Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Implementation of Parliamentary Committee and Auditor-General Recommendations — Indigenous Affairs Portfolio

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Parliamentary committee and Auditor-General reports identify risks to the successful delivery of government outcomes and provide recommendations to address them.

- The ANAO undertakes audits examining entities’ implementation of recommendations in line with commitments to the Parliament.

- This audit examined 25 agreed recommendations made to Indigenous Business Australia (IBA) and the National Indigenous Australians Agency (NIAA) between January 2020 and December 2022.

Key facts

- Six per cent of responses to parliamentary committee reports tabled in the Senate and 23 per cent of responses tabled in the House of Representatives were on time in 2022–23 and 2023–24. For Indigenous affairs reports, 5 per cent of responses were on time (February 2019 to August 2024).

- In an annual ANAO survey of entities that received Auditor-General performance audit recommendations, over 75 per cent of recommendations are reported implemented within 24 months. The ANAO has found that approximately one-quarter of performance audit recommendations described by entities as implemented are partly implemented or not implemented.

What did we find?

- IBA fully implemented three agreed recommendations and largely implemented the remaining one. Its arrangements for responding to recommendations, while largely fit for purpose, were not settled until April 2024.

- NIAA fully or largely implemented seven recommendations, while fourteen were partly implemented or ongoing. Arrangements for responding to recommendations are partly fit for purpose. New arrangements were documented in August 2024.

What did we recommend?

- Two opportunities for improvement were identified for IBA, relating to internal guidance and clarifying the role of the accountable authority.

- Five opportunities for improvement were identified for NIAA, relating to: monitoring parliamentary activity; assisting government to respond; and closing Auditor-General recommendations.

- One opportunity for improvement was identified for the Department of the Prime Minister and Cabinet to improve guidance on responding to parliamentary committee recommendations.

4 out of 4

Auditor-General recommendations were fully or largely implemented by IBA.

2 out of 10

parliamentary committee recommendations were fully or largely implemented by NIAA.

5 out of 11

Auditor-General recommendations were fully or largely implemented by NIAA.

Summary

Background

1. Indigenous Business Australia (IBA) is a corporate Commonwealth entity established under the Aboriginal and Torres Strait Islander Act 2005. IBA’s purpose includes to enhance Aboriginal and Torres Strait Islander self-management and economic self-sufficiency.1 The National Indigenous Australians Agency (NIAA) is a non-corporate Commonwealth entity established as an executive agency in 2019. It is the lead Australian Government agency for Aboriginal and Torres Strait Islander policies and programs. NIAA’s purpose includes advancing a whole-of-government approach to improving the lives of Aboriginal and Torres Strait Islander people.2

2. Parliamentary committee and Auditor-General reports identify risks to the successful delivery of government outcomes and provide recommendations to address them. Where a parliamentary committee has made policy recommendations, the responsible minister is required to prepare and table a government response in the Parliament. The Auditor-General provides independent assurance as to whether the Executive government is operating and accounting for its performance in accordance with the Parliament’s intent. Auditor-General reports, which include audited entities’ responses to recommendations, are tabled in the Parliament. The tabling in the Parliament of an agreed response to parliamentary committee or Auditor-General recommendations is a formal commitment by the government or an entity to implement the recommended actions.

3. Successful implementation of agreed3 recommendations by Australian government entities requires effective governance arrangements to respond to, monitor and implement recommendations, with fit-for-purpose and proportionate implementation planning that sets clear responsibilities and timeframes for delivering the agreed actions.

4. The ANAO undertakes audits of implementation of recommendations made by parliamentary committees and the Auditor-General.4

Rationale for undertaking the audit

5. Parliamentary committee and Auditor-General reports have identified risks to and shortcomings in the successful delivery of outcomes in the Indigenous affairs portfolio. Recommendations have specified actions aimed at addressing those risks and identified opportunities for improving public administration. Implementation of agreed recommendations delivers on a formal commitment to the Parliament and is an important part of realising the full benefit of a parliamentary inquiry or audit. Appropriate and timely implementation of agreed recommendations demonstrates accountability to the Parliament and a commitment to improving public administration.

6. This audit provides assurance to the Parliament about whether recommendations directed to IBA and NIAA are being implemented as agreed.

Audit objective and criteria

7. The audit objective was to examine whether the selected entities have implemented a selection of agreed parliamentary committee and Auditor-General recommendations.

8. To form a conclusion against the objective, the following high-level criteria were adopted.

- Do IBA and NIAA have fit-for-purpose arrangements to respond to, monitor and implement agreed recommendations?

- Did IBA and NIAA respond to and implement agreed recommendations effectively?

9. To allow sufficient time for implementation, the ANAO examined implementation of agreed recommendations made between January 2020 and December 2022. The 25 recommendations examined comprised 10 recommendations from three parliamentary committee reports, and 15 recommendations from four Auditor-General reports.

Conclusion

10. As at August 2024, IBA had largely implemented the agreed recommendations examined in this audit, and NIAA had partly implemented the agreed recommendations. Implementation was not supported by robust governance arrangements in either entity, although arrangements matured during the course of the audit.

11. IBA’s arrangements to respond to, implement and monitor agreed parliamentary committee and Auditor-General recommendations are largely fit for purpose. IBA documented practices for managing recommendations in 2024. As at August 2024, these practices were not fully implemented as IBA was not subject to any parliamentary committee recommendations. NIAA’s arrangements to respond to parliamentary committee and Auditor-General recommendations are partly fit for purpose. NIAA documented practices for managing recommendations in 2024. These included new practices for managing parliamentary committee recommendations. As at August 2024, these practices were not fully implemented. The practices have the potential to be fit for purpose.

12. NIAA’s advice to government on how to respond to parliamentary committee recommendations was partly effective. IBA fully implemented three of the four agreed Auditor-General recommendations and largely implemented the remaining one. NIAA fully implemented six of 21 agreed parliamentary committee and Auditor-General recommendations and largely implemented one. Implementation of the remaining 14 NIAA recommendations was either partial (seven) or ongoing as at August 2024 (seven).

Supporting findings

Arrangements for managing agreed recommendations

13. IBA documented practices to respond to, implement, monitor and close agreed parliamentary committee recommendations in April 2024. These practices include implementation planning that covers roles and responsibilities, timeframes and risk. As at August 2024, these practices had not been implemented as IBA had no active parliamentary recommendations. NIAA documented practices to identify and respond to parliamentary committee recommendations in September 2023. NIAA does not monitor compliance with required timeframes for responding to parliamentary committee recommendations, and practices could be improved to promote better timeliness. NIAA documented practices to implement, monitor and close agreed parliamentary committee recommendations in August 2024. This followed commitments made to the Executive Board, Audit and Risk Committee and the Parliament to clarify and improve practices. As at August 2024, NIAA’s practices documented in August 2024 have not been implemented. (See paragraphs 2.4 to 2.39)

14. IBA and NIAA have established practices to respond to, implement, monitor and close agreed Auditor-General recommendations, including reporting to audit and risk committees and providing implementation updates to accountable authorities. IBA’s management practices for Auditor-General recommendations were documented and strengthened to include implementation planning in April 2024. IBA’s practices could be improved to clarify the role of the IBA Board in approving responses to recommendations. NIAA’s practices were documented in August 2024. This included formalising practices for implementation planning established in October 2023, requiring reporting to the Executive Board on implementation and closure, and improving closure practices to support the Audit and Risk Committee to fulfil its assurance function. (See paragraphs 2.40 to 2.63)

Implementation of agreed recommendations

15. IBA was not the subject of parliamentary committee recommendations in the timeframe examined in this audit. NIAA was responsible for coordinating the government response to two parliamentary committee reports examined in this audit. NIAA did not provide draft responses and associated advice in sufficient time to enable government to table responses in the timeframes set by the Parliament. Draft responses prepared by NIAA were consistent with relevant Australian Government guidelines, except that responses to disagreed recommendations did not always clearly state why the recommendation was not accepted. Advice to the Minister for Indigenous Australians (the minister) for recommendations that were accepted did not always include implementation details; risks or sensitivities; or a timeframe. In October 2022, the minister requested more information on outstanding responses to parliamentary committee reports, which was not provided. In April 2024, NIAA recommended to the minister that a ‘standard response’ be made to 39 recommendations in 10 outstanding parliamentary reports dating back to 2010. The response ‘noted’ the recommendations and stated that, given the passage of time, a substantive response was no longer appropriate. This was in line with correspondence from the government, except that NIAA did not advise the minister on whether or why a different response might be warranted. (See paragraphs 3.5 to 3.21)

16. Implementation planning for the examined recommendations was limited in both entities.

- IBA assigned responsibility and identified implementation actions for all four recommendations. It did not establish timeframes or assign risk ratings.

- NIAA’s implementation planning for 10 parliamentary committee recommendations was partial or not undertaken. NIAA assigned responsibility for all 11 Auditor-General recommendations examined. Other elements of implementation planning were not consistently undertaken. (See paragraphs 3.22 to 3.26)

17. IBA’s monitoring, assurance and closure of the four recommendations improved over the time period examined by the audit. IBA monitored implementation progress for all Auditor-General recommendations. Reporting on some recommendations to the Audit, Risk and Performance Committee was not timely nor complete until the committee requested evidence of implementation in September 2022. After September 2022, IBA prepared closure reports and effectively closed all recommendations.

18. NIAA did not consistently monitor implementation progress for the parliamentary committee recommendations examined in this audit, or report on progress to an oversight or assurance body. NIAA did not formally close the three (of 10) recommendations it considered implemented. NIAA monitored implementation progress for all 11 Auditor-General recommendations examined in this audit, and reported progress to the Audit and Risk Committee. Reporting on some recommendations was not timely. While closure reports were prepared for all 11 recommendations (which NIAA considered implemented), one closure report had no supporting evidence, senior official approval was inconsistently recorded and evidenced, and 10 closure reports were not shared with the Audit and Risk Committee. The committee noted closure of all 11 recommendations. (See paragraphs 3.27 to 3.42)

19. IBA and NIAA’s implementation of the 25 agreed recommendations examined in this audit, as at August 2024, was as follows.

- Of four Auditor-General recommendations to IBA, IBA considered all four to have been implemented. The ANAO assessed that three recommendations were fully implemented and one was largely implemented.

- Of 10 parliamentary committee recommendations relevant to NIAA, NIAA considered two were fully implemented and one was partly implemented. The ANAO assessment agreed with NIAA’s.

- Of 11 Auditor-General recommendations to NIAA, NIAA considered all 11 to be fully implemented. The ANAO assessed that four recommendations were fully implemented, one was largely implemented, and six were partly implemented.

- Of the 21 recommendations relevant to NIAA, responses to 11 included commitments that were additional to the recommendation. The ANAO assessed that additional commitments were fully implemented for three; partly implemented for five; and that implementation was still ongoing for three. (See paragraphs 3.43 to 3.54)

Recommendations

20. The Auditor-General did not make any recommendations. Eight opportunities for improvement were identified, relating to:

- IBA’s practices for responding to parliamentary committee and Auditor-General recommendations;

- NIAA’s practices for monitoring parliamentary activity, assisting government to responding to parliamentary committee recommendations, and closing Auditor-General recommendations; and

- the Department of the Prime Minister and Cabinet’s guidance to Australian Government entities on responding to parliamentary committee recommendations.

Summary of entity responses

21. The proposed audit report was provided to IBA and NIAA. An extract of the proposed audit report was provided to the Department of the Prime Minister and Cabinet. Entities’ summary responses are provided below. Entities’ full responses are provided at Appendix 1.

Indigenous Business Australia

Indigenous Business Australia (IBA) wishes to thank the ANAO for their professional and collaborative engagement with IBA throughout this audit.

The performance audit process has been useful for IBA in driving further improvements in internal processes relating to the implementation and management of ANAO and parliamentary committee recommendations and IBA will consider the further opportunities for improvement as part of its continual improvement processes.

National Indigenous Australians Agency

The National Indigenous Australians Agency (NIAA) welcomes the findings of the audit, including that it has established practices to respond to, implement, monitor and close parliamentary committee and Auditor-General recommendations. The NIAA acknowledges the opportunities for improvement identified in the report and has already made significant progress to strengthen processes for managing and implementing parliamentary committee and Auditor-General recommendations.

Department of the Prime Minister and Cabinet

The Department of the Prime Minister and Cabinet (the department) regularly reviews processes to ensure the robust provision of support to parliamentary committees and guidance to entities. This includes providing advice to entities on parliamentary committee reports with substantive recommendations that require responses from the Government. As part of this process, the department ensures entities are aware of the timeframes under Senate resolution 44 for responding to committee reports.

The department’s Tabling Guidelines provide advice on the preparation of government responses, including that all recommendations must be addressed and reasons provided for not accepting a recommendation, and timeframes for responses as set by Parliament.

Key messages from this audit for all Australian Government entities

22. The ANAO undertakes audits of implementation of recommendations made by parliamentary committees and the Auditor-General. In June 2021, the ANAO published Audit Insights: Implementation of Audit Recommendations, which includes observations from these audits for the benefit of all Australian Government entities.

23. Below are further key messages identified in this audit and which may be relevant for the operations of other Australian Government entities.

Governance and risk management

1. Background

Introduction

1.1 Parliamentary committee and Auditor-General reports identify risks to the successful delivery of government outcomes and provide recommendations to address them.

- Parliamentary committees consist of members from one or both Houses of the Parliament. Parliamentary committee inquiries are used to ‘investigate specific matters of policy or government administration or performance’.5 Where a parliamentary committee has made policy recommendations, the responsible minister is required to prepare and table a government response in the Parliament.6

- The Auditor-General provides independent assurance as to whether the Executive government is operating and accounting for its performance in accordance with the Parliament’s intent. Auditor-General reports, which include audited entities’ responses to recommendations, are tabled in the Parliament.7

1.2 The tabling in the Parliament of an agreed response to a parliamentary committee or Auditor-General recommendation is a formal commitment by the government or an entity to implement the recommended action.

1.3 This is the seventh performance audit since 2019 that has examined the effectiveness of Australian Government entities’ implementation of agreed parliamentary committee and Auditor-General recommendations. Details of the previous audits can be found in Appendix 3 of this report. The ANAO has also published insights from these audits, for the benefit of all Australian Government entities.8

Parliamentary committee recommendations

1.4 The Australian Public Service (APS) operates largely under principles-based frameworks, including that established by the Public Service Act 1999 (PS Act).9 The PS Act requires ‘an apolitical public service that is efficient and effective in serving the Government, the Parliament and the Australian public’.10 Members of the APS are subject to integrity obligations specified in the PS Act, including the APS Values.11 The explanatory memorandum for the Public Service Bill 1999 stated that the APS Values ‘reflect public expectations of the relationship between public servants and the Government, the Parliament and the Australian community’.12

1.5 The Parliament has established expectations for the provision of government responses to parliamentary committee reports. The Senate has resolved that government responses to Senate and joint committee reports are required to be tabled in the Parliament within three months of the report being presented to the Senate.13 The House of Representatives (House) has resolved that government responses to House and joint committee reports are required to be tabled in the Parliament within six months of the report being presented to the House.14

1.6 Australian Government entities are responsible for preparing responses to parliamentary committee reports for government to consider. Provision of advice to support government in meeting its responsibilities to the Parliament is an important element of public-sector integrity and should be consistent with the expectations established by the Parliament, including through the PS Act.15

1.7 In previous audits of implementation of recommendations, the Auditor-General has reported on instances where entities have not effectively demonstrated implementation of all agreed recommendations examined by the ANAO (see Appendix 3). In response to these findings, the Secretary of the Department of the Prime Minister and Cabinet wrote to departmental secretaries in August 2019, stating that:

The presentation of documents to the Parliament is an important component of the Government’s accountability to the Parliament and the broader community. It is critical for responsible agencies to monitor and implement the parliamentary committee’s recommendations agreed to by the Government. Accordingly, I strongly encourage departments and agencies to finalise Government responses to parliamentary committee reports in a timely manner so that the Government can table its response to a committee report within the timeframes established through the respective resolutions of the House of Representatives and the Senate … In addition to providing timely responses to Committee reports, it is important that departments and agencies have processes in place to monitor the implementation of the recommendations accepted by the Government. This includes Secretaries providing regular updates to their Minister(s) on implementation progress.16

1.8 The President of the Senate (President) and the Speaker of the House (Speaker) present reports biannually to the Senate and House, respectively, on the status of government responses to parliamentary committee reports.17 For each reporting period, the President’s and Speaker’s status reports include: all parliamentary committee reports with an outstanding response, including those carried over from previous reporting periods, unless the relevant parliamentary committee agrees a response is no longer required; and all parliamentary committee reports that received a response in the current reporting period.

1.9 Status reports in 2022–23 and 2023–24 show the number of responses to parliamentary committee reports that were received in the required timeframes (Table 1.1 and Table 1.2). For the four reporting periods to June/July 2024:

- of the 231 parliamentary committee reports in the President’s status report that had received a full response in the preceding six-month period, 15 (six per cent) were on time; and

- of the 96 parliamentary committee reports in the Speaker’s status report that had received a full response in the preceding six-month period, 22 (23 per cent) were on time.

Table 1.1: Senate — status of government responses to parliamentary committee reportsa

|

Reporting period ending |

31 December 2022 |

30 June 2023 |

31 December 2023 |

30 June 2024 |

|

|

Number |

Number |

Number |

Number |

|

Reports with outstanding response |

318 |

333 |

357 |

270 |

|

Response overdue |

301 |

310 |

331 |

215 |

|

Reports that received partial responseb |

14 |

14 |

15 |

14 |

|

Reports that received full responsec |

18 |

26 |

31 |

156d |

|

Received late |

13 |

23 |

26 |

154 d |

|

Total included in status report |

350 |

373 |

403 |

440 |

|

|

Months |

Months |

Months |

Months |

|

Shortest timeframe taken to respond |

3 |

1 |

2 |

1 |

|

Longest timeframe taken to respond |

19 |

147 |

71 |

248 |

|

Longest timeframe without a response |

242 |

248 |

254 |

260 |

Note a: The ANAO identified discrepancies and could not obtain assurance over the completeness and accuracy of this data.

Note b: Partial responses occur where responses have been received for some but not all recommendations.

Note c: Includes responses denoted ‘Final*’ in the President’s report. This indicates the final response was provided during debate on a bill.

Note d: Includes ‘standard responses’ to 122 reports that noted all recommendations (see paragraph 1.11).

Source: ANAO analysis of the President’s Report to the Senate on the Status of Government Responses to Parliamentary Committee Reports.

Table 1.2: House of Representatives — status of government responses to parliamentary committee reportsa

|

Reporting period ending |

30 November 2022 |

20 June 2023 |

24 November 2023b |

2 July 2024 |

|

|

Number |

Number |

Number |

Number |

|

Reports with outstanding response |

132 |

122 |

84 |

69 |

|

Response overdue |

102 |

108 |

67 |

55 |

|

Reports that received partial responsec |

15 |

12 |

11 |

10 |

|

Reports that received full response |

23 |

18 |

16 |

39d |

|

Received late |

12 |

16 |

9 |

37 d |

|

Total included in status report |

170 |

152 |

111 |

118 |

|

|

Months |

Months |

Months |

Months |

|

Shortest timeframe taken to respond |

1 |

<1 |

3 |

2 |

|

Longest timeframe taken to respond |

39 |

27 |

90 |

77 |

|

Longest timeframe without a response |

113 |

119 |

98 |

105 |

Note a: The ANAO identified discrepancies and could not obtain assurance over the completeness and accuracy of this data.

Note b: In June 2023 the Liaison Committee of Chairs and Deputy Chairs agreed to recommend that House and joint committee reports presented prior to the commencement of the 46th Parliament (2 July 2019) be removed from the Speaker’s status report, unless the relevant committee resolved to retain those reports. Between the reporting periods ending in June 2023 and November 2023, 23 reports from the 45th Parliament were removed.

Note c: Partial responses occur where responses have been received for some but not all recommendations.

Note d: Includes ‘standard responses’ to 24 reports that noted all recommendations (see paragraph 1.11).

Source: ANAO analysis of the Speaker’s Schedule of the Status of Government Responses to Committee Reports.

1.10 In previous audits of implementation of recommendations, the Auditor-General has reported that compliance with the required timeframes was low for the parliamentary committee recommendations examined by the ANAO.18

1.11 In March 2024, the Assistant Minister to the Prime Minister (the assistant minister) wrote to all ministers stating that there were more than 340 parliamentary committee reports from previous Parliaments with outstanding responses, and that to address the backlog, the assistant minister proposed that, where a committee’s report predated the current Parliament, the default position would be to issue a ‘standard response’ (unless the minister considered that a different response was required). The ‘standard response’ would note each recommendation and state that ‘given the passage of time, a substantive Government response is no longer appropriate’. Between 1 April 2024 and 31 August 2024, 223 government responses were tabled in the Parliament. Of these, 188 (84 per cent) made the ‘standard response’.19 Of reports that received the ‘standard response’, 95 (51 per cent) were to parliamentary committee reports tabled in the 46th Parliament (that is, between 2 July 2019 and 11 April 2022). ‘Standard responses’ were made to a combined total of 2,464 parliamentary committee recommendations.

1.12 The President’s and Speaker’s status reports list a large number of parliamentary committee reports with outstanding responses. For the three reporting periods to November/December 2023, nearly twice as many reports were tabled as received responses. In the reporting period ending June/July 2024, due to the large number of ‘standard responses’ tabled following the assistant minister’s correspondence, the number of reports with outstanding responses decreased. Excluding these ‘standard responses’, 28 more parliamentary committee reports were added to the President’s status report than received a response, and one more parliamentary committee report was added to the Speaker’s status report than received a response. As at June/July 2024, 270 and 69 parliamentary committee reports with outstanding responses are listed in the President’s and Speaker’s status reports, respectively.

Auditor-General recommendations

1.13 The ANAO undertakes an annual survey of entities that had been subject to a performance audit on their progress in implementing Auditor-General recommendations within 24 months of the recommendation being made. Table 1.3 shows implementation status based on entity self-reporting for recommendations made in 2017–18 to 2021–22.

Table 1.3: Entity self-reporting of Auditor-General performance audit recommendations implemented within 24 months

|

|

Recommendations |

|||

|

Year in which recommendations made |

Recommendations (number) |

Self-reported as implemented (%) |

Self-reported as not implemented (%) |

No response provided (%) |

|

2017–18 |

126 |

81 |

19 |

0 |

|

2018–19 |

146 |

79 |

19 |

2 |

|

2019–20a |

141 |

84 |

7 |

8 |

|

2020–21 |

165 |

77 |

21 |

2 |

|

2021–22 |

161 |

80 |

20 |

0 |

Note a: The percentages for 2019–20 do not total to 100 per cent due to rounding.

Source: ANAO, Annual Report 2023–24, available from https://www.anao.gov.au/work/annual-report/anao-annual-report-2023-24 [accessed 29 August 2024].

1.14 Previous audits of implementation of recommendations have examined 72 performance audit recommendations which entities have reported as implemented. Of these recommendations, the Auditor-General found that 42 (58 per cent) were fully implemented, 11 (15 per cent) were largely implemented, 14 (19 per cent) were partly implemented, and five (seven per cent) were not implemented.20

Indigenous affairs portfolio

1.15 Responsibility for Indigenous affairs is within the Prime Minister and Cabinet portfolio.21 This responsibility comprises:

- ‘Australian Government Aboriginal and Torres Strait Islander policy, programs, and service delivery’; and

- ‘improving results for Aboriginal and Torres Strait Islander people through enhanced Indigenous economic rights to support economic independence, the provision of improved access to education, employment, health, wellbeing and other services, as well as the maintenance of cultural identity’.22

1.16 For the purposes of this audit, the Indigenous affairs portfolio is taken to comprise the 13 non-corporate and corporate Commonwealth entities and companies within the Prime Minister and Cabinet portfolio that relate primarily to Indigenous affairs.23

1.17 This audit focuses on two entities in the Indigenous affairs portfolio.

- Indigenous Business Australia (IBA) — IBA is a corporate Commonwealth entity established under the Aboriginal and Torres Strait Islander Act 2005. IBA’s purpose is to ‘assist and enhance Aboriginal and Torres Strait Islander self-management and economic self-sufficiency’; and ‘advance the commercial and economic interests of Aboriginal persons and Torres Strait Islanders by accumulating and using a substantial capital asset for the benefit of the Aboriginal and Torres Strait Islander peoples’.24 The IBA Board is the accountable authority for the entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

- National Indigenous Australians Agency (NIAA) — NIAA is an executive agency and non-corporate Commonwealth entity established on 1 July 2019. NIAA’s functions include leading and coordinating the Australian Government’s policy development, program design and implementation and service delivery for Aboriginal and Torres Strait Islander peoples; and coordinating Indigenous portfolio agencies and advancing a whole-of-government approach to improving the lives of Aboriginal and Torres Strait Islander people.25 The NIAA Chief Executive Officer is the entity’s accountable authority under the PGPA Act.

1.18 Table 1.4 shows IBA and NIAA’s budget and staffing levels for 2024–25.

Table 1.4: Budget and staffing levels, 2024–25

|

Entity |

Average staffing levela |

Total resourcing ($ m) |

|

Indigenous Business Australia |

234 |

390.2b |

|

National Indigenous Australians Agency |

1,486 |

4,358.2c |

Note a: Average staffing level is a method of counting that adjusts for casual and part-time staff to show the average number of full-time equivalent employees.

Note b: Comprises opening balance/cash reserves, total funds from government and total funds from other sources.

Note c: Comprises departmental and administered resourcing.

Source: Australian Government, Portfolio Budget Statements 2024–25 Budget Related Paper No. 1.13: Prime Minister and Cabinet Portfolio, 2024, pp. 142, 189.

Rationale for undertaking the audit

1.19 Parliamentary committee and Auditor-General reports have identified risks to and shortcomings in the successful delivery of outcomes in the Indigenous affairs portfolio. Recommendations have specified actions aimed at addressing those risks and identified opportunities for improving public administration. Implementation of agreed recommendations delivers on a formal commitment to the Parliament and is an important part of realising the full benefit of a parliamentary inquiry or audit. Appropriate and timely implementation of agreed recommendations demonstrates accountability to the Parliament and a commitment to improving public administration.

1.20 This audit provides assurance to the Parliament about whether recommendations directed to IBA and NIAA are being implemented as agreed.

Audit approach

Audit objective, criteria and scope

1.21 The audit objective was to examine whether the selected entities have implemented a selection of agreed parliamentary committee and Auditor-General recommendations.

1.22 To form a conclusion against the objective, the following high-level criteria were adopted.

- Do IBA and NIAA have fit-for-purpose arrangements to respond to, monitor and implement agreed recommendations?

- Did IBA and NIAA respond to and implement agreed recommendations effectively?

1.23 For the purposes of this audit, an ‘agreed’ recommendation means:

- agreed in full or in part; or

- agreed in principle, with a commitment to undertake a specific action.

1.24 To allow sufficient time for implementation, the agreed recommendations examined in this audit were limited to recommendations contained in:

- parliamentary committee reports tabled between January 2020 and December 2022, where a government response was received prior to 31 December 2022; and

- Auditor-General reports tabled between January 2020 and December 2022.

1.25 The scope of this audit did not include:

- parliamentary committee reports where the subject of the report was either a review of annual reports, or an inquiry or review into proposed bills or delegated legislation; and

- recommendations that substantially overlapped with another recommendation in the scope of this audit or were examined in another ANAO performance audit.

1.26 For details of the methodology used to select recommendations for inclusion in the audit scope, see Appendix 4.

1.27 This audit is the first of two in 2024–25 examining implementation of recommendations in the Indigenous affairs portfolio. This audit focuses on IBA and NIAA’s arrangements for managing and implementation of a selection of 25 agreed recommendations, comprising 10 parliamentary committee recommendations and 15 Auditor-General recommendations. For details of the recommendations examined in this audit, see Appendix 5. Entities’ implementation of six Auditor-General recommendations from Auditor-General Report No. 25 2019–20 Aboriginal and Torres Strait Islander Participation Targets in Major Procurements is the focus of the second audit.26

Audit methodology

1.28 The audit involved:

- reviewing entity documentation; and

- meeting with relevant entity staff.

1.29 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $450,000.

1.30 The team members for the audit were Ashley Stephens, Rebecca Storen, Lily Engelbrethsen, Benjamin Foreman, Jillian Hutchinson, Eliza Glascott, Bezza Wolba, Jennifer Eddie and Christine Chalmers.

2. Arrangements for managing agreed recommendations

Areas examined

This chapter examines whether Indigenous Business Australia (IBA) and National Indigenous Australians Agency (NIAA) have fit-for-purpose arrangements to respond to, implement and monitor agreed parliamentary committee and Auditor-General recommendations.

Conclusion

IBA’s arrangements to respond to, implement and monitor agreed parliamentary committee and Auditor-General recommendations are largely fit for purpose. IBA documented practices for managing recommendations in 2024. As at August 2024, these practices were not fully implemented as IBA was not subject to any parliamentary committee recommendations. NIAA’s arrangements to respond to parliamentary committee and Auditor-General recommendations are partly fit for purpose. NIAA documented practices for managing recommendations in 2024. These included new practices for managing parliamentary committee recommendations. As at August 2024, these practices were not fully implemented. The practices have the potential to be fit for purpose.

Areas for improvement

The ANAO identified two opportunities for improvement for IBA to improve its guidance on responding to parliamentary committee recommendations; and clarify the role of the accountable authority in approving responses to Auditor-General recommendations. The ANAO identified two opportunities for improvement for NIAA to monitor parliamentary committee activity and recommendations; and improve its advice to government on responding to parliamentary committee recommendations.

2.1 The tabling in Parliament of an agreed response to a parliamentary committee or Auditor-General recommendation is a formal commitment by the government or an entity to implement the recommended action.

2.2 Key observations from previous ANAO audits include the importance of governance arrangements to respond to, monitor and implement agreed parliamentary committee and Auditor-General recommendations. These arrangements include:

- establishing practices for identifying, responding to, implementing and closing recommendations;

- clearly assigning responsibility for the progression of individual recommendations;

- having systems in place to monitor and track the implementation of recommendations; and

- monitoring, oversight and assurance of implementation.27

2.3 Entities that do not have fit-for-purpose governance arrangements for the implementation of recommendations increase the risk of inconsistency in administration and decision-making and are less likely to implement recommendations in accordance with commitments made to the Parliament.

Are arrangements to manage parliamentary committee recommendations fit for purpose?

IBA documented practices to respond to, implement, monitor and close agreed parliamentary committee recommendations in April 2024. These practices include implementation planning that covers roles and responsibilities, timeframes and risk. As at August 2024, these practices had not been implemented as IBA had no active parliamentary recommendations. NIAA documented practices to identify and respond to parliamentary committee recommendations in September 2023. NIAA does not monitor compliance with required timeframes for responding to parliamentary committee recommendations, and practices could be improved to promote better timeliness. NIAA documented practices to implement, monitor and close agreed parliamentary committee recommendations in August 2024. This followed commitments made to the Executive Board, Audit and Risk Committee and the Parliament to clarify and improve practices. As at August 2024, NIAA’s practices documented in August 2024 have not been implemented.

2.4 Following NIAA’s establishment in July 2019, a number of NIAA’s corporate services were provided by the Department of the Prime Minister and Cabinet (PM&C) through a Memorandum of Understanding established in December 2019. Functions administered for NIAA under the arrangement included ministerial and parliamentary support, and governance, audit, risk and assurance activities.28 NIAA administered these functions from November 2022.

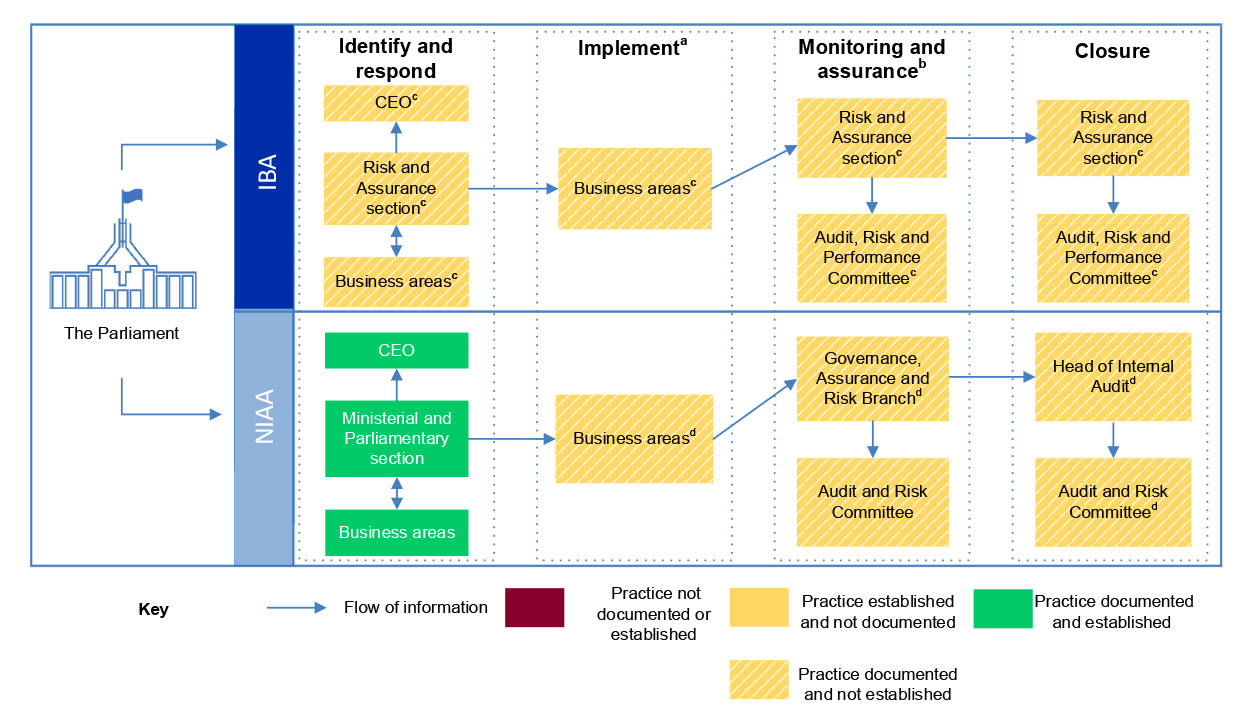

2.5 Figure 2.1 illustrates IBA’s and NIAA’s practices to identify and respond to; implement; monitor and assure; and close agreed parliamentary committee recommendations as at August 2024. ‘Documented’ practices refer to practices that are clearly set out in documented procedures or guidance. ‘Established’ practices refer to actions that are consistently followed to achieve an outcome.

Figure 2.1: Practices to respond to, implement and monitor agreed parliamentary committee recommendations, as at August 2024

Note a: Refers to implementation planning activities.

Note b: ‘Monitoring’ refers to the administrative process of compiling updates on the implementation of recommendations and preparing reporting for oversight and assurance bodies.

Note c: IBA documented its practices in April 2024 during the course of the audit. As IBA did not have any active parliamentary committee recommendations as at August 2024, it had not established the documented practices.

Note d: NIAA documented its practices to implement, monitor and close agreed parliamentary committee recommendations in August 2024 during the course of the audit.

Source: ANAO analysis of IBA and NIAA documentation.

2.6 IBA did not have parliamentary committee recommendations within the scope of this audit and is not frequently subject to parliamentary committee recommendations.

Identifying parliamentary committee recommendations

2.7 Established processes to identify relevant parliamentary committee recommendations support the entity to be efficient and effective in serving the government, the Parliament and the Australian public (see paragraph 1.4).

2.8 Government responses to parliamentary committee reports are prepared by a portfolio ‘lead entity’, which consults with other entities as required. The PM&C tabling guidelines specify that the PM&C Tabling Office identifies and notifies an entity that it will be the lead entity for coordinating the government response to a particular parliamentary committee report.29 It is the responsibility of the lead entity to consider whether input is required from other entities and to request input from those entities.

Indigenous Business Australia

2.9 IBA advised the ANAO in April 2024 that it had relied on other entities, particularly NIAA, to inform it of parliamentary recommendations relevant to IBA. In April 2024, IBA documented a process for identifying parliamentary recommendations that requires IBA’s Risk and Assurance section to monitor the Parliament’s website to identify recommendations relevant to IBA.

2.10 While NIAA is responsible for coordinating Indigenous portfolio agencies (see paragraph 1.17), NIAA does not have an established or documented practice for informing portfolio entities, such as IBA, of relevant recommendations.

National Indigenous Australians Agency

2.11 From 2020 to 2022, NIAA had some undocumented practices for identifying parliamentary recommendations. These practices were inconsistently implemented and did not capture all relevant parliamentary activity.

- 2020 — In April 2020, NIAA established a ‘Register of External Reviews’ for the purpose of capturing current and anticipated parliamentary committee reviews (and ANAO audits) relevant to NIAA, and identifying associated recommendations. The Register of External Reviews was provided to NIAA’s Audit and Risk Committee (ARC) at the June 2020 and September 2020 ARC meetings, and was not subsequently provided or maintained.The Register did not include all parliamentary committee reports relevant to NIAA.

- March 2021 to March 2022 — In this period the ARC had a standing agenda item for NIAA to report on Joint Committee of Public Accounts and Audit (JCPAA) recommendations related to or being implemented by NIAA. There were no relevant JCPAA recommendations in the period. The updates did not include recommendations from other parliamentary committees.

- 2022 — In June 2022, NIAA reported to the ARC that its established practice for identifying parliamentary committee recommendations was to rely on PM&C’s Tabling Office and Parliamentary and Ministerial Services section to notify the responsible business area, in line with PM&C’s tabling guidelines. In September 2022, NIAA’s Chief Operating Officer advised the ARC that NIAA’s Ministerial and Parliamentary section would be responsible for identifying and monitoring external reviews and parliamentary committee recommendations following the end of the shared service arrangement with PM&C (see paragraph 2.4) in November 2022. NIAA did not implement this practice.

2.12 In September 2023, NIAA documented its practices to identify relevant parliamentary recommendations. Where it is the lead entity, NIAA relies on PM&C’s Tabling Office to notify it, in line with PM&C’s tabling guidelines. Where it is not the lead entity, business areas rely on requests from lead entities to provide input to government responses and are required to notify NIAA’s Ministerial and Parliamentary section within the Office of the Chief Executive Officer of the request. The Ministerial and Parliamentary section is required to record the requests in a spreadsheet (see paragraph 2.22). NIAA advised the ANAO in June 2024 that the Ministerial and Parliamentary section does not monitor parliamentary activity, however individual line areas monitor inquiries relevant to their policy responsibilities.

Opportunity for improvement

2.13 National Indigenous Australians Agency could establish a centralised process to actively monitor:

- parliamentary committee activity to identify relevant recommendations for NIAA and to assist entities within the Indigenous affairs portfolio; and

- NIAA business area responses to parliamentary committee recommendations.

Assisting government to respond to parliamentary committee recommendations

2.14 The government is responsible for responding to parliamentary committee recommendations, and entities are responsible for providing advice to government on possible responses (see paragraph 1.6).

Indigenous Business Australia

2.15 In April 2024, IBA documented responsibilities and practices for coordinating, drafting and clearing responses to ‘external audit’ recommendations which, in the context of IBA’s April 2024 Internal and External Audit Charter, refers to Auditor-General and JCPAA recommendations. IBA updated the charter in August 2024 to clarify that ‘external audit’ includes parliamentary committees other than the JCPAA. IBA’s documented guidance does not include information on the requirements for government responses to parliamentary committee reports or the process for providing proposed responses to government.

Opportunity for improvement

2.16 Indigenous Business Australia could provide guidance to staff on preparation of responses to parliamentary committee reports and required timeframes, consistent with the PM&C tabling guidelines.

National Indigenous Australians Agency

2.17 In March 2022, NIAA reported to the ARC, in response to the ARC’s request for an update on arrangements for parliamentary committee recommendations, that business areas responded directly to ‘parliamentary enquiries’, and this communication was not coordinated centrally. This practice was undocumented.

2.18 In September 2023, NIAA documented practices for responding to parliamentary committee recommendations. After recommendations are identified (see paragraph 2.12), business areas are responsible for preparing the proposed government response for approval by the Chief Executive Officer and the minister and arranging for the approved government response to be tabled in Parliament or provided to the lead entity, where this is not NIAA. In August 2024, responsibility for arranging for responses to be approved and tabled was assigned to the Ministerial and Parliamentary section.

Timeliness of responses

2.19 As noted in paragraph 1.5, responses to parliamentary committee reports are required to be tabled within three or six months, depending on the type of committee. Entities are responsible for providing advice to government in sufficient time to meet these timeframes.30

2.20 Between February 2019 and August 2024, five per cent of parliamentary committee reports and nine per cent of parliamentary committee recommendations related to Indigenous affairs were responded to within the timeframes set by the Parliament (see Table 2.1). This is lower than the Australian Government average for 2022–23 and 2023–24 of between six and 23 per cent (see paragraph 1.9, Table 1.1 and Table 1.2).

Table 2.1: Timeliness of responses to parliamentary committee reports and recommendations relevant to Indigenous affairs, February 2019 to August 2024

|

Description |

Number (%) |

|

Parliamentary committee reports relevant to Indigenous affairsa |

57 (100%) |

|

26 (46%) |

|

3 (5%) |

|

Parliamentary recommendations relevant to Indigenous affairsa |

124 (100%) |

|

77 (62%) |

|

11 (9%) |

Note a: Includes parliamentary committee reports and recommendations that reference Indigenous affairs (based on a keyword search) or entities in the Indigenous affairs portfolio (see paragraph 1.16). Parliamentary committee reports where the subject of the report was a review of annual reports or estimates of government expenditure were excluded. Recommendations include those where an entity outside the Indigenous affairs portfolio is responsible for preparing the government response. There may be additional recommendations relevant to entities in the Indigenous affairs portfolio that were not captured.

Note b: Responses to House of Representatives committee recommendations are required within six months; responses to Senate and joint committee recommendations are required within three months (Department of the Prime Minister and Cabinet, Tabling Guidelines, PM&C, Canberra, 2022, p. 11).

Source: ANAO analysis of parliamentary reporting.

2.21 NIAA advised the ANAO in June 2024 that it is the responsibility of the relevant business area to comply with required timeframes for preparing government responses to parliamentary committee reports.

2.22 From December 2022, NIAA monitored government responses to parliamentary committee reports in a spreadsheet. The spreadsheet lists reports for which NIAA is the lead entity for coordinating the government response or is required to provide input. As at June 2024, the spreadsheet listed 12 reports (three for which NIAA was the lead entity for some or all recommendations) and omitted some reports relevant to NIAA. For example, in April 2024, NIAA provided advice to the minister on 10 parliamentary committee reports with outstanding government responses (see paragraph 3.21). None of the 10 reports were included in the spreadsheet. The spreadsheet includes dates that requests were received and responses are due, and does not clearly indicate whether and when responses were completed, which would allow for monitoring of compliance with required timeframes.

2.23 In August 2024, NIAA documented a requirement for the Ministerial and Parliamentary section to maintain a register of relevant recommendations from parliamentary committee reports, responsible business areas, details of responses and agreed implementation dates. Following the tabling of the government response, the Ministerial and Parliamentary section is required to provide this information to the Governance, Assurance and Risk Branch, which is responsible for monitoring implementation of agreed recommendations (see paragraph 2.35).

2.24 NIAA provides input to a whole-of-government document on the status of government responses to parliamentary committee reports, which is co-ordinated by PM&C (see paragraph 3.19).

Opportunity for improvement

2.25 National Indigenous Australians Agency could improve its advice to government on responding to parliamentary committee recommendations by:

- ensuring monitoring tools are complete; and

- recording achieved timeframes in order to identify and determine root causes for untimeliness, to inform continuous improvement.

Implementing parliamentary committee recommendations

2.26 Timely and successful implementation of parliamentary committee recommendations is facilitated by fit-for-purpose and proportionate implementation planning that sets clear responsibilities and timeframes for delivering the action that was agreed to in the government response. The nature of an implementation plan may vary depending on the complexity of a recommendation. Where implementation plans are not prepared, previous ANAO audits have shown that actions are not always implemented in a timely way or at all.31

2.27 Table 2.2 shows the ANAO’s assessment of IBA’s and NIAA’s implementation planning practices for agreed parliamentary committee recommendations as at August 2024.

Table 2.2: Assessment of implementation planning practices for agreed parliamentary committee recommendations, as at August 2024

|

|

IBAa |

NIAAb |

|

Does the entity assign responsibility for recommendation implementation? |

|

|

|

Does the entity set timeframes for recommendation implementation? |

|

|

|

Does the entity assign risk ratings for recommendation implementation? |

|

|

Key: ■ Practice not documented or established ▲ Practice established and not documented ![]() Practice documented and not established ◆ Practice documented and established

Practice documented and not established ◆ Practice documented and established

Note a: IBA documented new requirements for assigning responsibility, timeframes and risk ratings in April 2024. As at August 2024, these were not established as IBA had not received new parliamentary committee recommendations.

Note b: NIAA documented new requirements for assigning responsibility, timeframes and risk ratings in August 2024.

Source: ANAO analysis of IBA and NIAA documentation.

Indigenous Business Australia

2.28 In April 2024, IBA documented requirements to develop an implementation plan and assign a risk rating for agreed JCPAA and Auditor-General recommendations. IBA established an implementation plan template that includes fields for the responsible business area, actions to be taken, key deliverables, due dates and status of each action. These requirements were extended to recommendations from other parliamentary committees in August 2024 (see paragraph 2.15).

National Indigenous Australians Agency

2.29 In August 2024, NIAA documented requirements to develop an implementation plan for agreed parliamentary committee and Auditor-General recommendations, to be approved by relevant Senior Executive Service (SES) Band 2 officials within one month of the date the recommendation is agreed.32 An implementation plan template includes fields for responsible officers, activities and milestones, an implementation timeframe and a risk rating and mitigations.

Monitoring and assurance of implementation of parliamentary committee recommendations

2.30 Effective monitoring requires fit-for-purpose tracking of implementation progress. What constitutes fit for purpose will depend on the size of the entity, the nature of its business, its governance structure and the number and frequency of recommendations requiring attention.

2.31 Entities are required to establish an audit committee to provide independent advice and assurance to the entity’s accountability authority, including on the entity’s system of internal control.33

- IBA’s Audit, Risk and Performance Committee (ARPC) charter states that the role of the ARPC to provide ‘advice, assurance and support’ to the IBA Board. The charter states that the ARPC should satisfy itself that IBA has appropriate mechanisms for reviewing relevant external reports, including parliamentary committee reports, and implementing recommendations.

- NIAA’s ARC charter states that the role of the ARC is to provide ‘independence advice and assistance’ to the Chief Executive Officer including on the appropriateness of NIAA’s system of internal control. The charter states that the ARC’s consideration of NIAA’s control framework includes ‘relevant parliamentary committee reports and external reviews, internal and ANAO audit reports, providing advice to the Chief Executive Officer about significant issues identified and the implementation of agreed actions’.

Indigenous Business Australia

2.32 In April 2024, IBA documented responsibilities and practices for monitoring and assurance of the implementation of parliamentary committee recommendations. IBA’s Risk and Assurance section is responsible for tracking the implementation of recommendations in a register and reporting to the ARPC.

National Indigenous Australians Agency

2.33 In November 2021, NIAA’s ARC requested a paper describing NIAA’s processes to identify and monitor agreed recommendations from external reviews and parliamentary committee inquiries, and that NIAA develop a register of open recommendations. The paper was provided to the ARC in June 2022, which stated that no centralised register was used to monitor responses to recommendations. The paper did not describe arrangements to monitor implementation of agreed recommendations. In June 2022, the ARC requested updates on implementation of parliamentary recommendations. Updates were first provided in March 2024 (see paragraph 2.35). As at August 2024, a register of open recommendations had not been implemented.

2.34 Auditor-General Report No. 29 2023–24 Remote employment programs examined NIAA’s response to four agreed parliamentary committee recommendations relating to the Community Development Program.34 The audit report, presented for tabling in May 2024, included a recommendation that NIAA ensure that its ARC is providing assurance to the accountable authority that agreed parliamentary committee recommendations are implemented.35 NIAA agreed to the recommendation and stated that, ‘An updated approach was implemented in December 2023 which addresses this recommendation.’36

2.35 NIAA’s practices for monitoring and assurance of the implementation of parliamentary committee recommendations developed between November 2023 and August 2024.

- In November 2023, NIAA advised the ARC that it would align its process for monitoring and closing parliamentary recommendations with its process for monitoring Auditor-General recommendations. The process for monitoring Auditor-General recommendations included tracking recommendations in a register, which listed the responsible officer, implementation status and implementation date for each recommendation. NIAA also advised the ARC it would complete a ‘stocktake’ of parliamentary committee recommendations, which would involve confirming ‘appropriate lead areas’ and considering ‘the potential impact of agreed recommendations on other portfolio agencies’. In December 2023, the NIAA Chief Operating Officer provided the same advice to the Executive Board. As at August 2024, as noted at paragraph 2.33, there was no register.

- In March 2024 and June 2024, NIAA provided updates on implementation of parliamentary committee recommendations to the ARC. The updates included a list of nine parliamentary committee reports and, for each report the total number of agreed recommendations ‘with direct NIAA responsibility’. Recommendations were classified into five implementation status categories. Of the 37 recommendations summarised in the table, four were ‘completed’, 13 were ‘ongoing’, one was ‘largely implemented’, two were ‘partially implemented’, and 17 were ‘not implemented’. Information was provided at the aggregate level for each report, no information was provided on the implementation status of individual recommendations, responsible officers or implementation dates.

- In August 2024, NIAA documented responsibilities and practices for monitoring agreed parliamentary committee and Auditor-General recommendations. NIAA’s Governance, Assurance and Risk Branch is responsible for requesting quarterly implementation updates from business areas, including actions taken, status relative to the established timeframe, and an update on the risk rating if required. The Governance, Assurance and Risk Branch is responsible for reporting to the ARC and Executive Board on all outstanding recommendations and changes to timeframes and risk ratings.

Closure of parliamentary committee recommendations

2.36 When recommendations have been implemented, it is important they are formally closed and that prior to closure, evidence of implementation is subject to an appropriate level of scrutiny to ensure recommendations have been implemented in full in accordance with the intent of the recommendation.

Indigenous Business Australia

2.37 In April 2024, IBA documented a closure practice for agreed JCPAA recommendations. The practice requires preparation of a closure report that includes supporting evidence, which must be reviewed and approved by the Risk and Assurance section and relevant senior executive; and endorsed by the ARPC. This practice was extended to recommendations from other parliamentary committees in August 2024 (see paragraph 2.15).

National Indigenous Australians Agency

2.38 As noted in paragraph 2.35, NIAA advised the ARC and Executive Board in November 2023 and December 2023 respectively that it would implement a practice for closing agreed parliamentary committee recommendations that aligned with its established practice for closing Auditor-General recommendations (see paragraph 2.60).

2.39 In August 2024, NIAA documented a closure practice for agreed parliamentary committee and Auditor-General recommendations. This practice requires preparation of a closure report with supporting evidence of implementation, which requires approval by the relevant SES Band 2 official and the Head of Internal Audit. A closure report template sets out relevant considerations for closing recommendations, which are that actions taken in response to the recommendation: have addressed the whole scope of the recommendation and response; have been finalised and embedded; and are supported by sufficient evidence.37 Closure reports are required to be provided to the ARC for noting, and a report on closed recommendations must be provided to the Executive Board. The Governance, Assurance and Risk Branch is responsible for recording documentation and approvals.

Are arrangements to manage Auditor-General recommendations fit for purpose?

IBA and NIAA have established practices to respond to, implement, monitor and close agreed Auditor-General recommendations, including reporting to audit and risk committees and providing implementation updates to accountable authorities. IBA’s management practices for Auditor-General recommendations were documented and strengthened to include implementation planning in April 2024. IBA’s practices could be improved to clarify the role of the IBA Board in approving responses to recommendations. NIAA’s practices were documented in August 2024. This included formalising practices for implementation planning established in October 2023, requiring reporting to the Executive Board on implementation and closure, and improving closure practices to support the Audit and Risk Committee to fulfil its assurance function.

2.40 Auditor-General reports are prepared for the Parliament. Where entities agree to Auditor-General recommendations this represents a commitment to the Parliament that the entity will undertake the actions agreed to.38

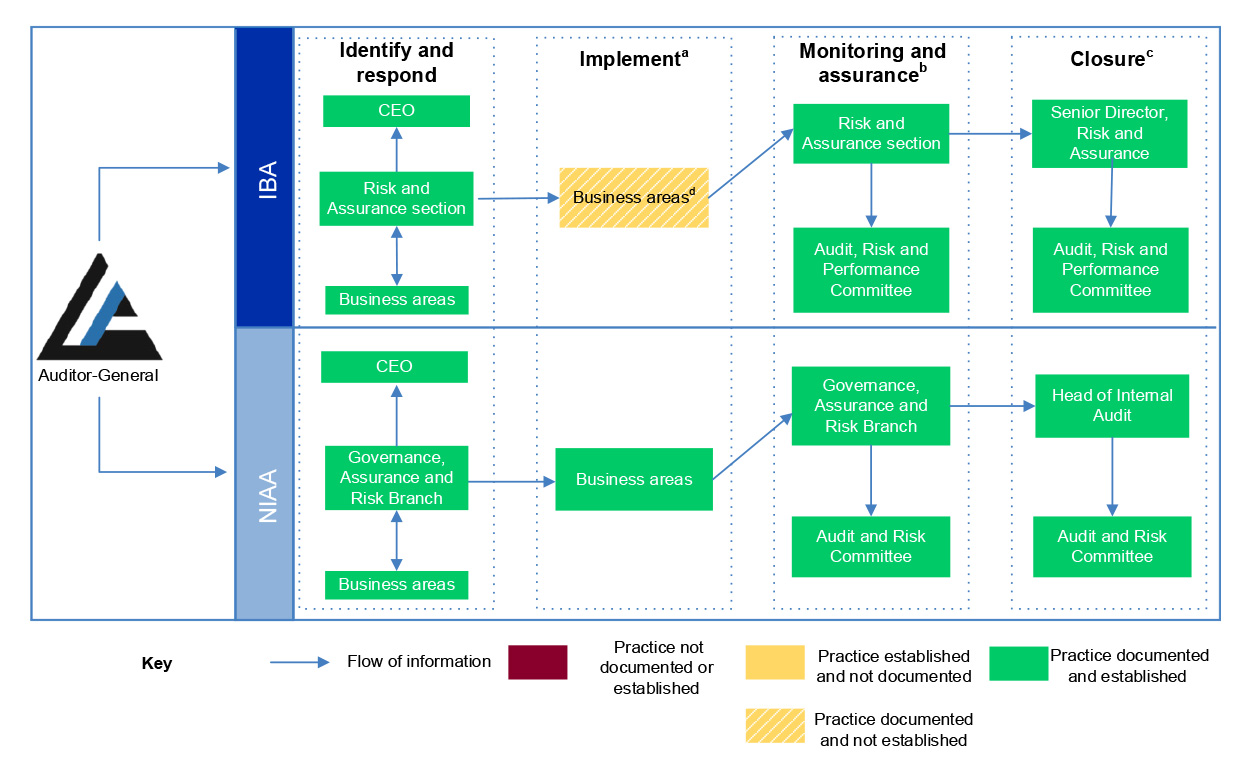

2.41 Figure 2.2 illustrates IBA’s and NIAA’s practices to identify and respond to; implement; monitor and assure; and close agreed Auditor-General recommendations as at August 2024. ‘Documented’ practices refer to practices that are clearly set out in documented procedures or guidance. ‘Established’ practices refer to actions that are consistently followed to achieve an outcome.

Figure 2.2: Practices to respond to, implement and monitor agreed Auditor-General recommendations, as at August 2024

Note a: Refers to implementation planning activities.

Note b: ‘Monitoring’ refers to the administrative process of compiling updates on the implementation of recommendations and preparing reporting for oversight and assurance bodies.

Note c: Both entities report closure of recommendations to their audit committees. IBA’s closure process requires the audit committee’s endorsement. NIAA’s process does not (see paragraphs 2.58 and 2.61).

Note d: IBA documented its practices in April 2024 after this audit commenced. As IBA did not have new Auditor-General recommendations as at August 2024, it had not established new documented requirements for implementation planning.

Source: ANAO analysis of IBA and NIAA documentation.

Identifying and responding to Auditor-General recommendations

2.42 The Auditor-General is required to provide a copy, or extract, of each proposed audit report to the accountable authority of an entity involved in the audit, and request written comments within 28 days. The Auditor-General is required to include all written comments received from entities in the final report.39 NIAA and IBA responded to all Auditor-General recommendations.

2.43 In their responses to Auditor-General recommendations, entities should clearly state whether they agree to implement the audit recommendation. IBA and NIAA agreed to all Auditor-General recommendations assessed as part of this audit.

Indigenous Business Australia

2.44 In April 2024, IBA documented its established practices for coordinating, drafting and approving responses to Auditor-General recommendations. Responses are required to be drafted by responsible officers, with input from the Risk and Assurance section, the General Counsel and the executive for the relevant business areas, and approved by the Chief Executive Officer. The accountable authority of IBA is the Board. IBA has not documented the process for the accountable authority to approve responses to Auditor-General recommendations.

Opportunity for improvement

2.45 Indigenous Business Australia could update its documented process to clarify that the Board is responsible for approving responses to Auditor-General recommendations.

National Indigenous Australians Agency

2.46 Before November 2022, PM&C’s Ministerial Support Division was responsible for coordinating responses to Auditor-General recommendations directed to NIAA. Following the end of the shared service arrangement with PM&C (see paragraph 2.4), responses to Auditor-General recommendations were coordinated by NIAA’s Governance, Assurance and Risk Branch, with input from business areas. The final response is approved by the Chief Executive Officer, the accountable authority of NIAA. These practices were documented in August 2024.

Implementing Auditor-General recommendations

2.47 Table 2.3 shows the ANAO’s assessment of IBA’s and NIAA’s practices for implementation planning for agreed Auditor-General recommendations as at August 2024.

Table 2.3: Assessment of implementation planning practices for agreed Auditor-General recommendations, as at August 2024

|

|

IBA |

NIAA |

|

Does the entity assign responsibility for recommendation implementation? |

◆ |

◆ |

|

Does the entity set timeframes for recommendation implementation? |

|

◆ |

|

Does the entity assign risk ratings for recommendation implementation? |

|

|

Key: ■ Practice not documented or established ▲ Practice established and not documented ![]() Practice documented and not established ◆ Practice documented and established

Practice documented and not established ◆ Practice documented and established

Note a: IBA documented new requirements for assigning timeframes and risk ratings in April 2024. As at August 2024, these were not established as IBA had not received new Auditor-General recommendations.

Note b: NIAA documented a new requirement for assigning risk ratings in August 2024.

Source: ANAO analysis of IBA and NIAA documentation.

Indigenous Business Australia

2.48 IBA did not require implementation plans for agreed Auditor-General recommendations until April 2024. As noted at paragraph 2.28, in April 2024, IBA documented practices for implementation planning including a requirement to assign a responsible officer, assign a risk rating, and develop an implementation plan (including due dates for planned actions) for the recommendation, within 10 business days of accepting it. It also created an implementation plan template.

National Indigenous Australians Agency

2.49 In October 2023, at the request of the ARC, NIAA developed an implementation plan for seven recommendations in Auditor-General Report No. 27 2022–23 Management of provider fraud and non-compliance.40 The plan includes activities, timeframes, responsible and accountable officers, and stakeholders consulted and informed for all seven recommendations. In August 2024, NIAA developed an implementation plan for eight recommendations in Auditor-General Report No. 29 2023–24 Remote employment programs.41 The plan includes activities, timeframes and responsible officers for all eight recommendations and risk ratings for six recommendations.

2.50 NIAA did not require implementation plans for agreed Auditor-General recommendations until August 2024. As noted at paragraph 2.29, in August 2024, NIAA documented practices for implementation planning for agreed Auditor-General recommendations, including a requirement to assign a responsible officer, assign a risk rating, and develop an implementation plan and timeframe for agreed recommendations within one month.42

Monitoring and assurance of implementation of Auditor-General recommendations

Indigenous Business Australia

2.51 IBA documented its established monitoring and assurance arrangements for Auditor-General recommendations in April 2024. IBA’s Risk and Assurance section maintains an ‘Audit and Review Recommendation Register’ based on input from responsible business areas. The Audit and Review Recommendation Register shows responsible officers and is updated by responsible officers. The Register does not show due dates for agreed Auditor-General recommendations. It categorises their implementation status.43 Where a recommendation is at risk of not being implemented by the due date (see paragraph 2.48), the responsible officer is required to provide an update to IBA’s Risk and Assurance section on the cause of the delay and controls to manage the risk.

2.52 The Audit and Review Recommendation Register is provided to the ARPC for assurance over implementation. The ARPC and CEO provide written updates to the IBA Board, which include information on actions taken in response to recommendations.

National Indigenous Australians Agency

2.53 NIAA’s monitoring arrangements for Auditor-General recommendations were documented in the 2019 Memorandum of Understanding with PM&C. Following the end of the shared services arrangement in November 2022 (see paragraph 2.4), reporting to the ARC and Executive Board in November 2023 and December 2023 included a summary of NIAA’s practices for monitoring and closing Auditor-General recommendations. These practices were documented in internal guidance in August 2024 (see paragraph 2.35).

2.54 NIAA maintains an ‘Audit Recommendations Report’ based on input from responsible business areas. The Audit Recommendations Report captures responsible officers, implementation due dates, and updates provided by responsible officers and the Head of Internal Audit. At the direction of the Executive Board in October 2023, NIAA developed a more detailed implementation tracking document for seven Auditor-General recommendations in Auditor-General Report No. 27 2022–23 Management of provider fraud and non-compliance. The tracking document was used to provide monthly implementation updates to the Senior Leadership Committee (an advisory body to the Executive Board).

2.55 Assurance arrangements for Auditor-General recommendations are documented in the ARC charter. The Audit Recommendation Report is provided to the ARC. In October 2023, the ARC provided a general update to the NIAA CEO on its monitoring of recommendations from Auditor-General Report No. 27 2022–23 Management of provider fraud and non-compliance.

2.56 From August 2024, the Governance, Assurance and Risk Branch was responsible for reporting to the Executive Board on all outstanding recommendations and changes to timeframes and risk ratings (see paragraph 2.35).

Closure of Auditor-General recommendations

Indigenous Business Australia

2.57 Prior to September 2022, IBA did not have an established closure practice for Auditor-General recommendations. In September 2022, the ARPC requested that IBA provide the ARPC with information on the actions taken to close recommendations and evidence used to support closure. The ARPC also requested that recommendations being closed be identified on the Audit and Review Recommendation Register provided to the ARPC at each meeting. In November 2022, IBA established a closure practice involving the preparation of a closure report. A closure report template was based on a template used for internal audit recommendations and included fields such as ‘Summary of Completed Actions’ and ‘Supporting Evidence’. The closure report template does not address risk. The closure report must be approved by the Senior Manager, Risk and Assurance.

2.58 In April 2024, IBA documented its closure practice, which requires approval from more senior managers including the Chief Executive Officer prior to endorsement from the ARPC. The documented practice requires closure reports to be presented to the ARPC. The closure report template was updated in April 2024 to require a risk rating.

2.59 IBA’s documented closure practice does not involve the Board. In practice, the Board is advised by the ARPC and the CEO when recommendations are closed. The Board does not approve closure of recommendations.

National Indigenous Australians Agency

2.60 NIAA prepares closure reports for Auditor-General recommendations, using a closure report template which includes fields for ‘implementation status’ (completed actions and actions taken to address underlying risks); ‘assessment of recommendation’; and supporting evidence. The template includes a field for Head of Internal Audit approval and states that ‘unambiguous written approval’ from an SES Band 2 official must be attached as evidence. Under the shared services arrangement with PM&C (see paragraph 2.4), until November 2022 PM&C was responsible for quality assurance of NIAA closure reports for Auditor-General recommendations prior to Head of Internal Audit approval. In June 2023, NIAA advised the ARC that, ‘where previously a recommendation may have been closed on the development of a new policy, it will now need evidence of how its [sic] working in practice to demonstrate completion’. In November 2023, the closure report template was updated to reflect the implementation status categories used by the ANAO. For the recommendations examined in this audit, approvals were poorly documented in closure reports (see paragraph 3.40).

2.61 NIAA reports closure of Auditor-General recommendations to the ARC. For the recommendations examined in this audit, minutes of the relevant meetings described the ARC as having ‘endorsed’, ‘approved’ or ‘agreed’ recommendations for closure (see paragraph 3.41). Meeting minutes do not record which recommendations were considered by the ARC. In June 2023, NIAA advised the ARC that its closure process does not require endorsement by the ARC.44

2.62 Closure reports were not consistently provided to the ARC for its assurance over the process. Between April 2020 and March 2024, NIAA reported the closure of 28 Auditor-General recommendations to the ARC, and provided closure reports for 16. In June 2024, closure reports were provided for all four recommendations reported closed. In March 2021, the ARC requested that where closure reports are not provided, details of actions undertaken to implement recommendations be recorded in the Audit Recommendations Report. NIAA subsequently recorded high-level updates on actions undertaken to implement recommendations in the Audit Recommendations Report (see paragraphs 3.37 to 3.38). However, these updates did not provide the ARC with evidence to demonstrate that agreed actions had been implemented.