Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of the Textile, Clothing and Footwear Post-2005 (SIP) Scheme

The objective of this audit was to assess whether the Scheme is being administered effectively by the department. The ANAO focussed on Program Year 1 of the Scheme, 2005–06, and examined DIISR's arrangements for:

- assessing the eligibility of entities to receive grants;

- assessing entities' claims for eligible expenditure;

- adhering to the funding limits for the Scheme when calculating and paying claims, and managing any debts that arise;

- and evaluating and reporting on whether the statutory objective of the Scheme is being met.

The audit did not examine the other components of the 2005–2015 industry assistance package; nor did it examine any of the programs delivered under the previous assistance package (2000–2005).

Summary

Introduction

The textile, clothing and footwear (TCF) industry in Australia covers a diverse range of products and incorporates all stages of production from the processing of raw materials to the supply of finished products. The industry is made up of around 4500 entities, including large companies like Pacific Brands Clothing Pty Ltd, high-end fashion designers, and familiar brand names like R.M. Williams, Speedo and Driza-Bone.

In 2005–06, sales and services income for the industry was $9.2 billion, and the industry accounted for 2.6 per cent of the total manufacturing activity in Australia. Around 48 000 people are employed in the industry, the majority of whom are based in the capital cities, especially Melbourne and Sydney. There is also significant activity in regional centres such as Geelong, Bendigo, Wangaratta, Albury-Wodonga and Devonport.1

Over the past ten years, the TCF industry has undergone rationalisation and restructuring in the context of increased global competition, new technologies, changing consumer patterns and tariff reductions.

Government assistance for the TCF industry

Currently, the major form of Australian Government support for the TCF industry is a ten-year assistance package, which commenced on 1 July 2005. This package includes $747 million in budget-funded programs along with a five-year pause on tariff reductions effective from 2005. The package was designed to help TCF firms adjust to a lower tariff environment, and it follows on from the industry assistance package that was in place from 2000 to 2005. Further tariff cuts are scheduled in 2010 and 2015.

The major program within the current assistance package is the TCF Post-2005 Strategic Investment Program Scheme (the Scheme). This Scheme is the focus of this audit and follows on from the TCF Strategic Investment Program (SIP) Scheme, which ran from 2000–01 to 2004–05.

The TCF Post 2005 (SIP) Scheme

The statutory objective of the Scheme is to foster the development of a sustainable and internationally competitive TCF manufacturing industry and TCF design industry in Australia by providing incentives that will promote investment and innovation in the industry. Grant funding of up to $575 million is available to eligible TCF entities across two five-year periods:

- up to $487.5 million to eligible TCF sectors from 2005–06 to 2009–10; and

- up to $87.5 million to the clothing and finished textiles sectors only from 2010–11 to 2014–15.

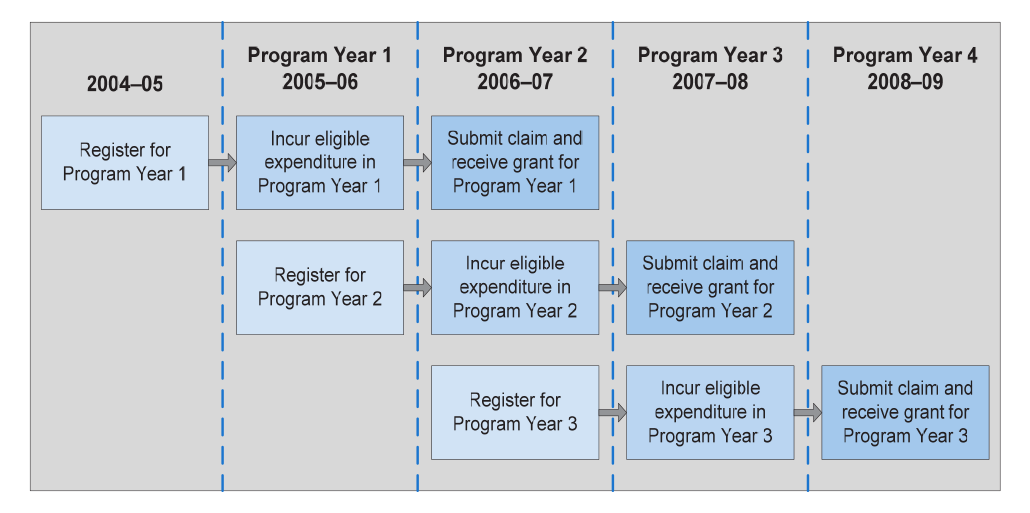

Each year of the Scheme is referred to as a ‘Program Year', which for most entities corresponds to a standard financial year ending 30 June. To receive assistance, entities must register prior to the commencement of each Program Year, incur eligible expenditure in the Program Year, and then submit a claim to receive a grant payment in the financial year after each Program Year. This rolling, three-year cycle is illustrated in Figure 1.

Figure 1 Overview of the registration, expenditure and claim / payment cycle for the TCF Post-2005 (SIP) Scheme, for Program Year 1 to Program Year 3

Source: ANAO based on the Textile, Clothing and Footwear Post-2005 Strategic Investment Program Scheme 2005

To register under the Scheme, an entity must show that it carries on or proposes to carry on an eligible TCF activity in Australia. These activities include: manufacturing of TCF products; design for manufacturing of TCF products; and certain ancillary activities such as warehousing and distribution. To qualify for support, entities must also spend more than $200 000 on eligible TCF activities during the relevant Program Year(s). Some 544 entities registered for the first year of the Scheme, 2005–06.

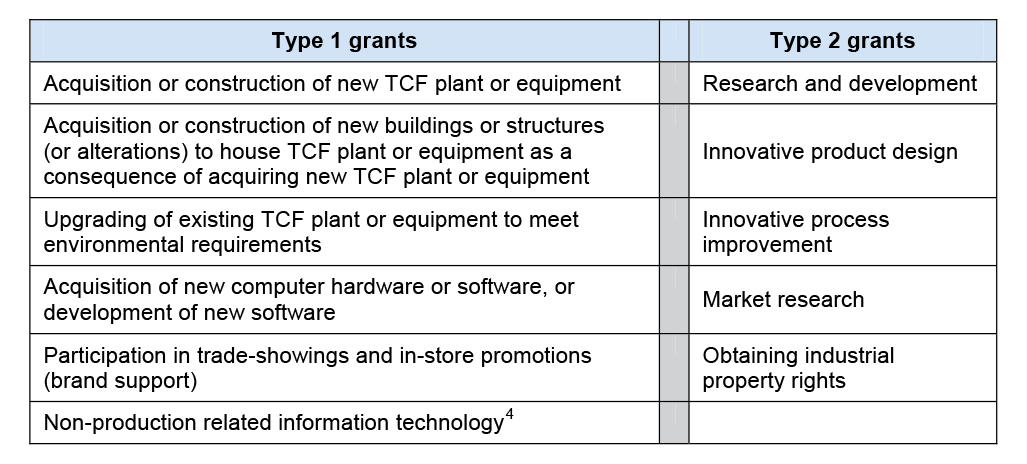

Entities that meet the eligibility requirements for the Scheme are able to access two types of grant payments—Type 1 grants provide up to 40 per cent of expenditure on eligible activities, while Type 2 grants provide up to 80 per cent of eligible expenditure. Table 1 lists the type of activities able to be claimed under these grants.

Table 1 Activities able to be claimed under the TCF Post-2005 (SIP) Scheme

Source: ANAO based on the Textile, Clothing and Footwear Post-2005 Strategic Investment Program Scheme 2005

After the end of each Program Year, entities can access scheme funds by lodging a claim for a grant payment, or by requesting an ‘advance' of a grant payment (to be followed by a claim). Advances must not exceed 20 per cent of the eligible grant amount for Type 1 grants, or 40 per cent of the eligible grant amount for Type 2 grants. When claiming and receiving an advance or grant payment, entities must be undertaking an eligible TCF activity.

Total grant payments are capped at $97.5 million per year for the period 2005–06 to 2009–103 and at $17.5 million per year for the period 2010–11 to 2014–15. If the total claims for scheme funds exceed the annual funding limit (as happened in Program Years 1 and 2), all claims are reduced through a modulation process designed to ensure that the annual funding cap is not exceeded. Some funding limits also apply to individual grant payments.

For Program Year 1, a total of $96.1 million in grants were paid to 341 entities.4 Payments ranged from a few hundred dollars to, in one case, over $6.4 million. However, the majority grants were under $300 000.

Legislative and administrative framework

The Scheme was established under the Textile, Clothing and Footwear Strategic Investment Program Act 1999 (the Act) and a disallowable instrument, the Textile, Clothing and Footwear Post-2005 Strategic Investment Program Scheme 2005 (the Scheme). The Act and Scheme are administered by the Department of Innovation, Industry, Science and Research (DIISR).5 AusIndustry, a service delivery division within DIISR, is responsible for the day to day administration of the Scheme. This includes: registering entities; assessing entities' advances and claims; paying grants and carrying out compliance and education activities. The Manufacturing division is responsible for the policy and legislative framework for the Scheme.

External reviews of the TCF industry

Since 2000, there have been two external reviews of government assistance to the TCF industry. The first was in 2002, during the previous TCF SIP Scheme, which was undertaken by the Productivity Commission;6 and the second in 2008, which was led by Professor Roy Green. The Terms of Reference for the 2008 review include an examination of the appropriateness and effectiveness of assistance provided under the 2005–2015 package, including the Scheme. Professor Green's report, Building Innovative Capability, was publicly released by the Minister in September 2008.

Audit objective and scope

The objective of this audit was to assess whether the Scheme is being administered effectively by the department. The ANAO focussed on Program Year 1 of the Scheme, 2005–06, and examined DIISR's arrangements for:

- assessing the eligibility of entities to receive grants;

- assessing entities' claims for eligible expenditure;

- adhering to the funding limits for the Scheme when calculating and paying claims, and managing any debts that arise; and

- evaluating and reporting on whether the statutory objective of the Scheme is being met.

The audit did not examine the other components of the 2005–2015 industry assistance package; nor did it examine any of the programs delivered under the previous assistance package (2000–2005).

Overall conclusion

The Scheme is the Australian Government's main budget funded program for the TCF industry, and is part of a broader industry assistance package worth $747 million. It provides up to $575 million in cash entitlements to eligible entities over the ten-year period until 2014–15, and follows on from the TCF SIP Scheme, which provided $641 million in benefits from 2000–01 to 2004–05. The aim of the Scheme is to foster the development of a sustainable and internationally competitive TCF industry in Australia.

Overall, the Scheme is being administered effectively by the department. There are sound processes and controls in place to assess the eligibility of entities to receive assistance and for calculating and paying grants within the funding limits of the Scheme. The department's approach to program management is responsive to the experience it has gained in administering this and other large industry assistance programs. Introducing self-assessment for selected entities will provide opportunities for DIISR to better target its program of site visits, as part of its claim assessment process. However, more broadly, the department is not in a position to assess by reference to key performance indicators whether the statutory objective of the Scheme is being met—the development of a sustainable and internationally competitive TCF industry in Australia.

In administering the Scheme, DIISR faces challenges in verifying expenditure claimed on innovation activities (a Type 2 grant). These activities made up nearly half of all claimed expenditure in 2005–06 and 2006–07, but they are not defined under the legislation, and are therefore open to interpretation by entities. Of the four main methods DIISR uses to assess claims, site visits provide the best means of gaining timely and first hand assurance that claimed expenditure was valid and that eligibility requirements were met. However, for Program Year 1, most site visits were undertaken outside the peak claim assessment period (from February to May 2007), when the bulk of claims were lodged. This limited the usefulness of these site visits.

DIISR's decision to introduce the self-assessment of claims on selected entities for Program Year 2 (and potentially beyond) provides a means to take a more targeted and risk-based approach to claim assessment. There is scope for DIISR to extend the benefits of such an approach by enhancing aspects of its compliance management strategy; this includes refining its program of site visits to target higher-risk entities during the claim assessment stage, and providing additional feedback and guidance to entities on the types of claims that are not supported, to minimise the risk of future mis-claiming.

An external review of the TCF industry conducted in 2008 found that the current Scheme and the previous TCF SIP Scheme have made a positive contribution to Australia's TCF industries, helping entities to reposition themselves to compete in the changing business environment.7 However, although the department collects a range of industry data, it has not developed the necessary key performance indicators to determine the impact of the Scheme on the TCF industry. To address this gap in its performance management framework, DIISR could develop and report against intermediate outcomes for the Scheme, as it does for the Automotive Competitiveness and Investment Scheme.

The ANAO made two recommendations aimed at improving DIISR's administration of the Scheme, which seek to enhance its compliance management strategy and its performance management framework.

Summary of DIISRs response

The department welcomes the ANAO's conclusion that the Scheme is being administered effectively, with sound processes and controls in place to assess eligibility of entities to receive assistance and for calculating and paying grants within the funding limits of the Scheme. In addition, the ANAO has indicated that the current assessment process is well-documented and timely. The department notes the ANAO's confirmation that appropriate measures have been taken to reduce the risk of debts occurring following the first year of the Scheme. The department agrees to implement the ANAO's two recommendations.

Key findings by chapter

Eligibility for assistance (Chapter 2)

AusIndustry is responsible for assessing whether entities have met eligibility requirements before paying any grants under the Scheme. These requirements include:

- being registered before 1 July of the relevant Program Year;

- Incurring more than $200 000 in eligible expenditure during the relevant Program Year(s)8 ;

- and undertaking an eligible TCF activity at the time of making a claim and receiving a payment in the financial year following each Program Year.

Registration of eligible entities

For Program Year 1, 544 entities had registered under the Scheme. The ANAO examined a sample of 40 files for entities that received a grant payment (around 10 per cent of grant recipients that year). All 40 entities had met key registration requirements. This included registering before the deadline of 1 July 2005, providing copies of their financial statements and a statement of strategic business intent, and estimates of expenditure on eligible activities for the next two Program Years. These estimates allow DIISR to gauge the demand for Scheme funds. Departmental staff followed standard processes when assessing applications for registration, as set out in a procedures manual.

Eligibility issues identified for Program Year 1

Based on its assessment of 374 claims received for Program Year 1, DIISR identified three separate instances where Scheme funds were provided to entities that were subsequently found to be ineligible for assistance. In brief, two of these cases involved entities that received an advance payment, but then became ineligible to apply for a grant. The third case, which is before the Administrative Appeals Tribunal, involved problems surrounding the transfer of registration from one entity to another. The department paid out a total of $578 000 to these entities, which amounted to less than one per cent of total grant payments that year.

Undertaking eligible TCF activities

DIISR does not independently verify that entities are undertaking an eligible TCF activity at each discrete period during the claim and payment cycle (Figure 1). Instead, it requires entities to provide written declarations about their eligibility to receive assistance at each stage of the registration and claim process. It then seeks to confirm the veracity of these declarations, through the following mechanisms, either in the actual claim year or during the three-year cycle for each Program Year:

- desk-based assessment of all claims;

- site visits to selected entities' premises; and

- searches on the Australian Business Register website, and the Australian Securities and Investment Commission website to confirm the entity is a registered business, and to identify any changes in the entity's status, which could affect its eligibility to receive a grant.

The ANAO confirmed that these checks were undertaken for Program Year 1. However, most site visits were not undertaken during the actual claim assessment period, which reduced DIISR's ability to gain first hand assurance that eligible TCF activities were being undertaken as claimed. Nevertheless, as discussed in Chapter 3, the department's decision to introduce the self assessment of claims for selected entities for Program Year 2 (and potentially beyond) provides an opportunity to undertake additional site visits during the claim and payment periods, and to confirm the eligibility of entities to receive support.

Assessing entities' claims (Chapter 3)

As outlined in Table 1, entities that satisfy the eligibility requirements for the Scheme are able to claim two types of grants – Type 1 grants provide up to 40 per cent of expenditure on eligible activities, while Type 2 grants provide up to 80 per cent of eligible expenditure.

Applications for grants are to be made in the financial year after the Program Year in which eligible expenditure was incurred. To access Scheme funds, entities can either request an advance of a grant, to be followed by a claim; or by lodging a claim only. Advances provide up to 20 per cent of the eligible grant amount for Type 1 grants and 40 per cent of eligible expenditure for Type 2 grants.

Claims for Program Year 1

For Program Year 1, DIISR received claims from 374 entities, with 245 of these also requesting an advance of a grant payment. The total amount of expenditure claimed by (but not paid to) entities was $271.2 million, almost half of which was for innovation activities, a Type 2 grant. A key challenge that DIISR faces in assessing claimed expenditure on innovation activities is that the Scheme does not define ‘innovation'. Instead, it provides general criteria on activities that are considered not to be innovative. This approach requires entities and the department to exercise judgement in determining which activities qualify for support.

Claim assessment methods

For Program Year 1, DIISR elected to assess all requests for advances and all claims, rather than allowing entities to self-assess their claims, as permitted under the Scheme. This approach was consistent with its coverage of claims during the previous TCF SIP Scheme. The key assessment methods were:

- desk-based assessment of all claims, which were conducted by the customer service manager (CSM) assigned to each entity;

- Review of auditor's reports, which entities are required to provide with their claim;

- site visits to selected entities' premises (110 visits, some 29 per cent of all claimants); and

- compliance appraisal visits for a smaller number of entities (15, some four per cent of all claimants), which are separate to CSM site visits, and aim to validate the work performed by auditors.

- These claim assessment methods were part of a broader compliance management strategy AusIndustry has developed to manage the risks associated with its day to day administration of the Scheme.

The ANAO examined 40 claims, and all claims had been subject to a desk based assessment by a CSM. All claims included an independent auditor's report, which attested that the revenue and expenditure amounts claimed by the entity had been substantiated, on a sample basis, by the auditor. However, most site visits, which provide a useful means of gaining first-hand assurance that activities were undertaken as claimed, took place outside the peak claim assessment. That is, most visits were undertaken from May to December 2006, before the bulk of claims were submitted in February 2007; or they were undertaken in June 2007, following the payment of grants for Program Year 1.

The main reason for site visits not being undertaken take during the peak claim assessment period is because the department had to meet the 60 day processing deadline for the advances and claims. The decision to assess all claims, rather than allowing appropriate claims to be self-assessed limited the usefulness of site visits as a tool to verify the expenditure claimed by entities. This was particularly relevant for innovation activities, which are not easily substantiated through desk-based assessment and are not explicitly covered in the auditor's report.

Claim assessment for Program Year 2 and beyond

Of the 378 claims received for Program Year 2, self-assessment was allowed in 60 claims, or around 15 per cent of all claims lodged with the department. In determining which claims were suitable for self-assessment, the department developed a risk rating procedure, which seeks to identify those entities that present a higher risk of making non-compliant claims. In practice, self-assessment means that these claims were approved and paid as claimed, without being subject to a full desk-based assessment. However, all entities were still required to provide an independent auditor's report as part of their claim, and may have undergone a previous site visit.

Self assessment allows the department to adopt a more risk-based approach to assessing claims. If implemented effectively, it will free up resources during the peak claim assessment period, allowing the department to focus these resources on assessing higher risk entities. There is scope for DIISR to extend the benefits of such an approach by enhancing aspects of its compliance management strategy. This includes refining its program of site visits, to target higher risk entities during the 60-day claim assessment stage, and providing additional feedback and guidance to entities on the types of claims that are not supported, to minimise the risk of future mis-claiming. Fact sheets and other guidance material also need to be regularly reviewed and updated.

Calculating grants and managing debts (Chapter 4)

DIISR determines the final grants to be paid to an entity after it takes into account:

- the amount of any advance provided;

- the requirement for grants not to exceed five per cent of an entity's total eligible revenue in the previous financial year; and

- the need to accommodate all grant payments within the annual funding limit for the Scheme ($97.5 million in Program Year 1).

All grants must be paid by 10 June after the end of each Program Year.

Payment system

DIISR uses the Integrated Program Management System (IPMS) to calculate grant entitlements and to perform other functions associated with its administration of the Scheme (for example, holding registration details of entities). Payments within IPMS are calculated using figures entered by AusIndustry CSMs during the assessment of claims. 9

Prior to making grant payments for Program Year 1, DIISR took a number of additional measures to gain assurance that IPMS was robust and reliable. This included engaging an external contractor, who developed a parallel system to check the accuracy of payments made in IPMS. AusIndustry also developed its own parallel payment system to check the accuracy of payments. It then conducted a review of payments made for Program Year 1, and identified two errors, the net impact of which was negligible.

The ANAO reviewed the payment system within IPMS, both for Program Year 1 and in relation to new functionality for Program Year 2 (which mainly covered debt management). Overall, the ANAO confirmed that:

- appropriate IT change management procedures and quality assurance controls are in place to preserve the completeness, accuracy and reliability of Scheme data; and

- appropriate application controls are in place to ensure the correct calculation of payments, and that scheme funds are managed within legislative funding parameters.

Final payments

Grant payments for Program Year 1 were made in the period 31 May 2007 to 7 June 2007, prior the payment deadline of 10 June 2007. A total of $96.1 million in cash entitlements were paid to 340 entities, and a further $1.07 million in deferred grant eligibility amounts was set aside for subsequent program years.10 In calculating grants, the department modulated all payments by a factor of 0.73 to ensure the annual funding limit of $97.5 million was not breached. It also reduced the individual entitlement of 186 entities to adhere to the five per cent sales-capping rule.

Scheme debts and ongoing management

In Program Year 1, $1.51 million in scheme debts were identified, relating to 52 separate entities. Individual debts ranged from $201 to $219 000, but most debts were under $50 000. Some 50 debts resulted from entities receiving more in an advance payment than their final grant entitlement, when it was subsequently determined. As of 30 June 2008, all 50 entities that had received overpaid advances had repaid their debts. DIISR took a number of steps to minimise the risk of debts occurring in Program Year 2 and beyond. This included seeking legislative changes to the Scheme and implementing better processes for assessing advances. For Program Year 2, five debts were identified by the department, which totalled around $334 000, significantly less than for Program Year 1.

DIISR's decision to exclude advance-related debts from the modulation process meant that it had to find an additional source of funding for Program Year 1 (and potentially beyond). Approval was received to re-allocate $1.51 million from another program administered by the department. This situation has created some ongoing issues for DIISR to manage, including having to find similar funding arrangements on an ongoing basis.

Governance and effectiveness (Chapter 5)

The Scheme is one of many industry programs delivered by AusIndustry, and is subject to the same governance arrangements that apply to other programs delivered within the department. These arrangements cover: planning and risk management; policies and procedures; delegations and authorisations; internal reporting and executive oversight; and stakeholder management. The ANAO confirmed that each of these elements was in place during the first year of the Scheme, and they continue to be part of DIISR's governance framework. However, for Program Year 1, there was a lack of agreement between the policy and program delivery teams on the appropriate basis for modulating grant payments. This matter took around eight months to resolve and put pressure on the development of the final payment system. The earlier escalation of this issue within DIISR would have assisted in more timely resolution of this matter.

Evaluating and reporting on the effectiveness of the Scheme

In 2008–09, DIISR included a specific performance indicator, and an associated performance target, to measure the increase in investment in plant and equipment and innovation. The target will give an appreciation of whether there has been an increase in investment over time. However, it does not measure whether this increase is a direct result of the Scheme, or whether the investment might have occurred in any case.

DIISR has relied on two external reviews of the TCF industry to comment on whether the Scheme and the previous TCF SIP Scheme have been beneficial for the industry and have achieved the desired policy outcomes.

External reviews of the TCF industry

The two external reviews of the TCF industry (in 2002 and 2008) have provided analysis, insights and recommendations to inform the Government's policy settings for the TCF industry. Professor Green's report, which was publicly released in September 2008 11, did not comment directly on whether the assistance provided under the current Scheme has assisted the industry to be more ‘sustainable' and internationally competitive', in line with its statutory objective. However, it concluded that the current Scheme and the previous TCF SIP Scheme have made a positive contribution to Australia's TCF industries, helping entities to reposition themselves to compete in the changing business environment. 12

Although the department collects a range of industry data, it has not developed the necessary key performance indicators to determine the impact of the Scheme on the TCF industry, and the longer-term policy objective of making the industry more sustainable and internationally competitive. To enhance its performance management framework, the ANAO considers that DIISR could develop and report against intermediate outcomes for the Scheme, as it does for the Automotive Competitiveness and Investment Scheme.

Footnotes

1 Productivity Commission 2008, Modelling Economy-wide Effects of Future TCF Assistance, Melbourne.

2 This grant is available only to entities carrying on eligible clothing or finished textile activities.

3 For Program Years 2006–07 to 2009–10 and 2011–12 to 2014–15, annual funding limits may include unspent funds from previous years, plus any deferred grant eligibility amounts.

4 A further $1.07 million in deferred grant eligibility amounts was set aside for subsequent Program Years.

5 Prior to the change of government in November 2007, the Scheme was administered by the Department of Industry, Tourism and Resources.

6 Productivity Commission 2003, Review of TCF Assistance, Report No. 26, Canberra

7 Green, R. 2008, Building Innovative Capability: Review of the Australian Textile, Clothing and Footwear Industries, Commonwealth of Australia, p. 62.

8 Entities who do not exceed this expenditure threshold are able to apply for grants of up to $50 000 under the TCF Small Business Program, which is also administered by DIISR.

9 These figures are checked by a team leader to confirm that they match the amounts approved by the delegate.

10 If an entity has invested in eligible activities, but has not exceeded the $200 000 threshold, the eligible grant amount (adjusted by modulation) is set aside to a subsequent Program Year until the threshold is passed.

11 Green, R. 2008, Building Innovative Capability: Review of the Australian Textile, Clothing and Footwear Industries, Commonwealth of Australia.

12 Ibid, p. 62.