Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Interpretative Assistance for Self Managed Superannuation Funds

The objective of the audit was to assess the effectiveness of the ATO's management of its interpretative assistance activities for SMSFs.

Summary

Introduction

Superannuation and self managed superannuation funds

1. Superannuation is a long-term vehicle for building retirement savings and is a key element of the Government’s policies to address the financial independence of Australia’s ageing population. In 2009–10, superannuation was the largest financial asset of Australian households. Three-quarters of all households had some superannuation assets, averaging $154 000 per household.1 Over the period from June 1999 to June 2011, total nationwide superannuation assets grew from $411 billion to $1340 billion.2 By 2035, Australians are projected to have increased their collective superannuation savings to $6100 billion.3

2. Superannuation funds are broadly categorised under the Superannuation Industry (Supervision) Act 1993 (SIS Act) into large funds, regulated by the Australian Prudential Regulation Authority (APRA) and self managed superannuation funds (SMSFs), which are regulated by the Australian Taxation Office (ATO). APRA-regulated funds usually involve a large number of members who pool contributions together. The capital created is professionally managed by trustees in compliance with superannuation law. Members may have a choice about the levels of risk they accept in their managed investments, but little or no influence over the specific investment strategies. In contrast, SMSFs must have fewer than five members who are also trustees. SMSF trustees decide on the investment strategies for their funds and are responsible for the compliance of the funds with the SIS Act and Regulations.

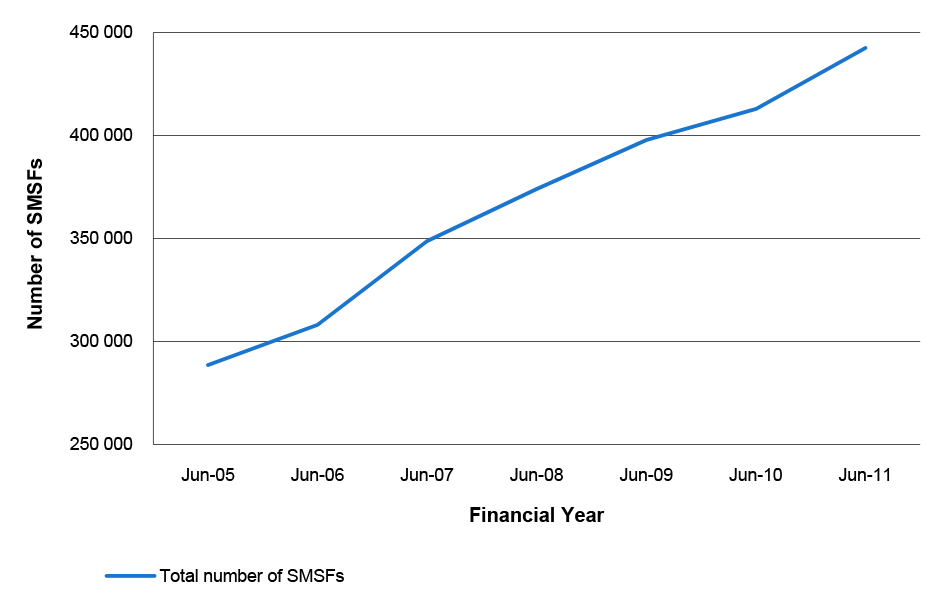

3. The SMSF sector is the largest superannuation sector by number of funds, and in 2011 held 30 per cent of all superannuation assets ($407.6 billion). Ninety-nine per cent of all superannuation funds were SMSFs. As at June 2011, there were 442 528 SMSFs, with 841 283 members.4 The SMSF sector has been growing rapidly (Figure 1). Since 2004–05, the number of SMSFs has increased by 64 per cent. During 2010–11, 32 875 new funds were registered, compared to 29 578 in the previous financial year.5

Figure 1 Growth in total number of SMSFs, June 2005 to June 2011

Source: Source: ANAO analysis of ATO, Self Managed Super Funds Statistical Report – December 2011.

4. The value of the SMSF sector has also been growing rapidly in recent years, increasing from $162 billion to $407.6 billion (estimated total assets) in the six years to June 2011, an average growth rate of 19 per cent. Comparatively, the average growth rate of APRA-regulated funds was 10 per cent.6

5. SMSF trustees are on average older, earn a higher income and have larger superannuation balances.7 For these people the level of personal control over the investment strategies, and a perception that management fees are lower than those of APRA-regulated funds, are among the key factors making SMSFs an attractive retirement savings vehicle. However, SMSF trustees also assume a number of specific risks, including having sole responsibility for meeting all legal obligations in relation to the compliance of their fund. While some trustees may decide to rely on advisers (such as financial or tax advisers) to help them with their investment decisions and with the management of their fund, they remain personally accountable for the compliance of their decisions with the SIS Act and Regulations. Significant penalties apply for non-compliance, which can include disqualification as a trustee, heavy financial penalties, prosecution and imprisonment.

Interpretative assistance for SMSFs

6. The ATO considers interpretative assistance to be a core part of the Commissioner’s role as the regulator of SMSFs.8 Interpretative assistance provides the Commissioner’s opinion on the application of taxation and superannuation law. The provision of interpretative assistance is a cornerstone of the ATO’s self-assessment and compliance regime and its importance is recognised in the ATO Taxpayers’ Charter which states that the ATO:

… aim[s] to provide accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.9

7. Since 2000 and following the identification of a knowledge deficiency among SMSF trustees in relation to their obligations, the ATO has considered that the provision of a range of education products would be the most effective way of improving trustees’ knowledge, understanding and compliance with their obligations under the SIS Act and Regulations.10

8. Since 200911, the ATO has defined SMSF interpretative assistance as comprising the following key products12:

- SMSF public rulings, determinations and product rulings: these are published statements of the Commissioner's opinion of how a provision of the SIS Act or Regulations applies, or would apply, to SMSFs generally, rather than in respect of the specific circumstances of a particular SMSF.

- Specific advice and written guidance13: These apply to specific transactions or arrangements that have been or might be entered into by the trustees of a SMSF. Whilst specific advice provides detailed information relating to a particular situation, written guidance delivers general assistance that cannot cover all individual circumstances of the recipient.

- SMSF publications, which include brochures and ATO website material.

9. The volume of SMSF interpretative assistance products delivered is small compared with the interpretative assistance products delivered on tax matters. For instance, the ATO has delivered nine SMSF public rulings since 2007–08, whereas it has delivered 32 tax public rulings. About 400 SMSF specific advice products were produced in 2009–10 and 2010–11, compared with approximately 18 000 tax private rulings.14

10. While the ATO provides interpretative assistance on the application of taxation and superannuation law, there is a substantive difference between the two types: a large proportion of taxation advice is legally or administratively binding on the Commissioner, and as such, provides the highest level of protection for taxpayers who rely on it.15 This means that if the taxation advice given by the ATO is incorrect and the taxpayer makes a mistake as a result, they are protected from paying tax that would otherwise be payable under the law and also from false and misleading statement penalties or interest charges.

11. By contrast, SMSF advice is not legally or administratively binding on the Commissioner and a trustee that relies on SMSF advice remains responsible for their action under SIS Act and Regulations. However, the ATO states that the fact that the trustee acted in accordance with that advice would be considered a relevant factor in their favour in the Commissioner’s exercise of any discretion as to what action would be taken in response to a breach of the law.16

Audit objective and criteria

12. The objective of the audit was to assess the effectiveness of the ATO’s management of its interpretative assistance activities for SMSFs.

13. The audit assessed whether:

- the ATO’s current interpretative assistance framework takes adequate account of the various aspects of quality;

- trustees and other SMSF stakeholders are satisfied that the ATO’s interpretative assistance processes meet their needs and that they have appropriate means of contributing to and providing feedback on interpretative assistance products and services; and

- information provided by the ATO in relation to SMSF interpretative assistance is readily accessible to trustees and other SMSF stakeholders.

Overall conclusion

14. The self managed superannuation fund (SMSF) sector has been growing rapidly in recent years, with the value of SMSF assets increasing by 19 per cent per year in the six years to June 2011. This sector was, at June 2011, the largest superannuation sector by number of funds and held 30 per cent of all superannuation assets. While SMSFs provide individuals with a higher degree of control over their investment strategy, trustees also assume sole responsibility for their financial security in retirement and for the compliance of their funds with the SIS Act and regulations. The provision of interpretative assistance to improve SMSF trustees’ knowledge, understanding and compliance with their legal obligations is an important part of the Commissioner’s role as the regulator of SMSFs.

15. Since December 2007, when the first SMSF determination was released, the ATO has produced nine public rulings and six determinations. In 2009–10 and 2010–11, the ATO has also produced 386 specific advice and 776 written guidance products. These numbers are small compared with the volume of interpretative assistance products delivered on tax matters and with the number of SMSFs.

16. Overall, the ATO’s management of SMSF interpretative assistance is effective and uses many of the elements which support the delivery of interpretative assistance in relation to taxation law. The ATO has implemented sound processes for the development of SMSF interpretative assistance products. Nevertheless, one area requiring a stronger focus is the timeliness of delivery, which has been inconsistent over time; fewer than half of the SMSF public rulings and determinations have been delivered within the ATO’s standard timeframe17 since 2008. There would also be value in the ATO assessing the extent to which interpretative assistance products meet the expectations of the SMSF market. In this regard, accessing information on SMSF matters and on interpretative assistance is difficult, and could be impacting negatively on the level of demand for interpretative assistance products, in particular originating from trustees.

17. The ATO has in place a suite of arrangements to engage key SMSF stakeholders in the development of interpretative assistance. These arrangements ensure that the role of other government agencies (Treasury, APRA and ASIC) in the administration of SMSFs is recognised. The ATO also effectively engages industry groups (representing professionals supporting the SMSF market) in the process of developing interpretative assistance. There would be benefit in the ATO considering ways to increase the direct engagement of trustees, through the further involvement of organisations representing SMSF trustees in the consultation process.

18. A quality assurance process (the Integrated Quality Framework, IQF) has been used across the ATO since 2009 and is applied to SMSF specific advice and written guidance products. The IQF provides a valuable perspective on the quality of these products. The timeliness of interpretative assistance was an issue in 2009–10 and 2010–11, with a significant proportion of interpretative assistance products not being delivered within the ATO’s applicable timeframes. The ATO has established a range of measures, including the Transforming Tax Technical Decision Making (T3DM) project, which should assist in timelines being more consistently met. Given the potential implications for trustees of having to wait for long periods of time for the ATO’s decisions, the timeframe to produce SMSF public rulings (16 months as a general rule) could be reconsidered, to match that of taxation public rulings (12 months).

19. Although the model for delivery of SMSF interpretative assistance closely mirrors the model used for taxation matters, a substantive difference between the two is the level of protection that trustees can expect. Unlike tax interpretative assistance, SMSF assistance is not legally or administratively binding on the Commissioner. This difference may not be apparent to all trustees, and it is not certain that trustees fully understand the legal weight of SMSF interpretative assistance.

20. The ATO has been delivering SMSF interpretative assistance in its current form since 2009. An assessment of the extent to which these products meet the expectations of the market would be timely. In particular, such an assessment could confirm to the ATO that interpretative assistance products are appropriate to the market’s requirements and circumstances, and that trustees understand the level of legal reliance that can be given to SMSF interpretative assistance.

21. The ATO provides access to a wide range of information and interpretative assistance products to the SMSF market. Most of these products are posted on the ATO website, which is an essential gateway. Navigating through this information, however, is difficult, which may impact on the useability of the information, especially by non-professionals. Improving access to the ATO information about SMSFs and about interpretative assistance products may, in turn, increase the level of demand for these products. In this way the ATO could further support SMSF trustees who wish to be ‘genuinely self-directed and self-sufficient’.18

22. To support the ATO’s efforts to make ongoing improvements to the delivery of interpretative assistance to SMSFs, the ANAO has made two recommendations. These recommendations concern the ATO assessing the extent to which interpretative assistance products meet the expectations of the SMSF market, and improving access to SMSF information and interpretative assistance products.

Key findings by chapter

Developing SMSF interpretative assistance (Chapter 2)

23. While the ATO is the regulator for SMSFs under the SIS Act and Regulations, other government agencies also have a role in the administration of this legislation. A suite of arrangements are in place for the ATO to engage Treasury, APRA and ASIC in the administration of interpretative assistance for SMSFs. These arrangements address the risks of inconsistency and inefficiencies that may occur in matters that involve cross-agency partnerships, and support the effective development of interpretative assistance for SMSFs.

24. Two key consultative committees are engaged in the development of SMSF public rulings and determinations: the National Tax Liaison Group–Superannuation Technical Subgroup (NTLG–STSG) and the Superannuation Consultative Committee (SCC). These two forums, in particular the NTLG–STSG, provide industry with an opportunity to directly and effectively participate in the development of the ATO’s precedential views. From the ATO’s perspective, the committees represent a conduit to gather intelligence and marshal industry expertise to assist in developing the ATO’s understanding of the significance and implications of issues affecting the industry. Membership to the two committees primarily includes professional organisations. Groups directly representing SMSF trustees do not have a strong representation at these committees. The ATO should continue to monitor the emergence of groups representing SMSF trustees and consider further including these groups in the consultative committees.

25. Since 2009, the ATO has used a quality assurance process (the Integrated Quality Framework, IQF) for written interpretative decision-making, which aims to continuously improve and assure the quality of specific advice and written guidance. Overall, the IQF results for specific advice and written guidance products and for 2009¬–10 and 2010–11 indicated a generally high level of performance against all the criteria measuring quality. The criteria that did not rate as well were appropriateness, administrative soundness and timeliness.

26. The impact of having to wait excessively for the ATO’s advice can be significant for trustees and their representatives; trustees may miss market opportunities or take financial decisions before advice is received and a lack of certainty can affect industry members’ ability to advise their clients. In this context, the ATO’s timeliness performance in delivering SMSF interpretative assistance products has not been consistent over time. Since 2008, fewer than half of the public rulings and determinations have been delivered within the ATO’s standard timeframe. In 2009–10, just 67 per cent of specific advice and 53 per cent of written guidance products were delivered within the specified 28-day timeframe.

27. The ATO does not conduct research specifically aimed at assessing the satisfaction of trustees and their representatives with SMSF interpretative advice products. Research on satisfaction with information and advice conducted by the ATO among tax agents indicates that just 59 per cent of respondents are satisfied or very satisfied. SMSF industry representatives also indicated that, while the advice and information provided by the ATO were considered valuable overall to professional advisers, they could be too technical and legalistic, narrowly focused and impractical for trustees.

Access to SMSF information and interpretative assistance (Chapter 3)

28. SMSF trustees are typically tertiary educated and are characterised by a desire to control their superannuation investment choices. A significant proportion of trustees choose to engage a professional adviser to help them set up and manage their fund. However, even in this case, trustees remain solely accountable for the decisions made and for the compliance of the fund with the SIS Act and Regulations. Consequently, it is important that the ATO, in order to effectively fulfil its role as SMSF regulator and to achieve high levels of voluntary compliance among trustees, ensures that trustees are able to access easily SMSF information and interpretative assistance products.

29. The ATO has a wide collection of material and information services available to trustees through a range of channels. However, access to this material is not straightforward:

- information on the website is not organised, overall, in a logical or practical manner;

- access to the ‘Life Cycle’ brochures and the superannuation call centre, which are expected to provide general information on SMSFs, is difficult because information about these two sources is not in a prominent location in the website;

- while the newsletter SMSF News is aimed primarily at trustees, its distribution list is minimal compared with the number of SMSFs and SMSFs trustees (the reasons for this low distribution are not clear); and

- information about the availability of specific advice and written guidance, which are the only services providing personal and circumstance-specific information, is not clearly advertised in ATO’s publications and website.

30. In a context where the subject matter (SMSFs) is complex and where decisions relating to SMSFs may have significant consequences for trustees, access to information and interpretative assistance is not as easy or practical as it could be. This does limit the extent to which this information and interpretative assistance products are useful to trustees and, in turn, the level of demand for SMSF interpretative assistance products. Improving trustees’ direct access to SMSF interpretative assistance could also reduce their dependence on professionals to administer their SMSF.

Summary of agency response

31. The ATO provided the following response to the audit report:

The ATO welcomes this review and believes the report generally reflects positively on our overall administration of interpretative assistance for self managed superannuation funds (SMSFs). We have worked to progressively improve the assistance provided to trustees and their advisers through targeted products and services that have been well received in the industry.

The ATO agrees with the recommendations you made in the report and we undertake to initiate the necessary action to implement our responses to them, as outlined in the attachment.

The ATO’s full comments are included at Appendix 1 of the report.

Footnotes

[1] Australian Bureau of Statistics, Household Wealth and Wealth Distribution 2009–10, 2011, p. 4.

[2] Attorney’s-General Department, Super System Review Final Report, Part One - Overview and Recommendations, 2010 p. 61 and Australian Prudential Regulation Authority, Statistics – Annual Superannuation Bulletin, June 2011 (issued 29 February 2012), p. 4.

[3] Attorney’s-General Department, ibid. p. 5, based on superannuation policy settings in force in June 2010.

[4] Australian Prudential Regulation Authority, Statistics – Annual Superannuation Bulletin, June 2011 (issued 29 February 2012), pp. 4 and 26.

[5] Australian Taxation Office, Self Managed Super Funds Statistical Report – Dec. 2011, Available from <http://www.ato.gov.au/superfunds/content.aspx?menuid=0&doc=/content/00309172.htm&page=6&H6> [accessed 29 March 2012]

[6] Australian Prudential Regulation Authority, op. cit., p. 30.

[7] Attorney’s-General Department, Super System Review Final Report, op. cit, p. 218.

[8] Australian Taxation Office, Practice Statement Law Administration 2009/5 – Provision of Advice and Guidance by the ATO in relation to the application of the Superannuation Industry (Supervision)

Act 1993 and the Superannuation Industry (Supervision) Regulation 1994 to Self Managed Superannuation Funds, 2009.

[9] Australian Taxation Office, Taxpayers’ Charter: What you need to know, June 2010, p. 9. Available from <http://www.ato.gov.au/content/downloads/cor63133_n2548.pdf> [accessed 15 February 2012].

[10] Australian Taxation Office, Practice Statement Law Administration 2009/5, op. cit., p. 9.

[11] Before 2009, specific advice and written guidance were not defined SMSF advice products. These types of advice were delivered under the form of ‘written correspondence’.

[12] Australian Taxation Office, Practice Statement Law Administration 2009/5, ibid.

[13] Oral guidance, although it exists as a form of SMSF interpretative advice in ATO’s documentation, is not currently implemented. Customers are able to contact a call centre where they can access general information about SMSFs, however the ATO advised that any specific request should be made in writing.

[14] Private rulings are comparable to SMSF specific advices in all but two key aspects: Tax private rulings are legally binding on the Commissioner, and they are published on the ATO website, in a de-identified form.

[15] Australian Taxation Office, Practice Statement Law Administration 2008/3 – Provision of Advice and Guidance by the ATO, 2008, p. 3.

[16] Australian Taxation Office, Practice Statement Law Administration 2009/5, op. cit., p. 22.

[17] The standard timeframe is the timeframe the ATO applies as a general rule to the delivery of rulings and determinations. There are no service standards for these products.

[18] Attorney’s-General Department, op. cit., p. 219.