Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Comcare’s Administration of its Workers’ Compensation Scheme Claims

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Comcare is the national authority for work health and safety and workers' compensation, and provides workers' compensation insurance and claims management to Australian Government entities.

- Effective administration of workers’ compensation claims is important for the optimal health and work outcomes for injured employees and the financial sustainability of the Comcare scheme.

- The audit assessed the effectiveness of Comcare’s administration of its workers’ compensation scheme claims.

Key facts

- As at 30 June 2022 193,312 Australian Government employees were covered by Comcare’s workers’ compensation scheme.

- The types of claims made in 2021–22 were: injury (52 per cent); disease (24 per cent); and psychological (24 per cent).

What did we find?

- Comcare’s administration of claims made under the workers’ compensation scheme is effective.

- Business processes and systems are in place to support the effective management of claims.

- Comcare has external efficiency and effectiveness measures and has been meeting its targets, however the target for the efficiency measure is not based on benchmarking.

What did we recommend?

- The Auditor-General made two recommendations related to reviewing the delegated claims management arrangements and improving Comcare’s corporate performance measures relating to claims management.

- Comcare agreed to the recommendations.

$196.2m

Compensation paid in 2021–22.

4,498

Number of open claims in 2021–22.

0.79%

Average premium rate for 2021–22 as a percentage of total payroll of Australian Government employers

Summary and recommendations

Background

1. Comcare is the national work health and safety and workers’ compensation authority, whose purpose is to ‘promote and enable safe and healthy work’. It was established under the Safety, Rehabilitation and Compensation Act 1988 (SRC Act) which sets out its powers and functions.

2. Under the SRC Act, the workers’ compensation scheme is a no-fault insurance scheme that provides rehabilitation and worker’s compensation to employees of the Australian Government, including Australian Government agencies, authorities and corporations. One of Comcare’s three key roles is as the workers’ compensation claims manager for Australian Government employees.

3. In terms of roles and responsibilities under the workers’ compensation scheme, employers (in the case of this audit, Australian Government employers) are responsible for the protection of the health and safety of their employees while at work, and to also manage employees’ rehabilitation. Comcare’s responsibilities are to provide compensation for supports (meet claims liabilities) and assist the employee and employer through the claims process.

Rationale for undertaking the audit

4. As the national authority for work health and safety and workers’ compensation, among other functions, Comcare is responsible for providing workers’ compensation insurance and claims management to Australian Government entities. During 2021–22, Comcare provided workers’ compensation coverage to 193,312 Australian Government employees, paid $196.2 million in workers’ compensation claims and collected $161.6 million in premiums from Australian Government entities. The effective administration of claims under the workers’ compensation scheme is important to ensure optimal return-to-health and return-to-work outcomes for injured employees, and the financial sustainability of the scheme. The audit will also provide Parliament with assurance that Comcare is appropriately managing claims made under the workers’ compensation scheme.

Audit objective and criteria

5. The objective of the audit was to assess the effectiveness of Comcare’s administration of claims for Australian Government entities under its workers’ compensation scheme.

6. To form a conclusion against the objective, the following criteria were applied.

- Does Comcare have business processes and systems in place that support the effective management of claims?

- Do Comcare’s governance arrangements enable effective oversight and efficient management of claims?

Conclusion

7. Comcare’s administration of claims made under the workers’ compensation scheme is effective, however Comcare has not benchmarked the target for its efficiency measure which means the efficiency of the claims management process is not clear.

8. Comcare has fit-for-purpose business processes and systems in place that support the effective management of claims. Comcare’s Claims Manual clearly sets out the end-to-end process for the management of claims and aligns with the Safety, Rehabilitation and Compensation Act 1988 (SRC Act). The systems used by Comcare to manage claims have appropriate controls in place to ensure accurate processing and there is evidence that the processes are appropriately applied.

9. Comcare’s governance arrangements enable effective oversight and management of claims. Comcare has external effectiveness and efficiency performance measures, however the efficiency measure target is not based on benchmarking, making it difficult to clearly demonstrate efficiency in claims management. Comcare reports on its claims related measures in its annual performance statements and for the past five financial years up to 2021–22 it has been meeting its targets. Internally, Comcare prepares detailed monthly claims management reports which contain reporting against internal performance measures on timeliness. Comcare is implementing a compliance and assurance framework and program of activities which are linked to identified risks.

Supporting findings

Claims management, guidance processes and systems

10. Comcare has documented its end-to-end claims management process in its Claims Manual. The guidance in the Claims Manual aligns with the SRC Act and is designed to facilitate the effective management of claims. The Claims Manual is supported by additional external scheme guidance which provides information on how to apply the relevant provisions of the SRC Act. (See paragraphs 2.2 to 2.16)

11. The ANAO observed no deviations from the documented end-to-end claims process that Comcare follows when processing and managing claims. Results of reconsiderations (internal reviews) and appeals are provided to the relevant claims staff for implementation or future improvements. Delegated claims management arrangements achieve positive results in terms of lower claim numbers, improved return to work rates and lower premiums for the two agencies involved in those arrangements. (See paragraphs 2.17 to 2.50)

12. Comcare has appropriate controls in place to ensure that its claims management systems are fit-for-purpose to support effective claims management. Claims managers’ activities are monitored, access to sensitive information is managed appropriately, and there is effective segregation of duties. Systems are maintained and managed under change control processes and security updates are regularly applied. A risk was identified for the external facing Customer Information System for employers, where Comcare does not have a process in place to ensure users’ access is removed when it is no longer required. (See paragraphs 2.53 to 2.66)

Performance measurement, reporting and compliance

13. Comcare reports externally on three corporate performance measures relating to claims management. The administrative cost ratio efficiency measure is related to Comcare’s purpose and is generally measurable, except it is not free from bias due to a lack of benchmarking to underpin the target. The other two effectiveness measures on average premium rate and the minimum funding ratio are related and measurable. There are internal performance measures primarily relating to timeliness. (See paragraphs 3.3 to 3.12)

14. Comcare reports on the three claims-related external performance measures in its annual performance statements and has been meeting its targets over the past five financial years to 2021–22. Comcare prepares detailed internal monthly claims management reports which include claims performance metrics. These reports are distributed internally to executive governance groups and to Comcare claims management staff. (See paragraphs 3.15 to 3.25)

15. Comcare is implementing a revised claims compliance and assurance framework in 2022–23, which is linked to the identification of key risks relating to claims management. Priority one assurance activities have been completed and recommendations for improvement were made. There is limited evidence of the implementation of recommendations and there is no formal avenue for reporting of results or tracking of implementation activity. (See paragraphs 3.26 to 3.48)

Recommendations

Recommendation no. 1

Paragraph 2.51

Comcare periodically reviews the delegated claims management arrangements, including identification of areas of efficiency and any lessons learned that could apply to Comcare’s management of claims, or inform the application of the arrangements to other non-corporate Commonwealth entities.

Comcare response: Agreed.

Recommendation no. 2

Paragraph 3.13

Comcare reviews its corporate performance measures to:

- undertake benchmarking for the administrative cost ratio performance measure target; and

- ensure more comprehensive coverage of it claims management function with a balance of efficiency and effectiveness measures.

Comcare response: Agreed.

Summary of entity response

16. The proposed final report was provided to Comcare. The full response from Comcare is at Appendix 1 and the summary response is presented below.

Comcare welcomes the findings and audit conclusion that our management of workers compensation claims is effective.

The report reflects the work Comcare has undertaken to uplift our claims management services, including recent efforts to improve governance and assurance of our processes. Comcare is committed to excellence in service provision and the report demonstrates the benefits of these initiatives and our ongoing work to improve Comcare’s claims management function.

The recommendations provide Comcare further opportunities to improve our service delivery. Reviewing our delegated claims management arrangements will help understand how strong performance has been achieved in that model. This may inform improvements in claims management more generally and will provide further insight into whether implementing these arrangements in other agencies will achieve similar levels of effectiveness and efficiency.

Comcare also acknowledges the findings and recommendation on our performance measures will help us strengthen our performance framework and reporting, ensuring alignment with the Commonwealth Performance Framework.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Performance and impact measurement

1. Background

Introduction

1.1 Comcare is the national work health and safety and workers’ compensation authority, whose purpose is to ‘promote and enable safe and healthy work’. It was established under the Safety, Rehabilitation and Compensation Act 1988 (SRC Act) which sets out its powers and functions.

1.2 Comcare’s role under the SRC Act includes:

- premium setting for workers’ compensation;

- the management of workers’ compensation claims;

- compliance and enforcement activities;

- training; and

- advice and services to the Safety, Rehabilitation and Compensation Commission.1

1.3 Comcare also has functions and responsibilities under the Work Health and Safety Act 2011 (WHS Act) as the national work health and safety regulator.2

1.4 Comcare is a corporate Commonwealth entity3 under the Public Governance, Performance and Accountability Act 2013 and is located within the Employment and Workplace Relations portfolio.

Workers’ compensation scheme

1.5 Under the SRC Act, the workers’ compensation scheme provides rehabilitation and worker’s compensation to the employees of the Australian Government, including Australian Government agencies, authorities and corporations. In addition, organisations (non-Australian Government) can be granted a licence by the Safety, Rehabilitation and Compensation Commission (SRCC) to self-insure for workers’ compensation under the SRC Act.

1.6 In administering the workers’ compensation scheme, Comcare has three key roles:

- scheme manager — maintain legislation, develop policy and guidance, analyse scheme data, identify trends, support the SRCC, provide ministerial advice, approve and monitor workplace rehabilitation providers, and recover costs for the functions performed under the SRC Act;

- insurer — workers compensation insurer including setting and collecting premiums to meet Comcare’s claims liability and claims administration costs; and

- claims manager — workers’ compensation claims manager for Australian Government employees, manage liabilities for common-law asbestos related conditions for the Australian Government, and administer the Parliamentary Injury Compensation Scheme.

1.7 The Comcare workers’ compensation scheme covers Australian Government employees, employees of self-insured licensees and others defined under the SRC Act, for injury or illness sustained as a result of their employment. As at 30 June 2022 the scheme covered a total of 442,458 full-time equivalent employees under the SRC Act. Of those, 193,312 were Australian Government employees.4

1.8 The scheme is a statutory no-fault compensation scheme5 and provides recovery and benefit supports, as set out in Table 1.1.

Table 1.1: Comcare workers’ compensation recovery and benefit supports

|

Supports |

Description |

|

Income support |

Incapacity payments provide compensation for loss of income during recovery. Amounts payable are determined based on a period of incapacity of up to 45 weeks and post-45 weeks, after an injury.a |

|

Medical treatment |

Reimbursement for reasonable medical, hospital, pharmaceutical and other treatment costs from the date of injury or illness. |

|

Workplace rehabilitation services |

Services to assist people to return to work, delivered or facilitated by a rehabilitation case manager or workplace rehabilitation provider. |

|

Attendant care services |

Assistance with personal care and daily living activities following a work-related injury or illness. |

|

Household services |

Assistance with household tasks following a work-related injury or illness. |

|

Aids, appliances and modifications |

Reimbursement of the cost of purchasing or repairing an aid or appliance, to alter place of residence, or modify a vehicle. |

|

Travel costs |

Reimbursement of travel costs to attend medical treatments. |

|

Permanent impairment and non-economic loss |

Permanent impairment benefit, with the amount payable based on the degree of impairment. |

|

Entitlements following work-related death |

Financial support and assistance for the dependant/s of a current or former Australian Government employee who died as a result of a work-related injury or illness. May be paid as a lump sum, fortnightly payment, reimbursement of funeral expenses or medical expenses. |

Note a: The calculation of incapacity payments is discussed in more detail at paragraph 2.13.

Source: Comcare website.

1.9 Part 2 of the SRC Act provides for the scheme to cover reasonable expenses for medical treatment. The term ‘reasonable’ is not defined in the SRC Act but guidance is provided to Comcare claims managers through the Clinical Framework for the Delivery of Health Services.6 Comcare’s Claims Manual states that ‘The reasonableness of each claim for medical treatment should be assessed on its merits based on the employee’s individual circumstances and available clinical evidence’. Claims managers can refer to the principles set out in the clinical framework to assess whether a medical treatment is effective in supporting an employee to return to work and return to health.

1.10 Comcare’s payment of medical treatments and benefit supports is based on guidance which sets out a baseline for these costs. For example, costs for medical and allied health treatments are based on the rates published by the Australian Medical Association and set out on the Comcare website.

1.11 The scheme also covers costs associated with rehabilitation to support an employee’s recovery, maintain or improve daily living activities, and/or remain at work or return to work. Rehabilitation is managed by the employer through rehabilitation case managers and rehabilitation service providers.

1.12 In terms of roles and responsibilities under the workers’ compensation scheme, employers (in the case of this audit, the Australian Government) are responsible for the protection of the health and safety of their employees while at work, and to also manage the employee’s rehabilitation. Comcare’s responsibilities are to provide compensation for supports (meet claims liabilities) and assist the employee and employer through the claims process.

1.13 To support its claims operations, Comcare has implemented a portfolio-based account management model where designated Comcare officers are allocated specific Australian Government portfolios to provide a central liaison point ‘to assist employers improve rehabilitation, return to work and workers compensation outcomes’.

Management of claims

1.14 When Comcare receives a claim for workers’ compensation from an Australian Government employee, the Comcare claims manager must assess it to determine whether it will be accepted under the SRC Act. This comprises three tests:

- a person must be an employee for the purpose of section 5 of the SRC Act;

- there must be an injury or disease as defined by sections 4, 5A, 5B, 6 and 7 of the SRC Act; and

- an injury or disease must result in incapacity for work, impairment requiring medical or similar treatment, or death.7

1.15 Comcare must also consider: whether the claim complies with certain conditions set out by the SRC Act; that the required medical evidence is available; the injury or illness is related to the claimant’s employment; and there are no situations which exclude eligibility for compensation. The SRC Act also provides guiding principles for Comcare claims managers to follow when assessing claims.

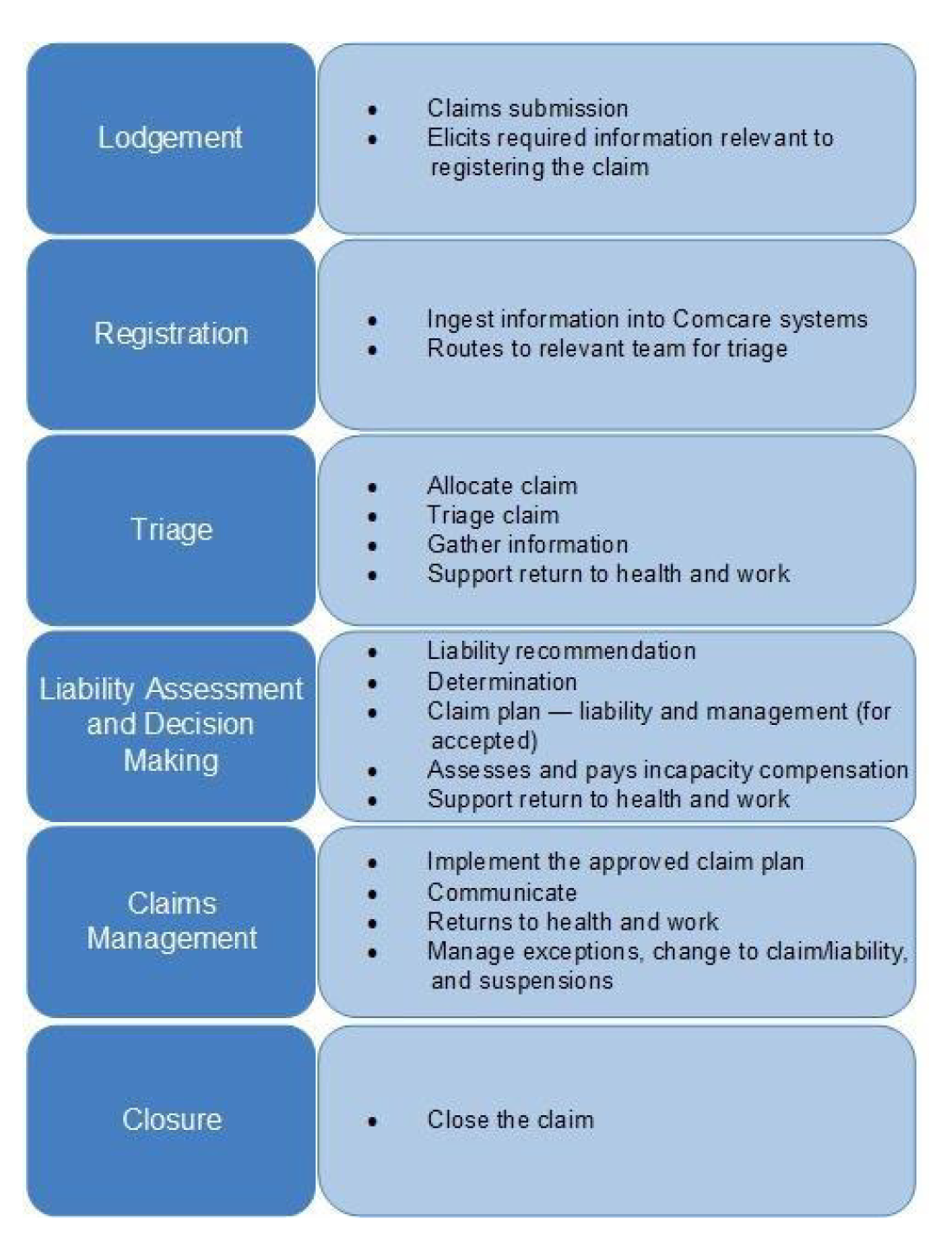

1.16 Comcare’s claims management process involves six steps:

- lodgement;

- registration;

- triage, information gathering and support;

- liability assessment and decision-making;

- claim management; and

- closure.

1.17 In addition to the above steps, reviews (reconsiderations) of claims case outcomes can be undertaken internally by Comcare and through external appeals at any time during the claims management and closure phases.

1.18 Figure 1.1 shows the number of workers’ compensation scheme claims for the past five years to 2021–22, for Australian Government employees. There was a total of 4,498 open claims in 2021–22.

Figure 1.1: Comcare workers’ compensation scheme claim numbers for Australian Government employees, 2017–18 to 2021–22

Note: Claims received are the number of claims lodged by employees; claims accepted are those that had an initial determination made by Comcare; serious claims are where one week or more of an employee’s time was lost.

Source: Comcare Annual Report 2021–22.

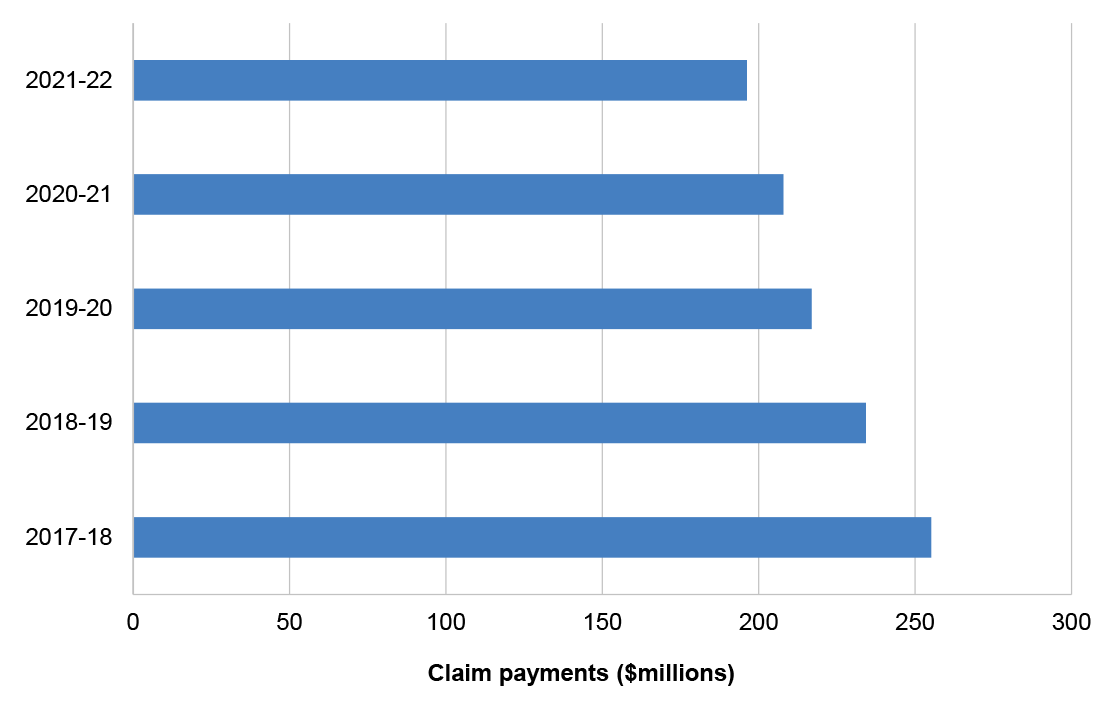

1.19 Figure 1.2 shows the amounts Comcare has paid in claims between 2017–18 and 2021–22.

Figure 1.2: Comcare workers’ compensation payments, 2017–18 to 2021–22

Source: Comcare Annual Report 2021–22.

1.20 Claims are managed by Comcare’s Claims Management Group, which is responsible for undertaking the end-to-end claims management process as well as other claims-related functions such as reconsiderations and appeals, and compliance activities. In 2021–22 Comcare had a total of 585.3 full-time equivalent employees and of those, 209.9 were located in Claims Management Group.

Premiums

1.21 The Comcare workers’ compensation scheme (for the Australian Government sector) is fully funded by cost recovery through the payment of premiums by Australian Government entities. Under the SRC Act, Comcare determines the premiums that Australian Government entities are required to pay for the financial year to ensure coverage under the scheme.

1.22 The setting of premiums for Australian Government entities is guided by the Safety, Rehabilitation and Compensation (97E(1) — Premium Determination) Guidelines 20228 under the SRC Act, and informed by actuarial advice. Prior to the commencement of the financial year, Comcare’s actuaries prepare a valuation report which provides an assessment of the financial viability of the scheme9, including an estimate of the total provision for outstanding claims (the total amount Comcare is liable for) and the scheme funding ratio.

1.23 The funding ratio is the level of assets over liabilities and is a measure of the ability of the scheme to meet the costs of future claims. A funding ratio above 100 per cent means that the scheme has assets sufficient to meet future liabilities. Comcare has set its minimum funding ratio at 110 per cent. Safe Work Australia’s Comparative Performance Monitoring Report 24th edition10 shows that for similar workers’ compensation schemes in Australia11, the average funding ratio was 113 per cent in 2020–21.

1.24 The Chief Executive Officer of Comcare can determine whether to apply a discount or levy (surcharge) to the premium pool.12 The application of these discounts and levies ensure that the scheme is viable and that employers are paying appropriate premium rates. Comcare’s current approach is a discount can be applied at over 125 per cent and a levy can be applied at below 110 per cent. In 2022–23 the funding ratio was 124 per cent and the Chief Executive Officer of Comcare determined that a premium discount of 10 per cent would be applied.

1.25 Table 1.2 shows the average premium rate across Australian Government entities over the past 10 years, the total premiums collected and whether a levy or discount was applied to the premium pool.

Table 1.2: Workers’ compensation premiums 2017–18 to 2021–22

|

Year |

Average premium rate (excl GST) % of total payroll |

Total workers’ compensation premiums $m |

Applied pool levy or discount % |

|

2017–18 |

1.23 |

285.2 |

5.0 |

|

2018–19 |

1.06 |

242.3 |

0.0 |

|

2019–20 |

0.85 |

163.3 |

-10.0 |

|

2020–21 |

0.85 |

167.4 |

0.0 |

|

2021–22 |

0.79 |

161.6 |

-10.0 |

Source: Comcare Annual Reports 2017–18 to 2021–22.

1.26 Over the past 10 years, average premiums for Australian Government entities met Comcare’s corporate performance measure and target ‘Average Commonwealth premium rate = 1% of payroll or lower’ (discussed in more detail from paragraphs 3.5 to 3.8). Comcare advised the ANAO in November 2022 that the decrease in the level of premiums is ’driven by an ongoing lower volume of new claims and reduced duration of incapacity and medical payments on accepted claims’. In addition, Comcare advised that preventative and risk-reduction work health and safety initiatives implemented by employers has led to lower rates of injury and illness and therefore a lower volume of new claims.

1.27 Figure 1.3 provides a comparison of Comcare’s premiums to other jurisdictions.

Figure 1.3: Ratio of premiums to payroll by jurisdiction, 2016–17 to 2020–21

Source: Safe Work Australia’s Comparative Performance Monitoring 24th edition.

Determining Australian Government employer premiums

1.28 Once the final premium pool has been set, Comcare then determines the premiums for each Australian Government employer based on the employer’s claims history over the past four years. The Comcare Premiums for 2018–19 Guide13 sets out the high-level process for determining premiums for each Australian Government employer.

|

Box 1: Process for determining premiums |

|

Step 1: Forecast overall insured scheme performance Comcare’s independent actuaries determine the premium pool each financial year based on forecasting the lifetime cost of claims for the overall scheme (estimated outstanding claims liability), and related claims management costs. Step 2: Set the final premium pool Comcare sets the premium pool for the overall scheme at the necessary level to fully fund the forecast lifetime cost of claims for the financial year. The final pool also incorporates an uncertainty margin (if required) to cover any potential variance between the forecast and actual cost of claims for the financial year and Comcare’s ability to ‘fund’ this uncertainty using the insured scheme’s assets. Step 3: Determine agency prescribed amounts Each Australian Government employer’s premium (prescribed amount) is calculated based on its share of the final premium pool, its recent claims activity and estimated total payroll. Step 4: Determine agency bonus/penalty adjustments Depending on the employer’s claims performance, for example, improved claims outcomes through effective rehabilitation and return to work rates, the premium is adjusted by applying a bonus (discount). In the case of poorer claims performance, a penalty (surcharge) is applied to the employer’s premium. Step 5: Indicative premium notice Entities are notified in April of their indicative premium for the coming financial year, which is based on their prior year’s payroll adjusted for inflation and the application of the bonus or penalty. Step 6: Final premium notice The final premium notice is issued in early July. |

Rationale for undertaking the audit

1.29 As the national authority for work health and safety and workers’ compensation, among other functions, Comcare is responsible for providing workers’ compensation insurance and claims management to Australian Government entities. During 2021–22, Comcare provided workers’ compensation coverage to 193,312 Australian Government employees, paid $196.2 million in workers’ compensation claims and collected $161.6 million in premiums from Australian Government entities. The effective administration of claims under the workers’ compensation scheme is important to ensure optimal return-to-health and return-to-work outcomes for injured employees, and financial sustainability of the scheme. The audit will provide Parliament with assurance that Comcare is appropriately managing claims made under the workers’ compensation scheme.

Audit approach

Audit objective, criteria and scope

1.30 The objective of the audit was to assess the effectiveness of Comcare’s administration of claims for Australian Government entities under its workers’ compensation scheme.

1.31 To form a conclusion against the objective, the following criteria were applied.

- Does Comcare have business processes and systems in place that support the effective management of claims?

- Do Comcare’s governance arrangements enable effective oversight and efficient management of claims?

1.32 The scope of the audit focused on the business management and governance of the claims process for the worker’s compensation scheme, specifically for claims by Australian Government employees which are managed directly by Comcare.

1.33 The audit scope did not include: Comcare’s role as scheme manager or insurer; claims managed by self-insured licensees; the management of claims under the delegated claims management arrangements; or pre-premium claims.14

Audit methodology

1.34 The audit methodology involved:

- examining the SRC Act;

- reviewing procedural guidance used to assess, determine and finalise claims;

- walkthroughs on how the guidance and processes are implemented in practice;

- walkthroughs of the systems used to manage claims and client interactions;

- reviewing relevant performance measures;

- examining reporting on claims management;

- reviewing compliance and assurance activities; and

- meetings with Comcare staff.

1.35 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $305,292.

1.36 The team members for this audit were Renina Boyd, Ben Thomson, Anne Rainger, James Wright, Sean Brindle and Michelle Page.

2. Claims management guidance, processes and systems

Areas examined

The audit examined whether Comcare’s business processes, supporting documentation and claims management systems support the effective management of claims.

Conclusion

Comcare has fit-for-purpose business processes and systems in place that support the effective management of claims. Comcare’s Claims Manual clearly sets out the end-to-end process for the management of claims and aligns with the Safety, Rehabilitation and Compensation Act 1988 (SRC Act). The systems used by Comcare to manage claims have appropriate controls in place to ensure accurate processing and there is evidence that the processes are appropriately applied.

Areas for improvement

The ANAO made one recommendation to Comcare to periodically review the delegated claims management arrangements to identify key learnings. The ANAO also suggested that Comcare: ensures appropriate user account controls exist for any future online portal/system for employers; and considers areas of automation and efficiency that could be implemented as part of the new claims management system.

2.1 As the workers’ compensation scheme is underpinned by comprehensive legislative requirements, it is critical that the accompanying business processes, including the documented procedures and systems for claims management, are clearly aligned with the legislation. Effective business processes will provide assurance that claims are being assessed appropriately and fairly.

Is there a documented claims management process which aligns with the legislation and designed to support effective claims management?

Comcare has documented its end-to-end claims management process in its Claims Manual. The guidance in the Claims Manual aligns with the SRC Act and is designed to facilitate the effective management of claims. The Claims Manual is supported by additional external scheme guidance which provides information on how to apply the relevant provisions of the SRC Act.

2.2 The SRC Act provides the legislative basis for Comcare’s management of workers’ compensation scheme claims. Under section 69(a) of the SRC Act, the key claims management function is:

to make determinations accurately and quickly in relation to claims and requests made to Comcare under this Act.

2.3 Comcare has developed a claims management lifecycle which provides the basis for the claims management process outlined in Figure 2.1.

Figure 2.1: Comcare claims management process

Source: Comcare’s The Way We Manage Claims July 2021.

2.4 The claims management process is detailed in guidance documentation which includes Comcare’s Claims Manual and supporting documents.

Claims Manual

2.5 The Claims Manual is the primary resource that Comcare claims managers use to administer their responsibilities under the SRC Act. The Claims Manual is a web-based document on Comcare’s intranet that details the processes to be followed when managing workers’ compensation scheme claims.

2.6 It is presented by each phase of the claims process and provides detailed instructions including step-by-step processes, as well as references to the relevant sections of the SRC Act. Examples of this alignment for each phase of the process are set out in Table 2.1.

Table 2.1: Examples of Comcare process documentation alignment with SRC Act

|

Phase |

SRC Act referencea |

Description of SRC section |

Claims Manual process |

|

Lodgement |

Section 53 — Notice of injury or loss of, or damage to, property |

Employees must notify Comcare if an injury or loss in the workplace has occurred and of their intention to claim for compensation. |

Lodgement is the process of notifying Comcare of a workplace injury or loss to commence a compensation claim. |

|

Registration |

Section 53 — Notice of injury or loss of, or damage to, property Section 54 — Claims for compensation |

Employees must notify Comcare that they wish to make a claim for compensation before the claim can proceed. |

Registration is the process of entering information into the claims management system. |

|

Triage, support and information gathering |

Section 14 — Injury arising out of or in the course of employment Section 59 — Certain documents to be supplied on request |

An injury must meet criteria to be eligible for compensation under the Act, including that it occurred in the course of employment. Documents related to the claim must be provided to Comcare upon request by the claimant or authorised party. |

Comcare will gather information to determine if the claim meets the legislative requirements. |

|

Liability determination |

Section 61 — Determinations to be notified in writing |

As soon as practicable after making a determination, Comcare must notify the employee. |

Comcare notifies the claimant of the outcome of their claim including reasons and terms of the determination. |

|

Claim Management |

Section 16 — Medical treatment Section 27 — Compensation for non-economic loss |

Comcare is liable under the Act to pay compensation for an injury suffered by an employee in the course of their work. Where an injury results in permanent impairment and compensation is payable, Comcare is liable to pay further compensation for non-economic losses. |

Claims for medical expenses are submitted to Comcare by employees. Comcare issues payments in line with the specified rates. Comcare will compensate for non-economic losses resulting from a permanent impairment, as assessed against the Guide to the Assessment of Permanent Impairment. |

|

Reconsideration |

Section 38 — Review of certain determinations by Comcare Sections 63 — Reviewable decision to be notified in writing |

An employee may request a review of a decision made by Comcare. Claimants will be notified in writing of the outcome of the review and will be given the opportunity to further apply to the Administrative Appeals Tribunal (AAT) for a review. |

Comcare will undertake a reconsideration of a decision it has made. The claimant will be notified in writing of the outcome of this reconsideration, and of further actions that will follow as a result. |

|

Appeals |

Section 64 — Applications to the AAT |

Affected parties may apply to the AAT for a review of a decision made by Comcare. |

If affected parties appeal to the AAT, Comcare will instruct a legal representative to act on its behalf in proceedings. |

Note a: The SRC Act references in the table are examples and do not show the full list of applicable sections of the Act relating to each phase of the claims management process.

Source: ANAO analysis of the SRC Act and Comcare Claims Manual.

2.7 The ANAO found that there was alignment between the requirements of the SRC Act and the process guidance in the Claims Manual.

2.8 Comcare updates the Claims Manual as required and since version two was released in July 2022, Comcare has made eight updates to the manual. The first update occurred on 1 August 2022, with the latest update occurring on 13 February 2023. Changes are documented and each change is marked as material or immaterial, with a list of internal stakeholders consulted prior to the change. Where changes are made to content in the Claims Manual, staff are notified through messages placed on the home page of the Claims Manual.

Other process documents

2.9 The Comcare Claims Manual is supported by a set of 53 scheme guidance documents15 which provide claims managers and rehabilitation case managers with information they need to consider when applying the provisions of the SRC Act. For example, the purpose of Scheme Guidance: No present liability determinations is to provide information on determining ‘no present liability’ where an employee no longer suffers the effects of their compensable condition under the SRC Act. The guidance provides: background on the relevant sections of the SRC Act; how to apply the policy; when to determine ‘no present liability’; and a point of contact for further information.

2.10 Internally, Comcare has business process maps that visually represent the steps in the claims process, outline who is responsible for the completion of the step, and the next step in the process. There are also ‘governance architecture’ documents which outline at a high level what is involved in each part of the claims process, as well as corresponding SRC Act references, links to the business maps, and links to external resources. Parts of these documents are noted by Comcare as under development, such as performance measures and risk.

Guidance for rates of payment for supports and benefits

2.11 In order to apply standard rates of payments for the supports and benefits that employees can claim under the scheme, as well as permanent impairment entitlements and payments associated with work-related deaths, Comcare sets out the basis for its pricing using various documents and reference sources.

Costs of medical treatments

2.12 For medical treatments that can be provided under the workers’ compensation scheme, Comcare uses the rates set out in the Australian Medical Association’s (AMA) List of Medical Services and Fees. Treatments provided by chiropractors, occupational therapists, osteopaths, physiotherapists and psychologists are based on the rates of payment set by the relevant workers’ compensation schemes in New South Wales, Queensland, South Australia, Victoria and Western Australia.16 Pharmaceutical service costs are based on the Pharmaceutical Benefits Scheme. Comcare claims managers may determine rates of payment for medical treatments where there are no existing references. Claims managers are to be guided by circumstances when considering whether a rate for a service or treatment is reasonable, and published national, state or territory rates are considered best practice.

Calculation of incapacity payments

2.13 Payments for incapacitated employees17 are calculated based on the employee’s earning capacity, recent earnings, leave, and whether they are in receipt of a pension or other lump sum payment. Comcare sets statutory amounts for incapacity payments for up to 45 weeks of incapacity, and beyond 45 weeks. ‘Normal weekly earnings’ is used as a fair representation of what an employee would have earned in a week, had the injury or illness not occurred. For the first 45 weeks of incapacity the employee is eligible for 100 per cent of their normal weekly earnings. After 45 weeks, incapacity payments are based on the percentage of normal weekly hours the employee works each week.

Permanent impairment payments

2.14 Comcare uses a permanent impairment guide to determine rates of compensation for claims in which an employee has suffered a permanent impairment.18 An assessment is conducted by Comcare to determine the level of impairment as a percentage based on the ‘whole person impairment’. Additionally, non-economic losses such as impacts on social relationships, recreation and leisure activities may be considered.

Payments associated with a work-related death

2.15 Maximum amounts for death lump sum payments and payments for funeral expenses are set by Comcare and indexed annually.

Other support payments

2.16 Comcare also has guidance on the rates of compensation for other supports including: household services; attendant care services; aids, appliances and modifications; and travel costs.

Are claims managed in accordance with the claims management process?

The ANAO observed no deviations from the documented end-to-end claims process that Comcare follows when processing and managing claims. Results of reconsiderations (internal reviews) and appeals are provided to the relevant claims staff for implementation or future improvements. Delegated claims management arrangements achieve positive results in terms of lower claim numbers, improved return to work rates and lower premiums for the two agencies involved in those arrangements.

2.17 In order to ensure that Comcare claims managers are administering their duties in line with legislative requirements and effectively managing claims, it is crucial that they follow the Claims Manual and other supporting guidance. This also promotes consistency in decision-making.

2.18 The key steps required in each stage of the claims process, as set out in the Claims Manual and underpinned by the SRC Act, are shown in Table 2.2.

Table 2.2: Processes undertaken by claims managers

|

Claims process |

Process requirements |

|

Lodgement |

Lodgement is where an employee (or their representative) lodges a claim with Comcare. Claims can be lodged through Comcare’s website, or using a hard copy claim form. |

|

Registration |

Registration is the process where claims documentation and information are transferred and/or manually entered into Comcare’s claims management system, Pracsys. A check for completeness of information is conducted and where information is unavailable (for example medical certificate or other medical evidence), generic placeholders are entered within Pracsys to allow the claim to progress. These placeholders are progressively replaced as the correct information comes to hand. After a claim has been registered, it is assigned to an Assistant Director in the Claims Management Group. The Assistant Director will oversee the claims management process. |

|

Triage, information gathering and support |

Through the triage process the claim is reviewed by internal stakeholders (such as claims managers, Assistant Directors, injury managers and legal officers where required) and the information needed to determine liability on the claim is discussed and agreed. Additional triggers for the triage phase are where a claim requires further decision making or following reconsiderations and/or appeals. As part of this phase, claims are also allocated to claims managers based on the complexity of the claim. |

|

Liability assessment and decision making |

Before a claim is accepted by Comcare, a determination must be made as to whether it meets the provisions of the SRC Act and liability is accepted. To determine liability, Comcare will triage the claim and gather all information needed. Upon making a determination, the employee and employer are advised of the decision by Comcare. |

|

Claims management |

Claims management includes assessing the injuries and condition of an employee and ascertaining the compensation and payments for which the employee is eligible. It includes facilitating support for medical treatment and the calculation of payments. For the claims management phase, there is less detail provided in the SRC Act and the processes are set out in the Claims Manual with detailed procedures to support claims managers. As part of this phase, Comcare will develop a claim plan which outlines the details of the claim, including assessment of functional capacity, treatment, rehabilitation, return to work goals, and a risk assessment. |

|

Closure |

When a claim is identified as being suitable for closure, the case is administratively closed in Pracsys. A claim may be re-opened at any time (for example an injury could reoccur). |

Source: ANAO analysis of Comcare’s claims procedures.

2.19 The ANAO undertook walkthroughs of each stage of the process (including the quality assurance reviews, reconsiderations and appeals) in January and February 2023. The walkthroughs were held with Comcare registrations officers, claims managers, Assistant Directors (Executive Level 1) and Directors (Executive Level 2). The participants were asked to demonstrate the steps taken in each stage of the process to manage a particular claim, and the ANAO observed no instances where Comcare did not follow the required processes. Staff also used the required templates for correspondence, linked documentation with its record-keeping system and recorded relevant case file notes.

Quality assurance reviews

2.20 An important component within the claims process is the quality assurance reviews19 that are undertaken by Assistant Directors (team leaders) on claims managers’ decisions. Quality assurance reviews are required to be undertaken for liability determinations and major decisions made by claims managers, including for documents conveying complex information about a claim.20 Quality assurance reviews are not usually required for previously agreed decisions within the existing employee claim plan, for example the approval of medical treatment or for routine correspondence.

2.21 The process requires the Assistant Directors in the claims operations teams to undertake a thorough review of the claim file in Pracsys — Comcare’s claims management system — and all linked documents stored in Comcare’s recordkeeping system, prior to the final decision being made and recorded in Pracsys. The quality assurance reviews look for evidence of:

- clear communication;

- accurate application of legislation and guidance, and sound judgement;

- correct use of templates;

- collaboration with internal and external stakeholders; and

- decision-making guided by the substantial merits of the case.

2.22 For initial liability decisions on claims, the quality assurance review must be undertaken and recorded in Pracsys before the determination can be finalised (and the claim progressed through Pracsys).

2.23 Where issues are found during the quality assurance review, the Assistant Directors can complete one-on-one and team training with claims managers and can also provide email feedback and through case notes on the claims file in Pracsys.

Reconsiderations and appeals

Reconsiderations

2.24 Comcare undertakes reconsiderations (internal reviews) of decisions made under the SRC Act, upon request by an employee or employer. Comcare can also review its own decisions, known as reconsideration of own motion.

2.25 The reconsideration process reviews a decision or decisions to ensure it was made correctly. The reviewing officer in Comcare must apply the same considerations that were performed when the initial decision was made. Reconsiderations must also be undertaken by a person separate to the Comcare officer/s who were involved in making the primary determination on the claim, except in the case of own motion reconsiderations.

2.26 Once the reconsideration process is complete, it has an internal review performed by the Director of the Reconsiderations and Appeals Team prior to approving the decision. Comcare must inform all parties of the outcome of the reconsideration. The Reconsiderations and Appeals Team will contact the relevant claims management team at the conclusion of the review process and the final outcome is discussed with the claims team (regardless of whether the decision is affirmed or overturned).

2.27 Table 2.3 shows the numbers of reconsiderations requests received by Comcare from 2018–19 to 2021–22 as well as the overall affirmation rates where the original decision was upheld.

Table 2.3: Reconsiderations by Comcare, 2018–19 to 2021–22

|

Type |

2018–19 |

2019–20 |

2020–21 |

2021–22 |

|

Injury |

278 |

185 |

140 |

160 |

|

Disease |

274 |

208 |

135 |

184 |

|

Psychological |

344 |

294 |

231 |

280 |

|

Total |

896 |

687 |

506 |

624 |

|

Affirmation rate |

81% |

77% |

73% |

78% |

Note: Data excludes reconsiderations of own motion and delegated claims management arrangements (discussed from paragraph 2.44 below).

Source: Comcare.

2.28 A case can be referred directly to the AAT by an employee or employer however Comcare will always undertake a reconsideration of the case prior to it being heard before the AAT.

Appeals

2.29 If an employer or employee does not agree with a reviewable decision made by Comcare, they can apply to the AAT21 for a review of the case. The AAT can:

- affirm a decision made by Comcare — the decision made by Comcare is unchanged;

- vary a decision — Comcare’s decision has been changed in some way;

- set aside and substitute a new decision — the AAT found that Comcare’s decision was incorrect and has amended all or part of the decision; or

- remit a decision back to Comcare for reconsideration.

2.30 Comcare has established an instructing officer role which: provides instructions to Comcare’s legal service providers; authorises payments for legal services and monitors performance; ensures correct records management; and ensures the AAT outcome is provided to the claims teams for implementation where required.

2.31 Comcare has implemented a Litigation Strategy 2020–23 which sets out Comcare’s approach to litigation including specific initiatives to improve litigation performance. Comcare advised that the implementation of the strategy has contributed to a reduction in cases heard before the AAT (see Figure 2.2).

Figure 2.2: Comcare AAT case numbers and affirmation rates, 2017–18 to 2021–22

Source: Comcare Annual Report 2021–22.

2.32 Once Comcare registers the appeal, the instructing officer provides instructions to Comcare’s legal service provider (selected from a panel of providers). A litigation strategy is prepared by the legal service provider, and Comcare arranges a litigation strategy meeting, ensures that Pracsys is updated and all records saved in Comcare’s records management system.

2.33 Once the outcome of an appeal is known, Comcare’s legal area advises the relevant claims team. If Comcare’s original decision has been changed by the AAT, Comcare must implement the new decision accurately and as quickly as possible. In addition to any requirement to implement changes to claims as a result of an AAT decision, Comcare’s legal area will identify lessons learned and make suggestions to Claims Management Group on improvements or enhancements to managing claims. Comcare advised ‘while no specific follow-up is undertaken on the implementation of lessons learned, they are discussed in various regular meeting forums’.

Other supports and advice

2.34 Supporting processes within the claims management process include daily triage meetings run by each Claims Management Group Assistant Director with their teams, supported by Comcare specialist staff where required, to provide guidance to claims managers as well as peer support.

2.35 Technical capability officers, clinical team and injury managers are available to provide support to claims managers throughout the claims management process. Technical capability officers assist Assistant Directors by providing training on technical aspects of the claims management process, including drafting decisions and interpreting legal advice, to claim management staff. Injury managers help to interpret advice of legally qualified medical professionals. They will review the claim file and consider the requirement for further medical information to determine the claim, and the appropriateness of the current treatment/s and rehabilitation.

Debt management

2.36 In circumstances where Comcare determines that it has compensated an employee more than they are legally entitled to receive, often due to a change in circumstances, this overpayment is known as a recoverable debt. Table 2.4 provides a summary of recoverable debts in 2021–22.

Table 2.4: Workers’ compensation scheme debts 2021–22

|

Debt |

Amount |

|

Total raised |

$4,728,763 |

|

Recovered |

$1,076,523 |

|

Waived |

$1,850,050 |

|

Written off |

$1,148,804 |

Source: Comcare.

2.37 The main types of payments made under the scheme that can lead to an overpayment are incapacity payments and rehabilitation, medical and permanent impairment payments.

2.38 Comcare has a debt recovery team responsible for the recovery of overpayments. The team will negotiate debtor agreements between Comcare and a debtor which sets out the formal commitment to repay overpayments and the recovery process.

2.39 Where an employee does not currently have the capacity to repay a debt, but would have the capacity should circumstances change, a debt may be written off (placed on hold). The debt remains legally repayable until it is waived, repaid or the statute of limitations expires, which is commonly six years. Debts may be waived by Comcare under some circumstances, for example where the debt arose due to an administrative error by Comcare.

Conflicts of interest

2.40 Comcare staff must take steps to identify and declare potential conflicts of interest22 where they may have knowledge of a claimant or some form of relationship with the claimant.

2.41 Comcare’s Declaration of Interest Procedure requires Australian Government and contractor employees to make an initial declaration upon commencement of employment and at least annually. An annual declaration is required to be made in July each year as a component of the Comcare performance development cycle, with the aim of avoiding conflicts of interest affecting Comcare’s decisions. Comcare also requires employees to submit supplementary declarations when a change of circumstances or role occurs throughout the year.

2.42 These declarations are reviewed for real or apparent conflicts of financial, personal, relationship, professional or other interests with official Comcare duties. Management strategies are used where a conflict is identified. These may include registering the interest, restricting or removing involvement with the case, or oversight by another Comcare officer when performing conflicting duties. At least one management strategy must be put in place for each conflict and the strategies are to be agreed upon and endorsed by a delegate.

2.43 The ANAO reviewed extracts of declared conflicts of interest recorded in Comcare’s HR system, Aurion, which included details of the perceived or actual conflict of interest and how the conflict will be managed. From July 2021 to February 2023, 21 declarations were recorded and of those, one case was transferred to another claims manager.

Delegated claims management arrangements

2.44 Under section 73B of the SRC Act, the Chief Executive Officer of Comcare can delegate decision-making powers under the scheme to officers of Australian Government employers (non-corporate Commonwealth entities) so they can manage their own claims, including making determinations. These arrangements are offered to enable entities to play a greater role in managing their claims and contribute to an efficient and effective workers’ compensation scheme. There are three models available to entities who wish to take up these arrangements: the employer is the delegate with Comcare as claims manager; the employer is the delegate with a service provider as the claims manager; and the employer is the delegate and claims manager.

2.45 Since 2016, Comcare has delegated its decision-making powers and responsibilities in relation to claims to Services Australia and the Australian Taxation Office (ATO), the two largest Australian Government entities (by total number of employees).23 To facilitate this, the Comcare Chief Executive Officer has issued instruments of delegation to Services Australia and the ATO.

2.46 Under the arrangements, Comcare has contracted two service providers to undertake the management of claims on behalf of Services Australia and the ATO.24 The service providers must use Pracsys for claims processing and have developed their own claims guidance which was endorsed by Comcare. The service providers undertake the processing of claims and are the employee/claimant’s key point of contact, however Services Australia and the ATO hold the decision-making role so any approvals need to be made by the delegates in those entities.

2.47 Comcare maintains a contract manager role over the service providers and holds monthly meetings with Services Australia and the ATO and their respective service providers to discuss claims activity and claims management performance. Comcare is also responsible for ensuring that Services Australia and the ATO are undertaking the claims management role in line with the SRC Act. Both entities are required to complete an annual certification of compliance to provide Comcare with assurance that they have met the requirements of the delegation arrangements.

2.48 Comcare commissioned Deloitte to undertake an examination of its contractual arrangements with its claims management service providers, noting a new tender process needs to occur in mid–2023, and the final report was provided to Comcare in March 2023. It found that the arrangements were financially beneficial for Services Australia and the ATO, and generally positive contract management arrangements were in place with room for improvement in Comcare’s monitoring of service performance.

2.49 Comcare provided the ANAO with data reports extracted from Pracsys which show that overall, the delegated claims management arrangements have led to the following improved outcomes.25

- The delegated claims management arrangements have resulted in higher return to work rates for both entities — as at October 2022 (for claims initially determined in the preceding 24 month period), Services Australia’s return to work rate was 88 per cent and the ATO’s was 84 per cent, compared with the overall return to work rate of 75 per cent.

- The higher return to work rates and lower claim numbers has subsequently led to lower premiums for both agencies — 0.13 per cent of ATO’s total payroll in 2021–22 (down from 0.36 per cent in 2018–19), and 0.59 per cent for Services Australia in 2021–22 (down from 1.04 per cent in 2018–19), compared with the Australian Government average of 0.79 per cent in 2021–22.

- Higher reconsideration affirmation rates26 — in 2021–22 the rate was 88 per cent (refer to Table 2.3 for Comcare’s affirmation rate).

- From 2018–19 to 2021–22, the timeframes for making new claims determinations within the 20 and 60 day targets has been better than Comcare’s — an average of 91 per cent for externally managed claims compared to an average of 83 per cent for Comcare.

- Relative to the other employers with the top 10 number of claims per 1,000 full time equivalent staff, the ATO and Services Australia have some of the lowest numbers of claims (also noting that those two agencies have the highest numbers of staff within that cohort).

2.50 Comcare advised that some of these positive outcomes are the result of the claims management, early intervention and rehabilitation functions being within the one agency, rather than split between Comcare as claims manager and the employer as rehabilitation manager. This is because the person making the decision on the claim can work closely with the person responsible for assisting the employee to return to work. There is evidence that Comcare has engaged in preliminary discussions with one other agency to consider adopting the delegated claims management arrangements.

Recommendation no.1

2.51 Comcare periodically reviews the delegated claims management arrangements, including identification of areas of efficiency and any lessons learned that could apply to Comcare’s management of claims, or inform the application of the arrangements to other non-corporate Commonwealth entities.

Comcare response: Agreed.

2.52 Comcare will commit to periodic reviews of the delegated claims management arrangements to identify opportunities for efficiency and improvement.

Are fit-for-purpose systems in place to support effective claims management?

Comcare has appropriate controls in place to ensure that its claims management systems are fit-for-purpose to support effective claims management. Claims managers’ activities are monitored, access to sensitive information is managed appropriately, and there is effective segregation of duties. Systems are maintained and managed under change control processes and security updates are regularly applied. A risk was identified for the external facing Customer Information System for employers, where Comcare does not have a process in place to ensure users’ access is removed when it is no longer required.

Claims management system

2.53 Comcare’s claims management system, Pracsys, is a custom-built system used to manage all aspects of claims for compensation under the scheme. It was introduced in Comcare over 20 years ago.

2.54 Pracsys provides the functionality for the end-to-end management of claims including key functions such as:

- claims registration, initial liability management and assessment, treatment payment authorisation plans, benefit denials, manual and system generated task reminders, rehabilitation monitoring, claims strategy plans, case file notes, manual and auto-generated letters and emails;

- claim payments including calculation of compensation payments, electronic funds transfer payments, overpayments and recoveries, and third party recoveries; and

- the ability to manage clinical panel27 advice/injury management services, reconsiderations and appeals.

2.55 Pracsys interacts with several other Comcare systems including records management, document scanning of claims evidence, payroll and financial systems, medical provider invoicing, online claims submission and an external employer portal (the latter explained in more detail at paragraph 2.59 below).

2.56 The ANAO undertook system walkthroughs of Pracsys and its interactions with the supporting systems and tested the system controls.

2.57 Pracsys was developed by Comcare to meet legislative requirements resulting in a level of complexity in its system interfaces and associated business processes. Although the walkthroughs of the end-to-end claims processes showed no significant risks or concerns in the systems design or control effectiveness, Comcare advised that end users found Pracsys was not user-friendly with limited intuitive workflows. This is mitigated through close supervisor verification and oversight of claims managers, and the detailed Claims Manual to support correct processing. There are appropriate controls in place to mitigate the risk of incorrect processing of claims information and ensure completeness and accuracy of claims data.

2.58 The ANAO also found that: controls are in place for the appropriateness of access to sensitive information; claims managers’ activities are monitored; there is effective segregation of duties controls between processing and approvals; systems are maintained and managed under change control processes; development occurs as required to maintain systems; and security updates are regularly applied through patch management.

Customer Information System (CIS)

2.59 CIS is the online reporting portal that Australian Government employers can use to view their employee claims activity. It draws information from Pracsys and can present it in different report formats. Employer rehabilitation case managers can see all claims under the employee’s claim record, including sensitive personally identifiable information. The record also includes the relevant Comcare claims manager and their contact details.

2.60 Each employer has a single ‘super user’ who is responsible for managing internal staff access via a form sent to Comcare for onboarding to CIS.

2.61 Passwords expire after 90 days however there is no control in place to determine if a user’s access is still appropriate. Comcare advised the ANAO that employers are not proactive in advising Comcare that a user account should be removed. In addition, the 90 day expiry period can be bypassed by the user resetting the password to maintain access. A review of expired accounts is performed by Comcare every six months, however this would not discover ongoing inappropriate access by former employees of Australian Government entities (or current employees who no longer require access) where the employee may have kept their CIS account active.

2.62 Account managers of the agencies must email a request to Comcare to manually remove user accounts which are no longer required. Given the level of personally identifiable information available through the system, the current user controls are not effective at addressing the risk that inappropriate access to data can occur, as a user could simply reset their password every 90 days to maintain access, if it has not been manually removed by Comcare.

2.63 As a result of the most recent user access review conducted in August 2022, Comcare deactivated 464 users from CIS (which Comcare advised represented 41 per cent of the total user base at the time).

|

Opportunity for improvement |

|

2.64 Any future online portal for employers could have a mechanism in place for user accounts to be monitored regularly by employers and required to be reported to Comcare for actioning of any expired user accounts, or by enabling employers to self-manage the accounts of their staff. |

New claims management system

2.65 In 2020–21 Comcare commenced the Claims Management Improvement Program which was a set of projects designed to improve claims management services and the outcomes achieve for Comcare’s clients. A key component of this program is the development and implementation of a new claims management system to replace Pracsys. Comcare expects the new system will:

- improve customer experience through user-centric service design;

- enhance the user experience for Comcare claims managers, contracted service providers and other government entities;

- where possible, enable digital claims management services and provide real-time, accurate information to stakeholders and users through integration with existing and future Comcare systems; and

- deliver modern ICT capability, increase use of cloud-based technology services and reduce operational management overheads.

2.66 Comcare anticipates that the new system will be in operation in 2024.

|

Opportunity for improvement |

|

2.67 As the current claims management system does not support intuitive workflows and requires some manual interventions when managing claims, Comcare could consider any areas of automation and efficiency that can be embedded in the new claims management system and related processes. |

3. Performance measurement, reporting and compliance

Areas examined

This chapter examines whether Comcare had appropriate performance measures and reporting to monitor the effective and efficient management of claims, and if there was a risk-based compliance program in place for claims management.

Conclusion

Comcare’s governance arrangements enable effective oversight and management of claims. Comcare has external effectiveness and efficiency performance measures, however the efficiency measure target is not based on benchmarking, making it difficult to clearly demonstrate efficiency in claims management. Comcare reports on its claims related measures in its annual performance statements and for the past five financial years up to 2021–22 it has been meeting its targets. Internally, Comcare prepares detailed monthly claims management reports which contain reporting against internal performance measures on timeliness. Comcare is implementing a compliance and assurance framework and program of activities which are linked to identified risks.

Area for improvement

The ANAO made one recommendation for Comcare to review its corporate performance measures so they sufficiently cover its claims management function including a balance of effectiveness and efficiency measures.

3.1 Comcare needs to be able to effectively measure the performance of the workers’ compensation scheme to provide assurance that the scheme is being managed appropriately and in line with legislative requirements. Corporate performance criteria are required to be related, measurable and complete under section 16EA of the Public Governance, Performance and Accountability (PGPA) Rule. Performance criteria should also include measures of effectiveness and efficiency, noting the latter is about obtaining the most benefit from available resources.

3.2 A compliance or assurance strategy should be linked to the entity’s risk management and fraud control frameworks and be actively used to assess compliance and facilitate continuous improvement, including appropriate monitoring and reporting on compliance activities and results.

Is an appropriate performance measurement regime in place to monitor the effective and efficient management of claims?

Comcare reports externally on three corporate performance measures relating to claims management. The administrative cost ratio efficiency measure is related to Comcare’s purpose and is generally measurable, except it is not free from bias due to a lack of benchmarking to underpin the target. The other two effectiveness measures on average premium rate and the minimum funding ratio are related and measurable. There are internal performance measures primarily relating to timeliness.

3.3 Comcare’s Corporate Plan 2022–23 outlines its purpose, roles, key activities, the five strategic priorities28 it will align its work to, as well as the performance measures, sub-measures and targets it will use to measure achievement of its purpose. In 2022–23 Comcare had 12 performance measures and 28 sub-measures with targets.29

External performance measures on claims

3.4 Section 16EA of the PGPA Rule and the Department of Finance Resource Management Guide (RMG) 131 Developing good performance information require entities to have meaningful performance information which relies upon a clear understanding of the entity’s purpose and expressing it in a way that is related and measurable.

3.5 Comcare has three corporate performance measure on claims, described in Table 3.1.

Table 3.1: Comcare’s performance measures relating to claims 2022–23

|

Program |

Key activitiesa |

Performance measure |

Performance targets and descriptions |

|

Strategic priority 5: Being adaptive and sustainable in the face of change. |

Delivering an adaptive, secure, digital environment which supports our agency to serve the needs of our stakeholders in an efficient and effective way. Using our portfolio management approach to deliver programs and projects for Comcare. Implementing our People Strategy 2019–2022 with a focus on culture and engagement, capability, talent and workforce planning. |

5.1 Comcare scheme is sustainable as evidenced through outcomes achieved by scheme participants. |

5.1.1 Target administrative cost ratio 15 to 25 per cent, expressed by the formula: Administration costs divided by (administration costs + claims costs). |

|

5.1.2 Average Commonwealth premium rate = 1 per cent of payroll or lower, calculated by: Sum of Commonwealth premium amounts divided by sum of Commonwealth payrolls. |

|||

|

5.1.3 Minimum funding ratio of 110 per cent, expressed by the formula: Total assets divided by net outstanding claims liability. |

|||

Note a: The key activities contained in Comcare’s Corporate Plan are enabling activities or delivery strategies rather than activities that reflect Comcare’s core functions.

Source: Comcare Corporate Plan 2022–23.

3.6 The ANAO assessed the measures against section 16EA of the PGPA Rule and the results are provided in Table 3.2.

Table 3.2: Assessment of performance measures

|

Performance measure |

Relateda |

Measurableb |

||

|

|

|

Reliable and verifiable |

Free from bias |

Assessable over time

|

|

Target administrative cost ratio 15 to 25 per cent |

◆ |

◆ |

▲ |

◆

|

|

Average Commonwealth premium rate = 1 per cent of payroll or lower |

◆ |

◆ |

◆ |

◆

|

|

Minimum funding ratio of 110 per cent |

◆ |

◆ |

◆ |

◆

|

Legend:

◆ Fully and/or mostly meets requirements

▲ Partially meets requirements

■ Does not meet requirements.

Note a: Related refers to the requirement of subsection 16EA(a) of the PGPA Rule 2014. In applying the ‘related’ criterion, the ANAO assessed whether the entity’s performance measures:

• related directly to one or more of the entity’s purposes or key activities;

• provided a clear link between purposes, key activities and performance measures; and

• were expressed in a consistent way.

Note b: In applying the ‘measurable’ criterion, the ANAO assessed whether the entity’s performance measures were:

• reliable and verifiable — supported by clearly identified data sources and methodologies;

• free from bias — provides an unbiased basis for the measurement and assessment of the entity’s performance; and

• assessable over time — able to provide a basis for an assessment of performance over time.

Source: ANAO analysis based on the PGPA Act and PGPA Rule.

3.7 The target administrative ratio efficiency measure is related to Comcare’s purpose and is largely measurable except for being free from bias because the target is not based on benchmarking and the calculation was derived from internal financial modelling by Comcare. The shift to a target range coincided with performance moving outside the previous target (see Table 3.4).30

3.8 The two effectiveness measures on the average Commonwealth premium rate and the minimum funding ratio are related to Comcare’s purpose and are measurable.

Other corporate measures indirectly associated with claims management

3.9 Comcare has two other measures in its Corporate Plan 2022–23 that are indirectly associated with claims management.

- Resolution of Administrative Appeals Tribunal matters — the effective handling of appeals, and the implementation of continuous improvements as result of key learnings from appeals outcomes, is an indirect contributor to effective claims management.

- Return to work rate — Comcare reports on the totality of return-to-work rates for both Australian Government (premium paying) employers and self-insured licensees, whereas Comcare only manages claims on behalf of Australian Government employers. The performance results are not truly indicative of effective claims management by Comcare, noting that self-insured licensees manage their own claims.

Internal claims management performance measures

3.10 Comcare has 11 internal claims management performance measures which are reported on in its internal Monthly Claims Management Reports as shown in Table 3.3.

Table 3.3: Internal claims performance measures

|

Claims process or function |

Performance measure and target |

|

Claims registration |

For Comcare managed claims, registration and allocation occurs within one business day of receipt 95 per cent of the time. |

|

Initial liability determinations |

Initial liability determined within 20 or 60 days from date claim is lodged with medical certificate for injury and disease claims respectively, 95 per cent of the time. |

|

Contact centre management |

Contact centre provides <0.5 queue abandonment rate.a |

|

Contact centre provides <46 second queue time, 95 per cent of the time. |

|

|

Information receipt |

Hard copy documents are scanned within two business days of receipt and provided to Claims Operations teams. |

|

Emails received through General Enquiries email address are actioned within two business days of receipt. |

|

|

Decisions on permanent impairment |

Permanent impairment claims determined within 90 days from date of receipt, 90 per cent of the time. |

|

Claims reconsiderations |

Reconsiderations determined within 30 days from date of receipt, 95 per cent of the time. |

|

Internal helpdesk responses |

Non-urgent helpdesk queries and other activity requests (e.g. system changes) are responded to within two business days, 95 per cent of the time. |

|

For complex matters where time and review are required, the internal client is kept up to date and reporting provided on status and next steps. |

|

|

Return to work |

Return to work rate of 85 per cent. |

Note a: Comcare has defined an abandoned call as a call that has more than 12 second waiting time and no agent has answered the call before the call is ended.

Source: ANAO analysis of Comcare’s Claims Management Group internal performance measures 2022–23.

3.11 Comcare should have a balance of effectiveness and efficiency measures for both its corporate (external) and internal performance measures so that it can clearly demonstrate whether it is appropriately managing the workers’ compensation scheme claims and meeting its targets. This will also ensure a comprehensive view of performance at both Comcare’s organisational level and for its claims management function.