Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Australian Office of Financial Management’s Management of the Australian Government’s Debt

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Debt is the largest liability on the Australian Government’s balance sheet.

- The level of public debt interest payments on Australian government debt is currently high giving rise to risks and costs to the Budget.

- The audit provides assurance to Parliament on the effectiveness of the Australian Office of Financial Management’s (AOFM) management of the Australian Government’s debt.

Key facts

- The AOFM manages the debt portfolio of the Australian Government and borrows on behalf of the Government. The Treasury oversees the AOFM’s borrowing activities.

- The AOFM issued $848.7 billion of Australian Government Securities (AGS) between 1 January 2020 and 30 June 2023.

- At the 2023–24 Mid-year Economic and Fiscal Outlook, the Australian Government is expected to pay $20.0 billion in interest payments on AGS in 2023–24, which is expected to increase to $28.2 billion by 2026–27.

What did we find?

- The AOFM is largely effective at managing Australian Government debt.

- The AOFM and Treasury have largely effective governance arrangements to support debt issuance and management activities but lacked clarity in relation to the accountabilities and responsibilities for oversight of debt management.

- The AOFM is largely effective at managing costs and risks associated with government debt. Financial risks relating to debt management were managed appropriately. The AOFM has policies and processes in place to support cost effective borrowing, but it does not assess whether the government debt portfolio was structured at least cost subject to acceptable risk.

What did we recommend?

- The Auditor-General made five recommendations to the AOFM and three recommendations to Treasury relating to governance, probity and performance evaluation of debt management activities.

- The AOFM and Treasury agreed to all recommendations.

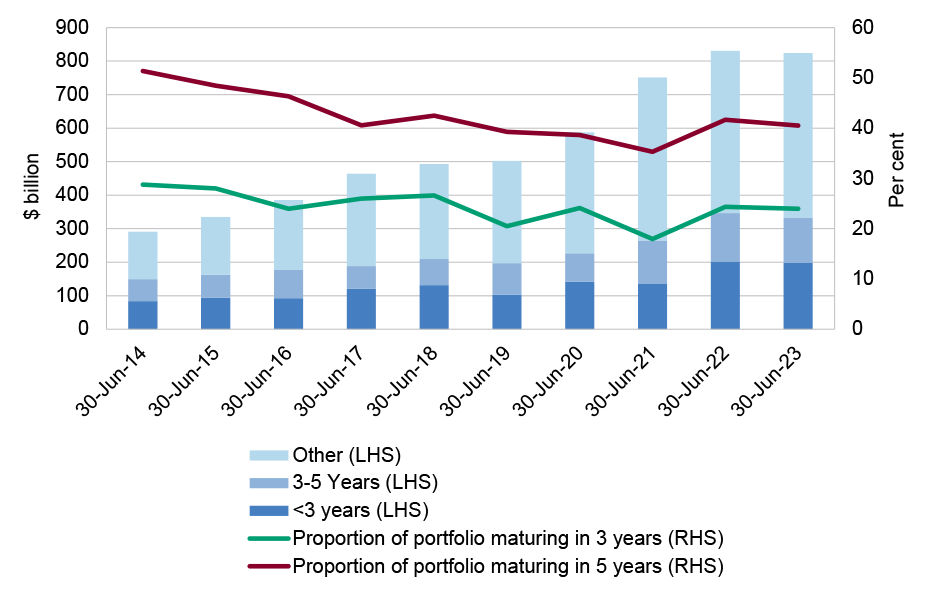

$889.8b

value of outstanding Australian Government Securities as at 30 June 2023.

2.43%

interest costs of the debt portfolio as a share of the value of the debt portfolio at 30 June 2023.

40%

proportion of outstanding Treasury Bonds as at 30 June 2023 that will mature and be repaid prior to 30 June 2028.

Summary and recommendations

Background

1. The Australian Office of Financial Management (AOFM) is responsible for the management of the Australian Government’s debt and related financial assets, such as cash holdings.1 The AOFM has been the sovereign debt manager for Australia since its establishment in 1999 and undertakes borrowing activities on behalf of the Australian Government.2 Before the AOFM was established, the Department of the Treasury (Treasury) was responsible for sovereign debt management. Treasury is the ‘lead economic adviser’ for the Australian Government, and aims to ‘provide advice to the Government and implement policies and programs to achieve strong and sustainable outcomes’.3

2. The Australian Government borrows money by issuing Australian Government Securities (AGS), previously named Commonwealth Government Securities. AGS issuance activities take place to meet the borrowing requirements of the Australian Government, especially when there is a Budget deficit4, and to maintain the effective operation of the AGS market.5

Rationale for undertaking the audit

3. AGS is the largest liability on the Australian Government’s balance sheet. The value of AGS outstanding has risen from $561.8 billion as at 1 January 2020 to $889.8 billion as at 30 June 2023, primarily due to increased Australian Government borrowing during the COVID-19 pandemic and is expected to continue to increase with future borrowing activities. The amount of interest required to be paid increases with the amount of AGS on issue.6 The amount and trajectory of AGS on issue is related to the fiscal sustainability of the Australian Government. Increased debt on issue incurs higher debt servicing7 costs in the long term.8 As noted by the International Monetary Fund, ‘prudent debt management’ can support government resilience to volatile market conditions and financial crises.9

4. The audit provides assurance to Parliament on the effectiveness of the AOFM’s management of the Australian Government’s debt.10

Audit objective and criteria

5. The objective of this audit was to assess the effectiveness of the AOFM’s management of the Australian Government’s debt.

6. To form a conclusion against the objective, the following high-level criteria were adopted:

- Was there an effective governance framework to manage government debt?

- Was government debt appropriately managed?

Conclusion

7. The AOFM is largely effective at managing the Australian Government’s debt.

8. The AOFM and Treasury have largely effective governance arrangements to support operational activities to fund the Australian Government, including establishing, approving and executing a strategy for debt management. The roles, responsibilities and accountabilities amongst key stakeholders in relation to debt management oversight and decision-making under the legislative framework are not transparent. There is a lack of clear documentation of debt management policy and operational decisions and the rationale behind these decisions. The AOFM lacked processes for the documentation and management of gifts, benefits and hospitality. The AOFM and Treasury could improve adherence to legislative requirements and internal policies relating to conflict of interest.

9. The AOFM is largely effective at managing costs and risks associated with Australian Government debt. The AOFM has a framework for managing funding risk and interest rate risk relating to its borrowing activities. The AOFM met the Australian Government’s borrowing requirements between 1 January 2020 and 30 June 2023. The AOFM did not define any targets, limits or benchmarks for the cost of the debt portfolio. The AOFM has policies and processes in place to support cost-effective borrowing, but it does not assess whether the debt portfolio was managed at least cost subject to acceptable risk. Debt management activities were supported by relevant information from internal and external sources in respect of economic and financial market conditions, and the fiscal conditions of the Australian Government. The AOFM’s borrowing decisions were consistent with relevant aspects of guidelines on best practices for public debt management published by the World Bank and International Monetary Fund.

Supporting findings

Governance arrangements

10. The AOFM has appropriate policies and procedures in place to issue Australian Government debt and to provide advice to the Treasurer and Secretary of the Treasury (the secretary), relating to debt management. The internal bases for advice and recommendations on debt management to the Treasurer and the secretary are mostly not documented, therefore not clear or transparent. The Treasurer and the secretary have oversight of debt management through policies and procedures for the annual oversight of debt management, however, while these establish parameters for debt issuance, these parameters can be operationally varied. The Commonwealth Inscribed Stock (Maximum Total Face Value of Stock and Securities) Direction 2020, which sets a maximum legislative limit on the total face value of debt, is the primary control on Australian Government borrowing. (See paragraphs 2.3 to 2.27)

11. The AOFM has established frameworks to manage risk, compliance and assurance. The AOFM has separate frameworks for the management of enterprise risk and financial risk. The AOFM Middle Office does not assume responsibility for the management of financial risks. The AOFM’s processes for the acceptance of gifts, benefits and hospitality by the AOFM’s CEO and staff are not aligned with relevant public sector requirements. The AOFM’s conflict of interest processes are not aligned with the AOFM’s conflict of interest-policy. The Treasury’s conflict of interest processes do not incorporate the AOFM CEO and for this reason are not aligned with Treasury’s conflict of interest policy and legislative requirements. (See paragraphs 2.28 to 2.82)

12. The AOFM has appropriate internal monitoring arrangements which report on the AOFM’s stated targets, limits and guidelines as outlined in key debt management oversight documents, however, monitoring and reporting does not lead to clear actions if targets, limits and guidelines are operationally exceeded. There is transparency around the levels of government debt. The Treasurer is required to report on debt through the Debt Statement at each Budget and Mid-Year Economic and Fiscal Outlook; this is developed by the Department of the Treasury with the advice of the AOFM. The AOFM publishes a range of debt information publicly through its Annual Report and website. To support added transparency, there is scope for the AOFM to publish more information publicly on its debt management approach and strategy. (See paragraphs 2.83 to 2.101)

Debt management

13. The AOFM has a framework for managing funding and interest rate risk relating to its borrowing activities. The AOFM met the Australian Government’s borrowing requirements between 1 January 2020 and 30 June 2023. There was no target, limit or guidelines for the cost of the debt portfolio. The AOFM has policies and processes in place to support cost-effective borrowing, but it does not assess whether the government debt portfolio was structured at least cost subject to acceptable risk. (See paragraphs 3.3 to 3.55)

14. The AOFM availed itself of relevant information in its debt management strategy and activities. The AOFM effectively sourced and analysed information that it received from market makers, AGS investors, the Department of the Treasury, the Reserve Bank of Australia, and from internal IT systems and analysis. The information was used by the AOFM to support and refine its debt management strategies, decisions and activities. (See paragraphs 3.56 to 3.77)

15. International best practices with respect to sovereign debt management have been described by the World Bank and International Monetary Fund’s Revised Guidelines for Public Debt Management (Guidelines). Aspects of the AOFM’s debt management decisions were assessed as consistent with the relevant provisions of the Guidelines. There are no Australian Government guidelines with respect to debt management. The AOFM’s syndicated borrowing activities are exempt from Division 2 of the Commonwealth Procurement Rules (CPR). The AOFM’s self-assessments of the compliance of its syndicated borrowing activities with the applicable provisions from Division 1 of the CPR were not fully documented. (See paragraphs 3.78 to 3.108)

Recommendations

Recommendation no. 1

Paragraph 2.23

The Australian Office of Financial Management and the Department of the Treasury should ensure that where governance arrangements are not defined by legislation, they are clearly documented, including clear roles and responsibilities.

Australian Office of Financial Management response: Agreed.

Department of the Treasury response: Agreed.

Recommendation no. 2

Paragraph 2.25

The Australian Office of Financial Management should document all governance meetings related to debt management; and ensure that there is clear and timely documentation of operational directives and limits relating to the execution of debt management.

Australian Office of Financial Management response: Agreed.

Recommendation no. 3

Paragraph 2.78

The Australian Office of Financial Management and the Department of the Treasury implement conflict of interest processes consistent with internal policies and legislative requirements.

Australian Office of Financial Management response: Agreed.

Department of the Treasury response: Agreed.

Recommendation no. 4

Paragraph 2.80

The Australian Office of Financial Management should:

- review whether a guiding principle, consistent with other Australian Public Service agencies, that officials are to generally avoid the acceptance of gifts, benefits and hospitality is appropriate for the organisation;

- document the basis for accepting offers of gifts, benefits and hospitality;

- document conflict of interest considerations for accepting offers of gifts, benefits and hospitality;

- document the disposal of gifts; and

- document considerations and benefits of providing official hospitality in line with the AOFM’s Accountable Authority Instructions.

Australian Office of Financial Management response: Agreed.

Recommendation no. 5

Paragraph 3.54

The Australian Office of Financial Management and the Department of the Treasury should:

- consider how transparency around the impacts of debt management decisions on cost and risk outcomes for the debt portfolio can be enhanced;

- review the Financial Risk Management Policy and debt management performance measurement framework with a focus on increasing transparency around the impacts of debt management decisions on cost and risk outcomes for the debt portfolio; and

- annually evaluate the Debt Management Strategy and the performance of the debt portfolio over various time horizons.

Australian Office of Financial Management response: Agreed.

Department of the Treasury response: Agreed.

Summary of entity responses

16. The proposed audit report was provided to the Australian Office of Financial Management and the Department of the Treasury. The AOFM’s and Treasury’s summary responses to the report are provided below and the full response is at Appendix 1. The improvements observed by the ANAO during the course of this audit are at Appendix 2.

Australian Office of Financial Management

The Australian Office of Financial Management (AOFM) welcomes the findings of the ANAO’s report, including that AOFM’s policies and processes support cost-effective borrowing and the appropriate management of financial risks; and that governance arrangements are largely effective in supporting debt issuance and management activities.

The AOFM agrees with the five recommendations, and notes that these primarily represent enhancements to established documentation and processes to achieve greater transparency. Implementation of the recommendations has already commenced.

The AOFM will work with the Treasury to increase transparency and strengthen existing documentation of governance arrangements and debt management decisions.

The AOFM will also review and enhance existing policies and procedures relating to gifts, benefits (including hospitality) and conflicts of interest. The AOFM notes the report’s finding relating to coverage of conflict of interest declarations of the AOFM CEO. The Treasury has updated its processes for conflict of interest, including the declaration and capture of interests for CEOs within the portfolio.

Department of the Treasury

Treasury welcomes the report and its recognition of the AOFM’s key role in supporting the Government’s response to the COVID-19 pandemic – raising the funding required to respond to the effects of the pandemic.

Since the establishment of the AOFM in 1999, fundamental responsibility for debt management has resided with the AOFM. The AOFM supports a well-functioning, competitive, liquid market in Australian Government Securities, underpinned by a transparent and consistent operational approach to debt management.

Treasury has a range of governance processes to provide assurance around the AOFM’s debt management approach, consistent with relevant debt management legislation. These processes are set out in the AOFM’s Financial Risk Management Policy (FRMP).

Treasury has updated its processes for conflict of interest, including the declaration and capture of interests for CEOs within the portfolio. As part of Treasury’s ongoing efforts to mature and enhance its pro-integrity culture, opportunities for further improvement will be identified and implemented.

Treasury has agreed with recommendations 1, 3 and 5.

Treasury will work with the AOFM to increase transparency and strengthen documentation of governance processes, including reviewing the FRMP and making governance arrangements publicly accessible.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Performance and impact measurement

1. Background

1.1 The Australian Office of Financial Management (AOFM) is responsible for the oversight and management of the government’s debt and related financial assets, such as cash holdings.11 The AOFM has been the sovereign debt manager for Australia since its establishment in 1999 and undertakes borrowing activities on behalf of the Australian Government.12 Before the AOFM was established, the Department of the Treasury (Treasury) was responsible for sovereign debt management. Treasury is the ‘lead economic adviser’ for the Australian Government, and aims to ‘provide advice to the Government and implement policies and programs to achieve strong and sustainable outcomes’.13

1.2 Australian Government Securities (AGS) are a form of debt instrument14, which allow the Australian Government to borrow money from investors in the financial markets for an agreed period of time. During this time, the Australian Government will pay periodic interest on the AGS15, then repay the principal amount, which is the ‘face value’, at an agreed future date, which is the ‘maturity date’.16

1.3 The amount of debt that Australia has on issue is recorded as a liability within the general government sector in the Australian Government’s Budget papers.17 This is represented in the Australian Government’s balance sheet, which records the value of the Australian Government’s assets and liabilities, and its net worth. AGS are the largest liability on the Australian Government’s balance sheet18, and the trajectory of AGS on issue as a share of the economy is a key determinant of the sustainability of the Australian Government’s fiscal condition and outlook.19

The Australian Office of Financial Management

1.4 The Australian Office of Financial Management (AOFM) is responsible for the management of the Australian Government’s debt and related financial assets, such as cash holdings.20 The AOFM has been the sovereign debt manager for Australia since its establishment in 1999, and undertakes borrowing activities on behalf of the Australian Government.21 The AOFM is a non-corporate commonwealth entity, is part of the Treasury portfolio and the AOFM Chief Executive Officer (CEO) is the Accountable Authority.

1.5 The AOFM was established in 1999 to ‘enhance the Commonwealth’s capacity to manage its net debt portfolio’ and to ‘assume responsibility for the Commonwealth’s existing debt management activities’.22

1.6 The AOFM is classified by the Australian Public Service Commission (APSC) as an ‘extra small agency’ with a specialist function.23 The AOFM had an average staffing level of 42 during 2022–23, and received departmental funding of $13.2 million in 202223.24 The AOFM states publicly on its website that its organisational structure is based on financial industry practice and comprises of a:

- Front Office — includes funding activities, market liaison, debt management strategy, financial risk management, research, and cash management;

- Middle Office — includes enterprise risk management, assurance and performance; and

- Back Office — includes business operations (including settlements and financial reporting), and corporate development.

Department of the Treasury

1.7 The Department of the Treasury (Treasury) is the ‘lead economic adviser’ for the Australian Government, which aims to ‘provide advice to the Government and implement policies and programs to achieve strong and sustainable outcomes’.25

1.8 The AOFM is a prescribed agency26 in the Treasury portfolio. The Accountable Authority of AOFM, the CEO, is employed by Treasury under section 22 of the Public Service Act 1999 as a Senior Executive Service (SES) officer. The CEO is then delegated Public Service Act 1999 powers by the Secretary to the Treasury (the secretary). The AOFM’s relationship with Treasury is discussed further in Chapter 2.

Debt issuance program

1.9 The AOFM is responsible for the issuance of AGS and for managing the Australian Government’s debt portfolio. As noted in section 51JA of the Commonwealth Inscribed Stock Act 1911, the AOFM borrows money on the Treasurer’s behalf through the issuance of AGS, which currently comprises three types of securities: Treasury Bonds, Treasury Indexed Bonds and Treasury Notes (see Box 1). In April 2023, the Australian Government announced that it would also begin issuing ‘sovereign green bonds’ — bonds to ‘back public projects driving Australia’s net zero transformation and boosting the scale and credibility of Australia’s green finance market’ — in mid-2024 following the development of a Green Bonds Framework and engagement with investors.27

|

Box 1: Description of Australian Government Securities (AGS)a |

|

There are currently three types of debt securities that are issued by the Australian Government:

|

Note a: Based on the face value of AGS on issue as of 1 May 2023.

Note b: The consumer price index is a measure of overall change in the pricing of a representative basket of consumer goods and is used to understand household inflation.

Source: Australian Government, Budget Measures: Budget Paper No. 1: 2023–24, Commonwealth of Australia, Canberra, 2023, p. 253. Australian Office of Financial Management, Annual Report 2021–22, AOFM, 2022, p. 19. ANAO analysis of face value of AGS on issue as of 1 May 2023 subject to the Treasurer’s Direction.

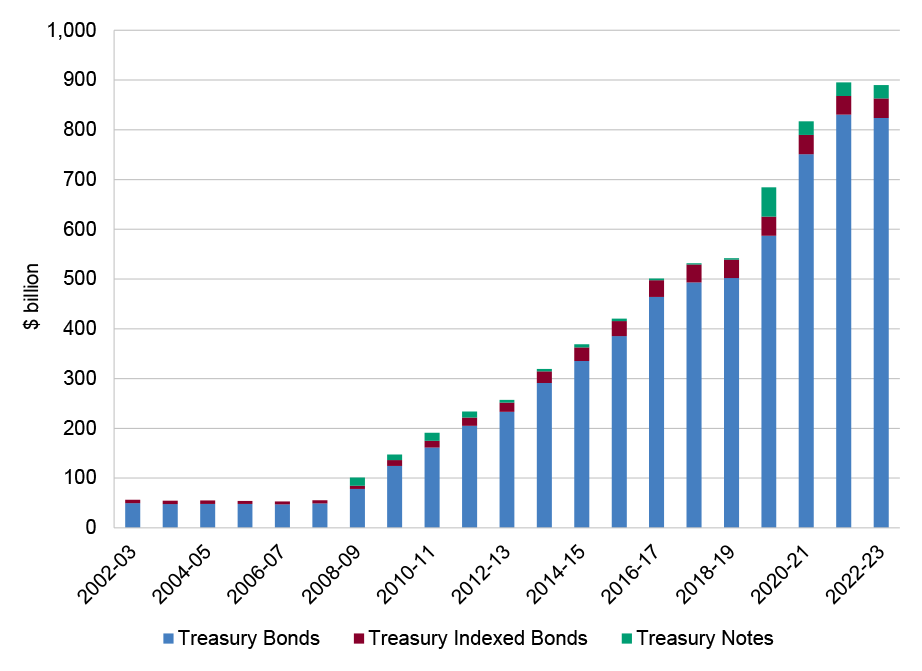

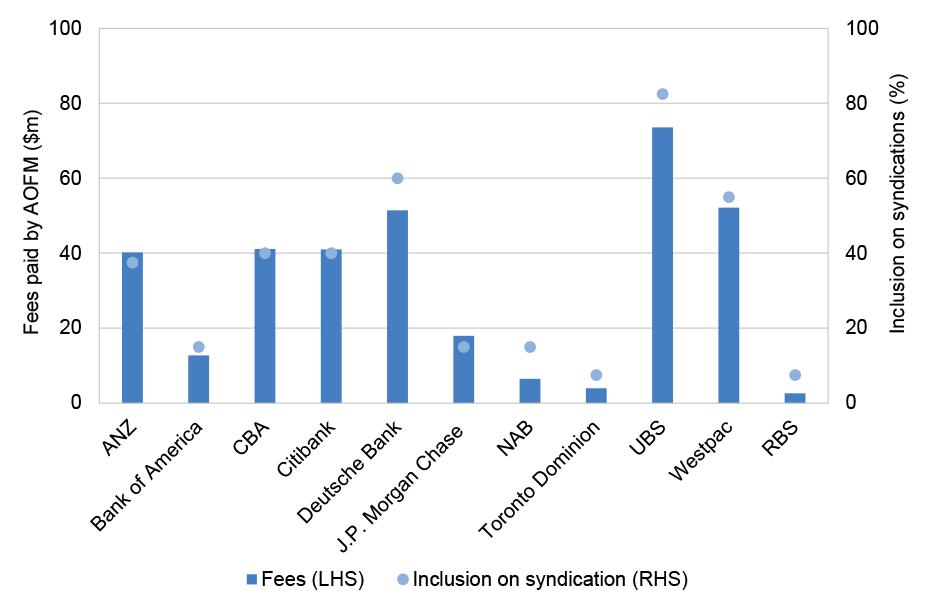

1.10 Figure 1.1 presents the face value of AGS on issue by type of debt security.

Figure 1.1: Face value of Australian Government Securities on issuea

Note a: Does not include other bonds and securities that are not subject to the Treasurer’s Direction as outlined in section 51JA(2A) of the Commonwealth Inscribed Stock Act 1911.

Source: AOFM Data Hub, ‘End of Financial Year Positions, Executive Summary, Overview of AGS outstanding and investments held’ [Internet], 2023, AOFM, available from https://www.aofm.gov.au/media/530 [accessed 6 February 2024].

1.11 The AOFM issues the securities into a limited number of maturities (or lines), to manage the debt portfolio. Limiting the number of maturities helps to ensure that each line is sufficiently liquid so that the securities can be readily traded in the secondary market28: the Australian fixed income market for institutional participants and the Australian Securities Exchange for retail investors.29 Creating liquidity in the secondary market attracts investors, promotes demand for AGS and assists in lowering borrowing costs.30 Having multiple, liquid lines also ensures there can be targeted investor demand for a given maturity, and reduces the risk of exhausting this demand.31

1.12 The AOFM’s issuance program is determined with respect to refinancing requirements for maturing AGS, the Budget funding requirements, Australian Government policy objectives in support of the AGS market, and operational considerations.32 Operational considerations can involve the AOFM deciding to hold higher or lower cash balances or to smooth issuance across financial years. Since the AOFM exercises ‘operational independence’, it can decide the appropriate course of action, such as holding higher or lower cash balances, or smoothing issuance across several years.33

1.13 The AOFM aims to manage the debt portfolio by ‘balancing costs and risks’.34 That is, there is a trade‐off between cost and risks in managing the debt portfolio. This is to be achieved through the AOFM’s purposes as listed in its annual report. These include35:

- Purpose 1: Meet the Government’s annual financing task while managing the trade-offs between costs and risks.

- Purpose 2: Ensure the Government can always meet its cash outlay requirements.

- Purpose 3: Conduct market facing activities in a manner that supports a well-functioning AGS market.

1.14 The AOFM has relationships with a variety of external stakeholders, including financial intermediaries. The AOFM has a list of 19 market makers, which are domestic and international financial intermediaries.36 Market makers buy AGS from and sell AGS to investors both domestically and globally to ensure that their investment needs are met and to support liquidity in the AGS market.37 The AOFM engages with market makers on a regular basis and receives information from these institutions on market conditions.

Debt increase in response to the COVID-19 pandemic

1.15 In March 2020, the Australian Government began to implement a range of policies to suppress the spread of the COVID-19 pandemic and support the Australian people and businesses during times of economic uncertainty. The March 2022 Budget stated that total direct economic support since the onset of the COVID-19 pandemic was $314 billion, and total direct economic and health support since the onset of the COVID-19 pandemic was $343 billion.38

1.16 Measures to support Australians included three stimulus packages, totalling $213.6 billion.

- A $17.6 billion economic stimulus package was announced on 12 March 2020, which aimed at keeping Australians employed, businesses open, and supporting households.39

- A $66 billion economic support package was announced on the 22 March 2020, which continued support for households, and businesses and employees, with the introduction of ‘[r]egulatory protection and financial support for businesses’.40

- A $130 billion economic support package was announced on 30 March 2020, which provided a ‘historic wage subsidy’ through the JobKeeper41 scheme.42

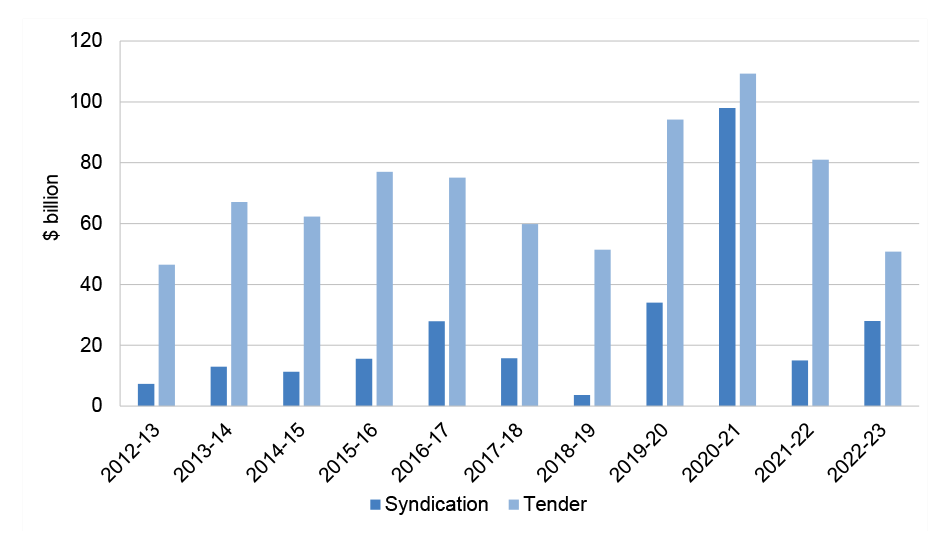

1.17 With increased spending from the Australian Government, the AOFM was tasked with increasing the funds available to the Australian Government through significantly higher issuance of AGS. Initially, there was a rapid increase in AGS issuance — the Treasury Bond issuance program for 201920 was expected to be $55 billion as at the 201920 MYEFO prior to the onset of the COVID-19 pandemic, but total Treasury bond issuance during the year of 201920 amounted to $128.2 billion.

1.18 A total of $848.7 billion in AGS was issued between the period within audit scope of 1 January 2020 to 30 June 2023 through tender and syndication, comprising $355 billion in Treasury Notes, $483.1 billion in Treasury Bonds and $10.6 billion in Treasury Indexed Bonds. Subsection 51JA(2) of the Commonwealth Inscribed Stock Act 1911 requires the Treasurer to give a ‘direction’ stipulating the maximum AGS that can be on issue. To reflect the Australian Government’s economic response to the COVID-19 pandemic, effective from 7 October 2020, the Treasurer directed that the maximum ‘face value’43 of AGS that can be on issue is $1,200 billion.44

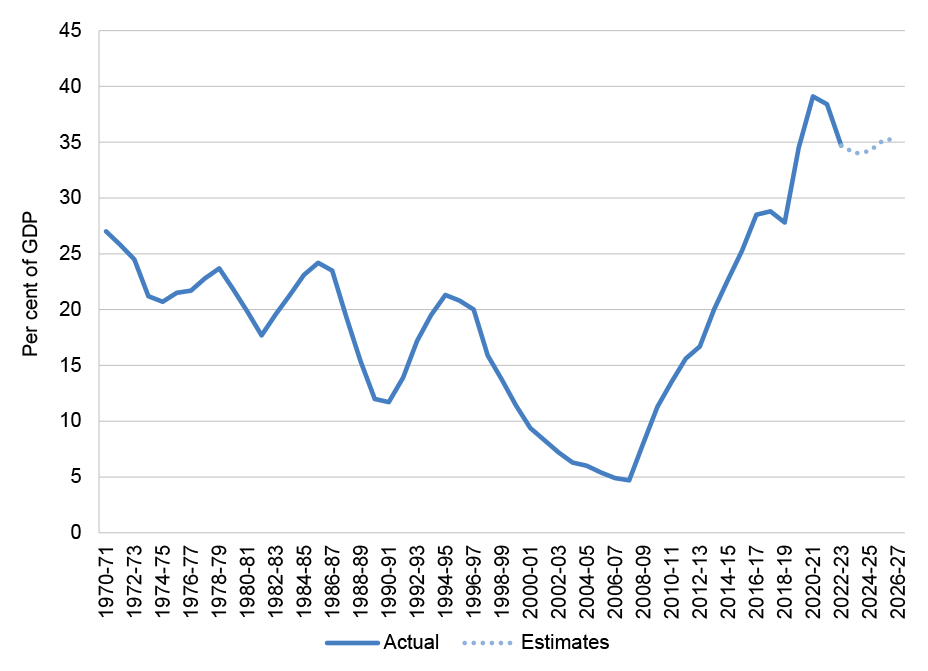

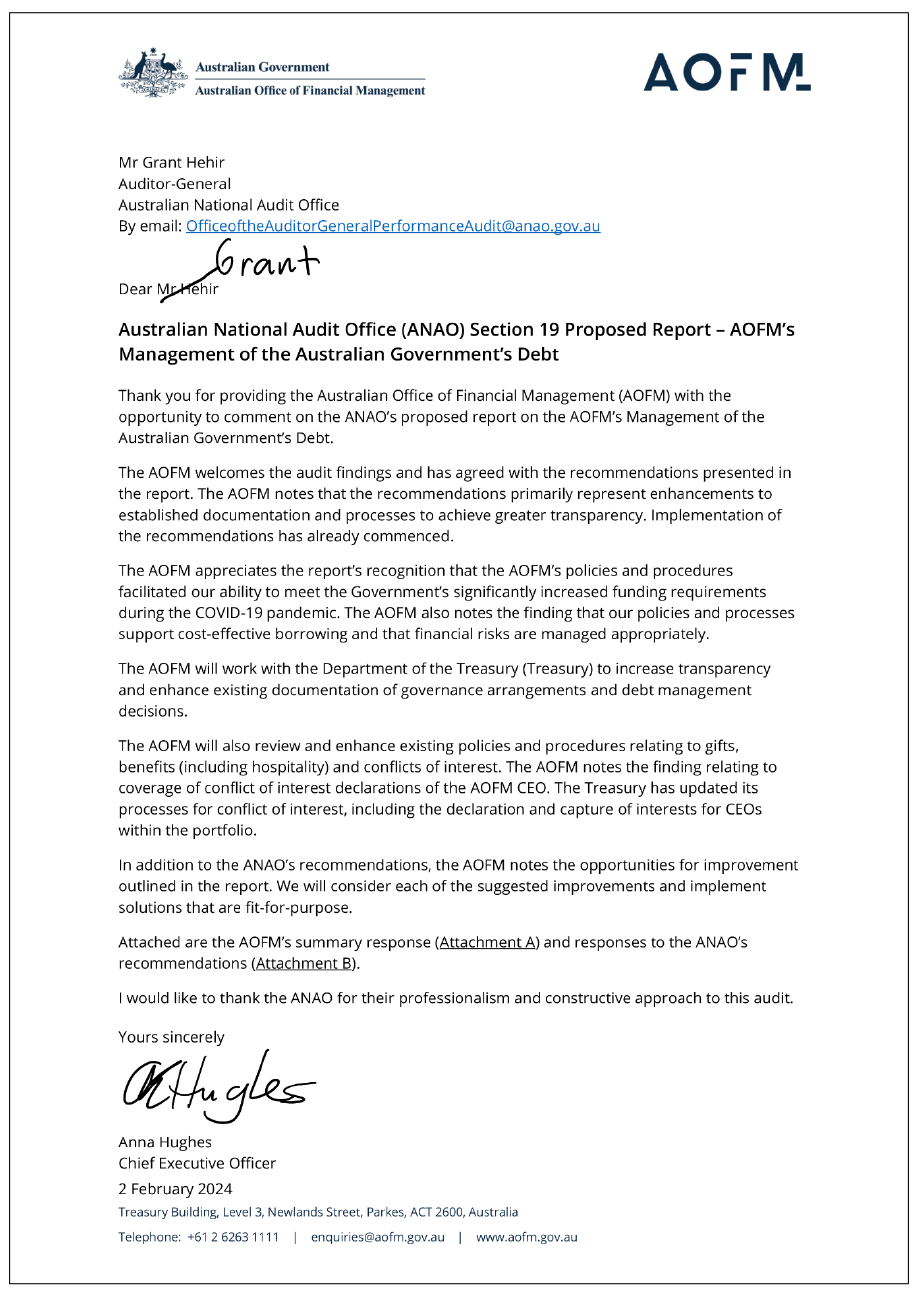

1.19 Figure 1.2 demonstrates how the face value of AGS has changed over time as a percentage of Gross Domestic Product45, including the increase between 2018–19 and 2021–22.

Figure 1.2: Face value of Australian Government Securities as a percentage of Gross Domestic Product

Source: Parliamentary Budget Office, Historical data published in the Australian Government’s latest Budget update [Internet], PBO, available from https://www.pbo.gov.au/publications-and-data/data-and-tools/data-portal [accessed 6 February 2024]. Data is current as of the 2023-24 Mid-year Economic and Fiscal Outlook.

Financial market conditions during the COVID-19 pandemic

1.20 Financial market conditions influence the interest rates applicable to AGS, and hence the interest payments made by the Australian Government to AGS investors. The onset of the COVID-19 pandemic caused volatility in global financial markets and prompted a significant fiscal and monetary policy response. To meet the Government’s borrowing requirements, the AOFM adapted its issuance operations through these market conditions and coordinated its activities with Treasury and the Reserve Bank of Australia (RBA). Appendix 3 draws on the market commentary presented in AOFM annual reports to provide a description of the evolution of AGS market conditions through the period within audit scope of 1 January 2020 to 30 June 2023.

Costs and risks of Australian Government debt

1.21 Interest payments on AGS, which are generally determined by prevailing AGS yields in financial markets as at the time of AGS issuance, impose ongoing costs on the Australian Government as debt is serviced and refinanced through time. As at the 2023–24 Mid-year Economic and Fiscal Outlook, the Australian Government is expected to pay $20.0 billion in interest payments on AGS in 2023–24, and this is expected to increase to $28.2 billion by 2026–27.46

1.22 There are risks associated with the Australian Government’s debt portfolio (expanded on in Box 2). These risks may impact the financial performance of the debt portfolio.47

|

Box 2: Types of risk associated with the Australian Government’s debt portfolioa |

|

The three main financial risks related to the Australian Government’s debt portfolio are as follows.

Other forms of risk related to debt management include the following.

|

Note a: Exchange rate risk was not included, as AOFM holds no foreign currency debt.

Source: AOFM documentation and Treasury, Review of the Commonwealth Government Securities Market [Internet], 2002, The Treasury, available from https://treasury.gov.au/review/cdmr/discussion-paper/appendix-2 [accessed 27 July 2023].

Previous reviews and audits

1.23 Auditor-General Report No. 14 of 1999–2000, Commonwealth Debt Management, focussed on Treasury and the newly established AOFM, and their ‘effectiveness of the raising, management and retirement of Commonwealth debt, consistent with an acceptable degree of risk exposure’. The audit found that the debt issuance programs conducted by Treasury and the AOFM were in accordance with the financing task and were being managed effectively. It also found that the borrowing program was being exposed to ‘new complexities’ due to uncertainty regarding market conditions, and an increase in risk management and accountability was necessary. The report also noted that there were several deficiencies when it came to financial derivatives, which could result in considerable financial losses. The report made six recommendations. AOFM and Treasury agreed to all six recommendations.48

1.24 Auditor-General Report No. 42 of 2004–05, Commonwealth Debt Management Follow-up Audit assessed the progress of implementation of the six recommendations from the initial audit, and to assess the impact of the changes made.49 The report found that, of the 15 actions identified from the previous audit, 11 were completed, and two were being progressed satisfactorily. The other two required further work. The report made two recommendations, of which AOFM agreed to one, and ‘agreed with qualification’ to the other.50

1.25 The Capability Review undertaken by the APSC in November 2015 identified a lack of clarity around the role of the AOFM Advisory Board as both a provider of strategic advice to the secretary and advice to AOFM on governance and corporate matters. The APSC noted that the Advisory Board functioned as a ‘board of directors’ would for a private company. The APSC also noted that the AOFM could play a broader role in contributing financial markets intelligence to the Department of the Treasury and the Department of Finance.

Rationale for undertaking the audit

1.26 AGS is the largest liability on the Australian Government’s balance sheet. The value of AGS outstanding has risen from $561.8 billion as at 1 January 2020 to $889.8 billion as at 30 June 2023, primarily due to increased Australian Government borrowing during the COVID-19 pandemic and is expected to continue to increase with future borrowing activities. The amount of interest required to be paid increases with the amount of AGS on issue.51 The amount and trajectory of AGS on issue is related to the fiscal sustainability of the Australian Government. Increased debt on issue incurs higher debt servicing52 costs in the long term.53 As noted by the International Monetary Fund, ‘prudent debt management’ can support government resilience to volatile market conditions and financial crises. 54

1.27 The audit provides assurance to Parliament on the effectiveness of the AOFM’s management of the Australian Government’s debt.55

Audit approach

Audit objective, criteria and scope

1.28 The objective of this audit was to assess the effectiveness of the AOFM’s management of the Australian Government’s debt.

1.29 To form a conclusion against the objective, the following high-level criteria were adopted:

- Was there an effective governance framework to manage government debt?

- Was government debt appropriately managed?

1.30 The audit did not examine:

- the debts issued prior to 1 January 2020 and after 30 June 2023 (noting that earlier time periods have been referenced in the report where relevant to audit findings);

- how the proceeds from debt issuance have been used by the Australian Government;

- debt issuance by other Australian Government agencies such as Housing Australia56 or the Australian Rail Track Corporation Limited;

- the Australian Government’s fiscal strategy; and

- the AOFM’s investment programs under the Australian Business Securitisation Fund (ABSF) or the Structured Finance Support Fund (SFSF).

Audit methodology

1.31 The audit methodology involved:

- a review of documentation held by the AOFM relating to the management of the Australian Government’s debt;

- analysis of AOFM’s transactional data;

- visits to the AOFM office in Canberra, which included demonstrations of business processes;

- meetings with AOFM staff and relevant stakeholders including AGS market makers and investors; and

- a review of AOFM’s governance arrangements, including its risk management system of controls and assurance activities, including those relating to its debt management.

1.32 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $601,254.

1.33 The team members for this audit were Vijay Murik, Hoa Nguyen, Nancy Jin, David Willis, Alyssa McDonald and David Tellis.

2. Governance

Areas examined

This chapter examines whether there is an appropriate governance framework for the management of Australian Government debt.

Conclusion

The Australian Office of Financial Management (AOFM) and Department of the Treasury (Treasury) have largely effective governance arrangements to support operational activities to fund the Australian Government, including establishing, approving and executing a strategy for debt management. The roles, responsibilities and accountabilities amongst key stakeholders in relation to debt management oversight and decision-making under the legislative framework are not transparent. There is a lack of clear documentation of debt management policy and operational decisions and the rationale behind these decisions. The AOFM lacked processes for the documentation and management of gifts, benefits and hospitality. The AOFM and Treasury could improve adherence to legislative requirements and internal policies relating to conflict of interest.

Areas for improvement

The ANAO made four recommendations: that the AOFM and Treasury ensure there are clear statements of debt management mandates, roles and responsibilities; that the AOFM document discussions and outcomes at all debt management governance meetings; that the AOFM and Treasury implement improved management of conflict of interest; and that the AOFM consider and document the basis for accepting offers of gifts, benefits and hospitality.

The ANAO also suggested: the AOFM consider aligning its financial risk management practices with the requirements for financial institutions; improve guidance in relation to market sensitive information; and consider improving transparency around its debt management strategy.

2.1 Public debt management is the process of establishing and executing a strategy for managing government debt and associated debt servicing costs, consistent with a prudent degree of risk. Effective public debt management should include clearly articulated governance arrangements that specify roles and responsibilities, a framework for managing risks that enables the identification and management of the trade-off between costs and risk in the government debt portfolio, as well as clear public reporting on performance against the measures of cost and risk adopted.57

2.2 Good public debt management includes that the allocation of responsibilities among financial agencies (such as the ministry of finance, the central bank and the debt management agency) for the purpose of debt management policy and undertaking primary debt issues58, should be publicly disclosed. It also includes that the objectives should be clearly defined and publicly disclosed, and that the measures of cost and risk that are adopted should be explained.59

Were appropriate policies and procedures in place to manage government debt?

The Australian Office of Financial Management (AOFM) has appropriate policies and procedures in place to issue Australian Government debt and to provide advice to the Treasurer and Secretary to the Treasury (the secretary), relating to debt management. The internal bases for advice and recommendations on debt management to the Treasurer and the secretary are mostly not documented, therefore not clear or transparent. The Treasurer and the secretary have oversight of debt management through policies and procedures for the annual oversight of debt management, however, while these establish parameters for debt issuance, these parameters can be operationally varied. The Commonwealth Inscribed Stock (Maximum Total Face Value of Stock and Securities) Direction 2020, which sets a maximum legislative limit on the total face value of debt, is the primary control on Australian Government borrowing.

Legislative framework

2.3 The Australian Government (Treasurer), Department of the Treasury (Treasury) and the AOFM have responsibilities for the management of public debt. The Charter of Budget Honesty Act 1998 sets out that the responsibility of the Government to manage financial risks faced by the Commonwealth prudently, having regard to economic circumstances, including by maintaining Commonwealth general government debt at prudent levels, and that relevant financial risks include risks arising from excessive net debt. Treasury, under the Administrative Arrangements Orders, deals with ‘borrowing money on the public credit of the Commonwealth’. AOFM’s purpose, under Schedule 1 of the Public Governance, Performance and Accountability Rule 2014 subparagraphs 2(e)(i) and 2(e)(ii) is:

- the advancement of macroeconomic growth and stability, and the effective operation of financial markets, through issuing debt, investing in financial assets and managing debt, investments and cash for the Australian Government; and

- any functions conferred on the entity by or under a law of the Commonwealth.

2.4 The powers delegated to the AOFM under legislation relate to the operational issuance of debt, the ability to enter into investments and related functions. The Treasurer delegates powers and functions under the Commonwealth Inscribed Stock Act 1911 (CIS Act), Loans Securities Act 1919 (LS Act) and Public Governance, Performance and Accountability Act 2013 (PGPA Act) to officials within the AOFM, including the CEO, and heads of business areas. 60 The CIS Act and the LS Act do not specify requirements for debt management. The scope of these delegations mean that delegates can issue debt (for example, at weekly auction Tenders) without each transaction requiring additional approval. The total face value of Australian Government Securities (AGS) that can be on issue is limited by a legislative instrument made by the Treasurer: the Commonwealth Inscribed Stock (Maximum Total Face Value of Stock and Securities) Direction 2020 (the Direction) (see paragraph 1.18). Delegations for legislation relating to debt management are outlined at Figure 2.1.

Figure 2.1: Delegations to Australian Office of Financial Management CEO

Note a: Under the Treasury Portfolio Governance (Australian Office of Financial Management) Instrument 2023, powers are delegated to the CEO of the AOFM for various powers related to employment: Australian Public Service Commissioner’s Directions 2022; Fair Work Regulations 2009; Governance of Australian Government Superannuation Schemes Act 2011; Long Service Leave (Commonwealth Employees) Act 1976; Maternity Leave (Commonwealth Employees) Act 1973; Public Interest Disclosure Act 2013; Public Service Act 1999; Public Service Classification Rules 2000; Public Service Regulations 2023; and Safety, Rehabilitation and Compensation Act 1988.

Source: ANAO analysis of relevant legislation and AOFM documentation.

Governance framework

2.5 Until June 2008, the Commonwealth Debt Management Charter (the Charter) and the accompanying Commonwealth Debt Management Memorandum of Understanding between AOFM and Treasury (the Memorandum of Understanding) provided detailed descriptions of the roles, accountabilities and requirements for the Treasurer, the secretary and the CEO of AOFM. The AOFM Advisory Board advised to discontinue the Charter and Memorandum of Understanding on 6 June 2008, and this was agreed by the secretary in the 2008–09 Annual Remit. Not all aspects of the Charter and Memorandum of Understanding were carried across in later internal policy and governance documents; in particular, there is less detail on governance arrangements and responsibilities in later internal policy and governance documents. Treasury advised in January 2024 that the decision to discontinue the Charter ‘coincided with a reduction in AOFM operational risk following decisions that AOFM would no longer use higher risk instruments such as derivatives and foreign exchange swaps’.

2.6 The Financial Risk Management Policy (FRMP) is an internal policy document that sets out the governance framework that the AOFM acts in accordance with, including governance forums, documents and roles for the management of Commonwealth debt. Governance roles are described at Table 2.1. The FRMP is to be reviewed annually by the AOFM61, with substantive62 changes agreed to by the secretary. The AOFM did not provide advice to the secretary on whether there had been any changes to the FRMP between 2019–20 and 2022–23. Treasury advised in January 2024 that ‘between 2019–20 and 2022–23, the AOFM did not make any substantive changes to the FRMP [and therefore] [n]o advice was provided to the Secretary during this period.’ Despite the role for the secretary outlined in the FRMP, Treasury’s oversight role of the AOFM is not legislated, and Treasury advised its oversight role is implicitly determined by Treasury’s role as the government’s lead economic advisor and Department tasked with the provision of fiscal and economic policy advice63, with high-level responsibility for ‘borrowing money’. Treasury, through the secretary, also supports the Treasurer’s role in debt management as set out in Table 2.1.

Table 2.1: Governance roles and responsibilities outlined by the Financial Risk Management Policy

|

Stakeholder |

Role |

Points of oversight |

|

Treasurer |

To ‘determine the scope and terms of the debt management mandate, acting on advice from Treasury and the AOFM’. |

Debt Issuance Ministerial Submission |

|

Secretary to the Treasury |

Is ‘responsible for oversight of the AOFM in executing its mandate’ and ‘provides advice to the Treasurer on debt management policy’. Supported in this role by the AOFM Advisory Board (re-established in March 2023, and previously operational between December 2000 and November 2016). |

Annual Remit, including Debt Management Strategy and Liquidity Management Strategy |

|

CEO of AOFM |

Is responsible for ‘operational debt management issues and the administration of the AOFM and conduct of its operations’. |

Provision of advice on cost and interest rate risk management to the secretary; recommending the Annual Remit to the secretary; Financial Risk Management Policy changes |

Source: ANAO analysis of AOFM’s Financial Risk Management Policies up to October 2022.

Governance structure

2.7 AOFM has established governance arrangements to support the CEO as the accountable authority for AOFM in providing advice on the management of the Australian Government’s debt and operationalising debt issuance. While it does not have a legislated role to govern the AOFM, Treasury’s implicit governance role in relation to debt management, is implemented primarily through the secretary’s oversight of the Annual Remit.

2.8 The Executive Leadership Group (ELG) is chaired by the AOFM CEO and comprises the heads of the AOFM’s business groups. It met monthly in the period January 2020 to December 2022. In 2023, the Executive Group has met weekly. Between January 2020 and May 2023 the ELG did not discuss issues related to the management of the Australian Government’s debt, but members of the ELG attended other AOFM committees that discussed these issues during this period.64 The ELG’s terms of reference outline that the group’s performance will be assessed by the CEO each year against three criteria: team culture, quality of advice and accountability.65

2.9 The role of the Portfolio Strategy Meetings is to review the key considerations of the AOFM’s debt management responsibilities. The terms of reference for the AOFM Portfolio Strategy Meeting state that meetings are chaired by the AOFM CEO and include staff members from the AOFM’s Front Office and are to be held ‘on a regular basis’. The FRMP states that interest rate risk (assessed as a key financial risk arising from the AOFM’s debt management activities)66 should be a regular topic at Portfolio Strategy Meetings. Presentation packs were prepared for all quarterly meetings between February 2020 and May 2023. Some presentation packs refer to the current trends related to interest rates. Meetings are not minuted.

2.10 The FRMP states that Cash Management Meetings are focussed on monitoring liquidity risk67 and are attended by the AOFM CEO and Front Office staff. The AOFM advised that this is ‘not a decision-making committee with [a] terms of reference or [a] charter’. Presentation packs were developed for meetings on most weeks between January 2021 and May 2023. Meetings are not minuted.

AOFM Advisory Board

2.11 The AOFM Advisory Board (Advisory Board) is convened by the secretary to assist the secretary to assess the AOFM’s proposed strategies and to advise the secretary on debt and investment markets.

2.12 The Advisory Board was first established in December 2000 and was dissolved in November 2016 by the secretary. As the Advisory Board was set up at the discretion of the secretary, it could be dissolved in the same manner. Several reasons were provided at the time for the dissolution of the Advisory Board:

- potential conflict (or perception thereof) between the market experience required of the Advisory Board members and the advice they were expected to provide;

- advice could be sought on a more flexible basis from experts as required; and

- findings of the Capability Review undertaken by the Australian Public Service Commission (APSC) in November 2015 including a lack of clarity around the role of the Advisory Board as both a provider of strategic advice to the Secretary and advice to AOFM on governance and corporate matters and that the Advisory Board functioned as a ‘board of directors’ would for a private company.

2.13 The Advisory Board was re-established in March 2023 by the secretary. The appointees were recommended by the then CEO of the AOFM in 2022, and subsequently approved and appointed by the secretary. Of the four external members of the re-established Advisory Board, two had been part of the Advisory Board at the point it was previously disbanded. The membership of the AOFM Advisory Board is published in the 2022–23 Annual Report.68The scope of the re-established Advisory Board is consideration and advice relating to the Annual Remit and related Debt Management Strategy (DMS) and Liquidity Management Strategy (LMS), and excludes AOFM corporate governance, operational matters and fiscal policy. This is in contrast to the scope of the previous Advisory Board (2000–2016), which included corporate governance and business planning.

2.14 The Budget Policy Division in Treasury has responsibility for providing secretariat services to the AOFM Advisory Board. Treasury provides a briefing to the secretary ahead of the Advisory Board meetings. The briefings provide an overview of the discussion topics but do not provide in-depth advice, separate analysis regarding debt management practices, and public policy in relation to debt, or strategies for implementation as proposed by AOFM.

Oversight of debt management

2.15 Treasury, through the secretary, supports the Treasurer’s role in debt management. The annual Debt Issuance Ministerial Submission (Debt Issuance Strategy) is provided by AOFM to the Treasurer to advise of the planned debt issuance before Budget each year. The Debt Issuance Strategy describes the financing task which is provided by Treasury to the AOFM when required. The Debt Issuance Ministerial Submission then formulates the total planned annual debt issuance by type of AGS required to meet the financing task. The FRMP states the Debt Issuance Strategy should be reviewed and updated when the government releases updated fiscal forecasts and projections.

2.16 The AOFM provided a ministerial submission to the Treasurer before the Budget for the years 2019–20, 2020–21, 2021–22, 2022–23 (March), 2022–23 (October) and 2023–24. These ministerial submissions outlined the AOFM’s issuance strategy for that year in relation to the financing task at Budget. The ministerial submissions were approved by the Treasurer in 2019–20, 2020–21 and 2021–22, and not approved (not signed) by the Treasurer in 2022–23 (March), 2022–23 (October) and 2023–24.

2.17 Additional updates, via a ministerial submission, at the Mid-Year Economic and Fiscal Outlook (MYEFO) were provided in 2019–20, 2020–21, and 2021–22. An update was provided in December 2022 (there was no MYEFO in 2022–23 due to the October 2022 Budget).

2.18 In 2020, the AOFM provided updated issuance submissions to the Treasurer on 7 April 2020, 5 June 2020, 2 July 2020, and 10 August 2020. These updates addressed the effects of the COVID-19 pandemic and monetary and fiscal policy responses on debt management and AGS issuance at the time. Three of the additional submissions were not approved by the Treasurer.

2.19 The AOFM’s Annual Remit facilitates the secretary’s oversight of the AOFM. The FRMP states that the Annual Remit ‘contains limits, targets and thresholds that the secretary to the Treasury seeks to have the AOFM operate within’ and ‘is the mechanism for the secretary to approve the targets, limits, and guidelines that comprise the strategies’. There is no legislative basis for the secretary’s approval of the Annual Remit. The Annual Remit includes the AOFM’s recommended annual strategies for debt management and liquidity management. The ‘limits, targets and guidelines’ in each Annual Remit includes Weighted Average Maturity (WAM), a measure of cost and risk for debt issuance in the year ahead (see paragraph 3.11); approach to issuance; and levels of cash held. AOFM advised that the approval of the Annual Remit is ‘an internal governance requirement’ per the FRMP and ‘not linked to a legislative requirement.

2.20 Annual Remits for the years 2019–20, 2020–21, 2021–22 and 2022–23 were provided to the secretary. These were approved before the start of the corresponding financial year in 2019–2069, 79 days after the beginning of the financial year in 2020–21, before the start of the financial year in 2021–22, and one day after the beginning of the financial year in 2022–23.70 The date of the approval of the Annual Remit did not affect ability of the AOFM to issue debt. AOFM advised that the ‘trigger for an annual remit is a financing task as part of the Budget process’. The absence of a signed remit prior to 1 July does not prevent AOFM from issuing AGS to meet Government financing needs’. The Annual Remit was not required to be updated when expected debt issuance changed.

2.21 Each Annual Remit informs the secretary of the AOFM’s adherence with the previous year’s Annual Remit. Treasury advised in January 2024 that ‘changes in issuance volumes from those advised in the annual remit reflect changes in the borrowing task [due to the evolving economic and fiscal outlook and the Government’s policy decisions]’. In 2019–20 and 2022–23, the AOFM reported that its operations were consistent with the previous Annual Remit. In 2020–21, the AOFM advised the secretary that the WAM issuance target was not met and the final volumes of Treasury Bonds and Treasury Notes in 2019–20 were considerably higher than set out in the 2019–20 Annual Remit. In 2021–22, AOFM advised the secretary that issuance in the first half of the year was lower than intended.

2.22 Treasury provided the secretary with advice prior to the approval of the Annual Remit from 2020–21 to 2023–24. In 2020–21 and 2021–22, this advice included recommendations to approve the Annual Remit or aspects thereof. Treasury advised the ANAO on 9 November 2023 that the Annual Remit is provided to the Treasurer ‘following agreement by the Treasury Secretary’ which ‘provides an opportunity for the Treasurer to express any concerns with the remit.’ A summary of the annual process for the establishment of the key debt management limits through the Debt Issuance Ministerial Submission and the Annual Remit is outlined at Figure 2.2.

Figure 2.2: Process for Debt Issuance Ministerial Submission and Annual Remit as of 2023

Note a: While the Annual Remit in practice is developed before the start of the Financial Year, AOFM advised that the timing is dependent on the provision of the financing task for the year, which could mean updates apart from the standard Budget and MYEFO timings.

Note b: While the Debt Issuance Ministerial Submission is also typically developed at Budget and MYEFO timings, their timings may change depending on changes to these financial updates.

Source: ANAO analysis of AOFM and Treasury documentation.

Recommendation no.1

2.23 The Australian Office of Financial Management and the Department of the Treasury should ensure that where governance arrangements are not defined by legislation, they are clearly documented, including clear roles and responsibilities.

Australian Office of Financial Management response: Agreed.

2.24 The AOFM will work with the Department of the Treasury to enhance existing documentation of governance arrangements not defined by legislation, including clear roles and responsibilities for the Treasurer, the Secretary to the Treasury and the AOFM CEO.

Department of the Treasury response: Agreed.

Recommendation no.2

2.25 The Australian Office of Financial Management should document all governance meetings related to debt management; and ensure that there is clear and timely documentation of operational directives and limits relating to the execution of debt management.

Australian Office of Financial Management response: Agreed.

2.26 The AOFM will document all governance meetings related to debt management.

2.27 The AOFM will review existing arrangements to identify if there are any gaps or opportunities for improvement regarding the clear and timely documentation of operational directives and limits.

Were there effective risk management, compliance and assurance arrangements to manage government debt?

The AOFM has established frameworks to manage risk, compliance and assurance. The AOFM has separate frameworks for the management of enterprise risk and financial risk. The AOFM Middle Office does not assume responsibility for the management of financial risks. The AOFM’s processes for the acceptance of gifts, benefits and hospitality by the AOFM’s CEO and staff are not aligned with relevant public sector requirements. The AOFM’s conflict of interest processes are not aligned with the AOFM’s conflict of interest policy. The Treasury’s conflict of interest processes do not incorporate the AOFM CEO and for this reason are not aligned with Treasury’s conflict of interest policy and legislative requirements.

2.28 Section 16 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) requires the accountable authority of a Commonwealth entity to establish and maintain an appropriate system of risk oversight and management and internal control for the entity. The Commonwealth Risk Management Policy requires that entities embed risk management into the decision-making activities of an entity, including implementation.71

2.29 The AOFM is a public sector and financial market entity which seeks to base its operational principles on financial industry best practice.72 Therefore, the AOFM’s financial risk management structures should take into consideration those of other financial market entities, especially with respect to establishing appropriate internal controls and the segregation of duties, in addition to meeting requirements of the Commonwealth Risk Management Policy.

2.30 The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) develop requirements and better practice guidance for financial risk management practices for regulated entities. While the AOFM is not regulated by APRA or ASIC, APRA’s and ASIC’s regulatory requirements and guidance represent best practice in the management of financial risks.

2.31 Prudential standards73 for all APRA-regulated entities requires that:

- risk frameworks address material risks to the entity, including market and investment risks;

- material risks associated with the institution’s strategic objectives and business plan must be explicitly managed through the risk management framework;

- the risk management function for the institution is operationally independent; has the necessary authority and reporting lines to conduct its activities effectively and independently; and has access to all aspects of the institution that have the potential to generate material risk; and

- the Chief Risk Officer must be independent from business lines, other revenue-generating responsibilities and the finance function.

2.32 Guidance from ASIC74 to funds management companies regarding their risk management obligations states that:

- documented risk management systems should include:

- policies and procedures for identifying, assessing and understanding each of the material risks of the fund operator’s business and funds operated;

- policies and procedures for ensuring there is adequate oversight of the risk management systems by both the party responsible for ownership of the risk and the compliance function, including appropriate reporting; and

- a policy or statement on the fund operator’s risk appetite and the risk tolerance for each material risk identified.

2.33 Funds management companies may segregate functions to allow for independent checks and balances; establish a designated risk management function and/or risk management committee.75

Management of risks

2.34 The AOFM has established a risk governance framework and an assurance framework to support its CEO to meet debt management obligations. The key elements of the AOFM’s risk governance framework in relation to debt management consists of the Enterprise Risk Management framework and the FRMP, as well as the ’targets, limits, and guidelines’ in the Annual Remit, DMS and LMS.76 The AOFM advised the ANAO in June 2023 that ‘[no] additional compliance, assurance or oversight activities were stood up to support the increase in Government debt. The AOFM dialled up issuance and existing processes and tools on hand were scalable.’

Enterprise risk management framework

2.35 The enterprise risk management framework outlines the AOFM’s approach for identifying, managing and reporting on strategic, portfolio and operational risks.

2.36 The Chief Risk and Assurance Officer (CRAO) is responsible for the timely monitoring and reporting of risks, incidents and treatments to the AOFM CEO, Executive Leadership Group and the Audit and Risk Committee. Business units are responsible for assessing risks and reporting risks and changes to risks to the Middle Office, which maintains the risk register. The CRAO attested for each annual review of the Enterprise Risk Management Framework provided to the CEO that AOFM officials consistently applied the risk management process, using templates to report risks appropriately.

2.37 Table 2.2 outlines the four portfolio risk categories identified in the Enterprise Risk Management Strategy for 2022–23, and AOFM’s appetite and management of these risks. As set out in Table 2.2, tolerances for the key financial risks outlined in the FRMP (interest rate risk and liquidity risk) are managed according to the provisions of the FRMP for measuring, mitigating and reporting on financial risks which is undertaken primarily by the Front Office as discussed at paragraph 1.6. The FRMP does not specify a risk oversight role for the Middle Office for these risks.

Table 2.2: AOFM portfolio risk taxonomy, appetite, and tolerances for 2022–23

|

Risk category |

Risk appetite and rationale |

Tolerance and control documentation |

|

Liquidity risk AOFM will not have the funds available to meet the Government’s payment obligations as they fall due. |

Minimal (low risk level) The ability to meet government cash flow requirements in a cost-effective manner goes to the core of AOFM obligations. Ready access to financial assets is taken to have primacy over other objectives. It is essential that the AOFM take the necessary steps to meet day-to-day outlays of government and avoid market or operational disruptions caused by AOFM action or inaction. |

Financial Risk Management Policy, supporting strategies, guidelines, and procedures. |

|

Market risk Exposure to the uncertainty in market parameters impacting the value of the asset and liability portfolios and/or public debt interest costs. |

Balanced (high risk level) Within the bounds of relevant legislation, the AOFM is well placed to assess and leverage appropriate market risks and opportunities to achieve overall portfolio optimisation. |

Financial Risk Management Policy, supporting strategies, guidelines, and procedures. |

|

Credit risk AOFM or a counterparty may default on its obligations or be unable to perform under the terms of a contract, creating financial loss. |

Minimal to cautious (low to medium risk level) The AOFM has a cautious appetite in relation to structured finance activities, due to the nature of the underlying asset classes. The AOFM has a minimal risk appetite for credit risk associated with debt management activities. Settlement failure arising from either the AOFM or a counterparty defaulting on its AGS obligations, would compromise AOFM’s financing obligations and carry with it the potential for significant reputational impact. |

|

|

Portfolio strategy Inadequate risk decision-making processes that underpin portfolio decisions. |

Cautious (medium risk level) To ensure AOFM adequately considers its core portfolio obligations it is important that we maintain sound risk-based decision-making processes based on reliable and relevant information. |

|

Source: AOFM documentation.

Enterprise assurance framework

2.38 Both enterprise and financial risks are supported by the AOFM’s assurance framework. The AOFM’s assurance framework consists of a policy, updated and approved by the CEO every three years, and an annual program.

2.39 The assurance framework is based on a three line of defence model, where Business Units own and manage risks and are responsible for reporting these to the Middle Office as the first line of defence, the Middle Office has oversight of and monitors risks, and internal audit provides additional assurance.

2.40 The annual assurance program showed that controls were developed for identified risks. The Middle Office’s assurance actions as a second line of oversight and control, is primarily through the Middle Office’s Daily Report, which provides a compliance check against ‘targets, limits, and guidelines’ including those outlined in the Debt Issuance Ministerial Submission and Annual Remit. The AOFM advises that in practice, the relevant limit reported against is the weighted average maturity (WAM). Other activities undertaken by the Middle Office largely involves checking that annual limits and financial risk policies are developed and reported against.

2.41 The AOFM has an Audit and Risk Committee that provides independent advice to the CEO. Audit and Risk Committee papers and minutes show Enterprise Risk and Assurance updates are provided at each Audit and Risk Committee meeting.

Management of non-compliance

2.42 The AOFM advised the ANAO in November 2023 that non-compliance is to be reported to the secretary and that this reporting takes place through the Annual Remit and Debt Issuance Strategy. The AOFM has not developed any process or procedures in the instance that non-compliance with financial risk tolerances is identified.

|

Opportunity for improvement |

|

2.43 The Australian Office of Financial Management could:

|

Management of probity

Fraud

2.44 The AOFM Fraud Control Plan was reviewed in 2019 and 2021, and outlines the AOFM’s approach to managing fraud. The Plan states that ‘the AOFM has a minimal risk appetite for fraud.’ The AOFM’s Fraud Manager is the CRAO who coordinates and manages the AOFM’s fraud control policies and processes.

2.45 As at February 2023, the CRAO reported to the AOFM Executive Leadership Group no instances of non-compliance with the AOFM’s fraud control policies have been identified. The AOFM advised the ANAO on 9 November 2023 that a register of instances of fraud has not been established as there have not been any identified instances of fraud.

Conflict of interest

2.46 The main legislative requirements relating to conflict of interest for Australian Public Service (APS) employees are as follows:

- under sub-section 13(7) of the Public Service Act 1999, an APS employee must take reasonable steps to avoid any conflict of interest (real or apparent) in connection with the employee’s APS employment; and must disclose details of any material personal interest of the employee in connection with the employee’s APS employment;

- under sub-section 29(1) of the Public Governance, Performance and Accountability Act 2013, an official of a Commonwealth entity who has a material personal interest that relates to the affairs of the entity must disclose details of the interest; and

- under sub-section 13(1) of the Public Governance, Performance and Accountability Rule 2014, an official of a Commonwealth entity who is the accountable authority of the entity and has a material personal interest that relates to the affairs of the entity must disclose that interest, in writing, to the entity’s responsible Minister.

2.47 The AOFM maintains internal policies to manage conflicts of interest and instances of fraud. The AOFM Conflict of Interest Policy is updated annually and includes guidance for all AOFM officials and consultants or contractors (including Audit and Risk Committee members).

2.48 The Policy provides guidance on the following:

- responsibilities of APS employees under the Australian Public Service Code of Conduct;

- Corporations Act 2001 provisions (Part 7.10, Division 3) prohibiting insider trading and the definition of insider trading;

- definitions of real, and apparent, conflicts of interest;

- responsibilities of the CEO, CRAO, managers and officials in relation to the management of conflicts of interest;

- CEO’s directions on the disclosure, and avoidance, of conflicts of interest, as well as guidance on determining the significance of any particular conflict; and

- templates for officials to declare any conflicts of interest, real or apparent.

2.49 The CEO provides additional guidance to AOFM officials on the disclosure of specific conflicts; determined to be a matter of priority:

- any dealings (including holding of equities) by AOFM officials in ASX [Australian Securities Exchange] Ltd;

- requirement for officials involved in selection of bids in investment transactions to disclose any interests they may have in firms that appear on the AOFM’s Investment Facility panel member list and/or market participants submitting proposals for the securitisation facilities; and

- requirement for officials involved in settlements or the retail registry facility to disclose any private dealings (including holding of equities) they may have in Computershare Australia.

2.50 The AOFM Conflict of Interest Policy specifically states:

All AOFM officials are prohibited from holding a direct interest in or trading Australian Government Securities (AGS) or AGS derivatives (e.g. Australian Government Bond futures and AGS depositary interests including Australian Government Bond Chess Depository Interests (CDIs)). Where the AGS or AGS derivatives form part of an investment portfolio such as a managed superannuation fund or investment scheme and individual trading decisions are not influenced by the official, this requirement does not apply.

2.51 All officials covered by the AOFM Conflict of Interest Policy are required to submit an acknowledgement each year that they are aware of the requirements of the PGPA Act — Duties of Officials; APS Code of Conduct; and AOFM’s Employment Policies and Procedures. This is done through the submission of the Declaration of Interests form (Annexure 1 to the Conflict of Interest Policy) on commencement and once per year.

2.52 The AOFM Conflict of Interest Policy states that for the management of conflicts:

Where a conflict of interest arises, the official and the manager share responsibility for its management. The conflict must be handled transparently and in a way that will stand up to scrutiny. A written record of actions taken to manage the conflict of interest must be made by the official and agreed by their manager, reviewed regularly, and updated when any circumstances change. Part B of Annexure A provides space for this conflict management plan to be recorded. Completed conflict management plans must be provided to the CRAO.

2.53 The CEO determines appropriate action in the event of a breach of the Conflict of Interest Policy.

2.54 The CRAO is responsible for the maintenance of a register of conflict of interest declarations and conflict management plans. However, the CRAO maintains individual declarations on their computer.

2.55 During the audit period of January 2020 and June 2023, there were two rounds of declaration of conflict of interest: August 2020 and March 2022. This demonstrates a gap of 20 months between declarations.77 One staff declaration was absent in 2020 and three staff declarations were absent in 2022.78

2.56 Conflict management plans are self-reported by the staff member. ANAO analysis of declarations made during these two rounds showed no evidence of what actions are taken by staff and their managers to manage conflicts and whether the CRAO was satisfied that declared conflicts of interest had been appropriately addressed.

2.57 The Audit and Risk Committee Charter requires that all Audit and Risk Committee members submit an annual written declaration to the CEO of real or apparent conflicts of interest they may have in relation to their responsibilities to be completed on the final yearly meeting. A declaration is also required at the beginning of each meeting, with the Chair, in consultation with the CEO, responsible for deciding if the committee member should excuse themselves from a discussion.

2.58 During the audit period, the Audit and Risk Committee members each signed the External Audit Committee Member Conflicts of Interest Declaration each year.

2.59 The AOFM Conflict of Interest Policy does not cover the CEO. SES employees are required to submit, at least annually, a written declaration of their own and immediate family’s financial and other material personal interests.79 The CEO, as an SES employed by Treasury, is covered by the Treasury Conflict of Interest Policy which states that new SES staff are required to ‘complete an annual conflict of interest declaration, starting with a declaration on commencement of their appointment’.

2.60 During the audit period, the CEO of the AOFM did not submit any conflict of interest declaration (including annual declarations or declarations upon commencement) to the secretary.

2.61 As advisors to the secretary, the AOFM Advisory Board is subject to the Treasury Conflict of Interest policy. In appointing the members, Treasury determined that a current or past market role of the AOFM Advisory Board member was not of itself a conflict, but designed a test where advisory roles were ‘not judged to have a conflict of interest’. AOFM Advisory Board members advised that they are requested to declare conflicts of interests ahead of each meeting. Any conflicts of interest are included as part of meeting minutes, and the Chair can excuse members from meetings at any point once this is made known. All AOFM Advisory Board members submitted conflict of interest declarations upon commencement.

2.62 Advisory board members do receive access to market sensitive information, but do not receive specific guidance from Treasury about confidentiality requirements for dealing with market sensitive information.

|

Opportunity for improvement |

|

2.63 The Australian Office of Financial Management and the Department of the Treasury could:

|

Gifts, benefits and hospitality requirements

2.64 Section 27 of the PGPA Act states that an official must not improperly use their position to gain, or seek to gain, a benefit to themselves or another person. The giving or receiving of gifts, benefits and hospitality can create the perception that an official is subject to inappropriate external influence.80

2.65 A policy for giving and receiving gifts, benefits and hospitality is an important element of a robust control environment and supports ethical conduct. The effective implementation of such a policy, which generally requires accurate disclosures by entity personnel, benefits from strong cultural settings within the entity, including the example set by senior leadership (‘tone at the top’).

2.66 AOFM’s requirements for managing the receipt of gifts, benefits and hospitality are contained in the Accountable Authority Instructions (AAIs), employment policies and procedures, and conflict of interest policies. The AOFM’s guidance states:

The AOFM’s role will give rise to offers of hospitality (e.g. meals, in house functions, attendance at corporate functions and other events). Acceptance of hospitality can be normal business practice but has the potential to cause perceived or actual conflicts of interest – which need to be either avoided or managed.

…

Hospitality on an ‘excessive’ scale (judged by either value or frequency) should be declined, even where there is a reasonable expectation that it will contribute to the achievement of the AOFM’s relationship management objectives.

2.67 There is no clear internal guidance or defined thresholds for cost or frequency on what is considered ‘excessive’ hospitality.

2.68 AOFM’s AAIs define official hospitality as the ‘use of public resources to provide hospitality to persons other than officials to facilitate the achievement of one or more entity objectives’. Under the AAIs, officials must not enter into an arrangement to provide official hospitality unless:

- delegated the authority under section 23 of the PGPA Act by the CEO; and

- the requirements of these instructions have been met.

2.69 Under the AAIs, decisions to approve official hospitality should be publicly defensible, and procured goods and services are subject to the Commonwealth Procurement Rules. The Chief Financial Officer (CFO) must ensure a permanent record is maintained of both approval and expenditure documentation on the provision of official hospitality for monitoring and reporting purposes.