Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Federal Airport Leases

The objectives of the audit were to assess whether DOTARS had developed and implemented an appropriate framework and procedures to administer lessee obligations entered into as part of the 1997 and 1998 leasehold sales of 17 Federal airports. In particular, the audit sought to: - review DOTARS' monitoring of lessee compliance with the Airport Leases and supporting sale documentation; - examine the effectiveness of the framework and procedures developed by DOTARS to administer lessee development commitments; and assess the impact of changes in the aviation environment on the management and monitoring of lessee obligations.

Summary

Introduction

Between 1997 and 2003, a total of 22 airports owned and operated by the Commonwealth were privatised. The sales were conducted in five stages and raised aggregate proceeds of $8.5 billion. The Australian National Audit Office (ANAO) has conducted performance audits of the sales of 18 of these airports. 1

Since the commencement of the airports privatisation process, significant changes have occurred in the aviation environment. This has included successive aviation industry shocks caused by the Asian economic crisis of 1998–99, the events of September 11 2001, the collapse of Ansett on 12 September 2001, the October 2002 Bali bombing, the SARS pandemic during 2002–03, and the Iraqi war. In this environment, the transition from public to private sector management has been successfully completed for all airports.

The airports privatisation program involved leasehold, rather than freehold, sales. As a result, the Commonwealth has an ongoing involvement in airport operations. The Department of Transport and Regional Services (DOTARS) is responsible for administering the Commonwealth's ongoing interests in the operation and management of Federal airports under both the statutory regulatory framework of the Airports Act 1996 (Airports Act), and the contractual arrangements entered into as part of the sales processes.

The Airports Act and its regulations provide for regulatory oversight of the operations at the privatised Federal airports. The stated objectives of the Act include: promotion of the sound development of civil aviation in Australia; establishment of a system for the regulation of airports that has due regard to the interests of airport users and the general community; and promotion of the efficient and economic development and operation of airports.

A number of legal agreements were used to facilitate each of the sales. In terms of ongoing Commonwealth involvement in airport operations, the major sale documentation comprised: a Sale Agreement between the Commonwealth, the lessee and its parent entities; an Airport Lease between the Commonwealth and an airport lessee company; and, for the major airports, a tripartite deed between the Commonwealth, the lessee and the lessee's financiers. DOTARS' administration of these agreements is the focus of this audit.

Audit scope and objectives

The objectives of the audit were to assess whether DOTARS had developed and implemented an appropriate framework and procedures to administer lessee obligations entered into as part of the 1997 and 1998 leasehold sales of 17 Federal airports2. In particular, the audit sought to:

- review DOTARS' monitoring of lessee compliance with the Airport Leases and supporting sale documentation;

- examine the effectiveness of the framework and procedures developed by DOTARS to administer lessee development commitments; and

- assess the impact of changes in the aviation environment on the management and monitoring of lessee obligations.

The scope of the audit included assessing the Department's management of lessees' development obligations under the sale documentation and its management of lessee compliance with other contractual obligations. A follow-up of relevant recommendations from the ANAO audit of the first three sales was also conducted. This performance audit does not examine the administration of the Airports Act regulatory framework.

Key findings

Resourcing

Managing airport lessee compliance with the lease and sale agreement requirements is one aspect of the Department's overall post-sale activities. ANAO recognises that DOTARS must prioritise available human and financial resources. In this context, the Department sees its primary responsibility to be the administration of the Airports Act and related regulations. Nevertheless, effective administration of the sale documentation is necessary both to achieve the intended sale outcomes, and to manage the Commonwealth's residual risks and liabilities, which are substantial.

While giving priority to regulatory responsibilities, we found that, over the period since the first sales were completed in 1997, DOTARS has given insufficient attention and resources to important aspects of managing the Airport Leases and Sale Agreements. With limited budget-funded resources currently available for both the regulatory and contract management functions, DOTARS needs to identify other means of appropriately resourcing its contract management responsibilities. This includes considering the merits of exercising the power provided by the lease for DOTARS to recover its reasonable lease administration costs from the lessees.

Recovery of various costs is provided for in the airport sale documentation, as follows:

- under the leases, airport operators pay the Commonwealth's costs of providing an Airport Environment Officer (AEO) at the airport. For 2003–04, DOTARS advised ANAO that total costs recovered under the leases in respect of Airport Environment Officers would be $1.584 million;

- under the Sale Agreements, for the first five years following the sales, airport operators paid the costs of Airport Building Controllers (ABC). The ABC costs were only recovered to the extent they are not recovered from fees paid by third parties under the relevant regulations, and were subject to a maximum annual cap; and

- under the leases and tripartite deeds, the Commonwealth's reasonable administration costs can be recovered from the lessees.

Prior to this performance audit, DOTARS had not estimated its reasonable lease administration costs. In March 2004, DOTARS advised ANAO that the cost of administering the leases and other sale documentation in 2003–04 was estimated to be $558 000. This figure includes the costs of 4.75 full time staff. As DOTARS' administration costs had not previously been identified, the Department was not in a sound position to make decisions about the extent to which it would recover, or not recover, its administration costs. Very few administration costs have been recovered.

Annual lease reviews

Annual meetings with each airport lessee are an important element of DOTARS' approach to managing lessee compliance with the Airport Leases. The Department's objective in conducting lease reviews is to ensure that it is sufficiently well informed to be able to assess an airport operator's compliance with the requirements of the Airport Lease.

A lease review should have been conducted each year with each of the seventeen airports included in the scope of this audit. Of the 68 annual lease review meetings that should have been held by 30 June 2004, with lessees of these 17 airports, 26 (38 per cent) had not been conducted or arranged by the completion of this report. This level of performance has not been reflected in DOTARS' performance reporting on the conduct of annual lease reviews.

Major improvements were made by DOTARS in 2002 to its conduct of lease review meetings. At that time, almost five years after the first lease agreements commenced, DOTARS began the process of reviewing the Airport Leases in a methodical and structured fashion. Also in that year, DOTARS systematically reviewed the individual leases on a clause-by-clause basis and sought specific information from lessees to ensure that they were meeting their obligations under the leases. ANAO considers that this more methodical and structured approach, combined with DOTARS seeking written confirmation or evidence from lessees demonstrating compliance, provides greater assurance that the Commonwealth's interests, within the terms of the lease contract, are being adequately protected.

Insurance

Appropriate insurance cover for the privatised airports is important to the Commonwealth for a number of financial and other (public interest) reasons. These include protecting the Commonwealth against claims made against it as landlord, and having the proceeds of insurance claims used to rebuild damaged or destroyed structures. The insurance requirements of lessees are set out in both the Airport Leases and the Sale Agreements.

After the first airport sales in 1997, DOTARS entered into a contract with an insurance adviser for annual assessments of lessee insurance policies. This contract ended on 30 November 2001. However, it was not until June 2002 that DOTARS formally commenced a tender process to appoint a new insurance adviser. DOTARS has advised ANAO that the reason for the delay in implementing a formal tender process was due to the turmoil in the insurance industry following the September 11 event. A new contract was signed in September 2002. Since that time, DOTARS has obtained reports on insurance policies in place at all of the 22 privatised airports.

Insurance reports were completed between December 2002 and August 2003 in relation to each of the 17 airports included in the scope of this audit. Most of the insurance reports were qualified on the grounds that the airports had not provided all necessary information to DOTARS' insurance adviser. In addition, for a number of the airports, the adviser concluded that certain insurances were either not in place as required, or there were deficiencies in the insurance policies that had been put in place.

DOTARS has reviewed all insurance reports and has contacted each airport to provide feedback on the results and seek a response to issues that were identified. However, ANAO found that this follow-up action was not timely. This finding is based on the fact that DOTARS did not formally raise matters arising from the first series of insurance reviews with the airport lessees until at least two months, and up to 14 months, after the reports were completed. On average, eight months elapsed between the insurance report being finalised and provided to DOTARS, and DOTARS following-up issues with the relevant lessee. Some issues still remain unresolved.

Airport development commitments

The Sale Agreements for 10 of the airports included a commitment from the lessee to a specified amount of capital expenditure on aeronautical infrastructure development over the first 10 years of the lease. Total Development Commitments of $699.8 million were specified across the various Sale Agreements.

The 10-year Development Commitments are divided into two five-year periods, defined in the Sale Agreement as Period One and Period Two. For the three Phase 1 airports, Period One was originally specified to end on 30 June 2002. For the seven Phase 2 airports that have Development Commitments, Period One was originally specified to end on 30 June 2003. 3

The respective Sale Agreements contain a reporting regime to assist DOTARS in monitoring lessees' compliance in achieving their Development Commitments. The contracted monitoring regime requires lessees to:

- provide DOTARS each year with a detailed expenditure plan for the balance of the relevant five-year Period, indicating how the lessee intends to comply with its obligations. Annual expenditure plans have been required since July 1997 for the Phase 1 airports and July 1999 for the Phase 2 airports; 4

- provide DOTARS with annual audited reports prepared by an Approved Auditor setting out the Airport Development Costs for the 12 month period. Annual audited cost reports have been required since September 1998 for the Phase 1 airports and September 1999 for the Phase 2 airports; and

- provide DOTARS with fully audited reports prepared by an Approved Auditor setting out the Airport Development Costs at the conclusion of Period One and Period Two. Except where DOTARS has agreed to extend Period One for certain airports, Period One ended on 30 June 2002 for the Phase 1 airports and on 30 June 2003 for the Phase 2 airports.

Administrative procedures

The airports were advised by DOTARS in February 1999 that, although airport lessees must report annually on their progress in meeting their development obligations, the main task for DOTARS would occur after the expiration of each of the five-year periods. DOTARS advised ANAO in February 2004 that, with this clear principle in mind, the Department commenced work in early 2003 to prepare and implement its Development Obligations for leased Federal airports—Procedures and Guidelines document to ensure that the Period One reports from the relevant Phase 1 and 2 airports would be assessed on a consistent basis. DOTARS further advised that the timing of preparation of this document clearly reflects the fact that the airports' medium term Development Commitments are a contractual, not regulatory, obligation.

ANAO found that DOTARS' development of procedures to administer these Commitments was not timely. In particular, the Department did not commence the development of procedures until 2003, more than five and a half years after the Phase 1 sales were completed. ANAO recognises that the Period One and Two reports are the key documents in assessing the extent to which the relevant lessees have met their Development Commitments. Nevertheless, the following observations are relevant:

- Annual expenditure plans and annual audited costs reports have been required since 1997 and 1998 respectively. The annual expenditure plans and annual audited cost reports provide important monitoring information to DOTARS and an opportunity 5 for DOTARS to provide timely feedback to lessees. ANAO considers that obtaining and using these annual plans and reports, in the manner now outlined in DOTARS' December 2003 procedures document, would have facilitated the timely finalisation of Period One outcomes by promoting a shared understanding with lessees of the contractual requirements.

- In 2000, DOTARS agreed to a four-year extension to Period One for one airport. Further extensions were agreed in 2003 and 2004 in relation to another two airports. The approach taken to the first extension in 2000 would have benefited from the earlier development and finalisation of DOTARS' procedures, particularly to achieve more timely resolution of the appropriate interest rate to apply to the deferred development expenditure.

Administration of reporting requirements

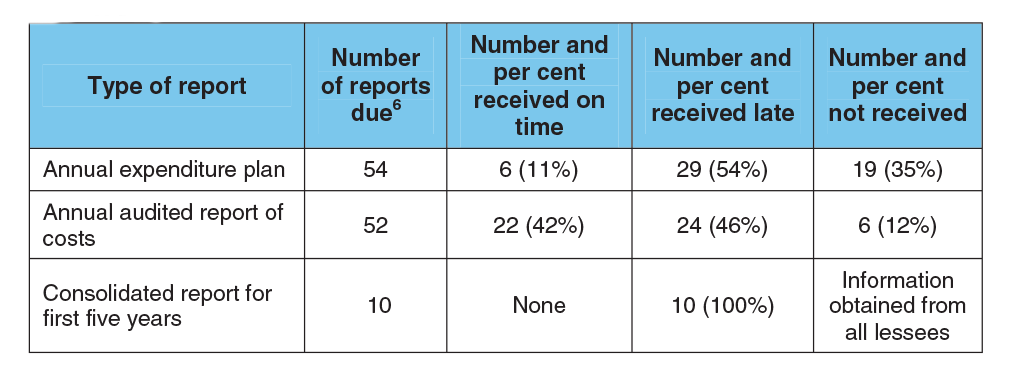

As is evident from Table 1, DOTARS has not obtained a significant number of the expenditure plans and audited cost reports from the lessees. In addition, where reports were obtained, they were often obtained after the due date. Of particular significance is that consolidated reports for the first five years, which are a prerequisite for DOTARS to assess the degree of compliance with the expenditure commitment, were not obtained until after the due date for all airports.

Table 1 Administration of Development Commitment Reporting Requirements: March 2004

Source: ANAO analysis of DOTARS data and DOTARS advice to ANAO

Outcomes

Had there been full compliance with the requirements of the Sale Agreements, outcomes for the first five years should have been known by the end of 2002 for the Phase 1 airports and by the end of 2003 for the Phase 2 airports. Due to delays in DOTARS obtaining compliant audited reports from the lessees, ANAO was unable to assess the extent to which the contracted Period One aggregate Development Commitment of $259.3 million had been achieved. As of March 2004, DOTARS had received some information in respect of Period One achievements from each of the 10 lessees. The information provided to DOTARS indicated the following:

- For five airports, the lessee claimed to have met, or exceeded, its Period One Commitment. In one instance, the airport lessee indicated it had met its full 10 year Commitment within the first five years. However, as DOTARS had only recently received the necessary audit reports, a final outcome had not yet been confirmed.

- For the remaining five airports, the information provided to DOTARS indicated that the Period One Commitment had not been met. Lessees of four of these airports have requested an extension to Period One. This has been granted in three instances and is being considered by DOTARS in relation to the fourth.

Follow-up of earlier audit recommendations

Audit Report No.38 1997–98 Sale of Brisbane, Melbourne and Perth Airports made eleven recommendations7. Three of these related to DOTARS' post-sale contract management role. Outlined below is ANAO's summary assessment of the implementation of the relevant recommendations.

Recommendation No.8: Comprehensive framework and procedures for leases

ANAO recommended that DOTARS develop a comprehensive framework and procedures to monitor and ensure lessee compliance with the Airport Leases. DOTARS' response to the recommendation was that it agreed with qualification, as follows:

DOTARS accepts that some further measures will be required in both areas, although there has been active management of the lease obligations underway since day 1 of the lease – the report notes some of the matters involved. DOTARS will initiate a formal lease meeting, with a mechanism involving each airport (and its major users) to review key lease clauses and issues associated with it. These meetings will be conducted annually. This will involve up to 18 separate meetings, with the Phase 2 sales now nearing completion. However, the key task will remain to continue to actively oversight those lease obligations which arise on a day-to-day basis.

Chapter 2 of this report examines DOTARS' administration of the Airport Leases including the conduct of annual lease reviews with individual airports. The specific undertaking made by DOTARS in its response to the recommendation was for annual lease review meetings to be conducted with each airport and its major users. For the seventeen airports included in this current ANAO audit, DOTARS conducted a lease review meeting with each airport in 2000–01 and has conducted, or arranged to conduct, a meeting with each airport in 2003–04. In other years, meetings were conducted with between three to seven lessees. DOTARS has advised ANAO that regulatory events and industry shocks in 2001–02 and 2002–03 diverted resources from conducting planned lease reviews.

Recommendation No.9: Safe custody arrangements for signed sale documentation

To manage the Commonwealth's ongoing risks under the sale documentation, ANAO's 1998 Audit Report found that it was important that arrangements be made for the ongoing storage and safe custody of this important documentation in an appropriate legal form. ANAO recommended that the Office of Asset Sales and IT Outsourcing, in consultation with DOTARS:

- for future airport sales, develop an agreed framework for the post-sale disposition of sale documentation including providing for appropriate safe custody arrangements for the original signed sale documentation in an appropriate legal form for the duration of the lease term, and placing, in the records of each agency, a full set of copies of the signed sale documentation; and

- establish appropriate safe custody arrangements for the original signed sale documentation relating to the Phase 1 airport sales, in an appropriate legal form, for the duration of the lease term.

All agencies, including DOTARS, agreed with this recommendation with the Australian Government Solicitor (AGS) noting that the Office of Asset Sales and IT Outsourcing had requested AGS to arrange for the safe keeping of all original sale documentation once same had been returned from relevant State Stamps Offices. In April 2004, AGS advised ANAO that, in relation to the Phase 1 and Phase 2 airports, it holds all original Sale Agreements and all original Tripartite Deeds. However, in respect of the Airport Leases, AGS holds the originals except in relation to three airports, where it holds a copy of the Airport Lease with the original initials on the front, and Brisbane, where AGS holds no Airport Lease and appears never to have done so.

Recommendation No.10: Procedures to monitor airport development

ANAO recommended that DOTARS develop and implement comprehensive administrative procedures to monitor ongoing development of the Phase 1 airports as required by the Airports Act and airport leases. DOTARS agreed with qualification to the recommendation. DOTARS commented that:

The Department considers that the comprehensive reporting process [outlined above] is sufficient to ensure effective monitoring. However, the area which requires further work is better defining the terms in the lease for assessing whether the site is being developed as an effective international airport. The activity in this area is essentially longer term (in our view all airports are likely to meet demand effectively over the next few years) but we accept that we can and should develop some guidance for both the airport operators and ourselves in this area now.

The first aspect of DOTARS' response was that the comprehensive reporting process outlined in the Sale Agreements was sufficient to ensure effective monitoring of airport development. ANAO's assessment of DOTARS' administration of the Sale Agreement reporting requirements is summarised in Table 1.

The other aspect of DOTARS' response was that guidance should be developed for airport operators and the Department on the terms in the lease, for assessing whether the site is being developed to an appropriate standard over the term of the lease. In this respect, in February 2004, DOTARS advised ANAO that the need for guidance had been overtaken by the submission and approval of Master Plans for all of the Phase 1 and Phase 2 airports. DOTARS further advised that it has taken the approach that monitoring of the ongoing development of the leased airports is best addressed having regard to the approved Master Plans and Major Development Plans.

Overall conclusions

The focus of this audit was on DOTARS' management of contracts entered into as part of the 1997 and 1998 leasehold sales of 17 Federal airports. Since the sales, significant changes have occurred in the Australian aviation market. This has included challenges arising from the Asian economic crisis, the 11 September 2001 events in the United States, the collapse of Ansett, the Bali bombing, the SARS pandemic and the Iraqi war. The changes in the aviation environment have increased the challenges facing DOTARS in its regulatory and contract management roles.

In terms of the audit objective, ANAO found that DOTARS took some time to develop procedures to administer important aspects of lessees' contractual obligations. The Department has indicated to ANAO that the approach taken was influenced by the impact of changes in the aviation environment. Commencing in 2002, the Department has taken steps in a number of areas to improve its contract management approach. ANAO considers that further attention is required in a number of areas, most notably as follows:

- Consideration of the merits of exercising the Commonwealth's contractual right to recover reasonable lease administration costs from lessees. At the time of the audit, insufficient attention had been given to managing the contracts over the period since privatisation. The cost recovery arrangements provided by the leases are one possible means to increase the resources allocated to the contract management function.

- Lease review meetings should be held with all airports at least once a year. Review outcomes should be documented, including an assessment of the level of compliance by lessees. Improved communication of review outcomes to lessees would also add value, including by specifying outstanding issues that lessees are expected to address.

- The comprehensive reporting process provided by the Sale Agreements to enable effective monitoring of Development Commitment progress has not been consistently and rigorously implemented. Revised procedures promulgated in 2003 should assist in this regard, but the key performance issue will be the timely and effective implementation of these procedures.

The audit also identified inaccuracies in DOTARS' reporting on its performance in managing the Airport Leases and Sale Agreements. 8

Recommendations and agency response

ANAO made nine recommendations concerning DOTARS' management of post-sale contractual obligations. DOTARS agreed with six recommendations and agreed with qualification to the remainder.

DOTARS' full response to the section 19 proposed audit report can be found at Appendix 1. The following was DOTARS' summary response.

The Performance Audit has provided the Department with an opportunity to review its administrative policies and practices in relation to the oversight of Lease and Development Obligations. The views and recommendations contained in the Report are being seriously considered by the Department as part of its commitment to continuous improvement in the oversight of and reporting on the performance of the Federal airport lessees. Nevertheless, whilst agreeing with all the specific recommendations made by ANAO, the Department has difficulty in accepting some of the analysis undertaken by ANAO in developing their conclusions.

The Department's approach to the oversight of the airports' Lease and Development Commitments obligations has consistently reflected the Government's policy objectives as articulated in the Airports Act 1996 and the use of the available resources. In particular, the Department firmly believes that it has achieved the prescribed policy outcomes envisaged by the Sale Agreements through the totality of its regulatory, contractual and operational oversight processes and the appropriate allocation of resources to risk.

The Department considers that the conclusions reached by the ANAO in this Audit do not adequately recognise either its wide-ranging oversight responsibilities in relation to lease management, or the substantial achievements of the airports themselves. The Department believes that this has resulted not only in a skewed assessment of the Department's lease oversight performance but also in insufficient regard being paid to the broad-ranging commercial and risk management systems implemented by the Department since privatisation of the Federal airports.

The audit review does not fully recognise the strategic policy basis under which the 22 Federal airports have been privatised. The Australian Government has achieved a significant aggregate revenue outcome ($8.5 billion) through the various Federal airport sales between July 1997 and December 2003. In return the Australian Government's contractual oversight framework provided by the airport leases clearly recognised that the privatised airports were to operate as closely as possible to freehold, in a business sense, for the 99 years of their leases. All airports have not only survived the transition from public to private sector ownership but have done so in a highly testing economic and aviation industry environment. In addition in aggregate terms they have delivered substantial new development well above that required under the terms of the Sale Agreements, representing capital expenditure (aeronautical and non-aeronautical) across the capital city airports since privatisation (excluding Sydney Airport) in the order of $570 million. Such capital investment has resulted in a significant increase in the value of the Australian Government's asset and reflects the success of the privatisation program.

It is also the Department's view that the conclusions reached in the Report insufficiently recognise the contractual nature of the lease and sale agreements that require, by their very nature, a degree of ‘reasonableness' from both parties in their application. Nor is adequate account taken of the economic challenges faced by the airports arising from the commencement of the airports' privatisation process and in particular the collapse of Ansett and the repercussions arising from the September 11 events. More specific comments about individual issues raised in the Report, such as Insurance and Development Obligations, are addressed in the Department's detailed response.

Footnotes

1 The first sales (referred to as Phase 1) occurred in 1997 and were reported on in ANAO Audit Report No.38 1997–98, Sale of Brisbane, Melbourne and Perth Airports, Canberra, March 1998. Phase 2 of the sales program, completed in 1998, was reported on in ANAO Audit Report No.48 1998–99, Phase 2 of the Sales of the Federal Airports, Canberra, June 1999. ANAO also audited the 2002 sale of Sydney (Kingsford Smith) Airport, which is reported on in ANAO Audit Report No.43 2002–03, The Sale of Sydney (Kingsford Smith) Airport, Canberra, May 2003. ANAO has not audited the 2001 sale of Essendon Airport or the 2003 sale of the remaining three Sydney Basin Airports.

2 Post-sale contract management related to Essendon Airport, Sydney (Kingsford Smith) Airport and the three Sydney basin airports (Bankstown, Camden and Hoxton Park) was excluded from the audit scope as these are relatively recent sales.

3 These dates can be extended with the Commonwealth's agreement. DOTARS has agreed to an extension in relation to three airports. The extensions range from one year to four years.

4 In February 2004, DOTARS advised ANAO that it had, in effect, waived the requirement for the Phase 2 airports to provide an expenditure plan for the first year following privatisation.

5 The Sale Agreements do not require DOTARS to respond to the expenditure plans and annual audited cost reports.

6 See Chapter 3 (Tables 3.3, 3.4 and 3.5) for further explanation of the number of reports that are due.

7 The recommendations established benchmark principles for both Phase 1 and future airport sales.

8 ANAO Audit Report No.11 2003–04, Annual Performance Reporting, Canberra, November 2003, examined performance reporting by five agencies, not including DOTARS. The focus of the audit was to identify whether the selected agencies' annual reports demonstrated the overall characteristics required to make annual reports appropriate instruments of accountability. In addition, in conjunction with the Department of Finance and Administration (Finance), ANAO published in April 2004 a Better Practice Guide on annual reporting.