Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Abatement Crediting and Purchasing under the Emissions Reduction Fund

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Clean Energy Regulator’s crediting and selection of carbon abatement to purchase under the Emissions Reduction Fund.

Summary and recommendations

Background

1. The Government established the Carbon Farming Initiative in September 2011 under which entities associated with the agricultural, forestry and legacy waste (landfill) emissions sectors of the economy could register projects and earn credits for every tonne of carbon abated. In November 2014, the Government expanded the Carbon Farming Initiative to form the $2.55 billion Emissions Reduction Fund (the fund)—allowing the registration of projects from all sectors of the economy and to purchase Australian Carbon Credit Units1 (primarily at auction) earned by projects to meet Australia’s greenhouse gas reduction targets.2 Projects already registered under the Carbon Farming Initiative transitioned automatically to the fund on its commencement on 13 December 2014.

2. The Department of the Environment and Energy (the department) is primarily responsible for the policy settings under which the initiative/fund3 operates and the development and approval of methods (which are applied by projects seeking registration under the fund).4 The Clean Energy Regulator (the regulator) is responsible for the administration of the fund, including:

- registering projects after undertaking assessments of project applicants and applications;

- verifying the carbon abatement claims of registered projects before issuing carbon credit units to project proponents; and

- purchasing credited and/or prospective carbon credit units from registered projects (through auctions).

3. As at 1 July 2016, the regulator has reported that it has registered over 600 projects, credited over 25 million carbon units and conducted three auctions (of which the first two were examined in this audit). The three auctions have resulted in contracts for the purchase of 143.3 million carbon credit units over the next 10-12 years from successful bidders at a cost of $1.7 billion (representing 68 per cent of the $2.55 billion fund).

4. The department reported in April 2016 that Australia is expected to surpass its 2020 cumulative abatement target by 78 million tonnes of carbon dioxide-equivalent, with the fund contributing an estimated 92 million tonnes.

Audit approach

5. The objective of the audit was to assess the effectiveness of the Clean Energy Regulator’s crediting and selection of carbon abatement to purchase under the Emissions Reduction Fund. To form a conclusion against this objective, the ANAO adopted the following high-level criteria:

- Did the regulator only register projects that met relevant legislative requirements?

- Did the regulator issue the correct quantity of carbon credit units to registered projects after verifying the claims from project proponents?

- Did the regulator design and implement the first and second auctions to purchase carbon credit units from eligible projects at least cost?

- Did the regulator appropriately manage the risks, operation and performance of the abatement crediting and purchasing components of the fund?

Conclusion

6. The Clean Energy Regulator has established sound arrangements to manage the crediting and selection of carbon abatement for purchase under the Emissions Reduction Fund. There are some aspects of the regulatory process that, nonetheless, require further attention—such as the level of documentation underpinning some areas of regulatory decision-making—to enable the regulator to better demonstrate the effectiveness of its regulatory activities.

Supporting findings

Registration of projects

7. The regulator appropriately assisted applicants to submit complete fund Project Registration Applications. In those cases where initial applications contained errors, ambiguities or insufficient information, the regulator effectively followed-up with applicants.

8. Applications for fund project registration and variation have been effectively assessed by the regulator, but documentation of some regulatory processes and decisions could be improved. In accordance with the design principles of the fund and the regulator’s risk appetite, streamlining arrangements have been introduced that have significantly reduced third-party data checks for many fund Project Registration Applications. Under these arrangements, the regulator has developed and implemented sound practices and processes to assess applications for fund project registration and variation. Improved documentation of the regulator’s consideration of the criteria for streamlined routine assessment and some project eligibility requirements would better position the regulator to demonstrate the basis on which registration decisions had been made.

9. The regulator has, in the main, applied sound processes to approve, declare and register fund projects in accordance with legislated timeframes. The decision minutes, while reflecting accurately the assessments undertaken, did not always contain all information relevant to the assessment process.

Assigning carbon credit units to projects

10. The regulator appropriately determined whether fund projects met their reporting obligations. Fund proponents submitted Certificate of Entitlement Applications (which provide the information on which the regulator undertakes its assessment), as well as supporting documentation, including Project Offsets Reports and independent Audit Reports (where required). These materials were also provided at intervals in accordance with legislated timeframes.

11. Appropriate arrangements are in place to assess the carbon abatement claims of fund projects against fund method requirements. The regulator’s Audit Report assessments determined that, in the main, reliance could be placed on the conclusions regarding proponents’ carbon abatement claims. The regulator’s detailed assessments of Certificate of Entitlement Applications/Project Offsets Reports satisfactorily addressed most of the assessment requirements, including those outstanding from project registration (which can include regulatory approvals and eligible interest holder consents). The justification for, and documentation supporting, streamlined routine assessments (determined on a risk basis) requires improvement to enable the regulator to demonstrate the robustness of these assessments.

12. Where the delegate approved the Certificate of Entitlement Applications, carbon credit units assigned to projects have been accurately calculated according to fund method requirements and recorded in public registers. While sound processes have been established by the regulator to approve, issue and register the correct quantity of carbon credit units to fund projects, the material prepared for the decision-makers did not always contain all information relevant to the required decision on whether to approve or refuse a Certificate of Entitlement Application. In addition, the decision minutes for applications undergoing routine assessments should more clearly indicate to the decision-maker the level of assurance that these assessments provide.

Identifying carbon credit units to purchase

13. Within the context of the legislated purchasing principles of the fund, the regulator effectively designed the auction methodology, parameters and delivery arrangements for the first two carbon abatement auctions that were examined in this audit.

14. For the first two auctions, the regulator created appropriate awareness of the process and established effective arrangements to inform potential auction participants of the requirements for participation and their rights and obligations if they were successful.

15. Overall, the first and second auctions were conducted effectively and in accordance with published auction guidance. The conduct of each auction was overseen by an external probity advisor engaged by the regulator.

16. The regulator selected the least-cost abatement to purchase within the established auction parameters. The fulfilment of carbon abatement contracts will be dependent on the satisfaction of conditions precedent, the abatement credited to the projects over time and the effectiveness of the ‘make good’ provisions of the contracts.

Governance of crediting and purchasing activities

17. The regulator has a well-established and integrated risk management framework to guide the development and implementation of risk management plans for the fund. Under this framework, the regulator has established sound processes to identify, assess and treat risks to the effective implementation of the fund.

18. The regulator has developed appropriate guidance, including standard operating procedures, work instructions and templates, to assist staff to assess fund Project Registration Applications, Certificate of Entitlement Applications/Project Offsets Reports and auction applications. The development of a register of fund standard operating procedures, templates and assessment tools would better position the regulator to monitor the accuracy and currency of its guidance materials.

19. The regulator has an established performance management framework to monitor and report on fund performance, with work to strengthen the framework undertaken over recent years. To date, the regulator has been monitoring and publicly reporting on the performance of the earlier initiative and the fund against activity based performance indicators. Since 2015–16, the regulator has enhanced key performance indicators to meet performance reporting requirements under the regulator’s Emissions Reduction Fund Blueprint, its Corporate Plan, its Portfolio Budget Statements, and the Regulator Performance Framework.

Recommendation

|

Recommendation No.1 Paragraph 3.14 |

The Clean Energy Regulator should ensure that appropriate documentation is retained to demonstrate the rationale for undertaking routine or detailed assessments of abatement crediting applications and that all relevant abatement crediting assessment criteria have been addressed during streamlined assessments. Clean Energy Regulator response: Agreed. |

Summary of entity response

20. The Clean Energy Regulator’s summary response to the proposed report is provided below, with the full response provided at Appendix 1.

The Clean Energy Regulator welcomes the ANAO’s report. We are pleased that, after a thorough sampling and review of our files related to both the original Carbon Farming Initiative (CFI) and the Emissions Reduction Fund (ERF), the ANAO has found that the arrangements and processes implemented by the Clean Energy Regulator are sound. We note that this assessment has been conducted on the basis of processes in place for the first four years of the two schemes. Our schemes and processes continue to mature, as does our approach to the management of risk and identification of potential non-compliance.

From the beginning, the agency designed its end to end controls and standard operating procedures for the ERF to ensure both compliance with the legislative purchasing principles and to ensure an appropriate balance between scheme risk and client burden. We believe that our controls encourage high levels of participation in the scheme, while ensuring that risks are managed appropriately. The CER has the ability, both in law and in practice, to step in at any time to ensure the integrity of the ERF scheme and purchasing process. We communicate extensively to ensure that our clients understand their obligations and have the necessary information to comply accordingly. We have specific processes and tools to ensure that any non-compliance is addressed quickly and effectively, often before it occurs or before a risk can manifest.

Of course, we are always alert to opportunities to mature our processes and respond quickly and appropriately when issues arise. We accept the single recommendation which focusses primarily on the opportunity to improve record keeping around decision making in the crediting part of the scheme. We are already working on this important measure and are confident that our changes will ensure even more robust and transparent administration of the ERF.

Our priority to date has been to manage a very large increase in applications to register projects, conducting auctions and managing the resulting contracts and delivery schedules. We now have 631 registered projects—450 of which were registered under the ERF, with the balance (181) registered during the CFI. Those projects have resulted in 309 contracts for more than 142 million tonnes of abatement at a contracted value of $1.7 billion. The stock of projects and contracts under our management will continue to rise over time. As projects deliver, a rapidly increasing proportion of our work will be in the crediting part of the scheme. We will engage with these changes, reallocate our resources as appropriate, and regularly review our risk appetite and our processes to ensure voluntary participation is high and risk of non-compliance is low.

1. Background

Introduction

1.1 Successive Australian Governments have committed to reduce Australia’s greenhouse gas emissions under the United Nations Framework Convention on Climate Change and undertaken a variety of actions to deliver on these commitments.

1.2 In 2011, the Government introduced a carbon pricing mechanism that required Australia’s biggest carbon emitters to pay a price for their emissions. To complement the carbon pricing mechanism, the Government also established the Carbon Farming Initiative in September 2011 under the Carbon Credits (Carbon Farming Initiative) Act 2011 (the CFI Act). Under this initiative, entities associated with the agricultural, forestry and legacy waste (landfill) emissions sectors of the economy could register projects and earn credits for every tonne of carbon abated. These credits could then be sold to entities with liabilities under the carbon pricing mechanism.

1.3 The Government repealed the carbon pricing mechanism with effect from July 2014 and, by legislative amendment in November 2014, expanded the Carbon Farming Initiative to form the Emissions Reduction Fund (the fund)—allowing the registration of projects from all sectors of the economy.

1.4 Under the fund, the Government committed $2.55 billion over 10 years to 2023–24 for the purchase of carbon Australian Carbon Credit Units (ACCUs5) (primarily at auction) earned by projects to be used to meet Australia’s greenhouse gas reduction targets.6 The Government also introduced changes to streamline the scheme and a safeguarding mechanism (to discourage large emitters from increasing their emissions above historical levels) commenced in July 2016. Projects already registered under the Carbon Farming Initiative transitioned automatically to the fund on its commencement on 13 December 2014.

1.5 The Department of the Environment and Energy (the department) is primarily responsible for the policy settings under which the initiative/fund7 operates and the development and approval of methods (which are applied by projects seeking registration under the fund).8 The Clean Energy Regulator (the regulator) is responsible for the administration of the fund, including:

- registering projects after undertaking assessments of project applicants and applications;

- verifying the carbon abatement claims of registered projects before issuing carbon credit units to project proponents; and

- purchasing credited and/or prospective carbon credit units from registered projects (through auctions).

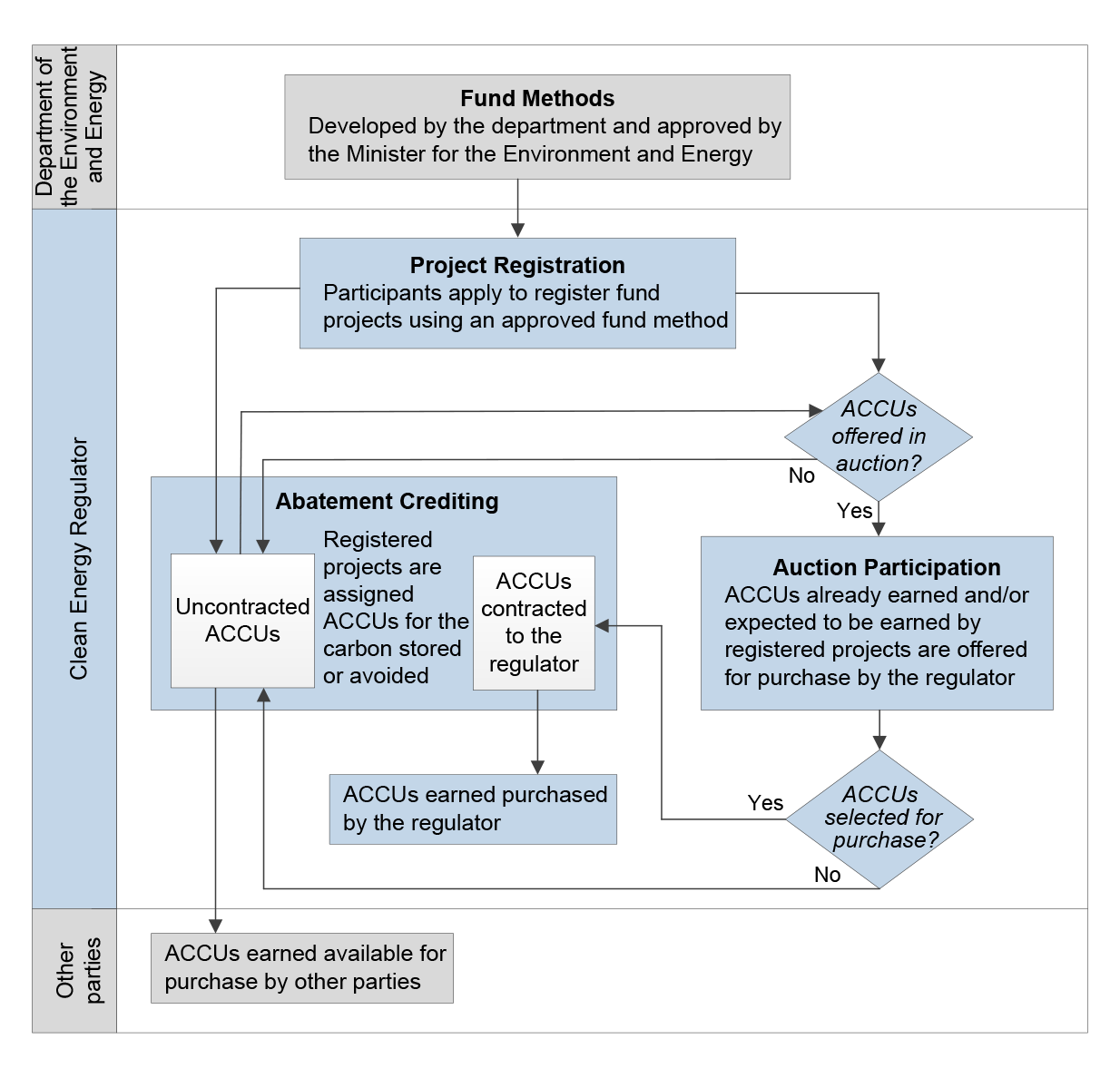

1.6 An overview of the fund’s abatement crediting and purchasing components is provided in Figure 1.1. Under the fund, registered projects can participate in auctions in advance of, or after, earning credit units for the carbon abated. The regulator only pays proponents of registered projects selected at auction for carbon credit units that have been earned. Carbon credit units not contracted to the regulator can be sold on the secondary market to enable other entities to meet their carbon abatement obligations.

Figure 1.1: Overview of the fund’s abatement crediting and purchasing components

Source: ANAO analysis of regulator information.

Emissions Reduction Fund implementation

1.7 As at 1 July 2016, the regulator has reported that it has registered 626 active fund projects9, 236 of which have been credited with a total of 25.4 million carbon credit units. The number of projects and carbon credit units issued by methods grouped by industry or theme is outlined in Table 1.1.

Table 1.1: Active fund projects and carbon credits issued, as at 1 July 2016

|

Method Group |

Registered Projects |

Carbon Abatement |

|||

|

|

No. of Methods(1) |

No. of Projects |

No. of Methods(1) |

No. of Projects |

ACCUs issued (tCO2-e) |

|

Vegetation and Sequestration |

12 |

344 |

12 |

106 |

11 866 309 |

|

Landfill & Alternative Waste Treatment |

6 |

125 |

8 |

91 |

10 990 724 |

|

Savanna Burning |

2 |

70 |

2 |

32 |

2 316 874 |

|

Agriculture |

4 |

32 |

2 |

7 |

182 454 |

|

Energy Efficiency |

6 |

38 |

- |

- |

- |

|

Transport |

2 |

7 |

- |

- |

- |

|

Industrial Fugitives |

1 |

10 |

- |

- |

- |

|

Total |

33 |

626 |

24 |

236 |

25 356 361 |

Note 1: After project registration, some project proponents volunteered to apply an updated method, while others have not.

Source: ANAO analysis of regulator information.

1.8 To date, the regulator has conducted three auctions (of which the first two were examined in this audit) and contracted to purchase 143.3 million carbon credit units over the next 10-12 years from successful bidders at a cost of $1.7 billion (representing 68 per cent of the $2.55 billion fund). Carbon credit units have been purchased at the first, second and third auctions at an average price of $13.95 per tonne, $12.25 per tonne, and $10.23 per tonne respectively. The number of projects and carbon credit units contracted at auction by method group is outlined in Table 1.2.

Table 1.2: Carbon credit units contracted at the first three auctions

|

Method Group |

Auction—April 2015 |

Auction—Nov 2015 |

Auction—April 2016 |

|||

|

|

No. of Projects |

ACCUs contracted (million tCO2-e) |

No. of Projects |

ACCUs contracted (million tCO2-e) |

No. of Projects |

ACCUs contracted (million tCO2-e) |

|

Vegetation and Sequestration |

68 |

25.7 |

71 |

25.6 |

46 |

47.2 |

|

Landfill & Alternative Waste Treatment |

64 |

16.6 |

12 |

3.6 |

10 |

1.6 |

|

Savanna Burning |

2 |

0.5 |

33 |

6.6 |

12 |

0.9 |

|

Agriculture |

9 |

4.4 |

6 |

4.1 |

2 |

0.3 |

|

Energy Efficiency |

- |

- |

5 |

3.7 |

3 |

0.5 |

|

Transport |

1 |

0.2 |

2 |

1.1 |

- |

- |

|

Industrial Fugitives |

- |

- |

2 |

0.8 |

- |

- |

|

Total(1) |

144 |

47.3 |

131 |

45.5 |

73 |

50.5 |

Note 1: The total number of ACCUs contracted may not add correctly due to rounding.

Source: ANAO analysis of regulator information.

1.9 The key milestones for the initiative and fund are outlined in Figure 1.2.

Figure 1.2: Carbon Farming Initiative and Emissions Reduction Fund timeline

Source: ANAO analysis of regulator information.

1.10 In December 2015, the Government indicated in Australia’s Second Biennial Report under the United Nations Framework Convention on Climate Change that the fund and other policies have ‘put [Australia] on track to meet [its] 2020 emissions reduction target’.10 The Department of the Environment and Energy subsequently reported in April 2016 that Australia is now expected to surpass its 2020 cumulative abatement target by 78 million tCO2-e, with the fund contributing an estimated 92 million tCO2-e.11

Audit approach

1.11 The objective of the audit was to assess the effectiveness of the Clean Energy Regulator’s crediting and selection of carbon abatement to purchase under the Emissions Reduction Fund. To form a conclusion against this objective, the ANAO adopted the following high-level criteria:

- Did the regulator only register projects that met relevant legislative requirements?

- Did the regulator issue the correct quantity of carbon credit units to registered projects after verifying the claims from project proponents?

- Did the regulator design and implement the first and second auctions to purchase carbon credit units from eligible projects at least cost?

- Did the regulator appropriately manage the risks, operation and performance of the abatement crediting and purchasing components of the fund?

1.12 The audit examined the regulator’s administration of initiative and fund projects in relation to their registration, abatement crediting and participation in the first two auctions by examining a 10 per cent sample of the respective populations (as at the closing date for registering fund projects to enable their participation in the second auction—27 October 2015). The audit did not examine the determination of fund methods by the department, the contracting of proponents successful at auction; compliance monitoring and enforcement activities; or the fund’s safeguarding mechanism.

1.13 In conducting the audit, the ANAO examined regulator records relating to the administration of the fund, including standard operating procedures, assessment tools, implementation strategies and plans, and other governance documentation. The ANAO also interviewed regulator staff and sought comments on the regulator’s administration of the fund from project proponents and peak industry groups.

1.14 The audit was conducted in accordance with the ANAO’s Auditing Standards at a cost to the ANAO of approximately $462 000.

2. Registration of projects

Areas examined

The ANAO examined activities undertaken and processes employed by the Clean Energy Regulator (the regulator) to register projects under the Carbon Farming Initiative (the initiative) and the Emissions Reduction Fund (the fund), including the: guidance provided to prospective applicants; assessment of project applicants and applications; and approval and declaration of registered projects.

Conclusion

The regulator has established sound processes to obtain from applicants the information necessary to effectively undertake the assessments required under the Carbon Credits (Carbon Farming Initiative) Act 2011 (the CFI Act). Those Project Registration Applications that were assessed as meeting requirements were approved by the delegate for registration under the fund. While the proof of identify and fit and proper person assessments have been undertaken satisfactorily, the project assessments did not always include documented consideration of all relevant criteria.

In accordance with the design principles of the fund and the regulator’s risk appetite, risk-based project assessment streamlining was introduced from April 2015. The streamlined assessment process has reduced the extent of third-party data checks undertaken by the regulator during the registration process for the majority of projects. By introducing these less-intensive routine assessments, the regulator has acknowledged, and accepted, the increased risk that applications that do not meet requirements are registered (although additional assessments are undertaken before registered projects benefit from being assigned carbon credit units). There would be merit in the regulator documenting the basis on which projects were assessed as meeting the criteria for streamlined assessment and undertaking the planned review (which is now overdue) of streamlining measures to determine their effectiveness in improving efficiency and managing risk.

Areas for improvement

To strengthen project registration arrangements, the regulator should: reinforce to staff the need for project assessments and decision minutes to document the assessors’ consideration of all relevant assessment criteria; and routinely reconcile the public Fund Project Register and the regulator’s Client Records Management (CRM) System to ensure the register’s currency and accuracy.

Did the regulator provide appropriate guidance on registering potential projects under the fund?

The regulator appropriately assisted applicants to submit complete fund Project Registration Applications. In those cases where initial applications contained errors, ambiguities or insufficient information, the regulator effectively followed-up with applicants.

2.1 The regulator has developed Project Registration Application and Client Information forms for the fund that, when completed accurately, elicits the necessary information regarding applicants’ projects to be appropriately assessed for fund registration. In cases where errors or ambiguities arise, or insufficient information has been provided, the regulator has effective processes in place to follow-up with the applicants. The prevalence of errors in application forms has reduced markedly following the replacement of hard-copy application forms with electronic smart forms from mid-2015. The use of smart forms has also reduced the time required by the regulator to assess applications.

2.2 Since 2014, the regulator has conducted annual client communication surveys to build an understanding of clients’ perceptions of its overall performance, staff performance, regulatory burden and preferred channels of communication. The results from the 2015 survey of clients who identified as participating in the earlier initiative or the fund were positive, but with some areas identified for improvement such as the provision of education, training and information to assist proponents to comply with their obligations.

Did the regulator effectively assess applications for fund project registration/variation?

Applications for fund project registration and variation have been effectively assessed by the regulator, but documentation of some regulatory processes and decisions could be improved. In accordance with the design principles of the fund and the regulator’s risk appetite, streamlining arrangements have been introduced that have significantly reduced third-party data checks for many fund Project Registration Applications. Under these arrangements, the regulator has developed and implemented sound practices and processes to assess applications for fund project registration and variation. Improved documentation of the regulator’s consideration of the criteria for streamlined routine assessment and some project eligibility requirements would better position the regulator to demonstrate the basis on which registration decisions had been made.

Project Registration Application and Client Information forms

2.3 Those Project Registration Application forms and Client Information forms (when required) submitted to the regulator have, in most cases, been completed correctly by applicants. After taking into account responses to any requests for further information from the regulator, 74 of the 87 Project Registration Applications and variations (85.1 per cent) examined by the ANAO12 were completed in full by applicants. While legal right and regulatory approval omissions were explicitly addressed during the application assessment process, the records retained by the regulator do not indicate whether other omissions had been addressed during the assessment process. The Client Information forms (which can include more than one form per project) were completed in full by applicants in relation to 23 of the 26 Project Registration Applications (88.5 per cent) examined by the ANAO where the regulator was required to establish the identity of the applicants (the remaining three applications were substantially complete).13

Proof of identity/fit and proper person assessment

2.4 The regulator can only register projects under the fund for applicants that can establish their identity and pass the fit and proper person test specified in the CFI Act.

Establishing proof of identity

2.5 Proof of identity testing required by the CFI Act involves the regulator’s examination of the personal details/business information and certified copies of common forms of identity documentation provided by fund applicants (which for individuals can include birth certificates, passports, drivers’ licenses and for body corporates includes certificates of incorporation/ registration). In relation to all 26 Project Registration Applications examined by the ANAO where the applicants were not existing scheme participants, the regulator verified that the proof of identity information and documentation supplied by the applicants met the requirements of the CFI Act.

Fit and proper person testing

2.6 The CFI Act requires project applicants to undergo a fit and proper person assessment for their projects to be registered as eligible fund projects, unless the applicants have already been assessed as meeting the fit and proper person requirements.

2.7 Since April 2015, the regulator has adopted triaging arrangements for the fit and proper person assessments to determine whether a detailed or routine assessment would be undertaken. Fund applicants not meeting the criteria for routine assessment are to undergo a detailed assessment, including third-party data checks. Those fund applicants that meet at least one of six specific criteria14 undergo a routine fit and proper person assessment that involves an assessment of the applicants’ assertions in their Client Information forms only. The regulator has acknowledged that, by undertaking routine assessments, it has accepted the risk (which it has assessed as low) that some participants that do not meet the fit and proper person requirements will be assessed as meeting those requirements.

2.8 Of the 28 Project Registration Applications examined by the ANAO that were required to undergo a fit and proper person assessment (26 detailed assessments and two routine assessments), 27 (96.4 per cent) were undertaken in accordance with standard operating procedures. The one exception was the result of an assessor error, which was rectified before any carbon credit units were issued for the project. The regulator has retained adequate documentation to support its fit and proper person assessments, except in relation to internal records searches for applicant compliance with other regulator programs/schemes. The retention of information on these searches on the assessment file would better evidence the regulator’s assessment process.

2.9 The assessors did not identify any adverse fit and proper person findings for 23 of the 28 assessments (82.1 per cent) examined by the ANAO and recommended that the applicants pass the fit and proper person test. The remaining five assessments identified adverse findings, such as convictions for illegal land clearing or infringement notices for environmental damage, which had the potential to impact on the applicants’ fit and proper person status. In four of these five assessments, the assessors applied the regulator’s guidance material for assessing the significance of adverse findings15, assessed the adverse findings as low risk (and documented their reasons) and recommended to the delegates that the applicants pass the fit and proper person test. The assessor for the remaining assessment recommended the application’s approval without documenting their consideration of the adverse finding against the regulator’s guidance material. The delegates accepted the assessors’ fit and proper person assessment recommendation on each occasion.

Project registration assessments

2.10 The CFI Act requires that the regulator not declare that an offsets project is an eligible project unless the regulator is satisfied that the project meets the specified criteria outlined in the Act. Additionality risk—the risk that emissions reductions credited under the fund would have occurred without scheme assistance—is among the key considerations to preserving the integrity of the fund. Under the fund, additionality risk is to be mitigated in two ways. First, approved fund methods are to be designed by the Department of the Environment and Energy (the department) to exclude most activities that are potentially commercially viable in their own right, which the Climate Change Authority considers has contributed to reasonably high additionality rates for the earlier initiative.16 Second, the regulator is to assess projects seeking registration against specified additionality criteria, such as meets newness requirement (project has not commenced implementation before fund registration) and meets regulatory requirement (project is not required to be carried out by or under a Commonwealth, state or territory law).

2.11 The regulator has developed and applies standard operating procedures for assessing Project Registration Applications against the registration criteria. The outcomes of the assessment are subsequently recorded in assessment tools17 (spreadsheets), with minutes prepared for the delegates justifying the assessor’s recommendation. In aggregate, the 557 fund Project Registration Applications (541 approvals and 16 refusals) determined as at 27 October 2015 were assessed by 30 assessors, reviewed by 25 reviewers and determined by 12 delegates (three of which determined over 90 per cent of Project Registration Applications).18

2.12 In November 2014, the regulator implemented a streamlined approach to documenting application assessments by combining the key elements of multiple assessment spreadsheets into a single assessment tool and reducing the contents of decision minutes. This approach eliminated unnecessary repetition in assessment documentation. The regulator further streamlined the assessment of fund Project Registration Applications by introducing a triage approach to application assessment using risk-based criteria from April 2015. The regulator undertakes a detailed project assessment for those applicants/Project Registration Applications that do not meet the criteria. Those applicants/Project Registration Applications that meet the criteria undergo a routine assessment that significantly reduces the examination of third-party information and places greater reliance on applicants’ assertions in their Project Registration Application forms. The majority of Project Registration Applications now undergo routine assessments.

2.13 The regulator’s decision to streamline assessments, which has reduced the level of review undertaken at project registration, is in accordance with the Government’s design principles for the fund19 and the regulator’s risk appetite statement for scheme compliance and effectiveness—‘in the interests of lowering transactional costs, [the regulator has an] appetite for accepting non-material and non-systemic non-compliance’. The regulator has acknowledged that, by undertaking routine assessments, it has accepted the risk (which it has assessed as low) that some applications that do not meet requirements will be assessed as meeting those requirements and be registered as eligible fund projects.20

2.14 To monitor the integrity of routine assessments, the regulator proposed to review the triage procedure and criteria six months after their introduction. The regulator informed the ANAO that its review of triage procedure and criteria have been undertaken in the context of reviews of post-auction processes rather than in the form originally proposed. For example, triage criteria were changed in advance of the third auction to better direct projects with higher regulatory additionality risk to detailed assessment. In June 2016, the regulator informed the ANAO that a more detailed review of the triage model was in the early stages of planning.

2.15 The basis on which the regulator determined that applications would be subject to a routine project assessment, as opposed to a detailed project assessment, was not sufficiently documented. Of the 21 Project Registration Applications examined by the ANAO that underwent a routine project assessment, evidence had been retained by the regulator justifying the decision to undertake a routine assessment for three projects (14.3 per cent). Improved documentation of triage assessments would allow the regulator to better demonstrate the basis on which Project Registration Applications were assessed as meeting the criteria for routine assessments and that the triage process was being appropriately applied.

2.16 Notwithstanding the limited documentation of its triage assessments, the regulator has developed and implemented sound practices and processes to assess project fund applications and variations. Assessors satisfactorily completed the assessment tools for each Project Registration Application and variation (including in relation to 59 of the 61 completed assessment tools (96.7 per cent) for applications examined by the ANAO).21 In general and in accordance with the regulators’ streamlining of project assessments, the extent to which the regulator reviewed information supplied by applicants in their Project Registration Applications against third-party data reduced markedly after the transition from the earlier initiative to the fund. The ANAO’s examination of the key assessment criteria common to all methods (including: obtaining regulatory approvals, eligible interest holder consents and legal right, and meeting the additionality criteria) indicated that third-party data checks of applicants’ assertions for fund projects reduced considerably when compared to earlier initiative projects.

2.17 In relation to the aspects of additionality common to all projects assessed by the regulator, regulatory additionality is the only aspect where the regulator has placed reliance almost exclusively on applicants’ assertions throughout the assessment of fund Project Registration Applications. Of the 60 fund project registration assessments examined by the ANAO where regulatory additionality was considered, only a small proportion relied on information other than applicants’ assertions. The regulator has, however, recently reconsidered its interpretation of the regulatory additionality criterion to more closely align with the general policy intent to credit only genuine and additional abatement under the fund, which has resulted in an increase in the standard that future projects need to meet under this criterion.

2.18 In relation to the registration of projects, there is scope for the regulator to improve its assessment of:

- Legal right—the regulator’s consideration of legal right22 was well documented in relation to the earlier initiative projects, but legal right does not form part of the documented checks undertaken by assessors at project registration for a sub-set of fund projects—sequestration projects. Decision minutes examined by the ANAO regarding the registration of sequestration projects provided to the delegate did not routinely document the regulator’s formal consideration of the extent to which applicants had established legal right for their projects. The regulator informed the ANAO that legal right is a universal consideration in all project registration assessments and that it will amend its sequestration assessment tool template to explicitly address consideration of legal right.

- List of excluded offsets projects—since January 2015, the regulator has reduced the extent to which its assessments explicitly consider whether prospective projects are included on the list of excluded projects.23 While the regulator routinely examined whether earlier initiative projects were excluded offsets projects (21 of 22 applicable assessments), only five of 17 detailed fund project assessments and none of the 21 routine fund project assessments explicitly considered whether the projects were included on the excluded offsets projects list.24 To strengthen the registration assessment process, the regulator should document its assessment of whether projects appear on the list of excluded offsets projects.

Did the regulator appropriately approve, declare and register fund projects?

The regulator has, in the main, applied sound processes to approve, declare and register fund projects in accordance with legislated timeframes. The decision minutes, while reflecting accurately the assessments undertaken, did not always contain all information relevant to the assessment process.

Project registration decision-making

2.19 The decision minutes prepared by the assessors accurately represented the Project Registration Application assessments undertaken, but some minutes did not include information to demonstrate that the assessments undertaken covered all relevant considerations—particularly whether legal right had been considered and the project activities were included on the list of excluded offsets projects (as noted earlier). All 85 decision minutes examined by the ANAO accurately represented the assessments undertaken by the assessors (with the remaining two Project Registration Applications examined withdrawn by the applicants concerned). However, 35 of the decision minutes (41 per cent)—34 of which relate to fund project registration assessments—did not address all relevant key assessment criteria. The inclusion of the results of the regulator’s assessment against all key assessment criteria in decision minutes for future fund project assessments would provide greater assurance that registered projects have met registration requirements.

2.20 The regulator is required to take all reasonable steps to ensure that a decision is made on an application within 90 days of the application being made or after further information is received from the applicant. The regulator has reported that it has met these decision timeliness requirements on all occasions. The ANAO’s analysis indicates that, in relation to the 85 project registration/variation decisions examined, timeliness indicators had been met.

2.21 The timeliness of fund project registration (measured in terms of elapsed days) has improved appreciably over time, with the regulator’s streamlining approach to application assessment one of the primary reasons. Of all 557 project registration decisions made as at 27 October 2015, 21 decisions relating to initiative applications required in excess of 150 elapsed days to determine, while no fund application has required longer than 118 elapsed days to determine. The cumulative average elapsed days to assess Project Registration Applications have been reducing over time to 49.6 days as at October 2015 (including an average of 79 days for initiative project assessments and 34.6 days for fund project assessments to October 2015) as outlined in Figure 2.1.

Figure 2.1: Elapsed days to assess initiative/fund Project Registration Applications, February 2012 to October 2015

Source: ANAO analysis of regulator information.

2.22 Delegates generally evidenced their approval or refusal of project registration applications by signing the decision minutes, as required by standard operating procedures. Since mid-2015, some delegates have not signed minutes, with reliance placed on fields within the CRM System to record the approval or refusal decision (relating to 31 of the 85 minutes examined by the ANAO (36.4 per cent)). The regulator informed the ANAO in April 2016 that this practice would cease until the integrity of documentation retained in the CRM System supporting the delegates’ decisions could be confirmed.25

Project registration declarations, notifications to stakeholders and entries in the Public Register

2.23 At the time the delegate approves the decision minute to register a fund project, the delegate is also to approve and issue to the project proponent a: declaration of the registered project (a copy of which is also forwarded to the relevant state/territory land registration office if the project is a sequestration offsets project); and notice outlining the project’s audit schedule when subsequently claiming carbon credit units. New projects are also required to be entered on to the regulator’s public Fund Project Register.26

2.24 Of the 85 fund project declarations examined by the ANAO, 49 (57.6 per cent) contained accurate and complete information, with the remaining 36 declarations not containing location details that are required by the CFI legislation. All proponents had been notified of the project registration assessment decision in a timely manner and all projects were accurately recorded in the public Fund Project Register (which is maintained on a spreadsheet separate from the regulator’s CRM System).27 The regulator also correctly established audit schedules for the 37 newly registered fund projects.

3. Assigning carbon credit units to projects

Areas examined

The ANAO examined the activities undertaken and processes employed by the Clean Energy Regulator (the regulator) to assign and register carbon credit units to projects under the Carbon Farming Initiative (the initiative) and Emissions Reduction Fund (the fund), including the assessment of Certificate of Entitlement Applications, Project Offsets Reports and independent Audit Reports (where required).

Conclusion

The regulator has obtained Project Offsets Reports and independent Audit Reports (where required) from project proponents in accordance with legislative requirements. These reports and the accompanying Certificate of Entitlement Applications were generally complete, but required information and/or documentation was not included in some cases. While the reports were appropriately assessed by the regulator, documentation supporting the less-intensive routine assessments—which will become more prevalent under the regulator’s streamlining approach—could be improved.

Those applications that have been assessed as meeting requirements were approved by the delegate, assigned the correct quantity of carbon credit units and registered appropriately in public registers.

Areas for improvement

One recommendation has been made aimed at improving the routine assessments of Certificate of Entitlement Applications/Project Offsets Reports.

To strengthen arrangements for the crediting of carbon abatement, the regulator should also:

- ascertain that unqualified Audit Reports do not contain any material findings and qualified Audit Reports clearly identify the material findings related to the reports’ qualification;

- review the streamlining measures to determine their effectiveness in improving efficiency and managing risk; and

- ensure that decision minutes of routine assessments clearly indicate the level of assurance that these assessments provide.

Did the regulator determine whether fund projects met their offset reporting obligations?

The regulator appropriately determined whether fund projects met their reporting obligations. Fund proponents submitted Certificate of Entitlement Applications (which provide the information on which the regulator undertakes its assessment), as well as supporting documentation, including Project Offsets Reports and independent Audit Reports (where required). These materials were also provided at intervals in accordance with legislated timeframes.

3.1 The first step in the issuing of credits for carbon abated by fund projects is the proponents’ submission of Certificate of Entitlement Application forms, accompanied by Project Offsets Reports outlining the project’s abatement achievements over a specified reporting period. Where required by the regulator, these are also accompanied by independent Audit Reports designed to verify the claims made.

3.2 The Carbon Credits (Carbon Farming Initiative) Act 2011 (CFI Act) provides flexibility for proponents regarding the frequency of the submission of offsets reports for their projects. Over their projects’ crediting periods (generally seven or 10 years), proponents are required to submit multiple Certificate of Entitlement Applications and Project Offsets Reports. In relation to the Certificate of Entitlement Applications/Project Offsets Reports examined by the ANAO28, all 35 were submitted at intervals in accordance with the requirements of the CFI Act, with reporting periods that commenced either at the start of the crediting period (initial offset reports) or at the conclusion of the previous offsets report (subsequent offsets reports). In those cases where errors, ambiguities or insufficient information are found, the regulator has established effective processes to follow-up proponents.

3.3 Under the initiative, all Project Offsets Reports were required to be accompanied by an independent Audit Report. This requirement was revised under the fund, with only some offsets reports provided by proponents over the crediting life of their projects (including initiative projects that transitioned to the fund) requiring an accompanying Audit Report.29 Independent Audit Reports covering the Project Offsets Reports examined by the ANAO were submitted in support of proponents’ Certificate of Entitlement Applications on all 28 occasions where required. Audit Reports were also submitted in support of two additional Certificate of Entitlement Applications examined by the ANAO when not required.

Did the regulator appropriately assess the carbon abatement claims of fund projects?

Appropriate arrangements are in place to assess the carbon abatement claims of fund projects against fund method requirements. The regulator’s Audit Report assessments determined that, in the main, reliance could be placed on the conclusions regarding proponents’ carbon abatement claims. The regulator’s detailed assessments of Certificate of Entitlement Applications/Project Offsets Reports satisfactorily addressed the majority of the assessment requirements, including those outstanding from project registration (which can include regulatory approvals and eligible interest holder consents). The justification for, and documentation supporting, streamlined routine assessments (determined on a risk basis) requires improvement to enable the regulator to demonstrate the robustness of these assessments.

Content of Certificate of Entitlement Applications, Project Offsets Reports and Audit Reports

3.4 After taking into account responses to requests for further information from the regulator, 10 of the 34 processed applications and offsets reports (29.4 per cent) examined by the ANAO30 contained all information and documentation required under the CFI Act. The remaining 24 applications and offsets reports did not include all required information or documentation, including whether the project had been implemented in accordance with the applicable method or whether sufficient details were provided regarding the calculation of the quantity of carbon abated.

3.5 The independent Audit Reports that are required to accompany fund Project Offsets Reports must: contain, among other things, a reasonable assurance opinion as to whether the project has been implemented in accordance with the project declaration, the applicable fund method and the requirements of the CFI Act in all material respects during the reporting period; and (since 2015) specify the quantity of verified abatement for the reporting period. The audits are required to be undertaken by qualified auditors registered with the regulator under the National Greenhouse and Energy Reporting Scheme (NGERS).31 All 30 Audit Reports of offsets reports examined by the ANAO were prepared by NGERS-registered auditors and contained the required reasonable assurance opinions. All Audit Reports since 2015 examined by the ANAO have also specified the quantity of verified abatement for the reporting period.

Assessment of Audit Reports

3.6 The audits of Project Offsets Reports are designed to provide assurance to the regulator regarding the extent to which projects met method eligibility requirements and carbon abatement claimed by proponents has been calculated in accordance with fund method requirements. The majority of fund project Audit Reports assessed by the regulator contained unqualified opinions regarding the fund projects’ compliance with scheme requirements.32 Of the 290 fund Audit Reports assessed by the regulator as at 27 October 2015, 277 (95.5 per cent) contained an unqualified audit opinion.33 The reasons for the qualification of some offsets reports included significant overstatement of carbon abatement in calculations and/or non-compliance with CFI Act or method requirements. In cases of significant overstatement, the regulator reduced the carbon credit units assigned to the projects concerned by the amount of the overstatement. While significant findings were infrequent, auditors commonly identified immaterial findings—in 100 of the 290 Audit Reports (34.5 per cent)—for matters relating to the calibration of measuring instruments, measurement techniques, immaterial understatement/overstatement and record-keeping.

3.7 A key component of the regulator’s assessment of the quality of the Audit Reports was an assessment of whether they were: structured correctly; complied with relevant legislative requirements; and complied with the regulator’s criteria. Over 90 per cent of audits (263 of the 290 Audit Reports) were assessed as meeting all three characteristics. Of the remaining 27 audits (9.3 per cent), 22 did not meet one or more of the characteristics, while the regulator’s records did not clearly indicate the outcomes of its assessment for the remaining five Audit Reports.

3.8 The ANAO also compared audit opinions against material findings and identified four Audit Reports with unqualified audit opinions that identified material findings (which should, prima facie, lead to qualified audit opinions) and three Audit Reports with qualified audit opinions that did not identify any material findings. These anomalies were not identified and/or corrected by the regulator. The regulator should strengthen review arrangements to identify any inconsistencies in Audit Reports and address identified issues before accepting the reports.

Assessment of project carbon abatement claims

3.9 The CFI Act requires the regulator to issue a fund project a certificate of entitlement (that is, carbon credit units) for abatement claimed during the offsets reporting period where specified regulatory criteria have been met. These criteria include whether regulatory approvals have been obtained or whether legal right has been demonstrated.

3.10 The regulator has developed standard operating procedures for assessing the carbon abatement claims of project proponents (which are similar to those for assessing project registration applications). Assessments have involved examining proponents’ assertions in their Certificate of Entitlement Applications/Project Offsets Reports, consideration of the regulator’s separate assessments of independent Audit Reports (outlined earlier) and confirmation against third-party data. The assessment results are recorded in assessment tools (spreadsheets) and/or minutes prepared for the delegates justifying the assessor’s recommendation. The 346 Certificate of Entitlement Applications/Project Offsets Reports (345 approvals and one refusal) determined as at 27 October 2015 were assessed by 13 assessors, reviewed by 15 reviewers and determined by six delegates (three of which determined over 85 per cent of carbon abatement claims from proponents). Audit Reports accompanied 83.8 per cent of Certificate of Entitlement Applications/Project Offsets Reports.

3.11 In accordance with the Government’s design principles for the fund and, as was the case for the assessment of fund Project Registration Applications, since April 2015 the regulator has streamlined the assessment of Certificate of Entitlement Applications/Project Offsets Reports. Under the streamlined arrangements, the regulator introduced a triage approach that utilises risk-based criteria. A detailed assessment of proponents’ carbon abatement claims is only undertaken for those projects where the most recent audit opinion has been qualified and/or where the proponents or projects are included on the Client Alert List and/or Project Alert List maintained by the regulator.34 Routine assessments, which rely primarily on independent Audit Reports (and their assessment by the regulator), are to be undertaken for projects where the most recent audit opinion has been unqualified. Given the high proportion of Audit Reports that are unqualified, most future assessments of Certificate of Entitlement Applications/Project Offsets Reports are likely to be considered by the regulator as ‘routine’.

3.12 The regulator has retained insufficient evidence to underpin its decisions to undertake routine assessments and that Certificate of Entitlement Applications/Project Offsets Reports that were subject to routine assessments met requirements. Of the 35 Certificate of Entitlement Applications/Project Offsets Reports examined by the ANAO, four were subject to a routine assessment (with the remainder having been submitted prior to the introduction of the triaging approach). The regulator did not retain documentation of the triaging of applications that underpinned its decision to undertake a routine assessment of these four applications. In addition, evidence has not been retained to demonstrate that the regulator assessed whether the contents of two of the four Certificate of Entitlement Application forms met CFI Act requirements.35

3.13 To better monitor the integrity of proponents’ carbon abatement claims in a streamlined assessment environment, the regulator should:

- improve the documentation of triage assessments of each Certificate of Entitlement Application against established criteria—particularly in relation to the project’s inclusion in or exclusion from the Client Alert List and/or Project Alert List;

- provide information to the delegate on the extent to which Certificate of Entitlement Applications meet requirements and eligibility criteria; and

- regularly review the ongoing validity of streamlining arrangements.

Recommendation No.1

3.14 The Clean Energy Regulator should ensure that appropriate documentation is retained to demonstrate the rationale for undertaking routine or detailed assessments of abatement crediting applications and that all relevant abatement crediting assessment criteria have been addressed during streamlined assessments.

Clean Energy Regulator response: Agreed.

3.15 In relation to the 31 detailed assessments examined by the ANAO, documentation was retained to evidence the regulator’s consideration of whether: the applicant passed the fit and proper person test; the applicant was the proponent; outstanding regulatory approvals and eligible interest holder consents had been obtained; and legal right had been fully demonstrated. There were, however, 13 detailed assessments (41.9 per cent) that contained only partial coverage of the relevant assessment areas, for example methodology questions that were not addressed (eight assessments) and insufficient consideration of the ‘no-double counting test’ (four assessments).36

Did the regulator appropriately approve, issue and register the correct quantity of carbon credit units to fund projects?

Where the delegate approved the Certificate of Entitlement Applications, carbon credit units assigned to projects have been accurately calculated according to fund method requirements and recorded in public registers. While sound processes have been established by the regulator to approve, issue and register the correct quantity of carbon credit units to fund projects, the material prepared for the decision-makers did not always contain all information relevant to the required decision on whether to approve or refuse a Certificate of Entitlement Application. In addition, the decision minutes for applications undergoing routine assessments should more clearly indicate to the decision-maker the level of assurance that these assessments provide.

Abatement crediting decision-making

3.16 Of the 34 Certificate of Entitlement Application decision minutes (used by the regulator to evidence acceptance or rejection of Certificate of Entitlement Applications) that were examined by the ANAO (all approved)37, 27 (79.4 per cent) contained all relevant information. There was information, which was relevant to the delegates’ decisions, for the remaining seven applications that was not included in the decision minutes, such as whether project contraventions of the CFI legislation identified by auditors were significant to the integrity of the applications (four assessments).

3.17 While detailed application assessments provide decision makers with reasonable assurance as to whether those applications meet requirements, the regulator informed the ANAO that it considers routine application assessments provide decision makers with limited assurance—a lesser standard.38 The content of decision minutes of routine assessments does not, however, clearly indicate that delegate decisions are made to the limited assurance standard. The regulator should revise its decision minute template for routine assessments to clearly indicate the level of assurance provided by the assessment activity.

3.18 In relation to the timing of decisions, delegates are required to take all reasonable steps to make a decision on an application within 90 days of the application being made or the proponent’s response to a request for further information. The regulator has reported that it has met these timelines on all occasions and the ANAO’s analysis confirmed that timelines had been met in relation to the 34 certificate of entitlement decisions that it examined.

3.19 The timeliness of Certificate of Entitlement Application decisions (measured in terms of elapsed days) has improved over time, as was the case for project registration. Of the 346 decisions made as at October 2015, the cumulative average elapsed days taken to assess the applications has reduced to 25 days (including an average of 13 days for those applications processed in 2015) as outlined in Figure 3.1.

Figure 3.1: Elapsed days to assess Certificate of Entitlement Applications, November 2012 to October 2015

Note 1: The first Certificate of Entitlement Application was approved in November 2012.

Source: Analysis of regulator information.

Certificate of entitlement declarations and register entries

3.20 At the time when the delegate approves the decision minute to approve a project’s abatement claim, the delegate is also to issue a certificate of entitlement to the project proponent specifying the number of carbon credit units to which the project is entitled. Based on the project information assessed, carbon credit units for the 34 approved Certificate of Entitlement Applications/Project Offsets Reports examined by the ANAO have been correctly calculated in accordance with fund method requirements by the regulator. In addition, carbon credit units issued to fund projects examined by the ANAO were recorded against the correct accounts in the Australian National Registry of Emissions Units.39

3.21 The regulator is also required to maintain a public Fund Project Register that summarises the details of all registered projects, including carbon credit units issued. Carbon credit units issued under the 34 approved certificates of entitlement examined by the ANAO were accurately recorded in the register. In addition, information related to Certificate of Entitlement Applications recorded in the regulator’s CRM System was accurate and complete for 32 of the 35 applications (91.4 per cent) examined, with the CRM System containing minor inaccuracies for the remaining three applications.

4. Identifying carbon credit units to purchase

Areas examined

The ANAO examined the activities undertaken and processes employed by the Clean Energy Regulator (the regulator) to identify carbon credit units for purchase from projects under the Emissions Reduction Fund (the fund), focusing on the design and conduct of the first two abatement auctions.

Conclusion

The regulator effectively designed and implemented the first and second fund auctions in accordance with established processes and probity guidance that, on the basis of the auction methodology applied, identified the least-cost abatement to purchase from projects over a 10-year period. The regulator created sufficient awareness of auction process requirements and appropriately supported potential proponents to participate in the auctions, including clearly outlining their rights and obligations should they be successful.

The carbon abatement contracts that have been established with successful auction participants contain schedules for the delivery of carbon credit units to the regulator over the life of the contracts. In relation to successful participants in the first auction, the regulator did not establish the capacity of their projects to generate sufficient carbon credit units to fulfil contractual requirements. The regulator strengthened arrangements to assess and treat the risk to the delivery of quantities offered at the second auction, and has indicated that arrangements will be further refined for future auctions.

Area for improvement

To strengthen the abatement purchasing arrangements, the regulator should continue to develop and periodically review abatement profiles for the most commonly used fund methods.

Did the regulator effectively design the auction methodology, parameters and delivery arrangements?

Within the context of the legislated purchasing principles of the fund, the regulator effectively designed the auction methodology, parameters and delivery arrangements for the first two carbon abatement auctions that were examined in this audit.

4.1 The CFI legislation provides for the regulator to purchase emissions reductions (carbon credit units) from proponents of eligible offsets project through a reverse auction, a tender or other purchasing process. To date, the regulator has exclusively used the reverse auction method to purchase carbon credit units.40

Auction methodology and design

4.2 The CFI legislation establishes six principles that the regulator must consider when purchasing emissions reductions, which include purchasing carbon abatement at least cost and ensuring that administrative costs are reasonable. Within the context of these purchasing principles, the Emissions Reduction Fund White Paper (released in April 2014) outlined the Government’s initial expectations of the parameters for purchasing emissions reductions under the reverse auction method. Key features included:

- participants submitting single, sealed bids for their project’s carbon abatement (comprising carbon credits already issued, as well as those yet to be generated at the time of the auctions);

- cost being the sole criterion for selection, with project risk and commercial readiness being assessed by the regulator in a pre-qualification phase;

- engendering competition by purchasing only 80 per cent of the emissions reductions offered for sale at an auction below a pre-set maximum price that the Government would be willing to pay (the benchmark price);

- the regulator having the option to terminate contracts if conditions precedent (relating to such issues as securing project finance and obtaining regulatory approvals) are not met in a reasonable timeframe;

- payment only after emissions reduction have occurred and carbon credit units have been issued to projects; and

- ‘make-good’ provisions requiring proponents to source emissions reductions from other projects should their own project earn insufficient carbon credit units to meet contract delivery requirements.

4.3 To assist with the further development of the auction methodology and parameters, the Department of the Environment and Energy (the department) engaged the Commonwealth Scientific and Industrial Research Organisation (CSIRO) to model likely bidding behaviour of fund auction participants under varying scenarios. The CSIRO’s report (dated September 2014) concluded that cultivating uncertainty (including on maximum prices, the scale of future auction opportunities and even the budget available) reduces strategic bidding behaviour, keeping bidders more focused on their own costs.

4.4 The regulator adopted the purchasing parameters contained in the fund’s White Paper and incorporated the advice received from CSIRO regarding potential bidder behaviour when designing the parameters of the first two auctions. The guidelines for the first auction indicated that after auction qualification and registration (discussed later in this chapter), fund proponents would be able to lodge a single bid for each tonne of carbon abatement offered at auction for each project. The Government would purchase the lowest cost 80 per cent of total emissions reductions offered at the auction below the benchmark price.

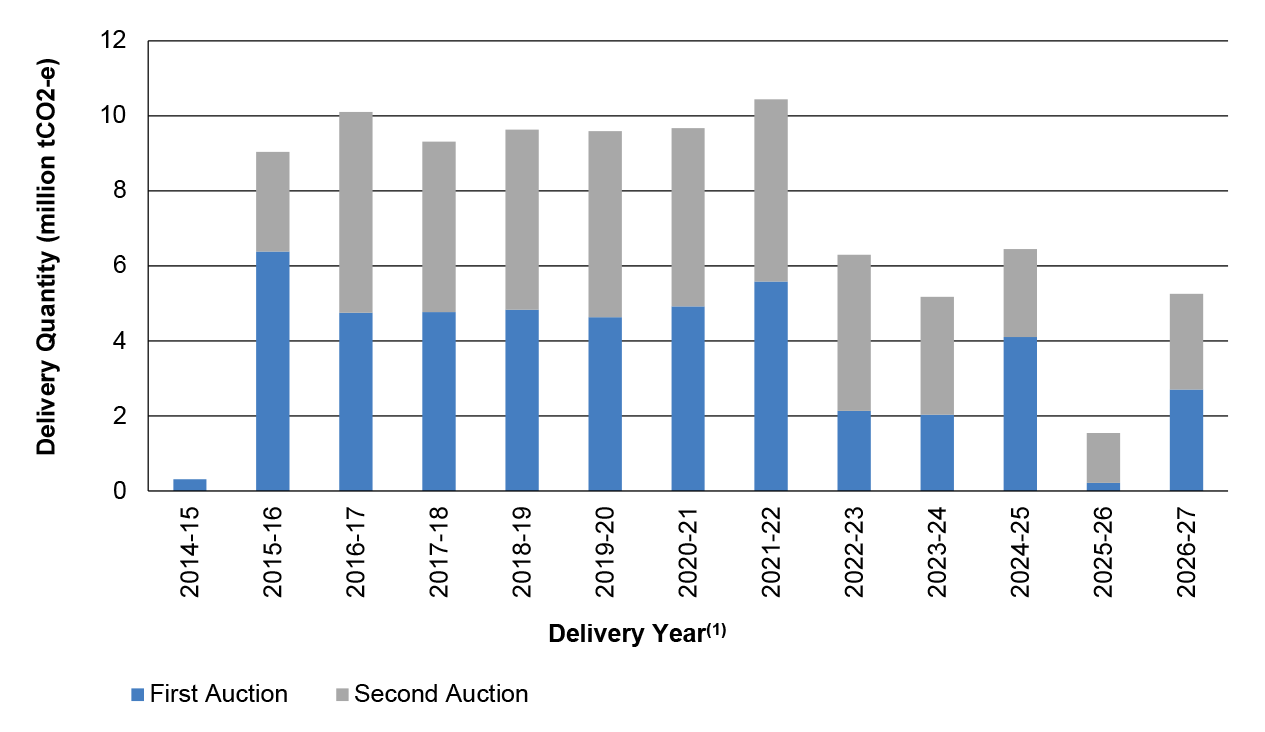

4.5 To maintain competition among potential bidders and reduce the opportunity for strategic bidding, the regulator varied the parameters of the second auction to allow for the purchase of between 50 and 100 per cent of the lowest-cost volume offered for sale by fund participants below the benchmark price.41 The regulator pre-determined five potential decision points based on key variables (using a bid assessment tool developed for the purpose) that the regulator assessed as representing greater value for money than other potential decision points within the 50–100 per cent volume purchase range. Two of the potential decision points represented the agreed boundaries of the 50–100 per cent range, with the other three placing emphasis on: the lowest average price; optimal volumes at moderate average prices; and the volume with the greatest diversity by fund method. The purchasing parameters for the first two auctions are outlined in Figure 4.1.

Figure 4.1 Purchasing parameters for the first and second auctions

Source: ANAO analysis of regulator information.

4.6 To protect the integrity of auction processes, the auction guidelines outlined: the matters that could result in potential auction participants being disqualified from participating in auctions (which included breaching the guidelines and suspected breaches of the Carbon Credits (Carbon Farming Initiative) Act 2011)); and the responsibilities of potential auction participants not to disclose their bidding strategy or to cause the purchasing process to become unfair or disorderly.

Auction delivery platform

4.7 For the first two auctions, the regulator determined that it would be directly responsible for handling the first two of the three stages of the auction process—namely, auction qualification and registration—while auction participants were required to use AusTender to lodge their bids to complete the auction process (using unique passcodes). As AusTender could not restrict auction participants lodging multiple bids for the same project, the regulator monitored the date and time of bid lodgement to determine and accept only the first bid lodged by participants, as required by the auction rules.

Did the regulator create appropriate awareness of the auction process, participation requirements and obligations on selected proponents?

For the first two auctions, the regulator created appropriate awareness of the process and established effective arrangements to inform potential auction participants of the requirements for participation and their rights and obligations if they were successful.

Auction process awareness

4.8 In the lead-up to the first auction, the regulator developed an Auction Communication Plan that identified potential audiences, key messages to be conveyed, a timetable of communication activities, and factors to be considered when evaluating the success of the communication approach. Communication activities outlined in the plan and undertaken included posts/updates to the regulator’s website and targeted emails to fund proponents and subscribers. An internal evaluation of the effectiveness of the regulator’s external communications and engagement activities during the first auction process identified positive results.

4.9 The regulator also developed an Auction Communication Plan for the second auction that, while similar to the communications plan for the first auction, included expanded and refined descriptions of potential audiences, key auction messages and factors to be considered when evaluating the success of communication approaches. The communication activities undertaken during the second auction were similar to those undertaken during the first auction, with the addition of information workshops conducted by the Carbon Market Institute under contract with the department. Information workshops were held in eight mainland capital and major regional cities during June 2015 and attracted a total of 525 participants.

Auction participation requirements and obligations on selected participants

4.10 The regulator developed auction guidelines that were made available to potential auction participants on the announcement of the dates of the auctions. These guidelines were the primary mechanism used by the regulator to inform proponents of participation requirements and their rights and obligations should they be selected. The guidelines for the first and second auctions specified:

- that projects related to the bid must be registered by the regulator;

- that participants must be qualified and registered to participate, using standard application forms;

- the elements that would constitute an eligible bid from an authorised bidder; and

- that contracts covering the project(s) commence automatically on the regulator’s notification of the bid’s success and acceptance of the participant’s offer.42

4.11 The auction qualification, registration and bid forms completed sequentially by fund proponents further outlined their rights and obligations. By completing and submitting the forms to the regulator, the proponent made a commitment to sell a specified quantity of carbon credit units under the terms and conditions of the Code of Common Terms of the Carbon Abatement Contract, supplemented by the commercial, delivery and financial terms outlined in the forms.

4.12 The notifications sent to auction participants after the completion of the qualification and registration stages also advised participants of the next steps in the auction process and the deadline for their completion. To reduce the potential AusTender access issues during the two -day auction bidding window, the auction registration notifications encouraged participants to create their AusTender usernames and passwords in advance. The regulator also produced guidance for auction participants on how to use AusTender to lodge their bids.

Did the regulator undertake the auctions effectively and in accordance with published auction guidance?

Overall, the first and second auctions were conducted effectively and in accordance with published auction guidance. The conduct of each auction was overseen by an external probity advisor engaged by the regulator.

Probity

4.13 In advance of both the first and second auctions, the regulator appointed an external probity advisor to examine whether the regulator’s processes and procedures for conducting, and their application during, the auctions resulted in auctions that were fair, transparent, accountable and equitable. The services performed by the probity advisor included:

- developing, and monitoring compliance with, the auctions’ Probity Plan and confidentiality declarations for those involved in the auction processes;

- assessing the adequacy, and sample testing the consistent application, of standard operating procedures and work instructions for auction processing;

- gaining an understanding of the bid assessment tools; and

- observing the handling and assessment of bids and the recommendation and acceptance of the proposed outcomes of the auctions.

4.14 At the conclusion of each auction, the probity advisor concluded that the regulator’s auction processes and procedures were fair and transparent and that the advisor did not identify any aspects of the process that contravened the principles of probity or impacted on the equitable treatment of auction participants. The probity advisor also considered that the suggested improvements to processes, procedures and systems identified during the first auction had been implemented for the second auction. The ANAO also observed key aspects of the handling and assessment of bids for the second auction and did not observe any non-conformance with the auction’s Probity Plan.

Regulator assessments

4.15 The ANAO examined, on a sample basis, the application of the regulator’s standard operating procedures and work instructions for the auction that were also examined by the probity advisor during the first two auctions. The ANAO found that:

- auction participants satisfactorily completed and signed application forms related to the sequential stages of auction qualification, registration (including approved bidders) and bidding;

- the regulator’s delegate approved the participants’ progress through the auction process after applications had been assessed as meeting the assessment criteria; and

- notifications were sent to the participants in a timely manner after the regulator had made a decision regarding the proponents’ applications.