Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Efficiency through Contestability Programme

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Efficiency through Contestability Programme in supporting entities to improve the efficient delivery of government functions.

Summary and key learnings

Background

1. In 2014–15, the Government introduced the Efficiency through Contestability Programme (the Programme) led by the Department of Finance (Finance). The Programme aimed to apply the most efficient way of designing and delivering government policies, programmes and services. The Programme was part of a Contestability Framework, which first considered whether government should deliver a function, and then assessed whether a function should be open to competition and the appropriate means for this to occur.

2. Under the Framework, a Contestability Programme Steering Committee developed and recommended a programme of work for Contestability Reviews, Functional and Efficiency Reviews, and Portfolio Stocktakes.1 Also under the framework:

- the Minister for Finance was to approve the programme of work, which was intended to progressively cover all areas of government;

- responsible Ministers, with the support of their entities, were to ensure the completion of planned reviews and make recommendations to Government on review outcomes, implementation arrangements and cessation of functions; and

- reviews were to provide the public sector and government with a robust evidence base to inform and guide its decision making.

3. After commencing a pilot in 2014, Finance implemented the Programme in 2015 and published supporting Contestability Programme Guidelines. The Programme ceased on 30 June 2017, although as envisaged at the outset of the Programme, implementation of many review recommendations by responsible entities was ongoing. In May 2017, the Minister for Finance observed that most portfolios had been reviewed through the Programme and that ‘Functional and Efficiency Review outcomes have achieved savings of around $5 billion from 2014–15 to 2020–21’.

Audit objective and criteria

4. The objective of the audit was to assess the effectiveness of the Efficiency through Contestability Programme in supporting entities to improve the efficient delivery of government functions. The criteria were:

- the Department of Finance effectively designed, administered and supported the oversight of the Programme;

- all reviews supported entities to design initiatives to improve the efficient delivery of government functions and make recommendations to Government (through the responsible Minister) on implementation arrangements; and

- selected entities have implemented agreed initiatives as planned and have monitored and reported on achieving planned financial and non-financial efficiency gains to Finance and the responsible Minister.

Conclusion

5. The Efficiency through Contestability Programme was effective in supporting entities to review the efficient and effective delivery of government functions. The Programme has produced many recommendations to improve the efficiency of administrative systems and, to a lesser extent, the contestability and means of delivering government functions. Substantial Budget savings have arisen from the Programme, although entities have not yet demonstrated the extent of efficiency and performance improvements supporting those Budget savings. Entities would benefit from developing performance measures that capture improvements in efficiency over time—such as through the use of baselines or benchmarks.

6. Finance effectively designed, administered and supported the implementation of many elements of the Programme. The department’s planning was sound and it provided adequate support and guidance to entities conducting reviews. Finance undertook planned evaluation, and in December 2017 concluded that the Programme supported Budget repair in excess of $5 billion over the forward estimates. Finance could have provided the Contestability Programme Steering Committee with more support to determine whether Functional and Efficiency Reviews met their terms of reference.

7. While often not following Programme guidelines, the reviews made a large number of recommendations to improve delivery of government functions and/or increase operational and administrative efficiencies, but did not often propose market based improvements. Many recommendations have been accepted or are being considered by Government, and the projected total net savings to Budget greatly exceed the cost of conducting the reviews.

8. Virtually all projected Budget savings from the Programme are from the four reviews whose implementation of recommendations was examined in detail in this audit.2 There has been divergence between entities in implementing recommendations against plans. Monitoring has focused on implementation progress, with little evaluation of whether savings from implementing recommendations are based on efficiency improvements rather than reductions in services or other outputs. Entity reporting to Finance has been mainly through the Budget process that focuses on net changes to appropriations.

Supporting findings

Administration of the Programme by Finance

9. To support the implementation of the Programme, Finance developed a programme implementation plan and programme guidelines, established governance arrangements including clear roles and responsibilities, conducted risk analyses and provided support and guidance to entities undertaking reviews on the limited occasions this was requested. In line with initial planning, support and guidance arrangements were focused on the conduct of reviews, with lesser coverage of the implementation of recommendations.

10. Finance supported the Contestability Programme Steering Committee to effectively carry out some but not all of its roles for the Programme. The department supported the Committee to provide strategic guidance and direction, consider the forward work programme and report on the progress of individual reviews and the Programme, but not to clearly determine whether Functional and Efficiency Reviews met their terms of reference. Finance provided administrative support for Committee meetings, including by preparing briefing papers, although it did not maintain records of decisions and action items for many meetings.

11. Finance undertook the majority of the monitoring and evaluation required under the Programme Implementation Plan. In particular, it regularly monitored individual reviews, monitored savings and analysed themes in recommendations across Functional and Efficiency Reviews, identified lessons learned and prepared a Programme Evaluation Report in December 2017. Finance has not evaluated Contestability Reviews completed after the pilot phase or undertaken a structured evaluation of Functional and Efficiency Reviews. Finance considers that the Programme has positively contributed to Budget repair, efficiencies, effectiveness and supporting Government decision making. However, the department has had limited visibility of the implementation of recommendations from reviews, which has diminished the extent to which conclusions can be drawn about improvements in efficiency and effectiveness. In early 2018, Finance was undertaking a stocktake of the implementation of review recommendations, to inform the Minister for Finance about the outcomes of the Programme and support the Secretaries APS Reform Committee.

Review recommendations, savings and costs

12. The conduct of reviews was compliant with many, but not all, expectations established in the Contestability Programme Guidelines and the review terms of reference. Less than half of the 22 Functional and Efficiency Reviews met planned timeframes for consideration by the responsible Minister and/or Government, and few reviews were assessed as meeting the terms of reference. Review reports generally did not include benchmarks to demonstrate efficiencies or assessments to evaluate the benefits of implementation. Transition arrangements to implement recommendations, where included in review reports, were not specific or detailed.

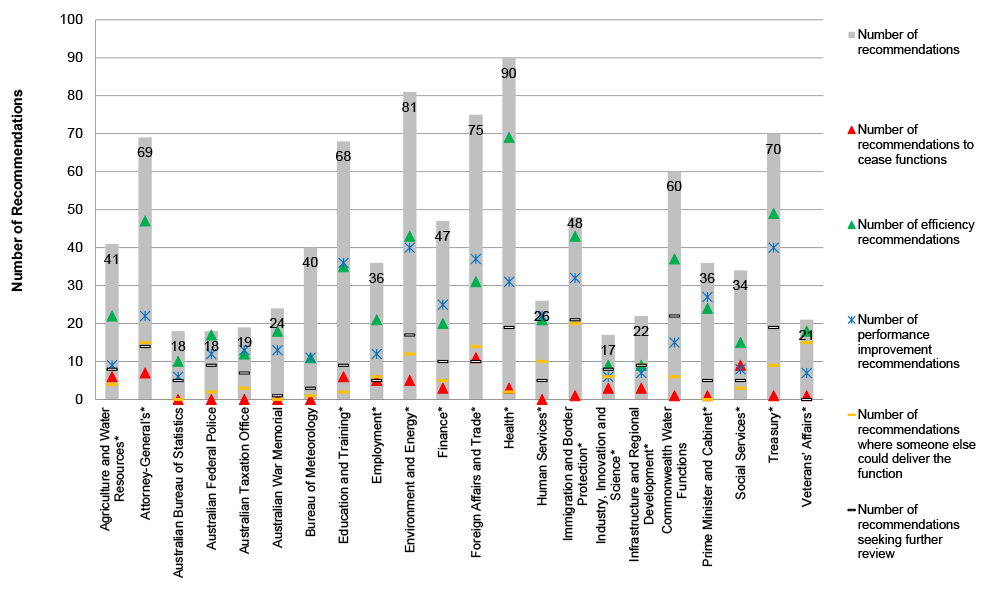

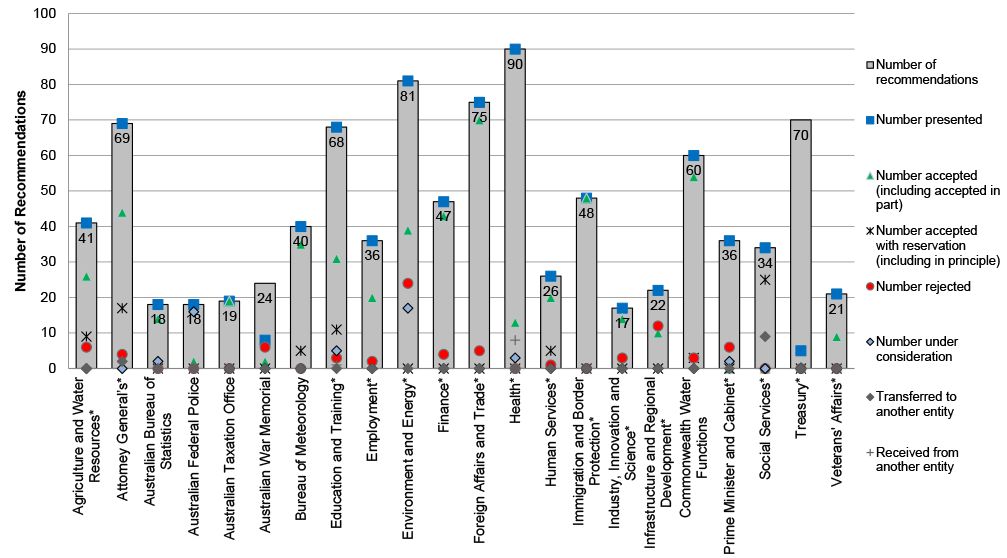

13. The Programme proposed many recommendations to improve the efficient delivery of government functions. A total of 960 and 74 recommendations were made across 22 Functional and Efficiency Reviews and 11 Contestability Reviews respectively. Recommendations often focused on internal system improvements such as structural change, streamlining processes, and adopting improved products and services. Relatively few recommendations were made to cease functions or identify opportunities for alternative providers of the function, and market based improvements almost exclusively focused on outsourcing.

14. Responsible Accountable Authorities generally considered all Functional and Efficiency Review recommendations, and supported or agreed, agreed in part, or in principle, a substantial majority (73 per cent) of those recommendations, and the relevant Minister considered and largely endorsed entities’ positions. Approximately one quarter of all recommendations were considered by Government, and generally focused on reducing expenditure or generating income. Few recommendations from these reviews were rejected by Accountable Authorities (68 recommendations, seven per cent), Ministers (79 recommendations, eight per cent) or the Government (35 recommendations, four per cent). Similarly, very few recommendations (three recommendations, four per cent) from Contestability Reviews were rejected, and the Government either accepted or is considering over half of all recommendations from these reviews. However, for three of the 11 Contestability Reviews, the responsible Minister had not considered recommendations, and recommendations from four Contestability Reviews were not considered by Government.

15. Estimated net savings to Budget of more than $5 billion over the forward estimates exceed the total reported cost ($18.7 million) of undertaking Functional and Efficiency Reviews and Contestability Reviews—although few entities were able to provide the full cost of the reviews. Savings to Budget were derived exclusively from Functional and Efficiency Reviews, and mainly from reductions in programme outlays ($5.0 billion) rather than departmental outlays ($122.3 million). Most reviews have not led to a net saving to Budget, with savings being reported for only eight of 25 participating entities.

Implementation of review recommendations

16. For the four reviews examined in detail, the Department of Employment, Comcare, the Department of Health and the Department of Social Services developed implementation plans for all or most of their accepted recommendations, while the Department of Foreign Affairs and Trade developed implementation plans for only ten per cent of its accepted recommendations. Where implementation plans were developed, they regularly included implementation milestones and lines of accountability. Eight plans (five per cent) established performance measures, and only one plan established benchmarks for performance measures.

17. While all entities have implemented or commenced implementing between 65 and 90 per cent of accepted recommendations from the four reviews, the Department of Employment, Comcare and the Department of Health demonstrated that implementation was in accordance with plans. The Department of Social Services provided plans for implementing eight of its 12 accepted recommendations, and demonstrated that it had implemented six recommendations and was implementing another six recommendations. The Department of Health had a number of accepted recommendations where implementation had not commenced or would not be progressed (35 per cent), and the Department of Foreign Affairs and Trade had not established completion dates for a number of recommendations where implementation had commenced.

18. Entities monitored and reported on the implementation of recommendations from the four reviews, but focused on milestones and deliverables and rarely on achieving outcomes. Only Comcare and the Department of Employment established and reported on measures of efficiency or effectiveness. One of the entities established baselines to support an assessment of efficiency or performance improvements. The Department of Health regularly monitored and reported to senior governance committees on the implementation of recommendations from its Functional and Efficiency Review. The Department of Social Services undertook some reporting on the implementation of individual recommendations to governance committees. The Department of Foreign Affairs and Trade undertook ad hoc monitoring and reporting arrangements to report on the progress of implementation. For some recommendations, departmental appropriations were reduced on the premise that operating efficiencies would be achieved. In the absence of a baseline, performance measures and trend analysis for efficiency, service level and quality it is difficult for entities to demonstrate that these initiatives have led to efficiencies and performance improvements.

19. Reductions over the forward estimates to the Budget arising from the Functional and Efficiency Reviews of the Department of Health, Department of Social Services and the Department of Foreign Affairs and Trade totalled $4.9 billion, which represented 95 per cent of total net savings for the Programme reported by Finance. Of the four reviews examined, only the Department of Employment has evaluated and reported the outcomes of the implementation of recommendations—from the Insurable Risk Contestability Review, although any savings arising from this review have not been returned to the Budget. The Department of Social Services has evaluated the implementation of one recommendation but could not demonstrate that all planned savings and efficiencies were achieved. The responsible Ministers for Health, Social Services and Foreign Affairs were involved in proposing savings through submissions to Government and the Budget process for individual or groups of recommendations arising from these reviews. Beyond these pre-established arrangements, processes were largely not in place to evaluate and report to these Ministers on the outcome of the implementation of recommendations.

Summary of entity responses

20. The proposed audit report, or an extract, was provided to the 25 entities listed in Appendix 2. Eleven entities formally responded, and 14 entities confirmed that they would not be providing a formal response to the audit. Summary responses from the primary audited entities are provided below, with full responses from all responding entities at Appendix 1.

Department of Finance

Finance notes the findings and key learnings in the Report.

Department of Education and Training

The Department of Education and Training acknowledges the Australian National Audit Office’s (ANAO) report and the associated work undertaken on the Efficiency through Contestability Programme. The department also acknowledges that there are no recommendations or findings to which it needs to respond.

Department of Jobs and Small Business

The Department of Jobs and Small Business agrees with the key learnings from the audit and was pleased the Australian National Audit Office found the Department had, in the context of the Commonwealth’s Insurable Risk Contestability Review:

- developed implementation plans for the accepted recommendations including milestones, performance measures and lines of accountability;

- demonstrated implementation was in accordance with these plans and had a structured approach to monitoring and reporting on implementation; and

- had evaluated and reported the outcomes of implementation.

Department of Health

The Department of Health was one of the key departments reviewed by the ANAO in assessing the effectiveness of the Efficiency through Contestability Programme. The Department notes that nearly all projected Budget savings for the Programme came from the four reviews contained in the ANAO report, [with a substantial proportion from the Department of Health].

The Programme, along with other reviews being undertaken in the Department at that time, assisted in identifying opportunities for efficiencies and improvements to be made in organisational capability. The ANAO acknowledged the large number of recommendations to be implemented by the Department and the well-developed implementation plans. The Report also highlighted that the recommendations of the Programme were integrated into the Health Capability Program Action Plan which had been developed to respond to the Health Functional and Efficiency Review.

The Department agrees with the ANAO’s key learnings for agencies identified in the Report focussing on programme design, governance and risk management, and performance and impact measurement outlined on [page 13] of the Report.

Since the reviews, the Department has undergone a number of structural changes and Machinery of Government changes. The outcomes of the reviews and learnings identified in the ANAO report will contribute to the ongoing need to improve organisational performance to support implementation of the Government priorities and ensure the Department is seen as a high performing agency.

Department of Human Services

The Department of Human Services (the department) notes the report’s findings. The department also notes that the report does not identify any issues or make any recommendations that are specific to the department.

Department of Social Services

The Department of Social Services (the department) welcomes the conclusion and key learnings for Australian Government entities identified in the audit report on the Efficiency through Contestability Programme. The audit report notes that 12 recommendations were accepted by the Government and/or the department during the department’s Functional and Efficiency Review in 2015. Since the ANAO concluded its fieldwork for this audit an additional three recommendations from the department’s 2015 Functional and Efficiency Review have been accepted, or partially accepted, and are being implemented. These include the cessation of Sickness Allowance and Utilities Allowance, which formed part of the Social Services Legislation Amendment (Welfare Reform) Act 2018 and the introduction of a family income test for Carer Allowance, subject to the passage of the Social Services Legislation Amendment (Payment for Carers) Bill 2018.

The department notes that of the total $5 billion in savings across the Forward Estimates achieved by all agencies, the department contributed $3.21 billion of these savings.

Department of Foreign Affairs and Trade

DFAT thanks the ANAO for this audit and observations on DFAT’s implementation of the Functional and Efficiency Review (FER) recommendations. DFAT’s FER delivered $50.5 million of savings and generated $221.5 million in additional revenue.

Of the 75 recommendations identified in the FER, 33 have been implemented. Implementation plans were in place for 23 recommendations, 12 of which have been fully implemented. Implementation plans were used where the recommendation was assessed by DFAT as having a level of complexity and risk that required additional oversight and governance.

Key learnings for all Australian Government entities

Below is a summary of key learnings identified in this audit that may be considered by other Australian Government entities.

Programme design

Governance and risk management

Performance and impact measurement

1. Background

Introduction

1.1 In 2013, the Australian Government introduced the Smaller Government Reform agenda to improve the efficiency and effectiveness of the Commonwealth public sector, and eliminate waste and duplication. As part of these reforms, the Government established the National Commission for Audit—an independent body tasked to review and report on the performance, functions and roles of the Commonwealth Government. The Commission’s Phase One Report, published in February 2014, stated that for the nation’s finances to be restored3:

The government will have to rationalise and streamline many of the things it currently does and in some areas stop doing things completely. This includes rationalising the number of bodies and agencies, ceasing many grant programmes and other ineffective programmes, limiting industry assistance and streamlining other functions.

Government needs to better apply market based and technological solutions to improve the way many government services are delivered. This includes considering opportunities for privatisation, making better use of data and information technology and a commissioning of greater private sector expertise in the design and delivery of services including e-Government services.

1.2 The National Commission of Audit sought to improve efficiency through a number of means, including:

- eliminating duplication of roles and responsibilities across levels of government and between entities in the Australian Public Service; and

- standardising corporate business processes and adopting the staged introduction of shared corporate services.4

Efficiency through Contestability Programme

1.3 As part of the Smaller Government reforms, the Government also introduced the Efficiency through Contestability Programme (the Programme) led by the Department of Finance (Finance). The aim of the Programme was to seek and apply the most efficient and effective way of designing and delivering government policies, programs and services. The Programme was to support the public sector in the process of transitioning from its traditional role as the ‘provider’ and ‘owner’ of government functions to more of a ‘co-designer’ and ‘enabler/funder’ of alternative provider models. The goal was to ensure that the ‘public sector is as big as it needs to be, but as small as it can be’.5

1.4 The Programme was part of the Commonwealth-wide Contestability Framework (the Framework), which the Australian Government introduced through the 2014–15 Budget. The Framework intended that a review would first consider whether government should deliver a function, and then assess whether the function should be open to competition and determine the appropriate means for this to occur. After commencing a pilot in 2014, Finance implemented the Programme in 2015 and published supporting Contestability Programme Guidelines.

1.5 Under the Framework, a Contestability Programme Steering Committee6 developed and recommended a program of work for Contestability Reviews, Functional and Efficiency Reviews, and Portfolio Stocktakes.7 Also under the Framework:

- the Minister for Finance was to approve the programme of work, which was intended to progressively cover all areas of government;

- responsible Ministers, with the support of their entities, were to ensure the completion of planned reviews and make recommendations to Government on review outcomes, potential implementation arrangements, progress on implementation of contestable arrangements and cessation of functions;

- the reviews were to provide the public sector and government with a robust evidence-base to inform and guide its decision making8; and

- entities needed to fund reviews within existing resource arrangements.

1.6 The Programme ceased on 30 June 2017, although the measure allowed ongoing application of the Contestability Framework.9 Finance advised in January 2018 that it has an ongoing policy advice role, advising the Minister for Finance and Government about the application of the Framework. In May 2017, the Minister for Finance observed that most portfolios and departments10, and a significant portion of funding, had been reviewed through the Efficiency through Contestability Programme.11 The Minister further observed that:

… Functional and Efficiency Review outcomes have achieved savings of around $5 billion from 2014–15 to 2020–21 – with around a further $14 billion over the period 2021–22 to 2026–27, through streamlining programs, improving span of control, systems and compliance processes, and terminating legacy programs.12

Analysing the contestability of government functions

1.7 The Programme defined contestability as ‘the prospect of competition in public sector functions to improve both the efficiency and effectiveness of contributing to achieving government’s outcomes’.13 The Contestability Framework notes that competition can come from outside the government or from other entities within the public service, and can improve the efficiency with which government programs are undertaken.

1.8 The Programme sought to systematically review government functions with a view to entities improving the effective achievement of government outcomes. Through the reviews, entities were asked to demonstrate how well they achieve government objectives and explore alternative and innovative means to improve efficiency. When considering the potential to improve efficiency, the reviews were to consider a spectrum of possible arrangements (see Table 1.1), both within and beyond the boundary of government.

Table 1.1: Spectrum of possible arrangements to improve efficiency

|

Type of improvement |

Alternate arrangements or options |

|

System |

Improve structures, e.g. flatter, less hierarchical structures; shared services Improve processes, e.g. streamline reporting requirements; joined up government Improve requirements, e.g. reduce unnecessary red tape and regulations Improve products or services, e.g. adopt user-centric design; move to digital solutions |

|

Engagement |

Improve government relations, e.g. shared footprint; integrated services Improve contractual practices, e.g. payment by outcomes Innovative public investment strategies, e.g. social investment bonds Develop behavioural and policy incentives to promote better compliance with, or take-up of, government initiatives |

|

Market |

Build a market Partner with others, e.g. Public Private Partnerships, cross-sector Alliances Form a Government Business Enterprise Privatise, outsource, mutualise |

Source: Finance, Contestability Programme Guidelines, 2015, p. 7.

1.9 Analysing the contestability of functions provided entities with an opportunity to consider:

- what role should the government have;

- how functions align to government priorities;

- how to best achieve a function’s intended effect;

- who is best placed to undertake a function; and

- how to encourage entities to improve the efficiency and delivery of the function, through the prospect of competition.

Contestability Programme reviews

1.10 As mentioned previously, Contestability Programme reviews include Portfolio Stocktakes, Contestability Reviews and Functional and Efficiency Reviews. Table 1.2 provides an overview of the purpose and lines of inquiry for entities for each of these reviews, as well as the number of reviews commissioned as part of the Programme. Where a Functional and Efficiency Review was completed, there was usually no need to undertake a Portfolio Stocktake.14 Both the Portfolio Stocktake and the Functional and Efficiency Review could lead to the entity identifying one or more functions to be subject to a Contestability Review.

1.11 To undertake the reviews, a review leader was appointed who was generally supported by a team that comprised contractors and/or internal staff. For Portfolio Stocktakes and Contestability Reviews, the review leader was usually a Senior Executive within the responsible entity, whereas for Functional and Efficiency Reviews an independent review leader needed to be appointed by the responsible Accountable Authority with the agreement of the Department of Finance.15 Accountabilities and responsibilities for the review were pre-determined by the type of review being conducted. Review leaders for Portfolio Stocktakes and Contestability Reviews were to report results to the responsible Accountable Authority (and the Contestability Programme Steering Committee). Independent review leaders for Functional and Efficiency Reviews were to report to the responsible Minister and the Minister for Finance. In all cases the Contestability Programme Steering Committee and the Department of Finance had an assurance and oversight role.

Table 1.2: Review types—purpose and key lines of enquiry

|

Review type |

Reviews commissioned |

Purpose |

Key lines of enquiry |

|

Portfolio Stocktakes |

7 |

Assess functions across a portfolio at a high level and identify the functions with the greatest potential to be delivered more efficiently through alternative means. |

|

|

Contestability Reviews |

12 |

Consider in detail how the identified functions should best be delivered through alternative means. |

|

|

Functional and Efficiency Reviews |

21a |

Consider the alignment of entity functions to government priorities; identify the functions with the greatest potential to be delivered more efficiently; and consider how these could be delivered through alternative means, operational improvements, and additional efficiencies. |

|

Note a: Twenty-two Functional and Efficiency Reviews were completed under the Programme as the Australian War Memorial completed a separate review to the Department of Veterans’ Affairs.

Source: Finance, Contestability Programme Guidelines, 2015, p. 7, 10 and 11.

Audit approach

1.12 The ANAO selected the Efficiency through Contestability Programme for audit because of its potential to generate significant efficiency improvements and Budget savings. Australian Government spending was in excess of $419 billion in 2013–14 when the Government introduced the Programme to improve efficiency and effectiveness in an environment where the Australian public sector was expected to deliver better public services to meet the growing needs of Australian citizens in the face of increasing Budget deficits.16

Objective, criteria and methodology

1.13 The objective of the audit was to assess the effectiveness of the Efficiency through Contestability Programme in supporting entities to improve the efficient delivery of government functions.

1.14 The audit criteria were:

- Finance effectively designed, administered and supported the oversight of the Programme;

- all reviews supported entities to design initiatives to improve the efficient delivery of government functions and make recommendations to Government (through the responsible Minister) on implementation arrangements; and

- selected entities have implemented agreed initiatives as planned and have monitored and reported on achieving planned financial and non-financial efficiency gains to Finance and the responsible Minister.

1.15 In undertaking the audit, the audit team:

- examined Finance’s records including Contestability Framework documents (including the Contestability Programme Guidelines, the Programme implementation plan, and briefings to the Secretary and the Minister), and interviewed relevant officials in Finance;

- for all Functional and Efficiency Reviews and Contestability Reviews commissioned, examined entities’ records (including briefings to the Accountable Authority and the responsible Minister, the review and contract information), and in some cases interviewed relevant officials. The ANAO also sought representations from entities where records were not available; and

- for selected reviews, examined entities’ records of the implementation of review recommendations.

Entities included in the audit

1.16 Finance was included in the audit as the programme administrator and as the entity responsible for seven reviews. For each of the 2217 Functional and Efficiency Reviews and 12 Contestability Reviews, at least one of the lead entities was selected for inclusion in the audit—25 entities in total (see Appendix 2).18

1.17 In addition, the following four reviews were selected to determine whether agreed recommendations had been implemented and achieved planned financial and non-financial efficiency gains:

- The Management of the Commonwealth’s Insurable Risk Contestability Review;

- The Department of Foreign Affairs and Trade and Portfolio Functional and Efficiency Review;

- The Department of Health Functional and Efficiency Review; and

- The Department of Social Services Functional and Efficiency Review.

These four reviews were selected as they were completed within the first 18 months of the Programme, which provided time for the entities to plan, implement and evaluate some of the efficiencies and performance improvements arising from agreed recommendations.

1.18 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $735 000.

1.19 Team members for this audit were Tracey Martin, Elizabeth Wedgwood, Irena Korenevski, Jacqueline Hedditch, Lucy Donnelly, Grace Guilfoyle, Nikol Jepson, David Hokin and Andrew Morris.

2. Administration of the Programme by the Department of Finance

Areas examined

The ANAO examined whether the Department of Finance (Finance) effectively designed, administered and supported the oversight of the Efficiency through Contestability Programme (the Programme).

Conclusion

Finance effectively designed, administered and supported the implementation of many elements of the Programme. The department’s planning was sound and it provided adequate support and guidance to entities conducting reviews. Finance undertook planned evaluation, and in December 2017 concluded that the Programme supported Budget repair in excess of $5 billion over the forward estimates. Finance could have provided the Contestability Programme Steering Committee with more support to determine whether Functional and Efficiency Reviews met their terms of reference.

Areas for improvement

Programme administration and support could have been improved by Finance: updating Programme guidelines, implementation plan and risk assessment (paragraphs 2.12 and 2.13); and incorporation of other entity reviews into Functional and Efficiency Reviews (paragraph 2.15).

Has Finance developed programme guidelines and support arrangements, and provided support and guidance to entities?

To support the implementation of the Programme, Finance developed a programme implementation plan and programme guidelines, established governance arrangements including clear roles and responsibilities, conducted risk analyses and provided support and guidance to entities undertaking reviews on the limited occasions this was requested. In line with initial planning, support and guidance arrangements were focused on the conduct of reviews, with lesser coverage of the implementation of recommendations.

Programme planning

2.1 On 19 June 2014, the Secretary of Finance approved the Efficiency through Contestability Programme Implementation Plan.19 The implementation plan included elements such as roles and responsibilities and resource management arrangements, but included few milestones beyond the pilot phase20 and no performance measures. The focus of Finance’s monitoring activities was on the conduct of reviews. Implementation of contestability recommendations arising from reviews was not captured in the monitoring arrangements as implementation was the responsibility of the relevant Minister and entity. The implementation plan indicated that an assessment of the implementation of early measures from initial reviews would provide valuable experience for later reviews and implementation plans. A briefing prepared in August 2014 for the incoming Finance Secretary noted weaknesses in monitoring and evaluation arrangements:

32. A detailed programme Evaluation Framework is yet to be developed. It was envisaged this Framework be developed with oversight by, and with involvement of representatives selected by, the CSC [Contestability Steering Committee21].

2.2 On 27 October 2014, the Government agreed to expand the Programme to include Functional and Efficiency Reviews. Finance developed a project plan for the expanded programme, which was approved by the responsible First Assistant Secretary on 19 January 2015. The project plan was to be used in conjunction with the implementation plan.

2.3 The project plan set out the purpose, objectives and deliverables of the Programme, dependencies, reporting arrangements, success measures, implementation phases and evaluation and review. Success measures included deliverables such as the number and timeliness of reviews completed. The focus of those measures was again on the conduct of the reviews and not their effectiveness. The project plan indicated that there would be an independent evaluation of individual Contestability Reviews (this intention is also included in the Contestability Programme Guidelines) and that in May 2017 Finance would repeat some aspects of the pilot evaluation, but this did not occur. Rather, Finance conducted its own evaluation, with a draft report prepared in September 2017 and a final report noted by the Minister for Finance in December 2017 (see paragraphs 2.49 to 2.51).22

2.4 Figure 2.1 outlines key programme planning and implementation timeframes.

Figure 2.1: Efficiency through Contestability Programme planning and key implementation dates

Source: Finance Programme Implementation Plan and briefings to the Finance Secretary and the Minister for Finance.

Programme guidelines

2.5 Programme guidelines were developed by Finance during the pilot phase of the Programme, in consultation with the Department of the Treasury, the Department of the Prime Minister and Cabinet and other entities involved in the pilot. Following approval from the Secretary of Finance, the Contestability Programme Guidelines were published on Finance’s website on 2 March 2015. The implementation plan included an expectation that the guidelines would be updated and additional guidance provided throughout the Programme on an as-needs basis.

2.6 The guidelines provided details of steps involved in undertaking Portfolio Stocktakes and Contestability Reviews, but provided less detail to support the conduct of Functional and Efficiency Reviews.23 Consistent with initial planning, the guidelines addressed the earlier phases of the Contestability Framework (identification and assessment), but provided little information to support the latter phases of the Framework (implementation of contestable arrangements and management).24 Finance advised the ANAO in January 2018 that, given the diversity of recommendations and implementation circumstances, tailored assistance was more appropriate than further updates to the guidelines.

Roles and responsibilities

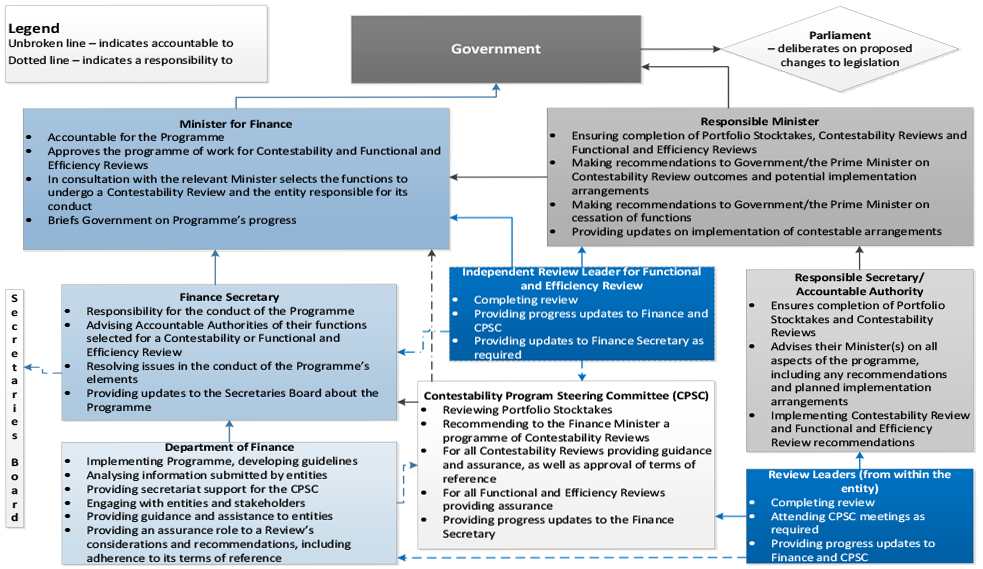

2.7 A clear set of roles, responsibilities and accountabilities for the Programme were established in the implementation plan and were added to and, in some cases, refined in the Contestability Programme Guidelines. An overview of roles and responsibilities presented in the guidelines is provided in Figure 2.2.

2.8 The Minister for Finance had primary accountability for the Programme and was supported by Finance and the Contestability Programme Steering Committee. Portfolio Ministers were responsible for completing reviews, making recommendations to Government, implementing contestable arrangements and providing updates on the implementation of contestable arrangements. Responsible Ministers were supported by the responsible Accountable Authority and, for Functional and Efficiency Reviews, the independent review leader.

2.9 Key responsibilities of Finance included: administering the Contestability Framework; establishing a three-year programme of work from 2014–15 with the agreement of the Minister for Finance; assisting entities to review existing functions against the framework; assessing new policy proposals; and reporting to Government on progress.

Figure 2.2: Roles and responsibilities for the Efficiency through Contestability Programme

Source: Adapted from Finance’s Contestability Programme Guidelines, March 2015, Appendix A Roles and Responsibilities, pp. 45–46.

Risk management

2.10 The implementation plan identified one strategic and three operational risks to the Programme. The strategic risk was: contestable arrangements that improve efficiencies are missed resulting in the Programme not delivering efficiencies to government functions. Two supporting operational risks were that there was a lack of buy-in from entities and entities are not incentivised to administer the Programme, both of which would lead to efficiencies not being achieved and entities maintain status quo arrangements. The other risk was that timeframes for the Programme were not met. Responsibility for these risks varied, however, the failure to deliver efficiencies to government functions was the responsibility of all parties.

2.11 Key controls were identified to address these risks, including: developing and updating practical and user-friendly guidelines; regular updates to the Contestability Programme Steering Committee and the Minister for Finance; use of external expertise during reviews and monitoring of reviews; establishing firm timeframes and due dates; assistance from Finance to undertake reviews; and consultation between the Minister for Finance and the responsible Minister to foster ownership and buy-in. These controls were in operation throughout the Programme, except for updating guidelines. Finance advised in April 2018 that an update to the Contestability Programme Guidelines was not required as these remained current throughout the Programme.

2.12 To avoid the risk outcome of efficiencies not being achieved, the implementation plan also noted that Finance’s key role will be to ensure the integrity of reviews and that opportunities for efficiency improvement are not missed. The implementation plan and risk assessment were not updated after the pilot phase of the Programme.

Guidance and support

2.13 The implementation plan and Programme guidelines envisaged that Finance would provide guidance and support to entities undertaking reviews. Finance advised that it had a limited role in providing guidance and support to individual reviews, although it engaged with entities through a number of forums. The forums included the Contestability Programme Steering Committee, meetings between Finance and entities at an Assistant Secretary level on a fortnightly basis (and other meetings as required at the First Assistant Secretary Level and Deputy Secretary levels), and ad hoc support and tailored guidance at officer level as needed (including through responses to email and telephone inquiries). Either or both the Minister for Finance and the Finance Secretary met with independent review leaders for 12 of the 22 Functional and Efficiency Reviews, which provided a forum for expectation setting.25

2.14 Entities generally did not seek guidance from Finance. However, some entities regularly met with Finance during the review process and received advice on better practice approaches to undertaking the review (for example, the Australian Federal Police sought advice on how to approach the review and met regularly with Finance during the review process). Finance maintained records of meetings with entities26, which demonstrated a focus on methodology and process.27

2.15 In relation to the guidance and support provided by Finance, views of entities shared with the ANAO was limited but mixed, ranging from satisfied to concerns about insufficient guidance on preferred methods for undertaking the reviews and the selection of independent review leaders. One issue where entities would have appreciated greater guidance and support from Finance was the incorporation of other reviews into Functional and Efficiency Reviews.

Has Finance supported the Contestability Programme Steering Committee to effectively oversight the Programme?

Finance supported the Contestability Programme Steering Committee to effectively carry out some but not all of its roles for the Programme. The department supported the Committee to provide strategic guidance and direction, consider the forward work programme and report on the progress of individual reviews and the Programme, but not to clearly determine whether Functional and Efficiency Reviews met their terms of reference. Finance provided administrative support for Committee meetings, including by preparing briefing papers, although it did not maintain records of decisions and action items for many meetings.

Establishing the Contestability Programme Steering Committee

2.16 The Contestability Programme Steering Committee was established by Finance as a key element of the governance arrangements for the Programme.

2.17 Membership of the Committee included representatives of entities involved in the pilot and early reviews, with the Chair being a Deputy Secretary from Finance. Membership changed over the duration of the Programme, as shown in Figure 2.3, to assist with the increasing number of reviews. Finance advised the ANAO in January 2018 that members were not selected as a representative of their entity, but rather as a Senior Executive Service employee of the Australian Public Service with significant subject matter expertise.

Figure 2.3: Contestability Programme Steering Committee membership

Source: ANAO analysis of Finance documentation.

2.18 The Committee’s roles and responsibilities were outlined in its terms of reference, which were first agreed in October 2014 and revised in October 2015.28 Table 2.1 outlines many of the specified roles and responsibilities of the Committee. These responsibilities were also reflected in the Programme Implementation Plan and the guidelines.

Table 2.1: Contestability Programme Steering Committee roles and responsibilities

|

Role and responsibility |

|

Provide strategic guidance and direction for the Programme |

|

Recommend a Programme of Contestability Reviews to the Minister for Financea |

|

Approve terms of referenceb for Contestability Reviews |

|

Provide guidance and assurance of all Contestability Reviews and Functional and Efficiency Reviewsc |

|

Provide progress updates to the Finance Secretary |

|

Review Portfolio Stocktakes |

|

Assess elements of the Programme for appropriateness, completeness and robustness |

|

Identify connections to related initiatives |

Note a: The Committee was also to make recommendations to the Secretary about functions to be reviewed.

Note b: The Committee’s role also included determining the terms of reference for individual reviews.

Note c: Assurance sought to determine whether reviews were carried out in accordance with the terms of reference, Contestability Framework and programme guidelines.

Source: Finance documents including the implementation plan June 2014, the Contestability Programme Guidelines March 2015 (pages 45–46), the Contestability Programme Steering Committee Terms of Reference October 2014 and revised in October 2015.

Discharging the Committees’ roles and responsibilities

2.19 As shown in Table 2.1, the Committee’s roles and responsibilities included providing: strategic guidance and direction for the Programme; input to the forward work programme; guidance and assurance about reviews; and recommendations and advice to the Minister for Finance and Secretary of Finance about aspects of the Programme.

Strategic guidance and direction for the Programme

2.20 The Committee provided strategic direction and guidance for the Programme during the pilot phase, at the conclusion of the pilot and throughout the implementation phase of the Programme.

2.21 During the pilot phase, the Committee’s guidance and direction included endorsing guidelines and reviewing material that was placed on the Programme website. At the conclusion of the pilot phase, the April 2015 Committee meeting resulted in a number of changes to the direction and administration of the Programme. A key change was that the Programme would have a greater focus on Functional and Efficiency Reviews, and Finance would provide further guidance and support to entities, including on evidence-based outcomes.29

2.22 Throughout 2015, the Committee continued to provide guidance and support for the Programme, with the support of Finance. For example, to address action items arising from the June 2015 Committee meeting, Finance sent an out of session email in October 2015 with a revised terms of reference for the Committee, guidelines on drafting reviews and better practice review approaches to assist members when reviewing reports. Between July and November 2015, Finance prepared a recommendation register and a benefits register to monitor the outcomes of reviews, although these registers were not used after they were created.

2.23 The Committee, with the support of Finance, continued to provide strategic direction for the Programme to the beginning of 2017. At that time, Finance’s Efficiency Improvement Branch met with individual members of the Committee to reflect on programme outcomes, lessons learnt and the future of the Programme. Members generally agreed that there was no further need for the Committee to continue. No further meetings of the Committee were held.

Forward work programme and commissioning reviews

2.24 Relating to the direction of the Programme, one of the roles of the Committee was to consider the forward work programme and recommend to the Finance Minister a programme of Contestability Reviews. The Committee did consider the forward work programme, in most cases noting the reviews that had been added to the programme of work.30

2.25 The programme of work was prepared by Finance and approval was sought from the Minister for Finance. In May and November 2014 the Government approved pilot Contestability Reviews and Functional and Efficiency Reviews. In May 2015, the Government agreed to a programme of work involving a further 30 reviews.31 The Minister for Finance commissioned 12 Contestability Reviews and 22 Functional and Efficiency Reviews by writing to the responsible Minister.32 The Secretary of Finance commissioned five Portfolio Stocktakes by writing to the responsible entity.

Terms of reference for Contestability Reviews

2.26 The Committee was required to approve terms of reference for Contestability Reviews.33 Terms of reference were to be signed by the Committee Chair (the Deputy Secretary from Finance). Meeting records indicate that terms of reference for eight Contestability Reviews were agreed at meetings in October and December 2014, and out of session in October and November 2014, and in June and October 2015. There was no evidence of agreement by the Committee to terms of reference for two reviews, and for another review there was limited evidence about when, or if, the terms of reference were agreed by the Committee. Finance advised the ANAO in January 2018 that two terms of reference were not approved by the Committee (Management of the Commonwealth’s Insurable Risk34 and More Efficient and Streamlined Business Processes35).

2.27 Finance advised the ANAO that the Committee was not a decision making body, but rather an advisory body—its function was to support decision makers, and report to the Secretary of Finance (through the Chair as specified in the terms of reference). One issue that was not clear in the various governance documents (see Table 2.1) was whether the Committee was reporting through the Chair, or to the Chair in his capacity as the Deputy Secretary responsible for the Programme.

Guidance and assurance for reviews

2.28 The Committee was also required to provide guidance and assurance for all Contestability Reviews and Functional and Efficiency Reviews.36 As discussed in paragraph 2.22, in October 2015 Finance developed better practice approaches to assist Committee members when reviewing reports.

2.29 To gain assurance about reviews, entities needed to submit draft reports to Finance so that Finance could confirm that the report adhered to the terms of reference and the Contestability Framework, and that the report was rigorous. Reviews were also required to adhere to the Contestability Programme Guidelines and the intent of the Programme. Once Finance had confirmed the Review had met these minimum expectations, the Accountable Authority of the entity was to provide the final report to the Committee.

2.30 Finance provided feedback on reviews or review recommendations through meetings, correspondence and Committee meetings. Briefing papers for Committee meetings related to Functional and Efficiency Reviews usually did not provide an overall assessment of whether the review met the terms of reference or the Contestability Programme Guidelines.37 The Committee was asked to agree on the appropriateness, completeness and robustness of reviews, or the extent to which they met the terms of reference for half of the Functional and Efficiency Reviews. The minutes of Committee meetings did not record whether it had been agreed that a review met the terms of reference or the Contestability Programme Guidelines, or the appropriateness, completeness and robustness of reviews.

2.31 For 11 Functional and Efficiency Reviews, there is no documentation38 to indicate whether Finance considered that a review met the terms of reference (this included six instances where a briefing or draft briefing was prepared by Finance for the Minister for Finance). For the remaining 11 reviews, there was some documentation to suggest that the review met the terms of reference. The quality of this documentation varied, and included signed correspondence from the Minister for Finance, draft briefings to the Minister for Finance or draft correspondence from the Minister for Finance and, for one39 review, a letter from the responsible Minister stated that the review met the terms of reference. Briefings to the Minister for Finance on final reports did not consider whether the review was conducted in accordance with the guidelines.40 Finance advised the ANAO that where a review did not meet the terms of reference this was brought to the Minister for Finance’s attention, but did not provide evidence to this effect.

2.32 Finance considered that four Contestability Reviews met the terms of reference, four did not meet the terms of reference, one review was considered to have met most of the expectations of the terms of reference and for two reviews there was not an assessment against the terms of reference by Finance. For eight reviews there was no evidence of Finance advising the Minister for Finance on whether the review met the terms of reference. The Committee was rarely asked to make an assessment of whether the review met the terms of reference.

Progress updates to the Finance Secretary and Minister

2.33 The Committee was to provide progress updates to the Secretary of Finance.41 The Committee would generally receive a progress update as part of the papers for Committee meetings, which would include progress of reviews against milestones. The Committee was not asked to and did not endorse these progress updates. Other material considered by the Committee generally did not seek the Committee to endorse a briefing paper for the Secretary. Further, meeting records and action items do not record Committee endorsement of proposed briefing material for the Secretary.

2.34 In practice, Finance, through the Deputy Secretary responsible for the Programme who was also the Committee Chair, prepared briefings on programme progress for the Secretary on a regular basis (which included programme arrangements, individual reviews or a set of reviews). In some instances, these briefings referenced Committee considerations or decisions. The Minister also received regular briefings on the Programme.

Finance’s administrative support for the Committee

2.35 The terms of reference for the Committee included that Committee members were to receive meeting papers prior to the monthly meeting and advice on progress of the Programme and any issues that arise. Finance arranged these meetings and provided a secretariat function for the Committee.

2.36 The Programme ran for 36 months, in which time 22 meetings were held between 29 October 2014 and 17 November 2016. In preparing for these meetings, Finance and entities attending meetings42 prepared briefing papers, which provided progress updates on specific reviews43, status reports by review type, and occasionally on programme guidelines, work programmes and evaluation.

2.37 While Finance regularly provided papers for the monthly Committee meetings, it generally did not maintain records of providing these papers in advance of the meetings to external Committee members.44 In addition, Finance: did not maintain meeting minutes for eight of the 22 meetings; maintained only a list of action items for one meeting (April 2016); and maintained meeting notes without records of decisions or action items for another meeting (July 2016).

2.38 After July 2016 Finance did not maintain Committee meeting records or action items. In September 2017, Finance advised the ANAO that the Committee:

… towards the end of the program met on an as needed basis, particularly once members were allocated to Champion reviews. The Champions were able to support agencies/Independent Review Leaders in progressing reviews and ensuring that the reviews met the intent of the Program …

Has Finance monitored and evaluated reviews, the implementation of recommendations, and that the Programme improved the efficient delivery of government functions?

Finance undertook the majority of the monitoring and evaluation required under the Programme Implementation Plan. In particular, it regularly monitored individual reviews, monitored savings and analysed themes in recommendations across Functional and Efficiency Reviews, identified lessons learned and prepared a Programme Evaluation Report in December 2017. Finance has not evaluated Contestability Reviews completed after the pilot phase or undertaken a structured evaluation of Functional and Efficiency Reviews. Finance considers that the Programme has positively contributed to Budget repair, efficiencies, effectiveness and supporting Government decision making. However, the department has had limited visibility of the implementation of recommendations from reviews, which has diminished the extent to which conclusions can be drawn about improvements in efficiency and effectiveness. In early 2018, Finance was undertaking a stocktake of the implementation of review recommendations, to inform the Minister for Finance about the outcomes of the Programme and support the Secretaries APS Reform Committee.

Monitoring

2.39 As discussed in the previous section, Finance supported the Committee to regularly monitor individual reviews. Finance also regularly reported to the Minister, and there was ad hoc reporting to other committees, including to the Secretaries Board in June 2015.

2.40 A key measure of performance was the number of reviews completed and key deliverables were that reviews were completed within one month of agreed deadlines. To support performance monitoring, Finance developed a dashboard to report on the progress of reviews. This dashboard included details of the review, its due date and status. Finance prepared 51 dashboards between 21 August 2015 and 27 February 2017. The final dashboard in February 2017 noted that three Contestability Reviews were incomplete.45

Evaluation

2.41 Evaluation and review activities undertaken by Finance have included:

- evaluation of pilot Contestability Reviews;

- a review of Programme and Committee arrangements for the pilot phase (lessons learnt); and

- evaluation of Functional and Efficiency Reviews.

Pilot Contestability Review Evaluation

2.42 Consistent with evaluation activities and timing identified in the implementation plan, between March and April 2015 Finance’s Efficiency Improvement Branch interviewed representatives from four of the pilot contestability reviews. These interviews identified a number of matters for Finance to address with future reviews including a lack of clarity about the Programme purpose and arrangements and a lack of guidance and support. Finance developed a list of actions to address these findings.

2.43 Finance has not undertaken a review of Contestability Reviews completed after the pilot phase.

Pilot Phase: Lessons learnt

2.44 In June 2015, Finance reported to the Secretaries Committee on Transformation on the opportunities and lessons learnt from the Programme. As described by Finance, key lessons learnt (and actions taken by Finance) included:

- a pilot phase to test methodologies. This resulted in refinement of the Programme to focus on Functional and Efficiency Reviews as the key review mechanism, supported by Contestability Reviews of cross-government functions as required;

- the pilot phase demonstrated that a level of independence in undertaking reviews is critical to ensure appropriate challenge of the status quo so that the best results are achieved;

- entities received greater value when they were able to engage with the Committee on their approach and initial recommendations. The role of the Committee evolved from approving and endorsing review documents during the pilot phase to providing guidance and assurance to agencies. Being involved at an earlier stage, the Committee was able to provide strategic guidance and challenge thinking and assumptions to influence the direction and outcomes of reviews; and

- Finance provided additional support for agencies through establishing a Community of Practice and a Govdex page for those agencies engaged with the Programme to share feedback, lessons learnt, knowledge and resources.

Evaluation of Functional and Efficiency Reviews

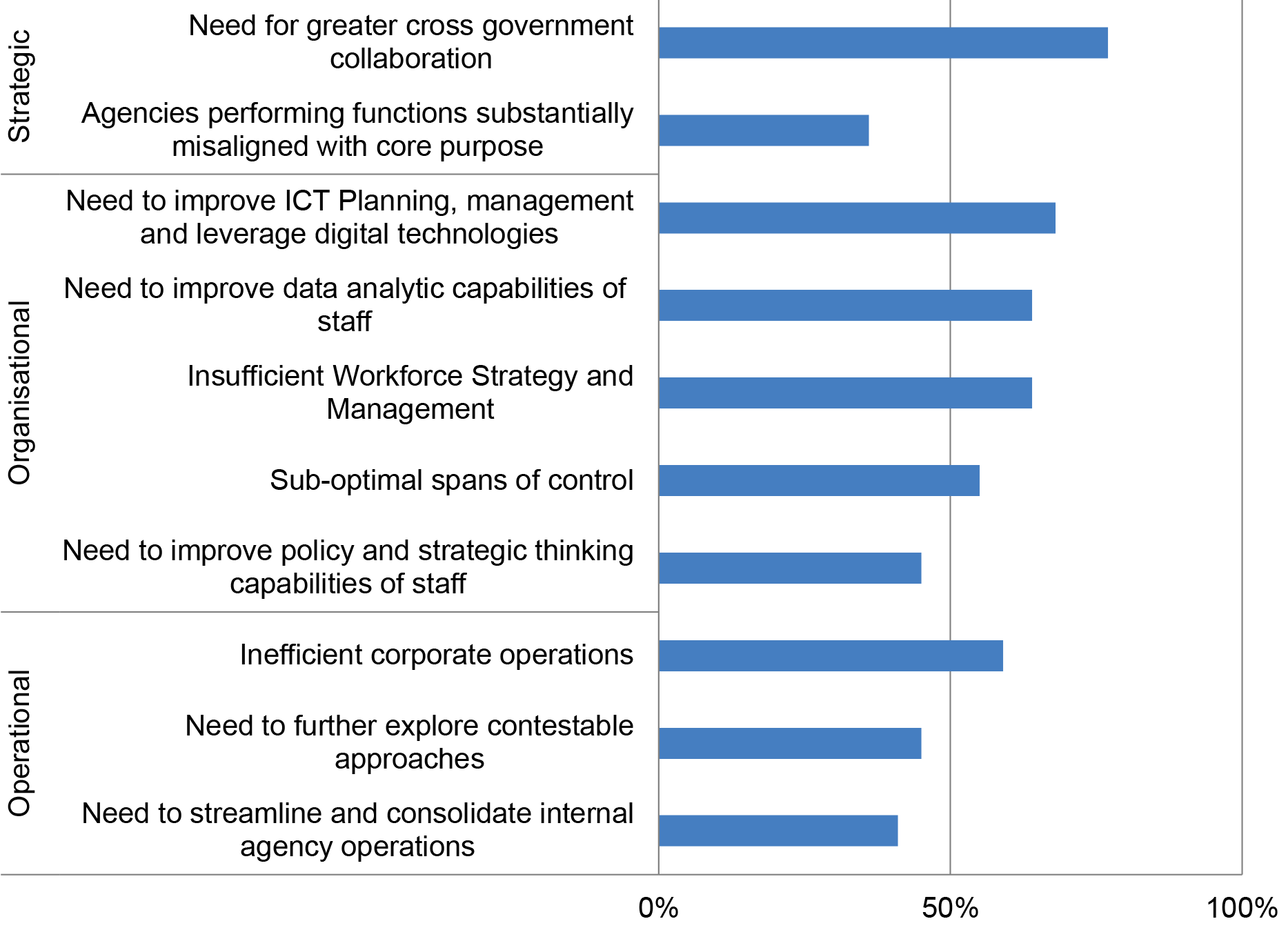

2.45 While Finance has not undertaken a structured evaluation of Functional and Efficiency Reviews, it analysed recommendation themes arising from these reviews in late 2016, as shown in Figure 2.4.46

Figure 2.4: Key operational, organisational and strategic issues identified by Functional and Efficiency Reviews

Source: Finance initial analysis of Functional and Efficiency Reviews.

2.46 Further, in early 2017, Finance’s Efficiency Improvement Branch met with members of the Committee to reflect on Programme outcomes, lessons learnt and the future of the Programme. Table 2.2 provides an overview of key points from these meetings.

Table 2.2: Summary of assessment of Programme outcomes, early 2017

|

Topic |

Conclusions |

|

Success of the Programme |

|

|

Functional and Efficiency Reviews |

|

|

What will help the APS to transform |

|

|

Recommendations |

|

Source: ANAO analysis of Finance documentation.

2.47 Other Finance records also indicate Finance’s assessments of what had worked well and challenges in undertaking the Functional and Efficiency Reviews. For example, these reviews are seen as providing savings to Government, being independent, being an effective tool for repositioning entities and driving change, and fostering cross-agency communication and collaboration. Challenges of undertaking these reviews have included the time taken to engage independent review leaders, balancing considerations of efficiency and effectiveness, Finance’s visibility of the implementation of recommendations, and focusing on departmental activities rather than administered programs. Finance also identified the need for better access to benchmarking data for agencies, and the development of more robust datasets to support cross functional activities.

2.48 Finance has tracked savings arising from Functional and Efficiency Reviews through the Budget process. At the time of the 2017–18 Budget, eight of the 22 Functional and Efficiency Reviews had reduced Budget outlays (see Table 3.1 and Table 3.2).47 Finance considered that a range of factors have influenced Programme outcomes including: the need for legislative changes to implement some recommendations; partial or incomplete implementation of recommendations; and recommendations that were rejected by the relevant agency and not brought forward for government decision.

Programme evaluation

2.49 On 18 December 2017, the Minister for Finance noted the Efficiency through Contestability Program: Summary Outcomes Report. The report identifies significant contributions the Programme has made to savings, efficiencies, effectiveness and supporting Government decision making including:

Over the three years of the Contestability Program, most Commonwealth departments and major entities were considered through the 21 Functional and Efficiency Reviews (the Reviews), under the Contestability Program. Announced outcomes of the Contestability Program have achieved savings of around $5 billion from 2014–15 to 2020–21.

These financial savings contribute to the Budget bottom line. In addition, the reviews are contributing to the efficient operation of Government through departmental efficiency and effectiveness. The Reviews have shaped the strategic directions for a number of entities, generated internal efficiencies, and driven more collaborative use of initiatives across Government. This includes the Department of Veterans’ Affairs (DVA) leveraging the Department of Human Services (DHS) Information Technology platforms, a whole-of-government approach to data through the Data Integration Partnership for Australia (DIPA), and the DHS Cooperative Procurement Program for Communication Products and Services for 58 entities.

The findings and recommendations from the Contestability Program will continue to inform the Government’s decision on key policy initiatives. These initiatives include: future directions on improving public sector productivity; implementing the Murray Darling Basin Plan; improving the resilience of the Bureau of Meteorology; and, DVA Veteran Centric Reform.

2.50 The evaluation also commented on lessons learnt, stating that:

- there was variability between reviews in their focus on efficiency and effectiveness—this may have been addressed by a more clearly defined scope at the outset of the review including a savings target;

- the cost of the reviews were met within entities existing budgets, reviews were resource intensive and it was not recommended that Reviews be undertaken regularly, or that a rolling program of Reviews be established;

- entities undertaking reviews later in the Programme were able to leverage off independent consultants who had developed a process for undertaking reviews and the experiences of other entities that had been through the process, including having access to whole-of-government benchmark data, obtained and verified by entities that had completed reviews; and

- the value of Contestability Reviews was limited by the variability of functions between agencies and as a result opportunities for efficiencies were limited. The topics of Contestability Reviews included outsourcing survey management functions, workforce management, rescue and fire-fighting services, property services, management of insurable risk, communications functions, anti-doping sample collection and analysis, records management, policy advice, social services to citizens and the interface between government and business.

2.51 In conducting the evaluation, Finance did not include detailed analysis of the implementation of recommendations. Chapters 3 and 4 of this report provide commentary on the savings and benefits from the Programme.

2.52 Finance advised the ANAO in January 2018 that:

- the Outcomes Report will be provided to responsible Secretaries and Accountable Authorities as part of the finalisation of the Contestability Programme.

- Finance was undertaking a stocktake of the implementation status of all recommendations arising from the reviews undertaken through the Contestability Programme. This work will inform the Minister for Finance about the outcomes of the Programme and support the work of the Secretaries APS Reform Committee.

3. Review recommendations, savings and costs

Areas examined

The ANAO examined whether all reviews supported entities to design initiatives to improve the efficient delivery of government functions and make recommendations to Government on implementation arrangements. This included consideration of whether reviews were undertaken in accordance with agreed work programmes, and recommended efficiency savings exceeded the cost of undertaking the reviews.

Conclusion

While often not following Programme guidelines, the reviews made a large number of recommendations to improve delivery of government functions and/or increase operational and administrative efficiencies, but did not often propose market based improvements. Many recommendations have been accepted or are being considered by Government, and the projected total net savings to Budget greatly exceed the cost of conducting the reviews.

Areas for improvement

The benefits of recommendations could have been improved by: reviewers limiting the total number of recommendations made and focusing on key recommendations to improve efficiency of departmental activities; and the reviews making greater use of entity performance data or benchmarks to estimate efficiencies claimed.

3.1 As discussed previously, the Minister for Finance commissioned 22 Functional and Efficiency Reviews and 12 Contestability Reviews for the Programme (see Appendix 3). One48 of the commissioned reviews was not undertaken as a separate Contestability Review—leaving 11 Contestability Reviews to be examined. This chapter examines aspects of compliance, cost and the extent to which the recommendations from these 33 reviews have been accepted.

Were reviews completed in accordance with Programme guidelines and terms of reference?

The conduct of reviews was compliant with many, but not all, expectations in the Contestability Programme Guidelines and review terms of reference. Less than half of the 22 Functional and Efficiency Reviews met planned timeframes for consideration by the responsible Minister and/or Government, and few reviews were assessed as meeting the terms of reference. Review reports generally did not include benchmarks to demonstrate efficiencies or assessments to evaluate the benefits of implementation. Transition arrangements to implement recommendations, where included in review reports, were not specific or detailed.

3.2 When undertaking reviews, a range of expectations were established in the guidelines, as well as generic and individual terms of reference for Contestability and Functional and Efficiency Reviews. These expectations, and the extent to which entities satisfied them, are discussed below.

Conducting the review process

3.3 The terms of reference established the aim, scope, timing, governance and resourcing arrangements for Functional and Efficiency Reviews and Contestability Reviews. Generic terms of reference for Functional and Efficiency Reviews were agreed by Government and specific terms of reference were to be agreed by Finance and the entity.49 An exception to this was that the Contestability Programme Steering Committee was to approve the terms of reference for Contestability Reviews. Timeframes for each Contestability Review and Functional and Efficiency Review were to be settled in individual terms of reference. An independent review leader or independent evaluator was to be appointed, with the agreement of Finance for all Functional and Efficiency Reviews and Contestability Reviews, respectively. Finally, responsible Secretaries were to ensure completion of Contestability Reviews, while responsible Ministers were to ensure the completion of all Functional and Efficiency Reviews.

Functional and Efficiency Reviews

3.4 Terms of reference were agreed between Finance and entities for 1950 of the 22 Functional and Efficiency Reviews.

3.5 Inconsistencies were observed in the approaches adopted for endorsing the independent review leaders:

- the Minister for Finance51 endorsed the review leader for sixteen reviews;

- Finance52 endorsed the review leader for five reviews; and

- it is unclear whether endorsement was given for one review. For the review of the Department of Environment and Energy, Finance agreed that endorsement would be inferred when the entity’s Minister wrote to the Minister for Finance nominating the independent review leader.53

3.6 Five entities contracted a review leader prior to receiving endorsement for the appointment of the candidate by Finance.54 The Department of Infrastructure and Regional Development appointed a review leader prior to Finance endorsement, and in response Finance nominated and the department then engaged a peer reviewer for the review. Another five entities did not provide to the ANAO contracts or agreements and did not report the agreement on AusTender.55

Timeframes

3.7 The time taken (on average 109 days) to agree the terms of reference, and nominate, receive Finance’s endorsement and appoint an independent review leader left entities with an average 113 days (16 weeks) to complete the review. Some entities had particularly limited timeframes to complete their review after agreeing terms of reference (the Australian War Memorial—14 days), nominating their independent review leader (Bureau of Meteorology—24 days) or endorsing the independent review leader (Australian Federal Police56—35 days after receiving endorsement from Finance). These entities were not able to complete reviews by the completion date proposed by the Minister for Finance and required extensions. In April 2018 Finance advised the ANAO that it assisted entities to conduct preparatory work concurrently to the appointment of an independent review leader to facilitate timely conduct of the reviews and, where appropriate, facilitated requests for extensions.

3.8 Terms of reference required Functional and Efficiency Review reports to be presented to the responsible Minister and the Minister for Finance by the agreed completion date and the guidelines required the responsible Secretaries to advise the Minister on all aspects of the Programme including recommendations. Further, the terms of reference specified the financial year and Budget process (Budget or Mid-Year Economic and Fiscal Outlook) in which the outcomes of the review should be considered—which was generally within four to eight weeks of the completion date. Timeframes agreed in terms of reference for the completion of each review varied between 147 and 396 days from the commissioning letter being sent (on average reviews were to be completed within 222 days [32 weeks] of commissioning). After the terms of reference had been agreed, nine entities required extensions to the agreed completion date during the review process.57

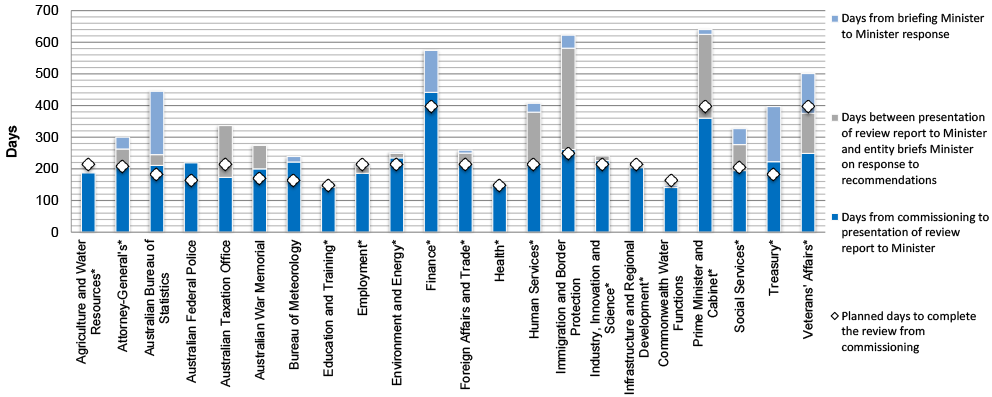

3.9 Figure 3.1 shows that 13 of the 22 reviews were presented to the Minister within the planned completion timeframe, while nine reviews were presented to the Minister after the planned completion date. Six entities briefed their Minister immediately on the entity’s position in regard to the Functional and Efficiency Review recommendations58, while other entities took up to 320 days59 to brief their Minister on their position, and the Australian Federal Police is yet to brief its Minister on its position.60 Prior to the completion of the Functional and Efficiency Review, some entities briefed the Responsible Minister on draft report recommendations.61

Figure 3.1: Elapsed time to complete reviews and brief responsible Ministers on review recommendations

Note a: Entities marked with an * are Departments of State.

Note b: Due to the Administrative Arrangements Order amendments introduced on 20 December 2017, the Department of Employment became the Department of Jobs and Small Business; the Department of Infrastructure and Regional Development became the Department of Infrastructure, Regional Development and Cities and the Department of Immigration and Border Protection became the Department of Home Affairs.

Note c: Dates presented in this figure for the Commonwealth Water Functions Review relate to the Minister for Environment and Energy.

Note d: For six entities, the relevant Minister responded to the briefing on Functional and Efficiency Review recommendations on the same day the Minster received the briefing for the Functional and Efficiency Review of the: Department of Agriculture and Water Resources; Australian Taxation Office; Australian War Memorial; Department of Education and Training (for both Stage 1 and 2 reports); Department of Health; and Department of Industry, Innovation and Science. Similarly, the relevant Minister responded to a briefing on the Functional and Efficiency Review recommendations within seven days of receiving the briefing for reviews of the: Department of Infrastructure and Regional Development; Department of Environment and Energy; and the Commonwealth Water Functions.

Source: ANAO analysis of entities’ documentation.

3.10 On average, 71 days (10 weeks) elapsed from the date the Minister was presented with the review report until entities briefed their Minister on their response to the recommendations—which did not meet the timeframe for consideration of report outcomes in the agreed Budget process. The consideration of nine62 entities’ Functional and Efficiency Review recommendations were deferred from the 2016–17 Mid-Year Eonomic and Fiscal Outlook until the Budget 2017–18. Only one of these entities (Department of the Treasury) demonstrated that recommendations from its review were considered during the Budget process 2017–18. For the remaining entities, Finance advised the ANAO that:

- consideration will occur in a later period for four entities63;

- the recommendations did not require a decision of the Government through the Budget process for two entities—Department of the Prime Minister and Cabinet, and Department of Finance;