Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Net Appropriation Agreements

The objective of this performance audit was to assess agencies' financial management of, and accountability for, the use of net appropriation agreements to increase available appropriations.

Summary

Background

An appropriation is an authorisation by the Parliament to spend an amount from the Consolidated Revenue Fund (CRF) for a particular purpose. Section 83 of the Constitution provides that no money shall be drawn from the Treasury of the Commonwealth 1except under an appropriation made by law.

In this context, net appropriation arrangements are a longstanding feature of the Commonwealth's financial framework. They provide a means by which an agency's appropriation item in the annual Appropriation Acts can be increased by amounts received from non-appropriation sources. This provides the agency with the appropriation authority to retain and spend those amounts.

During the course of the 1990s, the use of net appropriation arrangements became more widespread amongst agencies, in part reflecting public sector management reforms introduced at the time. This particularly related to an increasing focus on user charging and cost-recovery by agencies for some services, as a means of improving resource allocation and reducing the call on Budget funding for agency running costs.

Under the Commonwealth's current financial framework, Section 31 of the Financial Management and Accountability Act 1997 (FMA Act) allows the Finance Minister to enter into net appropriation agreements (known as Section 31 agreements) for the purposes of appropriation items in Appropriation Acts that are marked “net appropriation”. The FMA Act requires that an agreement be made with the Minister responsible for the appropriation item or, in the case of items for which the Finance Minister is responsible, with the Chief Executive of the agency for which the appropriation is made.

A Section 31 agreement specifies the types of departmental and/or administered receipts that will be eligible to be retained by the relevant agency, and the terms on which the relevant appropriation item will be increased for those receipts by operation of the agreement. For example, the agreement may require certain receipts to be shared with the Budget in nominated proportions. The annual Appropriation Acts provide that, if a Section 31 agreement applies to an appropriation item, the amount specified in the item is taken to be increased in accordance with the agreement, on the conditions set out in the agreement. The increase cannot be more than the relevant receipts covered by the agreement.

In this respect, the relevant provisions of the annual Appropriation Acts and FMA Act provide the Executive Government with the authority to increase the appropriations set out in the Schedules to the Appropriation Acts, providing certain specified steps are undertaken. The terms of Section 31 of the FMA Act must be complied with in order for an agency to obtain the authority to retain and spend amounts received from non-appropriation sources.

There has continued to be growth in the use of net appropriations since the commencement of the FMA Act. In 1996–97, the last full financial year prior to the Act commencing, agencies reported net appropriation receipts totalling $831 million. In 2003–04, 68 FMA Act agencies collectively reported receipts totalling $1.55 billion as having been added to their respective annual appropriations by operation of Section 31 agreements. In 2004–05, 67 agencies reported Section 31 receipts totalling $1.46 billion2.

Roles and responsibilities

In accordance with the framework created by the FMA Act, agencies are responsible for the control, management and reporting of their finances, including appropriations.

Quite specific obligations in relation to keeping proper accounts and records are placed on agency Chief Executives by the FMA Act and the Finance Minister's Orders (FMOs). These include an obligation to keep the records of the agency in a manner that, among other things, ensures that moneys are only expended for the purpose for which they were appropriated, and the limit (if any) on appropriations is not exceeded.

Agencies are expected to disclose estimated non-appropriation receipts as part of the Budget process. The actual Section 31 receipts added to an agency's annual appropriations are required to be disclosed in the agency's annual financial statements.

The responsibilities of the Department of Finance and Administration (Finance) relate to the maintenance of the financial framework established by the FMA Act, FMA Regulations and FMOs, and the provision of guidance on the operation of that framework.

In its most recent Annual Report, Finance noted that a number of audit reports have identified scope for improvements in the financial framework, predominantly in agencies' application of the framework3. In this context, during the first seven months of 2004, as part of its rolling review of various aspects of the financial framework, Finance undertook an examination of Section 31 of the FMA Act. The examination reflected emerging concerns within the Department about the form of Section 31 agreements, and agencies' application of the agreements4. The culmination of this work was the issuing, on 11 August 2004, of Finance Circular No. 2004/09, Net appropriation agreements (Section 31 Agreements).

The Finance Circular included a revised template for the preparation of Section 31 agreements. Associated with the Circular, Finance required all agencies to make a new agreement. By 30 June 2005, all agencies had executed a revised agreement using the new template.

The template was further revised on 30 June 2005, when Finance Circular No. 2004/09 was replaced by Finance Circular No. 2005/07, Net appropriation agreements (Section 31 Agreements). Issued in response to matters raised during the course of this performance audit, the most recent Circular included enhanced guidance to agencies on the execution of Section 31 agreements.

Audit objective

The objective of this performance audit was to assess agencies' financial management of, and accountability for, the use of net appropriation agreements to increase available appropriations.

Overall audit conclusions

Overall, this audit has revealed quite widespread shortcomings in the administration of net appropriation arrangements. In particular, there has been inadequate attention by a number of agencies to their responsibility to have in place demonstrably effective Section 31 arrangements that support additions made to annual appropriations and the subsequent expenditure of those amounts. Given the fundamental importance of appropriations to Parliamentary control over expenditure, improvements are necessary to secure proper management of net appropriation arrangements. The two recent Finance Circulars should assist in this regard, as will changes to Finance's practices in negotiating and executing agreements on behalf of the Finance Minister. Nevertheless, in terms of appropriation management, individual agencies are directly responsible for ensuring that an appropriation is available before spending funds from the CRF.

Accountability to the Parliament for the use of Section 31 arrangements to increase the annual appropriations provided through the annual Appropriation Acts is expected to occur through disclosure of estimated receipts in budget papers and actual receipts in agency financial statements. However, the current presentation of budget estimates does not assist in providing users of agency Portfolio Budget Statements (PBS) with a clear understanding of the extent to which the relevant agency expects to increase its annual appropriation for amounts collected under authority of its Section 31 agreement5. Further, the Australian National Audit Office (ANAO) found that agency financial statements have not accurately reflected the use of Section 31 arrangements.

While many of the issues raised by this audit are quite technical (in a legal sense), there are important considerations of appropriate accountability, including transparency, to the Parliament. In this respect, the Joint Committee of Public Accounts and Audit, in examining previous audit reports on aspects of the financial management framework, has emphasised the importance of managers understanding their responsibilities under the FMA Act. The Committee has also put on notice its intention to continue to investigate agency understanding of, and adherence to, the requirements of the financial framework6.

The measure being implemented by Finance to require agency Chief Executives to provide an annual statement of compliance with the legislative and policy elements of the financial management framework, with effect from 2005–06, should assist in ensuring a stronger agency focus on compliance issues of this kind, which are important from both a government and Parliamentary perspective.

Key findings

Establishing effective Section 31 arrangements (Chapters 2 and 3)

Significant Constitutional consequences result from the operation of Section 31 agreements. Specifically, an effectively executed agreement provides an agency with an appropriation authority to spend the receipts to which it applies. It is in this context that the issue of who can execute an agreement, and in what capacity, must be considered.

In order to comply with the provisions of the FMA Act, a net appropriation agreement must be made between the Finance Minister (as the whole-of-government representative) and the Minister responsible for the relevant agency or, for most Finance portfolio agencies, the agency Chief Executive. Accordingly, there are two signatories to a Section 31 agreement. Both signatories must have the necessary authority in order for an agreement to be effectively executed in accordance with the legislative requirements.

In almost all instances, a Finance official has signed the whole-of-government side of Section 31 agreements, as delegate of the Finance Minister. Finance officials must hold a written delegation from the Finance Minister in order to enter into these agreements.7

Similarly, the significant majority of agreements made to 30 June 2005 were signed by an official of the relevant agency, rather than the responsible Minister or, for Finance portfolio agencies, Chief Executive. Chief Executives of Finance portfolio agencies have an express power to delegate to agency officials, by written instrument, their power under subsection 31(2) of the FMA Act to make net appropriation agreements with the Finance Minister.8 The Treasurer and Attorney-General are also able to delegate their power under that subsection, as the responsible Minister. 9

However, other Ministers are not able to delegate their power to enter into Section 31 agreements with the Finance Minister. Nor is there any express power for Ministers to authorise a person to exercise that power for and on the Minister's behalf, or the required form any such authorisation should take. Relying on the Carltona principle 10, the Australian Government Solicitor (AGS) has advised agencies that, on balance, a Minister has an implied power to authorise officials to enter into Section 31 agreements for and on behalf of the Minister.

Where the Carltona principle applies in relation to a particular function or power, an important qualification to its operation is that the Minister's surrogate must be appropriately qualified to act on the Minister's behalf. Authority to so act may arise through an express authorisation from the Minister, or impliedly from the nature of the power or function. Based on legal advice, Chief Executives11 in agencies for which the Finance Minister is not responsible are considered to have an implied authority to enter into Section 31 agreements on their Minister's behalf. This is based upon the Chief Executive's responsibilities, under the FMA Act, for the financial management of the agency12.

Legal advice provided to both Finance and ANAO in June and July 2005 respectively was that officials who are not agency Chief Executives are not impliedly authorised to enter into Section 31 agreements on the Minister's behalf. Consequently, such officials require an express authorisation from the relevant Minister in order to be empowered to sign a Section 31 agreement.13 AGS has advised that the Minister may give such an express authorisation either in writing or orally.

Legal advice provided to Finance by AGS in June 2005 was that the question as to whether a written or oral express authorisation existed at the time the official signed the agreement is one of fact. However, AGS further advised that the ‘presumption of regularity' principle may apply in certain circumstances where an agency is not able to verify that an official had been expressly authorised by the Minister.

AGS advised that:

In this respect, it may be that an agreement signed by an official other than the Chief Executive is presumptively valid in circumstances where:

- the officer signed the agreement ‘for and on behalf of the Minister' or in some other way which indicated that the officer understood himself or herself to be acting under an authorisation from the Minister; and

- there is no evidence to support the view that the officer was not expressly authorised to enter into Section 31 agreements on behalf of the Minister.

Summary of assessment outcomes

ANAO examined 231 Section 31 agreements made between the commencement of the FMA Act on 1 January 1998 and 30 June 2005. Agreements were assessed in order to form a conclusion as to whether they had been effectively executed by both signatories. The assessment process was based on the evidence provided by agencies and Finance substantiating the authority of their respective signatories. The assessment was conducted using a decision tree that reflected a series of legal advices provided to Finance and ANAO by AGS regarding assessing the effectiveness of Section 31 agreements, including the application of a ‘presumption of regularity'. 14

Of the agreements examined, 157 (68 per cent) were assessed as having been effectively executed. Of the remaining agreements, 42 (18 per cent) were assessed as ‘ineffective'. A number of agencies were unable to provide evidence to demonstrate the effectiveness of a further 32 agreements (14 per cent). On the basis of the AGS legal advice, those agreements were assessed as ‘in doubt'.

ANAO also identified 16 agencies that had increased the reported available balance of their annual appropriations by amounts that were at no time captured by a Section 31 agreement, or that spent receipts prior to having an agreement in place. Collectively, these agencies were assessed as having ‘no agreement' in place in relevant periods.

The 2004–05 financial statements of each affected agency included disclosures relating to the period(s) in which a demonstrably effective agreement was not in place. Each agency was expected to identify the affected receipts and, where relevant, disclose the necessary adjustments to its reported available appropriation.

To the extent that amounts were identified as having been spent without appropriation, Section 83 of the Constitution was contravened. This was disclosed by the relevant agencies in their financial statements. Where the Section 83 breach was a result of the agency signatory to an agreement not being authorised or the agency not having an agreement, a corresponding breach of Section 48 of the FMA Act was also required to be reported, given the specific obligations placed on agency Chief Executives under that Section to keep proper accounts and records.15 Pursuant to the provisions of the Auditor-General Act 1997 (Auditor-General Act) and the ANAO Auditing Standards (which incorporate the Australian Auditing and Assurance Standards), these breaches were reported as ‘Other Statutory Matters' in the audit opinions of the affected agencies' 2004–05 financial statements. 16

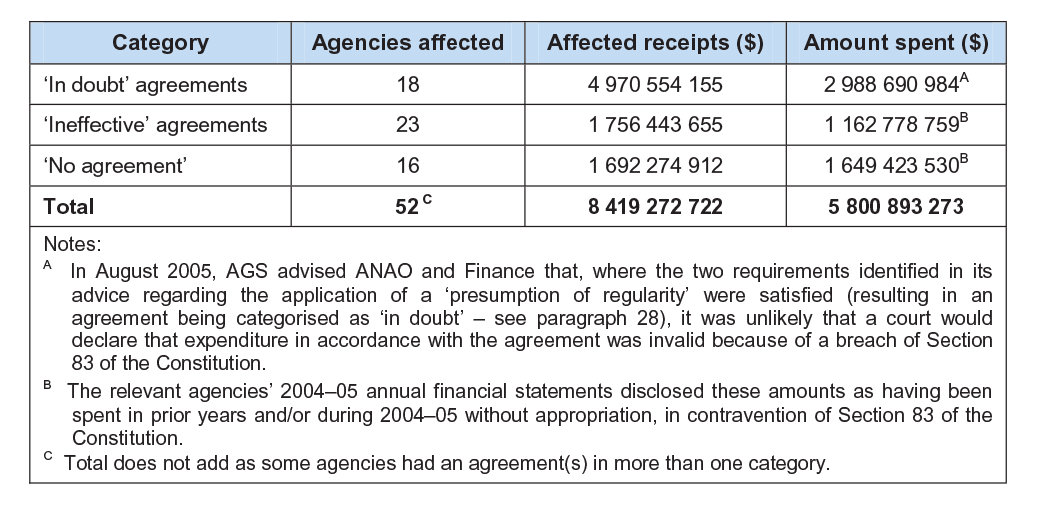

Table 1 summarises the receipts reported by agencies as having been received and, where relevant, spent during periods up to 30 June 2005 where the agency operated with an ‘ineffective' or ‘in doubt' agreement. Many of the relevant agencies had relied upon the affected agreement(s) since 1998 or 1999. The agreements were only replaced during 2004–05. Table 1 also includes the same information for those agencies that are in the ‘no agreement' category.

Table 1 Amounts collected and spent by agencies without having a demonstrably effective Section 31 agreement in place: 1997 to 2005

Source: ANAO analysis based on examination of Section 31 agreements, agencies' financial reporting, evidence and advice provided by agencies to substantiate the authority of signatories to agreements, and the decision tree of AGS advices on assessing the effectiveness of agreements.

Effective agreements

All 125 agreements that were signed by the responsible Minister or the relevant agency's Chief Executive (or an official acting in that capacity) were, consistent with legal advice provided to Finance, relevant agencies and ANAO, assessed as having been effectively executed by the agency. This was based on Chief Executives signing agreements under either an express or implied authorisation from the responsible Minister. However, seven of these agreements were assessed as being ‘ineffective', due to the Finance official who signed on the whole-of-government side not holding the necessary delegation from the Finance Minister, leaving 118 effective agreements.

Officials at levels below the Chief Executive had signed the agency side of the remaining 39 agreements that were assessed as effective. In each case, the relevant agency was able to provide evidence confirming that the official had been expressly authorised or delegated by the responsible Minister or Chief Executive. Finance was also able to demonstrate that the official who signed each of those agreements held the necessary delegation from the Finance Minister.

‘In doubt' agreements

Based on the AGS advice, a number of agencies relied upon a ‘presumption of regularity' for agreements in respect of which they were unable to substantiate the authority of the relevant signatory – 11 agencies in respect to the agency signatory to 23 agreements17, and Finance in respect to the Finance signatory to four agreements relating to four agencies18. In accordance with the AGS decision tree for assessing effectiveness, these agreements were assessed as ‘in doubt'.

The agreements for three other agencies were assessed as ‘in doubt' because, although they were unable to provide ANAO with evidence of an express Ministerial authorisation, there was sufficient and appropriate evidence available to provide an indication that the official may have been authorised19.

The 18 agencies with ‘in doubt' agreements disclosed this issue, and the affected receipts (including amounts that had been spent) in their 2004–05 financial statements. Many of the affected agreements were relied upon by the relevant agency as the authority to appropriate money over a number of financial years, including for part or all of the 2004–05 financial year. To 30 June 2005, those agencies' annual appropriations had been increased by amounts totalling $4.97 billion under the authority of ‘in doubt' agreements, with $2.99 billion of those receipts having been spent.

In August 2005, AGS advised ANAO and Finance that, where the two requirements identified in its advice regarding the application of a ‘presumption of regularity' were satisfied, it was unlikely that a court would declare that expenditure in accordance with the agreement was invalid because of a breach of Section 83 of the Constitution. Reference to this legal advice was included in the affected agencies' appropriations disclosure note to their 2004–05 financial statements.

The agencies that have sought to rely on a ‘presumption of regularity' depended upon the absence of any relevant records relating to them obtaining an express authorisation to exercise a statutory power on their Minister's behalf as the basis for claiming that there is no evidence the official was not authorised. In December 2005, Finance advised ANAO as follows:

Finance notes that these decisions were made by Chief Executives of the affected agencies and assessments made against the decision criteria (based on AGS legal advice).

ANAO's understanding, from separate legal advice received, is that the ‘presumption of regularity' is for the protection of those who are entitled to assume, because they cannot know, that the person with whom they deal has the authority that is claimed. For example, ‘the person in the street' who cannot know whether a government official with whom he or she deals has the authority to undertake a particular function.

The application of a ‘presumption of regularity' in relation to Australian Government agencies substantiating whether officials within the agency concerned complied with legislative requirements in executing a Section 31 agreement, where it is the agency that has relied on the agreement, is not desirable. Relying upon a ‘presumption of regularity' in this context inevitably leaves doubt as to the effectiveness of the agreement and, therefore, the amount of the appropriation that was legally available to the relevant agency. This does not reflect sound administrative practice, in the ANAO's view.

To put matters beyond doubt, ANAO and Finance agree that agencies should obtain a written authorisation from the responsible Minister before entering into Section 31 agreements on the Minister's behalf. The Circulars issued by Finance in August 2004 and June 2005 advocated this approach as best practice.

In the interests of an effective and accountable financial framework, ANAO has recommended that Finance examine possible further administrative and/or legislative changes that could limit the opportunity for agencies to rely upon a ‘presumption of regularity' when increasing their annual appropriations. This might involve clearer legislative requirements covering Ministers delegating or authorising officials to exercise the statutory power of entering into Section 31 agreements. It might also involve stronger recordkeeping requirements that are specific to the signing of Section 31 agreements. ANAO has also recommended that agencies' recordkeeping practices be improved.

‘Ineffective' agreements

In total, 42 agreements (18 per cent) across 23 agencies were assessed as being ‘ineffective'20. This assessment was based on the evidence and advice provided by agencies and Finance in relation to the authority of their respective signatories, considered against the decision tree of AGS advices.

To address the issue of ‘ineffective' agreements, on 24 June 2005, the Finance Secretary made two instruments under subsection 31(4) of the FMA Act21. They were:

- an instrument to cancel all agreements made on or before 30 June 2004. This step was taken to ensure each agency was operating on the basis of an effective agreement made under the new template 22and to provide certainty regarding which agreements were in operation; and

- an instrument (the Variation Instrument) to vary all agencies' current agreements as at 30 June 2005 to include, as eligible receipts, amounts retained by the agency in reliance on prior, ‘ineffective' agreements.

The Variation Instrument provided a basis for agencies to capture retrospectively all receipts that were subject to an ‘ineffective' agreement. An appropriation for the affected receipts was made available to agencies as at 30 June 2005, which would allow any unspent amounts to be lawfully spent. This action could not, however, remove past breaches of Section 83 of the Constitution that occurred due to agencies spending receipts collected under an ‘ineffective' Section 31 agreement.

The Variation Instrument applied in respect to receipts totalling $1.76 billion across 19 agencies23. Of those receipts, a total of $1.16 billion was disclosed by the relevant agencies as having been spent without appropriation between 1997–98 and

2004–05, in contravention of Section 83.

‘No agreement'

ANAO identified 14 agencies24 that had, for various reasons, reported their respective annual appropriations as having been increased by receipts totalling $105.31 million that had at no time been captured by a Section 31 agreement. 25Three of those agencies disclosed $62.76 million of those receipts as having been spent without appropriation between 1997–98 and 2004–05, in contravention of Section 83 of the Constitution.

In October 2005, the Government agreed to forgo recovery from the relevant agencies of the amounts collected during the periods not covered by a Section 31 agreement. In order to give effect to this position, it was necessary to provide for those receipts to be captured by an effective agreement. This would also provide the relevant agencies with appropriation authority in respect of any unspent amounts still held. As with the Variation Instrument, this would not remove past breaches of Section 83 of the Constitution that occurred due to agencies spending receipts not covered by a Section 31 agreement.

On 28 October 2005, the Finance Secretary executed two further variation instruments under subsection 31(4) of the FMA Act (Variation Instruments 2 & 3). Those instruments varied the current agreements for 11 agencies, such that the amounts collected in the ‘no agreement' period are eligible receipts for the purposes of the current agreement. Both instruments came into effect upon registration on the Federal Register of Legislative Instruments (FRLI) on 8 November 2005. Disclosure of the period not covered by an agreement, the affected receipts and, where relevant, amounts spent without appropriation and the associated breaches of Section 83 of the Constitution and Section 48 of the FMA Act was included in the affected agencies' 2004–05 financial statements.

A further two agencies, the Bureau of Meteorology (BoM) and Centrelink, were identified as having spent amounts totalling $1.59 billion prior to having a Section 31 agreement (and, for BoM, other necessary arrangements relating to appropriations) in place to provide them with appropriation authority26. Consequently, each contravened Section 83 of the Constitution and Section 48 of the FMA Act. The agreements subsequently executed for both agencies provided for the retrospective capture of all receipts collected during the period each did not have an agreement. Accordingly, neither agency was included in Variation Instruments 2 & 3 relating to ‘no agreement' periods. Both agencies disclosed this issue in their 2004–05 financial statements.

Eligible receipts

The FMA Act does not provide guidance as to the type of receipts that may be included in Section 31 agreements. Legal advice to agencies has been that the only express restrictions on the terms and operation of an agreement in relation to the amounts that may be applied to increase an appropriation item are:

- that the agreement must specify the receipts that are eligible receipts for the purposes of the agreement; and

- the increase in the appropriation item cannot be greater than the amount of those specified receipts that is received.

However, the extent to which agencies' adherence to these limited requirements could be monitored was not promoted by the broad and inclusive manner in which eligible receipts have been defined in individual agreements, using a category based approach. The template included with Finance Circular No. 2004/09 improved the clarity and precision with which the receipts that an agency is entitled to retain can be identified.

Difficulties have also been encountered over time in the use of Section 31 agreements to increase an agency's annual appropriation for amounts debited from internally managed Special Accounts. Specifically, there has been an absence of clarity about if and how this can occur. Often, the relevant agreement did not clearly cover notional intra-agency transactions of this type. There is also ongoing uncertainty as to whether these internal transactions are relevant receipts for the purposes of the net appropriation provisions of the annual Appropriation Acts. The uncertainty in respect to these transactions does not contribute to the orderly management and governance of appropriations. ANAO has recommended that Finance take the necessary steps to remove such uncertainty.

A third area where difficulties have arisen has involved the transfer of appropriation following a change of agency functions. Section 32 of the FMA Act enables the Finance Minister to issue a direction transferring appropriated amounts relating to a transferred function from the old agency to the new agency. The appropriation transferred can include any amounts added to an annual appropriation under the authority of Section 31 agreements. ANAO noted an instance where cash exceeding $25 million was passed from the Department of the Environment and Heritage to BoM, following BoM's prescription as a separate FMA Act agency in September 2002. A Section 32 direction transferring the appropriation authority to spend that cash was not executed. As a consequence, BoM spent those funds without appropriation authority, in contravention of Section 83 of the Constitution.

Accountability to the Government and the Parliament

The financial framework requires accountability for agency use of net appropriation arrangements in three primary ways, as follows:

- Since 1 January 2005, Section 31 agreements have been registered on the publicly available register, FRLI, enabling the Parliament to be aware of what agreements have been made since that date and their terms and conditions;

- Disclosure in PBS and Portfolio Additional Estimates Statements (PAES) of receipts estimated to be collected by the relevant agency under authority of a Section 31 agreement; and

- Disclosure in annual financial statements of the actual increase in the agency's annual appropriation under authority of Section 31.

ANAO found that improvements could be made in respect of each of these accountability mechanisms to assist in providing the Parliament with a complete and accurate record of the use of Section 31 arrangements. These are discussed below.

Registration of legislative instruments

Finance advised ANAO that it has consistently operated on the basis that, in the interests of accountability and disclosure to the Parliament, Section 31 agreements are properly regarded as legislative instruments and, therefore, should be registered on FRLI. Parliament has recently shown an interest in obtaining additional information to that already publicly available regarding the operation of Section 31 agreements. This includes information on the types of receipts covered by agreements. The registration of Section 31 agreements on FRLI will assist in this regard.

The Legislative Instruments Act 2003 (LI Act), under which FRLI was established, requires instruments made on or after 1 January 2005 to be lodged in electronic form with the Attorney-General's Department for registration as soon as practicable after being made. However, ANAO found that there have often been delays of some months between the signing of Section 31 agreements and their registration. To improve the benefits obtained from the registration of Section 31 agreements on FRLI, such registration should be timely.

Irrespective of other provisions of the LI Act, Section 31 agreements are taken to be legislative instruments for the purposes of the Act once registered on FRLI27. The Act further provides that Section 31 agreements are not subject to the Act's disallowance or sunsetting provisions. However, there is ongoing uncertainty regarding the extent to which the LI Act was intended to apply to Section 31 agreements. In particular, Schedule 1 to the Legislative Instruments Regulations 2004, which prescribes certain instruments that are declared not to be legislative instruments for the purposes of the LI Act, appears to specifically remove agreements of this nature from the concept of legislative instruments. In November 2005, AGS advised Finance that all doubt in this respect should be removed. Finance advised ANAO that it was considering options proposed by AGS in relation to addressing this issue.

Reporting on the use of Section 31 agreements

As part of their annual PBS prepared in conjunction with the Budget, agencies are required to disclose estimates of the receipts from non-appropriation sources that will be available to be used in delivering their approved departmental and administered Outcomes. The current presentation of those estimates does not assist in providing users of the PBS with a clear understanding of the extent to which the relevant agency expects to increase its annual appropriation for amounts collected under authority of their Section 31 agreement. Enhanced guidance in this area may assist in improving the utility of the information provided in this respect. ANAO's examination also identified that the accuracy and consistency of the Section 31 receipt estimates that are disclosed in agency PBSs could be improved.

In addition, ANAO identified a number of agencies that had overstated or misstated the Section 31 receipts disclosed in their financial statements and/or PBS by including items such as:

- accrual based revenue amounts and other non-cash transactions, rather than cash received;

- amounts that were not eligible items under the terms of the relevant Section 31 agreement;

- amounts that related to other legislative provisions of the FMA Act relating to appropriations management, rather than Section 31; and

- amounts credited to Special Accounts, which stand to the credit of the special appropriation provided by the FMA Act in relation to those Accounts, as also being added to the agency's annual appropriation as Section 31 receipts.

ANAO concluded that improvements are required to agencies' reporting and disclosure of appropriations, including in their PBS and PAES. A number of agencies moved to address reporting issues identified in this performance audit in their 2004–05 financial statements.

In this context, there will also be an increased focus on legislative compliance as part of ANAO's future financial statement audit coverage, as a supplement to the conventional financial statement audit.28 This will involve confirming the presence of key documents or authorities, and sample testing of relevant transactions directed at obtaining assurance about entities' compliance with key aspects of legislative compliance in relation to annual appropriations, special appropriations, annotated appropriations (through Section 31 arrangements) and special accounts. This will not provide a guarantee that all legislative breaches will be identified, but will give reasonable assurance as to the state of legislative compliance in key areas.

Financial framework enhancement opportunities

Many of the findings of this performance audit relate to agencies' understanding of, and compliance with, the financial framework. The audit also identified scope for enhancing certain aspects of the financial framework as it operates in respect to net appropriations.

Retrospective application of Section 31 agreements

It has been a common practice for agencies to enter into Section 31 agreements some time after the commencement of the period to which the agreement is then purported to apply. Indeed, nearly half of the agreements made to 30 June 2005 had been applied retrospectively to amounts received by the agency prior to the agreement being executed.

The basis on which legal advice provided to agencies has concluded that agreements made under Section 31 of the FMA Act can be expressed so as to apply to amounts previously received has been the broad nature of the language of that Section, and the absence of any provision requiring that such agreements may only operate prospectively. In this context, greater specificity in the FMA Act as to the conditions under which an agreement can be applied retrospectively to amounts previously received would assist in enhancing the rigour of the financial framework and promoting orderly governance of appropriations.

Irrespective of any legislative changes, retaining cash receipts for significant periods in anticipation of subsequently obtaining the necessary appropriation authority to spend those amounts, or operating for a period of time as if that authority existed when it did not, can put an agency at risk of spending in excess of its legally available appropriation. This risk would be reduced by changes to administrative practices that meant that, wherever possible, Section 31 agreements are in place prior to agencies receiving eligible amounts.

Role of Section 31 agreements

One of the more significant changes under the FMA Act from the net appropriation arrangements that previously existed was the change in the role played by the agreement itself.

Previously, the annual Appropriation Acts specified the sources from which net appropriations could be received. The agreements made under those arrangements identified, in a Schedule, the types of receipts an agency would be able to collect under the broad sources specified in the Appropriation Acts, and the quantum of such receipts expected to be collected in the relevant financial year. Under the FMA Act, the receipts each agency may use to increase its annual appropriation are established by the terms of its particular Section 31 agreement.

As discussed, difficulties have been encountered by a number of agencies in terms of ensuring an agreement that is relied upon has been effectively executed and/or is capable of operating in the manner intended. In this context, there may be merit in examining the on-going role of individual agency agreements in the management of net appropriations. Areas that could be examined include:

- The nature of the instrument that is used to provide an agency with access to net appropriations. Changes to the instrument could provide greater certainty over the effectiveness of net appropriation arrangements by reducing the potential for officials to act without Ministerial authorisation. One option may be to revise the relevant legislative provisions so that the Finance Minister (or his or her delegate) may, following consultation with the relevant Minister, issue a direction regarding the conditions under which specified receipts may be retained by an agency; and

- Whether instruments relating to individual agencies should be retained as the means of specifying eligible receipts. Specifically, returning the central role in net appropriations from individual agency agreements to the annual Appropriation Acts so as to provide certainty and transparency in relation to the majority of net appropriations that will be available to agencies, without the need for separate agency agreements in all cases.

In December 2005, Finance advised ANAO that:

Finance is currently examining possible policy, administrative and legal changes that could be effected to improve the operation and effectiveness of section 31 agreements, as part of a broader project to simplify the management of the financial framework.

Recommendations and agency responses

ANAO has made five recommendations. The first three are aimed at improving administration of net appropriation arrangements within the current financial framework. Specifically, they address the interaction of Section 31 agreements with the operation of Special Accounts (Recommendation No. 1) and establishing demonstrably effective Section 31 agreements (Recommendation Nos. 2 and 3). The final two recommendations identify opportunities for Finance to examine possible improvements to the framework (Recommendation Nos. 4 and 5).

Finance largely agreed to the recommendations (it agreed with qualification to Recommendation No. 1 and agreed to the remainder). Where they responded to recommendations, all other agencies agreed (one agency agreed with qualification to one recommendation). Detailed agency comments on the proposed audit report are included at Appendix 1 of the audit report, and a summary of agency responses to each recommendation is included at Appendix 2 of the audit report.

Footnotes

1 In this context, the Treasury of the Commonwealth refers to the CRF.

2 The $99 million reduction in Section 31 receipts reported in 2004–05 compared to 2003–04 is consistent with increased actual Section 31 receipts, combined with corrections made by agencies in 2004–05, in response to issues raised in this performance audit, to exclude amounts previously incorrectly disclosed as Section 31 receipts. See Chapter 1 (footnote 40) and Chapter 4 (paragraphs 4.45 to 4.54) of the audit report for more detail regarding those issues. In December 2005, Finance advised ANAO that overall departmental appropriations have also increased over the period and Section 31 appropriations have reduced as a proportion. Finance noted that, in 1996–97, Section 31 receipts comprised 6.1 per cent of agencies' departmental (running costs) appropriations, and that, by 2004–05, Section 31 receipts comprised only 4.4 per cent of agencies' departmental appropriations.

3 Department of Finance and Administration, 2004–05 Annual Report, October 2005, pp. 22 and 34.

4 ibid.

5 The Portfolio Budget Statements are targeted towards providing the Parliament with information regarding the proposed allocation of resources to Government outcomes. Information is provided to Parliament regarding ‘Other receipts available to be used', which is the estimated amount of receipts that are available to the agency for expenditure to contribute to the relevant outcome.

6 Report 404, Review of Auditor-General's Reports 2003–04 Third & Fourth Quarters; and First and Second Quarters of 2004–05, Joint Committee of Public Accounts and Audit, October 2005, p. 191.

7 Establishing effective Section 31 arrangements (Chapters 2 and 3)

8 This power is provided by Section 53 of the FMA Act.

9 Section 62A of the FMA Act provides the Treasurer with an express power to delegate, by written instrument, his or her powers under the FMA Act. The Law Officers Act 1964 provides the Attorney-General with an express power to delegate, in writing, his powers under all or any of the laws of the Commonwealth or a Territory to the Secretary to the Attorney-General's Department or to the person for the time being holding or performing the duties of the office specified in the instrument of delegation. AGS has advised that other Ministers administering the same relevant legislation as the Treasurer and Attorney-General also have a power of delegation.

10 That principle, established in Carltona Ltd v Commissioners of Works [1943 2 ALL ER 560], applies, in certain circumstances, to infer to a Minister a power to authorise officials to exercise, on the Minister's behalf, a power vested in the Minister, despite the absence of an express power to delegate or authorise.

11 Being the person with the special responsibilities set out in Section 44 of the FMA Act, as defined in Section 5 of the Act.

12 Section 44 of the FMA Act requires a Chief Executive to manage the affairs of the agency in a way that promotes efficient, effective and ethical use of the Commonwealth resources for which the Chief Executive is responsible.

13 The Treasurer and Attorney-General may elect to exercise their express power of delegation, or their implied power to authorise. In both cases, this must be expressly done in order to empower an official below the level of Chief Executive to sign Section 31 agreements.

14 See Figure 3.1 in Chapter 3 of the audit report.

15 Under Section 48, a Chief Executive must ensure that accounts and records of the agency are kept as required by the FMOs. In particular, clause 2.3 of the FMOs provides that Chief Executives must ensure that the accounts and records are kept in a way that ensures the limit on any appropriation is not exceeded. Where the deficiency in relation to an agency's Section 31 agreement related to the Finance signatory, the affected agency did not breach Section 48 of the FMA Act.

16 Subsection 57(4) of the FMA Act requires that, if the Auditor-General is of the opinion that the Chief Executive has contravened Section 48, the Auditor-General must state particulars of the contravention in the financial statement audit opinion.

17 For details of the relevant agencies, see Figure 3.2 in Chapter 3 of the audit report.

18 For details of the relevant agencies, see Figure 3.3 in Chapter 3 of the audit report.

19 For details of the relevant agencies, see paragraph 3.84 in Chapter 3 of the audit report.

20 For details of the relevant agencies, see Figure 3.4 in Chapter 3 of the audit report.

21 Subsection 31(4) provides that the Finance Minister may at any time cancel or vary an agreement, without the consent of the other party. This power has been delegated to the Finance Secretary.

22 As noted, Finance had required all agencies to make a new agreement using the revised template issued in August 2004. By 30 June 2005, all agencies had executed a revised agreement using the new template.

23Excluding cases where the ineffective agreement was not relied upon by the relevant agency to increase its annual appropriation, or the receipts collected under the agreement were not regularised by the Variation Instrument.

24 For details of the relevant agencies, see Figures 2.1 and 2.2 in Chapter 2 of the audit report.

25 In respect of five agencies, this situation arose due to the change in terminology used in annual Appropriation Acts, from “running costs” to “departmental items”, which meant that some existing agreements were unable to operate from the start of the 1999–2000 financial year. The inability of these agreements to continue to operate was not identified until mid-2005.

26 The bulk of the funds spent without appropriation relates to $1.56 billion received by Centrelink in 1998–99 from other Commonwealth agencies for the delivery of services.

27 Subsection 5(3) of the LI Act provides that an instrument that is registered is taken, by virtue of that registration and despite anything else in the Act, to be a legislative instrument.

28 In this respect, the objective of an audit of a financial report is to enable the auditor to express an opinion whether the financial report is prepared, in all material respects, in accordance with the Finance Minister's Orders, which include the application of the Australian Accounting Standards.