Archives Act 1983.

2.33 The Memorial’s Director’s Instructions 8.02 Records Management and Public Access Policy requires all records produced by the Memorial to be stored within a central record keeping system. This policy was last updated in October 2012. Administrative records are to be ‘listed and managed’ via Tower Records Information Management System (TRIM). Financial management information is to be stored within the Memorial Integrated Business Information System (MIBIS).

2.34 The ANAO observed the Memorial using SharePoint, TechOne, and Aconex22 to manage and store Development Project records. SharePoint is listed as the approved system for administrative records in a draft information management policy prepared in 2022. The draft policy has not been finalised nor approved and the Memorial was unable to provide evidence of an authority for the implementation and use of SharePoint as a central record keeping system. There were no registered files created for the Development Project. The Memorial’s six-monthly published file lists in accordance with Senate Order 12 do not include records of files created for the Development Project.23

2.35 The Memorial’s procurement policies require records of all approval requests, approvals and documentation relating to decisions to be stored in SharePoint, including decisions for not following mandatory procurement policy obligations. The Memorial SharePoint Naming Convention Guidelines dated April 2012 provides advice on consistent naming practices to be used for record keeping.

2.36 The ANAO identified deficiencies with the Memorial’s record keeping practices in Chapter 3 and Chapter 4 (see paragraphs 3.65, 3.66, 3.67 and 4.55).

Recommendation no.2

2.37 The Australian War Memorial update its records management policies to ensure electronic recordkeeping systems are defined and approved, and implement quality assurance controls to ensure records are maintained in accordance with its policy and the requirements of the Archives Act 1983.

Australian War Memorial response: Agreed.

2.38 The Memorial commenced the review and update of its Records Management policies in Q4 2023; it expects a revised policy to be agreed and implementation to commence not later than end Q2 2024.

Project management frameworks

2.39 The Memorial is managing contracts that form part of the Development Project collectively at a whole of project level. This approach is consistent with the delivery partner arrangements recommended in the Detailed Business Case and detailed in the Governance Handbook and in the Contracting Strategy and Procurement Schedule. The Memorial has engaged head contractors (under lump sum delivery contracts) for each of the MWPs. The Memorial maintains responsibility for overall risk, design, and integration between the MWPs.

2.40 The Memorial established a suite of project management plans which detail the Memorial’s approach to contract management for the Development Project. These include a Cost Management Plan, Risk Management Plan and Construction Management Plan. The plans provide guidance to staff to support delivery of the Development Project. Project management plans are reviewed annually, with appropriate version control arrangements in place.

Contract management plans

2.41 The Memorial’s corporate procurement team created a Contract Management Plan template in 2020. The procurement policy advises that the template should be used for all high value contracts. This template requires the contract manager to complete sections covering main contract details (supplier, deliverables, cost), performance measures, reporting requirements and to complete a risk assessment. The template also includes sections to record contract variations and contract reviews.

2.42 The Memorial developed a Construction Management Plan in July 2021 for the Development Project which has been revised five times, with the latest version dated 4 May 2023. This plan ‘outline[s] the process for transition from design and procurement to … ongoing delivery requirements’. The plan includes arrangements for engagement of head contractors for the MWPs, including interface between each MWP, scope and frequency of contractor meetings, communication protocols via Aconex, site diaries, safety, quality assurance, and program management, planning and logistics. The Memorial advised the Construction Management Plan is used instead of individual contract management plans, consistent with the program level approach taken for the management and delivery of the Development Project. The Memorial’s management of contracts is discussed further in Chapter 4.

Risk management

2.43 The Memorial’s Director’s Instructions 8.9, Risk Management Framework, require a full risk assessment for projects with a budget over $5 million. The Memorial developed a Risk Management Plan which sets out a risk management framework specific to the Development Project, including scope, governance, process, culture, tools and reporting. The Memorial strengthened the Development Project risk management processes in May 2022 with the introduction of a consolidated risk register, which is reviewed and updated quarterly. The risk register assigns ownership of significant risks to PSC and high risk to MDC. Both committees review project risk as standing agenda items. MDC reports to Council include a standing item on risk.

Australian Government assurance reviews

2.44 The Australian Government Assurance Reviews Framework, which includes Implementation Readiness Assessments (IRA) and Gateway Reviews (Gateway Review), applies to high-risk projects undertaken by non-corporate Commonwealth entities (NCEs) valued at $30 million or more24:

Assurance reviews do not replace an entity’s responsibility and accountability for implementation and delivery of a program/project. Assurance Reviews are designed to strengthen assurance practices and to build capability associated with the delivery and implementation of government programs/projects and services.

2.45 Decisions to implement assurance reviews are made by the Australian Government during budget funding approvals processes. As the Memorial is a corporate Commonwealth entity (CCE), there was no requirement for consideration of applying an IRA or Gateway Review.

|

Opportunity for improvement |

|

2.46 The Department of Finance could amend the scope of Resource Management Guide 106 Australian Government Assurance Reviews, to include corporate Commonwealth entities (CCEs) undertaking high risk projects valued at more than $30 million, particularly where such projects are of greater cost and complexity than business-as-usual activities. |

3. Were procurement activities conducted in accordance with Commonwealth Procurement Rules?

Areas examined

This chapter examines whether the Australian War Memorial (the Memorial) has conducted procurements in accordance with the Commonwealth Procurement Rules (CPRs).

Conclusion

Procurement activities were largely conducted in compliance with the CPRs. Higher value procurements were conducted through open and competitive processes and assessments were appropriately documented in tender evaluation reports. Value for money assessments were not adequately documented for the variation in price between tender responses and executed contracts or for lower value procurements.

Management of ethical and probity risks was partly effective. Engagement with the external probity advisor was insufficient for the scale and risk of the procurements. Conflicts of interest were not adequately documented and declared or known conflicts were not adequately managed. Incumbency risks related to the procurement for ongoing project management services were not adequately managed and steps were taken to avoid seeking ministerial approval for the entering into contracts on two occasions.

Minister’s briefs were insufficiently detailed to support the minister to meet their obligations under section 71 of the Public Governance, Performance and Accountability Act 2013.

Areas for improvement

The ANAO made two recommendations to the Memorial aimed at strengthening the ethical conduct of procurements and processes for assuring appropriate records are maintained of value for money assessments.

3.1 The Australian Government’s procurement framework is set out in the Commonwealth Procurements Rule (CPRs). Achieving value for money is the core rule of the CPRs.25 Entities can demonstrate the achievement of value for money by:

- conducting competitive procurement activities that treat all tenderers equitably and manage risks related to incumbent service providers;

- assessing financial and non-financial costs and benefits;

- documenting the methodology and outcomes of the evaluation of tender responses; and

- providing written advice to decision makers that supports an assessment of the proper use of public money consistent with the requirements of the Public Governance, Performance and Accountability Act 2013 (PGPA Act).26

3.2 The CPRs also require entities ‘maintain for each procurement a level of documentation commensurate with the scale, scope and risk of the procurement’ and ‘be retained in accordance with the Archives Act 1983’.27

Were procurement activities conducted in an open and competitive manner?

Open tenders and multiple quotes from panel arrangements for tenders were used to maximise competition for higher value procurements. Evaluation criteria for each procurement stage was not published at the beginning of multistage procurements. Lower value procurements were not adequately documented. Seventy-three per cent of contracts were reported on AusTender within the required 42 days. Incumbency risks were not appropriately managed for the project management services procurement.

Procurement planning

3.3 Procurement is the process of acquiring goods and services. It begins when a need has been identified and a decision has been made on the procurement requirement. Procurement continues through the processes of risk assessment, seeking and evaluating alternative solutions, and the awarding and reporting of a contract.28

3.4 Phases of procurement planning are set out in the Memorial’s procurement guidance documents including defining procurement requirements, estimating costs, approval to proceed prior to approaching the market, evaluation criteria and plans and complaint resolution processes (see Chapter 2 paragraphs, 2.10 to 2.14 and Table 2.1). The Memorial implemented a multistage procurement process for key Development Project contracts, including for the first three Main Works Packages (MWP): Southern Entrance (MWP1); CEW Bean Building (MWP2); and Anzac Hall and Glazed Link (MWP3).

3.5 The Memorial’s planned procurement approach, and the rationale for such, was documented for each category of procurement activities in the Project Contracting Strategy and Procurement Schedule (Project Strategy). The splitting of the project into construction MWP was designed to increase participation of companies of different sizes and improve value for money by expanding the pool of potential suppliers. The Memorial advised that it consulted with eight construction companies to inform the procurement strategy for the MWPs. There was no evidence of a market assessment of potential MWP tenderers or minutes of the pre-tender consultation with construction companies.

3.6 The CPRs require that the procurement approach be determined by the estimated cost of the procurement and the prescribed thresholds.29 Relevantly for the Memorial, open tender approaches to market must be used for non-construction services valued greater than $400,000 or for construction services greater than $7.5 million. The estimated cost also informs an assessment of the risk management and documentation required for size and scale of the procurement.30

3.7 The Memorial’s procurement policies state that an Approval to Proceed ‘should be sought for medium value and high value procurements’ using the Approval to Proceed form before the procurement progresses to the market. This form is a procurement plan that shows a delegate’s ‘in principle approval’ for the procurement and includes an estimation of costs, risk assessment, method of intended procurement and how value for money will be assessed.

3.8 Of the 18 procurements sampled, there were 15 medium and high-value procurements, and of these two procurements had Approval to Proceed forms signed by a delegate before progressing to market.3132

3.9 Costs were largely estimated for non-construction procurements in the 2018 Detailed Business Case (DBC). The cost estimates for high value construction procurements from the DBC were further refined by quantity surveyor analysis.

3.10 Procurement planning documentation was not commensurate with the scale, scope and risk of each procurement as required by section 7.2 of the CPRs. The method of procurement had been largely documented in the Project Strategy however, the absence of Approval to Proceed using the template set out in the Memorial’s procurement policy, limited the transparency of its procurement planning activities.

3.11 The Memorial advised in November 2023 that it mandated its Approval to Proceed process (see Appendix 2).

Method of tender

3.12 The ANAO identified a population of 207 contracts in June 2023 related to the Development Project, valued at $443,047,866.54. The ANAO took a targeted sample of 18 procurements (20 contracts) on the basis of materiality, value and risk. This included all six procurements over $10 million. The sample represents 87 per cent of the project’s total contracted value as of June 2023.3334 See Appendix 3 for a list of procurements, with the value of each contract as reported on AusTender at October 2023.35 Table 3.1 sets out the method of procurement used for each sampled item:

Table 3.1: Method of tender in sampled procurements (GST inclusive)

|

Form of tender |

Number of procurement |

Contract value as at June 2023 |

|

Open tendera |

12 |

$361,269,119.55 |

|

Limited tenderb |

6e |

$23,002,134.57 |

|

Totalc d |

18 |

$384,271,254.12 |

Note a: Open tender is an approach by the entity to the market inviting submissions from anyone interested in participating in the procurement. The approach to the market must be published on AusTender and include relevant request documentation. Potential suppliers must have at least 25 days, from the date and time of publish, to respond.36

Note b: Limited tender occurs when an entity directly approaches potential suppliers that they have selected.37

Note c: There were 18 procurements in the sample and 20 contracts. One procurement sampled resulted in three contracts added together to represent the value of the sample.

Note d: The total value of the sample includes contract values as reported on AusTender, or the initial value included in contracts where not reported on AusTender.38

Note e: Three procurements below the CPR threshold were sole source limited tender, one procurement approached five and another approached two potential suppliers. The single limited tender above the CPR threshold approached three potential suppliers.

Source: ANAO analysis.

3.13 Of the 12 open tender procurements sampled, two were from procurement panels representing six per cent of the value of open tender procurements sampled. For these panel procurements the Memorial approached six panellists for one and 19 panellists for the other procurement, consistent with the CPRs recommendation of approaching more than one panellist.39

3.14 Within the sample, one limited tender procurement was carried out above the procurement threshold after an unsuccessful open tender. This was the procurement for the Early Works Package 4, which followed an unsuccessful open tender process.

Equitable treatment of tenderers

3.15 The CPRs require entities to treat potential suppliers equitably throughout the process based on their ‘commercial, legal, technical and financial abilities and not be discriminated against due to their size, degree of foreign affiliation or ownership location or origin of their goods and services.’40

3.16 The publishing of evaluation criteria in tender documents informs potential suppliers how submissions are to be assessed and supports ‘the proper identification, assessment and comparison of submissions on a fair, common and appropriately transparent basis.’41 For multistage procurements, the CPRs require that criteria to be used at each stage and any limit on the number of respondents to be shortlisted must be included in the initial approach to market.42

3.17 Of the 18 procurements sampled by the ANAO, there were five Requests for Expressions Of Interest (REOI) released to the market as the first phase of nine multistage procurements. The five REOIs led to nine Request For Tender (RFT) processes. Table 3.2 sets out the results of the comparison between evaluation criteria released at REOI and RFT stages.

Table 3.2: Evaluation criteria published in multistage procurements in ANAO sample

|

Request for expression of interest |

Request for tender |

Evaluation criteria for each stage of the procurement released at the first stage |

|

Construction contractor(s) main works packagesa

|

Main Works Package 1 |

▲ |

|

Main Works Package 2 |

▲ |

|

|

Main Works Package 3 |

▲ |

|

|

Engineering design disciplines

|

Structural Engineering Services |

■ |

|

Electrical Engineering Services |

■ |

|

|

Communications and Security Engineering Services |

■ |

|

|

Architectural design services

|

Architectural Design Package 4 |

■ |

|

Architectural Design Package 1 |

■ |

|

|

Cost manager and quantity surveyor |

Quantity surveying services |

■ |

Key:

◆ Compliant with the requirement in paragraph 7.15 of the CPRs.

▲ Partly compliant with the requirement in paragraph 7.15 of the CPRs.

■ Not compliant with the requirement in paragraph 7.15 of the CPRs.

Note a: There was a second Request for Expression of Interest activity for Main Works Packages 1 and 3 which also did not include evaluation criteria to be used at RFT.

Source: ANAO analysis.

3.18 For MWP1, 2 and 3 there were changes in the evaluation criteria released at the different stages of the procurement process. There were also changes between the first REOI and the second REOI (REOI2) for MWP1 and 3. See Appendix 4 for further information on the publishing of evaluation criteria for the MWP.

3.19 Evaluation criteria for the RFT stage of Architectural Design Services, Engineering Design Disciplines, Cost Manager and Quantity Surveyor services was not published at REOI stage.

Incumbency advantage

3.20 When an incumbent provider competes for new work, it may have (or be perceived to have) certain advantages, such as understanding of an agency’s needs, established relationships with agency staff, and knowledge that is not available to other potential suppliers.43

3.21 For the procurement of project management services, the Memorial did not ensure equitable treatment of other tenderers competing with the incumbent supplier. The incumbent supplier provided advice to the Memorial on the scope of works for the future project management services. Conflict of interest declarations were not recorded. Case Study 2 outlines the history and key issues with this procurement.

|

Case Study 2 Procurement of project management services |

|

The Australian War Memorial (the Memorial) engaged Xact Project Management (Xact) in March 2018 for project management services to assist with the development of the Detailed Business Case (DBC), under an official order for a maximum value of $319,572.44 This was later varied in March 2019 to $999,999, one dollar below the threshold for ministerial approval.45 Consistent with the 2018 DBC, the Memorial identified a need for ongoing project management services as the Development Project progressed. Xact’s project manager provided detailed advice about the scope of works and potential suppliers for the future contract in October 2018 and January 2019. One Memorial official who received this advice became chair of the evaluation panel. On 5 February 2019, the Memorial issued a Request For Quotation (RFQ) to six panellists on the Property and Project Management Services Panel, including Xact.46 The RFQ stated the initial contract would be for three years with options to extend annually, up to nine years (to the end of the project in 2028). The RFQ asked respondents to supply rates based on up to ten hours per day, five days a week. Three panellists responded and were assessed: Xact scoring highest at 12.75, Tenderer 2 second at 11.3 and Tenderer 3 third at 9.6. Xact’s response to the RFQ proposed the incumbent project manager for the works. The panel’s evaluation of Xact’s submission included observations from the existing working relationship:

The delegate and evaluation team did not complete conflict of interest declarations. Each had an undeclared conflict from the working relationship with the incumbent project manager. The panel’s methodology for assessing value for money assumed two days per week for the project manager and three days per week for the assistant project manager over three years. Xact was ranked first for value for money based on this evaluation methodology. The rationale for this methodology was unclear and was not specified in the RFQ. Under this methodology Xact, which compared to other tenderers, had a higher priced project manager and a lower priced assistant project manager, ranked first. If the methodology assumed the project manager worked full time, as outlined in the RFQ, Xact would have ranked third by cost. The evaluation panel noted that Xact’s ‘proposal delivers the best value for money through its demonstrated capability and deep understanding of the project requirements.’ The evaluation assessed that the time lost in bringing in new project management services would undermine potential savings from other suppliers. The evaluation committee recommended Xact be awarded a three year contract term and noted the maximum value of the contract, including a 20 per cent contingency, as $2.5 million (GST inclusive). The delegate accepted the recommendation on 9 April 2019, to contract Xact based on the estimated price of $1,142,777 over three years. The Memorial executed a contract with TSA Management (ACT) trading as Xact Project Consultants on 1 May 2019, during the caretaker period, for $805,000, below the threshold for ministerial approval. The contract duration was 12 months to 30 April 202047 with the option to extend for up to eight years. The contract included the potential to engage four additional personnel, of whom only the assistant project manager was included in the evaluation committee’s value for money assessment. In September 2019, the Memorial advised the Minister that the contract was initially executed for five months ‘Due to the government being in caretaker mode at this time’ and that ‘TSA Management’s performance has been excellent and that the Memorial intends to exercise the option to extend this contract.’ The value of this contract has been varied twice: from $805,000 to $6,555,000 and then to $16,865,026. In the 24 June 2021 brief to the Minister for the approval of the second change in value, the Memorial advised:

The spending proposal to the Director for the second change in contract value, signed 3 August 2021, included a summary of value for money considerations largely relating to the increase in risks, costs and time in selecting a new project manager at that stage of the Development Project. This was not included in the brief to the Minister. On 5 August 2021, an internally prepared response to a request for advice from the Director about the procurement stated:

The Director was further advised in this advice that the Xact project manager ‘stepped aside at the appropriate time, ensuring he had no involvement with the procurement process’. The Director was not informed of the scoping advice provided by the project manager. |

Tenderer debriefing