Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Taxpayers’ Use of Transfer Pricing for Related Party Debt

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Transactions between two entities in the same group are related party transactions. The pricing of these transactions is transfer pricing.

- Interest on related party loans is generally tax deductible, so transfer pricing should be consistent with what would be expected between independent parties.

- Transfer mispricing can lead to a loss of tax revenue for the Australian Government.

- The audit provides assurance to Parliament on the effectiveness of the Australian Taxation Office’s (ATO’s) management of transfer pricing for related party debt.

Key facts

- 2020–21 inbound international related party borrowings in Australia totalled $520 billion, with $13.2 billion in interest expenses.

- The ATO assesses a sample of taxpayers’ largest and highest risk transactions.

- The ATO aims to review all 85 Top 100 and 250 Top 1,000 taxpayers annually.

What did we find?

- The ATO is largely effective at managing taxpayers’ use of transfer pricing for related party debt. Effectiveness is reduced by not assessing, meeting and reporting on assurance targets.

- The ATO is largely effective at identifying and managing transfer pricing risks for related party debt.

- The ATO has established a largely effective strategic framework to manage taxpayers’ use of related party debt.

- The ATO is largely effective at managing taxpayers’ use of transfer pricing for related party debt.

What did we recommend?

- The Auditor-General made four recommendations to: determine the number of assurance reviews required to gain assurance, analysing and recording why entities may not lodge reporting, scrutinising taxpayers who choose not to use the ATO’s primary engagement mechanism, and improving training.

- ATO agreed to three of the recommendations and in principle to one.

1,563

economic groups in the Top 100 and Top 1,000 in 2021–22, 85 and 1,478, respectively.

58%

of corporate income tax in 2021–22 was paid by Top 100 and Top 1,000 taxpayers.

~63% and 61%

completed annual target reviews of Top 100 and Top 1,000 taxpayers between 2020–21 and 2022–23.

Summary and recommendations

Background

1. The Australian Taxation Office (ATO) is the principal revenue agency responsible for administering the tax system and aspects of the superannuation system. As part of its duties, the ATO conducts compliance activities to ensure taxpayers are complying with tax requirements. The ATO’s stated purpose is to contribute to the economic and social wellbeing of Australians by fostering willing participation in the tax, superannuation, and registry systems.

2. The ATO’s Corporate Plan 2023–241 identifies multinational tax performance as a key focus area, with a number of deliverables, including:

- address key risks to the corporate tax base and close tax loopholes so that the community has confidence that public and multinational businesses are paying the right amount of tax in Australia; and

- support the integrity of the tax system by boosting tax transparency through better public reporting of large business tax information.2

Rationale for undertaking the audit

3. The latest publicly reported figures indicate that in 2020–21 inbound international related party borrowings in Australia totalled $520 billion, with $13.2 billion in interest expenses paid.3 The ATO monitors entities belonging to the Top 100 and Top 1,000 populations.4 Approximately 33 per cent of these inbound related party borrowings were attributed to the Top 100 entities and an additional 40 per cent were reported by the Top 1,000 entities.

4. The ATO has identified inbound related party borrowings as a key risk. In the ATO’s 2022 assurance activities for the Top 100 entities, related party financing represented the highest proportion of unassured items receiving a red flag rating5 to indicate likely non-compliance with income tax laws.6 Similarly, amongst the Top 1,000 entities, financing assurance activities resulted in a higher amount of low assurance and red flag ratings (22 per cent) than other areas reviewed.7 Interest bearing loans were the largest category of financing risks reviewed.8

5. This audit will provide assurance to the Parliament that the ATO effectively manages transfer pricing for related party debt, using sound strategies and processes to address risks and to ensure related party debt is appropriately priced. This audit was identified as a priority by the Parliament’s Joint Committee of Public Accounts and Audit in the context of the ANAO’s 2022–23 and 2023–24 Annual Audit Work Program.

Audit objective and criteria

6. The objective of the audit was to assess the effectiveness of the ATO’s management of transfer pricing for related party debt.

7. To form a conclusion against the objective, the following criteria were adopted.

- Are the risks relating to transfer pricing for related party debt appropriately managed?

- Does the ATO have a sound strategic framework to manage the use of transfer pricing for related party debt?

- Does the ATO effectively manage transfer pricing for related party debt?

Conclusion

8. The ATO is largely effective at managing taxpayers’ use of transfer pricing for related party debt. Effectiveness is reduced by not assessing, meeting and reporting on assurance targets.

9. The ATO is largely effective in identifying and prioritising risks to transfer pricing for related party debt. Its processes operate at the ATO business line level and are sound. The risk is primarily managed through use of the Top 100 Justified Trust Program and Top 1,000 Combined Assurance Program. However, management of risk is undermined by the ATO not meeting its stated taxpayer review targets to gain its desired level of assurance. Annually, the ATO seeks to review the entire Top 100 population, and 250 taxpayers within the Top 1,000 economic groups. This has not occurred during the audit period and the ATO has not conducted a process to determine whether an annual review of 250 Top 1,000 taxpayers provides sufficient oversight. There is no reporting to the Strategic Management Committee (SMC) on progress against targets for completed Pre-lodgment Compliance Reviews (PCRs) or Combined Assurance Reviews (CARs). The ATO does not conduct analysis on the reasons taxpayers may not be required to complete Country-by-Country local file reporting. Risk reporting occurs on a quarterly basis at the business level. As the risk has been rated as in tolerance, reporting has not been escalated to the enterprise level.

10. The ATO has established a largely effective strategic framework to manage the use of transfer pricing for related party debt. The principles outlined in Organisation for Economic Co-operation and Development (OECD) transfer pricing guidance are reflected in the ATO’s guidelines for staff and taxpayers. The ATO has a sound strategy to engage with taxpayers with related party debt, primarily through the application of Practical Compliance Guideline 2017/4 (PCG 2017/4), though training for staff is not mandatory and records of staff training are not kept. Further, while the ATO aims to review all taxpayers using related party debt that do not apply PCG 2017/4, this does not occur in the majority of cases. The ATO effectively supports engagement with taxpayers through the completion of assurance reviews, though a lack of IT quality controls means it cannot be determined with certainty that the Top 1,000 population is complete and accurate.

11. The ATO is largely effective at managing transfer pricing for related party debt. Data and intelligence are gathered to monitor taxpayer behaviour. The ATO largely applies its framework to analyse related party finance, though there are some variations in how the Top 100 and Top 1,000 teams verify taxpayer application of PCG 2017/4, and record analysis of taxpayer financing and capital structures.

Supporting findings

Managing risks related to transfer pricing for related party debt

12. The ATO has sound processes for identifying and prioritising risks to transfer pricing for related party debt at the business level. Procedures governing the operation of the ATO’s risk management framework are comprehensive and well-articulated. Data obtained through the Reportable Tax Position Schedule disclosures and the International Dealings Schedule is used along with self-assessments via PCG 2017/4 to monitor trends and detect risks. While Country-by-Country local file reporting provides further data, the ATO was unable to quantify the total number of taxpayers with a reporting obligation that had not complied with lodgment requirements. (See paragraphs 2.4 to 2.32)

13. The ATO uses the Top 100 Justified Trust Program and Top 1,000 Combined Assurance Program to engage with Top 100 and Top 1,000 taxpayers to manage transfer pricing risk. To gain assurance each year, the ATO aims to review all Top 100 taxpayers, and 250 Top 1,000 taxpayers. These targets have not been met over the last four years, and the ATO was unable to determine whether the Top 1,000 target provided sufficient oversight over the population. (See paragraphs 2.33 to 2.58)

14. As the business level risk relating to transfer pricing for related party debt has remained in tolerance, it has not been escalated for enterprise level consideration. At the business level the risk is monitored by the Public Groups SMC. The SMC receives quarterly reporting on the transfer pricing risk, but has not been provided with reporting on progress against targets for completed PCRs or CARs, meaning that the SMC cannot properly monitor the level of assurance the ATO has over the Top 100 and Top 1,000 populations’ use of transfer pricing for related party debt. Until October 2023, the SMC was required to ‘provide regular reports’ to the Public Groups Executive. This did not occur. (See paragraphs 2.59 to 2.63)

Strategic framework to manage the use of transfer pricing for related party debt

15. The principles outlined in OECD transfer pricing guidance are reflected in legislation and ATO guidance for both its staff and taxpayers. The ATO has taken action to incorporate recent updates to the OECD guidance into Australian law. The ATO’s approach to Country-by-Country reporting is largely consistent with its international obligations. (See paragraphs 3.3 to 3.27)

16. The ATO has developed a sound strategy to engage with taxpayers who use transfer pricing for related party debt. PCG 2017/4 forms the basis of the strategy. The ATO verifies taxpayer application of PCG 2017/4 through PCRs for the Top 100 population and CARs for the Top 1,000 population. Experts in the ATO’s Economist Practice are consulted to determine that transfer pricing has occurred appropriately. Staff have access to training to analyse transfer pricing, though training is not mandatory. Support is available to assist taxpayers in applying PCG 2017/4. While the ATO aims to review taxpayers who do not apply PCG 2017/4 this does not occur for the majority of cases. (See paragraphs 3.28 to 3.67)

17. The ATO has a framework to support engagement with taxpayers using related party debt. The Action Differentiation Framework categorises taxpayers by size and applies a risk-based ‘engagement experience’. These two factors determine the regularity and intensity of the ATO’s review processes to gain assurance over taxpayers’ income tax, including their use of related party debt. Case teams undertaking assurance reviews are supported by other ATO business lines when engaging taxpayers and finalising assurance outcomes. (See paragraphs 3.68 to 3.107)

Does the ATO effectively manage transfer pricing for related party debt?

18. The ATO has documented processes to gather data and intelligence on Top 100 and Top 1,000 taxpayers using related party debt. Profiling of taxpayers occurs early in the review process via internal and publicly available information. Data and intelligence are sourced from information disclosed by taxpayers as part of their responsibilities under Australian income tax law or from information requested by the ATO during the review process. (See paragraphs 4.3 to 4.13)

19. The ATO manages transfer pricing for related party debt largely as intended. There are some variations in how the Top 100 and Top 1,000 teams verify taxpayers’ application of PCG 2017/4, and record analysis of taxpayers’ financing and capital structures. (See paragraphs 4.14 to 4.32)

Recommendations

Recommendation no. 1

Paragraph 2.29

The Australian Taxation Office conduct further analysis to determine and monitor why taxpayers may not lodge Country-by-Country local file reporting.

Australian Taxation Office response: Agreed.

Recommendation no. 2

Paragraph 2.54

The Australian Taxation Office take action to:

- determine the number of completed Tax Assurance Reports considered sufficient to gain assurance that Top 100 taxpayers are appropriately using transfer pricing for related party debt; and

- determine how to gain sufficient assurance over the Top 1,000 population through the use of Combined Assurance Reviews and gap analysis, while also formalising how gap analysis should be conducted.

Australian Taxation Office response: Agreed.

Recommendation no. 3

Paragraph 3.43

The Australian Taxation Office take action to ensure all taxpayers with related party debt that do not apply Practical Compliance Guideline 2017/4 are reviewed in accordance with the Australian Taxation Office’s goals.

Australian Taxation Office response: Agreed in principle.

Recommendation no. 4

Paragraph 3.60

The Australian Taxation Office:

- make training in related party financing mandatory for new case officers where related party financing is likely to be relevant to their role; and

- develop and maintain a register to ensure all staff are trained consistently and remain up to date in developments around transfer pricing for related party debt.

Australian Taxation Office response: Agreed in principle with (a); Agreed with (b).

Summary of entity response

20. The proposed audit report was provided to the ATO. The ATO’s summary response is reproduced below. Their full response is included at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed at Appendix 2.

The ATO welcomes this review and is pleased the report acknowledges the ATO has sound strategies and processes to address transfer pricing risk for related party debt.

Since the Tax Avoidance Taskforce commenced, we have transformed our approach to profit shifting related risks, including related party debt. We are very proud of the outcomes achieved and strive to continue this success. We continually look to evolve and improve our approach and welcome the input from the ANAO.

The ATO was one of the first tax administrations globally to release detailed guidance on our compliance approach. Further supported by litigation success, we have removed more than $45 billion of interest deductions for past and future years from the system. Through our compliance programs we have coverage of over $341 billion or 80% of all inbound interest bearing related party debt and this continues to increase.

Our range of programs are designed to encourage voluntary compliance by large businesses. Our increased guidance, detection of incorrect tax positions, litigation successes, and ‘locking in’ behavioural changes as part of settlements is driving permanent changes in taxpayers risk profiles. These programs also provide the Australian community with confidence that all large businesses are regularly reviewed to assure that they pay the right amount of tax.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Performance and impact measurement

Policy/program design

1. Background

Introduction

1.1 The Australian Taxation Office (ATO) is the principal revenue agency responsible for administering the tax system and aspects of the superannuation system. As part of its duties, the ATO conducts compliance activities to ensure taxpayers are complying with tax requirements. The ATO’s stated purpose is to contribute to the economic and social wellbeing of Australians by fostering willing participation in the tax, superannuation, and registry systems.

1.2 The ATO’s Corporate Plan 2023–249 identifies multinational tax performance as a key focus area, with a number of deliverables, including:

- address key risks to the corporate tax base and close tax loopholes so that the community has confidence that public and multinational businesses are paying the right amount of tax in Australia; and

- support the integrity of the tax system by boosting tax transparency through better public reporting of large business tax information.10

Transfer pricing

1.3 Multinational groups operate on an international basis, dispersing business units across the globe for a variety of reasons. Transactions between two entities in the same group are called related party transactions. The pricing of these transactions is referred to as transfer pricing. The transactions must be priced as if the entities were independent parties operating wholly independently (at ‘arm’s length’) from one another. The arm’s length principle is outlined in Australian legislation in subdivisions 815-B and 815-C of the Income Tax Assessment Act 1997 (ITAA 1997). The arm’s length principle requires the terms of transactions between related parties to be comparable to transactions between independent and separate entities.

Related party debt

1.4 Interest expense on corporate debt is generally determined to be tax deductible in Australia under section 8-1 of the ITAA 1997. This creates the risk that loans may be made under conditions which are inconsistent with what would be expected when obtaining financing from an independent third party. These conditions may include artificially high interest rates or a lack of security and guarantees which would ordinarily reduce interest payable. Entities involved in mispricing may underpay their Australian tax liability by using related party arrangements. To combat this, the ATO monitors taxpayers’ use of transfer pricing for related party debt to ensure those transactions satisfy Australia’s transfer pricing laws, which are applied to best achieve consistency with the Organisation for Economic Co-operation and Development (OECD) Transfer Pricing Guidelines 2017. The ATO has identified transfer pricing risk as a key focus for tax avoidance.11 Box 1 describes hypothetical instances of transfer pricing.

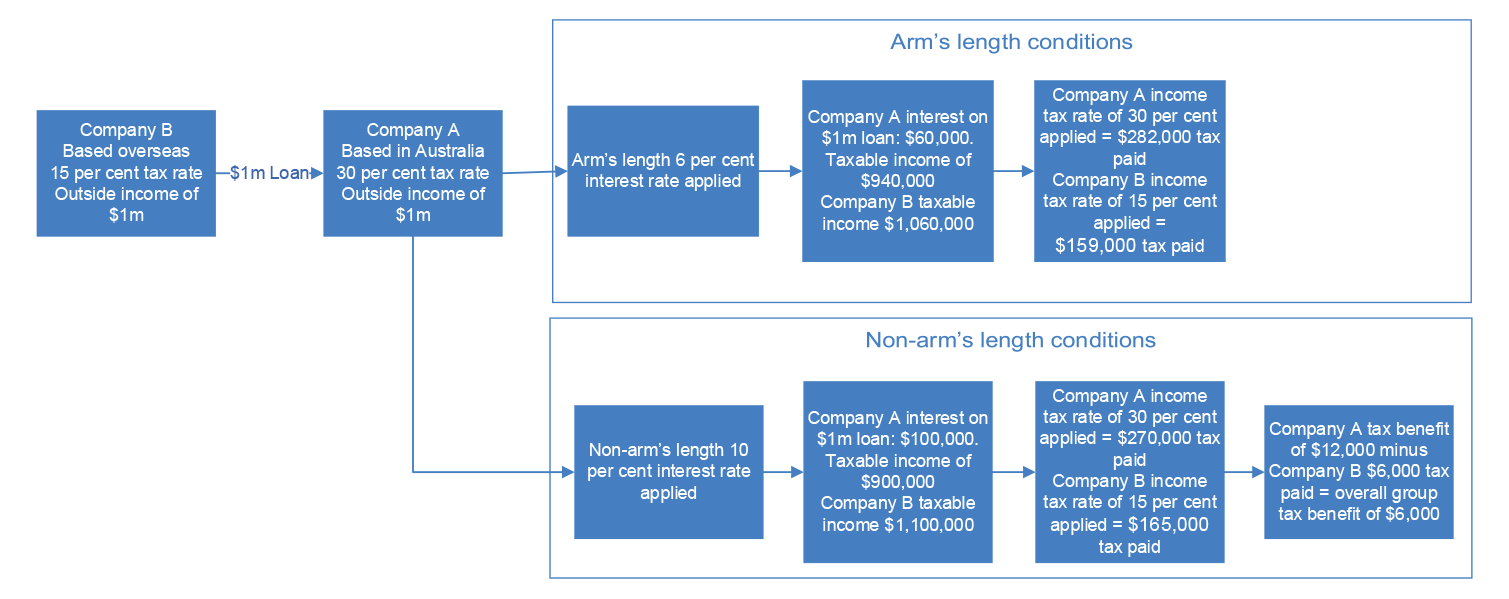

|

Box 1: Hypothetical transfer pricing |

|

1.5 Company A is an Australian subsidiary of an overseas parent company (company B), and company A enters a financing arrangement with company B. The interest repayments are a deductible expense on company A’s financial accounts. If company B operates in a country with lower corporate tax rates, the interest income is taxed at a lower rate and the interest expense is deductible at a higher tax rate. Therefore, both companies gain an aggregate tax benefit. In the case of transfer mispricing, the interest rate is inflated, as a result, the deduction for company A is also inflated. If company A is encouraged to enter into more debt than reasonable then it will be highly geared. In other words, the capitalisation structure will be thin. Figure 1.1 contains two examples of hypothetical transfer pricing using an arm’s length interest rate of six per cent, and a non-arm’s length interest rate of 10 per cent to illustrate the tax effects of transfer pricing and transfer mispricing. |

Figure 1.1: Hypothetical transfer pricing

Note: Overall group tax benefit is the difference between the total tax paid in non-arm’s length and arm’s length scenarios.

Source: ANAO analysis.

1.6 The ATO’s Client Engagement Group (CEG) focuses on engagement to make it easy for taxpayers (including their representatives) to meet their obligations. CEG tailors engagement activities (such as reviews and audits) according to behaviour and risk level. The current CEG Group Plan has identified maintaining high levels of compliance across the tax systems and the avoidance of deterioration of tax performance as a critical outcome for the ATO. Within CEG, the Public Groups12 division ensures taxpayers which are members of public groups pay the right amount of tax to meet their Australian obligations. Public Groups division provides oversight of the strategy for transfer pricing, and is responsible for the administration of a range of tax frameworks, including transfer pricing for related party debt.

Previous audits and review

1.7 Auditor-General Report No. 5 of 2014–15 Annual Compliance Arrangements with Large Corporate Taxpayers found that Annual Compliance Agreements13, which were viewed positively by participants, had a low take-up rate, with taxpayers preferring Pre-lodgment Compliance Reviews (PCRs). (For more information relating to PCRs see from paragraph 3.79)

1.8 Auditor-General Report No. 18 of 2019–20 Tax Avoidance Taskforce — Meeting Budget Commitments found that there had been a significant increase in compliance revenue over the life of the Tax Avoidance Taskforce, and that it was not clear the extent to which this was as a result of the Budget funding provided. Tax Avoidance Taskforce funding contributes to the ATO’s work managing transfer pricing for related party debt.

Rationale for undertaking the audit

1.9 The latest publicly reported figures indicate that in 2020–21 inbound international related party borrowings in Australia totalled $520 billion, with $13.2 billion in interest expenses paid.14 The ATO monitors entities belonging to the Top 100 and Top 1,000 populations.15 Approximately 33 per cent of these inbound related party borrowings were attributed to the Top 100 entities and an additional 40 per cent were reported by the Top 1,000 entities.

1.10 The ATO has identified inbound related party borrowings as a key risk. In the ATO’s 2022 assurance activities for the Top 100 entities, related party financing represented the highest proportion of unassured items receiving a red flag rating16 to indicate likely non-compliance with income tax laws.17 Similarly, amongst the Top 1,000 entities, financing assurance activities resulted in a higher amount of low assurance and red flag ratings (27 per cent) than other areas reviewed.18 Interest bearing loans were the largest category of financing risks reviewed.19

1.11 This audit will provide assurance to the Parliament that the ATO effectively manages transfer pricing for related party debt, using sound strategies and processes to address risks and to ensure related party debt is appropriately priced. This audit was identified as a priority by the Parliament’s Joint Committee of Public Accounts and Audit in the context of the ANAO’s 2022–23 and 2023–24 Annual Audit Work Program.

Audit approach

Audit objective, criteria and scope

1.12 The objective of the audit was to assess the effectiveness of the ATO’s management of transfer pricing for related party debt.

1.13 The audit focused on the ATO’s management of transfer pricing for related party debt for the Top 100 and Top 1,000 populations from 2019–20 to 2022–23.

1.14 To form a conclusion against the objective, the following criteria were adopted.

- Are the risks relating to transfer pricing for related party debt appropriately managed?

- Does the ATO have a sound strategic framework to manage the use of transfer pricing for related party debt?

- Does the ATO effectively manage transfer pricing for related party debt?

Audit methodology

1.15 The audit methodology included:

- review of ATO documentation such as strategies, plans, risk documents, meeting papers and minutes, reporting and internal briefings;

- meetings with ATO officers; and

- detailed technical walkthroughs of processes and procedures with ATO officers.

1.16 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $592,982.

1.17 The team members for this audit were Shane Armstrong, Ally Cerritelli, Michael Dean, Renae Lowden, Anthony Ditton, Alison Millea, and David Tellis.

2. Managing risks related to transfer pricing for related party debt

Areas examined

This chapter examined whether the Australian Taxation Office (ATO) identified and prioritised risks to transfer pricing for related party debt, and appropriately manages these risks.

Conclusion

The ATO is largely effective in identifying and prioritising risks to transfer pricing for related party debt. Its processes operate at the ATO business line level and are sound. The risk is primarily managed through use of the Top 100 Justified Trust Program and Top 1,000 Combined Assurance Program. However, management of risk is undermined by the ATO not meeting its stated taxpayer review targets to gain its desired level of assurance. Annually, the ATO seeks to review the entire Top 100 population, and 250 taxpayers within the Top 1,000 economic groups. This has not occurred during the audit period and the ATO has not conducted a process to determine whether an annual review of 250 Top 1,000 taxpayers provides sufficient oversight. There is no reporting to the Strategic Management Committee (SMC) on progress against targets for completed Pre-lodgment Compliance Reviews (PCRs) or Combined Assurance Reviews (CARs). The ATO does not conduct analysis on the reasons taxpayers may not be required to complete Country-by-Country local file reporting. Risk reporting occurs on a quarterly basis at the business level. As the risk has been rated as in tolerance, reporting has not been escalated to the enterprise level.

Areas for improvement

The ANAO made two recommendations: that the ATO take action to determine the number of completed Tax Assurance Reviews considered sufficient to provide assurance that the Top 100 population is appropriately using related party debt and to determine how to gain sufficient assurance over the Top 1,000 population through the use of CARs and gap analysis, while formalising the gap analysis process. The ANAO also recommended that the ATO conduct further analysis to monitor taxpayers who are not lodging Country-by-Country local file reporting.

The ANAO also suggested that the ATO should consider having a review cycle for the justified trust methodology for the Top 100 and Top 1,000 assurance programs.

2.1 The ATO’s Corporate Plan 2023–2420 identifies multinational tax performance as a key focus area, with a number of deliverables, including:

- address key risks to the corporate tax base and close tax loopholes so that the community has confidence that public and multinational businesses are paying the right amount of tax in Australia; and

- support the integrity of the tax system by boosting tax transparency through better public reporting of large business tax information.21

2.2 The Commonwealth Risk Management Policy notes that risk management is ‘fundamental to good governance’22, and that good risk management ‘supports the better delivery of government services through more effective decision-making, greater preparedness for unexpected events and supports innovation.’23

2.3 This requires the ATO to manage risks relating to transfer pricing for related party debt.

Does the ATO have sound processes for identifying and prioritising risks to transfer pricing for related party debt?

The ATO has sound processes for identifying and prioritising risks to transfer pricing for related party debt at the business level. Procedures governing the operation of the ATO’s risk management framework are comprehensive and well-articulated. Data obtained through the Reportable Tax Position (RTP) Schedule disclosures and the International Dealings Schedule (IDS) is used along with self-assessments via Practical Compliance Guideline 2017/4 (PCG 2017/4) to monitor trends and detect risks. While Country-by-Country local file reporting provides further data, the ATO was unable to quantify the total number of taxpayers with a reporting obligation that had not complied with lodgment requirements.

The ATO’s risk management process

2.4 The documents that govern risk management at the ATO are the Enterprise Risk Management Framework (ERMF), the Risk Management Guide, and Risk Management Chief Executive Instructions.

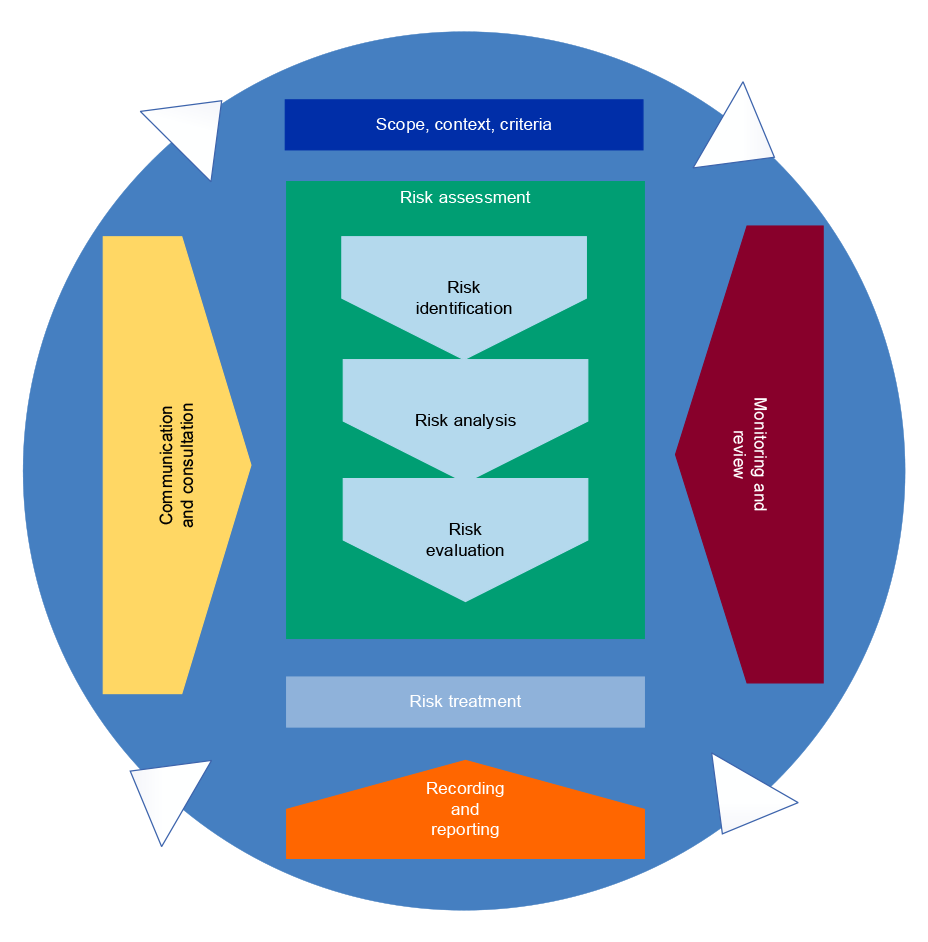

2.5 The ATO’s Risk Management Guide states that the ‘[ERMF] and risk management processes apply to all levels of risk across the ATO.’ The ATO’s risk management process was developed to meet the ATO’s obligations under the Commonwealth Risk Management Policy, and is based on ISO 31000:201824, outlining the cyclical nature of the process. This is depicted at Figure 2.1.

Figure 2.1: The ATO’s risk management process

Source: ANAO analysis of ATO documentation.

2.6 The ERMF states that the risk methodology is ‘the practical tool that should be used in all planning activities to ensure a positive and proactive approach to risk management is applied.’ Guidance on risk management is made available to staff through internal risk management training courses, and risk management templates are provided on the ATO intranet. The ATO also uses a Chief Executive Instruction (CEI) on risk management, which outlines staff responsibilities for risk management.25

Risks relating to transfer pricing for related party debt

2.7 Transfer pricing for related party debt is considered at both the enterprise and business levels.

Enterprise level risks related to transfer pricing for related party debt

2.8 Enterprise level scrutiny of transfer pricing for related party debt risk has taken two different forms through the period of the audit. Until May 2021, the relevant enterprise level risk was ‘PMB26 — International Risk’, and its short description was ‘Multinational entities use international related party or cross border arrangements to reduce Australian tax payable.’ This risk was endorsed in January 2018, and was closed in February 2022. The ATO advised the ANAO in November 2023 that it rationalised its enterprise level risks in May 2021.

2.9 As a result, the current enterprise level risk is ‘Tax and superannuation performance in accordance with the law’, and is described as:

There is a risk that performance of the tax and superannuation systems move out of tolerance due to our inability to identify and address in a timely manner lodgment and correct reporting issues resulting in reduced community confidence and willing participation and further reduced revenue performance.27

2.10 The ATO describes the management strategy as:

…focused on sustained improvement in tax and superannuation compliance and, in turn, long-term system health. Strategies can be designed to improve correct participation in the system and to address non-compliance thereby improving both gross and net system performance.28

2.11 The ATO’s handling of the risk of transfer pricing at the business level is consistent with this approach, and the ATO maintains a risk assessment and treatment plan for this enterprise level risk.

Business level risks related to transfer pricing for related party debt

2.12 The relevant business level risk is ‘Arm’s Length Conditions’. This business risk is managed by the Arm’s Length Conditions – Related Party Finance Risk Cluster (finance risk cluster) (see from paragraph 2.17). The Arm’s Length Conditions Risk and Issue Treatment Plan (the plan) notes that:

The risk of artificially inflating financing costs exists due to the absence of terms normally seen in a loan negotiated at arm’s length, such as security or guarantees. Alternatively, conditions are present which would not ordinarily exist in arm’s length transactions (e.g. the loan is denominated in a foreign currency, or the loan is deeply subordinated29). The existence of the former, or absence of the latter, would ordinarily reduce the interest payable under the loan.

2.13 The plan notes that ‘the risk is already in existence’, and that the use of related party financing is ‘a common technique used to reduce or eliminate Australian company tax on Australian profits.’ This risk was created in July 2016, and the plan examines how the risk has evolved over time. Table 2.1 illustrates the population and revenue consequence of the risk. The approach to treating this risk is discussed in Chapter 3.

Table 2.1: Population and revenue consequence based on 2020 data

|

Population |

Value of transactions |

Tax at risk (or tax revenue effect) |

|

3,968 taxpayers with ‘inbound’ loans. |

The loan principal amount from IDS and Country-by-Country reporting data is $29,782 million for ‘inbound’ loans. |

Based on IDS and Country-by-Country data the estimated revenue consequence is $3,981,572,34530 for ‘inbound’ loans. |

Source: ANAO analysis of ATO documentation.

2.14 The ATO advised the ANAO in November 2023 that it did not ‘track how many [Full Time Equivalent (FTE)] or how much funding’ was attributed to managing the risk, and that the only team fully dedicated to working on the risk was the finance risk cluster, which was five FTE. The ATO further advised the ANAO in November 2023 that the Top 100 Network was 24 FTE and the approximate FTE for case teams from Engagement and Assurance was 160 (see paragraph 3.82). For the Top 1,000 team FTE was 114, and Economist Practice31 (see paragraph 3.53) consisted of 100 FTE, with the ATO stating:

Related party financing is one of the focus areas of these programs, however, as they consider all tax risks, the true “cost” is some portion of this. In addition, there are resources that might work on transfer pricing for related party debt in [Economist Practice, Review and Dispute Resolution, Tax Counsel Network], and all of [Engagement and Assurance].’

2.15 The ATO’s Risk Management Guide notes that endorsement of risks by risk owners can be maintained within the business area. Evidence of risk endorsement is indicated through the approval of risk assessment documents. Analysis of risk treatment plans between 2016–17 and 2022–23 indicates that the risk was considered, and largely appropriately endorsed32 by the SMC (see paragraph 2.62).

2.16 The Risk Management Guide states that ‘Enterprise risks should be reviewed every twelve months as a minimum’. It is silent on a review timeframe for business level risks. Analysis of risk treatment plans between 2016 and 2023 indicates that the risk has been reviewed and updated annually.

Risk management

2.17 The focus on potential risks is examined by the ATO at the individual taxpayer level. The ATO manages business level risks through the use of ‘risk clusters’, which are used ‘to treat and manage risks that exhibit common factors, characteristics or behaviours within a population in a consistent manner.’ Table 2.2 outlines the broad functions of the finance risk cluster and provides examples of work done in each of these areas.

Table 2.2: Finance risk cluster functions and examples of activity

|

Finance risk cluster function |

Examples of activity |

|

Identify the need for external guidance and assist in design and delivery of such guidance |

PCG 2017/4a and additional Schedules. |

|

Internal capability building and guidance |

Training and development materials (see from paragraph 3.58). |

|

Input into the development and refinement of risk filters |

The ATO analyses RTP Schedule disclosures providing tailored guidelines to assist specialist teams to risk assess information provided by taxpayers. |

|

Technical input into strategic compliance activities |

The cluster encourages teams to seek technical advice when required. |

|

Identifying strategic cases that are potential litigation test cases and providing technical input to those cases to be litigation ready |

Identifying potential cases and assessing the strategic value of matters for litigation, contributing to the ATO’s preparation for an appeal to the Federal Court of Australia. |

|

Advocating for law reform, as necessary |

The cluster has not initiated any law reform advocacy. It has responded to requests about potential law reform. |

Note a: Australian Taxation Office, Practical Compliance Guideline 2017/4, ATO, 2020, available from https://www.ato.gov.au/law/view/document?docid=COG/PCG20174/NAT/ATO/00001 [accessed 19 October 2023].

Source: ANAO analysis of ATO documentation.

2.18 The ATO advised the ANAO in August 2023 that the transfer pricing risk was identified before the finance risk cluster was established. The ATO advised the ANAO in August 2023, that prior to the introduction of the Top 100 Justified Trust Program (see from paragraph 2.41) (and the Top 1,000 Combined Assurance Program, see from paragraph 2.46) there was a risk identification process involving analysis of tax return data, and that the approach could not be targeted.

2.19 The finance risk cluster was established ‘at a similar time’ to the Top 100 Justified Trust Program, to address the risk and test the extent to which it may manifest in the taxpayers using related party financing. The Top 100 Justified Trust Program was then used to obtain assurance as part of managing the risk. If assurance was not obtained, then further compliance activity may be undertaken.

2.20 The Top 100 Justified Trust Program and the Top 1,000 Combined Assurance Program, ‘at a case level, [form] a significant part of the treatment strategy’, and ‘for both the Top 100 and Top 1,000 populations, transfer pricing of related party debt is a significant part of the assurance program.’ The ATO advised the ANAO in August 2023 that individual taxpayer risks were identified and tested via justified trust and this then provided the ‘springboard’ for compliance activities.

2.21 The ATO advised the ANAO in August 2023 that justified trust enabled it to take the next step from risk identification, and that without justified trust, the ATO would not be able to target its work, meaning matters would be escalated to audits or reviews as required and without a clear structure in place. In November 2023 the ATO advised the ANAO that justified trust ‘builds and maintains community confidence that taxpayers are paying the right amount of tax’, and that it enabled the ATO to focus the use of its resources into ‘the right areas.’

2.22 The treatment strategy contains three phases. Phase one, which has been finalised, focused on developing a compliance strategy, internal and external communications, development of a strategy on advisors, developing risk filters33 and metrics, and internal engagement to ‘attempt to address associated legislative issues.’ Phases two and three are combined in the treatment plan34, with the ATO advising the ANAO in September 2023 that the rollout of these phases is ‘ongoing with a particular focus being continuous improvement’.

2.23 The plan includes a delivery plan that outlines key milestones and months in which work on identified key milestones was scheduled to occur. Aside from providing technical support to internal clients, all delivery plan items are reported on in quarterly SMC reports. The plan contains five key performance indicators (KPIs) that seek to identify ‘indicators of success/key metric[s] for determining effectiveness.’ These, and reporting against these KPIs, are contained in Table 2.3.

Table 2.3: Finance risk cluster KPIs and internal reporting

|

KPI |

Reporting |

|

Active compliance |

|

|

‘The first KPI is the key KPI for which reporting is provided to the [Strategic Management Committee (SMC)]. For this purpose, key case outcomes are reported to the SMC on a quarterly basis in the SMC Quarterly report’ (see paragraph 2.62). Reporting on changes to taxpayer behaviour ‘[is] demonstrated by changes in disclosures and is tracked through the Reportable Tax Position (RTP) Schedule questions.’ RTP trends and insights are reported to the SMC on an annual basis. |

|

There is no formal reporting to the SMC against KPIs 2a and 2b. The ATO advised the ANAO in September 2023: ‘This is considered and assessed internally by the team along with the cluster SES [Senior Executive Service]’. |

|

Prevention |

|

|

This KPI is tracked via trends in the annual RTP analysis. |

|

Proof of absence |

|

|

These KPIs are tracked via trends in the annual RTP analysis.

|

|

|

Note a: International, Support, and Programs division.

Source: ANAO analysis of ATO documentation.

Using monitoring processes to inform risk prioritisation

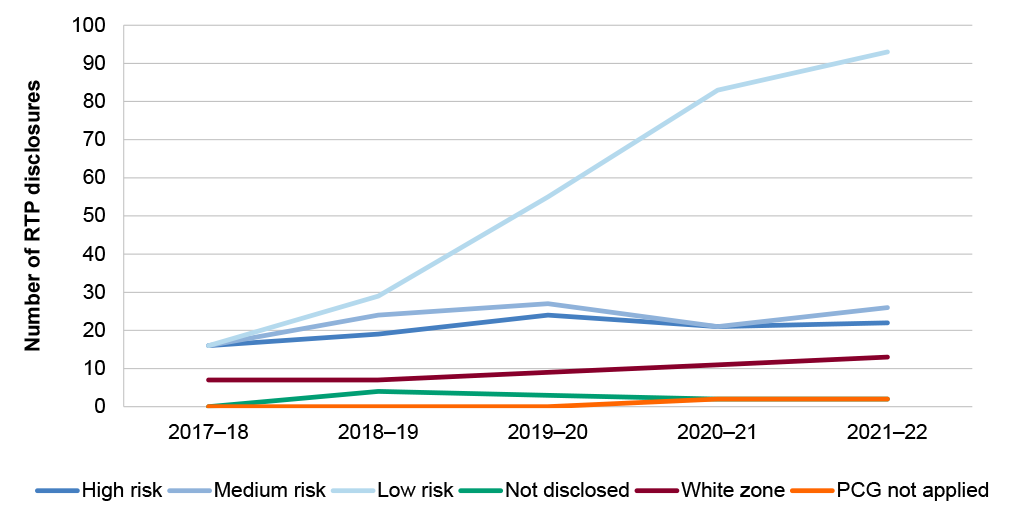

2.24 The plan notes that the ATO uses information in the RTP and other tax return schedules to ‘recommend appropriate active compliance activities on the higher risk arrangements that require assurance’, and that the growth of self-assessments via PCG 2017/4 (see from paragraph 3.40), provides a greater opportunity for the ATO to monitor trends and detect risks.

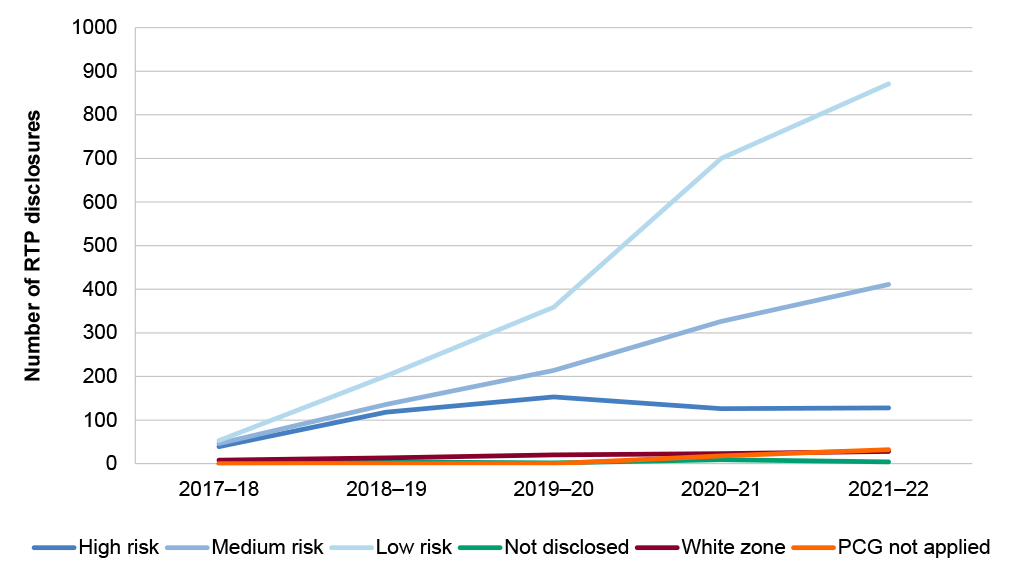

2.25 RTP Schedule disclosures (see from paragraph 4.7) collect information on taxpayers’ use of related party debt. Prior to 2021, taxpayers were only required to report the risk zone for their highest self-assessed risk zone arrangement. Since 2021, taxpayers are required to report the three most material arrangements. If the highest risk zone arrangement was not one of the three most material, this is also required to be reported. The ATO advised the ANAO in August 2023: ‘The RTP self-assessments disclosed by the taxpayers may only represent a portion of their related party financing transactions.’ For more information on RTP Schedule disclosures, see Figure 3.3 and Figure 3.4.

2.26 The ATO advised the ANAO in November 2023:

[T]he total number of related party transactions and the respective amount for each such transaction across all taxpayers that might use related party debt is not presently collected by the ATO.

2.27 Further data was acquired through taxpayer disclosures in the IDS.35 Transaction-level information was only required to be provided by taxpayers completing local file36 requirements. Table 2.4 outlines taxpayers who may be required to provide local file reporting and those that have provided it.

Table 2.4: Country-by-Country local file reporting 2019–20 to 2022–23

|

Year |

May be required to lodge |

Count of lodgers |

|

2019–20 |

5,598 |

3,943 |

|

2020–21 |

6,921 |

4,033 |

|

2021–22 |

7,900 |

4,103 |

|

2022–23a |

5,884 |

2,775 |

Note a: 2022–23 data is incomplete as tax returns are lodged throughout the year.

Source: ATO documentation.

2.28 The ATO advised the ANAO in November 2023 that the difference in the number required to lodge and the total count of lodgers was due to a series of possible exemptions. The ATO was unable to provide a further breakdown of the reasons those who may be required to lodge had not lodged: ‘In relation to non-lodgment of the full local file, we do not have a definitive count of [taxpayers] with a reporting obligation that have not complied with lodgment requirements.’37

Recommendation no.1

2.29 The Australian Taxation Office conduct further analysis to determine and monitor why taxpayers may not lodge Country-by-Country local file reporting.

Australian Taxation Office response: Agreed.

2.30 The ATO will conduct further analysis to determine and monitor why taxpayers may not lodge Country-by- Country local file reporting.

2.31 The ATO advised the ANAO in August 2023 that transaction-level data on related party financing received through the IDS was unstructured, imperfect, and incomplete. As a result, the ATO focused on assessing the three biggest and highest risk transactions outlined in RTP Schedule disclosures.38 The ATO was unable to verify that the transactions reported by taxpayers were the biggest and highest risk transactions. The ATO used the justified trust methodology to understand how individual taxpayers approached the use of related party debt (see from paragraph 2.35).

Updating strategies to account for new and emerging risks

2.32 The Arm’s Length Conditions Risk and Issue Treatment Plan is updated annually by the finance risk cluster taking into account how the risk has continued to evolve, and how the treatment approach should change.

Are risks to transfer pricing for related party debt managed in accordance with ATO requirements?

The ATO uses the Top 100 Justified Trust Program and Top 1,000 Combined Assurance Program to engage with Top 100 and Top 1,000 taxpayers to manage transfer pricing risk. To gain assurance each year, the ATO aims to review all Top 100 taxpayers, and 250 Top 1,000 taxpayers. These targets have not been met over the last four years, and the ATO was unable to determine whether the Top 1,000 target provided sufficient oversight over the population.

Justified trust

2.33 To manage the risk to transfer pricing for related party debt, the ATO uses the broader justified trust concept to engage the members of its Top 100 (see from paragraph 2.41) and Top 1,000 (see from paragraph 2.46) populations39 (see from paragraph 3.73 for details how the Top 100 and Top 1,000 populations are established). The ATO defines the concept of justified trust as:

A reasonable conclusion based on sufficient evidence that the taxpayer is complying with its tax obligations and paying the right amount of tax in relation to its business and economic activities connected or linked to Australia.

2.34 Further, justified trust is:

How we build and maintain community confidence taxpayers are paying the right amount of tax. Justified trust is a concept from the Organisation for Economic Cooperation and Development (OECD).40

Justified Trust builds and maintains community confidence that taxpayers are paying the right amount of tax. It also allows us to focus our resources in the right areas.41

2.35 To achieve justified trust for both the Top 100 and Top 1,000 populations, the ATO focuses on four areas:

- understanding a taxpayer’s tax governance framework;

- identifying tax risks flagged to market;

- understanding significant and new transactions; and

- understanding why the accounting and tax results vary.42

2.36 The ATO’s website describes the intended outcomes from its approach to justified trust:

Justified trust gives the community confidence that large businesses are paying the right amount of tax. This fosters broader willing participation and engagement across the tax and superannuation system.

Our approach helps us focus how we minimise the income tax and Goods and Services Tax (GST) tax gaps through:

- our engagement strategy (for example, identifying and resolving areas of concern at the earliest possible time)

- active compliance (for example, audit cases)

- active prevention across the market (for example, through Taxpayer Alerts, Practical Compliance Guidelines, or Public Rulings).43

2.37 The importance of the justified trust approach to managing risk is noted in the Public Groups SMC charter. It states that the SMC’s objective is to manage ‘risks to the tax system relevant to Public and Multinational Businesses, providing justified trust that the right amount of tax is being paid.’44

2.38 The threshold for assurance has been articulated in the Justified Trust Methodology Guide:

Assurance has been achieved where the team confirms that the taxpayer’s tax treatment aligns with the income tax law and the ATO’s view as to its application.

Assurance can be obtained where sufficient analysis has been conducted and/or supporting documentation obtained to confirm that the taxpayer’s tax treatment accords with the income tax law.

Alternatively, assurance can be obtained through escalation (e.g. audit, objection, litigation) where the ATO and the taxpayer have a material difference of opinion in relation to the tax treatment. Once the ultimate outcome of an escalation procedure has been determined and applied (whether favourable or unfavourable to the taxpayer), assurance will have been obtained.

2.39 Three overall assurance ratings can be applied to Top 100 and Top 1,000 taxpayers: high, medium and low (see paragraph 3.80). Obtaining justified trust requires a taxpayer to meet two metrics:

- a minimum of 90 per cent of its tax activity and economic activity must be correctly reported; and

- meeting all seven qualifying factors for the income tax period covered by the Tax Assurance Report.45

2.40 For both the Top 100 and Top 1,000 populations, of the seven qualifying factors, there is one directly related to transfer pricing for related party debt: ‘International related party dealings and CFCs.’46 As part of this qualifying factor, the ATO must have a medium level of assurance47 that ‘material or significant’ international related party dealings satisfy the arm’s length principle pursuant to subdivision 815-B of the Income Tax Assessment Act 1997 (ITAA 1997). This includes that no further action is necessary. Top 100 taxpayers achieving justified trust are then subject to a ‘Monitoring and Maintenance’ approach. (See from paragraph 3.83).

Top 100

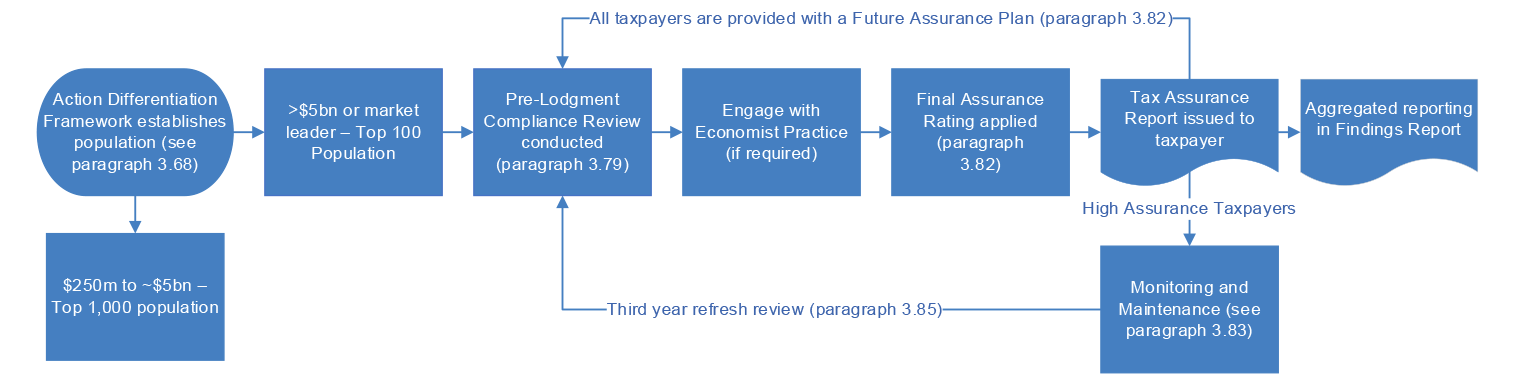

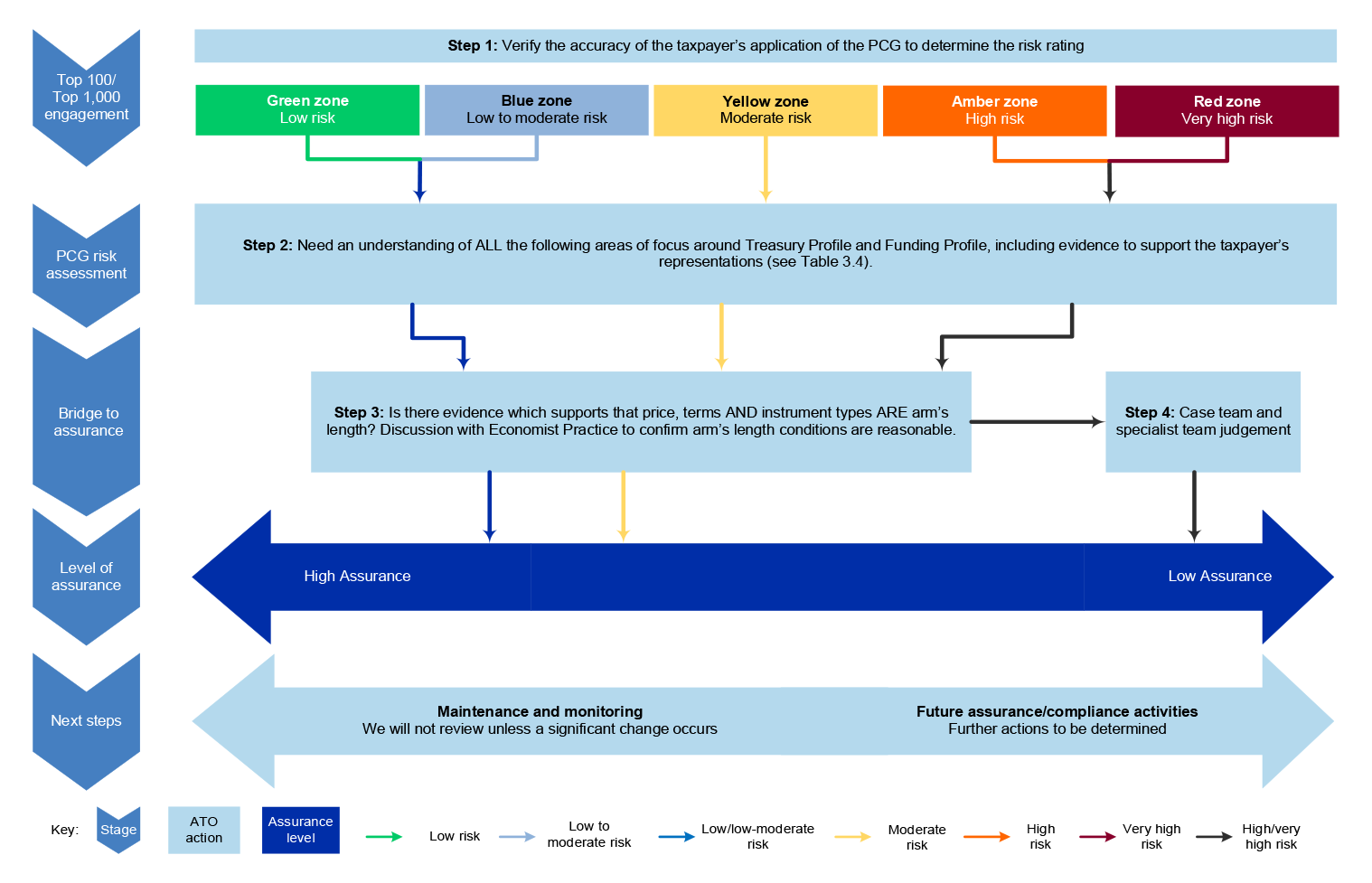

2.41 Figure 2.2 depicts how the ATO assesses Top 100 taxpayers as part of the Top 100 Justified Trust Program.

Figure 2.2: Top 100 justified trust process

Source: ANAO analysis of ATO documentation.

2.42 The Justified Trust Methodology Guide for the Top 100 population states:

In the Australian context, the concept relates to the level of assurance we have that a taxpayer has paid the right amount of tax on its business and economic activities connected or linked to Australia. Justified trust does not represent absolute certainty that the taxpayer is complying with all their tax obligations and the amount of tax paid is completely accurate, as this level of certainty is not attainable. It reflects a level of confidence that the taxpayer is complying with its Australian tax obligations.

2.43 To obtain justified trust, the ATO conducts a PCR (see paragraph 3.81), which leads to the development of a TAR (see from paragraph 3.82).

2.44 Table 2.5 provides more insight into the total number of Top 100 taxpayers assessed via TARs and also those taxpayers who have achieved justified trust and are now subject to a ‘Monitoring and Maintenance’ approach.

Table 2.5: TARs and Monitoring and Maintenance Reports issued 2019–20 to 2022–23

|

Year |

Population |

TARs issued |

Monitoring and Maintenance |

Total population coverage |

Population coverage (%) |

First-time TARs |

Improved assurance rating |

Reduced assurance rating |

|

2019–20 |

82 |

53 |

3 |

56 |

68 |

17 |

20 |

0 |

|

2020–21 |

84 |

35 |

22 |

57 |

68 |

5 |

15 |

0 |

|

2021–22 |

85 |

33 |

21 |

54 |

64 |

3 |

15 |

2a |

|

2022–23 |

85 |

37 |

18 |

55 |

65 |

5 |

10 |

2a |

Note a: In 2021–22, one taxpayer, and in 2022–23, two taxpayers had a rating change to ‘not rated’.

Source: ANAO analysis of ATO documentation.

2.45 Even though the ATO aims to complete a TAR for each Top 100 taxpayer annually48, it is not possible for this to be achieved, as some taxpayers have obtained justified trust and have moved into Monitoring and Maintenance. Taking into account TARs issued, and taxpayers subject to Monitoring and Maintenance, the ATO has annually scrutinised, on average, 66.25 per cent of Top 100 taxpayers over the last four years, and has therefore not achieved the level of assurance that it has sought. It should be noted that TARs may take more than a year to complete, and the ATO maintains a case coverage plan for the Top 100 population, planning and tracking taxpayer engagement. Further, TARs also examine multiple income years if a TAR was not issued in the year previously.

Top 1,000

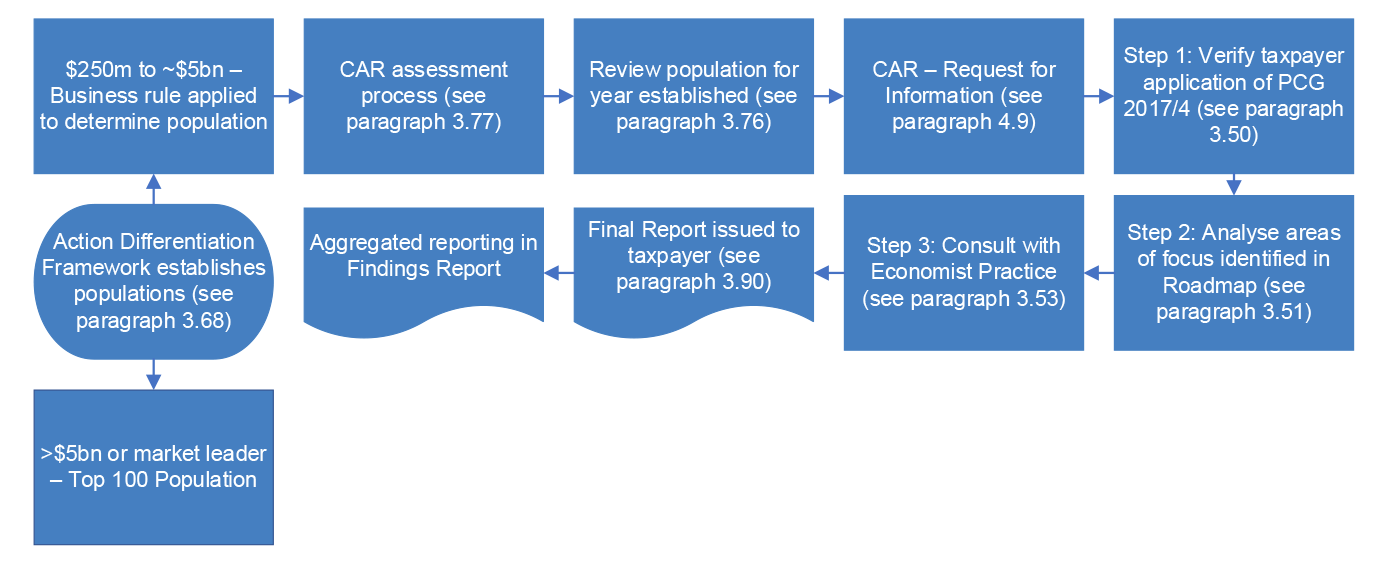

2.46 Figure 2.3 depicts how the ATO assesses Top 1,000 taxpayers through CARs.

Figure 2.3: Top 1,000 CAR process

Source: ANAO analysis of ATO documentation.

2.47 Since 202149, the ATO has used CARs to ‘obtain assurance that large public and multinational groups are reporting the right amount of both income tax and GST. CARs also identify and address [income tax] and GST tax risk.’ CAR findings are recorded in Combined Assurance Reports. Transfer pricing for related party debt is a comparatively small part of the CAR process. The ATO identified the Tax Avoidance Taskforce50 as a driver for the adoption of justified trust for the Top 1,000 population.

2.48 A CAR seeks to deliver a tailored experience for taxpayers that is influenced by their previous assurance ratings, leading to a trend of faster and more efficient reviews ‘and, in some cases, improved assurance ratings.’ The ATO aims to complete 250 CARs per year. Table 2.6 provides the number of CARs from 2019–20 to 2022–23.

Table 2.6: Combined Assurance Reports issued, 2019–20 to 2022–23

|

Year |

Total completed |

Percentage of target achieved |

First-time reviews |

Assurance rating improved |

Assurance rating maintained |

Assurance rating reduced |

|

2019–20a |

212 |

N/Ab |

212 |

N/A |

N/A |

N/A |

|

2020–21c |

104 |

41.6 |

49 |

4 |

35 |

16 |

|

2021–22 |

198 |

79.2 |

110 |

14 |

56 |

18 |

|

2022–23 |

158 |

63.2 |

54 |

26 |

63 |

15 |

Note a: 2019–20 relates to Streamlined Assurance Reviews (SARs) which were conducted prior to 2020–21.

Note b: There was no annual target for SARs.

Note c: First time reviews and changes to assurance ratings for 2020–21 are calculated from previously issued SARs.

Source: ANAO analysis of ATO documentation.

2.49 Even though the ATO aims to complete 250 CARs every year51, it has achieved, on average, 61.3 per cent of this target since CARs were developed. The ATO advised the ANAO in January 2024 that no formal process had been undertaken to determine whether 250 CARs provided sufficient assurance prior to the commencement of the program. The ATO advised the ANAO in March 2024 that between 2020–21 and 2022–23, 62 per cent of Top 1,000 taxpayers with High or Medium disclosures received a CAR and a further 10 per cent did not meet the CAR selection criteria based on Total Business Income (TBI) alone. The ATO further advised the ANAO in March 2024 that CARs covered 76 per cent of medium and high risk TBI.

2.50 While the ATO analyses RTP Schedule disclosures (see paragraph 3.41), it then uses this analysis to identify high and medium risk. Top 1,000 taxpayers not subject to CARs may require further scrutiny via a ‘gap analysis program’ (approved by the SMC (see paragraph 2.62) in September 2023) to allow the ATO to gain further assurance over taxpayer use of related party debt (the ‘T1,000 gap population’). This is done by identifying high risk financing arrangements based on the loan quantum and implied interest rate. Prior to this, there was no further methodical analysis of taxpayers, though the ATO advised the ANAO in January 2024 that issues may have been identified in the course of other work.

2.51 The ATO advised the ANAO in February 2024 that the data used by the team responsible for this gap analysis to assess Top 1,000 taxpayers with related party debt is disclosed via the RTP Schedule, the IDS, and [Country-by-Country] local file reporting ‘where available’.

2.52 The ATO was unable to provide how many Top 1,000 taxpayers had been assessed since the introduction of the gap analysis process, with the ATO advising the ANAO in February 2024 that the ‘gap analysis process is currently in its initial phase’.

2.53 The ATO does not have guidance and training material for staff to analyse transactions, as the material is ‘currently under development.’

Recommendation no.2

2.54 The Australian Taxation Office take action to:

- determine the number of completed Tax Assurance Reports considered sufficient to gain assurance that Top 100 taxpayers are appropriately using transfer pricing for related party debt; and

- determine how to gain sufficient assurance over the Top 1,000 population through the use of Combined Assurance Reviews and gap analysis, while also formalising how gap analysis should be conducted.

Australian Taxation Office response: Agreed.

2.55 The ATO will review its current assurance approaches to ensure we are achieving our goals and formalise the findings.

Amending the justified trust methodology to respond to changes in risks

2.56 The ATO advised the ANAO in December 2023 that no emerging risks had been identified that led to changes to how transfer pricing was assessed by the Top 100 Justified Trust Program, and there had been no formal process applied to review the Justified Trust methodology. The methodology was amended to incorporate GST and income tax in 2019, and changes to the Monitoring and Maintenance approach (see from paragraph 3.83) were made in 2020 and 2022. The ATO advised the ANAO in November 2023 that it ‘typically [sought] feedback where significant modifications are made to the program’ and evidence of consultation processes was provided, but there had been no changes to the Top 1,000 methodology since 2016.

|

Opportunity for improvement |

|

2.57 The Australian Taxation Office could consider developing a review cycle for the Top 100 and Top 1,000 justified trust methodologies. |

Reporting on risk

2.58 The ATO publicly reports the aggregate findings from its Top 10052 and Top 1,00053 programs on an annual basis. These findings reports include reporting on transfer mispricing for both the Top 100 and Top 1,000 populations. The ATO also advises taxpayers of risks for large corporate groups.54

Is oversight of the management of risks to transfer pricing for related party debt fit for purpose?

As the business level risk relating to transfer pricing for related party debt has remained in tolerance, it has not been escalated for enterprise level consideration. At the business level the risk is monitored by the Public Groups SMC. The SMC receives quarterly reporting on the transfer pricing risk, but has not been provided with reporting on progress against targets for completed PCRs or CARs, meaning that the SMC cannot properly monitor the level of assurance the ATO has over the Top 100 and Top 1,000 populations’ use of transfer pricing for related party debt. Until October 2023, the SMC was required to ‘provide regular reports’ to the Public Groups Executive. This did not occur.

Risk oversight bodies

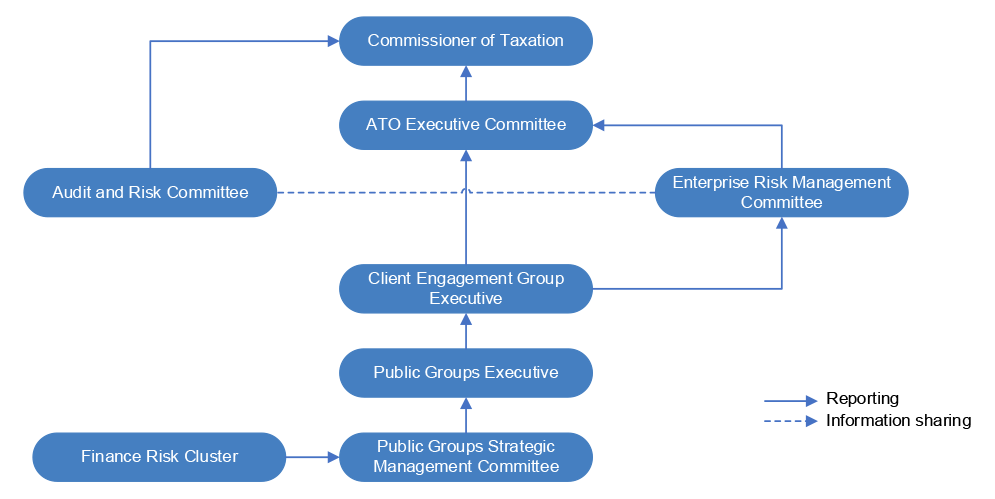

2.59 Figure 2.4 illustrates the ATO’s governance structure around risk. Oversight of risks occurs at the enterprise and business levels. As the related party debt risk is primarily addressed at the business level, oversight is also focused on the business level.

Figure 2.4: Risk governance structure

Source: ANAO analysis of ATO documentation.

Enterprise level

2.60 Oversight of enterprise level risks is undertaken by the ATO’s Enterprise Risk Management Committee. Its objective is: ‘To positively influence the ATO’s ability to manage priority areas of risk associated with achieving its strategic objectives.’ The Committee seeks to ensure priority risks are being managed consistent with the ERMF, to consider advice provided in relation to effectiveness of the ATO’s risk management regime, and to consider emerging risks in the context of the ATO’s strategic objectives.

2.61 The Enterprise Risk Management Committee’s charter states that the committee will escalate significant risks to the ATO Executive Committee, and provide regular advice to the Audit and Risk Committee via the Chief Risk Officer. The ATO advised the ANAO in September 2023 that the relevant risk ‘has not been rated out of tolerance and so it has not been escalated to the [Client Engagement Group] Executive or the ATO Risk Committee as part of the escalation procedures.’

Business level

2.62 Oversight of the business level risks to transfer pricing for related party debt is the responsibility of the Public Groups SMC. Its objective is to ‘[manage] risks to the tax system relevant to Public and Multinational Businesses, providing justified trust that the right amount of tax is being paid.’ The committee seeks to satisfy itself that a sound approach has been followed to manage risks, that emerging risks are actively identified and managed, that risk management is consistent with the enterprise risk framework, and to set the direction for Public Groups’ strategic approach. The SMC receives reporting on transfer pricing for related party debt on a quarterly basis (see from paragraph 2.23). This reporting does not include information on the number of PCRs or CARs completed against the ATO’s target of annual review of the entire Top 100 population and annual review of 250 Top 1,000 taxpayers.

2.63 The SMC’s charter states that the committee will ‘Provide regular reports to the [Public Groups] Executive, tracking the treatment of the priority risks’, and ‘provide risk investment recommendations to the [Public Groups] Executive to ensure resources are allocated in accordance with risk priorities and treatment strategies.’ The ATO advised the ANAO in November 2023 that as the risk remained within tolerance, there had been no escalation of matters to the Public Groups Executive. The terms of the charter require the committee to ‘provide regular reports’, rather than to report on an as-needs basis. The SMC charter was revised and endorsed by the SMC in October 2023. The requirement to provide regular reporting to the Public Groups Executive was removed from this version of the SMC charter.

3. Strategic framework to manage the use of transfer pricing for related party debt

Areas examined

This chapter examined whether the Australian Taxation Office (ATO)’s strategic framework to manage the use of transfer pricing for related party debt was sound, and whether implementation and oversight arrangements were appropriate.

Conclusion

The ATO has established a largely effective strategic framework to manage the use of transfer pricing for related party debt. The principles outlined in Organisation for Economic Co-operation and Development (OECD) transfer pricing guidance are reflected in the ATO’s guidelines for staff and taxpayers. The ATO has a sound strategy to engage with taxpayers with related party debt, primarily through the application of Practical Compliance Guideline 2017/4 (PCG 2017/4), though training for staff is not mandatory and records of staff training are not kept. Further, while the ATO aims to review all taxpayers using related party debt that do not apply PCG 2017/4, this does not occur in the majority of cases. The ATO effectively supports engagement with taxpayers through the completion of assurance reviews, though a lack of IT quality controls means it cannot be determined with certainty that the Top 1,000 population is complete and accurate.

Areas for improvement

The ANAO made two recommendations: that the ATO ensure that all taxpayers who do not apply PCG 2017/4 are reviewed as the ATO states will occur, and that the ATO make training mandatory for new case officers and develop and maintain a register to ensure all staff are trained consistently.

The ANAO also suggested that the ATO ensure experienced case officers undertake refresher training, and that the ATO develop clearly defined metrics that qualify an economic group for inclusion within the Top 100 population.

3.1 The ATO’s Corporate Plan 2023–24 identifies multinational tax performance as a key focus area, with the following key deliverables:

- address key risks to the corporate tax base and close tax loopholes so that the community has confidence that public and multinational businesses are paying the right amount of tax in Australia;

- support the integrity of the tax system by boosting tax transparency through better public reporting of large business tax information;

- positively influence the behaviours of advisors in the provision of tax advice and their interactions with the ATO; and

- support large business through the timely provision of tailored advice and guidance, and other contemporary services.55

3.2 This requires the ATO to develop a strategic framework that has been properly implemented, and is appropriately oversighted, to ensure transfer pricing for related party debt is managed effectively.

Are the principles outlined in OECD guidance reflected in the ATO’s transfer pricing guidelines?

The principles outlined in OECD transfer pricing guidance are reflected in legislation and ATO guidance for both its staff and taxpayers. The ATO has taken action to incorporate recent updates to the OECD guidance into Australian law. The ATO’s approach to Country-by-Country reporting is largely consistent with its international obligations.

The OECD Transfer Pricing Guidelines

3.3 The OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD Guidelines)56 promote a consistent approach to transfer pricing matters for tax administrations and taxpayers across jurisdictions.57 OECD member countries periodically provide input to review and revise the Guidelines in response to emerging issues. The ATO advised the ANAO in July 2023 that it is ‘actively involved in OECD work programs’. The OECD Guidelines aim to ensure countries secure an appropriate tax base and avoid double taxation, encouraging international trade and minimising conflict.58

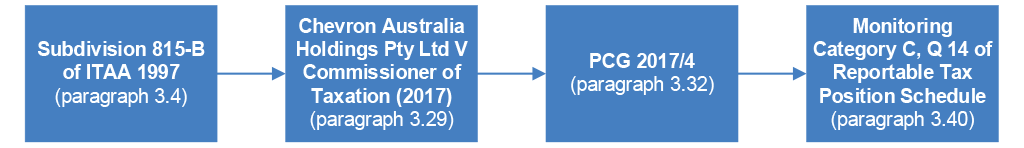

3.4 The 2017 edition of the OECD Guidelines is provided as a guidance document in the Income Tax Assessment Act 1997 (ITAA 1997) subdivision 815-B, paragraph 815-135(2)(a). Subsection 815-315(1) of the ITAA 1997 states:

For the purpose of determining the effect this Subdivision has in relation to an entity, identify arm’s length conditions so as best to achieve consistency with the documents covered by this section.

3.5 The OECD Guidelines centre around the arm’s length principle.59 This provides that where the conditions of a transaction between related parties are not what would be expected from independent parties, then:

any profits which would, but for those conditions, have accrued to one of the enterprises, but, by reason of those conditions, have not so accrued, may be included in the profits of that enterprise and taxed accordingly.

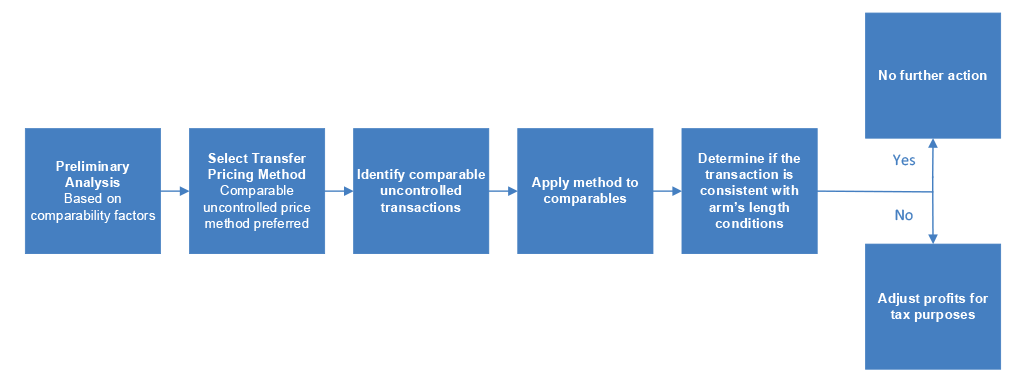

3.6 Under the OECD Guidelines, the appropriate transfer price is to be determined through comparability analysis. This analysis compares the conditions of a controlled transaction60 to the conditions that would be expected in a comparable uncontrolled transaction between independent parties. Figure 3.1 depicts the steps undertaken in comparability analysis to determine the appropriate arm’s length conditions of a transaction.

Figure 3.1: Comparability analysis

Source: ANAO analysis of OECD documentation.

3.7 The initial preliminary analysis requires identifying the commercial or financial relationship between parties to understand the underlying transaction. The OECD Guidelines provide five comparability factors to inform this analysis.61 This preliminary analysis informs the selection of a transfer pricing method using criteria outlined by the OECD Guidelines. The five comparability factors are also considered when selecting comparable transactions.62 Applying the selected transfer pricing method to comparables determines if the transaction is consistent with the arm’s length conditions. When a transaction is inconsistent with the arm’s length conditions, the taxpayer’s profits may be adjusted for tax purposes to correct distortions.

3.8 In addition to the comparability analysis process, the OECD Guidelines cover administrative approaches to avoiding and resolving transfer pricing disputes and transfer pricing documentation.

3.9 In January 2022, the OECD published a new version of the Guidelines, incorporating an additional chapter on Transfer Pricing Aspects of Financial Transactions (Chapter X of the OECD Guidelines).63 This additional guidance has not yet been introduced into Australian law (see from paragraph 3.21). The ITAA 1997 continues to reference the 2017 edition of the OECD Guidelines.

Consistency of ATO guidance with OECD principles

3.10 Justified trust (see paragraph 2.33) applies a tailored engagement policy where the assurance activities undertaken for a taxpayer will differ based on taxpayers’ individual circumstances. The OECD Guidelines state that effective risk identification and assessment are essential in the early stages of transfer pricing enquiries to identify which arrangements warrant an in-depth review and the commitment of resources.

3.11 Subdivision 815-B of the ITAA 1997 establishes the arm’s length principle for cross-border conditions between entities. The definition of arm’s length conditions, comparability factors, considerations for selecting a transfer pricing method and comparable circumstances contained in the legislation are consistent with OECD statements on these concepts. Table 3.1 summarises the consistency of ATO guidance for staff and taxpayers against the principles of the OECD Guidelines.

Table 3.1: Assessment of the consistency of ATO guidance with OECD principles

|

OECD principle |

Level of consistency |

|

Comparability analysis internal ATO guidance |

◆ |

|

Comparability analysis public guidance |

◆ |

|

Dispute resolution |

◆ |

|

Documentation |

◆ |

Key: ◆ Consistent ▲ Partially consistent ■ Inconsistent

Note: There was a minor departure from the OECD’s guidelines in PCG 2017/4, however, it was immaterial to the overall finding.

Source: ANAO analysis of ATO and OECD documentation.

Comparability analysis internal ATO guidance

3.12 Case teams engage Economist Practice to conduct comparability analysis and determine the appropriate arm’s length conditions (see from paragraph 3.53 for more information on Economist Practice). Top 1,000 case teams complete a Standard or Streamlined Toolkit to provide Economist Practice with information to determine the intensity of review required and to conduct analysis.64

3.13 The information requested in these Toolkits identifies the relationship between parties and the economically relevant characteristics of the transaction in line with the comparability analysis process in the OECD Guidelines. The Standard Toolkit provides a template for the ATO to complete its own analysis of the taxpayer’s transfer pricing method selection. There is no equivalent documentation completed by Top 100 teams as these cases are ‘a more bespoke product’. The ATO applies a ‘more streamlined approach’ to the Top 1,000 population.

3.14 The ATO’s Guide to Analysing Related Party Debt assists case officers in their examination of related party finance arrangements and identification of arm’s length conditions. This Guide directs staff to three areas of focus — understanding the group’s global and local business funding profiles, understanding the commercial and financial relations between parties and understanding the taxpayer’s approach to determining arm’s length conditions. The first two areas of focus assist with the accurate delineation of the controlled transaction as suggested by the OECD Guidelines. The third area of focus, ‘understanding the taxpayer’s approach to determining arm’s length conditions’, considers evidence provided by the taxpayer supporting their approach to applying transfer pricing methods and determining the arm’s length conditions (see paragraph 3.53).

Comparability analysis public guidance

3.15 The ATO website provides a general explanation of the arm’s length principle and comparability analysis for taxpayers. It states the arm’s length principle:

involves comparing what a business has done and what an independent party would have done in the same or similar circumstances. This principle is supported by all Organisation for Economic Co-operation and Development (OECD) countries.65

3.16 The ATO website also reflects the OECD Guidelines in its definition of comparable transactions. The ATO’s public guidance regarding transfer pricing methods66 identifies that where comparable transactions are available, the CUP method67 ‘is the most direct and reliable way to apply the arm’s length principle’ in line with the OECD Guidelines.68

Dispute resolution

3.17 The mutual agreement procedures (MAPs)69 Minimum Standards are outlined in the OECD Making Dispute Resolution Mechanisms More Effective Report70 (the Minimum Standards) and covered in Chapter IV of the OECD Guidelines. The ATO advised the ANAO in July 2023 that five MAPs have been undertaken in relation to the Top 100 and Top 1,000 populations for related party debt in the years between 2017–18 and 2021–22.

3.18 Australia has published MAP statistics, peer review reports and a MAP country profile in accordance with the Minimum Standards. The published MAP statistics show cases have been on average resolved within the 24-month timeframe provided by the Minimum Standards across 2017–18 to 2021–22. The ATO also provides guidance for taxpayers on its website in accordance with the Minimum Standards requirements.

3.19 The OECD Guidelines provide additional guidance for conducting advance pricing arrangements (APAs)71 under the MAP article (bilateral and multilateral APAs) in Annexure II to Chapter IV. The ATO advised the ANAO in July 2023 that there are no currently active APAs which apply to transactions involving related party debt.72

Documentation

3.20 Taxation Ruling 2014/8 sets out the Commissioner’s opinion on the transfer pricing documentation requirements in subdivision 284-E of Schedule 1 of the Taxation Administration Act 1953. This is consistent with the OECD Guidelines statement that ‘requirements should balance the tax administration’s need for information and the compliance burdens on taxpayers.’ The OECD Guidelines also state that transfer pricing documentation requirements should be reasonable and focused on material transactions to ensure mindful attention to the most important matters. This should balance the tax administration’s need for information with the compliance burden on taxpayers.

Process for adopting updates to the OECD Guidelines

3.21 The ATO has commenced a Minor and Technical Amendment (MTA) process to update references in the ITAA 1997 to incorporate the 2022 OECD Guidelines, in place of its current reference to the 2017 Guidelines. An MTA process is used to achieve minor law changes, such as updating references in tax law. It involves the ATO submitting an application for the inclusion of an amendment in an MTA schedule in a Treasury omnibus bill. At the time of this audit, the ATO had engaged with Treasury to include minor technical amendments to incorporate the 2022 OECD guidelines in the next available bill.

Country-by-Country reporting obligations

3.22 The OECD’s three-tiered Country-by-Country reporting approach, comprising of a master file, local file and Country-by-Country report, aims to address a lack of quality data in transfer pricing matters.73 Country-by-Country reporting applies in Australia to income years commencing from 1 January 2016, as recommended by the OECD Guidelines.

3.23 Subdivision 815-E of the ITAA 1997 requires ‘CBC reporting entities’74 to give statements corresponding to the three tiers in the OECD Guidelines annexures. The OECD Guidelines recommend all multinational enterprise groups should be required to file an annual Country-by-Country report with an exemption for groups with a consolidated group revenue below €750 million. The ITAA 1997 requires entities to file a Country-by-Country report if they are a parent company with an annual global income of at least $1 billion, or a member of a group with such a parent.

3.24 The OECD Guidelines state: ‘no exemptions from filing the Country-by-Country Report should be adopted apart from the exemptions outlined in this section.’ The ATO provides exemptions for all three reporting tiers on the grounds of administrative relief, fast-track exemptions or exemptions on formal request in certain circumstances.75 For the period up to 30 June 2023, 11 Top 100, and 28 Top 1,000 taxpayers have been granted an exemption for the Country-by-Country report.

3.25 The ATO provides its own local file form for taxpayers to complete, comprising of a short form, Part A and Part B.76 The short form includes questions addressing the local entity information required by the OECD Guidelines. Part A captures some information on the controlled transactions set out in Annexure II of the OECD Guidelines, including a description of the transactions, the amount of payment and receipts and identification of associated enterprises. Part B requires the taxpayer to provide attachments in line with the OECD Guidelines.77