Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

AQIS Cost-recovery Systems Follow-up Audit

An ANAO audit of AQIS' cost-recovery systems was conducted in 2000-01 (Audit Report No 10, 2000-01), following a request from the Joint Committee of Public Accounts and Audit (JCPAA). That audit aimed to assess the efficiency and effectiveness of the management of AQIS' cost-recovery systems, and provide assurance to Parliament that cost-recoverable programs were identifying and recovering the full costs of services provided, without cross-subsidisation. The ANAO made six recommendations for improving the efficiency and effectiveness of AQIS cost-recovery systems. The JCPAA, at a subsequent hearing, made a further three recommendations. The objective of the follow-up audit was to assess AQIS' implementation of the ANAO and the JCPAA recommendations. The audit also aimed to determine whether implementation of these recommendations, or alternative actions taken to address the issues leading to the recommendations, had improved AQIS' management of its cost-recovery processes.

Summary

Background

The Australian Quarantine and Inspection Service (AQIS) delivers quarantine and inspection services, including border control services, and export inspection, auditing and certification services. Thirteen AQIS programs are conducted on a cost-recovery basis, with clients being directly charged for the provision of services. AQIS' cost-recovery policy states that each cost¬recovered program must recoup its own costs, reflecting a requirement that AQIS prevent cross¬subsidisation between programs.

ANAO Audit Report No.10 2000–01, AQIS Cost-Recovery Systems, examined the accuracy and effectiveness of the cost-recovery systems employed by AQIS. The report contained six recommendations designed to assist AQIS to improve the efficiency and effectiveness of its cost¬recovery systems. The Joint Committee of Public Accounts and Audit (JCPAA), at a public hearing on the audit report, added two recommendations, and endorsed the ANAO's sixth recommendation. This latter recommendation addressed the issue of better alignment of fees charged to particular clients with the costs associated with servicing those clients.

Key findings

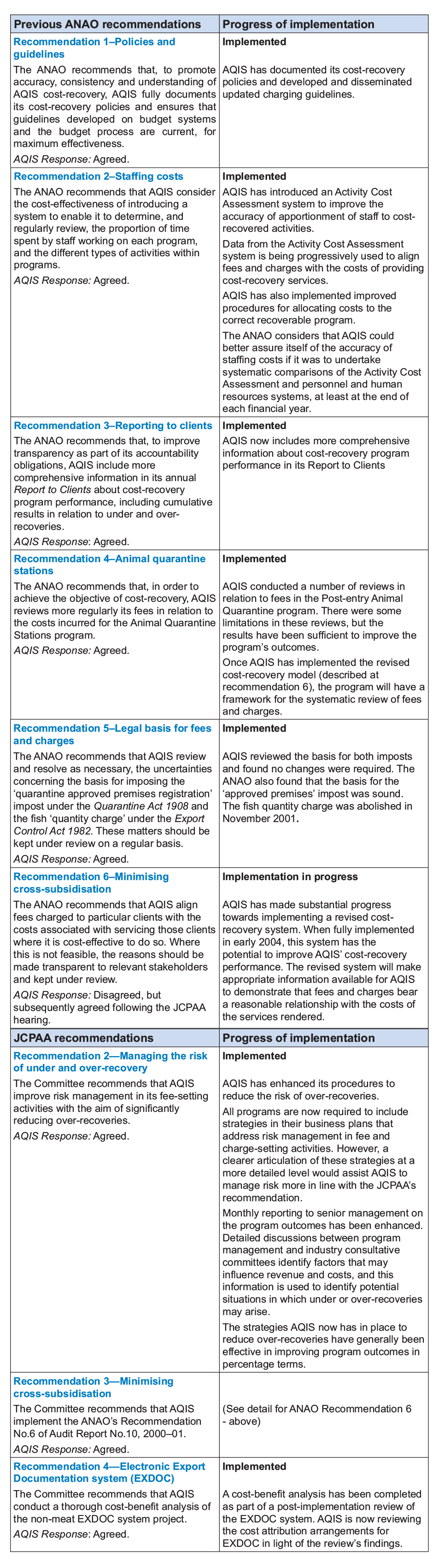

Figure 1 Progress in implementing recommendations of the previous audit

Conclusion

AQIS has implemented ANAO recommendations 1, 2, 3, 4 and 5, and JCPAA recommendations 2 and 4. AQIS initially disagreed with ANAO recommendation 6. However, the JCPAA, at a public hearing, reinforced the importance of better aligning fees with charges in its recommendation 3. AQIS consequently agreed to this recommendation, and has made substantial progress in its implementation.

AQIS is continuing to enhance its cost-recovery management pursuant to the recommendations of the original audit. This follow-up audit includes a number of suggestions to assist this process.

In particular, the ANAO suggests that AQIS consider undertaking systematic comparisons of staffing cost attributions from the Activity Cost Assessment and personnel and human resources systems.

Overall, AQIS has improved its management of cost-recovery. Improvements to charging guidelines and client reporting have enhanced the quality and quantity of information available to stakeholders. AQIS has also taken steps to improve its attribution of staffing costs.

AQIS' new budget management system, new activity cost assessment system, revised cost model and updated procedural documents will provide a sounder framework for managing cost¬

recovery. They will facilitate alignment of fees and charges with costs at an activity level, enabling AQIS to better manage over and under-recoveries for each activity.

The ANAO has made no further recommendations in this audit.

Departmental response

The department's full response to the follow-up audit is as follows:

[I] consider the report to be an accurate and fair reflection of the progress made by AQIS to implement the recommendations made by the ANAO and the Joint Committee of Public Accounts and Audit in relation to the performance audit ‘AQIS Cost-recovery Systems'.

Since the first audit report, AQIS has significantly improved its systems for cost-recovery. The AQIS Fees and Charges Policy, developed as a result of an ANAO recommendation, has been a useful document to clarify AQIS' policy in terms of cost-recovery. AQIS will further develop this policy to implement improvements suggested by the ANAO in the follow-up audit. The new budget system has made the task of allocating costs to the correct programs more efficient, and cost-recovery information, such as budgeting policy and procedures and the treatment of over-recovered funds, has been fully documented and is now utilised on a regular basis. AQIS has also expanded its information provided to clients through the Report to Clients, produced on an annual basis.

The information collected via the Activity Cost Assessment (ACA) system is being progressively used to align program fees and charges with the cost of providing these services to clients. These fees and charges are now being modelled based on an activity-based costing methodology. AQIS notes the ANAO's suggestion that systematic comparisons of staffing cost attributions from the ACA data and the human resources systems should be undertaken. AQIS is seeking to develop a procedure to verify the consistency and validity of data captured through the ACA system. AQIS is also considering using this information to provide some other important performance indicators, such as a chargeable hour indicator.

While the follow-up performance audit does not contain any recommendations, the suggestions contained in the report will assist AQIS in further improving its cost-recovery systems.