Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Complaints by the Australian Taxation Office

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The effective handling of complaints is necessary for the Australian Taxation Office (ATO) to ensure its client experience and interactions are well designed, tailored, fair, and transparent.

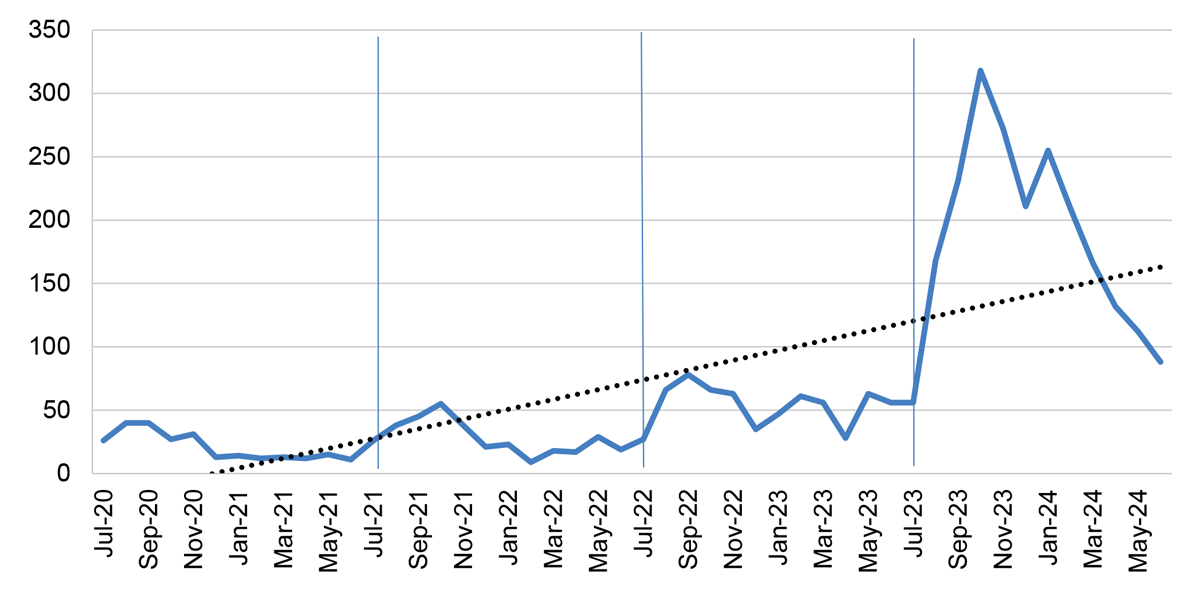

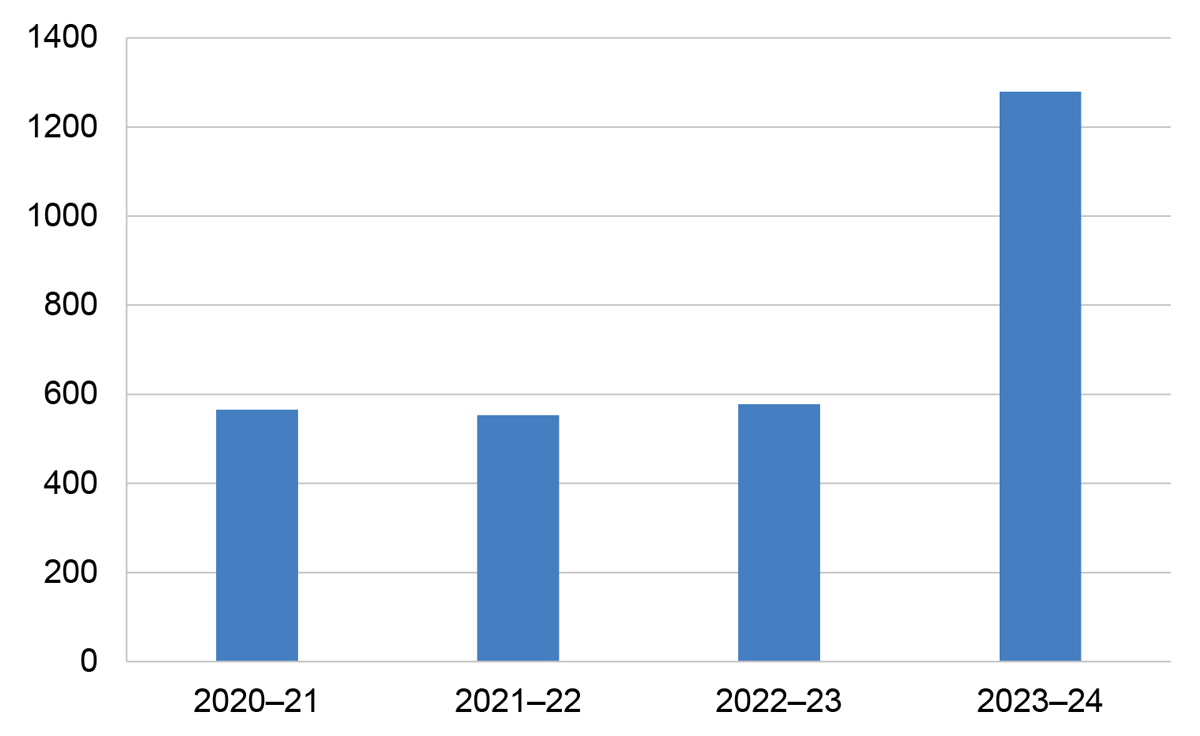

- The volume of complaints received by the ATO has nearly doubled between 2020–21 and 2023–24.

- The audit provides assurance to Parliament on the effectiveness of the ATO’s management of complaints.

Key facts

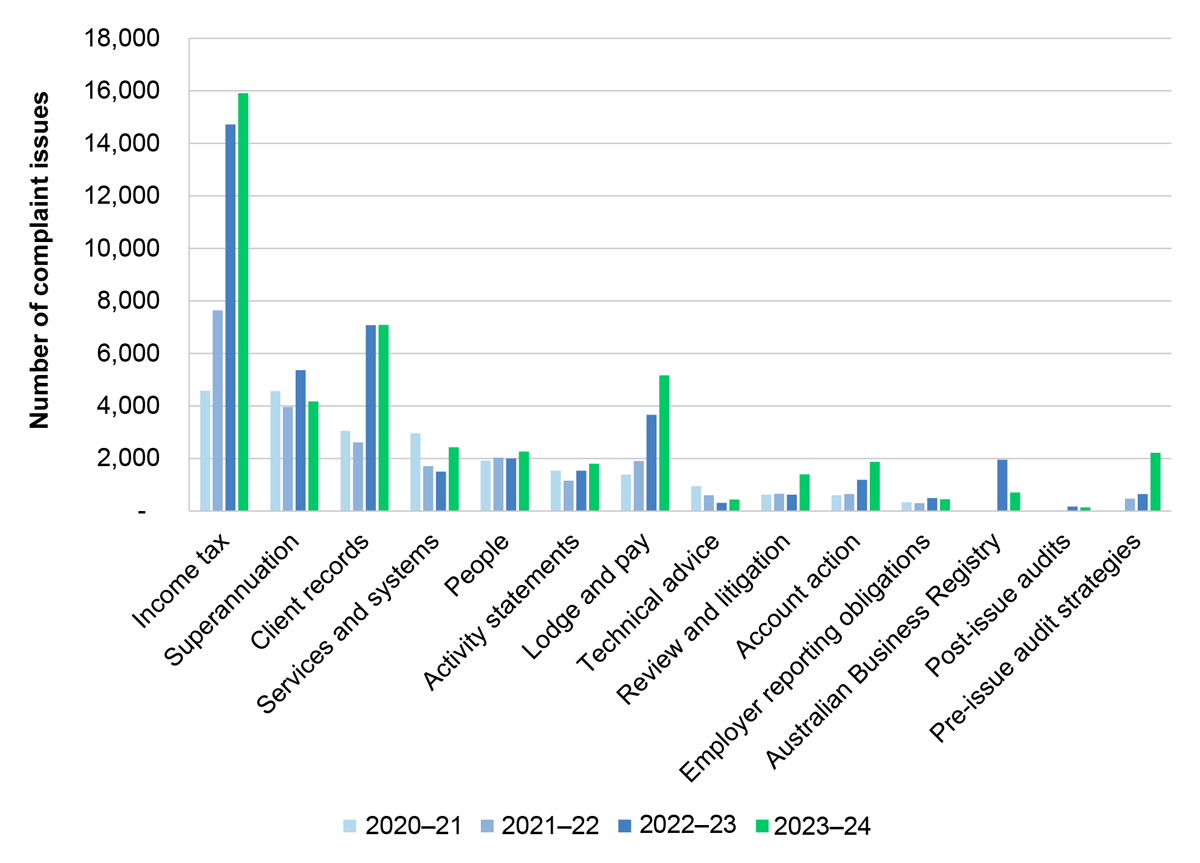

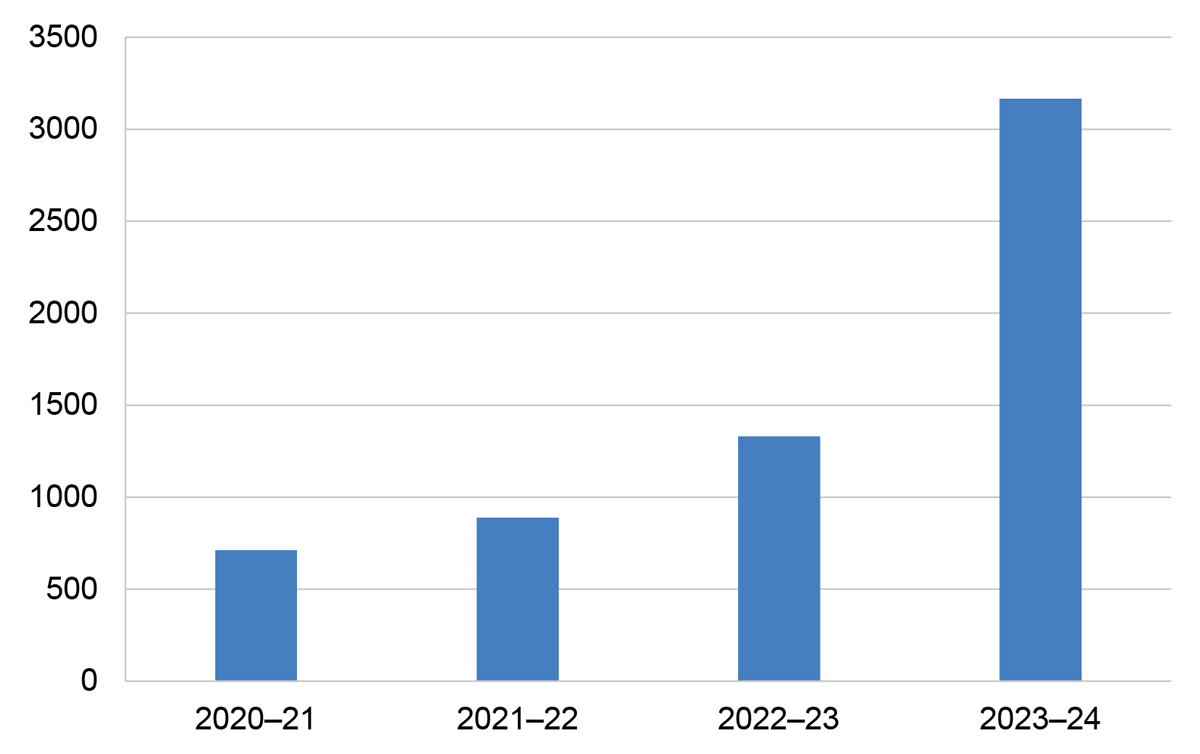

- Income tax, superannuation, and client records are generally the three most common complaints between 2020–21 and 2023–24.

- Complaints are analysed daily to report on and address emerging trends.

- The Inspector-General of Taxation (IGTO) made six recommendations to the ATO between 2020 and 2024 to improve the handling of complaints.

What did we find?

- The ATO’s management of complaints is largely effective. Effectiveness would be improved if the ATO’s analysis of its complaints data also sought to identify the underlying causes of complaints and used this information to improve business processes and complaint handling.

- The ATO has developed largely effective arrangements to handle complaints.

- The ATO has largely effective monitoring, reporting, and process improvements.

- Implementation of the IGTO’s six complaint handling recommendations was largely effective.

What did we recommend?

- The Auditor-General made four recommendations to: better document conversations with complainants, conduct root cause analysis, enhance public reporting, and improve implementation of recommendations from the IGTO.

- The ATO agreed to all of the recommendations.

1m 34s

average time to answer inbound complaint calls in 2023–24, against its service standard of 15 minutes or less.

56.5%

of complaints across all business lines between 2020–21 and 2023–24 related to timeliness.

935%

increase in complaints about accounts where personal information had been compromised between 2020–21 and 2023–24.

Summary and recommendations

Background

1. The Australian Taxation Office (ATO) is the principal revenue collection agency of the Australian Government. Its roles and responsibilities include administering legislation governing tax, superannuation and the Australian Business Register. The ATO’s corporate plan 2024–251 outlines a strategic objective to ensure its client experience and interactions are ‘well designed, tailored, fair, transparent.’ This objective includes a core priority to ‘enable trust and confidence through policy, sound law design and interpretation, as well as resolving disputes’.

2. The ATO Charter (the Charter) outlines the ATO’s commitments to its clients and what can be expected in interactions with the ATO.2 Under the Charter, the ATO is obligated to be fair and reasonable, provide professional service, provide support and assistance, keep clients’ data and privacy secure, and keep the community informed. This includes working with clients to address concerns and informing them how to make a complaint. The Charter provides ‘we treat all complaints seriously and aim to resolve them quickly and fairly.’

Rationale for undertaking the audit

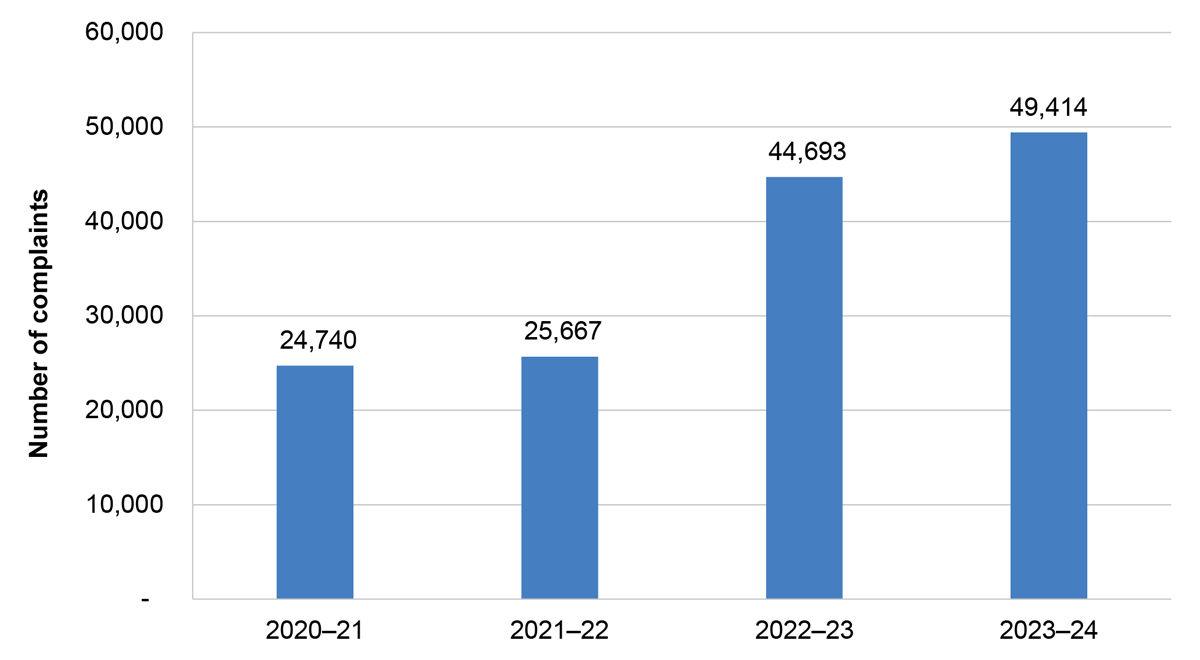

3. The Commonwealth Ombudsman’s Better Practice Complaint Handling Guide states that ‘Australian Public Service agencies and contractors must deliver high quality programs and services to the Australian community in a way that is fair, transparent, timely, respectful and effective’3, and that ‘[g]ood complaint handling will also help meet general principles of good administration, including fairness, transparency, accountability, accessibility and efficiency’.4 Between 2020–21 and 2023–24 the number of complaints received by the ATO, including those referred by the Inspector-General of Taxation and Taxation Ombudsman (IGTO), increased from 24,740 to 49,414.

4. This audit will provide assurance to Parliament of the Australian Taxation Office’s effectiveness in managing complaints, including engaging with complainants, resolving complaints, and the implementation of relevant IGTO recommendations.

Audit objective and criteria

5. The audit objective was to assess the Australian Taxation Office’s effectiveness in managing complaints.

6. To form a conclusion against the objective, the following criteria were adopted.

- Does the ATO have fit-for-purpose arrangements to support the effective handling of complaints?

- Does the ATO report on complaints, effectively review its complaints management framework, and seek to improve processes and service delivery?

- Were agreed recommendations from the Inspector-General of Taxation regarding ATO complaint handling effectively implemented?

Conclusion

7. The ATO’s management of complaints is largely effective. Effectiveness would be improved if the ATO’s analysis of its complaints data also sought to identify the underlying causes of complaints and used this information to improve business processes and complaint handling.

8. The ATO’s complaints management framework is largely aligned with the Commonwealth Ombudsman’s Better Practice Complaints Handling Guide. The complaints process is accessible through multiple channels, and complaints are triaged to allocate complaints to resolvers with appropriate experience. The ATO seeks to resolve complaints at first contact. The proportion of complaints resolved at first contact has declined over the last four financial years. The ATO uses timeliness of complaint handling as its indicator for efficiency. The process is reliant on complainant feedback to improve accessibility. The ATO largely applies its framework to handle complaints, though it does not consistently document discussions with complainants to extend complaint due dates which has an impact on the accuracy of performance reporting. The ATO has also not consistently communicated taxpayer review rights to the complainant.

9. The ATO is largely effective at reporting on complaints, collecting complaint data to monitor incoming complaint volumes, categories of complaints, performance against service commitments and performance of key complaint topics. The data is used to generate internal reports based on the needs of individual business areas and bodies that meet to discuss complaint trends. Public reporting through the ATO Annual Report consists of the total number of complaints received and performance against the ATO service commitment targets. The ATO is able to determine which issue categories lead to increases in complaints but does not identify the root causes of these increases. Analysis of cross-product issues indicates that ‘timeliness’ is the largest complaint issue across many business lines, accounting for 56.5 per cent of all complaints from 2020–21 to 2023–24.

10. The ATO is largely effective in using a variety of sources including complaint data to identify business improvements to enhance both the complaint handling system and broader ATO processes and service delivery. It manages these through the Business Intelligence and Improvement register to iteratively improve its processes and service delivery. The ATO could strengthen its Business Intelligence and Improvements framework.

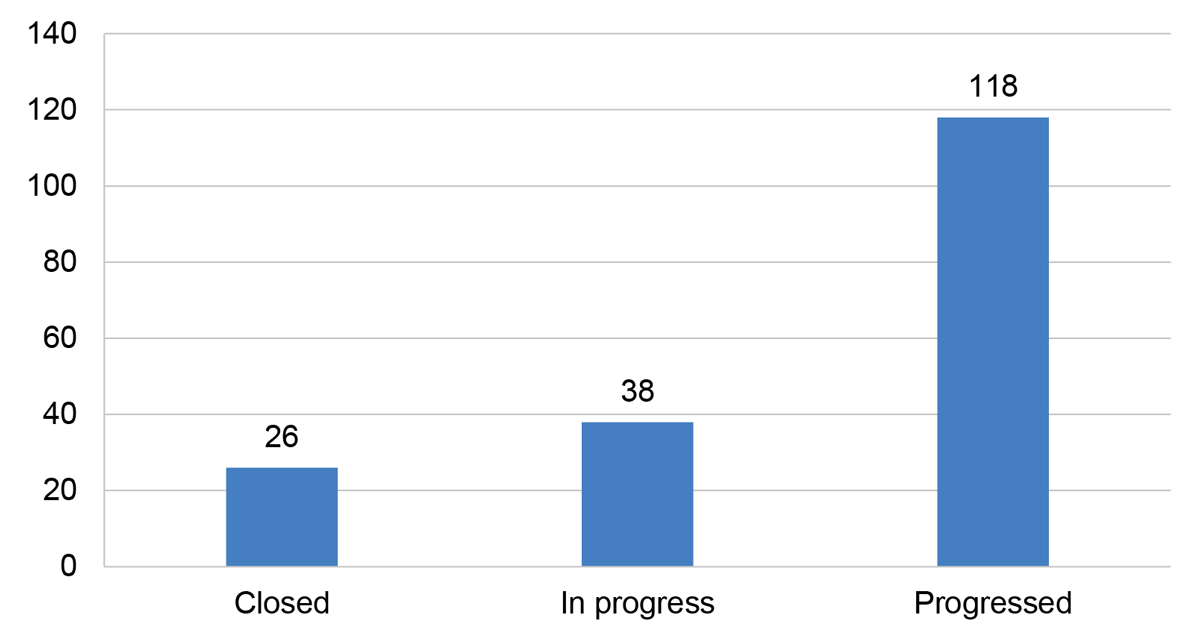

11. The ATO was largely effective in implementing the six IGTO recommendations made between 1 July 2020 and 30 July 2024 concerning the ATO’s management of complaints. The ATO has guidance to assist business lines developing implementation plans for recommendations. Implementation plans for the selected recommendations were largely consistent with this guidance, with the exception that the ATO’s template does not address measures of success or outcomes to be realised as required in ATO guidance. Recommendations are monitored through quarterly reporting to the ATO External Scrutineers Unit (ESU), the Audit and Risk Committee (ARC) and the IGTO. Reporting of selected recommendations was completed for all relevant quarters, though there were inconsistencies in reporting regarding revisions to the target implementation date of one recommendation. Three of the selected recommendations were assessed by the ANAO as implemented in full, two were largely implemented, and one was assessed as partly implemented. The ATO completed closure statements with attached evidence of implementation for all selected recommendations, though these were all endorsed after the reported closure dates and the ATO did not establish if the desired outcome of the recommendation had been achieved before closure of the recommendations. Evidence gathering and finalisation of the closure statements continued after the closure date for five of the six recommendations, with two also identifying ongoing work at the time of closure.

Supporting findings

Arrangements to support the effective handling of complaints

12. The ATO’s complaints management framework is largely aligned with the Commonwealth Ombudsman’s Better Practice Complaint Handling Guide. Complaints are received, are categorised, and are sent to the relevant Business Service Line if they cannot be resolved at first point of contact. Resolution is through prioritisation of calls to the complaints hotline, the use of First Contact Resolution, and via complaint categorisation at the point of receipt. The ATO approach to determining efficiency focuses on timeliness and does not consider inputs and outputs. (See paragraphs 2.3 to 2.48)

13. The process to make a complaint to the ATO is clearly articulated on its website, and guidance documents provided to staff to explain the complaints process are clear. The complaints process is accessed primarily through online web form and telephone, and is largely compliant with the BPG. The ATO does not specifically survey complainants on the ATO’s complaint management process, however complainants who have had an identity-verified interaction with the ATO were eligible to be randomly sampled for the ATO’s broader monthly Client Experience Survey. The information on complaints obtained through this survey does not support meaningful analysis. The ATO relies on complainant feedback to identify and address accessibility issues, and does not proactively monitor and assess potential accessibility barriers. The ATO implements changes when issues are brought to its attention through this channel. (See paragraphs 2.49 to 2.61)

14. The ATO uses notes, attachments and templates in the Siebel work management system to record actions taken while resolving a complaint. The complaint capture template was consistently completed by ATO staff. The issues template was largely completed in line with ATO guidelines and use of this template increased from 2020–21 to 2023–24. Notes and attachments recorded in Siebel and analysed by the ANAO indicate the ATO actions complaints in accordance with its guidance. Regular ongoing contact was not consistently maintained with complainants in 2022–23 and 2023–24, and some complainants were not advised of their review rights when a complaint was closed. The ATO did not have a discussion with complainants before extending due dates in the majority of complaint cases. The extended due dates exceed the ATO’s service commitment to resolve complaints within 15 business days. (See paragraphs 2.62 to 2.86)

Reporting, process improvement, and review

15. The ATO generates internal reports based on the needs of individual business areas and bodies that meet to discuss complaints. Public reporting through the ATO Annual Report consists of the total number of complaints received and performance against the ATO service commitment targets. The ATO is able to determine which issue categories have led to increases in complaints, but does not identify the root causes of these increases. Analysis of cross-product issues indicates that ‘timeliness’ is the largest complaint issue across many business lines, accounting for 56.5 per cent of complaints from 2020–21 to 2023–24. (See paragraphs 3.2 to paragraph 3.42)

16. The ATO uses a variety of sources including complaint data to identify opportunities to improve its complaints management framework. The ATO manages changes to its complaints management framework manually through the Business Intelligence and Improvement register. The ATO does not undertake regular evaluation of its complaint handing processes. (See paragraphs 3.43 to 3.46)

17. The complaint data collected by the ATO is used to monitor incoming complaint volumes and categories, performance against service commitments and performance of key complaint topics. The ATO also improves non-complaint handling processes and service delivery through the Business Intelligence and Improvement register. There is an opportunity for the ATO to strengthen the Business Intelligence and Improvements framework. (See paragraphs 3.47 to 3.63)

Implementation of Inspector-General of Taxation recommendations regarding complaint handling

18. The ATO has guidance for business lines developing implementation plans to address recommendations from the Inspector-General of Taxation and Taxation Ombudsman (IGTO). The ATO External Scrutineers Unit coordinates this process. Implementation plans were developed for all selected recommendations and largely reflect ATO requirements. Implementation plans are not provided to the IGTO for feedback as required and the implementation plan template does not address measures of success or outcomes to be realised as required in ATO guidance. (See paragraphs 4.3 to 4.21)

19. The implementation of recommendations from the IGTO is primarily monitored through quarterly reporting. The ATO’s External Scrutineers Unit sources updates from Business Service Lines on the implementation of recommendations to produce quarterly reporting. These updates were often returned to ESU after their due date and lacked evidence of action taken. The progress of selected recommendations was reported to the IGTO and ATO Audit and Risk Committee (ARC) in all relevant quarters. The ATO classified four of the six closed recommendations as implemented by their original target date. There are inconsistencies in the reporting of revisions to the target implementation date of one recommendation to the ARC. These revisions were made after the previous target date had passed. (See paragraphs 4.22 to 4.49)

20. Three of the six closed recommendations were assessed by the ANAO as implemented in full, two were largely implemented, and one was assessed as partly implemented. The ATO completed all required closure statements, although endorsement was provided after the closure date for all recommendations, and evidence attached was not sufficient to provide assurance of implementation status without seeking documentation from additional sources. Evidence gathering and finalisation of the closure statements continued after the closure date for five recommendations, with two also identifying ongoing work. The ATO did not establish if the desired outcome of the recommendation had been achieved before closure of the recommendations. (See paragraphs 4.50 to 4.80)

Recommendations

Recommendation no. 1

Paragraph 2.86

The Australian Taxation Office:

- conducts and documents any discussion with complainants before extending complaint due dates; and

- communicates and documents that review rights have been discussed with the complainant in accordance with its own guidance.

Australian Taxation Office response: Agreed.

Recommendation no. 2

Paragraph 3.40

The Australian Taxation Office:

- analyses the root causes of complaints, particularly where there has been a significant increase in volumes; and

- enhances its public reporting on complaint trends, causes, and outcomes in its Annual Report to better align with the Commonwealth Ombudsman’s Better Practice Complaint Handling Guide to improve transparency to the Parliament.

Australian Taxation Office response: Agreed.

Recommendation no. 3

Paragraph 4.21

The Australian Taxation Office shares implementation plans for agreed recommendations with the Inspector-General of Taxation.

Australian Taxation Office response: Agreed.

Recommendation no. 4

Paragraph 4.78

The Australian Taxation Office gains sufficient assurance of implementation by closing recommendations only after providing:

- the required senior executive endorsement; and

- appropriate closure statement evidence, in accordance with its guidance.

Australian Taxation Office response: Agreed.

Summary of entity response

21. The proposed audit report was provided to the ATO. The ATO’s summary response is reproduced below and its full response is at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed in Appendix 2.

The Australian Taxation Office (the ATO) welcomes the ANAO’s report and finding that the ATO is largely effective in managing complaints.

Whilst complaints represent a very small portion of our interactions with taxpayers, we understand the importance of complaints in helping us to continue to improve their experience.

We are proud of the work we do to deliver for the Australian community in a manner that meets Government and community expectations. We are pleased to see the ANAO has found the ATO has developed largely effective arrangements to handle complaints and that we monitor, report and process improvements effectively. We remain committed to understanding the systemic issues that may be driving trends through complaints as it enables us to continually improve how we operate.

The ATO agrees with the four recommendations in the report. Implementation of the recommendations and opportunities for improvement identified by the ANAO will help us further strengthen our complaints processes, and ensure we continue to effectively meet our commitments to taxpayers and the Australian Government.

Key messages from this audit for all Australian Government entities

22. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Performance and impact measurement

1. Background

Introduction

1.1 The Australian Taxation Office (ATO) is the principal revenue collection agency of the Australian Government. Its roles and responsibilities include administering legislation governing tax, superannuation and the Australian Business Register. The ATO’s corporate plan 2024–255 outlines a strategic objective to ensure its client6 experience and interactions are ‘well designed, tailored, fair, transparent.’ This objective includes a core priority to ‘enable trust and confidence through policy, sound law design and interpretation, as well as resolving disputes’.

1.2 The ATO Charter (the Charter) outlines the ATO’s commitments to its clients and what can be expected in interactions with the ATO.7 Under the Charter, the ATO is obligated to be fair and reasonable, provide professional service, provide support and assistance, keep clients’ data and privacy secure, and keep the community informed. This includes working with clients to address concerns and informing them how to make a complaint. The Charter provides ‘we treat all complaints seriously and aim to resolve them quickly and fairly.’

Complaints management

1.3 The ATO defines a complaint as:

An expression of dissatisfaction with an ATO process, service, action or product or the handling of a complaint where the client is expecting an individual resolution or response. It may result from the ATO not being able to meet a client’s expectations, not meeting our Charter commitments or both. The client is seeking a remedy for their own or an authorised client’s tax affairs.

1.4 ATO Corporate Complaints is the business area responsible for the overall management of complaints in the ATO. The ATO advised the ANAO in May 2024 that its processes for handling complaints are based on the Commonwealth Ombudsman’s Better Practice Complaint Handling Guide (BPG)8 and the Australian and New Zealand Standard Guidelines for complaint management in organisations (AS/NZS 10002:2022).

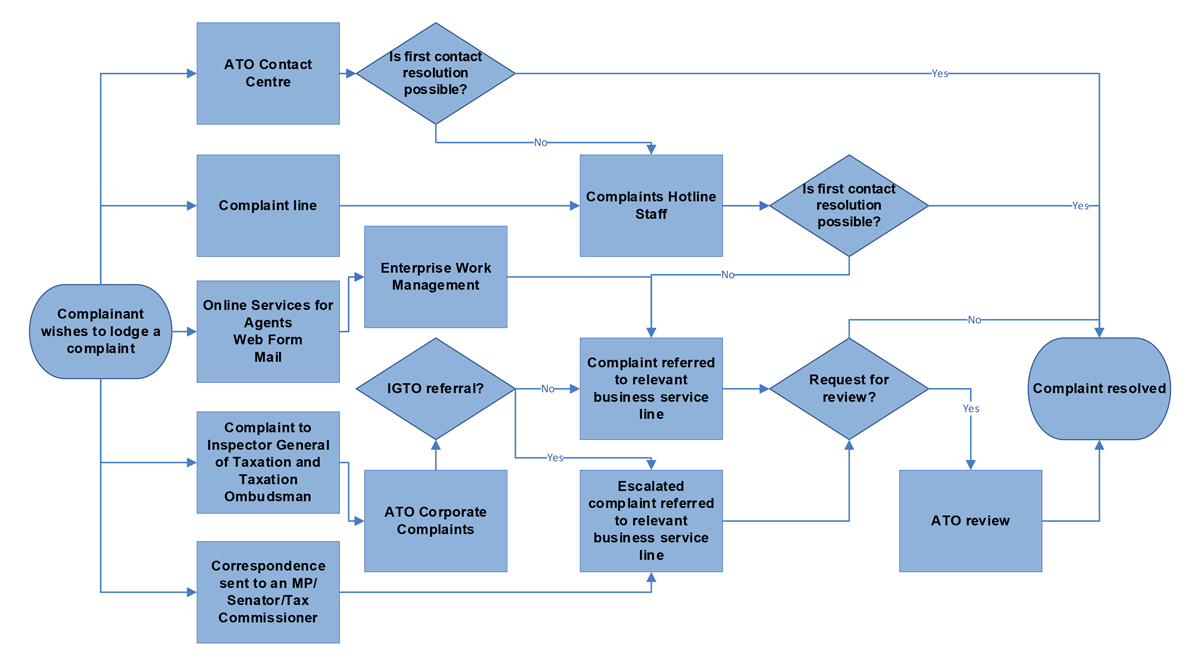

1.5 Complaints may be received by the ATO via phone, mail or online and are directed to either the complaints hotline or Enterprise Work Management (EWM)9. The hotline attempts to resolve complaints at first contact. When this is not possible, complaints are directed to the relevant business lines for resolution. ATO business lines have complaints networks which liaise with ATO Corporate Complaints.

1.6 Complaints received by online form or mail are processed into the ATO’s work management system, Siebel by EWM (no first contact resolution (see paragraph 2.16) is attempted), and then routed to the relevant business line for action.

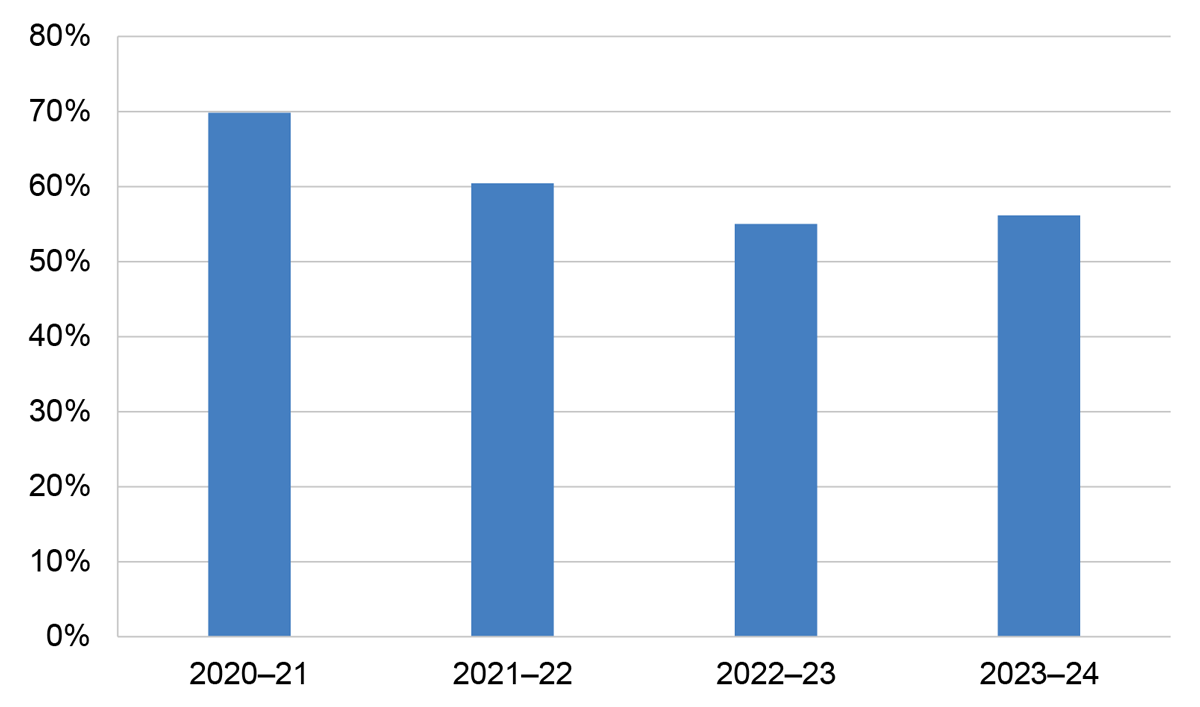

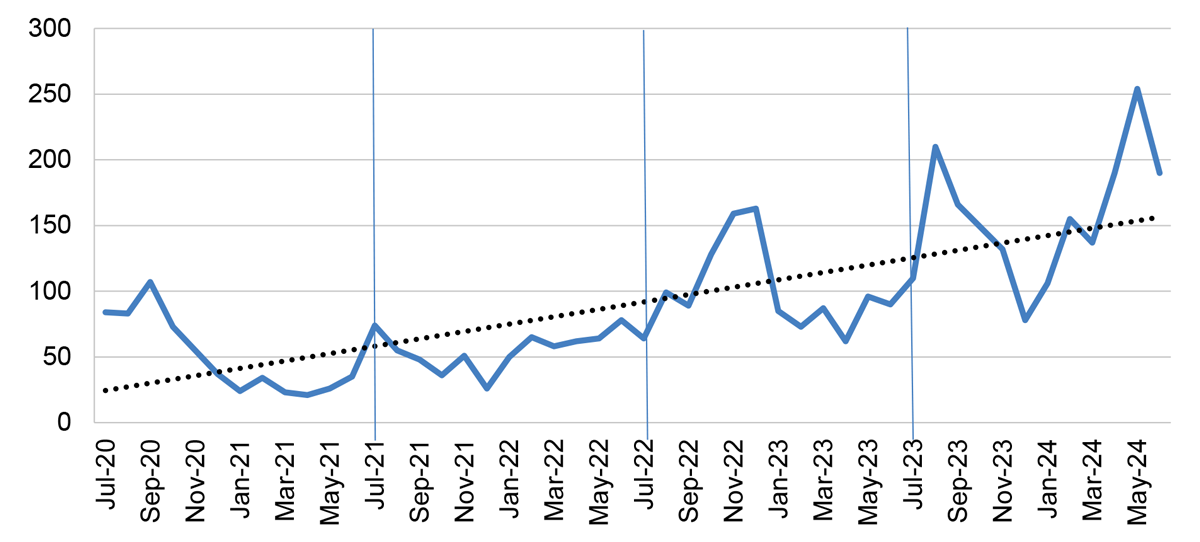

1.7 Figure 1.1 shows the annual number of complaints received (including those referred by the IGTO, see paragraph 2.34) by the ATO from 2020–21 to 2023–24, based on figures published in ATO annual reports.

Figure 1.1: Complaints received by the ATO in 2020–21 to 2023–24

Source: ANAO analysis of ATO Annual Reports 2020–21 to 2023–24

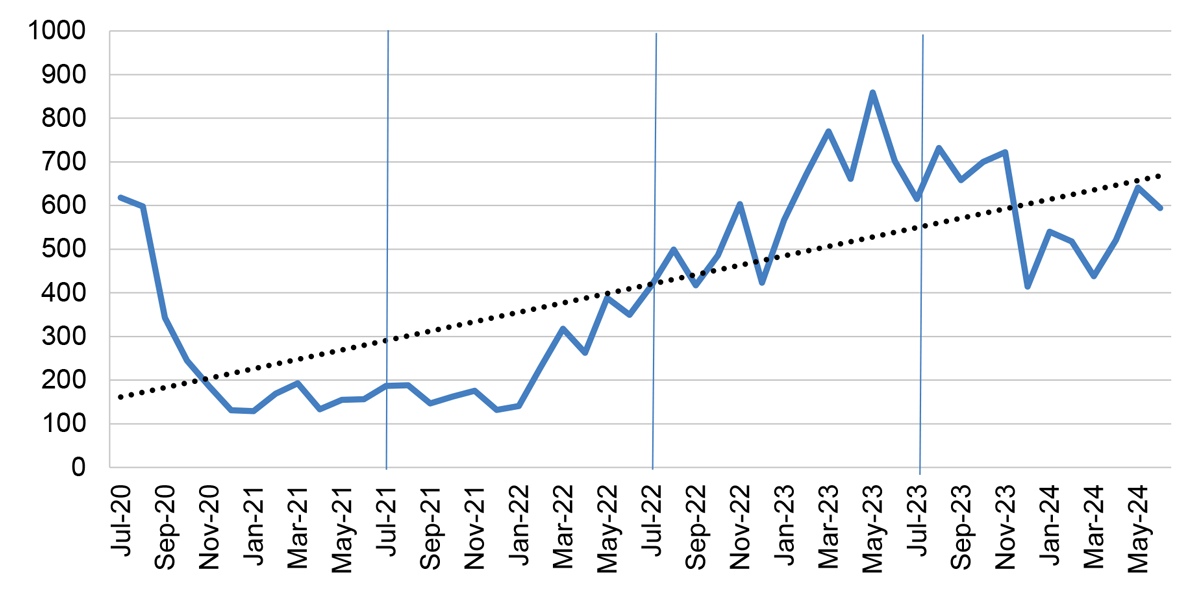

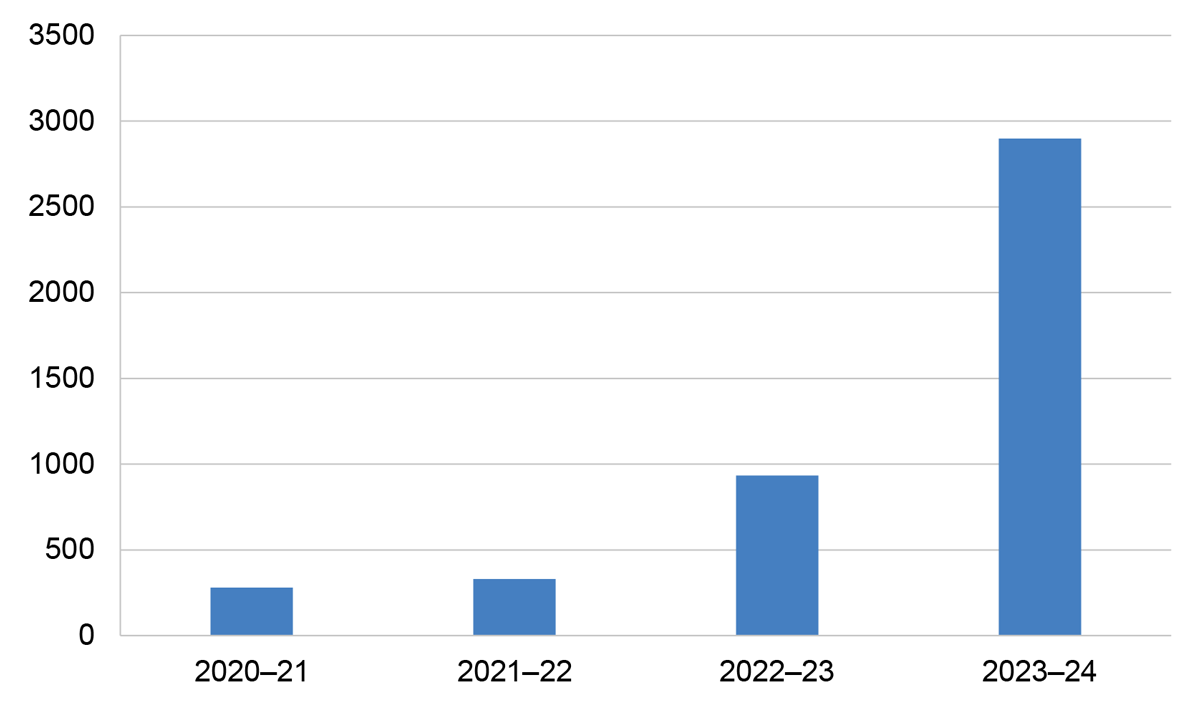

1.8 The ATO categorises the complaints it receives by the term ‘product’. Income tax has the highest number of complaint issues, increasing in volume from 4,583 complaints in 2020–21 to 15,915 in 2023–24. Superannuation and Client Records were the next top three most common complaint issues every year during this period, except in 2023–24 as Lodge and Pay10 complaints surpassed Superannuation.

1.9 Figure 1.2 shows the number of complaint issues related to each product from 2020–21 to 2023–24, as reported in ATO annual reports.

Figure 1.2: Complaint issues by product from 2020–21 to 2023–24a

Note a: The number of complaint issues differs from total number of complaints as a complaint may include multiple issues and complaint issues are not captured when a complaint is resolved during the initial interaction with a client. See paragraph 3.16 for more information on increases in income tax complaints.

Source: ANAO analysis of ATO Annual Reports 2020–21 to 2023–24.

Inspector-General of Taxation and Taxation Ombudsman

1.10 The Inspector-General of Taxation is an independent Commonwealth body established through the Inspector-General of Taxation Act 2003. The Taxation Ombudsman function was transferred from the Commonwealth Ombudsman in 2015. This included the role of investigating unresolved ATO complaints and providing specialised tax complaints services. These two functions combined to form the Inspector-General of Taxation and Taxation Ombudsman (IGTO).

1.11 After attempting to resolve a complaint with the ATO, complainants can lodge a dispute about the ATO’s actions with the IGTO for independent investigation.11 The IGTO may also refer or transfer complaints to the ATO for resolution.

1.12 In addition to its complaints function, the IGTO conducts review investigations into broader or systemic tax administrative issues, and publishes reports containing its findings and recommendations.12 These reviews are usually initiated by the IGTO based on stakeholder consultation, research and analysis, or ministerial referral, and aim to ensure the administration of the tax system aligns with community expectations.

Previous audits and review

1.13 Auditor-General Report No. 19 of 2013–14 Management of Complaints and Other Feedback13 found that the ATO’s complaints handling framework is well designed but there are opportunities for the ATO to have a better understanding of issues which are subject to complaints (see paragraph 3.10) and the needs of complainants (see paragraph 2.52), and to better use intelligence from client feedback (see paragraph 2.59). The ANAO made three recommendations aimed at improving reporting (see paragraph 3.6) and performance measures (see paragraph 3.7), implementing a more coherent agency-wide quality assurance approach (see paragraph 2.38), and limiting sensitive information about named officer complaints being included in records (see paragraph 2.67). The ATO agreed with all three recommendations.

Rationale for undertaking the audit

1.14 The Commonwealth Ombudsman’s Better Practice Complaint Handling Guide states that ‘Australian Public Service agencies and contractors must deliver high quality programs and services to the Australian community in a way that is fair, transparent, timely, respectful and effective’14, and that ‘[g]ood complaint handling will also help meet general principles of good administration, including fairness, transparency, accountability, accessibility and efficiency’.15 Between 2020–21 and 2023–24 the number of complaints received by the ATO, including those referred by the Inspector-General of Taxation and Taxation Ombudsman (IGTO), increased from 24,740 to 49,414.

1.15 This audit will provide assurance to Parliament of the Australian Tax Office’s effectiveness in managing complaints, including engaging with complainants, resolving complaints, whether complaints inform business and service improvements, and the implementation of relevant IGTO recommendations.

Audit approach

Audit objective, criteria and scope

1.16 The audit objective was to assess the Australian Taxation Office’s effectiveness in managing complaints.

1.17 To form a conclusion against the objective, the following criteria were adopted.

- Does the ATO have fit-for-purpose arrangements to support the effective handling of complaints?

- Does the ATO report on complaints, effectively review its complaints management framework, and seek to improve processes and service delivery?

- Were agreed recommendations from the Inspector-General of Taxation regarding ATO complaint handling effectively implemented?

1.18 The audit focused on the ATO’s complaints management processes and the implementation of related IGTO recommendations between 1 July 2020 and 30 June 2024.

Audit methodology

1.19 The audit methodology included:

- review of ATO documentation such as strategies, plans, risk documents, meeting papers and minutes, reporting and internal briefings;

- meetings with ATO officers; and

- walkthroughs of processes and procedures with ATO officers.

1.20 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $546,217.

1.21 The team members for this audit were Shane Armstrong, Raza Gulani, Ally Cerritelli, Renae Lowden, Taylah Morgan and David Tellis.

2. Arrangements to support the effective handling of complaints

Areas examined

This chapter examined whether the Australian Taxation Office (ATO) has fit-for-purpose arrangements to support the effective handling of complaints.

Conclusion

The ATO’s complaints management framework is largely aligned with the Commonwealth Ombudsman’s Better Practice Complaints Handling Guide. The complaints process is accessible through multiple channels, and complaints are triaged to allocate complaints to resolvers with appropriate experience. The ATO seeks to resolve complaints at first contact. The proportion of complaints resolved at first contact has declined over the last four financial years. The ATO uses timeliness of complaint handling as its indicator for efficiency. The process is reliant on complainant feedback to improve accessibility. The ATO largely applies its framework to handle complaints, though it does not consistently document discussions with complainants to extend complaint due dates which has an impact on the accuracy of performance reporting. The ATO has also not consistently communicated taxpayer review rights to the complainant.

Areas for improvement

The ANAO made a recommendation aimed at ensuring that the ATO has and documents discussions with complainants prior to extending complaint due dates, and documenting that a complainant has been informed of their review rights in accordance with ATO guidance.

2.1 The ATO’s corporate plan 2024–2516 outlines a strategic objective to ensure its client experience and interactions are ‘well designed, tailored, fair, transparent.’ This objective includes a core priority to ‘enable trust and confidence through policy, sound law design and interpretation, as well as resolving disputes’.

2.2 The Commonwealth Ombudsman’s Better Practice Complaint Handling Guide describes a strong complaint handling system as being ‘designed and delivered in a way that meets better practice principles.’17

Is there an effective complaints management framework that is also designed to support the efficient handling of complaints?

The ATO’s complaints management framework is largely aligned with the Commonwealth Ombudsman’s Better Practice Complaint Handling Guide. Complaints are received, are categorised, and are sent to the relevant Business Service Line if they cannot be resolved at first point of contact. Resolution is through prioritisation of calls to the complaints hotline, the use of First Contact Resolution, and via complaint categorisation at the point of receipt. The ATO approach to determining efficiency focuses on timeliness and does not consider inputs and outputs.

Foundations of the complaint handling framework

2.3 In 2009 the Office of the Commonwealth Ombudsman developed a Better Practice Complaints Handling Guide (the BPG) based on the Australia/New Zealand Standard Guidelines for complaint management in organisations. In 2022 the ANAO conducted an audit into the management of complaints by the Office of the Commonwealth Ombudsman and confirmed that the BPG aligned with the Australian Standard.18

2.4 The ATO circulated the BPG to its National Complaints Forum19 (See Appendix 3) in October 2009. From January 2011 the ATO referenced the BPG as something that guided its approach to complaints, and in February 2011 began to consider a process to assess its complaint handling framework against the BPG. In April 2013, the ATO finalised a business case to ‘enhance the ATO complaints and compliments management process.’ This process was commenced in February 2012 and completed in October 2014. It included consideration of the recommendations and findings from Auditor-General Report No. 19 of 2013–14 Management of Complaints and Other Feedback.

2.5 In April 2022 the ATO updated its complaint acknowledgement process and ensured it continued to remain based on the BPG. The ATO confirmed in May 2024 that its complaint handling procedure framework remained based on the BPG.

The complaint handling process

2.6 Figure 2.1 illustrates a high-level summary of the complaint handling process from receipt to closure.

Figure 2.1: The complaint handling process

Source: ANAO analysis of ATO documentation.

Complaint receipt and categorisation

2.7 Complaints directly received from complainants generally enter the ATO via one of the following avenues — calling the ATO either via the complaints hotline or a general ATO phone number (in which the caller indicates they wish to make a complaint), completion of the complaints online web form, via email, via mail, or through Online Services for Agents (OSfA). Complaints can also be forwarded to the ATO through Inspector-General of Taxation and Taxation Ombudsman; or through correspondence sent to the ATO by a Member of Parliament, a Senator, or the Commissioner and/or the Second/Deputy Commissioners.

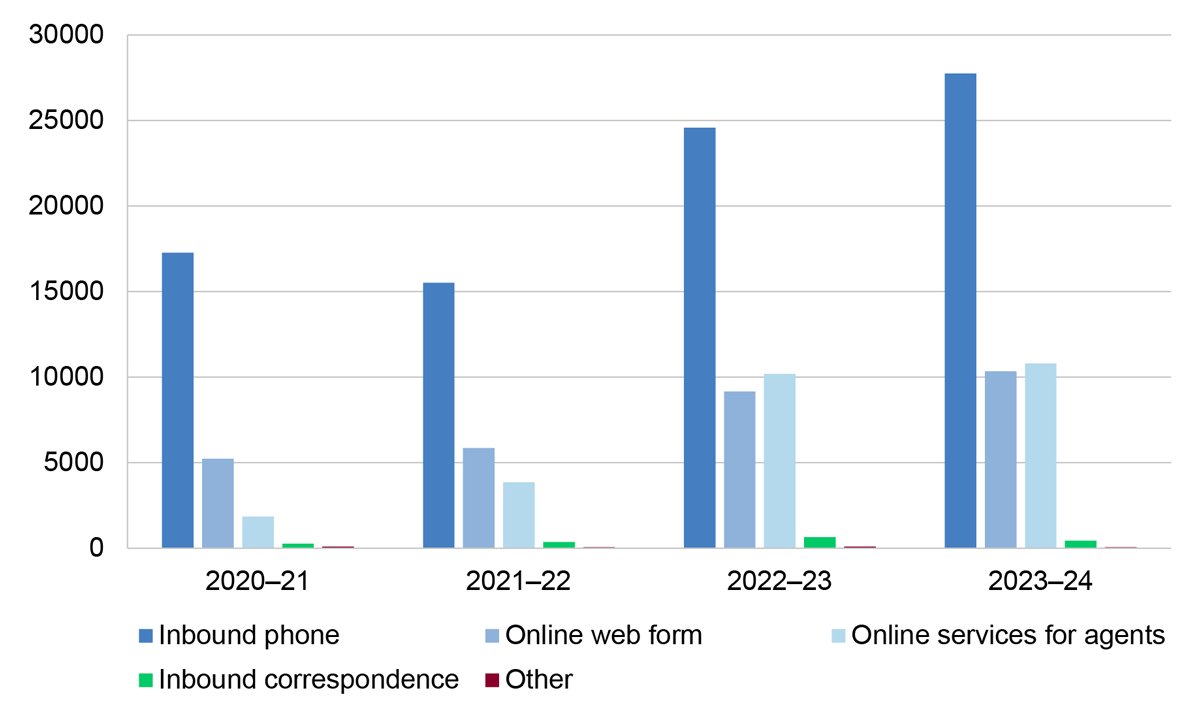

2.8 The ATO receives most of its complaints by telephone, mail, OSfA, and online web form through the ATO website. Figure 2.2 illustrates complaint volumes by channel from 2020–21 to 2023–24.

Figure 2.2: Complaint volumes by channel 2020–21 to 2023–24

Source: ANAO analysis of ATO documentation. ‘Other’ includes outbound and internally transferred phone calls, fax.

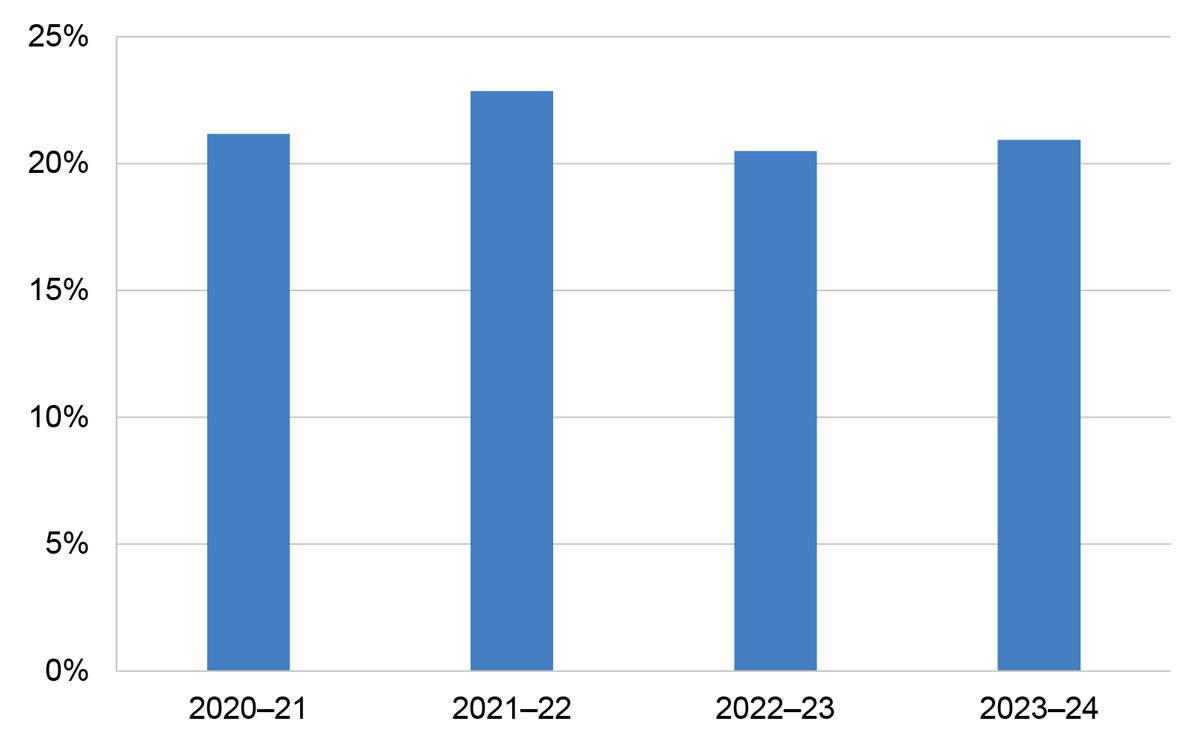

2.9 Analysis of the proportions of complaints received via each channel provides an indication of trends in complainant behaviour. Figure 2.3 shows that inbound telephone calls have been in a gradual downward trend between 2020–21 and 2023–24 as more complaints were made by online web form and through OSfA.

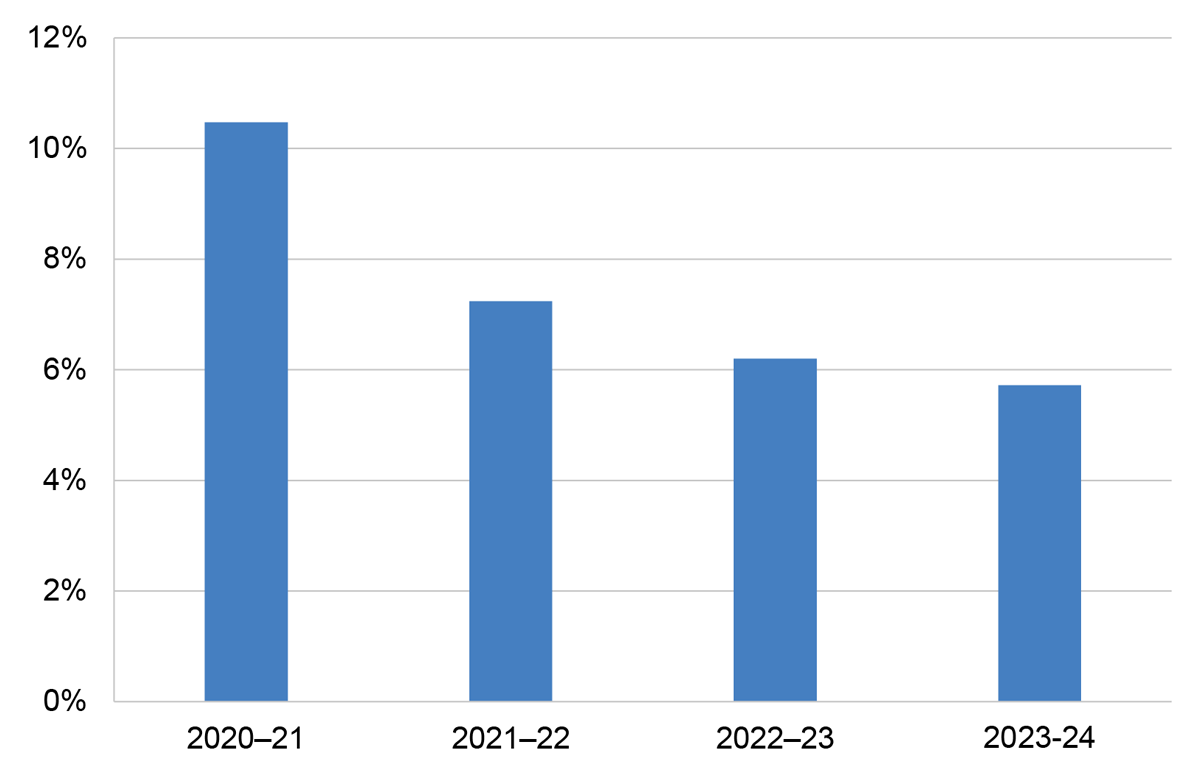

Figure 2.3: Proportion of complaints received via inbound telephone call 2020–21 to 2023–24

Source: ANAO analysis of ATO documentation.

2.10 The ATO advised the ANAO in September 2024 that it encouraged complaints to be lodged through the telephone ‘as this is often the fastest way for complaints to be finalised and/or escalated’, and that the complaint hotline was prioritised over other queues. The ATO applies a service commitment of an average wait time for inbound general calls of less than 15 minutes, and 40 per cent of inbound tax practitioner calls answered within seven minutes.20 Table 2.1 outlines ATO complaint handling telephone wait times from 2020–21 to 2023–24.

Table 2.1: Average wait time of complaint hotline queues 2020–21 to 2023–24

|

|

Inbound or transfera |

2020–21 (m:ss) |

2021–22 (m:ss) |

2022–23 (m:ss) |

2023–24 (m:ss) |

|

General |

Inbound |

2:13 |

1:37 |

1:52 |

1:33 |

|

|

Transfer |

1:48 |

1:28 |

1:35 |

1:23 |

|

Tax Practitioner |

Inbound |

2:30 |

1:41 |

1:58 |

1:38 |

|

|

Transfer |

1:44 |

1:28 |

0.47 |

2:08 |

|

Total |

Inbound |

2:16 |

1:38 |

1:54 |

1:34 |

|

|

Transfer |

1:48 |

1:28 |

1:35 |

1:23 |

Note a: Inbound calls are those made directly by the complainant. A transferred call is a call transferred from another part of the ATO to complaint handling staff.

Source: ANAO analysis of ATO documentation.

2.11 In September 2024 the ATO advised that it had 175 staff skilled to answer complaints hotline calls, with 88 skilled in business complaints, 57 skilled in individuals complaints, and 30 skilled in superannuation complaints.

2.12 The BPG states that complaint handling staff ‘must demonstrate professional, empathetic, effective complaint handling practices in accordance with internal policy and procedures and better practice guidelines’.21

2.13 The ANAO reviewed 20 telephone complaints received by the ATO randomly selected out of the random sample for 2023–24 (see paragraph 2.63). Staff applied appropriate complaint handling procedures in observed calls.

2.14 The ATO also accepts complaints via an online complaints form22, which then prompts ATO complaint resolvers to attempt to contact the complainant via telephone to confirm the complainant’s identity. Figure 2.4 shows that complaints received via this method increased as a proportion of all complaints in 2021–22. The ATO advised the ANAO in November 2024 that this trend was driven by complaints made by State Public Trustees relating to complaints about copies of documents, and lost member superannuation requests.

Figure 2.4: Proportion of complaints received via online web form 2020–21 to 2023–24

Source: ANAO analysis of ATO documentation.

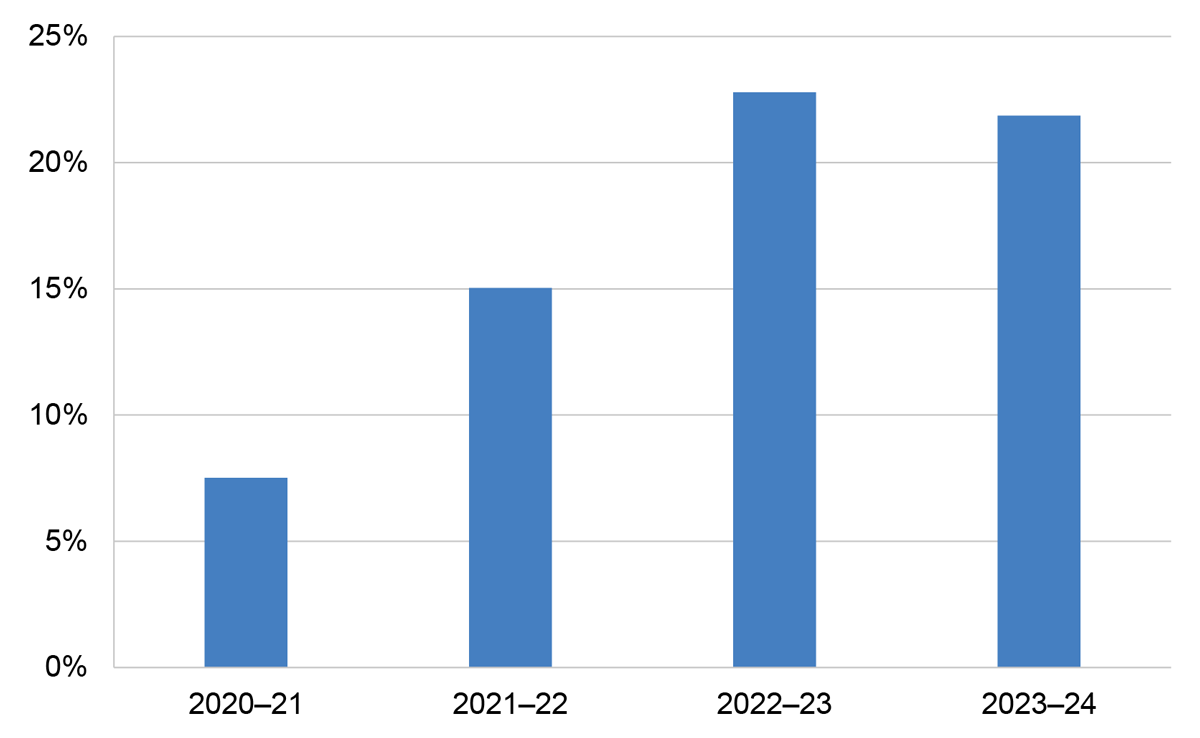

2.15 Figure 2.5 indicates that complaints received through OSfA have increased significantly since 2020–21. The ATO advised the ANAO in November 2024 that it did not report on complaint channels, but advised that increased functionality and use of OSfA in 2019 had led to this increase.

Figure 2.5: Proportion of complaints received through Online Services for Agents 2020–21 to 2023–24

Source: ANAO analysis of ATO documentation.

2.16 Clients that contact ATO via telephony either to the ATO Contact Centre or the Complaints Hotline directly will have staff attempt First Contact Resolution (FCR) where appropriate.

- There must be no previous complaints about the same issue from the same complainant.

- The issue is not recurring.

- The complaint can be solved immediately (in real time).

- The staff member has the necessary skills to resolve the complaints.

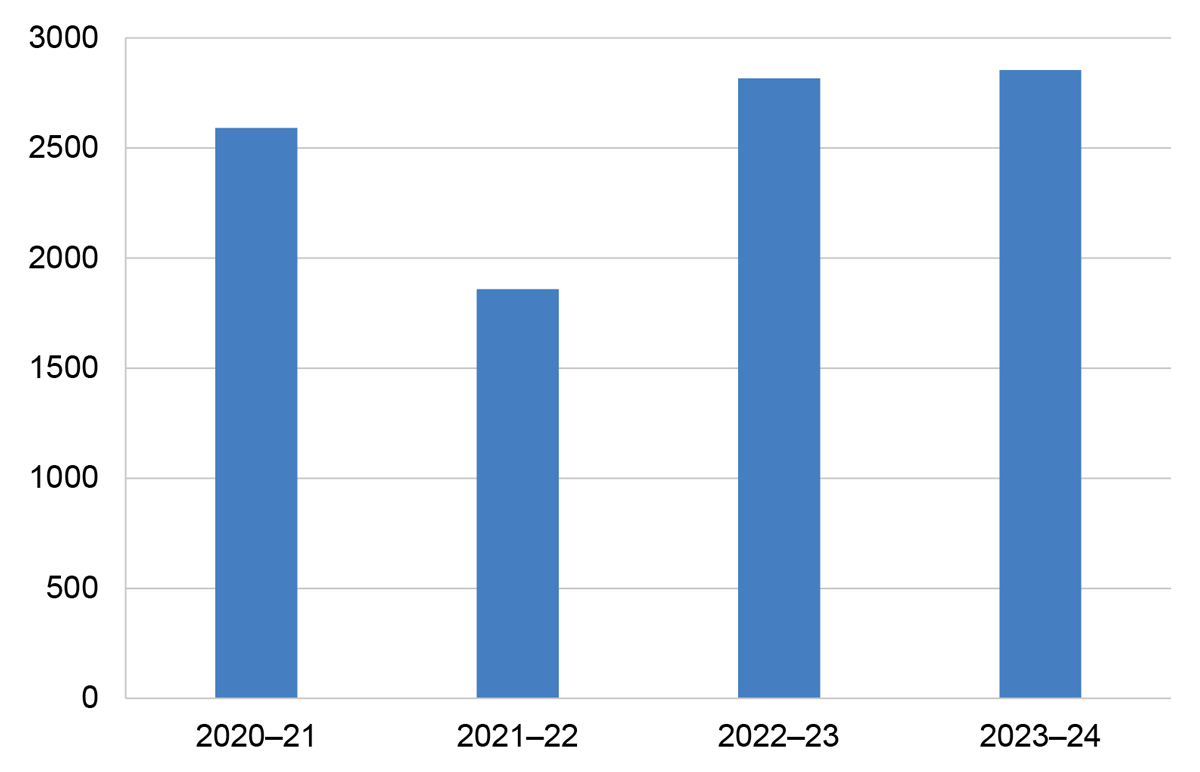

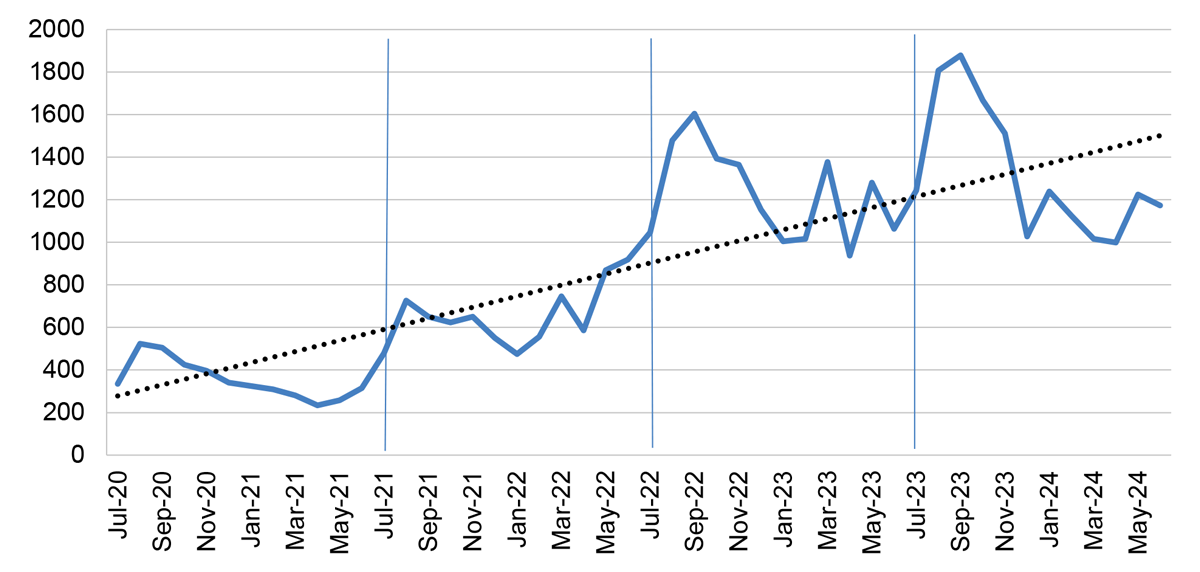

2.17 Figure 2.6 shows the annual volume of complaints resolved at first contact, and Figure 2.7 shows the proportion of complaints resolved at first contact as a percentage of total complaints resolved each year.

Figure 2.6: Annual volume of complaints resolved at first contact 2020–21 to 2023–24

Source: ANAO analysis of ATO documentation.

Figure 2.7: Proportion of complaints resolved at first contact

Source: ANAO analysis of ATO documentation.

2.18 The volume of complaints resolved at first contact ranged between 1,859 and 2,854 between 2020–21 and 2023–24, but have declined as a proportion of complaints over the last four financial years. The ATO advised the ANAO in November 2024 that it did not monitor this trend at the corporate level.

2.19 Analysis of complaints resolved at first contact indicates that minimal data is collected on these complaints, and that the Complaint Categorisation Guide (see paragraph 2.23) is not applied to categorise complaints. This means that complaints resolved at first contact cannot be easily categorised for analysis.

2.20 If a complaint cannot be resolved at first contact, complaint handling staff record the details of the complaint in the ATO’s work management system, Siebel, recording details about the complainant, the nature of the complaint, and then categorising the complaint using the ATO Corporate Complaints Classification Guide, and the complaint is directed to the relevant Business Service Line (BSL).

2.21 The BPG recommends triaging complaints early in the complaints capture and resolution process. The ATO’s FCR methodology and criteria (see paragraph 2.16) generally aligns with the BPG’s triaging guidance. The Complaints Hotline triages complaints to the appropriate BSL where a complaint cannot be resolved at first contact. Staff guidance allows for triaging of urgent and hardship (see paragraph 2.52) complaints.

2.22 Each BSL has a National Complaints Coordinator and complaints staff. If the coordinator identifies the complainant as a prior client, the complaint is reclassified and allocated to ATO Review (see paragraph 2.30).23 Coordinators assign complaints to resolvers who become the complaint owner, ensuring that the staff have the appropriate skills and have not managed or approved the original decision or any subsequent review of the matter.

2.23 The ATO uses a Complaint Categorisation Guide to categorise complaints, enabling them to be handled by staff with sufficient experience or expertise. This approach also enables the ATO to perform a broad range of analysis of complaint data. For more information see paragraph 3.10.

2.24 Two of 11 BSLs use complexity classifications in Siebel set by Complaints Hotline staff, the remainder use knowledge of their staff’s skillsets to allocate complaints for resolution. Complaints with lower complexity are sent to lower APS level staff, and higher complexity to higher APS level staff. No further complexity classifications are allocated in complaints capture or the BSLs.

2.25 Table 2.2 outlines the total number of BSL-managed complaints managed by each BSL between 2020–21 and 2023–24. The ATO identified trends across the three BSLs with the largest complaint volumes, their drivers were identified, and the trends were then reported.

Table 2.2: BSL-managed complaints by BSL 2020–21 to 2023–24

|

BSL |

2020–21 |

2021–22 |

2022–23 |

2023–24 |

|

ATO Corporate |

151 |

23 |

52 |

65 |

|

Commonwealth Business Registry Services/Australian Business Register |

1,275 |

309 |

1,893 |

621 |

|

Economic Stimulus Brancha |

462 |

N/A |

N/A |

N/A |

|

Fraud and Criminal Behavioursb |

N/A |

N/A |

N/A |

39 |

|

Individuals and Intermediaries |

1,271 |

1,504 |

1,418 |

3,509 |

|

International Support and Programs |

36 |

21 |

46 |

36 |

|

Private Groups and Individuals |

24 |

16 |

30 |

37 |

|

Private Wealth |

44 |

35 |

51 |

108 |

|

Review and Dispute Resolution/Objections and Review |

500 |

640 |

582 |

1,305 |

|

Business Service Lead – Frontline Operations |

12,770 |

18,224 |

36,004 |

38,338 |

|

Superannuation and Employer Obligations |

3,932 |

2,114 |

1,287 |

1,349 |

|

Small Business |

873 |

373 |

483 |

340 |

Note a: Ceased June 2021.

Note b: Commenced July 2023.

Source: ANAO analysis of ATO documentation.

Complaint escalation

2.26 If a complainant requests review or escalation of their complaint, ATO staff are required to obtain sufficient details of the client’s reasons for wanting to escalate or review. This information is captured in Siebel as a new complaint activity. If the reviewing officer requires more information upon receiving the complaint, they are required to request it.

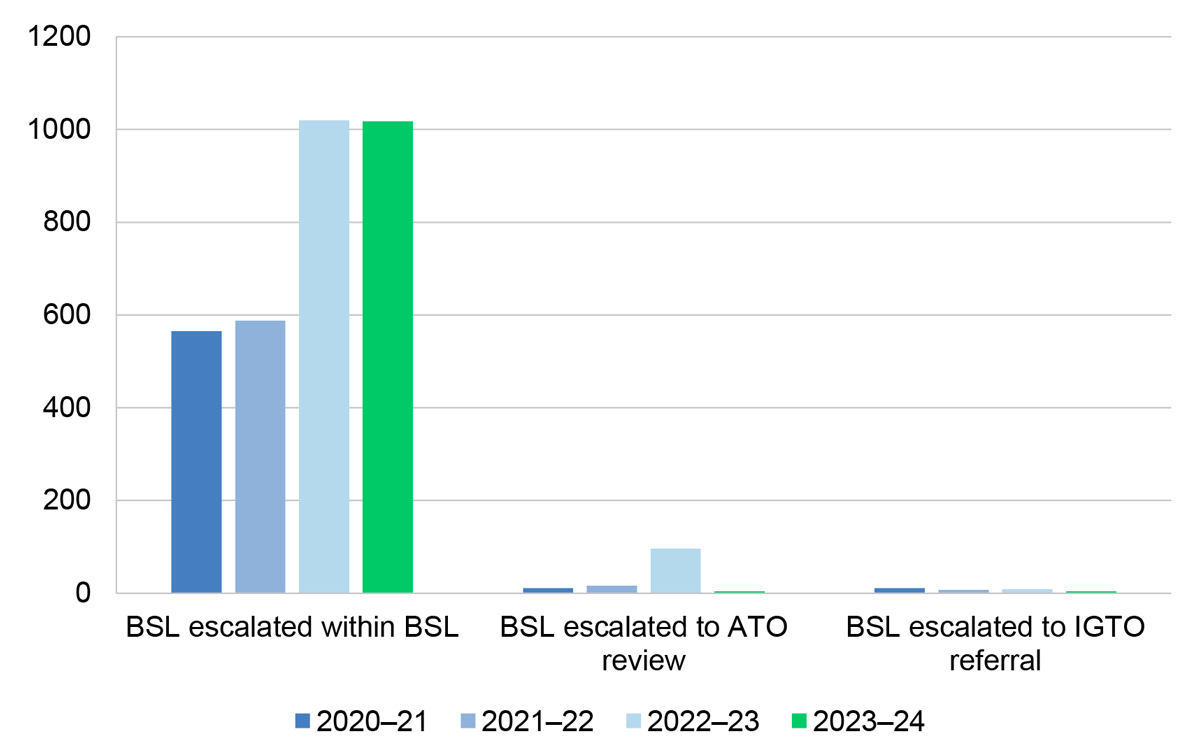

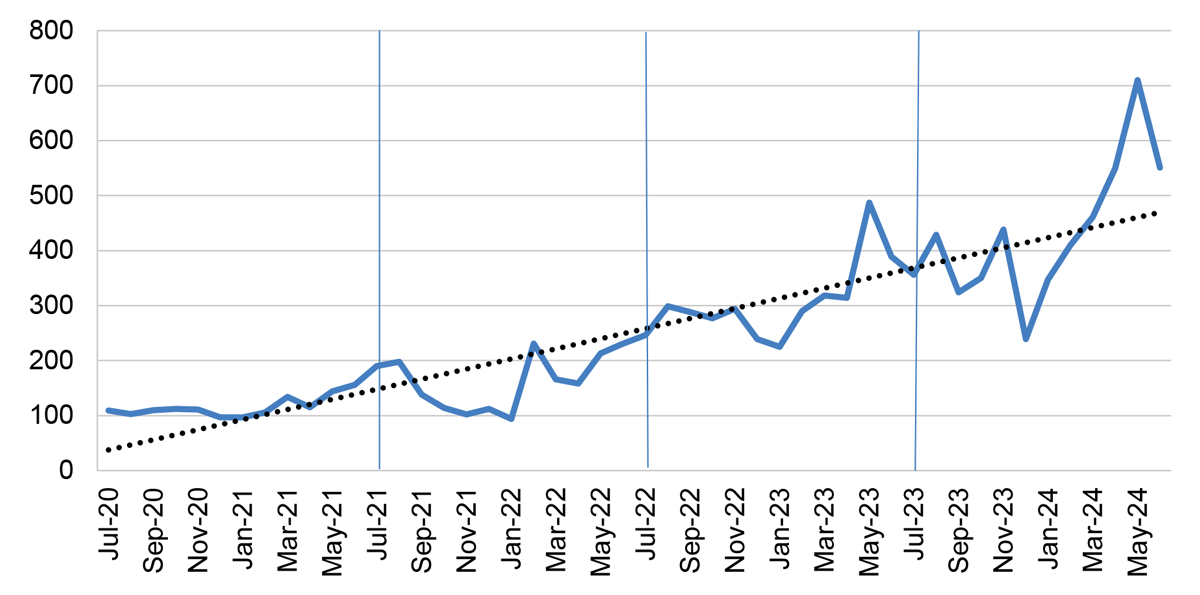

2.27 Figure 2.8 outlines the total number of escalations across each of the three categories. BSL escalated complaints have increased by 80 per cent between 2020–21 and 2023–24. The ATO advised the ANAO in November 2024 that it did not monitor BSL escalated volumes.

Figure 2.8: Complaint escalations 2020–21 to 2023–24

Source: ANAO analysis of ATO documentation.

2.28 A request for escalation can be made directly to the original resolver, who is required to bring the matter to their manager or technical advisor to ensure they have been fair and reasonable and have looked at all possible solutions within legal parameters. The complaint is then escalated to a higher-level resolver within the BSL or considered for ATO Review. Requests for escalation can also be received and actioned via the ATO Complaints hotline. These requests are documented as an escalated complaint and actioned by a different officer to the original complaint handler. The complaint is allocated within Siebel to senior or managerial staff within the same BSL, becoming a BSL escalated complaint.

2.29 ATO Review is the highest level of complaint escalation within the ATO. Reviews are personally managed by a complaint manager in the ATO Complaints and External Review team who is responsible for independently reviewing the complaint. A complainant can request their complaint become an ATO Complaint review if it meets any of the following criteria:

- the complainant is unsatisfied with the outcome of either a BSL-managed or BSL escalated complaints;

- the problem is recurring;

- the complaints involves serious allegations of staff impropriety that may lead to legal action; or

- any other circumstances at the discretion of ATO Complaints.

2.30 Where BSLs seek for a complaint to be managed as an ATO Review there is a template for staff which states that circumstances not outlined in the ATO Review criteria are discussed with the BSL coordinator and are approved at the discretion of ATO Complaints. These circumstances may include but are not limited to:

- the complaint is about issues of a sensitive nature;

- there may be a reputational risk to the ATO;

- possible systemic issues;

- the matter is considered complex, requiring input from several BSLs; and

- where there are time sensitivities.

2.31 The ATO may refuse a request for review if the complainant is a ‘Prior Client’. Prior Clients are complainants ‘who persistently contact ATO complaints about issues.’ and their behaviour demonstrates that they ‘will not or cannot accept the ATO’s decision relating to their complaint.’ A complainant that is a Prior Client may still request an independent IGTO investigation of their complaint.

IGTO complaints referrals and transfers

2.32 The Inspector-General of Taxation and Taxation Ombudsman (IGTO) can also submit complaints to the ATO.

2.33 Complaints transferred to the ATO (‘IGTO transfers’) are complaints made to the IGTO that have not been previously made to the ATO. These complaints are received from the IGTO by the ATO and treated the same way as a complaint that was made directly to the ATO.

2.34 Complaints referred by the IGTO (‘IGTO referred’) are complaints made to the IGTO that have previously been considered by the ATO. These complaints are prioritised and sent to the appropriate BSL mailbox for direct allocation to an officer to assist the IGTO in their complaint investigation.

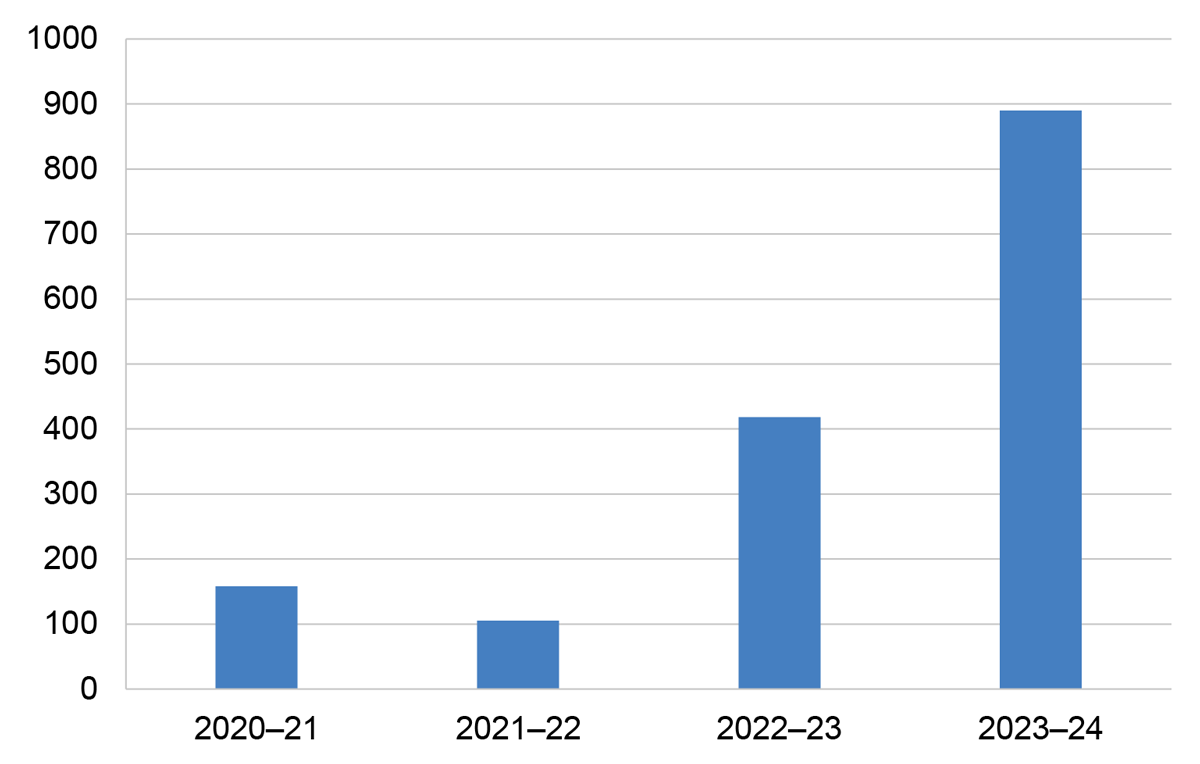

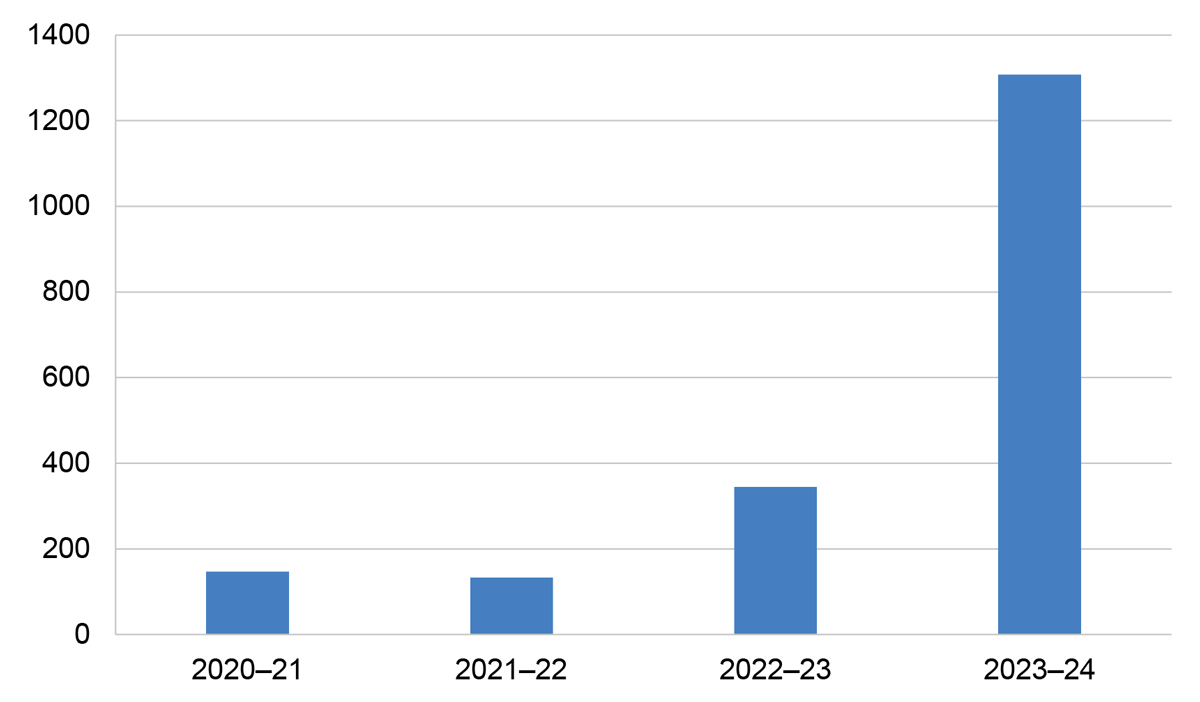

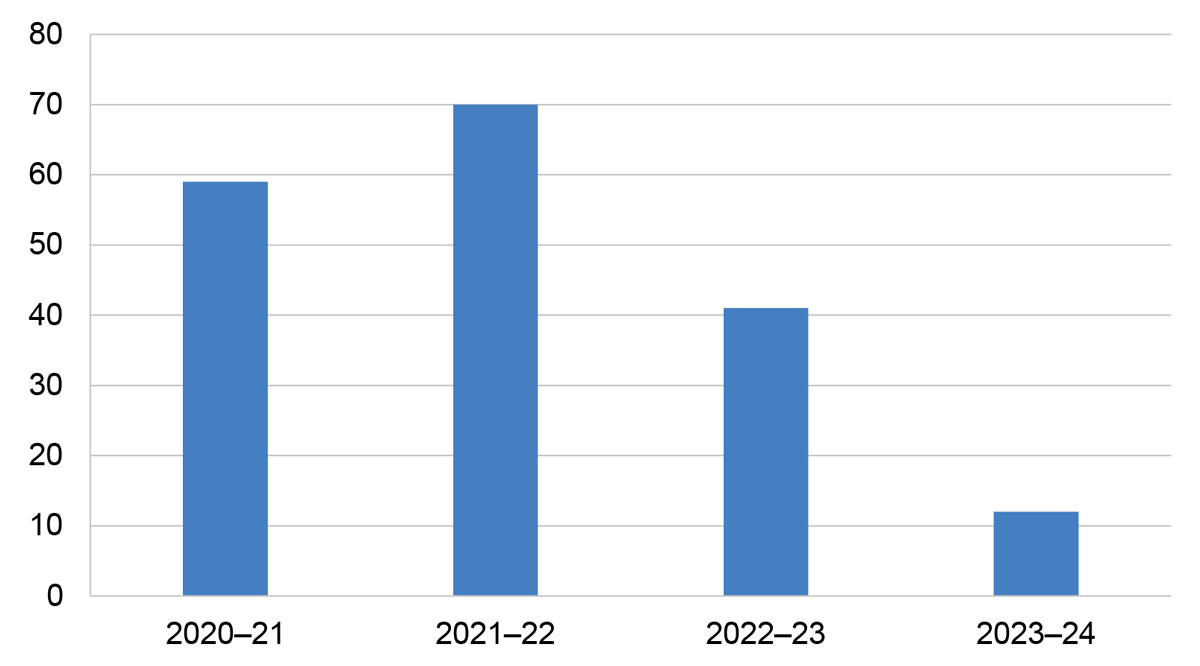

2.35 Figure 2.9 outlines the volume of IGTO transfers between 2020–21 and 2023–24. There has been a 113 per cent increase in IGTO transfers between 2022–23 to 2023–24. The ATO observed these trends, and advised the ANAO in November 2024 that changes to IGTO triaging processes and complaint handling processes had driven these trends.

Figure 2.9: Volume of IGTO transfers 2020–21 to 2023–24

Source: ANAO analysis of ATO documentation.

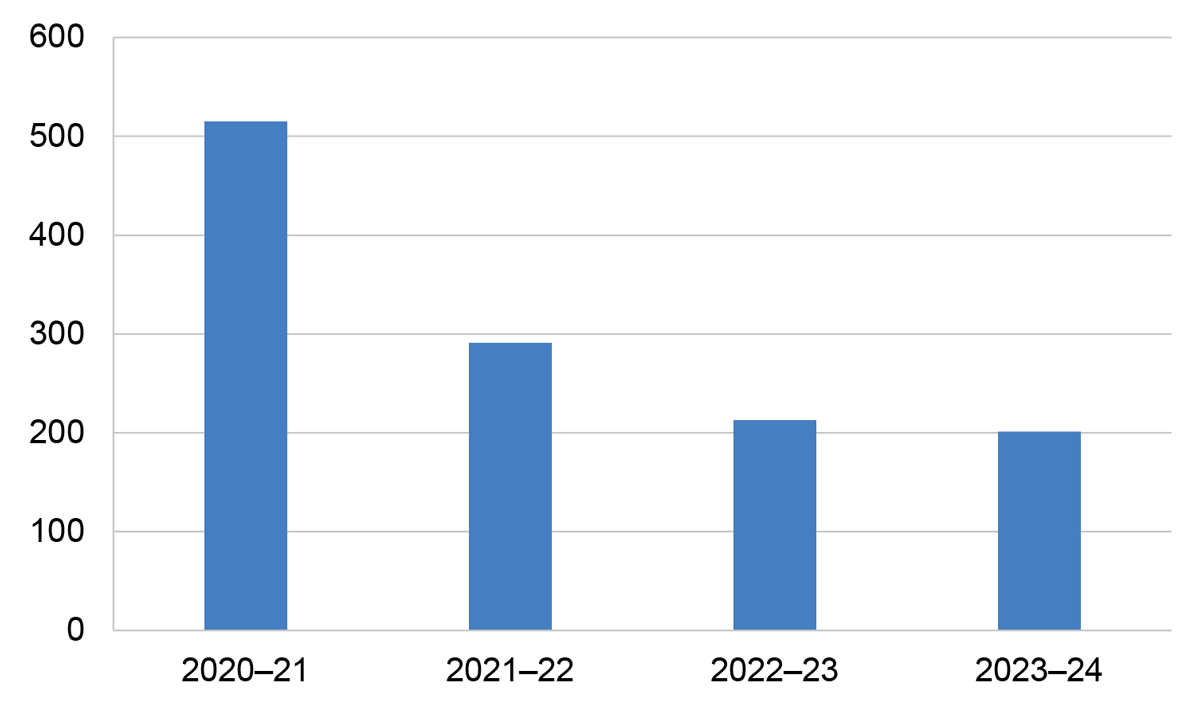

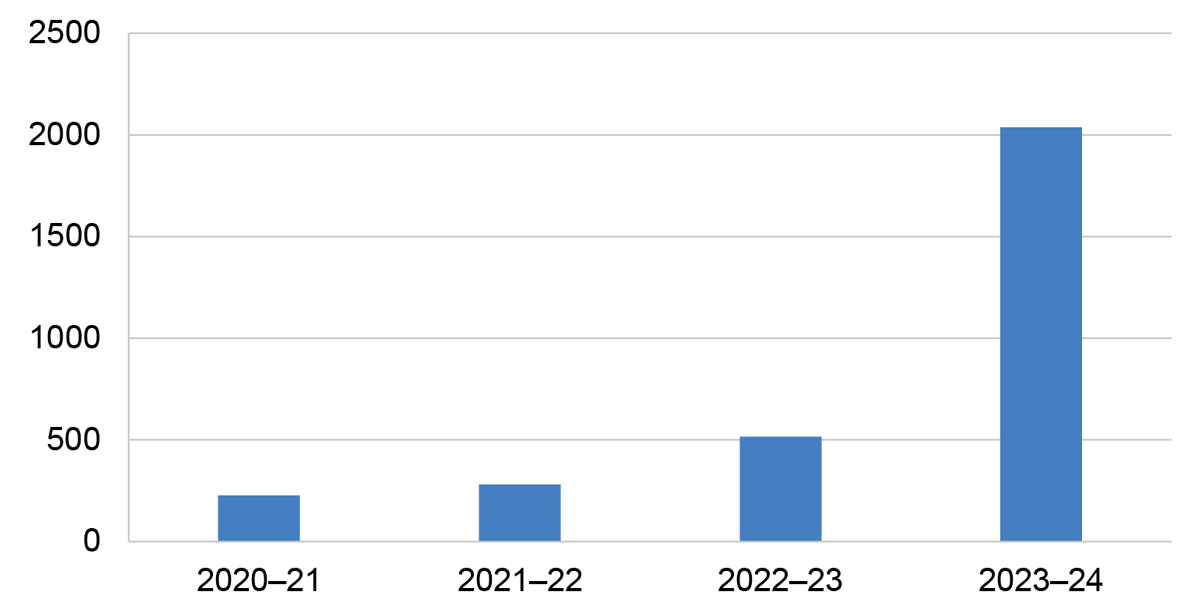

2.36 Figure 2.10 outlines the volume of IGTO referrals made between 2020–21 and 2023–24. It illustrates a 61 per cent reduction in IGTO referrals between 2020–21 and 2023–24. The ATO observed these trends, and advised the ANAO in November 2024 that complaints about COVID-19 stimulus measures such as JobKeeper, Cash Flow Boost, and COVID-19 Early Release of Super, had driven these trends.

Figure 2.10: Volume of IGTO referrals 2020–21 to 2023–24

Source: ANAO analysis of ATO documentation.

2.37 The ATO does not refer complaints received through ATO channels to the IGTO. The ATO advises complainants that if they are dissatisfied with the outcome of their complaints they can request an independent investigation by the IGTO. Complaints received by the IGTO may be sent to the ATO via the IGTO Case Management System to undertake a ‘Prior Check.’ This check is to determine if the complaint has previously been lodged with the ATO, if not it is treated as an IGTO transfer, giving the ATO the first opportunity to resolve the matter. If there is a prior complaint or an exception applies, the ATO will refer the complaint back to the IGTO.

Quality assurance

2.38 The ATO advised the ANAO in November 2024 that it changed its quality assurance process for complaints in October 2024. Prior to October 2024, quality assurance assessments were conducted in each BSL that were a part of the ATO Quality Framework by a Quality Assessor from that BSL.24 Frontline Operations was part of the ATO Quality Framework, and accounted for approximately 85 per cent of complaints received. Each quarter, the assessor generates a random sample of their BSL’s finalised products, including any complaints handled by that BSL in that quarter. The number of complaints included in the sample is dependent on the availability of assessors familiar with the complaints process for a given quarter. The sample complaints were assessed for service, accountability, accuracy, and performance and assign each category a grade of exceed, achieved, room for improvement, or considerable room for improvement. ATO Quality reviewed each assessment after it had been submitted by the Quality Assessor. The results of the ATO’s Quality Assurance process were included in internal ATO quarterly reporting provided to SES and EL2 Directors across all BSLs including Frontline Operations.

Efficiency of the complaint handling process

2.39 The Department of Finance defines efficiency as:

The extent to which an activity’s inputs are minimised for a given level of activity outputs, or the extent to which outputs are maximised for a given level of inputs. Efficiency considerations must be balanced with whether the use will also be effective, economical and ethical.25

2.40 The ATO takes a limited approach to determining efficiency, focusing on timeliness and not considering inputs and outputs. The ATO bases its complaints handling framework on the BPG, which uses timeliness as its primary efficiency measure. FCR supports efficiency in compliance with the BPG (see paragraph 2.16). The BPG outlines triaging complaints as an efficiency measure to allocate time and resources only where they are necessary. Complaints are triaged early into the handling process as either eligible for FCR or into the appropriate BSL. The ATO Intranet provides policy and guidance for staff when dealing with ‘unreasonable complainant conduct’, which is also outlined in the BPG as a measure that promotes efficiency.

2.41 The ATO’s website hosts a complaints page with information for clients about the complaints process.26 The ATO website states that the ATO will acknowledge a complaint within three business days of it being lodged, and that the ATO aims to resolve complaints within 15 business days.

2.42 The ATO Complaints Insights report (see Appendix 3) includes data on complaints more than 50 days old, complaints finalised within 15 days, and complaints finalised by the extended due date negotiated by ATO staff and the complainant. In the ATO’s weekly review data of on-hand unresolved aged complaints and the percentage of complainants contacted within 3 days of their complaint being received are all reported. ATO Complaints also report on this data in Executive Snapshots (See paragraph 3.37 for more information on timeliness measures).

Staff training and guidance

2.43 The ATO has a 20 day mandatory training program for frontline operators. This program contains a dedicated module covering complaints. Guidance documents for complaints staff are available on the ATO intranet. The two main types of guidance documents are Job Aids and Enterprise Knowledge Management (EKM). Job Aids are typically under five pages and provide focused guidance on a specific aspect of the complaints process such as logging a multiple client complaint in Siebel. The EKM documents provide guidance on complex or multi-step processes such as how to reclassify and reallocate an activity in Siebel. These documents have multiple variables and links embedded for staff to pursue further reading on aspects of the process.

Tracking completion

2.44 Mandatory training in complaint handling is undertaken as part of the onboarding process for Frontline Operations staff. The general staff mandatory training module covers a section on the ATO Charter, with links provided for staff to read further on complaint handling. This is compliant with the BPG which suggests that all staff be made aware of the complaints handling process to provide support. The ATO has further training modules related to complaints handling; a complaints overview, complaints capture for all staff, complaints capture for hotline staff, and training on how to provide apologies to clients. These modules are not mandatory and are to be completed at the discretion of staff. ATO People Learning Development and Inclusion tracks staff completion of non-mandatory training, monitoring the number of staff that complete training per month. The ATO complaints network does not track staff completion of mandatory or non-mandatory complaints training.

2.45 Mandatory and non-mandatory training modules have been updated between March 2023 and June 2024. There is no fixed schedule for updating training materials. When an error or change is identified the training materials are updated as required.

Ongoing training

2.46 The BPG recommends that regular ongoing training be provided to staff. The ATO stated in October 2024 that refresher training is provided when a need is identified, or a system is changed. Where trends are identified staff are offered ‘burst sessions’. No records of ‘burst sessions’ were provided for the 2021 to 2024 period. Frontline Operations Complaints resolver staff are scheduled for one hour of Learning and Development time each fortnight. Frontline Operations Complaints resolvers discuss their learning needs during coaching and check-ins. The ATO has not scheduled any refresher training.

Performance and wellbeing

2.47 The ATO monitors staff performance using the ‘Compass’27 framework. Active participation is a requirement under the ATO Enterprise Agreement 2024. The Compass framework is used by an ATO employee and their manager to set performance goals and monitor performance. Compass has a tool that allows for the recording of outcomes from Compass check-ins. Check-ins must be made quarterly and are recommended to be done fortnightly. Performance data from Compass check-ins is used for staff training and guidance.

2.48 The ATO aims to conduct regular check-in conversations as part of their staff coaching program to prevent burnout. Staff are encouraged to work with their leaders where they require support, which can be in the form of additional breaks, debriefing after a call, or having some additional time off phones. Staff are rotated between telephony and processing, with complaints being a subset of their work type. For staff who are regularly facing challenging interactions the ATO has an Employee Assistance Program available. The ATO has a framework for managing inappropriate client behaviour28, incidents of client aggression are noted in Siebel, and these clients may be placed on managed service plans.29 Staff are asked to enter proposed leave through a preferencing process, and leave is approved ensuring the complaints hotline has sufficient coverage across the network.

Is the complaints process clear, accessible, and responsive to the public?

The process to make a complaint to the ATO is clearly articulated on its website, and guidance documents provided to staff to explain the complaints process are clear. The complaints process is accessed primarily through online web form and telephone, and is largely compliant with the BPG. The ATO does not specifically survey complainants on the ATO’s complaint management process, however complainants who have had an identity-verified interaction with the ATO were eligible to be randomly sampled for the ATO’s broader monthly Client Experience Survey. The information on complaints obtained through this survey does not support meaningful analysis. The ATO relies on complainant feedback to identify and address accessibility issues, and does not proactively monitor and assess potential accessibility barriers. The ATO implements changes when issues are brought to its attention through this channel.

Clarity of the complaints process

2.49 The BPG outlines that a complaints system should be publicised, have multiple access points, and complaints should be encouraged from clients. The ATO is largely compliant with the BPG in this regard. The ATO’s complaints system has multiple access channels and information about the complaints process and what can be expected from the ATO is available, in multiple languages. Complaints are encouraged, and the absence of any penalty to complainants is communicated clearly.

Accessibility of the complaints process

2.50 The ATO’s accessibility measures are largely compliant with the requirements of the BPG. The process is simple, it has multiple access points, and the ATO Charter is accessible in 25 languages other than English. The ATO relies on feedback received from complainants to improve the accessibility of its complaints process and does not perform community or public outreach to identify access barriers.

2.51 The ATO has an internal digital inclusion guide which outlines key areas for the ATO’s digital services to be accessible. The ATO’s digital complaints services are compliant with these guidelines. The ATO migrated its digital services (ato.gov.au) to the Digital Experience Platform as of January 2024. The ATO incorporated the Digital Service Standard Version 1 into the design and is in alignment with the Standard. The ATO delivered phase one of its digital service improvements in July 2024 and is continuing to implement digital service improvements aimed at ensuring digital complaints processes are agile, user-centred, secure and accessible.

2.52 ATO call centre staff are trained to respond to questions made by complainants regarding accessibility and vulnerability issues, but are not prompted by scripting to initiate questions about accessibility or vulnerability. The Complaints Identification and Capture training module for all staff covers hardship and urgent complaints. When a client can produce evidence of serious financial hardship, they are able to be given priority processing of an income tax return with the hardship team. A complaint is considered urgent if the complainant wants to fast track an ATO action (that is not processing of an income tax return), where normal processes would fail to deliver the necessary assistance, and is experiencing exceptional circumstances such as:

- serious financial hardship without evidence; or

- suicide threats; or

- court orders or immediate legal action; or

- domestic abuse; or

- disaster (for example: bushfire or flood).

2.53 There are EKM documents for staff to use regarding vulnerable clients, hearing, speech, and vision impaired clients, and priority processing and urgent requests. A training module covers accessing and using content related to vulnerable clients, and call handling techniques for clients who are hearing impaired or have accessibility needs. For clients that are experiencing hardship or have complaints considered urgent, the ‘urgent’ or ‘hardship’ classifications are added to the complaint description field in Siebel with a note stating ‘documentary evidence has been discussed’ for hardship complaints. 22 complaints out of a total complaint population of 49,414 included this information in 2023–24.

2.54 The BPG states that ‘outreach can improve accessibility and visibility of your agency, particularly if you provide services to vulnerable groups with significant access barriers.’ To identify accessibility barriers and improve accessibility of their complaints handling services, the ATO assesses feedback from clients and makes improvements accordingly (see paragraph 2.59). The ATO does not perform complaint-focused community outreach to support vulnerable groups with access barriers.

2.55 The ATO informs clients of their right to lodge a complaint via written correspondence when a staff member makes a decision about the client’s tax affairs. All frontline operator staff are provided with overview training (see paragraph 2.43) and non-complaint handling call centre staff are to attempt FCR where a client expresses dissatisfaction. Where FCR is not possible, the client is transferred to the Complaints Hotline or is provided with alternative options to lodge a complaint if transfer is unavailable.

Responsiveness of the complaints process

2.56 The ATO has a benchmark of acknowledging a complaint within three days of the ATO receiving it, and the benchmark for average call wait time is under 15 minutes. Table 2.1 indicates that the ATO meets this benchmark for complaint related calls. The ATO prefers contact to be made by telephone as many complaints require ‘proof of record ownership’. This can also be achieved via letter which requires more time than telephony. The ATO’s performance against its three-day acknowledgement benchmark is monitored and reported on in the ATO’s Weekly Review and Executive Snapshot (see Appendix 3).

2.57 As part of finalising a complaint, the resolver is expected to verify that the complainant is satisfied with the result of their complaint. There is guidance available to staff outlining that they must:

- advise the complainant of the outcome of all identified issues;

- explain the reasons for the decision(s) made;

- ensure the complainant is satisfied (within the limitations of that can legally and reasonably be done); and

- inform the complainant of their further rights of review.

2.58 Where the complainant receives an unfavourable outcome resolvers must send a complaint finalisation letter/email outlining their review rights. This correspondence is attached to Siebel.

Feedback on the complaints process

2.59 The BPG states:

Find out what your complainants think of your complaint handling process and what would improve the experience for them. Options include seeking feedback when complaints are finalised, periodic surveys, monitoring social media, user testing, research and focus groups.

2.60 The ATO introduced an additional question to its existing monthly survey (see paragraph 4.61), based on a recommendation from the IGTO, asking if clients were informed of their right to make a complaint regarding an outcome or advice between July 2022 to June 2023, however the question was removed from the survey in June 2023. The ATO stated to the ANAO in September 2024 that currently complainants were not specifically surveyed, noting that complainants who have had an identity-verified interaction with the ATO were eligible to be randomly sampled as one of the approximately 38,000 clients approached for the ATO’s broader monthly Client Experience Survey. The ATO advised the ANAO in September 2024 that this survey had an approximately five per cent response rate (1,800 respondents). The ATO advised the ANAO in September 2024 that it was able to identify survey respondents who had interacted with the ATO to complain, but that:

there is no methodology to sample complainants in a specific or representative way. Corporate Research receives too few such responses each year to perform any meaningful analysis. Typically, around 20 such responses are received annually.

2.61 The ATO uses unsolicited feedback to improve the complaint handling process. For example:

- The character limit in the online complaint lodging forms was increased from 500 to 1000 after receiving multiple items of feedback.

- The online form was updated to include a tailored accessibility question after receiving feedback. If ‘Yes’ is selected, a free text field opens for the complainant to provide details of any adjustments they may require during the complaints process.

Are complaints managed in accordance with the complaints management framework?

The ATO uses notes, attachments and templates in the Siebel work management system to record actions taken while resolving a complaint. The complaint capture template was consistently completed by ATO staff. The issues template was largely completed in line with ATO guidelines and use of this template increased from 2020–21 to 2023–24. Notes and attachments recorded in Siebel and analysed by the ANAO indicate the ATO actions complaints in accordance with its guidance. Regular ongoing contact was not consistently maintained with complainants in 2022–23 and 2023–24, and some complainants were not advised of their review rights when a complaint was closed. The ATO did not have a discussion with complainants before extending due dates in the majority of complaint cases. The extended due dates exceed the ATO’s service commitment to resolve complaints within 15 business days.

Selection of complaints for testing

2.62 Complaints received by the ATO are recorded as activities within the Siebel work management system. A service request is then created in Siebel to capture the main complaint activity and any related activities which are created or linked to resolve the complaint.

2.63 A random sample of 73 complaint service requests was selected by the ANAO for each year from 2020–21 to 2023–24 to assess whether ATO complaints are managed in accordance with the complaints management framework. This resulted in a total sample of 292 complaint cases.

Siebel templates

2.64 The ATO uses ‘smart scripting’ work management templates in Siebel to ensure complaint data is captured correctly. These templates are added to the main complaint activity. Data from Siebel related to the selected sample of complaints was extracted into a spreadsheet, including the responses to these templates and other details added to the service request.

Complaint capture template

2.65 The complaint capture template is to be completed by frontline or EWM staff when a complaint cannot be resolved at first contact (see paragraph 2.16). The complaint capture template requires staff to identify the type of complaint, details of the complainant, the complaint background, the desired outcome, whether the complaint is about an ATO representative, and the complaint topic and sub-topic.

2.66 Responses to these fields were included in a spreadsheet of data extracted from Siebel for the random sample of 73 complaint services requests for each year from 2020–21 to 2023–24. All mandatory fields of the capture template included in the report were completed in 95 per cent or more of the examined service requests for each year from 2020–21 to 2023–24.

2.67 Responses to whether a complaint was about an ATO representatives within the main complaint activity on Siebel were analysed from the extracted sample of 292 complaints, this field was completed in 268 instances. Complaints related to ATO representatives are managed to maintain the privacy of the ATO representative and the nature of the investigation are restricted.

2.68 Optional fields in the capture template including complainant details, preferred contact number, alternative contact number, email address, preferred contact method and address do not appear in reporting generated by Siebel and were not tested.

Complaint issues template

2.69 The first section of the complaint issues template is to be completed by the main complaint owner as soon as the complaint is received. If a complaint involves multiple issues this template should be completed for each issue.

2.70 The issues template includes categorisation of the complaint into the three tiers of the ‘issues tree’, product, topic and issue (see paragraph 3.10). Once the complaint outcome has been finalised, the issues template is to be revisited and completed with the complaint finalisation status, reason for escalation (if applicable), outcome of the complaint, relevant ATO Charter commitment and whether an apology was provided to the complainant.

2.71 Table 2.3 shows results from analysis of the issues template responses extracted from Siebel for the sampled complaint service requests.

Table 2.3: Assessment of the issues template responses

|

Template element |

2020–21 |

2021–22 |

2022–23 |

2023–24 |

|

Product |

◕ |

● |

● |

● |

|

Topic |

◕ |

● |

● |

● |

|

Issue |

◕ |

● |

● |

● |

|

Issue escalated and substantiated (where applicable)a |

◑ |

N/A |

◯ |

● |

|

Outcome of complaint |

◑ |

◑ |

● |

● |

|

Charter commitment identified |

◑ |

◑ |

● |

● |

|

Apology provided or not |

◑ |

◑ |

● |

● |

Key: ◯ Negligible ◔ Partially complete ◑ Half complete ◕ Mostly complete ● Complete

Note a: Within the sample of 73 from each year, issue escalation was required for two complaints in 2020–21, no complaints in 2021–22, one complaint in 2022–23 and one complaint in 2023–24.

Source: ANAO Analysis of ATO documentation.

2.72 The fields in the issues template related to the complaint product, topic and issue were completed from 2021–22 onwards, but were not completed in 10 of the 73 complaints cases analysed for 2020–21.

2.73 Fields relating to the complaint finalisation status, escalation of the issue, outcome of the complaint, related charter commitment and apologies are ‘to be completed once an Outcome has been determined.’ The complaint outcome, charter commitment and apology fields were not completed in 30 analysed cases in 2020–21 and in 27 cases in 2021–22 but were completed for 2022–23 and 2023–24.

2.74 Analysis of the issues template in Siebel indicates a finalisation status was assigned in 259 of the 292 cases tested in the sample.

Resolving complaints in Siebel

2.75 The ATO provides steps to action BSL managed complaints in a reference guide for complaint owners. The complaint owner is required to record notes against complaint activities detailing client related information, client interactions and actions taken on the complaint activity. ATO BSLs predominantly use this ATO Corporate Complaints guidance to manage complaints, with some BSLs supplementing this with additional guidance.30

2.76 The reference guide provides 19 steps to action BSL managed complaints. Steps one to five address determining if the matter has been correctly classified as a complaint and allocating a service request in Siebel. If these steps were not completed, a record would not be created in Siebel. The application of the steps after this preliminary classification, steps six to 19, were analysed in the 73 sampled service requests for each year from 2020–21 to 2023–24 by considering notes and attachments on the Siebel file which detail actions taken to resolve the complaints. Table 2.4 shows the results of this analysis.

Table 2.4: Assessment of Siebel service requests against ATO guidance

|

Reference guide step |

2020–21 |

2021–22 |

2022–23 |

2023–24 |

|

Step 6 — Update summary field with main complaint owner details |

◕ |

● |

◕ |

◕ |

|

Step 7 — Make contact with the complainant (where further information is required) |

● |

● |

● |

● |

|

Step 8 — Complete the Complaint Issues template |

● |

● |

● |

● |

|

Step 9 — Regular ongoing contact |

◕ |

◕ |

◑ |

◑ |

|

Step 10 — Repeat contact from the complainant |

● |

● |

● |

● |

|

Step 11 — Develop a complaint action plan, if applicablea |

N/A |

N/A |

N/A |

N/A |

|

Step 12 — Seek specialist knowledge (if necessary)b |

● |

● |

● |

● |

|

Step 13 — Identify related existing BAU activities in Siebel |

● |

● |

● |

● |

|

Step 14 — Identify if linked activities are required |

● |

● |

● |

● |

|

Step 15 — Extend the due date (if necessary) |

◕ |

◕ |

◕ |

● |

|

Step 16 — Arrange for approval to close complaint (if required)c |

● |

N/A |

N/A |

N/A |

|

Step 17 — Contact complainant (final contact) |

◔ |

◔ |

◕ |

◕ |

|

Step 18 — Finalise the complaint |

● |

● |

● |

● |

|

Step 19 — Additional contact after complaint is closed for remedya |

N/A |

N/A |

N/A |

N/A |

Key: ◯ Negligible ◔ Partially complete ◑ Half complete ◕ Mostly complete ● Complete

Note a: Not all steps are applicable to all complaint matters. An assessment of N/A has been assigned where no instances in which a step was applicable were observed in the sample.

Note b: Step 12 applied to four complaints in 2020–21, three in 2021–22, one in 2022–23 and two in 2023–24.

Note c: Step 16 was completed for two cases in 2020–21. Approval to close a complaint is required by some business lines in limited circumstances, predominantly when complaints are being handled by a newly trained staff member.

Source: ANAO Analysis of ATO documentation.

2.77 The main complaint owner’s details were documented in the service request summary page for 44 of the analysed complaints in 2020–21, 60 complaints in 2021–22, 43 complaints in 2022–23, and 41 complaints in 2023–24. This equates to 64.4 per cent of complaints analysed by the ANAO between 2020–21 and 2023–24.

2.78 Guidance for step nine states regular ongoing contact ‘as a general guide’ should be maintained with the complainant weekly unless otherwise negotiated, but may vary on a case by case basis. Regular ongoing contact with the complainant was observed in 49 service requests from 2020–21, 53 service requests from 2021–22, 29 service requests from 2022–23 and 31 from 2023–24. In many instances where regular contact was not maintained, this was due to a delay between the date the complaint arose and when the complainant was first contacted by the complaint owner. The ATO advised the ANAO in November 2024:

The delay between the date a complaint arose and the date the complainant is first contacted has increased in more recent years due to the increase in total complaints being received.

The ATO previously undertook initial contact within three days of a complaint being received. As the number of complaints increased the ability to undertake an initial contact within three days was impacted due to resource limitations.

From April to June 2022 the ATO introduced a written acknowledgment process to replace the initial contact. The ATO ensured that the acknowledgement process aligned with the Better Practice Guide (BPG).

2.79 When a due date for complaint finalisation beyond 15 business days is required, the complaint extension of due date (EDD) template is to be completed in Siebel. This relates to step 15. The EDD template is used to record the ATO’s performance against its service commitment target to ‘resolve 85% of complaints within 15 business days, or within the date negotiated with the client.’ The 15-business day service standard applies unless an extension is discussed with the complainant. ATO guidance states ‘a discussion needs to occur with the client before an extension can occur. This discussion needs to be documented in Siebel notes.’

2.80 Table 2.5 shows the ATO’s extension of complaint due dates for complaint extending beyond 15 business days for complaint finalisation.

Table 2.5: Extension of complaint due dates

|

|

2020–21 |

2021–22 |

2022–23 |

2023–24 |

Total |

|

EDD template completed after conversation with complainant |

6 |

2 |

0 |

1 |

9 |

|

EDD template completed with no conversation with complainant |

10 |

13 |

23 |

30 |

76 |

|

EDD template not completed |

7 |

6 |

7 |

1 |

21 |

|

Total |

23 |

21 |

30 |

32 |

106 |

Source: ANAO analysis of ATO data.

2.81 In the 106 complaints analysed which extended beyond 15 business days for complaint finalisation, there were 21 instances where an EDD template was not completed, and 76 instances where an EDD template was completed with a due date extension but no discussion with the complainant about this was recorded. From the 76 complaints where there was no documented discussion with the complainant, 42 had a final due date listed over three months after the date the complaint arose.

2.82 The ATO tracks and reports on the finalisation rates of complaints with extended due dates through quarterly ATO Complaints Insight reports. The reports identify the percentage of complaints finalised within 15 days, and the percentage of complaints finalised within extended due dates.

2.83 The ATO tracks complaints aged 50 days or more through weekly reports sent to the ATO Complaints Executive, and aged complaints are also reported as a percentage of the total volume of complaints currently unresolved.

2.84 A lack of supporting documentation to properly evidence that extending due dates has been discussed with complainants means the ATO does not have sufficient assurance that its reported performance against its service commitment to resolve 85 per cent of complaints within 15 business days or within the date negotiated with the client is accurate.

2.85 The instructions for step 17 concerning final contact with the complainant provide, ‘In all circumstances however, review rights must be provided to the complainant when finalising a complaint, whether it’s in writing or over the phone and documented appropriately in Siebel.’ 126 out of 292 in the sample analysed service requests did not indicate review rights had been provided to the complainant as required when final contact was made.

Recommendation no.1

2.86 The Australian Taxation Office:

- conducts and documents any discussion with complainants before extending complaint due dates; and

- communicates and documents that review rights have been discussed with the complainant in accordance with its own guidance.

Australian Taxation Office response: Agreed.

3. Reporting, review, and process improvement

Areas examined

This chapter examines if the ATO effectively reports on complaints, seeks to improve its processes and service delivery, and effectively reviews its complaints handling framework.

Conclusion

The ATO is largely effective at reporting on complaints, collecting complaint data to monitor incoming complaint volumes, categories of complaints, performance against service commitments and performance of key complaint topics. The data is used to generate internal reports based on the needs of individual business areas and bodies that meet to discuss complaint trends. Public reporting through the ATO Annual Report consists of the total number of complaints received and performance against the ATO service commitment targets. The ATO is able to determine which issue categories lead to increases in complaints but does not identify the root causes of these increases. Analysis of cross-product issues indicates that ‘timeliness’ is the largest complaint issue across many business lines, accounting for 56.5 per cent of all complaints from 2020–21 to 2023–24.

The ATO is largely effective in using a variety of sources including complaint data to identify business improvements to enhance both the complaint handling system and broader ATO processes and service delivery. It manages these through the Business Intelligence and Improvement register to iteratively improve its processes and service delivery. The ATO could strengthen its Business Intelligence and Improvements framework.

Areas for improvement