Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Effectiveness of the Export Finance and Insurance Corporation

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Export Finance and Insurance Corporation (Efic).

Summary and recommendations

Background

1. The Export Finance and Insurance Corporation (Efic) is the Australian Government's export credit agency. Efic was established in its current form1 on 1 November 1991 under the Export Finance and Insurance Corporation Act 1991 (the Efic Act) as a corporation wholly owned by the Australian Government. Efic sits within the Foreign Affairs and Trade portfolio. Efic is classified as a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

2. The primary purpose of Efic is to provide financial solutions and support to Australian export businesses that are unable to secure funding from the private sector, with the objective of facilitating and encouraging Australian export trade and to encourage private financiers in Australia to finance or assist in financing exports.

3. Efic is classified by the Department of Finance (Finance) as a material agency. It has risk weighted assets of $2.7 billion; exposure on its Commercial Account of $2 billion2 3 and available capital of $674.5 million as at 30 June 2018.

Rationale for undertaking the audit

4. The Australian Government is increasingly undertaking balance sheet activity to achieve policy objectives. Given Efic is responsible for the investment and management of over $5 billion in funds on behalf of the Australian public, this audit assessed whether Efic's mandate and purposes are being met effectively.

Audit objective and criteria

5. The objective of this audit was to assess the effectiveness of Efic.

6. To form a conclusion against the audit objective, the ANAO adopted the following high-level audit criteria:

- Efic is operating within its prescribed mandate;

- Efic is effectively managing its financial and service delivery functions; and

- Efic is meeting its statutory and prudential responsibilities.

Conclusion

7. Efic is effectively undertaking its functions, except for its annual performance statement reporting.

8. Efic is operating within its prescribed mandate. It has developed a framework to interpret, operationalise and comply with each mandate requirement.

9. Efic effectively manages its financial and service delivery functions, and the evidence can support a view that Efic is operating on an appropriately commercial basis.

10. Efic is meeting its statutory and prudential management responsibilities, however Efic's annual performance statement reporting should be enhanced to enable a more comprehensive assessment of overall progress against its purpose.

Supporting findings

Compliance with prescribed mandate

11. Efic has established a framework to interpret its mandate and determine how it will be operationalised. This includes an internal compliance document to define how Efic intends to operationalise its Statement of Expectation requirements.

12. Efic's activities in monitoring commercial markets to identify situations where the private sector will not provide financial support to an export business (the 'market gap') are largely appropriate. Efic communicates with customer relationship banks and analyses comparative market pricing for small and medium-sized enterprise (SME) transactions, although it does not undertake proactive monitoring of the market gap for the wider export industry and does not report on situations where it assists an export business to obtain private sector finance.

13. Efic is adequately focusing its efforts on SMEs through tailored products and services. In response to the 2014 Statement of Expectations specifying the need for SMEs to be effectively supported, Efic implemented the EficDirect online loan platform to streamline Small Business Export Loans. In combination with other new initiatives and strategies, this has resulted in a general increase in both the volume of facilities provided to SMEs, and in the average value of SME transactions as a proportion of the total value of transactions undertaken annually in the Efic portfolio. There are opportunities to improve Efic's coverage of export supply chain SMEs.

14. Efic complies with its prescribed mandate in relation to Australian content, financial viability and other relevant requirements. Efic consistently applies requirements in relation to the number of facilities which can be provided to an individual entity over a three-year period. Efic has appropriate structures for understanding and applying requirements in relation to environmental and social standards.

15. The Defence Export Facility has been established and Efic is providing support to the defence export sector in line with Australian Government objectives. Efic participates in intergovernmental discussions to remain informed on opportunities to support the defence export sector, and is undertaking a campaign to raise awareness of the financial support services available to defence exporters.

Financial and service delivery functions

16. The evidence can support a view that Efic is operating on an appropriately commercial basis. In line with its mandate, Efic generates sufficient reserves to sustain and expand its operations and undertakes its functions with the objective of not undercutting private sector financiers. There is a need for Efic to ensure an appropriate balance is maintained between its commercial objectives and its fulfilment of government expectations surrounding the facilitation and encouragement of private sector support for Australian export trade.

17. Efic engages effectively with government and external stakeholders to execute its mandate through activities closely overseen by responsible managers. Marketing campaigns and initiatives are used by Efic to extend knowledge of its support offering to exporters in new and existing industries. Efic proactively engages with export businesses to facilitate potential applications.

Statutory and prudential responsibilities

18. Efic meets relevant legislative requirements regarding accountability, management and performance, however Efic's annual performance reporting should be enhanced in relation to the completeness of assessment information. Efic conducts treasury activities in accordance with a control framework approved by its Board and applies Anti-Money Laundering and Counter-Terrorism Financing assessment procedures to each transaction.

19. Efic meets its risk management obligations and manages its credit, funding and other risks effectively.

20. Efic has established governance structures that are aligned to its statutory obligations. The Board comprises members appointed by the responsible Minister together with the Efic Managing Director, and is supported by the Board Audit and Risk Committee, internal management committees and the Executive.

Recommendation

Recommendation no. 1

Paragraph 4.21

The Export Finance and Insurance Corporation include both quantitative and qualitative performance measures in the annual performance statement to enable a more comprehensive assessment of overall progress against its purpose. This should include measures to address mandated requirements to encourage banks and other financial institutions to finance, or assist in financing, export contracts or eligible export transactions.

Export Finance and Insurance Corporation response: Agreed.

Summary of entity response

21. A summary response from the Export Finance and Insurance Corporation is provided below, while the full response is provided at Appendix 1.

The Export Finance and Insurance Corporation (Efic) welcomes the proposed report and is pleased with the Report's conclusion that:

- Efic is operating within its prescribed mandate. It has developed a framework to interpret, operationalise and comply with each mandate requirement.

- Efic effectively manages its financial and service delivery functions, and the evidence can support a view that Efic is operating on an appropriately commercial basis.

- Efic is meeting its statutory and prudential management responsibilities, noting Efic's annual performance statement reporting could be improved to enable a more comprehensive assessment of overall progress against its purpose.

Efic notes that the ANAO has made only one recommendation to include more qualitative measures in the annual performance statement reporting. We welcome the ANAO's suggestions on the types of qualitative measures that can be incorporated into our reporting. For example, we know that Efic's involvement often acts as a catalyst for the private market to step forward and provide support to businesses. While it is often difficult to quantify the benefit of Efic's 'crowding in' of the private market, we acknowledge that such qualitative measures would enhance our current reporting.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit that may be relevant for the operations of other Australian Government entities.

Performance and impact measurement

1. Background

Introduction

Purpose and prescribed mandate

1.1 The Export Finance and Insurance Corporation (Efic) is the Australian Government’s export credit agency. Efic was established on 1 November 1991 under the Export Finance and Insurance Corporation Act 1991 (the Efic Act) as a corporation wholly owned by the Australian Government. Efic sits within the Foreign Affairs and Trade portfolio, and is classified as a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

1.2 Efic has operated under various statutory frameworks and forms since 19574. The Export Payments Insurance Corporation was originally established to insure export businesses against the risk of non-payment by overseas buyers. The entity later took on the role of insuring offshore investments against non-commercial losses such as war damage, and providing finance for exports of capital goods.

1.3 Upon Efic’s establishment in its current form in November 1991, Australian exporters were subject to challenging economic conditions—the Australian interest rate was 8.5 per cent, having peaked at 17.5 per cent in January 1990.5 Efic was established to provide financial support to Australian based companies who were exporting, participating in the global supply chain or seeking to grow internationally.6 Efic provides financial solutions, risk management options and professional advice when the private market is unable or unwilling to do so. 7

1.4 The Efic Act sets out the following key functions of Efic:

- to facilitate and encourage Australian export trade by providing insurance and financial services and products to persons involved directly or indirectly in export trade;

- to encourage banks and other financial institutions in Australia to finance or assist in financing exports;

- to manage the Australian Government’s aid-supported mixed credit program (discontinued, although loans are still outstanding under this);

- to provide information and advice regarding insurance and financial arrangements to support Australian exports;

- to assist the Northern Australia Infrastructure Facility (NAIF) in the performance of the functions of the NAIF and to provide incidental assistance, where agreed, to the States and Territories in relation to financial arrangements and agreements related to the terms and conditions of grants of financial assistance for the construction of Northern Australia economic infrastructure; and

- as directed by the Minister, to assist Commonwealth entities and Commonwealth companies in performing their functions or achieving their purposes by providing services in relation to financial arrangements and agreements.

Operational Overview

1.5 Efic delivers its functions through the use of two main accounts; the Commercial Account and the National Interest Account.

1.6 The Commercial Account is the primary operating account for transactions entered into by Efic, where the risks are underwritten by Efic as a corporation. The majority of transactions are undertaken on Efic’s Commercial Account (90.7 per cent).8

1.7 The National Interest Account is an account for undertaking transactions under ministerial direction where such transactions are deemed to be in the national interest. Risks relating to these transactions are underwritten by the Australian Government (as opposed to Efic as an individual corporation). The National Interest Account also houses the Defence Export Facility, which is intended to assist Australian companies to obtain the finance required to underpin the sales of their defence and defence-related equipment overseas.

1.8 Through these accounts Efic provides loans, bonds, guarantees and insurance to exporters and subcontractors within the export supply chain (refer to Appendix 2 for further details of Efic’s financial products).

1.9 In 2017–18, Efic financially supported 160 Australian export businesses (direct exporters and businesses within the export supply chain) providing a total of $194 million in facilities in relation to $1.39 billion in export contracts. Efic received $13.9 million in revenue (post tax) from its Commercial Account transactions, and paid a $5.8 million dividend to the Australian Government out of its prior year net profit. Efic further provided $32.3 million of revenue from the National Interest Account to the Australian Government in 2017–18.

1.10 Insurance and guarantee facilities (in the form of bonds, guarantees, trade credit insurance and reinsurance) equate to 38 per cent of Efic’s current portfolio (refer below). Of Efic’s open facilities, 62 per cent are loans to export businesses.

Figure 1.1: Efic portfolio — loans vs other financial products

Source: ANAO analysis of Efic’s facilities.

1.11 Under Efic’s primary duties, as set out in subsection 8(2) of the Efic Act, it is required in performing its functions to have regard to the desirability of improving and extending the range of insurance and other financial services and products available (whether from Efic or otherwise) to persons involved, or likely to be involved, directly or indirectly, in Australian export trade.

1.12 The 2012 Productivity Commission Inquiry: Australia’s Export Credit Arrangements (Productivity Commission review)9 recommended that Efic’s Commercial Account product range be limited to guarantees and bonds, including the provision of bonds on behalf of an exporter in respect of export contracts. The Productivity Commission review also recommended that the product range may include the provision of reinsurance, for a limited period, to cover country and sovereign risk insurance provided to SMEs by the private sector. The Government formally responded to the Productivity Commission Report and did not agree with this recommendation10. The Minister issued a new Statement of Expectations (dated 13 November 2014) which stated: ‘The Government intends to amend the Efic Act and enhance Efic’s demonstration role by allowing Efic to provide loans in a broader range of circumstances’.

1.13 As at 21 November 2018, Efic had 280 active facilities, with a total transaction value of $5.7 billion11. Figure 1.2, Figure 1.3 and Table 1.1, provide an overview of these active transactions and facilities.

Figure 1.2: Transaction by industry sector

Source: ANAO analysis of Efic’s open portfolio data as at 21 November 2018.

Figure 1.3: Transaction by region (export destination)

Source: ANAO analysis of Efic’s open portfolio data as at 21 November 2018.

Table 1.1: Transaction by facility type

|

Facility Type |

Number of transactions |

Percentage of total transactions (%) |

Value of transactions ($) |

|

Bond — Advance Pay |

14 |

5.00 |

10,359,021.72 |

|

Bond — Performance |

39 |

13.90 |

66,235,089.18 |

|

Bond — Warranty |

21 |

7.50 |

9,095,995.65 |

|

Direct Loan |

44 |

15.70 |

2,396,928,277.90 |

|

Export Credit Loan (ECL) |

33 |

11.70 |

35,903,931.21 |

|

Export Finance Guarantee (EFG) |

9 |

3.20 |

822,498,559.37 |

|

Export Line of Credit (ELOC) |

32 |

11.40 |

29,618,576.63 |

|

Export Working Capital Guarantee (EWCG) |

14 |

5.00 |

14,077,553.86 |

|

FEFG |

6 |

2.10 |

259,130,727.79 |

|

MTI |

1 |

0.40 |

276,441,077.10 |

|

Overseas Direct Investment Guarantee (ODI) |

3 |

1.10 |

7,833,333.33 |

|

Reinsurance Guarantee |

1 |

0.40 |

18,828,773.12 |

|

Rescheduled Debt |

1 |

0.70 |

1,741,889,753 |

|

Small Business Export Loan (SBEL) |

62 |

22.10 |

8,356,824.00 |

|

Total |

280 |

100 |

5,687,197,493.86 |

Source: ANAO analysis of Efic’s open portfolio data as at 21 November 2018.

1.14 Under section 62 of the Efic Act, the Australian Government explicitly guarantees the due payment by Efic of any money that becomes payable, including its borrowings from third parties. Efic has a credit rating of AAA by Standard and Poor’s (S&P).

1.15 Efic is required to borrow money to fund loans made to Australian exporters or buyers of Australian exports. Funding may also be required to cover borrower defaults or calls by lending banks on guarantees made by Efic.

1.16 Efic’s Treasury function is responsible for raising funds at competitive rates. This is performed through borrowing in the global capital markets and the use of derivative products to manage currency and interest rate risk. Under section 11 of the Efic Act, Efic are able to enter into swaps, foreign exchange agreements, forward rate agreements, options or hedge agreements.

1.17 On the 4 April 2019, the Australian Parliament passed the Export Finance and Insurance Corporation (Efic) Amendment (Support for Infrastructure Financing) Bill 2019, effecting changes to the Efic Act. These amendments, together with a new Statement of Expectations that has subsequently been issued by the Minister to Efic, enact a number of new measures that impact Efic as follows:

- a new trading name, ‘Export Finance Australia’;

- an additional $1 billion in callable capital; and

- the requirement to exercise a new overseas infrastructure financing power to provide finance for infrastructure development in the Indo-Pacific region, with a particular focus on the Pacific region (including Timor-Leste), based on an Australian benefit test (considering benefits such as greater Australian participation (including SMEs) in export supply chains, more Australian jobs and financial proceeds from overseas to Australia).

1.18 Due to the timing of these changes they were not considered within the scope of the audit and therefore are not further referred to within this report.

Audit rationale and approach

1.19 The Australian Government is increasingly undertaking balance sheet activity to achieve policy objectives. Given Efic is responsible for the investment and management of over $5 billion in funds on behalf of the Australian public, this audit assessed whether Efic’s mandate and purposes are being met effectively.

Audit objective, criteria and scope

1.20 The objective of this audit was to assess the effectiveness of Efic.

1.21 To form a conclusion against the audit objective, the ANAO adopted the following high-level audit criteria:

- Efic is operating within its prescribed mandate;

- Efic is effectively managing its financial and service delivery functions; and

- Efic is meeting its statutory and prudential responsibilities.

1.22 The focus of the audit was on:

- Efic operating in the market gap and facilitating and encouraging Australian export trade;

- Efic operating on a commercial basis and consulting and engaging with relevant stakeholders; and

- Efic’s governance structures and support of their ability to meet their statutory and prudential requirements including managing their credit and funding risks.

Audit methodology

1.23 The major audit tasks included:

- examination of legislation, relevant external reports, and Efic documentation;

- analysis of Efic data, including sample testing of transactions and underlying evidence to ensure compliance with internal and mandate requirements. The sample selected:

- included open, closed and in progress transactions on the Commercial Account as well as transactions on the National Interest Account;

- provided coverage over all facilities provided by Efic (all Efic products);

- comprised transactions with enterprises with a range of sizes as well as overseas governments and buyers; and targeted high-risk areas and countries;

- provided coverage over all industries assisted by Efic;

- included a mixture of long- and short-term facilities;

- included facilities of different monetary values; and

- facilities from a range of jurisdictions that Efic’s clients operate in;

- interviews with Efic executive, management and staff; interviews with key reporting stakeholders, including the Department of Foreign Affairs and Trade and Austrade12; and

- interviews with international export trade organisations, specifically UK Export Finance, Export Development Canada and New Zealand Export Credit, for comparative information.

1.24 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $308,855.

2. Compliance with prescribed mandate

Areas examined

This chapter examines whether Efic is operating within its prescribed mandate as set out in relevant primary and subordinate legislation.

Conclusion

Efic is operating within its prescribed mandate. It has developed a framework to interpret, operationalise and comply with each mandate requirement.

Areas for improvement

There have been no recommendations identified.

- The ANAO has suggested areas for improvement in relation to: Statement of Expectation compliance plans; confirmation of the market gap from relationship banks; market gap monitoring activities; the incorporation of the Integral Test into EficDirect; and succession and support planning for key technical roles.

Has Efic established how it will address each requirement of its prescribed mandate operationally?

Efic has established a framework to interpret its mandate and determine how it will be operationalised. This includes an internal compliance document to define how Efic intends to operationalise its Statement of Expectation requirements.

Statement of Expectations and enabling legislation

2.1 The Statement of Expectations is the Australian Government’s statement of key priorities and objectives as they relate to the purposes of Efic, made and published under section 34 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act). The most recent Statement of Expectations is dated 7 September 2017 and was made by the Minister for Trade, Tourism and Investment (Minister).

2.2 Efic’s mandate issued under the Statement of Expectations and Export Finance and Insurance Corporation Act 1991 (the Efic Act) addresses four key areas:

- provision of financial products and services on commercial terms to export businesses and buyers that are not supported by the private financial sector (limited by Efic’s commercial risk exposures on its commercial account and regulatory requirements);

- provision of financial support under Ministerial direction (on Efic’s National Interest Account);

- sharing of knowledge and infrastructure (for establishment and operations) to support other Australian Government entities (usually with some similarity in nature of operations), without adversely affecting 1 and 2 above; and

- delivery of dividends to government where possible, which are not in excess of Efic’s profit for the year (refer to paragraph 3.7 for further details) or otherwise as specifically directed under section 55A of the Efic Act (including at Ministerial direction).

2.3 A Statement of Expectations applies only to the extent that compliance with the statement is not inconsistent with the enabling legislation (in this case the Efic Act). The requirements set out in the Statement of Expectations are consistent with the Efic Act.

2.4 The Statement of Expectations establishes that, in making decisions on the support to be provided to export businesses, Efic must:

- ensure its activities fill the ‘market gap’ where private sector finance is not forthcoming;

- support a wide range of SMEs;

- ensure projects have significant Australian content and are financially viable;

- limit the number of Commercial Account transactions provided to the same entity to three facilities within a three-year period; and to adhere to environmental, social standards and international treaty requirements.

2.5 Efic’s compliance with these Statement of Expectations requirements has been examined in the subsequent sections of this Chapter.

Statement of Intent and compliance documentation

2.6 The Chair of the Efic Board provides the Minister with Efic’s Statement of Intent. This expresses and confirms the Board’s intention to meet the requirements outlined in the Statement of Expectations and acknowledges Efic’s obligations to comply with the Efic Act.13

2.7 In the Statement of Intent, Efic advises that its purpose is to: ‘outline how Efic will direct its operations to meet [the Minister’s] expectations.’

2.8 Efic produces an internal ‘Efic’s Statement of Expectations — Compliance’ document (‘internal document’) which sets out each requirement from the Statement of Expectations, the Efic ‘owner’ of the requirement and a description of how Efic intends to comply with the requirement.

2.9 The internal document forms the framework for Efic to interpret its mandate and determine how it will be operationalised. For some requirements in the internal document, the description of how Efic intends to comply with each requirement is not sufficiently explained to enable an effective understanding of how Efic will meet the given requirement. Instances are detailed in Table 2.1.

Table 2.1: Instances where the description of how Efic intends to comply with a Statement of Expectations requirement is not sufficiently explained

|

Mandate requirement |

Audit analysis |

|

Support a range of Small & Medium-sized Enterprises (SMEs) |

The Statement of Expectations requires Efic to support a wide range of SMEs, including tourism operators, online businesses, exporters of intellectual property and other related rights, and businesses engaged in overseas direct investment. The internal document does not identify how the business development SME team will effectively focus on a wide range of industries, including those within the specific categories identified in the Statement of Expectations. |

|

Online Transaction Register |

The Statement of Expectations requires Efic to publish, through an online register, information on all transactions within eight weeks of signature. Efic has interpreted this as requiring it to maintain a transaction register on its website which lists all facilities provided by the organisation in the current financial year. This means that prior year transactions which are still open / yet to mature are not included in the register, although information on transactions from earlier years is contained in the respective Annual Reports. |

|

Three by Three Rule |

The Statement of Expectations requires that Efic limit the number of facilities on the Commercial Account provided to the same entity to three facilities within a three-year period. Further facilities with the same entity must be approved by the Efic Board, and can be approved only on the basis that the transaction is to an emerging market or where the transaction will not crowd out the private sector (the ‘three by three rule’) (refer to paragraphs 2.53–2.54 for further details). Efic is also required to report to DFAT the basis of support for repeat ‘transactions’ (specifically, information on entities who have more than three transactions with Efic in a three-year period). Efic interprets transactions to be ‘facilities’ to apply this requirement. A facility is classified by Efic as one or more products for which one application was made by the applicant. Therefore, this can comprise multiple products/transactions (Loan, Bond, Guarantee, Warranty) for which one market assessment is completed in relation to the same export contract (which may service multiple jurisdictions). Although this interpretation is reasonable, it is not clearly set out in Efic’s internal document. |

Source: ANAO analysis.

2.10 Appendix 3 provides a table detailing the requirements of the Statement of Expectations and the extent to which Efic has operationalised each requirement. This table takes into consideration the effect of Efic’s interpretation of requirements on the facilitation and encouragement of export trade. Where Efic has operationalised a requirement yet there are opportunities for improvement identified, the relevant paragraph in this report is referenced.

2.11 Efic should further define how it will operationalise each requirement of the Statement of Expectations. In doing so, it should consider the achievement of its purposes in furthering the facilitation and encouragement of Australian export trade and encouraging the private finance sector to support Australian exporters and export supply chain businesses.

Does Efic appropriately monitor commercial markets to identify the ‘market gap’?

Efic’s activities in monitoring commercial markets to identify situations where the private sector will not provide financial support to an export business (the ‘market gap’) are largely appropriate. Efic communicates with customer relationship banks and analyses comparative market pricing for small and medium-sized enterprise (SME) transactions, although it does not undertake proactive monitoring of the market gap for the wider export industry and does not report on situations where it assists an export business to obtain private sector finance.

2.12 The Statement of Expectations requires that:

Efic must not provide financial services or products on its Commercial Account unless Efic is satisfied that private sector providers are unable or unwilling to support financially viable business activities. Efic should ensure its activities fill the ‘market gap’ where private sector finance is not forthcoming. [The Minister] expect[s] Efic to monitor the capacity of the commercial markets and to take this into account when determining the scope of its activities.

2.13 Efic receives requests for financial support and generally identifies these as being reflective of the market gap. This is on the basis that Efic assumes that any business approaching it must already have tried and failed to obtain financial support from private financiers. 14

Transaction level assessment of market gap

2.14 Efic documents a market gap rationale in an Efic Credit Memorandum for each transaction. Corporate, Sovereign and Project Finance (CSPF)15 transactions require significant discussions regarding the potential for private finance with the applicant, banks and other export credit agencies (which establishes the market gap). For SME transactions where there is a private relationship banker (details of which must be provided by the applicant), Efic informs an applicant’s relationship banker of proposed financing to test the market gap and to determine the bank’s willingness to provide finance. Efic does not require a response from the relationship bank to confirm the market gap, nor actively follow this up before it proceeds with the transaction. In 61 per cent of complete SME transactions subject to audit testing, no response from the relationship bank was received before Efic entered into the transaction.

2.15 In relation to its short-term trade credit insurance product, the New Zealand Export Credit Office (NZECO) requires confirmation from private insurers (may be via a private sector broker), that the private insurer has reviewed and is unwilling to provide short-term trade credit cover as a pre-condition of NZECO assessing a short-term trade credit application. This is to ensure NZECO is not competing with short-term trade credit insurers.

2.16 Where an application has not come through as a direct referral from a bank, there is increased risk that a private financier has not been consulted on the specifics of the proposed transaction.

2.17 In order to ensure that there is a market gap Efic could act to ensure that a response is received from the relationship bank of each applicant confirming that their bank will not finance the export transaction.

Proactive monitoring of the market gap

2.18 Efic provides updates to relationship banks16 on any facility contracts it has signed with their clients on a quarterly basis. Efic undertakes Pricing Methodology and Strategy Reviews17 which analyse comparative market pricing for transactions of low dollar value and short duration (which are typical requirements for SME financing). Examples of known bank pricing structures are referenced as part of each review.

2.19 Efic does not have a dedicated market research area and does not undertake proactive monitoring of the market gap for the wider export industry or specific export sectors / markets to ensure its financial support is appropriately targeting the market gap.

2.20 Export Development Canada has at least one team that focuses on market trends and opportunities although this team is not restricted solely to identification of the market gap. NZECO conducts meetings with private trade credit insurers and key broking agencies to confirm and discuss the current market gap / obstacles and the role that they are performing.

2.21 To assist in defining the market gap, Efic indicated that it will undertake a regular market gap review and hold regular formal engagements with the major banks and financial institutions to confirm their risk appetite for supporting export businesses within each industry and market. An annual strategy day was held by Efic in November 2018 that involved DFAT, Austrade and private financiers and included a review of existing products and services and where opportunities may exist for Efic. This event could be used in future to formally define the market gap.

Assistance to private finance sector

2.22 The Australian Government intends that Efic assist firms to secure finance for export and to invest overseas. The Efic Act outlines that one of Efic’s core functions is to encourage banks and other financial institutions in Australia to finance or assist in financing exports.

2.23 Although Efic engages with banks and other financiers in negotiating CSPF transactions, Efic does not proactively encourage private sector financiers to take on SME facilities. Efic undertakes annual reviews of financial viability and credit risk and at this time a potential transfer to a private financier would be considered. However, no evidence was found of transactions having been on-sold to private financiers after a financial support/loan agreement had been signed.

2.24 In contrast, following confirmation that private insurers are unwilling to provide short-term trade credit cover before entering into a trade credit transaction, NZECO requires each of its short-term trade credit clients to approach private insurers every 12 months to again test their willingness to provide them with cover, before NZECO will consider assessing a policy renewal. NZECO further records examples where its due diligence has highlighted risks that have encouraged an exporter not to proceed with a sale. For example, where a fraudulent buyer was identified during the NZECO due diligence process which resulted in the exporter not shipping and avoiding losses.

2.25 Efic does not report on transactions that it has ‘assisted’ in moving over to private financiers (for example where a bank voluntarily takes on a transaction after Efic’s completion of due diligence). This has been analysed at paragraph 4.20, and associated Recommendation 1.

Does Efic adequately focus its efforts on Small and Medium-Sized Enterprises (SMEs)?

Efic is adequately focusing its efforts on SMEs through tailored products and services. In response to the 2014 Statement of Expectations specifying the need for SMEs to be effectively supported, Efic implemented the EficDirect online loan platform to streamline Small Business Export Loans. In combination with other new initiatives and strategies, this has resulted in a general increase in both the volume of facilities provided to SMEs, and in the average value of SME transactions as a proportion of the total value of transactions undertaken annually in the Efic portfolio. There are opportunities to improve Efic’s coverage of export supply chain SMEs.

Focus on SMEs in Statement of Expectations

2.26 The Statement of Expectations states that: ‘the Minister expects Efic to support a wide range of SMEs, including tourism operators, online businesses, exporters of intellectual property and other related rights, and businesses engaged in overseas direct investment’. Overseas direct investment is defined by Efic as ‘investment by Australian companies in business operations overseas. This can take the form of a new or ‘green field’ investment, expansion of an existing facility or an acquisition or joint venture’.

2.27 This is reflective of the 2012 Productivity Commission Inquiry: Australia’s Export Credit Arrangements (Productivity Commission review)18, which found no convincing evidence to indicate there were failures in financial markets that impeded access to debt or equity finance for large firms, or for resource and infrastructure projects located in Australia. The Productivity Commission review recommended that Efic’s mandate and operations on the Commercial Account should be reoriented to address information-related failures in financial markets that impede access to export finance by newly exporting SMEs. The Australian Government formally responded to the Productivity Commission Report and disagreed with the recommendation. The Minister issued a new Statement of Expectations (dated 13 November 2014) which instructed Efic not to support large onshore resource projects. The subsequent Statement of Expectations (dated 7 September 2017) removed the restriction and allowed Efic to support both onshore and offshore resource projects.

2.28 Efic has adopted a definition for SMEs as entities having annual revenues of up to $150 million. This definition stems from section 3A of the Efic Act, which defines a large business as a business with prior year revenue of $150 million revenue or more, and therefore, by default, SMEs fall into the less than $150 million revenue category.

2.29 Efic provides facilities to SMEs in a range of different industry sectors. SMEs from the specific named industries in the Statement of Expectations are included in the generic industries in Figure 1.2 (as classified by Efic). Industry segment information is captured by Efic in the Infor system for these specific named industries.

EficDirect

2.30 Efic’s online portal ‘EficDirect’ was introduced in 2015–16. EficDirect facilitates the provision of Small Business Export Loans (SBEL), which are unsecured loans obtained through an online application and approval system for businesses with a turnover of between $250,000 and $10 million that have been trading for at least two years. Customers whose business exports relate to specific restricted sectors cannot apply for a Small Business Export Loan.19

2.31 All applications via EficDirect are recorded in Efic’s Infor system. These are initially assessed by Client Liaison Officers (CLO), who conduct a quality and completeness check before being passed on to a Business Development Manager (BDM) and/or the Transaction Management (TM) team (more experienced staff) to be formally assessed. Enquiries are also received via telephone and webchat, which do not always get recorded in Infor unless determined by the CLO to be a potential opportunity. This means that not all enquiries related to potential facilities are subject to review by senior/experienced staff, which may result in missed opportunities to support viable export transactions.

In-supply chain SMEs

2.32 Efic is only permitted to provide support to SME suppliers of domestic resource projects (and related infrastructure) where the SME good or service is integral to the performance of a resource export project (and related infrastructure) under the Statement of Expectations. These requirements are addressed within Efic’s policy documents and transaction processes across its portfolio.

2.33 An application for Efic financial support (provision of a bond, guarantee or loan) in relation to a good or service that is considered part of the export supply chain (rather than a direct export arrangement) must relate to an export contract or proposed contract in place with a buyer (for example, an offtake agreement20 with a foreign buyer). The applicant’s contract for supply (whether in a Head Contract with an overseas buyer or in the applicant’s contract supporting the export contract) must be integral to the performance of that export contract or the related export project (the conditions to assess this are known as the ‘Integral Test’ — illustrated in Figure 2.1 below).

Figure 2.1: Financial support arrangements in export supply chains

Source: ANAO analysis based on Efic information.

2.34 The first part of the Integral Test (‘First threshold test’) looks at aspects of the arrangement to assess whether the applicant is required to do something (produce or transport, extract or exploit goods or render services) to enable the exporter to fulfil its obligations under the export contract. Where the applicant’s contract provides business support services, rather than being an essential part of the export supply chain, it is less likely to be assessed as ‘integral’ and be eligible for financial support.

2.35 The second part of the Integral Test (‘Second threshold test’) assesses whether the risk category that applies to Efic’s involvement is within its risk appetite.

- Nil to medium risk support arrangements would generally be considered within Efic’s risk appetite. These are described as arrangements where support is given in relation to the performance of: the export contract itself; the exporters’ obligations to other contractors (including the applicant) in the export supply chain; the applicant’s obligations to the exporter or other contractors for the performance of activity in the export supply chain or an exporters’ obligations to contractors (including the applicant) for the provision of business support services to the exporter21.

- Medium to high risk support arrangements would generally not be supportable by Efic under its risk appetite. These are described as support given in relation to the performance of: the contractor applicant’s obligations to the exporter for the provision of business support services to the exporter; the applicant’s obligations to another contractor in the export supply chain for the provision of business support services to that contractor; OR the applicant’s obligations to another contractor providing business support services to the exporter.

2.36 Any transactions that fall outside of the Integral Test parameters require further review by the Efic Executive and may not be approved. All transactions that meet the Integral Test must go to the relevant delegate for approval and all assessments performed under the Integral Test are saved and accessible internally on MyEfic, regardless of the outcome.

2.37 Of the 519 transactions entered into by Efic during the period 1 July 2016 to 21 November 2018 (916 transactions across the portfolio were considered in total, 91 are still in progress and 306 were not finalised for various reasons), 53 (just over 10 per cent) related to supply chain contracts. It is noted that this does not include supply chain SMEs supported indirectly through opportunities generated for them (where they are privately financed) as a result of Efic financially supporting large offshore projects.

2.38 The process could be made more efficient for supply chain SMEs if the Integral Test could be incorporated into the EficDirect platform.

SME facilities and transactions — trend analysis

2.39 Figure 2.2 shows the trend in the number of SME facilities issued by Efic since 2010.

Figure 2.2: Number of facilities provided to SMEs (2010–2018)

Source: ANAO analysis of signings in Efic Annual Reports.

2.40 In 2013, Efic introduced initiatives to assist SME clients in the form of banking partnerships for working capital solutions and a strategy and associated products for global supply chains. The results of these initiatives were evident in the increase in number of SME transactions during that year. The significant increase in the number of SME transactions within the financial year ending 30 June 2014 was primarily related to 99 Risk Participation Agreements provided to the Asian Development Bank that were not repeated in the following year.22 Taking the variances of 2013 and 2014 into account, there has been a general increase in the volume of SME transactions since the implementation of EficDirect in 2015-16.

2.41 Figure 2.3 analyses the value of SME transactions as a proportion of the total value of transactions undertaken annually in the Efic portfolio from 2010 to 2018.

Figure 2.3: Value of SME transactions as a proportion of the total value of transactions undertaken annually in the Efic Portfolio (2010–2018)

Source: ANAO analysis of signings in Efic Annual Reports.

2.42 In the period 2010 to 2014 the average value of SME transactions as a proportion of the total value of transactions undertaken annually in the Efic portfolio was 19 per cent. In the period post the introduction of the 2014 Statement of Expectations, this average increased to 55 per cent. This may reflect that Efic has increased its focus on supporting SMEs.

Does Efic comply with its prescribed mandate in relation to Australian content, financial viability and other relevant requirements?

Efic complies with its prescribed mandate in relation to Australian content, financial viability and other relevant requirements. Efic consistently applies requirements in relation to the number of facilities which can be provided to an individual entity over a three-year period. Efic has appropriate structures for understanding and applying requirements in relation to environmental and social standards.

Australian content requirements

2.43 The Efic Act requires Australian content or benefits to accrue from certain proposed transactions for an export business to qualify for Efic financing23. The Statement of Expectations requires Efic to ensure domestic and overseas resource projects have significant Australian content.

2.44 Efic has applied an Australian content test across its whole portfolio as a way to meet all Australian benefits and content requirements under the Efic Act. Under this test, Efic will lend only up to a maximum of 85 per cent of the total content of a transaction, with the actual percentage of support to be provided dependent on the percentage of Australian content, which is defined as:

- goods manufactured or produced in Australia;

- inputs sourced from other Australian suppliers;

- services, including management and professional services provided by third parties, performed in Australia or by Australians employed outside Australia; and

- the Australian exporter’s profit margin.

2.45 Management representations by the applicant in relation to Australian content (in the form of a legal declaration) are relied on by Efic. As part of its Transaction Risk Assessment procedures, Efic confirm the beneficial owners to the company and request financial information from these owners. Efic can trace the profit margin from this information for the beneficial owner/s allowing for the calculation of the profit margin attributable to Australia. It is noted however that Australian content at the time of the transaction may be an estimate until the export contract or project is completed.

2.46 Efic conducts audits of Australian content against an Exporter’s Deed representations. These audits are conducted annually for a sample of four to five SME and CSPF clients. Efic has stated that if issues are found within this sample, the sample size would be increased (noting that the sample is focused on buyer finance and project finance transactions where the Australian content may be less obvious than in domestic transactions). The sample size in comparison to the total population of transactions for the year and the lack of an applied sampling methodology does not allow for Efic to draw appropriate conclusions nor provide assurance in relation to management representations across all transactions.

2.47 The Australian content test measures goods manufactured or produced in Australia; inputs sourced from other Australian suppliers; services, including management and professional services provided by third parties, performed in Australia or by Australians employed outside Australia; and the Australian exporter’s profit margin.

2.48 Efic is proposing to apply a new Efic Australian Benefit Policy across its portfolio to allow for a more direct consideration of the benefits of proposed transactions to Australia’s domestic and export economy. It is intended that this policy will improve the focus of Efic’s financial support to encourage Australian export trade and ensure that Efic’s financial exposure is aligned with the overall benefits flowing to Australia.

2.49 As a comparative example, NZECO 24 only considers applications where ‘an economic benefit to New Zealand exists from the transaction’ that NZECO would be underwriting. Economic benefits are demonstrated through:

- the nature and value of the goods or services provided within New Zealand, either solely or in conjunction with other New Zealand residents including expenditure on materials (excluding customs, excise/duties, imports), labour, overheads, and marketing cost elements,

- services delivered by New Zealanders employed or contracted offshore;

- the level of New Zealand intellectual property in the transaction; and

- profit derived from the transaction that will be repatriated back to New Zealand.

2.50 When NZECO is nearing its prudential or facility limits, NZECO prioritises New Zealand value-added content over other potential New Zealand benefits, such that the New Zealand value-added content must be at least 30 per cent of the transaction being supported by NZECO.

Financial viability

2.51 The Statement of Expectations states that, in making decisions on the support to be provided to export businesses, Efic must ensure that the relevant projects are financially viable. The financial viability of providing support for domestic and overseas resource projects (and related infrastructure) is demonstrated through a due diligence process applied by Efic to applications. In summary, the due diligence process involves:

- confirmation of export contract existence or technical assessment for application (refer paragraph 2.63);

- market gap assessment (refer paragraphs 2.14–2.17);

- Credit Risk Assessment (including review of financial viability, market and export country risks) (refer paragraphs 4.34–4.36);

- Transaction Risk Assessment (incorporating anti-money laundering and corruption and reputational risk assessment) (refer paragraph 4.28); and

- Environmental and Social Risk Assessment (refer paragraphs 2.56–2.63).

2.52 Efic has an appropriate framework in place to assess the financial viability of projects.

Three by three rule

2.53 The Statement of Expectations requires Efic to limit the number of Commercial Account transactions provided to the same entity to three facilities within a three-year period. Further transactions with the same entity must be approved by the Efic Board on the basis that the transaction is to an emerging market, or where the Board assesses that the transaction will not crowd out the private sector. In Efic’s Statement of Expectations Compliance Table, the Efic Board has pre-approved a list of emerging markets, being all economies not classified as ‘advanced’ economies by the International Monetary Fund as published biannually in its World Economic Outlook.

2.54 Efic has interpreted the three by three rule as three facilities in total per customer. A facility can include one or more products and for which only one market assessment needs to be undertaken in relation to one export contract. For example, a customer can apply for an Export Credit Loan (ECL), a Performance Bond, a Warranty Bond and a Guarantee related to one particular Export Contract to a certain country (or could service multiple jurisdictions). This package of products (four products) would then count as one facility for the purpose of tracking against the three-by-three rule. Where multiple market assessments are required or the products applied for relate to multiple export contracts, these would then be classified as separate facilities for the applicant. Only when the number of such facilities (which can be more than three products) is exceeded (three within a three-year period) is Board approval required to be obtained prior to issuing any further products to the same customer.

2.55 Testing identified five exporters with more than three facilities (as per Efic’s definition of the composition of a facility) within a three-year period. All had Board approval.

Environmental and social standards and compliance with OECD and international treaty requirements

2.56 Efic is required under the Statement of Expectations to provide products and services having regard to the Australian Government’s World Trade Organisation and other international commitments, including the United National Convention Against Corruption. Efic applies anti-money laundering and corruption controls as part of its Transaction Risk Assessment process (refer paragraph 4.28).

2.57 Efic complies with the Organisation for Economic Co-operation and Development (OECD) Recommendation of the Council on Common Approaches for Officially Supported Export Credits and Environmental and Social Due Diligence (OECD Common Approaches). Efic also voluntarily applies the Equator Principles, a global benchmark risk management framework, to identify and manage environmental and social risks in projects.

2.58 The OECD Common Approaches apply to officially supported export credits, while the Equator Principles apply to certain transaction types associated with projects, as outlined in Appendix 4.

2.59 The Equator Principles relate to the following financial products:

- where total Project capital costs are US$10 million or more, and include project finance or project finance advisory services;

- project-related corporate loans where total loan amount is at least US$100 million, loan tenor is at least two years and the Equator Principles Financial Institutions’ individual commitment before syndication or sell down is at least US$50 million (can also be export finance in the form of buyer credit however the majority of the project needs to evidence effective operational control, either direct or indirect, by the applicant); and

- bridge loans with a tenor of less than two years expected to be refinanced by project finance or a project-related corporate loans meeting other relevant criteria above.25

2.60 Efic has implemented a procedure for environmental and social review of transactions that determines the level of environmental and social review required for each proposed transaction based on the type of financial support requested, the nature of the project activities and the role of the business applicant in the transaction (refer Appendix 5). In accordance with the Statement of Expectations, Efic publishes this procedure for environmental and social review and regularly reviews it to ensure it is consistent with better-practice environmental and social standards, including the International Finance Corporation (IFC) Performance Standards26, the OECD Guidelines for Multinational Enterprises, the Equator Principles and OECD Common Approaches.

2.61 New projects are classified into Category A, B or C in accordance with the following definitions and managed in accordance with the procedure detailed at Appendix 5:

- Category A — potentially significant adverse environmental and/or social impacts;

- Category B — Between the two extremes represented by categories A and C; and

- Category C — minimal or no adverse environmental and/or social impacts.

2.62 In accordance with the Statement of Expectations, Efic publicly discloses its prospective involvement in transactions associated with projects that have potentially significant adverse environmental and social impacts (Category A projects). Efic takes submissions online and by post from the public in relation to potential Category A projects for consideration to report. The Efic Board annually reviews Efic’s involvement in Category A projects and Efic discloses any Category A projects (usually related to extractive resource projects) on its website.

2.63 Efic has two engineers (technical assessors) who have primary responsibility for examining the technical viability of financial support applications (i.e. the technical features of the applications rather than financing terms). These staff are also responsible for performing assessments of borrower or sponsor compliance with OECD Common Approaches and Australia’s other treaty obligations as they relate to environmental and social risk factors.27 These staff undertake applicant and client site visits domestically and internationally to perform compliance and technical assessments for financial support applications of $2 million or more. For financial support applications that fall below this threshold, a desktop assessment is performed by the Transaction Management Team and reviewed by these assessors with particular focus on any compliance (and technical) risk concerns. Technical assessors must remain appraised of current international obligations and best practice and business technical requirements to assess technical applications across diverse industry sectors.28

2.64 Efic does not have any documented arrangements for backup or succession in relation to these roles.29

Supporting other Australian Government Entities

2.65 In accordance with its mandate, Efic provides back office, infrastructure and operational support for the Northern Australia Infrastructure Facility (NAIF) and National Housing Finance and Investment Corporation (NHFIC).30

2.66 Efic also supports DFAT through provision of advice on financial management practices to understand how Efic executes its mandate. This also assists DFAT to prepare briefings to the Minister for Trade, Tourism and Investment.

Has Efic effectively established the Defence Export Facility in line with government objectives?

The Defence Export Facility has been established and Efic is providing support to the defence export sector in line with Australian Government objectives. Efic participates in intergovernmental discussions to remain informed on opportunities to support the defence export sector, and is undertaking a campaign to raise awareness of the financial support services available to defence exporters.

2.67 The Defence Export Facility is part of a package of strategic measures identified by the Australian Government in January 2018 aimed at increasing investment and employment within the defence industry sector:

The Defence Export Facility has been established to assist Australian companies to obtain the finance required to underpin the sales of their defence and defence-related equipment overseas and to provide confidence to the Australian defence industry to identify and pursue new export opportunities knowing Efic’s support is available when there is a market gap for defence finance.31

2.68 The Minister for Trade, Tourism and Investment (Minister) made a written direction on 15 January 2018 under section 26 of the Efic Act identifying circumstances in which applications for national interest transactions are, or are not, to be referred to the Minister. The direction sets out that an application to the Minister for Efic to enter into a national interest transaction (in accordance with Parts 4 and 5 of the Efic Act) in relation to the provision of financial support for an Australian defence export must satisfy specific conditions. These include the requirement that:

- there is a private finance market gap for the proposed export of approved defence-specific or dual use32 goods or services (for direct export or part of the supply chain);

- the proposed transaction has been subject to Efic’s due diligence process (refer paragraph 2.51) and;

- is unable to be financed wholly or in part on Efic’s Commercial Account.

2.69 Efic’s administration of transactions that are the subject of referrals under these requirements are known as the ‘Defence Export Facility’33. Under the Minister’s direction Efic can refer applications to the Minister for approval that meet the conditions for 10 years until the maximum aggregate financial exposure for transactions under the Defence Export Facility reaches US$3 billion. No specific targets have been set out for management of the Defence Export Facility.

2.70 The export of defence and dual-use goods is restricted under Australian Customs legislation as well as the Weapons of Mass Destruction (Prevention and Proliferation) Act 1995 and the Defence Trade Controls Act 2012, which covers the intangible supply of defence and strategic goods list technologies. Efic addresses these requirements in providing support for defence exports. Efic is part of an Interdepartmental Committee which meets regularly (generally monthly) to ensure broad inter-agency engagement across Defence Export Facility applications and monitor the implementation of the Government’s Export Strategy. This Committee reviews applications to export defence-related equipment (that is, the transfer or supply of controlled technology, information or services) to sensitive destinations. The membership of this committee includes the Department of Defence, the Defence Export Office, Department of Industry, Innovation and Science, Austrade and DFAT. Consultations with relevant agencies also provide Efic with the opportunity to gain current insights on the Defence export industry and related markets.

2.71 The private finance market gap for defence exports is determined through Efic’s regular communications with industry sector representatives and other Commonwealth entities. Efic have noted that there can be significant risk exposure for defence exports as future orders may be unknown (procurement is often arranged on an annual basis by buyers) and cancellation can occur at any time. Generally, other defence export stakeholders, especially the Australian Defence Export Office, take the lead in identifying defence export arrangements that may require Efic to provide financial support for exporters, however Efic is now more actively seeking Defence Export Facility opportunities through consultation with these stakeholders34.

2.72 From 1 July 2016 to 21 November 2018, Efic had 15 transactions on the National Interest Account with a total value of $522 million. Of these transactions, two customer’s products were included in the Defence Export Facility, with a combined value of $190 million. The presence of the two defence transactions on the National Interest Account is due to one transaction reaching the credit limit on the Commercial Account, and, for the second transaction, the credit decision relying on protected information to which Efic was not privy.

2.73 Financial assistance will continue to be provided via the Commercial Account for defence transactions, however if Efic reaches its risk and capital exposure limits for the Commercial Account, it can extend the facility via access to the National Interest Account for these transactions (with the Minister’s approval as outlined above). Efic does not hold capital against the transactions on the National Interest Account as the Australian Government bears responsibility for risks on this account.

3. Financial and service delivery functions

Areas examined

This chapter examines whether Efic is effectively managing its financial and service delivery functions.

Conclusion

Efic effectively manages its financial and service delivery functions, and the evidence can support a view that Efic is operating on an appropriately commercial basis.

Areas for improvement

There have been no recommendations identified.

The ANAO has suggested areas for improvement in relation to: the provision of further support to first-time exporters; the timing in which the identity verification of an applicant is completed in the transaction process; and collaboration with other Australian Government entities to identify opportunities to facilitate and encourage Australian export trade.

Are Efic’s operations conducted on an appropriately commercial basis?

The evidence can support a view that Efic is operating on an appropriately commercial basis. In line with its mandate, Efic generates sufficient reserves to sustain and expand its operations and undertakes its functions with the objective of not undercutting private sector financiers. There is a need for Efic to ensure an appropriate balance is maintained between its commercial objectives and its fulfilment of government expectations surrounding the facilitation and encouragement of private sector support for Australian export trade.

Legislative requirements

3.1 Upon its establishment in 1991, Efic received a $6 million equity injection to assist with its establishment, and a secondary equity injection of $200 million in July 2014 that restored Efic’s capital base following a $200 million special dividend paid in June 201335.

3.2 The Export Finance and Insurance Corporation Act 1991 (Efic Act) outlines Efic’s requirements to be self-sustaining while ensuring that it delivers on its set purpose. Subsection 49(a) of the Efic Act highlights ‘the need for Efic to generate reserves sufficient to support expansion of its operations’, and subsection 56(1) of the Efic Act details that ‘The Board is required to ensure, according to sound commercial principles, that the capital and reserves of Efic at any time are sufficient’. Export credit agencies such as Export Development Canada are also required to be self-funded and operate on commercial principles similar to Efic.

3.3 The investment approval issued by the Finance Minister under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) requires Efic’s treasury investments to be restricted to entities rated AA- or better for approved (foreign) entities, or Australian Authorised Deposit-taking Institutions (ADIs)36 rated BBB- or better37.

3.4 The Statement of Expectations sets out the Minister’s requirement that Efic conduct its transactions with Australian export businesses on a commercial basis and therefore ensure that its pricing does not undercut private sector financiers where the potential for private support is present, nor should it undercut pricing for comparable risks where private sector support is absent for Australian export businesses.

3.5 Efic does not offer nor provide finance or insurance to Australian export businesses at concessional rates, instead it offers products on commercially comparable terms to private sector financiers, which are aimed at Efic’s knowledge of the market gap where private financiers are unwilling to operate on the basis of risk. This is supported by Efic’s Pricing Methodology and Strategy Reviews38 (latest review dated 22 February 2018) and an established matrix of risk rating and tenor of exposure to ensure Efic does not compete on price for its products with the private finance market. This includes analysis of comparative market pricing for transactions of low dollar value and short duration (typical requirements of SMEs). Examples of known bank pricing structures are referenced as part of each review.

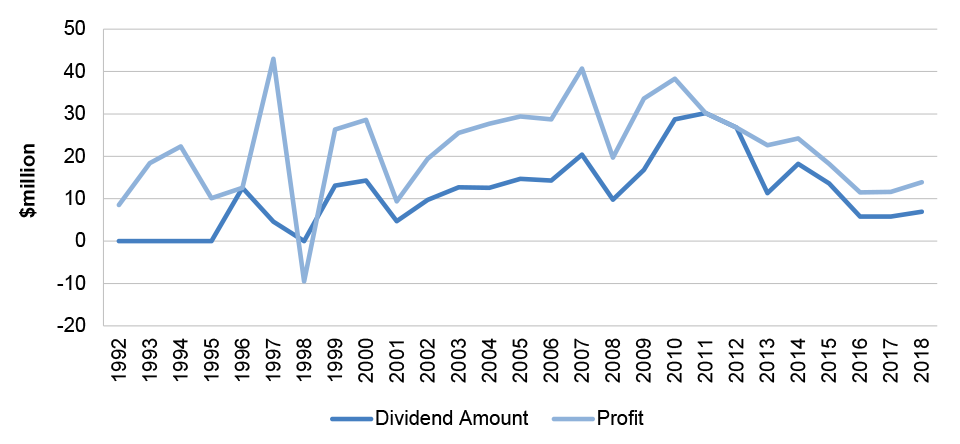

3.6 Efic’s performance, profitability, capital and reserves are a standing agenda item for the Efic Board. Efic has achieved profits each year, with the exception of 199839. Figure 3.1 below details the profits achieved by Efic in relation to the Commercial Account since its establishment as a separate corporation in 1991.

Figure 3.1: Profits achieved by Efic (Commercial account)

Note: From 1 July 2015, a Tax Equivalent charge of 30 per cent on accounting profit (in addition to an equivalent state tax that covers payroll and land tax) was introduced under competitive neutrality arrangements. This impacts on operating profit from 2015 onwards.

Source: ANAO analysis of Efic Annual Reports.

3.7 Subsection 55(1) of the Efic Act provides Efic with the ability to pay annual dividends to the Australian Government as approved by the Board. The declared dividend must not exceed Efic’s profit for that year (subsection 55(4)) (this is separate to any dividends which the Minister can direct Efic to pay in excess of profit under section 55A of the Efic Act). Since the enactment of the Efic Act in 1991, Efic has returned $307.6 million to the Commonwealth in the form of a dividend, with the first dividend paid in 1996. Figure 3.2 below shows the dividends returned to the Commonwealth by Efic since it began operations in 1991.

Figure 3.2: Dividend paid by Efic to the Commonwealth

Note: Excludes the special dividend paid in 2013 (see paragraph 2.1).

Source: ANAO analysis of Efic Annual Reports.

3.8 The Efic Act and Statement of Expectations do not include any specific targets in relation to profits, dividends or return on equity for Efic. The data at Figures 3.1 and 3.2 reflect that Efic is generating annual profits and returning dividends to government, however Table 3.1 indicates that Efic’s return on equity is lower than that of the major Australian Banks.40

Table 3.1: Return on Equity Comparison

|

Entity |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Efic |

10.9% |

5.5% |

2.6% |

2.6% |

3.1% |

|

Commonwealth Bank of Australia |

18.7% |

18.2% |

16.1% |

15.7% |

14.1% |

|

National Australia Bank |

11.6% |

14.8% |

14.3% |

14.0% |

11.7% |

|

ANZ Bank |

15.4% |

14.0% |

10.3% |

11.7% |

11.0% |

|

Westpac Bank |

16.4% |

15.8% |

14.0% |

13.8% |

13.0% |

Note: The fall in Efic’s return on equity ratio between 2014 and 2015 relates to the introduction of the Tax Equivalent charge of 30 per cent on accounting profit (in addition to an equivalent state tax that covers payroll and land tax) under competitive neutrality arrangements. This impacted on Efic’s operating profit from 2015 onwards.

Source: ANAO analysis of Efic, Commonwealth Bank of Australia, National Australia Bank, ANZ Bank and Westpac Bank Annual Reports.

3.9 Efic’s return on equity comparative to the major banks needs to be considered in the context of its obligation to operate in the market gap, fulfil community service obligations, and limitations on the product range it is able to offer. Noting this, Efic’s payment of dividends and that it is meeting the requirements under the Efic Act to generate sufficient reserves to sustain and expand its operations, on balance the evidence can support a view that Efic is operating on an appropriately commercial basis.

Balance between commerciality and government objectives

3.10 The Statement of Expectations states that Efic should:

Encourage banks and other financial institutions carrying on a business in Australia to finance, or assist in financing, export contracts or eligible export transactions.

3.11 In addressing this expectation, part of Efic’s role is to demonstrate that commercial returns are possible where Efic has supported a financially viable transaction that the private sector was unable, or unwilling, to support. This aims to ‘narrow the market gap’ and therefore have private financiers take on a greater range of financially viable export transactions.

3.12 It is noted that any activities by Efic to facilitate greater participation by the private sector in the financing of particular export transactions will necessarily involve Efic forfeiting the commercial returns which may have resulted from its own investment in the associated transactions.

3.13 Efic’s focus on commerciality can impact on decision making in this regard and limit Efic’s willingness to encourage Australian export trade.

3.14 In the 2012 Productivity Commission Inquiry: Australia’s Export Credit Arrangements (Productivity Commission review) it was noted that practically all Australian exports, by both volume and value, take place without the assistance of Government (including Efic). Although no reference was made to how Efic could or does support the growth of Australian export trade, it was observed that while Efic is supposed to operate in the market gap, most of Efic’s activities were directed at supporting larger businesses, and that there was no convincing evidence that a market gap exists for large businesses. Efic’s mandate was subsequently changed to focus its support on small businesses, which aligns with the Statement of Expectations from 2014 stating ‘The Government has decided to get the best out of Efic by having it focus support for SMEs seeking to expand their opportunities in overseas markets’.

3.15 The average value and term length of SME transactions in Efic’s portfolio is less than that of CSPF transactions. This means that unless substantial volumes of SME transactions are undertaken, the returns from SME products are not on par with those generated from CSPF transactions. On this basis, Efic is now placing a more formal focus on the pursuit of CSPF transactions, which was endorsed by the Efic Board in April 201841 in relation to the need to:

Grow the business within our current mandate (by being more focused and proactive and less concerned about volume and more about profitability).

3.16 Efic needs to be able to balance its requirement to operate commercially and be self-sustaining with its requirement to facilitate and encourage Australian export trade, and encourage banks and other financial institutions carrying on business in Australia to finance, or assist in financing, export contracts or eligible export transactions.

Does Efic effectively consult and engage with relevant stakeholders?

Efic engages effectively with government and external stakeholders to execute its mandate through activities closely overseen by responsible managers. Marketing campaigns and initiatives are used by Efic to extend knowledge of its support offering to exporters in new and existing industries. Efic proactively engages with export businesses to facilitate potential applications.

Stakeholder engagement plan

3.17 Efic has a stakeholder engagement plan, developed in December 2015. The Board is provided with semi-annual updates on activities against this plan.42

3.18 The stakeholder engagement plan identifies 11 main external stakeholders, including:

- SME clients;

- large corporate and sovereign clients;

- direct government relationships, including DFAT and relevant Ministers;

- central government agencies;

- government business services;

- government regulatory services;

- industry groups;

- professional associations;

- financial institutions;

- civil society organisations; and

- the media.

3.19 Efic employed a new Head of Marketing and External Relations in November 2018 who has been tasked with updating Efic’s stakeholder engagement plan.

Engagement with export businesses

3.20 Efic maintains a management structure for stakeholder engagement which has the objective of ensuring financial and service delivery functions are undertaken with close oversight by senior management. Staff in the respective functional teams (refer Figure 3.3 below) are responsible for maintaining quality in both operational delivery and in the delivery of support to export businesses.

3.21 Marketing campaigns and initiatives are used by Efic to extend knowledge of Efic’s support offering to exporters in new and existing industries. Efic undertakes marketing campaigns for specific industry areas and emerging markets each year (fashion, wine and SMEs were some of the areas that were the subject of marketing campaigns in 2018). However, the Marketing Team does not always obtain formal feedback in relation to the effectiveness of marketing campaigns or initiatives to improve future marketing efforts, and the rationale and strategy behind these campaigns is not fully apparent (and not substantively documented). Efic should consider assessing the effectiveness of its marketing campaigns and other initiatives to generate applications to ensure that its marketing is well-positioned and targeted to meet its objectives and mandate.