Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Defence's Management of the Mulwala Propellant Facility

Please direct enquiries relating to reports through our contact page.

The audit objective is to assess the effectiveness of the Department of Defence's management of the Mulwala Redevelopment Project.

Summary and recommendations

Background

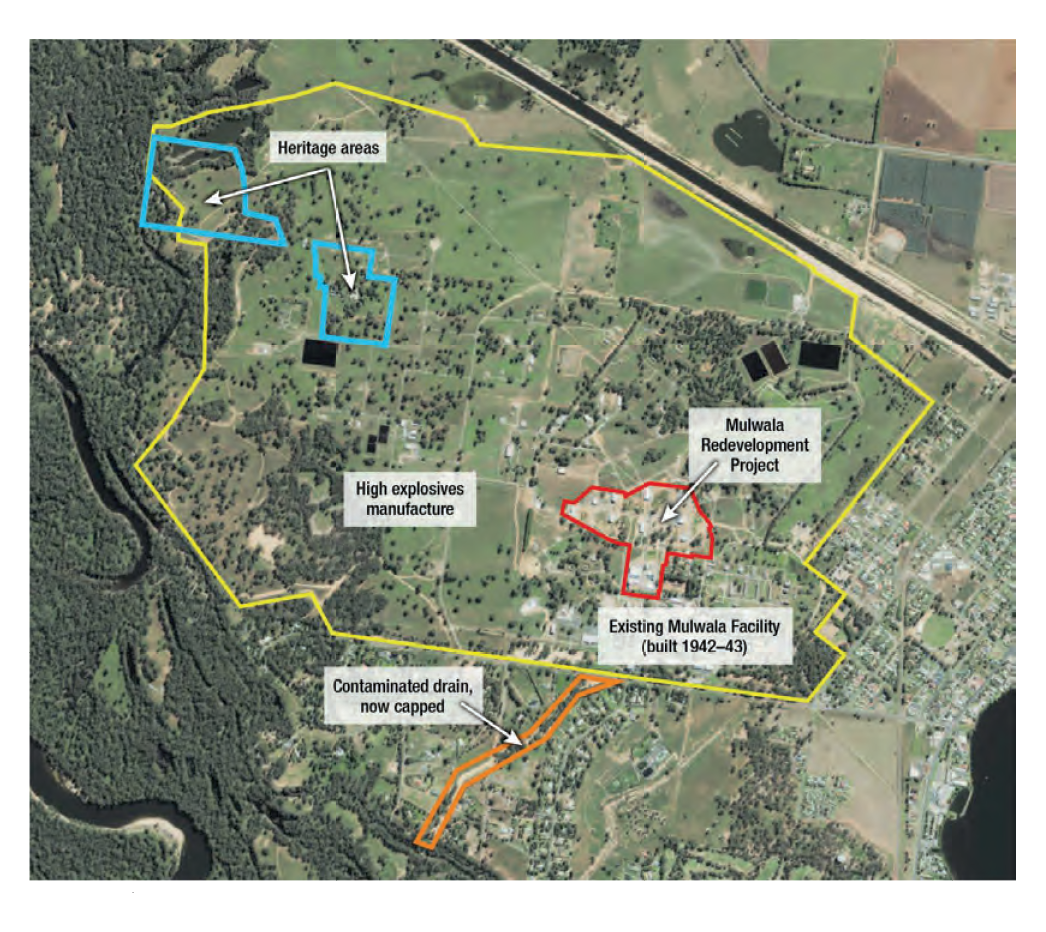

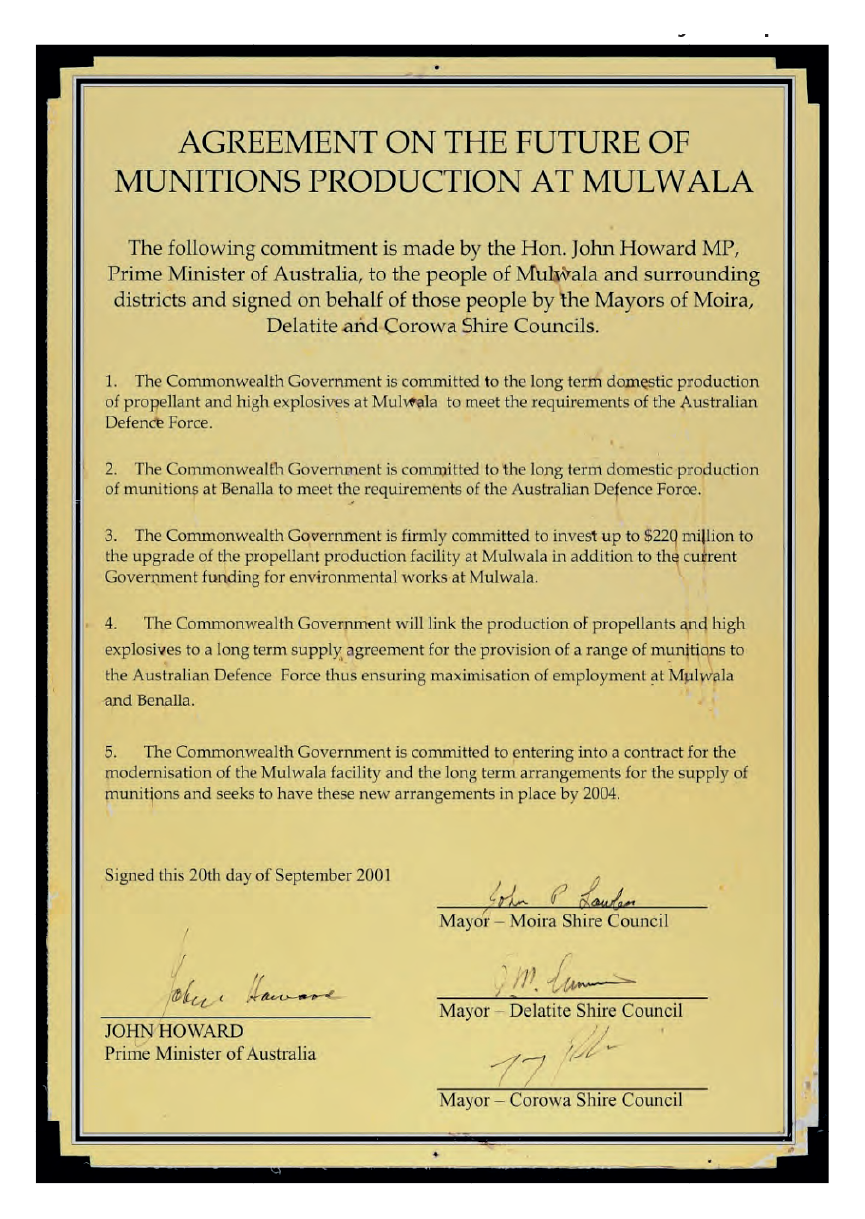

1. The Mulwala Facility is the sole remaining manufacturing site of military propellants and high explosives in Australia. The 1030-hectare site is near the border of New South Wales and Victoria. Until recently, it included around 300 buildings, the majority of which were constructed in the early 1940s and the remainder in the early 1990s. The nearby munitions facility at Benalla, Victoria, uses some of the output of the Mulwala Facility in its operations. The facilities at Mulwala and Benalla are owned by the Commonwealth and operated by a third party. In 2001, the Government announced that the Mulwala Facility would be redeveloped by 2004, at a cost of up to $220 million.

Audit objective and criteria

2. The audit objective was to assess the effectiveness of the Department of Defence’s management of the Mulwala Redevelopment Project. The audit focused primarily on the progress of the project, including its cost and schedule performance, and Defence’s management of risks and issues. In this context, the audit also considered:

- the transition from the 1998 Mulwala Agreement (and the companion Strategic Agreement for Munitions Supply, for the Benalla Facility) to the 2015–20 Strategic Munitions Interim Contract; and

- the progress of environmental remediation of the Mulwala site.

3. To form a conclusion against the audit objective, the ANAO adopted the following high-level audit criteria:

- project risks were identified and managed effectively;

- the project is progressing to the expectations of the Commonwealth in terms of value for money, timeliness and delivery of required capability;

- arrangements for contractor operation of the redeveloped facility ensure that production capability is available when needed by the Australian Defence Force; and

- progress is being made in resolving environmental issues associated with both legacy and redeveloped facilities.

Conclusion

4. When completed, the Mulwala redevelopment should deliver a facility with much higher levels of safety, automation and environmental compliance than are provided by the plant built in 1942–43. However, Defence’s management of the project, particularly in its early stages, was not effective.

- The redevelopment is expected to be completed more than five years late, due to Defence’s misunderstanding of the technical risk in the project, the general lack of commercial expertise in constructing propellant manufacturing facilities, and shortcomings in Defence’s project management resourcing and approach. Defence’s subsequent internal review processes provided useful advice on key risks and their remediation.

- Reflecting the delay in completion arising from the unexpected complexity of the redevelopment, the costs are estimated at some $415 million by 2017, against an approved project budget of $371 million (inflation-adjusted). This estimate includes further work, at a cost of some $44 million, that is still required to bring the facility up to an industrial level of production, as originally intended. Significant expenditure is yet to be budgeted for decontamination and demolition.

5. From 1999 to 2015, Defence has paid $526 million for munitions produced by the Mulwala and Benalla Facilities, and has paid $1.874 billion in order to build, operate and maintain the facilities.1 The capability to manufacture munitions in Australia has provided regional economic and employment benefits and some strategic value in terms of security of supply. Defence advised Government in 2000 and 2014 that the facilities should be closed, and also advised in 2012 that the strategic requirement to manufacture munitions in Australia is minimal. This suggests that the cost of building, operating and maintaining the facilities did not represent value for money.

6. From 2009 to 2014, Defence unsuccessfully attempted to conduct a competitive tender for operation of the Mulwala Facility and the related munitions facility at Benalla. In late 2014, Defence entered into a five-year interim contract that provides some improvement in value for money. With the redevelopment of the Mulwala Facility nearly completed, Defence is now in a better position to advise the Government on options for the future operation of the facilities, and develop a cost-effective implementation plan.

7. Defence has made progress on environmental remediation of the Mulwala site, but the process is expensive and long-term, and will require continued commitment. Because of the hazardous nature of some of the soon-to-be-redundant buildings, Defence should develop a risk-based implementation plan for decontamination and demolition.

Supporting findings

Project rationale and planning

8. Defence did not manage the development of plans for the Mulwala Redevelopment Project effectively. Defence had difficulty in aligning the project into either its capability or facilities project model, and applied some aspects of both models to the project. The area in Defence performing the role of Lead Capability Manager for the project changed several times.

9. Between 2001 and 2006, Defence sought to redevelop the Mulwala Facility through the then Government’s preferred option of private financing. This approach did not succeed because Defence had little leverage over the then contractor, Australian Defence Industries, and because of the safety and environmental problems at Mulwala. After the Government approved Budget funding for the project in 2006, Defence negotiated a contract that was signed in 2007.

10. The project was announced without detailed requirements. The scope of the project was adjusted to match the cost envelope announced in July 2001. This approach excluded some key requirements of the redevelopment, such as decontamination and demolition of redundant buildings. Further, extensive scope changes occurred until contract signature in 2007, and continued to be made until the end of the project.

11. Defence’s advice to government in 2001, 2005 and 2006 did not adequately assess the risks involved in establishing a new propellant facility. In April 2006, Defence assessed the technical risk as low, but made no mention of cost and schedule risk. While the technology to be used in the new facility was long-proven, the risks involved in establishing a new chemical plant to produce hazardous materials required assessment and mitigation. In the event, the contracted schedule was too short, provision for project/engineering staff was inadequate, and Defence did not take into account the general lack of commercial expertise in constructing propellant manufacturing facilities.

Establishing the new facility

12. Defence did not manage the Mulwala Redevelopment Project’s construction and commissioning phases effectively. The construction phase commenced late, and within a year was facing delays and unrealistic scheduling. The commissioning phase, involving the introduction of hazardous chemicals into the new facility, also experienced long delays. Defence attributed these delays to technical problems, contractor inexperience in work of this nature, and lack of Defence project office resourcing and expertise.

13. By 2010, Defence and the prime contractor (Lend Lease) were involved in lengthy and expensive disputes over project scope and schedule. Between 2011 and 2015, Defence negotiated five deeds with Lend Lease, providing further payments, extended deadlines and changes of scope. While the deeds contributed to better relations with the contractor, the first two deeds failed to provide enduring solutions to the technical and schedule issues affecting the project.

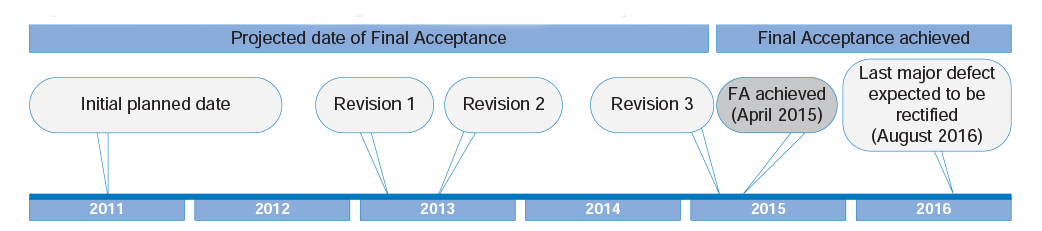

14. Defence commissioned four Gate Reviews of the project to assess progress. The reviews provided useful advice on key risks and their remediation. Following the first review, the project was placed on Defence’s Projects of Concern list in December 2012. In late 2013, after the second review, Defence adopted a more pragmatic approach under which overall commercial considerations would take precedence over rigid enforcement of the contract. In early 2015, Defence adopted an effective two-stage process for finalising the project, which enabled the new facility to commence the ramp-up to industrial-scale production. As at February 2016, Lend Lease’s rectification of the last of the five significant defects was expected to be completed by August 2016, more than five years after the contracted completion date of June 2011.

15. When completed, the Mulwala redevelopment should deliver a facility with much higher levels of safety, automation and environmental compliance than are provided by the plant built in 1942–43. Defence advised the ANAO that the Mulwala Redevelopment Project would be completed within its $371 million budget. However, this advice excludes funds used from non-project sources to pay for redevelopment costs. Further work, at an estimated cost of some $44 million, is also required to bring the facility up to an industrial level of production. Taken together, total current and planned expenditures are estimated to be some $415 million by 2017, with significant expenditure yet to be budgeted for decontamination and demolition.

Delivering munitions to the Australian Defence Force

16. The operating contractor, Thales, has met Defence’s orders for propellant, high explosives and munitions under two related contracts. For over a decade, the contracts were largely self-managed by Thales, and Defence did not manage the subsidies (capability and other payments) effectively. Recognising its longstanding contract-management shortfalls, Defence established a Strategic Munitions Contracts Directorate in 2011, and achieved some savings. This directorate successfully managed a complicated transition to the interim contract in 2015, including the acquisition of the Benalla Facility by Defence.

17. From 1999 to 2015, Defence paid $526 million for munitions produced by the Mulwala and Benalla Facilities. Defence paid $1.874 billion in order to build, operate and maintain the facilities: $1.386 billion in capability and other payments; $371 million in redevelopment costs; and $117 million for environmental and facilities remediation.

18. In general, domestically produced munitions are more costly than similar munitions sourced internationally.2 A 2013 RAND review of Australia’s munitions manufacturing industry observed that, if maintaining a domestic munitions industry is desirable, using the full production capacity at Benalla is the key to controlling costs. The capability to manufacture munitions in Australia has provided regional economic and employment benefits and some strategic value in terms of security of supply. Defence advised Government in 2000 and 2014 that the facilities should be closed, and also advised in 2012 that the strategic requirement to manufacture munitions in Australia is minimal. This suggests that the cost of building, operating and maintaining the facilities did not represent value for money.

19. Between 2009 and 2014, Defence sought to conduct a competitive tender for a new operating contract to replace the 1998–2015 contracts, but did not manage the process effectively. The tender was cancelled because of delays in the release of the Request for Tender and uncertainties arising from the unfinished Mulwala Redevelopment Project. Defence’s costs for the tender process were some $24 million. Defence had envisaged introducing improved contractual arrangements through the tender process, but the significant government assistance still required would have continued to reduce value for money for Defence.

20. An interim operating contract for the period 2015–20 includes a performance regime and reduced government assistance, representing some improvement in value for money. There would be significant merit in another approach to market to replace the interim contract. In doing so, Defence should learn key lessons from the first, unsuccessful, attempt. In particular, it should clearly define Defence’s current and future munitions requirements, and allow sufficient time to complete the process before mid-2020.

Managing the operating environment at Mulwala

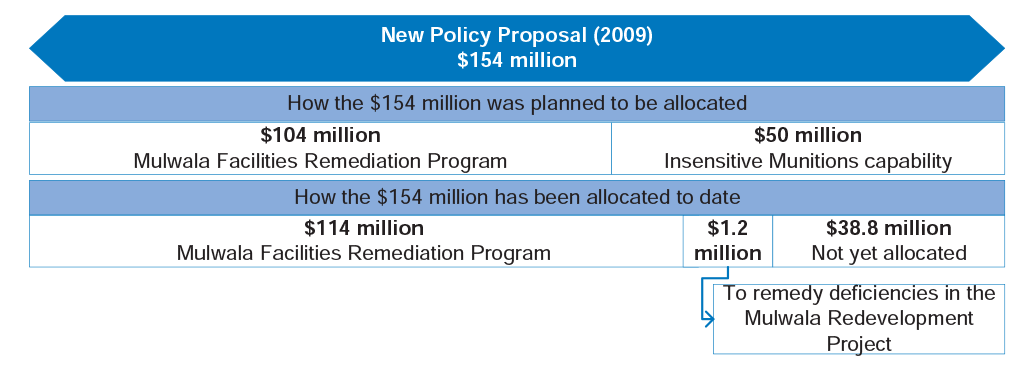

21. Defence has improved environmental and safety compliance at Mulwala. The department has expended $8.4 million of $11.8 million allocated for groundwater decontamination at Mulwala (Figure S.1). Defence has also expended $108.4 million of $154 million allocated for new Work Health and Safety and environmental requirements, but the Mulwala site is still operating under some environmental waivers, mostly because of the delays in Final Acceptance of the Mulwala Redevelopment Project.

22. Defence is not adequately preparing for decontamination and demolition at Mulwala. A significant amount of funding will be required for decontamination and demolition works, given the potential for spontaneous combustion of some soon-to-be-redundant buildings. At the time of the audit, no funding had been planned or approved. Due to the planning time involved and the number of planning, environmental and heritage approvals that will be required, Defence will need to commence these processes as soon as possible.

23. A 2014 scoping study estimated that the cost of decontaminating and demolishing redundant buildings at Mulwala would be some $31 million. This minimum cost does not include a range of additional work, and the final clean-up of Mulwala is likely to cost considerably more.

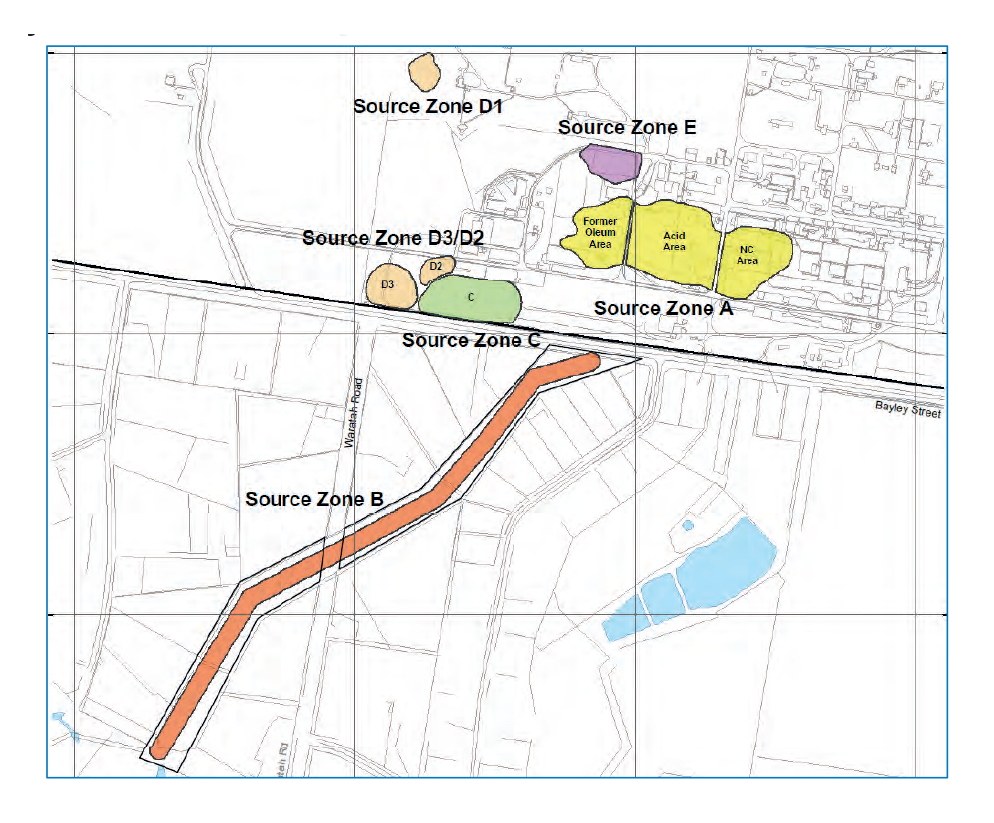

Figure S.1: The Mulwala site, 2012

Source: Defence.,

Recommendations

|

Recommendation No.1 Paragraph 4.37 |

To achieve better value from the significant investment in a domestic munitions capability to date, the ANAO recommends that, by the end of 2016, Defence:

Department of Defence response: Agreed. |

|

Recommendation No.2 Paragraph 5.31 |

To plan effectively for the decontamination and demolition of redundant buildings at the Mulwala Facility, the ANAO recommends that Defence:

Department of Defence response: Agreed. |

Summary of entity responses

24. The proposed audit report was provided to Defence, with extracts provided to the principal contractors involved in the Mulwala Redevelopment Project and the Mulwala Facility: Lend Lease, Thales Australia, ATK and GHD.

25. Defence, Lend Lease and Thales Australia provided formal responses to the proposed audit for reproduction in the final report; these are provided in the Appendices. Other relevant comments received from Defence, Lend Lease, Thales and ATK have been incorporated into the report. Summaries of the responses from Defence and Thales Australia are set out below. Lend Lease did not provide a summary response.

Department of Defence

Defence acknowledges the findings contained in the audit report of Defence’s Management of the Mulwala Propellant Facility, and agrees with the two recommendations made by the ANAO.

The Mulwala Propellant Factory is now the most modern propellant facility in the world, providing a strategic capability to the ADF as well as ongoing, highly skilled employment in regional Australia.

Defence welcomes the ANAO findings that the Gate Review and Projects of Concern processes utilised by CASG increased transparency of the issues associated with the project and had positive effects on the project outcomes.

The Mulwala Redevelopment Project has delivered a facility with much higher levels of safety, automation and environmental compliance than the plant it replaces. Throughout the duration of the project the management of personnel and plant safety, together with the emphasis on achieving environmental compliance were of paramount importance. Of significance, the Mulwala facility has continued to produce large quantities of high quality propellant to the Australian Defence Force (ADF) and commercial customers whilst incorporating the new facility into the plant’s operations.

Defence has replaced previous contractual arrangements for the supply of propellant, high explosives and munitions with the Strategic Munitions Interim Contract, a performance based contract that will provide an improved value for money outcome to Defence.

The project has delivered improved environmental and safety compliance at Mulwala. Defence actively manages the longstanding environment and heritage issues associated with historic and present day manufacturing at Mulwala, in conjunction with other Federal, State and Local community stakeholders.

Thales Australia

Thales Australia thanks the ANAO for the provision of the extract of the draft report […] and for the invitation to provide a response regarding this document. The content of [the extract] was heavily redacted—no recommendations were included and only a limited number of summary findings and conclusions. On this basis, it is extremely difficult for Thales to provide an appropriate commentary on the suitability of the report and recommendations for the future. Beyond this though, the Commonwealth has demonstrated strong leadership in reinvigorating the Mulwala facility through asset modernisation, environmental remediation and the establishment of the new propellant precinct—although troubled in its project execution. Further the implementation of the Commonwealth’s performance-based Strategic Munitions Interim Contract (SMIC) is already delivering over 20% reduction in the costs to operate the facilities realized since the start of SMIC. The company is fully committed to being the Commonwealth’s operator of these critical major hazard facilities which have proven (with preceding munitions facilities) to provide a vital capability to the Australian Defence Force in times of major conflict.

1. Background

Introduction

1.1 The Mulwala Facility is the sole remaining manufacturing site of military propellants and high explosives in Australia. The 1030-hectare site is near the border of New South Wales and Victoria. Until recently, it included around 300 buildings, the majority of which were constructed in the early 1940s and the remainder in the early 1990s. The nearby munitions facility at Benalla, Victoria, uses some of the output of the Mulwala Facility in its operations. The facilities at Mulwala and Benalla are owned by the Commonwealth and operated by a third party. In 2001, the Government announced that the Mulwala Facility would be redeveloped by 2004, at a cost of up to $220 million.

|

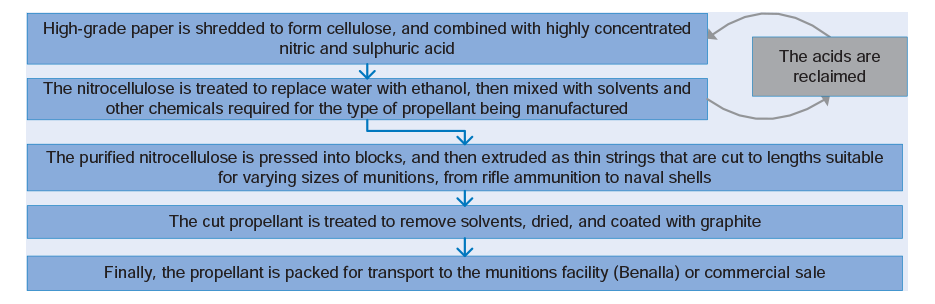

Box 1: What is propellant? |

|

In the ballistics context, propellant is an energetic, reactive and dangerous chemical product that is manufactured in the form of grains or pellets. Propellant is used to fill cartridge cases or artillery shells, which are then capped with a projectile (a bullet, high-explosive shell, etc) to make a complete round of ammunition (or, generically, munitions). When a weapon trigger causes a hammer to strike the primer, the propellant begins a controlled burn that, in microseconds, propels a bullet or other projectile towards its target. The propellant manufactured at Mulwala is nitrocellulose-based. |

|

The Mulwala propellant manufacturing process

Source: ANAO analysis. |

|

To achieve consistent performance, safe operation and long-term storage, the final propellant product must meet stringent requirements in relation to chemical composition, size and quality. Much of the propellant produced at Mulwala is finely tuned to optimise the performance of the Australian Defence Force’s main infantry weapon, the F88 Austeyr rifle. Each grain of propellant for the 5.56mm ammunition (magnified at right) is 1.15mm long, 0.95mm in diameter, and has a hole through the middle. |

The Mulwala Facility

1.2 Construction of the Mulwala Facility began in October 1942, and by September 1945 it had manufactured 330 tonnes of propellant. The buildings and equipment constructed and installed at Mulwala in 1942–43 are still in use, and continue to produce propellant for both Australian Defence Force and commercial use.3

1.3 The safety and environmental standards that apply today bear little resemblance to those from the 1940s. The plant’s operation for over 70 years has left a legacy of environmental problems, and a range of workplace safety issues requiring ongoing management (Figure 1.1). The Mulwala Redevelopment Project (or the project), announced in July 2001, was intended to modernise the plant and address some of the environmental and safety issues. The project has been managed by the Department of Defence (Defence).

Figure 1.1: Propellant Press House cutting machines, 2000

Note: Operators manually feed strings of pressed propellant to the cutting machines. This process, still used in 2016, is an example of the manual nature of the work in the old Mulwala Facility.

Source: ADI Limited, Preliminary Proposal for modernisation of the Mulwala Facility, June 2000.

Ownership of the Mulwala Facility, and organisational arrangements within Defence

1.4 The Mulwala Facility has had a number of changes in ownership and operation (Table 1.1).

Table 1.1: Ownership and operation of the Mulwala Facility, 1942–2016

|

Years |

Description |

|

1942–84 |

Mulwala was managed by a variety of government bodies, outside of the usual Defence estate framework. |

|

1984–89 |

With the establishment of the Office of Defence Production within Defence, the Mulwala Facility came under Defence administration. |

|

May 1989 |

Australian Defence Industries Pty Limited (ADI)a was established as a wholly-owned Government corporation. ADI assumed responsibility for seven sites—including Mulwala—that made ammunition components. |

|

1991–93 |

ADI made representations to the then Government about the viability of the Mulwala Facility.b ADI and Defence signed a Long Term Ammunition Agreement in 1993, and Mulwala was returned to Defence ownership. ADI was required to invest $148 million (1992 prices) to construct a new facility at Benalla. In return, Defence would procure munitions for a period of 20 years to 30 June 2015, and, as part of the cost of munitions, would repay ADI’s investment. ADI’s investment would be completely repaid by 30 June 2015, on which date Defence could exercise an option to purchase the Benalla Facility at a peppercorn price of $1. |

|

By 1996 |

ADI rationalised Australia’s munitions production to two sites—Mulwala (propellants and high explosives) and Benalla (a new $150 million munitions factory completed with private financing). |

|

1998 |

In preparation for the sale of ADI, Defence and ADI renegotiated the operating contracts for Mulwala and Benalla. This led to the signing of two new agreements in July 1998: the Mulwala Agreement relating to the Mulwala Facility, and the Strategic Agreement for Munitions Supply (SAMS) relating to the Benalla Facility. |

|

November 1999 |

The Government sold ADI to Transfield Holdings Limited and Thales Australia (at that time Thomson CSF) for $346.8 million, but due to a range of occupational health and safety, environmental and modernisation issues, Defence retained ownership of Mulwala. The Mulwala Agreement and the SAMS were novated to the new owners. |

|

2006– present |

The former ADI is wholly owned by Thales Australia. Under the trading name Australian Munitions, Thales continues to operate both Mulwala and Benalla.c |

Note a: Australian Defence Industries Pty Limited was renamed ADI Limited in January 1996. For convenience, the remainder of this report refers to the company as ADI.

Note b: ADI advised Defence that it could not cost-effectively operate Mulwala, given the overheads associated with running an inefficient and sub-optimal facility that required both modernisation and the rectification of significant occupational health and safety and environmental issues. See ANAO Audit Report No. 40 2005–06, Procurement of Explosive Ordnance for the Australian Defence Force (Army), fn. 49, p. 48.

Note c: For convenience, this report refers to Australian Munitions/Thales Australia as Thales.

Source: ANAO analysis.

1.5 Two of the eleven groups within Defence have responsibility for managing key aspects of the Mulwala Facility. The Capability Acquisition and Sustainment Group (CASG, formerly the Defence Materiel Organisation) manages the contracts for operating and redeveloping the facility. The Defence Estate and Infrastructure Group (formerly the Defence Support and Reform Group) supports CASG with program management for the delivery of capital estate projects.

Overseas production of propellants

1.6 Internationally, the number of propellant manufacturing facilities is limited. Locations of overseas production sites include Belgium, Sweden, Finland, Switzerland, South Africa, Brazil, Canada and the United States. The factories in Canada and the United States are considered sister factories to the Mulwala Facility—all three were built in the 1940s. The US facility (Radford Army Ammunition Plant, in Virginia) transitioned to a new prime contractor in 1995 and 2012, and has undergone significant modernisation efforts in recent years. The Canadian facility (in Quebec) has been operated by five owners since it was privatised in 1965. Both the Canadian and American facilities have also had to deal with longstanding environmental issues. Nearer to Australia, Indonesia commenced the development of a new propellant facility in 2014. In 1999, the United Kingdom took an alternative approach, and chose to cease production of propellant in Bishopton, Scotland. At the time, the UK Government was satisfied that sufficient and reliable alternative sources existed in Europe and further afield to meet future requirements.

Audit approach

1.7 The audit objective was to assess the effectiveness of the Department of Defence’s management of the Mulwala Redevelopment Project. The audit focused primarily on the progress of the project, including its cost and schedule performance, and Defence’s management of risks and issues. In this context, the audit also considered:

- the transition from the 1998 Mulwala Agreement (and the companion Strategic Agreement for Munitions Supply, for the Benalla Facility) to the 2015–20 Strategic Munitions Interim Contract; and

- the progress of environmental remediation of the Mulwala site.

1.8 To form a conclusion against the audit objective, the ANAO adopted the following high-level audit criteria:

- project risks were identified and managed effectively;

- the project is progressing to the expectations of the Commonwealth in terms of value for money, timeliness and delivery of required capability;

- arrangements for contractor operation of the redeveloped facility ensure that production capability is available when needed by the Australian Defence Force; and

- progress is being made in resolving environmental issues associated with both legacy and redeveloped facilities.

1.9 The audit method involved review of Defence records relating to the Mulwala Redevelopment Project and management of the Defence estate, ANAO visits to the Mulwala and Benalla Facilities, and discussions with senior Defence and Thales management.

1.10 The audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of approximately $384 000.4

2. Project rationale and planning

Areas examined

- Defence’s management of planning for the Mulwala Redevelopment Project; and

- risk management of the project.

Conclusion

Defence had difficulty in aligning the Mulwala Redevelopment Project into either its capability or facilities project model. From 2001 to 2006, in line with government direction, Defence sought private finance for the project, but had little leverage in attempting this approach. Defence concluded that two successive private finance proposals in 2005 did not represent value for money. Government then approved Budget funding for the project, and reduced the project scope so that it aligned with the 2001 cost announcement. Demolition of the old facility was one of the omitted items. After the Government approved Budget funding in 2006, Defence negotiated a contract that was signed in 2007.

Defence’s focus on cost meant that there was limited focus on the risks inherent in the project. Early on, Defence concluded that the project was low-risk, because the technology was long-proven; this substantially underestimated the risks inherent in a large-scale project to build a plant that would handle, and produce, hazardous chemicals.

2.1 Between 1998 and 2000, Defence reviewed options for retaining a domestic capability for the manufacture of propellant. Since at least the 1990s, Defence had recognised that the Mulwala Facility presented serious occupational health and safety and environmental concerns, and was contributing to an inefficient and costly manufacturing process. In the 1998 Mulwala Agreement with Australian Defence Industries (ADI), Defence undertook to conduct a Strategic Review with a view to modernising the facility.

2.2 Completed in 1999, the Strategic Review identified five options for modernisation. The recommended option was to replace essential areas at Mulwala, at a cost of $1.096 billion over 30 years. The expected price premium for a domestic munitions manufacturing capability was 32 per cent.5 In advice to Government during 2000, Defence also canvassed with Ministers the option of closing the Mulwala Facility, on the basis that there was no compelling justification to retain the current level of domestic propellant and high explosive manufacturing capability. Subsequently, the then Government requested that Defence submit a proposal to retain a domestic manufacturing capability and redevelop the facility at Mulwala.

2.3 The Government announced on 9 July 2001 that the Mulwala Facility would be retained and updated, at a cost of over $200 million. In addition, Defence would address environmental and safety remediation of the Mulwala site, and would negotiate for ADI to purchase the site and build a new facility in exchange for a higher-priced 20-year supply agreement with the ADF.

2.4 On 20 September 2001, the Prime Minister signed a public declaration with the Mayors of the Moira, Delatite and Corowa Shire Councils, committing the Government to invest up to $220 million in the Mulwala Redevelopment Project, with new long-term arrangements intended to be in place by 2004 (Figure 2.1).

Figure 2.1: Prime Minister’s commitment to a new Mulwala Facility, 20 September 2001

Source: Defence.

Did Defence manage the development of plans for the Mulwala Redevelopment Project effectively?

Defence did not manage the development of plans for the Mulwala Redevelopment Project effectively.

Defence had difficulty in aligning the project into either its capability or facilities project model, and applied some aspects of both models to the project. The area in Defence performing the role of Lead Capability Manager for the project changed several times.

Between 2001 and 2006, Defence sought to redevelop the Mulwala Facility through the then Government’s preferred option of private financing. This approach did not succeed because Defence had little leverage over the then contractor, Australian Defence Industries, and because of the safety and environmental problems at Mulwala. After the Government approved Budget funding for the project in 2006, Defence negotiated a contract that was signed in 2007.

The project was announced without detailed requirements. The scope of the project was adjusted to match the cost envelope announced in July 2001. This approach excluded some key requirements of the redevelopment, such as decontamination and demolition of redundant buildings.

Further, extensive scope changes occurred until contract signature in 2007, and continued to be made until the end of the project.

Responsibility for the project

2.5 Defence had difficulty in fitting the Mulwala Redevelopment Project into either its capability or facilities project model. In practice, Defence applied aspects of both models to the project.

2.6 The area in Defence performing the role of Lead Capability Manager for the project changed several times. The Navy sought to transfer the role to Army in 2011, but the Army did not formally accept the role until July 2013. In June 2014, the Army proposed that there be no Lead Capability Manager, and that the then Defence Materiel Organisation (DMO) should assume the role of ‘Project Realisation Manager’. The DMO agreed that the project did not align with the normal Capability Manager project responsibilities, as it did not deliver any specific capability to the Services. In consequence, the DMO (now Capability Acquisition and Sustainment Group) assumed the new role in January 2015.

2.7 Defence advised the ANAO in November 2015 that the armed Services are no longer directly involved in the management of the Mulwala Facility. The 2014 Strategic Munitions Interim Contract is now the basis by which certain munitions are provided to the Services. The Services are directly involved in deciding which munitions are sourced from Benalla.

Financing the project

The private finance option, 2001–06

2.8 The July 2001 Government decision focused on seeking private finance for the redevelopment of the Mulwala Facility by selling the facility to ADI, with direct investment by the Government retained as an alternative option. In a change of strategy in July 2003, the Government decided to redevelop the facility through private financing by ADI under an operating lease.6 After much delay, ADI submitted a private finance proposal in March 2005, and a revised proposal in July 2005. Defence concluded that neither the original nor the revised proposal by ADI represented value for money.7

2.9 On 15 December 2005, ADI declined to provide a third private finance proposal. Defence therefore recommended in January 2006 that the Minister seek Government approval of a direct investment option (that is, Budget-funded), and also advised him that it might in future seek additional funding to remediate the Mulwala site.

2.10 Notable factors leading to the failure of the private finance option included that:

- ADI was not a willing participant in the negotiation, as it already had a long-term supply contract with Defence (to 2015), and the prospect of a new 20-year contract in return for modernising the plant gave Defence little leverage over ADI.

- ADI had returned the Mulwala site to Defence ownership in 1993 because of its safety and environmental problems, and had little incentive to resume ownership of the site.

The direct investment option, 2006 onwards

2.11 The May 2006 Budget provided $338.7 million ($323 million out-turned) for the Mulwala Redevelopment Project. The Budget measure included additional resourcing of $131 million, with Defence to provide $208 million from existing resources.8 An ongoing cost increase of $9 million per year after the completion of the project was to be absorbed by Defence.

2.12 Contract negotiations between Defence and Bovis Lend Lease9, under a sole-source arrangement, ran from April to August 2006. In September 2006, as a form of Second Pass approval10, the Minister wrote to other members of the Government advising that an affordable contract price had been agreed within the previously agreed project cost. The Minister also noted that only $63 million had been allocated for site remediation, facilities upgrade, insensitive munitions capability and heritage management works, whereas the full cost of these separate works was estimated at $230 million.

2.13 The Mulwala Redevelopment Project design-and-construct contract with Lend Lease was signed on 8 June 2007. Lend Lease subcontracted ATK Launch Systems—the rocketry division of Orbital ATK—to provide the production process design, critical equipment and support for start-up, product qualification and performance testing of the new facilities.11

Project scope

2.14 The project scope underwent many changes from 1999 to 2007 (Table 2.1).

Table 2.1: Mulwala Redevelopment Project scope and financing changes, 2001–07

|

|

2001 |

2002 |

2003a |

2004 |

2005 |

2006 |

2007 |

|

Capability options |

|||||||

|

Total replacement of the nitrocellulose, propellant and solvent processes |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Plant capacity – 360 tonnes / Surge capacity – 530 tonnes |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

|

Plant capacity – 530 tonnes / Surge capacity – 800 tonnes |

|

|

|

|

|

|

✔ b |

|

Insensitive Munitions capability |

✔ |

✔ |

✔ |

✔ |

|

|

|

|

Administrative complex |

|

|

✔ |

✔ |

|

|

|

|

Decontamination and demolition of redundant buildings |

|

✔ |

✔ |

✔ |

|

|

|

|

Heritage management |

|

|

|

✔ |

|

|

|

|

Incinerator |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

|

Performance and safety testing facility |

|

|

✔ |

✔ |

✔ |

✔ |

✔ |

|

Financing options |

|||||||

|

Private |

✔ |

✔ |

✔ |

✔ |

✔ |

|

|

|

Government |

|

|

|

|

|

✔ |

✔ |

Note a: The 2003 scope change also focused on the type of private finance, rather than the cost (see paragraph 2.8).

Note b: In 2007, $9.5 million for increased surge capacity was included in the project scope, funded from project contingency.

Source: ANAO analysis of Defence records.

2.15 After approving the expansion of the initial scope in 2003, the Government subsequently approved a reduced scope in December 2005. As the focus of the project shifted during 2005—to achieving a direct investment cost that would fit within the Government’s September 2001 commitment of up to $220 million—Defence adjusted the project scope to the cost envelope, by removing from the project all elements not essential to delivering a safer manufacturing capability. This approach included the removal of key requirements such as decontamination and demolition of redundant buildings. Defence noted in 2005 that the reduced scope was not its preferred option:

as this option would simply provide a modern facility for a product that has been made at Mulwala for the past 40 years, rather than equipping the plant to meet future ADF requirements.12

2.16 Defence assured the Minister in 2005 that the reduced-scope option met the intent of the Prime Minister’s 2001 commitment to the local shire councils. Defence also advised the Government that an additional $95 million was needed to upgrade the remainder of the Mulwala site to meet all current and anticipated regulations and standards to 2010, and that no such funding had been identified.

2.17 After contract signature in 2007, scope changes continued until the end of the project.

Did Defence adequately identify and manage the risks involved in establishing a new facility?

Defence’s advice to government in 2001, 2005 and 2006 did not adequately assess the risks involved in establishing a new propellant facility. In April 2006, Defence assessed the technical risk as low, but made no mention of cost and schedule risk. While the technology to be used in the new facility was long-proven, the risks involved in establishing a new chemical plant to produce hazardous materials required assessment and mitigation.

In the event, the contracted schedule was too short, provision for project/engineering staff was inadequate, and Defence did not take into account the general lack of commercial expertise in constructing propellant manufacturing facilities.

Advice to Government on risk

2.18 Defence’s advice to Government in July 2001 was finalised within twelve days of public rallies in Benalla and Mulwala supporting the redevelopment of the Mulwala Facility, and the then Government’s decision was made within five days of receiving the Defence advice. The only consideration of project risk in Defence’s advice to the Government was in the context of importation of propellant and high explosives, and the need for stockpiling to avoid disruptions to munitions production at Benalla. Defence advised the Government that effective mitigation strategies were available to address most of those risks.

2.19 Defence’s 2001 advice to government did not address the potential difficulties of constructing a new facility, but implied that it would be straightforward to sell the existing facility to ADI, renegotiate existing agreements that were already very favourable to ADI, and have ADI build a new facility.

2.20 When Defence advised the Government in December 2005 about the reduced-scope options, there was a brief mention of schedule risk in obtaining a further proposal from ADI, but again there was no detailed consideration of project risk.

2.21 In April 2006, in the context of seeking Budget approval for the project, Defence’s advice simply stated that:

Subject to the approval of funding, the technical risks associated with this proposal are assessed as low.

Risk management

2.22 Defence’s risk management of the project began in late 2002 with a workshop to develop a risk management plan. Throughout the project, Defence maintained a risk log and conducted regular risk workshops. Defence’s 2005 Risk Management Plan assessed the technical risk as follows:

The standard propellant technology and processes to be utilised are proven and in-service in other countries. The capability sought by Government is not unique and is well within the capacities and experience of the preferred tendering company.

2.23 This assessment focused on technology risk (the technological maturity or otherwise of the proposed capability), at the expense of the broader concept of technical risk (the likelihood that the system will not reach its goals because of immaturity or design, configuration and implementation aspects of the system).13

2.24 The project also lacked a formal Technical Risk Assessment by the then Defence Science and Technology Organisation (DSTO). The DSTO commenced preparation of an assessment in 2005, but subsequent advice from the Project Director indicated that it was not required. Moreover, the DSTO was not invited to review proposals for the baseline manufacturing plant or other options. Consequently, when the project office was finalising its Science and Technology Plan in mid-2010 (three years after the Lend Lease contract was signed and the DSTO was first tasked with producing this plan), the technical risks were defined in a ‘rudimentary’ Technical Risk Assessment before any technical risk mitigation strategies could be developed.

2.25 In January 2009, when construction was experiencing schedule slippage and significant budget underspend, Defence initiated an internal review (the Budd Review) to identify risks and provide assurance that the project was realistic and achievable. In relation to risk management, the April 2009 Review report indicated that there was no evidence that the risk management process supporting the project was working effectively.

2.26 Defence records indicate that its risk management did not take into account the general lack of commercial expertise in projects of this nature, given that propellant manufacturing facilities are constructed infrequently.

2.27 In summary, the risks associated with constructing and commissioning a plant of the nature of the new Mulwala Facility were not well understood at the commencement of the project. In particular, Defence underestimated:

- the difficulties and time required for integrating plant, process and product (propellant);

- the need to provide adequate human resources and, in particular, engineering staff; and

- the challenges involved in delivering a propellant manufacturing plant, as opposed to the construction of buildings.

2.28 Moreover, Defence acknowledges that there was an assumption that propellant produced in the new facility would be automatically incorporated into production ammunition immediately after Final Acceptance. This led Defence to focus on the stage of propellant ‘qualification’, allocating inadequate time to the prerequisite activity of demonstrating that the plant worked on an industrial scale.14

3. Establishing the new facility

Areas examined

- Defence’s management of the Mulwala Redevelopment Project—including the construction, commissioning and completion stages, and internal reviews; and

- the final outcome of the project.

Conclusion

Defence’s underestimate of risk and the prime contractor’s inexperience in work of this nature became evident in the Mulwala Redevelopment Project’s construction and commissioning phases, with delays and unrealistic scheduling. Defence’s imposition of liquidated damages in March 2010 was followed by significant commercial disputes, adding to the delays. Through numerous contract alterations, Defence agreed that the original schedule had been unrealistic, committed more funding and extended the schedule. However, the contractor failed to meet multiple deadlines.

Defence’s internal review processes provided useful advice on key risks and their remediation. In late 2013, after the second internal review, Defence adopted a more pragmatic approach under which overall commercial considerations would take precedence over rigid enforcement of the contract. Defence granted Final Acceptance to the contractor in April 2015. However, resolution of the last of five major defects is not expected until August 2016—more than five years after the contracted completion date.

Reflecting the delay in completion arising from the unexpected complexity of the redevelopment, costs are estimated at some $415 million by 2017, against an approved project budget of $371 million (inflation-adjusted). This estimate includes further work, at a cost of some $44 million, that is still required to bring the facility up to an industrial level of production, as originally intended. Significant expenditure is yet to be budgeted for decontamination and demolition.

When completed, the Mulwala redevelopment should deliver a facility with much higher levels of safety, automation and environmental compliance than are provided by the plant built in 1942–43.

3.1 Under Defence’s June 2007 fixed-price contract for the Mulwala Redevelopment Project, valued at $263 million, Lend Lease was required to:

Design, Construct and Commission a propellant plant and support facilities that will safely, economically and reliably produce the nine propellants that have been developed and then Qualified by the Contractor.

3.2 The nine propellants to be produced and qualified in the new factory included propellants for 5.56 mm rifle ammunition, 5-inch naval shells, and mortar and artillery shells. The construction works included new nitrocellulose, solvent and propellant plants—to be built within the footprint of the existing plant, a confined burn facility, a Performance and Safety Testing Centre and a Production Process Support Facility. Construction was to begin within 12 months of contract signature, reach Practical Completion (completion of facility construction) within 33 months (March 2010), and achieve Final Acceptance (plant commissioned and specified propellants successfully qualified) within four years (June 2011).

3.3 These contract milestones were not met, and Final Acceptance was achieved in April 2015, nearly four years later than expected. Major defects were to be rectified by the end of 2015, but this target was not met.

Did Defence manage and review the project’s construction and commissioning phases effectively?

Defence did not manage the Mulwala Redevelopment Project’s construction and commissioning phases effectively. The construction phase commenced late, and within a year was facing delays and unrealistic scheduling. The commissioning phase, involving the introduction of hazardous chemicals into the new facility, also experienced long delays. Defence attributed these delays to technical problems, contractor inexperience in work of this nature, and lack of Defence project office resourcing and expertise.

By 2010, Defence and the prime contractor (Lend Lease) were involved in lengthy and expensive disputes over project scope and schedule. Between 2011 and 2015, Defence negotiated five deeds with Lend Lease, providing further payments, extended deadlines and changes of scope. While the deeds contributed to better relations with the contractor, the first two deeds failed to provide enduring solutions to the technical and schedule issues affecting the project.

Defence commissioned four Gate Reviews of the project to assess progress. The reviews provided useful advice on key risks and their remediation. Following the first review, the project was placed on Defence’s Projects of Concern list in December 2012. In late 2013, after the second review, Defence adopted a more pragmatic approach under which overall commercial considerations would take precedence over rigid enforcement of the contract.

3.4 Site mobilisation and construction commenced in October 2008 (three months late), but already there was concern at slow progress in design activities, with a forecast delay of 6–7 months in the 14-month design schedule.

3.5 After the first year of construction work, in October 2009, most building envelopes were essentially complete, and the first operational building in the new facility, the Performance and Safety Testing Centre, was transitioned into service. However, the contract administrator advised Defence that on-time completion of the project would be ‘optimistic’.

The major causes of delay

3.6 The commissioning phase involved the introduction of highly concentrated acids and other energetic materials into the new facility. This was not a simple process, and delays increased, with safety incidents and failed attempts to use the new equipment. From November 2011 to May 2012, the contract administrator repeatedly reported that the project was losing a month of schedule each month. At this stage, each month of delay was costing Defence approximately $1 million, due to the need to extend the support contracts with Thales, GHD, Qinetiq and others.15 In November 2011, the project director advised the Chief Executive Officer of the Defence Materiel Organisation that:

It is clear that commissioning of the Modernised Facility at Mulwala is proving far more difficult than originally expected.16

3.7 Delays continued as a result of emerging technical issues and the need to proceed safely. However, by late 2012 Lend Lease and ATK successfully produced three of the four required grades of nitrocellulose, and commenced initial test production of the first of the military-grade propellants that they were required to manufacture, test and qualify.

3.8 In September 2014, Lend Lease conducted a Propellant Facility Performance Test, with four full-scale production-size batches being manufactured. The test showed that the Solvent Fume Extraction system was inadequate to meet other than minimal production rates. Further, two elements of the production process—excess effluent generation and excess usage of ethanol—were identified as not meeting the contractual criteria.

3.9 Defence records indicate that the lack of an engineer in Defence’s project office left Defence unable to judge issues independently when confronted with conflicting advice from external engineering organisations.

Defence response to the delays

Deeds with the contractor

3.10 In March 2010, the deadline for Practical Completion by Lend Lease passed without construction having been finished, and Defence imposed liquidated damages on Lend Lease. Eighteen days later, Lend Lease made the first of a succession of commercial claims against Defence, eventually seeking up to $155 million for alleged additional works (157 claims of scope creep were put forward), extensions of time, and compensation for delays.17

3.11 Defence and Lend Lease were unable to resolve the dispute between them until external mediation led to preliminary resolution through a deed. Defence records indicate that there was very little collaboration or cooperation between Defence and Lend Lease during the dispute period. In all, from 2011 to 2015, Defence negotiated five deeds with Lend Lease, providing further payments, extended deadlines and changes of scope, as outlined in Box 2.18

|

Box 2: Post-contract deeds with Lend Lease, 2011–15 |

|

Deed 1, 9 February 2011, $15.7 million Final Acceptance: 24 February 2013

|

|

Deed 2, 15 November 2011, $26 million Final Acceptance: 24 February 2013

|

|

Deed 3, 6 September 2013 Final Acceptance: 31 March, 13, 20, 30 June 2013 To enable negotiation of Deed 4, imposition of liquidated damages was postponed four times. |

|

Deed 4, 20 December 2013 Final Acceptance: 15 February 2015

|

|

Deed 5, 9 April 2015 Final Acceptance: 30 April 2015

|

Note a: Figures are GST exclusive.

Note b: Liquidated damages were applied to Lend Lease from May to December 2010 ($1.3 million for late Practical Completion), and from December 2014 to April 2015 ($5.2 million for late Final Acceptance).

Source: ANAO analysis of Defence documentation.

3.12 While the deeds contributed to better relations with the contractor, the first two deeds failed to provide enduring solutions to the technical and schedule issues affecting the project.19 The amendments of the contracted date for Final Acceptance are shown in Figure 3.1.

Figure 3.1: Schedule slippage in planned Final Acceptance date

Note: The revisions were effected by the deeds listed in Box 2.

Source: ANAO analysis of Defence documentation.

3.13 In settling Lend Lease’s initial claims through Deed 1, Defence acknowledged that the originally contracted period of 15 months for the commissioning process was too short. Defence concluded that the settlement was the best that could be achieved under the circumstances, and that it removed complex risks, avoided the project stalling, and had the potential to remove some of the antagonism from relationships with the contractor.

3.14 Lend Lease’s various claims for compensation and damages were eventually settled in late 2011 through Deed 2. Defence considered the reduction in the number of propellants through this deed to be logical, because three propellants were no longer used by the ADF and one was very similar to a propellant that remained in the contract. In Defence’s view, this further settlement removed risk, increased the likelihood of achieving Final Acceptance by reducing the number of propellants, clarified technical and contractual issues and established a clear process for high-level governance of any further issues.

3.15 By mid-2013, Defence believed that the reimposition of liquidated damages (contractually due from 26 August 2013) would lead to a second formal dispute with Lend Lease. Deed 3 gave time for the negotiation of Deed 4, which provided a consideration to Lend Lease in recognition of its support for a staged handover of the facility. This approach was intended to spread the acceptance of various parts of the facility over a 12-month period, and allow Thales, as Operator and Maintainer, to work towards the commencement of operations in the new facility.

3.16 The staged handover envisaged by Deed 4 occurred during late 2013 and early 2014, with operation and maintenance of a number of buildings transferred from Lend Lease to Thales.20

Internal reviews and a Project of Concern

3.17 Defence conducted four Gate Reviews21 of the Mulwala Redevelopment Project. The reviews were detailed and recommended methods to assist in remediating the project, as shown in Box 3. The reviews also observed features of the contracting arrangements and approach which required attention by the parties, including the benefits of: a more commercial and pragmatic approach by Defence; and establishment of better relationships for mutual benefit.

3.18 Following the first Gate Review in March 2012, the project was placed on Defence’s Projects of Concern list in December 2012. There was particular concern at that time over poor schedule performance to date and the adequacy of the budget to complete the project.

|

Box 3: Defence Gate Reviews of the Mulwala Redevelopment Project |

|

March 2012: The review board recommended strong action to ensure acceptable contractor performance. The review also observed that risks had not been adequately assessed and the decision to have Lend Lease as the prime and ATK as its principal subcontractor had added to management complexity. May 2013: The review board found that the contractor appeared to be applying suitable resources in order to work through the technical issues, but the project lacked a detailed understanding of the goal and a strategic commercial approach. This approach was considered necessary in light of the likely reimposition of liquidated damages, a tight project budget and the uncertainty being cast over transition plans by the competitive tender for operating the Mulwala and Benalla Facilities. The review board recommended the establishment of a high-level team to develop a commercial strategy. The strategy that Defence eventually adopted aimed for a more pragmatic/commercial approach, under which overall commercial considerations would take precedence over rigid enforcement of the contract. May 2014: The review board concluded that the prognosis remained uncertain and of concern. Scope, cost and schedule were all under pressure, key technical issues were yet to be resolved, there were known risks and the continuing prospect of emergent unknowns, and qualification was yet to be achieved for any of the five propellants. The review praised the more pragmatic approach and attempts to establish better relations with Lend Lease. However, it also emphasised the importance of obtaining a fully functioning safe propellant plant, proven by the production of five qualified propellants, meeting environmental standards and supported by applicable documentation. February 2015: The review board noted positive signs since the previous Gate Review, and ‘pragmatic compromises’ on what was originally intended to be achieved. The two key inputs to progress were identified as the involvement of Thales through advice and assistance to Lend Lease, and the Project Director’s work to significantly improve relationships between Defence, Lend Lease and Thales. |

3.19 In response to an extract from this audit report, ATK advised the ANAO in January 2016 that:

Regarding Defence Gate Reviews, ATK agrees that risks were not adequately assessed. In addition, the contracting arrangement was made more complex and indeed the ability to perform inhibited when the Government announced a competition for management of the facility. Whether intentional or not, the competition for management of the facility overlapping the redevelopment project generated conflicts when cooperation and information sharing between all the stakeholders was necessary. The environment improved dramatically after the facility competition was cancelled and the three parties, Lend Lease, ATK, and Thales worked together to achieve technical success, delivering a world class facility.22

Did Defence manage the completion of the project effectively?

In early 2015, Defence adopted an effective two-stage process for finalising the project, which enabled the new facility to commence the ramp-up to industrial-scale production.

As at February 2016, Lend Lease’s rectification of the last of the five significant defects was expected to be completed by August 2016, more than five years after the contracted completion date of June 2011.

3.20 As shown in Box 2, the deeds between Defence and Lend Lease postponed Final Acceptance several times. In late 2014, Defence and Lend Lease discussed how the project could be concluded in a way that best suited all parties, but failed to reach agreement. Defence then directed Lend Lease to: complete propellant qualification testing, resolve major defects and offer a higher degree of confidence concerning the future operability of the new facility before Final Acceptance could be achieved. At this stage, Defence’s Projects of Concern reporting was showing high risk against all aspects of the project (commercial, technical, schedule, cost and reputation).

3.21 By April 2015, Lend Lease had made significant progress: the propellant manufacturing and finishing areas and the packing area had been substantially completed, and the rest of the new facility had reached Final Acceptance and was being operated and maintained by Thales or being transferred to Thales’ operational control. The five propellants still specified in the contract had been assessed as meeting the requirements for propellant performance against the contract test matrix. Further, Thales management believed that it could rectify outstanding issues, contingent on the completion of the Deed 5 rectifications and support from Defence to make a series of modifications/upgrades to enable a full product range to be produced at the required throughput rate as well as addressing outstanding plant reliability and waste-related issues.

3.22 In early 2015, Defence adopted a two-stage process for finalising the project: Lend Lease would rectify five significant defects after Final Acceptance (that is, by the end of 2015), and Thales would take over the new facility and begin the industrialisation process.23 Industrialisation was expected to take two years, subject to successful completion of the Deed 5 rectifications by Lend Lease. For Defence, the key advantages in adopting the two-stage approach were that: the Thales workforce could be redeployed from supporting test activities to commencing relocation to the new facility; the facility would not be shut down for a year while the remaining defects were fixed; and the Defence project team could be disbanded. Through Deed 5, Defence granted Final Acceptance to Lend Lease on 30 April 2015. As at February 2016, rectification of the last of the five major defects by Lend Lease was expected to occur by August 2016, eight months behind the schedule agreed in April 2015, and more than five years after the contracted completion date.

3.23 As a consequence of the five deeds that amended the Lend Lease contract, and the long delay in completing the project, a number of Defence contracts had to be extended in both time and scope. In particular, the Thales Support Services Contract was extended from 1 December 2012 to 30 June 2015, and the scope was extended to include safety training for Thales operational staff, development of Major Hazard Facility (MHF) Comcare licensing for the redeveloped facility, and initial operation and maintenance of the Nitrocellulose Plant.

3.24 The history of the project suggests that Defence’s implementation would have benefited from:

- selection of a contractor with a demonstrated track record in delivering the capability being acquired;

- a more active, and direct, relationship between Defence and the prime contractor;

- an effective Project Control Board to oversee project management; and

- more active Defence management and oversight of the engineering aspects of the project.

Has the project delivered the agreed outcomes?

When completed, the Mulwala redevelopment should deliver a facility with much higher levels of safety, automation and environmental compliance than are provided by the plant built in 1942–43.

Defence advised the ANAO that the Mulwala Redevelopment Project would be completed within its $371 million budget. However, this advice excludes funds used from non-project sources to pay for redevelopment costs. Further work, at an estimated cost of some $44 million, is also required to bring the facility up to an industrial level of production. Taken together, total current and planned expenditures are estimated to be some $415 million by 2017, with significant expenditure yet to be budgeted for decontamination and demolition.

3.25 When completed, the Mulwala redevelopment should deliver a facility with much higher levels of safety, automation and environmental compliance than are provided by the plant built in 1942–43. Verbal advice from Thales to Defence is that: the facility is more robust in nitrating nitrocellulose (at good nitration rates, with lower environmental impact through nitrous oxides output); initial production from the propellant manufacturing and finishing elements of the plant is producing good-quality product; but significant issues remain in relation to plant reliability, production rate and output of volatile organic compounds. Thales considers that qualification of propellant from the redeveloped facility will be achieved without significant issues being encountered, contingent on successful completion of the Deed 5 rectifications and continued support from Defence regarding the required modifications/upgrades. Thales has further advised Defence that it is in a position to progress qualification of a new ‘flake’ propellant manufactured in the new plant.

Finalising the modernisation

3.26 After the redeveloped facility produced propellant to satisfy initial tests and demonstrate its availability for production, there was a requirement to industrialise the facility. Defence paid Thales an initial $4.8 million to operate the redeveloped facility from 1 July to 30 September 2015 under the operating contract.24

3.27 In November 2015, Defence contracted Thales to further develop and operate the new facility. At that time, completion of industrialisation was scheduled for June 2017, although a staged transfer of production was intended to occur over 20 months.25 The estimated cost of the industrialisation program was $33 million, funded predominantly from Mulwala Redevelopment Project Net Personnel and Operating Costs, with supplementation from sustainment funding.

3.28 Separately, in late 2015 Defence was also preparing to fund a number of additional modifications to the redeveloped facility, mostly using Capability Realisation Program funding.26 These capital projects, which are intended to ensure an industrial rate of production, plant reliability and environmental compliance, were initially costed at some $11 million, and included:

- improvements to manufacturing processes, such as replacement of agitators, and upgrade of the conveyor system;

- environmental control in the packing building; and

- doubling of the width of 6000m of clearways, and installation of 1500m of pathways to replace the ‘totally inadequate and unsatisfactory’27 network provided by the Mulwala Redevelopment Project.

Cost summary

3.29 Defence advised the ANAO that the Mulwala Redevelopment Project would be completed within its budget of $371 million. However, this advice excluded funds from non-project sources that have been used to pay for redevelopment costs. For example, Defence advised that some $18 million was paid from non-project sources (‘sustainment’ funding) for works such as:

- adding the new facilities to the existing site-wide Major Hazard Facilities (MHF) licence;

- cost of Thales labour to operate the new facilities during Lend Lease testing and during the industrialisation period;

- removal and destruction of waste materials produced during testing;

- specialist contractor engineering support; and

- other associated costs at the new Mulwala facilities.

3.30 Further, some $44 million of non-project funding is being spent to finalise and fully industrialise the new plant, tasks which were in the originally contracted project scope.

3.31 Notwithstanding Defence’s project reporting, Table 3.1 shows that the redevelopment (as distinct from the ‘project’) has cost some $371 million to date, and will have cost an estimated $415 million by 201728, with significant expenditure yet to be budgeted for decontamination and demolition.

Table 3.1: Estimated redevelopment costs to 2017

|

|

|

$million |

|

Budget |

||

|

Mulwala Redevelopment Project budget approved by Government (inflation-adjusted to November 2015, including contingency)a |

|

371 |

|

Costs |

||

|

Costs to date |

||

|

Mulwala Redevelopment Project |

360 |

|

|

Non-project funding used for redevelopment purposes |

18 |

|

|

Liquidated damages paid to Defence by Lend Lease |

(7) |

371 |

|

Estimated future costs |

||

|

Industrialisation |

33 |

|

|

Remediation of deficiencies through capital works in support of industrialisation |

11 |

44 |

|

Estimated cost of redevelopment to 2017b |

415 |

|

|

Estimated overspend to 2017 |

44 |

|

Note a: Excludes Defence’s internal Project Office costs, which until June 2015 were funded through the separate appropriation for the Defence Materiel Organisation; Defence does not include these costs in its project reporting. Defence estimated its Project Office costs for the years 2001–16 at some $17 million.

Note b: Significant expenditure is yet to be budgeted for decontamination and demolition.

Source: ANAO analysis of Defence records.

3.32 Two further issues relating to the Mulwala Facility have not been fully resolved:

4. Delivering munitions to the Australian Defence Force

Areas examined

- value for money under the 1998–2015 operating agreements;

- the competitive tender for operating the Mulwala and Benalla Facilities; and

- efforts to obtain better value under the interim 2015–20 contract.

Conclusion

Contractor operation of the Mulwala Facility and the associated Benalla Facility since 1998 has fulfilled the ADF’s domestic orders for munitions. Defence paid $526 million for munitions produced by the facilities. Defence paid $1.874 billion in order to build, operate and maintain the two munitions facilities. The cost of the capability to manufacture munitions in Australia has provided regional economic and employment benefits and some strategic value in terms of security of supply. Defence advised Government in 2000 and 2014 that the facilities should be closed, and also advised in 2012 that the strategic requirement to manufacture munitions in Australia is minimal. This suggests that the cost of building, operating and maintaining the facilities did not represent value for money.

Between 2009 and 2014, Defence sought to conduct a competitive tender for operation of the Mulwala and Benalla Facilities. The tender process was cancelled because of delays in the release of the Request for Tender and uncertainties arising from the unfinished Mulwala Redevelopment Project. In late 2014, Defence entered into a five-year interim contract that provides some improvement in value for money. Defence is now in a better position to advise the Government on options for the post-30 June 2020 operation of the facilities, and develop a cost-effective implementation plan.

Area for improvement

The ANAO has made a recommendation for Defence to advise the Government on options for the post-2020 arrangements at Mulwala and Benalla.

4.1 From July 1998 to June 2015, two interrelated contracts governed the production of propellant and high explosives at the Mulwala Facility, and the production and sale of ammunition from the Benalla Facility:

- the Mulwala Agreement—Thales was required to manufacture propellant and high explosives to be supplied to the Benalla Facility; and

- the Strategic Agreement for Munitions Supply (SAMS)—Thales was required to maintain a capability at the Benalla Facility to manufacture explosive ordnance for the Australian Defence Force.31

4.2 The two 1998 agreements were originally framed to guarantee the future of ADI (now Thales) as the ‘first choice source of a specified range’ of explosive ordnance to Defence. In effect, the agreements maximised the sale price for ADI’s ammunition business at the cost of locking the Defence customer into high-cost/high-subsidy supply arrangements.32 By 2006, Defence had recognised that both agreements were financially complex and burdensome to administer.33

Did Defence manage the 1998–2015 operating contracts effectively and achieve value for money?

The operating contractor, Thales, has met Defence’s orders for propellant, high explosives and munitions under two related contracts. For over a decade, the contracts were largely self-managed by Thales, and Defence did not manage the subsidies (capability and other payments) effectively. Recognising its longstanding contract-management shortfalls, Defence established a Strategic Munitions Contracts Directorate in 2011, and achieved some savings. This directorate successfully managed a complicated transition to the interim contract in 2015, including the acquisition of the Benalla Facility by Defence.

From 1999 to 2015, Defence paid $526 million for munitions produced by the Mulwala and Benalla Facilities. Defence paid $1.874 billion in order to build, operate and maintain the facilities: $1.386 billion in capability and other payments; $371 million in redevelopment costs; and $117 million for environmental and facilities remediation.

In general, domestically produced munitions are more costly than similar munitions sourced internationally. A 2013 RAND review of Australia’s munitions manufacturing industry observed that, if maintaining a domestic munitions industry is desirable, using the full production capacity at Benalla is the key to controlling costs. The capability to manufacture munitions in Australia has provided regional economic and employment benefits and some strategic value in terms of security of supply. Defence advised Government in 2000 and 2014 that the facilities should be closed, and also advised in 2012 that the strategic requirement to manufacture munitions in Australia is minimal. This suggests that the cost of building, operating and maintaining the facilities did not represent value for money.

Expenditures, production and profit sharing under the agreements

4.3 From 1999 to 2015, under the Mulwala Agreement and the SAMS, Defence paid:

- $526 million to purchase munitions manufactured by Thales at the two facilities, at a variable ‘unit price’ representing the cost of materials and labour; and

- $1.386 billion to maintain the capability of the two facilities to manufacture a specified amount of propellant or munitions (capability payments, indexed annually).

4.4 Mulwala’s production is either: supplied to the Benalla Facility for incorporation into ammunition purchased by Defence; supplied directly to Defence as a finished product (mostly high explosives); or sold into the commercial propellant and specialty chemicals markets. During the life of the Mulwala Agreement, the Mulwala Facility produced an average of 585 tonnes of propellant per year, and annual production of high explosives ranged from 72 to 650 tonnes. Thales achieved some growth in production of propellants, and fulfilled Defence’s orders for propellant, high explosives and munitions.

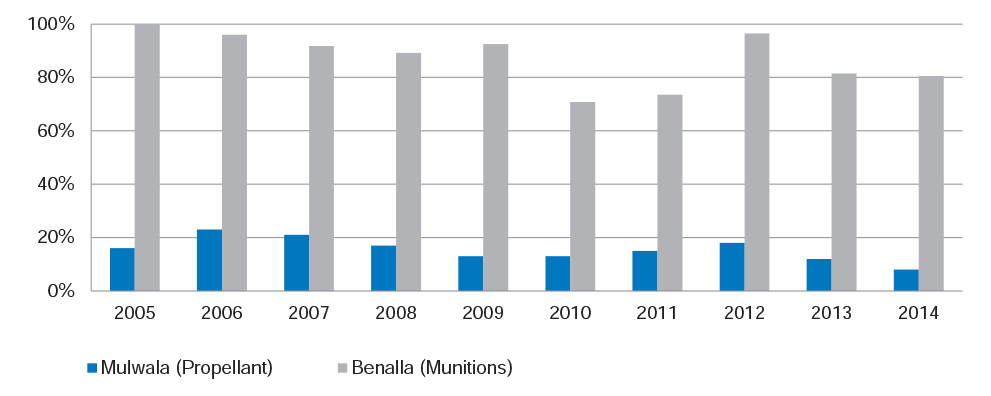

4.5 An average of 15.6 per cent of annual propellant production from the Mulwala Facility has been used for ADF purposes from 2005 to 2014 (Figure 4.1). By contrast, an average of 87 per cent of annual munitions production from Benalla has been sold to the ADF.34 High explosives produced at Mulwala have been used almost exclusively for ADF purposes.

Figure 4.1: Mulwala and Benalla production used for ADF purposes, 2005–14

Source: Thales Australia.

4.6 In 1998, Defence and Thales agreed on a management arrangement whereby Thales would derive no profit from the manufacture of propellant destined for Benalla for incorporation into Defence munitions. In return, Thales was given the right to exploit the Mulwala Facility for commercial production. The 1999 Strategic Review35 observed that operating the two facilities for the quantities required for the ADF’s peacetime needs alone would have been prohibitively expensive. As part of the overall arrangement, Defence would receive a share of the profit from commercial sales, and would use it to offset its capability payments:

- From 1999 to 2014, Defence’s share of profit from the Mulwala Facility was $26.3 million, some 25 per cent of the net profit. Defence also received from Thales a fixed rent of $57 000 per year under a lease that accompanied the Mulwala Agreement.

- From 2001 to 2014, Defence’s share of profit from commercial sales from the Benalla Facility amounted to $6.59 million.

Capability payments and contract management

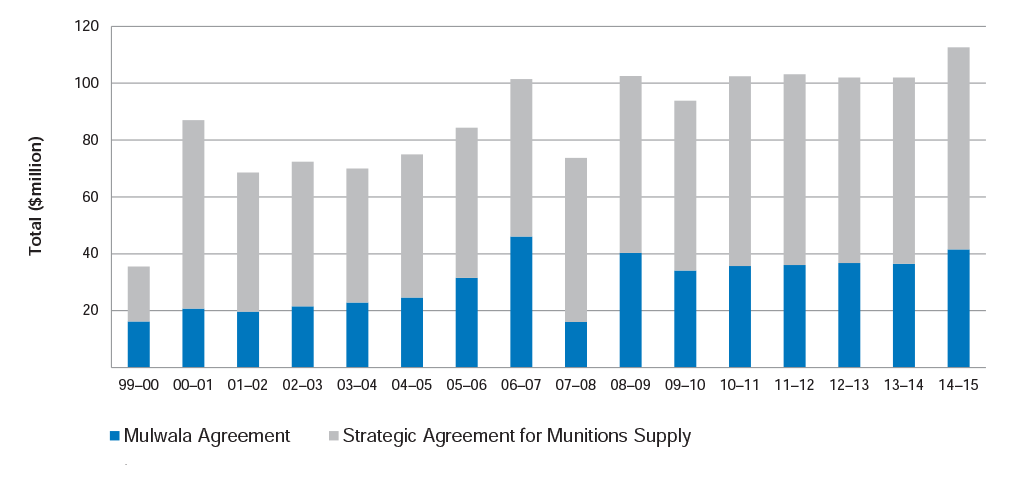

4.7 Capability and other payments represented the subsidy provided to Thales to meet the fixed costs of production at Mulwala and Benalla. The payments were also designed to repay the ADI investment in constructing the Benalla Facility, at the Long Term Bond Rate plus 6.6 per cent. From 1999 to 2015, Defence paid capability and other payments of $1.386 billion: $480 million under the Mulwala Agreement, and $906 million under the SAMS (Figure 4.2).36

Figure 4.2: Capability payments to Thales, 1999–2015

Source: Defence.