Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Issuing, Compliance and Contracting of Australian Carbon Credit Units

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Australian Government issues Australian Carbon Credit Units (ACCUs). ACCUs are generated by registered projects that reduce emissions or store carbon in line with legislated ACCU methods.

- ACCUs can be sold by project proponents to the Australian Government or other buyers.

- The Carbon Credit (Carbon Farming Initiative) Act 2011 (the CFI Act) establishes the regulatory framework for ACCUs.

- This audit assessed the Clean Energy Regulator’s (CER’s) effectiveness in relation to ACCU issuing, compliance, and contract management of ACCU purchases.

Key facts

- At January 2024, 140.1 million ACCUs had been issued to 633 projects.

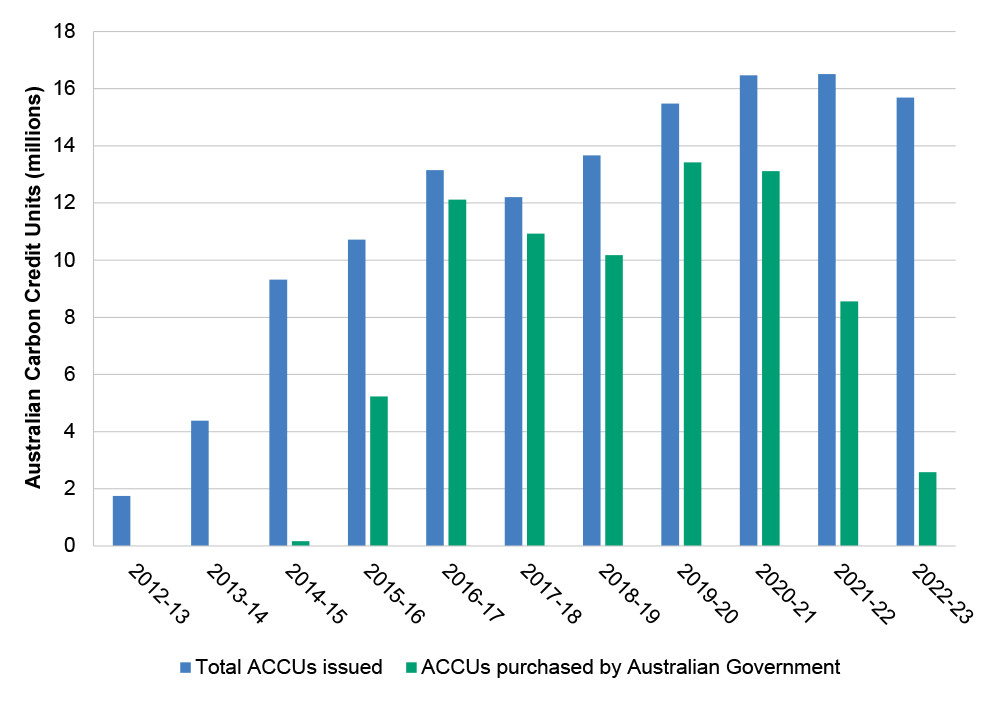

- The Australian Government has purchased approximately 62 per cent of issued ACCUs.

What did we find?

- Administration of the issuing, compliance and contracting of ACCUs was largely effective.

- The development of ACCU methods and the issuing of ACCUs was largely effective.

- The CER’s approach to management of ACCU scheme compliance activities was effective.

- The CER’s management of carbon abatement contracts was largely effective.

What did we recommend?

- One recommendation related to the provision of information to the responsible minister was made to the Department of Climate Change, Energy, the Environment and Water (DCCEEW). Responsibility for this function transferred from the CER to DCCEEW in 2023.

- DCCEEW agreed to this recommendation.

55%

of ACCUs credited to vegetation and sequestration projects as at 14 January 2024.

15

reverse auctions to contract ACCUs have been run by the Australian Government between 2015 and 2023.

91%

of ACCUs purchased by the Australian Government were contracted through the initial four auctions held in 2015 and 2016.

Summary and recommendations

Background

1. Australian Carbon Credit Units (ACCUs) are issued by the Australian Government through a regulatory framework established under the Carbon Credit (Carbon Farming Initiative) Act 2011 (the CFI Act). The Clean Energy Regulator (CER) has primary responsibility for administering the ACCU scheme.

2. Under the ACCU scheme, ACCUs are generated by registered projects that reduce emissions or store carbon in line with rules set under legislative instruments called methodology determinations (ACCU methods). Project proponents register projects under an approved ACCU method and generate ACCUs according to the abatement achieved.

3. Project proponents have the option to bid in auctions for a contract to sell ACCUs to the Australian Government. Alternatively, project proponents can sell ACCUs to organisations with emissions reduction obligations under the Safeguard Mechanism or who wish to voluntarily offset their emissions.1

Rationale for undertaking the audit

4. The Australian Government has identified the ACCU scheme will play a role in Australia achieving its 2030 and 2050 emissions reduction targets. This audit provides assurance to Parliament on the CER’s regulatory activities in relation to ACCU issuing and compliance, and contract management activities related to ACCU purchases.

Audit objective and criteria

5. The objective of this audit was to assess the effectiveness of the Clean Energy Regulator’s issuing, compliance and contracting activities related to ACCUs.

6. To form a conclusion against the objective, the following criteria were used.

- Are ACCUs issued in accordance with legislative requirements?

- Are ACCU compliance activities managed effectively?

- Are ACCU scheme contracts administered effectively?

Conclusion

7. Administration of the issuing, compliance and contracting of ACCUs was largely effective. The CER’s ACCU issuing, compliance and contracting activities are consistent with the CFI Act and Australian Government frameworks. There are opportunities to address weaknesses in the information systems used to administer the ACCU scheme as well as further improve monitoring and reporting related to compliance and conflict-of-interest declarations.

8. The development of ACCU methods and the issuing of ACCUs was largely effective. While the CER and responsible departments effectively administered the development of ACCU methods between November 2020 and February 2023, a CFI Act requirement to provide ongoing ministerial updates of interests declared by Emission Reduction Assurance Committee (ERAC) members was not met. The CER assessed applications for ACCU issuances against the requirements of the CFI Act and ACCU method. Weaknesses in privileged user access controls in the information systems used to administer the ACCU scheme were identified in 2018–19 and the CER’s actions to address these weaknesses are ongoing.

9. The CER has implemented an effective approach to ACCU scheme compliance activities. The CER has established and implemented a compliance framework that incorporates the range of regulatory powers provided under the CFI Act. The framework aligns with the guidance and principles outlined in the Australian Government’s Resource Management Guide for Regulatory Performance. This includes maintaining and publishing a compliance and enforcement strategy and providing guidance and information to help regulated entities understand their obligations and responsibilities. The CER is implementing ACCU scheme compliance activities. The CER monitors and reports on its performance related to ACCU scheme compliance.

10. The CER’s administration of carbon abatement contracts in the ACCU scheme was largely effective. The CER has established an appropriate contract management framework that is consistent with the practices outlined in the Australian Government Contract Management Guide. The CER is implementing actions to improve compliance with entity-wide conflict-of-interest arrangements. The contract management framework has been adjusted to reflect changes in the ACCU scheme, including the introduction of optional delivery contracts and the establishment of a fixed delivery exit arrangements process. Key contract management controls have been implemented each year between 2018 and 2023.

Supporting findings

Issuing Australian Carbon Credit Units

11. The CER and responsible department set up and implemented governance arrangements that supported the development and ministerial approval of ACCU methods in line with legislative requirements between November 2020 and February 2023. Improvements can be made to record keeping associated with ministerial appointments to the Emission Reduction Assurance Committee (ERAC). Ongoing ministerial updates of interests disclosed by ERAC members did not occur as required under the CFI Act. (See paragraphs 2.3 to 2.37)

12. The CER’s implementation of the ACCU crediting assessment process is largely appropriate. The CER has improved record keeping related to issuing ACCUs. Information provided by project proponents is assessed against the requirements of the CFI Act and relevant ACCU method. The information systems supporting the administration of the ACCU scheme have weaknesses that create a risk that unauthorised or unapproved activities may not be detected in these systems. (See paragraphs 2.38 to 2.57)

Compliance

13. The CER’s compliance framework for the ACCU scheme includes oversight committees, risk management activities, policies, procedures and guidance material. The CER’s compliance policy outlines the compliance activities the CER targets at different types of non-compliance. An ACCU scheme compliance plan, external guidance material, and internal procedures guide how the CER will implement compliance activities. Four risks related to ACCU scheme compliance are monitored through the CER’s entity-level risk management framework. (See paragraphs 3.3 to 3.32)

14. The CER uses regulatory powers under the CFI Act to address potential and identified non-compliance. Fit and proper tests and the ACCU issuance process are applied to scheme entry and the issuance of ACCUs. The CER uses the CFI Act’s auditing powers to verify the information presented by project proponents. The CER applies enforceable undertakings, ACCU relinquishments and project revocation powers when non-compliance is identified. Information on the outcomes of enforceable undertakings could be more clearly presented on the CER’s website. (See paragraphs 3.33 to 3.71)

15. The CER monitors and reports on its performance related to ACCU scheme compliance, including activities and outcomes. Internal monitoring can be improved by reporting on the implementation status of all compliance activities. External reporting would be further improved through the addition of quantitative information on compliance activities and improving the structure of some ACCU scheme compliance related information on the CER’s website. (See paragraphs 3.72 to 3.90)

Contract management

16. The CER has established an ACCU scheme contract management framework for selecting, contracting and purchasing ACCUs. The ACCU contract management framework is consistent with the Australian Government guidance including for managing contract performance, delivery and variations. The CER has implemented actions to improve compliance with its entity-wide conflict-of-interest declaration processes. Probity advisors did not identify any material issues in the 15 ACCU scheme auctions. The CER did not maintain complete records of staff compliance with auction probity plans. (See paragraphs 4.2 to 4.23)

17. The CER is undertaking its carbon abatement contract administration activities in accordance with its contract management framework. The CER is also implementing its procedure to manage applications for fixed delivery exit arrangements. (See paragraphs 4.24 to 4.33)

Recommendation

Recommendation no. 1

Paragraph 2.36

The Department of Climate Change, Energy, the Environment and Water:

- improves record keeping practices to demonstrate decisions are consistent with legislative requirements; and

- implements procedures for notifying the responsible minister of interests declared by Emission Reduction Assurance Committee members as required by the Carbon Credits (Carbon Farming Initiative) Act 2011.

Department of Climate Change, Energy, the Environment and Water response: Agreed.

Summary of entities’ responses

18. The proposed audit report was provided to the CER. An extract of the proposed audit report was provided to DCCEEW. The CER’s and DCCEEW’s summary responses to the proposed audit report are provided below and their full responses at Appendix 1.

Clean Energy Regulator summary response

The Clean Energy Regulator (CER) welcomes the Australian National Audit Office’s (ANAO) audit into issuing, compliance and contracting of Australian Carbon Credit Units (ACCUs). The ACCU scheme plays a crucial role in addressing climate change and supporting Australia’s transition to net zero by 2050, and the CER is committed to this outcome through effective and efficient regulation supported by robust and enduring systems and processes.

The valuable insights produced by the ANAO through this audit will be incorporated into the CER’s ongoing administration of the ACCU Scheme as part of our culture of continuous improvement. This will support the ongoing evolution of the Australian carbon market and its pivotal role in Australia’s pathway to net zero.

Department of Climate Change, Energy, the Environment and Water summary response

The department acknowledges the ANAO’s audit report extract on the Issuing, compliance and contracting of Australian Carbon Credit Units.

The department recognises that the ANAO found that administration of the Australian Carbon Credit Unit (ACCU) method development and the issuing of ACCUs was largely effective.

The department takes its governance obligations including management of conflicts of interest very seriously, and is committed to continuous improvement in its systems and processes to ensure decisions are consistent with all legislative requirements. The department agrees with the ANAO’s recommendation. The department considers implementation of the recommendation, which has already commenced, will improve its current processes and support effective management of the ACCU Scheme and other future programs.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Policy/program implementation

1. Background

Introduction

1.1 The Clean Energy Regulator (CER) administers the Australian Carbon Credit Units (ACCU) scheme. This involves the CER:

- implementing a regulatory framework for issuing ACCUs established through the Carbon Credits (Carbon Farming Initiative) Act 2011 (the CFI Act); and

- purchasing ACCUs on behalf of the Australian Government to be used to meet Australia’s emissions reduction commitments.

1.2 The Australian Government department that deals with climate change matters, including greenhouse gas abatement programs, has responsibility for policy matters related to the ACCU scheme and supporting ministerial decision-making under the CFI Act. Since 1 July 2022, this department has been the Department of Climate Change, Energy, the Environment and Water (DCCEEW).

1.3 ACCUs are financial products issued by the Australian Government to eligible projects for emissions abatement achieved under the CFI Act. ACCUs represent carbon abatement that can be sold by project proponents to the Australian Government or to organisations to offset greenhouse gas emissions. One ACCU represents one tonne of carbon dioxide equivalent (CO2-e) of greenhouse gas that has been abated.2

1.4 Under the ACCU scheme, ACCUs are generated by registered projects that reduce emissions or store carbon in line with rules set under legislative instruments called methodology determinations (ACCU methods). Project proponents register projects under an approved ACCU method and generate ACCUs according to the abatement achieved.

1.5 Project proponents have the option to bid in auctions for a contract to sell ACCUs to the Australian Government. Alternatively, project proponents can sell ACCUs on the private market. Private market buyers include organisations with emissions reduction obligations under the Safeguard Mechanism or who wish to voluntarily offset their emissions.3

ACCUs issued and contracted by the Australian Government

1.6 At 14 January 2024, 1,769 projects were registered across 52 ACCU methods.4 The 140.1 million ACCUs issued have been credited to 633 of the registered projects. Since April 2015, the Australian Government has held 15 auctions and awarded 612 contracts to purchase ACCUs.5 At 2 January 2024, the Australian Government has purchased 81.7 million ACCUs out of a total contracted volume of 244.5 million ACCUs.6 The number of ACCUs issued and purchased by the Australian Government since the ACCU scheme commenced is shown in Figure 1.1.

Figure 1.1: ACCUs issued and purchased by the Australian Government

Source: ANAO analysis of CER contract register 14 January 2024.

Australian Carbon Credit Units scheme

1.7 The ACCU scheme has operated in three forms since the CFI Act commenced in 2011:

- the Carbon Farming Initiative between 2011 and 2014;

- the Emissions Reduction Fund between 2014 and 2023; and

- the ACCU scheme from 2023.

Carbon Farming Initiative

1.8 The Carbon Farming Initiative began in 2011 as a complementary measure to the Australian Government’s Carbon Pricing Mechanism. Entities associated with the agricultural, forestry and legacy waste emissions sectors of the economy could register projects and earn ACCUs for the carbon sequestered or emissions avoided by these projects. ACCUs could be sold to other entities with liabilities under the Carbon Pricing Mechanism. The Carbon Pricing Mechanism was repealed from 1 July 2014.

1.9 There have been 14.4 million ACCUs surrendered to the Australian Government by organisations with liabilities under the Carbon Pricing Mechanism.7 This is approximately 10 per cent of all ACCUs issued up to January 2024.

Emissions Reduction Fund

1.10 In November 2014, the Australian Government transitioned the Carbon Farming Initiative to the Emissions Reduction Fund. While the regulatory processes for projects to create ACCUs remained similar to the Carbon Farming Initiative, amendments to the CFI Act allowed the Australian Government to purchase ACCUs through the Emissions Reduction Fund.

1.11 Through the Emissions Reduction Fund, the Australian Government made $2.55 billion available over 10 years for the purchase of ACCUs. A further $2 billion was made available for ACCU purchasing in 2018–19. At January 2024, the Australian Government had purchased around 81 million ACCUs, representing approximately 62 per cent of issued ACCUs.8

1.12 The Emissions Reduction Fund was complemented by a Safeguard Mechanism designed to prevent large greenhouse gas emitting facilities from increasing their emissions. Organisations whose emissions increased over the allocated baseline were required to purchase ACCUs to offset the emissions in excess of the allocated baseline. At 1 August 2023, almost 1.3 million ACCUs representing approximately 1 per cent of issued ACCUs have been surrendered to the Australian Government by entities to meet obligations under the Safeguard Mechanism.

Australian Carbon Credit Units scheme

1.13 In 2022, the Australian Government transitioned from using the term ‘Emissions Reduction Fund’ to the term ‘ACCU scheme’ for describing ACCU–related regulatory and purchasing activities under the CFI Act.

1.14 In May 2023, the Australian Government reallocated an uncommitted $1.9 billion from $4.5 billion that had been allocated to purchasing ACCUs through the Emissions Reduction Fund to fund activities under the Powering Australia Plan. These emissions reduction activities identified in the Powering Australia Plan include continued Australian Government purchasing of ACCUs.9

1.15 From 1 July 2023, changes were made to the Safeguard Mechanism to require large greenhouse gas emitting facilities to reduce their emissions in line with Australia’s international emissions reduction targets. Facilities that exceed their annual Safeguard Mechanism baseline have the option of purchasing ACCUs from the Australian Government to meet their allocated baseline.10

Responsibility for administering the Carbon Credit (Carbon Farming Initiative) Act 2011

1.16 The CER has administered ACCU crediting and compliance since the commencement of the CFI Act in 2011 and ACCU purchasing since the start of the Emissions Reduction Fund in 2014.

1.17 The CFI Act defines the role of the minister responsible for making decisions on ACCU methods and establishes the Emissions Reduction Assurance Committee (ERAC).11 ERAC’s role includes providing the minister with assessments on the appropriateness of new and existing ACCU methods.

1.18 The Australian Government entity responsible for supporting ERAC in the development and administration of ACCU methods is not specified by the CFI Act. These functions supporting ERAC have moved between the Australian Government department responsible for climate change matters and the CER over the life of the ACCU scheme.12

Australian Carbon Credit Units scheme processes

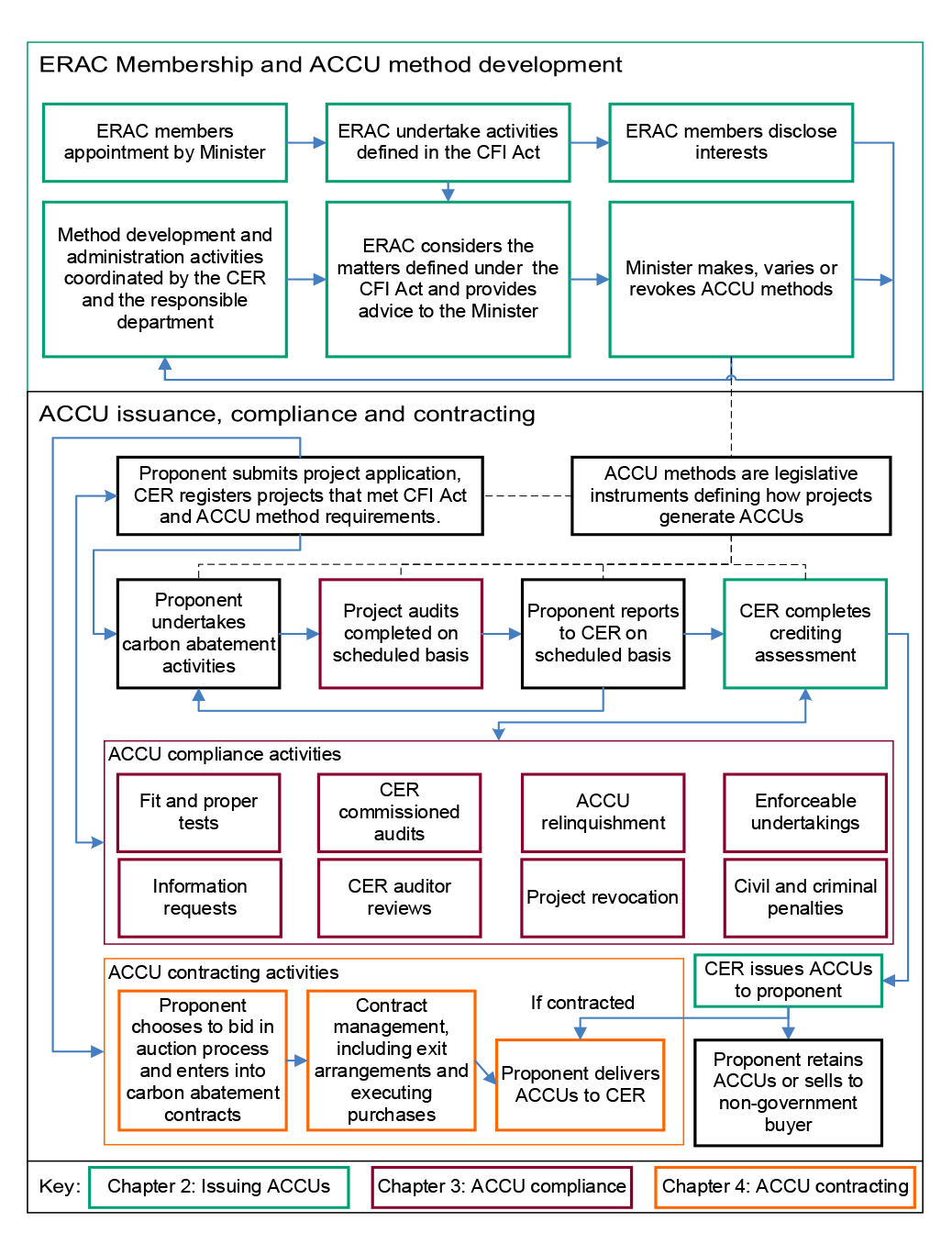

1.19 ACCU scheme processes include ACCU method development, ACCU issuance, ACCU scheme compliance activities, and contract management related to Australian Government ACCU purchasing. A high-level overview of these ACCU scheme processes is presented in Figure 1.2.

Figure 1.2: High-level overview of the ACCU scheme

Source: ANAO presentation of CFI legislation and CER information.

1.20 ACCU methods are legislative instruments that define how projects will generate ACCUs and are made by the responsible minister. The minister can also vary or revoke existing ACCU methods. The minister must receive advice from ERAC before making decisions regarding the ACCU methods. The CER and the responsible department provide ERAC with ACCU method development and administration support.

1.21 A proponent seeking to generate ACCUs must first apply to the CER to register a project. The CER registers a project after assessing the application against the CFI Act and relevant ACCU method. The project then undertakes the carbon abatement activities and provides reports to the CER. Reporting to the CER is designed to demonstrate carbon abatement activities have been undertaken and the resulting abatement has been measured as required by the CFI Act and relevant ACCU method. The CER undertakes a crediting assessment on submitted reports to inform the decision to issue ACCUs.

1.22 The CER is responsible for compliance activities to maintain the credibility and environmental integrity of the ACCU scheme.13 Compliance activities performed by the CER under the CFI Act include assessments such as fit and proper tests and the ACCU issuance process; the use of reporting requirements and auditing powers; administrative actions including the relinquishment of ACCUs or project revocation; enforceable undertakings; and civil and criminal penalties.

1.23 ACCU scheme project proponents can choose to bid into auctions for ACCU scheme carbon abatement contracts. Successful bidders operate their ACCU projects and generate ACCUs which are then purchased by the Australian Government at the auction bid price. Project proponents without carbon abatement contracts may choose to hold the ACCUs or sell them on the private market.

Previous reviews of the Australian Carbon Credit Units scheme

Auditor-General report

1.24 Auditor-General Report No. 14 2016–17 Abatement Crediting and Purchasing under the Emissions Reduction Fund examined the CER’s administration of ACCU project registration, ACCU abatement crediting, and the first two auctions for the Australian Government’s purchase of ACCUs.14 This report concluded the CER established sound arrangements to manage the crediting and selection of carbon abatement for purchase under the Emissions Reduction Fund. Some opportunities for improving ACCU regulatory processes were identified, including one recommendation to improve the documentation of decision-making when assessing ACCU crediting applications.15

Climate Change Authority reviews

1.25 There is a requirement in the CFI Act for the Climate Change Authority to undertake reviews of the operation of the CFI Act and related legislative instruments every three years. These reviews were conducted in 2014, 2017, 2020, and 2023. Each review has made recommendations to the CER and the Australian Government on a range of issues including carbon markets, scheme integrity, governance, risk management and climate resilience.

Australian Government commissioned reviews

1.26 The Report of the Expert Panel examining additional sources of low cost abatement (King Review) was presented in February 2020. Fourteen of its 26 recommendations concerned improvements to the Emissions Reduction Fund in the areas of crediting, method development, and governance. The Australian Government agreed or agreed in principle to all 14 of these recommendations related to the Emissions Reduction Fund.

1.27 The Independent Review of Australian Carbon Credit Units (Chubb Review) presented its final report in December 2022. It made 16 recommendations on scheme governance, transparency, method development, and the revocation of the avoided deforestation method. The Australian Government accepted all recommendations in principle.

Rationale for undertaking the audit

1.28 The Australian Government has identified the ACCU scheme will play a role in Australia achieving its 2030 and 2050 emissions reduction targets.16 This audit provides assurance to Parliament on the CER’s regulatory activities in relation to ACCU issuing and compliance, and contract management activities related to ACCU purchases.

1.29 The Joint Committee of Public Accounts and Audit (JCPAA) identified the Emissions Reduction Fund as an audit priority for 2022–23.

Audit approach

Audit objective, criteria and scope

1.30 The objective of this audit was to assess the effectiveness of the Clean Energy Regulator’s issuing, compliance and contracting activities related to ACCUs.

1.31 To form a conclusion against the objective, the following criteria were used.

- Are ACCUs issued in accordance with legislative requirements?

- Are ACCU compliance activities managed effectively?

- Are ACCU scheme contracts administered effectively?

1.32 This audit did not examine:

- the CER’s administration of other programs, including the Safeguard Mechanism or the Renewable Energy Target;

- the responsible Australian Government departments’ activities related to the CFI Act, other than the analysis of ministerial briefings related to method administration presented in Chapter 217;

- activities related to organisations’ use of ACCUs, such as offsetting emissions or claiming carbon neutrality; or

- the implementation of recommendations arising from the Chubb Review.

Audit methodology

1.33 To address the audit objective, the Australian National Audit Office (ANAO):

- examined the CER’s records of ACCU scheme administration and DCCEEW’s records of ministerial advice on ACCU methods and ERAC matters;

- reviewed samples of decisions to issue ACCUs and a range of contract management activities;

- held meetings with officials from the CER and DCCEEW; and

- considered publicly available material related to the effectiveness of the ACCU scheme and material provided to the ANAO through the audit’s citizens contribution facility.

1.34 The ANAO received one public contribution and met with this contributor.

1.35 The ANAO has cooperative evidence gathering arrangements in operation with entities. On 3 May 2023 at the commencement of audit fieldwork, the CER advised the ANAO that it was unable to provide certain information to the ANAO on a cooperative basis due to legislative restrictions under the CFI Act. On 30 May 2023, the Auditor-General issued the CER with a notice to provide information pursuant to section 32 of the Auditor-General Act 1997. This enabled the CER to provide access to information taking account of legislative requirements. Following receipt of the notice, the CER provided the ANAO with access to relevant information over the course of the audit.

1.36 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $550,000.

1.37 The team members for this audit were Joshua Francis, Marcus Newberry, Lorcan Stevens and Corinne Horton.

2. Issuing Australian Carbon Credit Units

Areas examined

This chapter examines whether the development and approval of Australian Carbon Credit Units (ACCU) methodology determinations (ACCU methods) was consistent with Carbon Credits (Carbon Farming Initiative) Act 2011 (CFI Act) and if the Clean Energy Regulator (CER) has effectively administered the issuance of Australian Carbon Credit Units.18

Conclusion

The development of ACCU methods and the issuing of ACCUs was largely effective. While the CER and responsible departments effectively administered the development of ACCU methods between November 2020 and February 2023, a CFI Act requirement to provide ongoing ministerial updates of interests declared by Emission Reduction Assurance Committee (ERAC) members was not met. The CER has assessed applications for ACCU issuances against the requirements of the CFI Act and ACCU method. Weaknesses in privileged user access controls in the information systems used to administer the ACCU scheme were identified in 2018–19 and the CER’s actions to address these weaknesses are ongoing.

Areas for improvement

The Australian National Audit Office (ANAO) made one recommendation to the Department of Climate Change, Energy, the Environment and Water (DCCEEW) related to notifying the responsible minister of interests declared by ERAC members as required by the Carbon Credits (Carbon Farming Initiative) Act 2011.

The CER can improve controls to address weaknesses in privileged user access identified through ANAO’s annual financial statement audits.

2.1 The CER issues ACCUs under the CFI Act. The rules for undertaking ACCU scheme projects and generating ACCUs are defined by ACCU methods established under the CFI Act. To be issued with ACCUs, project proponents must provide the CER with the evidence defined in the relevant ACCU method to demonstrate the amount of carbon abatement achieved by the project.

2.2 Effective regulation of activities related to the issuing of ACCUs requires:

- ACCU methods to be developed and approved in accordance with the CFI Act; and

- the CER to issue ACCUs in accordance with the CFI Act.

Was the development and approval of methodology determinations consistent with legislative requirements?

The CER and responsible department set up and implemented governance arrangements that supported the development and ministerial approval of ACCU methods in line with legislative requirements between November 2020 and February 2023. Improvements can be made to record keeping associated with ministerial appointments to the Emission Reduction Assurance Committee. Ongoing ministerial updates of interests disclosed by ERAC members did not occur as required under the CFI Act.

2.3 ACCU methods are legislative instruments defining the requirements for projects that generate ACCUs. ACCU methods also specify the evidence project proponents are required to submit to the CER to be issued ACCUs. Methods are published on the Federal Register of Legislation and have the structure summarised in Table 2.1.19

Table 2.1: Structure of ACCU methods legislative instruments

|

Part |

Description |

Summary |

|

1 |

Preliminary |

Method starting date, duration, and definitions. |

|

2 |

Activity description |

Briefly defines type of projects that operate under the method. |

|

3 |

Project requirements |

Project specific requirements, which might include how to demonstrate or document requirements such as project areas, additionality, and crediting periods. |

|

4 |

Net abatement amount |

Defines how the quantity of abatement a project achieves is determined. |

|

5 |

Reporting, record keeping and monitoring |

Defines the offset reporting requirements, record keeping requirements, and monitoring requirements. |

Source: ANAO summary of ACCU methods.

ACCU methods made, varied, and revoked

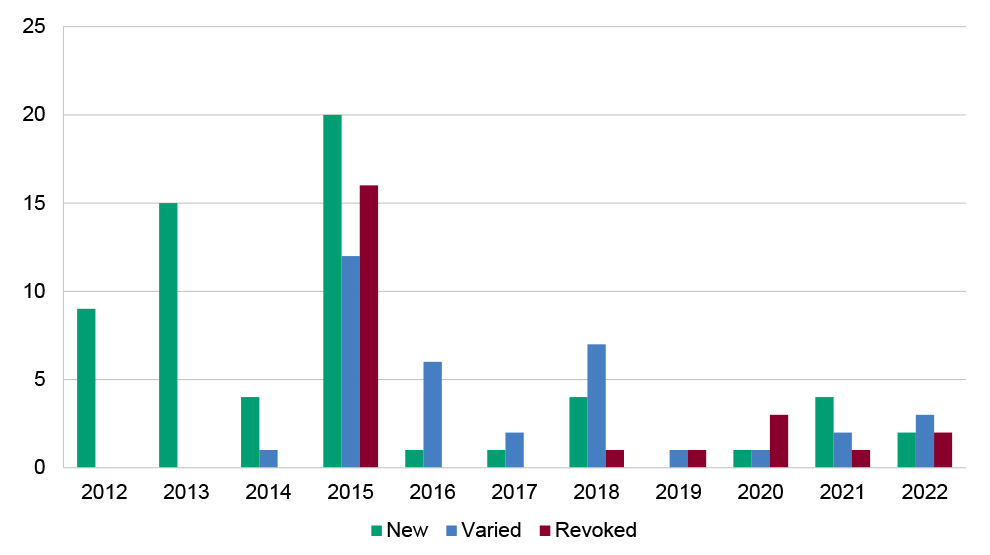

2.4 Between the ACCU scheme’s establishment in 2011 and 2022, the Federal Register of Legislation shows there have been 61 ACCU methods made under the CFI Act, with 35 variations and 24 revocations (Figure 2.1).

Figure 2.1: ACCU methods newly created, varied, or revoked in each year since the start of the ACCU scheme

Source: ANAO analysis of CER records and Federal Register of Legislation.

ACCU methods with projects and issued ACCUs

2.5 At January 2024, 1,769 projects had been registered against 52 ACCU methods. ACCUs have been issued to 633 projects using 36 ACCU methods.20 More detail on the numbers of ACCU methods, project type and the ACCUs issued is presented in Table 2.2.

Table 2.2: Overview of ACCU scheme methods, projects, and ACCUs issued

|

Method group by project activity type |

Active methods |

Registered projects |

Methods with ACCUs issued |

Projects with ACCUs issued |

Total ACCUs issued |

|

Vegetation and sequestrationa |

19 |

863 |

13 |

391 |

77,229,425 |

|

Landfill and waste treatmentsb |

6 |

187 |

6 |

123 |

42,630,564 |

|

Savanna burningc |

6 |

81 |

4 |

64 |

12,921,136 |

|

Energy efficiencyd |

5 |

57 |

3 |

23 |

2,634,140 |

|

Agriculturee |

9 |

553 |

7 |

21 |

2,312,733 |

|

Industrial fugitivesf |

3 |

14 |

2 |

9 |

2,243,599 |

|

Transportg |

2 |

11 |

1 |

2 |

149,139 |

|

Facilities and carbon captureh |

2 |

3 |

0 |

0 |

0 |

|

Total |

52 |

1,769 |

36 |

633 |

140,120,736 |

Note a: Vegetation and sequestration methods include avoided clearing of native regrowth; plantation forestry; native forest from managed regrowth; reforestation and afforestation; reforestation by environmental or Mallee plantings; and tidal restoration of blue carbon ecosystems methods.

Note b: Landfill and waste methods include alternative waste treatment; landfill gas; electricity generation from landfill gas; and source separated organic waste methods.

Note c: Savanna burning methods include savanna fire management emissions avoidance and sequestration and emissions avoidance methods.

Note d: Energy efficiency methods include aggregated small energy users; commercial building energy efficiency; high efficiency commercial appliances; industrial and commercial emissions reduction; industrial efficiency and fuel efficiency; industrial equipment upgrades; and refrigeration and ventilation fans methods.

Note e: Agriculture methods include animal effluent management; beef cattle herd management; soil carbon in soil; soil organic carbon sequestration; irrigated cotton fertiliser efficiency; and beef cattle nitrate feed supplements methods.

Note f: Industrial fugitives methods include coal mine waste gas; and oil and gas fugitives methods.

Note g: Transport methods include aviation, and land and sea transport methods.

Note h: Facilities and carbon capture methods include facilities, and carbon capture and storage methods.

Source: ANAO analysis of CER ACCU project register, 14 January 2024 version.

Legislated process for developing ACCU methods

2.6 The CFI Act provides the responsible minister with the ability to make, vary, or revoke ACCU methods.21 Under the CFI Act, the responsible minister is required to consider advice regarding ACCU methods’ compliance with offsets integrity standards, potential risks, and stakeholder consultations before making a decision related to that method. Before making, varying, or revoking methods the minister must request ERAC provide advice on the proposed new, varied, or revoked method.

2.7 The ERAC is established under the CFI Act and is responsible for providing independent expert advice on ACCU methods to the responsible minister.22 ERAC provides advice regarding the ACCU methods’ compliance with the offsets integrity standards, potential risks and stakeholder consultations before the Minister makes a decision in relation to that method. ERAC is also required by the CFI Act to review ACCU methods to ensure that they remain compliant with the offsets integrity standards. More information on the offsets integrity standards is presented in paragraph 2.16 and Table 2.5.

Governance arrangements

2.8 Between 2011 and 2020, the Australian Government department responsible for climate change matters developed and administered ACCU methods under the CFI Act.23 In November 2020, primary responsibility for ACCU method development and administration was transferred from the Department of Industry, Science, Energy and Resources (DISER) to the CER. In February 2023, these functions were transferred from the CER to the responsible department, now the Department of Climate Change, Energy, the Environment and Water (DCCEEW).

2.9 This report examines the CER’s administration of ACCU methods and provision of ERAC secretariat functions between November 2020 and February 2023, and the responsible department’s support of these activities in its role to provide advice to the relevant minister.24

2.10 When responsibility for administration of ACCU methods moved to the CER in 2020, governance arrangements were documented in a series of proposals agreed to in meetings between the responsible department and the CER. These arrangements outlined the roles of the department and the CER in providing information to the minister to support decision-making on ACCU methods in accordance with the CFI Act. These arrangements are set out in Table 2.3.

Table 2.3: ACCU method decision-making responsibilities between November 2020 to February 2023

|

Function and CFI Act references |

Responsible department roles |

CER roles |

|

When making decision to make, vary, or revoke a method, the minister is required to request advice from ERAC under section 105 of the CFI Act. |

Briefs the minister in support of decision-making related to ACCU methods. Assesses whether abatement is eligible to meet international commitments. |

Provides information to the responsible department to assist it in briefing the minister. |

|

Methods meet offsets integrity standards under paragraphs 106(4)(a) and 114(2)(a) of the CFI Act. |

Briefs the minister on compliance with offsets integrity standards when making ACCU method decisions. |

Provides secretariat functions to ERAC. When requested by ERAC provides evidence, including data analysis and expert advice. Provides ERAC’s advice to the department to assist the department briefing the minister. |

|

Risk assessments related to adverse environmental, economic or social impacts likely to arise under paragraphs 106(4)(c) and 114(2)(c) of the CFI Act. |

Briefs the minister on any adverse environmental, economic, and social impacts. Advises CER of any policy or legal issues with an ACCU method. |

Provides information to the responsible department to assist it in briefing the minister. |

|

Minister must be advised of consultations with stakeholders under section 123D and subsections 255(g) and (hc) of the CFI Act. |

Briefs the minister on stakeholder consultation outcomes when making ACCU method decisions. |

Undertakes stakeholder consultations and provides the responsible department with outcomes of stakeholder consultations. |

|

Publishing of method decisions and ERAC’s advice related to the minister’s decision under subsections 106(11), 114(8), and 123(5) of the CFI Act. |

Publishes on its website proposed method, ERAC’s advice to the minister and non-confidential public submissions. Lodges method legislative instruments with Federal Register of Legislation. |

Provides the responsible department with documents to be published on the department’s website. |

Source: ANAO review of CER records.

2.11 These governance arrangements did not define responsibilities for the appointment of ERAC members and the disclosure of interests by ERAC members.25 These matters are further examined in paragraphs 2.22 to 2.37.

Monitoring and reporting on method development

2.12 The ACCU method administration involves the development of new methods and review of existing methods.26 The responsible minister prioritised the development of five new ACCU methods for 2021 and another five new methods for 2022. These new method development priorities were included in the CER’s method development workplans for these years with proposed delivery dates at the end of these calendar years.

2.13 Method reviews include periodic reviews and crediting period extension reviews. Periodic method reviews assess if a method remains compliant with the offsets integrity standards. Crediting period extension reviews determine whether to extend the crediting period that projects using that method can earn ACCUs.27 Method reviews may result in no change, a variation, or revocation of a method; or in a new method being developed.

2.14 The CER maintained an internal method development tracker that set out progress in ACCU method administration activities including developing new ACCU methods; and reviewing, making variations, and revocations to existing ACCU methods. From February 2021 to December 2022, the CER’s method development tracker followed the progress in ACCU method administration activities of 13 ACCU methods in 2021 and 14 ACCU methods in 2022. A summary of the monitoring and reporting of progress in ACCU method administration tasks during 2021 and 2022 from the CER’s method development tracker is presented in Table 2.4.

Table 2.4: Assessment of CER’s ACCU method development tracker against work plans for 2021 and 2022

|

Activity |

Workplan 2021 |

Completed |

Workplan 2022 |

Completeda |

|

|

Planned |

Implemented |

Planned |

Implemented |

|

New methods |

5 |

5 |

5 |

0b |

|

Variations |

2 |

2 |

2 |

0 |

|

Revocations |

0 |

2c |

1 |

1 |

|

Method reviewsd |

6 |

6e |

6 |

3 |

|

Total |

13 |

15 |

14 |

4 |

Note a: Analysis up to December 2022 ERAC meeting.

Note b: Due date extended to mid-2023 or 2024.

Note c: The two revocations arose from outcomes of method reviews (crediting period extension reviews).

Note d: Includes both periodic reviews and crediting period extension reviews.

Note e: Includes four completed reviews and two reviews that were closed due to all projects under those methods having been revoked.

Source: ANAO review of CER records.

2.15 The CER met the ministerial priorities for the development of new ACCU methods in 2021. In 2022, new method priorities were carried over to the 2023 method development tracker. In January 2024 the CER advised the ANAO that the Chubb Review and Safeguard Mechanism reforms impacted the development of new ACCU methods in 2022.28

Approvals, variations and revocation of methods

2.16 The CFI Act states the responsible minister must not make a methodology determination unless the minister is satisfied that the determination complies with the offsets integrity standards.29 The offsets integrity standards are defined in the CFI Act and are outlined in Table 2.5.

Table 2.5: Offsets integrity standards information provided to the minister

|

Standard |

Element |

|

Additionality |

A method should result in carbon abatement that is unlikely to have occurred had the method activity not been undertaken. |

|

Measurable and verifiable |

A method involving removal, reduction or emissions of greenhouse gases should be measurable and capable of being verified. |

|

Eligible carbon abatement |

A method should provide abatement that is able to be used to meet Australia’s international mitigation obligations. |

|

Evidence-based |

A method should be supported by clear and convincing evidence. |

|

Project emissions |

Greenhouse gas emissions emitted as a direct result of the project should be deducted. |

|

Conservative |

Where a method involves an estimate, projection, or assumption, it should be conservative. |

Source: CFI Act, section 133.

2.17 ERAC is established under the CFI Act. One of ERAC’s roles is to assess the compliance of methods against the offsets integrity standards. The CFI Act requires ERAC’s assessment to be provided to the responsible minister when the minister makes decisions in relation to ACCU methods.

2.18 The CFI Act requires the following information to be provided to the minister before a decision is made to make, vary, or revoke an ACCU method30:

- a draft methodology determination and explanatory statement;

- a hazard assessment report or review identifying any likely adverse work health and safety impacts resulting from method activities;

- a technical assessment report and material prepared for ERAC in response to the report, if a technical assessment is undertaken;

- a summary of stakeholder views and issues raised in consultation process prepared for ERAC, including submissions on adverse social, economic, environmental impacts;

- ERAC advice on whether draft methods meet the offsets integrity standards;

- Australian Government Solicitor or other legal advice on legal compliance; and

- notices of method changes, ERAC advice to minister, and public consultation published on the responsible department’s website.

2.19 The ANAO examined the information provided by the CER and the responsible department that supported all 14 ministerial decisions related to ACCU method approvals, variations, and revocations made between November 2020 and February 2023. The CER and responsible department provided the minister with the information required by the legislation, including:

- the compliance of all 14 ACCU methods with the offsets integrity standards; and

- the other types of information required under the CFI Act as listed in paragraph 2.18.

Consideration of matters raised about ACCU methods

2.20 The Australian Public Service Framework for Engagement and Participation provides best practice guidance for Australian Government entities in their interactions with non-government stakeholders.31 The framework states that engagement with stakeholders involves:

Processes through which public servants and the public interact. These processes seek to unearth and exchange expertise to design, improve and test policy, programs and services. They may also share information with the public about a policy, program or service.

2.21 A group of academics have raised concerns publicly and directly with ERAC about the compliance of some ACCU methods with the offsets integrity standards.32 ERAC’s meeting minutes show that ERAC considered these concerns, including working with the CER and the responsible department to undertake additional analyses. The engagement with stakeholders’ concerns regarding ACCU scheme methods is consistent with the Australian Government framework on engagement and participation. An example of ERAC’s consideration of these concerns in presented in Case study 1.

|

Case study 1. Consideration of concerns with the human induced regeneration ACCU method |

|

Concerns were raised about the human induced regeneration (HIR) ACCU method and whether it continued to meet the offsets integrity standards.a ERAC undertook a range of engagement activities related to these concerns, including:

|

Note a: Carbon Credits (Carbon Farming Initiative) (Human-Induced Regeneration of a Permanent Even-Aged Native Forest—1.1) Methodology Determination 2013. This method was automatically repealed on 1 October 2023 as part of the sunsetting of legislative instruments. No new ACCU projects can be made using this method from this date, while existing projects that have started their crediting period will continue to operate https://cer.gov.au/schemes/australian-carbon-credit-unit-scheme/accu-scheme-methods/closed-methods (see the Vegetation and sequestration methods heading). [accessed 27 February 2024].

Note b: This material was moved to DCCEEW’s website following the transfer of ERAC secretariat functions from CER to DCCEEW and is available from https://www.dcceew.gov.au/climate-change/emissions-reduction/emissions-reduction-fund/assurance-committee [accessed 8 April 2024].

Appointment of ERAC members

2.22 During the period November 2020 and February 2023 when the CER held primary responsibility for ACCU method development and administration, the relevant department was responsible for supporting the responsible minister to make ERAC appointments.33

2.23 Under the CFI Act, ERAC members must be appointed by the minister.34 The CFI Act also specifies requirements relating to the experience of the person to be appointed, maximum period of appointment, and the disclosure of any conflicts of interest to the minister.35

2.24 The ANAO reviewed seven ministerial briefings for 16 appointments and reappointments of ERAC members between April 2020 and March 2023 to assess if these appointments were supported by evidence demonstrating all CFI Act requirements had been met.

2.25 The requirements for appointment to be made by ministerial written instrument and to be less than five years were met for all appointments.36

2.26 A disclosure of appointees’ interests that conflict or could conflict with proper performance of their duties were included with the ministerial briefings for 14 of the 16 appointments.37 The rationales provided by the department for not including disclosures of interest for two of the 16 appointments is inconsistent with the CFI Act. The CFI Act does not include any exceptions to requirements for disclosure of ERAC members interests to the minister.

2.27 Departmental advice on the CFI Act requirement for responsible ministers to be satisfied ERAC appointees have ‘substantial experience or knowledge and significant standing in at least one field of expertise’ relevant to ERAC functions was not presented consistently across seven ministerial briefings for 16 appointments and reappointments as:38

- nine appointments were supported by a departmental assessment that this requirement was met and information such as a curriculum vitae;

- four appointments were supported with information such as a curriculum vitae, but did not include a department assessment this requirement had been met;

- one appointment was supported by a departmental assessment but no information such as a curriculum vitae was included with the briefing; and

- the remaining two appointments were not supported by either a departmental assessment this requirement was met or the inclusion of information such as curriculum vitae in the appointment briefs.

2.28 The records of these ministerial briefings retained by DCCEEW varied in format and often did not present departmental advice clearly against all relevant requirements of the CFI Act. DCCEEW did not have complete records of the ministerial briefings and decisions.39 The issues with record keeping lessen the department’s ability to demonstrate compliance with the CFI Act and that appropriate briefings were provided to ministers.

Disclosures of interest by ERAC members

2.29 The CFI Act requires ERAC members to:

- disclose the nature of any interests related to the matter being considered or about to be considered in a meeting of ERAC40; and

- give written notice to the responsible minister of ‘all interests, pecuniary or otherwise, that the member has or acquires and that conflict or could conflict with the proper performance of the member’s functions’.41

2.30 The CFI Act also specifies actions that must be taken when ERAC members disclose an interest to an ERAC meeting. These actions include the disclosure and related determinations being recorded in the minutes.

2.31 These CFI Act requirements are supported by an ERAC Disclosure of Interest Policy. The policy:

- requires that ERAC members complete a personal interest declaration prior to appointment and highlights a continuing obligation to update this declaration42;

- outlines that ERAC members have an ongoing obligation to inform the ERAC chair and ERAC secretariat when there is a material change in the matters in the personal interest declaration or new disclosures are made; and

- states the ERAC secretariat will notify the minister of declared conflicts of interest as they are identified.

2.32 A disclosure of interests register was maintained by the ERAC secretariat. This register was included in all meeting packs of the 25 scheduled ERAC meetings reviewed by the ANAO. Declarations of interests and decisions on how ERAC would handle the declarations were recorded in ERAC meeting minutes and the disclosure of interests register reviewed by ANAO.

2.33 The responsible minister was not advised of changes in ERAC members’ interests managed through the disclosure of interests register maintained by the ERAC secretariat, except in one instance where a disclosure was included as part of an approval brief for an ACCU method. This failure to advise the responsible minister of the updated declarations was inconsistent with the requirements of section 261 of the CFI Act and the ERAC Disclosure of Interest Policy.

2.34 Advice provided to the ANAO in February 2024 by CER and DCCEEW indicates arrangements for transferring the information from the ERAC secretariat operating within CER to the relevant department responsible for briefing the minister were not established.43 Responsibility for this requirement of the CFI Act was not included in the governance arrangements examined in paragraphs 2.8 to 2.11.44

2.35 DCCEEW advised the ANAO in February 2024 that the department has commenced updating the processes related to ERAC appointments and providing written notice of ERAC members’ declared interests to the responsible minister. As at March 2024 these activities had not yet been completed.

Recommendation no.1

2.36 The Department of Climate Change, Energy, the Environment and Water:

- improves record keeping practices to demonstrate decisions are consistent with legislative requirements; and

- implements procedures for notifying the responsible minister of interests declared by Emission Reduction Assurance Committee members as required by the Carbon Credits (Carbon Farming Initiative) Act 2011.

Department of Climate Change, Energy, the Environment and Water response: Agreed.

2.37 The department is committed to improving its management of information in alignment with legislative requirements as identified in the audit report. The department is implementing an updated process to provide written notice of Emissions Reduction Assurance Committee members’ declared interests to the responsible minister. In addition, the department is implementing an information assets management policy to improve record keeping practices and a program-specific checklist to demonstrate that decisions are consistent with legislative requirements.

Did the Clean Energy Regulator appropriately issue Australian Carbon Credit Units to projects?

Information provided by project proponents is assessed against the requirements of the CFI Act and relevant method prior to ACCUs being issued. The information systems supporting the administration of the ACCU scheme have weaknesses that create a risk that unauthorised or unapproved activities may not be detected in these systems.

2.38 All participants in the ACCU scheme are required to report on their projects by submitting ACCU crediting applications to the CER at regular intervals.45 The CER assesses these crediting applications to determine if ACCUs are to be issued to the project, or if compliance actions are required. The CER’s entity-level risk register identifies the importance of the ACCU crediting process by46:

- including an entity-level risk that ‘participants are issued ACCUs they are not eligible to receive’; and

- identifying the ACCU crediting process as a ‘high-impact, preventative’ control to mitigate the entity-level risk that ‘ACCU scheme administration does not support abatement in in an evolving carbon market’.

2.39 Auditor-General Report No. 14 of 2016–17 Abatement Crediting and Purchasing under the Emissions Reduction Fund (the 2016–17 report) reviewed the CER’s crediting of ACCUs up to October 2015 and found47:

- appropriate arrangements were in place to assess the carbon abatement claims of fund projects against fund method requirements;

- ACCUs credited to projects had been accurately calculated according to fund method requirements and recorded in public registers; and

- improvements could be made to the record keeping to allow the CER to better demonstrate the appropriateness of regulatory decision-making.48

2.40 The ANAO has examined the CER’s ACCU crediting between 2018 and 2023 to assess if the improvements identified in the 2016–17 report have been implemented by the CER, and if the CER continues to appropriately implement ACCU crediting assessments.

Information required to be submitted with ACCU crediting applications

2.41 The CFI Act and the CFI Rule define the information required to be submitted with all applications for ACCUs to be credited to registered projects.49 The relevant method for each project also identifies additional method-specific requirements related to reporting, evidence, and auditing to be included with ACCU issuance applications. Information is submitted in three parts for each ACCU issuance application: a certificate of entitlement application; a project offset report with supporting evidence; and an audit report when required.

Certificate of entitlement application

2.42 The certificate of entitlement application is a web-based form that collects information about the status of the project and amount of abatement claimed. This form requires declarations from the applicant that the project continues to meet legislated requirements to be a registered ACCU project. These declarations include meeting the fit and proper tests; continuing to hold the legal right to undertake the project; compliance with record keeping requirements; and not subject to any requirements to relinquish ACCUs.

Project offsets report and supporting evidence

2.43 The project offset report and supporting evidence outline the project’s abatement achievements over the reporting period. The information required to be presented in the project offset report is set out in the CFI Act and the relevant ACCU method. Depending on the specific ACCU method supporting evidence includes measurement reports, remote sensing data, regulatory approvals, modelling outputs, and evidence of expenses.

Audit reports

2.44 Audit reports must be prepared by an auditor registered under the National Greenhouse and Energy Reporting Regulations 2008. These audit reports are required to provide reasonable assurance the project offset report is prepared in accordance with the relevant sections of the CFI Act and there have been no changes that may lead to revocation of the project. Each project is subject to a minimum of three scheduled audits.50 Additional audits must be submitted with applications claiming more than 100,000 ACCUs.51 Auditing in the ACCU scheme is further examined in paragraphs 3.45 to 3.56.

Assessment of applications to issue ACCUs

2.45 A summary of how the CER assesses ACCU crediting applications and an overview of the ANAO’s analysis of these assessments is presented in Table 2.6. To assess the appropriateness of the CER’s issuance of ACCUs between 2018 and 2023, the ANAO completed two sample-based reviews of 283 crediting applications:

- a process review of 257 approved ACCU crediting applications to provide assurance that five steps of the ACCU crediting assessment were completed52; and

- a crediting assessment review of 26 approved crediting applications and the supporting evidence to provide assurance that the CER’s assessments and approvals of ACCU credit applications were appropriate when compared to the information and evidence submitted with the crediting application.53

Table 2.6: ANAO analysis of CER ACCU crediting assessments

|

Summary of the CER’s assessment of ACCU crediting applications |

ANAO analysis of CER implementation of ACCU crediting assessments |

|

|

Application submission and determination of assessment type

|

◆ |

|

|

Crediting Application Assessment

|

◆ |

|

|

Finalise and issuing ACCUs

|

◆ |

|

Key: ◆ Appropriately implemented ▲ Some issues with implementation ■ Not implemented.

Source: ANAO analysis.

Addressing documentation recommendation from the 2016–17 report

2.46 The CER has addressed recommendation 1 from the 2016–17 report related to improving the level of documentation underpinning some areas of regulatory decision-making. In November 2017, the CER considered this recommendation implemented after incorporating the risk review of each application into an information system workflow.54

2.47 For the 26 crediting applications approved between 2018 and 2023 examined in the ANAO’s crediting assessment review:

- all had documented risk assessments retained on each application’s record that identified the basis for a routine or detailed crediting assessment; and

- assessment and decisions for both routine and detailed assessments were documented in the same format, and all relevant abatement crediting assessment criteria had been addressed.55

Review of crediting application assessments

2.48 The CER documents the analysis, review, and decision of ACCU issuance applications using crediting assessment tools. Each specific ACCU method has a credit assessment tool designed to capture the specific requirements of the method. The 26 crediting assessments reviewed by the ANAO used seven different ACCU method specific crediting assessment tools.56

2.49 In all 26 applications in the ANAO’s crediting assessment review, the CER had assessed the application met the CFI Act and Rule requirements relevant to ACCU crediting applications, including:

- the requirements for the format of the application and the information to be provided with the application have been met57; and

- the matters required to be covered by the assessor’s recommendation and the approver’s decision.58

2.50 The CER’s crediting assessment also includes method specific assessments that support the decision to issue ACCUs. These method specific assessments were completed for all 26 crediting assessments reviewed in detail by the ANAO. The CER’s assessment was consistent with the evidence supplied by the project proponent. An example of method specific assessments applied to ACCU crediting applications for human induced regeneration (HIR) projects is presented in Case study 2.

|

Case study 2. ACCU crediting assessment for human induced regeneration (HIR) projects |

|

The nine crediting assessment tools related to human induced regeneration (HIR) projects reviewed by the ANAO documented the CER’s HIR method specific assessment activities. These HIR specific crediting assessments involved:

|

2.51 In all 26 applications included in the ANAO’s crediting assessment review, the CER had documented each project’s compliance with the relevant ACCU method’s audit requirements. The CER’s crediting of ACCUs in these 26 applications was supported by the assurance opinions. The CER’s use of audits to support compliance with the CFI Act is further examined in paragraphs 3.45 to 3.56.

Information systems supporting the issuance of Australian Carbon Credit Units

2.52 The ACCU issuance process occurs through the CER’s information systems. These information systems are built on a customer relationship management (CRM) software platform that includes59:

- a client portal where project proponents submit their crediting application and supporting evidence;

- a series of internal workflows, databases and an electronic record management system that support and document the CER’s assessment and decisions related to ACCU crediting applications; and

- the Australian National Registry of Emissions Units (ANREU) system that supports the issuance, holding, transfer, and acquisition of ACCUs.

2.53 In 2018–19, the ANAO identified weaknesses in user management controls in both the CRM and ANREU.60 These were raised as audit findings through the financial statements audit process. These weaknesses related to the monitoring of users with privileged access such as administrator roles. An appropriate user control environment manages the risk of privileged users undertaking inappropriate or unauthorised actions through independent review and verification of the activities of these users.61

2.54 In the ANAO’s 2021–22 financial statements audit, the ANAO identified additional weaknesses and made further audit findings.62

- Weaknesses in change management controls for CRM. These weaknesses related to segregation of duties, documentation and approval of changes made in the production environment of the CRM.

- Further weaknesses in user management access controls for ANREU and CRM as privileged user monitoring controls had not been implemented or relied on information that could have been modified by privileged users reducing the effectiveness of these controls.

2.55 The CER implemented a series of actions to improve the control environment for the CRM and ANREU between 2018–19 and 2022–23.

- Reducing the number of users with ANREU administrator access by 75 per cent in February 2020.

- Implemented privileged identity management processes including alerts, emails, and independent reviews in 2020–21. These resolved the 2018–19 finding in relation to ANREU and improved the control environment for the CRM.

- Undertaking work in 2023 to address the weaknesses identified in 2021–22. At August 2023, the ANAO’s assessment is that CER’s control environment for the CRM and ANREU is not yet fully effective for detecting unauthorised changes.

2.56 There remains a risk that unauthorised or unapproved activities occur in these systems and these activities are not detected in a timely manner.63 The ANAO will review CER’s progress in addressing these audit findings as part of the 2023–24 financial statements audit.

Changes to the crediting assessment process

2.57 In late 2022, the CER commenced a project to transition the crediting assessment tool from a spreadsheet template to integrated workflows in the CER’s information systems. The CER intends the transition to integrated workflows to improve the efficiency of its assessments and increase data analytics capabilities. At the time of the ANAO’s fieldwork for this performance audit, the transition had recently commenced and the ANAO has not tested the effectiveness of this new approach.

3. Compliance

Areas examined

This chapter examines whether the Clean Energy Regulator (CER) has implemented an effective compliance approach for the Australian Carbon Credit Unit (ACCU) scheme under the Carbon Credits (Carbon Farming Initiative) Act 2011 (CFI Act).

Conclusion

The CER has implemented an effective approach to ACCU scheme compliance activities. The CER has established and implemented a compliance framework that incorporates the range of regulatory powers provided under the CFI Act. The framework aligns with the guidance and principles outlined in the Australian Government’s Resource Management Guide for Regulatory Performance. This includes maintaining and publishing a compliance and enforcement strategy and providing guidance and information to help regulated entities understand their obligations and responsibilities. The CER is implementing ACCU scheme compliance activities. The CER monitors and reports on its performance related to ACCU scheme compliance.

Areas for improvement

The Australian National Audit Office (ANAO) identified six opportunities for the CER to further improve monitoring and reporting related to ACCU scheme compliance.

3.1 The CFI Act’s explanatory memorandum states that effective enforcement arrangements are ‘vital to the credibility of the [ACCU] scheme’ and non-compliance could bring the scheme into disrepute.64

3.2 To assess if the CER has implemented an effective approach to ACCU compliance activities, the ANAO examined if the CER:

- established an appropriate compliance framework for the ACCU scheme;

- implemented ACCU scheme compliance activities; and

- is monitoring and reporting on ACCU scheme compliance.

Has the Clean Energy Regulator established an appropriate framework for Australian Carbon Credit Unit compliance activities?

The CER’s compliance framework for the ACCU scheme includes oversight committees, risk management activities, policies, procedures and guidance material. The CER’s compliance policy outlines the compliance activities the CER targets at different types of non-compliance. An ACCU scheme compliance plan, external guidance material, and internal procedures guide how the CER will implement compliance activities. Four risks related to ACCU scheme compliance are monitored through the CER’s entity-level risk management framework.

3.3 The CFI Act provides the CER with a range of compliance powers related to the ACCU scheme. These compliance powers are outlined in Appendix 3 and include:

- assessments such as fit and proper tests and the ACCU issuance process;

- reporting requirements and auditing powers;

- administrative actions including the relinquishment of ACCUs or project revocation;

- enforceable undertakings; and

- civil and criminal penalties.

Business units and executive committees

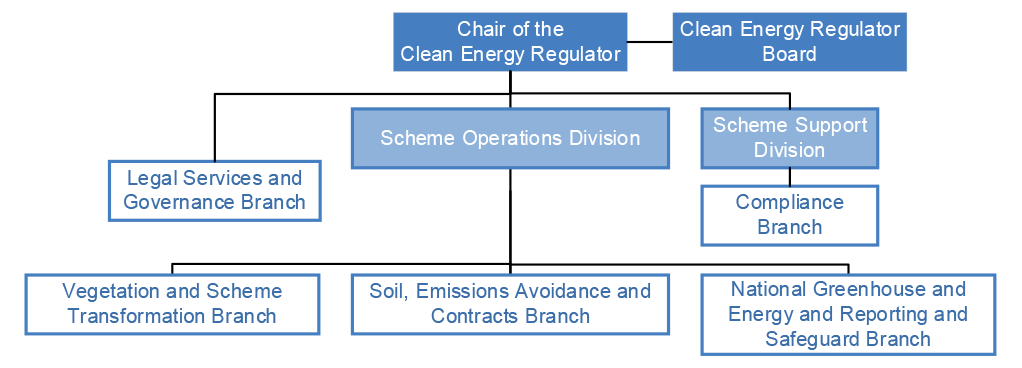

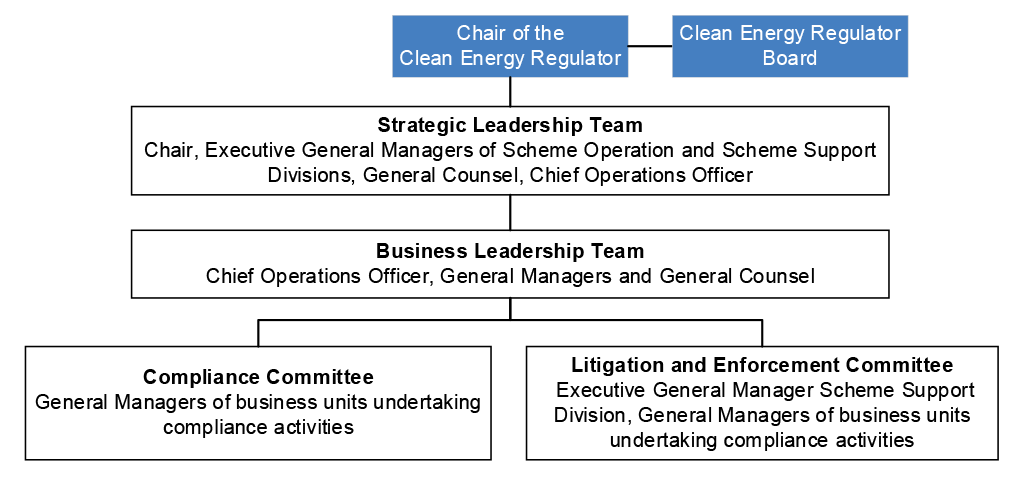

3.4 Business units in the Scheme Operations Division are responsible for administering the ACCU scheme, including delivering a range of compliance activities. The Legal Services and Governance Branch and the Compliance Branch perform legal and compliance related functions across all schemes administered by the CER, including the ACCU scheme. Figure 3.1 presents an overview of the CER’s business units involved in ACCU scheme compliance.

Figure 3.1: Business units involved with ACCU scheme compliance

Source: ANAO presentation of CER material.

3.5 The Strategic Leadership Team and Business Leadership Team are senior executive level committees with oversight roles across all the CER’s operations, including compliance activities. The Compliance Committee and the Litigation and Enforcement Committee are subcommittees of the Business Leadership Team that are focused on compliance matters. The Compliance Committee was established in April 2016. The Litigation and Enforcement Committee was established in September 2018.65 An overview of the executive committees related to ACCU scheme compliance is presented in Figure 3.2.

Figure 3.2: Executive committees involved with ACCU scheme compliance

Source: ANAO presentation of CER material.

Compliance Committee

3.6 The Compliance Committee’s terms of reference states that the committee ‘will establish a program of work that reflects the priorities of business areas and program implementation responsibilities.’ While Compliance Committee records demonstrate planning for upcoming committee activities, a documented program of work was not developed by the Compliance Committee.

3.7 The terms of reference also outline the Compliance Committee is to provide seven types of strategic advice and support to the CER’s program areas. The ANAO reviewed the minutes of all 13 Compliance Committee meetings held between July 2021 and July 2023. The Compliance Committee is meeting its terms of reference in relation to two of these seven activities:

- ‘discussing and addressing existing and emerging patterns and trends of non-compliance within and across programs as well as with other Commonwealth legislation’; and

- ‘promoting partnering and collaboration with other regulatory agencies for mutual benefit and better compliance outcomes’.

3.8 The Compliance Committee is not fully delivering on five of the seven activities outlined in its terms of reference. While Compliance Committee records demonstrate the committee noted papers across these five activities, the committee itself did not undertake the actions described in the terms of reference. As illustrated in Case study 3, ‘noting’ papers on these matters was not considered to demonstrate that the committee has delivered the specific actions described in its terms of reference.

|

Case study 3. Compliance committee |

|

The Compliance Committee’s terms of reference include the activity ‘Monitoring and evaluating implementation of agency compliance strategies, policies and procedures and testing for consistency with the agency’s risk appetite.’ Meeting minutes demonstrate that the Compliance Committee received regular updates on compliance strategies, policies, and procedures. Compliance Committee records do not demonstrate how the Compliance Committee evaluated implementation, or tested if strategies, policies, and procedures were consistent with the CER’s risk appetite. |

3.9 The CER provided ANAO with evidence of how these five activities were implemented by the CER’s business units, rather than the Compliance Committee. For example:

- business units undertaking quarterly assessments that compliance strategies, policies and procedures are consistent with the agency’s risk appetite, and this quarterly assessment presented to the CER board;

- strategic directions for scheme compliance plans being set through the development of the CER’s corporate documents including the corporate plan, annual report, compliance and enforcement priorities, divisional and branch business plans; and

- the Legal Services and Governance Branch maintaining a list of proposed legislative amendments and progressing these amendments with the responsible department.

3.10 In December 2023, the CER advised the ANAO that the Compliance Committee’s terms of reference are due for review in early 2024. The activities described in the Compliance Committee’s terms of reference create an expectation the committee is responsible for delivering these activities, rather than the business units.

|

Opportunity for improvement |

|

3.11 The CER revises the Compliance Committee’s terms of reference to clearly identify the activities the committee delivers and the matters the committee discusses or notes. |

Litigation and Enforcement Committee

3.12 The Litigation and Enforcement Committee’s terms of reference states that this committee:

- is focussed on addressing non-compliance and generally deals with individual cases of non-compliance; and

- ensures that compliance cases are conducted ‘in a timely, professional manner and according to relevant legal and policy requirements … and internal KPIs’.

3.13 The Litigation and Enforcement Committee papers for 21 meetings held between July 2020 and May 2023 included:

- reporting against investigative key performance indicators including numbers of investigations opened and closed, age of active investigations and cases on hold;

- status updates of active enforceable undertakings and rectification agreements;

- advice on investigations opened and closed since the last meeting; and

- updates on current cases.

3.14 Between July 2020 and May 2023, the Litigation and Enforcement Committee dealt with one compliance case related to the ACCU scheme. Information on the progress of this case was presented to 14 Litigation and Enforcement Committee meetings, including as a specific agenda item in five of these meetings. More information on this case is presented in paragraph 3.61.

3.15 Almost all of the compliance cases considered by the Litigation and Enforcement Committee between July 2020 and May 2023 related to the Small-scale Renewable Energy Scheme (SRES), rather than the ACCU scheme. In December 2023, the CER advised the ANAO that this is to be expected as the SRES scheme’s high transaction volumes and upfront incentives lead to greater numbers of non-compliance cases that fall into the scope of the Litigation and Enforcement Committee.

Compliance policies, plans, procedures and guidance

3.16 Framework documents such as policies, plans, internal procedures, and external guidance help ensure compliance activities achieve the intended outcomes. The CER has both an entity-level compliance policy and an ACCU scheme-specific compliance plan. These documents are supported by internal procedures and external guidance material published on the CER’s website.

CER compliance policy

3.17 The CER has a publicly available Compliance policy for education, monitoring and enforcement activities (CER compliance policy).66 The CER compliance policy ‘outlines [the CER’s] approach to particular aspects of compliance activities under the schemes [it] administer[s]…’. The CER’s compliance policy describes the responsibilities of:

- scheme participants, which includes the responsibility for complying with relevant requirements under the schemes administered by the CER; and

- the CER in relation to scheme compliance, which include:

- explaining how schemes work and what participants can do to comply with scheme requirements;

- monitoring compliance;

- facilitating and enforcing compliance with each scheme;

- collecting, analysing, providing, and publishing information and data; and

- accrediting auditors and inspectors for the schemes the CER administers.

3.18 The CER’s compliance policy includes a response continuum for non-compliance issues. This response continuum describes the compliance activities the CER targets towards different compliance attitudes and types of non-compliance across the schemes it administers. These participant attitudes and CER’s responses are summarised in Table 3.1.

Table 3.1: Clean Energy Regulator response continuum to non-compliance

|

Participant’s attitudes and behaviours |

Clean Energy Regulator’s response |

|

Voluntary compliance — committed to doing the right thing.

|

Help and support

|

|

Accidental non-compliance — trying to do the right thing, but not always succeeding.

|

Inform and advise

|

|

Opportunistic non-compliance — do not want to comply but will if made to.

|

Correct behaviour

|

|

Intentional non-compliance — decision to be non-compliant.

|

Enforce

|

Source: Adapted from CER’s Compliance policy for education, monitoring and enforcement activities.

3.19 The CER’s implementation of the compliance responses described in Table 3.1 for the ACCU scheme are examined in paragraphs 3.33 to 3.71.