Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Australian Wool Innovation

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Rural research and development corporations (RDCs) help drive agricultural innovation and improve profitability, productivity, competitiveness and long-term sustainability of Australia's primary industries. RDCs are funded by industry levies and payments from the Australian Government through Statutory Funding Agreements (SFAs).

- This audit examined whether Australian Wool Innovation (AWI) is effectively complying with the SFA.

Key facts

- AWI is a not-for-profit company established under the Wool Services Privatisation Act 2000. It is an industry-owned RDC.

- In October 2020, AWI and the Australian Government entered into a 10-year SFA, which contains five performance principles that AWI must ‘act in accordance with and uphold’.

What did we find?

- AWI is largely effective in meeting the requirements of the SFA.

- AWI’s management and governance arrangements are largely appropriate.

- AWI is largely effective in applying the performance principles under the SFA.

- AWI’s arrangements for the management of funds are largely effective.

What did we recommend?

- There were six recommendations to AWI aimed at improving: board performance reviews; the development and maintenance of a balanced portfolio; measurement and reporting on improvements in administrative efficiency; arrangements to determine eligible research and development (R&D) processes for preparing matching payment claims; and risk management.

- AWI agreed to six recommendations.

$3.6bn

Total value of Australian wool exports in 2021–22.

25%

Greasy (unprocessed) wool sold on the world market is produced by Australia.

$57.7m

Levy and matching payments received by AWI via the SFA in 2021–22.

Summary and recommendations

Background

1. Australian Wool Innovation Limited (AWI) is a not-for-profit company established under the Wool Services Privatisation Act 2000 (Wool Services Privatisation Act). It is one of 10 industry-owned rural research and development corporations (RDCs) in Australia.1 AWI is a public not-for-profit company limited by shares and owned by AWI shareholders.2 Its purpose is to:

- enhance the profitability, international competitiveness and sustainability of the wool industry;

- increase value, demand and market access for Australian wool; and

- invest in research, development, extension and marketing initiatives whilst collaborating and consulting with stakeholders.3

2. AWI is governed by a Board of Directors (board), which appoints a Chief Executive Officer (CEO). As well as the Wool Services Privatisation Act, AWI is subject to the requirements in the Corporations Act 2001, Australian Charities and Not-for-profits Commission Act 2012 and other legislation applicable to companies and not-for-profit entities. As a non-government entity, AWI is not subject to the requirements of the Public Governance, Performance and Accountability Act 2013 and associated rules.

Rationale for undertaking the audit

3. RDCs are a vehicle through which the Australian Government and primary producers co-invest in research and development for the benefit of industry and regional communities. RDCs help drive agricultural innovation and seek to improve the profitability, productivity, competitiveness and long-term sustainability of Australia’s primary industries.

4. On 20 October 2021, the Senate Rural and Regional Affairs and Transport Legislation Committee wrote to the Auditor-General requesting an audit be conducted on AWI. The Joint Committee of Public Accounts and Audit identified the topic as an audit priority of the Parliament for 2022–23.

5. This audit provides independent assurance to Parliament on AWI’s compliance with the requirements of the Statutory Funding Agreement (SFA), including in relation to governance and management, application of the performance principles, and the management of funds.

6. This is the first Australian National Audit Office (ANAO) audit of AWI, or any industry-owned RDC.4 This audit was conducted under paragraph 18B(1)(b) of the Auditor-General Act 1997 (Auditor-General Act). AWI is a Commonwealth partner as defined in subsection 18B(2) of the Auditor-General Act.

Audit objective and criteria

7. The audit objective was to examine whether AWI is effectively meeting the requirements of the SFA.

8. To form a conclusion against the objective, the following high-level audit criteria were adopted.

- Does AWI have appropriate management and governance arrangements?

- Is AWI effectively applying the performance principles under the SFA?

- Is AWI effectively managing funds in accordance with the SFA?

9. The audit focused on AWI’s compliance with the requirements under the SFA. The audit did not examine:

- merits of decisions made by the AWI board;

- the effectiveness of the programs, projects or investments undertaken by AWI; and

- the effectiveness of the Department of Agriculture, Fisheries and Forestry’s (DAFF) role in overseeing the operations of and administering the funding for AWI.

Conclusion

10. AWI is largely effective in meeting the requirements of the SFA. It has been making improvements to its governance, stakeholder engagement and monitoring and evaluation arrangements; however, some of AWI’s polices and processes need to be updated to align with the current SFA.

11. AWI’s management and governance arrangements are largely appropriate. AWI details its governance arrangements in policies, which are regularly reviewed. AWI assesses the skills and performance of its board annually. The skills assessed largely align with the skills required by the SFA, except for skills relating to public policy and administration. AWI had not established policy and guidance for its directors and officers regarding the SFA requirement to not engage in agri-political activity. AWI has established a risk management policy and framework and prepares risk profiles for each of its programs and support and administrative areas, which are regularly reviewed. AWI has established a strategic plan that aligns with and has regard to the SFA performance principles and relevant guidelines. AWI has appropriate arrangements to address issues identified in performance reviews.

12. AWI is largely effective in applying the performance principles under the SFA. AWI engages with stakeholders and is undertaking cross-industry and cross-sectoral collaboration. AWI has not established a research, development and extension (RD&E) investment profile, against which the balance of the portfolio can be monitored. The investment portfolio does not outline the planned proportion or target of projects against AWI’s strategic plan’s priorities, government and industry priorities, or by risk and return. AWI has established a measurement and evaluation framework to track and report on outcomes of RD&E and marketing activities and is measuring and demonstrating improvement in governance. It is not effectively monitoring or reporting on improvements in administrative efficiency.

13. AWI’s arrangements for the management of funds are largely effective. AWI has policies for spending funds and has established largely effective processes for approving projects and purchase orders in accordance with its financial delegations. AWI does not have a documented control framework to provide visibility over the effectiveness of its processes and controls. AWI has not established a methodology for calculating the proportion of eligible R&D for projects. The terminology and approach used by AWI in its matching payment claims differs from year to year as well as differing from the terminology and approach used by DAFF. There are substantial differences between the R&D excess amounts listed in AWI’s matching payment claims and the data in DAFF’s systems. AWI is not managing risk for high-risk and high-value projects in accordance with its Risk Management Framework. AWI’s annual reports comply with the SFA requirements. It publishes plans, reports, priorities and key information about its activities.

Supporting findings

Governance and management

14. AWI’s governance arrangements largely align with ASX Corporate Governance Principles and Recommendations. AWI details its governance arrangements in policies and protocols, which are regularly reviewed. AWI’s board meeting records are largely complete and it assesses the skills and performance of its board annually. The skills assessed largely align with the skills required by the SFA, except for skills relating to public policy and administration. AWI has established a code of conduct and probity policies. AWI has established a risk management policy and framework. It prepares risk profiles for each of its programs and support and administrative areas, which are reviewed by the Audit and Risk Committee every six months. (See paragraphs 2.3 to 2.61)

15. AWI has established a strategic plan for 2022–25. The strategic plan is accompanied by an annual operating plan that provides a detailed outline of activities under individual programs. AWI consulted with its key stakeholders on the development of its 2022–25 Strategic Plan. The strategic plan aligns with and has regard to the SFA performance principles and relevant guidelines. (See paragraphs 2.62 to 2.70)

16. AWI has arranged its Reviews of Performance (ROP) and Annual Performance Meetings with DAFF in accordance with the SFA and publishes its progress in implementing ROP recommendations on the ROP Implementation Portal. AWI has implemented recommendations from other independent reviews including the WoolPoll Review and the Wool Selling Systems Review. (See paragraphs 2.71 to 2.85)

Performance principles

17. AWI’s consultation and communication approaches, in place as at March 2023, largely align with DAFF’s best practice guide principles and industry-specific guidance. AWI has established stakeholder consultation forums and commissions an annual survey to seek feedback from woolgrowers. AWI engages with stakeholders to identify RD&E priorities and activities. AWI is undertaking cross-industry and cross-sectoral collaboration to address shared challenges and draw on experience from other sectors. (See paragraphs 3.3 to 3.32)

18. AWI has established arrangements to monitor and report on investment against its strategic portfolios and government and industry strategic plans and priorities. It has established arrangements to monitor and report on the collaboration status of its projects. While AWI identifies the balance of risk and return for its projects, this information is not provided to the board to support oversight and inform investment decision-making. AWI has not established an RD&E investment profile, against which the balance of the portfolio can be monitored. The investment portfolio does not outline the planned proportion or target of projects against AWI’s strategic plan’s priorities, government and industry priorities, or by risk and return. (See paragraphs 3.33 to 3.57)

19. AWI has established a measurement and evaluation framework to track and report on outcomes of RD&E and marketing activities. AWI publishes reports on its progress against annual program targets every six months. AWI’s annual reports are accompanied by performance reports, which provide a high-level summary of AWI’s investments. AWI is measuring and demonstrating continuous improvement in governance. It is not effectively monitoring or reporting on improvements in administrative efficiency. (See paragraphs 3.60 to 3.76)

Management of funds

20. AWI has financial policies for spending funds, which are reviewed. It has established financial delegations and largely effective processes for approving projects and purchase orders in accordance with its financial delegations. AWI’s financial reports and matching payment claims are independently audited. AWI has established arrangements to review its compliance with SFA clauses relating to the management and application of funds. AWI does not have a documented control framework to provide visibility over the effectiveness of its processes and controls. (See paragraphs 4.3 to 4.34)

21. AWI has not established a methodology for calculating the proportion of eligible R&D for projects. AWI’s processes are reliant on examples and interpretations from the 2010–2013 SFA. The terminology and approach used by AWI in its matching payment claims differ from year to year as well as differing from the terminology and approach used by DAFF. There are substantial differences between the R&D excess amounts listed in AWI’s matching payment claims and the data in DAFF’s systems. AWI identifies project risks and mitigations. AWI is not managing risk for high-risk and high-value projects in accordance with its Risk Management Framework. (See paragraphs 4.35 to 4.75)

22. AWI’s annual reports comply with the requirements of the SFA and the Australian Charities and Not-for-profits Commission Act 2012. AWI publishes its annual reports on its website. It publishes documentation required to be made public under the Corporations Act 2001 and the SFA on its website. AWI has also published plans, reports, priorities and key information about its activities. (See paragraphs 4.78 to 4.80)

Recommendations

Recommendation no. 1

Paragraph 2.30

Australian Wool Innovation update its polices, board performance review processes and reporting to include all skills listed in the Statutory Funding Agreement.

Australian Wool Innovation response: Agreed.

Recommendation no. 2

Paragraph 3.58

Australian Wool Innovation develop, implement and maintain a balanced portfolio by:

- establishing an investment profile, which outlines a target proportion of projects against AWI, government and industry priorities and for each risk and return category; and

- monitoring investments and the balance of the portfolio against these targets.

Australian Wool Innovation response: Agreed.

Recommendation no. 3

Paragraph 3.77

Australian Wool Innovation establish performance indicators to measure and report on improvements in administrative efficiency.

Australian Wool Innovation response: Agreed.

Recommendation no. 4

Paragraph 4.50

Australian Wool Innovation improve its arrangements for determining eligible R&D by:

- updating its policies and processes to align with the 2020–2030 Statutory Funding Agreement; and

- establishing methodology outlining how to consistently determine and review the proportion of eligible R&D assigned to projects.

Australian Wool Innovation response: Agreed.

Recommendation no. 5

Paragraph 4.65

Australian Wool Innovation improve its processes for preparing matching payment claims by:

- using consistent terminology that aligns with the terminology used by the Department of Agriculture, Fisheries and Forestry; and

- accurately calculating and recording excess R&D in accordance with the Statutory Funding Agreement 2020–2030 and the Wool Services Privatisation Act 2000.

Australian Wool Innovation response: Agreed.

Recommendation no. 6

Paragraph 4.76

Australian Wool Innovation consistently apply the processes and requirements for project risk management outlined in its risk management framework.

Australian Wool Innovation response: Agreed.

Summary of entity response

Australian Wool Innovation Ltd (AWI) welcomes the review and findings that AWI is largely effective in meeting our requirements under the Statutory Funding Agreement with the Commonwealth.

AWI operates under the principle of continuous improvement and welcome the findings from the ANAO to further strengthen our processes.

AWI agrees to all 6 recommendations.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Program implementation

1. Background

Introduction

1.1 Australian Wool Innovation Limited (AWI) is a not-for-profit company established under the Wool Services Privatisation Act 2000 (Wool Services Privatisation Act). It is one of the 10 industry-owned rural research and development corporations (RDCs) in Australia.5 AWI is a public not-for-profit company limited by shares and owned by AWI shareholders.6 It is established to:

(i) receive funds from the Commonwealth of Australia comprising proceeds from the Wool Levy and contributions by the Government to research and development in relation to the wool industry and account to the Government and Parliament of the Commonwealth of Australia for the expenditure of such funds;

(ii) seek funds from other persons for research and development, innovation and other activities for the benefit of Australian woolgrowers;

(iii) manage funds the Company receives and risks related to the Company’s ongoing expenditure and funding;

(iv) investigate and evaluate the requirements for research and development and innovation in relation to the wool industry;

(v) provide funds for research and development and innovation activities in relation to the wool industry;

(vi) facilitate the dissemination, adoption and commercialisation of the results of research and development and innovation in relation to the wool industry;

(vii) manage, develop and exploit intellectual property from research and development activities, and to receive the proceeds of such development and exploitation;

(viii) provide services to Australian woolgrowers in the interests of the Australian wool industry; and

(ix) engage in any other activities in the interests of the Australian wool industry,

in each case for the benefit of Australian woolgrowers.

1.2 AWI is governed by a Board of Directors, which appoints a Chief Executive Officer (CEO). As well as the Wool Services Privatisation Act, AWI is subject to the requirements in the Corporations Act 2001, Australian Charities and Not-for-profits Commission Act 2012 and other legislation applicable to companies and not-for-profit entities. As a non-government entity, AWI is not subject to the requirements of the Public Governance, Performance and Accountability Act 2013 and associated rules.

AWI’s relationship with the Australian Government

1.3 AWI’s relationship with the Australian Government is outlined in the Wool Services Privatisation Act, associated regulations and an agreement with the Australian Government called the Statutory Funding Agreement (SFA). The SFA outlines AWI’s governance and performance requirements and defines the conditions under which AWI may invest wool levies and government matching payments.

1.4 In October 2020, AWI and the Australian Government entered into a 10-year SFA, which contains five performance principles that AWI must ‘at all times act in accordance with and uphold’.

- Engage stakeholders to identify research, development and extension (RD&E)7 priorities and activities that provide benefits to the industry.

- Ensure RD&E priorities and activities (Marketing Activities and Other Activities) are strategic, collaborative and targeted to improve profitability, productivity, competitiveness and preparedness for future opportunities and challenges through a Balanced Portfolio.

- Undertake strategic and sustained cross-industry and cross-sectoral collaboration that addresses shared challenges and draws on experience from other sectors.

- Governance arrangements and practices to fulfil legislative requirements and align with contemporary Australian best practice for open, transparent and proper use and management of funds.

- Demonstrate positive outcomes and delivery of RD&E and marketing benefits to Levy Payers and the Australian community in general, and show continuous improvement in governance and administrative efficiency.

1.5 The Department of Agriculture, Fisheries and Forestry (DAFF) administers the funding for AWI and monitors AWI’s compliance with the SFA.

1.6 Australia is one of the world’s largest wool producers, producing around 25 per cent of greasy (unprocessed) wool sold on the world market. The value of Australian wool exports in 2021–22 was $3.6 billion. Around 80 per cent of Australia’s greasy wool exports are sent to China for processing.8

AWI funding

1.7 Section 31 of the Wool Services Privatisation Act provides for the Commonwealth to make two categories of payments to AWI, outlined in Table 1.1. This is also detailed in clause 14 of the SFA.

Table 1.1: Categories of Commonwealth payments to AWI

|

Category of payment |

Description |

Calculation of payment |

Activities permitted to be funded |

|

Levy payments (Category A) |

Payments in relation to the wool levy |

Equal to total amount of wool levy received by the Commonwealth |

Research and development; Marketing; and Other Activitiesa |

|

Matching payments (Category B) |

Payments in relation to research and development |

Equal to half of AWI’s eligible research and development expenditure, capped at 0.5 per cent of the Gross Value of Production of the wool industry for the financial year. |

Research and development activities for the benefit of Australian woolgrowers and the Australian community generally |

Note a: The SFA defines Other Activities as ‘activities of AWI (other than Marketing Activities and R&D Activities) that are supported by Levy Payers and shareholders, and that relate to a function for which there is market failure’.

Source: ANAO summary of provisions in the Wool Services Privatisation Act 2000 and SFA 2020–2030.

1.8 The Wool Services Privatisation Act and SFA provide that AWI will pay the Commonwealth for any expense incurred by the Commonwealth in collection, recovery and administration of levy funds.

1.9 Wool that is ‘produced in Australia and sold by the producer, used in the production of other goods, or that is exported [attracts] a levy or charge’.9 The rate of the wool levy is set by wool levy payers, who vote every three years on the amount of levy they will pay for the next three-year period through a legislated poll known as WoolPoll, which is conducted by AWI.10 The current levy rate, elected in WoolPoll 2021 and effective from July 2022, is 1.5 per cent of the sale value of shorn greasy (unprocessed) wool.

1.10 Matching payments are funds paid by the Commonwealth for R&D activities.

1.11 The combined amount for levy payments and matching payments is drawn annually from the Consolidated Revenue Fund via a special appropriation. Levy payments and matching payments comprise the majority of AWI’s revenue. In 2021–22, levy payments were $43.8 million (67 per cent of AWI total revenue) and the matching payments were $13.9 million (21 per cent), with a total of $57.7 million (88 per cent) provided to AWI via the SFA (Table 1.2).

1.12 The SFA also provides for AWI to receive voluntary contributions.11 This is a pathway for AWI to receive funds from investors for the purposes of R&D and marketing. For example, AWI projects that are co-funded by industry receive investment via the voluntary contributions pathway. AWI includes voluntary contributions in ‘sales of goods & services’ in its financial statements (Table 1.2).

Table 1.2: Summary of AWI revenue from 2017–18 to 2021–22

|

Revenue |

2017–18 $’000 |

2018–19 $’000 |

2019–20 $’000 |

2020–21 $’000 |

2021–22 $’000 |

|

Wool levy |

72,479 |

68,077 |

37,773 |

33,634 |

43,756 |

|

Government contributions |

17,870 |

20,801 |

19,971 |

16,584 |

13,931 |

|

Licence fees |

7,321 |

6,789 |

6,583 |

2,881 |

4,829 |

|

Interest |

2,556 |

2,907 |

2,181 |

824 |

520 |

|

Royalties |

1,975 |

1,963 |

1,707 |

1,953 |

1,617 |

|

Sale of goods and servicesa |

35 |

35 |

377 |

247 |

23 |

|

Voluntary contributionsb |

207 |

363 |

443 |

443 |

468 |

|

Rents and sub-lease rentals |

548 |

201 |

100 |

182 |

112 |

|

Other operating revenue |

79 |

14 |

34 |

143 |

17 |

|

Total revenue |

103,070 |

101,150 |

69,169 |

56,891 |

65,273 |

Note a: AWI reports voluntary contributions as part of sale of goods and services in its financial statements. In January 2023, AWI advised that it is planning to report voluntary contributions separately in its financial statements going forward. The table separates voluntary contributions and sale of goods and services.

Note b: Values reflect year of revenue recognition rather than year of receipt.

Source: ANAO summary from AWI annual reports and information provided by AWI.

Rationale for undertaking the audit

1.13 RDCs are a vehicle through which the Australian Government and primary producers co-invest in research and development for the benefit of industry and regional communities. RDCs help drive agricultural innovation and seek to improve the profitability, productivity, competitiveness and long-term sustainability of Australia’s primary industries.

1.14 On 20 October 2021, the Senate Rural and Regional Affairs and Transport Legislation Committee wrote to the Auditor-General requesting an audit be conducted on AWI. The Joint Committee of Public Accounts and Audit identified the topic as an audit priority of the Parliament for 2022–23.

1.15 This audit provides independent assurance to Parliament on AWI’s compliance with the requirements of the SFA, including in relation to governance and management, application of the performance principles, and the management of levies and Australian Government funding.

Audit approach

Audit objective, criteria and scope

1.16 The audit objective was to examine whether AWI is effectively meeting the requirements of the SFA.

1.17 To form a conclusion against the objective, the following high-level audit criteria were adopted.

- Does AWI have appropriate management and governance arrangements?

- Is AWI effectively applying the performance principles under the SFA?

- Is AWI effectively managing funds in accordance with the SFA?

1.18 The audit focused on AWI’s compliance with the requirements under the SFA. The audit did not examine:

- merits of decisions made by the AWI board;

- the effectiveness of the programs, projects or investments undertaken by AWI; and

- the effectiveness of DAFF’s role in overseeing the operations of and administering the funding for AWI.

Audit methodology

1.19 The audit methodology included:

- examining AWI’s documentation, with a focus on documents that relate to its governance arrangements, strategic planning, project management, financial management, and funding expenditure;

- assessing a sample of AWI projects and purchase orders for compliance against the requirements in the SFA and AWI’s policies;

- a site visit to AWI’s office in Sydney to observe a meeting of a key stakeholder forum with peak wool industry representative organisations;

- meeting with relevant AWI staff;

- meeting with AWI’s independent financial statement auditor; and

- meeting with relevant DAFF staff, as required.

1.20 The ANAO received 15 submissions from the public via the citizen contribution facility on the ANAO website.

1.21 This audit was conducted under paragraph 18B(1)(b) of the Auditor-General Act 1997 (Auditor-General Act). AWI is a Commonwealth partner as defined in subsection 18B(2) of the Auditor-General Act.

1.22 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $466,500.

1.23 The team members for this audit were Casey Mazzarella, Se Eun Lee, Hayley Pang, Ben Thomson, Tessa Coy, Bradley Medina and Corinne Horton.

2. Governance and management

Areas examined

This chapter examines whether Australian Wool Innovation (AWI) has established appropriate management and governance arrangements.

Conclusion

AWI’s management and governance arrangements are largely appropriate. AWI details its governance arrangements in policies, which are regularly reviewed. AWI assesses the skills and performance of its board annually. The skills assessed largely align with the skills required by the Statutory Funding Agreement (SFA), except for skills relating to public policy and administration. AWI had not established policy and guidance for its directors and officers regarding the SFA requirement to not engage in agri-political activity. AWI has established a risk management policy and framework and prepares risk profiles for each of its programs and support and administrative areas, which are regularly reviewed. AWI has established a strategic plan that aligns with and has regard to the SFA performance principles and relevant guidelines. AWI has appropriate arrangements to address issues identified in performance reviews.

Areas for improvement

The ANAO made one recommendation for AWI to update its polices and review processes to include all skills listed in the SFA.

The ANAO identified two opportunities for improvement for AWI to set gender diversity objectives and disclose environmental and social risks; and to ensure a complete record of directors’ resolutions is maintained.

2.1 Clause 10.2 of the SFA outlines the five performance principles that AWI is required to meet, one of which is ‘for governance arrangements and practices to fulfil legislative requirements and align with contemporary Australian best practice for open, transparent and proper use and management of Funds’. Chapter 3 examines AWI’s application of the other four performance principles.

2.2 In this chapter the Australian National Audit Office (ANAO) assessed whether AWI has established appropriate management and governance arrangements. Appropriate management and governance arrangements include:

- establishing and maintaining policies that articulate the corporate governance structure and governance arrangements as well as AWI’s responsibilities in accordance with the SFA12;

- maintaining records of key decisions, especially resolutions by the board of directors13;

- establishing an effective risk management framework14;

- establishing and implementing a strategic plan15; and

- establishing arrangements to review performance and address any issues that are identified.16

Does AWI have a fit-for-purpose corporate governance framework?

AWI’s governance arrangements largely align with ASX Corporate Governance Principles and Recommendations. AWI details its governance arrangements in policies and protocols, which are regularly reviewed. AWI’s board meeting records are largely complete, and it assesses the skills and performance of its board annually. The skills assessed largely align with the skills required by the SFA, except for skills relating to public policy and administration. AWI has established a Code of Conduct and probity policies. AWI has established a risk management policy and framework. It prepares risk profiles for each of its programs and support and administrative areas, which are reviewed by the Audit and Risk Committee every six months.

ASX principles and recommendations

2.3 Clause 8.1 of the SFA requires AWI to ‘maintain, implement and regularly review a framework of good corporate governance to ensure proper use and management of [funds]’. The SFA notes that ‘in maintaining the governance framework, AWI should draw on best practice as appropriate’.

2.4 AWI stated that it is ‘committed to governance systems that enhance performance and ensure AWI operates legally and responsibly on all matters and maintains the highest ethical standards’.17 AWI’s 2021–22 annual report explained that, while it is not a listed company, AWI uses the ASX Corporate Governance Principles and Recommendations18:

as guidance in its governance practices to the extent that they are reasonably applicable to AWI’s circumstances as a not for profit entity with charitable objects to act in the best interests of Australian woolgrowers.19

2.5 AWI reported against the ASX Corporate Governance Principles and Recommendations in its 2019–20 and 2020–21 annual reports. From 2022, AWI published a Corporate Governance Statement on its website where it reports its governance arrangements against the ASX Corporate Governance Principles and Recommendations.

2.6 The ANAO reviewed AWI’s statements in its 2020–21 annual report and August 2022 Corporate Governance Statement. AWI’s statements against the ASX principles and recommendations are supported by evidence in AWI policies and practices and, overall, align with the ASX principles and recommendations. Two ASX recommendations were assessed by the ANAO as partly aligning.

- Recommendation 1.5: AWI has not set measurable objectives for achieving gender diversity in the composition of its board, senior executives and workforce generally.

- Recommendation 7.4: AWI does not disclose its exposure to environmental or social risks.

|

Opportunity for improvement |

|

2.7 Setting and disclosing measurable objectives for achieving gender diversity, as well as AWI’s progress towards achieving those objectives, and disclosing AWI’s exposure to environmental or social risks will support AWI’s alignment with the ASX Corporate Governance Principles and Recommendations. |

Corporate governance structure

2.8 AWI has established a corporate governance structure, which is articulated in a suite of corporate governance polices. The corporate governance structure is illustrated in Figure 2.1. Key governance policies that are published on AWI’s website20 include:

- Constitution;

- Board Charter;

- Rules and Procedures Governing the Election of Directors;

- Charter of Committees of the Board;

- Board Nomination Committee Charter;

- Code of Conduct and Business Ethics; and

- Corporate Governance Statement.

2.9 AWI maintains a register of its policies and protocols. The register records the adherence checks; document owner; where the policy is available; how the policy is provided to staff (for example, as part of induction, role or incident specific, etc.); the next review date; review cycle; and approver. The majority (70 per cent) of its policies are reviewed at least every 12 months.

2.10 In March 2021, AWI conducted a review of all company policies, guidelines and protocols to ‘ensure each is current in terms of the dates they are due to be reviewed and the content is still relevant’. The review was presented to the Audit and Risk Committee (ARC), where the minutes indicate that it was received and reviewed.

Board

2.11 AWI’s Constitution empowers the board of directors (the board) to manage and control the business and affairs of AWI. AWI’s Board Charter outlines the functions and responsibilities of the board and management of AWI. The board and its committees meet regularly throughout the year. AWI publishes the number of board meetings held, as well as the number of board and board committee meetings that each board member attended, in its annual report.

Board independence

2.12 The Board Charter states that ‘the majority of directors of the Company will be independent directors, and the Chairperson must be an independent director’.

2.13 AWI stated in its 2021–22 annual report that ‘all directors meet the criteria for independence in accordance with the ASX Corporate Governance Principles and Recommendations’.21 It advised that one director’s tenure exceeded 10 years22 and that ‘an assessment was conducted in conjunction with the Board performance review process and the Board found that the director met the criteria to a high level and was endorsed as an independent director’.

Figure 2.1: AWI corporate governance structure

Source: ANAO summary of AWI corporate structure.

Board committees

2.14 The Constitution provides that the board may establish and delegate any of its powers to committees. AWI has established four board committees:

- Audit and Risk Committee;

- People and Culture Committee;

- Research and Development Committee; and

- Marketing and Product Innovation Committee.23

2.15 The committees are required to meet at least twice each financial year. Each committee is required to report to the board at the first meeting subsequent to each committee meeting. The committees generally hold meetings on the day prior to or the same day as board meetings.

Meeting records

2.16 Section 55-5 of the Australian Charities and Not-for-profits Commission Act 2012 (ACNC Act) requires registered entities to keep written records that correctly record their operations, including meeting minutes. The board and its committees’ meeting records are largely complete, recording the proceedings and resolutions of the board in minutes and approving the minutes at the following meeting.

2.17 The ANAO examined board meeting papers for the period June 2020 to February 2023. Board meetings include a ‘board only session’. No formal minutes are recorded for these sessions. This compromises the completeness of the records of the board’s proceedings and resolutions.

2.18 In October 2021, the board’s deliberations and decisions regarding the establishment of a new senior executive role, Chief Marketing and Innovation Officer (CMIO),24 were not documented in the board’s minutes. There are no records of the board’s deliberations or resolutions regarding the establishment of the CMIO role, nor its responsibilities or remuneration package. Nor are there records of the board’s resolutions regarding the appointment of a candidate to the role.

2.19 AWI advised that the board’s deliberations regarding the CMIO role occurred during board only sessions and via email and ‘were not recorded at the time due to the high level of sensitivity and confidential nature of the topic’.

2.20 AWI provided records of emails between the Chair and directors discussing and refining the position description for the role; updating directors regarding the Chair’s progress negotiating the contract and remuneration package with the candidate; and providing advice that the contract had been signed. The email records do not provide evidence of the board’s resolutions regarding the establishment of the role, its remuneration or appointment of a candidate to the role. AWI acknowledged that the decisions regarding the CMIO role should have been better recorded:

With hindsight the Board acknowledge that this should have been noted in the November 2021 meeting following the appointment of the CMIO and associated changes.

2.21 A full record of the proceedings and resolutions of directors’ meetings, as well as resolutions passed by directors without a meeting, should be captured in minutes. This ensures a complete record of the directors’ resolutions is maintained.

|

Opportunity for improvement |

|

2.22 Recording formal minutes of deliberations and decisions of the board during ‘board only sessions’ and for deliberations via email and other mediums, will provide a more complete and accurate record of the proceedings and resolutions of directors and support compliance with section 55-5 of the Australian Charities and Not-for-profits Commission Act 2012. |

Skills Based Board

2.23 Clause 8.2 of the SFA states that ‘AWI must maintain a Skills Based Board of Directors with the necessary skills and experience to effectively govern AWI’. It defines a skills based board as ‘a board of directors which can demonstrate collective expertise against a range of relevant areas’. The relevant skills required by the SFA are listed in Table 2.1.

2.24 The Constitution states that ‘The Board shall be composed of Directors who collectively possess the skills required to properly discharge its functions’. The Board Charter states that ‘the Board, supported by the [Board Nomination Committee25], will endeavour to ensure that it has, or has access to, the appropriate range of expertise to properly fulfil its responsibilities’. The areas of expertise are listed in Table 2.1.

2.25 The Board Charter states that the board will ‘review the range of expertise of its members on a regular basis and ensure that it continues to have, or have access to, the expertise set out [in the Charter]’. The board commissions a review of its performance annually, which is facilitated by an external adviser.

2.26 Directors are asked to rate their level and currency of knowledge and skill in each of the skill areas (listed in Figure 2.2 and Table 2.1). The individual scores are combined into a single skills matrix to reflect the collective skills and experience the board possesses. The skills matrix is published in the annual report.

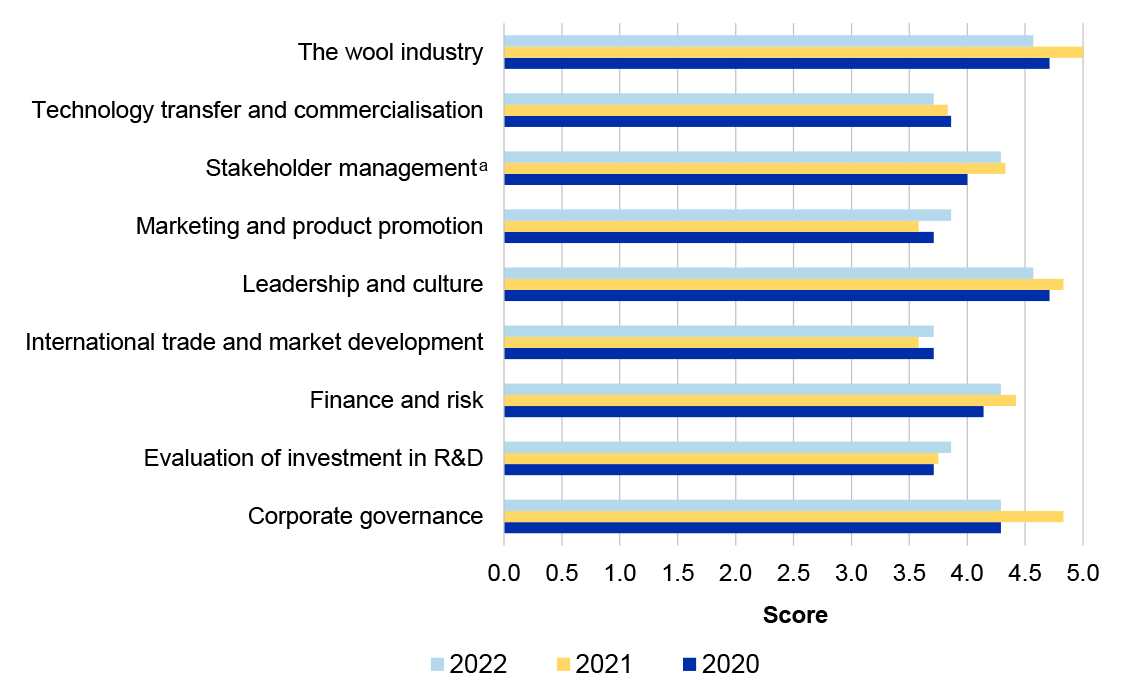

2.27 The ANAO examined the reports from the board performance reviews in 2020, 2021 and 2022. Figure 2.2 illustrates the reviews’ analyses of the board’s collective skills.

Figure 2.2: AWI board skills matrix

Note a: In the 2022 board performance review, this skill was updated to ‘stakeholder management, including government relations’.

Source: ANAO summary of board skills matrices from 2020 to 2022.

2.28 Table 2.1 compares the skills listed in the SFA, areas of expertise listed in the Board Charter and the skills listed in the board annual performance review skills matrix.

Table 2.1: Alignment with SFA skills

|

SFA skills |

Board Charter areas of expertise |

Board performance review skills |

|

Governance, risk and compliance |

Executive management of a corporation |

Leadership and culture |

|

Corporate governance |

Corporate governance |

|

|

Finance, accounting and audit |

Financial and business management |

Finance and risk |

|

R&D, innovation, technology and technology transfer, commercialisation and adoption of R&D |

Oversight and administration of Research and Development |

Evaluation of investment in R&D |

|

Research and development and commercialization of R&D outcomes |

||

|

Technology transfer and commercialisation |

||

|

Science |

||

|

Conservation and management of natural resources |

||

|

Product promotion and marketing (including communications) |

Product promotion and retail marketing |

Marketing and product promotion |

|

Exports and export market development |

Domestic and international market development and international trade |

International trade and market development |

|

Wool industry knowledge, including practical growing and/or production experience |

The Australian wool growing industry |

The wool industry |

|

The wool processing industry in Australia and overseas |

||

|

Public policy and administration |

No corresponding area of expertise included in Board Charter |

No corresponding skill included in board performance review skill matrix |

|

No corresponding skill required by the SFA |

No corresponding area of expertise included in Board Charter |

Stakeholder managementa |

Note a: In the 2022 board performance review, this skill was updated to ‘stakeholder management, including government relations’.

Source: ANAO comparison of SFA, AWI Board Charter and AWI Board performance review skills lists.

2.29 The Board Charter areas of expertise and board performance review skills largely align with the skills required by the SFA. The SFA skill ‘public policy and administration’ is not included in either the Board Charter’s areas of expertise or the performance review skills. AWI is not assessing or reporting on whether its current or potential directors collectively possess this skill.

Recommendation no.1

2.30 Australian Wool Innovation update its polices, board performance review processes and reporting to include all skills listed in the Statutory Funding Agreement.

Australian Wool Innovation response: Agreed.

2.31 This will be included in 2022/23 Annual Report.

Probity

Values and code of conduct

2.32 AWI has established a Code of Conduct and Business Ethics Policy (Code of Conduct), which is published on AWI’s website.26 The Code of Conduct outlines AWI’s values and its expectations for how its directors and officers, managers, employees and contractors and consultants providing services for AWI (AWI People) will carry out their duties and responsibilities. The Code of Conduct outlines AWI’s polices on a range of probity matters including:

- anti-bribery and corruption (including secret commissions or profits);

- giving or receiving gifts; and

- conflicts of interest.

2.33 The Code of Conduct also outlines the procedures for reporting non-compliance.

2.34 AWI has established a Whistleblower Policy, which is published on AWI’s website.27 The policy details the responsibilities of directors, officers, employees and contractors and consultants to ‘help detect, prevent and report instances of suspicious activity or wrong doing’. It outlines:

- how to report suspicious activity or wrongdoing;

- the investigative process; and

- protections for whistleblowers.

2.35 AWI has established a Fraud and Corruption Control Plan. The plan outlines AWI’s approach to fraud and corruption prevention and detection as well as its procedures for responding to detected fraud or corruption.

Gift register

2.36 The Code of Conduct states that ‘all gifts offered to or provided by AWI People must be reported to the Company Secretary’ and that ‘all such gifts shall be recorded in a Gift Register’.

2.37 AWI has maintained a Gifts Register in various forms since 2010. From 2015, AWI managers have been required to answer a monthly survey, which asks if they or any of their staff have received gifts and, if they have, to provide information about the gifts. From November 2020, a question regarding gifts given was added to the survey. The survey does not ask about gifts that were offered but not accepted. The survey results are reviewed and approved by the Company Secretary and manually compiled into the Gifts Register. The Gifts Register does not record gifts that were offered but not accepted or gifts that were given by AWI People. The Gifts Register is not reviewed by the board.

2.38 The gift register for directors is maintained by the Company Secretary and held separately from the Gifts Register. In February 2023, AWI added a standing agenda item for directors to declare gifts and review the director gift register at board meetings. The gift register for directors is not published on AWI’s website.

Conflicts of interest register

2.39 The Code of Conduct states that AWI will ‘keep a register of all actual potential and perceived conflicts of interest reported in accordance with this Code, other than conflicts of interest that are merely trivial’. The Code of Conduct provides that ‘material conflicts of interest and conflicts of interest involving AWI’s directors shall be a standing agenda item at Board meetings’.

2.40 From 2015, AWI managers have been required to answer a monthly survey, which asks if they or any of their staff have interests that require disclosure and, if so, to provide information about the interests. The survey results are reviewed and approved by the Company Secretary and manually compiled into the Executive Interests Disclosure Table and the Staff Conflicts of Interest Register.

2.41 AWI has established a Directors Disclosure of Interests Register. The ANAO examined board meeting records from June 2020 to October 2022. During this period, the board reviewed the Directors Disclosure of Interests Register at all board meetings (excluding out of session meetings).28 Changes to directors’ interests were reported on several occasions and subsequently updated on the Directors Disclosure of Interests Register.

2.42 The CEO report for all board meetings (excluding out of session meetings) included a standing item at which the CEO reported on any new interests that needed to be disclosed by the Senior Executive Group. No new interests were reported to the board during the period reviewed. The Conflict of Interests Register records two entries from the senior executive group during the period reviewed. There is no record of non-director interests being reported to the board.

2.43 The Code of Conduct states that ‘unless the Board determines otherwise, where a director has a conflict of interest, he/she must not be present while the matter is being considered at a Board meeting and must not vote on the matter’. During the period examined, there were three instances of directors noting potential conflicts of interest related to the topic of deliberations during a board meeting or board committee meeting. In one instance, the board committee did not consider that the director had a conflict of interest. In the other two instances, the minutes indicate that the directors left the meeting during the board’s deliberations.

Probity training

2.44 The Fraud and Corruption Control Plan states that ‘AWI regularly provides fraud and corruption training for its employees and directors’. The Code of Conduct states that ‘all AWI group staff are required to complete awareness training on modern slavery key principles’.

2.45 AWI advised that Code of Conduct and Business Ethics training is delivered via an online training course. Staff are required to complete the training annually. AWI provided reports of staff completion of the course, which showed a completion rate of 99.1 per cent in 2020 and 96.5 per cent in 2021.

Agri-political activity

2.46 Clauses 9.1 to 9.5 of the SFA prohibits AWI from engaging in agri-political activity29 or acting as an Industry Representative Organisation.30 AWI has not established arrangements to ensure it does not engage in agri-political activity. AWI confirmed that it ‘currently [has] no formal policies, training documentation or guidelines in relation to not engaging in Agri-political activities’. It explained that not engaging in agri-political activity is ‘part of [its] DNA’ and ‘is discussed during inductions and is well understood by the business’.

2.47 Recent Reviews of Performance (ROP)31 indicate that stakeholders have a negative perception of AWI’s compliance with the SFA’s requirement not to engage in agri-political activity. Despite stakeholder perceptions, neither the 2018 nor 2021 ROP found AWI to be engaging in agri-political activity. The 2021 ROP stated that ‘while there is acknowledgement of the agri-political nature of the industry there was no clear evidence of Board or AWI executive members bringing this into Board decisions’. More information about ROPs is at paragraphs 2.73 to 2.76.

2.48 The Department of Agriculture, Fisheries and Forestry (DAFF) advised that it has not issued any notices requiring AWI to take action to address agri-political issues.

2.49 AWI advised the ANAO that many stakeholders do not understand AWI’s role as a rural research and development corporation (RDC) or what comprises agri-political activity, which has created tensions between AWI and its stakeholders. AWI is making efforts to better communicate its role to stakeholders. For example, at the August 2022 Woolgrower Industry Consultation Panel (WICP) meeting:

The AWI Chair spoke of the importance of the delineation between what the AWI can assist with under its Statutory Funding Agreement and what was outside its scope. Namely policy and lobbying, which often fell on the shoulders of the various woolgrower bodies. A summary document illustrating the different roles of the organisations has been made available to all wool growing bodies.

2.50 Articulating and disclosing the standards of behaviour required by the SFA regarding agri-political activity in a Code of Conduct or other governance policy supports effective communication of these expectations to AWI People and stakeholders.

2.51 In February 2023, AWI updated its Code of Conduct to include a section on agri-political activity. The updated Code of Conduct quotes the SFA definition of agri-political activity and states that:

AWI people are expected to conduct themselves at all times apolitically by not engaging in agri-political activity when representing AWI. This includes the support for particular candidates or political parties and advocating/supporting policy positions.

2.52 The updated Code of Conduct states that a violation ‘will subject an AWI person to disciplinary action, which may include summary termination of employment or an engagement’. It also notes that ‘questions and guidance on what is and isn’t considered Agri-political activity should be directed to the [General Manager] Consultation and Engagement’.

2.53 AWI advised that agri-political activity will be incorporated into its annual probity training from March 2023. The training will incorporate questions covering potential scenarios that may involve agri-political activity.

Risk management

Audit and Risk Committee

2.54 AWI has established an Audit and Risk Committee (ARC). The ARC has three members, all of whom are independent directors, and is chaired by an independent director. The committee’s charter and membership is published on AWI’s website.32 AWI publishes the number of ARC meetings and the number of directors in attendance in its annual report. In 2021–22, the ARC met eight times.

2.55 The ANAO examined ARC meeting records from June 2020 to October 2022. A monthly finance report is prepared and tabled at each ARC meeting. If the meeting was not held in a certain month, the report is tabled at the next ARC meeting and two reports are reviewed. A legal services report is prepared for every meeting. This report contains information on AWI’s legal and regulatory requirements, intellectual property matters and any (legal) opposition the company is facing from various sources as well as progress in resolving these issues.

2.56 Risk was considered by the ARC in 10 of 20 meetings from June 2020 to October 2022. The external auditor attended and provided reports twice a year, in April and August.

Risk Management Policy and Framework

2.57 AWI has established a Risk Management Policy, which is published on AWI’s website33 and outlines AWI’s risk appetite. AWI has also established a Risk Management Framework. The framework outlines AWI’s risk management process and risk reporting framework. The framework includes a risk matrix and risk assessment template.

2.58 AWI prepares risk profiles for each of its programs and support and administrative areas, which are reviewed by the ARC every six months. The risk profiles were most recently reviewed by the ARC in August 2022.

2.59 The risk profiles identify the program’s risk in not achieving targets. They assess the likelihood and consequence of the risk and assign a risk level. The profiles identify risk source(s) and current controls and assess the ‘risk current control rating’. Risk profiles identify treatments and assess the adequacy of controls. They also include a ‘risk completion timeline’.

2.60 The risk profiles, titled ‘program delivery risk statements’, are also included in internal annual program achievement reports.

2.61 Project risk management is discussed in paragraphs 4.67 to 4.75.

Does AWI establish and maintain a strategic plan as required under the SFA?

AWI has established a strategic plan for 2022–25. The strategic plan is accompanied by an annual operating plan that provides a detailed outline of activities under individual programs. AWI consulted with its key stakeholders on the development of its 2022–25 Strategic Plan. The strategic plan aligns with and has regard to the SFA performance principles and relevant guidelines.

Establishing a strategic plan

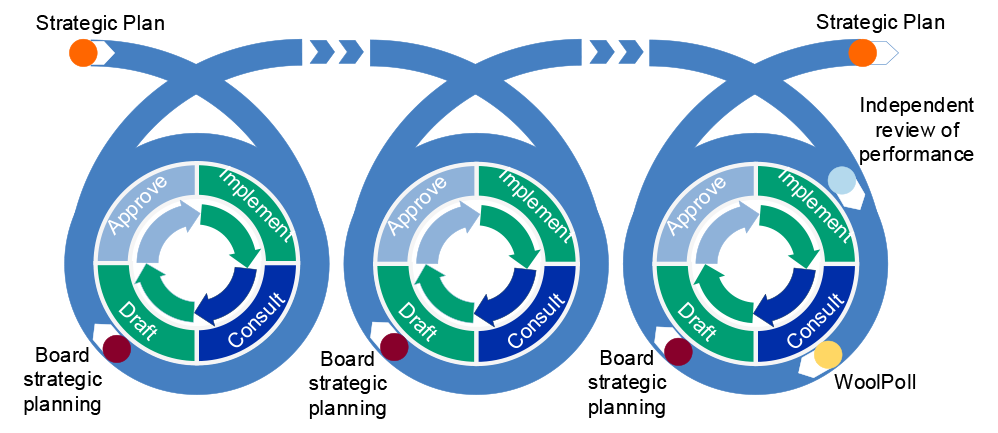

2.62 Clause 13 of the SFA requires AWI to establish and maintain a strategic plan that has regard to the performance principles and Guidelines for Statutory Funding Agreement 2020–2030 (the guidelines).34 AWI has a three-year strategic planning timeframe. This is aligned with triennial ROPs and WoolPoll35, where woolgrowers vote on the amount of levy they will pay for the next three-year period. This enables the next three-year strategic plan to be informed by the results of the review and the levy poll. The diagram below illustrates AWI’s planning cycle.

Figure 2.3: AWI planning cycle

Source: Adapted from AWI Woolgrower Consultation and Communication Plan, July 2022.

2.63 AWI’s current strategic plan covers the period 2022–23 to 2024–25. The strategic plan is accompanied by ‘individual yearly operating plans that detail the individual programs to enhance the overall strategy’. The Strategic Plan 2022–2025 and the Annual Operating Plan (AOP) 2022–2023 were presented to the AWI Board at its June 2022 meeting. The AOP was approved by the board at the meeting and the strategic plan was ‘received and reviewed’. AWI advised that the strategic plan went through minor amendments after the board’s review and was approved by the CEO prior to publication.

2.64 Both plans were published on AWI’s website on 29 June 2022 and provided to the Secretary of DAFF36 and to the Minister for Agriculture, Fisheries and Forestry.

2.65 The strategic plan outlines five key priorities for 2022–25.

- Growing the value and international demand for wool.

- Wool harvesting.

- Collaboration, consultation and engagement.

- Sustainability.

- Strengthening the supply chain.

2.66 Each area of priority has associated key performance indicators against which to measure progress and achievement at the end of the three-year period. The strategic plan also has four overall performance indicators.

2.67 The AOP contains yearly performance indicators and targets for each program area. AWI reports on progress against the annual indicators in program achievement reports, which are published biannually. Results of performance against the indicators are reported in annual reports.

Consultation

2.68 AWI consulted with its two primary consultation forums, the WICP and Woolgrower Consultation Group (WCG), during the development of its Strategic Plan 2022–2025. Minutes of the relevant WICP and WCG meetings document the feedback received and how the feedback was addressed by AWI. AWI’s Strategic Plan 2022–2025 outlines the consultation process undertaken during its development.

Regard to performance principles and guidelines

2.69 AWI’s strategic plan aligns with and has regard to the performance principles and relevant guidelines. AWI’s application of the performance principle related to governance is examined in paragraphs 2.3 to 2.61. AWI’s application of the other four performance principles is examined in paragraphs 3.1 to 3.76.

2.70 The AOP 2022–23 maps AWI’s program areas against the strategic priorities outlined in the strategic plan. The AOP also maps AWI’s strategic priorities against the pillars and focus areas of two key industry strategies, the Wool2030 Strategy and Sheep Sustainability Framework.

Does AWI have appropriate arrangements to address issues identified in performance reviews?

AWI has arranged its ROPs and Annual Performance Meetings with DAFF in accordance with the SFA and publishes its progress in implementing ROP recommendations on the ROP Implementation Portal. AWI has implemented recommendations from other independent reviews including the WoolPoll Review and the Wool Selling Systems Review.

Annual Performance Meetings

2.71 AWI arranges Annual Performance Meetings with DAFF each financial year, in accordance with clauses 11.1 and 11.2 of the SFA. The 2021 and 2022 Annual Performance Meetings were held in June 2021 and July 2022 respectively.

2.72 At the meetings, AWI delivered a presentation on its performance and achievements against the performance principles to DAFF. AWI’s 2022 presentation reported against the KPIs from the guidelines.37 In July 2022, DAFF stated that AWI ‘has satisfactorily met the requirements of the 5 performance principles for 2021–22’.

Review of Performance

2.73 Clauses 10.6 and 10.8 of the SFA provide that the Commonwealth may request AWI obtain an independent review of its performance against the performance principles every three years.

2.74 Following the commencement of the 2020–30 SFA, DAFF has requested one review of AWI’s performance against the performance principles in 2021. The 2021 ROP made 14 recommendations. The 2021 ROP Implementation Plan, which was agreed between DAFF and AWI, details the actions AWI will take to address the recommendations. The recommendations, the agreed implementation plan, and AWI’s progress to implement the recommendations are published on AWI’s Review of Performance Implementation Portal (ROPIP).38

2.75 AWI provides reports to DAFF on its implementation progress every two months. DAFF determines the overall progress of implementation and completion status of recommendations, after which the ROPIP is updated. As at November 2022, the ROPIP stated that AWI has completed the implementation of nine of the 14 recommendations, with overall implementation progress at 91.5 per cent.39 The remaining five recommendations are reported as ‘in progress’ and are at various stages of completion:

- improve engagement with the wool industry (80 per cent);

- commission an independent report to measure international sentiment towards mulesed40 wool (15 per cent);

- WoolQ stakeholder engagement plan and go/no go analysis (70 per cent);

- investigate the opportunity for a brand strategy for ‘wool’ (95 per cent); and

- modernisation of people management and culture (95 per cent).

2.76 AWI’s reported progress against the 2021 ROP recommendations is supported by evidence.

Other reviews

2.77 AWI has commissioned two independent reviews, the 2020 WoolPoll Review and the 2016 Wool Selling Systems Review (WSSR). AWI has addressed the issues identified by both reviews. AWI may also commission other reviews or reports, as necessary.

WoolPoll Review

2.78 The 2018 ROP found that ‘WoolPoll can be a costly process for the same outcome, where more stability may be more beneficial for both AWI and levy payers’ and recommended that an independent assessment of the WoolPoll mechanism be conducted. AWI agreed to the recommendation.

2.79 As DAFF41 administers the legislation that regulates WoolPoll, DAFF agreed to conduct the WoolPoll Review. The final report was published in October 2020. The review found that ‘WoolPoll remains an appropriate and contemporary process that provides government with assurance about what wool levy payers want their levy rate to be’ and outlined 10 recommendations to optimise the process in respect to improving procedures, bolstering transparency, and clarifying roles and responsibilities.

2.80 Eight of the 10 recommendations from the WoolPoll Review were for AWI and two were for DAFF. The ANAO reviewed AWI’s implementation of the WoolPoll Review recommendations. All eight recommendations have been implemented.

Wool Selling Systems Review

2.81 In October 2014, AWI selected a panel to undertake a review assessing ‘the state of all wool selling systems currently available to Australian wool producers’. The key objectives of the Australian Wool Selling Systems Review (WSSR) were:

to improve the returns that woolgrowers receive for their wool through:

(a) evaluating whether greater efficiencies and cost savings within the exchange of ownership between the seller and the first buyer are attainable

(b) understanding the potential for increased competitive tension throughout the wool selling process and how it can be achieved, and

(c) determining whether there is sufficient transparency within the exchange of ownership to allow woolgrowers to make the most informed commercial decisions about their wool growing enterprise.

2.82 The WSSR Panel released an issues paper in December 2014 and a discussion paper in July 2015. The final WSSR report was released in February 2016. Six of the eight recommendations were applicable to AWI. The ANAO reviewed AWI’s implementation of the WSSR recommendations. All recommendations applicable to AWI have been implemented.

WoolQ options paper

2.83 In May 2019, AWI commissioned Port Jackson Partners (PJP) to ‘evaluate the ownership, operation and the liquidity of WoolQ and present options to the AWI Board and CEO’.

2.84 In October 2019, PJP provided its report to the board. The report outlined PJP’s ‘assessment of ownership and governance options for WoolQ as well as [its] assessment of how to achieve the broader objectives of transparency and choice in the wool industry’. The report identified key challenges faced by WoolQ and options for next steps. The report noted that:

Ownership and governance of WoolQ are subsidiary to broader data transparency issues.

- Many potential investors/owners are conflicted. It is unlikely other entities would [be] interested in taking a stake in WoolQ prior to it demonstrating take up unless the intention was to frustrate its development.

- New ownership unlikely to address impediments to uptake. Those with the potential to help resolve impediments to take up, are those with the greatest incentive to frustrate WoolQ’s development and impede industry transparency and restructuring more broadly.

2.85 More information regarding WoolQ is at Appendix 3.

3. Performance principles

Areas examined

This chapter examines whether Australian Wool Innovation Limited (AWI) is effectively applying the performance principles under the Statutory Funding Agreement (SFA).

Conclusion

AWI is largely effective in applying the performance principles under the SFA. AWI engages with stakeholders and is undertaking cross-industry and cross-sectoral collaboration. AWI has not established a research, development and extension (RD&E) investment profile, against which the balance of the portfolio can be monitored. The investment portfolio does not outline the planned proportion or target of projects against AWI’s strategic plan’s priorities, government and industry priorities, or by risk and return. AWI has established a measurement and evaluation framework to track and report on outcomes of RD&E and marketing activities and is measuring and demonstrating improvement in governance. It is not effectively monitoring or reporting on improvements in administrative efficiency.

Areas for improvement

The ANAO made two recommendations for AWI to establish an investment profile, which outlines a target proportion of projects against AWI, government and industry priorities and in each risk and return category; and establish performance indicators to measure and report on improvements in administrative efficiency.

The ANAO identified one opportunity for improvement for AWI to establish structure and consistency in its platform recording stakeholder engagement and interactions.

3.1 The SFA outlines five performance principles that AWI must ‘at all times act in accordance with and uphold’. The performance principles are:

(a) to engage stakeholders to identify RD&E42 priorities and activities that provide benefits to the industry;

(b) to ensure RD&E priorities and activities (Marketing Activities and Other Activities43) are strategic, collaborative and targeted to improve profitability, productivity, competitiveness and preparedness for future opportunities and challenges through a Balanced Portfolio;

(c) to undertake strategic and sustained cross-industry and cross sectoral collaboration that addresses shared challenges and draws on experience from other sectors;

(d) for governance arrangements and practices to fulfil legislative requirements and align with contemporary Australian best practice for open, transparent and proper use and management of Funds; and

(e) to demonstrate positive outcomes and delivery of RD&E and marketing benefits to Levy payers and the Australian community in general, and show continuous improvement in governance and administrative efficiency.

3.2 Performance principle (d) is examined in Chapter 2. In this chapter the ANAO assessed whether AWI is effectively applying the remaining four performance principles.

- Principles (a) and (c) are examined in the first section of this chapter, which considers AWI’s stakeholder engagement and collaboration.

- Principle (b) is examined in the second section, which considers AWI’s management of RD&E priorities and activities through a balanced portfolio.

- Principle (e) is examined in the third section of this chapter, which considers how AWI demonstrates the outcomes and benefits of its activities.

Does AWI undertake effective stakeholder engagement and collaboration?

AWI’s consultation and communication approaches, in place as at March 2023, largely align with the Department of Agriculture, Fisheries and Forestry’s (DAFF) best practice guide principles and industry-specific guidance. AWI has established stakeholder consultation forums and commissions an annual survey to seek feedback from woolgrowers. AWI engages with stakeholders to identify RD&E priorities and activities. AWI is undertaking cross-industry and cross-sectoral collaboration to address shared challenges and draw on experience from other sectors.

Stakeholder engagement

3.3 In July 2022, AWI developed a new Woolgrower Consultation and Communications Plan (communications plan). The communications plan identifies a range of key stakeholder groups, along with engagement channels for each group.

Stakeholder consultation forums

3.4 AWI has two primary consultation forums, the Woolgrower Industry Consultation Panel (WICP) and Woolgrower Consultation Group (WCG). The WICP and WCG were established in 2019 to replace the Woolgrower Industry Consultation Committee (ICC), which operated from 2010. This was to implement a recommendation from the 2018 Review of Performance (ROP) to redefine the ICC ‘to ensure a more independent advisory body’. The role and membership of the WICP and WCG is summarised in Table 3.1. The ANAO observed the WICP meeting in August 2022.

Table 3.1: Role and membership of WICP and WCG

|

Forum |

Role |

Meetings |

Membership |

|

WICP |

|

Quarterly |

|

|

WCG |

|

Biannually |

|

Note a: The WICP woolgrower industry representatives comprise: ASHEEP, Australian Association of Stud Merino Breeders, Australian Superfine Wool Growers’ Association, Australian Woolgrowers Association, Broad Wool Representative, Commercial Merino Ewe Competitions Association, MerinoLink, Pastoralists & Graziers Association of Western Australia, and WoolProducers Australia.

Note b: The WCG woolgrower industry representatives comprise the WICP members as well as AgForce Queensland, Australian Dohne Breeders Society, Birchip Cropping Group, Flinders Ranges Merino, Liebe Group, Livestock SA, Mallee Sustainable Farming Group, Monaro Farming Systems (MFS), NSW Farmers Association, NSW Stud Merino Breeders’ Association, Queensland Merino Stud Sheepbreeders Association, SA Stud Merino Sheepbreeders Association, Stud Merino Breeders Association of Tasmania, Stud Merino Breeders’ Association of WA, SuperBorder, Tasmanian Farmers & Graziers Association, Victorian Farmers Federation, Victorian Stud Merino Sheep Breeders Association, and Western Australian Farmers Federation.

Source: ANAO summary of WICP and WCG.

3.5 The WICP and WCG terms of reference state that ‘membership, including the process for appointing the independent Chair of the WICP, as well as performance of the committees will be reviewed annually as part of the ongoing monitoring and evaluation of AWI’s consultation activities’. At the December 2021 WCG meeting, AWI proposed that two new members of the WICP be appointed. Nominations were sought from the WCG, with AWI recommending ASHEEP and MerinoLink for nomination. The minutes state that the WCG endorsed the proposal without objection.

3.6 The 2021 ROP found that many woolgrowers do not feel engaged and represented by WICP representatives. The majority of woolgrowers (56 per cent) are not aware of who their representatives are on the WICP and 14 per cent rated communication from their WICP representatives as ‘good’ or ‘very good’. AWI advised that it is working to raise the profile of the WICP through various communication channels, including through its podcast and quarterly magazine, and working directly with woolgrowers.

3.7 AWI’s other stakeholder forums include:

- the Animal Welfare Forum, which was established by AWI in 2009 to engage with key animal welfare organisations and researchers on sheep welfare issues and meets annually; and

- state-based woolgrower extension networks in each state, which are funded by AWI and run under the guidance of a Producer Advisory Panel comprising six to eight woolgrowers and stakeholders. The extension networks provide information, training and workshops to woolgrowers at regional and grassroots levels.

WICP member priorities

3.8 AWI receives feedback on WICP members’ RD&E and marketing priorities in WICP meetings. From its inaugural meeting in September 2019 to May 2022, WICP members have identified 157 concerns and priorities for AWI. Their top priorities related to:

- flystrike (including mulesing) (18 per cent);

- various RD&E programs or projects, including those relating to training workshops and industry events (13 per cent); and

- labour shortage and shearing (11 per cent each).

WICP and WCG surveys

3.9 AWI conducts post-meeting surveys after each WICP and WCG meeting. The post-meeting surveys seek to capture the members’ satisfaction with AWI’s consultation efforts, whether the members’ consultation expectations are being met, and whether information provided by AWI at the meeting was useful. The ANAO examined the survey results from 2020 to August 2022. During this period, there were two surveys of the WCG and 11 surveys of the WICP.

3.10 Table 3.2 summarises average ratings provided by WCG respondents and Table 3.3 summarises average ratings provided by WICP members to the survey questions.

Table 3.2: Summary of WCG survey results — averagesa

|

Question |

December 2021 |

May 2022 |

|

How do you rate AWI’s consultation efforts from [the relevant] WCG meeting? |

7.38 |

7.78 |

|

How well are the consultation expectations of your organisation currently being met by AWI? |

7.00 |

7.39 |

|

Was the update on AWI’s marketing and R&D activities provided at the [relevant] WCG meeting useful? |

7.92 |

7.78 |

|

Is the material provided prior to the WCG meeting relevant? |

Yes — 92% |

Yes — 88% |

Note a: Survey ratings were provided on a scale of 1 to 10, with 1 being poor and 10 being exceptional.

Source: ANAO summary of WCG member surveys.

Table 3.3: Summary of WICP surveya results — averagesb

|

Question |

Mar 20 |

Nov 20 |

Mar 21 |

May 21 |

Aug 21 |

Mar 22 |

May 22 |

|

AWI’s consultation efforts in mid-2018 |

6.5 |

5.40 |

7.00 |

4.00 |

5.00 |

8.00 |

6.22 |

|

AWI’s consultation efforts at relevant meeting |

7.00 |

6.75 |

8.00 |

4.00 |

5.00 |

8.33 |

8.22 |

|

Consultation expectations being met? |

Yes — 75% |

Yes — 50% |

Yes — 100% |

Yes — 0% |

Yes — 100% |

Yes — 100% |

Yes — 89% |

|

Awareness and understanding of AWI activities after the meeting |

More — 50% |

More — 50% |

More — 33% |

N/A |

More — 0% |

More — 50% |

More — 88% |

|

AWI’s efforts to address and respond to the issues raised at the meeting |

7.25 |

6.50 |

7.00 |

1.00 |

5.00 |

9.00 |

8.22 |

Note a: The surveys are optional. Surveys conducted in May 2020, June 2020, August 2020, and October 2021 received zero responses and were not included in the above table. Responses for the months listed in the table above range from one response to nine responses. Due to the small number of respondents to the surveys, the results may be skewed, especially if there is one particularly low or high score.

Note b: Survey ratings were provided on a scale of 1 to 10, with 1 being poor and 10 being exceptional.

Source: ANAO summary of WICP member surveys.

Woolgrower sentiment surveys

3.11 AWI commissions a survey of woolgrowers annually. The survey gathers feedback from woolgrowers across several different focus areas, including woolgrowers’ ‘experience’ of AWI activities and programs; woolgrower satisfaction with AWI communication and engagement; and the importance of AWI to the Australian wool industry.

3.12 The ANAO examined the survey results from 2020, 2021 and 2022. The surveys consistently reported that respondents who are more familiar and engaged with AWI’s programs are more likely to be satisfied with the outcomes of the programs.44 The survey reports noted that AWI’s challenge is to reach those who are not aware of AWI’s programs and incentivise those who are aware, but not engaged, to make the decision to engage in AWI’s programs.