Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Design of the Energy Price Relief Plan

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Energy Price Relief Plan (the plan) was announced on 9 December 2022 and was designed to ‘shield Australian families and businesses from the worst impacts of predicted energy price spikes.’

- This audit provides assurance to Parliament on the effectiveness of the design of the plan.

Key facts

- The Department of the Treasury (Treasury) and the Department of Climate Change, Energy, the Environment and Water (DCCEEW) were the Australian Government entities leading the design of plan.

- In October 2022 the Australian Energy Regulator’s (AER) estimate for the Default Market Offer (DMO) 2023–24 was that retail electricity prices would increase by between 41 and 51 per cent for residential customers compared to the previous year. In May 2024 the AER’s final determination for DMO 2023–24 showed an increase of between 20.5 and 24.9 per cent.

What did we find?

- The design process for the plan was largely effective.

- The development of the plan was informed by sound policy advice.

- Arrangements established to support the implementation of the plan were largely effective.

- Arrangements to assess the achievement of outcomes for the plan are largely effective.

What did we recommend?

- There was one recommendation to Treasury relating to risk management arrangements. There were no recommendations to DCCEEW.

- Treasury agreed to the recommendation.

$3–3.5 bn

was the combined budget for the package of measures over five years.

5

measures made up the Energy Price Relief Plan.

38 days

between the government request for policy options and announcement of the plan.

Summary and recommendations

Background

1. In September 2022 the Australian Energy Regulator reported that over the course of 2022, the war in Ukraine resulted in price volatility and price hikes for energy on international markets.1 Due to the links between domestic and export markets this affected domestic customers and the wider economy. Simultaneously, domestic factors contributed to wholesale energy price increases.

2. The Department of the Treasury (Treasury) and the Department of Climate Change, Energy, the Environment and Water (DCCEEW) were lead entities in the development of policy options to seek to address energy price increases. On 9 December 2022, the Prime Minister, the Treasurer, and the Minister for Climate Change and Energy announced the Energy Price Relief Plan (the plan) — a package of measures designed to ‘shield Australian families and businesses from the worst impacts of predicted energy price spikes.’

Rationale for undertaking the audit

3. The budget for the package of measures under the Energy Price Relief Plan was estimated between $3 billion and $3.5 billion over five years. The government sought urgent advice on options to seek to address energy price increases.

4. The audit provides assurance to Parliament on whether the Energy Price Relief Plan was effectively designed and the effectiveness of planned frameworks for implementation and evaluation.

Audit objective and criteria

5. The objective of this audit was to assess the effectiveness of the design process for the Energy Price Relief Plan.

6. To form a conclusion against the objective, the following criteria were adopted.

- Was the development of the plan informed by sound policy advice?

- Was implementation effectively planned?

- Are the arrangements to assess the achievement of outcomes of the plan effective?

7. The audit did not assess:

- the design or implementation of the Capacity Investment Scheme which was also included in the 9 December 2022 announcement;

- the design of the Australian Domestic Gas Security Mechanism reforms agreed to by government in September 2022; or

- the implementation of the extension of the energy bill rebates announced in May 2024.

Conclusion

8. The design process for the Energy Price Relief Plan was largely effective. The design process could have been improved with earlier engagement with delivery agencies. The Energy Price Relief Plan would benefit from a plan to assess the achievement of outcomes.

9. The development of the Energy Price Relief Plan was informed by sound policy advice. Roles and responsibilities, relevant guidance and risk management processes were in place to support the development of the Energy Price Relief Plan. Benefits of policy options were assessed and were supported by evidence. During the design process industry stakeholders were consulted on the gas market interventions. Stakeholders within the APS were consulted in the development of policy options, except for: Services Australia; the Department of Infrastructure, Transport, Regional Development, Communications and the Arts (DITRDCA); and the Department of Veterans’ Affairs (DVA). Earlier engagement with APS delivery agencies would have improved the consideration of implementation within the policy advice provided to government. Treasury and DCCEEW did not document risks associated with rapid policy development and risk mitigation strategies. Activities that can assist in reducing risks were undertaken, including seeking expert advice, engaging industry stakeholders, and establishing fit-for-purpose governance and coordination arrangements.

10. Arrangements established to support implementation of the Energy Price Relief Plan were largely effective. Policy advice to government identified risks for all measures. Risks related to the Australian Domestic Gas Security Mechanism reforms were considered when the reforms were initially developed in 2022, however risks specific to bringing forward the commencement of the reforms were not incorporated with other risks included in policy advice. Treasury and DCCEEW monitored risks for three of the five measures — targeted electricity bill rebate, mandatory gas code of conduct, and coal price cap. The department responsible for the implementation of the targeted electricity bill rebate was not identified in policy advice provided to government in December 2022 and was not confirmed by government until August 2023. Treasury had not established a risk assessment and an implementation plan for the targeted electricity bill rebate and the gas price cap. Treasury’s progress reports to government on the targeted electricity bill relief included elements of implementation planning.

11. Arrangements to assess the achievement of outcomes for the Energy Price Relief Plan were largely effective. While activities to assess the achievement of outcomes for individual measures have been planned or undertaken, plans to assess the collective impacts of the five measures under the Energy Price Relief Plan were not established. Monitoring arrangements have been established for four of five measures and implemented — the Australian Domestic Gas Security Mechanism has not been activated. Treasury and DCCEEW have produced reporting on the collective impacts of select measures. DCCEEW has conducted a review of the coal price cap. Planning has commenced for reviews of the targeted electricity bill rebate, mandatory gas code of conduct and Australian Domestic Gas Security Mechanism.

Supporting findings

Development of the plan

12. Roles and responsibilities were defined for the development of policy options. Treasury and DCCEEW have largely relevant guidance on developing policy advice available for staff. The departments did not document risks, and associated mitigation strategies, related to policy development. Activities that may reduce risks were undertaken: Treasury and DCCEEW sought expert advice; the Australian Competition and Consumer Commission (ACCC) engaged with select industry stakeholders; and the Department of the Prime Minister and Cabinet (PM&C) established fit-for-purpose governance and coordination arrangements. (See paragraphs 2.3 to 2.19)

13. During the development of policy advice, APS stakeholders — except for Services Australia, DITRDCA and DVA — were engaged in the design of all measures. Select industry stakeholders were engaged on the gas market interventions prior to policy advice being provided to government. (See paragraphs 2.20 to 2.81)

14. Market modelling and data and advice from relevant government entities was used to support advice to government on policy options. Potential impacts of the proposed policy options included in policy advice were supported by evidence. Treasury and DCCEEW’s impact analysis included an assessment of regulatory burden costs and benefits for three measures — gas price cap, mandatory gas code of conduct and bringing forward the commencement of the Australian Domestic Gas Security Mechanism reforms. While DCCEEW had undertaken a preliminary assessment, an impact analysis was not undertaken for the remaining two measures — targeted electricity bill rebate and coal price cap. (See paragraphs 2.82 to 2.94)

Planning for implementation

15. Advice to government identified risks for four of the five measures. Risks related to the Australian Domestic Gas Security Mechanism reforms were considered as part of an earlier impact assessment process and specific risks related to bringing forward the commencement of the reforms were not highlighted in policy advice. Advice did not document the risk that payments may be made to ineligible recipients under the targeted electricity bill rebate measure. DCCEEW undertook risk assessments for two of the five measures — the mandatory gas code of conduct and the coal price cap. Risks were monitored for three of the four measures led by Treasury and DCCEEW — the targeted electricity bill rebate, mandatory gas code of conduct, and coal price cap. Risk reporting was undertaken by Treasury for the targeted electricity bill rebate and by DCCEEW for the mandatory gas code of conduct. Risks related to the gas price cap and coal price cap measures were not reported. (See paragraphs 3.3 to 3.16)

16. Advice to government included information on implementation of all five measures under the plan. Policy advice on the targeted electricity bill rebate and the coal price cap measures did not identify which department would be responsible for implementation. Implementation plans were established for three measures — mandatory gas code of conduct, coal price cap and bringing forward the commencement of the Australian Domestic Gas Security Mechanism reforms. Implementation planning activities were undertaken for the remaining two measures. For the targeted electricity bill rebate, Treasury had not established an implementation plan. Elements of implementation planning were included within progress reports provided to government. Implementation planning was discussed in governance meetings co-chaired by Treasury and Services Australia. (See paragraphs 3.17 to 3.38)

Monitoring and assessing the achievement of outcomes

17. Subsequent to the announcement of the Energy Price Relief Plan in December 2022, oversight and monitoring frameworks have been established and implemented for four of five measures — the Australian Domestic Gas Security Mechanism has not been activated and therefore monitoring arrangements have not been implemented. Monitoring activities are being undertaken in accordance with the frameworks which have been established. (See paragraphs 4.3 to 4.29)

18. Treasury and DCCEEW outlined the objectives and estimated impacts of the Energy Price Relief Plan. Plans to assess the collective impacts of the five measures under the plan were not established. Entities have developed plans to assess the achievement of outcomes for the individual measures, except for the gas price cap. Treasury and DCCEEW have reported collective impacts of the Energy Price Relief Plan and DCCEEW has conducted a review of the New South Wales coal price cap. Statutory reviews of the mandatory gas code of conduct and the Australian Domestic Gas Security Mechanism reforms are due to be undertaken during 2025. (See paragraphs 4.30 to 4.70)

Recommendations

Recommendation no. 1

Paragraph 3.16

The Department of the Treasury develop risk management guidance for staff where Treasury is the lead agency for a policy, including for managing risks identified in policy advice.

Department of the Treasury response: Agreed.

Summary of entity responses

19. The proposed report was provided to the Department of the Treasury and the Department of Climate Change, Energy, the Environment and Water. Extracts of the proposed report were provided to the ACCC, AER, DVA, Services Australia, DITRDCA, DISR, and PM&C.

20. Treasury, DCCEEW, the AER and DISR provided summary responses and these are below. Full responses from these entities are included at Appendix 1.

Department of the Treasury

Treasury welcomes the report, in particular the reflection that the policy was based on sound advice and that both policy and implementation development were largely effective to achieve the desired policy outcomes. Treasury also welcomes the report’s key messages, especially regarding the need to adapt risk appetite to short timeframes and urgent delivery. This aligns with Treasury’s risk management policy, noting our higher appetite for risk in these circumstances while still balancing potential consequences.

Treasury agrees with the recommendation presented in the report. Treasury accepts the ANAO’s evidence regarding the risk assessments and implementation planning during the development of the Energy Price Relief Plan. Treasury considers the recommendation recognises the ANAO’s findings and Treasury acknowledges it could develop guidance on how the risk management framework should be applied in situations where timeframes are short and delivery is urgent.

Treasury has engaged an external review of the implementation of the first round of the Energy Bill Relief Fund and will leverage findings from this review in drafting further risk management guidance.

Department of Climate Change, Energy, the Environment and Water

The Department of Climate Change, Energy, the Environment and Water (the department) welcomes the ANAO report and the conclusion that the design process for the Energy Price Relief Plan was largely effective, with no recommendations made for the department.

The Government’s Energy Price Relief Plan was a package of measures developed to shield Australian families and businesses from the worst impacts of predicted energy price spikes. This rapid policy development occurred within complex electricity and gas markets and required engagement across multiple agencies and other parties during its development and implementation.

The ANAO’s observations including areas of improvement applicable in the unique setting of rapid policy development are valuable insights that will inform and influence the department’s continual improvement practices in stakeholder engagement and program governance.

Australian Energy Regulator

The AER was provided with extracts from the proposed report.

The AER notes that there are no findings or recommendations relating to the AER.

The AER notes the contents of the report, including the key messages. The key messages reflect the experience and approach of the AER.

Department of Industry, Science and Resources

The Department of Industry, Science, and Resources (the department) acknowledges the Australian National Audit Office’s proposed audit report on the Design of the Energy Price Relief Plan.

The department acknowledges the report’s key findings on policy design, governance and risk management. The department strives to achieve meaningful stakeholder engagement to ensure feedback is accounted for in policy design. In the design and implementation of the Australian Domestic Gas Security Mechanism (ADGSM) reforms, two public consultation processes were conducted – on the design of policy and on the draft guidelines – to inform the development of effective policy that contributes to the delivery of positive outcomes for our stakeholders.

The department is committed to establishing and improving robust governance and risk management practices, and notes these principles are particularly important when designing and implementing policy initiatives in constrained timeframes.

Key messages from this audit for all Australian Government entities

21. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Policy design

Governance and risk management

1. Background

Introduction

1.1 Energy supply begins with electricity and gas being generated or produced to be sold in wholesale markets. Energy retailers buy electricity and gas in the wholesale markets, and then bundle it with transportation services of transmission and distribution networks to sell to end-use customers. The transport of electricity from generators to consumers is facilitated through a ‘pool’, or spot market, where the output from all generators is aggregated and scheduled at five-minute intervals to meet demand.2

1.2 The retail energy markets allow retailers to supply and sell electricity, gas and energy services to residential and business customers. Retail electricity and gas prices are comprised of costs relating to wholesale, network, retail and environmental schemes, as well as the retailer’s margin.

1.3 Gas prices impact the prices of other fuel sources, including coal. Gas is usually the highest priced generation source in the spot market, and is most likely to be used when demand is high.3

1.4 Over the course of 2022, events in Ukraine resulted in price volatility and price hikes for energy on international markets.4 During 2022 wholesale prices for energy increased in Australia due to the links between domestic and export markets, which affected domestic customers and the wider economy.5

1.5 The October 2022–23 Federal Budget noted further domestic causes for wholesale energy price increases as ‘temporary domestic electricity market disruptions exacerbated by ageing generation assets and inadequate policy certainty to support investment in new energy infrastructure.’

1.6 The October 2022–23 Federal Budget included the Department of the Treasury’s (Treasury) expectation that:

- retail electricity prices would ‘increase by average of 20 per cent nationally in late 2022’ and ‘by a further 20 per cent in 2023–24’; and

- retail gas price would increase ‘by up to 20 per cent in both 2022–23 and 2023–24’.

1.7 In October 2022 the Australian Energy Regulator’s (AER) estimate for the setting of the Default Market Offer (DMO)6 2023–24 was that retail electricity prices would increase by between 41 and 51 per cent compared to the previous year. In May 2023 the AER’s release of the final determination of the DMO 2023–24 showed an increase of between 20.5 and 24.9 per cent for residential customers compared to the previous year.

Energy Price Relief Plan

1.8 On 9 December 2022 the Prime Minister, the Treasurer, and the Minister for Climate Change and Energy announced a package of measures designed to ‘shield Australian families and businesses from the worst impacts of predicted energy price spikes.’7 This package of measures was referred to as the Energy Price Relief Plan (the plan). These measures are outlined in Table 1.1.

Table 1.1: Measures within the Energy Price Relief Plan

|

Measure |

Description |

|

Targeted electricity bill rebate |

Targeted electricity bill rebates to eligible households and small businesses facilitated through agreements with state and territory governments. The rebate was delivered through electricity retailers and applied to household and small business electricity bills. |

|

Gas price cap |

A 12 month emergency cap, an upper limit, on gas prices at $12 per gigajoulea applied to new domestic wholesale gas market contracts by east coast producers.b |

|

Mandatory gas code of conduct |

Codes of conduct provide a set of rules or minimum standards for an industry, which cover the relationship between industry participants and their customers. To support the limit on gas prices and administer the measure, the Competition and Consumer (Gas Market Code) Regulations 2023 were introduced, to ensure adequate supply of wholesale gas to the domestic market at reasonable prices and terms.c |

|

Coal price cap |

Introduction of an upper limit on the price of coal used for electricity generation to $125 per tonne in New South Wales and Queensland. A rebate to generators was implemented to cap the amount an electricity generator spends on coal for its electricity generation. |

|

Bringing forward commencement of Australian Domestic Gas Security Mechanism (ADGSM) reforms |

Reforms to the ADGSM which included:

In the October 2022–23 Federal Budget the government announced the reforms to the ADGSM, which were to commence in mid-2023. Commencement of the reforms was brought forward to be in place by 1 April 2023 as part of the Energy Price Relief Plan. |

Note a: A joule is the unit used to measure energy. A gigajoule equals one billion joules.

Note b: The gas price cap applied in all states and territories apart from Western Australia and the Northern Territory.

Note c: The Gas Market Code applies in all states and territories, apart from Western Australia as it is physically separated from the east coast regulated market.

Source: ANAO summary of public documentation.

1.9 The gas price cap, mandatory gas code of conduct, coal price cap, and bringing forward commencement of reforms to the ADGSM were intended to impact prices in wholesale markets. The targeted electricity bill rebate was intended to impact retail electricity bills.

1.10 The May 2023–24 Federal Budget included the following funding details in relation to the Energy Price Relief Plan:

- $1.5 billion over two years from 2023–24 for targeted electricity bill rebates8;

- $14.7 million over 5 years from 2022–23 (and $2.7 million per year ongoing) to the Australian Competition and Consumer Commission (ACCC) for administering and enforcing compliance with the gas price cap and the mandatory gas code of conduct9;

- $9.5 million over 3 years from 2022–23 for the AER10 to monitor coal and gas markets across the National Electricity Market11;

- $0.4 million in 2022–23 to accelerate the reforms to the Australian Domestic Gas Security mechanism12, and

- an estimate ‘not for publication (nfp) due to commercial sensitivities’ for the coal price cap.

1.11 In August 2023 the Department of Climate Change, Energy, the Environment, Water (DCCEEW) briefed the Minister for Climate Change and Energy that initial estimates for the costs of rebates were between $1.5 billion to $2 billion.

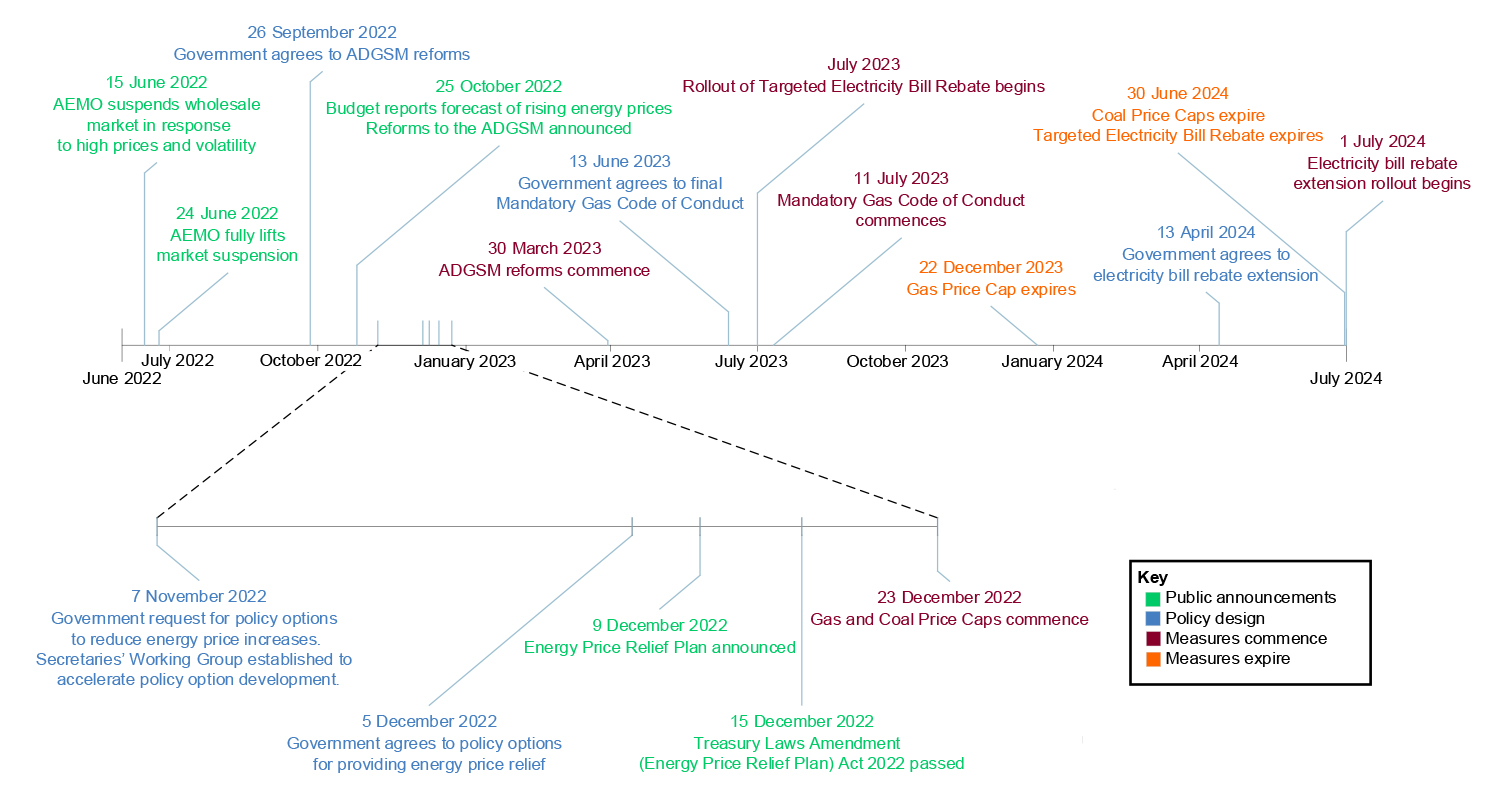

1.12 A timeline of key events in relation to the measures, including commencement and expiry of measures, is available at Figure 1.1. The gas price cap and the coal price cap were required to be implemented soon after the announcement of the Energy Price Relief Plan to have an impact on the DMO.13 The price caps were complemented by the other three measures — targeted electricity bill rebates, mandatory gas code of conduct and the bringing forward of the Australian Domestic Gas Security Mechanism. Legislative and governance frameworks that support the Energy Price Relief Plan measures are listed at Appendix 3.

Figure 1.1: Timeline of events in relation to the Energy Price Relief Plan

Source: ANAO analysis.

Targeted electricity bill rebate

1.13 The Commonwealth Government agreed to co-fund the final rebate with state and territory governments, and payments were administered through electricity retailers as a deduction from electricity bills.

1.14 In March 2023, 5.1 million households and small businesses were expected to be eligible to receive the rebate. These recipients and the rebate amount are outlined in Table 1.2.

Table 1.2: Targeted electricity bill rebate recipients and the rebate amount as at April 2023

|

Recipients |

Rebate amount contributed by the Commonwealth Government ($) |

Estimated number of eligible recipients at March 2023 |

|

Households located in New South Wales, Victoria, Queensland, South Australia and Tasmania |

250 |

4.5 million households |

|

Households located in Western Australia, Northern Territory and the Australian Capital Territory |

175 |

0.6 million households |

|

Eligible small businesses |

325 |

1 million small businesses |

Source: ANAO analysis of entity documentation.

1.15 In September 2023 the targeted electricity bill rebate was extended to the non-self-governing territories, which included 2,243 households and 265 businesses, and provided:

- $500 per household in Norfolk Island and Jervis Bay Territory;

- $350 per household in the Indian Ocean Territories of Christmas Island and Cocos (Keeling) Islands; and

- $650 per business in all non-self-governing territories.

Gas price cap

1.16 On 22 December 2022 the acting Treasurer issued a Gas Market Emergency Price Order under the Competition and Consumer Act 2010, capping the price of wholesale gas at $12 per gigajoule for a period of 12 months. The gas price cap came into effect on 23 December 2022 and expired on 22 December 2023.

Mandatory gas code of conduct

1.17 To support the implementation of the mandatory gas code of conduct measure, on 11 July 2023 the Competition and Consumer (Gas Market Code) Regulations 2023 (Gas Market Code) commenced. The Gas Market Code is mandatory and builds on the previously existing voluntary code of conduct for the gas industry.14 The Gas Market Code included:

- a reasonable price for regulated gas, in the form of a price cap set at $12 per gigajoule, which supersedes the 12-month emergency gas price cap;

- a framework for gas producers to seek exemptions from the price cap in return for specified conditions, including enforceable commitments for additional domestic supply;

- transparency and conduct obligations for gas market negotiations to increase the visibility of the amount of uncontracted gas to be produced;

- conduct provisions to establish process standards for commercial negotiations; and

- a requirement for a review of its operation be undertaken no later than 1 July 2025.

Coal price cap

1.18 In December 2022 the Commonwealth Government reached an agreement with the New South Wales and Queensland state governments to implement a cap of $125 per tonne on coal produced in each state, with costs to be shared equally with between the Commonwealth Government and state governments.

1.19 On 21 December 2022 legislation to implement this change was passed in New South Wales. On 23 December 2022 the New South Wales Minister for Energy issued directions to coal mines and power stations to impose the price cap. In late December 2022 the Queensland Government used existing powers to direct state-owned coal generators to implement the price cap. The coal price cap expired on 30 June 2024.

Bringing forward commencement of Australian Domestic Gas Security Mechanism reforms

1.20 The Australian Domestic Gas Security Mechanism (ADGSM) commenced on 1 July 2017. The ADGSM is intended to ensure there is sufficient gas supply to meet the needs of Australian energy users and allows the Minister for Resources to limit gas exports if a gas supply shortfall is forecast.

1.21 In the October 2022–23 Federal Budget the government announced funding to implement reforms to the ADGSM, including enabling the decision to activate the ADGSM to be made quarterly rather than annually. In December 2022 government agreed to bring forward the commencement of these reforms as part of the Energy Price Relief Plan. The reforms came into effect on 30 March 2023.

Roles and responsibilities across Energy Price Relief Plan measures

1.22 DCCEEW is responsible for matters relating to energy policy and the national energy market including electricity, gas and liquid fuels.15

1.23 Treasury is the Australian Government’s lead economic adviser. Its role is to anticipate and analyse policy issues with a whole-of-government perspective, including providing economic analysis and policy advice on matters such as the economy, budget, taxation, the financial sector, foreign investment, structural policy, superannuation, small business, housing affordability and international economic policy.16

1.24 The Department of Industry, Science and Resources (DISR) is responsible for matters relating to the resources sector, including Australia’s role as an energy supplier to overseas markets and the role of gas in Australia’s transition to net zero.17

1.25 The Australian Competition and Consumer Commission (ACCC) is an independent Commonwealth statutory authority responsible for enforcing the Competition and Consumer Act 2010 and other legislation, promoting competition and fair trading, and regulating national infrastructure.18

1.26 The Australian Government entities involved in the design, establishment and ongoing monitoring of each measure are outlined at Table 1.3.

Table 1.3: Australian Government entities involved in the Energy Price Relief Plan

|

Measure |

Design of policy options (prior to announcement) |

Establishment of the measure |

Monitoring and administration |

|

Targeted electricity bill rebate |

Treasury and DCCEEWa |

Treasuryb |

Treasury |

|

Gas price cap |

ACCC |

Treasury |

ACCC |

|

Mandatory gas code of conduct |

ACCC |

Treasury and DCCEEW |

ACCCc |

|

Coal price cap |

DCCEEW |

DCCEEW |

DCCEEWd |

|

Bringing forward commencement of reforms to the ADGSM |

DISR |

DISR |

DISR |

Note a: On 12 August 2024 DCCEEW advised the ANAO that Treasury were involved in the design to include eligibility criteria. On 12 August 2024 Treasury advised the ANAO that DCCEEW had developed the policy option.

Note b: Services Australia, the Department of Veterans’ Affairs, and the Department of Infrastructure, Transport, Regional Development, Communications and the Arts contributed work to the implementation of the bill rebate.

Note c: Other entities — DCCEEW, DISR, ACCC and Treasury — have administrative functions under the Gas Market Code, such as supporting the operation of the exemptions framework.

Note d: AER is the appointed regulator for the coal price cap in New South Wales. Treasury processes payments from Commonwealth Government to New South Wales and Queensland governments as part of federation funding agreement schedules.

Source: Advice provided to the ANAO from entities and ANAO analysis of entity documentation.

Extension of electricity bill rebates in 2024

1.27 In the 2024–25 Federal Budget the government announced that the targeted electricity bill rebate would be extended in time over three years from 2023–24, costed at $3.5 billion. The May 2024 announcement included that eligibility for the electricity bill rebate would be expanded, providing for all households a $300 credit and $325 credit for around one million small businesses, to apply to electricity bills over 2024–25.

Rationale for undertaking the audit

1.28 The estimated budget for the package of measures under the Energy Price Relief Plan was between $3 billion and $3.5 billion over five years. The government sought urgent advice on options to seek to address energy price increases.

1.29 The audit provides assurance to Parliament on whether the Energy Price Relief Plan was effectively designed and the effectiveness of planned frameworks for implementation and evaluation.

Audit approach

Audit objective, criteria and scope

1.30 The objective of this audit was to assess the effectiveness of the design process for the Energy Price Relief Plan.

1.31 To form a conclusion against the objective, the following criteria were adopted.

- Was the development of the plan informed by sound policy advice?

- Was implementation effectively planned?

- Are the arrangements to assess the achievement of outcomes of the plan effective?

1.32 The audit did not assess:

- the design or implementation of the Capacity Investment Scheme19 which was also included in the 9 December 2022 announcement;

- the design of the Australian Domestic Gas Security Mechanism reforms agreed to by government in September 2022; or

- the implementation of the extension of the energy bill rebates announced in May 2024.

Audit methodology

1.33 The audit methodology included:

- examination of entities’ records relating to the design and implementation of measures under the Energy Price Relief Plan;

- meetings with relevant departmental staff from Treasury and DCCEEW; and

- meetings with the ACCC; AER; DISR; Services Australia; the Department of Infrastructure, Transport, Regional Development, Communications and the Arts; the Department of the Prime Minster and Cabinet; and the Department of Veterans’ Affairs to discuss the measures that they were involved in designing and administering.

1.34 The audit team received nine public submissions.

1.35 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $514,000.

1.36 The team members for this audit were Chayathri Kulatunge, Lorcan Stevens, Marcus Newberry, Jacqueline Hedditch and Corinne Horton.

2. Development of the plan

Areas examined

This chapter examines whether the development of the Energy Price Relief Plan (the plan) was informed by sound policy advice.

Conclusion

The development of the Energy Price Relief Plan was informed by sound policy advice. Roles and responsibilities, relevant guidance and risk management processes were in place to support the development of the Energy Price Relief Plan. Benefits of policy options were assessed and were supported by evidence. During the design process industry stakeholders were consulted on the gas market interventions. Stakeholders within the APS were consulted in the development of policy options, except for: Services Australia; the Department of Infrastructure, Transport, Regional Development, Communications and the Arts (DITRDCA); and the Department of Veterans’ Affairs (DVA). Earlier engagement with APS delivery agencies would have improved the consideration of implementation within the policy advice provided to government. The Department of the Treasury (Treasury) and the Department of Climate Change, Energy, the Environment, Water (DCCEEW) did not document risks associated with rapid policy development and risk mitigation strategies. Activities that can assist in reducing risks were undertaken, including seeking expert advice, engaging industry stakeholders, and establishing fit-for-purpose governance and coordination arrangements.

Areas for improvement

The ANAO suggested that Treasury and DCCEEW consider developing an approach to consulting delivery agencies during the design process. The ANAO also suggested that Treasury and DCCEEW document risk mitigation strategies for rapid policy development.

2.1 The Australian Government’s Delivering Great Policy model20 sets out when entities provide policy advice, entities:

- clearly define the intent of a proposed policy, the benefits and impacts;

- demonstrate the best option using evidence, including informing policy through quantitative and qualitative evidence and considering the wider context the proposed policy will exist within; and

- involve key stakeholders within and outside the APS to ensure that government initiatives are reflective of diverse views and have broad support.

2.2 The Commonwealth Risk Management Policy21 requires that risk management is embedded into the decision-making activities of the entity, including policy design.

Were appropriate roles and responsibilities, guidance and risk management processes established to support the development of the plan?

Roles and responsibilities were defined for the development of policy options. Treasury and DCCEEW have largely relevant guidance on developing policy advice available for staff. The departments did not document risks, and associated mitigation strategies, related to policy development. Activities that may reduce risks were undertaken: Treasury and DCCEEW sought expert advice; the Australian Competition and Consumer Commission (ACCC) engaged with select industry stakeholders; and the Department of the Prime Minister and Cabinet (PM&C) established fit-for-purpose governance and coordination arrangements.

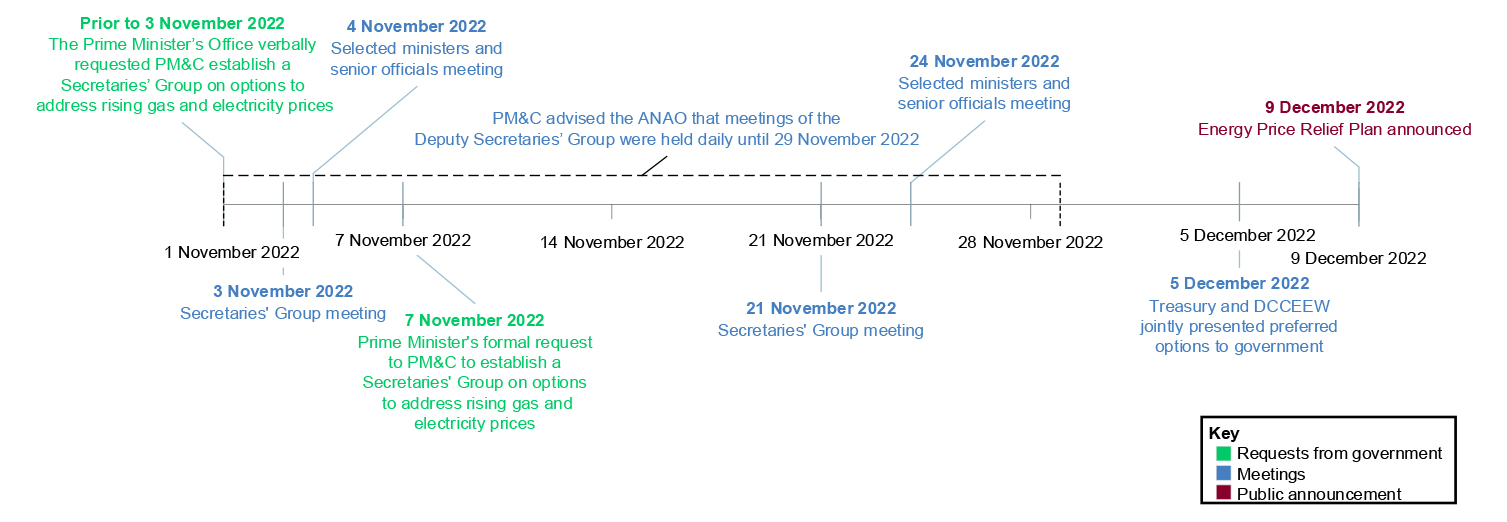

Roles and responsibilities for the development of policy options

2.3 On 7 November 2022 the Prime Minister formally requested the Secretary of PM&C establish a Secretaries’ Group on options to address rising gas and electricity prices.22 The Secretaries’ Group was to develop policy options for consideration by government in December 2022, following consultation with relevant ministers in late November 2022. The Prime Minister requested that policy options could commence from as early as 1 January 2023.

2.4 The Secretaries’ Group included the Secretaries of the following departments:

- PM&C (Chair);

- Department of the Treasury (Treasury) (Deputy Chair);

- Department of Finance (Finance);

- Department of Industry, Science and Resources (DISR); and

- Department of Climate Change, Energy, the Environment and Water (DCCEEW).

2.5 Secretaries were to be supported by senior officials from the ACCC, Australian Energy Market Operator (AEMO)23 and the Australian Energy Regulator (AER). The Secretaries’ Group met twice, on 3 and 21 November 202224 (Figure 2.1). Key outputs from the group were draft policy options and advice.

Figure 2.1: Key meetings during the development of policy options

Source: ANAO analysis.

2.6 The Terms of Reference for the Secretaries’ Group defined Treasury, DCCEEW and DISR as lead entities for developing preliminary policy options to mitigate the impact of high energy prices.25

2.7 In November 2022 Treasury and DCCEEW developed 20 preliminary policy options, which included both short-term and longer-term options. On 5 December 2022 Treasury and DCCEEW jointly presented preferred options to government.

2.8 A Deputy Secretaries’ Group was also formed as the primary means of coordinating work across agencies and was to meet daily.26 In June 2024, PM&C advised the ANAO that meetings of the Deputy Secretaries’ Group ‘were held daily during the busiest period in the policy development process’ between 1 and 29 November 2022.

2.9 Two meetings of selected ministers and senior officials were held on 4 and 24 November 2022. The meetings were designed to present ministers with progressively more detailed policy options. Overviews of outcomes from meetings were shared with Treasury, DCCEEW, DISR, the Department of Finance and the Department of Foreign Affairs and Trade.

Guidance materials for developing policy advice

2.10 As at September 2024 content on Treasury’s and DCCEEW’s intranet webpages contained links to PM&C’s Cabinet Handbook27, which includes guidance on providing policy advice to government. Treasury’s intranet linked to guidance materials from the Office of Impact Analysis (OIA). DCCEEW’s intranet linked to the Department of Finance’s Budget Process Operational Rules28, which sets out processes for developing policy options. DCCEEW established a checklist, template and internal guidance on the process and content required in drafting policy advice, which were available via the department’s intranet and were not marked as mandatory for staff to follow.

2.11 As at September 2024, learning modules on the Delivering Great Policy model and on basic economic principles needed in applications to policy were available to Treasury staff. Training on the Australian Government budget process was available to DCCEEW staff.

2.12 Economic modelling and analysis informed policy advice that was provided to government in December 2022. At the time policy options were being developed in November and December 2022, Treasury and DCCEEW had guidance material on economic modelling and analysis in November 2022 — such guidance was not readily available via the departments’ intranet.

2.13 Treasury and DCCEEW have not established guidance for staff that may be involved in rapid policy development processes.

Risk management arrangements for the development of policy options

2.14 Treasury’s July 2022 risk management framework specifies a risk category for policy advice and analysis, which includes risk to the ‘ability to provide quality, timely, influential, and accurate policy advice, and analysis.’ Treasury’s risk tolerance guide states that it has a ‘low risk tolerance for not delivering influential advice and analysis and not cooperating with our stakeholders.’

2.15 In August 2022 DCCEEW’s Executive Board29 approved the enterprise risk management frameworks and policies of the former Department of Agriculture, Water and the Environment, and Department of Industry, Science, Energy and Resources for use as interim risk management arrangements ‘in parallel’.30 The Department of Industry, Science, Energy and Resources’ Risk Management Framework 2021 outlined a lower tolerance that its ‘advice will be considered irrelevant, inaccurate or poorly informed’, as well as for ‘failing to keep government and our ministers informed and prepared’.

2.16 Activities that were conducted by APS entities that may assist in reducing risks during rapid policy development included the following.

- Treasury and DCCEEW sought expert implementation advice and experience during the policy development and adjusted the policy options as necessary. For instance, the AER and the AEMO provided advice to the departments and to government in relation to the policy options. (See paragraph 2.30).

- The ACCC engaged with select industry stakeholders to inform its advice to Treasury on the gas market interventions. Engaging stakeholders can identify risks and opportunities for policy development. (See paragraph 2.28).

- PM&C established fit-for-purpose governance and coordination arrangements through the Secretaries’ Group and Deputy Secretaries’ Group, with clearly defined roles and responsibilities. Reporting on the development of policy options was provided to selected ministers and senior officials to assist government decision-making. Senior APS officials were involved in the development of policy options. (See paragraphs 2.3 to 2.9).

- Treasury and DCCEEW mobilised necessary skills and knowledge within each department.

2.17 Within Treasury a project taskforce was established, which was sponsored by the relevant Deputy Secretary. DCCEEW held ‘daily stand-up meetings’ to provide status updates on matters, including with the relevant Deputy Secretary. In April 2024 DCCEEW advised the ANAO that such meetings were attended by officers, senior executive and subject matter experts from across the department. In August 2024, DCCEEW advised the ANAO that subject matter experts from the AEMO and the AER also attended daily meetings to provide input into the design process as relevant.

2.18 Treasury and DCCEEW did not document identification of challenges and risks to rapid policy development, mitigation strategies and did not establish the risk appetite. Rapid policy development may require a different risk appetite and risk mitigation strategies to those adopted in more normal times.31

Opportunity for improvement

2.19 Treasury and DCCEEW document risk mitigation strategies for rapid policy development.

Was appropriate stakeholder consultation undertaken?

During the development of policy advice, APS stakeholders — except for Services Australia, DITRDCA and DVA — were engaged in the design of all measures. Select industry stakeholders were engaged on the gas market interventions prior to policy advice being provided to government.

2.20 Making ‘practical to implement policy’ entails collaborating with implementers early and evaluating policy options with input from implementers and end users. The Australian Public Service Commission’s guidance on ‘getting stakeholder engagement right’ includes developing a system for recording and incorporating stakeholder feedback into deliverables and providing updates to stakeholders on consultation findings.32

2.21 Treasury’s program management framework states ‘Effective stakeholder management and engagement can identify risks, and opportunities for program development and delivery.’ The program management framework contains tools and templates for stakeholder management and engagement, including a communications plan, stakeholder engagement plan, stakeholder analysis matrix, and a stakeholder feedback tracker.

2.22 DCCEEW’s business planning toolkit includes guidance on understanding relationships with key stakeholders. The tool is designed to assist staff in analysing the expectations of key stakeholders and the implications for strategy, and to help develop a clear understanding of how key stakeholders present challenges, opportunities and risks to strategy and how to work with stakeholders. DCCEEW’s project management intranet page includes a link to the Australian Public Service Commission’s guidance on stakeholder engagement as ‘other things to consider’.

2.23 Through the terms of reference for the Secretaries’ Working Group (see paragraphs 2.3 to 2.7) Secretaries were required to, among other things, engage in confidence with key stakeholders including to ensure the workability of options under consideration.

Stakeholder consultation prior to providing policy advice to government in December 2022

2.24 In December 2022 Treasury and DCCEEW developed an impact analysis33, which covered three of the five measures — the gas price cap, mandatory gas code of conduct, and bringing forward the commencement of Australian Domestic Gas Security Mechanism reforms (see paragraph 2.89). The policy options were developed through consultation within government and in targeted industry discussions.

2.25 The impact analysis set out that:

The market sensitivities associated with the measures considered in this Impact Analysis, as well as the urgency in which they need to be developed and implemented reduced the viability of extensive, public consultation on specific options for Government action thus far. There will however be future opportunity to consult stakeholders prior to the implementation of some of the options highlighted.

2.26 The impact analysis identified stakeholder groups, their impact on energy price relief options, and the potential impacts of the policy options on each stakeholder group.34

2.27 Table 2.1 outlines consultation activities that occurred before policy advice was provided to government in December 2022, within and outside the APS.

Table 2.1: Consultation before policy options were provided to government in December 2022, by measure

|

Energy Price Relief Plan measures |

Consultation activities before policy advice was provided to government |

|

|

|

Outside APS |

Within APSa |

|

Targeted electricity bill rebate |

No |

Yesb |

|

Gas price cap |

Yes |

Yes |

|

Mandatory gas code of conduct |

Yes |

Yes |

|

Coal price cap |

No |

Yesc |

|

Bringing forward commencement of Australian Domestic Gas Security Mechanism reforms |

No |

Yes |

Note a: A forum for consultation within the APS was the Secretaries’ and Deputy Secretaries’ groups (see paragraph 2.3 to 2.8).

Note b: In December 2022 the AER estimated the amount required to compensate customers for some or all of the projected price rises for the targeted electricity bill rebate measure. Key implementation partners — Services Australia, DVA and DITRDCA — were not consulted until after policy advice was provided to government in December 2022.

Note c: DCCEEW’s consultation activities included the engagement of two external consultants (see paragraph 2.30).

Source: ANAO analysis of entity documentation.

2.28 For two of the five measures, stakeholder consultation was undertaken outside the APS — the gas price cap and mandatory gas code of conduct. On 22 October 2022 the Treasurer requested the ACCC work with Treasury to develop advice by mid-November 2022 on options to improve the functioning of the east coast gas market, including a mandatory code of conduct and consideration of a reasonable price. Between 31 October and 8 November 2022, the ACCC met with eight industry stakeholders — three of the eight meetings were also attended by DISR. On 11 November 2022 the ACCC Chair provided advice to the Treasurer, following which a summary of the ACCC’s advice was published on Treasury’s website.35

2.29 The impact analysis noted that earlier consultations had been held on the reforms to the Australian Domestic Gas Security Mechanism and that:

stakeholder consultation on the design of the ADGSM reforms before implementation will also be necessary to avoid early design flaws and any unintended consequences with other options to provide energy price relief.

2.30 Within the APS, consultation with most stakeholders was undertaken for the five measures.

- Targeted electricity bill rebate — during November and December 2022 the Australian Energy Regulator (AER) estimated the amount required to compensate customers for some or all of the electricity price rises projected in scenarios based on from inputs and assumptions provided by DCCEEW. APS delivery agencies were not consulted during the design process (see paragraph 2.34).

- Gas price cap and mandatory gas code of conduct — in November 2022 APS entities — including AEMO, AER, DISR, and the Attorney-General’s Department — provided comments to Treasury on the policy options for the gas market interventions. On 28 November 2022 AEMO provided DCCEEW with considerations on the gas price cap.

- Coal price cap — in December 2022 the AER provided advice on the potential impact of the coal price cap on the Default Market Offer outcomes (see Appendix 4). To inform advice to government DCCEEW worked with the AER and had engaged two external consultants, Ernst & Young36 and ACIL Allen37, to provide expert advice on electricity market analysis and economic modelling (see Appendix 4). The external consultants signed deeds of confidentiality.

- Bringing forward the commencement of the Australian Domestic Gas Security Mechanism reforms — DISR provided the policy advice on the measure. In November 2022 DISR received feedback from the Department of Home Affairs38 on the drafting of amendments to the Customs (Prohibited Exports) Regulations 1958. The December 2022 impact analysis identified key stakeholders (see paragraph 2.26) and stated that the government was consulting with companies subject to the Australian Domestic Gas Security Mechanism regulations, as well as consulting with market advisory bodies on reform implementation.

Targeted electricity bill rebate

2.31 The December 2022 policy advice to government noted that targeted households and small businesses, electricity retailers, as well as state and territory governments would be affected by the policy option. The rebate was to be delivered through electricity retailers. Unlike the state and territory governments, the Commonwealth Government did not have existing administrative arrangements with electricity retailers. Therefore, the targeted electricity bill rebate was designed to be delivered by state and territory governments, with costs to be reimbursed by the Commonwealth Government through federation funding agreement schedules.39

2.32 The design of the targeted electricity bill rebate did not identify arrangements for the following as recipients of the rebate:

- hardship customers40 — policy advice to government in April 2024 on the extended targeted energy bill rebate included the expansion of the bill rebate to 100,000 hardship customers; and

- non-self-governing territories41 (see paragraph 2.58).

2.33 On 27 August 2024 DCCEEW advised the ANAO that the hardship customer cohort was identified and considered in the design of the 2023–24 round of the targeted electricity bill rebate, and that the decision was made to use the concessions framework42, including for the following reasons:

- ‘the bill rebate was designed around systems already in place and systems that had documentation around concession holders for states and territories’; and

- ‘in the very short timeframe available … creating new structures based on hardship status could have jeopardised delivery’.

2.34 In the development of policy advice, Treasury and DCCEEW did not consult delivery agencies — Services Australia, DVA and the DITRDCA.43 After the announcement the three delivery APS agencies contacted Treasury (see paragraphs 2.50, 2.56 and 2.58). The rebate was delivered through electricity retailers and applied to household and small business electricity bills. To deliver the rebate to households, electricity providers needed to know whether customers were eligible for the rebate.

- To deliver the rebates to households considered as part of an ‘expanded cohort’, customers were required to share their consent for their nominated electricity provider to check their concession status for eligibility. Services Australia became the initial point of contact to collect consent from customers and share confirmation of customers’ eligibility with the customers’ nominated electricity provider (see paragraphs 2.50 to 2.54).

- The involvement of DVA identified that 12,000 of the agency’s clients needed to be prompted to contact their energy provider, or state or territory government, to give consent and to have the rebate applied to their electricity bills (see paragraphs 2.56 and 2.57).

- DITRDCA identified that the targeted electricity bill rebate needed to be extended to non-self-governing territories and assisted in the administration of the bill rebate to the non-self-governing territories (see paragraphs 2.58 and 2.59).

2.35 The importance of providing quality advice was highlighted in an independent review of government processes for implementing large public programs and projects.44 The report observes that:

The development of a policy and its delivery are inextricably linked. Implementation should be integral to policy design. A policy cannot be elegant if its execution is poorly communicated, ineptly administered or inadequately evaluated. The proof of the pudding is in the eating.45

2.36 During November and December 2022, the AER estimated the amount required to compensate customers for some or all of the electricity price rises projected in scenarios, based on inputs and assumptions provided by DCCEEW.

Opportunity for improvement

2.37 Treasury and DCCEEW consider developing an approach to consulting with delivery agencies during the policy development process.

Stakeholder consultation following the announcement of the Energy Price Relief Plan

2.38 Treasury and DCCEEW continued consulting stakeholders within and outside the APS after the announcement of the Energy Price Relief Plan, including on elements of design for all measures.

Energy Price Relief Plan stakeholder engagement strategies

2.39 Advice to government in December 2022 on options to provide energy price relief included a stakeholder engagement strategy and an international engagement strategy. The strategies related to all measures, except for the targeted electricity bill rebate. Stakeholders considered under the strategies included industry entities and international partners, industry energy market participants, industry peak bodies, electricity retailers, energy market bodies (AER and AEMO), and the ACCC.

2.40 In accordance with the stakeholder engagement strategy, on 12 and 19 December 2022 DCCEEW provided the AER and AEMO with briefings on the advice that was provided to government on the Energy Price Relief Plan. Treasury advised the ANAO on 12 August 2024 that it did not provide a separate briefing to the ACCC ‘given they were deeply involved in the process’.

2.41 In December 2022 government agreed that the relevant ministers would develop a communications strategy on the approach to addressing energy prices for government approval by 1 March 2023.

2.42 In May 2023 DCCEEW established communications principles and objectives to support communications on the Energy Price Relief Plan, which were developed based on research and findings from an external consultant.46 The external consultant was commissioned to undertake research on community awareness, understanding and sentiment on changes in energy prices, and to bring together recommendations for the communications on the Energy Price Relief Plan.47 Recommended activities, related to the principles and objectives established by DCCEEW, included a strong communications and media strategy, update to website content with background information on relevant measures and consideration of paid advertising to increase social media posts.

2.43 On 25 May 2023 the Minister for Climate Change and Energy noted the communications principles and recommended activities from DCCEEW, and the research findings from the external consultant. DCCEEW updated the energy.gov.au website for information on the Energy Price Relief Plan, which included links to other relevant websites.48 DCCEEW did not undertake the other recommended activities.

Targeted electricity bill rebate

2.44 At meetings of the Prime Minister, Premiers and Chief Ministers on 9 December 2022 and 3 February 2023, it was agreed that Commonwealth Government, state and territory Treasurers would develop and finalise the targeted electricity bill rebate measure. Between May and December 2023 federation funding agreement schedules were signed with all states and territories.

2.45 For the first round of the targeted electricity bill rebate in 2023–24, Treasury did not develop a stakeholder consultation plan. Between March and June 2023 Treasury organised retailer information sessions, workshops, and received queries from electricity retailers. Treasury did not document its engagement with state and territory government departments, and electricity retailers using a structured approach. The risk of not recording stakeholder feedback in a structured manner is that lessons learned may not be comprehensively incorporated into future policy and implementation decisions.

2.46 Treasury worked with DCCEEW to update the energy.gov.au website as a central source of information for the targeted electricity bill rebate across all jurisdictions. Treasury had liaised with Services Australia and DVA on providing eligible recipients with targeted letters and messages.

2.47 In advice to government in April 2024 on the extension of the electricity bill rebate measure, Treasury and DCCEEW noted the ‘lower than expected’ take-up of the rebate reduced its effectiveness to deliver relief to households.

2.48 Treasury and DCCEEW’s advice to government on the extension of the targeted electricity bill rebate measure outlined elements of a consultation and communication plan, including engagement activities with stakeholders outside the APS and APS delivery agencies. The plan included the provision of $7 million contingency reserve for mailouts to improve awareness and uptake of the electricity bill rebates. As at 5 November 2024 Treasury has drafted a stakeholder engagement log and commenced drafting of a program plan, which includes a stakeholder engagement strategy.

Services Australia

2.49 The targeted electricity bill rebate was delivered through electricity retailers and applied to household and small business electricity bills. To deliver the rebate to households, electricity providers needed to know whether household customers were eligible for the rebate.49

2.50 On 27 November 2023 Services Australia advised the ANAO that initial contact by the Department of Social Services regarding the implementation of the Energy Price Relief Plan was made on 15 December 2022.

2.51 In April 2023 a total of 5.6 million customers were expected to be eligible for the rebate. Of the total, around 4.6 million (75 per cent) customers already received concessional rates or rebates from their energy retailers, and whose eligibility details could be confirmed by approved energy retailers using existing arrangements via Services Australia’s Centrelink Confirmation eServices.50 These customers were considered part of the ‘existing cohort’. Customers in the existing cohort were able to have their eligibility confirmed from July 2023.

2.52 The remaining 960,000 (25 per cent) customers eligible for the rebate did not already receive rebates from their energy retailers and were considered part of an ‘expanded cohort’.51 To deliver the rebates to households in the expanded cohort, customers were required to share their consent for their nominated electricity provider to check their concession status for eligibility. Services Australia became the initial point of contact to collect consent from customers and share confirmation of customers’ eligibility with the customers’ nominated electricity provider via Services Australia’s existing Centrelink Confirmation eServices system.

2.53 Services Australia provided a solution to deliver the rebate, which included:

- expanding the existing Centrelink Confirmation eServices system52 to include recipients in the ‘expanded cohort’, to make it easier for state, territory governments, and energy retailers to determine household eligibility and administer the rebate; and

- building a workflow within the existing customer online services platform to collect customer consent for the expanded customer cohort, with a staff assisted solution as customer support. Services Australia contacted customers in the expanded cohort via a mailout with instructions on how to provide consent.

2.54 Customers in the expanded cohort were able to provide consent to Services Australia from September 2023 to have their eligibility confirmed for electricity retailers to apply the rebate.

2.55 In July 2023 to guide its stakeholder consultation approach, Services Australia established a communication snapshot, which:

- outlined roles for Treasury, DCCEEW, Services Australia, and state and territory governments, along with electricity retailers;

- set out a communication approach for different customer segments; and

- identified target audiences and key messages.

Department of Veterans’ Affairs

2.56 On 16 December 2022 DVA contacted Treasury to ensure that eligible veterans and their families on a low income were included, noting the announcement of the targeted electricity bill rebate measure. As at April 2023, approximately 151,000 DVA clients were eligible for the rebate, most of whom did not have to take any action to receive the rebate. Of the 151,000 DVA eligible clients, there were approximately 12,000 (8 per cent) DVA clients in the ‘expanded cohort’, who were required to contact their energy provider, or state or territory government to give consent and to have the rebate applied to their electricity bills.

2.57 In August 2023 DVA established a project management plan which detailed its communication approach. To deliver the rebate to DVA clients, DVA had planned to communicate with DVA clients via SMS or hard copy letter, to prompt clients to provide consent.

Department of Infrastructure, Transport, Regional Development, Communications and the Arts

2.58 In March 2023 the DITRDCA contacted Treasury requesting a ‘way for Norfolk Island, Christmas Island, Cocos (Keeling) Islands and Jervis Bay Territory (non-self-governing territories) to have access to programs and funding other states and territories do for their communities.’ In August 2023 Treasury advised the Treasurer that the initial design of the targeted electricity bill rebate measure did not specifically provide for households and businesses in the non-self-governing territories.

2.59 In September 2023 the Commonwealth Government agreed to deliver electricity bill rebates to all households and businesses in the non-self-governing territories of Norfolk Island, Christmas Island, Cocos (Keeling) Islands and Jervis Bay Territory. Between March and June 2023, Treasury and the DITRDCA negotiated arrangements to administer the bill rebate to the non-self-governing territories.

Energy bill relief governance meetings

2.60 The energy bill relief governance meeting forum was established in February 2023 and was co-chaired by Treasury and Services Australia. Its purpose included providing visibility of eligibility and policy and identifying delivery solutions. Between February 2023 and November 2023, 34 energy bill relief governance meetings were held. Attendees included DCCEEW, Services Australia, and DVA, and the Australian Energy Council53 attended once in February 2023.

2.61 Key activities discussed at the energy bill relief governance meetings were implemented, including the release of a consent workflow, publishing of website materials, and the sending out of targeted letters.

Gas price cap and mandatory gas code of conduct

2.62 On 14 December 2022 Treasury outlined to the Treasurer that the legislation — Treasury Laws Amendment (Energy Price Relief Plan) Bill 2022, which includes the enabling framework for a gas price order, creating the gas market codes and introducing the targeted electricity bill rebate — had been ‘drafted and cleared in extremely compressed timelines.’ The legislation to administer the gas price cap commenced on 23 December 2022.

Public consultation commencing December 2022

2.63 In November and December 2022 Treasury drafted a consultation paper, a draft instrument for the gas price cap and an exposure draft for the framework that provided for the mandatory gas code of conduct, with input from DCCEEW, DISR, ACCC, AER, and the Australian Government Solicitor, as well as the Office of International Law. Treasury provided drafting instructions to the Office of Parliamentary Counsel in the Attorney-General’s Department.

2.64 Treasury published the consultation paper on its website seeking input on the design of the gas elements of the Energy Price Relief Plan, which was accompanied by the draft instrument for the gas price cap and the exposure draft for the framework to underpin the mandatory gas code of conduct.54 Public consultation on the gas price cap was open from 9 December 2022 to 15 December 2022. For the mandatory gas code of conduct public consultation was open from 9 December 2022 to 7 February 2023.

2.65 On the gas price cap Treasury received submissions from 29 entities and had a structured approach for recording issues raised on the draft legislative instrument. It did not document how the issues raised were addressed. Treasury did not provide updates to stakeholders on consultation findings. On 12 August 2024 Treasury advised the ANAO that it did not publish a separate consultation update following consultation noting that the Competition and Consumer (Gas Market Emergency Price) Order 2022 was registered shortly after consultation was closed.

2.66 On the mandatory gas code of conduct Treasury received submissions from 63 entities. Neither Treasury nor DCCEEW established a system for recording and incorporating stakeholder feedback. On 26 April 2023 an update to stakeholders on consultation findings was provided in the consultation paper developed for the second round of public consultation on the mandatory gas code of conduct (see paragraph 2.70).

Gas Code Ministerial Advisory Committee and gas code working group

2.67 The Gas Code Ministerial Advisory Committee was established to provide guidance on key policy and administrative processes, including supporting ministerial decisions on applications for conditional exemption under the Competition and Consumer (Gas Market Code) Regulations 2023 (Gas Market Code).55 Its membership comprised of Senior Executive Service (SES) Band 3 representatives from DCCEEW, DISR and Treasury — DCCEEW and DISR co-chaired the committee. The terms of reference stated that the ACCC was a technical adviser to the Gas Code Ministerial Advisory Committee. The Gas Code Ministerial Advisory Committee met for the first time on 27 March 2023.

2.68 A gas code working group was set up to provide support to the Gas Code Ministerial Advisory Committee. Its member entities mirrored that of the Ministerial Advisory Committee and was made up of SES Band 1 representatives.

2.69 The terms of reference for the Gas Code Ministerial Advisory Committee stated that it would meet as required. DCCEEW served as the secretariat for the Gas Code Ministerial Advisory Committee and gas code working group. The Gas Code Ministerial Advisory Committee met 18 times between March 2023 and May 2024; meeting outcomes were recorded for 10 meetings and outcomes from eight meetings were not recorded. During three meetings in March 2023, the committee discussed advice from the ACCC, the design of the mandatory gas code of conduct and drafting of policy advice.

2.70 The gas code working group met 17 times between January and June 2023; minutes were documented for six meetings and were not available for 11 meetings. Minutes that were available for the six meetings show that the AER attended all six meetings and two external consultants56 joined three meetings. Discussions of the working group covered drafting of the code, as well as overviews of submissions received from the first and second rounds of public consultation on the mandatory gas code of conduct (see paragraph 2.64 and 2.71).

Public consultation in April 2023

2.71 In April 2023 DCCEEW created a stakeholder engagement and consultation plan for the second round of consultation on the development of the mandatory gas code of conduct. Between 26 April 2023 and 12 May 202357, DCCEEW held a second round of public consultations, seeking views on a consultation paper and an exposure draft for the mandatory code of conduct.58 DCCEEW received 51 submissions from 43 entities.

2.72 DCCEEW conducted 26 consultation meetings with key stakeholders between 3 and 12 May 2023 during which information on the mandatory gas code of conduct was presented by DCCEEW.

2.73 While minutes were not recorded, DCCEEW created documents to summarise feedback raised on the mandatory gas code of conduct. DCCEEW established a spreadsheet to record the actions taken and outcomes in relation to matters raised through feedback — outcomes were recorded for 32 of the 212 (15 per cent) matters raised.

2.74 In June 2023 Treasury and DCCEEW produced an addendum to the December 2022 impact analysis, which highlighted for the public the updates that had been made to the mandatory gas code of conduct as a result of consultation findings. The addendum was published on the OIA’s website.

2.75 In June 2023 government agreed to the final design of the mandatory gas code of conduct. The advice to government noted feedback received during the second round of consultation on the code of conduct.

Coal price cap

2.76 Advice to the Commonwealth Government on options to provide energy relief in December 2022 stated that coal producers and coal generators in New South Wales and Queensland would be affected, and that households and businesses purchasing electricity from retailers in these states would benefit from lower electricity prices. The Commonwealth Government agreed to negotiations with New South Wales and Queensland governments. On 9 December 2022, coal price caps were noted as actions being undertaken by the Commonwealth Government, New South Wales and Queensland governments at a meeting of the Prime Minister, Premiers and Chief Ministers.

2.77 DCCEEW met with the New South Wales and Queensland Governments and with Queensland power station operators in December 2022, following the announcement of the Energy Price Relief Plan. DCCEEW advised the ANAO on 10 October 2024 that engagement with power station owners and operators was left to state governments due to their closer relationships with these groups.

2.78 The Commonwealth Government and the New South Wales Government negotiated a federation funding agreement schedule59, which was signed on 18 May 2023. The federation funding agreement schedule between the Commonwealth Government and the Queensland Government was signed by the Minister for Climate Change and Energy on 21 May 2024 and by the Queensland Premier on 27 July 2024.60

Bringing forward commencement of Australian Domestic Gas Security Mechanism reforms

2.79 On 5 December 2022 DISR held meetings with three liquefied natural gas (LNG) exporters to discuss the implementation of the Australian Domestic Gas Security Mechanism reforms. On 9 December 2022 the Minster for Resources wrote to LNG exporters to discuss the announcement of the Energy Price Relief Plan. On 20 December 2022, referencing the government’s announcement of the reforms to improve the Australian Domestic Gas Security Mechanism on 25 October 2022, the Minister for Resources wrote to gas producers, ACCC and AEMO, inviting views on areas of improvement for proposed arrangements to implement the reforms.

2.80 DISR incorporated stakeholder engagement processes into its project planning documentation. DISR conducted a round of public consultation seeking feedback on reforms to the Australian Domestic Gas Security Mechanism. Consultation was open between 9 February 2023 and 23 February 2023.

2.81 DISR received feedback via email, letters and meetings from 25 entities within and outside the APS between 18 January 2023 and 10 March 2023, and 29 formal submissions between 17 and 23 February 2023. DISR maintained a consultation log spreadsheet for recording and incorporating stakeholder feedback into deliverables. DISR’s responses to the matters raised through email, letters and meetings were recorded in the spreadsheet for 48 of the 68 (73 per cent) matters raised. DISR’s responses regarding matters raised through the formal submissions were not recorded in the spreadsheet. DISR provided an update to stakeholders on consultation findings by including on its public consultation website a link to the outcomes — the commencement of the ADGSM reforms.

Did policy advice assess the costs and benefits of different policy options?

Market modelling and data and advice from relevant government entities was used to support advice to government on policy options. Potential impacts of the proposed policy options included in policy advice were supported by evidence. Treasury and DCCEEW’s impact analysis included an assessment of regulatory burden costs and benefits for three measures — gas price cap, mandatory gas code of conduct and bringing forward the commencement of the Australian Domestic Gas Security Mechanism reforms. While DCCEEW had undertaken a preliminary assessment, an impact analysis was not undertaken for the remaining two measures — targeted electricity bill rebate and coal price cap.

2.82 The Australian Government’s Regulatory Impact Analysis Framework 2020 required entities that present policy options to government to complete an impact analysis.61 An impact analysis is intended to answer seven questions: what is the policy problem you are trying to solve; why is government action needed; what policy options are you considering; what is the likely net benefit of each option; who did you consult and how did you incorporate their feedback; what is the best option from those you have considered; how will you implement and evaluate your chosen option? The impact analysis is a key mechanism for communicating the policy problem to be solved, the need for government action, as well as the costs and net benefits of a policy option.

Development of policy options

2.83 Treasury and DCCEEW used market modelling and data, as well as advice from other government entities, to support its policy advice (see Appendix 4). Modelling and analysis were conducted by Treasury and DCCEEW, with input from the AER. In developing its policy advice to government, Treasury and DCCEEW also relied on advice from the ACCC and DISR for three of the five measures — the gas price cap, mandatory gas code of conduct, and bringing forward commencement of the ADGSM reforms. Key information on potential impacts of the proposed policy options included in the December 2022 policy advice to government was supported by evidence.

2.84 Advice to government was informed by quantitative evidence and Treasury conducted a high-level qualitative analysis to identify international policy responses to high energy prices. The December 2022 advice to government reflected the context within which the proposed policy options would exist, including short term and medium-to-long term government programs62 that intend to address energy affordability.

2.85 To guide consideration of preliminary options, the Secretaries’ Group terms of reference (see paragraphs 2.3 to 2.7) provided criteria63 to present and assess options against.

2.86 On 2 November 2022 DCCEEW documented its assessment of 20 preliminary options against the criteria, which included four of the five final preferred policy options — the measure to bring forward the commencement of the Australian Domestic Gas Security Mechanism reforms was not included.

- The assessment identified that 11 of the 20 options were aligned with the criteria and nine of the 20 options were poorly aligned with the criteria. The four of the five final preferred policy options that were assessed by DCCEEW had been identified as aligning with the criteria.

- A consideration of complexity, Australian Government capacity to implement, timing of implementation, requirements for legislation and which relevant stakeholder would incur costs was included in the assessment.