Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Cyber Resilience of Government Business Enterprises and Corporate Commonwealth Entities

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the management of cyber security risks by three government business enterprises or corporate Commonwealth entities. The entities selected for audit are ASC Pty Ltd, the Australian Postal Corporation and the Reserve Bank of Australia.

Summary and recommendation

Background

1. The Australian Government’s ability to effectively and efficiently deliver its functions relies on government entities prioritising information security. If government information systems can be accessed by intruders, this could compromise the financial and identity security of individuals and the commercial interests of corporations. A secure cyberspace supports online activities for individuals, business and the public sector. Cyber resilience is an entity’s ability to continue providing services while deterring and responding to cyber intrusions. Cyber resilience also reduces the likelihood of cyber intrusions that threaten Australians’ privacy and Australia’s social, economic and national security interests.

2. The Protective Security Policy Framework is administered by the Attorney-General’s Department to assist Australian Government entities protect their people, information and assets, at home and overseas. Non-corporate Commonwealth entities are required to apply the Protective Security Policy Framework. While cyber security is a strategic priority for the Australian Government, it is not mandatory for government business enterprises and corporate Commonwealth entities to apply the Protective Security Policy Framework. Accordingly it is better practice for such entities to implement the Top Four and other Essential Eight mitigation strategies in the Australian Government Information Security Manual (Information Security Manual).1

3. Since 2013–14 when the Information Security Manual became mandatory policy for non-corporate Commonwealth entities, the Auditor-General has tabled four performance audits in the Parliament that assessed the cyber security resilience of 14 such entities.2 The audits identified that only four entities (29 per cent) had complied with mandatory government requirements for information security, and that the regulatory framework had not driven sufficient improvement in cyber security.

4. Three corporate entities were included in this audit: Australian Postal Corporation (Australia Post) and ASC Pty Ltd (ASC), both government business enterprises; and the Reserve Bank of Australia (Reserve Bank), a corporate Commonwealth entity. These entities were selected based on the character and sensitivity of the information collected, stored and reported — including that the entities manage critical infrastructure or systems of national interest.

Rationale for undertaking the audit

5. Despite the importance of cyber security in safeguarding the Australian Government’s digital information, there has been ongoing low levels of cyber resilience of non-corporate Commonwealth entities and weaknesses in the regulatory framework for ensuring compliance with mandatory cyber security strategies. This audit was undertaken to enable comparison with government business enterprises and corporate Commonwealth entities, and provide information to help strengthen the regulatory framework and improve cyber resilience of Commonwealth entities. In line with the requirements for performance audit of government business enterprises under the Auditor-General Act 1997, the Joint Committee of Public Accounts and Audit provided approval for the Australian National Audit Office (ANAO) to examine the cyber resilience of Australia Post and ASC.

Audit objective and criteria

6. The audit objective was to assess the effectiveness of the management of cyber security risks by Australia Post, ASC and the Reserve Bank.

7. To form a conclusion against this objective, the ANAO adopted three high-level criteria:

- Have entities managed cyber security risks in line with their own risk arrangements?

- Have entities managed cyber security risks in line with key aspects of the Information Security Manual?

- Do entities have a culture of cyber security resilience?

Conclusion

8. The Reserve Bank and ASC have effectively managed cyber security risks. Australia Post has not effectively managed cyber security risks, and should continue to implement its cyber security improvement program and key controls across all its critical assets to enable cyber risks to be within its tolerance level.

9. All three entities have a fit for purpose cyber security risk management framework. ASC and the Reserve Bank have met the requirements of their respective frameworks by implementing the specified information and communications technology (ICT) controls that support desktop computers, ICT servers and systems. Australia Post has not met the requirements of its framework, having not implemented all specified key controls.

10. The Reserve Bank and ASC have implemented controls in line with the requirements of the Information Security Manual, including the Top Four and other mitigation strategies in the Essential Eight. Australia Post has not fully implemented controls in line with either the Top Four or the four non-mandatory strategies in the Essential Eight.

11. The Reserve Bank and ASC are cyber resilient, with high levels of resilience compared to 15 other entities audited over the past five years. Australia Post is not cyber resilient but is internally resilient, which is similar to many of the previously audited entities. The Reserve Bank has a strong cyber resilience culture, ASC is developing this culture, and Australia Post is working towards embedding a cyber resilience culture within its organisation.

Supporting findings

Cyber security risk management frameworks

12. All three entities have a fit for purpose cyber security risk management framework. They each have enterprise-wide risk management arrangements that incorporate cyber security, and specific frameworks for managing cyber security risks appropriate to their operations. Each specific framework either includes the Information Security Manual or incorporates elements of it, with Australia Post and the Reserve Bank also adopting aspects of recognised national and international cyber security frameworks applicable to their industry and regulatory environment. The Reserve Bank has fully established all six assessed risk management and governance arrangements for cyber security. Australia Post and ASC have established three of the six arrangements and partially or largely established the other three arrangements.

13. The Reserve Bank and ASC have met the requirements for implementing ICT controls contained in their cyber security risk management framework. Australia Post has not met the requirements for ICT controls in its framework, having not implemented all specified key controls, and as a result has rated the overall cyber risk as significantly above its defined tolerance level.

Alignment with the Information Security Manual risk mitigation strategies

14. The Reserve Bank and ASC have implemented controls in line with the requirements for the Top Four mandatory cyber security risk mitigation strategies of the Information Security Manual. Australia Post has implemented two of the Top Four mitigation strategies: patching ICT applications and minimising privileged user access.

15. ASC and the Reserve Bank have implemented controls in line with all four non-mandatory mitigation strategies in the Essential Eight. Australia Post has implemented controls for one of those mitigation strategies — daily backups of data. All three entities have implemented mitigation strategies beyond the requirements of the Essential Eight, such as the Reserve Bank using machine learning and analytics to detect cyber threats.

Cyber security resilience

16. The three entities are at different stages in embedding a cyber resilience culture. The Reserve Bank has a strong cyber resilience culture, having established all 13 assessed behaviours and practices in the areas of cyber security governance and risk management, roles and responsibilities, technical support and monitoring compliance. ASC is developing a cyber resilience culture, having embedded seven of the assessed behaviours and practices and working to more fully establish the other six cyber security behaviours and practices within its business processes. While having embedded eight of the 13 assessed behaviours and practices, Australia Post has not systematically managed cyber risks, including not assessing the effectiveness of controls applied outside its specified cyber security risk management framework. Nevertheless, Australia Post is working towards embedding a cyber resilience culture.

17. The Reserve Bank and ASC are cyber resilient as they have met the requirements of their fit for purpose cyber security risk management frameworks. Australia Post is not cyber resilient as it has not met the requirements of its own framework. The Reserve Bank and ASC are also cyber resilient under the requirements of the Information Security Manual, as they have implemented the Top Four cyber security risk mitigation strategies and have effective ICT general controls for logical access and change management. Accordingly, the two entities have a high level of protection from internal and external cyber security threats. Australia Post is not cyber resilient under the requirements of the Information Security Manual, but is internally resilient with effective ICT general controls in place for managing logical access and change processes.

18. The Reserve Bank and ASC respectively had the highest and equal third highest level of cyber resilience of 17 entities examined by the ANAO over the past five years. Australia Post was not cyber resilient, which was similar to many of the previously audited entities. The small number of government business enterprises and corporate Commonwealth entities assessed (three) means it is not possible to draw conclusions as to the relative level of cyber resilience of corporate compared to non-corporate Commonwealth entities.

Recommendation

Recommendation no. 1

Paragraph 2.28

Australia Post conducts risk assessments for all its critical assets where it has not already done so and takes immediate action to address any identified extreme risks to those assets and supporting networks and databases.

Australia Post: Agreed.

Summary of entity responses

19. Summary responses from Australia Post, ASC and the Reserve Bank are provided below, with the full responses at Appendix 1.

Australian Postal Corporation

As a government business enterprise operating in a number of competitive markets (including parcel services, government services, financial services, identity services and retail services), Australia Post conducts its complex business operations in a highly competitive commercial environment, maintaining both community and commercial obligations. We are committed to upholding the security and integrity of the assets and information we maintain.

Australia Post agrees with Recommendation no. 1. Australia Post has clear oversight of its critical asset infrastructures and has prioritised actions under a program of work already underway to address this recommendation. This will involve conducting risk assessments for critical assets not yet assessed, updating assessments for those already assessed, and taking immediate action to address any concerns that are identified. Monitoring of the implementation of this program of work will be managed through our information security risk management and compliance programs, and will be reported to senior management and our Board, through its Audit & Risk Committee.

Australia Post notes that it has been assessed as ‘Internally Resilient’ under the grading scheme developed by the Australian National Audit Office and applied in the Report. In our view that determination reflects the significant volume of resources and effort Australia Post has already committed to developing its cyber resilience, but that there is still work to be done to move towards, and maintain, a high level of external resilience.

Australia Post maintains a high level of cyber resilience across its critical platforms and systems supporting government, identity and financial services – a number of which have received external accreditation against the Australian Government Information Security Manual (Manual).

Australia Post is not required to apply or comply with the Manual or its Top Four mitigation strategies, but has voluntarily chosen to incorporate aspects of the Manual into its cyber security framework – together with other industry-leading frameworks such as the National Institute of Standards and Technology Cybersecurity Framework – as a matter of best practice.

Australia Post is committed to ensuring the security and integrity of its information systems, and to deterring and responding to cyber intrusions. Our continued vigilant focus on the further implementation of our cyber security risk management framework, and on protecting the integrity and security of our systems, will assist in the preservation of a strong framework of cyber resilience for the benefit of our employees, customers and the Australian community.

ASC Pty Ltd

ASC agrees with the findings in the report with regard to ASC and is pleased with the ANAO determination that ASC is cyber resilient. ASC will use the detail contained in the report to further strengthen those areas where opportunities to improve have been highlighted by the ANAO audit team.

ASC would like to express our appreciation of the manner in which the ANAO audit team conducted the audit with the audit activities providing ASC with a thorough and independent review and assessment of our cyber security implementation and posture. ASC believes that both parties exited from the audit with new learnings that will assist us both in future activities around cyber security.

Reserve Bank of Australia

The Reserve Bank of Australia (RBA) agrees with the findings in the report and that the report is an accurate assessment of our cyber resilience.

The RBA will continue to align with the security controls outlined in the Australian Government lnformation Security Manual and relevant industry security standards as part of our efforts to maintain a strong financial system for all Australians. The RBA is committed to ensuring that we are a cyber-resilient organisation and we will continue to adapt our security strategy to the changing cyber landscape.

Key messages from this audit for all Australian Government entities

20. Below is a summary of key messages, including instances of good practice, identified in this audit that may be relevant for the operations of other Commonwealth entities. Also, Chapter 4 of this report includes lists of behaviours and practices identified in this and previous ANAO audits that, if implemented, may improve the level of cyber resilience of Commonwealth entities.

Governance and risk management

1. Background

Introduction

1.1 The Australian Government’s ability to effectively and efficiently deliver its functions relies on government entities prioritising information security. If government information systems can be accessed by intruders, this could compromise the financial and identity security of individuals and the commercial interests of corporations.3 It could also compromise national security, and diminish the Government’s reputation and the willingness of individuals and organisations to share their information with the Government.4

1.2 A secure cyberspace supports online activities for individuals, business and the public sector. Cyber resilience is an entity’s ability to continue providing services while deterring and responding to cyber intrusions. Cyber resilience also reduces the likelihood of cyber intrusions that threaten Australians’ privacy and Australia’s social, economic and national security interests.

1.3 The Protective Security Policy Framework is administered by the Attorney-General’s Department to assist Australian Government entities to protect their people, information and assets, at home and overseas. Under the Public Governance, Performance and Accountability Act 2013, non-corporate Commonwealth entities are required to apply the Protective Security Policy Framework as it relates to their risk environment. Since April 2013, the Protective Security Policy Framework has stated that non-corporate Commonwealth entities must mitigate common and emerging cyber threats. The Protective Security Policy Framework mandates non-corporate Commonwealth entities implementing four strategies that are detailed in the Australian Government Information Security Manual (Information Security Manual) published by the Australian Signals Directorate.5 The strategies have been referred to as the ‘Top Four’ and address: application whitelisting; patching applications; restricting administrative privileges; and patching operating systems. The strategies are described in Chapter 3 of this report.

1.4 Despite cyber security being a strategic priority for the Australian Government and an increasing risk across government entities6, it is not mandatory for government business enterprises and corporate Commonwealth entities to apply the requirements under the Protective Security Policy Framework. The framework currently represents better practice for such entities. Those entities are only required to apply the Protective Security Policy Framework if they are directed to comply under a government policy order under sections 22 or 93 of the Public Governance, Performance and Accountability Act 2013. No such orders have been issued to date.

Previous audits of entities’ cyber security resilience

1.5 Starting in 2013–14, the Auditor-General has tabled four performance audits in the Parliament that assessed the cyber security resilience of 14 non-corporate Commonwealth entities.7 The entities examined in those audits held information across a range of economic, commercial, policy or regulatory, national security, program and service delivery, and corporate activities. The audits identified that only four entities (29 per cent) had complied with mandatory government requirements for information security, and that the regulatory framework had not driven sufficient improvement in cyber security.

1.6 The Australian Parliament’s Joint Committee of Public Accounts and Audit (JCPAA) published Report 467: Cybersecurity Compliance in October 2017. The report followed a Committee inquiry based on Auditor-General Report No.42 2016–17 Cybersecurity Follow-up Audit. The Committee’s 10 recommendations and their current status of implementation are shown in Appendix 2. As at April 2019, five recommendations had been implemented (one implemented late), two partly agreed and/or partly implemented and three agreed or partly agreed but not yet implemented. The lack of timely responses to these recommendations is not in line with the JCPAA’s statement in Report 467 that ‘as a strategic priority, it is crucial that Commonwealth entities be accountable to the Australian Parliament on cybersecurity’.8

Rationale for undertaking the audit

1.7 Despite the importance of cyber security in safeguarding the Australian Government’s digital information, there has been ongoing low levels of cyber resilience of non-corporate Commonwealth entities and weaknesses in the regulatory framework for ensuring compliance with mandatory cyber security strategies. This audit was undertaken to enable comparison with government business enterprises and corporate Commonwealth entities, and provide information to help strengthen the regulatory framework and improve cyber resilience of Commonwealth entities. In line with the requirements for performance audit of government business enterprises under the Auditor-General Act 1997, the JCPAA provided approval for the Australian National Audit Office (ANAO) to examine the cyber resilience of the Australian Postal Corporation and ASC Pty Ltd.

Audit approach

1.8 Of 79 Australian Government business enterprises and corporate Commonwealth entities, three entities were selected for this audit: Australian Postal Corporation (Australia Post) and ASC Pty Ltd (ASC), both government business enterprises; and the Reserve Bank of Australia (Reserve Bank), a corporate Commonwealth entity.

1.9 The selection process for this audit included an assessment of each entity against the following factors:

- type of information held by the entity;

- type of services provided by the entity; and

- whether the entity manages critical infrastructure or systems of national interest, such as those relating to financial services and information technology, which continue to be a focus for cybercriminals.

1.10 Table 1.1 outlines the key information collected, stored and used by Australia Post, ASC and the Reserve Bank.

Table 1.1: Audited entities’ information holdings and service characteristics

|

Entity |

Economic or commercial information |

Citizens’ personal information |

National security or critical infrastructure |

Program and service delivery |

Policy or regulatory body |

|

Australia Post |

✔ |

✔ |

✔ |

✔ |

– |

|

ASC |

✔ |

– |

✔ |

✔ |

– |

|

Reserve Bank |

✔ |

– |

✔ |

✔ |

✔ |

Source: ANAO analysis.

Australia Post

1.11 The Australian Postal Corporation (Australia Post) operates under the Australian Postal Corporation Act 1989. It is a government-owned business required to earn a commercial rate of return and meet specified community service obligations.9 The Australian Government is Australia Post’s only shareholder through the Minister for Communications and the Minister for Finance. Australia Post’s Chair is selected by the Minister for Communications and the Minister for Finance.10

1.12 Australia Post provides direct services to its customers in the following areas:

- a national retail network;

- mail delivery, parcel delivery and shipping services, domestically and internationally;

- financial transactions and payment services, domestically and internationally;

- identity verification services, including for passports, licence renewals and proof of age cards; and

- data management and logistics services, for business and government.11

1.13 Australia Post provides financial services through a network of more than 4000 post offices, including over 2500 post offices in rural and remote Australia. It also manages an extensive physical operational asset base and the provision of these services is supported by over 1500 applications. Australia Post directly employs around 35,000 people across its integrated delivery, logistics, retail and eCommerce network.12

ASC

1.14 ASC (formerly known as the Australian Submarine Corporation) was established as a joint venture in 1985 to design and build a new fleet of submarines for the Royal Australian Navy. ASC has been a wholly government owned business since 2000. ASC is a proprietary company limited by shares registered under the Corporations Act 2001 — all the shares issued in the capital of ASC are owned by the Commonwealth of Australia, represented by the Minister for Finance. The Chair of the ASC Board is appointed by the Finance Minister. In 2017–18, ASC had approximately 2200 employees.

1.15 ASC provides the following services:

- sustainment for the current fleet of Collins Class submarines, which includes maintenance, repairs and design upgrades;

- training services for submariners;

- building the Hobart Class air warfare destroyers; and

- building the lead and second Arafura Class offshore patrol vessels.

Reserve Bank

1.16 The Reserve Bank was established under the Reserve Bank Act 1959 as Australia’s central bank. The Reserve Bank is a statutory authority with the power to make monetary and banking policy. The Reserve Bank is governed by two boards: the Reserve Bank Board and the Payments System Board. In June 2018, the Reserve Bank had 1362 employees.

1.17 The Reserve Bank is responsible for the following areas and objectives:

- setting the interest rate on overnight loans in the money market (‘cash rate’) through monetary policy;

- setting a target for the cash rate through financial market operations;

- maintaining the stability of the financial system through mitigating and responding to major financial disturbances;

- overseeing Australia’s payment system and regulating the infrastructure supporting the clearing and settlement of transactions in financial markets;

- providing a range of banking services to the Australian Government and overseas central banks; and

- all aspects of the production, issuance, security of, and the maintenance of confidence in, Australian banknotes.

Audit objective, criteria and scope

1.18 The audit objective was to assess the effectiveness of the management of cyber security risks by Australia Post, ASC and the Reserve Bank.

1.19 To form a conclusion against this objective, the ANAO adopted three high-level criteria:

- Have entities managed cyber security risks in line with their own risk arrangements?

- Have entities managed cyber security risks in line with key aspects of the Information Security Manual?

- Do entities have a culture of cyber security resilience?

1.20 The scope included:

- assessing whether the entities met the requirements of their chosen cyber security risk management framework, including assessing the cyber security controls that were implemented;

- assessing whether the entities’ management of cyber security risks aligned with key aspects of the Information Security Manual, as government business enterprises and corporate Commonwealth entities are not required to apply the Protective Security Policy Framework; and

- similar to the previous audit13 in the series, assessing entities’ cyber security culture, that is, the shared organisational attitudes, values and behaviours regarding cyber risks that complement the technical security solutions for managing cyber risks.

1.21 The assessment was performed on the corporate platform and selected systems that were rated as critical by the entities. The selected systems were: the Reserve Bank’s Information and Transfer System14; ASC’s Enterprise Resource Planning System15; and Australia Post’s Corporate Data Warehouse and eParcel application.16

1.22 The selected systems did not include: financial and human resource management information systems, which were non-critical; security sensitive and classified networks within ASC17; and Australia Post’s retail environment or systems supporting government, identity and financial services.18

1.23 Given the large number of critical applications in these entities, a sample of critical applications was selected to assess each entity’s capability of implementing adequate controls for protecting, detecting and responding to cyber threats. The basis for taking this approach is that entities would prioritise and invest in the protection of applications and information assets that were critical to their business. The effectiveness of the entities in managing cyber security risks across the selected critical systems would provide an indication of their cyber threat mitigation strategies for other critical systems across the entity. Additionally, a sample of controls were tested from each entity’s cyber security framework that were focused on areas that were relevant to mitigating cyber threats, such as system configuration, network security, identity management, and logging and monitoring.

Audit methodology

1.24 In December 2018 and January 2019, the ANAO collected and reviewed documents and tested selected systems in each entity for the period 1 January 2018 to 8 February 2019. Staff were interviewed in all three entities, including executive staff, Board members, and audit and risk committee members.

1.25 During fieldwork for the audit, in December 2018 a new edition of the Information Security Manual was published. Entities’ security controls continued to be examined under the 2017 edition during the audit. However, if a control was assessed as inadequate it was also examined under the December 2018 edition of the Information Security Manual to establish if the control was adequate under the new edition.19 Entities were also asked to describe their response to the new requirements in the Information Security Manual and assess whether those requirements would apply to their cyber security culture.

1.26 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $720,000. The team members for this audit were Esther Barnes, Edwin Apoderado, Kelvin Le, Jason Ralston, Carissa Chen, David Ma, David Willis, Bola Oyetunji and Andrew Morris.

2. Cyber security risk management frameworks

Areas examined

This chapter examines whether the entities have established fit for purpose cyber security risk management frameworks and managed cyber security risks according to those frameworks.

Conclusion

All three entities have a fit for purpose cyber security risk management framework. ASC and the Reserve Bank have met the requirements of their respective frameworks by implementing the specified information and communications technology (ICT) controls that support desktop computers, ICT servers and systems. Australia Post has not met the requirements of its framework, having not implemented all specified key controls.

Areas for improvement

This chapter has one recommendation aimed at Australia Post taking timely action to address cyber security risks associated with its critical assets (paragraph 2.28).

Do entities have a fit for purpose cyber security risk management framework?

All three entities have a fit for purpose cyber security risk management framework. They each have enterprise-wide risk management arrangements that incorporate cyber security, and specific frameworks for managing cyber security risks appropriate to their operations. Each specific framework either includes the Australian Government Information Security Manual or incorporates elements of it, with Australia Post and the Reserve Bank also adopting aspects of recognised national and international cyber security frameworks applicable to their industry and regulatory environment. The Reserve Bank has fully established all six assessed risk management and governance arrangements for cyber security. Australia Post and ASC have established three of the six arrangements and partially or largely established the other three arrangements.

Design of entities’ cyber security risk management frameworks

2.1 The audit examined each entity’s approach to cyber security as part of their overall management of risks as well as the specific risk management frameworks in place for managing cyber security risks. Table 2.1 summarises the entities’ risk management frameworks for cyber security.

Table 2.1: Entities’ cyber security risk management frameworks

|

Entity |

Summary of the cyber security risk management framework |

|

Australia Post |

Incorporates aspects of the following frameworks:

|

|

ASC |

Incorporates the Australian Government Information Security Manual. |

|

Reserve Bank |

Incorporates the Australia Government Information Security Manual and aspects of the following frameworks:

|

Note a: The NIST Cybersecurity Framework, developed in the United States in 2014 in response to a Presidential Executive Order, provides guidance to help organisations better understand, manage and reduce cyber security risks.

Source: ANAO analysis of entity documents.

2.2 In establishing their cyber security risk management frameworks, all three entities assessed various existing international and national frameworks, including the Australian Government Information Security Manual (Information Security Manual). Despite the Top Four mitigation strategies not being mandatory for these entities (as discussed in Chapter 1), all three entities included these strategies in their cyber security risk management frameworks. All three entities’ frameworks also covered the additional four mitigation strategies in the Essential Eight (as discussed in Chapter 3). The cyber security risk management frameworks of the Reserve Bank and Australia Post also incorporate national and international standards.

2.3 The Reserve Bank reviewed its cyber security risk management framework in 2016, engaging an external firm to assess the most commonly used IT industry frameworks and identify potential controls to complement its prevailing protection mechanisms based on the Information Security Manual. The review was completed in 2016 and recommended that the Reserve Bank define a set of principles based on commonly used frameworks20 to address risks not covered by the Information Security Manual. The review suggested a risk-based approach to implementing elements of ISO 27001, the most commonly used framework by central banks, and also elements of other frameworks. Accordingly, the Reserve Bank implemented ISO 27001 in conjunction with the Information Security Manual, and other frameworks as set out in Table 2.1. The Reserve Bank also participated in the SWIFT Customer Security Program, which seeks to establish a security baseline for the entire financial community, and fosters transparency of security compliance across participants.

2.4 ASC adopted the Information Security Manual as its security framework, which is an appropriate approach given the nature of its operations and membership within the Defence Industry Security Program.21 The program requires members to comply with the Defence Security Principles Framework, which includes a requirement to comply with the Protective Security Policy Framework and Information Security Manual.

2.5 Similar to the Reserve Bank, Australia Post has established a security framework that incorporates requirements from the Information Security Manual, NIST, and other frameworks as set out in Table 2.1. Australia Post’s security standards include certain controls from each framework and were selected based on risk and applicability to Australia Post’s business and environment.

Effectiveness of entities’ risk management and governance arrangements for cyber security

2.6 Table 2.2 shows the effectiveness of the three entities’ risk management and governance arrangements for cyber security. The assessment is based on criteria developed by the ANAO in the previous cyber resilience audit report.22

Table 2.2: Effectiveness of entities’ risk management and governance arrangements for cyber security

|

Areas assessed for risk management and governance arrangements |

Australia Post |

ASC |

Reserve Bank |

|

Enterprise-wide governance arrangements |

◆ |

◆ |

◆ |

|

Information security roles assigned and responsibilities communicated |

◆ |

◆ |

◆ |

|

ICT security incorporated into strategy, planning and delivery of services |

◆ |

▲ |

◆ |

|

ICT operational staff understand the vulnerabilities and cyber threats to the system |

▲ |

▲ |

◆ |

|

Integrated and documented architecture for data, systems and security controls |

▲ |

▲ |

◆ |

|

Systematic approach to managing cyber risks, including assessments of the effectiveness of controls and security awareness training |

▲ |

◆ |

◆ |

|

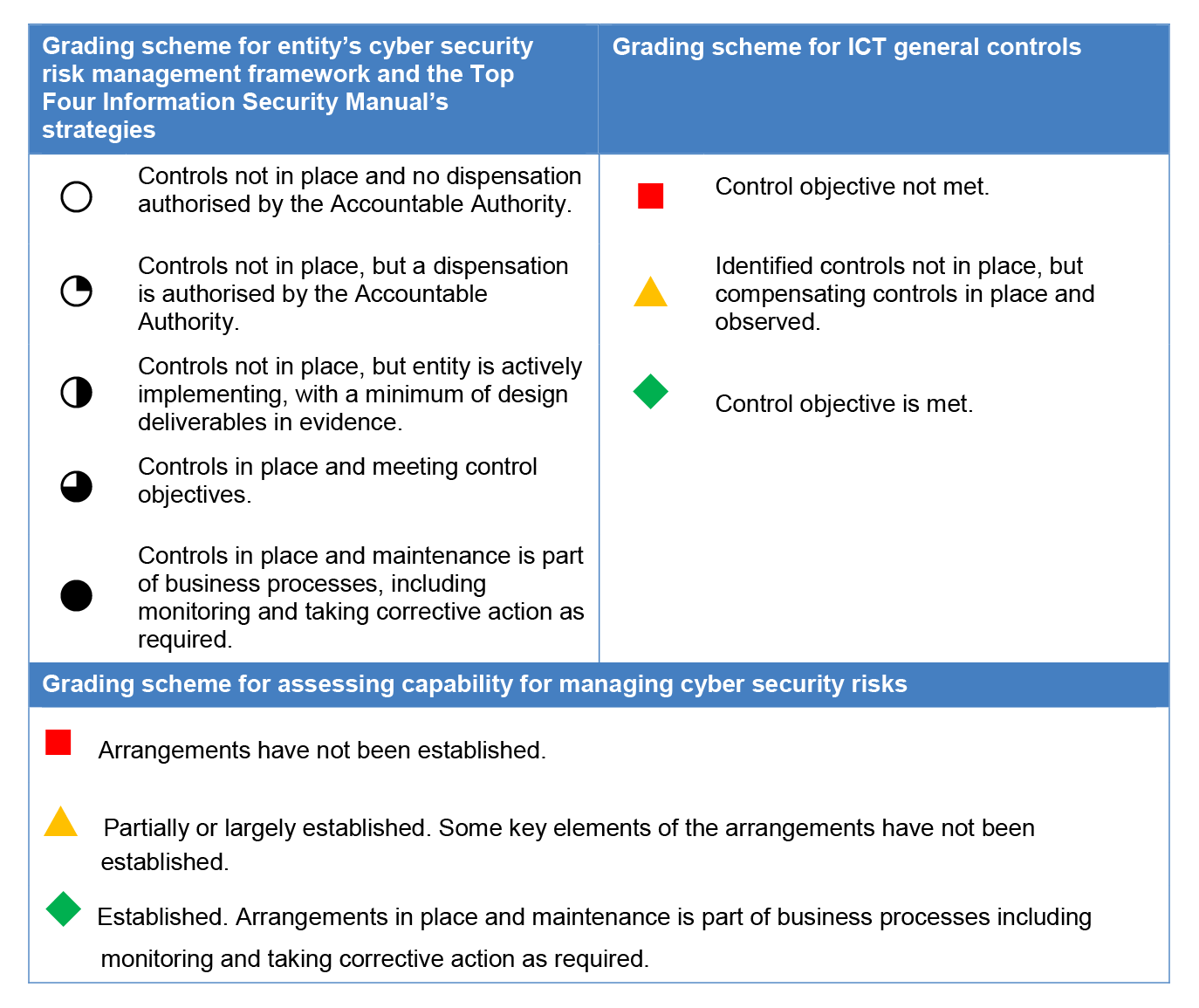

Key: ◆ Established. Arrangements in place and maintenance is part of business processes including monitoring and taking corrective action as required. ▲ Partially or largely established. Some key elements of the arrangements have not been established. ■ Arrangements have not been established. |

|||

Source: ANAO analysis.

2.7 Table 2.2 shows that the Reserve Bank has all six assessed risk management and governance arrangements in place to support its management of cyber security risks. Australia Post and ASC both have established three of these arrangements and partially or largely established the other three arrangements, where some key elements have not been implemented.

Enterprise-wide governance arrangements

2.8 All three entities have an Enterprise Risk Management Framework that was supported by risk management plans or policies. The frameworks were aligned with the Australian and New Zealand standard (AS/NZS ISO 31000:2009) for the development of risk management frameworks and programs.23 In all three entities, cyber risks were identified and managed with other types of business risks on entity risk registers. In addition, the Reserve Bank has published a Risk Appetite Statement that covers cyber attacks on its systems or networks that states: ‘The Bank has a very low appetite for damage to Bank assets from threats arising from malicious attacks’.24 Australia Post also has a Risk Appetite Statement that states it supports: ‘a highly secure environment and will not tolerate data security incidents resulting in material theft, loss or corruption of business or confidential internal and customer data.’ ASC does not have a Risk Appetite Statement.

2.9 All three entities have governance arrangements in place involving senior executives and board level committees, which meet regularly to consider and manage cyber security risks. The committees are supported by adequate monitoring and reporting on cyber security matters.

Information security roles assigned and responsibilities communicated

2.10 Clearly defined information security roles are assigned either to individuals or committees in all three entities. All three entities have appointed security advisors, such as a Chief Information Security Officer, to assist more senior staff or to assist with the daily delivery of information security requirements.

ICT security incorporated into strategy, planning and delivery of services

2.11 Australia Post and the Reserve Bank have effectively incorporated ICT security into their strategies, plans and activities to deliver services. Specifically, Australia Post and the Reserve Bank include ICT security arrangements in strategic plans, business planning processes, project management arrangements, and financial management processes.

2.12 ASC’s strategic plans identify cyber security as a risk for its business. ASC uses governance arrangements for cyber security to involve senior executives in further developing its cyber security capability. The Chief Information Security Officer is leading the implementation of capability development activities. There is currently no long-term, approved plan in place for additional investments in cyber security. Further investments in cyber security are managed as part of ASC’s business planning process. ASC includes its ICT security budgets and expenditure in its financial management processes. ASC’s information security strategy that was developed in 2016 has come to an end. ASC advised in May 2019 that the business case for the Digital Transformation Program, which encompasses a new IT Strategy, had been completed and was being progressed through the relevant approval processes.

ICT operational staff understand the vulnerabilities and cyber threats to the system

2.13 The Reserve Bank has comprehensive arrangements in place to support ICT operational staff understand cyber threats to the ICT systems that support corporate and service operations. The Reserve Bank primarily uses in-house operational staff to support its ICT systems. All ICT operational staff, and contract staff working on-site, are required to complete a security induction. Activities to inform ICT staff about potential cyber threats to the Reserve Bank’s systems include daily, weekly and monthly briefings and forums among ICT security and operational teams.

2.14 Australia Post and ASC mostly use in-house operational staff to support their ICT systems. These staff and external contractors are required to complete a security induction process. Both entities encourage their ICT security staff to identify and complete training that supports their roles and responsibilities, although there is no mandatory cyber security training requirement for staff in the ICT security teams. Both entities’ ICT security teams undertake a range of in-house activities to identify potential vulnerabilities, and regularly discuss the results with ICT operational staff. Although Australia Post provided vulnerability reports and risk assessments, these did not cover all critical systems. ASC does not document all the vulnerabilities identified from its assessments.

2.15 Australia Post and the Reserve Bank actively contribute to external industry and professional forums that enable the sharing of information on cyber security. ASC participates in a limited number of external forums as a means of obtaining updates and increasing its awareness of cyber security vulnerabilities and cyber security threats.

Integrated and documented architecture for data, systems and security controls

2.16 The Reserve Bank has identified, and clearly described and documented, its critical ICT assets. The Reserve Bank has also documented the threats, risks and mitigations to those assets. Incident response plans and business continuity plans include the priority of services to be maintained or restored in the entity.

2.17 ASC has not separately identified critical ICT assets, instead treating all information assets as critical. ASC has documented the threats, risks and mitigations that would be required under a generic threat scenario to the critical information network that was examined by the ANAO.25 Further work would be required by ASC to develop tailored threat and risk profiles for specific information assets. ASC has not updated its information security strategy since 2016 and is progressing the approval of a new strategy (as discussed in paragraph 2.12). Plans for incident response and business continuity identify the priority of services that need to be maintained or restored by ASC.

2.18 While Australia Post has identified its critical ICT assets, it has not documented the threats, risks and mitigations against all critical assets. Further work is required by Australia Post to validate the level of exposure and protection required across its critical assets. Australia Post has scheduled initiatives to progress risk and threat assessments for all critical assets. Australia Post has also established plans to respond to incidents and business continuity events, including the priority of services to be maintained or restored.

Systematic approach to managing cyber risks, including assessments of the effectiveness of controls and security awareness training

2.19 ASC and the Reserve Bank have systematic approaches to managing cyber security risks that include, but are not limited to:

- implementing a baseline of prescribed controls, that are regularly monitored and assessed for effectiveness;

- the sanctioned use of additional mitigation strategies when necessary;

- performing penetration tests of ICT systems, networks or applications to find security vulnerabilities that an attacker could exploit; and

- delivering security awareness training for all entity staff, such as phishing simulations to try to gather personal information using deceptive emails and websites.

2.20 Similarly, Australia Post has defined an approach to managing cyber security risks that includes security awareness training. However, it has not implemented baseline26 controls on all critical assets or undertaken recent assessments to determine the effectiveness of alternative cyber security controls. Accordingly, it has not been systematic in managing cyber risks.

Have entities met the requirements of their cyber security risk management framework?

The Reserve Bank and ASC have met the requirements for implementing ICT controls contained in their cyber security risk management framework. Australia Post has not met the requirements for ICT controls in its framework, having not implemented all specified key controls, and as a result has rated the overall cyber risk as significantly above its defined tolerance level.

2.21 The ANAO reviewed a sample of controls supporting desktop computers, ICT servers and systems in Australia Post, ASC and the Reserve Bank. As all three entities’ frameworks for managing cyber security risks included elements of the Information Security Manual, there was overlap in the ANAO’s testing of these frameworks reported in this chapter and of controls under the Information Security Manual reported in Chapter 3. There was complete overlap for ASC that adopted the Manual, considerable overlap for the Reserve Bank, but greater variation in testing for Australia Post.27

2.22 In respect of the Reserve Bank, the ANAO reviewed eight of 16 mandatory SWIFT controls, some of which were aligned to the Top Four strategies. The sampled controls covered the SWIFT principles relating to reducing attack vulnerabilities, preventing compromise of credentials, segregating privileges and detecting anomalous activity. For Australia Post, the ANAO reviewed two of 13 Tier 1 Cyber Security mitigation controls and eight of 189 Information Security Standards controls, which Australia Post had specified in its cyber security risk management framework.28 These controls covered infrastructure and malicious content vulnerability management, security procedures and tools, system security configuration, identity management, logging and monitoring, and security awareness. For ASC, the ANAO reviewed 65 of 830 Information Security Manual controls that covered access to systems, operating systems and application hardening, system administration and patching, and event logging and monitoring. The 65 controls were selected given their alignment to the requirements of the Essential Eight.

2.23 In ASC and the Reserve Bank, all sampled controls were designed and implemented as specified in their respective cyber security risk management framework. Where mitigating controls were used to supplement mandatory standards in the framework, these were operating effectively. There was some scope for both entities to include more detailed guidance in documentation supporting review and monitoring activities, although the existing entity personnel were adequately skilled and experienced in applying the required procedures. As part of the audit, non-ICT security staff in a wide range of roles in the two entities were interviewed to ascertain whether security awareness activities were available, promoted and attended by staff. Entity staff, at all levels, advised that they were aware of the entity’s security programs, cyber security incident and response processes, and how to report suspicious emails.

2.24 All three entities monitor for the presence of cyber security incidents, both internal and external. The ICT security team in each entity is responsible for notifying staff when there is a heightened threat of a cyber security incident. Any incidents are to be investigated by the ICT security team to determine the root causes; after which remediation plans are to be developed and communicated to internal stakeholders. The Reserve Bank was proactive in its approach to security incidents and has implemented mitigation strategies to reduce the risk of incidents occurring. For example, the intelligence function within the ICT security team had identified potential concerns with a ransomware attack (WannaCry), and implemented controls to detect and prevent the threat. Similarly, all entities communicated the concerns of the PageUp breach29 to its staff and provided guidance on how to respond to attacks arising from the breach. All entities also assessed the impact on its environment and where required, extended investigations and discussions to external stakeholders to limit the exposure.

2.25 In Australia Post, only half of the sampled controls (five of 10) were designed and implemented as specified in its cyber security risk management framework. Three of the 10 sampled controls were partly implemented and two controls were not implemented. No approval documentation or risk assessment was available to support the deviation from the framework.

2.26 Australia Post’s cyber security framework and controls have been the focus of internal reviews, which highlighted that Australia Post had not fully implemented the security standards in its cyber security risk management framework. Based on the recommendations of the internal reviews, to mitigate cyber security risks Australia Post had implemented controls that are outside its framework. Similar to the findings of Australia Post’s internal reviews, the ANAO’s analysis found that Australia Post had not fully implemented all key controls specified in its cyber security risk management framework (refer previous paragraph). As discussed in Chapters 3 and 4, the overall set of mitigating controls implemented have not been sufficient to address cyber security risks. That is, Australia Post’s existing controls do not sufficiently mitigate the risks it has identified.

2.27 Australia Post has rated its overall cyber security risk as significantly above its defined risk tolerance level.30 Consequently, in 2018 Australia Post established a cyber security program, ‘Securing Tomorrow’, which focuses on reducing cyber risks to within its risk tolerance by 2020. The program is a three year program that addresses long-term strategic initiatives. However, to inform ‘Securing Tomorrow’, Australia Post has not performed risk assessments for all its critical assets31, which has limited its visibility of the threats and current controls for those assets.

Recommendation no.1

2.28 Australia Post conducts risk assessments for all its critical assets where it has not already done so and takes immediate action to address any identified extreme risks to those assets and supporting networks and databases.

Australia Post response: Agreed.

2.29 Australia Post agrees with Recommendation no. 1. Australia Post has clear oversight of its critical asset infrastructures and has prioritised actions under a program of work already underway to address this recommendation. This will involve conducting risk assessments for critical assets not yet assessed, updating assessments for those already assessed, and taking immediate action to address any concerns that are identified. Monitoring of the implementation of this program of work will be managed through our information security risk management and compliance programs, and will be reported to senior management and our Board, through its Audit & Risk Committee.

3. Alignment with the Information Security Manual’s risk mitigation strategies

Areas examined

This chapter examines whether entities have managed their cyber security risks in line with key aspects of the Information Security Manual.

Conclusion

The Reserve Bank and ASC have implemented controls in line with the requirements of the Information Security Manual, including the Top Four and other mitigation strategies in the Essential Eight. Australia Post has not fully implemented controls in line with either the Top Four or the four non-mandatory strategies in the Essential Eight.

Areas for improvement

This chapter has identified strategies and controls for Australia Post to strengthen to be in line with the Top Four and other mitigation strategies in the Essential Eight. ASC and the Reserve Bank could further strengthen some controls for patching applications and operating systems; ASC could also strengthen controls for application whitelisting.

3.1 To safeguard information from cyber security threats, non-corporate Commonwealth entities must implement four mitigation strategies (commonly known as the ‘Top Four’) from the Information Security Manual (refer paragraph 1.3). The four mitigation strategies, in combination with a further four (non-mandatory) mitigation strategies, form a baseline known as the ‘Essential Eight’.

3.2 The four required strategies, of the Essential Eight, are defined in Table 3.1. The remaining four non-mandatory strategies are described later in the chapter in Table 3.3.

Table 3.1: Top Four mandatory mitigation strategies

|

Mitigation strategy |

Why apply the strategy? |

|

To prevent malware delivery and execution |

|

|

Application whitelisting |

All non-approved applications, including malicious code, are prevented from executing. |

|

Patch applicationsa |

Security vulnerabilities in applications can be used to execute malicious code on systems. |

|

To limit the extent of cyber security incidents |

|

|

Restrict administrative privileges |

Administration accounts are the ‘keys to the kingdom’. Adversaries use these accounts to gain full access to information and systems. |

|

Patch operating systems |

Security vulnerabilities in operating systems can be used to further the compromise of systems. |

Note a: A patch is a piece of software designed to fix problems with, or update, a computer program or its supporting data. Examples of common applications include web browsers, Microsoft Office, Java, Flash and PDF viewers.

Source: Adapted from Australian Cyber Security Centre documents.

3.3 As government business enterprises or corporate Commonwealth entities, it is not mandatory for Australia Post, ASC or the Reserve Bank to implement the Top Four mandatory strategies of the Essential Eight. Nevertheless, each entity addressed the Top Four mitigation strategies, and the other four strategies in the Essential Eight, in their cyber security risk management frameworks.

3.4 This chapter examines whether the three entities have implemented controls in line with the Top Four and other Essential Eight mitigation strategies in the Information Security Manual, to enable comparisons with previous ANAO audits of cyber security in non-corporate Commonwealth entities (refer Chapter 4). While it was not mandatory for the entities to do so under the Protective Security Policy Framework, implementing the Top Four strategies, or elements of them, was necessary to satisfy the requirements of their own cyber security risk management framework.

Have entities implemented controls that would be in line with the Top Four cyber security risk mitigation strategies?

The Reserve Bank and ASC have implemented controls in line with the requirements for the Top Four mandatory cyber security risk mitigation strategies of the Information Security Manual. Australia Post has implemented two of the Top Four mitigation strategies: patching ICT applications and minimising privileged user access.

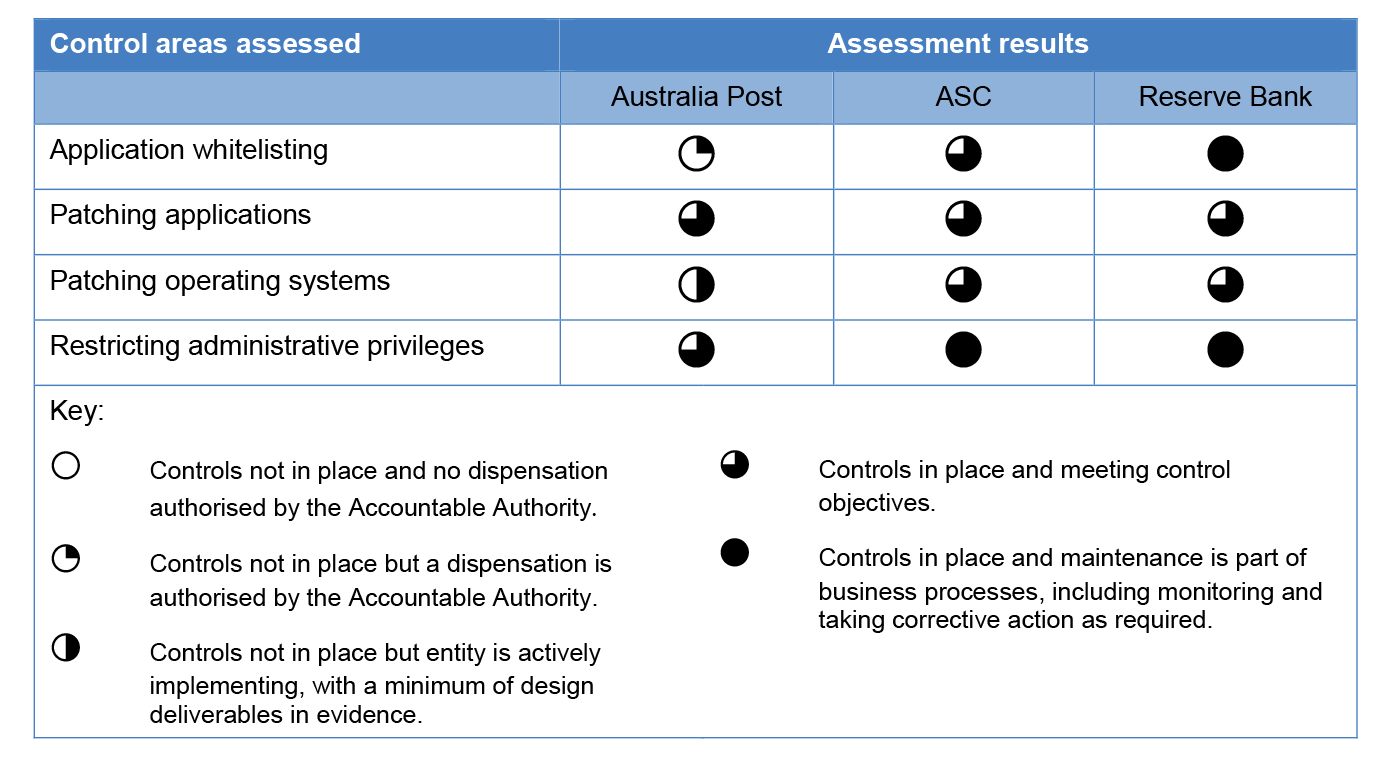

3.5 Table 3.2 shows the three entities’ implementation of the Top Four mitigation strategies. The results, from the application of a standard set of assessment criteria, were aggregated to an overall grade that is described in more detail in Appendix 3.

Table 3.2: Entities’ implementation of the Top Four mitigation strategies

Source: ANAO analysis.

3.6 Table 3.2 shows that the Reserve Bank and ASC implemented each of the Top Four mitigation strategies and therefore would have met the mandatory requirement set out in the Protective Security Policy Framework (and linked to the Information Security Manual). Australia Post implemented two of the Top Four mitigation strategies.

Application whitelisting

3.7 The purpose of application whitelisting is to protect systems and networks from security vulnerabilities in existing applications, and prevent unauthorised applications from running on ICT systems. One of the Top Four mitigation strategies is application whitelisting for desktops and servers.

3.8 The Reserve Bank and ASC have implemented whitelisting controls in both the desktop and server environments using several methods that were consistent with the Information Security Manual and allowed a balance between the entity’s security and business operational needs. ASC does not have procedures for removing whitelisting rules or a process for regularly reviewing whitelisting rules for its Windows desktops and servers other than when new applications were being added.

3.9 ASC and the Reserve Bank have documented application whitelisting strategies, which allowed for exemptions such as when developing, testing and installing applications. ASC requires a risk assessment for exemptions and the Reserve Bank requires mitigating controls to be put in place for exemptions. Both ASC and the Reserve Bank require any changes — additions, modifications, or deletions of applications — from the entity’s whitelisting library to be reviewed and approved by the ICT security team.

3.10 Australia Post has no application whitelisting controls in place to block unauthorised applications from executing on its corporate desktop or server environments. Australia Post had assessed the associated risks and determined that application whitelisting controls would not be suitable for operations within particular environments, such as its corporate desktop and server environments. Australia Post advised the ANAO that it has implemented application whitelisting controls supporting its retail32 and deliveries environments. In the absence of application whitelisting controls for its corporate desktop and server environments, Australia Post advised the ANAO that it has implemented some other controls to mitigate risks. However, the ANAO’s testing of these mitigating controls found that they were not directly applicable to the threats faced and did not provide sufficient coverage, protection or monitoring of the security vulnerabilities in applications.

Patching applications and operating systems

3.11 To protect ICT systems from known vulnerabilities, the Top Four mitigation strategies require entities to deploy security patches as soon as possible after being identified by vendors, independent third parties, system managers or users. The timeframe in which patches must be implemented is according to their assessed level of risk. Under the Information Security Manual, patching (or where not available, other mitigating controls) is mandatory within 48 hours of the detection of security vulnerabilities with an extreme risk.

3.12 All three entities have patch management standards that cover the patching of vulnerabilities and help ensure the integrity and authenticity of patches. All three entities conduct checks for vulnerabilities and have developed approaches to address vulnerabilities when defined patches are not available.

3.13 All three entities did not always meet the required timeframes for patching applications and operating systems, including for some extreme risk patches in ASC and Australia Post, and for some non-extreme risk patches within the Reserve Bank.33 ASC undertook immediate remediation for some of the critical patches for extreme risks that were identified during the audit, and was aware of the challenge in meeting patching requirements within the required timeframes.

3.14 All three entities schedule patching of their applications, and operating systems, using a risk-based approach. When patches were not applied within the required timeframes for applications or operating systems, ASC and the Reserve Bank had other protections in place that were in line with the Top Four mitigation strategies. These were application whitelisting, logging of activities and monitoring. ASC and the Reserve Bank are updating their processes to take into consideration the length of time that patches were not applied and the potential for increased exposure to ICT risks during that time.

3.15 Australia Post remediates patches to desktops and servers, however, patch remediation only occurs for extreme and high risk patches in server environments. This has resulted in remediation activities not occurring within the timeframes required by the entity and under the Information Security Manual. Australia Post operates a number of older operating systems, which has contributed to the patch management challenges. Australia Post is aware of the issues with its patch management and has projects in place to address them and uplift older systems to new versions. These projects are scheduled to be rolled out over the next six months. In the interim, Australia Post advised the ANAO that it has implemented monitoring and other controls to mitigate the risks with its remediation of patches; however, the ANAO’s testing of these other controls found that they were generally not sufficient to address the associated risks.

Restricting administrative privileges

3.16 Misuse of privileged access can lead to significant security compromises, such as the unauthorised disclosure of information, systems or processes becoming unavailable, or financial impropriety. The Top Four mitigation strategies include a requirement for administrative privileges to be regularly reviewed, and restricted only to users who need them and are duly authorised.

3.17 All three entities have security policies, standards and guidelines for granting and revoking account access to entity systems and required appropriate authorisation for access to privileged accounts. ASC and the Reserve Bank also have controls in place to prevent users from accessing the Internet from privileged accounts, which would allow sensitive information to be sent to an external site beyond the entity’s secure ICT environment; and assigned privileged accounts to administrative groups, not individual accounts. Australia Post allows privileged accounts to access the Internet, but to only an authorised list of websites.

3.18 The Reserve Bank performed quarterly reviews to ensure that users’ access to privileged accounts is authorised correctly and monthly assessments of the strength of users’ passwords, for example, to ensure that separate passwords are being used for standard access and privileged access accounts. ASC performed monthly revalidation of privileged access and Australia Post performed quarterly user access reviews for some applications and infrastructure. ASC and Australia Post did not perform regular assessments of passwords being used across its network. ASC had established mitigating controls for this password-related risk that it had assessed to be low and had accepted the implications.

3.19 The Reserve Bank and ASC have enabled logging for their servers and desktops. Australia Post has enabled its servers to log the information required under the Information Security Manual, however, logging has not been configured for Australia Post’s desktops.

Have entities implemented controls that would be in line with the four non-mandatory strategies in the Essential Eight?

ASC and the Reserve Bank have implemented controls in line with all four non-mandatory mitigation strategies in the Essential Eight. Australia Post has implemented controls for one of those mitigation strategies — daily backups of data. All three entities have implemented mitigation strategies beyond the requirements of the Essential Eight, such as the Reserve Bank using machine learning and analytics to detect cyber threats.

3.20 As discussed in paragraph 3.1, in addition to the Information Security Manual’s Top Four mandatory mitigation strategies, an additional four non-mandatory mitigation strategies form a baseline known as the Essential Eight. Table 3.3 describes the four non-mandatory strategies.

Table 3.3: Four non-mandatory mitigation strategies of the Essential Eight

|

Mitigation strategy |

Why apply the strategy? |

|

To prevent malware delivery and execution |

|

|

Configure Microsoft Office macroa settings |

Microsoft Office macros can be used to deliver and execute malicious code on systems. |

|

User application hardeningb |

Flash, Internet advertisements and Java are popular ways to deliver and execute malicious code on systems. |

|

To limit the extent of cyber security incidents |

|

|

Multi-factor authentication |

Stronger user authentication makes it harder for adversaries to access sensitive information and systems. |

|

To recover data and system availability |

|

|

Daily backups |

To ensure information can be accessed following a cyber security incident, such as a ransomware incident. |

Note a: Macros are embedded code that can contain a series of commands to automate repetitive tasks.

Note b: Application hardening involves: configuring web browsers to block or uninstall Flash, advertisements and Java on the Internet; and disabling unneeded features in Microsoft Office, web browsers and PDF viewers.

Source: Adapted from Australian Cyber Security Centre documents.

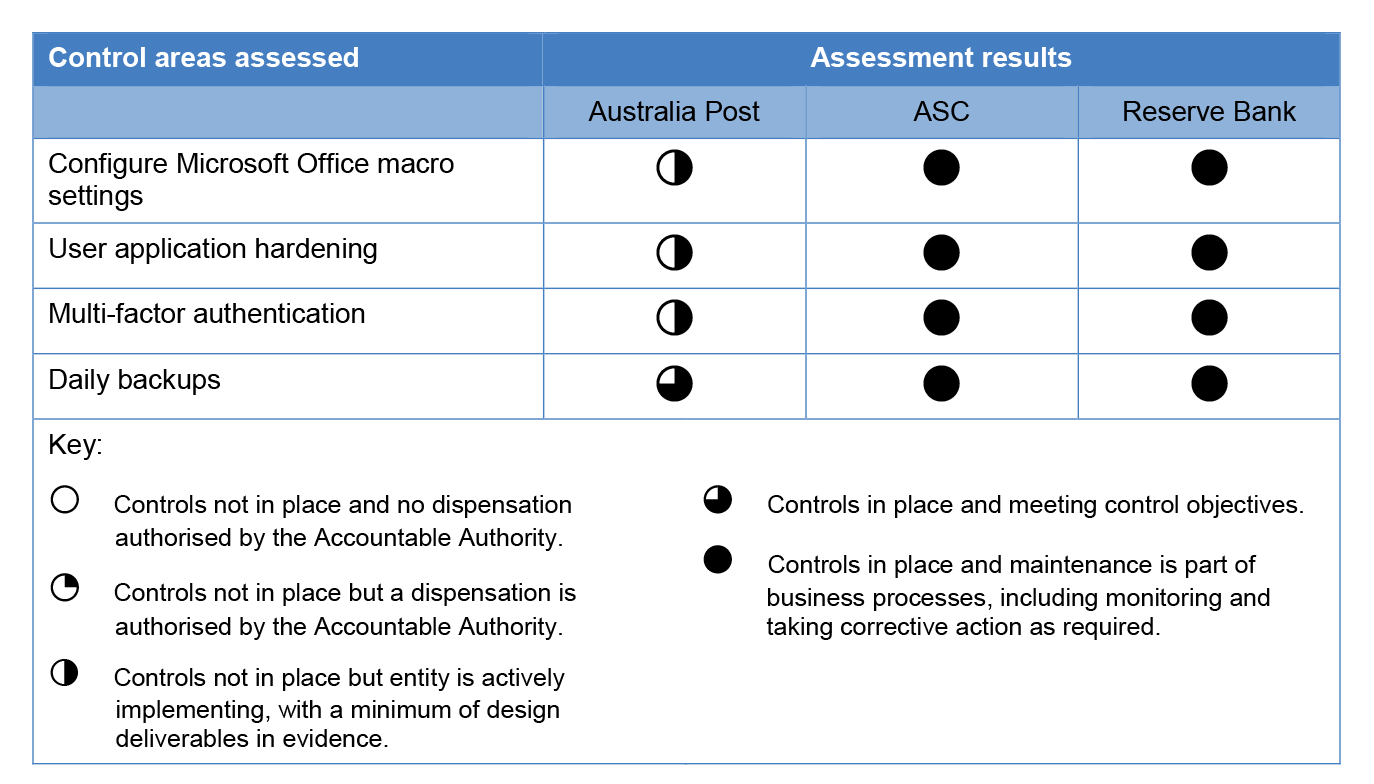

3.21 As shown in Table 3.4, ASC and the Reserve Bank have implemented the four non-mandatory strategies in the Essential Eight. Australia Post has implemented one of the non-mandatory strategies. As with Table 3.2, the results were based on the application of a standard set of assessment criteria and were aggregated to an overall score, which is discussed in more detail in Appendix 3.

Table 3.4: Entities’ compliance with the non-mandatory mitigation strategies in the Essential Eight

Source: ANAO analysis.

Configure Microsoft Office macro settings

3.22 Effectively configured Microsoft Office macro settings address adversaries’ attempts to create macros that can deny users’ access to sensitive or classified information. Microsoft Office macro settings should only allow trusted macros in the entity’s ICT environment and restrict general and low-privileged users’ ability to change macro security settings. The Information Security Manual recommends that entities block all macros in documents taken from the Internet.

3.23 ASC and the Reserve Bank have implemented full controls of Microsoft Office macros. Users are not able to override configured macro settings and can only manage their macros within ‘trusted locations’. Both ASC and the Reserve Bank have considered risks associated with users managing their own macros and implemented additional controls that alert their ICT security teams to any potential issues.

3.24 Australia Post’s controls do not restrict users’ ability to override configured macro settings, including adding and modifying trusted locations. Further, Australia Post has not considered the risks associated with users managing their own macros. Australia Post advised the ANAO that it has configured other controls to mitigate the execution of malicious code. However, the ANAO’s testing of these mitigating controls found that not all of the configured controls are applicable to the threats faced, or provide adequate coverage. The ineffectiveness of the other mitigating controls, coupled with the absence of application whitelisting controls, increases Australia Post’s risk exposure to malicious code execution. The ANAO notes that Australia Post has included the implementation of appropriate Microsoft Office macro configuration as one of the initiatives in its ‘Securing Tomorrow’ program.

User application hardening

3.25 When applications are frequently updated and appropriate security settings applied, it is more difficult for adversaries to exploit any security vulnerabilities they may discover. Disabling unneeded features in Microsoft Office and configuring web browsers to block Flash, Internet advertisements and Java further reduces the risk of malicious content being introduced to entities’ ICT environments.

3.26 All three entities have standard operating procedures for hardening systems and applications. ASC has a defined standard operating environment to support its ICT environment, which was developed using the Common Operating Environment Policy produced by the Department of Finance. ASC’s application hardening security settings are appropriately configured and were implemented in line with its own requirements and the Information Security Manual. The Reserve Bank’s standard operating environment was developed using Australian Signals Directorate guidance. Australia Post’s standard operating environment was based on Windows and Linux.

3.27 The Reserve Bank blocks Internet advertisements and Flash on web browsers; and has consulted with, and implemented the guidance of, vendors when configuring applications. The Reserve Bank does not block Java content on web browsers, but scans Java files using a malware analysis tool prior to deploying the files to the end-user.

3.28 Australia Post does not block Internet advertisements on its web browsers and Flash or Java on its desktop environments. Australia Post also does not have appropriate security settings applied on Google Chrome or Adobe Reader, such as allowing passwords to be saved and an ability to run outside of protected mode. Australia Post relies on other controls such as security monitoring to detect cyber threats. However, the ANAO’s testing found that the other controls in place are insufficient to address the associated risks.

Multi-factor authentication

3.29 Multi-factor authentication requires users to provide at least two independent methods to gain access to an ICT system. These may include:

- something a user knows, such as a password;

- something a user has, such a physical token or software-based certificate; and

- something unique to the user, such as their fingerprint.

3.30 According to the Information Security Manual, entities should use multi-factor authentication for all users; however, certain users such as privileged users, system and database administrators, positions of trust and remote access must use multi-factor authentication. The Information Security Manual also recommends that passwords used in multi-factor authentication processes are not used for other ICT systems.

3.31 ASC and the Reserve Bank have defined requirements for multi-factor authentication and each has implemented multi-factor authentication for privileged users and remote access users. ASC requires multi-factor authentication for users with positions of trust and for general users. The Reserve Bank requires multi-factor authentication for users with access to important data, but not for general users and has instead implemented other controls for general users.

3.32 Australia Post has implemented multi-factor authentication for remote access users, general users and default system accounts, but not for all privileged users. Australia Post relies on monitoring controls to address the risks associated with compromised accounts, however, these controls have not been applied in all environments. Australia Post’s ‘Securing Tomorrow’ program has initiatives to expand the use of multi-factor authentication, including for privileged users.

3.33 ASC and the Reserve Bank both use a combination of a token and a password for multi-factor authentication. ASC and the Reserve Bank use passwords in accordance with the Information Security Manual’s standards.

3.34 Australia Post uses a token for remote access users, which meets the Information Security Manual’s requirements. Australia Post’s documented password standards also meet the requirements of the Information Security Manual, however, the actual implementation does not. Australia Post has completed a risk assessment in regard to this deviation from its security framework.

3.35 All three entities have implemented separate security zones for accessing sensitive ICT assets; ASC and the Reserve Bank require privileged users to re-authenticate by using multi-factor authentication to access the separate security zones. Australia Post requires multi-factor authentication for administrators to access its separate security zones.

Daily backups

3.36 Backups of systems and data are common practices by organisations and support business continuity in the event of disruption to ICT systems, such as through cyber attacks or failures of storage hardware.

3.37 The Information Security Manual recommends that backups:

- of important information are performed daily;

- are stored offline and off-site, or stored online, but configured to be non-rewritable;

- are stored for three months or more; and

- are tested regularly to ensure that information can be restored if the need arises.

3.38 All three entities have documented standard operating procedures for backups, although Australia Post’s standards do not detail procedures for performing backups. Australia Post’s standards also do not describe its access controls and account management procedures for backups.

3.39 All three entities store their backups both onsite and off-site, and have established processes for restoring backups.

Mitigation strategies beyond the Information Security Manual’s Essential Eight

3.40 The Reserve Bank has implemented cyber risk mitigation strategies beyond the requirements of the Information Security Manual’s Essential Eight. These strategies focus on enhancing the security functions relating to identification and detection of cyber threats through the use of machine learning and analytics. These strategies can assist with modelling system and user behaviour, and notifying ICT security of potential areas to investigate or focus. ASC is assessing the same capability to support its current security framework.

3.41 Secure coding practices focus on identifying and preventing security flaws during program code development. All three entities have implemented secure coding practices at varying levels. The implementation of these practices is important for entities that develop programs to support their business operations and customers. The practices range from implementing security coding policies and standards to automated penetration testing of software.

4. Cyber security resilience

Areas examined

This chapter examines whether entities are cyber resilient, with a culture of cyber resilience.

Conclusion

The Reserve Bank and ASC are cyber resilient, with high levels of resilience compared to 15 other entities audited over the past five years. Australia Post is not cyber resilient but is internally resilient, which is similar to many of the previously audited entities. The Reserve Bank has a strong cyber resilience culture, ASC is developing this culture, and Australia Post is working towards embedding a cyber resilience culture within its organisation.

Do entities have a cyber resilience culture?

The three entities are at different stages in embedding a cyber resilience culture. The Reserve Bank has a strong cyber resilience culture, having established all 13 assessed behaviours and practices in the areas of cyber security governance and risk management, roles and responsibilities, technical support and monitoring compliance. ASC is developing a cyber resilience culture, having embedded seven of the assessed behaviours and practices and working to more fully establish the other six cyber security behaviours and practices within its business processes. While having embedded eight of the 13 assessed behaviours and practices, Australia Post has not systematically managed cyber risks, including not assessing the effectiveness of controls applied outside its specified cyber security risk management framework. Nevertheless, Australia Post is working towards embedding a cyber resilience culture.

4.1 A cyber resilience culture is comprised of the shared organisational attitudes, values and behaviours that characterise how an entity considers cyber risks in its day-to-day activities.34

4.2 An assessment was undertaken for this audit of whether Australia Post, ASC and the Reserve Bank have a culture of cyber resilience. The assessment expands the analysis of management arrangements, and elements of cyber resilience culture published in Auditor-General Report No.37 2015–16 Cyber Resilience, Auditor-General Report No.53 2017–18 Cyber Resilience and the July 2018 edition of ANAO Audit Insights.35

4.3 In combination, the presence of the following types of behaviours and practices may assist entities to build a strong cyber resilience culture:

- governance and risk management;

- roles and responsibilities;

- technical support; and

- monitoring compliance.

4.4 The audit collected evidence of the existence of the behaviours and practices from the three entities. A grading scheme was applied to assess an entity’s capability in the areas that contribute to having a strong cyber resilience culture.

Governance and risk management

4.5 Table 4.1 shows the capabilities assessed for the governance and risk management of cyber risks in the three entities.36

Table 4.1: Governance and risk management capability

|

Behaviours and practices |

Australia Post |

ASC |

Reserve Bank |

|

Establish a business model and ICT governance that incorporates ICT security into strategy, planning and delivery of services.a |

◆ |

▲ |

◆ |

|

Manage cyber risks systematically, including through assessments of the effectiveness of controls and security awareness training.a |

▲ |

◆ |

◆ |

|

Task enterprise-wide governance arrangements to have awareness of cyber vulnerabilities and threats.a |

◆ |

◆ |

◆ |

|

Adopt a risk-based approach to prioritise improvements to cyber security and to ensure higher vulnerabilities are addressed. |

▲ |

▲ |

◆ |

|

Key: ◆ Established. Arrangements in place and maintenance is part of business processes including monitoring and taking corrective action as required. ▲ Partially or largely established. Some key elements of the arrangements have not been established. ■ Arrangements have not been established. |

|||

Note a: This information is also presented in Table 2.2.

Source: ANAO analysis.