Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of the Parliamentary Expenses Management System

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Parliamentary Expenses Management System (PEMS) is the IT system for parliamentarians, their staff and administering agencies to claim and process office and travel expenses and administer payroll services.

- The aim of PEMS was to be the key enabling IT system to support better administration, accountability, and transparency of work expenses for parliamentarians and their staff.

- The audit assessed if the Department of Finance (Finance) successfully implemented the PEMS project to deliver required capabilities and agreed project outcomes.

Key facts

- PEMS was intended to allow parliamentarians, their staff and administering agencies to claim office and travel expenses, process payroll, request leave and access budget reports.

What did we find?

- Finance was partly effective in implementing the PEMS project.

- Project governance, planning and risk management arrangements were in place, although they were not impactful in driving successful project outcomes.

- PEMS supports the payment of office and travel claims and delivery of payroll services. However, these processes are supported by manual workarounds and end users were not appropriately consulted on the design of PEMS, impacting user views on the system.

What did we recommend?

- There were two recommendations related to ensuring future projects have agreed scope and user requirements and that Finance measures the delivered capability of PEMS against expected benefits.

- Finance agreed to the recommendations.

151,221

office and travel claims processed through PEMS in 2022–23.

$74.3m

total cost of PEMS project to June 2023 against original budget of $38.1 million.

2117

end users of PEMS as at July 2023.

Summary and recommendations

Background

1. Parliamentarians are provided with a range of support services and allowances to assist them to carry out their duties including office accommodation and facilities, travel costs and staff. The Parliamentary Expenses Management System (PEMS) is the IT system used by parliamentarians and their staff to claim office and travel expenses and that processes payroll services for parliamentary staff.

2. PEMS was implemented as a result of a recommendation from a 2016 review into the parliamentary entitlement system that noted the need for a fit-for-purpose online expenses system to replace manual processing and support high quality customer service. The Department of Finance (Finance) was responsible for the delivery of the IT system, with input from the Independent Parliamentary Expenses Authority (IPEA).

3. The project commenced in January 2018 and was delivered through a staged approached with original completion due by June 2020.

Rationale for undertaking the audit

4. The Auditor-General agreed to undertake an audit into PEMS on 4 April 2023.1 The audit was conducted to provide assurance to Parliament on how effective Finance was in successfully delivering the PEMS project. A previous ANAO audit of IPEA, tabled in March 2021, identified delays and budgetary overruns in the implementation of the project.

Audit objective and criteria

5. The audit objective was to assess the effectiveness of Finance’s administration of the PEMS project.

6. The high-level criteria were:

- Did Finance effectively manage the PEMS project to achieve the agreed deliverables?

- Does the system meet the agreed deliverables, and achieve outcomes including alignment with relevant legislative requirements?

Conclusion

7. Finance’s administration of the PEMS project was partly effective.

8. Finance established appropriate project governance arrangements, project documentation and risks plans. However, initial planning did not clearly define the scope and user requirements. This led to a significant increase to costs and multiple delays. The project was supported by internal project reporting to governance bodies and external reviews, however these reports did not support sufficient actions or decisions to keep the project on track. Finance has not assessed if the benefits of PEMS have been achieved.

9. The current PEMS capability does not meet all deliverables as agreed in the business case. The functionality delivered meets basic requirements to process office and travel expenses and payroll for parliamentary staff. There is a reliance on manual workarounds particularly for payroll services. Reporting functionality to meet legislative requirements was delayed. Parliamentarians and their staff were not sufficiently consulted throughout the project implementation to ensure the system was simple and easy to use.

Supporting findings

Management of PEMS

10. Finance established appropriate project governance arrangements, including a project board and steering committee which comprised representatives from technical, business and stakeholder areas. Project governance forums operated throughout the project and met regularly, supported by papers and minutes. (See paragraphs 2.2 to 2.8)

11. The PEMS project team developed a project brief and project management plan to support project delivery. However, the initial scope was not clear, there was an inconsistent approach to gathering and agreeing user requirements, and the change management process was not always followed. Original milestones were not met and the project schedule was re-baselined a number of times following delays. This impacted the budget, with Finance reprioritising internal funding towards the project. IPEA provided administered appropriation funding to Finance which was used for the departmental purposes of the project. Risk management processes and documentation were in place to identify and track risks and issues, with risks realised throughout the project. Finance does not have a process in place to track if the benefits of PEMS, as presented in the business case, have been achieved. (See paragraphs 2.9 to 2.47)

12. There was reporting to stakeholders on project status and delivery. This reporting was not effective in supporting appropriate escalation and decision making to resolve project issues. The findings of the Gateway Reviews of PEMS were inconsistent with Finance’s internal reporting on project status and were based on the re-baselined delivery. The performance measure reported in Finance’s annual performance statements does not provide a complete view of PEMS performance. (See paragraphs 2.48 to 2.70)

System and deliverables and capabilities

13. For the functionality that has been delivered, PEMS correctly processes office expenses, travel claims and payroll, supported by manual processing. Controls around the claim process are largely appropriate, however there are a number of manual workarounds in relation to payroll services. There is a backlog of items that need to be implemented in order for the system to meet its scope as set out in the business case and user requirements. (See paragraphs 3.3 to 3.18)

14. The transparent reporting of expenses was delayed. PEMS expenditure reporting functionality was originally due in January 2020, with the expenditure reporting component released to IPEA in November 2023 and IPEA publishing its first reports in December 2023. Based on the design of the reporting component of PEMS the system will support the reporting of expenses. (See paragraphs 3.19 to 3.23)

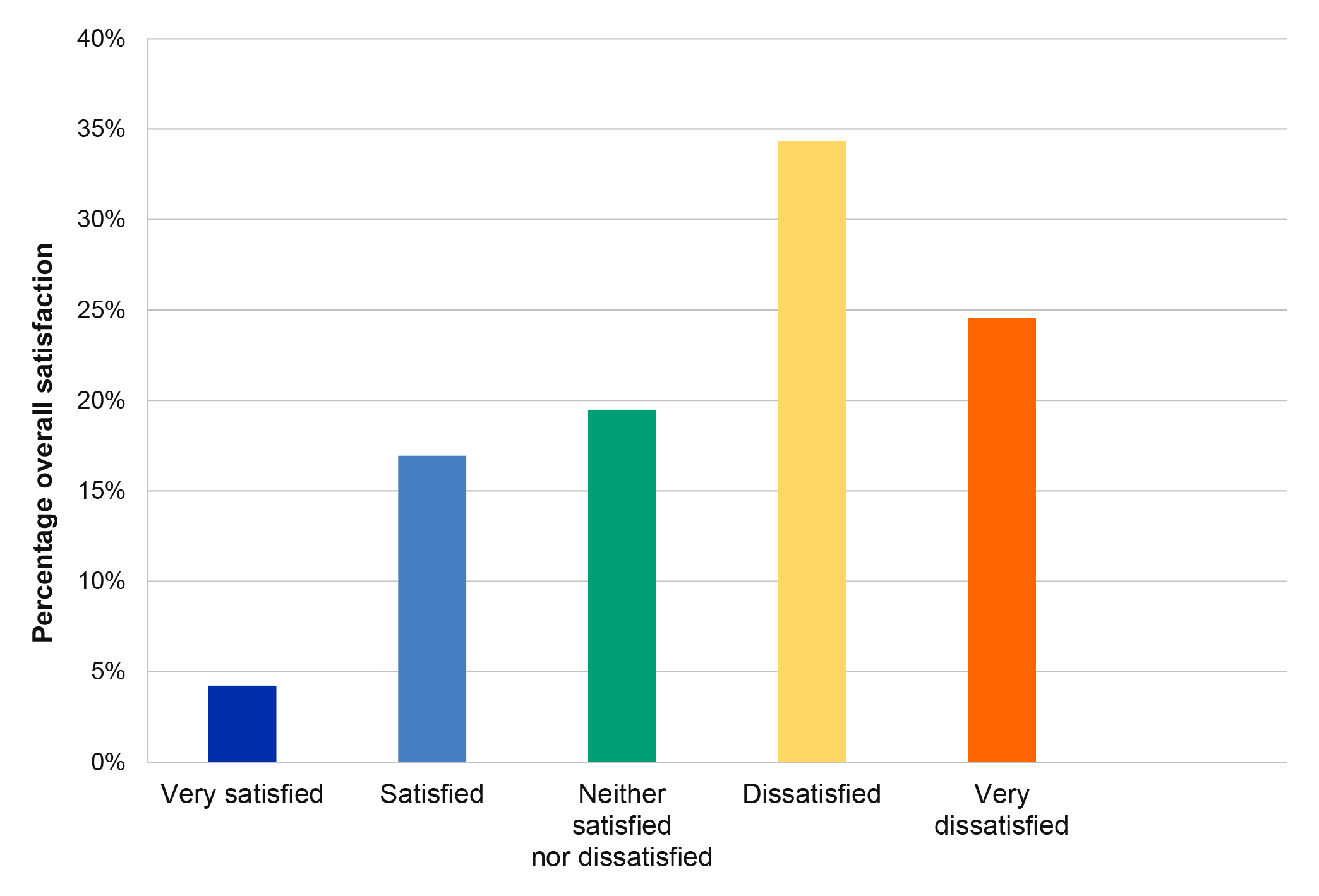

15. User experience was planned to be considered in project establishment however it was not a focus throughout project implementation. Users of the system have reported that they are not satisfied with the usability of the system. (See paragraphs 3.24 to 3.41)

Recommendations

Recommendation no. 1

Paragraph 2.32

Department of Finance ensures future projects have:

- clearly defined and agreed scope and deliverables;

- a planned approach to gathering and agreeing user requirements that is followed; and

- a process to implement and monitor changes to scope and requirements, including budgetary impacts.

Department of Finance response: Agreed.

Recommendation no. 2

Paragraph 2.46

Department of Finance completes a benefits realisation review by December 2024 to:

- track whether PEMS does or will have the future capability to deliver its intended benefits as originally agreed by government; and

- establish a process to track and report on the ongoing benefits of PEMS.

Department of Finance response: Agreed.

Summary of entity response

16. The proposed final report was provided to Finance. Extracts of the proposed report were provided to IPEA and the Digital Transformation Agency (DTA). Finance and DTA summary responses to the report are provided below and the full responses from all three entities are at Appendix 1.

Department of Finance

The Department of Finance (Finance) welcomes the report and agrees to the ANAO’s two recommendations in the areas of defining project scope and user requirements more clearly, and conducting a benefits realisation assessment.

Governance arrangements have been significantly strengthened over the past 12 months and have led to the successful delivery of Milestone 8. These will carry through to the shift from project delivery to a new phase of overseeing the future strategic direction of PEMS, including:

- Clear accountabilities have been introduced for project delivery

- Transparent and accountable processes are in place for prioritisation of system changes and future enhancements of PEMS

- User engagement has been reinvigorated with workshops held with Parliamentarians and their staff to understand their needs, and the User Reference Group has been re-established, with regular meetings in place.

Finance would like to acknowledge the commitment and dedication of employees in the department and IPEA who work every day to support Parliamentarians and their staff, including those working to support PEMS.

Finance will continue to work collaboratively with key stakeholders to deliver ongoing system enhancements to improve functionality and the experience of users. This includes continuing the work with the User Reference Group to ensure the client experience is appropriately prioritised.

Independent Parliamentary Expenses Authority

No summary response provided.

Digital Transformation Agency

The Digital Transformation Agency (DTA) acknowledges the findings contained in the extract of the audit report provided for comment, and acknowledges no recommendations have been directed to it. The PEMS program was commissioned prior to the introduction of new assurance requirements administered by the DTA in late 2021. These requirements were introduced as part of the Commonwealth Digital and ICT Investment Oversight Framework (IOF), which supports the Australian Government to manage its digital and ICT-enabled investments — from early planning through to project delivery and realisation of planned benefits. The DTA will carefully consider the findings and recommendations in the full report, and apply them, where applicable, in the administration of the IOF.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Policy/program implementation

1. Background

Introduction

1.1 Parliamentarians are provided with a range of supports and allowances to assist them to carry out their duties including the following.

- Office expenses — for example printing and communication, office stationery and supplies, and property operating expenses (such as cleaning, security and fit out for electoral offices).2

- Travel expenses — for both parliamentarians and staff. This includes for example commercial transport (such as commercial aircraft, trains, taxis), travel allowance to cover accommodation, meals and incidentals for overnight stays and other allowances such as a budget for travel in large electorates.3

- Staff — ‘personal employees’ (such as Chief of Staff, advisor, media advisor or office manager) and ‘electoral employees’ (based in parliamentarians’ electoral offices).4

1.2 The use of office and travel expenses by parliamentarians is covered by:

- the Parliamentary Business Resources Act 2017 — provides for parliamentarian remuneration, expenses, allowances, and other public resources, it also imposes compliance and enforcement arrangements;

- Parliamentary Business Resources Regulations 2017 — provides details on travel expenses, travel allowances, office accommodation and equipment, insurance, and legal assistance available; and

- determinations made under the Parliamentary Business Resources Act 2017 that provide further clarifications on the arrangements.

1.3 Parliamentarians hire staff under the Member of Parliament (Staff) Act 1984 (MOPS Act) to help them fulfill their duties. The Commonwealth Members of Parliament Staff Enterprise Agreement sets the staff employment terms and conditions. Domestic travel expenses for parliamentary staff are generally not included in the Parliamentary Business Resources Act 2017. A determination of the MOPS Act and the Enterprise Agreement guide the eligibility and rules for parliamentary staff domestic travel, for example staff may only travel if directed by their employing parliamentarians and may only travel by the most efficient direct route available.

1.4 The Department of Finance (Finance) and the Independent Parliamentary Expenses Authority (IPEA) support the above arrangements as outlined in Table 1.1.

Table 1.1: Parliamentary expenses by administering agency

|

|

Agency |

Role |

|

Office expenses

|

Finance |

Processing and providing advice on claims |

|

IPEA |

Conducting reporting and assurance on claims |

|

|

Travel expenses |

IPEA |

Processing and providing advice on claims and conducting reporting and assurance on claims |

|

Parliamentary staff payroll services |

Finance |

Processing on-boarding of staff, termination and paying salaries and supporting work, health and safety |

|

115 |

75 |

219 |

Source: Department of Finance, About MaPS [Internet], Finance, available from https://maps.finance.gov.au/about-maps-and-other-services/about-maps [accessed 29 August 2023].

Independent Parliamentary Expenses Authority (IPEA), Who we are [Internet], IPEA available from https://www.ipea.gov.au/about-ipea/who-we-are [accessed 29 August 2023].

Parliamentary Expenses Management System (PEMS)

1.5 PEMS is the IT system used by parliamentarians and their staff to claim office and travel expenses and perform human resources tasks. Administering agencies also use PEMS to process and pay claims and administer payroll services for parliamentary staff.

1.6 PEMS refers to the combination of an online portal, with a front-end interface, and a back-end SAP enterprise resource planning (ERP) solution.5 Parliamentarians and their staff interact with PEMS via the front-end interface for claims, employee self-services and reporting. IPEA and Finance access both the front-end and the back-end ERP to process and pay claims and administer payroll services for parliamentary staff.

1.7 PEMS was developed in response to the 2016 Independent Parliamentary Entitlements System Review that recommended Finance develop a business case for government consideration for a fit-for-purpose work expenses system.6

1.8 The Australian Government agreed to the second pass business case (business case) for the PEMS project as part of the 2017–18 Mid-Year Economic and Fiscal Outlook (MYEFO) process, including agreement for Finance to deliver the project in-house by June 2020 and provided funding of $38.1 million.

1.9 The project commenced in January 2018 with the aim to deliver a ‘fit-for-purpose online, integrated and agile ICT system to provide self-service capabilities, reduce manual processing and facilitate improved reporting to assist parliamentarians to better manage and monitor expenses.’

1.10 The project was delivered through eight milestones, with changes to scope and timeframes throughout the project (see paragraph 2.24). Milestones 1–5 delivered a front-end portal with online forms connected to the previous IT system (Entitlements Management System). Milestone 6 and Milestone 7 replaced this with the new ERP system for financial management (Milestone 6), payroll services (Milestone 7 phase 1) and office and travel expenses (Milestone 7 phase 2). Milestone 8 covers functionality to support public expenditure reporting. Finance advised the ANAO on 18 December 2023, that the expenditure reporting functionality was released in PEMS in November 2023, with IPEA publishing its first report in December 2023.

Table 1.2: PEMS project milestones

|

Milestone |

Deliverables |

Actual release dates |

|

1–5 |

Release of client portal, eight online forms for travel and office expenses and supporting functionality such as ‘office manager’ (view claims for an office), ability to print forms, notifications and re-assignment of claims Front end functionality only with connection to the previous Entitlements Management System |

Progressive releases from 1 July 2018 to 14 December 2018 |

|

6 |

PEMS back-end financial related functions and additional development to continue online forms until the release of Milestone 7 phase 1 and 2 |

1 July 2019 |

|

7 phase 1 |

Payroll services functionality, including entry and processing of pay and applying for certain leave types within PEMS |

1 July 2021 |

|

7 phase 2 |

Office and travel expenses claim functionality and self-service budget reports for parliamentarians and their staff |

1 July 2022 |

|

8 |

Public expenditure reporting for IPEA |

December 2023 |

|

91 |

258 |

150 |

Source: ANAO analysis of PEMS project documentation.

1.11 There is a backlog of items from the project intended to be delivered over the next two to three years (see paragraph 3.14 to 3.16).7

1.12 Finance built the system, customising a SAP solution, with input from IPEA. The roles and responsibilities are outlined in Table 1.3.

Table 1.3: Finance and IPEA roles and responsibilities in the PEMS project

|

Business area |

Role in PEMS implementation |

|

Service Delivery Office (SDO) |

|

|

ICT Division |

|

|

Ministerial and Parliamentary Services (MaPS) Division |

|

|

IPEA |

|

|

130 |

325 |

Source: Department of Finance PEMS project documentation.

1.13 In 2022–23 PEMS processed 35,833 office claims and 115,388 travel expense claims.

1.14 In 2022–23 PEMS paid out approximately $153 million in office expenses, $61 million in travel expenses and processed $270 million in payroll for parliamentary staff payroll.9

Rationale for undertaking the audit

1.15 The Auditor-General agreed to undertake an audit into PEMS on 4 April 2023. The audit was conducted to provide assurance to Parliament on how effective Finance was in successfully delivering the PEMS project. A previous ANAO audit of IPEA, tabled in March 2021, identified delays and budgetary overruns in the implementation of the project.

Audit approach

Audit objective, criteria and scope

1.16 The audit objective was to assess the effectiveness of Finance’s administration of the PEMS project.

1.17 The high-level criteria were:

- Did Finance effectively manage the PEMS project to achieve the agreed deliverables?

- Does the system meet the agreed deliverables, and achieve outcomes including alignment with relevant legislative requirements?

1.18 The audit scope included assessing Finance’s project management and implementation — project planning, governance, delivery, finances, and reporting — and whether the project delivered the required IT capability.

Audit methodology

1.19 The audit involved examining:

- governance arrangements throughout the project lifecycle;

- project documentation such as project plans, schedules, workforce planning and project reviews;

- evidence that project implementation plans were followed and evidence of change management processes and controls;

- the project’s financial management and reporting;

- the risk management approach and evidence of active management of project risks;

- internal and external reporting on the project including to project stakeholders;

- a survey of parliamentarians and their staff to assess the user experience;

- PEMS (through IT demonstrations) to test processes; and

- meetings with key staff in Finance, IPEA and Digital Transformation Agency.

1.20 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $589,626.

1.21 The team members for this audit were Anne Rainger, Ben Thomson, Renina Boyd, Dr Vivian Turner, Thea Ingold, Kelvin Le, Caitlin Williams, Aaron Ramshaw and Michelle Page.

2. Management of the Parliamentary Expenses Management System project

Areas examined

This chapter examines whether the Department of Finance (Finance) effectively managed the Parliamentary Expenses Management System (PEMS) project to achieve agreed deliverables.

Conclusion

Finance established appropriate project governance arrangements, project documentation and risks plans. However, initial planning did not clearly define the scope and user requirements. This led to a significant increase to costs and multiple delays. The project was supported by internal project reporting to governance bodies and external reviews, however these reports did not support sufficient actions or decisions to keep the project on track. Finance has not assessed if the benefits of PEMS have been achieved.

Areas for improvement

The ANAO made two recommendations: ensuring projects had appropriate approaches to gathering and agreeing business requirements; and Finance undertake a benefits realisation process.

The ANAO identified one opportunity for improvement for Finance to review its performance measure and targets to better track the performance of PEMS and how it relates to Finance’s key activities.

2.1 When managing complex projects, it is important to have fit-for-purpose project planning documentation that clearly identify project scope, requirements, timeframes, and budget. Good governance and risk management enables monitoring of project requirements, sound decision making and ensures project outcomes are achieved. Effective project reporting supports transparency and accountability of project progress.

Was there effective project governance oversight in place?

Finance established appropriate project governance arrangements, including a project board and steering committee which comprised representatives from technical, business and stakeholder areas. Project governance forums operated throughout the project and met regularly, supported by papers and minutes.

2.2 Finance’s project management guidance states that:

- governance should provide an identifiable, single point of accountability for project delivery;

- governance structures should reflect the size and complexity of the project;

- projects require two levels of governance — operational and strategic — that for complex projects should include a project control group (operational) and a project steering committee (strategic); and

- projects may establish working groups where appropriate to support the project.

PEMS project governance

2.3 The PEMS project governance forums comprised a project board between January 2018 and August 202210 and steering committee throughout the project. A design authority also met from June 2020 to November 2021 to provide guidance, advice, and assurance on scope and business requirements for Milestone 7. As set out in the PEMS project management plan, the governance forums were intended to report to the Project’s Senior Responsible Office (Deputy Secretary, Business Enabling Services)11 who reported into Finance’s enterprise governance structures as outlined in Figure 2.1.

Figure 2.1: PEMS planned project governance roles and responsibilities

Note: While the project governance structures were intended to report to Finance’s Executive Board it was not involved in project governance outside of funding decisions (see paragraph 2.17) and a project status update in September 2023.

Source: ANAO analysis of the PEMS Project Governance Roles and Responsibilities figure from the PEMS project management plan.

2.4 The terms of reference for the project board and steering committee contained information on key areas such as objectives, escalation and delegation of issues, frequency and recording of meetings, and quorum. The terms of reference were not dated nor were changes clearly identified through version control. The remit of the project board and steering committee as per their terms of reference is outlined in Table 2.1.

Table 2.1: Project board and steering committee terms of reference

|

|

Project board |

Steering committee |

|

Objective |

|

The steering committee will provide advice and support to the project and to the Senior Responsible Officer as decision maker and signatory authority for the project. The steering committee will consider and endorse recommendations for approval by the Senior Responsible Officer, which will include consideration of options, engagement and communication and strategic direction. |

|

Role |

|

|

|

Frequencya |

Fortnightly |

Monthly |

|

Chair |

Project Executive |

Senior Responsible Officer |

|

Membership |

Service Delivery Office (SDO) representatives, and senior users from the Independent Parliamentary Expenses Authority (IPEA) and Ministerial and Parliamentary Services (MaPS) (SES Band 1 level). Finance’s Chief Financial Officer (CFO) was an observer. |

Project Executives, senior users (MaPS SES Band 2 and IPEA CEO), senior supplier (SDO SES Band 2) and representatives from the Digital Transformation Agency, Australian Tax Officeb, and the Department of the Prime Minister and Cabinet.c |

|

104 |

194 |

221 |

Note a: Between January 2018 and August 2018 project board meetings were monthly and steering committee meetings were every second month. The meeting frequency was changed to fortnightly and monthly respectively after recommendations from the second Gateway Review (July 2018).

Note b: The Australian Tax Office representative was on the steering committee until June 2021 when the representative changed job roles and was not replaced.

Note c: From September 2022 the Special Minister of State’s Chief of Staff became an observer on the steering committee. From March 2023 an independent external advisor (who was a former Gateway Reviewer of PEMS) also joined the steering committee.

Source: Project board and steering committee terms of reference.

2.5 In line with Finance’s internal project management guidance, the project board was set up to monitor progress of the project on an operational level. The steering committee was set up to provide oversight and strategic advice to the project board and Senior Responsible Officer as the decision maker.12

2.6 The project board and steering committee met as per the terms of reference. Meetings were supported by meeting papers, action items were tracked and meeting minutes recorded. The ANAO reviewed project board papers and minutes from January 2019 to August 2022 and steering committee papers and minutes for the period January 2019 to April 2023. Project updates, schedule, risks, issues, budget and change management were consistently discussed.

2.7 In March 2023 the steering committee agreed to revised governance arrangements to support ‘business as usual’ management of PEMS and the project moving from ICT division (as an IT-led project) to MaPS division (business-led project). The new arrangements included continuing the steering committee13, a PEMS management board (previously the project board), and PEMS working group (with a key focus being the prioritisation of the backlog as outlined in paragraph 3.14 to 3.16). The steering committee and management board terms of reference were comparable to their predecessors in terms of roles and delineation between the forums. The steering committee terms of reference were amended to include the committee actively incorporating the experience of users in decision making.

2.8 Other project governance roles are outlined below.

- Senior Responsible Officer/Project Sponsor — chair of the steering committee, oversight and approval, ultimate responsibility for achieving the objectives and benefits. This was the Deputy Secretary, Business Enabling Services.

- Project Executive — chair of the project board, oversight and approval, authorise project status and transitions. This was the First Assistant Secretary of the Information, Communication and Technology (ICT) Division who led the project between 1 January 2018 and March 2023. This was the First Assistant Secretary of MaPS from March 2023.

- Senior Supplier — responsible for producing agreed deliverables, technical integrity and quality of project and represents those designing, developing and procuring the project products. This was the First Assistant Secretary of SDO between 1 January 2018 and February 2021 and from 1 July 2022. The First Assistant Secretary ICT Division (also the project board chair and Project Executive) was the Senior Supplier between February 2021 and 1 July 2022 (covering the period when responsibility for the technical build moved to the ICT Division).

Were there fit-for-purpose project implementation plans in place which were followed by Finance?

The PEMS project team developed a project brief and project management plan to support project delivery. However, the initial scope was not clear, there was inconsistent approach to gathering and agreeing user requirements, and the change management process was not always followed. Original milestones were not met and the project schedule was re-baselined a number of times following delays. This impacted the budget, with Finance reprioritising internal funding towards the project. IPEA provided administered appropriation funding to Finance which was used for the departmental purposes off the project. Risk management processes and documentation were in place to identify and track risks and issues, with risks realised throughout the project. Finance does not have a process in place to track if the benefits of PEMS, as presented in the business case, have been achieved.

Project planning

2.9 The initial project documentation for the PEMS project included a project brief, project management plan and an initial risk and issues register.

2.10 Finance’s guidance outlines that initial project documentation should be provided to the Project Sponsor and governance bodies for review, comment and final approval. The approval process for the initial project documentation did not follow the internal guidance as outlined in Table 2.2. Finance was also unable to provide final signed copies of initial project documentation.

Table 2.2: Initial PEMS project documentation and approval

|

Document |

Governance body |

Approval |

|

Project brief

|

Project board — discussed at 30 January 2018 meeting |

Approved 28 February 2018 |

|

Steering committee — provided to 14 February 2018 meeting |

No discussion or approval recorded in meeting minutes |

|

|

Project management plan

|

Project board — provided to 29 March 2018 meeting |

No approval recorded in meeting minutesa |

|

Steering committee — not provided to steering committee |

N/A |

|

|

Initial risk and issue register

|

Project board — completed risk register initially provided to 29 March 2018 meeting |

Discussion but no approvalb |

|

Steering committee — updated risk register provided to 6 April 2018 meeting |

Discussion but no approval |

|

|

113 |

194 |

168 |

Note a: A Gateway Review (see paragraph 2.53) in March 2018 included a critical recommendation that a project management plan for PEMS is completed. A subsequent Gateway Review in July 2018 outlined that the action was partially implemented and no date of approval for the project plan was provided.

Note b: The risk register was an operational/living document, with updates discussed at risk workshops and provided to governance bodies with meeting papers.

Source: Initial PEMS project documentation and governance papers.

2.11 The project brief and project management plan included appropriate information specific to the PEMS project, except for sufficient details on scope (see paragraph 2.14) and budget. The 13 capabilities detailed in the project brief did not specify clear or sufficiently detailed deliverables, and budget was provided as a total project cost with no breakdown of how it was to be spent.

2.12 The project management plan was updated in response to the significant changes to scope and timeline — creation of Milestone 7 (plan updated July 2019), delay of Milestone 7 from April 2020 to July 2021 (plan updated January 2021) and splitting Milestone 7 into phase 1 and 2 (plan updated February 2021). A project management plan was not in place to support the delivery of Milestone 8.

2.13 The revised project management plan was approved by the project board each time the project was re-baselined. The approved project plan was provided to the steering committee for visibility, not endorsement as per Finance’s internal project management guidance. The updated plans were also not finalised following the review by governance forums.14

Project scope

2.14 During the project Finance did not have a clear scope of the PEMS project agreed with MaPS and IPEA as business owners. Scope was inconsistently represented throughout project documentation, presented as 13 core capabilities (see paragraph 3.2) and as high-level milestone deliverables.

2.15 Unclear and inconsistent scope definition created risks and issues throughout the project as evidenced by:

- Gateway Review recommendations — outlined the critical need to finalise business requirements, including governance sign-off;

- discussion surrounding scope at project board and steering committee meetings;

- risks and issues included in the risk register (i.e. scope is referenced in 14 risks and six issues from a sample risk register dated 12 April 2022);

- scope being reported in the project status report as amber or trending down for eight months between September 2019 and May 2020;

- recommendations from a review of the PEMS build (as at 20 November 2020) conducted by SAP that found there needed to be alignment between business, SDO and ICT Division to ensure functional scope was delivered; and

- scope items being moved to the backlog of outstanding deliverables (see paragraph 3.14).

Budget

2.16 Through the 2017–18 Mid-Year Economic and Fiscal Outlook (MYEFO) process the Australian Government approved $38.1 million (to 2020–21) for the development of PEMS.15 The initial funding included project funding, comprising a mix of capital and operating funding, and ongoing funding to support the operating and maintenance costs of PEMS. Throughout the project, Finance made internal reallocations of funding towards the project and IPEA also made contributions. The PEMS funding and expenditure breakdown is outlined in Table 2.3.

Table 2.3: PEMS funding and expenditure 2017–18 to 2022–23

|

|

Initial funding 2017–18 MYEFO for PEMS project $m |

Reallocated funding from Finance and IPEA $m |

Total funding $m |

Actual spend $m |

|

PEMS project budget |

30.2a |

29.1b |

59.3 |

60.7 |

|

Operating and maintenance budget |

14.9c |

0 |

14.9 |

13.6 |

|

Total PEMS |

45.1 |

29.1 |

74.2 |

74.3 |

|

117 |

144 |

148 |

75 |

66 |

Note a: The initial MYEFO decision provided for $38.1 million, including $30.2 million in capital funding for PEMS.

Note b: Finance provided a total of $23.4 million and IPEA provided $5.7 million, including $5.0 million in June 2020 and $0.7 million in 2021–22 from its administered funding (see paragraph 2.18).

Note c: The initial MYEFO decision included $2.7 million for operating and maintenance costs for 2019–20, $4.0 million for 2020–21 and then $4.1 million per financial year ongoing funding. This figure includes the initial $6.7 million to 2020–21 from the initial MYEFO announcement and $4.1 million per annum for 2021–22 and 2022–23.

Source: PEMS budget breakdown provided by Finance.

2.17 Finance’s main internal funding reallocations were provided in June 2019, December 2020, and March 2021. These budget injections were approved by Finance’s Executive Board. Specific papers were provided to the Executive Board outlining the need for the additional funding for the March 2021 decision. The June 2019 and December 2020 decisions were part of Finance’s broader process for requesting internal budget adjustments. The PEMS project was included in the overall request for bids.

2.18 IPEA contributed $5.7 million to the project from its administered appropriation related to Outcome 1, consisting of $5.0 million in June 2020 and a second transfer of $0.7 million in 2021–22.16 This was used by Finance for departmental expenditure on the PEMS project.17 There was no documented evidence of Finance’s decision making and how Finance considered the relevant frameworks to apply to the transactions, noting that money initially appropriated for administered purposes was used for departmental purposes. This increases potential risks to the controls put in place by the Parliament, in particular to ensure that appropriations are used for the intended purpose and with the Parliament’s permission.18

2.19 Finance advised the ANAO on 4 October 2023 that total expenditure to 30 June 2023 was $74.3 million, including $60.7 million from the PEMS project budget. This represents a 96 per cent increase from the original PEMS project budget. In Finance’s financial statements as at 30 June 2023, the total expenditure is reflected as $45.9 million of software assets. The remaining $28.5 million spent has been recognised as operating expense through 2017–18 to 2022–23, including $3.9 million of impairment.

2.20 In addition, Finance was provided $4.0 million in the 2023–24 Federal Budget for further development of PEMS during 2023–24 (see paragraphs 3.14 to 3.16).

Workforce

2.21 Finance advised the ANAO that the majority of expenditure for the PEMS project was on contractors, consultants, outsourcing and employees.19 For Finance to build PEMS in-house the business case stated that a fully contracted workforce would be required. Finance advised that the project workforce planning was covered under an initial procurement plan. This document is the approval to approach the market for resources for PEMS and another project. It was not a discrete document that maps the resources or capability required over the project and it did not specify what resources were specifically for PEMS. The initial PEMS project management plan listed the areas resources would be required (for example, organisational change management and technical architecture and configuration) and included a high-level structure of the SDO delivery teams. A resourcing plan was implemented for the updated project management plan for Milestone 7. The plan covered July 2019 to June 2020, and outlined the roles required, expected effort (represented as estimated hours/days of work required and full-time equivalent resourcing) according to build component (for example, payroll services, travel, office and budget).

2.22 During the project additional resources were required. Finance advised the ANAO that the decision to procure additional project resources was managed through changes to the integrated project plan and schedule. Updates were made to the integrated schedule throughout the project. However, Finance was unable to demonstrate how changes to resource requirements were operationalised. For example, when the schedule was delayed there was no evidence that the resource plan was updated in response. Conversely, when there was budget overspend there was no separate documentation or process that captured a new resourcing profile to reduce expenditure.

Project schedule and timing

2.23 The business case, project brief and project management plan included the proposed timeline for project delivery, outlined through a series of milestones. Each milestone had a brief description of the expected functionality to be delivered and the proposed delivery date. The milestone descriptions were presented differently to the way project scope was detailed, which was through the 13 core capabilities (see Table 3.1).

2.24 The project experienced delays in particular for the delivery of the Enterprise Resource Planning (ERP) solution for human resources, office and travel expenses and reporting. In addition, milestones were re-named, functionality was moved between milestones and scope not delivered as further discussed in paragraphs 3.8 to 3.16. The changes to the milestones are set out in Appendix 3. Key points in the delivery timeline are outlined below.

- The original Milestones 1 to 5 were largely delivered on time with minor changes to timeframes and milestones re-named.20

- Milestone 6 was originally the delivery of the ERP solution, including implementing financial backend related functionality, human resources and integrated expenses management for office and travel claims. The original due date for Milestone 6 was 1 July 2019. In February 2019 the steering committee agreed to deliver the financial backend functionality on 1 July 2019 and deliver the remaining functionality for the project in Milestone 7 with a new delivery date of April 2020.

- In September 2019 the steering committee agreed to delay the delivery of Milestone 7 to 1 July 2020 and in May 2020 it agreed to further delay the delivery to 1 July 2021.

- In December 2020 the steering committee agreed to split Milestone 7 into two phases — phase 1 for human resources (due 1 July 2021) and phase 2 for expense management of office and travel claims and expenditure reporting (with delivery date to be set later).

- In July 2021 the steering committee agreed to set the delivery date of Milestone 7 phase 2 as April 2022. In December 2021 the steering committee agreed to move this to July 2022.

- Further delays occurred for the expenditure reporting component of PEMS, discussed further in paragraph 3.20.

2.25 Decisions to delay milestone releases were approved by governance forums (both project board and steering committee), with the reasons for the main delays outlined in Table 2.4.

Table 2.4: Reasons provided to project governance on key delays in the project schedule

|

Steering committee decision date |

Re-baseline decision |

Reason provided |

|

February 2019 |

Milestone 7 created with due date of April 2020 |

Upcoming federal election increased activity for MaPS and IPEA which created risk of diverting MaPS and IPEA project resources, slippage within the project schedule and there were in-scope items that could not be delivered if the release date was not delayed. |

|

September 2019 |

Milestone 7 delayed from April to July 2020 |

Reported resource shortage affecting development of work. Design requirements not finalised, issues with testing and delays to key components of the build. |

|

May 2020 |

Milestone 7 delay from July 2020 to July 2021 |

Lack of specialist resources to support reporting, user acceptance testing and data validation and migration. Testing behind schedule. Data designs do not support business needs and require re-design. |

|

December 2020 |

Split Milestone 7 into phase 1 (July 2021) and phase 2 (delivery date to be set latera) |

Lack of SDO technical resources, six-month pause in build work.b In addition, issues with parts of the build (reporting and expense management) would affect delivery times. |

|

December 2021 |

Milestone 7 phase 2 delayed from April 2022 to July 2022 |

Testing was behind schedule. Potential election to occur at time of release was considered high risk due to disruption with end users and increased workload of MaPS and IPEA. Reporting functionality would not be completed to a robust level before April 2022. |

|

133 |

108 |

170 |

Note a: The steering committee decided in July 2021 to set phase 2 as April 2022.

Note b: The build component of the project was put on hold due to a fraud case which resulted in termination of IT resources on the project and the need to hire replacement IT resources.

Source: ANAO analysis of PEMS project and governance documentation.

2.26 The project delays increased the project length from the proposed two and a half years to more than five years duration. This three-year delay has impacted the project resources required.

User requirements

2.27 Finance did not have a consistent approach to gathering business requirements, in particular for the full ERP solution for human resources and office and travel expenses. Various approaches were used to gather and confirm requirements throughout the project.

- High-level requirements developed by Finance in 2017 that informed the IT solution (as an ‘commercial off-the-shelf’ product) and the intended core capabilities of PEMS.

- Business process models — documents developed by the SDO between August 2018 and November 2020 that articulate system business rules.

- User stories — as a parallel process to the business process models. Between August and October 2018 Finance worked with IPEA to develop user stories to cover a high-level statement of what the system should do.

- Knowledge transfer workshops — demonstration workshops were held in March 2020 to show and explain the solution to business areas to assist with user acceptance testing. Subsequent reporting to the project board showed these sessions highlighted design gaps that required further IT build work.

- Solution playback sessions — these sessions were held between May 2020 and June 2020 to identify system operability issues and gaps between what was required functionality and what functionality was available in the system at the time.

- List of ‘essential items’ — for Milestone 7 phase 2 (July 2022) a list of ‘essential items21’ was developed (informed by the solution playback sessions and the work of the design authority). This would form the minimum viable product (MVP) for delivery of phase 2.

2.28 Finance did not articulate the connection between the above approaches and whether these approaches captured a complete view of user requirements to inform the PEMS build.

2.29 Throughout the project there were delays in agreeing business requirements. The project status report (see paragraph 2.48) consistently reported requirements definition (under ‘design’) as red and amber throughout the project. On 26 November 2019 the steering committee agreed to ‘baseline22’ the requirements in the business process model documents without final approval from IPEA as business owners of the travel expenses component. The steering committee minutes noted that IPEA did not agree to this approach. There is no evidence that the travel expenses requirements in the baselined documents were subsequently formally agreed by Finance and IPEA.

2.30 The delays in agreeing business requirements resulted in Finance building and customising the system, as early as February 2019, without requirements being agreed by business owners. Finance called this ‘building at risk’ and the approach was noted in discussions at governance forums and in risk registers. The risk of this approach was realised when the system build had to be re-worked when it was identified that the solution would not meet business requirements.

2.31 Unclear requirements and poorly defined scope at the start of the project also led to incorrect assumptions on the amount of customisation required from a ‘commercial off-the-shelf’ IT system. The initial project plan had an assumption that no more than 10 per cent of the system would need to be configured. Finance advised that it did not track the percentage of configuration required, and that office and travel expense management was a largely bespoke system and Milestone 8 is an entirely bespoke system. This meant that more IT build work was required than planned, leading to schedule delays and continued increases in project cost.

Recommendation no.1

2.32 Department of Finance ensures future projects have:

- clearly defined and agreed scope and deliverables;

- a planned approach to gathering and agreeing user requirements that is followed; and

- a process to implement and monitor changes to scope and requirements, including budgetary impacts.

Department of Finance response: Agreed.

2.33 Finance has implemented significant improvement initiatives in PEMS, revising the approach to governance, processes, practices, and project outcomes. Finance will incorporate the ANAO recommendations as part of the design and delivery of future PEMS improvements. Finance has also recently undertaken an audit into its approach to delivering complex projects. Outcomes and lessons learnt from these audits will be incorporated into future PEMS project delivery work and shared for broader application across the department and the APS.

Project change management

2.34 The project management plan outlined the approach to managing changes to the ‘approved baseline for the project’.23 This included a change request template to capture the details and impact of the change and a change register to track requests over the project.

2.35 There is no evidence that the governance bodies used this process to effectively manage change in the project. Separate scope decisions were being made by business areas without undergoing the change request process. For example, MaPS approved changes in 2019 to the scope of human resources capability to remove on-boarding, personnel administration, time administration and organisational planning. Further, in addition to the change request process, system requirements that were not delivered were placed on a backlog (see paragraphs 3.14 to 3.16). Finance’s processes were unclear on what items should have gone through the change request process and what decisions could be made outside the process.24

Risk management

2.36 The PEMS project was initially rated as a medium risk project as outlined in the business case. During the project, significant changes to schedule, budget and scope occurred. There is no evidence that Finance reevaluated the overall project risk rating during the project.

2.37 The PEMS project had risk documentation that aligned to Finance’s enterprise risk management guidance from 2017. Project risk documentation and risk management activities for the project included:

- risk register;

- risk workshops;

- PEMS project risk and issue management plan; and

- risk reporting.

2.38 The risk register was established at project onset. The risk register was updated for individual risks regularly, and included risk description, source/cause, date raised, current controls, proposed treatments and risk owners. Project issues were also included in the risk register.25

2.39 Finance advised that risk workshops were held approximately monthly, were not formal meetings, minutes were not kept and that the workshops were responsible for maintaining and updating the risk register. Finance also advised meetings included Project Executive, Project Manager/Director and representatives from IPEA, MaPS and the SDO.

2.40 The PEMS project risk and issue management plan was established 18 months into the project, in July 2019. It provides high-level information on how risks and issues are to be managed throughout the project.

2.41 Risks and issues were reported at every project board and steering committee meeting and were included in the project status reports provided to governance forums (see paragraph 2.48).

2.42 Although risk documentation and risk management procedures were in place, it did not necessarily prevent risks being realised. Table 2.5 provides an example of a key risk, including risk description, source/cause of the risk, current controls and proposed treatments.

Table 2.5: How budget risks were managed through the risk register

|

|

Detail provided in risk register |

|

Risk description |

Risk #42 — Cost to deliver the project will exceed budget tolerance Date raised — 29 October 2019 |

|

Source/cause |

|

|

Current controls |

|

|

Proposed treatments |

|

|

93 |

233 |

Note: The above table provides a snapshot of how budget risks were addressed throughout the project. Risk #42 was the first risk to address budget issues in October 2019. Additional risks were raised in May 2020 and June 2022 to address separate budget issues. This included potentially ceasing the project unless additional funding is sourced, and the cost of enhancements was not affordable without further funding. A project issue was raised in response to the realisation of several risks in October 2022, with the cost to deliver the remainder of the project exceeding the available funds. This issue has not been closed.

Source: Risk registers provided by Finance.

2.43 The ANAO assessed the effectiveness of the treatment in managing the budget risk. The risk controls in the risk registers are focused on reducing the risk through monitoring or remediation once the risk is realised, i.e. seeking additional funding and re-directing existing Finance employees to the project instead of using contractors. However, the project had budgetary risk throughout the project and both the monitoring and reactionary remedial actions did not effectively manage the risk of budget overspend.

Benefits realisation

2.44 The benefits of PEMS to parliamentarians, administering agencies and government were outlined in the business case. These included: client centric service delivery; improved administration efficiency and effectiveness; increased transparency of parliamentarian expenses; providing agility in enabling ICT to cater for future changes; and value for money by minimising ICT capital investment. Benefits management was included in the project brief, the initial project management plan and the updated plans.

2.45 At times during the project Finance attempted to develop processes to track benefits, for example a benefits realisation plan was developed in 2019 and updated in 2021. Given the delays to the project, reduced scope and user views of the system, coupled with Finance not having a current process in place to track benefits, there is no evidence that the expected benefits of PEMS have been realised. Finance advised it intends to undertake work on benefits realisation as part of the two to three year strategy for PEMS improvements, with the approved strategy due early 2024.

Recommendation no.2

2.46 Department of Finance completes a benefits realisation review by December 2024 to:

- track whether PEMS does or will have the future capability to deliver its intended benefits as originally agreed by government; and

- establish a process to track and report on the ongoing benefits of PEMS.

Department of Finance response: Agreed.

2.47 A benefits realisation review is in progress. Feedback from this audit will be incorporated into the approach, which will be finalised in the first half of 2024.

Was there effective reporting to relevant stakeholders?

There was reporting to stakeholders on project status and delivery. This reporting was not effective in supporting appropriate escalation and decision making to resolve project issues. The findings of the Gateway Reviews of PEMS were inconsistent with Finance’s internal reporting on project status and were based on the re-baselined delivery. The performance measure reported in Finance’s annual performance statements does not provide a complete view of PEMS performance.

Project reporting

Project status reports

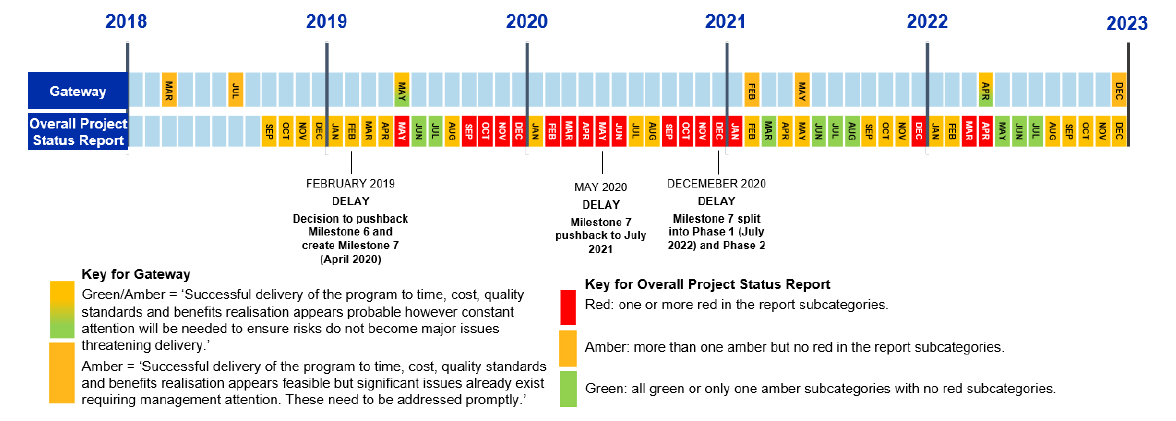

2.48 Project status reports were provided to the project board from September 2018 until August 2022 and to the steering committee until March 2023. The reports contained an overview of the project status and a range of subcategories aligned with project components, such as schedule, resources and testing. The report used a ‘traffic light’ system to rate the overall project status and against the separate subcategories, with accompanying points to provide context to the ratings. Figure 2.2 shows the overall status results reported to the project board and steering committee.

Figure 2.2: Overall status of the project from 2018–2023 as reported in the project status reports

|

|

Jan |

Feb |

March |

April |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

|

2018 |

|

|

|

|

|

|

|

|

▲ |

▲ |

▲ |

▲ |

|

2019 |

▲ |

▲ |

▲ |

▲ |

■ |

◆ |

◆ |

▲ |

■ |

■ |

■ |

■ |

|

2020 |

▲ |

■ |

■ |

■ |

■ |

■ |

▲ |

▲ |

■ |

■ |

■ |

■ |

|

2021 |

■ |

▲ |

▲ |

▲ |

▲ |

◆ |

▲ |

▲ |

▲ |

▲ |

▲ |

■ |

|

2022 |

▲ |

▲ |

■ |

■ |

◆ |

◆ |

◆ |

▲ |

▲ |

▲ |

▲ |

▲ |

|

2023 |

|

▲ |

◆ |

|

|

|

|

|

|

|

|

|

|

53 |

53 |

53 |

64 |

53 |

53 |

55 |

49 |

49 |

53 |

53 |

53 |

53 |

Key: ■ = project status reported as red (one or more of the subcategories were rated red).

▲= project status reported as amber (more than one subcategory was rated amber but no red in the subcategories).

◆ = project status reported as green (all subcategories rated as green or only one amber subcategory, with no red rated subcategory).

Note A steering committee meeting was not held in January 2023.

Source: ANAO analysis of project status reports.

2.49 The project status reports provided sufficient detail on project implementation. However, throughout the reporting of the project ‘risks’, ‘issues’, ‘governance’ and ‘project management’ continued to be rated as green. The description of a green rating in the report was ‘identified issues being managed and updated regularly’. The updates in the report under these subcategories were more around routine matters rather than providing a clear view of project issues. For example, under ‘governance’ the update was the next meeting date and under ‘risk’ the update was how many risks were in the risk register (regardless of their severity). This approach to reporting masked the overall project health.

Other operational reporting

2.50 Other operational reports were produced to support the project, for example:

- PEMS weekly status report — these reports were originally a two–four page summary by respective areas of the project (for example SDO, ICT Division and data migration). The format changed from May 2020 to support increased reporting in response to delaying Milestone 7. Key components of the updated report were a traffic light assessment across project components (for example, schedule, testing), key activities in the previous and upcoming week, escalation of issues and key milestones. Finance advised these were provided to the Project Executive and business areas (MaPS and IPEA) involved in the project teams.

- Adoption tracker — the project board received statistics on the usage of PEMS (smart form solution) from October 2019 to September 2021. The statistics included the number of users and transactions performed. Meeting minutes from the project board did not demonstrate discussion of the contents of the tracker.

- Routine updates were also provided to the Major Projects Committee between July 2021 and September 2023.26 This committee did not have governance responsibility for PEMS and the project was presented for information only.

Ministerial briefings

2.51 Finance provided briefings to the Minister for Finance and the Special Minister of State as outlined in Table 2.6.

Table 2.6: Summary of briefs on PEMS provided to Ministers during the project

|

Date |

Minister briefed |

Summary |

|

March 2018 |

Finance |

Noted the initial progress of the project and requested signing of a circular to assist in the recruitment of parliamentarians for the user reference group. |

|

June 2018 |

Finance |

Noted an update on the PEMS initial releases and support for early adoption of PEMS. |

|

November 2020 |

Finance |

Brief notes PEMS is not on track due to delays in user acceptance testing, unanticipated need to acquire specialised resources and complexity in build due to unique parliamentary process. Mitigations to this are re-baselining the project release date for office and travel expenses. |

|

March 2021 |

Finance |

Noting an update on the projects and steps taken to progress the project by 1 July 2022. |

|

July 2021 |

Finance |

Noting the two amber ratings received through the Gateway Reviews process (see paragraph 2.61). |

|

September 2022 |

Special Minister of State |

Noting the steps being undertaken to address the issues with PEMS. The brief indicated a ‘minimal viable product’ for expenditure report would be delivered by 31 October 2022.

|

|

October 2022 |

Finance |

|

|

133 |

133 |

172 |

Note: PEMS was also covered in the incoming government brief for the Special Minister of State.

There was a gap in briefings between July 2018 and October 2020. Finance advised that this was in part due to the 2019 election and ministerial and machinery of government changes and the Australian Government and Finance responding to natural disasters and the COVID-19 pandemic.

Source: ANAO review of ministerial briefs provided by Finance.

Secretary briefings

2.52 Three written briefs were provided to the Secretary of Finance (September 2018, November 2020 and June 2021) on the PEMS rollout and project issues. Operational updates on project activities were also provided.27 The Executive Board of Finance received updates on PEMS in February 2021 and when it agreed to provide additional funding to the project in June 2019, December 2020 and March 2021 (see paragraph 2.17). The Secretary is chair of the Executive Board.

Gateway Reviews

2.53 Finance has responsibility for the Gateway Review policy and co-ordination of Gateway Reviews across non-corporate Commonwealth entities. Gateway Reviews aim to facilitate effective planning, management and delivery of major IT projects being delivered in entities.28 Gateway Review reports are intended to be given to the Senior Responsible Officer to provide an assessment of issues that may jeopardise delivery and benefits. Five of the seven PEMS Gateway Reviews were addressed to the Project Executive as Senior Responsible Officer and not the actual Senior Responsible Officer (Deputy Secretary).

2.54 The business case approved by government for PEMS included that the project would be subject to Gateway Reviews. As at October 2023, the project has undergone seven Gateway Reviews as outlined in Table 2.7.

Table 2.7: Summary of Gateway Reviews and outcomes

|

Focus of the reviewa |

Completed |

No. of recommendations |

Overall ratingb |

|

Combined gate 0–3 (business need, business case, delivery strategy and investment decision) |

March 2018 |

8 |

Amber |

|

Gate 4 (readiness for service review)

|

July 2018 |

10 |

Amber |

|

May 2019 |

8 |

Green/Amber |

|

|

Gate 4/mid-stage program review

|

February 2021 |

9 |

Amber |

|

May 2021 |

9 |

Amber |

|

|

April 2022 |

8 |

Green/Amber |

|

|

December 2022 |

9 |

Amber |

|

|

113 |

128 |

152 |

71 |

Note a: The Gateway Reviews process includes multiple reviews throughout the project at key points (referred to as ‘gates’ for project or ‘review stages’ for programs which have interrelated projects). Each review has a specific focus and the number of reviews is determined by the complexity and timeframes of the project or program. Depending on structure of the program or project a blended approach between gates and review stages can occur. More information is available in Guidance on Assurance Reviews Process, Resource Management Guide 106 [Internet], Department of Finance, available from https://www.finance.gov.au/publications/resource-management-guides/guid…- [accessed 4 November 2023].

Note b: The PEMS project had a combined review for gate 0–3 in March 2018 given the first deliverable was due in July 2018. There were multiple reviews for stage 4 with each looking at different milestone delivery. A blended approach was adopted from February 2021 to combine the review points of a project and program.

Note c: Red was defined as: ‘Successful delivery of the program/project appears to be unachievable. There are major issues on program/project definition, schedule, budget, quality or benefits delivery. The program/project may need to be re-baselined and/or overall viability re-assessed.’

Note d: Amber was defined as: ‘Successful delivery of the program to time, cost, quality standards and benefits realisation appears feasible but significant issues already exist requiring management attention. These need to be addressed promptly.’

Note e: Green/Amber was defined as: ‘Successful delivery of the program to time, cost, quality standards and benefits realisation appears probable however constant attention will be needed to ensure risks do not become major issues threatening delivery.’

Note f: Green was defined as: ‘Successful delivery of the program/project to time, cost, quality standards and benefits realisation appears highly likely and there are no major outstanding issues that at this stage appear to threaten delivery significantly.’

Source: Summarised by ANAO from Gateway Review reports and meeting minutes from the project board and steering committee.

2.55 ANAO analysis of gateway review ratings against project status report ratings for the overall project status (see paragraph 2.48) shows discrepancies as outlined in Figure 2.3.

Figure 2.3: Gateway Reviews and project status reporting timeline

Note: Project status reports started in September 2018.

The May 2019 red rating in the project status report was due to delays in the schedule for data migration and preparation for the technical cutover (series of activities to prepare for the new system) for Milestone 6. The delay was resolved by the next report.

Source: ANAO analysis of Gateway Review reports and PEMS project status reports.

2.56 Factors impacting the overall rating in each review are outlined below.

- March 2018 — rated as amber with the report noting that Finance was using a ‘commercial off-the-shelf’ solution and implemented by the SDO that has used the technologies with other agencies, which lowers the technical implementation risk. The review however noted the project was under schedule pressure, it was unclear whether a ‘commercial off-the-shelf’ solution would meet the expectations of parliamentarians and their staff and that extensive communication and organisational change management was required for successful implementation.

- July 2018 — rated as amber noting the schedule continued to be under pressure and it was still unclear if the scope of the work would meet expectations of all stakeholders or if the budget would be able to meet emerging requirements from business areas. The review noted that if the recommendation to capture and prioritise user needs and requirements is not implemented promptly the project may become unachievable.29

- May 2019 — rated as green/amber noting progress was being made, including implementation readiness for financial related functions (Milestone 6); the new delivery date of April 2020 is achievable and that it was anticipated that Finance’s Executive Board would fund increased scope.

- February 2021 — rated as amber noting issues outside the control of the project during 2020 (for example, IT build paused due to loss of technical resources and need to re-hire) that necessitated replanning and re-baselining. The report also noted issues involving clearer responsibilities and accountability within the project, business readiness and operational support. The report did note the considerable work in progress as a mitigating factor.

- May 2021 — rated as amber due to issues with the readiness for the next phase (Milestone 7 phase 2) and with stakeholders/end-user engagement. The review stated these issues were mitigated with the planned successful delivery of Milestone 7 phase 1 and green ratings for governance and planning and risk management. Although Milestone 7 phase 1 was delivered on time, it was with reduced functionality (see paragraphs 3.10 to 3.16).

- April 2022 — rated as green/amber with delivery of Milestone 7 phase 2 (due 1 July 2022) a ‘high probability’. The report noted issues in arrangements for post ‘go-live’, deferral of expenditure reporting and testing and defect remediation.

- December 2022 — rated as amber noting PEMS had ‘been delivered and is operating’ and the schedule for expenditure reporting (Milestone 8) ‘appears reasonable’. However, the report notes considerable stakeholder concerns, the budget is exhausted and work is required to explore usability issues.

2.57 The definition of an overall red rating was met during the project, for example there were ongoing issues with the scope of the project, the schedule (and therefore benefits realisation) was re-baselined several times, and the budget was supplemented by additional funding. However, Gateway Reviews are a point in time assessment and the PEMS reviews occurred after the project was re-baselined. The reviews therefore looked at the overall likelihood of success for the project based on the new parameters. This approach potentially reduced the impact of the Gateway Reviews in being able to appropriately escalate issues for action by the Senior Responsible Officer.

2.58 The December 2022 Gateway Review listed two further reviews that needed to be completed. The first in May 2023 to confirm the readiness of Milestone 8 and the second in December 2023 to conclude the project. The review covering Milestone 8 commenced in September 2023.30

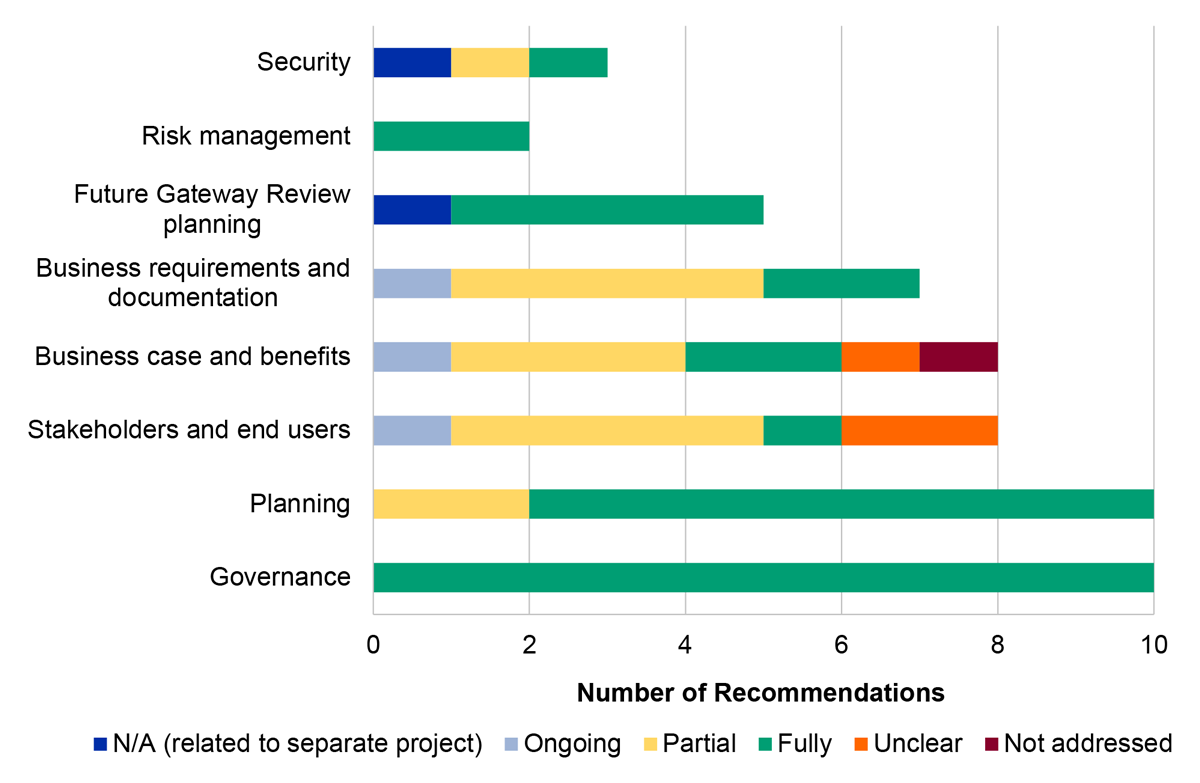

2.59 The ANAO examined the recommendations made in the Gateway Review reports and their level of urgency as set by the Gateway Review teams, shown in Figure 2.4.

Figure 2.4: Number of recommendations raised in review reports for March 2018 to December 2022 (broadly categorised by ANAO) and their assigned urgency

Note: The Gateway Review recommendation categories are:

Note a: Critical (do now): ‘To increase the likelihood of a successful outcome it is of the greatest importance that the program should take action immediately.’

Note b: Essential (do by): To increase the likelihood of a successful outcome the program should take action in the near future. Whenever possible essential recommendations should be linked to program milestones (for example, before contract signature and/or a specified timeframe i.e. within the next three months).

Note c: Recommended: The program should benefit from the uptake of this recommendation. If possible, recommendations should be linked to program milestones (for example, before contract signature and/or a specified timeframe i.e. within the next three months).

Source: ANAO analysis of Gateway Review reports

2.60 When progress of the recommendations was reviewed in subsequent Gateway Reviews, recommendations in the planning and governance categories were more likely to be fully met, as shown in Figure 2.5. Recommendations in the stakeholders and end users category were predominantly partially met, with the implementation of some recommendations remaining unclear to the gateway reviewers.

Figure 2.5: Outcomes of the Gateway Review recommendations for March 2018 to April 2022 as detailed in the subsequent Gateway Review

Note: This figure does not include if recommendations from the December 2022 Gateway Review have been completed as the subsequent Gateway Review has been delayed and not conducted as at October 2023.

The N/A relates to a project to support the COMCAR Automated Resource System (CARS project). This project was included in the PEMS second pass business case but managed as a separate project. The July 2018 Gateway Review was a combined PEMS and CARS review with some recommendations for the CARS project. These are represented as a N/A in the figure as the PEMS project did not need to implement these.

Source: ANAO analysis of Gateway Review reports.

2.61 Gateway Reviews have an enhanced notification process which requires escalation of issues to an agency’s accountable authority and/or Minister. This process is triggered by red ratings or sequential amber or amber/red ratings.31 The project twice received two consecutive amber ratings that were then followed by a green/amber rating, triggering the first level of enhanced notification. Finance complied with the enhanced notification process after both sets of consecutive amber ratings.32

External reporting

External performance reporting

2.62 The Public Governance, Performance and Accountability Act 2013 (PGPA Act) establishes a framework for monitoring and evaluating performance that requires entities to have meaningful performance information which relies upon a clear understanding of the entity’s purpose and expressing it in a way that is related, measurable and complete.

2.63 PEMS was included in the performance measures in Finance’s corporate plan and annual reports from 2017–18 to 2023–24. The 2022–23 measure is depicted in Table 2.8.33

Table 2.8: Finance performance measure for PEMS 2022–23

|

Program |

Key activities |

Performance measure and description |

Performance target and description |

|

Delivering effective services to, and for, government — key activities and performance measures |

Deliver ministerial and parliamentary services: Provide a range of services to Parliamentarians, their employees and others as determined by the Australian Government to assist them in undertaking their duties. |

Improve administration of parliamentary work expenses — the timeliness, efficiency, clarity and transparency of the administration of parliamentary work expenses is improved. |

Increased usage of PEMS by parliamentarians and their staff. The target is represented by a ‘✔’.a |

|

106 |

141 |

126 |

133 |

Note a: The corporate plan defines a tick as: ‘that an assessment approach will be used to measure performance for the given reporting period/s.’ The methodology detailed against the performance measures is ‘Measured through provision of additional functionality and increased number of claims processed through PEMS’.

Source: Finance’s Corporate Plan 2022–23.

2.64 The ANAO assessed the 2022–23 measure and target against section 16EA of the Public Governance Performance and Accountability Rule 2014 (PGPA Rule) as set out in in Table 2.9.

Table 2.9: Assessment of performance measure 2022–23

|

Performance measure and target |

Relateda |

Measurableb |

||

|

Reliable and verifiable |

Free from bias |

Assessable over time |

||

|

Measure: Improve administration of parliamentary work expenses — the timeliness, efficiency, clarity and transparency of the administration of parliamentary work expenses is improved |

◆ |

■ |

■ |

■ |

|

Target: Increased usage of PEMS by parliamentarians and their staff |

||||

|

144 |

80 |

110 |

91 |

104 |

Key: ■ Does not meet requirements.

▲ Partially meets requirements.

◆ Fully and/or mostly meets requirements.

Note a: Related refers to the requirement of subsection 16EA(a) of the PGPA Rule 2014, as amended. In applying the ‘related’ criterion, the ANAO assessed whether the entity’s performance measures:

related directly to one or more of the entity’s purposes or key activities; and

provided a clear link between purposes, key activities and performance measures.

Note b: In applying the ‘measurable’ criterion, the ANAO assessed whether the entity’s performance measures were:

reliable and verifiable — supported by clearly identified data sources and methodologies;