Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Collection of North West Shelf Royalty Revenue

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess whether the Department of Industry, Innovation and Science has effectively and efficiently administered the collection of North West Shelf royalty revenues.

Summary and recommendations

Background

1. Most natural resources in Australia are publicly owned. The Australian, state and territory governments collect royalties levied on petroleum extraction to ensure that the community receives a benefit from their development.

2. The Department of Industry, Innovation and Science (DIIS) is responsible for the collection of royalties levied on off-shore petroleum operations from the North West Shelf (NWS) project located in Australian Government regulated waters off the Western Australian coast. NWS petroleum products include: crude oil, condensate, natural gas, liquefied natural gas and liquefied petroleum gas (both propane and butane).

3. Revenue reported by producers from NWS petroleum sales between July 2014 and December 2015 was $19.7 billion. From this, $1.9 billion in royalties was collected. The Australian Government retained $0.6 billion (32.3 per cent) and the remaining $1.3 billion (67.7 per cent) was paid to Western Australia.

Audit objective and criteria

4. The audit objective was to assess whether the Department of Industry, Innovation and Science had effectively and efficiently administered the collection of NWS royalty revenue.

5. To form a conclusion against the audit objective, the ANAO assessed whether:

- the royalty collection framework, including the agreed administrative arrangements between the Australian Government and Western Australia, enabled efficient and effective administration;

- an adequate framework was in place for accurately calculating NWS petroleum production and sales; and

- the amounts subtracted from sales receipts to calculate the amounts of royalty payable were likely to be accurate and valid.

Conclusion

6. The administration of the collection of NWS petroleum royalties by DIIS has not been sufficiently efficient or effective as the existing assurance arrangements do not effectively address key risks to the accurate calculation of royalty payable.

7. NWS royalties are a considerable revenue source each year for both the Australian and Western Australian governments. But there is no formal agreement outlining the day-to-day roles and responsibilities of the respective departments involved in the collection of NWS royalty revenue. The DIIS also does not have a comprehensive procedure manual in place.

8. There are some significant shortcomings in the framework for calculating NWS royalties. The consolidated Royalty Schedule, which governs those calculations, has not been updated in the last 10 years. In addition, the testing of the meters that are relied upon to identify production and allocate it to the appropriate field for royalty calculation purposes has not been sufficiently comprehensive or frequent.

9. The amount of royalty paid is reduced by producers being permitted to claim significant deductions in areas such as operating costs and the depreciation of capital assets.1 There has been limited scrutiny of the claimed deductions. Some errors in the claiming of deductions have been identified, but the available evidence indicates that the problems are much greater than has yet been quantified.

Supporting findings

Administrative arrangements

10. The division of roles and responsibilities between DIIS, on behalf of the Australian Government, and the Western Australian Department of Mines and Petroleum (DMP) has not been adequately set out. In particular, DIIS has not set out the level of assurance it requires for royalty collections or agreed with DMP the specific administrative arrangements that would support a conclusion that the correct amount of royalty is being collected.

Calculating petroleum production and sales

11. The royalty calculation has not been adequately defined and kept up to date.2 An external review prepared for DMP in October 2015 highlighted insufficient detail in the Schedule about deductible expenditure, leading to incorrect claiming.3

12. At the start of this ANAO performance audit there were gaps in records relating to the titles on which royalties should be charged, and the relevant royalty rate. DIIS and DMP have addressed this situation. As a result, DIIS has now developed a good understanding of the titles on which royalties should be charged, and the royalty rates that are to be charged.

13. The current administrative arrangements provide insufficient assurance that production is being fully identified and accurately allocated to fields for royalty calculation purposes. The key shortcoming relates to testing of metering. There is sporadic testing by DMP of metering on-shore; no equivalent meter testing off-shore; and there is limited testing of the NWS operator’s production accounting system.

Costs deducted from the gross well-head value

14. More than $5 billion worth of deductions were claimed against petroleum revenues in the 18 months to December 2015. These deductions were claimed under the broad categories of: operating costs; depreciation; cost of capital; depreciated asset disposal; crude oil excise; condensate excise; processing tariffs and joint venture participant costs.

15. Any costs that are claimed as deductions by NWS producers reduce the royalty amount that is payable. DIIS relies on DMP’s compliance work and does not undertake any further activities to gain assurance that only eligible deductions have been claimed. DIIS has not agreed with DMP the deductions data that DMP should obtain and the information obtained is not sufficiently detailed to be adequately assured that only valid deductions are being claimed.

16. The Royalty Schedule does not permit all the deductions currently being claimed. On this basis, the ANAO has doubts about the eligibility of deductions claimed for the cost of debt and equity funded capital, excise paid on crude oil and excise paid on condensate.

17. There has not been adequate scrutiny of claimed deductions. Of note:

- it has been 17 years since there has been an audit of the NWS operator’s control procedures for royalty calculations;

- there have been recent annual reviews by DMP of cost deductions, but this work has involved quite limited testing and there has been no major, comprehensive examination since 2006. The limited work that has been undertaken has, nevertheless, highlighted potential problem areas. But little action has been taken in response to those findings; and

- more recently, the Western Australian Government commissioned consultants to undertake some data analytic procedures on capital and operating expenditure items claimed by NWS producers. That work, although quite limited in scope, has provided some valuable insights. The report’s findings indicate that there is a risk of significant errors in the claiming of deductions. To date, there has been agreement that a net amount of $8.6 million in royalties has been underpaid requiring adjustments, but many matters identified by the consultants have not yet been addressed, and a comprehensive review of claimed deductions has not been commissioned, such that the full extent of any errors in the calculation and payment of royalties has not been quantified.

Recommendations

Recommendation No.1

Paragraph 2.26

The Department of Industry, Innovation and Science improve governance over the administration of the royalty calculation and collection function by:

- implementing an appropriate accountability framework with the Western Australian Department of Mines and Petroleum that clearly sets out the roles and responsibilities of each party; and

- developing a procedure manual that covers all aspects of its responsibilities in relation to the collection of North West Shelf royalties. This should include identifying the activities undertaken by the Western Australian Government that the department relies upon, and the compliance and reporting procedures that are to be employed to oversee and be assured about the conduct of those activities.

Department of Industry, Innovation and Science’s response: Agreed.

Recommendation No.2

Paragraph 3.15

The Department of Industry, Innovation and Science, through the Joint Authority, set a timeline and regularly review progress against this timeline so as to expedite changes to the Royalty Schedule aimed at updating and improving the clarity of descriptions relating to deductible expenditure, and incorporating expenditure relating to new fields.

Department of Industry, Innovation and Science’s response: Agreed.

Recommendation No.3

Paragraph 3.41

The Department of Industry, Innovation and Science work with the Western Australian Department of Mines and Petroleum to implement improved controls for the verification of North West Shelf petroleum production and sales to provide increased assurance that the approach taken when allocating production to fields is complete and accurate.

Department of Industry, Innovation and Science’s response: Agreed.

Recommendation No.4.

Paragraph 4.33

The Department of Industry, Innovation and Science work with the Western Australian Department of Mines and Petroleum to:

- verify the validity of deductions claimed prior to 2014; and

- develop and implement a comprehensive strategy for gaining a reasonable level of assurance that deductions claimed by the North West Shelf producers in 2015 and later years are valid and calculated in accordance with the Royalty Schedule.

Department of Industry, Innovation and Science’s response: Agreed.

Summary of entity responses

18. The proposed audit report issued under section 19 of the Auditor‐General Act 1997 was provided to the Department of Industry, Innovation and Science and was also provided to the Western Australian Department of Mines and Petroleum. The Department of Industry, Innovation and Science and the Western Australian Department of Mines and Petroleum summary responses are provided below, while their full responses are provided at Appendix 1.

Department of Industry, Innovation and Science

The department welcomes the audit by the ANAO and acknowledges the areas for improvement identified in the Proposed Report. The department agrees the accountability and assurance frameworks over the administration of collection of North West Shelf (NWS) petroleum royalties can be improved, in particular to ensure they are appropriately documented and that the operational responsibilities of the Australian and Western Australian Governments are clearly articulated. This is reflected in the department’s agreement with all four recommendations of the audit report.

The department believes the current processes over royalty collection are robust and provide for the accurate, efficient and comprehensive collection of NWS royalty payments. The department will confirm their reliability in partnership with the Western Australia Government and the NWS joint venture participants in actioning the report’s recommendations.

Western Australian Department of Mines and Petroleum

The Department of Mines and Petroleum’s (DMP’s) North West Shelf royalty revenue verification processes are robust and adequate, and the Commonwealth and State Governments can be confident that royalties are being accurately assessed and collected.

The DMP looks forward to working with the Department of Industry, Innovation and Science (DNS) to implement its responses to the ANAO audit.

DMP notes that the ANAO was auditing DIIS, and not DMP, and therefore does not accept or support many of the comments in the report relating to DMP’s processes.

1. Background

Introduction

1.1 Most natural resources in Australia are publicly owned. The Australian, state and territory governments collect royalties, which are levied on petroleum extraction to ensure that the community receives a benefit from their development. The Department of Industry, Innovation and Science (DIIS) is responsible for the collection of royalties levied on off-shore petroleum operations from the North West Shelf (NWS) project located in Australian Government regulated waters off the Western Australian coast. NWS petroleum products include: crude oil, condensate, natural gas, liquefied natural gas and liquefied petroleum gas (both propane and butane).

1.2 Revenue reported by producers from NWS petroleum sales between July 2014 and December 2015 was $19.7 billion. From this, $1.9 billion in royalties was collected.

1.3 NWS royalties are shared between the Australian and Western Australian governments. Of the $1.9 billion in royalties for the period July 2014 to December 2015, the Australian Government retained $0.6 billion (32.3 per cent) with $1.3 billion (67.7 per cent) being paid to Western Australia.

North West Shelf Project

1.4 The NWS project commenced in the early 1970s with the discovery of natural gas off the north-west coast of Australia, located some 1260 kilometres north of Perth (see Figure 1.1). The NWS petroleum exploration and recovery operation accounts for more than one-third of Australia’s oil and gas production. It is a joint venture project between seven major international companies.4

1.5 Royalties are to be paid on petroleum recovered under two exploration permits: WA-28-P and WA-1-P, as well as the retention leases and production licences derived from those permits.

Figure 1.1: Location of the North West Shelf project area

Source: Based on a map provided by the Western Australian Department of Mines and Petroleum.

1.6 The Offshore Petroleum and Greenhouse Gas Storage Act 2006 and Offshore Petroleum (Royalty) Act 2006 (Royalty Act) set out the basic framework for the payment of NWS area royalties. This includes the royalty rate to be applied and how the royalties will be shared between the Australian Government and Western Australia.

Royalty calculation

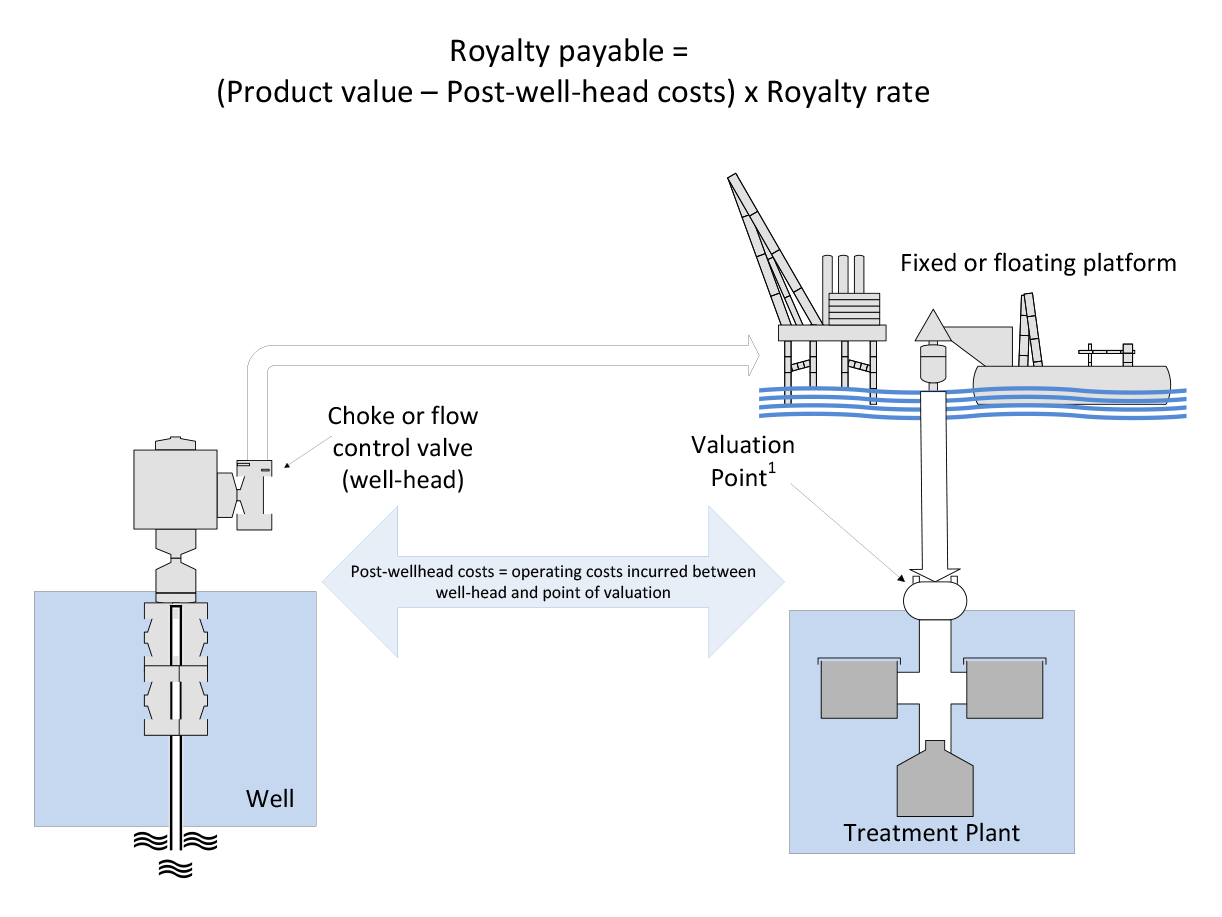

1.7 Royalty payable on production in the NWS area is calculated as a percentage of the well-head value. The well-head value is to be calculated separately for each NWS permit, lease and licence area. It is calculated as the gross value of petroleum recovered from a well5 reduced by allowable costs (being the transportation and processing costs incurred between the choke or first flow control valve to the point of valuation, see Figure 1.2).6

Figure 1.2: Calculation of royalty payable

Note 1: The valuation point differs by petroleum product (see footnote 6).

Source: ANAO analysis.

Audit approach

1.8 The audit objective was to assess whether DIIS had effectively and efficiently administered the collection of NWS royalty revenue.

1.9 To form a conclusion against the audit objective, the ANAO examined whether: the royalty collection framework, including the agreed administrative arrangements between the Australian government and Western Australian government, enables efficient and effective administration; an adequate framework is in place for accurately calculating NWS petroleum production and sales; and amounts subtracted from sales receipts to calculate the amount of royalty payable are likely to be accurate and valid.

1.10 The methodology employed for the audit included:

- interviewing relevant DIIS staff;

- examining relevant documentation, including historical file reviews, procedures manuals, administrative documentation and data; and

- receiving advice and information from the: Western Australian Department of Mines and Petroleum (DMP), Australian Taxation Office, National Offshore Petroleum Titles Administrator (NOPTA), Department of Immigration and Border Protection, Queensland Treasury and the South Australian Department of State Development.

1.11 Following the issue of the Report Preparation Papers for this performance audit, in the context of finalising the audit of DIIS’ 2015–16 financial statements, the department and the ANAO agreed on some work to be undertaken by DIIS to provide assurance on the completeness and accuracy of NWS royalty revenue. This was to involve documentation being requested from each Joint Venture Participant that would allow a third party to confirm the accuracy of key drivers of the royalty payable, including production quantities, revenue and deductions for each of three months. Based on a sample of transactions selected for detailed testing, this work was to allow conclusions to be drawn about:

- the completeness of royalty revenue received from the NWS and in particular whether the external records of ships and collection information support the identification of all possible royalty collection from this region;

- the accuracy of royalty revenue received from the NWS, based on sample testing undertaken and the review of any discrepancies; and

- any weaknesses in the systems reviewed, their potential impact and follow up action undertaken, and any associated risks.

1.12 The performance audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of approximately $583 640.

2. Administrative arrangements

Areas examined

The ANAO examined whether the royalty collection framework, including the agreed administrative arrangements between the Australian and the Western Australian governments, enable efficient and effective administration.

Conclusion

NWS royalties are a considerable revenue source each year for both the Australian and Western Australian governments. But there is no formal agreement outlining the day-to-day roles and responsibilities of the respective departments involved in the collection of NWS royalty revenue. The Department of Industry, Innovation and Science (DIIS) also does not have a comprehensive procedure manual in place.

Area for improvement

The ANAO has recommended that DIIS implement an appropriate accountability framework with the Western Australian Department of Mines and Petroleum that clearly sets out the roles and responsibilities of each party. The ANAO has also recommended that DIIS develop a procedure manual that covers all aspects of its NWS royalty collection responsibilities.

Introduction

2.1 The power to legislate and administer activities in the sea around Australia has long been a disputed issue.7 In 1979, an Offshore Constitutional Settlement (OCS) was agreed to by all jurisdictions and set the framework for current legislative and administrative arrangements for the collection of off-shore petroleum royalties. This settlement included that:

- the Australian Government would regulate off-shore petroleum arrangements from the three mile territorial sea to the outer limits of the continental shelf;

- a Commonwealth-WA Offshore Petroleum Joint Authority be established, consisting of the relevant Australian government and state minister and being given responsibility for major matters arising under legislation.8 In the event of a disagreement, the Australian government minister would have the power to veto decisions proposed by the state where the decision would endanger or prejudice the national interests;9

- day-to-day administration would continue to be in the hands of the state minister and state officials; and

- the Commonwealth would retain a final say in the determination of royalties.

2.2 In support of OCS implementation, procedures for the collection and verification of royalties were agreed between the Australian Government and the states during the 1980s. These procedures noted that the relevant Australian Government department (currently DIIS) ‘has overall responsibility for actions taken under Commonwealth off-shore petroleum legislation and will need to satisfy itself in regard to the adequacy of the administrative arrangements’. The agreed approach included the state and Australian Government departments agreeing and documenting procedures for the measurement of production and the assessment/verification of royalties payable.10

Have administrative responsibilities been clearly defined?

The division of roles and responsibilities between DIIS, on behalf of the Australian Government, and the Western Australian Department of Mines and Petroleum (DMP) has not been adequately set out. In particular, DIIS has not set out the level of assurance it requires for royalty collections or agreed with DMP the specific administrative arrangements that would support a conclusion that the correct amount of royalty is being collected.

2.3 At the Australian Government level, administrative tasks relating to the collection of NWS royalties are performed by DIIS. DIIS also represents the Minister for Resources and Northern Australia on title-related matters, such as production licence applications/renewals and setting royalty rates, through the Joint Authority.

2.4 DIIS’ royalty collection function is performed by one employee reporting to a supervisor, both of whom have other responsibilities within the Uranium and R&E International Branch of the department’s Resources Division. The relevant performance indicators for DIIS administrative tasks are:

- timely and accurate delivery of audit and monthly administration and verification of royalties; and

- timely and accurate calculation, verification and advice to the Commonwealth Treasury of the amount payable to Western Australia.11

2.5 At the state level, DMP performs day-to-day administrative functions and maintains the relationship with the NWS producers. This includes royalty calculations and obtaining assurance about the accuracy of royalty payments. DIIS has defined its role as obtaining limited assurance that DMP has followed ‘due process’ in determining the royalty to be paid.

2.6 There is no formal agreement outlining the day-to-day roles and responsibilities of the two departments. Table 2.1 provides ANAO’s summary of the key roles performed by DIIS and DMP.

Table 2.1: Administrative roles performed by DMP and DIIS

|

DMP activities |

DIIS activities |

|

Maintains the relationship with the NWS producers including an agreement (‘Royalty Schedule’) setting out what petroleum revenues will be included in the calculation of NWS royalties and the costs that are to be deductible. |

- |

|

Maintains an online portal for the reporting of NWS petroleum production levels, sales information and deductions made by the NWS producers. |

- |

|

Calculates the royalty payable based on monthly producer submissions of sales and deductions data, and provides this information to DIIS. |

Reviews the accuracy of DMP’s monthly calculations by checking that DMP has applied the correct royalty percentage and that state/Australian Government shares of royalties have been correctly apportioned. Updates federal budget estimates and tracks variances between forecast and actual receipts. Receives royalty payments and advises the Department of the Treasury to distribute the state share of royalties to Western Australia. |

|

Annually reviews monthly production and sales data. This includes:

|

Reviews DMP’s annual revenue checking process including checking that shipping records confirm the petroleum volumes that were provided in each month, but does not perform any additional verification procedures on production quantities, values and deductions. |

Source: ANAO analysis.

2.7 A detailed understanding of risks to royalty collection and associated mitigation strategies is central to the Australian Government being satisfied that the correct amount of royalty is being collected. In this regard, the department’s business planning documentation identifies general risk themes (such as underpayments, payment duplication and fraud), but does not set out how such risks would manifest themselves in royalty collection (for example, unreported production or shipments, non-arms-length shipping transactions, or over-claimed/ineligible deductions).

2.8 In this context, DIIS has not undertaken a systematic assessment of risks to the Australian Government or documented an underlying rationale for the activities currently being undertaken.12 Rather, DIIS is reliant only on DMP to effectively manage royalty calculation and collection and obtains minimal assurance that effective processes are in place to collect the correct amount (discussed further in Chapters 3 and 4).

2.9 In July 2016, DIIS advised the ANAO that:

While DIIS recognises the expertise that DMP has developed over several decades, we continue to perform annual verification activities to ensure DMP is following due process. DIIS is of the view that it is appropriate to allow a peer Government agency with the requisite expertise to perform its role under the carve-out of administrative functions autonomously.

2.10 In similar circumstances, the Parliament, through Committee inquiries, has indicated that it expects the relevant Commonwealth department to be more actively involved than DIIS is with the NWS. For example in Report 190, of the Joint Committee of Public Accounts (1981), Petroleum Royalties and Excise, the Committee found that the then department had ‘been too willing to vacate the field in favour of the state authorities and have not made sufficient effort to establish check procedures by which to ensure that royalty payments are correctly determined’.

2.11 The manner of DIIS’ approach to assurance activities requires careful consideration, but the broad frameworks in place already provide for agreeing an approach with DMP or, if required, mandating it. As was noted in paragraph 2.2, the approach envisaged by governments was for agreement to be reached about the administrative (measurement/verification) activities to be undertaken by both parties, with the aim of providing the Commonwealth with satisfaction that the correct amount of royalty was being collected.13

2.12 The Joint Authority arrangements in the Royalty Act further support this through the inclusion of a power of direction about the manner in which DMP (in the name of the state minister) determines the well-head value.14

2.13 It would be timely for DIIS to initiate the development of an appropriate accountability framework that sets out the:

- level of assurance required by DIIS for royalty verification purposes;

- specific activities DMP will perform to provide that assurance as well as the frequency of their occurrence; and

- reporting arrangements that provide DIIS with sufficient and appropriate information on which to conclude that the correct amount of royalty has been collected.

2.14 The concept of adopting a formal agreement for such functions is not new. A memorandum of understanding was being negotiated in 2011 as part of (abandoned) legislative changes that were to transfer legal responsibility for royalty administration from the state minister to the National Offshore Petroleum Titles Administrator (NOPTA). At that time, DIIS (then the Department of Resources, Energy and Tourism) advised the Senate Economics Legislation Committee that:

Under the arrangements we have in the bills, the functions currently undertaken by the WA department would be undertaken by the titles administrator. Strictly speaking, they would not have a direct role in the collection and verification of those royalties. However, this is one of the sorts of functions we had envisaged in the memorandum of understanding whereby our departments could enter into a service level agreement whereby we could engage the services of the Western Australian department, if it is agreeable; to continue to undertake the role it does now on a cost recovery basis.15

Monthly checking of royalty calculations

2.15 Each month, extraction of petroleum from the NWS area raises a royalty liability that the NWS producers pay to DIIS. In support of this process, the NWS operator uploads to the DMP’s Royalties Online database the proportion of total production allocated to each field by product and the NWS producers upload sales reports. The reports contain the sales quantity and value, deductions and royalty payable for the month. Once all of the information has been received, DMP issues DIIS a ‘monthly payfile’ report that includes:

- a monthly summary with the volumes and sales figures for each NWS project producer;

- an allocation of the production quantities of each commodity to each producing field;

- the royalty payable by each producer for each petroleum field;

- its calculation of the Western Australian and Commonwealth shares of the NWS royalty, as well as its calculation of condensate excise (discussed in paragraphs 4.9 to 4.12) compensation owed to Western Australia.

2.16 DMP also sources shipping and banking information from producers at the end of each year to verify monthly data submissions.

2.17 DIIS’ monthly validation process does not examine whether production has been attributed to the correct field16, rather, DIIS checks the:

- royalty percentage applied to the well-head value for each field; and

- state/Commonwealth shares of royalties for each field.

2.18 DIIS has refined this process down to copying and pasting a selection of cells from DMP’s monthly payfile report into a spreadsheet containing relevant percentages and formulas such that it checks for discrepancies in summary line items, and if these exist, may identify the likely field(s) and producer(s) affected. If there is a discrepancy, DIIS contacts DMP to clarify and resolve the issue. When no such discrepancies are apparent, DIIS provides confirmation to DMP that the amount is correct and that the Commonwealth Department of the Treasury has been advised to release the state’s portion of the royalty.

2.19 Such a process can only provide assurance that the producer’s figures have been correctly applied, not that the figures are accurate in aggregate or for each field.17

DMP’s annual review

2.20 During the audit the ANAO sought advice from DIIS on how it obtains assurance about the accuracy of monthly reporting on the level and value of production in the NWS area. DIIS advised the ANAO that DMP seeks to verify reported production amounts through an annual review process focusing on shipping information. During the ANAO audit, this activity was conducted in December 2015 for one of the NWS producers for Financial Year 2014–15, and was observed by the ANAO and DIIS.

2.21 The process involves DMP sourcing data from NWS producers that shows shipment transaction details (such as vessel names, dates of shipment for different products, the quantity loaded, amount received and a currency conversion calculation). DMP then visits the headquarters of producers to match this information with associated information in cargo reports and bank statements. DMP also compares the shipping transaction details to information supplied by the Department of Immigration and Border Protection (DIBP) showing the quantity and the value of cargo shipped from the port of Dampier18 and the Okha vessel.19 Although the ANAO observed DMP officers performing this later comparison, the process is not documented by DMP.

2.22 This matching process provides some assurance that the amount and value of petroleum products included in monthly reporting (and thus in the royalty calculation) can be found in shipping and banking records. However, it does not provide assurance that such reporting is complete. A key limitation in this regard is that shipping information does not record the specific fields and licence areas from which the petroleum was sourced. In the event that shipments from within NWS licence areas were not recorded in the transaction reports provided to DMP, this would not be identifiable from the current verification process. Assurance about the completeness of shipments reported to DMP needs to be obtained. As was noted in paragraph 1.11, following the issue of the Report Preparation Papers for this performance audit, and in the context of finalising the audit of DIIS’ 2015–16 financial statements, the department and the ANAO agreed on some work to verify the completeness of shipments. This followed-on from comparative analysis of the shipping information obtained from DIBP against shipping receipts and information held by DMP, which had identified some anomalies that required further investigation.

2.23 DIIS reviews DMP’s annual review process and obtains copies of the operators’ source documentation (cargo transaction reports), recording a summary of production volumes. DIIS then compares the volumes in the summary with those in each of the monthly payfile reports for the year. DIIS’s 2014 final report on this process noted that:

Its purpose is to satisfy Commonwealth concerns that WA DMP is following due process to reach the agreed financial outcomes in the years concerned for royalties collected and shared by the Commonwealth and Western Australia (WA). It is not a financial audit per se, and the Commonwealth does not undertake detailed auditing as such. By verifying WA DMP’s due processes, the Commonwealth’s level of confidence in the financial outcome is satisfied.

2.24 DIIS has no procedural documentation supporting its annual review of volumes. In this regard, DIIS advised ANAO in April 2016 that:

There is not currently a DIIS procedure manual in place for the audit20 of the WA DMP, rather the audit is generally conducted by obtaining the documents outlined in the audit plan sent to WA DMP prior to the audit. Historically the knowledge transfer process for this role has been maintained by one lead auditor with prior experience in the process performing the audit with the assistance of another DIIS officer. The past five audit years have been performed by the same two DIIS officers who have maintained responsibility for this function.

2.25 The DIIS ‘audit plan’ contains no detail about what the process is intended to achieve and little information on how it is to be undertaken, simply mentioning that DIIS will obtain DMP’s annual review documentation for each producer and:

match against DIIS records of NWS sales and royalty advised by WA DMP throughout 2014–15 (noting that there can be no direct comparison of these two parallel WA DMP and DIIS records - general satisfaction only.21)

Recommendation No.1

2.26 The Department of Industry, Innovation and Science improve governance over the administration of the royalty calculation and collection function by:

- implementing an appropriate accountability framework with the Western Australian Department of Mines and Petroleum that clearly sets out the roles and responsibilities of each party; and

- developing a procedure manual that covers all aspects of its responsibilities in relation to the collection of North West Shelf royalties. This should include identifying the activities undertaken by the Western Australian Government that the department relies upon, and the compliance and reporting procedures that are to be employed to oversee and be assured about the conduct of those activities.

Department of Industry, Innovation and Science’s response: Agreed.

2.27 The department will work with WA DMP to better document roles and responsibilities. The department will update the procedure manual to incorporate the procedures presently employed to gain assurance over the completeness and accuracy of royalty revenue collected. This exercise will also assist in succession planning for the function and provide a useful resource for the ANAO as part of its annual assurance audit of the department’s annual financial statements.

3. Calculating petroleum production and sales

Areas examined

The ANAO examined whether an adequate framework is in place for accurately calculating NWS petroleum production and sales.

Conclusion

There are some significant shortcomings in the framework for calculating NWS royalties. The consolidated Royalty Schedule, which governs those calculations, has not been updated in the last 10 years. In addition, the testing of the meters that are relied upon to identify production and allocate it to the appropriate field for royalty calculation purposes has not been sufficiently comprehensive or frequent.

Area for improvement

The ANAO made two recommendations relating to DIIS:

- seeking to expedite updates and improvements to the Royalty Schedule; and

- improving controls over the verification of petroleum production and sales, particularly through more comprehensive and frequent testing of meters.

Is the royalty calculation adequately defined and up-to-date?

The royalty calculation has not been adequately defined and kept up to date. An external review prepared for DMP in October 2015 highlighted insufficient detail in the Schedule about deductible expenditure, leading to incorrect claiming.

Note: The review is discussed in paragraphs 4.24 to 4.32 of this report and highlighted matters such as insufficient detail being included in the Royalty Schedule to guide decisions about deductible expenditure and the magnitude of deductions.

3.1 The method for calculating NWS royalties is not fixed in legislation. Rather, the Royalty Act provides flexibility for the Western Australian state minister with responsibility for petroleum to negotiate the parameters for the royalty’s calculation with producers, including in determining the meaning of the term ‘value at the well-head’ on which royalty rates are to be charged.22

3.2 Historically, negotiations with the NWS producers led to the development of three separate ‘Royalty Schedules’ setting out parameters for the calculation of the well-head value in different petroleum fields of the NWS area. In 2006, the Australian Government agreed to these schedules being consolidated. In broad terms, the 2006 consolidated Royalty Schedule:

- provides a method for valuing all the petroleum produced in the NWS area; and

- lists expenditure categories (for each petroleum field) that may, and may not, be claimed as deductions from petroleum revenues, together with the percentage of costs that may be claimed in each expenditure category. The percentage allocation reflects that some expenditure categories can relate to deductible post-well-head (transport and processing) activities, as opposed to non-deductible pre-well-head (exploration and extraction) activities.

3.3 The Royalty Schedule is not a public document.

3.4 Figure 3.1 provides an overview of how the amount of royalty is determined and distributed.

Figure 3.1: Calculation of royalty payable

Note 1: Section 75 of the Offshore Petroleum and Greenhouse Gas Storage Act 2006 provides that NWS royalties are to be shared between the Australian and the Western Australian Governments. As shown above, the Australian Government’s share of the royalty ranges from a maximum of 40 per cent to a minimum of 32 per cent depending on the royalty rate (discussed in paragraph 3.23) applying to each petroleum title.

Source: ANAO analysis of the Royalty Schedule.

3.5 Consistent with a 1987 High Court decision23, the method of valuation adopted in such agreements cannot be arbitrary. The role of the WA state minister is to arrive at an ‘objectively true’ result which ‘fairly accords with the value of the petroleum at the well-head’. While primary responsibility for this task rests with the state minister, the Australian Government Minister for Resources and Northern Australia also has a role. Specifically, a Joint Authority consisting of the state minister and Australian Government minister ‘must’ direct the state minister about the manner in which the state minister determines:

- the well-head location (that is, a valve station on a well);

- the value at the well-head; and

- the quantity of petroleum that is recovered from a well (including by use of an approved measuring device).

3.6 Where the ministers disagree, the Australian Government minister has the power to decide the matter as a decision of the Joint Authority and the state minister must comply. Accordingly, DIIS has responsibility for keeping the Australian Government minister informed about any concerns about the ongoing suitability of Royalty Schedules, such that its minister is in a position to resolve matters through the Joint Authority.24 DIIS records indicate that there has been at least one such disagreement, resulting in a direction being issued (see paragraph 4.7).

Currency of the Schedule

3.7 The consolidated Royalty Schedule contains some inbuilt review mechanisms. An example is the annual review process for keeping the deduction provisions up-to-date. This process places the onus on the NWS producers to review the costs and percentages listed in the Schedule and seek agreement from the state minister for any changes of more than five per cent. Such a review is required to occur by 30 September each year, with any agreed adjustments to take effect from 1 January in the following calendar year.25

3.8 The ANAO was not able to locate any references to such reviews or resulting changes on DIIS files. In this context, it is evident that the consolidated Royalty Schedule has not been kept up-to-date with regard to allowable deductions.26 A report prepared for DMP in October 2015 highlighted that the Schedule does not have sufficient detail to provide guidance regarding deductible expenditure quantities and their respective claimable percentage, which has led to incorrect claiming (discussed at paragraphs 4.24 to 4.32).

3.9 Another area where practices depart from the Schedule relates to NWS producers reporting production by petroleum field rather than by well or licence area. DIIS commented to the ANAO that it considers reporting by field to be more efficient for administrative reasons. But the Royalty Schedule requires that royalties be calculated by licence area rather than being aggregated.

Extent and timeliness of actions taken to address weaknesses in the Schedule

3.10 In December 2015, DMP advised the ANAO that it had provided an updated Royalty Schedule to the NWS operator in April 2015, but had not received a response. Further advice provided by DMP in February 2016 noted that the updates narrowly relate to an expansion project for two adjoining fields27 in the NWS area and that:

- the update was not a full update of the Royalty Schedule, but rather some updates to the deductible expenditure tables;

- the updates are ‘in very rough draft form’ and still subject to negotiations; and

- no agreement had been reached with the NWS operator.

3.11 A separate document obtained by DIIS from DMP identifies that negotiations commenced on 1 July 2013 with an offer made by the NWS operator and that DMP provided a ‘final’ response nearly two years later in April 2015. This was followed by further negotiations.

3.12 DMP has advised the ANAO that these negotiations relate to determining the proportion of capital and operating expenditure that will be deductible for royalty calculation purposes, which has required reference to engineering drawings/plans and technical experts.

3.13 The delay has meant that the expansion fields are being charged royalties calculated using interim allowance rates for deductions. As a result, royalty amounts may need to be revised if and when agreement is reached. DMP wrote to the NWS operator in December 2015 noting that it was important for the process to be concluded as soon as possible. But, as at August 2016, it remains unresolved.

3.14 DIIS was not involved in the development of updates to the Schedule, was aware of the content of the Schedule provided to the NWS operator, or sought updates on the delays. As noted in paragraph 3.6, DIIS has an important role in keeping informed about any concerns about the ongoing suitability of Royalty Schedules, such that it can advise its minister of any actions that may need to be undertaken through the Joint Authority, including the issuing of directions. Such an approach would be consistent with internal DIIS legal advice of 8 August 2013, which suggested that an appropriate use of the direction power might be to require an annual update of the Royalty Schedule.

Recommendation No.2

3.15 The Department of Industry, Innovation and Science, through the Joint Authority, set a timeline and regularly review progress against this timeline so as to expedite changes to the Royalty Schedule aimed at updating and improving the clarity of descriptions relating to deductible expenditure, and incorporating expenditure relating to new fields.

Department of Industry, Innovation and Science’s response: Agreed.

3.16 The NWS Consolidated Royalty Schedule is currently being updated with the addition of a new platform and associated infrastructure.

Does DIIS have a good understanding of the titles on which royalties should be charged, and the royalty rates that are to be charged?

At the start of this ANAO performance audit there were gaps in records relating to the titles on which royalties should be charged, and the relevant royalty rate. DIIS and DMP have addressed this situation. As a result, DIIS has now developed a good understanding of the titles on which royalties should be charged, and the royalty rates that are to be charged.

Titles

3.17 The sea off the coast of Western Australia is divided into a grid of blocks, which may be tendered for the purposes of encouraging off-shore exploration for natural resources. Petroleum companies may bid for time-limited exploration permits to obtain an exclusive right to explore one or more of these blocks for petroleum fields. This may lead them to:

- relinquish the exploration permit or apply to renew the exploration permit in order to keep exploring;

- apply to have one or more blocks containing petroleum discoveries declared a ‘location’ as a precursor to seeking extraction rights; and/or

- apply to retain exclusive access to the blocks by converting blocks in declared locations to:

- a retention lease: where exploration has identified resources, but extraction is not yet commercially viable; or

- a production licence: permitting extraction and sale of the resources. A production licence may also be obtained after a retention lease has been issued.

3.18 The Royalty Act provides that royalties are to be paid on petroleum recovered under exploration permits, retention leases or production licences (collectively known as ‘titles’) in the NWS area. For royalty purposes, the NWS area includes the blocks under titles directly related28 to two exploration permits: WA-28-P and WA-1-P.29

3.19 A detailed understanding of changes in these titles is required to calculate the royalty. DIIS had not retained documentation to support a complete understanding of the NWS area.

3.20 Current title information is maintained by the National Offshore Petroleum Titles Administrator (NOPTA), a statutory officeholder located within DIIS. NOPTA’s record of current title information is published in the National Electronic Approvals Tracking System (NEATS): http://neats.nopta.gov.au/, which was launched in May 2012 and consolidated information previously managed by the states and territories.30 In February 2016, NOPTA advised the ANAO that NEATS did not provide a full record of title areas directly related to the exploration permits WA-28-P and WA-1-P due to missing historic data.

3.21 In July 2016, DIIS advised the ANAO that:

NOPTA has obtained documents from DMP archives and updated the Titles Register and NEATS with copies of original grant and renewal title instruments for the NWS titles listed …

3.22 The titles provided correspond with the ANAO’s understanding of the NWS area.

Royalty rates

3.23 A key input to the calculation of royalties is the rate of royalty to be applied to the well-head value. Sections 6, 7 and 8 of the Royalty Act provide a framework for determining what this rate should be for each type of title.

3.24 The rate of royalty paid by the producer on the well-head value of petroleum is 10 per cent for petroleum production licences, exploration permits and retention leases. In the case of existing production licences, the rate paid by a producer is increased where a secondary production licence is obtained, with the increased rate then applying prospectively to the original and secondary licences.31 The increased rate is determined by the Joint Authority and must be between 11 per cent and 12.5 per cent (inclusive).

3.25 The ANAO sought evidence from DIIS showing the determination of the rate of royalty for each title. DIIS was initially unable to provide relevant documentation. Advice from the department to the ANAO in April 2016 noted that it was relying on titles being listed as primary licences or secondary licences in the Royalty Schedule32, but that it and DMP had conducted an extensive search of respective records and was not able to locate source documents. Similarly, DIIS was not able to locate a range of relevant departmental files, with only five royalty rate determinations being located by the ANAO on files (or in production licence instruments on the NOPTA website).

3.26 Analysis undertaken by the ANAO of information published in the WA government gazette identified information able to be used to identify the nature (primary or secondary) of the NWS production licences, allowing all but four of the royalty rates to be indirectly identified. In July 2016, DMP subsequently found the instruments showing the determination of royalty rates for the outstanding titles and provided them to DIIS.

Has production been fully identified?

The current administrative arrangements provide insufficient assurance that production is being fully identified and accurately allocated to fields for royalty calculation purposes. The key shortcoming relates to testing of metering. There is sporadic testing by DMP of metering on-shore; no equivalent meter testing off-shore; and there is limited testing of the NWS operator’s production accounting system.

Production data

3.27 Establishing the gross value of petroleum33 is complicated by petroleum being extracted from a variety of wells and then transported through pipes to:

- Okha (a floating production, storage and offloading vessel used in the production of gas and the production and sale of crude oil); or

- the Karratha Gas Plant for processing into different products, via the North Rankin, Goodwyn and Angel platforms.

3.28 As shown in Figure 1.1, common pipelines are used to transport different forms of petroleum, co-mingled, from NWS production licence areas to the treatment facility near Karratha. A back-allocation technique is therefore used to reconcile and allocate the volume of processed products back from the first point of sale/transfer to each production licence area in order to determine the production of each area. Fundamental to this technique is the sampling, metering and chemical analysis of flows entering, leaving or being consumed within the defined boundaries of the system (for example from individual wells to first point of sale/transfer). This is to ensure that the processed products are back-allocated in the correct proportions to each production licence area. Accurate back-allocation of production to the licence area of extraction is important because the royalty rate applying in different licence areas can vary between ten and 12.5 per cent, inclusive (see paragraph 3.24).

3.29 DMP’s monthly payfile report (see paragraph 2.15) states that the: ‘Actual split of NWS sales quantities and values is not available’ and that production volumes and values are based on the producer’s ‘Field Allocations for the month’.34 In effect, this means that the reporting of monthly production for each field is a producer estimate rather than an ‘objective’ assessment of the well-head value for a well or title.

3.30 Direct verification of off-shore petroleum extraction presents significant logistical challenges. The NWS area is large and verification necessitates regular:

- off-shore site visits to petroleum fields and platforms;

- inspection of meters at relevant valuation points (such as wells, platforms and offloading/uploading flanges), including their accuracy with regard to the volume and the composition of petroleum;

- examination of whether production data in the systems of the NWS operator reflects metered readings; and

- checks that the producers have appropriately back-allocated final petroleum products to the place of extraction. For example, some forms of petroleum (such as gas and condensate) are taken out of wells in a raw state and piped together to the processing plant in Karratha, then transformed into final products before sale.

3.31 In July 2016, DMP advised the ANAO that it:

Verifies petroleum production and sales in two ways. The Production Accounting System (PAS) audit35 verifies the quantity produced and sales volumes of domestic gas, condensate, LNG and LPG products. This type of audit is a desktop comparison between what is reported by NWS operators internally and to DMP.

The accuracy of this desktop audit is determined by meter uncertainty. The meter uncertainty, and therefore the accuracy of the production quantities, can be verified by metering verification. Testing of meters could be carried out annually, but at the moment is more sporadic.

3.32 During the ANAO performance audit, DMP also advised the ANAO that the NWS operator engages third parties to test the accuracy of meters in the NWS area every three months.36 In support of this, DMP provided technical reports of some of the tests conducted during 2015. DMP further advised that it normally witnesses this testing on an annual basis, however an officer was not able to witness the testing during 2015 due to ‘operational issues’.37 Table 3.1 provides a summary of the testing observed by DMP since 2005. In July 2016, DMP advised the ANAO that:

The Royalties Branch of DMP intends to formalise, through a memorandum of understanding, the current arrangement that is in place with the Petroleum Division of the DMP [which schedules and undertakes the metering testing] with regards to the frequency and performance of the:

- metering Accuracy Verification Testing (AVT) and reporting to the Royalties Branch; and

- frequency of Production Accounting System (PAS) audits and reporting to the Royalties Branch.

Table 3.1: Reports conducted over the twelve-year period (2005–2016)

|

Report type |

No. of reports |

Coverage, comprehensiveness, and purpose of report |

|

Domestic Gas Accuracy Verification Tests Report Years: 2005, 2007 to 2009, 2011, 2012, 2014, 2016. |

8 |

These tests are to check the accuracy of the measurements of gas flow and quality at the meter station/custody transfer point connecting the Karratha gas plant to the major gas supply pipelines for Western Australia. A complete verification process was not witnessed by DMP in any year. The reports note that all aspects of the calibration processes for each meter station could not be witnessed within the allocated visiting time, but that key calibration functions were witnessed. DMP has advised that its domestic gas accuracy verification test reports are conducted more frequently due to: the complexity of metering; because it considers the accuracy of the metering facilities to be of high risk where such tests are not frequently conducted; and meter errors exceeding tolerance levels would have a large dollar impact. |

|

LNG and Condensate Shore to Ship Loading Operations Report Year: 2015. |

1 |

Loading of one shipment of LNG and one shipment of condensate was observed to test the accuracy of the amount loaded and its composition. The LNG and condensate loading reports were both compiled over the course of four days. For condensate, the volume measurement process was observed for one of the two condensate tanks on-shore. LNG: DMP notes that the LNG checks are complex but does not consider that more frequent checks are necessary because volumes are based on LNG tanker measurement and because loaded amounts reflect what is listed in commercial agreements and delivered to buyers. Condensate: DMP considers that this frequency of reporting is sufficient because the calibration of shore tanks and vessel tanks is valid for 10 to 15 years. |

|

Crude Oil Report |

0 |

No reports related to the loading of crude oil, or meter verification at the Okha platform or the port of Dampier. |

|

Butane Report / Propane Report |

0 |

No reports related to the loading of butane or propane at the port of Dampier, or meter verification. |

Source: ANAO analysis of reports supplied by DMP.

3.33 As the table shows, the majority of testing observed by DMP was of domestic gas, with little coverage of other products. The domestic gas testing observed is generally restricted to a check of measurement accuracy at the final ownership transfer points. Of the other NWS products, DMP observed LNG and condensate being loaded from shore to ship once since 2005, while LPG (propane and butane) and crude oil were not observed at all. In the case of the condensate testing, this involved observing the use of ‘dip-tape’38 to measure the volume of one of two tanks on a ship being loaded for export.

3.34 Between 2005 and 2014, DMP observations of accuracy verification testing inspections highlighted some issues with the operation of meters, including some cases where redundancy meters were not functioning. In one case, a secondary meter was out of service for five years following its identification. Unrectified metering issues can compromise the integrity of production measurement. These matters need to be addressed promptly to have assurance that production is being accurately recorded for royalty purposes.

3.35 No checking is undertaken at meters off-shore in the NWS title areas. This means that DMP does not obtain any assurance about the accuracy of meter readings at off-shore wells and platforms.39 DMP is therefore not in a position to verify that final (refined) petroleum products have been accurately back-allocated to the place of extraction using independently verified data. Based on ANAO consultation with the ATO and some state departments, testing of off-shore meters for compliance purposes is not common practice in Australia. However, such testing is used as a key control in comparable international jurisdictions such as Norway and the United States of America.

3.36 In addition, there is little assurance gained over the calculation methodology coded in the NWS operator’s production accounting system (PAS) for back-allocating final products to their source well/field.40 While DMP has documented the key measuring points in the back-allocation process, it has only conducted logic tests of whether:

- final PAS production figures reported for each petroleum product reflected reported loadings and inventory changes; and

- production volumes in the PAS matched the monthly production data submitted to DMP for one month in each respective year.

3.37 This testing was undertaken using one month’s production data in the years 2015, 201141 and 2010, and found no discrepancies.

3.38 A number of significant additions and upgrades to the PAS system occurred between 2005 and 2014, including the: replacement of an off-shore platform and the addition of fields and facilities. Given these changes, verification that the calculation equations correctly allocate production volumes to extraction locations is important for the accurate calculation of royalties. The reports provided by DMP do not state that the PAS back-allocation calculation equations have been verified.

3.39 Similarly, the PAS is used more broadly than the NWS and the reports DMP have provided to the ANAO did not explicitly address whether assurance is obtained that the PAS only reports, and doesn’t exclude, production from the NWS area.

3.40 Meter readings and back-allocation calculations are the basis for the production data in the PAS. This data is extracted from the PAS to generate the production figures reported to DMP for royalties. Given that:

- independent verification and testing of metering is sporadic; and

- no assurance is gained that all (and only) NWS area production is reported by PAS and production is correctly back-allocated to extraction locations;

the current approach is only capable of providing an insight into potential problem areas rather than assurance that reported quantities are accurate each year.

Recommendation No.3

3.41 The Department of Industry, Innovation and Science work with the Western Australian Department of Mines and Petroleum to implement improved controls for the verification of North West Shelf petroleum production and sales, to provide increased assurance that the approach taken when allocating production to fields is complete and accurate.

Department of Industry, Innovation and Science’s response: Agreed.

3.42 In documenting the assurance framework, the department will work with WA DMP to assess the adequacy of controls, including those managed by the NWS operator, to ensure the risks over verification are adequately managed. Where the need for additional assurance processes are identified, appropriate action will be taken by relevant parties.

4. Costs deducted from the gross well-head value

Areas examined

The ANAO examined whether the amounts subtracted from sales receipts to calculate the amount of royalty payable are likely to be accurate and valid.

Conclusion

The amount of royalty paid is reduced by producers being permitted to claim significant deductions in areas such as operating costs and the depreciation of capital assets. There has been limited scrutiny of the claimed deductions. Some errors in the claiming of deductions have been identified, but the available evidence indicates that the problems are much greater than has yet been quantified.

Areas for improvement

The ANAO made one recommendation to improve the future approach taken to examining claimed deductions, as well as to thoroughly scrutinise past claims.

How much have producers claimed as a deductions in the calculation of the amount of royalty to be paid?

More than $5 billion worth of deductions were claimed against petroleum revenues in the 18 months to December 2015. These deductions were claimed under the broad categories of: operating costs; depreciation; cost of capital; depreciated asset disposal; crude oil excise; condensate excise; processing tariffs and joint venture participant costs.

4.1 The 2006 consolidated Royalty Schedule has been the vehicle used to define costs that may be claimed as deductions for royalty purposes. As was shown in Figure 1.2, deductions can be claimed for costs incurred in moving petroleum from a valve at the top of a well to a defined point of valuation (post-well-head costs). This includes the costs of processing, storing and transporting petroleum from each production well to an operating platform and on to an inlet (if piped) or discharge point (if shipped) at the treatment plant on Burrup Peninsula in Karratha, Western Australia.

4.2 The Schedule establishes monthly limits on the total amount of post-well-head expenditure that may be claimed as deductions, with any expenditure above those limits carried forward to the next month. With some adjustments for fuel gas, deductible costs can vary up to a limit of 50 per cent of the gross value of production for oil projects or 90 per cent of the gross value of production for gas projects for each royalty period.

4.3 Table 4.1 provides a summary of the cost categories nominated as deductible, in the Royalty Schedule.

Table 4.1: Summary of deductable cost categories in the Royalty Schedule

|

Cost category |

Comprises |

|

Operating costs |

Examples include costs of operating platforms in petroleum fields, environmental monitoring activities and some on-shore costs. |

|

Petroleum produced but not sold |

The value of gas used as fuel and the value of petroleum lost, used (excluding fuel gas), flared or vented. |

|

Depreciation of capital assets |

Examples include helidecks, platform mooring, storage tanks, and payments towards town and community services. |

|

Decommissioning costs |

Arms-length costs associated with removing post-well-head capital assets after petroleum recovery is completed. |

|

Joint venture participant costs (where additional to NWS operator costs) |

An agreed portion (13 per cent) of post-well-head costs associated with production, processing, storage, transportation or marketing of petroleum from the licence areas (including some insurance costs). |

|

Processing tariff |

The post-well-head component of any processing tariff incurred by the NWS producers for the use of infrastructure they don’t own in the NWS royalty area (provided that there is no overall increase in total post-well-head cost if the tariff had not applied). |

|

Liquefied natural gas shipping costs |

Operating and capital costs associated with project-owned LNG vessels including, for example, an annual capital charge for each vessel. |

Source: ANAO analysis of the Royalty Schedule.

Is adequate information obtained on claimed deductions to inform compliance activities?

Any costs that are claimed as deductions by NWS producers reduce the royalty amount that is payable. DIIS relies on DMP’s compliance work and does not undertake any further activities to gain assurance that only eligible deductions have been claimed. DIIS has not agreed with DMP the deductions data that DMP should obtain and the information obtained is not sufficiently detailed to be adequately assured that only valid deductions are being claimed.

4.4 During the audit, DMP provided the ANAO with a monthly data report it receives from the NWS operator that aggregates figures across the various cost categories identified in Table 4.1 above. Another document obtained from DMP suggests that, in the past, reporting has included some more detailed information such as:

- movements in non-commissioned capital asset expenses, deductions relating to commissioned capital assets and, capital asset retirements; and

- operating expenditure cost items by field and facility and the percentage of those costs that are claimed to be post-well-head.

4.5 Given the actual and potential size of allowable deductions being claimed by NWS producers on a monthly basis, it would be reasonable to expect DIIS, in consultation with DMP, to have developed and implemented a robust compliance strategy and included strong controls around verifying the validity of deductions being claimed. In this regard, DIIS has not agreed any procedures with DMP or sought to obtain any direct assurance, on behalf of the Australian Government, that deductions are being claimed correctly. DIIS considers that this is not its role, and advised the ANAO that validity of deductions is a task delegated to DMP as the day-to-day administrator and that DIIS did not undertake additional verification of claimed deductions against the terms of the Royalty Schedule. As such, the Australian Government’s interests are not being adequately protected.

Does the Royalty Schedule clearly permit all of the claimed categories of deductions?

The Royalty Schedule does not permit all the deductions currently being claimed. On this basis, the ANAO has doubts about the eligibility of deductions claimed for the cost of debt and equity funded capital, excise paid on crude oil and excise paid on condensate.

4.6 As discussed in paragraph 3.2, the Royalty Schedule sets out parameters for the calculation of the well-head value including deductions. It was developed by DMP and is not a public document. Notably, the Schedule allocates responsibility to the NWS operator to review the costs and percentages that apply to deductions and to seek agreement to changes from the WA state minister. In addition, under the Royalty Act, DIIS and DMP have responsibilities, as follows:

- the state minister is assigned responsibility for negotiating or determining the well-head value (including deductible costs); and

- the state minister is required to comply with directions issued by the Joint Authority, on which the Australian government minister has power to decide matters (as a decision of the Joint Authority), where there is disagreement.

4.7 Based on DIIS records and advice to the ANAO only one Joint Authority direction was identified. It was dated 12 August 1993 and was issued under legislation that was repealed in 2006.42 The instrument directs that deductions be allowed for the cost of debt and equity funded capital and for excise paid on crude oil.

4.8 This direction is not reflected in the 2006 consolidated Royalty Schedule. For example, in regard to the cost of capital deduction, the merging of Royalty Schedules in 2006 resulted in key parts of the deduction section being omitted from the consolidated Schedule. The remaining clause no longer identifies that it is an allowable deduction. Similarly, no deductions for crude oil excise are mentioned in the Royalty Schedule.

Condensate excise deductions

4.9 Notwithstanding that the current Royalty Schedule does not explicitly provide for the deductibility of any form of excise, data supplied by DMP indicates that condensate43 excise deductions totalling $705.1 million were claimed for the 18-month period 1 July 2014 to 31 December 2015. The related reduction in royalty revenue as a result of those deductions was $88.1 million.

4.10 The charging of excise on the value of condensate production was first introduced by the Australian Government in 2008, with the relevant announcement noting that:

As part of this measure, the Australian Government will provide the Western Australian (WA) Government with ongoing compensation for the loss of shared Offshore Petroleum Royalty revenue resulting from imposing the Crude Oil Excise on condensate. This arises because Crude Oil Excise payments are a deductible expense for calculating the Offshore Petroleum Royalty.

An initial payment of $80 million will be paid to the WA in 2007–08, with payment in subsequent years adjusted to equal the impact of removing the condensate exemption on royalty payments to Western Australia.44

4.11 Given the intended policy position that condensate excise be deductible, the ANAO sought advice from DIIS on where the Royalty Schedule provides for such deductions. DIIS was not able to identify such a clause. In April 2016, DIIS advised ANAO that the deductibility of payments made under the Excise Tariff Act 1921 was provided for by the 12 August 1993 direction and that:

In this regard we envisage that the deductibility of these costs is implicitly captured by the definition of post well head costs in the Schedule as outlined below:

“post well head costs” means:

(a) (i) such operating costs incurred between the well-head and the point of valuation as are agreed or determined to the extent that such costs are actually and necessarily incurred;

4.12 The direction instrument expressly directs that excise payable on crude oil is to be deductible, but does not refer to excise paid on condensate. Further, to the extent that the existing Royalty Schedule defines post-well-head costs, it lists them in a schedule to the Royalty Schedule or requires an agreement or a determination to be made. DIIS’ view is also inconsistent with the approach taken by DMP in relation to similar payments to government. For example, in July 2013, DMP advised the NWS operator that carbon tax payments were not an allowable deduction from the well-head, noting that:

“post well-head costs” are set out extensively in the definition of that term in item 1 of the Royalty Schedule. These do not include costs under or associated with the Clean Energy Act 2011 or any other taxing statute. … There is nothing in the Royalty Schedule to support a petroleum royalty reduction… for carbon tax related expenses.

Is there adequate scrutiny of claimed deductions?

There has not been adequate scrutiny of claimed deductions. Of note:

- it has been 17 years since there has been an audit of the NWS operator’s control procedures for royalty calculations;

- there have been recent annual reviews by DMP of cost deductions, but this work has involved quite limited testing and there has been no major, comprehensive examination since 2006. The limited work that has been undertaken has, nevertheless, highlighted potential problem areas. But little action has been taken in response to those findings; and

- more recently, the Western Australian Government commissioned consultants to undertake some data analytic procedures on capital and operating expenditure items claimed by NWS producers. That work, although quite limited in scope, has also provided some valuable insights. The report’s findings indicate that there is a risk of significant errors in the claiming of deductions. To date, there has been agreement that a net amount of $8.6 million in royalties has been underpaid requiring adjustments, but many matters identified by the consultants have not yet been addressed, and a comprehensive review of claimed deductions has not been commissioned, such that the full extent of any errors in the calculation and payment of royalties has not been quantified.

1999 examination of control procedures

4.13 In June 1999, the NWS operator’s external auditor performed procedures, requested by the NWS operator in relation to the royalty, over the controls supporting the calculation of deductions calculations for January, February and April 1998. The findings were that, subject to noted exceptions, the calculation methods were in accordance with the Royalty Schedules45 and the calculations and procedures were performed correctly. During the course of this ANAO performance audit, DMP provided the ANAO with a copy of the Report of Factual Findings, but it was unable to locate a copy of the appendices setting out the procedures employed and the nature of the exceptions.46

4.14 DMP advised the ANAO that it had met with the NWS operator in June 1999 to discuss the factual findings and that it had ‘expressed concern that there was not an indication of internal controls testing’.47 This led to DMP sharing (with the NWS operator) the cost of an audit of the NWS operator’s control procedures in relation to royalty deduction calculations for January and February 1998. The purpose of this work was to express an opinion about the effectiveness of those control procedures in place at that time. The September 1999 report stated that:

- the NWS operator had maintained, in all material respects, effective control procedures in relation to the calculations for January and February 1998;

- the internal controls structure, within which the audited control procedures operate, was not audited and no opinion was expressed as to its effectiveness; and

- any projection of the evaluation of control procedures to future periods was subject to the risk that the procedures may become inadequate because of changes in conditions, or the degree of compliance with them deteriorating.

4.15 DMP has not had any such further audits of control procedures undertaken in the subsequent 17 years.

Annual reviews by the state department of cost deductions

4.16 DIIS does not seek to obtain monthly deductions data from DMP. In April 2016, DIIS advised the ANAO that an assessment of the validity of claimed deductions is the responsibility of DMP and that it does not undertake additional assessment of claimed deductions against the terms of the Royalty Schedule. Rather, DIIS relies on work undertaken by DMP.

4.17 DMP describes this work as being a ‘royalty cost audit’. But the work is not conducted in accordance with the Australian Auditing Standards.48 During the ANAO performance audit, three reports were provided to the ANAO outlining the key findings of DMP’s review of deductions claimed for the calendar years: 2012, 2013 and 2014. The 2012 and 2013 reports examined a single month, with small sample sizes (the ten highest value assets capitalised in that month being reviewed along with the ten highest value operating cost items) and reliance on assurances from the NWS operator (including that the correct post well-head percentages were used for operating costs).

4.18 Each of the 2012, 2013 and 2014 reports highlighted potential problem areas relating to deductions.

4.19 DMP’s 2012 review identified problems with the NWS operator’s systems, including incorrect:

- useful life periods being used in the NWS operator’s depreciation system leading to under-claiming of deductions; and

- coding of depreciation methods, leading to the wrong depreciation method being used.

4.20 Importantly, the 2012 report also noted problems with how some assets were categorised in the NWS operators accounting systems, including incorrect deduction percentages being applied to expenses. In this regard, the Royalty Schedule assigns a deductible percentage to a range of operating and capital expenses that partly or fully relate to non-deductible pre-well-head (exploration and extraction) expenses and partly or fully to deductible post-well-head (transport and processing) expenses. A correct categorisation (as pre-or post-well-head, or part thereof) in the NWS operator’s accounting systems is required for the accurate calculation of deductions. The balance between pre-and post-well-head may also change over time depending on how assets are used.

4.21 DMP’s 2013 cost report outlined that deduction percentages for one of the NWS fields may no longer accurately reflect the split between pre and post-well-head costs, noting:

There is also an indication that the current approved NRA Royalty Deductions Schedule requires to be reviewed as some cost elements have changed their PWH [post-well-head] % greater than 5% requiring a review of these elements.