Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Commonwealth Leased Office Property

Please direct enquiries through our contact page.

The objective of the audit was to assess whether effective arrangements have been established by Finance to achieve value for money outcomes for Commonwealth leased office property.

Summary and recommendations

Background

1. Australian Government entities use real estate such as offices, shopfronts and special purpose facilities to assist in delivering outcomes.

2. Within the non-Defence domestic property portfolio, 94 per cent of office accommodation is leased rather than owned. In 2016–17, expenditure on leased office property (excluding capital costs) was around $2 billion.

3. Under the Public Governance, Performance and Accountability Act 2013, accountable authorities are responsible for the proper management and use of resources under their control. At the same time, the Department of Finance (Finance) has a broader role to administer the Commonwealth Property Management Framework. This Framework provides guidance and requirements on various aspects of leased or owned Commonwealth property in Australia.

4. Since 2014, Finance has pursued a ‘program of work’ on leased office property that has included three main activities:

- an initiative to reduce surplus or vacant office space, focussing initially on the Australian Capital Territory (ACT) — known as Operation Tetris;

- establishing coordinated procurement1 arrangements for property services, which are mandatory for non-corporate Commonwealth entities (NCEs); and

- improving the collection and use of property data to support decision-making and reporting.

5. The Minister for Finance has announced savings of $300 million for Operation Tetris, and a further $100 million in savings from the coordinated procurement arrangements.

Rationale for undertaking the audit

6. This topic was selected for audit because leased office property represents a significant recurrent expense to the Australian Government and due to the significance of Finance’s program of work. Key initiatives being pursued in this area of public administration are part of a broader government agenda to create a smaller, smarter and more productive and sustainable public sector. The audit was intended to provide assurance on whether significant funding on leased office property is being managed effectively at a whole-of-government level.

Audit objective and criteria

7. The objective of the audit was to assess whether effective arrangements have been established by Finance to achieve value for money outcomes for Commonwealth leased office property.

8. To form a conclusion against the audit objective, the ANAO adopted three high-level criteria:

- Was Operation Tetris executed effectively?

- Were good processes followed and sound advice provided to government to inform the establishment of the coordinated procurement of property services?

- Are whole-of-government arrangements supported by relevant property data and a suitable performance framework?

Conclusion

9. Finance’s program of work on leased office property has reduced surplus office space, established coordinated procurement arrangements for property services and improved the collection of property data. It is evident that efficiencies and savings have been realised from this work, but Finance’s approach to estimating and tracking savings was not robust.

10. Operation Tetris has been effective in delivering better utilisation of existing Commonwealth office space, mainly in the Australian Capital Territory. The reported $300 million in savings to entities was not supported by a sound methodology.

11. For the establishment of coordinated procurement arrangements for property services, Finance’s approach of informing decisions by conducting a contestability review followed by a market testing review was sound. Cost savings were a key benefit envisaged from the arrangements. Finance’s advice was not supported by a sufficiently robust savings methodology during the main decision-making stages. While a more structured approach was used to allocate the $105.3 million in identified savings after the new arrangements had been implemented, much of the savings estimated by the allocation analysis relate to changes in market conditions rather than from the aggregation of government purchasing power.

12. Finance has improved its processes for collecting property data from entities. Its analysis of data and reporting has focussed on a narrow set of performance measures and does not include cost indicators.

Supporting findings

Operation Tetris: Reducing surplus office space

13. Prior to 2015, Finance had not used property data collected from entities (since 2009) to systematically identify surplus office space and inform appropriate responses. Following the initiation of Operation Tetris in April 2015, Finance identified various proposed moves that were expected to reduce the Commonwealth’s property footprint in the ACT by about 50,000 square metres by 2018.

14. In important respects, frameworks have been strengthened. In particular, changes made to the Commonwealth Property Management Framework provided greater central visibility and authority over certain lease proposals. Finance did not follow through on establishing appropriate funding arrangements to promote and support involvement by entities.

15. The methodology used to estimate and track relevant costs and benefits was not sufficiently robust or transparent. Important aspects of the methodology were not clearly documented, and the approach followed did not include all relevant costs (including fit-out and relocation costs). Moves were tracked but the estimates were not verified or adjusted to reflect actual outcomes.

Establishing a coordinated procurement for property services

16. Options were identified and compared. The consideration of options drew on the results of a market testing review that was informed by engagement with the property services industry (including industry advice on potential savings from a changed approach).

17. Finance’s advice to government was not supported by robust analysis and evidence during the main decision-making process to establish a coordinated procurement for property services. In particular, Finance did not test the savings claims made by industry against entities’ property arrangements. A more structured approach for allocating the specified total quantum of savings was developed after the new arrangements were implemented, although the estimated savings used for allocative purposes relate largely to changes in market rents and reflecting the occupational density target rather than from the aggregation of government purchasing power.

Property data and reporting

18. Finance has recently improved its processes for collecting property data from entities, establishing an online system in 2017 to replace previous manual processes. This online system allows entities and selected external providers to update and analyse data in real time. While Finance did not undertake a comprehensive review of the data before the online system was developed, it has since initiated an external review to assess the usefulness of the data.

19. Finance has not yet established all the elements of a fit-for-purpose performance framework to assess and report on its program of work on property efficiency matters. Broad objectives have been set but are not well-defined, and current performance metrics are incomplete and not properly integrated — addressing occupational density but not cost or other relevant indicators.

Recommendations

Recommendation no.1

Paragraph 3.80

The Department of Finance ensure that its ongoing program of work to deliver savings and efficiencies on Commonwealth leased office property is supported by a robust and transparent savings methodology, including by:

- identifying all relevant costs and benefits that apply;

- providing a clear rationale for any assumptions used;

- testing principles against entities’ particular property arrangements; and

- verifying estimates when actual data is available.

Finance’s response: Agreed.

Recommendation no.2

Paragraph 4.22

The Department of Finance improve its framework for assessing and reporting on its program of work on Commonwealth leased office property and related activities by: setting clearly defined objectives; and better integrating performance measures, including cost indicators.

Finance’s response: Agreed.

Summary of Finance’s response

20. Finance’s formal response is provided at Appendix 1.

Key learnings for all Australian Government entities

21. Below is a summary of key learnings, including instances of good practice, which have been identified in this audit that may be relevant for the operations of other Commonwealth entities.

Policy design

1. Background

Overview of Commonwealth leased office property

1.1 Australian Government entities use real estate such as offices, shopfronts and special purpose facilities such as quarantine stations to assist in delivering outcomes. The Commonwealth estate is large and diverse, and can be grouped into three portfolios:

- the Defence property portfolio — held and managed by the Department of Defence;

- the non-Defence overseas property portfolio — held and managed by the Department of Foreign Affairs and Trade; and

- the non-Defence domestic property portfolio — held and managed by individual entities, with the Department of Finance (Finance) principally responsible for managing Commonwealth-owned properties.2

1.2 Within the non-Defence domestic property portfolio, 94 per cent of office accommodation is leased rather than owned. Ten entities hold 68 per cent of the leased space. In 2016–17, expenditure on leased office property (excluding capital costs) was around $2 billion.

1.3 Over recent decades, there have been a number of changes in the Commonwealth’s approach to the acquisition and management of office accommodation. In the past the Commonwealth owned a much larger number of properties than it presently does. There have also been periods characterised by greater devolved or centralised control of property. Factors that influence the Commonwealth’s leased office accommodation footprint include:

- government decisions on the functions and activities of entities, including ‘machinery-of-government’ changes;

- changes in the size of the Australian Public Service; and

- developments and trends in office-based work and technology.

Accountability framework and management arrangements

1.4 The resource management and accountability framework established by the Public Governance, Performance and Accountability Act 2013 (PGPA Act) applies to Commonwealth property, including leased office space. In particular:

- the PGPA Act places obligations on accountable authorities to promote the proper use and management of public resources for which they are responsible;

- entities must comply with the Commonwealth Procurement Rules, including in relation to leased office property; and

- there are further rules and guidance set out in the Commonwealth Property Management Framework, issued by Finance, and in Accountable Authority Instructions issued at the entity level.

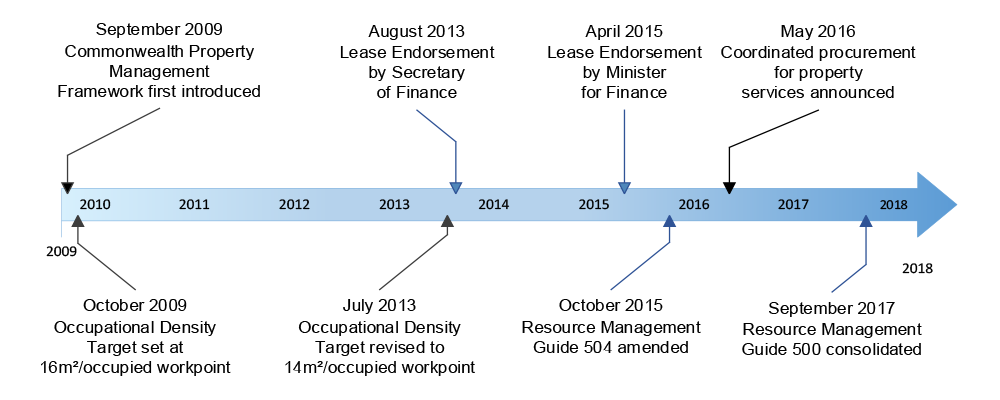

1.5 The Commonwealth Property Management Framework was introduced in 2009 and is currently presented in a single Resource Management Guide. The Guide sets out requirements and provides guidance on various matters including: planning; budgeting and funding; leasing; capital works; ownership and disposal; and reporting. As illustrated in Figure 1.1, the Commonwealth Property Management Framework has evolved over time.

Figure 1.1: Major changes to the Commonwealth Property Management Framework, 2009–18

Source: ANAO based on analysis of documents provided by Finance.

The Department of Finance’s role

1.6 Finance has a role in various aspects of Commonwealth property, including leased office space, reflecting its responsibilities under successive Administrative Arrangements Orders. Under the current Administrative Arrangements Order, Finance’s responsibilities include:

Commonwealth property policy framework, legislation and policy for the management of property leased or owned by the Commonwealth, including acquisition, disposal and management of property interests.

1.7 Finance’s organisational structure includes business areas with responsibility for different property functions, including Commonwealth property efficiency. Since 2014, Finance has undertaken a ‘program of work’ aimed at driving improved whole-of-government outcomes for leased office property and related services. The key initiatives are:

- targeted efforts to better utilise existing vacant or surplus office accommodation, known as ‘Operation Tetris’;

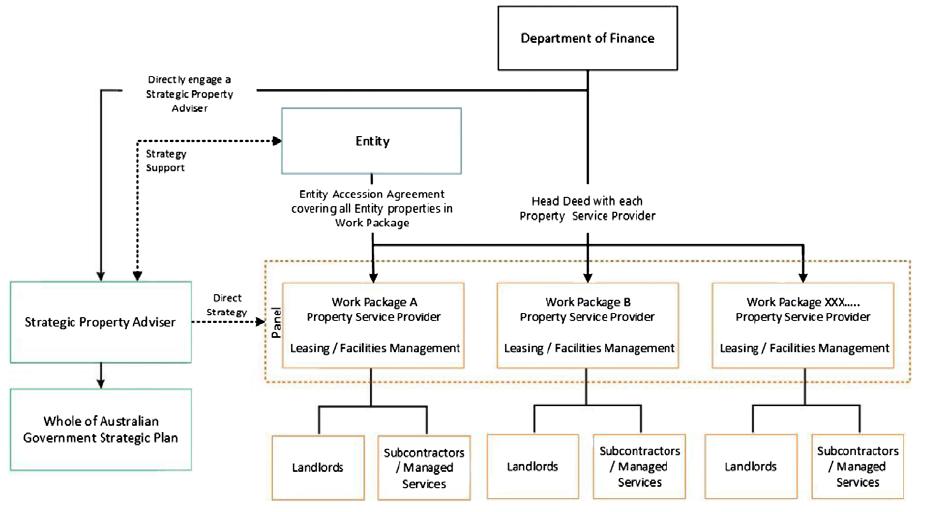

- establishing a coordinated procurement of property services in 2017, supported by the appointment of a Strategic Property Adviser and three Property Services Providers; and

- improving the collection and use of property data to support decision-making and reporting on the Commonwealth’s use of leased office property.

The initiatives described under this program of work have also been listed under the National Property Efficiency Program.

1.8 The Minister for Finance has announced savings of $300 million for Operation Tetris, with a further $100 million in savings expected from the coordinated procurement arrangements.

Audit rationale and approach

1.9 This topic was selected for audit because leased office property represents a significant recurrent expense to the Australian Government and due to the significance of Finance’s program of work. Key initiatives being pursued in this area of public administration are part of a broader government agenda to create a smaller, smarter and more productive and sustainable public sector. The audit was intended to provide assurance on whether significant funding on leased office property is being managed effectively at a whole-of-government level.

Audit objective, criteria and scope

1.10 The objective of the audit was to assess whether effective arrangements have been established by Finance to achieve value for money outcomes for Commonwealth leased office property.

1.11 To form a conclusion against the audit objective, the ANAO adopted three high-level criteria:

- Was Operation Tetris executed effectively?

- Were good processes followed and sound advice provided to government to inform the establishment of the coordinated procurement of property services?

- Are whole-of-government arrangements supported by relevant property data and a suitable performance framework?

1.12 The scope of the audit focussed on the three main activities covered by Finance’s program of work: Operation Tetris; the establishment of the coordinated procurement of property services; and efforts to improve the collection and use of property data to support decision-making and reporting.

Methodology

1.13 The audit method mainly involved an examination and analysis of documentation and property data held by Finance. This work was supported by interviews with departmental staff. Entities’ views were reflected in documentation held by Finance, particularly in relation to the establishment of the coordinated procurement of property services and related savings.

1.14 Audit procedures included:

- reviewing advice and briefing material provided to government and the Parliament;

- assessing whether requirements, including under the Commonwealth Property Management Framework, were met;

- analysing the basis of costs and benefits identified by Finance; and

- identifying and analysing property data used in decision-making processes.

1.15 The audit was conducted in accordance with relevant ANAO auditing standards at a cost to the ANAO of $333,517.

1.16 The team members for this audit were Emily Drown, Erica Sekendy, Stephen Cull and Brian Boyd.

2. Operation Tetris: Reducing surplus office space

Areas examined

The ANAO examined whether Operation Tetris was executed effectively by the Department of Finance (Finance), particularly with respect to identifying surplus office space in a systematic manner and establishing arrangements to deliver whole-of-government savings and efficiencies.

Conclusion

Operation Tetris has been effective in delivering better utilisation of existing Commonwealth office space, mainly in the Australian Capital Territory. The reported $300 million in savings to entities was not supported by a sound methodology.

Areas for improvement

Finance’s efforts to reduce vacant or surplus office space are now being managed through the coordinated procurement of property services (examined in Chapter 3).

Was surplus office space identified in a systematic manner?

Prior to 2015, Finance had not used property data collected from entities (since 2009) to systematically identify surplus office space and inform appropriate responses. Following the initiation of Operation Tetris in April 2015, Finance identified various proposed moves that were expected to reduce the Commonwealth’s property footprint in the ACT by about 50,000 square metres by 2018.

2.1 The signing of a property lease typically represents a significant financial commitment for entities and requires consideration of relevant costs, benefits and risks. Such decisions necessarily involve a degree of judgement, including in relation to market conditions and the broader policy environment.

2.2 In 2015, Finance initiated a project to make better use of vacant or surplus space owned or leased by the Commonwealth. This was to be achieved by absorbing entities’ lease requirements, where feasible, into existing vacant office accommodation.

Origin of Operation Tetris

2.3 The project that became known as ‘Operation Tetris’ was initiated by Finance in April 2015. At that time, Finance provided advice to the Minister for Finance (Minister) outlining a strategy to reduce the extent of Commonwealth leased office accommodation in the Australian Capital Territory (ACT). Finance noted that several large leases would expire between 2015 and 2018 and that long-term tenants were required for Commonwealth-owned buildings, subject to the Parliamentary Standing Committee on Public Works agreeing to Finance’s proposal to move out of its then Commonwealth-owned building into a new privately-owned premises in the ACT.

2.4 Finance identified the potential to reduce lease costs in the ACT in the order of $200 million over 10 years by directing entities with expiring leases into surplus leased or Commonwealth owned space.3 A list of proposed moves was identified to the Minister, which were expected to reduce the Commonwealth’s property footprint in the ACT by about 50,000 square metres by 2018 (Table 2.1). Opportunities for improving whole-of-government outcomes in other locations, including Adelaide and Brisbane, were also noted.

Table 2.1: Proposed moves in the Australian Capital Territory as at 14 April 2015

|

Entity |

Current location |

Current Net Lettable Area (m2) |

Surplus area filled |

New Net Lettable Area (m2) |

|

Department of the Environment and Energy |

33 Allara Street, Canberra |

9,123 |

John Gorton building, Canberra |

9,753 |

|

Shared Services Centre |

10-14 Mort Street, Canberra |

10,218 |

Garema Court building, Canberra |

10,873 |

|

17 Moore Street, Canberra |

||||

|

50 Marcus Clarke Street, Canberra |

||||

|

60 Marcus Clarke Street, Canberra |

||||

|

Department of Communications and the Arts |

38 Sydney Ave, Canberra |

9,464 |

Nishi building Levels 3-7, Canberra |

9,055 |

|

Digital Transformation Agency |

New Requirement |

3,195 |

Nishi building Levels 0-2, Canberra |

3,195 |

|

Australian Electoral Commission |

West Block Offices, Canberra |

4,800 |

50 Marcus Clarke Street, Canberra |

4,800 |

|

Murray Darling Basin Authority |

Allara Street, Canberra |

5,040 |

50 Marcus Clarke Street, Canberra |

5,040 |

|

Safe Work Australia |

220 Northbourne Avenue, Canberra |

1,760 |

50 Marcus Clarke Street, Canberra |

1,760 |

|

Office of the Fair Work Ombudsman |

SAP House, Canberra |

1,200 |

50 Marcus Clarke Street, Canberra |

1,200 |

|

Australian National Audit Office |

19 National Circuit, Canberra |

7,073 |

Treasury building, Canberra |

6,396 |

|

|

Total Demand |

51,963 |

Total Supply |

52,072 |

Source: ANAO based on Finance’s advice to the Minister for Finance (14 April 2015).

2.5 Finance identified that a strategy of absorbing surplus leased space provides a whole-of-government outcome that is consistent with the Commonwealth Property Management Framework — to facilitate informed decision-making and the efficient, effective, economical and ethical use of Australian Government property resources.

2.6 The advice followed on from a Strategic Leasing Review undertaken by Finance in late 2014. The scope of the Review covered all entities within the General Government Sector (except Defence) and aimed to assist government to more fully understand the nature and extent of the Commonwealth’s property commitment. The Review identified three areas where further analysis was warranted, to find efficiencies and savings measures:

- focusing on leases due to expire in the next two years (about 1000), identifying opportunities to consolidate the number of leases and use existing space more efficiently;

- review existing governance processes, including the Resource Management Guides on property, and the occupational density target; and

- review the supporting contracts, including to assess the suitability of coordinated procurements or shared services arrangements.

2.7 The Review also observed the difficulty of collating the necessary property data, and pointed to the need for further investment in this area.

2.8 Finance’s advice in April 2015 did not identify any particular reasons why surplus space was available in the identified entities — for example, as a result of machinery-of-government changes or other government decisions; market conditions making it difficult to secure sub-tenants; or the appropriateness of the original leasing decisions.4 The advice noted that the Commonwealth has not historically leveraged its portfolio buying power, with lease decisions being based on individual entity needs consistent with the accountability regime.

2.9 In May 2015, the Minister announced that Commonwealth leases for office space would be considered at a whole-of-government level to maximise the efficient use of leases across government. Potential savings were estimated to be $200 million over ten years with the Minister advised that this estimate was ‘conservative’ as it ‘relates only to rent’, although this was not accurate as the estimate also included relocation and fit-out costs.

Initial savings analysis

2.10 Early in the audit, the ANAO identified that Finance had commissioned analysis from an external firm, Synergy Group. In January 2018, Finance advised the ANAO that: ‘The product from Synergy Group was the power point presentation titled ACT Property Assessment. Synergy did not provide further supporting analysis.’

2.11 In July 2018, Finance provided the ANAO with a copy of a cost model developed by Synergy Group in February 2015. The cost model was not part of Finance’s records and was not provided in response to a number of specific requests made by the ANAO to Finance starting in December 2017. There is also no evidence that Finance had possession of, and considered, the cost model when it provided advice to the Minister in April 2015 or subsequently.

2.12 The cost model provides indicative savings for five proposed moves, which are estimated to produce savings of some $200 million (including fit-out costs and relocation costs).5 The assumptions underpinning the savings are outlined in the cost model.

2.13 The cost model provides the basis for a more robust methodology to estimate savings than that later employed by Finance to estimate the $300 million in claimed savings from Operation Tetris (see paragraphs 2.33 to 2.36).

National roll-out proposed

2.14 On 8 February 2016, the Minister announced that on the basis of successful implementation in the ACT, Operation Tetris (as it was now called) would be rolled-out nationally. In early May 2016, Finance advised the Minister that it would initially focus on the business districts in Adelaide and Brisbane, with other major capital cities to follow. The advice noted that nationally 59 per cent of leases were due to expire over the next three years, representing 42 per cent of the total leased area.

2.15 In January 2018, Finance advised the ANAO that Adelaide and Brisbane were identified following a desktop analysis of upcoming lease expiry dates. It advised that these jurisdictions were used to test the concept outside of the ACT, ahead of the planned implementation of the coordinated procurement of property services.6 Finance further advised the ANAO that the focus on leases in these locations did not preclude ‘Tetris-type’ moves in other locations where opportunities were available, noting that additional requirements had been placed on entities, aimed at identifying and using surplus space.7

2.16 Finance provided further advice to the Minister in September 2016 confirming that the pilot projects had commenced, and based on initial desktop modelling were estimated to reduce rent by $4.6 million a year in Adelaide and $7.2 million a year in Brisbane. On 3 April 2017, the Minister announced that Operation Tetris was on track to realise savings of $300 million over 10 years, stating that since the national roll-out, Operation Tetris had successfully filled over 60,000 square metres of vacant space in the ACT and a further 7,000 square metres in other capital cities.

2.17 Operation Tetris was not specifically piloted in other capital cities but has been incorporated into the coordinated procurement arrangements for property services. Relocating entities into suitable surplus space is one of the options to be considered under these arrangements.

Property data collected since 2009

2.18 The principles established under the original Commonwealth Property Management Framework supported a focus on achieving the best value for money outcome for property decisions. In accordance with these principles, entities were required to have regard to whole-of-government outcomes in their property decision-making. There were processes to support the sharing of information and collaboration.

2.19 Finance has been collecting property data from entities since 2009 when the Commonwealth Property Management Framework was first introduced. Referred to as the Australian Government Property Data Collection (PRODAC), this was established as an evidence base for the office space leased and owned by the Australian Government. In June 2018, Finance advised the ANAO that PRODAC was initially established to identify whether entities were meeting the occupational density target rather than a broader purpose.

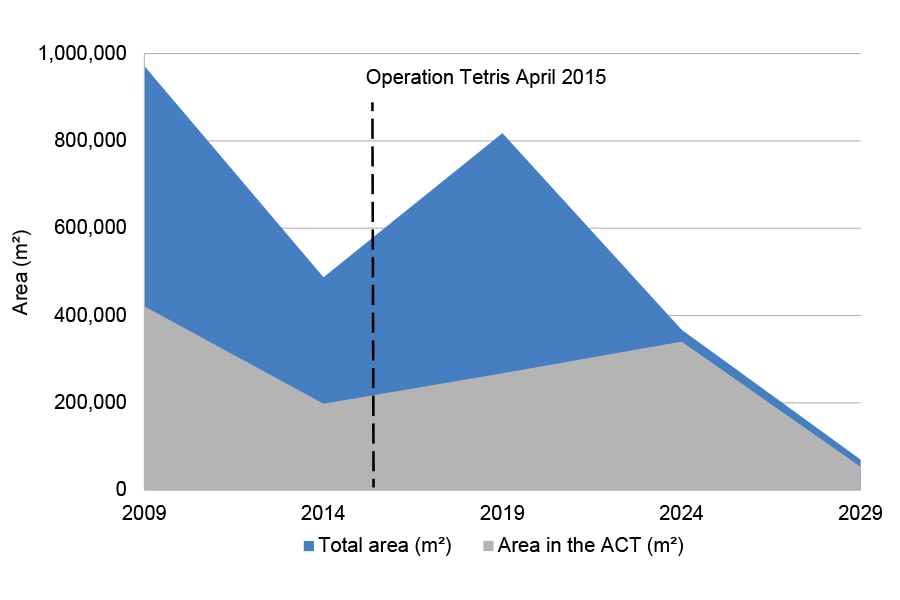

2.20 Prior to the Strategic Leasing Review in 2014 and the initiation of Operation Tetris in 2015, the review and analysis of property data was not a regular, business-as-usual activity undertaken by Finance. This was the case notwithstanding Finance’s responsibilities under successive Administrative Arrangements Orders and that leases expire on a fairly continuous or rolling basis. As shown in Figure 2.1, at the time Operation Tetris was initiated there was a looming peak of leased area due to expire nationally and in the ACT.

Figure 2.1: Lease area due to expire as at September 2009

Source: ANAO based on the Australian Government Office Occupancy Report 2010.

Were frameworks strengthened to deliver better whole-of-government outcomes?

In important respects, frameworks have been strengthened. In particular, changes made to the Commonwealth Property Management Framework provided greater central visibility and authority over certain lease proposals. Finance did not follow through on establishing appropriate funding arrangements to promote and support involvement by entities.

Changes to the Commonwealth Property Management Framework

2.21 At the time that Operation Tetris was initiated, there were no specific requirements or formal mechanisms directing entities into surplus or vacant office space.

2.22 In April 2015, Finance recommended two amendments to the existing Lease Endorsement Process under the Commonwealth Property Management Framework. These were agreed by government:

- to provide the Minister or nominee with the authority to endorse significant entity lease proposals; and

- to require entities to relocate to currently surplus Commonwealth leased accommodation, as determined by the Minister or nominee.

2.23 In September 2015, Finance made a number of changes to the Commonwealth Property Management Framework, as approved by the Minister, including to:

- require entities to notify Finance of any proposed procurements of office accommodation or retail shopfronts with a value on a whole-of-life basis of over $2 million;

- require entities to undertake a Local Impact Assessment in specified circumstances;

- provide the Minister with the authority for endorsing leases above existing thresholds8 (removing the previous role of the Secretary of Finance); and

- providing the Minister with the authority to impose conditions on lease procurements following notification and assessment, and to ‘call in’ any lease for endorsement that would otherwise fall under thresholds.

2.24 The first and fourth changes were particularly aimed at promoting better utilisation of surplus leased office space. These changes provided greater visibility and authority on entities’ proposed leasing activities that fell below the thresholds where formal endorsement and cost–benefit analysis were required. The Framework was further amended to clarify the authority of the Minister to impose conditions in circumstances where an entity proposes to exercise an option to extend a current lease (rather than taking up available space elsewhere).

2.25 In practice, the Minister did not ‘direct’ entities to move into vacant space. Rather, the Minister could determine that a lease procurement not proceed due to the availability of surplus office space — in effect to ‘block’ a move proposed by an entity. This approach was taken in respect to lease proposals submitted by the Department of Communications and the Arts, where the Minister did not endorse any proposals except for the Department to relocate to vacant space in the Nishi building in Canberra. Also, prior to the Commonwealth Property Management Framework being amended in September 2015, the Department of Veterans’ Affairs’ (DVA) proposal to relocate to privately-leased office accommodation was not endorsed by the Secretary of Finance. Instead, agreement was reached for DVA to occupy surplus office space at the Australian Taxation Office’s (ATO) building in Civic, Canberra, which was seen to provide a better whole-of-government outcome.

Finance’s role in assisting moves

2.26 Finance played a prominent role in facilitating moves under Operation Tetris. To streamline the process of setting up co-location arrangements and relocating to new premises, Finance facilitated site visits and negotiated leasing arrangements between entities. Finance also developed or used a suite of guidance documents and tools to assist entities in negotiating and transferring leased space between entities. These included a Commonwealth National Lease, Memorandum of Understanding templates for subleasing, cost–benefit analysis templates, an accommodation register to advertise excess space, and a financial analysis tool used to evaluate accommodation options.

2.27 Finance prepared a ‘lesson learnt’ paper for its involvement with some of the moves that occurred.9 Lessons included the need for: good data and information to identify appropriate participants, including information beyond data captured in PRODAC; sufficient time to allow negotiations and relocations to occur to optimise benefits from relocations; clearly defined roles and responsibilities for each party; and guidelines on how costs are to be shared. In June 2018, Finance advised the ANAO that it has taken these lessons (as relevant) into account when establishing the coordinated procurement of property services and supporting arrangements. As evidence, Finance pointed to:

- a revision to the Commonwealth Property Management Framework requiring the ‘host’ or tenant entity to charge the intended sub-tenant a rent consistent with prevailing market conditions (rather than, for example, the higher rent being paid by the tenant entity);

- proactively planning for lease expiries several years in advance (the Strategic Property Adviser role); and

- requiring Property Service Providers to provide property data to Finance on behalf of entities to improve the quality of data.

Funding mechanisms

2.28 Finance’s initial advice to the Minister in April 2015 noted that the development of a whole-of-government framework to improve property efficiency needed to consider funding arrangements. That is, there was a need to determine how the efforts to reduce surplus space affect the amount that entities are funded for accommodation expenses, and how any savings can be returned to the Budget through, for example, adjustments to entities’ appropriations.

2.29 Finance noted that some smaller entities had raised concerns about the affordability and consistency of the proposed moves to their business needs. Finance stated that:

- the department’s Property and Construction Division was working with its Budget Group to identify solutions to the administration of funding arrangements, including the redistribution of overall savings from the strategy; and

- it proposed to provide formal advice to the affected agencies of the strategy10 and to work with agencies through implementation arrangements including budget matters.

2.30 Finance consulted internally on the question of funding and cost allocation issues for Operation Tetris in July 2016, presenting different scenarios for consideration. The internal responses pointed to the complexity of the issues and the need for different approaches to cater for the range of circumstances likely to apply. The scenarios contemplated changes to entities’ appropriations, to provide whole-of-government benefits.

2.31 Finance was unable to produce to the ANAO any records that evidenced whether the issues raised in the internal consultation were resolved and, if so, what arrangements were put in place. In January 2018, Finance advised the ANAO that:

In relation to funding arrangements, some issues that have arisen are specific to certain entities and specific moves, other issues are relevant more broadly across entities. Where the issues are broadly relevant to most entities Finance is working to resolve the issues and provide guidance through appropriate mechanisms. For example, RMG500 states that entities moving into a sub-lease arrangement should not be charged above current market rental rates. This will assist in ensuring that entities participating in Operation Tetris (which results in a better whole-of-Government outcome) are not disadvantaged at an entity level compared to approaching the market and entering into a new lease.

2.32 Two entities involved in Operation Tetris identified the need for additional funding. The Department of Communications and the Arts received funding of $19.2 million over 11 years from the previous host tenant, the Department of Industry, Innovation and Science, to supplement rent at its new premises. As part of co-location arrangements, DVA received approximately $4.3 million from the ATO to fund fit-out costs at its new premises.

Were robust and transparent methods used to estimate and track relevant costs and benefits?

The methodology used to estimate and track relevant costs and benefits was not sufficiently robust or transparent. Important aspects of the methodology were not clearly documented, and the approach followed did not include all relevant costs (including fit-out and relocation costs). Moves were tracked but the estimates were not verified or adjusted to reflect actual outcomes.

Savings methodology

2.33 Rather than updating and applying the Synergy model that underpinned its April 2015 advice to the Minister (see paragraphs 2.10 to 2.13), Finance’s saving methodology involved three elements:

- the average cost per square metre of office space — $460;

- the size of the Net Lettable Area (NLA) of office space filled — NLA filled; and

- the timeframe over which savings were calculated — 10 years.

These elements supported the simple equation that was used to estimate the $300 million in claimed savings from Operation Tetris: $460 times NLA filled times 10 years.

2.34 In January 2018, Finance advised the ANAO that the methodology it used is an estimate of the rent no longer leaving the General Government Sector as a result of sub-leasing arrangements within government. It noted that these are savings to government as a whole, not savings to individual entities who moved (which still pay rent to the host entity). Finance further advised the ANAO that the approach of reducing rent payments outside the General Government Sector creates an immediate savings or efficiency to government by reducing the total rent expenses incurred by the affected entities.

2.35 Clarification was sought from Finance on each element of the savings methodology, and whether other costs, such as fit-out costs and relocation costs (which were addressed in the Synergy model), were taken account of in the savings calculation. As outlined in Box 1, Finance’s responses raised further questions about the basis of the methodology, and whether the approach taken was soundly based and consistently applied.

|

Box 1: The three elements of Finance’s savings methodology for Operation Tetris |

|

Source: ANAO based on advice and documents provided by Finance.

2.36 Relocation and other associated costs were not addressed by Finance’s methodology. In July 2018 Finance commented to the ANAO that costs such as fit-out and relocation would apply regardless of whether the entity moved under Tetris or into a new lease. The ANAO’s analysis was that this assumption did not necessarily hold.11

Tracking moves and validating estimates

2.37 Finance tracked and recorded the moves that occurred under Operation Tetris. The latest report (29 January 2018) listed 16 separate moves that are attributed to the $300 million in claimed savings (Appendix 2).12 Of these moves, 11 were undertaken in Canberra, four in Adelaide, and one in Sydney. The reports do not identify when the moves occurred. Three of the nine moves that were initially planned under Operation Tetris, and which made up the estimated $200 million in savings within the ACT (see Table 2.1) were not undertaken as planned. Two of the planned moves ended up going to different locations.

2.38 The moves that occurred in Brisbane (one of the two pilot sites outside the ACT) are not recorded in this report, or the previous four reports. In March 2018, Finance advised the ANAO that no ‘Tetris’ moves occurred in Brisbane; instead the Brisbane pilot focussed on joint approaches to market. The projects in Brisbane were longer term and eventually rolled into the work of the Strategic Property Adviser. Finance advised that the $7.2 million expected savings for the property moves that occurred in Brisbane were not included in the $300 million in savings attributed to Operation Tetris.

2.39 The January 2018 report states that the moves resulted in savings of $29.8 million over the next ten years, with total area filled of 65,265 square metres. The report notes that the savings are based on property data from February 2016, and an average lease cost of $460 per square metre.13 It also notes that the savings figures for the four moves that are listed for Adelaide, which total $2.1 million, are based on ’actual avoided rent’ not the methodology that was used for the ACT moves. This was not the case. Rather, the savings in the report were calculated using the same methodology as applied to the moves in the ACT (that is, the average rent of $460 multiplied by the NLA filled times 10 years).

Validating the final outcome of moves

2.40 The need for verification of the actual savings was identified in Finance’s initial advice to the Minister in April 2015, where it said that the estimates provided by the external firm were approximate and needed further verification by a detailed cost–benefit analysis. No such analysis was undertaken, or advice provided to the Minister on the actual outcome of Operation Tetris compared to the estimated savings, which were then publicly announced.

2.41 In the absence of analysis by Finance, the ANAO identified that sub-leasing agreements between entities involved in Operation Tetris provide a potential source of data to compare against Finance’s savings methodology. That is, the agreements would indicate how closely the agreed lease terms and rental costs matched the assumptions in Finance’s methodology ($460 per square metre and a 10 year lease term).

2.42 Finance provided the ANAO with draft leasing agreements for two of the then 16 moves attributed to Operation Tetris (which involved Commonwealth-owned buildings). Finance advised that entities were not required to provide sub-leasing agreements as part of Operation Tetris, so it was unable to supply a complete set of documents. The ANAO obtained a further three finalised sub-leasing agreements from its existing records and processes for auditing entities’ financial statements.

2.43 Analysis of the five sub-leasing agreements revealed that the assumptions in Finance’s savings methodology did not consistently hold. For example, in two cases, the agreed lease term was around seven and five years respectively, reducing the size of the expected savings compared to Finance’s estimate which assumed 10 years (in one case it was over, at 10.4 years). Also, in four of the five cases examined, the rental cost per square metre was materially less than the $460 average used in Finance’s savings methodology, reducing the expected savings for those moves compared to the estimate.14 In addition, there were differences in the net lettable area reported in Finance’s summary tracking sheet for Operation Tetris and the net lettable area listed in the sub-leasing agreements.

2.44 The analysis undertaken by the ANAO did not include all of the then 16 moves attributed to Operation Tetris and does not provide a basis for extrapolating the results across the remaining moves. Data provided by Finance in September 2018 indicated that for some moves the lease terms and rent rates may be above the 10 years and $460 assumed in Finance’s estimate, potentially increasing the expected savings compared to the estimate for these particular moves. The data supplied by Finance was not prepared on the same basis as the ANAO’s analysis. Rather, Finance used property data self-reported by entities into the Australian Government Property Register (formerly known as PRODAC).

2.45 The analysis undertaken by the ANAO and the data supplied by Finance reinforces that there would have been merit in more robust tracking and verification of moves as they occurred. This would have informed advice to the Minister on the extent to which the publicised savings estimates were being realised. As a case in point, Finance’s original savings estimate for DVA’s move into the ATO’s leased premises in Canberra ($49 million over ten years) was higher than the savings indicated by the ANAO’s analysis ($33.1 million) and by Finance’s subsequent estimate provided in September 2018 ($35.5 million). All three estimates were also significantly lower than the $84 million in efficiencies announced for this move in March 2014.15 The announced efficiencies of $84 million was based on a 17 year lease term, which included two optional five-year extension periods.

2.46 While Operation Tetris has now concluded, the ANAO has recommended that Finance ensure its ongoing program of work to deliver savings and efficiencies on Commonwealth leased office property is supported by a robust and transparent savings methodology (see paragraph 3.80). This includes verifying estimates when actual data is available — a key task that was not done well on Operation Tetris.

Savings have been retained by entities

2.47 At the time it was being implemented, Finance did not address how the Operation Tetris savings would be treated. That is, whether savings would be returned to the Budget or retained by entities.16

2.48 In March 2018, Finance advised the ANAO that the savings generated from Operation Tetris were being considered as part of broader advice to government on a range of property-efficiency matters, including the coordinated procurement of property services. The advice referred to by Finance was provided to government in March 2018.

2.49 The savings models that underpinned Finance’s March 2018 advice included some analysis of savings from Operation Tetris and recommendations on how these savings should be treated. An external firm17 was commissioned by Finance in October 2017 to assist with the development of a savings model for Operation Tetris and other property-efficiency measures. For Operation Tetris, annual savings of $20 million were identified. These savings related to 11 ‘landlord’ entities that received revenue from entities under sub-tenancies arrangements. The savings were quantified from the 2018–19 financial year onwards, on the assumption that prior year savings had been retained by the relevant entity and not returned to the Budget. The consultant’s report recommended that the potential savings of $20 million a year be returned to the Budget.

2.50 In June 2018, Finance advised the ANAO that it did not make any recommendations to government on the return of Operation Tetris savings to the Budget. Finance further advised the ANAO that at this time savings from Operation Tetris remain with relevant entities — noting that future decisions on the treatment of savings are a matter for government.

3. Establishing a coordinated procurement for property services

Areas examined

The ANAO examined whether the Department of Finance (Finance) followed good processes and provided sound advice to government to inform the establishment of coordinated procurement arrangements for property services.

Conclusion

For the establishment of coordinated procurement arrangements for property services, Finance’s approach of informing decisions by conducting a contestability review followed by a market testing review was sound. Cost savings were a key benefit envisaged from the arrangements. Finance’s advice was not supported by a sufficiently robust savings methodology during the main decision-making stages. While a more structured approach was used to allocate the $105.3 million in identified savings after the new arrangements had been implemented, much of the savings estimated by the allocation analysis relate to changes in market conditions rather than from the aggregation of government purchasing power.

Areas for improvement

The ANAO has recommended that Finance ensure that its ongoing program of work to deliver savings and efficiencies on Commonwealth leased office property is supported by a robust and transparent savings methodology.

Were options for the procurement of property services identified and compared?

Options were identified and compared. The consideration of options drew on the results of a market testing review that was informed by engagement with the property services industry (including industry advice on potential savings from a changed approach).

3.1 Finance has developed a framework to guide consideration — and a government decision — about which goods or services are suitable for a coordinated procurement.18 A key requirement is for a scoping study to be undertaken to examine the case for change. Such studies are to examine: entities’ needs; industry and market; administrative arrangements; volumes and values; as well as consulting with industry and entities.

3.2 A coordinated procurement is an initiative to establish whole-of-government arrangements for goods and services in common use to maximise market benefits and to deliver efficiencies and savings. The Government’s intention to establish a coordinated procurement of property services was announced in the 2016–17 Budget. In September 2017, the Minister for Finance (Minister) announced that the coordinated procurement was being implemented, and complements other property efficiency measures, including Operation Tetris. There are two main parts to the arrangements:

- the appointment of three property service providers19 to deliver leasing and facilities management services to entities (Box 2); and

- the appointment of a strategic property adviser20 to develop and maintain a whole-of-government leasing strategy.

|

Box 2: Examples of leasing and facilities management services to be provided by property service providers under the coordinated procurement arrangements |

|

Leasing services include:

Facilities management services include:

|

Source: ANAO based on documents provided by Finance.

Scoping study

3.3 Finance initiated a scoping study for property services in August 2015. It engaged two external advisors21 to examine the then decentralised property management model in place22 and investigate alternative models for more efficient and cost effective management. The engagement was referred to as the Property Services Market Testing Review (Market Testing Review).

3.4 The Market Testing Review followed on from the Government’s consideration of the Contestability Review of Property Services (Contestability Review) — an external review commissioned by Finance in the context of the Efficiency through Contestability Programme.23 The final report on the Contestability Review identified opportunities for the Commonwealth to strengthen collective purchasing arrangements and recommended that a scoping study be undertaken to identify the optimal form of collective purchasing. This recommendation was supported by Finance and agreed to by government.

3.5 Originally the Market Testing Review report was to be provided to Finance in September 2015, around four weeks after the external providers were engaged. This timeframe was to enable government’s consideration during the 2015–16 Mid-Year Economic and Fiscal Outlook. In contrast, the Contestability Review suggested that, consistent with previous scoping studies for procurement arrangements, the scoping study might take 6–12 months. The Market Testing Report was finalised in March 2016.

Industry consultation

3.6 The Market Testing Review was largely informed through engagement with industry (in September 2015), and included two main processes to solicit views and feedback:

- an initial market sounding, where the external advisers met with nine heads of organisations who deliver property services; and

- a formal Request for Information (RFI), issued via AusTender, which formed the basis of the market testing and sought industry views on: leasing services; facilities services; and capital works.

3.7 As part of the RFI, industry was asked to describe the optimal model for leasing and facilities services, and capital works; and to provide comments on three other models under consideration (Box 3).

|

Box 3: Property models consulted on with industry during the Market Testing Review |

|

Source: ANAO based on documents provided by Finance.

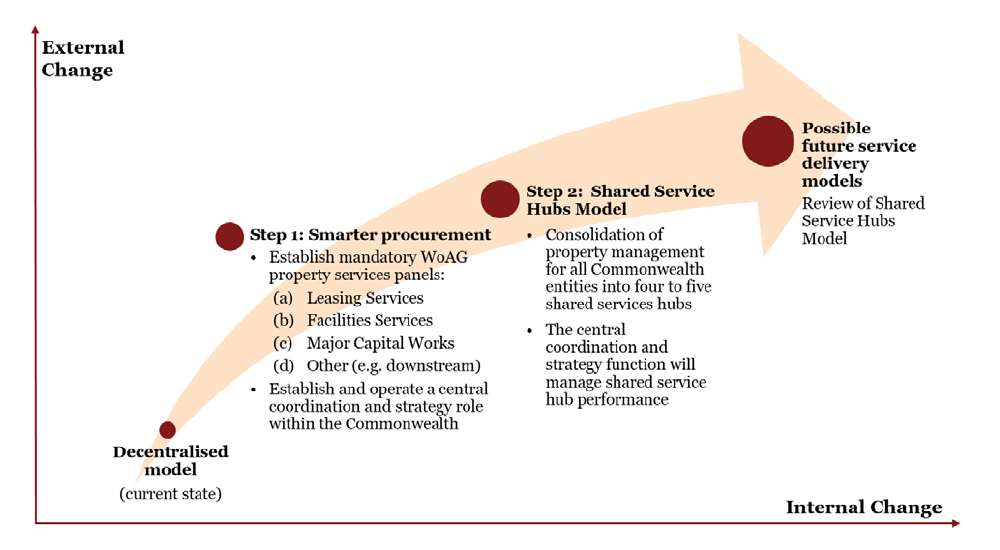

3.8 Industry insight was sought primarily to determine which model would deliver the largest savings and efficiencies and what alternate models should be considered. The questionnaire for industry sought qualitative and quantitative data supporting how each of the three models in Box 3 would impact on industry’s ability to achieve savings for the Australian Government.

3.9 The RFI received three responses from service providers in relation to the market testing questions on leasing services (one of these respondents was subsequently engaged as a Property Service Provider).24 The respondents also identified some strengths and weaknesses of the current and the two proposed models, including that a number of larger entities where sufficient scale has been achieved were already delivering collective purchase functions efficiently and effectively. Finance’s advice to government on the outcome of the Contestability Review was that property management and advisory services are already ‘highly contested’ with a significant level of outsourcing for property services across the Commonwealth. In the end, two industry respondents considered that a Shared Services Hub model was the optimal model for leasing services, with the remaining respondent favouring the Centralised model.25 In all cases, the respondents pointed to the need for greater integration of property functions.

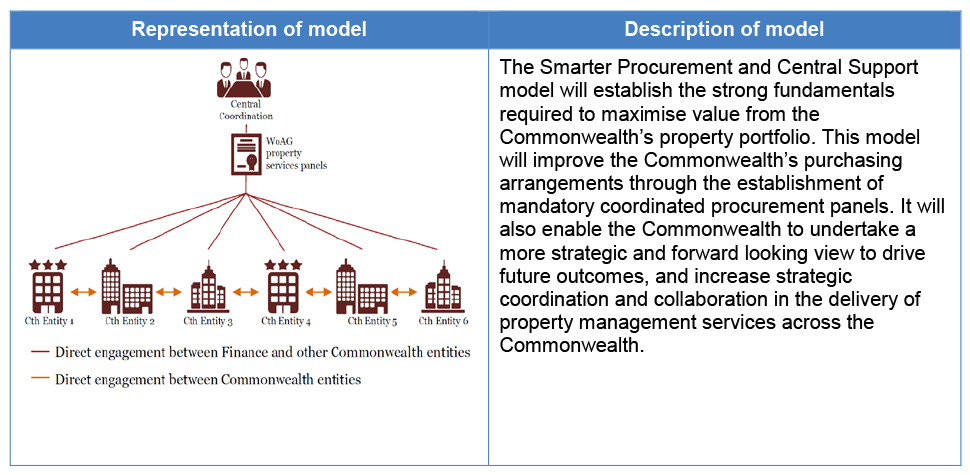

Entity consultation

3.10 Consultation with Australian Government entities occurred through a Steering Committee and a Property Services Market Testing Reference Group established by Finance with entity representatives and the external advisers. The consultation process extended until the final scoping study was delivered (March 2016) and was primarily focused on obtaining stakeholder views on potential models and to validate ideas identified from industry.

Recommended model

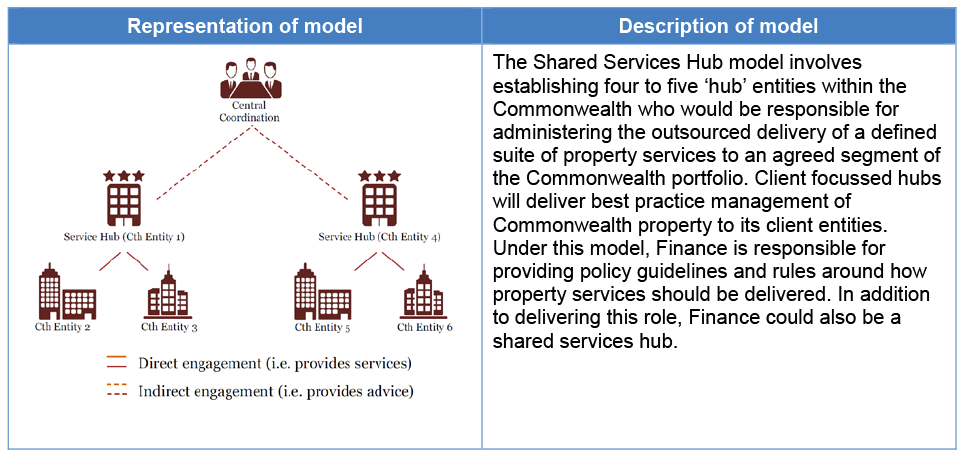

3.11 The final report of the Market Testing Review (March 2016) recommended a two-phased approach to the delivery of property management services across the Commonwealth. As depicted in Figure 3.1, this involved a move away from a decentralised model to the implementation of a ‘Smarter Procurement and Central Support Model’ in Phase 1, followed by a review and consideration of the Shared Services Hub model in Phase 2.

Figure 3.1: Recommended model of the Market Testing Review

Source: ANAO reproduction of the two-phased approach presented to the Minister for Finance in December 2015.

3.12 The recommended model was assessed to deliver the optimal mix of short and long term benefits to the Commonwealth. The final Market Testing Review report noted that:

…phase one enables the Commonwealth to realise short term savings with minimal internal structural change within the Commonwealth (the change is external rather than internal) and the lowest level of implementation risk. Phase two will then drive even further savings through internal structural change to how the Commonwealth manages property services (albeit with higher levels of implementation risk).

3.13 The Smarter Procurement and Central Support Model recommended for Phase 1 was not one of the models that was consulted on with industry during the RFI process. This model emerged during the development of the Market Testing Review report. The model and associated description are shown in Figure 3.2.

Figure 3.2: Smarter Procurement and Central Support model

Source: ANAO presentation of information in the final Market Testing Review report (March 2016).

3.14 In outlining this model, the Market Testing Review report notes that it is fundamentally the same as the decentralised model but with key operational improvements, namely separate property service panels26 and a more formalised coordination role by Finance. The report stated that:

Responsibility for delivery of property services would continue to be governed by the Commonwealth Property Management Framework, with individual Commonwealth entities remaining responsible for contract management, service delivery and relationships with suppliers. However, Finance will provide a more formalised central coordination and support role in the delivery of WoAG27 property services. This includes establishing panels for key property services (e.g. leasing, facilities management, capital works project management and energy), oversight of the head agreements with suppliers and helping all Commonwealth entities to transition onto these panels.

3.15 As previously mentioned (paragraph 3.7), the Shared Services Hub model was consulted on during the RFI process and is shown in Figure 3.3. Early drafts of the report on the Market Testing Review recommended a Shared Services Hub model as the most beneficial property services model to deliver leasing, facilities management and capital works services. This was consistent with the Australian Government’s existing shared services agenda and was favoured by the industry respondents as the optimal model for leasing services. The recommendation was also supported by entity stakeholders, some of which indicated the successful operation of existing ‘clusters’ between entities.

Figure 3.3: Shared Services Hub model

Source: ANAO presentation of information in the final Market Testing Review report (March 2016).

3.16 In late 2015 Finance assessed that the best approach would be an initial focus on consolidating external procurements at the whole-of-government level prior to any potential move towards mandatory service hubs. Finance’s records indicate that the development of a two-phased approach emerged to maximise Australian Government buying power and to reduce the implementation risk of moving directly to a Shared Services Hub model that required greater internal structural changes.

3.17 On the basis of the decision to defer the implementation of shared services hubs, the Smarter Procurement and Central Support model was canvassed with entity representatives at the final Property Services Market Testing Reference Group meeting in February 2016. At that time, entity representatives expressed concern over several aspects of the recommendation, including:

- the move to a two-phased approach given the previous support for a single Shared Service Hub model;

- the lack of detailed risk assessment for each option presented in the report; and

- the reliability of the projected savings given the 10 year forecast.

3.18 In regard to entity concerns over the estimated savings, Finance undertook to clearly spell out in its advice to government the approach for how savings would be calculated and harvested across entities.

Other models examined

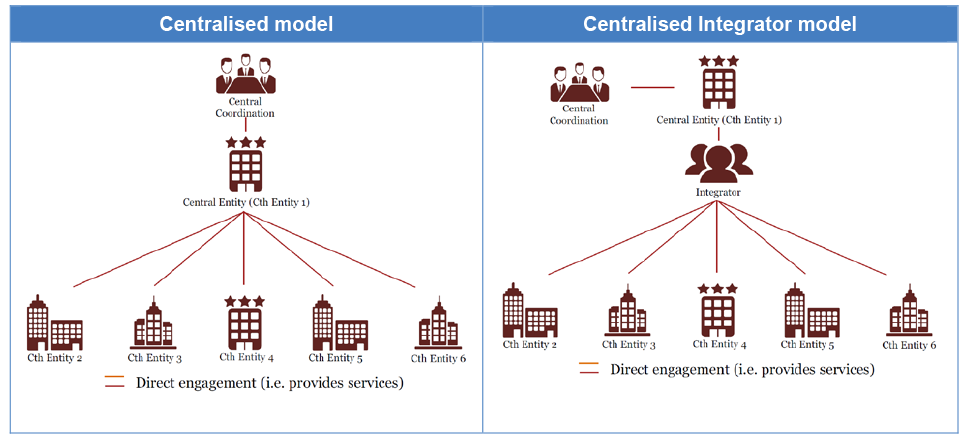

3.19 In addition to the Smarter Procurement and Central Support model and the Shared Services Hub model, the Market Testing Review report identified two other models that were also assessed as capable of delivering cost savings and improved efficiencies to the Commonwealth, namely: the Centralised model; and the Centralised Integrator model (as depicted in Figure 3.4).

Figure 3.4: Centralised model and Centralised Integrator model

Source: ANAO reproduction of information from the final Market Testing Review report (March 2016).

3.20 The Centralised model had been canvassed with industry as part of the RFI process but the Centralised Integrator model had not been (see Box 3 at paragraph 3.7). Like the Smarter Procurement and Central Support model, the Centralised Integrator model emerged during the development of the Market Testing Review report. In brief, this model is characterised by centralising property management activities within one Australian Government entity and engaging an industry specialist to deliver the property management activities that have historically been the responsibility of the Commonwealth — that is, procurement and contract management.

3.21 Table 3.1 presents the analysis of savings for each of the four models identified in the Market Testing Review.

Table 3.1: Comparison of cost savings across the models identified in the Market Testing Review

|

Model |

Estimated savings (FY17–21) |

||

|

|

Rent |

Facilities |

Net cost savings after implementation costs |

|

Smarter Procurement and Central Support model |

$174.8m |

$100.5m |

$285.4m |

|

Shared Services Hub model |

$232.4m |

$133.8m |

$419.1m |

|

Centralised model |

$211.5m |

$127.6m |

$368.1m |

|

Centralised Integrator model |

$211.5m |

$127.6m |

$361.4m |

Source: ANAO based on the final Market Testing Review report, March 2016.

3.22 The Market Testing Review report stated that the current decentralised model did not maximise value for the Commonwealth as a result of the duplication of services and excess vacant space, primarily due to a lack of consolidated leasing. This model was considered unlikely to provide any net cost savings.

3.23 The decentralised approach was used as a base case for the assessment of savings across the other models. Cost savings were estimated as a reduction in the 2015 baseline cost and are discussed further from paragraph 3.34. Of the four proposed options, the Shared Services Hub model was assessed to generate the highest net savings across the five year period to 2021 and the Smarter Procurement and Central Support model the least net savings.

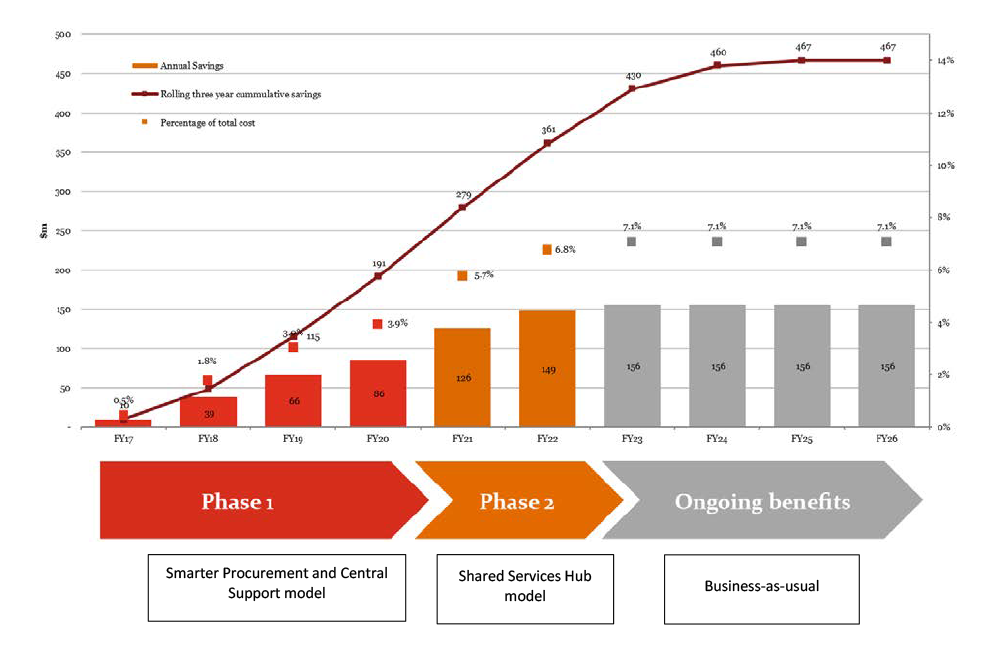

Savings estimates for the recommended model

3.24 The final report of the Market Testing Review suggested that the proposed two-phased approach would deliver savings in excess of $1 billion over the ten years to the end of 2025–26 ($1,066 million after implementation costs of $32 million). Figure 3.5 illustrates the breakdown of savings across the two phases and the estimated ongoing savings once peak annual savings are expected to be reached.

Figure 3.5: Estimated ten year savings forecast exclusive of implementation costs

Source: ANAO modification of diagram in the final Market Testing Review report, March 2016.

3.25 Of the total estimated savings:

- $201 million ($187 million after implementation costs) was attributed to Phase 1 — under the Smarter Procurement and Central Support model;

- $275 million ($266 million after implementation costs) to Phase 2 — under the Shared Services Hub model; and

- a further $624 million ($614 million after implementation costs) in ongoing benefits over the remaining four years to 2025–26.

3.26 For the purposes of the report, the Phase 2 savings and ongoing ‘business-as-usual’ benefits were calculated on the assumption that the Shared Services Hub model would immediately follow Phase 1.

3.27 As discussed further below, three limitations were identified with the approach taken in the Market Testing Review to estimate savings for the recommended model:

- the estimates were broadly determined and based on input from a small number of industry participants;

- these industry estimates were not tested against entities’ particular arrangements and were not specifically sought for the Smarter Procurement and Central Support model; and

- there were irregularities in the way the savings were calculated, including the nature of the adjustments made and some of the assumptions used.

Industry input

3.28 The cost saving estimates were obtained from the small number of industry providers that responded to the Market Testing Review — that is, the three providers that commented on leasing arrangements and four providers (including the three other providers) that commented on facilities management arrangements. Specific information sought from industry included:

- how current leasing and facility costs could be reduced for the Commonwealth by optimising the operating model, addressed by the market testing question: ‘How can you deliver savings?’;

- a quantification of savings as a result of the above changes, supported by specific examples where the industry provider has implemented the identified cost saving measure; and

- the comparative likelihood that these savings would be achieved under the current decentralised model, Shared Services Hub model or Centralised model.

3.29 As previously noted, industry was not asked to estimate savings for Phase 1 of the recommended model — the Smarter Procurement and Central Support model.

3.30 The Market Testing Review reported that in most cases industry identified a potential saving of 15 to 20 per cent across the leasing and facilities service portfolios through the implementation of the industry-identified changes.28 This estimate was reported inconsistently throughout the report and not could not be quantified from industry responses, which varied significantly in detail between the respondents (see Table 3.2).

Table 3.2: Lease savings identified by industry participants

|

Industry participant A |

Industry participant B |

Industry participant C |

|

|

|

Source: ANAO presentation of information in the final Market Testing Review report (March 2016).

3.31 Industry were asked to validate the estimated savings by providing domestic or international examples where the same cost savings measures had been implemented, either in the private or public sector. The examples provided by the respondents predominantly related to the private sector industry and/or international organisations. They provided little insight to support the claimed savings in an Australian Government setting. Of the 18 case studies provided by industry, only one could be identified as relating to a public sector entity. There was also no clear correlation between the savings identified in the industry case studies and the claimed savings in Table 3.2.

No entity testing

3.32 The savings estimates were not tested against entities’ property service arrangements. The Market Testing Review did not test the claimed savings with entities or an examination of an entity’s operational or bespoke requirements; nor was it required to under the terms of the engagement with the advisers for the review. Finance did not conduct additional testing of the savings estimates provided by its advisers, advising the ANAO in June 2018 that it ‘accepted the savings estimates put forward by its expert advisers and, therefore did not undertake a separate analysis’.

Savings calculations for the recommended two-phased approach

3.33 The Market Testing Review noted that the estimated cost savings were limited by a reliance on industry and the identified ‘risk that industry has been selective with their responses’.29

3.34 Cost savings were estimated as a reduction in the 2015 baseline costs for 94 non-corporate Commonwealth entities (NCEs) that lease property within Australia.30 Baseline costs were summarised into cost components and a more ‘conservative’ savings estimate was applied across each component than that identified by industry. Table 3.3 illustrates the adjustments made to the industry estimates for the purposes of the Market Testing Review calculations. Adjustments were also made to account for phased savings as leases expire and the assumption that only half of the total potential lease cost savings will be achieved by 2021.

Table 3.3: Application of industry estimates in the Market Testing Review

|

Cost componenta |

Industry savings estimate provided |

Final savings estimate applied |

|

Rent |

10–15% |

5% |

|

Facilities services |

10–20% |

10% |

|

Capital works |

3–5% |

2.5% |

|

Australian Public Service (APS) staff costs |

Up to 50% |

10%b |

Note a: The Market Testing Review notes that industry did not comment on management fees but assumed savings for this cost were five per cent by 2021.

Note b: Estimates in the Review assume potential saving of 10 per cent to account for additional resources required to establish the shared service hubs.

Source: Final Market Testing Review report, March 2016.

3.35 The Shared Services Hub model was used as the starting point upon which savings for the other three models were calculated. For example, the savings attributed to the Smarter Procurement and Central Support model was calculated based on the assumption that this model could deliver only 75 per cent31 of the expected leasing and facilities management savings from the Shared Services Hub model due to difficulties coordinating leasing and facility contracts.

3.36 While the assumptions made were documented in the review, there were apparent inconsistencies in the application of some assumptions, which had the potential to impact on the final reported savings for the Smarter Procurement and Central Support model. For example, the review noted that the savings expected under the Shared Services Hub model for management fees and Australian Public Service (APS) staffing costs were not expected to be optimised for the Smarter Procurement model, yet 100 per cent of the management fee savings were passed on to the Smarter Procurement model.32

3.37 The Market Testing Review recommended implementing two models across two phases. Under the two-phased approach, further adjustments33 were made to the individual savings calculated for each model to achieve the final estimated cost savings of $476 million ($453 million after implementation costs).

Was advice to government supported by suitable analysis and evidence?

Finance’s advice to government was not supported by robust analysis and evidence during the main decision-making process to establish a coordinated procurement for property services. In particular, Finance did not test the savings claims made by industry against entities’ property arrangements. A more structured approach for allocating the specified total quantum of savings was developed after the new arrangements were implemented, although the estimated savings used for allocative purposes relate largely to changes in market rents and reflecting the occupational density target rather than from the aggregation of government purchasing power.

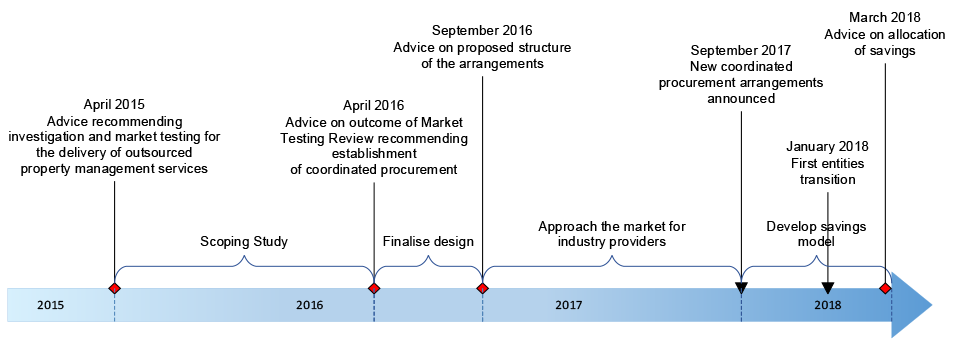

3.38 Finance provided advice to government on various occasions during the decision-making process to establish a coordinated procurement of property services. As illustrated in Figure 3.6, this included:

- advice on the outcome of the Market Testing Review in April 2016, including the estimated savings of introducing a coordinated procurement for property services;

- advice on the proposed structure of the coordinated procurement arrangements in September and October 2016, following a further design and consultation process; and

- advice in March 2018 on the allocation of savings from the coordinated procurement arrangements, following the development of a savings model.

Figure 3.6: Timeline for establishing the coordinated procurement of property services

Source: ANAO based on documents provided by Finance.

Outcome of the Market Testing Review

3.39 Following the Market Testing Review, Finance recommended the establishment of mandatory whole-of-government coordinated procurement for non-corporate Commonwealth entities in respect to specified services.34 This was agreed by government. Finance’s advice included a summary of the two-phased approach proposed in the Market Testing Review, but it did not specifically seek agreement from government to this approach or the implementation of Phase 1 as described in the Review.

3.40 Finance determined that a further design process was required to identify the appropriate delivery model for managing leased office property and related services. It recommended that the ‘structure’ of the arrangements be subsequently agreed by the Minister for Finance. This approach was supported. The two reviews commissioned by Finance to examine the case for change in the management of leased office property — the Contestability Review and the Market Testing Review — did not result in a preferred model being proposed to government at the main stage of the decision-making process.

Savings estimates

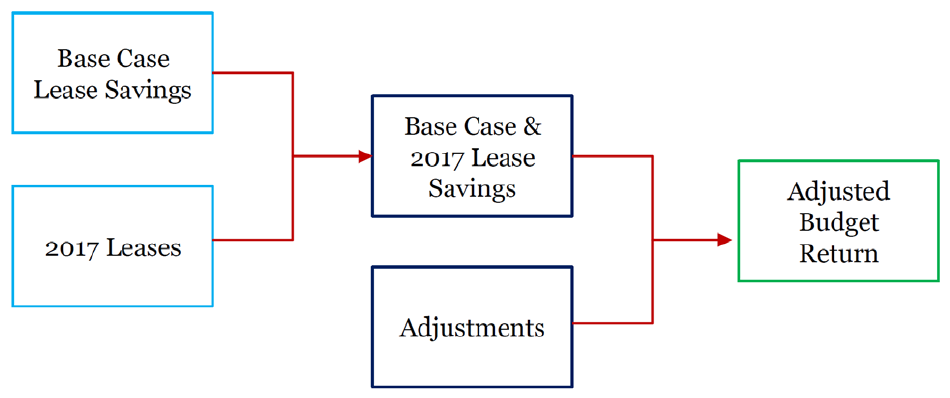

3.41 In its April 2016 advice to government, Finance noted that its advisers on the Market Testing Review identified indicative savings of $105.3 million over the four years to 2019–20 (and $183.7 million to 2020–21). These indicative savings were said to comprise $17 million from a reduced leasing footprint and $88.3 million in consolidated purchasing.

3.42 In Finance’s advice to government, the indicative savings estimate of $105.3 million was the most prominently described benefit of establishing a coordinated procurement. It was a central part of Finance’s policy case for recommending this option.

3.43 The Market Testing Review did not include any reference to indicative savings of $105.3 million. In May 2018, Finance advised the ANAO that this estimate was derived from the cumulative savings estimates in the review and was adjusted to:

- remove the savings attributed to the Department of Defence35;

- remove capital expenditure; and

- reflect the expectation that savings would not be achieved until the 2017–18 financial year.

3.44 Finance did not adjust the estimate to fully account for costs specific to the model adopted for Phase 1. The estimated savings in service provider management fees was based on 100 per cent of the savings estimated for the Shared Services Hub model also applying to the Smarter Procurement model (see paragraph 3.36). The Market Testing Review stated that the management fee savings estimated for the hub-type model represented ‘the estimated savings that the Commonwealth will receive as a result of the current larger number of small outsourced service provider contracts being consolidated into four larger outsourced property services contracts. These savings were not adjusted for the Phase 1 model which used three (not four) Property Service Providers or to account for any other differences in the models. 36

3.45 Finance advised that management fees for the three Property Service Providers used in Phase 1 are in the order of $45 million a year once all entities have transitioned to the new arrangements. The advice sought agreement for establishment costs of $3 million for the establishment and management of the coordinated procurement37 but did not otherwise refer to the cost of the Property Services Providers. There was no evidence to indicate that Finance undertook analysis to determine the net result of engaging the providers to replace entity’s existing outsourced arrangements.

3.46 Finance advised that the savings estimate was conservative and likely to materially understate the actual savings that will be realised over time, citing industry’s view that savings for leasing and facilities services could be as high as 20 per cent and indicating that savings could be in the order of $400 million a year. Finance also advised that the savings could not be confirmed until the new procurement arrangements are operational. To manage the risk that they may be overstated, Finance recommended, and government agreed, that the indicative savings be held in the Contingency Reserve38 until further advice was provided to government in the 2017–18 Budget context on the treatment of savings and Finance’s ongoing management costs.

3.47 Further advice on savings was not provided to government until March 2018 — around two years after government’s decision to establish a coordinated procurement. Finance’s further advice on the indicative savings estimate was provided after a number of entities had transitioned to the new arrangements, and after external providers were engaged to support the new arrangements. (Paragraphs 3.61 to 3.75 discuss Finance’s process for providing this further advice.)

Consultation with entities

3.48 Entities were provided an opportunity to comment on Finance’s proposal to introduce a coordinated procurement for property services. Finance did not make available to entities the final Market Testing Review which formed the basis of the recommendations and savings reported to government.

3.49 Some entities, including those that had large holdings of leased office property, did not support the proposal. One of the main concerns raised by entities was that Finance did not provide sufficient detail to explain how claimed savings were to be achieved. While entities offered support for the intent of the proposal — to reduce property costs across the Commonwealth — issues were raised around some common themes, including:

- the absence of a proper consultation process to match the complexity and significance of the proposal;

- the absence of detail on how the proposed arrangements would work;

- the basis for delivering actual realisable savings – including over and above those already being achieved through existing measures such as the occupational density target; and

- doubts about whether centralisation would be more effective than the arrangements large entities already had in place or working towards, including shared services hubs.

Other expected benefits and implementation risks

3.50 Finance’s advice to government focussed on how to reduce costs by consolidating the Commonwealth’s significant property-related purchasing power. The advice included general statements about other identified objectives of establishing a coordinated procurement, including the goal of ‘maximising competition’ while not unnecessarily distorting the market.

3.51 Finance advised that the Australian market is characterised by only a few large property service providers able to meet the entirety of the Commonwealth’s need. It noted that industry impacts will, as suggested by the Review’s advisers, need to be considered in the development phase. No analysis was provided by Finance in April 2016 on how the competition would be maximised under the proposed coordinated procurement arrangements.