Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Debt Relief Arrangements

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office’s administration of debt relief arrangements.

Summary

Introduction

1. The Australian Taxation Office (ATO) is responsible for administering Australia’s tax and superannuation legislation, and seeks to build confidence in its administration through helping people to understand their rights and obligations, improve ease of compliance and access to benefits, and manage non-compliance with the law. The effective management of debt is also a key factor in maintaining community confidence in the fairness and equity of Australia’s tax and superannuation systems.

2. A debt arises when a tax, duty or charge becomes legally due and payable.1 The ATO expects tax debtors to pay their debts as and when they fall due for payment. However, if the debt is not paid by the due date, the ATO can take appropriate action to recover it. The ATO’s policy is to adopt a ‘community first’ approach when deciding the recovery options it will take, and differentiates between taxpayers who are trying to do the right thing and meet their obligations, and those who are not.2 Accordingly, the ATO takes into account the compliance history of taxpayers and their capacity to pay a tax debt.

3. The ATO encourages people to contact them as soon as practicable if they are experiencing difficulties in meeting their tax or superannuation obligations, and will assist them to manage their obligations and prevent their debt from escalating. Information relating to financial hardship is available on the ATO’s website, and the ATO also conducts a range of community engagement activities to communicate its messages to taxpayers. While the ATO has measures in place to identify and support taxpayers who may be experiencing financial difficulties, the onus is on taxpayers or their representatives to contact the ATO and discuss their financial circumstances and debt payment arrangements.

4. Debt recovery options available to the ATO include negotiating a payment arrangement to allow taxpayers to pay their debt over an agreed period of time, using garnishee powers to collect the debt directly from a taxpayer’s bank account or salary, or as a last resort seeking payment of the debt through court action. The ATO may also decide not to pursue the liability, or to reduce or cancel the amount of debt the taxpayer owes. These options are referred to collectively in this report as ‘debt relief’ arrangements.

5. Debt relief options include: the waiver3of debt; full or partial release from tax liabilities where payment may cause serious hardship to taxpayers4; and acceptance of a compromised amount of revenue against the full value of the debt where it has assessed that the entire balance is unlikely to be paid. The ATO may also decide not to pursue a debt where it is uneconomical to do so or irrecoverable at law, including through automated bulk processes for lower value and aged debts that have been in the system for some time.5

6. In addition to their primary debt, taxpayers may be liable for general interest and penalty charges.6 In certain circumstances, the ATO may agree to a remission of the general interest and penalty charges, meaning that all or part of the general interest charge that has accrued, including for the late payment of a debt, is cancelled.7 Each debt relief option is governed by specific legislation, delegations and criteria, subject to the type of tax for which the debt arises.

7. Debt relief options can only be applied to collectable debt—that is, debt that is not subject to objection or appeal or any form of insolvency administration. The ATO was managing $31.7 billion in total debt holdings as at 30 June 20128, of which $16.6 billion was collectable debt and $15.1 billion was impeded debt.9 The age of the collectable debt varies, with around $7.0 billion being outstanding for more than two years, including over $1.5 billion for more than five years; aged debt being generally more difficult to recover. Activity statement debt (particularly relating to the goods and services tax) and income tax debt accounted for the bulk of the collectable debt: $9.1 billion in activity statement debt, and $7.1 billion in income tax debt.10 All collectable debt is subject to the ATO’s debt management and recovery processes, including where taxpayers are eligible for some form of debt relief.

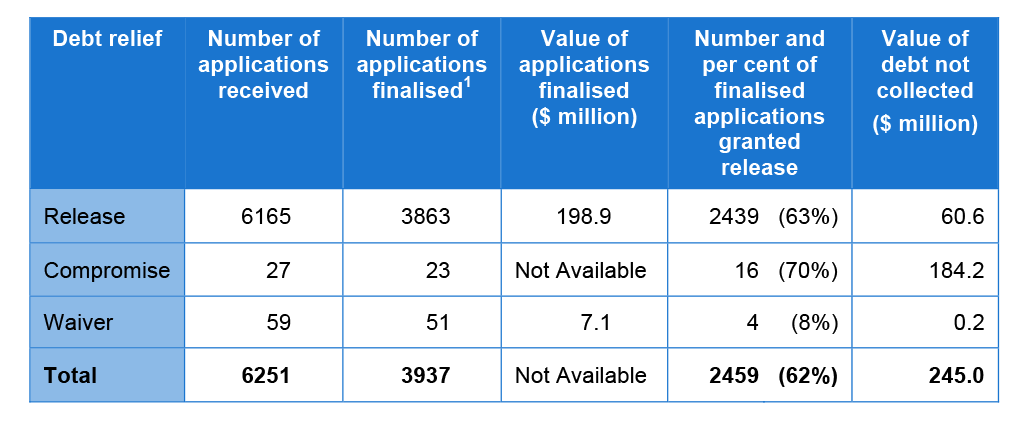

8. The value of debts subject to some form of debt relief in 2011–12 was $4.6 billion. Of this amount: $2.4 billion was not pursued11 either because the debts were uneconomic to pursue or irrecoverable at law12; $1.6 billion was for remission of general interest charges; $391 million was for remission of penalty charges; $184.2 million was compromised; $60.6 million was released; and around $200 000 was waived. The number and value of applications received and granted waiver, release, and compromise from debt in 2011–12 are set out in Table S1. The table indicates that 62 per cent of the applications finalised were granted full or partial relief of their debt.

Table S.1 Waiver, release, and compromise applications received, finalised and granted in 2011–12

Source: ATO.

Note 1: Applications may not be finalised in the year that they are received. The difference between the number of release applications received and finalised in 2011-12 was mainly due to a high number of applications being received late in the financial year, and 1573 applications ‘finalised without decision’, where taxpayers failed to bring all lodgements up to date or did not provide the required information.

9. Of those cases granted full or partial relief of their debts through release, compromise or waiver in 2011–12, most (69 per cent) involved relief of between $2500 and $50 000, while 81 per cent of the total value of relief was granted to cases where the relief exceeded $100 000.13

Administration of taxation debt

10. The ATO’s Debt business line has primary responsibility for the management and reporting of debt, including debt relief. Guidance material, staff training and appropriate delegations support the assessment of debt relief applications. The ATO also applies a quality assurance regime to its debt relief processes and practices, and taxpayers have various rights of review of the decisions the ATO has made about their application for debt relief.

11. In managing debt cases, the ATO relies on two information and communications technology (ICT) systems—a new integrated core processing system established in 2010 that operates in parallel with a number of legacy systems.14 Taxpayers may have several accounts in these two systems, and while this situation has little impact on individual taxpayers it creates additional work for ATO staff to assess and manage debt relief cases as they must use information from both systems.

Audit objective and criteria

12. The objective of the audit was to assess the effectiveness of the ATO’s administration of debt relief arrangements. The audit assessed whether:

- information was readily available on debt relief options to people in serious hardship;

- those cases being considered for debt relief were effectively assessed;

- debt cases that were not pursued and re-raised or cancelled at a later date were being appropriately managed; and

- debt relief outcomes were accurately reported.

The ATO’s communication with taxpayers and key stakeholders was also examined.

Overall conclusion

13. In managing taxation debt, the ATO must balance support for taxpayers experiencing financial hardship with its responsibilities to collect revenue. The decision to reduce or cancel a debt represents a loss of revenue for the Commonwealth, and may also advantage one taxpayer over another if debt relief decisions are not consistently applied. In 2011-12, the ATO collected $301 billion in taxation revenue, had collectable debt holdings of $16.6 billion and granted $4.6 billion in debt relief.15

14. The ATO’s management of debt relief arrangements is generally effective, given the volume of transactions and the extent of the need to have regard to taxpayers’ personal circumstances. The ATO promotes early engagement by taxpayers if they are unable to meet their tax obligations and provides considerable information about debt management and relief. It also has effective arrangements for identifying, assessing and managing applications from taxpayers experiencing financial hardship, and recently improved its debt reporting arrangements. There is scope, however, to improve the quality assurance processes for general interest charge remission to help ensure these decisions are consistently applied. Assessing the extent to which debt release decisions have supported taxpayers in meeting their tax obligations in the longer term, would also inform debt relief strategies and improve the quality of decision making.

15. Debt relief applications are mainly assessed and managed by the Debt Hardship Capability team within the Debt business line. The team has specialist debt knowledge and the capability to consider taxpayers’ financial circumstances. Formal guidance material supports the assessment of debt relief cases, and staff training, supervision and delegations aim to provide consistency across assessments, recognising that debt relief decisions are complex and require judgements about taxpayers’ financial hardship and their capacity to pay. The ANAO analysed a sample of 629 cases across all major categories of debt relief (waiver, release, compromise, individual non-pursuit and remission of general interest charges), and did not identify any notable non-compliance with ATO processes and record keeping obligations.

16. To support compliance with its debt relief processes and procedures, the Debt business line has specific quality assurance mechanisms in place, including controls over automated processes. These mechanisms do not, however, adequately cover the decisions to remit general interest charges that can be made by staff in other business lines, who are often at relatively low classification levels. There would be benefit in the ATO’s quality assurance reviews giving particular attention to providing assurance that these decisions are being made in accordance with relevant policies and procedures.

17. Reporting on debt relief arrangements within the ATO was limited prior to early 2013, covering only combined figures for non-pursued debt and the remission of general interest and penalty charges. In April 2013, the ATO implemented a new reporting framework that is intended to provide more accurate and detailed information on all aspects of debt management, including debt reductions by category of debt relief.16

18. The ANAO has made two recommendations aimed at: enhancing assurance processes for the remission of general interest charges; and improving the ATO’s ongoing administration of debt relief arrangements by assessing the extent to which debt release decisions have assisted taxpayers to meet their tax obligations in the longer term.

Key findings by chapter

Engaging with tax debtors and supporting debt staff (Chapter 2)

19. To encourage and support taxpayers’ compliance with their tax obligations, the ATO provides a range of information relating to debt management on its website to assist taxpayers in meeting their payment obligations, and also provides advice in writing and by telephone.

20. While online information about debt relief is available, it does not fully cover all aspects of debt relief and is difficult to locate. A new website is being developed to improve accessibility and the clarity of messages as part of the ATO’s strategy to deliver more services online. As the ATO expands its online service delivery, consideration will need to be afforded to those taxpayers who are less comfortable with, or whose personal circumstances may limit their access to, these services.

21. The ATO conducts community engagement activities that allow communication of specific messages to taxpayers, including in relation to debt relief, and to obtain feedback on the standard of services being provided. Results from a survey of 54 financial counsellors completed for this audit indicated that the ATO performed reasonably well in responding to taxpayers in hardship and in engaging with counsellors.17 The results also provided useful information for management about opportunities to improve the negotiation of debt hardship arrangements. The ATO could also consider including questions relating to taxpayers’ engagement with the ATO about the management of their debts in its annual surveys, as these do not currently cover debt management issues.18

22. The processing of debt cases is supported by guidance material that sets out policies and procedures to be followed by staff when assessing applications for relief. Training courses are also delivered to ATO staff in order to provide them with the necessary skills to engage taxpayers and work through debt management options. Debt business line staff have access to 15 courses that most directly relate to debt management and debt relief arrangements, with ATO records indicating a significant increase in staff attendance since July 2011. The results from the survey of financial counsellors may be useful to the ATO when reviewing its annual learning and development plan.

Assessing debt relief applications (Chapter 3)

23. Assessing a taxpayer’s circumstances and eligibility for some form of debt relief involves an understanding of the relevant legislation and the ATO’s policies and procedures. ATO staff are required to assess taxpayers’ circumstances against factors that, by their nature, require a degree of judgement, including that the decision to grant debt release will allow taxpayers to gain control of their finances. The ANAO’s analysis of the administration of a sample of applications for waiver and release of a debt19 indicated general compliance with ATO processes and record keeping obligations. However, in respect of compromise, the ATO could strengthen its record keeping for the relatively small number of cases it manages each year.20

24. In examining decision-making processes for the non-pursuit of individual debts and the remission of general interest charges, this audit drew on the findings of the ANAO’s 2010–11 and 2011–12 audits of the ATO’s financial statements. These audits indicated that the ATO had appropriate approvals and recording of remittal values. The audits also noted that there was generally less oversight of the decisions to remit general interest charges than other forms of debt relief. This is despite decisions to remit these charges being made across the ATO and often by officers at relatively low classification levels.21

25. The ATO commissions external consultants to conduct annual independent reviews of its debt release decisions. As these reviews have a relatively narrow focus, examining only the assessment of ‘serious hardship’ and if taxpayers were kept informed of the progress of their application, there would be benefit in the ATO reviewing the ongoing value of these reviews. The ATO does not assess the outcomes of debt release decisions, including the extent to which they have supported taxpayers to meet their taxation payment obligations in the longer term. Such analysis would provide a better understanding of the factors involved in assessing taxpayers’ financial hardship and the quality of debt release decisions, as well as informing debt relief strategies.

26. As previously noted, taxpayers are expected to meet their debt obligations where they have the capacity to pay. Decisions to reduce or cancel debts represent a loss of revenue for the Commonwealth, and if not consistently applied may advantage one taxpayer over another. The ATO has several mechanisms to assess the quality and consistency of its administration and decision making. In particular, the Integrated Quality Framework22 (IQF) processes aim to provide assurance that there are no systemic issues in the administration of the tax and superannuation systems, and the Debt Quality Management System is used to assess the quality of the work of individual staff members in the Debt business line.

27. While the Debt Quality Management System assessment processes are generally sound, the ATO is redesigning the IQF to provide a greater level of assurance on the work being undertaken. The new IQF processes are to be implemented in 2013–14. There would be benefit in increasing the quality assurance review for the remission of general interest charges to provide greater assurance that decisions are being applied consistently and staff are following the appropriate procedures, including not to remit these charges as an inducement to finalise a debt.

28. Taxpayers can request the ATO to review a decision not to grant relief from their debt. However, information provided by the ATO about the main options for review is not clear in all instances. Notably, the ATO website advises taxpayers that they cannot dispute or disagree with a general interest charge decision through the objections process, only advising taxpayers that they can contact the ATO to discuss the matter. Further, it does not advise that complaints and objections regarding release decisions are dealt with differently by the ATO.23 While the ATO’s processes for managing taxpayers’ objections are sound, it would be helpful if the ATO better communicated the processes for disputing or disagreeing with their decisions. There have been relatively few objections and reviews of the ATO’s debt release decisions upheld in recent years. Only four of 209 objections finalised in 2011–12 were upheld (less than 2 per cent), and similarly one of 12 appeals to the Administrative Appeals Tribunal was upheld.

Automated debt relief processes (Chapter 4)

29. The ATO initiated the Change Program in 2002 to establish an up‑to‑date ICT capability and replace the agency’s multiple ICT systems with a single business system. In June 2010, the ATO announced that the implementation of the Change Program was formally completed. However, a range of legislative changes, combined with changes in project scope and a series of delays and extensions, resulted in the full functionality of the original program specifications not being achieved. As a result, the ATO continues to use two ICT systems to administer tax and superannuation (the integrated core processing (ICP) system and the legacy systems).

30. While these ICT arrangements have no direct impact on taxpayers, they limit the ATO’s capacity to administer certain business operations without intervention. For debt management, this means using systems separate from the main ICT systems to support the management of taxpayers’ applications for release, waiver and compromise, and to report on the movement of debt cases and the different categories of debt relief. While the ATO recognises the risks and challenges of maintaining two complex, parallel ICT systems, it noted that there are multiple demands for system upgrades and enhancements that have to be prioritised across the ATO.

31. The ATO applies processes in both ICT systems to allow the bulk non‑pursuit of debts that have been outstanding for some time and are considered uneconomical to follow up or are irrecoverable at law. In the legacy systems, just over $462 million of debt was not pursued during 2011–12. This bulk process is safeguarded by two key controls—executive review and approval of bulk non-pursuit parameters and a sampling review of the output of the process—that provide reasonable assurance of the integrity of the process.

32. There is, however, only a limited, interim bulk non-pursuit capacity in the ICP system as full functionality is not yet available. Since September 2010, debts in this system totalling just under $50 million were not pursued, covering debts that are potentially uneconomical to pursue, but none that are potentially irrecoverable at law. There is a potential backlog of cases that will not be processed until the full bulk non-pursuit capability is available in the ICP system, scheduled for September 2013.

33. Debts that the ATO has assessed as uneconomical to pursue through the bulk non-pursuit and individual non-pursuit processes can be re-raised at a later date, subject to changes in the taxpayer’s circumstances, using either ICT system. Analysis of the ATO’s systems for re-raising non-pursued debt found that the five relevant business rules are being properly implemented in the relevant systems. The ATO’s internal procedures to impose general interest and penalty charges and to run monthly bulk processes to deal with very low value automatic remissions are also sound, and ANAO testing has found no material mistakes in the process.

Reporting debt relief (Chapter 5)

34. The ATO developed a new debt reporting framework in 2012–13, primarily to meet the reporting requirements associated with the additional program funding allocated in the 2012–13 Budget. The framework provides the Debt business line with improved management information on the value and ‘flow’ of debts, including for the categories of debt relief. Previously, the focus of reporting had been on debt collection, with the ATO advising that reporting of debt relief had traditionally been regarded as a lower priority and undertaken on an ad hoc basis.

35. The first full report under the new framework, the debt flow weekly summary report, was produced in April 2013. The ATO now produces four reports that provide information on debt relief—the other reports being the non-pursuit report, the hardship capability report, and a report on the value of general interest and penalty charges imposed and remitted each month. These three reports provide high-level data on some but not all aspects of debt relief, and will complement the more detailed information provided in the new report. Refinements to the four debt reports depend on the ATO further developing its ICT systems. These changes would address issues that currently constrain the debt reporting capability, including that data must be sourced from the standalone systems used by the Debt Hardship Capability team.

36. There is limited public reporting of debt relief arrangements in the Commissioner of Taxation’s annual reports and accompanying financial statements.24 Reporting would be strengthened by the consolidated presentation of all debt relief arrangements, broken down by category, and by the ATO ceasing to use the terms ‘non-pursuit’ and ‘write-off’ interchangeably. These terms do not accurately distinguish between those debts the ATO has chosen not to pursue but can re-raise at a later date (non-pursuit) and those it had decided not to recover (write-off).

Summary of agency response

37. The ATO provided the following summary comment to the audit report:

The ATO welcomes this audit and considers the report supportive of our overall approach to managing the debt relief arrangements. The audit recognises that the ATO’s management of debt relief arrangements are generally effective given the volume of transactions and the need to have regard to taxpayers’ personal circumstances. The report also acknowledges the ATO has effective arrangements for identifying, assessing and managing applications from taxpayers experiencing financial hardship.

The ATO recognises the audit highlights several opportunities to strengthen and further improve the management of debt relief. In particular, ensuring the objective of debt release strategies, in supporting taxpayers to gain control of their financial circumstances and meet taxation obligations in the longer term. We also acknowledge the benefit of an increased focus on the assurance of the quality and consistency of general interest charge remission decisions. The ATO agrees with the two recommendations contained in the review.

38. The ATO’s full response is included at Appendix 1.

Recommendations

|

Recommendation No.1 Para 3.87 |

To inform debt release strategies, the ANAO recommends that the Australian Taxation Office assesses (through a sampling approach) the extent to which it has achieved its objective of supporting taxpayers to gain control of their financial circumstances and meet taxation payment obligations in the longer term. ATO response: Agreed |

|

Recommendation No.2 Para 3.90 |

To provide increased assurance of the quality and consistency of decisions to remit general interest charges, the ANAO recommends that the Australian Taxation Office undertakes specific quality assurance assessments on general interest charge remission decisions and includes a focus on these decisions in the IQF summary reports. ATO response: Agreed |

Footnotes

[1] This report refers to these debts broadly as taxation debt.

[2] Commissioner of Taxation, Annual Report 2011–12, p. 44.

[3] A debt due to the Commonwealth can only be waived—that is, expunged and not subsequently recovered or re‑raised—by the Finance Minister or appointed delegate.

[4] Serious hardship is where an individual is ‘deprived of necessities according to normal community standards’: ATO, Practice Statement Law Administration, PS LA 2011/17: Debt relief.

[5] Debts that the ATO decides not to pursue may be re-raised at a later date if changes to a taxpayer’s circumstances would support collection of the debt.

[6] The ATO applies a range of interest charges where taxpayers have not paid the full amount of the tax debt, or not paid by the due date, in order to compensate the Government for the time value of money. Penalties are imposed where taxpayers have failed to meet their tax obligations, such as to lodge a tax return.

[7] ATO policy states that it is inappropriate to remit the general interest charge as an inducement to finalise a debt. ATO, Practice Statement Law Administration, PS LA 2011/12.

[8] Commissioner of Taxation, Annual Report 2011–12, p. 58.

[9] Impeded debt is subject to legal requirements, such as the taxpayer undergoing insolvency proceedings or disputing the debt owed to the ATO. There are no available debt relief options for impeded debt.

[10] The remaining $0.3 billion mainly related to superannuation guarantee charge debt.

[11] The ATO’s financial statements allow for the non-collection of revenue amounts (including debt subject to relief arrangements) by providing for the impairment of taxation receivables. In 2011–12, the ATO’s financial statements disclose in Note 19 total taxation receivable (gross) of $31.7 billion and an allowance for impairment of $11.5 billion. While debts that are not pursued because they are uneconomical to do so are impaired in the financial statements, they can be re-raised (as outlined in footnote 5).

[12] This figure includes around $462 million not pursued in 2011–12 as a result of automated bulk non-pursuit processes in the legacy systems that identified large volumes of lower value and aged debts and some that were irrecoverable at law. The ICP system has identified almost $50 million of lower value and aged debts for non-pursuit since its inception in September 2010.

[13] The ATO did not maintain statistics on the age of debt relief cases.

[14] The ICP system processes, among other things, income tax and fringe benefits tax. The legacy systems process taxes that include goods and services tax, pay-as-you-go (PAYG) tax installments, excise, and superannuation guarantee.

[15] Total taxation revenue was reported in the Commissioner of Taxation, Annual Report 2011–12, p. 58. Collectable debt holdings relate to multiple previous years and was valued at $16.6 as at 30 June 2012. In addition, there was $15.1 billion in impeded debt that was not subject to debt relief arrangements, over the same period.

[16] The new reporting framework will provide a weekly summary report of the value of debt holdings at the start and end of the week, and debt in-flow and out-flow, including debts resolved by collection or reduction (debt relief).

[17] In March 2013, Financial Counselling Australia surveyed 54 financial counsellors from across Australia (excluding New South Wales and Tasmania) about their experiences in dealing with the ATO, specifically the Debt Hardship Capability team, to negotiate a debt hardship arrangement for their clients.

[18] Two annual surveys—the ATO professionalism survey and the Community Perceptions survey—are commissioned by the ATO but neither includes any questions relating to debt management or relief.

[19] The ANAO analysed all 77 applications for waiver of a debt finalised during the 18 month period 1 July 2011 to 31 December 2012, and 460 of around the 9499 applications for release of debt actioned between 1 July 2011 and 30 June 2012.

[20] The ANAO examined the case management records for 42 of the 98 compromise cases finalised between 1 July 2009 and 31 December 2012.

[21] The ATO remitted general interest charges valued at $1.9 billion in 2010–11 and $1.6 billion in 2011–12.

[22] The Integrated Quality Framework is the principal means of improving and assuring the quality of work across the ATO. It aims to identify systemic issues concerning processes and procedures at the corporate and team level.

[23] Complaints are initially managed within the Debt team that made the original decision, whereas objections follow a more formal process and are reviewed by another business line to provide an independent assessment.

[24] Debt relief information can also be provided in response to a request for information at Senate Estimate committees or to support ATO funding proposals.