Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Establishment and Management of the Communications Fund

The objective of the audit was to assess the effectiveness of the management and administration of the Communications Fund, including an assessment of:

- the development and implementation of appropriate investment strategies; and

- the robustness of the governance structures and controls relating to investment activities.

Summary

Introduction

The $2 billion Communications Fund was established by the previous Government as part of a $3.1 billion package aimed at ‘future proofing' telecommunications in regional Australia (that is, ensuring that people in rural, regional and remote parts of Australia share equitably in the benefits and future advances in technology).1 It was the then Government's policy2 that the Fund exist in perpetuity, thereby ensuring that a source of revenue would always be available to implement responses to reviews of the adequacy of telecommunications in regional, rural and remote areas of Australia.

The Communications Fund was established on 23 September 2005, with $2 billion credited to the Fund three days later. The legislation to establish the Communications Fund was developed in a compressed three week period, to fit in with the timetable for the Telstra sale process. It was necessary for the Telstra sale legislation to be passed as soon as practicable before the end of 2005 in order for the sale of the Commonwealth's remaining Telstra shares to occur by the end of 2006. Amongst other things, this put pressure on the time available for developing the legislation to establish the Communications Fund.

The broad legislative approach for the Communications Fund was developed by the then Department of Communications, Information Technology and the Arts (DCITA)3, with some consultation with the Department of the Treasury (Treasury), where a joint Treasury/ Department of Finance and Deregulation (Finance)4 taskforce on establishing the Future Fund was located.5 Drafts of the proposed legislation were also provided to Finance.

The legislation provides that the Minister for Broadband, Communications and the Digital Economy and the Minister for Finance and Deregulation (Finance Minister) are the responsible Ministers for the Fund.6 However, Finance's ongoing involvement with the Fund, following finalisation of the investment arrangements, has been limited to receiving monthly updates of the balance of the Fund's investments, with DBCDE having primary responsibility for the ongoing administration of the Fund. This is consistent with Finance advice to ANAO that the then Minister for Communications, Information Technology and the Arts was assigned the main responsibility for the Fund. DBCDE has advised ANAO that the Ministers, and consequently their departments, have had a joint role in progressing the development of the longer-term investment strategy and governance framework for the Fund, and that only after the strategy and framework were in place did DCITA, on behalf of their Minister, take primary responsibility for the day-to-day administration of the Fund and its monitoring and reporting arrangements.

In September 2005, the responsible Ministers authorised the Australian Office of Financial Management (AOFM) to place the $2 billion fund capital in a term deposit with the Reserve Bank of Australia (RBA). A working group comprising officials from DCITA, Finance and Treasury was then established to develop the longer-term investment strategy and governance arrangements for the Fund, to inform the development of the Investment Authorisation (to be signed by the two responsible Ministers) and the subsidiary Investment Guidelines (issued by DCITA to the AOFM). Treasury has advised ANAO that it was invited to provide input to the group given its experience with the Future Fund.

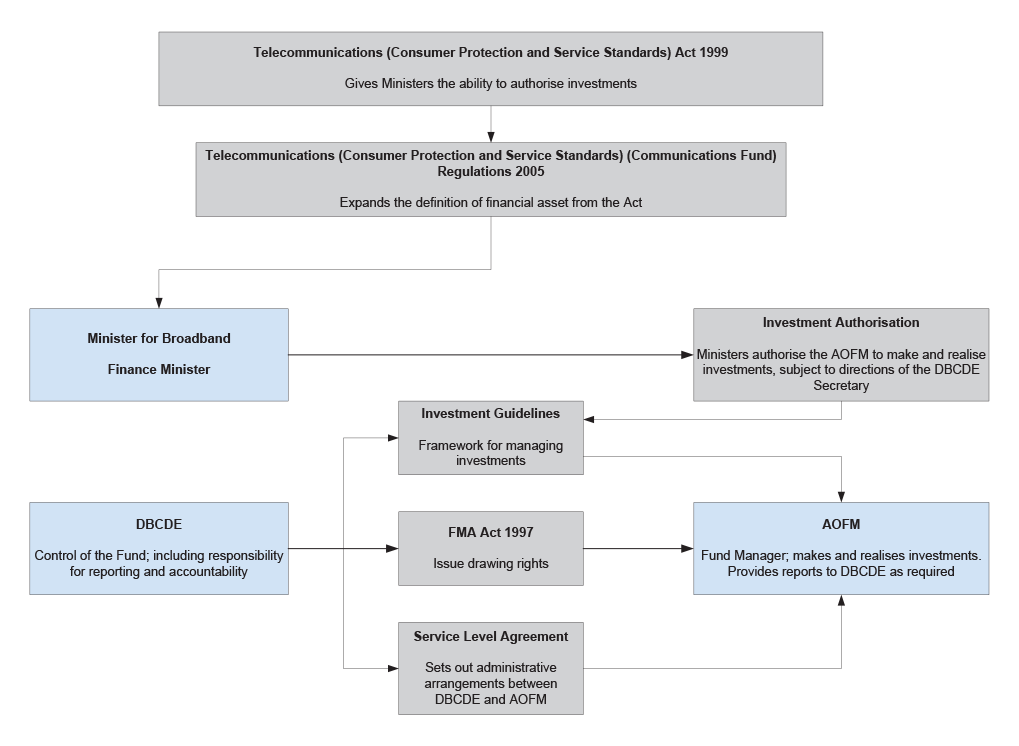

The AOFM was subsequently appointed to manage the investments of the Communications Fund on a long-term basis under the approved investment strategy (the Investment Guidelines). Figure 1 illustrates the governance arrangements for the Communications Fund.

Figure 1 Communications Fund governance structure

Source: ANAO analysis of DBCDE records.

DBCDE's 2007–08 financial statements report the balance of the investments of the Communications Fund as at 30 June 2008 to be $2.36 billion.

In the 2008–09 Federal Budget, it was announced that the Communications Fund would be abolished, with funds being transferred to the Building Australia Fund, which is one of three new ‘Nation Building Funds' (or infrastructure Funds) that are set to be established by 1 January 2009.7 Initial funding of $41 billion is expected to be provided by the Government for the three new Funds.

Audit scope and objective

The objective of the audit was to assess the effectiveness of the management and administration of the Communications Fund, including an assessment of:

- the development and implementation of appropriate investment strategies; and

- the robustness of the governance structures and controls relating to investment activities.

Audit fieldwork was conducted in DBCDE and the AOFM, as well as Finance, Treasury and the Department of the Prime Minister and Cabinet (PM&C).8 In addition, ANAO consulted with and examined relevant records held by the consultant engaged by DCITA to advise on financial products and an earning rate benchmark for the Communications Fund. ANAO engaged Applied Financial Diagnostics to assist in assessing agencies' approach to managing and investing the Communications Fund, including the development and implementation of investment strategies for the Fund.

Audit Conclusions

The then Government's policy of having the Communications Fund exist in perpetuity meant that the policy intent was to maintain the Fund's nominal $2 billion value, with all earnings on the Fund to be available for expenditure on regional telecommunications. This policy intent was recognised by the Senate Environment, Communications, Information Technology and the Arts Committee in its recommendation (agreed to by the then Government) that the Fund be established with cash, not Telstra shares, as well as by agencies in establishing the arrangements for the Communications Fund.9 However, DBCDE advised ANAO that, in the compressed time that was available to establish the enabling legislation for the Communications Fund, it was not possible to obtain expert advice on how the Fund should be best invested to meet the policy intent of a perpetual fund with the purpose of providing an ongoing funding stream for expenditure on regional telecommunications. In addition, Finance has advised ANAO that, at that time, special expertise in managing financial asset funds was being established within Finance.

Against this background, DCITA advised the then Minister for Communications, Information Technology and the Arts that the legislation should enable a broad range of instruments to be purchased, rather than being limited to fixed interest and like products, in order to retain flexibility so as not to limit the future investment strategy for the Fund. The proposed broad range of investments represented a significant departure from the categories of conservative investments authorised by the Financial Management and Accountability Act 1997 (FMA Act). Treasury raised issues about the breadth of the proposed categories of investments, but these issues were not addressed by DCITA.10

After the legislation was passed, a firm was engaged by DCITA, with the assistance of Finance and Treasury,11 for three weeks to provide investment strategy advice. However, the approach taken was not consistent with the earlier decision that broad legislative investment powers were necessary to enable wide consideration of investment options. Specifically:

- the consultant was required to provide advice on investments to be included in a fixed interest portfolio; and

- the consultant was advised that the Fund was to invest only in low risk assets and to be able to realise investments within three months.

The three agencies represented on the working group have each advised ANAO that a key consideration for the working group was the then Minister for Communications, Information Technology and the Arts' public statement that the Fund would earn, from day one, a rate not less than the cash rate.12 Agencies have further advised that these investment parameters focused the working group on designing an investment mandate that ensured a high level of certainty in achieving at least the cash rate, and limiting the probability of realising a negative return in the period leading up to the first telecommunications review. As a result, the working group pursued an investment strategy comprising conservative and low-risk assets, rather than examining the merits of investing in the full range of assets permitted by the legislation.

Subsequently, through the Investment Authorisation, signed by the two responsible Ministers, and the Investment Guidelines issued by DCITA, the Communications Fund has been restricted to investing in a portfolio of low risk, highly liquid, fixed interest assets. This approach closely aligns with the approach adopted for entities investing under the FMA Act and is also more consistent with the policy that the Fund be perpetual in nature. This outcome, which reflects a prudent approach, emphasises the importance of agencies having greater regard to the principles that underlie the existing financial framework before proposing significant departures from it. In this context, Treasury has advised ANAO that its concerns about the legislation were subsequently addressed through the administrative arrangements put in place for the Fund.

In the 2008–09 Federal Budget, the Government announced that the new infrastructure Funds are to reside in the Finance and Deregulation portfolio, where experience has been gained from the establishment of the Future Fund and Higher Education Endowment Fund (HEEF). In addition, the timeframe for the establishment of the new infrastructure Funds is considerably longer than was available for the Communications Fund. These different circumstances should be of value in delivering more robust and timely investment arrangements for the infrastructure Funds that reflect the policy intent for the Funds.

Key findings by Chapter

Chapter 2—Development of the Legislative Framework

The legislation establishing the Communications Fund stated that the provisions of the FMA Act that typically govern the investment of public funds do not apply to the Communications Fund. As noted in ANAO Audit Report No.22 of 2004–05, Investment of Public Funds, during the development of the FMA Act, the Joint Committee of Public Accounts and Audit re-assessed the types of investments it considered appropriate for the different nature of Commonwealth entities and concluded that, with the exception of Government Business Enterprises and Statutory Marketing Authorities, entities should be required to invest funds conservatively.

By way of comparison to the FMA framework, the legislation establishing the Communications Fund broadly defines a financial asset. Specifically, in addition to the types of investments permitted under the FMA Act, the legislation permits the Communications Fund to be invested in:

- debentures or stocks issued by a government;

- shares in, or debentures of, other bodies;13

- an interest in a managed investment scheme; and

- a derivative (either to protect or enhance the value of, or return on, an investment).

On two occasions during the development of the legislation, Treasury raised with DCITA issues relating to the proposed breadth of the permissible investments when the Fund's purpose was to produce an income stream to be spent on regional telecommunications. Treasury's concerns were not addressed by DCITA in the drafting of the legislation. DBCDE has advised ANAO that:

- it was not apparent to DCITA that the first Treasury correspondence was raising concerns. The Treasury correspondence had advised DCITA that, from the perspective that sections of the proposed legislation relating to the Communications Fund had been largely copied from the draft Future Fund Bill, Treasury had no concerns with the content, noting that the Communications Fund legislation would allow the Fund to be invested in a broad range of financial assets.14 The correspondence also asked DCITA for advice on the process, timing and means for addressing the investment objective, the extent of the capital contribution and how the perpetual nature of the Fund would be preserved, as these issues had not been addressed in the draft Bill and Treasury assumed that many of these issues would be raised when the Bill was introduced. However, there is no record of DCITA responding to Treasury; and

- there was insufficient time to address the concerns raised in the second Treasury correspondence, as within hours of the time Treasury's comments were received, the then Minister for Communications, Information Technology and the Arts had requested policy approval from the then Prime Minister, Treasurer and Minister for Finance and Administration. The second Treasury correspondence reiterated that Treasury had concerns with the broad range of powers in relation to the Fund being put up for Parliamentary approval without a framework about how the investment of the Fund would operate, and that there was no mechanism to ensure the perpetual nature of the Fund.

DBCDE has also advised ANAO that it was not possible, in the time available to develop the legislation, for it to seek expert external advice on the investment powers. Finance was not heavily involved in the development of the legislation and, in any event, has advised ANAO that special expertise in managing financial asset funds was being established in Finance at that time. Treasury has advised ANAO that its concerns were subsequently addressed through the administrative arrangements put in place for the Fund.

Chapter 3—Development of the Investment Strategy

A sound investment strategy for a fund like the Communications Fund should be underpinned by a solid understanding of the purposes for which the Fund's earnings are to be used and the amount of, and timeframes for, future drawdowns of these earnings.

As a result of amendments to the proposed Communications Fund legislation requiring the Fund to be established immediately after the passage of that legislation and Telstra sale legislation, rather than following the completion of the Telstra sale (as had originally been proposed), there was no investment strategy in place for Fund at the time of its inception. As an interim measure, Ministers authorised the AOFM to invest the $2 billion principal of the Fund in a six-month term deposit with the Reserve Bank of Australia (RBA). This was intended to provide sufficient time for longer term investment arrangements to be developed for the Fund.

Against the background of DCITA being unable to obtain expert advice when the legislation was being developed due to time constraints, the working group (comprising officials from DCITA, Finance and Treasury) concluded that, in developing a long term investment strategy for the Fund, independent expert advice would be sought. DCITA engaged an asset consultant, with the assistance of Finance and Treasury, but the value of the contract was limited (a $10 000 fee for advising on an investment strategy for a $2 billion perpetual fund).

Ministers had decided that the legislation should be drafted so as to not limit the authorised investments to fixed interest or like products, with the various alternatives possible under the legislation to be investigated after its passage. However, the consultant was restricted to considering a portfolio of low risk, highly liquid, fixed interest assets.15 As noted, the three agencies represented on the working group have each advised ANAO that a key consideration for the working group was the then Minister for Communications, Information Technology and the Arts' public statement that the Fund would earn, from day one, a rate not less than the cash rate.

Implementation of the longer term investment strategy for the Communications Fund required a new authorisation instrument to be made by Ministers. DCITA and Finance first advised Ministers in March 2006 that a new instrument would be required to be executed. However, it took more than nine months for the new instrument to be prepared by agencies for Ministers to sign.16 In addition, there were significant delays in establishing the long term investment strategy for the Fund (referred to as the Investment Guidelines). The Investment Guidelines were not finalised until June 2007, 15 months after the initial six month term deposit had matured. Although its Minister is one of the two responsible Ministers, Finance is not a party to the Investment Guidelines and has not been involved in overseeing the ongoing investment activities of the Fund.

In addition, the Investment Guidelines issued by DCITA restrict the investment of the Communications Fund further below the limits authorised by Ministers (in terms of credit risk17 and tenor18 limits). They also do not reflect the intended perpetual nature of the Fund (with the Guidelines requiring both the principal and interest of the Fund to be able to be liquidated within three months). These approaches have potentially limiting effects on the investment returns able to be achieved by the Fund. However, the potential impacts of these approaches on Fund returns was not analysed in developing the investment strategy.

Chapter 4—Investment Activities of the Fund

The AOFM is required by the Investment Guidelines to focus on maximising investment returns for the Fund within the parameters set. The working group's views on the import of statements made by Ministers led to tight parameters surrounding the investment of the Communications Fund.

There were also a number of aspects of the approach being taken in investing the Communications Fund which, within the conservative investment approach adopted for the Fund, have potentially further restricted investment returns. In particular, authorisation instruments and investment instructions to the AOFM were not updated in a timely manner in light of revised mandates set by Ministers. As a result, the Communications Fund was restricted to investing in RBA term deposits for an extended period, although Ministerial mandates and authorisations permitted investment in a broader range of instruments which could have been expected to provide higher returns.19

Agency responses

DBCDE's full response to the audit is included at Appendix 1 to the report. In addition, each of DBCDE, the AOFM, Finance and Treasury provided summary responses to the audit, as follows.

DBCDE

The Department of Broadband, Communications and the Digital Economy notes that the ANAO has concluded that the investment approach taken for the Communications Fund (the Fund) closely aligns to the approach adopted for entities investing under the Financial Management and Accountability Act 1997, is more consistent with the policy that the Fund be perpetual in nature, and reflects a prudent approach.

The Department of Communications, Information Technology and the Arts consulted with the Department of Finance and Administration and Treasury in the development of the Fund legislation which occurred in a compressed timeframe and worked jointly with them in the development and implementation of investment arrangements. The investment approach was developed having regard to commitments made by the Government during Parliamentary debate and was progressed in a careful and considered manner given the significant funds involved and the complex processes required.

As the first significant fund of its type, each of the agencies was required to build a base of expertise and carefully develop relevant legislative and Ministerial instruments while managing the Fund which had been established 17 months earlier than reflected in the originally introduced bill. The process has resulted in a soundly managed Fund that has consistently met or exceeded its investment targets.

AOFM

The AOFM has no general comments on the report.

Finance

Finance notes the report's review and findings. Finance agrees with both recommendations, noting that the approach to the Communications Fund, and its timing, was in the context of the Telstra sale legislation. Consequently, the Communications Fund's governance structure and investment arrangements are different to other funds since established, such as the Future Fund.

The existing framework that supports the Future Fund and the Higher Education Endowment Fund will assist with establishing the Government's policy for the Nation Building funds.

Treasury

The Treasury welcomes the work undertaken by the ANAO to assess the effectiveness of management and administrative arrangements relating to the Communications Fund.

Regarding the investment arrangements for the Communications Fund, Treasury notes that a key consideration for the working group was the Government's public statement that the Fund would be invested in low-risk assets and would earn, from day one, a rate not less than the cash rate. These investment parameters focused the working group on designing an investment mandate that ensured a high level of certainty in achieving at least the cash rate, and limiting the probability of realising a negative return in the period leading up to the first RTIRC meeting. As a result, the working group pursued an investment strategy comprising conservative and low-risk assets, rather than examining the possible investment returns that could have been achieved by investing in the full range of assets that are permissible under the Telecommunications (Consumer Protection and Service Standards) Act 1999.

Footnotes

1 Senator the Hon. Helen Coonan, Minister for Communications, Information Technology and the Arts, Government Guarantees $2 billion cash for fund, Media Release, 11 September 2005.

2 Up until September 2007, the $2 billion principal of the Fund was not protected by specific legislation. However, there were a number of public references made prior to the legislative change in 2007 about the perpetual nature of the Communications Fund. For example, the second reading speech for the legislation that established the Communications Fund referred to the creation of a 'dedicated and perpetual' Fund and the terms of reference for the Senate Environment, Communications, Information Technology and the Arts Committee Inquiry into the provisions of the relevant Bill was to consider ‘the establishment of a perpetual $2 billion Communications Fund'.

3 Prior to the change of Government following the 2007 Federal election and the issuing of a new Administrative Arrangements Order, the Department of Communications, Information Technology and the Arts (DCITA) was primarily responsible for the administration of the Communications Fund. DCITA was abolished following the change of Government, and the new Department of Broadband, Communications and the Digital Economy (DBCDE) is now primarily responsible for the administration of the Communications Fund.

4 Prior to the change of Government following the 2007 Federal election and the issuing of a new Administrative Arrangements Order, the Department of Finance and Deregulation was known as the Department of Finance and Administration. The Department is referred to as Finance throughout this report.

5 The drafting instructions for the establishment of the Communications Fund and its investment powers were based on similar provisions contained in an early draft version of the Future Fund Bill 2005. However, the Future Fund Bill was subsequently refined and enhanced.

6 Prior to the change of Government following the 2007 Federal election, the responsible Ministers were the Minister for Communications, Information Technology and the Arts, and the Minister for Finance and Administration.

7 It was announced that the new Funds would be managed by the Future Fund Board of Guardians (the Board), whose primary role is to set the strategic direction of the investment activities of the Funds under its management (currently the Future Fund and Higher Education Endowment Fund) consistent with the Investment Mandate for each Fund. The Board is supported in its functions by the Future Fund Management Agency (FFMA), an FMA agency in the Finance and Deregulation portfolio. The FFMA is responsible for the development of recommendations to the Board on the most appropriate investment strategy for each fund and for the implementation of these strategies. All administrative and operational functions associated with the management of the Funds are undertaken by the FFMA. Source: <www.futurefund.gov.au> [accessed on 10 June 2008].

8 PM&C provided advice to the former Prime Minister on the extent of the investment powers for the Communications Fund and the appointment of the AOFM as the fund manager.

9 Up until September 2007, the perpetual nature of the Fund was not recognised in the establishing legislation.

10 See further at paragraph 19 of the report.

11 The evaluation panel comprised a representative from each of DCITA, Finance and Treasury. The decision on which firm to appoint was made by DCITA, with the contract signed by DCITA on behalf of the Australian Government.

12 At the same time, the then Minister for Communications, Information Technology and the Arts had stated that an investment mandate would be developed and that this mandate and the investments would ensure that the amount earned on the $2 billion would grow and be available for investment and use in response to the recommendations of regional telecommunications inquiries.

13 It is noteworthy that the then Government's initial proposal to constitute the Fund with Telstra shares was not supported during the passage of the legislation because of concerns that the value of the Fund would have fluctuated as the Telstra share price moved. The Bill to establish the Communications Fund was subsequently amended to require $2 billion in cash to be credited to the Fund but the list of authorised investments continued to permit the purchase of shares.

14 The Communications Fund Bill was based on an early draft of the proposed Future Fund legislation. The Future Fund Bill was introduced in the Parliament three months after the Communications Fund legislation was passed. The Future Fund legislation has a more constrained approach to the use of derivatives than was initially proposed for the Future Fund and used in the Communications Fund legislation.

15 DCITA also did not provide the consultant with an expected drawdown profile for the fund, further complicating the consultant's task. For example, Ministers had been advised that no drawdowns were expected to be required before 2009, but this information was not provided to the consultant.

16 DBCDE has advised ANAO that changes to the Regulations needed to be made during this period, as well as the then Ministers obtaining the then Prime Minister's approval for their chosen course of action.

17 Credit risk is the risk of financial loss arising from a counterparty to a transaction defaulting on its financial obligations under that transaction.

18 The tenor of an investment is its time to maturity, or the investment term.

19 By way of comparison, agencies investing amounts standing to the credit of special accounts under the provisions of Section 39 of the FMA Act and FMA Regulation 22 are able to invest in a broader range of conservative financial instruments than just term deposits. All of these instruments are permitted for the Communications Fund under the relevant legislation and regulations, but were not authorised by Ministers until January 2007.