Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Effectiveness of the National Disability Insurance Agency’s Management of Assistance with Daily Life Supports

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- To provides assurance to Parliament on the effectiveness of the National Disability Insurance Agency’s (NDIA) management of assistance with daily life (ADL) supports and its management of operational risks, including the implementation of recommendations from prior ANAO audits.

- In 2021–22 NDIA made $28.6 billion in payments to 534,655 participants. The NDIS is expected to grow to 1,017,522 participants and $89.4 billion by 2032.

Key facts

- NDIA met four of ten Participant Service Guarantee targets for plan development and implementation by December 2022.

- Sixty per cent of plans reviewed in November 2022 met quality requirements for inclusion of reasonable and necessary supports.

- Price limits for ADL supports increased by 18 per cent from 2019–20 to 2022–23.

What did we find?

- NDIA’s management of assistance with daily life supports was partly effective.

- NDIA has largely fit for purpose policies, procedures and guidelines to support the administration of ADL and largely fit for purpose planning and implementation arrangements.

- NDIA has partly effective processes to manage the risks to the proper use of resources for all support categories.

What did we recommend?

- There were 13 recommendations to the NDIA, relating to planning decisions, managing fraud and conflict of interest risks, and fully implementing seven prior ANAO audit recommendations.

- One joint recommendation to NDIA and Services Australia, relating to NDIA’s access to Centrelink information.

- One recommendation to the Australian Government, relating to fraud control requirements for the NDIA.

58%

of NDIS participants choose a registered plan manager to manage their allocation of funding for NDIS supports.

55%

of all participants (295,281) aged seven years and over received funding for ADL supports.

$96,996

was the average value of ADL supports in participant plans approved in 2021–22.

Summary and recommendations

Background

1. The National Disability Insurance Scheme (NDIS or the Scheme) was established in 2013 under the National Disability Insurance Scheme Act 2013 (NDIS Act) to provide funding for reasonable and necessary supports for eligible people with disability. The NDIS is jointly funded by the Australian, state and territory governments under bilateral agreements. In 2021–22, NDIA made $28.6 billion in payments to 534,655 participants for NDIS supports. Fifty-five per cent of all participants (295,281) aged seven years and over received funding for assistance with daily life (ADL) supports, averaging $96,996 per year. The NDIS is expected to grow to 1,017,522 participants and $89.4 billion for the year ending 30 June 2032.

2. The National Disability Insurance Agency (NDIA) is the Australian Government entity responsible for delivering the NDIS. The NDIA contracts Partners in the Community (PITC) organisations, including Local Area Coordinators (LACs) and Early Childhood (EC) Partners to assist participants with applying to join the NDIS and then developing and implementing their plan of funded NDIS supports.

3. Funding for each NDIA participant is determined through the development of a participant plan, which sets out the participant’s goals and aspirations, the reasonable and necessary supports that they require and will be funded, and how that funding will be managed. Plans can be developed by NDIA staff or LACs and are then approved by a NDIA delegate. NDIA assists participants to implement their plan by publishing information and guidance materials and monitoring plan use.

4. ADL is one of the fifteen categories of supports funded by the NDIS and provides funding for self-care activities, such as showering, eating and moving around the house, and household tasks, such as meal preparation, cleaning and yard maintenance.

Rationale for undertaking the audit

5. Prior audits1 and reviews2 have identified issues with NDIS planning, decision-making, communications, service delivery, access to supports and fraud controls (see paragraphs 1.18 to 1.21). This audit provides assurance to Parliament on the effectiveness of the NDIA’s management of ADL supports and its management of operational risks, including the implementation of recommendations from prior audits. This audit was identified as a Joint Committee of Public Accounts and Audit priority of the Parliament for 2019–20 and 2020–21.

Audit objective and criteria

6. The objective of the audit was to assess the effectiveness of the NDIA’s management of assistance with daily life supports.

- Does the NDIA effectively support NDIS participants who require assistance with daily life?

- Does the NDIA effectively manage operational risks to the proper use of resources in administering assistance with daily life supports?

Conclusion

7. The NDIA’s management of assistance with daily life supports was partly effective. Seven out of nine recommendations made by the Auditor-General in prior audits relating to improved decision-making controls and fraud controls, which relate to the NDIA’s management of risks to proper use of resources, were not fully implemented.

8. The NDIA has developed largely fit for purpose policies, procedures and guidelines to support the administration of ADL, informed by feedback mechanisms and continuous improvement processes. NDIA communications support staff, partner and provider understanding of ADL however, additional communications could be developed to support participant understanding. The NDIA conducts research to inform its communications approach and assesses its effectiveness.

9. NDIA’s planning and implementation arrangements are largely fit for purpose. Results of internal quality reviews of decisions to fund reasonable and necessary supports are continually below target. The NDIA publishes guidance material to assist participants to use their allocated funding and implement their plans, and monitors plan usage through regular reports. While the NDIA monitors and assesses participant outcomes through the collection of feedback and data points, greater analysis could be undertaken to inform service improvement.

10. The NDIA has partly effective processes in place to manage the risks to the proper use of resources for all support categories, including ADL, with deficiencies identified in relation to the quality of its decision-making, staff related conflicts of interest and fraud controls. The NDIA partly implemented recommendations from Auditor-General Report No. 14 2020–21 Decision-Making Controls for NDIS Participant Plans. NDIA has established and follows appropriate arrangements for setting prices for funded supports including ADL. NDIA’s management of conflict of interest risk is largely effective for Board members, SES staff and Partners in the Community (PITC). Controls for managing APS staff and contractor providers of support coordination conflicts of interest are partly effective.

11. NDIA has a partly fit for purpose fraud control framework and has partly implemented recommendations from Auditor-General Report No. 50 2018–19 National Disability Insurance Scheme Fraud Control Program. The NDIA has partly effective controls for managing the risk of overclaiming by participants and providers.

Supporting findings

Support for NDIS participants who require assistance with daily life

12. NDIA has policies, procedures and guidelines that support NDIA staff and Local Area Coordinators (LAC) with the administration of assistance with daily life (ADL) supports. The NDIA is currently changing its approach to publishing guidelines on its website to improve how it communicates with participants. The NDIA has effective processes to update Operational Guidelines. Documentation to govern NDIA staff access to Services Australia’s Centrelink system was inadequate. (See paragraphs 2.4 to 2.13)

13. NDIA communications include the Operational Guidelines, Participant Booklets and web content. Some information is published in different formats, such as easy read, Braille, Auslan video and languages other than English. Local Area Coordinators support participants to understand ADL supports and include these within their plans where relevant. NDIA has Standard Operating Procedures (SOPs) to support staff and partner implementation of the NDIS, including ADL supports. Participant understanding could be improved with further research of the communication needs of specific cohorts. (See paragraphs 2.18 to 2.34)

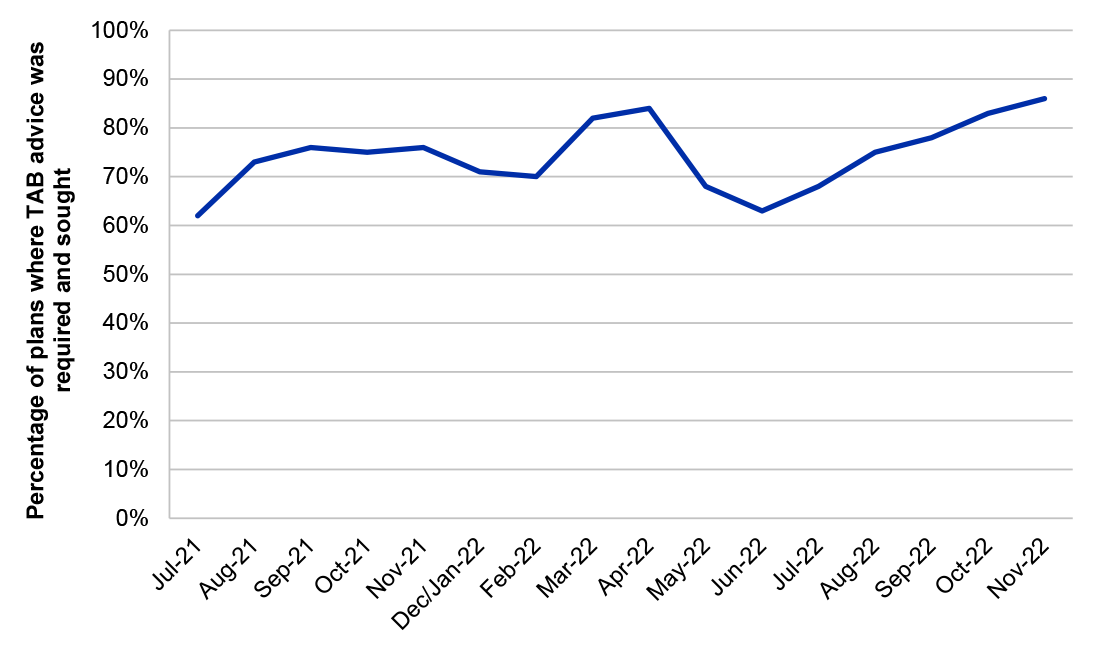

14. The NDIA has a structured process for developing and approving plans, based on the complexity of participants’ needs. Plans can be developed by Local Area Coordinators or NDIA planning officers and are then approved by a NDIA delegate. Plans up to the value of $385,000 can be developed and approved by a single delegate. The NDIA uses a typical support package (TSP) calculation to aid consistency in decision-making. The NDIA has not assessed the impacts on participant plan outcomes or scheme sustainability from high usage by planners of the World Health Organization Disability Assessment Schedule 2.0 (WHODAS) assessment tool. Since October 2021, the quality of decisions to fund supports considered reasonable and necessary for participants’ needs have been below NDIA’s target of 75 per cent. NDIA’s results against its key performance measure of starting planning within 21 days of Scheme access decision have consistently been above its 95 per cent target since quarter one, 2021–22 and results against the performance measure of approving a plan within 56 days have improved since 2021–22 and reached the target for the first time in quarter two, 2022–23. (See paragraphs 2.35 to 2.76)

15. The NDIA supports participants to implement NDIS funding for supports for activities of daily life (ADL) through education and guidance materials and monitoring use of approved funding. NDIA publishes guidance and online resources to assist participants to connect with and choose NDIS support providers and spend the funding within their plan. Participants may receive funding for tiered levels of support coordination to help implement and manage their plan. Participant survey results indicated the majority understood what happens after the plan is approved and where to seek assistance with implementing their plan. NDIA monitors the implementation phase by tracking the numbers of days it takes for a participant to activate their plan from the date of approval. NDIA generates reports to identify those participants who have not activated their plan within 90 days and may require additional support from NDIA staff or Local Area Coordinators. NDIA has established processes to support monitoring of plan use and connecting with participants at specified intervals or usage rates but does not monitor or report on compliance with these processes. NDIA policy does not assist staff to identify unexpected, overused or underused expenditure. Plan utilisation rates averaged 75 per cent nationally with a gradually increasing trend. (See paragraphs 2.77 to 2.108)

16. The NDIA assesses outcomes for participants, and their families and carers, including through short form and long form questionnaires. These questionnaires include participants who receive ADL funded supports but the results are not categorised by reference to ADL specifically. The survey results are reported monthly to the Board and quarterly to the Disability Reform Ministerial Council. NDIA collects comprehensive data but does not undertake analysis of trends or outcomes to inform service improvement. NDIA provided a 2019 data set to ABS for data linkage. The ANAO saw no evidence of plans for ongoing data linkages which could inform assessment of participant outcomes. The NDIA may improve its ability to measure participant outcomes in the future through the implementation of its 2022–27 Research and Evaluation Strategy. (See paragraphs 2.109 to 2.126)

NDIA management of risks to proper use of resources

17. The NDIA has partly implemented the three recommendations from Auditor-General Report No. 14 2020–21 Decision-making controls for NDIS Participant Plans. ICT controls aligned to policy requirements for planning decisions have not been implemented. The NDIA reports on the effectiveness of its continuous improvement activities developed to address issues identified in quality monthly reviews. The NDIA does not analyse outcomes of internal or external reviews of decisions to inform continuous improvement. The NDIA has aligned service delivery key performance indicators and quality metrics for reasonable and necessary decision-making. (See paragraphs 3.3 to 3.28)

18. NDIA has established processes for setting the price limits that providers may charge participants for individual funded supports, which include a regular review of set prices and consideration of benchmarks. NDIA demonstrated compliance with its internal requirement for price limits set for the 2022–23 financial year. NDIA’s Pricing Strategy defines three pricing levels and uses pricing regulation to foster value for money and encourage increased supply in the market. The Pricing Strategy does not specify how NDIA’s performance against the objective or criteria will be measured. NDIA has not set a timeframe for when price deregulation will occur. NDIA has established a reference group with external stakeholder membership to undertake regular pricing reviews. The results of the 2021–22 pricing review were published on 22 June 2022 and took effect on 1 July 2022. The Annual Pricing Reviews are informed by financial benchmarking surveys of providers each year and the NDIS Disability Support Worker Cost Model. NDIA publishes the pricing limits for each support category on its website. The price limits for ADL support items have increased by 18 per cent from 2019–20 to 2022–23. (See paragraphs 3.29 to 3.54)

19. The NDIA has established controls for identifying and managing conflict of interest risks for its Board and Senior Executive Service (SES) staff, which include annual declarations of material interests. The Board should implement procedures to manage conflict of interest risks arising from declarations of members relating to lived experience of disability. APS level staff are required to declare conflicts of interest but there are limited mechanisms to ensure this occurs. Combined with the lack of ICT controls for accessing participant records, staff controls represent an area of risk, especially for plan delegates. NDIA has largely fit for purpose controls for managing Local Area Coordinator conflict of interest risk, including requirements for these to be declared and reported to NDIA, and provision of compliance assurance statements to NDIA. NDIA was unable to quantify the impact that conflicts relating to support coordinators poses to participants. (See paragraphs 3.55 to 3.88)

20. The frequency and rigour of NDIA’s assessment of fraud risks is insufficient given it has assessed the fraud risk associated with the agency’s activities to be high. The 2019 Fraud and Corruption Risk Register has been updated in November 2022 but not yet approved by the Board. The risk assessment that informs the overall risk rating assigned to fraud risks is not documented. The NDIA Board does not have adequate oversight of fraud risk. NDIA has not fully implemented four of the recommendations from Auditor-General Report No. 50 2018–19 National Disability Insurance Scheme Fraud Control Program. (See paragraphs 3.92 to 3.153)

21. NDIA utilises prevention and detection controls and compliance activities to manage the risk of overclaiming. NDIA has identified key overclaiming risks for home and living supports, including ADL support types. The assessment has not identified controls or mitigation strategies for all risks. NDIA has inadequate system controls for claims for payment, in particular, from self-managed participants. NDIA is piloting stronger controls for providers claiming the Temporary Transformation Payment. (See paragraphs 3.157 to 3.172)

Recommendations

22. This report makes 13 recommendations to the NDIA relating to governance of systems access, planning, conflict of interest, and implementing prior audit recommendations on controls for planning decisions and fraud. There is one recommendation to NDIA and Services Australia to document arrangements for NDIA staff to access Centrelink information. There is one recommendation to the Australian Government to align fraud control requirements for NDIA with those of non-corporate Commonwealth entities.

Recommendation no. 1

Paragraph 2.14

The National Disability Insurance Agency (NDIA) and Services Australia document the arrangements for NDIA staff to access information in Services Australia’s Centrelink mainframe system, including setting out the legislative basis, terms and conditions for use, and applicable governance arrangements.

National Disability Insurance Agency response: Agreed.

Services Australia response: Not Agreed.

Recommendation no. 2

Paragraph 2.57

The National Disability Insurance Agency (NDIA) review:

- the use of the World Health Organization Disability Assessment Schedule 2.0 (WHODAS) tool by planners in developing participant plans, including analysis of plan outcomes, to assess the impact the use of this assessment tool has on participant plan outcomes and scheme sustainability; and

- guidelines, procedures and web content to ensure it transparently conveys NDIA policy about the use of assessment tools consistent with legislative requirements.

National Disability Insurance Agency response: Agreed.

Recommendation no. 3

Paragraph 3.8

The National Disability Insurance Agency reviews the impact of its policy changes relating to approval of plans that vary from Typical Support Packages (TSPs), including:

- assessing the impact on plan funding outcomes, plan costs and overall scheme costs of no longer requiring higher delegation approval of plans with funding that varies by more than eight per cent from the TSP; and

- undertaking a post-implementation review of its new integrated TSP calculator to ensure variations from the TSP reference point are supported by appropriate evidence of participants’ circumstances and determine whether ongoing monitoring is needed.

National Disability Insurance Agency response: Agreed.

Recommendation no. 4

Paragraph 3.14

The National Disability Insurance Agency implement the first recommendation of Auditor-General Report No. 14 2020–21 Decision-making Controls for NDIS Participant Plans by including controls relating to participant planning considerations and approvals within its new PACE ICT system, to align the system processes with internal policy requirements and to better support planning processes for reasonable and necessary decision-making.

National Disability Insurance Agency response: Agreed.

Recommendation no. 5

Paragraph 3.22

The National Disability Insurance Agency (NDIA):

- fully implement the second recommendation of Auditor-General Report No. 14 2020–21 Decision-making Controls for NDIS Participant Plans by using outcomes data from internal reviews and Administrative Appeals Tribunal reviews (and other mechanisms such as Independent Expert Reviews), including early resolution outcomes, to inform continuous improvement in reasonable and necessary decision-making; and

- regularly publish summaries of NDIA review data and analysis to improve transparency of review processes.

National Disability Insurance Agency response: Agreed.

Recommendation no. 6

Paragraph 3.79

The National Disability Insurance Agency (NDIA) improve its management of conflicts of interest by implementing:

- procedures for how the Board manages conflicts arising from declared interests of members;

- mandatory requirement for all NDIA staff, contractors engaged by NDIA and Partners in the Community staff to make an annual declaration of any real or apparent conflict of interest;

- mandatory business practices and ICT controls to restrict access to participant records that relate to a real or apparent conflict of interest reported to NDIA; and

- ICT controls to log all access and amendments to participant records in CRM and PACE, by staff, contractors and Partners in the Community and conduct regular audits of access logs for compliance with policies and declared conflicts of interest.

National Disability Insurance Agency response: Agreed.

Recommendation no. 7

Paragraph 3.89

The National Disability Insurance Agency assess and quantify the conflict of interest risks posed by providers delivering both support coordination and provision of supports to the same participant, and implement controls to mitigate the risk to participants.

National Disability Insurance Authority response: Agreed.

Recommendation no. 8

Paragraph 3.101

The Board of the National Disability Insurance Agency:

- conduct a fraud risk assessment at least annually, until such time as the board assesses that risk of fraud relevant to the agency’s activities has moderated to less than high risk, at which time risk assessments be conducted consistent with the Fraud Control Policy;

- identify those fraud risks that are outside the Board’s risk tolerance and regularly assess the treatments and controls for those risks; and

- record the Board and risk committee’s ongoing consideration of fraud risk including the regular assessment and monitoring of fraud risks outside tolerance and the efficacy of controls.

National Disability Insurance Agency response: Agreed.

Recommendation no. 9

Paragraph 3.110

The National Disability Insurance Agency fully implement the first recommendation of Auditor-General Report No. 50 2018–19 National Disability Insurance Scheme Fraud Control Program by regularly updating the Risk Register with planned controls, the delivery date and the project or activity under which the control will be developed and implemented.

National Disability Insurance Agency response: Agreed.

Recommendation no. 10

Paragraph 3.119

The National Disability Insurance Agency fully implement the fifth recommendation of Auditor-General Report No. 50 2018–19 National Disability Insurance Scheme Fraud Control Program and ensure visibility of the fraud control environment by providing regular reports to the Board containing a summary of the status of the Fraud and Corruption Risk Register including:

- the untreated and treated risk ratings for each of the fraud risk types;

- the controls effectiveness rating for each of the fraud risk types; and

- the actions required on controls, with implementation dates.

National Disability Insurance Agency response: Agreed.

Recommendation no. 11

Paragraph 3.121

When conducting risk assessments for each risk listed in the Fraud and Corruption Risk Register, the National Disability Insurance Agency document the factors considered, their weighting and the rationale for the overall risk rating. The Board should regularly review the risk assessment, including on each occasion it considers a proposed amendment or update to the Fraud and Corruption Risk Register.

National Disability Insurance Agency response: Agreed.

Recommendation no. 12

Paragraph 3.129

The National Disability Insurance Agency fully implement the fourth recommendation of Auditor-General Report No. 50 2018–19 National Disability Insurance Scheme Fraud Control Program by undertaking a review of its project management of fraud control. This review should:

- map all projects and activities with fraud control dimensions, including their status, linkages, relative priority and resourcing;

- determine whether additional projects or activities are required to close any gaps between the fraud risks and the implemented and planned fraud controls within projects; and

- support updating the Fraud and Corruption Risk Register.

National Disability Insurance Agency response: Agreed.

Recommendation no. 13

Paragraph 3.138

The National Disability Insurance Agency fully implement the second recommendation of Auditor-General Report No. 50 2018–19 National Disability Insurance Scheme Fraud Control Program to improve its active fraud detection methods by implementing data matching activity as a matter of priority, and on a continuing basis.

National Disability Insurance Agency response: Agreed.

Recommendation no. 14

Paragraph 3.145

That the National Disability Insurance Agency fully implement part (b) of the third recommendation of Auditor-General Report No. 50 2018–19 National Disability Insurance Scheme Fraud Control Program by establishing performance measures for its investigative functions that align with organisational goals for fraud investigations.

National Disability Insurance Agency response: Agreed.

Recommendation no. 15

Paragraph 3.154

The Australian Government aligns the fraud control requirements for the National Disability Insurance Agency with those of non-corporate Commonwealth entities, including the Commonwealth Fraud Control Policy and the reporting requirements of subsection 17AG(2) of the Public Governance, Performance and Accountability Rule 2014.

National Disability Insurance Agency response: Noted.

Attorney-General’s Department response: Noted.

Summary of entity responses

23. The proposed audit report was provided to the National Disability Insurance Agency and extracts were provided to Services Australia (relating to Recommendation no. 1) and to the Attorney-General’s Department (relating to Recommendation no. 15). The summary responses, and ANAO rejoinder to Services Australia’s response are reproduced below, with the full responses provided at Appendix 1. The improvements observed by the ANAO during the course of this audit are at Appendix 2.

National Disability Insurance Agency

The National Disability Insurance Agency (NDIA) welcomes the ANAO’s performance audit on the Effectiveness of the NDIA’s management of assisting with daily life (ADL) supports.

The NDIA acknowledges the audit findings and agrees with the recommendations. The NDIA is committed to strengthening its ADL support related governance, risk management and control environment to ensure it is effectively managing key service delivery risks that may have adverse impact on the National Disability Insurance Scheme (NDIS) as well as scheme financial sustainability pressures.

The NDIA will roll out its new ICT system (PACE) nationally in Q2 FY2023/24. The new ICT system is expected to better support key service delivery processes, the control environment, monitoring activities and management reporting for effective decision making. In this regard, ANAO recommendations and improvement opportunities in the report are most welcome.

The creation of the Fraud Fusion Taskforce and recent NDIS funding announcement by the Australian Government as well as transition to the new ICT system will enable NDIA to further improve its Fraud Control Program, management of conflict of interest risks and compliance monitoring.

The NDIA agrees with recommendation no:15, noting this recommendation is to be primarily addressed by the Australian Government. The NDIA welcomes the opportunity to contribute.

Services Australia

Services Australia (the agency) notes that the finding of the report that there was no written protocol or agreement between the two agencies setting out the scope, terms or legislative basis on which staff of the National Disability Insurance Agency (NDIA) access the agency’s Centrelink mainframe to support verification of participant details.

The agency is focused on maintaining the security of customer information, and on ensuring that customer records are only accessed by appropriately authorised individuals or entities for a documented business purpose in line with relevant legislative or other Government policy requirements. To that end, the agency has a Statement of Intent with the NDIA that provides the overarching framework under which NDIA is granted access to certain agency systems, and a Protected Information Disclosure document that provides the legislative basis. The agency provides access to Centrelink information systems on the basis of specified position numbers within NDIA. The access is provided as a result of a rule written into the Centrelink mainframe and does not need to be individually requested by NDIA staff, as it is specifically associated with the requirements of those positions. The position numbers are within the NDIA human resources organisational structure. The systems architecture documents provide further evidence of the controls that are in place to manage user access by NDIA staff in accordance with the above control framework.

ANAO comments on Services Australia’s response

24. The ANAO assessed the Statement of Intent between NDIA and Services Australia and other documentation received from Services Australia as not adequately setting out the scope, terms, legislative basis and governance for NDIA staff to access Centrelink mainframe systems. The Disclosure of Protected Information to the National Disability Insurance Agency instrument provided by Services Australia is a document recording the delegation of decision-making authority from the Chief Executive Centrelink to various officers within Services Australia to authorise the disclosure of information to NDIA staff where it is to assist in the administration of the NDIS or to support the work of the NDIS Fraud Taskforce and the NDIA’s Fraud and Compliance branch. Services Australia did not provide any documentation of decisions made under the instrument, including its consideration of the appropriateness of a request by NDIA to disclose information or grant access to the Centrelink mainframe. The ANAO notes that the NDIA agreed to work with Services Australia to implement Recommendation no. 1 by documenting ‘appropriate arrangements to govern the means of provision, removal, and audit of access to Services Australia’s Centrelink mainframe’.

Attorney-General’s Department

The Attorney-General’s Department notes recommendation 15, which is directed to the Australian Government to align the fraud control requirements of the National Disability Insurance Agency (a Commonwealth corporate entity) with those of non-corporate Commonwealth entities. Implementation of the recommendation is a matter for government and the department will work closely with the Department of Finance, the National Disability Insurance Agency and other relevant entities should it be pursued.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Stakeholder engagement

Performance and impact measurement

1. Background

Introduction

1.1 The National Disability Insurance Scheme (NDIS or the Scheme) was established in 2013 under the National Disability Insurance Scheme Act 2013 (NDIS Act) to provide funding for reasonable and necessary supports for eligible people with disability. Assistance with daily life is one of the categories of support funded by the NDIS and provides funding for self-care activities and household tasks. The National Disability Insurance Agency (NDIA) is the Australian Government entity responsible for delivering the NDIS.

National Disability Insurance Scheme

1.2 The NDIS replaced primarily state-based disability care arrangements and became fully operational in 2020. The Scheme objectives include supporting the independence and social and economic participation of people with disability, providing them with choice and control in the delivery of their supports, and facilitating a nationally consistent approach to disability support.

1.3 Over 2021–22, the NDIA made $28.6 billion in payments to 534,655 participants. The NDIS is jointly funded by the Australian, state and territory governments under bilateral agreements. In 2021–22, state and territory governments contributed $11.02 billion to the Scheme.3

Participants, planning and supports

1.4 To be an eligible NDIS participant, an individual must have a has a disability that is, or is likely to be permanent, and results in a substantial reduction in functional capacity, or have an impairment where the provision of early intervention supports is likely to reduce the individual’s future disability support needs. They must also be under the age of 65 and satisfy the residence requirements (citizenship or visa) set out in section 23 of the NDIS Act.

1.5 Once an individual is assessed to be eligible to participate in the NDIS, the NDIA or a contracted organisation, a Local Area Coordinator (LAC), develops an individualised participant plan for that participant.4 The plan sets out the participant’s goals and aspirations, general supports (informal, community and mainstream), and the reasonable and necessary supports that they require and will be funded under the NDIS.5

1.6 NDIA will not fund a support if it:

- is not related to the participant’s disability;

- is the same as other supports delivered under different funding through the NDIS;

- relates to day-to-day living costs that are not related to a participant’s support needs;

- is likely to cause harm to the participant or pose a risk to others; or

- can be more appropriately or effectively delivered by another system.

1.7 There are three types of NDIS funding:

- core supports, to enable participants to complete activities of daily living (assistance with daily life is one of four support categories within this support type);

- capital supports, such as home modifications; and

- capacity building supports, to build independence and skills, such as support for increased social participation.

Plan implementation

1.8 Participants can choose their service providers from which they purchase supports. Self-managed and plan managed participants can use unregistered or registered providers. Agency managed participants can only access registered providers.6 Participant plans may include funding for support coordination and plan management. Support coordinators assist participants to implement plans. Plan managers are responsible for the financial management of plan budgets, such as by making payments.

1.9 The prices which providers can charge for their services are subject to price regulation by the NDIA. All participants can negotiate prices lower than the NDIS price limits. Only self-managed participants may purchase a service costing more than the NDIS price limit established for that particular type of NDIS service.

Assistance with daily life

1.10 NDIS funding for core, capital and capacity building supports, is further catalogued into 15 support categories and 802 support items. Assistance with daily life (ADL) is the core support category relating to assisting with or supervising personal tasks of daily life to enable the participant to live as autonomously as possible. There are 134 ADL support items including support for self-care activities, such as showering, dressing and eating, as well as household tasks such as meal preparation, cleaning and yard maintenance.

1.11 The NDIA does not routinely report on ADL. Data provided by NDIA for this audit indicated 295,281 participants aged seven or older included ADL in their plan in 2021–2022. This represents 55 per cent of all participants. The average annual value of ADL supports for new plans developed in 2021–22 is $96,996.

1.12 Supported Independent Living (SIL) is an ADL support for participants with higher needs who require dedicated help at home from a disability support worker most of the time, including overnight support. At 30 June 2022 there were 26,950 SIL participants, which represent around five per cent of the total numbers of NDIS participants, and payments to SIL participants accounted for 32 per cent of all NDIS participant payments. The average annual payment for SIL participants was $340,900. The average annual payment for all other participants not in receipt of SIL (with and without ADL) was $39,500.

National Disability Insurance Agency

1.13 The NDIA was established under the NDIS Act in 2013 to administer the NDIS. The NDIA is a corporate Commonwealth entity, and its accountable authority is the NDIA Board, supported by an Independent Advisory Council. The Board reports to the Minister for the NDIS and to the Ministerial Council of Commonwealth, state and territory ministers responsible for disability services. The NDIA Chief Executive Officer (CEO) is responsible for the day-to-day administration supported by an Executive Leadership Team (ELT).7

1.14 NDIA functions include determining whether an individual is eligible to become a NDIS participant and approving and reassessing participant plans. The NDIA’s other functions include advising and reporting on NDIS financial sustainability, developing and enhancing the disability sector, building community awareness of disabilities, and undertaking analysis and research.

1.15 The NDIS Quality and Safeguards Commission (the NDIS Commission) is responsible for the regulation and registration of service providers and disability support workers, and handling of complaints about the quality and safety of services provided by providers. NDIA is responsible for managing complaints relating to decisions or actions by NDIA or Partners in the Community (PITC) staff, and complaints about fraud and provider payment non-compliance. The NDIA and the NDIS Commission work together to resolve critical incidents and share and refer complaints related to the other’s responsibilities.

Local Area Coordinators

1.16 NDIS delivery is supported by organisations funded under PITC grant funding. PITC organisations include Local Area Coordination (LAC) and Early Childhood (EC) Partners. This audit considered the activities of LACs as the PITC organisations involved in planning and implementation of ADL supports.

1.17 The LAC role includes helping participants to:

- understand and access the NDIS;

- develop the NDIS plan and liaise with the NDIA delegate for plan approval;

- implement the plan, including help to understand and use the supports;

- access community supports;

- monitor plan implementation; and

- undertake plan reassessments and plan variations.

Previous audits and reviews

1.18 Auditor-General Report No. 13 2017–18 Decision-making Controls for Sustainability — National Disability Insurance Scheme Access made four recommendations relating to access processes, information technology, quality control and review processes.

1.19 There were six recommendations from Auditor-General Report No. 50 2018–19 National Disability Insurance Scheme Fraud Control Program and three recommendations from Auditor-General Report No. 14 2020–21 Decision-making Controls for NDIS Participant Plans. This audit assessed NDIA’s implementation of recommendations from those performance audits.

1.20 The Joint Standing Committee on the National Disability Insurance Scheme 2020 Report into Supported Independent Living noted issues related to a lack of choice and control in provider arrangements; poor communication with participants, families and carers; delays in approvals; and conflicts of interest in the support, tenancy and support coordination functions. Its NDIS Planning Final Report, also published in 2020, noted concerns about planning decision inconsistencies, planner errors and poor communication.

1.21 During the audit, NDIA was implementing changes from The National Disability Insurance Scheme Amendment (Participant Service Guarantee and Other Measures) Act 2022, incorporating recommendations from the 2019 Review of the National Disability Insurance Scheme Act 2013 — Removing Red Tape and Implementing the NDIS Participant Service Guarantee (‘the Tune Review’).8

1.22 On 18 October 2022, the Australian Government announced an Independent Review into the NDIS, to report to Disability Reform Ministers by October 2023.9

Rationale for undertaking the audit

1.23 Prior audits10 and reviews11 have identified issues with NDIS planning, decision-making, communications, service delivery, access to supports and fraud controls. This audit provides assurance to Parliament on the effectiveness of the NDIA’s management of ADL supports and its management of operational risks, including the implementation of recommendations from prior audits. This audit was identified as a Joint Committee of Public Accounts and Audit priority of the Parliament for 2019–20 and 2020–21.

Audit approach

Audit objective, criteria and scope

1.24 The objective of the audit was to assess the effectiveness of the NDIA’s management of assistance with daily life supports.

1.25 To form a conclusion against the objective, the following criteria were adopted.

- Does the NDIA effectively support NDIS participants who require assistance with daily life?

- Does the NDIA effectively manage operational risks to the proper use of resources in administering assistance with daily life supports?

1.26 The audit assessed the NDIA’s implementation of prior audit recommendations and fraud control framework.

1.27 The audit did not assess Scheme access decisions, the quality of service delivery by providers or the effectiveness of the NDIA’s market stewardship activities in respect of the market for assistance with daily life supports. The audit did not review the ‘myplace’ participant or provider portals. NDIA advised that a new participant portal is under development. The scope of the audit also excluded children with disability or developmental delay aged six or under, and the associated work of EC Partners. Most ADL participants are adults and the NDIA’s ‘early childhood approach’ for children aged six or under differs from that applied to adults and older children.

Audit methodology

1.28 The audit methodology included:

- review of NDIA documentation including policies, procedures, guidance and training material, and external communications;

- review of NDIA governance material, Board and executive committee papers and minutes;

- analysis of NDIA data, including public sources and data produced for this audit;

- meetings with NDIA staff, including executives and the Participant Advocate;

- walkthrough of participant planning processes;

- meetings on site with staff from two Local Area Coordinators from Canberra and Goulburn;

- analysis of Administrative Appeal Tribunal decisions;

- review of Joint Standing Committee on the National Disability Insurance Scheme reports, hearings and submissions; and

- review of 35 citizen contributions to the audit, including 16 from participants or family.

1.29 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $678,000

1.30 The team members for this audit were Jason Millward, Barbara Das, Evan Lee, Anne-Sophie Colin, Qing Xue, Zhuo Li, David Vandersee, Christine Chalmers and Alexandra Collins.

2. Support for NDIS participants who require assistance with daily life

Areas examined

This chapter examined whether the National Disability Insurance Agency (NDIA) effectively supports National Disability Insurance Scheme (NDIS) participants who need assistance with daily life (ADL) supports, including NDIA policies, procedures and guidelines, whether communications were effective, NDIA planning and implementation processes, and assessment of outcomes.

Conclusion

The NDIA has developed largely fit for purpose policies, procedures and guidelines to support the administration of ADL, informed by feedback mechanisms and continuous improvement processes. NDIA communications support staff, partner and provider understanding of ADL however, additional communications could be developed to support participant understanding. The NDIA conducts research to inform its communications approach and assesses its effectiveness.

NDIA’s planning and implementation arrangements are largely fit for purpose. Results of internal quality reviews of decisions to fund reasonable and necessary supports are continually below target. The NDIA publishes guidance material to assist participants to use their allocated funding and implement their plans, and monitors plan usage through regular reports. While the NDIA monitors, and assesses participant outcomes through the collection of feedback and data points, greater analysis could be undertaken to inform service improvement.

Areas for improvement

The ANAO made two recommendations aimed at documenting arrangements for NDIA staff access to Services Australia’s Centrelink ICT system and reviewing planner use of assessment tools to identify the impact on participant plan outcomes and scheme sustainability.

The ANAO identified three opportunities for improvement including analysis of communication needs and utilisation trends for specific participant cohorts, and supporting data linkage with other entities.

2.1 Accurate, easy to understand and accessible policies, procedures and guidelines supports quality decision-making and efficient administration. After being granted access to the NDIS, participants engage in the NDIS planning phase which determines the types and amount of supports each participant can receive, and how their plan will be managed. Implementation processes assist participants to make use of their funded supports within their plan. The ongoing assessment and evaluation of administrative effectiveness and participant outcomes can inform NDIA’s management of the NDIS and support continuous improvement.

2.2 Once granted access to the scheme, participants work with planners in NDIA or Local Area Coordinators (LACs)12, to develop their participant plan. Participant plans set out each participant’s goals, current circumstances and the types and amounts of general supports (not NDIS funded and known as informal, community, and mainstream supports), and the reasonable and necessary supports that will be funded under the NDIS. The ANAO assessed NDIA’s plan development guidance and quality review processes.

2.3 A key NDIS purpose is to enable people with disability to exercise choice and control in pursuing their goals and in the delivery of their funded supports. The ANAO assessed the NDIA’s approach to supporting participants in the implementation stage of ADL, particularly in making connections with ADL providers, and whether NDIA was supporting participants to meet their goals.

Does the NDIA have fit for purpose policies, procedures and guidelines for assistance with daily life supports?

NDIA has policies, procedures and guidelines that support NDIA staff and Local Area Coordinators (LAC) with the administration of assistance with daily life (ADL) supports. The NDIA is currently changing its approach to publishing guidelines on its website to improve how it communicates with participants. The NDIA has effective processes to update Operational Guidelines. Documentation to govern NDIA staff access to Services Australia’s Centrelink system was inadequate.

NDIA policies, procedures and guidelines

2.4 In 2019, Mr David Tune AO PSM was commissioned by the Australian Government to undertake a review of the NDIS to assist in developing a Participant Service Guarantee (PSG) which would improve service delivery experiences for participants (Tune Review).13 The NDIA agreed to the recommendation of the Tune Review to publish ‘information, in accessible formats, about how it determines when a support is reasonable and necessary.’14 The commitment to publish clearer guidelines and procedures, including for reasonable and necessary supports, was included in NDIA’s Corporate Plan 2020–2024. In 2019, the NDIA commenced the Operational Guidelines Refresh Project to improve how it communicates policy and makes operational decisions. The project plans to transition from 12 publicly available Operational Guidelines, supported by internal policy guidance, to around 40 publicly available Operational Guidelines. NDIA internal Standard Operating Procedures (SOPs) will no longer include policy guidance but will focus on information to assist staff and partners on supporting administrative processes.

2.5 New Operational Guidelines are published in webform and downloadable versions in plain English on a dedicated website.15 The intent is to improve comprehension by participants, partners and providers and staff by putting all policy material in the public domain and better align guidelines with legislation. As at April 2023, the NDIA advised that were five Operational Guidelines still to be refreshed and published in the new format.

2.6 ADL is one of 15 support categories funded by the NDIS and provides funding for self-care activities and household tasks. NDIA does not have distinct policies or guidelines for ADL. Instead, policies and guidelines are grouped thematically around the participant journey, including access to the Scheme, developing and reviewing a plan of funded supports and plan use, supported by Operational Guidelines and Standard Operating Procedures (SOP) on specific topics. ADL is covered by eight topic specific Operational Guidelines within the Home and Living category as well as other Operational Guidelines that apply to the broader NDIS scheme.

2.7 The Auditor-General Report No. 14 2020–21 Decision-making Controls for NDIS Participant Plans found that the NDIA had established largely appropriate policies and processes for participant planning and internal guidance and training materials were consistent with legislation. While that report found the NDIA instrument of delegation had not been updated to reflect organisational changes, the NDIA now maintains a current instrument of delegation.

2.8 Operational Guidelines and SOPs provide appropriate guidance to planners and delegates to support ADL decisions under NDIS legislation. Documentation is consistent with current legislation, Intergovernmental Agreements and the Applied Principles and Tables of Support to Determine Responsibilities NDIS and other service (APTOS).16 The NDIA has feedback mechanisms and continuous improvement processes in place to ensure its Operational Guidelines and SOPs are consistent with legislation and are understood.

2.9 ANAO analysis of Administrative Appeals Tribunal decisions published in 2021–22 did not identify any systemic issues with NDIA policies, procedures or guidelines related to ADL.

2.10 Although the overarching guidelines and SOPs are appropriate, there are risks associated with how some processes have been operationalised.

- There are inconsistencies between SOPs and NDIA website guidance about the use of assessment tools (see paragraph 2.51).

- NDIA internal delegation instruments permit a delegate to both develop and approve a plan up to an annual value of $385,000 (rather than having a separation between the plan development and approval duties). In 2021–22, 17,707 plans were both developed and approved by one delegate (with $2.2 billion aggregate value of supports) and the ANAO found NDIA had insufficient controls for managing staff conflicts of interest and did not undertake risk based compliance activities (see paragraph 2.48).

- Providers can claim and be paid the Temporary Transformation Payment (TTP) without having satisfied the eligibility criteria for such payment (see paragraph 3.171).

- Providers can claim payment directly from the NDIA or Plan Managers without confirmation from the participants that the services were provided. Similarly, self-managed participants can submit claims for payment without providing evidence of services provided (see paragraph 3.95).

Governance arrangements for policies, procedures and guidelines.

2.11 The NDIA sets out its policy hierarchy, including governance arrangements, in the Policy, Operational Guidelines and Standard Operating Procedure. Processes for approving amendments to policy documents are clearly set out and are risk-based. Minor updates, such as formatting and typographical errors, can be approved by the relevant Senior Executive Service branch manager (SES Band 1). New content for existing policies must be approved by the relevant SES general manager (SES Band 2). Major amendments, such as new guidelines or content that changes the operation of the Scheme, require approval from the internal Participant Experience Committee through to the CEO or the Board depending on the significance of the change.

2.12 The NDIA followed its approval processes for updating Operational Guidelines, including consultation with the Independent Advisory Committee and stakeholders.

2.13 NDIA Standard Operating Procedures set out processes for NDIA staff to access Services Australia’s Centrelink mainframe system to support verification of participant details such as identity, residency and citizenship, or to obtain contact details if NDIA information was out of date. Between February 2022 and February 2023, 255 NDIA staff had access to the Centrelink mainframe. This access arrangement is referenced but not detailed in the Statement of Intent agreement between the Chief Executive Officers of NDIA and Services Australia dated June 2021 which covers all services provided by Services Australia to NDIA. There was no written protocol or agreement between the two agencies or records of decisions by Services Australia setting out the scope, terms, or legislative basis for access granted to NDIA staff. The documentation and governance for NDIA staff access to Centrelink systems is inadequate to ensure the appropriateness of NDIA’s access to and use of the sensitive data in Centrelink’s mainframe system.

Recommendation no.1

2.14 The National Disability Insurance Agency (NDIA) and Services Australia document the arrangements for NDIA staff to access information in Services Australia’s Centrelink mainframe system, including setting out the legislative basis, terms and conditions for use, and applicable governance arrangements.

National Disability Insurance Agency response: Agreed.

2.15 Access to the Centrelink mainframe is currently managed through the NDIA’s identity and access management system, Azure Active Directory, and is subject to an approval process. The ICT Services Branch will work with Services Australia, in addition to internal legal teams, to document appropriate arrangements to govern the means of provision, removal, and audit of access to Service Australia’s Centrelink mainframe. Additionally, the ICT Services Branch will review and where appropriate modify the technical control and governance of access to ensure alignment with the agreed arrangements.

Services Australia response: Not Agreed.

2.16 Services Australia has provided documents showing the scope, terms and legislative basis for specified NDIA positions to be provided access to agency systems. This access is provided to NDIA staff on a read-only basis to support NDIA in carrying out its functions. Access is provided to NDIA staff in accordance with Schedule 3 of the Statement of Intent, in that those NDIA staff in relevant positions have a legitimate ‘need to know’ to perform their duties. Other NDIA staff may request access via a request form, through a process that is managed in accordance with the Statement of Intent, and relevant cyber security and other access policies.

ANAO comments on Services Australia’s response

2.17 The ANAO assessed the Statement of Intent between NDIA and Services Australia and other documentation received from Services Australia as not adequately setting out the scope, terms, legislative basis and governance for NDIA staff to access Centrelink mainframe systems. The Disclosure of Protected Information to the National Disability Insurance Agency instrument provided by Services Australia is a document recording the delegation of decision-making authority from the Chief Executive Centrelink to various officers within Services Australia to authorise the disclosure of information to NDIA staff where it is to assist in the administration of the NDIS or to support the work of the NDIS Fraud Taskforce and the NDIA’s Fraud and Compliance Branch. Services Australia did not provide any documentation of decisions made under the instrument, including its consideration of the appropriateness of a request by NDIA to disclose information or grant access to the Centrelink mainframe. Services Australia included in its response a policy documented titled ‘External Access to Services Australia Systems’ and dated 9 December 2021. This policy sets out data sharing principles and processes including initial evaluation of requests, confirming legal authority, conducting ethics and fraud review, and risk management. Further, where systems access is required, the policy sets out a list of requirements to be included in a written agreement with the organisation being granted access. Services Australia did not provide any documentation of these internal policy requirements having been satisfied in relation to NDIA staff access to the Centrelink mainframe. The ANAO notes that the NDIA agreed to work with Services Australia to implement Recommendation no. 1.

Do communications support participant, partner and provider understanding of assistance with daily life supports?

NDIA communications include the Operational Guidelines, Participant Booklets and web content. Some information is published in different formats, such as easy read, Braille, Auslan video and languages other than English. Local Area Coordinators support participants to understand ADL supports and include these within their plans where relevant. NDIA has Standard Operating procedures (SOPs) to support staff and partner implementation of the NDIS, including ADL supports. Participant understanding could be improved with further research of the communication needs of specific cohorts.

Stakeholder communications

2.18 The NDIA’s primary communication channel for all stakeholders is the website, www.ndis.gov.au, which attracts 300,000 visitors and 1.7 million page views per month. This sets out Operational Guidelines, participant booklets, videos and other material on access, planning and plan implementation.

2.19 The NDIS website includes hundreds of stories and 64 videos17, many featuring participants’ experiences with planning and implementing their NDIS plans. Videos feature on NDIA’s social media pages (Facebook, Instagram, LinkedIn and Twitter) to promote new or specific website content. Further communications support is provided by the National Contact Centre, which the NDIA reported answered 1.085 million calls, 1.07 million emails and 985,000 webchats in 2021–22.

2.20 The ANAO found the content of NDIA’s communications to be largely consistent with legislation and policy and underpinned by sound governance processes to develop and publish new content and products. The NDIA developed an ‘NDIA Style Guide’ in 2018 adapted from the Australian Government Style Manual.18 NDIA communications are largely consistent with its internally developed style guide, including use of plain English, and publication of easy read versions of documents. Minor inconsistencies were identified which indicates that further work is required to simplify and standardise terminology. For example:

- ‘Assistance with Daily Life’ in participant plans is referred to as ‘Daily Activities’ in the myplace portal and some web content, and as ‘Assistance with Daily Living’ in some web content.

- The Participant Booklet 1: Applying for the NDIS, states that ‘The NDIS provides reasonable and necessary funding to people with a permanent and significant disability so they can access the supports they need to live and enjoy their life’.19 The term ‘significant disability’ is not referenced in the NDIS Act, the NDIS eligibility webpage20 or in the operational guideline ‘Do you meet the disability requirements’.21

2.21 The NDIA has continuous improvement processes, including internal and external feedback mechanisms, to revise and update Operational Guidelines and web content to support consistency with legislation and to improve understanding.

2.22 The Participant First engagement initiative is one of the NDIA’s co-design processes which connects staff to the lived experience and expertise of 4795 stakeholders, including participants and their family members and carers. The Participant First program includes focus groups, one-on-one interviews, and working groups intended to improve the services provided by NDIA. Participant First members are involved in testing groups to redevelop Operational Guidelines, policies and processes; and revising easy read guides and other publications on the NDIS website.

2.23 The ANAO assessed the NDIA’s communication of changes that commenced on 1 July 2022 arising from the National Disability Insurance Scheme Amendment (Participant Service Guarantee and Other Measures) Bill 2022.22 This incorporated recommendations from the 2019 Review of the NDIS Act (the Tune Review).23 The ANAO found communications to be largely consistent with legislation and policy and underpinned by sound governance and clearance processes to develop and publish new content and products. The NDIA provided communication via email and intranet updates to staff and LACs to support their awareness of the changes. The NDIA published a summary of the legislative changes on its website with a table setting out each change and the impact for participants.

Accessibility and usability of communications

2.24 The NDIA does not have ADL-specific communication products or channels. Communications are focussed on NDIS processes, such as scheme access, planning, plan implementation and review, as well as topic-specific products such Supported Independent Living (SIL), Individualised Living Options and Reasonable and Necessary Supports.

2.25 The Home and Living Program, which includes ADL supports, has its own Communications and Engagement Strategy and it was the subject of a consultation process in June 2021. Respondents indicated a preference for getting information about ‘where and how you live?’ from Support Coordinators or LACs (65 per cent) and the NDIS website (55 per cent). In response to the consultation question ‘How helpful is the NDIS website to find information on home and living supports?’, three per cent found it very helpful, 29 per cent somewhat helpful and 29 per cent said it was not at all helpful. Eighteen per cent found it neither helpful nor unhelpful and 21 per cent had never looked at the NDIS website.

2.26 NDIA engaged Icon Agency in 2022 to undertake a benchmarking review of the NDIS website, informed by focus groups and a user survey in August and September 2022 with 893 respondents. Two thirds of respondents were providers (590), 153 participant respondents (17 per cent) and 161 respondents (18 per cent) who were family members, friends or carers.24 As the survey results were not disaggregated by stakeholder type, participant perspectives were not clearly reflected in broader responses. Neither this study or other reviews focussed sufficiently on the specific communication needs of participants based on their disability, English language proficiency, cultural background, geographical location or length of engagement in the Scheme.

2.27 The benchmarking report completed in September 2022 found website usage was high (aggregated across all stakeholder cohorts), with 69 per cent visiting www.ndis.gov.au at least once per week. Similar to the Home and Living consultation survey responses and public contributions to this audit, only 16 per cent of respondents to the benchmark review found it easy to find information on the website, with 37 per cent finding it difficult. The search function was the most common area cited for improvement, followed by simpler language, clearer menus and improved navigation. The ANAO observed limitations with the search function, including lack of facility to filter and refine searches. Participants reported finding information more easily through google searches and provider websites. Glossary and acronyms pages were also out of date.

|

Opportunity for improvement |

|

2.28 Future research and evaluation activities could benefit from specific analysis of the varied communication needs of participants based on their disability, English language proficiency, cultural background, geographical location and whether they are a new or ongoing participant. |

Communication formats

2.29 The Participant Service Charter sets out what participants can expect of NDIA and Partners in the Community (PITC), including Local Area Coordinators (LACs) and Early Childhood Partners. The Participant Service Charter is based on five principles for engagement with participants and commits to offering service that is: transparent; responsive; respectful; empowering; and connected. The Participant Service Charter requires the NDIA to communicate in participants’ preferred formats.

2.30 NDIA policies and procedures support accessibility and compliance with Web Content Accessibility Guidelines 2.0, including providing plans, letters and other key information in formats preferred by participants. Content is published online in a range of formats, including: web content (in plain English); standard Portable Document Format (PDF); Word (to assist Optical Character Recognition software); easy-read versions of documents with simplified language and diagrams; videos with transcripts; Australian sign language (Auslan); Braille; and translations into languages other than English. In December 2022, a range of NDIA information products were made available in Auslan, Braille and translations into five languages other than English (bringing the total to 17). Online information (web content) is not routinely published in Braille.

2.31 NDIA guidance requires products such as Participant Booklets to be available in a range of formats and translations into languages other than English but there is no NDIA policy setting out what web content should be in different formats or languages, or which non-English languages should be used. NDIA documentation did not evidence how the 17 non-English languages currently used were selected.

2.32 The NDIA funds translation and interpreting services (including for Aboriginal and Torres Strait Islander languages) to support participant interaction with the NDIA or LACs, such as in planning meetings. The NDIA Practice Guide on Assisting communication sets out that additional translation and interpreter services for languages other than English are not funded as a support within a participant plans as these are not disability related supports and are expected to be sourced from mainstream services.25 The NDIA has not assessed whether this impedes plan implementation for affected participant cohorts.

2.33 The NDIA provides funding through the National Aboriginal Community Controlled Health Organisation (NACCHO) for 50 Aboriginal Disability Liaison Officers (ADLO) to ‘improve how the NDIS connects with Aboriginal and Torres Strait Islander people with disabilities.’ A component of the funding requires NACCHO to engage an external party to undertake an evaluation of the program. In November 2022, the contract was extended and the evaluation component varied to require delivery of the final evaluation report by May 2024.

Participant Service Improvement Plan communication commitments

2.34 The NDIA developed a participant Service Improvement Plan (SIP) 2020–21 in August 2021, which was refreshed for 2022–23, setting out its plan of actions to meet the Participant Service Charter and the Participant Service Guarantee.26 NDIA reports quarterly to Disability Reform Ministers on progress implementing the SIP. While NDIA reported all five of the commitments relating to communications27 were completed, ANAO observed that further improvements were required to meet the commitment ‘Our documents will use consistent terms and definitions with less jargon’, for example, improving consistency of language (discussed paragraph 2.10).

Is the NDIA effectively supporting participants in planning for assistance with daily life supports?

The NDIA has a structured process for developing and approving plans, based on the complexity of participants’ needs. Plans can be developed by Local Area Coordinators or NDIA planning officers and are then approved by a NDIA delegate. Plans up to the value of $385,000 can be developed and approved by a single delegate. The NDIA uses a typical support package (TSP) calculation to aid consistency in decision-making. The NDIA has not assessed the impacts on participant plan outcomes or scheme sustainability from high usage by planners of the World Health Organization Disability Assessment Schedule 2.0 (WHODAS) assessment tool. Since October 2021, the quality of decisions to fund supports considered reasonable and necessary for participants’ needs have been below NDIA’s target of 75 per cent. NDIA’s results against its key performance measure of starting planning within 21 days of an access decision have consistently been above its 95 per cent target since quarter one, 2021–22 and results against the performance measure of approving a plan within 56 days have improved since 2021–22 and reached the target for the first time in quarter two, 2022–23.

Plan development

2.35 Section 34 National Disability Insurance Scheme Act 2013 (NDIS Act) requires the funding for supports in plans to be both reasonable and necessary.

|

What is a ‘reasonable and necessary’ NDIS-funded support? |

|

What is a ‘reasonable and necessary’ support is set out in section 34 — these supports:

|

2.36 The staff involved in preparing, advising on, or approving plans depends on the participant’s circumstances and support needs. Participants are streamed into general, supported, intensive, super intensive or complex streams for planning and management purposes.

2.37 If streamed to ‘general’ or ‘supported’, a LAC meets with the participant to develop a plan that is subsequently approved by a NDIA delegate. In 2020–21, LACs developed nearly 70 per cent of plans for participants aged seven or over. NDIA planners undertake all steps of the planning process for participants with more intensive support needs. Participants with complex needs, including those in hospital or younger people in, or at risk of entering, residential aged care, are allocated to specialised NDIA planners.

2.38 Participant plan development largely follows a single process, although for some ADL supports, expert teams assist. Where plans include home and living supports, the Home and Living (HAL) team assesses the home and living support needs, finishes building the draft plan and assists the NDIA delegate consider the entire plan for approval. Plans for participants with complex needs are fully prepared by specialist planners, in consultation with HAL. Dedicated teams of planners support participants in hospital with accommodation needs, as well as participants aged under 65 years, living in, or at risk of entering, residential aged care.

2.39 Information gathered in the pre-planning phase is recorded in the NDIA’s business IT system, CRM, and helps planners identify reasonable and necessary supports to include in plans. Planners check the participant’s record for an assessment of their primary disability that indicates functional impact and if the assessment on file is not current and/or the participant does not have a current assessment from a medical professional (or equivalent), the planner assesses functional capacity using the World Health Organization Disability Assessment Schedule 2.0 (WHODAS).28

2.40 Information collected by the planner informs the automated calculation of a Typical Support Package (TSP) funding amount for NDIS supports relative to a participant’s functional capacity.29 The TSP assists planners to guide and support consistency in decision-making consistency and does not limit plan amounts.

2.41 During planning, the planner and participant discuss the participant’s preferred plan management approach to determine how expenditure against approved plan budgets should be managed. Plan managed or self-managed participants can use unregistered providers. Table 2.1 outlines the plan funding.

Table 2.1: Plan management approaches for all participants as at December 2022

|

Approach |

How it works |

Providers |

Pricing |

Participants |

|

Self-managed (fully) |

NDIA pays participants so they can pay providers directly |

Registered or unregistered |

Not subject to NDIS pricing arrangements or price limits |

23% |

|

Plan managed |

Participants choose a registered plan manager (NDIS-funded), who pays other providers for the participant |

Registered or unregistered |

Must not exceed NDIS price limits |

58% |

|

Agency managed |

Managed by the NDIA. Providers claim payment from NDIA electronically |

Registered |

12% |

|

|

Self-managed (partly) |

For example, ADL funding is self-managed and other funding is agency managed |

Agency managed supports must be registered. |

NDIS price limits for agency or plan-managed supports |

7% |

Source: ANAO analysis of NDIA documentation.

2.42 During plan development, planners complete a risk assessment. Where a registered plan manager is used to manage the funding, the NDIA considers whether to mitigate any risks to the participant by, for example, approving a plan of shorter duration (encouraging more frequent oversight) or offering regular check-ins, as agreed during the plan implementation meeting (paragraph 2.79).

2.43 Plan duration is determined based on participants’ circumstances, including how stable their needs are, any expected life transitions (such as finishing school), and personal preference. CRM uses the recorded information to recommend plan duration, but planners vary plan duration as needed. In April 2021, the NDIA moved to longer plan durations, now up to 36 months duration, to simplify the planning process for participants with less variability in their circumstances and needs.

2.44 As of June 2022, four in every five participants had been through a full cycle of developing a plan, using it, and having a new plan developed and implemented. In August 2019, the NDIA introduced automatic plan extensions to prevent gaps in participant supports for plans that reached their end date before a full reassessment took place. In April 2021, the NDIA introduced the option, for planners to offer (between April and 30 June 2021) participants in certain circumstances30 an automatic extension of their plan for up to 12 months.

2.45 As of April 2023, the NDIA’s website did not specify a timeframe within which a reassessment should be completed following an automatic extension, and internal guidance states it must be done as soon as possible The NDIA advised the ANAO that automatic extensions could occur more than once on a plan.

Delegation of decision-making powers

2.46 Authority to approve plans is limited by the financial limits set out in the NDIA Chief Executive Officer’s instruments of delegation. For example, planning staff with the lowest delegation may approve plans with an annualised budget of up to $330,000 for participants with the lowest assessed level of function. Specified Executive Level 2 and SES Band 1 officers may authorise plans with annualised value up to $1.1 million. Four specified SES officers may authorise plans valued over $1.1 million.

2.47 The NDIA appropriately maintained its instrument of delegation, including issuing updates on 1 July 2022 to reflect legislative changes around plan variations and reassessments.

2.48 The ANAO’s 2021–22 financial statements audit found that key IT system controls operated effectively to ensure plan approvals complied with instruments of delegation. The ANAO observed that, while there was segregation of duties between access and planning decisions, and for plans prepared by LACs (subject to NDIA delegate approval), a single delegate could both prepare and approve participant plans in certain circumstances. In 2021–22:

- single delegates developed and approved 7198 plans for new participants, with an aggregated plan value of $0.6 billion; and

- there were 10,509 plans where single delegates developed and approved initial plans and the same delegates approved the subsequent plans, with a total value of these plans of $1.6 billion.

2.49 In the 2021–22 financial statements audit, the ANAO recommended the NDIA review its overall monthly quality review sampling methodology to address the increased risks of error and fraud associated with single delegate approved plans, including at lower levels.

Assessment tools

2.50 NDIA delegates must consider relevant assessments when deciding whether to approve the funding of a support in a participant plan. NDIA encourages participants to provide the agency or a LAC with an assessment from their treating medical professional for consideration during planning meetings.

2.51 Where a participant’s record does not include a medical assessment, or more information is required, the planner uses the World Health Organization Disability Assessment Schedule 2.0 (WHODAS) assessment tool to calculate a functional capacity assessment to inform plan development. The National Disability Insurance Scheme (Supports for Participants) Rules 201331 requires the use of assessment tools in plan development to be specified in NDIA’s Operational Guidelines. The use of assessment tools is specified in NDIA internal SOPs but are not included in the publicly accessible Operational Guidelines.