Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Effectiveness of Public Sector Boards — Australian Film, Television and Radio School

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Boards play a key role in the effective corporate governance of an entity, by maintaining a focus on organisational performance and conformance with relevant requirements such as the Commonwealth finance law and enabling legislation.

- The Australian Film, Television and Radio School (AFTRS) has not been subject to an in-depth performance audit in recent years.

- This audit provides the Parliament with independent assurance regarding board governance at AFTRS.

Key facts

- AFTRS is a corporate Commonwealth entity established under the Australian Film, Television and Radio School Act 1973 (AFTRS Act).

- AFTRS provides screen and broadcast education, training and research.

- The AFTRS council is the accountable authority under the finance law and a ‘governing body’ under the Corporate Governance of Higher Education Standards Framework (Threshold Standards) 2021.

What did we find?

- The governance board in AFTRS is largely effective.

What did we recommend?

- There were three recommendations made to: review internal processes to ensure that convocation appointments are made in accordance with all requirements of the AFTRS Act and that a roll of all members of convocation is maintained; that staff and student elections are carried out in accordance

with all requirements of the Australian Film, Television and Radio School (Council Elections) Regulations 2017; and improve systematic monitoring and review of performance. - AFTRS agreed to all three recommendations.

$25 million

received in government departmental appropriations in 2020–21

$8.4 million

generated in own source revenue in 2020–21

3

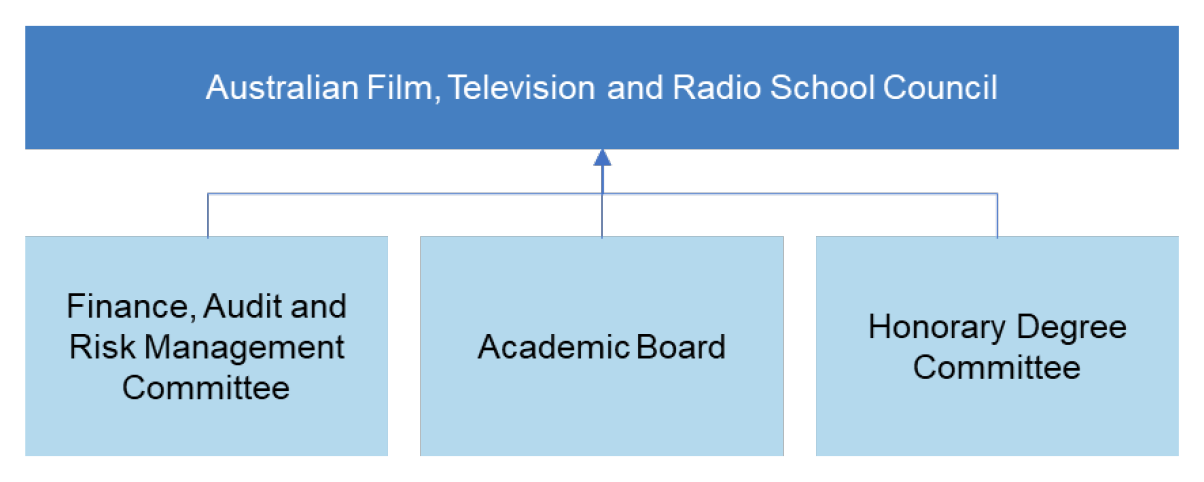

committees to assist the AFTRS council in carrying out its functions

Summary and recommendations

Background

1. The governing board of a corporate Commonwealth entity is the accountable authority for the entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act)1, with responsibility for ‘leading, governing and setting the strategic direction’ for the entity.2

2. Around 59 corporate Commonwealth entities subject to the PGPA Act have governing boards, comprising a total of approximately 600 board positions.3 Corporate Commonwealth entities with governance boards vary significantly by function, and governance boards may also vary in their composition, operating arrangements, independence and subject-matter focus, depending on the specific requirements of their enabling legislation and other applicable laws.

Boards and corporate governance

Duties and roles

3. Boards play a key role in the effective governance of an entity. Corporate governance is generally considered to involve two dimensions, which are the responsibility of the governing board:

Performance — monitoring the performance of the organisation and CEO. This also includes strategy — setting organisational goals and developing strategies for achieving them, and being responsive to changing environmental demands, including the prediction and management of risk. The objective is to enhance organisational performance;

Conformance — compliance with legal requirements and corporate governance and industry standards, and accountability to relevant stakeholders.

…

it is important to understand that governing is not the same as managing. Broadly, governance involves the systems and processes in place that shape, enable and oversee management of an organisation. Management is concerned with doing – with co-ordinating and managing the day-to-day operations of the business.4

4. In the Australian Government sector context, boards must govern the entity in a way that complies with the requirements of any enabling legislation, the Commonwealth finance law (which includes the PGPA Act and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule)), and other applicable laws and requirements.

5. Sections 15 to 19 of the PGPA Act impose duties on accountable authorities in relation to governing the corporate Commonwealth entity for which they are responsible. As the accountable authority, members of Commonwealth governing boards are also officials under the PGPA Act and subject to the general duties of officials in sections 25 to 29 of the PGPA Act.

Australian Film, Television and Radio School

6. The Australian Film, Television and Radio School (AFTRS) is a corporate Commonwealth entity established under the Australian Film, Television and Radio School Act 1973 (AFTRS Act). AFTRS’ mission is: ‘Delivering world-leading creative education across the nation, so Australian talent and culture thrive at home and around the world’. AFTRS’ purpose is: ‘Working hand-in-hand with our screen and broadcast industries, AFTRS is a global centre of excellence that provides Australians with the highest level of screen and broadcast education, training and research’.5

7. The council of AFTRS is the accountable authority under the finance law. The council is a ‘governing body’ under section 6.1 of the Corporate Governance of Higher Education Standards Framework (Threshold Standards) 2021.6 Under the AFTRS Act, all acts and things done in the name of, or on behalf of, the school by the council or with the authority of the council are deemed to have been done by the school.

Rationale for undertaking the audit

8. This topic was selected for audit as part of the ANAO’s multi-year audit program that examines aspects of the implementation of the PGPA Act. Amongst other things, the PGPA Act requires the accountable authority of an entity to establish and maintain an appropriate system of risk oversight and management, and an appropriate system of internal controls.

9. This audit is part of a series of performance audits of board governance which provides independent assurance to the Parliament on whether the selected boards have established effective arrangements to comply with the audited legislative and policy requirements and adopted practices that support effective governance. The audits also focus on any examples of better practice which may be worth highlighting as a learning for other boards.7

10. Four entities were included in the ANAO’s 2018–19 board governance audit series. For this second tranche of audits, the ANAO selected three corporate Commonwealth entities with enabling legislation (statutory authorities) that had no performance audit coverage in recent years. This enabled the ANAO to examine selected aspects of legal compliance and board governance in entities not often subject to in-depth performance audit, to ensure the selected entities were getting the basics right.

11. This report outlines the audit of AFTRS in the Infrastructure portfolio.

Audit objective and criteria

12. The objective of the audit was to assess the effectiveness of the governance board in the AFTRS.

13. To form a conclusion against this objective, the following high-level criteria were adopted.

- The AFTRS council’s governance and administrative arrangements are consistent with relevant legislative requirements and the council has structured its own operations in a manner that supports effective governance.

- The AFTRS council has established fit-for-purpose arrangements to oversight compliance with key legislative and other requirements, and the achievement of entity purposes.

14. The audit examined the period July 2019 until March 2022. This is referred to as the review period.

Conclusion

15. The governance board in the AFTRS is largely effective.

16. The AFTRS council has been largely effective in ensuring that its governance and administrative arrangements are consistent with relevant legislative requirements and structuring its own operations in a manner that supports effective governance. In the period reviewed by the ANAO the council’s arrangements were effective except for not being fully compliant with convocation appointment and student election requirements.

17. The AFTRS council has established largely fit-for-purpose arrangements to oversight compliance with key legislative and other requirements, and the achievement of entity purposes. In the review period the council’s arrangements were effective except for non-compliance with some of the corporate plan and annual performance statements requirements of the Commonwealth finance law, and a lack of systematic monitoring or review of performance.

Supporting findings

Council governance and structure

18. Council members were appointed in accordance with relevant legislative requirements. One new convocation appointment to the council in the review period was not made in full accordance with the Australian Film, Television and Radio School Act 1973 (the Act). In the 2020– 21 elections for staff and student members of the council, AFTRS did not meet all the requirements of the Australian Film, Television and Radio School (Council Elections) Regulations 2017. The Act states that an appointment is not invalid by reason only of a defect or irregularity in connection with the appointment. (See paragraphs 2.3 to 2.20)

19. Council meetings were properly constituted and there were mechanisms for enabling decisions to be taken without meetings. AFTRS records did not enable the ANAO to confirm whether quorum requirements were met for some of the honorary degree committee meetings. (See paragraphs 2.21 to 2.31)

20. The council has established a charter, set expectations for school management and the secretariat, and assessed its own performance. The council’s terms of reference do not provide sufficient information on its operating procedures, including performance assessment of the council and its members. The policies approved by the council did not include all areas that relate directly to the PGPA Act and other key legislative responsibilities of the council. For example, the AFTRS Code of Conduct, Student Handbook, Privacy and Freedom of Information Processes, Business Continuity Plan and Work Health and Safety Policy were not approved by the council or its committees. (See paragraphs 2.35 to 2.60)

21. There is an internal audit function that provides assurance to the council. The council, through the finance, audit and risk management committee, has oversight of internal audit and the school’s response to internal audit findings and recommendations. During the review period the internal audit provider did not provide an annual report on the overall state of internal controls in AFTRS, as required by the Internal Audit Charter. (See paragraphs 2.61 to 2.71)

Oversight of compliance and the achievement of entity purposes

22. The council established arrangements to oversight compliance with the elements of enabling legislation selected for ANAO review. The oversight arrangements include: review by the finance, audit and risk management committee of compliance information; and a requirement that significant compliance breaches identified by management are to be reported to the committee and the council. The council does not have a compliance policy or framework to assist in its oversight of compliance with the AFTRS Act or regulations, or other legislative requirements. While there are processes for actioning and monitoring activity relating to the ministerial Statement of Expectations and the AFTRS Statement of Intent prepared in response to the minister, these documents are not referenced in entity corporate plans or annual reports. (See paragraphs to 3.9 to 3.16)

23. There is oversight of, and compliance with, the PGPA Act corporate governance requirements selected for ANAO review. The arrangements include annual information and declarations to the council from management relating to compliance with the PGPA Act and PGPA Rule. AFTRS has recognised a need to improve its approach to risk management and reporting, and has initiated an improvement process. In February 2022, AFTRS prepared a fraud risk register which was scheduled to be provided to the finance, audit and risk management committee in June 2022, along with the Fraud Control Policy and Fraud Control Plan. This will facilitate AFTRS meeting its obligations under section 10 of the PGPA Rule. (See paragraphs 3.17 to 3.47)

24. There is oversight of school performance against the purposes and performance measures identified in the corporate plan and Portfolio Budget Statements. The corporate plan was not fully compliant with one of the five minimum requirements of the PGPA Rule, relating to performance measurement and assessment. The annual performance statements were not a standalone document and were not fully compliant with two of the three minimum requirements of the PGPA Rule related to the reporting of results and analysis. AFTRS has commenced activities to improve the development of performance measures included in its corporate plans, which will impact how results are presented in the annual performance statements. (See paragraphs 3.52 to 3.61)

25. The council assesses the achievement of performance measures included in the corporate plan annually, as part of its approval of the annual performance statements. There has been no systematic monitoring or review of performance. (See paragraphs 3.62 to 3.74)

26. During the review period, there were arrangements for the council, through the finance, audit and risk management committee, to receive assurance relating to the school’s performance against the purposes and performance measures identified in the corporate plan. (See paragraphs 3.75 to 3.79)

Recommendations

Recommendation no. 1

Paragraph 2.8

The AFTRS council review internal processes to ensure that convocation appointments are made in accordance with all requirements of the Australian Film, Television and Radio School Act 1973 and that a roll of all members of convocation is maintained.

Australian Film, Television and Radio School response: Agreed.

Recommendation no. 2

Paragraph 2.16

The AFTRS council review internal processes to ensure that staff and student elections are carried out in accordance with all requirements of the Australian Film, Television and Radio School (Council Elections) Regulations 2017.

Australian Film, Television and Radio School response: Agreed.

Recommendation no. 3

Paragraph 3.65

The AFTRS council implement systematic monitoring and review of the achievement of performance measures included in the corporate plan and Portfolio Budget Statements.

Australian Film, Television and Radio School response: Agreed.

27. The ANAO also suggested fifteen areas of improvement related to board governance in AFTRS.

Summary of entity responses

28. A summary response from AFTRS is provided below and AFTRS’s full response can be found at Appendix 1. An extract of the draft report was also provided to the Department of Finance (Finance). A summary response from Finance is provided below and Finance’s full response can be found at Appendix 1.

Australian Film, Television and Radio School

AFTRS welcomes the proposed report, agrees with all recommendations and has noted the opportunities for improvement.

AFTRS is pleased that the ANAO found the governing board, being AFTRS Council, to be largely effective in ensuring that its governance and administrative arrangements are consistent with relevant legislative requirements and that it has structured its own operations in a manner that supports effective governance.

AFTRS is confident that implementing the report’s recommendations, together with a thorough examination of the opportunities for improvement, will further enhance the AFTRS Council’s already strong governance arrangements and practices.

Department of Finance

The Department of Finance (Finance) welcomes this report.

As the ANAO notes, accountable authorities have certain duties and responsibilities under the Public Governance, Performance and Accountability Act 2013 (PGPA Act). To assist accountable authorities in understanding and meeting these duties, Finance provides all new accountable authorities with PGPA framework guidance and an offer of in-person briefings with Finance officials. These in-person briefings are also provided to boards, councils and senior executives where requested.

Key messages from this audit for all Australian Government entities

29. This audit is part of a series of governance audits that have applied a standard methodology to the governance of individual boards. Key messages from this ongoing series of audits will be drawn on to update the ANAO Insights product on Board Governance available on the ANAO website.8

1. Background

Introduction

1.1 The governing board of a corporate Commonwealth entity is the accountable authority for the entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act)9, with responsibility for ‘leading, governing and setting the strategic direction’ for the entity.10

1.2 Around 59 corporate Commonwealth entities subject to the PGPA Act have governing boards, comprising a total of approximately 600 board positions.11 Corporate Commonwealth entities with governance boards vary significantly by function, and governance boards may also vary in their composition, operating arrangements, independence and subject-matter focus, depending on the specific requirements of their enabling legislation and other applicable laws.

Boards and corporate governance

1.3 Sections 15 to 19 of the PGPA Act impose duties on accountable authorities in relation to governing the corporate Commonwealth entity for which they are responsible (see Box 1).12 As the accountable authority, members of Commonwealth governing boards are also officials under the PGPA Act and subject to the general duties of officials in sections 25 to 29 of the PGPA Act.13

|

Box 1: Department of Finance, Duties of Accountable Authorities (RMG 200), April 2021 |

|

Your general duties as an accountable authority The additional duties imposed on you as an accountable authority are to:

Governing your entity You are responsible for leading, governing and setting the strategic direction for your entity. Governing your entity includes:

|

1.4 Boards play a key role in the effective governance of an entity. Corporate governance is generally considered to involve two dimensions, which are the responsibility of the governing board:

Performance — monitoring the performance of the organisation and CEO. This also includes strategy — setting organisational goals and developing strategies for achieving them, and being responsive to changing environmental demands, including the prediction and management of risk. The objective is to enhance organisational performance;

Conformance — compliance with legal requirements and corporate governance and industry standards, and accountability to relevant stakeholders.

…

it is important to understand that governing is not the same as managing. Broadly, governance involves the systems and processes in place that shape, enable and oversee management of an organisation. Management is concerned with doing – with co-ordinating and managing the day-to-day operations of the business.14

1.5 The relationship between effective corporate governance and organisational performance is summarised in Box 2.

|

Box 2: The relationship between corporate governance and organisational performance |

|

Narrowly conceived, corporate governance involves ensuring compliance with legal obligations, and protection for shareholders against fraud or organisational failure. Without governance mechanisms in place — in particular, a board to direct and control — managers might ‘run away with the profits’. Understood in this way, good governance minimises the possibility of poor organisational performance … more recent definitions of good governance emphasise the contribution good governance can make to improved organisational performance by highlighting the strategic role of the board. Legal compliance, ongoing financial scrutiny and control, and fulfilling accountability requirements are fundamental features of good corporate governance. However, a high-performing board will also play a strategic role. It will plan for the future, keep pace with changes in the external environment, nurture and build key external relationships (for example, business contacts) and be alert to opportunities to further the business. The focus is on performance as well as conformance. The board is not there to simply monitor and protect but also to enable and enhance.a In summary, research conducted by those working closely with boards suggests that:

|

Note a: M Edwards and R Clough, Corporate Governance and Performance: An Exploration of the Connection in a Public Sector Context, Corporate Governance ARC Project, Paper No. 1, January 2005, pp. 4–5.

Note b: ibid., p. 14.

Culture and governance

1.6 The interplay of the ‘hard’ and ‘soft’ attributes of governance — and the criticality of board and organisational culture to an entity’s performance, values and conduct — have been central themes in notable Australian inquiries into organisational misconduct. These have included the 2003 Royal Commission into the failure of HIH Insurance15, the 2018 Australian Prudential Regulation Authority (APRA) Prudential Inquiry into the Commonwealth Bank of Australia16 and the 2019 Royal Commission into the financial services industry.17 While the specific focus of these inquiries was on financial institutions, their key insights on culture and governance (Box 3) have wider applicability and provide lessons for all accountable authorities, including governance boards.18

|

Box 3: Key insights for governance boards — Hayne Royal Commission, APRA Prudential Inquiry, HIH Royal Commission |

|

The 2019 Hayne Royal Commission emphasised the need for boards to get the right information about emerging non-financial risks; to seek further or better information where what they had was clearly deficient; and ensure they use information to oversee and challenge management’s approach to these risks. The 2019 Hayne Royal Commission further emphasised that every entity must ask the questions raised by the 2018 APRA Prudential Inquiry:

The 2019 Hayne Royal Commission recommended that entities should, as often as reasonably possible, take proper steps to:

The earlier HIH Royal Commission similarly warned in 2003 of the dangers of a ‘tick the box’ mentality towards corporate governance and highlighted the benefits of periodic review by boards of corporate governance practices to ensure their suitability. |

Source: ANAO, Audit Insights: Board Governance, 17 May 2019, available from https://www.anao.gov.au/work/audit-insights/board-governance.

1.7 Many Auditor-General reports have made findings consistent with those appearing in the reports of these inquiries.19 In April and May 2019, the Auditor-General presented a series of performance audits that reviewed whether the boards of four corporate Commonwealth entities had established effective arrangements to comply with selected legislative and policy requirements, and adopted practices that support effective governance:

- Report No.34 2018–19 Effectiveness of Board Governance at Old Parliament House — published on 18 April 2019;

- Report No.35 2018–19 Governance of the Special Broadcasting Service Corporation — published on 26 April 2019;

- Report No.36 2018–19 Effectiveness of Board Governance at the Australian Institute of Marine Science — published on 30 April 2019; and

- Report No.37 2018–19 Effectiveness of Board Governance at the Sydney Harbour Federation Trust — published on 2 May 2019.20

1.8 The ANAO also published an audit insights product from this series of audits, which outlined a number of key messages that may be relevant to the operations of other Commonwealth boards as well as broader governance arrangements in Commonwealth entities.21 22

The Public Governance, Performance and Accountability Act 2013 (PGPA Act)

1.9 The objects of the PGPA Act include: to establish a coherent system of governance and accountability across Commonwealth entities; and to require the Commonwealth and Commonwealth entities to meet high standards of governance, performance and accountability.23

1.10 As discussed in paragraph 1.3, the PGPA Act includes both general duties of accountable authorities and general duties of officials. It also establishes obligations relating to the proper use of public resources (that is, the efficient, effective, economical and ethical use of resources).24 In so doing, the PGPA Act establishes clear cultural expectations for all Commonwealth accountable authorities and officials in respect of resource management.

1.11 The Department of Finance (Finance), which supports the Finance Minister in the administration of the PGPA Act framework, has also issued a range of guidance documents on the technical aspects of resource management under the framework.

1.12 In April 2019 the Auditor-General made an agreed recommendation to Finance to update its guidance to accountable authorities having regard to the key insights and messages for accountable authorities identified in recent inquiries and reviews (the Hayne Royal Commission and APRA Prudential Inquiry).25

1.13 In November 2019 Finance released a two-page paper titled: Lessons learned from the private sector: Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. This paper highlights that accountable authorities should be mindful of inquiries and reviews undertaken in the private sector and should consider any lessons that could be learned in their entity’s context. The paper also stated the following.

- The accountable authority cannot simply rely upon the information presented by senior executive staff, they have the responsibility to request more information where necessary to fulfil their duties.

- The delegation of its powers does not discharge the duties of the accountable authority to ensure that those powers are being exercised correctly.

- The practical effectiveness of an entity’s governance model and internal controls should be periodically tested. Technically ticking every best practice box is not functional as culture and governance are never ‘fixed’.26 27

1.14 Relevantly, Finance also released A guide for corporate Commonwealth entities on the role of audit committees in September 2021.28 The guide states that:

Audit committees are integral to good corporate governance. They provide advice to accountable authorities, assist them to meet their duties and obligations, and support the development of key practice and capacity within [corporate Commonwealth entities] CCEs.29

1.15 In December 2021 Finance advised the ANAO that:

- it monitors the appointment of new accountable authorities on a regular basis;

- to support accountable authorities in meeting their responsibilities under the PGPA Act, the Finance Secretary issues a new accountable authority with an introductory email providing guidance material, tools and resources available on the Finance website. These emails also offer in-person briefings from senior officials on their duties under the PGPA Act;

- it also provides broader PGPA framework briefings to senior executives and officials of PGPA Act entities and companies on request; and

- during 2020–21, it provided 17 new accountable authority introductory emails and delivered 14 in-person briefings. The briefings delivered by Finance officials in 2020–21 were to a combination of accountable authorities, officials and board members. Of the 14 in-person briefings, six were delivered to board members.

Rationale for undertaking the audit

1.16 This topic was selected for audit as part of the ANAO’s multi-year audit program that examines aspects of the implementation of the PGPA Act. Amongst other things, the PGPA Act requires the accountable authority of an entity to establish and maintain an appropriate system of risk oversight and management, and an appropriate system of internal controls.

1.17 This audit is part of a series of performance audits of board governance which provides independent assurance to the Parliament on whether the selected boards have established effective arrangements to comply with the audited legislative and policy requirements and adopted practices that support effective governance. As discussed in paragraph 1.8, the audits also focus on any examples of better practice which may be worth highlighting as a learning for other boards.

1.18 As discussed in paragraph 1.7, four entities were included in the ANAO’s 2018–19 board governance audit series. For this second tranche of audits, the ANAO selected three corporate Commonwealth entities with enabling legislation (statutory authorities) that had no performance audit coverage in recent years. This enabled the ANAO to examine selected aspects of legal compliance and board governance in entities not often subject to in-depth performance audit, to ensure the selected entities were getting the basics right. Each entity in this series of audits will be subject to a separate audit with three audit reports to be tabled.

1.19 The three entities included in the ANAO’s 2021–22 board governance audit series are:

- Commonwealth Superannuation Corporation (CSC) in the Finance portfolio;

- Australian Hearing Services (Hearing Australia) in the Social Services portfolio; and

- Australian Film, Television and Radio School (AFTRS) in the Infrastructure portfolio.

Australian Film, Television and Radio School

1.20 The Australian Film, Television and Radio School (AFTRS) is a corporate Commonwealth entity established under the Australian Film, Television and Radio School Act 1973 (AFTRS Act). AFTRS’ mission is: ‘Delivering world-leading creative education across the nation, so Australian talent and culture thrive at home and around the world’.30 AFTRS’ purpose is: ‘Working hand-in-hand with our screen and broadcast industries, AFTRS is a global centre of excellence that provides Australians with the highest level of screen and broadcast education, training and research’.31

1.21 The council of AFTRS is the accountable authority under the finance law. The council is a ‘governing body’ under section 6.1 of the Corporate Governance of Higher Education Standards Framework (Threshold Standards) 2021.32 Under the AFTRS Act, all acts and things done in the name of, or on behalf of, the school by the council or with the authority of the council are deemed to have been done by the school.33

1.22 The director of the school is appointed by the Governor-General on the recommendation of the council (through the responsible minister). The director of the school manages the affairs of the school, subject to the general direction of the council.34

1.23 Under section 8 of the AFTRS Act, the council shall consist of:

- three members appointed by the Governor-General;

- three members of convocation35 appointed by the council;

- the director of the school;

- a staff member elected by the staff members of the school in the manner prescribed in regulations36; and

- a student of the school elected by the students of the school in the manner prescribed in regulations.37

1.24 All council members (except the director of the school) are appointed on a part-time basis and are paid remuneration that is determined by the Remuneration Tribunal. The director of the school is appointed on a full-time basis with remuneration determined by the Remuneration Tribunal. The director’s terms and conditions of employment (including performance payment) are determined by the council.

1.25 The council has established three committees to assist it in carrying out its functions: the finance, audit and risk management committee; the academic board; and the honorary degree committee.

1.26 At 30 June 2021, there were 160 staff, of whom 53 worked part-time. The executive team comprised divisional directors who manage key strategic and operational activities and report to the director of the school. The executive team covers areas including: teaching and learning; partnerships and development; first nations and outreach; people and culture; and finance and technology. In 2020–21 AFTRS received approximately $25 million in government departmental appropriations and $8.4 million in own source revenue.38

Audit approach

Audit objective, criteria and scope

1.27 The objective of the audit was to assess the effectiveness of the governance board in the Australian Film, Television and Radio School (AFTRS).

1.28 To form a conclusion against this objective, the following high-level criteria were adopted.

- The AFTRS council’s governance and administrative arrangements are consistent with relevant legislative requirements and the council has structured its own operations in a manner that supports effective governance.

- The AFTRS council has established fit-for-purpose arrangements to oversight compliance with key legislative and other requirements, and the achievement of entity purposes.

1.29 The audit examined the period July 2019 until March 2022. This is referred to as the review period.

Audit methodology

1.30 In undertaking the audit the ANAO:

- reviewed council and committee papers and minutes from July 2019 to March 2022;

- reviewed a range of relevant documentation including school corporate plans, strategy documents, council and committee charters, risk registers, conflict of interest declarations and other key policy and process documentation;

- held discussions with the current council chair, director of the school and other senior school staff;

- observed one council meeting in December 2021 and one finance, audit and risk management committee meeting in November 2021;

- reviewed relevant guidance and reviews on council and corporate governance; and

- examined internal audit and assurance reports.

1.31 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $170,000.

1.32 The team members for this audit were Michelle Page, Peter Bell and Susan Ryan.

2. Council governance and structure

Areas examined

This chapter examines if the council’s governance and administrative arrangements are consistent with relevant legislative requirements, including the Commonwealth finance law, and the council has structured its own operations in a manner that supports effective governance.

Conclusion

The AFTRS council has been largely effective in ensuring that its governance and administrative arrangements are consistent with relevant legislative requirements and structuring its own operations in a manner that supports effective governance. In the period reviewed by the ANAO the council’s arrangements were effective except for not being fully compliant with convocation appointment and student election requirements.

Areas for improvement

The ANAO made two recommendations aimed at the council reviewing internal processes to ensure that:

- convocation appointments are made in accordance with all requirements of the Australian Film, Television and Radio School Act 1973 and that a roll of all members of convocation is maintained; and

- staff and student elections are carried out in accordance with all requirements of the Australian Film, Television and Radio School (Council Elections) Regulations 2017.

The ANAO also suggested nine areas of improvement, related to the council:

- using a Council Skills Matrix;

- ensuring that committee charters include sufficient information and process to guide the recording and approval of out-of-session decisions;

- ensuring information on committee membership and meeting attendance is accurately recorded in meeting minutes;

- updating the council terms of reference to outline its relevant operating procedures;

- confirming that committee terms of reference/charter requirements have been satisfied and that committees report annually to the council on the adequacy of the discharge of their responsibilities;

- identifying in the council’s terms of reference the key policies it will approve which relate to the council’s legislative responsibilities and support the institutional culture it wishes to promote;

- formalising induction processes for council and committee members;

- formalising when and how the council will assess its own performance; and

- reviewing the implementation of arrangements to assess the performance of council and committee members.

2.1 Board governance and structure encompasses how the entity establishes and manages the board in accordance with its duties and responsibilities under the Commonwealth finance law — which includes the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) — its enabling legislation and other regulatory requirements. The Australian Film, Television and Radio School’s (AFTRS) enabling legislation is the Australian Film, Television and Radio School Act 1973 (AFTRS Act). The AFTRS council is the accountable authority and governance board for the school. The council is a ‘governing body’ under section 6.1 of the Corporate Governance of Higher Education Standards Framework (Threshold Standards) 2021.39 To assess the effectiveness of the governance board in AFTRS, the ANAO examined whether:

- the council’s governance and administrative arrangements are consistent with relevant legislative requirements; and

- the council has structured its own operations in a manner that supports effective governance.

Are the council’s governance and administrative arrangements consistent with relevant legislative requirements?

Council members were appointed in accordance with relevant legislative requirements. One new convocation appointment to the council in the review period was not made in full accordance with the Australian Film, Television and Radio School Act 1973 (the Act). In the 2020–21 elections for staff and student members of the council, AFTRS did not meet all the requirements of the Australian Film, Television and Radio School (Council Elections) Regulations 2017. The Act states that an appointment is not invalid by reason only of a defect or irregularity in connection with the appointment.

Council meetings were properly constituted and there were mechanisms for enabling decisions to be taken without meetings. AFTRS records did not enable the ANAO to confirm whether quorum requirements were met for some of the honorary degree committee meetings.

2.2 To assess if AFTRS’ governance and administrative arrangements were consistent with legislative requirements, the ANAO examined the structure, membership, nomination, election, appointment and reappointment of council members, the constitution of council meetings and the transparency of council decision-making. The audit examined the period July 2019 until March 2022. This is referred to as the review period.

Were council members and the chair appropriately appointed, and were acting arrangements properly conducted?

2.3 Under subsection 8(1) of the AFTRS Act the council shall consist of:

- three members appointed by the Governor-General;

- three members of convocation40 appointed by the council;

- the director of the school;

- a staff member elected by the staff members of the school in the manner prescribed in regulations41; and

- a student of the school elected by the students of the school in the manner prescribed in regulations.42

2.4 Two Governor-General reappointments were made during the review period. AFTRS maintained evidence of these reappointments.

2.5 Two convocation reappointments were made by the council during the period reviewed by the ANAO. These were evidenced in council minutes and decision records. One new convocation appointment was made during the review period. AFTRS records indicate that this new appointment was not made in full accordance with the AFTRS Act.

2.6 Section 22 of the AFTRS Act requires the council to keep a roll of all members of convocation. New convocation appointments to council are to be made from this roll.43 The council has not maintained a roll of members of convocation. The council appointed a person who had not yet been admitted to convocation. The person should first have been admitted to convocation (through a council vote to admit the person to convocation on the basis that they were suitably qualified and had the relevant knowledge or experience in connection with films, television or radio).44 Once the person was admitted to convocation, the person was eligible for appointment to the council.

2.7 Although the two-step process for this new convocation appointment was not followed, subsection 8(6) of the AFTRS Act states that an appointment is not invalid by reason only of a defect or irregularity in connection with the appointment.

Recommendation no.1

2.8 The AFTRS council review internal processes to ensure that convocation appointments are made in accordance with all requirements of the Australian Film, Television and Radio School Act 1973 and that a roll of all members of convocation is maintained.

Australian Film, Television and Radio School response: Agreed.

2.9 Internal processes will be updated to ensure the correct adherence of convocation appointments to the AFTRS Act and that a roll of convocation members is maintained.

2.10 Acting arrangements for the director of the school were approved by the Governor-General. The new appointment of the director of the school in March 2020 was approved by the Governor-General.

2.11 The council chair wrote to the Minister for Communications, Cyber Safety and the Arts (minister) in June 2020 to confirm the appointment of the long-standing (10 months) vacancy of a member appointment by convocation. This letter advised that the council had discussed its composition and the skills mix of its members when considering the new appointment. The council could usefully consider whether the use of a formal skills matrix would assist in its identification of suitable persons for appointments.

2.12 There were two staff and two student members elected to council during the review period. The processes for staff and student elections are outlined in the Australian Film, Television and Radio School (Council Elections) Regulations 2017 (regulations). Amongst other things, the regulations set out requirements relating to:

- the eligibility of staff and students to nominate for elections;

- the timing of opening and closing of nominations and the opening and closing of voting for the elections; and

- how the order of candidates on the ballot paper should be determined.

2.13 AFTRS uses election software (Election Buddy) for the management of nominations, voting and count processes for both staff and student elections.

2.14 In the 2020–21 elections for staff and students, AFTRS:

- correctly described the eligibility requirements for nomination45 in the email seeking nominations for the staff member of council, but incorrectly described these requirements in an email containing advice to staff about nominating for the election;

- allowed insufficient time between the opening and closing of voting for the student election (13 days and 23.5 hours rather than 14 days) as set out in subsection 16(1) of the regulations; and

- used a feature in its election software to randomise the order of staff and student candidates rather than the use of lots to determine the order of candidates, as required by subsection 16(4) of the regulations.

2.15 Although AFTRS did not meet all the requirements of the regulations, subsection 8(6) of the AFTRS Act states that an election of a member is not invalid by reason only of a defect or irregularity in connection with the election.

Recommendation no.2

2.16 The AFTRS council review internal processes to ensure that staff and student elections are carried out in accordance with all requirements of the Australian Film, Television and Radio School (Council Elections) Regulations 2017.

Australian Film, Television and Radio School response: Agreed.

2.17 Internal processes will be updated and full compliance with the Regulations will be met when preparing the next iteration of staff and student elections.

2.18 In the period reviewed by the ANAO, there was a three-month gap in the term of the student elected member to council. This gap arose because of the period between the elected student council member finishing their course as a final year student (and therefore no longer meeting the conditions for council membership) and when the next student council member elections were held. AFTRS records indicate that such circumstances have resulted in a gap of up to five months (in a one-year tenure) in student elected member representation on the council. The council considered the end dates for student elected members to council in May 2018 and noted the potential gap in representation which may result.

2.19 The three council committees comprise a combination of both council and non-council members. During the period reviewed there were four reappointments of non-council members, one reappointment of a council member and one new appointment of a council member to a committee. Council meeting minutes evidenced council decision-making about the reappointments/appointments. AFTRS records did not evidence consideration of the past performance of committee members and the individual or collective skill requirements of committees. The council could usefully consider whether the use of a formal skills matrix would also assist in this respect.

|

Opportunities for improvement |

|

2.20 There is an opportunity for improvement for the council to use a Council Skills Matrix to assist in the selection and reappointment of council members and non-council members, council succession planning, and decision-making for the allocation of council members and non-council members to committees. |

Were meetings properly constituted, and is there a mechanism enabling decisions to be taken without meetings?

Council meetings

2.21 The council should hold such meetings as are necessary for the performance of its functions.46 The council usually holds five meetings each financial year.

2.22 A quorum at a council meeting is five members.47 For voting, questions arising at a meeting of the council are decided by a majority of the votes of the members present. The member presiding at a meeting has a deliberative vote and, in the event of an equality of votes, also has a casting vote.48 Quorum requirements for council were met during the period reviewed.

2.23 Council meetings are minuted and the minutes record decisions made and actions to be taken. Council meeting papers include draft minutes of the previous meeting for council approval.

2.24 The council’s terms of reference outline procedures for the preparation and approval of meeting minutes. The terms of reference outline the mechanisms to facilitate decisions without meetings. In unforeseen circumstances, and with the approval of the chair, decisions of the council may be made without notice by circular resolution. Quorum requirements must still be met in these circumstances.

Council committees

2.25 Section 12 of the AFTRS Act allows the council to establish and delegate functions to a committee of council. The council has established three committees to assist it in carrying out its functions: the finance, audit and risk management committee; the academic board; and the honorary degree committee.

2.26 The council has approved terms of reference/charters for each of these committees, which document the membership, number of meetings per year, quorum requirements and the need to ensure that minutes of the meetings are prepared and maintained. The committee terms of reference/charters do not document how to manage out-of-session decisions.

2.27 Each committee prepared meeting minutes for the period reviewed. Draft minutes of the previous meeting were provided to the committee for approval. The committee meeting minutes were tabled at the next practicable council meeting.

2.28 Quorum requirements for the finance, audit and risk management committee meetings were met during the review period. The committee regularly updated the council on its activities and made recommendations to the council as appropriate.

2.29 Quorum requirements for the academic board meetings were met during the period reviewed. The committee regularly updated the council on its activities and made recommendations to the council as appropriate.

2.30 AFTRS records did not enable the ANAO to confirm whether quorum requirements were met for some of the honorary degree committee meetings. In September 2020, the committee was approved to operate as a council committee, with members comprising selected council and academic board members. The terms of reference for that structure were approved by the council in December 2021. Prior to this, the committee was a sub-committee of the academic board and did not have formal terms of reference. It operated under an Honorary Degree & Award Policy and Procedure (September 2020) which outlined membership (consisting of external academic board members) but did not outline quorum requirements. During the period reviewed, there were inconsistencies in how membership and attendance at meetings were recorded, including who were voting members and who were attendees. For example, in October 2020 the director of the school chaired the meeting, when the committee composition documented in the procedure was that the director was ‘invited’ to the committee but was not a ‘member’ of the committee. There was also only one council member at this meeting, when the procedure stated that the committee composition was two council members.

|

Opportunities for improvement |

|

2.31 There are opportunities for improvement for the council to:

|

Has the council structured its own operations in a manner that supports effective governance?

The council has established a charter, set expectations for school management and the secretariat, and assessed its own performance. The council’s terms of reference do not provide sufficient information on its operating procedures, including performance assessment of the council and its members. The policies approved by the council did not include all areas that relate directly to the Public Governance, Performance and Accountability Act 2013 and other key legislative responsibilities of the council. For example, the AFTRS Code of Conduct, Student Handbook, Privacy and Freedom of Information Processes, Business Continuity Plan and Work Health and Safety Policy were not approved by the council or its committees.

There is an internal audit function that provides assurance to the council. The council, through the finance, audit and risk management committee, has oversight of internal audit and the school’s response to internal audit findings and recommendations. During the review period the internal audit provider did not provide an annual report on the overall state of internal controls in AFTRS, as required by the Internal Audit Charter.

2.32 During the period reviewed, the council was supported by three committees.

- Finance, audit and risk management committee — reviews the appropriateness of the council’s: financial reporting; performance reporting; system of risk oversight; and system of internal controls. Provides a forum for communication between the council and senior management, the internal auditor, the ANAO and the service provider contracted by the ANAO. This committee includes two non-council members.

- Academic board — oversees the quality assurance of teaching, learning and research activities of the school; approves new curricula; approves major changes to courses of study; ensures the curricula are designed to meet the standards of the higher education sector; reviews policies, procedures and guidelines related to the admission, enrolment, assessment and progress of students in approved courses of study; and makes recommendations as appropriate relating to academic matters and student support. The committee is chaired by a non-council member who is a higher education specialist and includes three non-council members.

- Honorary degree committee — considers and advises on the process for nominations; considers, advises and approves based on the specific criteria for selection, as outlined in the Honorary Degree and Awards Policy and Procedure; and considers nominees and recommends a ranked shortlist to council for conferrals. The committee has the same chair as the academic board and includes three non-council members.

2.33 The governance structure of the council and its high-level committees is illustrated in Figure 2.1.

Figure 2.1: Council committees

Source: ANAO analysis of AFTRS’ council and committee charters, meeting minutes and papers.

2.34 To assess if the AFTRS council had structured its own operations in a manner that supports effective governance, the ANAO examined the charters, committee arrangements, oversight of key policies, induction, council performance assessments and arrangements for the establishment and operation of the internal audit function. The ANAO also considered behavioural observations of the operation of the council.

Does the council have a fit-for-purpose charter, set expectations for entity management and the council secretariat, and assess its own performance?

Charter

2.35 A board charter is a written document that sets out such things as:

- the functions, powers, and membership of the board;

- role, responsibilities and expectations of members, both individually and collectively, and of management49;

- role and responsibilities of the chairperson50;

- procedures for the conduct of meetings51; and

- policies on board performance review.

2.36 A charter can provide a single reference point that clearly sets out the functions, powers and membership of the board, as well as roles, responsibilities and accountabilities, consistent with relevant legislative requirements. Board charters can also articulate the desired culture of the board and address the ‘soft attributes’ of governance discussed in Chapter 1 of this audit relating to board culture and behaviours, which are critical to good governance.52

2.37 The Australian Institute of Company Directors has indicated that:

In most organisations the governance framework is determined by the legislation that it has been created under … However, there are many aspects of modern governance which the board must consider and act upon that lie outside legal requirements. The board charter is one way of documenting these matters.53

2.38 The AFTRS council’s terms of reference outline the legislation under which AFTRS was established and responsibilities of the council under the PGPA Act. The council terms of reference refer to the establishment of committees to assist in the discharge of the council’s responsibilities. The terms of reference also include information on: appointments to council; roles of council; matters requiring council authority; key documents to be approved by council; secretariat and management of meetings; and the duties of council members. Duties of council members include the duty to disclose interests relating to the affairs of AFTRS and for the council to identify any conflict of interest before discussion of the relevant agenda item or topic. The council terms of reference do not outline the frequency of meetings, how often and what mechanisms it will use to assess its own performance (individually and/or collectively), council skills required beyond those mentioned in the AFTRS Act (these are knowledge or experience in connection with films, television or radio) or succession planning activities.

2.39 Council approved charters/terms of reference have been prepared for all three committees.

2.40 The finance, audit and risk management committee’s charter refers to its specific functions outlined in section 17 of the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) to review the appropriateness of the council’s: financial reporting; performance reporting; system of risk oversight and management; and system of internal controls. The charter requires the committee to provide a statement to council on:

- whether, in the committee’s view, the annual financial statements comply with the PGPA Act, the PGPA Rule, the accounting standards and supporting guidance; and in respect of the appropriateness of AFTRS’ financial reporting as a whole, referencing, if required, any specific areas of concern or suggestions for improvement; and

- the appropriateness of the annual performance statements.

2.41 The charter does not outline the committee’s reporting requirements for communicating its conclusions on the assessment of appropriateness of risk oversight and management, or the system of internal controls. However, the charter requires that ‘biannually, the committee will conduct a self-assessment of performance assessing its conduct and deliverables against the charter’.54

2.42 The finance, audit and risk management committee maintains a listing of regular agenda items mapped against its charter responsibilities and a list of previous and scheduled audits. It also maintains a list of ‘risk focus areas’ examined by the committee since February 2019. This serves as a reminder to committee members on their role and which specific areas of interest have already been examined.

2.43 The academic board and honorary degree committee terms of reference do not outline when or how their performance will be assessed.

|

Opportunities for improvement |

|

2.44 There are opportunities for improvement for the council to:

|

Council expectations for entity management and the council secretariat

2.45 The council has set expectations for school management in its terms of reference. The terms of reference outlines matters requiring council authority. This includes the role of the director of the school under the AFTRS Act to manage the affairs of the school under the general direction of council. It also outlines those areas related to major changes in approach, new areas of significant investment or substantial new conditions impacting the running of the school, that should be subject to council approval. A list of areas such as: approval of lease conditions and signing; approval of expenditure over specific thresholds; and investments are also identified in the terms of reference.

2.46 The council’s terms of reference also include the corporate governance cycle and how the council will set areas of strategic focus and oversight key activities. This includes the examination of specific documents including the corporate plan, annual report, risk management plan and reporting on annual budget and forecasts.

2.47 Although the council terms of reference outline some of the key policies that the council approves, there is no consolidated list maintained in the terms of reference. From a review of the council meeting papers and minutes, the ANAO identified that the council approved key policies such as HR Delegations and Financial Delegations (December 2021), Administrative Orders (December 2021)55, Risk Management Policy and Guideline (March 2022), Fraud Control Policy (February 2020) and Fraud Control Plan (February 2020).

2.48 The policies approved by council do not include other areas that relate directly to the PGPA Act, and other key legislative responsibilities of the council. For example, the AFTRS Code of Conduct (December 2018)56, Student Handbook57, Privacy and Freedom of Information Processes, Business Continuity Plan and Work Health and Safety Policy (November 2017) are not approved by the council or its committees. Policies such as these enable the governance board to influence behaviours and can be an important mechanism in communicating the desired culture within the school. Reviews such as the 2018 APRA Prudential Review58 and the 2019 Hayne Royal Commission59 have highlighted that boards need to be alive to how incentives in organisations can drive inappropriate behaviours. Periodic council review of these policies can assist in its messaging to the school as a whole about the institutional culture it wishes to promote.

2.49 The council terms of reference outline arrangements and expectations for the council secretariat. The corporate secretary for the council is managed out of the Office of the Chief Executive Officer (Governance Unit) by the Head of Governance. The corporate secretary is responsible for providing all secretariat functions to council, including drafting meeting agendas and papers, in consultation with the director of the school and council chair. In July 2021 the reporting lines for this role were updated to include a reporting line direct to the director of the school and the council chair.

|

Opportunity for improvement |

|

2.50 An opportunity for improvement is for the council to identify in its terms of reference the key policies it will approve which relate to the council’s legislative responsibilities and support the institutional culture it wishes to promote. |

Council induction, education and performance

2.51 The council’s terms of reference do not identify induction requirements. There were five new council members during the period reviewed. Induction for these new members consisted of access and information on the use of the council document sharing tool (BoardEffect) and one-on-one induction sessions with a governance unit representative. Governance reference material, including the AFTRS Act, is included within BoardEffect. Induction information for staff and students also included more detailed information on obligations under the AFTRS Act and an overview of the school’s governance framework.

2.52 In June 2021 all council members received refresher training on their PGPA Act obligations. Relevant materials to support the training session were included on BoardEffect and could be accessed by council members at any time.

2.53 To assist the council in understanding the school’s strategic environment and risks, the council has established a number of standard meeting agenda items covering areas such as: director of the school’s report; staff and student member reports; corporate strategy; strategic risk profile; and financial reports. The finance, audit and risk management committee also receives ‘risk in focus’ sessions within its meetings to provide a ‘deeper dive’ into the relevant strategic risks. For example, since July 2020 the committee has examined the risk in focus areas of ‘management of COVID-19’, ‘staff workload’, ‘research’ and ‘PGPA Act accountability’.

2.54 In the review period the council held a strategy day during which the council was able to engage with the executive on the direction of the school and to discuss its five-year strategy. A council strategy day was held in July 2020. The next strategy day was planned for May 2022.

2.55 The council terms of reference do not outline when or how the council will assess either the performance of individual council members or its performance as a group in discharging its legislative functions.

2.56 In December 2021 the council undertook a survey process for its members. The survey consisted of 88 statements which were rated using a ten-point scoring system to determine the extent to which the council member agreed or disagreed with the statement. The survey considered themes related to performance, culture and oversight. The survey was completed by all council members plus the chair of the academic board (a non-council committee member). The survey was not completed by other non-council committee members, key executives or the Head of Governance. Better practice suggests that all persons who have a direct relationship with the governing body should contribute to such surveys.60 The survey did not assess the role of the chair or the chair of the committees. There were two statements which related to the performance of the council committees:

The Boards standing committee structure is lean and strategic.

The Board Sub-Committees administered by the Board contributed effectively to the operation and management of the organisation.

2.57 Based on the outcomes of the survey and related discussions, eight actions were agreed by the council in December 2021. These actions included:

- succession and talent plan to be tabled and discussed;

- annual council member performance conversations with the chair; and

- council to assess its own performance every two/three years.

2.58 The finance, audit and risk management committee charter requires the committee, biannually, to conduct a self-assessment of performance, assessing its conduct and deliverables against the charter. In June 2020 the committee performed a self-assessment which consisted of a survey of eight questions and a discussion. The self-assessment covered areas such as strengths of the committee, priorities of the committee, management improvement opportunities and ideas to increase the committee’s effectiveness. The self-assessment resulted in the committee adding two standing items to its meeting agenda, related to an oral update from the director of the school and a financial position snapshot.

|

Opportunities for improvement |

|

2.59 Opportunities for improvement for the council are to:

|

Behavioural observations

2.60 The ANAO attended one council meeting in December 2021 and one finance, audit and risk management committee meeting in November 2021. The ANAO interviewed the council chair and director of the school in March 2022. Interviews were also held with key senior executive officers. In those meetings, and through a review of council and committee papers and minutes, the ANAO observed council and committee members collectively displaying a range of qualities and behaviours that indicate a positive governance culture at the council level.61 These included:

- an openness to declaring conflicts of interest;

- an ability to conduct meetings in a professional, collegiate and respectful manner;

- a willingness to undertake sufficient preparation to enable meetings to be conducted in a productive manner;

- an understanding of their obligations as the accountable authority under the PGPA Act and the challenges facing the school;

- a desire and commitment to act in the best interests of the school;

- a willingness to invest in their own understanding of issues and entity operations; and

- direct engagement with the school executive on key areas of interest.

Is there an internal audit function that provides assurance to the council and does the council have oversight of internal audit and the entity’s response to internal audit findings and recommendations?

2.61 The finance, audit and risk management committee’s charter outlines specific responsibilities related to the oversight of internal audit. These include:

- to provide a forum for communication between the council and senior management, the internal auditor, the ANAO and the service provider contracted by the ANAO;

- to approve the internal audit program and ensure that the internal audit function is adequately resourced and has appropriate standing within AFTRS;

- to promote co-ordination between management and internal and external audit;

- to review any significant matters reported by the internal auditors and ascertain whether management’s response is adequate; and

- to ensure that the internal auditors are independent of the activities that they audit.

2.62 In July 2021 the council, following a recommendation from the finance, audit and risk management committee, approved the reappointment of the internal audit provider (KPMG) for a further three-year period. To inform its recommendation, the committee considered the past performance of the provider, quality of deliverables, skills and experience and fee.

2.63 During the period of the review, the finance, audit and risk management committee approved an internal audit plan outlining the activities to be performed by the internal audit provider. The plan included the proposed audit coverage over the relevant period, including internal audit title, scope and objectives, executive sponsor, link to risk profile, estimated days and quarter in which the internal audit was planned to be executed.

2.64 In September 2019, the committee reviewed the internal audit plan for financial year 2020 and financial year 2021. In November 2020, the committee approved changes to the internal audit plan. The committee considered the priority of internal audits and updated the prioritisation for planned audits.

2.65 In September 2021, the committee approved the internal audit plan for financial years 2022 to 2024. This included three internal audits in the first year and four internal audits in each subsequent year. The adequacy of the breadth of coverage was also considered across the areas of information technology, education and curriculum, operations and finance and governance.

2.66 In the period reviewed by the ANAO, the finance, audit and risk management committee reviewed the outcomes of internal audit activities. This included management responses to audit findings and recommendations.

2.67 An ‘implementation status report’ is provided to the committee on a regular basis. This report tracks the implementation of internal audit recommendations, including agreed action, responsibility, target dates and status. The report also identifies when the internal audit provider validated that the audit recommendation had been implemented by management.

2.68 In November 2021 the finance, audit and risk management committee reviewed the Internal Audit Charter. The purpose of the charter is to address the roles, responsibilities, authorisation, activities and reporting relationships of the internal audit function. It includes the activities and reporting of the internal audit provider. Section 10.3 of this document states that:

The internal audit function will also report to the FARM [finance, audit and risk management] Committee at least annually on the overall state of internal controls in AFTRS and any systemic issues requiring management attention based on the work of the internal audit function.

2.69 For the period reviewed, this report was not provided by the internal audit provider. In November 2021 the finance, audit and risk management committee agreed to add this reporting requirement to its calendar of activities to ensure that it is prepared and reviewed by the committee for 2021–22.

2.70 At each council meeting the finance, audit and risk management committee chair has provided an oral report on the activities of the committee and the approved minutes of the previous meeting were tabled for noting.

2.71 During the review period the council, through the finance, audit and risk management committee, had effective oversight of the internal audit function and management’s response to internal audit findings and recommendations.

3. Oversight of compliance and the achievement of entity purposes

Areas examined

This chapter examines if the council has established fit-for-purpose arrangements to oversight compliance with key legislative and other requirements, including the Commonwealth finance law, and the achievement of entity purposes.

Conclusion

The AFTRS council has established largely fit-for-purpose arrangements to oversight compliance with key legislative and other requirements, and the achievement of entity purposes. In the review period the council’s arrangements were effective except for non-compliance with some of the corporate plan and annual performance statements requirements of the Commonwealth finance law, and a lack of systematic monitoring or review of performance.

Areas for improvement

The ANAO made one recommendation aimed at ensuring that the council implements systematic monitoring and review of the achievement of performance measures included in the corporate plan and Portfolio Budget Statements.

The ANAO suggested six areas for improvement, related to the council:

- referencing the ministerial Statement of Expectations and AFTRS Statement of Intent (and related progress against it) in corporate plans and annual reports;

- documenting its policy and framework for monitoring legislative compliance;

- continuing its initiative to improve the level of maturity of risk management in AFTRS, by reviewing the content of reporting to the council and the finance, audit and risk management committee;

- ensuring that the finance, audit and risk management committee has an opportunity to review a detailed fraud risk assessment and a plan for how AFTRS will deal with specific fraud risks;

- progressively increasing the alignment of the school’s performance measures included in its corporate plans with the PGPA Rule and Finance guidance; and

- ensuring that the annual performance statements are in a standalone document that addresses all the minimum requirements of the PGPA Rule.

3.1 Accountable authorities have a duty to establish and maintain an appropriate system of internal control for the entity, including by implementing measures directed at ensuring officials of the entity comply with the Commonwealth finance law.62 To assess the effectiveness of the governance board in the Australian Film, Television and Radio School (AFTRS), the ANAO examined whether the AFTRS council has established fit-for-purpose arrangements to oversight:

- compliance with key legislative and other requirements; and

- the achievement of entity purposes.

Has the council established fit-for-purpose arrangements to oversight compliance with key legislation and other requirements?

The council established arrangements to oversight compliance with the elements of enabling legislation selected for ANAO review. The oversight arrangements include: review by the finance, audit and risk management committee of compliance information; and a requirement that significant compliance breaches identified by management are to be reported to the committee and the council. The council does not have a compliance policy or framework to assist in its oversight of compliance with the AFTRS Act or regulations, or other legislative requirements. While there are processes for actioning and monitoring activity relating to the ministerial Statement of Expectations and the AFTRS Statement of Intent prepared in response to the minister, these documents are not referenced in entity corporate plans or annual reports.

There is oversight of, and compliance with, the PGPA Act corporate governance requirements selected for ANAO review. The arrangements include annual information and declarations to the council from management relating to compliance with the PGPA Act and PGPA Rule. AFTRS has recognised a need to improve its approach to risk management and reporting, and has initiated an improvement process. In February 2022, AFTRS prepared a fraud risk register which was scheduled to be provided to the finance, audit and risk management committee in June 2022, along with the Fraud Control Policy and Fraud Control Plan. This will facilitate AFTRS meeting its obligations under section 10 of the PGPA Rule.

3.2 To assess if the council has established fit-for-purpose arrangements to oversight compliance with key legislation and other requirements, the ANAO examined processes to identify, monitor and report on relevant enabling legislation, and actions to address any identified breaches. The audit examined the period July 2019 until March 2022. This is referred to as the review period.

Is there oversight of, and compliance with, any Statements of Expectations and Statements of Intent?

3.3 As part of the Australian Film, Television and Radio School’s (AFTRS) governance framework, each year the responsible minister sends the chair of council a ‘Statement of Expectations’. This statement sets out the minister’s expectations for the financial year. For 2021–22, this statement included the minister’s expectations for policy priorities, approaches to reform, strategic imperatives and the emphasis to be placed on stakeholder relations and collaborative working.

3.4 The response to statements of ministerial expectations is through a formal reply from the chair of council in the form of a ‘Statement of Intent’. This statement outlines how AFTRS will address the expectations through its own activities and strategic focus areas.

3.5 A Statement of Expectations and corresponding Statement of Intent was prepared for each of the financial years reviewed by the ANAO (for example, 2019–20, 2020–21 and 2021–22).

3.6 The Statement of Intent for each of the periods reviewed was reflected in the content of the relevant period’s corporate plan. Although the council did not monitor the achievement of activities outlined in each Statement of Intent, it did monitor the achievement of the strategic priorities and activities outlined in the corporate plan. The content and monitoring of information included in corporate plans is discussed further at paragraph 3.52 to 3.61.

3.7 Council meeting papers and minutes reflect the content and discussion of the Statement of Expectations and Statement of Intent. AFTRS does not refer to either the Statement of Expectations or Statement of Intent in its corporate plans or annual reports for 2019–20 or 2020–21. The importance of these documents merits the inclusion of appropriate references in the AFTRS corporate plan and annual report.

|

Opportunity for improvement |

|