Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Debt Management and Recovery in Services Australia

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

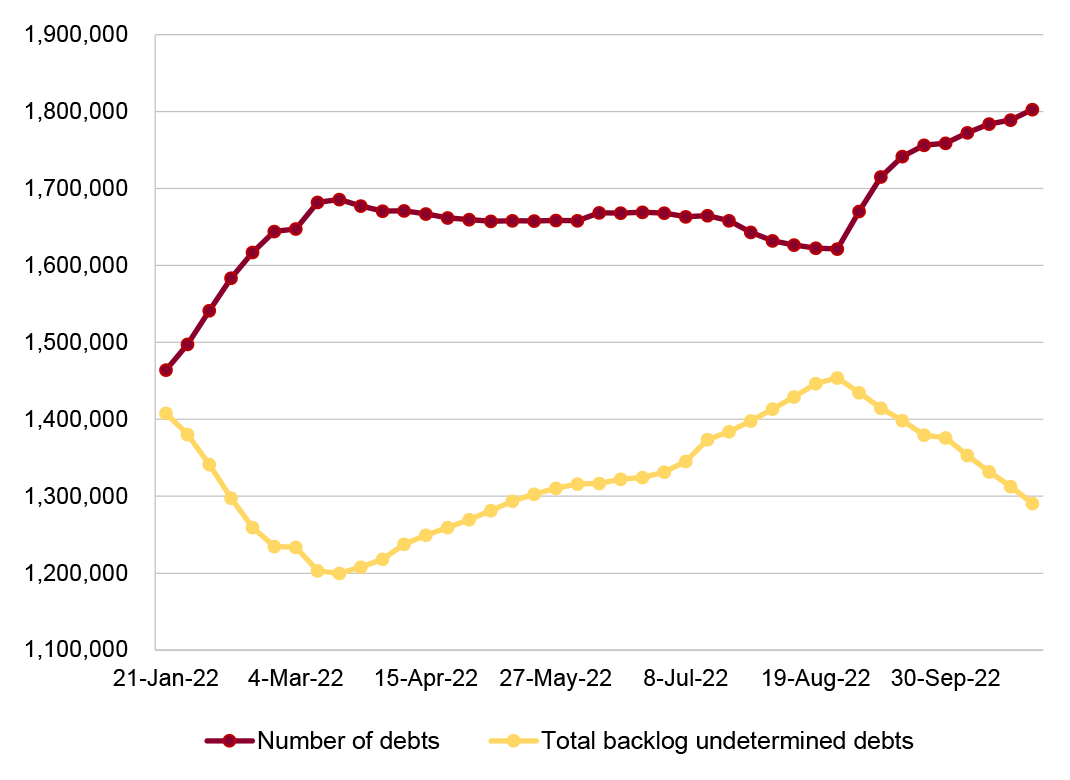

- Debt balances and the value of undetermined debt have been increasing since 2018.

- Debt management reflects a complex system of legislation, policies and procedures, internal governance arrangements and relationships with policy entities.

Key facts

- Services Australia managed social security and welfare debts on behalf of nine policy entities in 2021–22.

- Debt management includes: detecting potential overpayments; determining whether a debt is legally recoverable; raising the debt for recovery; and managing the debt under a payment arrangement or waiving or writing-off the debt.

- Since 2019, natural disasters combined with the impacts of the COVID-19 pandemic, have led the Australian Government to implement pauses to debt raising and recovery, including temporarily writing-off debts.

What did we find?

- Services Australia has partly fit-for-purpose debt administration and recovery governance arrangements. Arrangements for oversight, roles and responsibilities, policies and procedures, training and quality checking do not sufficiently support staff to effectively undertake debt activities.

- Services Australia has not established effective risk-based strategies to detect and deter debt. Services Australia does not assess effectiveness of debt management activities.

- Services Australia accurately reports on debt balances.

What did we recommend?

- There were four recommendations to Services Australia aimed at: oversight arrangements, effectiveness and usability of policies and procedures, establishing a debt management strategy and internal targets for performance.

- Services Australia agreed to all four recommendations.

$1.9bn

estimated value of undetermined debt in 2021–22

51%

of potential overpayments awaiting decision were determined in 2021–22.

$3.7bn

of the $4.6 billion total outstanding debt at 30 June 2022 was temporarily written-off

Summary and recommendations

Background

1. Services Australia is the Australian Government’s primary service delivery agency. Its purpose is to support Australians by delivering high-quality and accessible services and payments on behalf of the Australian Government (in partnership with other government entities). In 2021–22, Services Australia made $226.7 billion in payments under three key program areas. Sixty-seven per cent ($152.2 billion) of payments made in 2021–22 were administered under Program 1.1 — Services to the community — Social security and welfare. Program 1.1 is the focus of the audit.

2. Services Australia aims to ‘pay the right person, the right amount through the right program at the right time.’ Where incorrect information is supplied by customers, there are delays in notification of a customers’ changes in circumstances, or Services Australia makes an administrative error, overpayments or underpayments can occur. Where there is an overpayment, a debt may arise, and legislation generally requires Services Australia to recover the debt.

3. Services Australia aims to manage debt ‘quickly, accurately and in a sensitive manner’1 and in accordance with government policy decisions. The debt management process involves detecting potential overpayments (once detected these are classified as undetermined debts), determining whether potential overpayments are legally recoverable and a debt should be waived or raised for recovery, and managing the recovery of the determined debts. Decisions about debt (such as to determine that there is a debt, waive or write-off a debt, or enter into a recovery arrangement) must be made in accordance with relevant legislation including the Social Security Act 1991, Social Security (Administration) Act 1999, A New Tax System (Family Assistance) (Administration) Act 1999, Student Assistance Act 1973 and Paid Parental Leave Act 2010.

Rationale for undertaking the audit

4. At 30 June 2022 there was $4.6 billion outstanding social security and welfare debt that has been determined (1,668,870 individual debt cases), and $1.9 billion undetermined debt2, across more than 47 debt benefit groups. Of the total debt, $3.7 billion was temporarily written-off at 30 June 2022 (1,344,838 individual debt cases). Debt balances and the value of undetermined debt have been increasing since 2018. This audit was identified as a Joint Committee of Public Accounts and Audit (JCPPA) priority of the Parliament for 2022–23. This audit provides the Parliament with assurance that Services Australia is managing and recovering debt effectively with fit-for-purpose arrangements.

Audit objective and criteria

5. The objective of the audit is to assess the effectiveness of Services Australia’s management of social security and welfare debt.

6. To form a conclusion against the objective, the following criteria were applied.

- Does Services Australia have fit-for-purpose debt management governance arrangements?

- Has Services Australia developed and implemented effective strategies and processes to manage debt?

- Does Services Australia assess and accurately report on the effectiveness of its debt management and performance activity?

Conclusion

7. Services Australia’s debt management and recovery of social security and welfare debt on behalf of policy entities is partly effective. Services Australia does not have a coordinated approach for the debt management lifecycle including detecting potential overpayments, determining whether a potential overpayment is a legally recoverable debt, raising the debt and either waiving or recovering the debt.

8. Services Australia has partly fit-for-purpose debt administration and recovery governance arrangements. Services Australia’s processes for managing and coordinating debt management and recovery activities include internal governance arrangements and informal and formal arrangements with policy entities responsible for the social security and welfare payments administered by Services Australia. These arrangements are not clearly documented. Services Australia has policy and procedures and training materials for debt management and recovery. Staff deemed ‘proficient’ through quality checking activities did not achieve correctness targets in 2021–22 when processing new debts.

9. Services Australia has partly effective strategies to detect, determine and recover debt. Debt is detected through processes designed to manage payment accuracy risks rather than risk-based compliance and enforcement strategies. In 2021–22, Services Australia determined 51 per cent of undetermined debts available for processing. The end of debt pauses relating to natural disasters and the COVID-19 pandemic contributed to a backlog of detected debts awaiting determination. Services Australia does not monitor debt detected relative to the risk of overpayment for all social security and welfare payments. The effectiveness of debt management and recovery activities is not measured.

10. Services Australia accurately reports on debt balances in its annual reports and to the policy entities for inclusion in their financial statements. Services Australia has partly established adequate arrangements to assess and report on the effectiveness of its management of debt. The single debt related performance measure reported externally by Services Australia was discontinued from 2021–22. Services Australia’s internal measures do not assess performance against all aspects of the debt management process. Services Australia and the Department of Social Services (DSS) have established performance measures under the bilateral arrangement, and are piloting additional performance measures to replace those that are no longer fit-for-purpose.

Supporting findings

Governance

11. Seven entities with policy responsibility for social security and welfare payments managed by Services Australia have delegated debt related functions and powers to Services Australia’s Chief Executive Officer (CEO). It is unclear what processes are in place to ensure delegations from policy entities are current. In 2021–22, internal delegations from Services Australia’s CEO to staff to undertake debt management and recovery were only limited by the value of the debt to be actioned and the level of the staff. Services Australia oversees and coordinates debt management and recovery activities via bilateral agreements, organisational reporting structures, governance and operational committees and informal and formal contact arrangements with policy entities. The relationship between these arrangements is not documented. The bilateral arrangements do not clearly set out debt management roles and responsibilities or escalation pathways (see paragraphs 2.3 to 2.22).

12. Services Australia has 250 policies and procedures for debt management and recovery which are accessible by all staff. References to legislation in guidance materials are generally current and accurate, with a few exceptions. Procedures do not inform staff of whether they are carrying out an administrative process or a legislative function for which they require a delegation. Internal training is grouped into debt raising (48 training days), debt recovery (10 training days) or a combination of both elements (50 training days). Results of quality assurance activities indicate that policies, procedures and training do not sufficiently support staff assessed as ‘proficient’ to achieve the target correctness rate of 95 per cent or higher when determining new debts (see paragraphs 2.26 to 2.42).

Strategies and processes to manage and recover debt

13. Services Australia does not have a strategy for detection and deterrence of debt. Services Australia manages the prevention and detection of debt through strategies and compliance activities focused on payment accuracy. Improvements in payment accuracy can reduce the occurrence of debt. Operational plans focus on the processing of undetermined debt and managing the end of the debt pauses. While Services Australia proposes to adopt a risk-based approach to debt management in the future, current strategies and plans are not risk-based. Payment accuracy focused strategies and plans did not set out performance measures and targets to support an assessment of the effectiveness of Services Australia’s activities across the debt management lifecycle (see paragraphs 3.3 to 3.18).

14. Debt detection is a product of business processes and activities designed to manage payment accuracy risks including processing changes in customers’ circumstances, reconciliations of customer estimated income to actual income and compliance activities. Automated processes detected 99 per cent of the number and 99 per cent of the value of debts detected in 2021–22. In 2021–22, planned compliance activities were largely dependent on operational capacity, limiting risk-based prioritisation. The breakdown of debts detected by each method is not reported or monitored to determine the effectiveness of debt detection relative to the overpayment risk. Overpayment risk is not estimated for all social security and welfare payments administered by Services Australia. There are no benchmarks or targets for debt detection activities across the entity (see paragraphs 3.25 to 3.36).

15. In 2021–22, Services Australia made 1,764,464 determination decisions representing 51 per cent of undetermined debts available to be actioned. The number of undetermined debts awaiting determination was affected by various debt pauses. Of the determination decisions made, seven per cent were finalised as no debt, 32 per cent were waived and 61 per cent were raised for recovery. System controls supporting delegate decision-making are not always consistent with delegation instruments. Policy and procedures do not provide sufficient information to support some key information and decisions on the customer record. Services Australia did not meet its timeliness performance measures for determining debt in 2021–22 (see paragraphs 3.37 to 3.50).

16. Services Australia manages the recovery of debt through temporary and permanent write-offs, waivers, payment arrangements negotiated with customers and referrals to external collection agents. In 2021–22 Services Australia reduced its debt balance by $1.9 billion through recoveries ($1.3 billion), waivers ($0.1 billion), permanent write-offs and debt reductions ($0.5 billion) of determined debts outstanding. Of the $4.6 billion of outstanding debt as at 30 June 2022, 81 per cent was temporarily written-off (reflecting debt pauses for the COVID-19 pandemic and natural disasters) and 12.5 per cent was under a recovery arrangement valued at $0.6 billion. While the power to write-off a social security and welfare debt for a period of time is found in the relevant legislation, Services Australia treated temporary write-offs of debt pauses as administrative decisions in some cases. Services Australia does not have performance measures to enable an assessment of the appropriateness of its debt recovery activities (see paragraphs 3.51 to 3.62).

Reporting and performance measurement

17. Services Australia reports debt balances and debt recovery in its annual reports, internal reports and through regular financial reports to the policy entities, for inclusion in policy entities’ financial statements. The reports accurately represent outstanding balances for determined debt and debt recoveries. Services Australia provides assurance to policy entities on the accuracy of its debt reports through annual assurance letters from its Chief Financial Officer. Services Australia produces one internal report about weekly debt activities (see paragraphs 4.2 to 4.13).

18. Until 2021–22, Services Australia reported externally on a single debt measure (debt under recovery), that was generally measurable, but not related to an activity. From 2021–22 this measure has been discontinued, and no other debt measure is in place. Services Australia has a limited set of internal measures to assess debt management performance; the measures do not have targets and do not cover all debt management and recovery activities. Since January 2022 the measures have been reported weekly. For seven entities that Services Australia managed debt on behalf of in 2021–22, only the bilateral arrangements with the Department of Social Services (DSS) contained debt performance measures and reporting requirements. Additional pilot measures were introduced in 2021–22 as DSS and Services Australia agreed the existing bilateral measures were not fit-for-purpose. No targets have been set for the pilot measures, therefore the current reporting does not facilitate an assessment of the effectiveness of Services Australia’s management of debt on behalf of DSS (see paragraphs 4.14 to 4.36).

Recommendations

Recommendation no. 1

Paragraph 2.22

Services Australia document and map the internal and bilateral oversight arrangements for all debt management activities, including reporting lines, roles and responsibilities of governance committees and officer level meetings and performance reporting.

Services Australia response: Agreed.

Recommendation no. 2

Paragraph 2.42

Services Australia review the effectiveness and usability of policies and procedures, training and supervision relating to debt management activities to improve staff proficiency rates and results of quality assurance activities.

Services Australia response: Agreed.

Recommendation no. 3

Paragraph 3.18

Services Australia establish a risk-based debt management strategy that:

- defines goals, strategies, activities and performance measures for detection and deterrence (including raising and recovery); and

- determines a debt risk appetite or tolerance, and maps planned debt management activities to relevant risks.

Services Australia response: Agreed.

Recommendation no. 4

Paragraph 4.36

Services Australia establish internal targets to inform a clear assessment of its performance on all debt management and recovery activities.

Services Australia response: Agreed.

Summary of entity response

19. The proposed audit report was provided to the Services Australia and an extract was provided to DSS. The summary responses are reproduced below, with the full responses provided at Appendix 1. The ANAO’s comments on Services Australia’s responses to the report’s recommendations are at the relevant paragraphs of this report. The improvements observed by the ANAO during the course of this audit are at Appendix 2.

Services Australia

Services Australia (the Agency) notes the findings of the report that the Agency’s arrangements for debt management and recovery are partly effective, having regard to internal and external governance arrangements, Agency strategies to inform debt management activities, performance monitoring and reporting, and staff training and quality assurance.

The Agency’s primary focus is on delivering payments and services to the Australian community. Debt management and recovery is a consequence of this function, and especially payment accuracy, rather than an objective in its own right. Accordingly, the Agency’s strategies, performance measures, and governance arrangements are focussed on ensuring the right payment to the right person at the right time, to prevent customers from incurring a debt.

The Agency is committed to continually improving its internal and external governance arrangements, performance monitoring and reporting, and the guidance and support to staff to ensure the ongoing effectiveness of arrangements for debt management and recovery.

Department of Social Services

The Department of Social Services (the Department) acknowledges the insights outlined in the Australian National Audit Office proposed (Section 19) extract report on Debt Management and Recovery in Services Australia.

The Department considers there to be a close and collaborative working relationship between it and Services Australia on a range of matters, including debt and compliance policy. The Section 19 report should recognise the legal framework that underpins the way Services Australia operates in relation to social security law. In addition to this, there is a range of informal and formal channels that help foster this relationship, with the Department’s Head Agreement providing the overarching governance framework for engagement and accountability between the two entities. The Department acknowledges the ANAO has recognised the current work underway to review and strengthen the bilateral governance arrangements. The Department notes the Bilateral Management Arrangement forms one part of the overall engagement on debt matters, with regular dialogue on these matters occurring at all levels, including between the Secretary and the CEO of Services Australia.

The Department notes the ANAO conclusion the Random Sample Survey (now known as the Payment Accuracy Review Program or PARP) underestimates the overpayment risk for annually reconciled payments. The PARP is the primary assurance mechanism to measure the integrity of current, point in time, payment outlays administered by the Department and delivered by Services Australia. The principal objective of PARP is to provide an estimate of the accuracy of outlays for surveyed payments and to estimate the impact of administrative errors, not to detect and raise debts.

In relation to Family Tax Benefit (FTB), by intentional policy design, the government pays a ‘provisional’ fortnightly FTB rate which is reviewed at annual reconciliation, with some recipients receiving a debt or a top-up. A separate methodology would need to be developed, to measure the risks associated with an annual reconciliation process. This issue was not raised as part of the recent independent PARP methodology review commissioned by the Department.

The Department notes the ANAO’s reference to the collective work of the Department and Services Australia in reviewing the Key Performance Measures (KPMs) detailed in the Payment Assurance Service Arrangement. The Department is currently working with Services Australia to set appropriate targets for the new KPMs and notes the report’s findings, benchmarks are required to assess the effectiveness of Services Australia’s management of debt on behalf of the Department.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Policy/program implementation

Records management

1. Background

Social security and welfare payments

1.1 Services Australia is the Australian Government’s primary service delivery agency. Its purpose is to support Australians by delivering high-quality, accessible services and payments on behalf the Australian Government (in partnership with other government entities). Its vision is to make government services simple. In 2021–22, Services Australia made $226.7 billion in payments under three key program areas3 as shown in Table 1.1.

Table 1.1: Services Australia’s program areas 2021–22

|

Program |

Examples of payments and services |

Total payments made ($ billion) |

Customersa (million) |

|

Program 1.1 Services to the community — Social security and welfarea |

Centrelinkb payments and benefits such as the Age Pension, Carer Payment, Disability Support Pension, Parenting Payment, Child Care Subsidy, Jobseeker, Youth Allowance and Austudy |

152.2 |

11.4 |

|

Program 1.2 Services to the community — Health |

Medicare and the Pharmaceutical Benefits Scheme |

72.7 |

26.4 |

|

Program 1.3 Child Support |

Administering child support payments between parents or non-parent carers of children |

1.8 |

1.2 |

|

Emergency payments |

Pandemic Leave Disaster Payment, Economic Support Payments, Coronavirus Supplement, Coronavirus Disaster Payment and Emergency Payments |

16.6 |

Not reported |

Note a: Services Australia refers to a recipient of a payment under the social security and welfare program as a ‘customer’.

Note b: Centrelink refers to payments and benefits made under Program 1.1 Services to the community — Social security and welfare.

Source: Services Australia Annual Report 2021–22, p. iii.

1.2 Program 1.1 Services to the community — Social security and welfare is the focus of the audit. Sixty-seven per cent ($152.2 billion) of payments made in 2021–22 were administered under this program. The social security and welfare program provides income support and benefits to older Australians, carers, people with disabilities, families, jobseekers and students.

1.3 Services Australia’s aim is to ‘pay the right person, the right amount through the right program at the right time’.4 Where incorrect information is supplied by customers, there are delays in notification of customers’ changes in circumstances or Services Australia makes an administrative error, overpayments or underpayments can occur.5 Where there is an overpayment, a debt may arise and legislation generally requires Services Australia to recover the debt.6

Management of debt

1.4 Debt management is an important part of Services Australia’s core business. It is central to achieving customer service and policy entity efficiency goals. Services Australia aims to manage debt ‘quickly, accurately and in a sensitive manner’.7 Through effectively managing debt in accordance with policy decisions of the Australian Government and relevant legislation, Services Australia seeks to maintain public confidence and support the efficient, effective and ethical use of Commonwealth resources.

1.5 Figure 1.1 shows the high-level process that Services Australia follows in the management of debt.

Figure 1.1: Debt management process

Source: ANAO summary and analysis of Services Australia’s policy and procedures.

1.6 The detection process involves identifying that an overpayment has occurred. This can occur when a customer notifies Services Australia of a change in their circumstances or through other activities including: annual reconciliations; data matching; regular payment reviews; and tip-offs. Where a potential overpayment has been detected it is classified as an undetermined debt and registered in the Debt Management Information System (DMIS).

1.7 The determination process involves undetermined debts being investigated to confirm if there is an overpayment that is legally recoverable. Where this condition is met, the value of the debt is calculated, a debt is raised and the customer is notified of the debt. When raising the debt, the delegate will establish whether the debt should be waived or recovered. If an overpayment is not legally recoverable, no debt exists (see footnote 6).

1.8 At the conclusion of the determination process, the undetermined debt is classified as a determined debt and the recovery of any outstanding debt balances is managed by Services Australia. Arrangements are made between the customer and Services Australia to repay the debt. If the debt is not paid by the due date (28 days from notification), there are a number of debt recovery arrangements that can be entered into such as cash repayments and withholdings from customer benefit payments. The type of recovery action is considered by the customer’s status, for example, Services Australia can make withholdings from benefits and payment for current customers, whereas alternate arrangements are needed for non-current customers.8 Further recovery action can be taken where a suitable recovery arrangement is not entered into by the customer including Services Australia engaging external collection agents to recover debts of non-current customers. Where a person is in a vulnerable situation or experiencing financial difficulties, Services Australia aims to work with the person to determine a suitable way forward.

Debt raising legislative framework

1.9 Services Australia detects, determines, waives and recovers debt for Program 1.1 under the following legislation9:

- Social Security Act 1991;

- Social Security (Administration) Act 1999;

- A New Tax System (Family Assistance) (Administration) Act 1999;

- Student Assistance Act 1973;

- Paid Parental Leave Act 2010;

- Data-matching Program (Assistance and Tax) Act 1990;

- Farm Household Support Act 2014 and Minister’s Rules;

- Public Governance, Performance and Accountability Act 2013; and

- Public Governance, Performance and Accountability Rule 2014.

Policy entities

1.10 In 2021–22 Services Australia partnered with a range of entities to deliver social security and welfare payments and manage debts. Policy entities for Program 1.1 included the Department of Social Services (DSS), Department of Education, Skills and Employment (DESE)10, Department of Agriculture, Water and Environment (DAWE)11, Department of Home Affairs, the National Recovery and Resilience Agency (NRRA)12, Australian Trade and Investment Commission, Department of Veterans’ Affairs (DVA), Department of Infrastructure, Transport, Regional Development and Communications (Infrastructure)13 and the Australian Taxation Office (ATO).

1.11 Where Services Australia manages a policy entity’s debt, the value of debt accrued is reported in the policy entity’s annual financial statements (rather than in Services Australia’s). Bilateral arrangements between the policy entities and Services Australia aim to support debt management, oversight, reporting and data sharing arrangements.

Value of debt

1.12 Table 1.2 sets out the undetermined and determined levels of social security and welfare debt as at 30 June 2022. It is set out by debt benefit type which is the equivalent of the payment type under which the debt occurred. Around 90 per cent of social security and welfare debt raised is managed by Services Australia on behalf of DSS.

Table 1.2: Value of undetermined and determined debt by debt benefit (payment) type as at 30 June 2022

|

Debt benefit group |

Undetermined debt (potential overpayments)a

|

Determined debts |

||||||

|

|

Total value of debts ($ million) |

Percentage of total value (%) |

Total number of debts |

Percentage of total number (%) |

Total value of debts ($ million) |

Percentage of total value (%) |

Total number of debts |

Percentage of total number (%) |

|

Family Tax Benefit (reconciliation only)bc |

12 |

0.61 |

4332 |

0.29 |

1980 |

43.03 |

607,165 |

36.38 |

|

Parenting Payment Singlec |

125 |

6.57 |

50,173 |

3.35 |

518 |

11.25 |

75,212 |

4.51 |

|

Age Pensionc |

476 |

24.99 |

318,632 |

21.3 |

152 |

3.3 |

42,217 |

2.53 |

|

Newstart Allowancec |

109 |

5.7 |

71,307 |

4.77 |

408 |

8.86 |

156,786 |

9.39 |

|

Child Care Subsidy (reconciliation only)bd |

123 |

6.47 |

89,874 |

6.01 |

380 |

8.27 |

202,614 |

12.14 |

|

Disability Support Pensionc |

122 |

6.4 |

63,126 |

4.22 |

242 |

5.25 |

45,726 |

2.74 |

|

Carer Paymentc |

106 |

5.58 |

41,790 |

2.79 |

179 |

3.89 |

33,652 |

2.02 |

|

JobSeeker Paymentc |

184 |

9.67 |

229,488 |

15.34 |

81 |

1.76 |

145,561 |

8.72 |

|

Youth Allowance (Student)c |

119 |

6.27 |

112,343 |

7.51 |

127 |

2.76 |

49,355 |

2.96 |

|

Family Tax Benefit (excluding reconciliation)bc |

137 |

7.22 |

194,101 |

12.98 |

88 |

1.91 |

98,889 |

5.93 |

|

Coronavirus Supplementc |

125 |

6.55 |

94,422 |

6.31 |

61 |

1.32 |

62,077 |

3.72 |

|

Parenting Payment Partnerc |

51 |

2.67 |

27,961 |

1.87 |

132 |

2.86 |

33,642 |

2.02 |

|

Austudy — Customerc |

33 |

1.72 |

29,732 |

1.99 |

71 |

1.55 |

19,512 |

1.17 |

|

ABSTUDYc |

35 |

1.83 |

29,732 |

1.99 |

23 |

0.5 |

7223 |

0.43 |

|

Youth Allowance (Jobseeker)c |

31 |

1.62 |

42,428 |

2.84 |

21 |

0.47 |

28,870 |

1.73 |

|

Total for 32 other debt benefit typesef |

117 |

6.14 |

96,198 |

6.43 |

139 |

3.02 |

60,369 |

3.62 |

|

Total |

1905 |

100 |

1,495,639 |

100 |

4602 |

100 |

1,668,870 |

100 |

Note a: The reported number and value of undetermined debts includes parked and Family Tax Benefit qualification debts. See footnote 68 and Appendix 5 for further information about these debts.

Note b: Debt raising for Family Tax Benefit, Child Care Subsidy and Farm Household Allowance have been grouped into debt benefit groups reconciliation only (where debts are determined on a financial year basis, for example in the annual reconciliation process after actual [rather than estimated] income is confirmed and payments are balanced) and exclude reconciliation debts (where debts occur throughout the year, for example when they are triggered by notification of a change in customer circumstances).

Note c: DSS was the policy entity for these debt benefit groups.

Note d: DESE was the policy entity for the Child Care Subsidy.

Note e: This provides a combined subtotal to show the debt benefit types that are not one of the top 15 in terms of value or number of debts.

Note f: Policy entities include ATO, AGD, DAWE DESE, Department of Home Affairs, DSS and DVA. Table 1.2 does not include debts arising from Infrastructure or Australian Trade and Investment Commission payments.

Source: ANAO analysis of Services Australia, Debt Profile Report, 30 June 2022.

1.13 Figure 1.2 shows the total levels of debt since 2016. Since 2016 undetermined debt has risen by around $2 billion, while the total debts raised and recovered have fallen by more than $1 billion. Debt pauses have influenced debt balances. During debt pauses, Services Australia does not:

- actively pursue recovery of debts (and temporarily writes-off the debt); and

- does not raise new debts for customers in the affected regions, except in the case of fraud, serious non-compliance or at the request of the customer who would like the debt to be raised (meaning a potential overpayment remains undetermined during this period).

1.14 Since 2019, natural disasters such as bushfires and floods, combined with the impacts of the COVID-19 pandemic, led the Australian Government to implement debt pauses, either for all customers or customers within a specified local government area.14

- The first national debt pause commenced on 3 April 2020, announced by the Minister for Government Services. In November 2020, debt raising activity recommenced.

- Between February 2021 and February 2022, Services Australia implemented further pauses to debt raising and recovery in specific regions impacted by natural disasters.15 Services Australia gradually recommenced debt raising from January 2022 and recovery from July 2022.

Figure 1.2: Debts raised for recovery, debts recovered and undetermined debts from customers who received social security and welfare payments 2016 to 2022

Note: All values reflect the amounts reported in each year. No adjustments have been made for inflation.

Note: The reported number and value of undetermined debts includes parked and Family Tax Benefit qualification debts. See footnote 68 and Appendix 5 for further information about these debts.

Note: The undetermined debts (potential overpayment) value reported for 2017 is the value reported at 30 April 2017 in Services Australia’s Debt Profile Report. The 30 June 2017 value was not available.

Note: The total value of debt raised and the total value of debt recovered in a financial year reflect amounts reported in Services Australia’s annual reports between 2016–17 and 2021–22. These amounts are rounded to the nearest $10 million.

Source: ANAO analysis of Services Australia’s annual reports and internal debt reports.

1.15 From August 2022 under phase one of the Situational Hardship Project16, disaster affected customers are no longer subject to automatic debt pauses. Customers impacted by disasters, or in receipt of a crisis payment, can choose how they manage their debt repayments and can request a debt repayment pause of 1, 2 or 3 months through staff assisted or self-service channels.17 Customers are able to request two pauses in a 12 month period. Phase two of this project has been delayed 12 months and is due for completion in September 2023. It is expected to incorporate other hardship events and explore the feasibility of enhanced digital channels such as two-way SMS. A post implementation review is planned for completion in 2023.

Rationale for undertaking the audit

1.16 At 30 June 2022 there was $4.6 billion outstanding social security and welfare debt that has been determined (1,668,870 individual debt cases), and $1.9 billion undetermined debt18, across more than 47 debt benefit groups. Of the total outstanding debt, $3.7 billion was temporarily written-off at 30 June 2022 (1,344,838 individual debt cases). As shown in Figure 1.2, debt balances and the value of undetermined debt have been increasing since 2018. This audit was identified as a Joint Committee of Public Accounts and Audit (JCPPA) priority for the Parliament for 2022–23. This audit provides the Parliament with assurance that Services Australia is managing and recovering debt effectively with fit-for-purpose arrangements.

Audit approach

Audit objective, criteria and scope

1.17 The objective of the audit is to assess the effectiveness of Services Australia’s management of social security and welfare debt.

1.18 To form a conclusion against the objective, the following criteria were applied.

- Does Services Australia have fit-for-purpose debt management governance arrangements?

- Has Services Australia developed and implemented effective strategies and processes to manage debt?

- Does Services Australia assess and accurately report on the effectiveness of its debt management and performance activity?

1.19 The audit focused on social security and welfare debt management and recovery activities and did not examine Medicare or Child Support debt. In some parts of the audit, analysis was narrowed to a selection of payment types. Services Australia does not provide debt management and recovery services for all social security and welfare payments, only payments where overpayments were detected were examined. The audit focused on Services Australia’s debt governance and undertook testing of debt detection, determination and recovery activities in 2021–22. The audit had regard to debt governance, strategy and reporting and performance measurement in prior years and 2022–23. The audit did not examine the Online Compliance Intervention System For Debt Raising and Recovery (colloquially known as Robodebt).

Audit methodology

1.20 The audit involved:

- examination of documentation held by Services Australia, and where necessary policy entities, related to debt management and recovery, including bilateral arrangements, governance/committee papers, strategies, policies and procedures and debt reporting;

- meetings with relevant Services Australia and selected policy entity staff;

- examination of the operation and key controls of Services Australia’s financial and debt systems used to manage debt; and

- extraction and analysis of debt data and reports on debt from key Services Australia financial and debt systems.

1.21 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $941,000.

1.22 The team members for this audit were Tracey Martin, Renina Boyd, Leah Farrell, Sonya Carter, Ewan McPherson, Aiden Williams, Lauren Huning, Anne-Sophie Colin and Alexandra Collins.

2. Governance

Areas examined

This chapter examines whether Services Australia had fit-for-purpose debt management and governance arrangements, comprising: arrangements to support the oversight and coordination of debt management and recovery; and fit-for-purpose debt management policies and procedures.

Conclusion

Services Australia has partly fit-for-purpose debt administration and recovery governance arrangements. Services Australia’s processes for managing and coordinating debt management and recovery activities include internal governance arrangements and informal and formal arrangements with policy entities responsible for the social security and welfare payments administered by Services Australia. These arrangements are not clearly documented. Services Australia has policy and procedures and training materials for debt management and recovery. Staff deemed ‘proficient’ through quality checking activities did not achieve correctness targets in 2021–22 when processing new debts.

Areas for improvement

The ANAO made two recommendations aimed at documenting governance arrangements (paragraph 2.22) and reviewing policies and procedures to improve effectiveness and useability (paragraph 2.42).

The ANAO also identified three opportunities for improvement relating to: maintaining currency of delegations with policy entities (paragraph 2.6); clearly and consistently defining the organisation’s role in managing debt in bilateral arrangements (paragraph 2.12); and establish a framework for reviewing debt management policies and procedures (paragraph 2.33).

2.1 Governance arrangements are critical to the success of program administration. It is important that governance arrangements are documented, mapped across an organisation to show interrelated functions and, where more than one entity is involved, agreed responsibilities between the relevant entities. Robust governance arrangements set out governance structures, roles and responsibilities, lines of accountability and delegation, internal controls19, reporting arrangements and performance expectations. Effective arrangements can limit ambiguity in terms of roles and responsibilities and establish clear governance and controls.

2.2 This chapter examines whether Services Australia clearly articulated and implemented governance structures and roles and responsibilities to support oversight and coordination of debt management. It also examines whether fit-for-purpose policies and procedures were developed to address requirements set out in legislation. Reporting and performance arrangements for debt are examined in Chapter 4.

Has Services Australia established arrangements to support oversight and coordination of debt management and recovery?

Seven entities with policy responsibility for social security and welfare payments managed by Services Australia have delegated debt related functions and powers to Services Australia’s Chief Executive Officer (CEO). It is unclear what processes are in place to ensure delegations from policy entities are current. In 2021–22, internal delegations from Services Australia’s CEO to staff to undertake debt management and recovery were only limited by the value of the debt to be actioned and the level of the staff. Services Australia oversees and coordinates debt management and recovery activities via bilateral agreements, organisational reporting structures, governance and operational committees and informal and formal contact arrangements with policy entities. The relationship between these arrangements is not documented. The bilateral arrangements do not clearly set out debt management roles and responsibilities or escalation pathways.

Delegated functions and powers

2.3 The accountable authorities of the policy entities that are responsible for social security and welfare payments and benefits20 delegate their debt management functions under relevant legislation to the Chief Executive Officer (CEO) of Services Australia.21 The policy entities did not impose limitations on Services Australia’s exercise of the delegated debt powers and functions. As a result, there is no requirement for Services Australia to consult policy entities when making delegated decisions such as waiving debts.

2.4 Services Australia’s Legal Services Division holds the policy entity delegations. It is unclear what practices are in place for the Legal Services Division to communicate with relevant business areas when updates or amendments to these instruments are required. In June 2022, Administrative Arrangement Orders made changes to the composition of policy entities for whom Services Australia manages payments (following machinery of government changes). All but one of the delegation instruments from the affected policy entities were updated in June 2022, with the delegation from the Department of Education not updated until November 2022.

2.5 The CEO of Services Australia delegates responsibilities for debt management activities on behalf of policy entities to Services Australia staff (see Figure 2.1). The CEO’s delegations, referred to as internal delegations, are kept within the Delegations and Authorisations Register (the register). A review of the register found:

- Services Australia officials that were delegated debt management functions ranged in level from APS 1 and above; 88 per cent of debt powers were delegated at APS1 to APS6 levels.

- In 2021–22, internal delegations generally did not limit debt management functions and powers to staff carrying out specific debt activities or those working within specified debt related branches or divisions of Services Australia. The internal delegations imposed limitations based on the value of the debt.

|

Opportunity for improvement |

|

2.6 Services Australia could establish mechanisms to ensure delegations from policy entities are valid at all times and are amended, where necessary, in a timely way, including when there are machinery of government changes and development of or changes to legislation. |

Debt management governance

2.7 There are three components to Services Australia’s governance of debt.

- Bilateral arrangements are in place at a broad relationship level between Services Australia and each policy entity.

- Internal governance arrangements involving senior executive governance committees, a debt specific operational committee and various divisions and branches carrying out debt management activities.

- Officer level contact between Services Australia’s branches with debt management responsibility and the branch within the policy entity responsible for administering the relevant payment type managed by Services Australia.

Bilateral arrangements

2.8 The key purpose of Services Australia’s bilateral arrangements is to provide a robust basis for service delivery expectations and establish clear deliverables, performance measures (service levels) where required, and issues management and resolution processes.22

2.9 Services Australia’s responsibility for the management of debts arising from payments that it delivers were set out in bilateral arrangements with seven policy entities reviewed by the ANAO.23 Services Australia’s role in relation to debt varied by entity, see Table 2.1, and are subject to the delegations from policy entities.

Table 2.1: Services Australia’s debt management role set out in bilateral arrangements

|

Entity |

Services Australia debt responsibility |

|

Department of Agriculture, Water and Environment (DAWE) |

Debt reporting |

|

Department of Education, Skills and Employment (DESE) |

Debt reporting |

|

Australian Taxation Office (ATO) |

Debt detection |

|

Department of Home Affairs (DHA) |

Debt detection, raising, recovery and reporting |

|

Department of Social Services (DSS) |

Debt raising, recovery, management and reporting |

|

Department of Veterans’ Affairs (DVA) |

Debt recovery and reporting |

|

Department of Infrastructure, Transport, Regional Development and Communications (Infrastructure) |

Debt management |

Source: ANAO analysis of bilateral arrangement documents between Services Australia and policy entities.

2.10 The seven sets of bilateral agreements did not contain debt specific governance arrangements. Services Australia advised the ANAO that the general governance arrangements24 outlined in the head agreements and service schedules of the bilateral arrangements could be used for the management of debt.25 The application of general governance arrangements to debt activities conducted by Services Australia is not clear because agreements do not always record the payments and services delivered by Services Australia for the relevant policy entity.

2.11 The terms of reference for the committees established under the bilateral arrangements did not include the oversight of debt. Between June 2021 to June 2022, debt was mentioned in the minutes or papers of eight strategic or operational committees between Services Australia and five policy entities (DSS, DESE, DVA, ATO, DAWE). The debt related items primarily discussed updates from Services Australia, with four instances of decisions made about debt and three instances of issues regarding debt raised or escalated to other committees. With the exception of the bilateral committees with DSS and DAWE which required regular performance reporting or further information about debt activities, the discussions relating to debt at other policy entity committees were minor queries and non-urgent in nature.

|

Opportunity for improvement |

|

2.12 Where Services Australia has a debt responsibility to fulfil on behalf of a policy entity, there is an opportunity to define the nature and scope of Services Australia’s role in debt management in bilateral arrangements documents using language that is consistent with Services Australia’s internal policy and procedures. |

Services Australia’s internal governance arrangements

2.13 Services Australia advised that eleven branches are involved in debt detection, determination and recovery of social security and welfare debt (see Figure 2.1). The responsibilities of these branches are not documented in delegations or supporting policy and procedures. Services Australia’s organisation chart depicts lines of responsibility for branches, divisions and groups, with the Deputy Chief Executive Officer, Payments and Integrity and the Deputy Chief Executive Officer, Customer Service Design responsible for the various branches carrying out debt management activities. Services Australia advised the ANAO that responsibility for debt related matters is shared across various divisions at National and General Manager (NM and GM) levels and is driven by the payment type. The relationship and interactions between the three governance components described at paragraph 2.7 are not documented.

Figure 2.1: Components of Services Australia’s governance of debt management in August 2022

Note: Services Australia payment areas have changed since August 2022.

Source: ANAO analysis of Services Australia’s records and advice.

2.14 There is an operational committee that focuses on debt and payment accuracy, established in December 2020. The Debt and Integrity Projects Board (the Board) oversees projects and initiatives related to improving debt management. The Board is the decision-making body for the Debt and Integrity Program. The Debt and Integrity Projects Board is chaired by the GM Debt and Integrity Projects Division and reports to the Deputy CEO Payments and Integrity Group.

2.15 The Board’s terms of reference are clear and include key activities and deliverables of the Board, membership26 and frequency of meetings (intend to meet fortnightly). Services Australia advised that the Board met 26 times between June 2021 and June 2022, papers or minutes were maintained for 25 meetings, two of these being extraordinary meetings.27 Seven meetings of the Board have been documented between July and December 2022.

2.16 In August 2022, Services Australia’s governance structure was comprised of eight enterprise committees segregated into three tiers.28

- Tier 1 comprised of the Executive Committee (CEO and Deputy CEOs, meeting fortnightly).

- Tier 2 comprised of the Enterprise Business and Risk Committee (CEO, Deputy CEOs and GMs, meeting fortnightly) and the Transformation and Integration Committee (Deputy CEOs and GMs, meeting fortnightly).

- Tier 3 comprised of the Customer Sub-Group (Deputy CEOs and GMs, meeting fortnightly), People Sub-Group (Chief Operating Officer and GMs, meeting monthly), the Security Sub-Group (Deputy CEOs and GMs, meeting fortnightly), the Portfolio Management Steering Group (GMs and NMs, meeting monthly) and the Enterprise Automation & Digital Delivery Board (GMs and NMs, meeting monthly).

2.17 Services Australia also has an Audit and Risk Committee which meets at least six times a year and provides independent assurance to the CEO on the appropriateness of the financial and performance reporting, risk management system and internal controls.

2.18 Services Australia’s enterprise committees did not have a significant role in the oversight and decision-making of debt matters. The enterprise committees discussed matters relating to debt management 15 times in 2021–22, and received supporting papers for three matters. Five of the eight committees discussed and made decisions about debt matters infrequently and generally did not deliberate on effectiveness of debt management activities.29 The Audit and Risk Committee received papers or discussed debt matters three times. Except for the Enterprise Business and Risk Committee, debt was not referenced in the terms of reference for enterprise committees.30

Payments-based officer contacts

2.19 There are a range of formal and informal meetings between Services Australia and policy entities on day-to-day debt operations that are not described in the bilateral arrangements.

2.20 Services Australia advised the ANAO that aspects of governance arrangements, such as issues escalation, are payment specific. The ANAO examined payment-based officer contacts for six payment types (Austudy [DSS], Age Pension [DSS], Family Tax Benefit [DSS], Child Care [DESE], Parenting Payment Single [DSS] and Farm Household Allowance [DAWE]).

2.21 Services Australia provided evidence of eleven examples of payment-based contacts with policy entities to resolve debt matters, and an additional five where the policy entity contacted Services Australia for information or clarification. The discussions primarily addressed low level issues or inquiries at an officer level. In 2021–22, across the six payment types, issues were discussed via telephone or email at the officer level for five payment types. The examples provided did not demonstrate the use of general bilateral governance arrangements (for the relevant policy entity) or payment specific escalation processes that Services Australia advised they follow. In some cases, matters raised were not resolved.

Recommendation no.1

2.22 Services Australia document and map the internal and bilateral oversight arrangements for all debt management activities, including reporting lines, roles and responsibilities of governance committees and officer level meetings and performance reporting.

Services Australia response: Agreed.

2.23 As noted in the report, the Agency oversees and coordinates debt management and recovery activities via bilateral agreements, organisational reporting structures, governance and operational committees, and informal and formal contact arrangements with policy entities.

2.24 These agreements are intended to be strategic and principles-based. The level and frequency of engagement, composition of governance committees, reporting arrangements and granularity of any performance measures or targets will, of necessity, be driven by a range of factors including the risk tolerance and appetite of the partner entity, the materiality, and the risk and the complexity associated with the payments or services being delivered. In addition, the nature of debt management arrangements are subject to change including due to a range of external factors, and consequently the nature of reporting — including performance monitoring — is constantly under review. Finally, any changes to these bilateral agreements would need to be developed in consultation with the relevant partner agencies.

2.25 The Agency notes that the bilateral arrangements, including the performance measures and targets, in place with the Department of Social Services in respect of the social security and welfare payment programme are currently under review. More broadly, the Agency acknowledges that there is scope to improve the currency and coverage of these arrangements, as well as the clarity with which these existing arrangements relate to each other, including the ongoing appropriateness of the governance, reporting and performance measurement arrangements, as well as the interaction of officer-level escalation processes within bilateral governance arrangements.

Have fit-for-purpose policies and procedures been developed to support effective debt management and recovery?

Services Australia has 250 policies and procedures for debt management and recovery which are accessible by all staff. References to legislation in guidance materials are generally current and accurate, with a few exceptions. Procedures do not inform staff of whether they are carrying out an administrative process or a legislative function for which they require a delegation. Internal training is grouped into debt raising (48 training days), debt recovery (10 training days) or a combination of both elements (50 training days). Results of quality assurance activities indicate that policies, procedures and training do not sufficiently support staff assessed as ‘proficient’ to achieve the target correctness rate of 95 per cent or higher when determining new debts.

Debt policy and procedures

2.26 Services Australia’s Operational Blueprint is accessible to all staff and contains reference material to support delivery of services. Services Australia has published social security and welfare debt management policy and procedures in its Operational Blueprint. Within the Operational Blueprint there is a debt section that includes 250 documents (comprised of topics [5], sub-topics [30], procedures [179], annotations [21] and attachments [15]). An individual policy and procedure document contains up to five parts (major headings): Background; Process; References; Resources; and Training and Support.

2.27 Table 2.2 provides an overview of the structure of the debt section of the Operational Blueprint that sets out five topics that are relevant to social security and welfare debt.

Table 2.2: Structure of debt policy and procedures in the Operational Blueprint

|

Topics |

Number of Sub-Topics |

Number of Procedures |

|

|

General debt management information |

7a |

40 |

|

|

Debt raising (determination) |

9 |

60 |

|

|

Debt recovery for Centrelink |

9 |

59 |

|

|

Debt waivers and write-offs |

2 |

11 |

|

|

Recovery of Centrelink compensation debts |

3 |

9 |

|

| 95 | |||

Note a: General debt management information sub-topics include debt identification (detection), debt investigation and the debt management information system.

Source: ANAO analysis of the Operational Blueprint.

2.28 Debt guidance is generally not structured by payment type to which the debt relates. Six sub-topics under the debt raising topic relate to groups of payments: pension debts; student debts; family assistance debts; paid parental leave and dad and partner debts; child care debts; and Social Security Act 1991 debts.

2.29 The structure of debt policy and guidance does not provide a pathway for the decision-making and processing steps required when a potential overpayment is detected (see Figure 1.1). The guidance is not set out by payment type that gave rise to the debt that would allow ease of reference to the particular legislative or policy requirements for the type of potential overpayment to be actioned by a Services Australia officer. Most of the documents in the debt section of the Operational Blueprint have been in place since February 2015 and were frequently updated (three quarters of the documents had been updated 17 times or more, with some documents updated more than 60 times). The frequency of amendments requires staff to closely review and follow the relevant policy or procedure each time they complete the task.

2.30 The ANAO observed that the use of the search function within the Operational Blueprint produces a long list of material that contains the key words searched for, including material that is less relevant displayed towards the top of the search results. Finding payment related debt material is not straightforward, as a document title rarely indicates the scope of its contents.

2.31 Some documents provide links to lists of debt teams or other contacts such as partnership teams. Generally, there is limited information about where to go for help. Services Australia advised the ANAO in December 2022 that support is available to staff in locating relevant material including through a hints and tips page, Quality Development Officers, Team leaders, a Level 2 Debt Helpdesk and Level 3 Debt Policy Team, and a pilot of an Operational Blueprint Virtual Assistant (designed to help staff find the information they need).

2.32 Most (167, 79 per cent) of the Operational Blueprint documents reference legislation. References to legislation were generally current, complete and accurate, with a few exceptions.31 The references were usually not embedded within the description of the process and instead listed in the reference section.32 Overall, there were 13 documents that did not reference current legislation33, 10 documents that did not have complete references to legislation and 39 documents which did not have accurate references to legislation. Examples of characteristics that did not meet current, complete and accurate references to legislation include a reference to a bill rather than an act passed by parliament, legislation title incomplete, legislation that was not in force, legislation sections not listed and the legislation section listed was incorrect.

|

Opportunity for improvement |

|

2.33 There is an opportunity for Services Australia to establish a clear framework for reviewing debt management policies and procedures to maintain their completeness, accuracy and internal consistency. |

Internal training

2.34 Debt management policy and procedures in the Operational Blueprint provide links to training courses under the ‘Training and Support’ heading in individual documents. Training courses are accessible on Services Australia’s intranet through the Learning Management System. The ANAO examined 37 debt courses available online in July and August 2022, few courses referred to legislation (10) or delegations (six) to support staff understanding of when they must comply with social security and welfare law and must have an appropriate delegation to make a decision.34

2.35 Services Australia has a Debt Learning Plan for staff who are new to a debt management activity. The plan includes three training pathways. Debt raising training includes considerable payment stream training (Phase 2b in Table 2.3), involving 35 days of training, and 99 courses. The training is grouped for completion in phases by skill-level and experience. Table 2.3 sets out for each training pathway the number of days and courses to be completed and the training content.

Table 2.3: Debt training pathways content and time to complete

|

Training pathway |

Training days (number) |

Training courses (number) |

Training content |

|||||

|

|

|

|

Phase 1: Customer Service Skills |

Phase 2a: Debt raising technical |

Phase 2b: Payment streams technical |

Phase 2c: Debt raising upskill |

Phase 3a: Debt recovery specific |

Phase 3b: Debt recovery upskill |

|

Debt raising |

48 |

158 |

✔ |

✔ |

✔ |

✔ |

✘ |

✘ |

|

Debt recovery |

10 |

69 |

✔ |

✘ |

✘ |

✘ |

✔ |

✔ |

|

Debt raising and recovery |

50 |

185 |

✔ |

✔ |

✔ |

✔ |

✔ |

✔ |

Key: ✔ Included in pathway ✘ Not included in pathway.

Source: ANAO analysis of Services Australia’s Debt Learning Plan.

2.36 Services Australia maintains records of self-paced learning in its Learning Management System, and advised the ANAO that it plans to record attendance at facilitated training in this system. Services Australia did not demonstrate that it monitored or determined whether debt staff had completed minimum requirements (such as the Debt Learning Plan) or individual staff training recorded in performance plans.

Quality assurance

2.37 Staff completing debt raising and recovery activities are subject to quality assurance processes within the relevant branch.35 Two programs support quality checking: Quality Online (QOL) and Quality Management Application (QMA).

- QOL supports sampling and quality checking of work completed by staff in the Customer First and Customer Record systems. Proficiency levels are applied by system or benefit type, and activity type.36

- QMA supports sampling and quality checking of work completed by a staff member in the Process Direct system. Proficiency is applied to a skill tag37 or through an auto-sampling model.38

2.38 The proficiency level determines the required correctness rate and sampling rate for work completed by staff, see Table 2.4. It is intended that staff achieve proficiency ratings of ‘proficient’ in QOL and ‘experienced’ in QMA, so that when undertaking processing they achieve a 95 per cent correctness rate or higher. After two weeks and completion of at least 20 cases for a type of debt task (for example, determining whether a potential overpayment is a debt), regular proficiency assessments are undertaken until these proficiency levels are achieved and then reviewed every 12 months. Where a staff member has a ‘proficient’ or ‘experienced’ proficiency rating and their correctness rates regularly fall below the 95 per cent level, a proficiency assessment is triggered.

Table 2.4: Quality checking minimum correctness and sampling rates by proficiency level and system

|

Proficiency level QOL |

Proficiency level QMA |

Minimum correctness rate to be achieved by staff |

Quality checking sampling rate for work completed |

|

Learner |

Entry |

<85%a |

100% |

|

Intermediate |

Established |

85% to <95% |

25% |

|

Proficient |

Experienced |

95% or higher |

2% |

Note a: Staff undertaking new activities also have a proficiency level of ‘entry’.

Source: Services Australia, Staff Quality Management Application (QMA) Proficiency Policy, August 2021, p. 1, Quality Management Application in Process Direct 111–20010800, p. 6, and Updating Proficiency for QOL 111–20071707, p. 10.

2.39 The Compliance and Debt Operations Branch (one of the branches with responsibility for debt raising and recovery activities) provided the ANAO with the number of staff at proficiency levels for QOL by system and skill tag. Depending on the payment type or debt process, between 45 to 60 per cent of staff in that branch had not achieved a ‘proficient’ rating in QOL. Compliance and Debt Operations staff generally do not undertake processing in the Process Direct system, meaning QMA did not contain debt processing quality check records for these staff.39 The proficiency ratings for QOL indicate that policy and procedures do not sufficiently support staff when processing debt.

2.40 For Compliance and Debt Operations Branch staff between August 2021 and September 2022, the number of items checked varied by fortnight from 14 to 300 quality checks for a debt activity. Over this period, 2842 debt, 3686 new debt (determination of an undetermined debt) and 1359 recoveries items were quality checked.40

2.41 For Compliance and Debt Operations Branch staff who were assessed as ‘proficient’ in QOL for debt processing activities, Figure 2.2 shows correctness rates ranged from 83 to 100 per cent in quality checks for debt processes.41 New debt items checked had the lowest (unsatisfactory) correctness rates, while recoveries had consistently high (satisfactory) correctness rates. Quality assurance results for new debts indicated that policy and procedures, training and supervision do not sufficiently support staff to achieve desired correctness rates of 95 per cent or higher.

Figure 2.2: Quality check correctness rates in QOL for ‘proficient’ staff, debt processing fortnightly August 2021 to September 2022

Source: ANAO analysis weekly QOL correctness results between 26 August 2021 and 22 September 2022.

Recommendation no.2

2.42 Services Australia review the effectiveness and usability of policies and procedures, training and supervision relating to debt management activities to improve staff proficiency rates and results of quality assurance activities.

Services Australia response: Agreed.

2.43 The Operational Blueprint is the key source of procedural guidance and information to support Agency staff in delivering payments and services, including in relation to debt management activities. The Operational Blueprint is regularly updated based on staff feedback, helpdesk enquiries, feedback from section 126 and 135 reviews under the Social Security (Administration) Act 1999, and AAT outcomes and policy or legislative change. Operational Blueprint guidance requires a balance between correctly translating legislation and policy, and ensuring the information is concise, user friendly, and able to be quickly and accurately translated by our frontline staff into action.

2.44 Operational Blueprints are complemented by other workforce capability activities such as daily staff communication, formal training, coaching, on the job experience, daily team briefings established through our high performance programme Empowering Excellence, direct supervision, and the support of Quality Development Officers and their reviews.

2.45 Further, the Agency has implemented and operationalised its quality policies and guidelines. These include quality call listening for all staff undertaking telephony activities, Aim for Accuracy exercises to provide assurance that the work has been through quality checking processes, ensuring that Quality Development Officers are in place to support quality results, and targeted checking processes when systemic issues are identified.

2.46 There are also escalation processes in place for more difficult cases, including Team Leaders, Quality Development Officers and function-specific helpdesks. As the ANAO has identified, quality and proficiency have been impacted by significant redeployments of staff in response to pandemics and emergency responses, as well as large influxes of new staff requiring the full spectrum of training. Since staff have returned to their core functions in 2022, the Agency has been focusing on refreshing the skills of experienced staff, as well as ensuring new staff have the skills and experience required to undertake debt management functions. The Agency will continue to focus on supporting its workforce to obtain and retain the skills and experience required to deliver debt management functions effectively and within expected proficiency thresholds.

2.47 The quality assurance and proficiency management framework is an Agency-wide framework. The Agency will focus on strengthening the feedback loop from frontline staff, appeal/debt/AAT outcomes, customers, and quality outcomes to ensure all elements of the workforce capability approach are maximised.

2.48 ANAO comments on Services Australia’s response

2.49 The proficiency levels from QOL for staff in the Compliance and Debt Operations Branch is set out in paragraph 2.39. The correctness rates for debts processed by staff assessed as ‘proficient’ and the ANAO’s finding that policy and procedures, training and supervision do not sufficiently support staff to achieve desired correctness rates of 95 per cent or higher is set out in paragraph 2.41 and Figure 2.2.

3. Strategies and processes to manage and recover debt

Areas examined

This chapter examines whether Services Australia has developed and implemented effective strategies and processes to manage and recover social security and welfare debt comprising: debt strategies; debt detection activities; debt determination decisions; and debt recovery.

Conclusion

Services Australia has partly effective strategies to detect, determine and recover debt. Debt is detected through processes designed to manage payment accuracy risks rather than risk-based compliance and enforcement strategies. In 2021–22, Services Australia determined 51 per cent of undetermined debts available for processing. The end of debt pauses relating to natural disasters and the COVID-19 pandemic contributed to a backlog of detected debts awaiting determination. Services Australia does not monitor debt detected relative to the risk of overpayment for all social security and welfare payments. The effectiveness of debt management and recovery activities is not measured.

Area for improvement

The ANAO made one recommendation aimed at establishing a debt management strategy (paragraph 3.18).

3.1 Regulatory functions include administering, monitoring, promoting compliance and enforcing regulation. Regulation is defined as ‘any rule endorsed by government where there is an expectation of compliance’.42 Services Australia fulfils a regulatory function by administering payments and recovering debt on behalf of policy entities.43

3.2 A risk-based and data-driven approach to the development and implementation of compliance and enforcement activities enables an entity to:

- allocate limited resources to the greatest risks of non-compliance; and

- encourage voluntary compliance and deliver proportionate responses.

Does Services Australia have a fit-for-purpose risk-based strategy for debt management?

Services Australia does not have a strategy for detection and deterrence of debt. Services Australia manages the prevention and detection of debt through strategies and compliance activities focused on payment accuracy. Improvements in payment accuracy can reduce the occurrence of debt. Operational plans focus on the processing of undetermined debt and managing the end of the debt pauses. While Services Australia proposes to adopt a risk-based approach to debt management in the future, current strategies and plans are not risk-based. Payment accuracy focused strategies and plans did not set out performance measures and targets to support an assessment of the effectiveness of Services Australia’s activities across the debt management lifecycle.

3.3 Services Australia’s general debt management policy and procedure states that the bilateral arrangements with the Department of Social Services (DSS) contain a debt management framework to maximise correct payments and detect and investigate debts. The framework employs three key strategies:

- prevent debt — through minimising the risk of incorrect payments;

- detect debt — through detecting and fixing incorrect payments; and

- deter debt — through promoting voluntary compliance through the recognition of risks and penalties, including the likelihood of detection, debt recovery and possible prosecution.

3.4 The bilateral agreement for payment assurance between Services Australia and DSS states that Services Australia is responsible for undertaking debt management and developing and undertaking compliance strategies. This involves identifying current and emerging risks associated with incorrect payments to inform development of joint compliance strategies.

3.5 Services Australia does not have a strategy for a risk-based approach to debt management (prevention, detection, determination and recovery). Debt management is a feature of, and influenced by, other strategies, roadmaps and the Compliance Assurance Programme that focus on payment accuracy, see Table 3.1. Except for the Payment Integrity Strategy (see paragraph 3.6), Services Australia has not mapped how any of these key documents will enable it to deliver on one of the measures of success contained in the Master Plan 2021–2244: ‘Our response to compliance and debt management is targeted based on risk’.

Table 3.1: Documents contributing to strategic and operational planning for debt management activities

|

Document |

Prevent strategies |

Detect strategies |

Deter strategies |

Risk-based |

Debt performance measures for prevent, detect and deter |

Alignment to other documents |

|

Payment accuracy roadmap |

✔b |

✘ |

✘ |

✘ |

✘ |

Payment integrity strategy |

|

Payment integrity strategy |

✔b |

✘ |

✘ |

✔e |

✘ |

Payment accuracy roadmap and Debt restart |

|

Debt restart 2.0 |

✘ |

✘ |

✔d |

✘ |

✘ |

Payment integrity strategy |

|

Debt Reform paper, including the Debt Modernisation Roadmap |

✘ |

✘ |

✘ |

✘ |

✘ |

Debt Modernisation Program |

|

Debt Modernisation Program |

✘ |

✘ |

✔c |

✘ |

✘ |

Debt Reform paper Debt Modernisation Charter |

|

Debt Modernisation Chartera |

✘ |

✘ |

✘ |

✘ |

✘ |

Debt Modernisation Program |

|

Compliance Assurance Programme |

✘ |

✔c |

✘ |

✔f |

✘ |

Payment integrity strategy |

Key: ✔ The document addresses this element ✘ The document does not address this element.

Note a: The Debt Modernisation Program is the delivery mechanism for modernising Services Australia’s Debt Reforms. Debt Modernisation Program Projects are endorsed and overseen by the Debt and Integrity Projects Board (see paragraph 2.14), and includes the Debt Modernisation Roadmap initiatives.

Note b: These are payment accuracy prevention strategies which aim to prevent payment inaccuracy and may have an impact on debt.

Note c: This includes data matching compliance activities which may lead to the detection of potential overpayments.

Note d: These include operational plans to recommence debt raising and recovery action or some organisational transformation improvement projects. For example, focusing on communications with customers.

Note e: Services Australia planned to adopt a risk-based approach to debt in this strategy.

Note f: Some compliance activities were investigated based on risk factors (see paragraph 3.30).

Source: ANAO analysis of Services Australia’s records.

Payment accuracy initiatives

3.6 The Payment Integrity Strategy was endorsed by the Executive Committee in April 2021. The strategy planned to move towards a risk-based human centred approach to payment integrity, establishing the following goals for: