Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Bank Prudential Supervision

The objective of this follow-up audit was to assess the extent to which APRA has implemented recommendations regarding the supervisory framework and cross-border banking made in ANAO's 2001 audit of bank prudential supervision.

Summary

Background

The Australian Prudential Regulation Authority (APRA) was established on 1 July 1998 to promote prudent behaviour by authorised deposit-taking institutions (including banks), insurance companies, superannuation funds and other financial institutions. APRA aims to protect the interests of depositors, policy holders and members through development and enforcement of prudential standards and practices focused on the quality of an institution's systems for identifying, measuring and managing its various business risks.

APRA is responsible for supervising the 52 banks authorised under the Banking Act 1959 (Banking Act) to operate in Australia. Of these, there are 14 Australian banks, 10 foreign bank subsidiaries and 28 foreign bank branches. 1

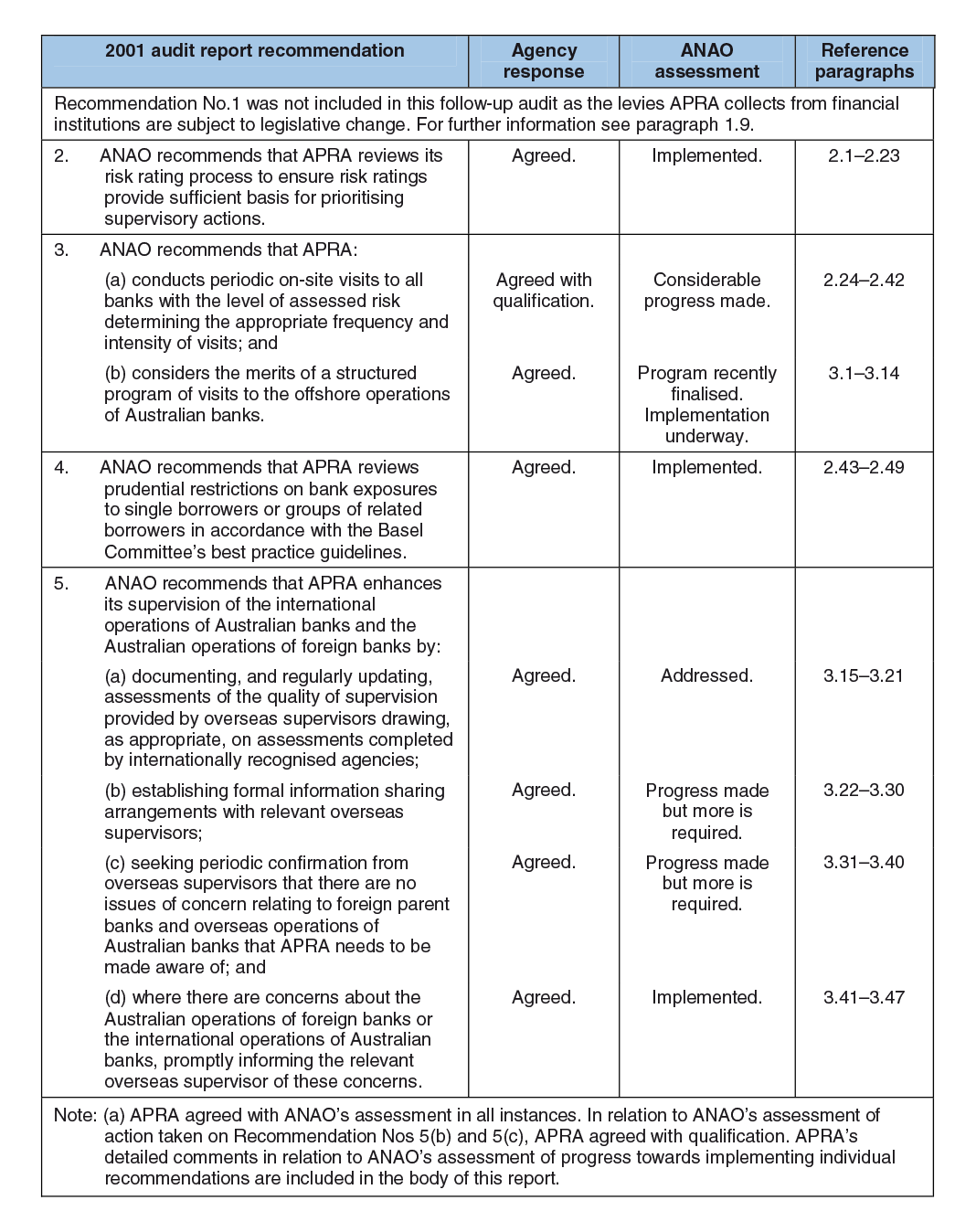

In 2001, the Australian National Audit Office (ANAO) completed a performance audit on APRA's prudential supervision of banks (Audit Report No.42 2000–01 Bank Prudential Supervision). The audit report made one recommendation concerning the levies APRA collects from supervised financial institutions. This recommendation was not followed-up in this audit report as legislation changing the determination of these levies was introduced into Parliament on 9 December 2004. The audit report made a further four recommendations directed at improving APRA's bank prudential supervision framework and its supervision of cross-border banking operations. APRA agreed with qualification to one part of one recommendation and agreed to all parts of the other three recommendations.

Audit objective

The objective of this follow-up audit was to assess the extent to which APRA has implemented recommendations regarding the supervisory framework and cross-border banking made in ANAO's 2001 audit of bank prudential supervision.

Audit conclusion

APRA has also implemented the recommendation regarding concerns it may hold about the Australian operations of foreign banks or the international operations of Australian banks, having made efforts to contact overseas supervisors regarding these concerns. Some progress has been made in relation to the other recommendations about supervision of cross-border banking, although ANAO considers that further progress is required in relation to:

-

completing implementation of the structured offshore review program that was finalised in April 2005;

-

pursuing formal information sharing arrangements with overseas supervisors; and

-

APRA supervisors being aware of any issues of concern relating to the parents of foreign banks and overseas operations of Australian banks.

Table 1: Progress in implementing recommendations from the 2001 audit report(a)

Source: ANAO analysis.

APRA Response

APRA's response to the section 19 proposed audit report was as follows:

APRA is pleased that the ANAO, in this follow-up audit, has recognised the considerable amount of effort APRA has, over recent years, devoted to improving the robustness and consistency of our supervision tools, methodologies and approaches. This has been a particular focus of the new Executive Group which was appointed to APRA in mid-2003.

APRA believes that through the enhancements to our supervisory armoury—such as the PAIRS [Probability and Impact Rating System] rating system, the new APRA-wide supervision framework and our activity tracking systems—we have significantly improved APRA's capacity to deliver more vigilant, vigorous and effective prudential regulation, and in a consistent manner across regulated institutions. These enhancements cover not only banks, to which this specific audit report relates, but all institutions supervised by APRA.

This improvement process must, of course, be an on-going one. APRA operates in an ever-changing legislative, financial and operational environment and our supervisory tools need to evolve with developments affecting the institutions that we regulate. They will also evolve to reflect changes in supervision practices and technology. APRA's Executive Group is committed to ensuring that our armoury remains at the forefront of supervisory best practice.

We welcome the report's findings that APRA has fully implemented a number of the recommendations in the original report and is well on the way to implementing the other recommendations. Those recommendations which APRA considered most important to its supervisory effectiveness received the highest priority. Now that APRA has been able to build up staff resources, we are making good progress on the other recommendations.

However, in one area—establishing formal information-sharing arrangements with our supervisor counterparts overseas—progress is not fully in APRA's hands. Progress also depends on the willingness and capacity of other supervisors, given their own legislative and confidentiality constraints, to agree to our requests. That said, we continue to build our network of contacts within the international supervisory community and, even if formal arrangements are not in place, we will, as we have for many years now, maintain an open dialogue with our counterparts and take every opportunity to discuss issues of mutual interest.

APRA will report on its attention to the findings of this ANAO audit in its 2004–05 Annual Report.

Footnotes

1 The Banking Act distinguishes between foreign-owned bank branches and foreign-owned bank subsidiaries. Under the Banking Act, foreign bank subsidiaries are subject to the same legislative and prudential requirements as Australian owned banks. This allows them to take retail deposits from members of the public. In comparison, foreign bank branches are subject to similar requirements but the home country prudential supervisor governs their solvency. As a consequence, they are exempt from certain prudential requirements, including capital adequacy, and are prohibited from undertaking certain types of retail deposit business.

2 During an on-site visit, APRA seeks to gain an understanding of a specific bank's business developments, changes to risk management systems and processes, and changes to operational controls. In addition, APRA assesses whether a bank's risk management plans are both appropriate and followed in practice.