Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Container Examination Facilities Follow-up

The objective of this follow up audit was to examine Customs' implementation of the eight recommendations in the ANAO Report No.16 2004–05 and the two related recommendations from JCPAA Report 404. The audit has had regard to issues affecting the implementation of the recommendations and has taken into account changed circumstances and new administrative arrangements since the previous audit.

Summary

Background

The Australian Customs Service (Customs) is the regulatory agency with primary responsibility for protecting Australia's borders. Customs seeks to prevent illegal and harmful goods from entering Australia. To strengthen its border protection capability Customs has established Container Examination Facilities (CEFs) in Melbourne, Sydney, Brisbane and Fremantle as part of a more comprehensive and integrated approach to sea cargo examination in Australia's major ports.1

The CEFs combine container X-ray technology with physical examination and a range of other resources such as pallet and mobile X-ray units, drug detector dogs and ionscan technology. CEFs were implemented to:

- prevent the flow of prohibited and restricted items2 into Australia;

- increase the volume of sea cargo inspected;

- minimise losses to revenue from smuggling and revenue evasion;

- protect legitimate industry from non-compliant importers and exporters; and

- improve the security of sea cargo trade.

Prior to the introduction of the CEFs, Customs examined between 4000 and 5000 twenty-foot equivalent unit (TEU) containers a year.3 The establishment of the CEFs has allowed Customs to increase the national inspection target to 133 000 TEUs per year.4 The CEFs have been used to detect illicit drugs, alcohol, tobacco and firearms. CEFs have also identified compliance breaches such as undeclared, undervalued or misdescribed goods and copyright and trademark infringements.

Previous audit

The ANAO completed a performance audit of Customs' Container Examination Facilities in December 2004, Report No.16 2004–05, Container Examination Facilities. The report concluded that, overall, the CEFs were administratively effective but that improvements could be made to CEF administration and operational effectiveness. The audit made eight recommendations directed to improving the targeting of cargo containers for X-ray and examination, data management and performance reporting, logistical operations and contract management. Customs agreed to all of the recommendations.

Review by the Joint Committee of Public Accounts and Audit

The Joint Committee of Public Accounts and Audit (JCPAA) reviewed the previous audit and published its findings in Report 404, Review of Auditor-General's Reports 2003–2004: Third & Fourth Quarters; and First and Second Quarters of 2004–2005. The report supported the ANAO's findings and made two additional recommendations. These related to data integrity and the management of contracts for logistical service providers.

Significant developments have occurred since the previous audit and the JCPAA review

Since the original audit there have been a number of developments that have affected CEF operations. These include the introduction of the Integrated Cargo System (ICS) and Cargo Risk Assessment (CRA) system. Customs has also completed reviews of both its intelligence operations and CEF effectiveness.

The ICS and CRA were fully implemented in 2005 and replaced existing legacy systems. The ICS is the transaction processing system that receives and records cargo information. The CRA system forms part of the ICS and assesses cargo information to identify potentially high risk cargo. These systems play a major role in determining which cargo containers are selected for CEF inspection.

In late 2006 Customs undertook a review of intelligence operations. This identified deficiencies in Customs' intelligence processes and operations. Customs has introduced structural changes and commenced a number of projects to improve intelligence and targeting. Customs intends that, for the CEFs, this will include the provision of dedicated intelligence support.

The CEF effectiveness review was undertaken in October 2006. The review brought to notice a number of areas requiring attention, including image analysis, targeting, intelligence and training. The review made 40 recommendations, which Customs is working to implement.

Audit objective

The objective of this follow up audit was to examine Customs' implementation of the eight recommendations in the ANAO Report No.16 2004–05 and the two related recommendations from JCPAA Report 404. The audit has had regard to issues affecting the implementation of the recommendations and has taken into account changed circumstances and new administrative arrangements since the previous audit.

Overall conclusion

The ANAO concluded that Customs has made significant progress in implementing the eight recommendations from ANAO Audit Report No.16 2004–05, which were directed at improving the targeting of cargo containers for X-ray and examination, data management and performance reporting, logistical operations and contract management. Customs has also made significant progress in respect of the two recommendations from JCPAA Report 404, which related to data integrity and the management of contracts for logistical service providers.

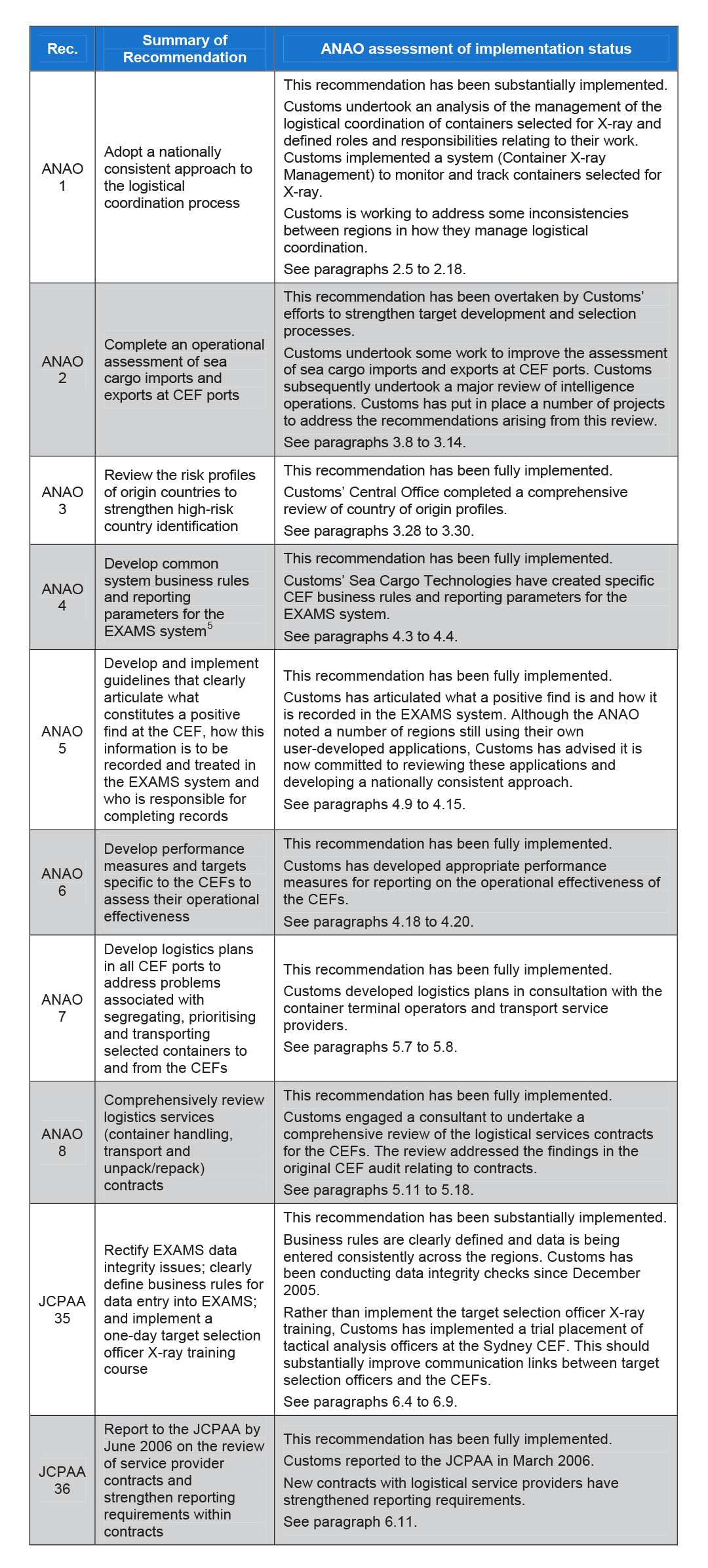

Six of the ANAO recommendations have been fully implemented, one has been substantially implemented and one has been overtaken by Customs' efforts to strengthen target development and selection processes. One of the JCPAA recommendations has been fully implemented and the other has been substantially implemented. Table 1 below provides a summary of the original recommendations and the ANAO's assessment of progress against each.

Since the previous audit, Customs has undertaken a number of initiatives to improve its CEF operations. These included the reviews of both intelligence operations and CEF effectiveness. Customs is progressively implementing the recommendations arising from these reviews. In implementing the ANAO and JCPAA recommendations, and reviewing and revising its operations, Customs has improved CEF administration and operational effectiveness.

In the current audit, the ANAO identified two areas which offer further opportunities for improvement. These related to the adoption of improved analytical tools for evaluating cargo information and developing mechanisms for measuring the effectiveness of cargo profiles. Customs has undertaken to review these issues.

Table 1: Summary of the original ANAO and JCPAA recommendations and the findings of the follow up audit

Agency response

Customs welcomes the follow up Audit on the Container Examination Facilities and the ANAO conclusions that Customs has improved CEF administration and operational effectiveness since the first audit.

Customs is pleased with the findings that six of the ANAO recommendations have been fully implemented, one has been substantially implemented and one has been overtaken by Customs' internal work on target development and selection processes. In addition, Customs agrees that one of the JCPAA recommendations has been fully implemented and the other has been substantially implemented.

As noted in the ANAO report, Customs has undertaken a number of initiatives to improve the CEF operations and continues to be committed to continuous improvement across all its program areas.

Customs also acknowledges the two areas that ANAO has identified which may offer further improvement and undertakes to review improved analytical tools for evaluating cargo information and developing mechanisms for measuring the effectiveness of cargo profiles.

Footnotes

1 Customs' has examination facilities in Adelaide and Darwin that operate a range of technology but do not have container X-ray technology.

2 Prohibited and restricted items include illicit drugs, weapons, pornography, unsafe products, therapeutic goods, wildlife, quarantine items and items that breach intellectual property rights.

3 Twenty-foot equivalent units is the industry standard measure of shipping containers.

4 Customs also maintains a target of 13 300 TEU to be physically examined.

5 The Examination Data Management (EXAMS) system is Customs' application for recording the details of cargo selected for inspection and the results.