Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Customer Debt-Follow-up Audit

The objective of this follow-up audit was to examine Centrelink's progress in implementing the recommendations of the 2004–05 audit and the subsequent JCPAA inquiry.

Summary

Introduction

Centrelink is the Commonwealth's primary payment agency and is responsible for the distribution of social security payments to eligible customers. In 2006–07, Centrelink made payments totalling some $66.3 billion.1 The accurate and efficient distribution of these payments is dependent on Centrelink's business processes. When an incorrect payment is made by Centrelink which results in a customer receiving a greater benefit than they were entitled to receive, the customer may incur a debt to the Commonwealth. It is the responsibility of Centrelink to recover this debt in an efficient and timely manner.

Customer debt arises primarily from customers failing to notify Centrelink of changes in circumstances or providing incorrect information to Centrelink. Where debt arises solely from Centrelink administrative error, and the customer could not reasonably be expected to know they were being overpaid, the debt can be waived.2

A level of customer debt will always exist due to the nature of the social security system, which relies on customers accurately reporting changes to their details in a timely manner. The value of Centrelink's customer debt base has been steadily increasing from $967 million in 2003, to approximately $1.3 billion at 30 June 2007. The debt base consists of approximately 650 000 customers.

In August 2004, the ANAO completed a performance audit examining Centrelink's administration of its customer debt base - Audit Report No.4 2004–05 Management of Customer Debt. The audit concluded that while Centrelink had improved the effectiveness of its debt management processes and practices, the debt base continued to grow rapidly. Further, the ANAO found many inconsistencies across the debt management practices employed in the network, particularly in relation to prevention and recovery, which could be improved to produce better outcomes.

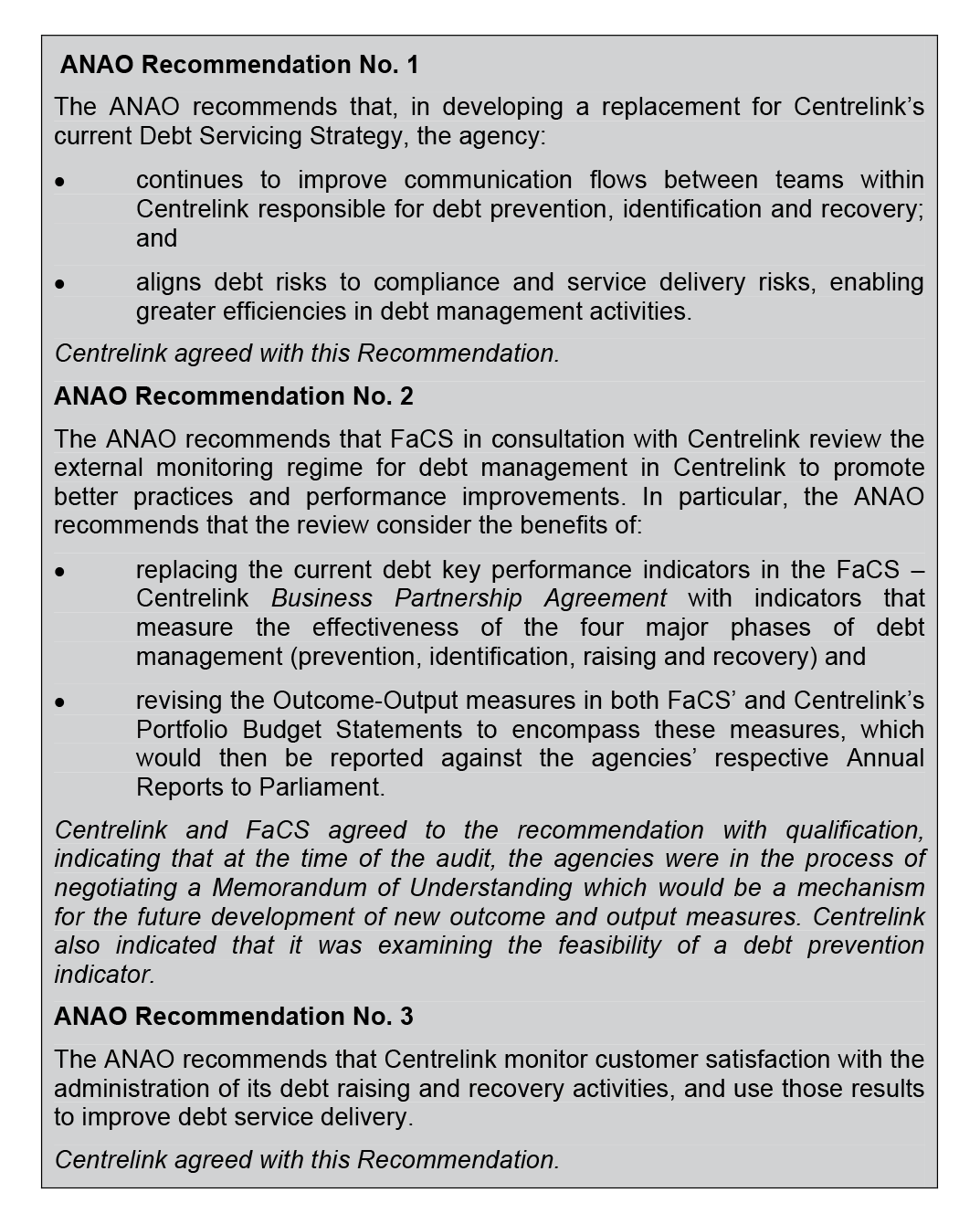

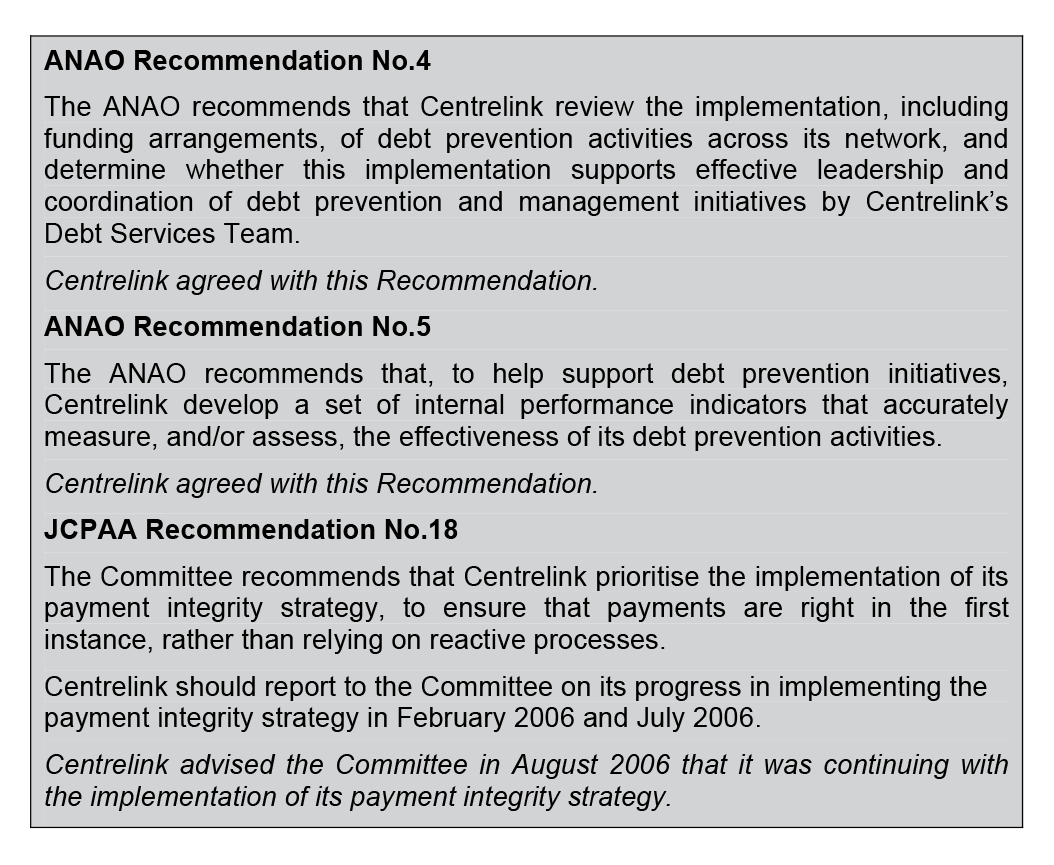

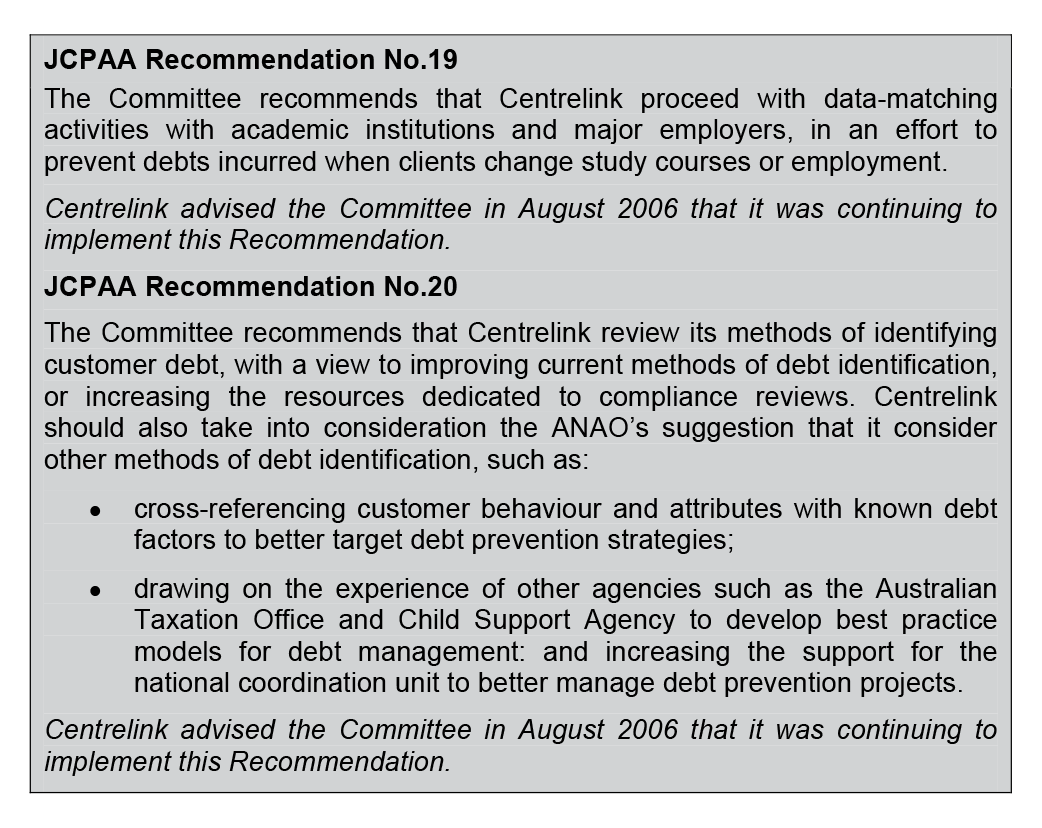

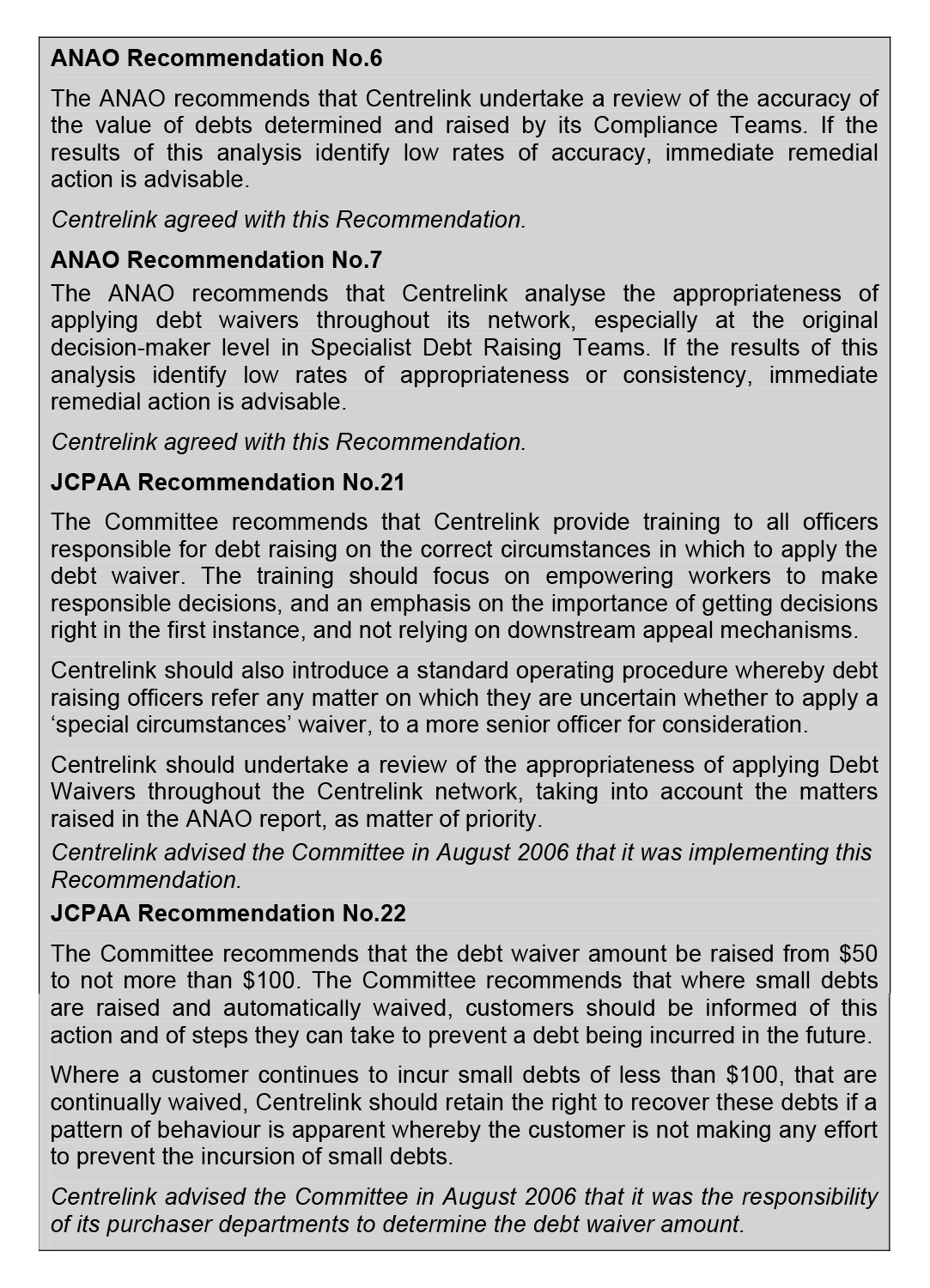

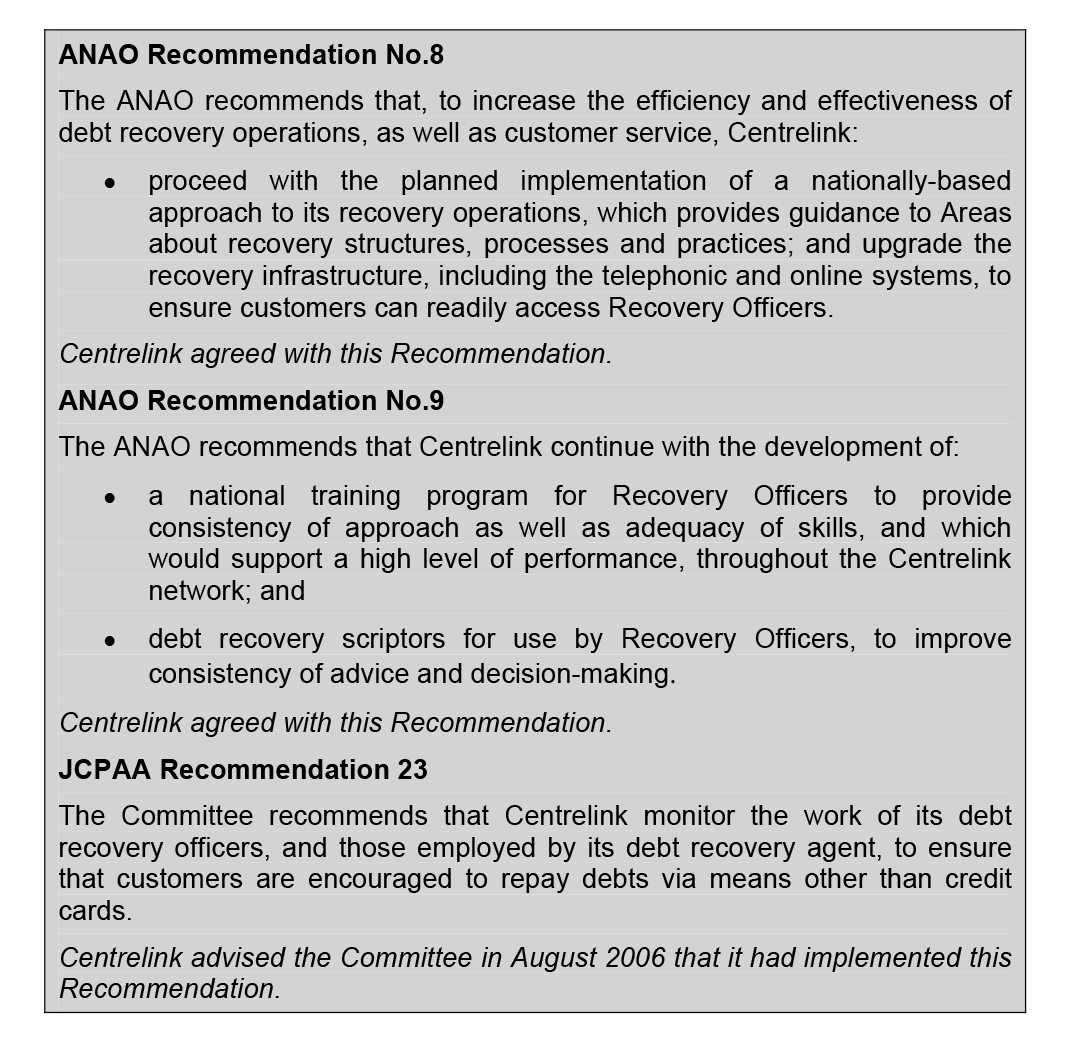

The ANAO made nine recommendations relating to Centrelink's management of its customer debt base. Centrelink and its purchaser departments agreed to all nine recommendations. Subsequent to the audit, the Joint Committee of Public Accounts and Audit (JCPAA) conducted an inquiry into Centrelink's customer debt administration and made a further six recommendations.3 Centrelink responded to the JCPAA in August 2006 indicating that they had implemented, or were in the process of implementing all of the Committee's recommendations with the exception of Recommendation No. 22, relating to the value of the automatic debt waiver. Centrelink advised the Committee, on that issue, it was the responsibility of its purchaser departments to determine the automatic waiver value.

Audit objective and scope

The objective of this follow-up audit was to examine Centrelink's progress in implementing the recommendations of the 2004–05 audit and the subsequent JCPAA inquiry.

The audit focused on Centrelink's debt management operations including prevention, identification, raising and recovery.

The audit scope took into account the changes made to the Commonwealth's welfare program structure since the previous debt audit, and examined Centrelink's debt management arrangements with, at the time of the audit fieldwork, its main purchaser departments: the Department of Families, Community Services and Indigenous Affairs (FaCSIA), the Department of Employment and Workplace Relations (DEWR), and the Department of Education, Science and Training (DEST).4

The two major criteria for this audit were:

- to establish whether Centrelink has implemented the previous audit's and JCPAA's recommendations relating to customer debt management; and

- to establish Centrelink's current performance in administering its customer debt.

Conclusion

The ANAO found that Centrelink and its purchaser departments had either fully or partially implemented all of the recommendations of the previous audit and JCPAA inquiry, with the exception of JCPAA Recommendation No. 22, which recommended that the debt waiver amount be raised from $50 to $100.

In implementing the recommendations of the previous audit and JCPAA inquiry, Centrelink had undertaken a significant ongoing restructure of its debt management operations that had improved consistency, efficiency and performance measurement. This had allowed Centrelink to meet the performance requirements of its purchaser departments. However, the ANAO still found notable inconsistencies across the Centrelink network, particularly in its allocation of resources to debt prevention; its application of debt waivers; and its approach to recovering debts.

Despite the identified improvements to debt management administration, the ANAO also found that the value of the debt base and its associated characteristics (including the number of debtors and the age profile of the debt base), had continued to increase. The ANAO notes that this is occurring at a time when the level of consumer debt in Australia is rising. Between 1 July 2003 and 31 December 2007, nominal household debt levels within Australia increased from 126.4 per cent to 160.4 per cent of disposable income.5

In these circumstances it is particularly important that Centrelink and its purchaser departments focus on gaining a better understanding of the factors driving the changes in the debt base. Undertaking an analysis of the debt base would usefully inform the framing of a nationally integrated program based approach to debt management. Such a framework would allow the implementation of more effective measures to prevent the circumstances that result in a customer incurring a debt and, in the longer term, slow the growth in the value of the debt base.

The ANAO made two recommendations based on the findings of the follow-up audit.

Key findings

Chapter 2 - Value and Profile of the Debt Base

The ANAO found a continuation of the trends in the customer debt base identified in the previous audit. These included:

- the value of the debt base had been steadily increasing from $967 million in 2003, to approximately $1.3 billion at 30 June 2007. The number of customers with debts had also increased from 548 700 in 2003 to 651 540 at 30 June 2007;

- the portion of the debt base under some form of recovery arrangement had reduced from 75 per cent to 69.9 per cent; and

- the debt base continued to age, with 45 per cent of debts in excess of two years duration at 30 June 2007, compared with 37 per cent in 2004.

In order to implement strategies which effectively contain and reduce the growing trends of the customer debt base, it is important that the underlying drivers are understood. The ANAO found that Centrelink and its purchaser departments had undertaken limited work to develop a full appreciation of the underlying drivers of the customer debt base. The ANAO considered that this prevented Centrelink from being able to efficiently and effectively target its debt management resources, particularly debt prevention, to address the root cause(s) of the growth in the debt base. The ANAO made one recommendation to address this issue.

Chapter 3 - Business Management Processes for Administering Customer Debt

Recommendations made in the 2004–05 audit and agency responses

Finding

Centrelink had implemented Recommendations No. 1 and No. 3. FaCSIA had implemented Recommendation No. 2 and DEWR and DEST had partially implemented Recommendation No. 2.

The ANAO found that Centrelink implemented a new Debt Servicing Strategy in May 2007. The 2007–10 Debt Servicing Strategy, combined with the major restructure of internal operations, better allowed Centrelink to integrate all facets of debt management into the one operational stream.

A new suite of performance indicators that were, or will be, publicly reported on, had been developed for all components of the administration of customer debt except for debt prevention. The ANAO found that FaCSIA (now FaHCSIA) had developed a debt prevention indicator that was still in the early stages of implementation and, accordingly, was not tested. DEWR and DEST (now DEEWR) had not implemented a debt prevention indicator as they considered the inherent difficulty in measuring debt prevention meant that their resources were more effectively focused on developing practical debt prevention projects.

The ANAO recognises the difficulty in developing an overall debt prevention indicator(s). However, in pursuing its practical debt prevention activities, there would be benefit in DEEWR measuring the effectiveness of the activities against their objectives in order to provide an assurance on DEEWR's ability to prevent debt within its payment programs. Given DEEWR and FaHCSIA are adopting different approaches to measuring the impact of debt prevention activities, the ANAO considers that there would also be benefit in the departments sharing their experiences with a view to understanding and learning from the risks and benefits of each approach.

Centrelink had undertaken three customer service surveys during 2004–05. However, the ANAO notes the last survey was undertaken in 2005. The ANAO considers that there would be benefit in Centrelink periodically undertaking further monitoring, whether through similar surveys or other available means, to update its knowledge about customer views on debt management customer service and to identify further opportunities to improve its service delivery.

Chapter 4 - Debt Prevention

Recommendations made in the 2004–05 audit and JCPAA inquiry, and agency responses

Finding

Centrelink had implemented these Recommendations. However, the ANAO noted that further improvements were required by Centrelink to allow the full impact of the Recommendations to be realised.

Operational debt prevention activities

Centrelink's main causes of customer debt continued to be under-declared or undeclared income, which accounted for 56 per cent of the number of debts raised, and 48 per cent of the value of debts raised during 2006–07. Qualification7 (eligibility to receive the entitlement) is the second major cause of debt in terms of value accounting for 14 per cent of the value of debts raised during 2006–07.

A key component of Centrelink's Debt Servicing Strategy 2007–2010 is to ‘minimise customer debt by building it [debt prevention] into standard customer service delivery so that debt prevention operates as part of mainstream customer service.'8 Centrelink reviewed its debt prevention activities in 2005 and, as a result, restructured its internal operations to allow the integration of debt prevention into the Business Integrity business line.

However, under the new structure, the ANAO found little evidence of a nationally integrated approach to debt prevention with the fragmentation particularly evident in the areas of resourcing and coordination of debt prevention activities.

Resourcing levels at both a staff and budget level varied across the network. This was found to be largely due to an approach that allowed each Area Business Integrity unit to determine its debt prevention budget from the overall Area budget without the benefit of an over-arching network strategy. This was also supported by some Areas using resources to target internal debt prevention operations, for example reducing administrative error, while other Areas focused their resources on ‘out-reach' projects such as engaging specific industries or employers.

Consistent with the absence of an integrated national approach, the ANAO found that the problems identified in the previous audit relating to the coordination of debt prevention activities still existed. Despite implementing a national online project management system for debt prevention activities, the Early Intervention Activity Database, the ANAO found a lack of a quality control processes for the system and little evidence that the information reported by the system was robust and could be usefully relied upon.

Accordingly, the ANAO made one recommendation aimed at improving the national framework for debt prevention activities.

The ANAO notes that in December 2007, Centrelink undertook a further restructure of its debt prevention activities, which consolidated debt prevention operations into its National Support Office (NSO). The ANAO regards this restructure as having the potential to address the coordination and resourcing issues identified in the current and previous audit. However, as the restructure was undertaken after the completion of the audit fieldwork, the ANAO did not assess its effectiveness.

Preventing debts caused by administrative error

The ANAO found that the restructure of Centrelink's internal business operations and the formation of the Business Integrity business line had allowed the NSO to better communicate to the network the importance of payment integrity and minimising administrative error. This was complemented by the, continuing operation of the payment integrity strategy – ‘Getting it Right'9, aimed at ensuring that customers are paid the right entitlement from the first contact with Centrelink. However, the ANAO found no evidence that Centrelink measured the impact of these initiatives in preventing administrative error.

Measuring the effectiveness of debt prevention

The ANAO found that Centrelink had developed an internal set of performance indicators in 2007 which were reported against on a quarterly basis. These indicators included:

- 95 per cent of reviews undertaken by Centrelink do not contain administrative error with a dollar impact;

- for each of payment reported in the Random Sample Survey (RSS)10, the percentage of customer driven errors will be maintained or improved based on the same trimester of the previous year; and

- a reduction in the rolling twelve month average percentage of the number of debts in the RSS from the corresponding period in the previous year.

Chapter 5 - Administering the Debt Base

Debt Identification

Recommendations made in the JCPAA inquiry and agency responses

Finding

Centrelink had implemented these Recommendations.

Centrelink continued to review its debt identification activities. In this context, the ANAO found that Centrelink had utilised and built on data matching activities with academic institutions (through the Centrelink Academic Reassessment Transformation (CART) project) and major employers.

Centrelink and its then purchaser department DEST, had also conducted a successful program of increased Service Profile Review activity for student payments. This increased activity allowed Centrelink to triple the amount of fortnightly savings. At the same time, the amount of customer debt identified as a result of Service Profile Reviews only increased by approximately 50 per cent, indicating that the Service Profiling Reviews were identifying customers with incorrect details before they could accumulate large amounts of debt. In this circumstance, the ANAO considered that DEEWR, the agency now responsible for the administration of student payments, and Centrelink should maintain the use of Service Profile Reviews amongst the suite of debt identification and prevention measures.

Debt Raising

Recommendations made in the 2004–05 audit and JCPAA inquiry, and agency responses

Finding

Centrelink had implemented ANAO Recommendations No. 6 and No. 7 and partially implemented JCPAA Recommendation No. 21. Centrelink and its purchaser departments had not implemented JCPAA Recommendation No. 22.

Accuracy of debt raising by Compliance Teams

Centrelink undertook an internal audit of compliance debt raising during 2005, which included the accuracy of debts raised by Compliance Teams. The audit found a significant error rate across the debts raised by Compliance Teams (more than 40 per cent of debts sampled contained at least one error).

The primary action taken in response to the internal audit was the development of a pilot project to trial four different debt raising procedures within Compliance Teams. The project identified a best practice model for Compliance Teams to investigate and raise debts.11

The ANAO found no evidence of a post project review to assess the effectiveness of the trials undertaken. Accordingly, the ANAO considered that due to the magnitude of the findings of the internal audit, Centrelink should re-assess the accuracy of debts raised by Compliance Teams to assess the effectiveness of the measures implemented.

Debt waivers

Centrelink undertook an internal audit of debt waivers in 2006 and found no breaches of legislation or significant breakdowns in the internal controls12. However, the internal audit identified considerable variances in the training provided to Debt Raising Officers across Areas, and a reliance on on-the-job supervision to ensure Debt Raising Officers were applying correct procedures. The internal audit made several recommendations concerning training and guidance.

In order to promote a more consistent national approach Centrelink had taken action to address these recommendations which included: providing extensive training to delegated Officers; ensuring that debt waivers were considered as part of the debt raising process by updating the debt raising Scriptor13; and undertaking an extensive revision of E-reference materials relating to debt waivers. However, the ANAO found that not all Officers had been provided with the necessary training to effectively process debt waivers.

During this audit, the ANAO found improved processes for applying a debt waiver. However, the ANAO still identified notable inconsistencies between Centrelink's Areas in applying the provisions of Social Security Law relating to debt waivers, particularly in the areas of customers in receipt of multiple payments and customers experiencing special circumstances. These inconsistencies have the potential to influence customer outcomes between debt raising sites.

The JCPAA recommended that the debt waiver amount be increased from $50 to not more than $100 (JCPAA Recommendation No. 22). DEEWR advised it had undertaken some analysis on the debt waiver amount in 2006 and did not support an increase to the amount on the basis that it could be regarded as cost effective, in many cases, to recover debts less than $50 in value. The ANAO found that Centrelink did not measure the costs of debt administration to the extent that a comprehensive analysis could be undertaken to determine the cost effectiveness of debt recovery. Accordingly, the ANAO suggests that Centrelink and its purchaser departments undertake an analysis to determine the amount(s) where it is no longer cost effective to pursue a debt and, therefore, it should be automatically waived.

Debt Recovery

Recommendations made in the 2004–05 audit and JCPAA inquiry, and agency responses

Finding

Centrelink had implemented these Recommendations.

Debt recovery business structures

The ANAO found that Centrelink had consolidated its debt recovery operations into six sites. Centrelink had also undertaken a significant investment in infrastructure within these sites, which included installing enhanced computer systems with programs used by mercantile agents such as Pulse and SoftFone.14

However, the ANAO found continuing inconsistencies in the level of customer service between recovery sites which could lead to different outcomes for customers. The ANAO concluded that these inconsistencies were mainly due to the lack of a central document for Debt Recovery Officers that clearly detailed the intent of the recovery process and the expected outcomes. Accordingly, the ANAO considered there would be merit in Centrelink developing an outcome statement for its recovery processes to improve the consistency in service delivery.

Skills and training provided to debt recovery staff

Centrelink now has in place a national training package for Recovery Officers. This package includes both theoretical and practical exercises such as: listening to calls taken by more experienced officers; taking calls with a more experienced officer listening for quality control; and regular training updates as legislation and guidelines change.

While training material has been revised and updated, the ANAO found that the delivery of the training to recovery staff was inconsistent across the network. In particular, a number of Recovery Officers had received the initial induction training, however, due to resource constraints, subsequent modules within the training package were not being delivered to those Recovery Officers as they were needed.

Customers' use of credit cards to repay debts

The ANAO found that Centrelink Debt Recovery Officers and the Mercantile Agents were not offering the credit card option as the primary method of payment.

Consistency of service delivery

While Centrelink had implemented a framework to achieve greater efficiency and consistency in its debt administration, the ANAO continued to identify inconsistencies in its operations between debt raising and recovery sites of a magnitude that could result in a significant variance in customer outcomes. This was mainly due to each site developing its own interpretation of the national guidelines and procedures in place.

As Centrelink is a national service provider, customers would reasonably expect that the outcome of the administration of their debt would not be dependent on their geographical location. The ANAO suggests that Centrelink develop procedures for delivering more consistent levels of customer outcomes across its debt management sites

Recommendations

The ANAO made two recommendations. The first recommendation emphasised the need for Centrelink and its purchaser departments to undertake an analysis of the drivers of its increasing debt base. The second recommendation related to the governance arrangements in place for Centrelink's debt prevention database.

Summary of agencies' responses

The Chief Executive Officer of Centrelink provided the following response to the proposed audit report:

Centrelink welcomes the overall conclusions of the audit and acknowledges the effort made by the ANAO to understand the challenges facing our organisation and the work already undertaken since the 2004 ANAO audit of Debt Management to improve debt management processes and practices.

These initiatives have included development of a Debt Management Strategy, continuing regular consultation with Policy Departments to improved shared outcomes, refined Key Performance Indicators and an intense review of internal work practices leading to a centralised debt management structure. These initiatives have improved the profile and importance of debt management within Centrelink. Other initiatives include enhanced debt identification techniques, improved technical support tools and restructuring of service delivery that have improved timeliness and accuracy of debt processing.

Centrelink is continuing to look for areas for improvement in debt management and will be implementing further initiatives in the near future with particular reference to the ANAO's recommendation of cross agency analysis of both new and existing debts.

The Secretary of the Department of Families, Housing, Community Services and Indigenous Affairs provided the following response to the proposed audit report:

In respect of Recommendation No. 1 to better understand the underlying drivers of the customer debt base profile, FaHCSIA has commissioned an actuarial study with a view to inform on an overarching debt strategy. This will investigate the reasons for the increase in the debt base with a corresponding increase in the numbers of customers experiencing debt and the ageing of the debt base.

In relation to the JCPAA recommendation that the debt waiver limit be raised from $50 to less than $100, FaHCSIA in consultation with the Department of Education, Employment and Workplace Relations and Centrelink, will also consider this matter in light of the actuarial research mentioned above.

The Secretary of the Department of Human Services provided the following response to the proposed audit report:

The Department of Human Services (DHS) welcomes the follow-up report by the ANAO noting that Centrelink is the primary payment agency responsible for the distribution of social security payments to eligible customers, and that effective administration and management of the customer debt base is consequently an important issue.

The previous ANAO audit of Centrelink's administration of Customer Debt in August 2004 made nine recommendations. The follow-up audit criteria were to establish whether Centrelink has implemented the previous audit's along with the JCPAA's recommendations and to establish the current performance.

Centrelink has restructured its operations to improve consistency, efficiency and performance measurement. The reduction of recommendations from nine to two in the follow-up audit demonstrates Centrelink's ability to evolve through business process improvement and the implementation of ANAO recommendations.

Centrelink debts primarily arise from customers failing to notify Centrelink of changes in circumstances or providing incorrect information. Debts can also result from administrative error.

DHS notes that there will always be a level of customer debt due to the nature of the social security system and that Centrelink is continuously striving to provide effective and efficient processes for managing the debt base. The follow-up audit enables Centrelink to incorporate relevant learnings in the development of further improvements, especially in debt preventions and debt recovery.

The Secretary of the Department of Education, Employment and Workplace Relations provided the following response to the proposed report:

The Department of Education, Employment and Workplace Relations (DEEWR) agrees with the general content of this report, which is a very useful adjunct to the ongoing work between DEEWR and Centrelink in the area of debt management. DEEWR particularly welcomes the report's emphasis on debt prevention as well as proactive management of outstanding debt. DEEWR's fundamental expectation is that Centrelink's front-line customer service reflects this emphasis, through processes that support payment accuracy and prevent overpayment.

Footnotes

1 Centrelink, 2007, Annual Report 2006-07, p. 11.

2 The application of a waiver is dependent on the debt meeting the requirements of the Social Security Act 1991 (Cth) (ss1237A(1); 1237A(2); 1237AAA(1); 1237AAC; or 1237AAD).

3 Joint Committee of Public Accounts and Audit, Report 404, Review of Auditor General's Reports, Parliamentary Paper 394/2005.

4 Note: due to the Administrative Arrangements Order changes of December 2007 FacCSIA/FaHCSIA and DEWR/DEST/DEEWR are used interchangeably throughout this report depending on the time period referred to.

5 Reserve Bank of Australia, <http://www.rba.gov.au/statistics/bulletin/B21HIST.XLS> [accessed 14 April 2008].

6 ANAO Audit Report No.4 2004–05, Management of Customer Debt, Centrelink, p. 41.

7 An example of a customer incurring a debt due to qualification is a student reducing their study load to part-time or ceasing to study altogether and failing to inform Centrelink.

8 Centrelink, Centrelink Debt Servicing Strategy 2007–2010, p. 7.

9 The Getting it Right strategy is Centrelink's main strategy aimed at ensuring payment correctness and was implemented in November 2000. The purpose of the strategy is to establish a framework for improving accuracy and accountability within the Centrelink network.

10 The Random Sample Survey (RSS) is the primary mechanism used by Centrelink's key purchaser departments (FaHCSIA and DEEWR) to measure the accuracy of outlays across programs delivered by Centrelink. The RSS provides a point in time analysis of a sample of customers' circumstances designed to establish whether customers are being correctly paid.

11 Centrelink also recently initiated the National Workflow Management Pilot. Through this project, all Business Integrity Area Teams, including Compliance Teams, will develop a common business approach to issues such as debt management.

12 Centrelink Internal Audit, Debt Waivers, October 2006, p. 8.

13 A scriptor is a work-flow tool developed by Centrelink which aims to standardise and automate processes used by CSAs to enter data into payment systems and create consistent customer records.

14 SoftFone is the trading name of a specialised telephony software that allows the user to dial numbers and carry out other phone functions such as call queuing using a computer screen, mouse and keyboard. Pulse is another form of telephony software that allows phone calls to be made via a broadband connection.