Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of the National Housing Finance and Investment Corporation

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The National Housing Finance and Investment Corporation (NHFIC) has been in operation since June 2018 to improve housing outcomes through increasing the supply of affordable housing. NHFIC offers loans, investments, grants and loan guarantees to encourage investment in affordable housing.

- NHFIC is supported by the Australian Government with funding of more than $2 billion for its operations and its reserves.

- The Australian Government has provided a guarantee for all of NHFIC's debts (other than to the Commonwealth) in relation to NHFIC's contracts and transactions executed before 1 July 2023.

Key facts

- NHFIC delivers five programs: the Affordable Housing Bond Aggregator; the National Housing Infrastructure Facility; capacity building; the First Home Loan Deposit Scheme and research.

- NHFIC is supported by Export Finance Australia (EFA) for its support functions and accommodation.

What did we find?

- The administration of NHFIC is partly effective.

- NHFIC has incorporated design expectations into its strategies and has developed frameworks to deliver against its Investment Mandate.

- NHFIC's implementation and reporting does not clearly demonstrate that it is achieving its purpose to 'improve housing outcomes for Australians'.

What did we recommend?

- The Auditor-General made five recommendations to address deficiencies in NHFIC's:

- monitoring and reporting on performance under its services agreement with EFA;

- risk management;

- compliance management; and

- measuring and presenting its achievements in delivering 'improved housing outcomes'.

- NHFIC agreed to all five recommendations.

$1.2 billion

raised by NHFIC through three bond issuances between March 2019 and June 2020.

9983

First Home Loan Deposit Guarantees issued between 1 January 2020 and 30 June 2020.

26

loans provided to community housing providers up to June 2020 with a combined value of $1.3 billion.

Summary and recommendations

Background

1. In June 2018 the National Housing Finance and Investment Corporation (NHFIC) was established under the National Housing Finance and Investment Corporation Act 2018 (NHFIC Act) to ‘improve housing outcomes for Australians, particularly vulnerable Australians who need social and affordable housing’.1 NHFIC is a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013. NHFIC is part of the Treasury portfolio and reports to the Assistant Treasurer and Minister for Housing (minister). NHFIC is subject to the minister’s directions outlined in the National Housing Finance and Investment Corporation Investment Mandate Direction 2018 (Investment Mandate).

2. NHFIC was established to help reduce pressure on housing affordability. It does this through the provision of loans, investments, grants and loan guarantees to encourage investment in housing, with a particular focus on affordable housing.

3. NHFIC’s services are delivered through five programs which are: the Affordable Housing Bond Aggregator (AHBA), the National Housing Infrastructure Facility (NHIF), capacity building, the First Home Loan Deposit Scheme (FHLDS) and research. A high level description of each of the programs is summarised in Table S.1 below.

Table S.1. Summary of NHFIC’s programs

|

Program |

Description |

|

1. Affordable Housing Bond Aggregator |

To make loans to registered community housing providers, using money borrowed from the Commonwealth and by raising finance by the issue of bonds on the commercial market. |

|

2. National Housing Infrastructure Facility |

To provide finance for eligible infrastructure projects that would not otherwise have proceeded, or would only have proceeded at a much later date or with a lessor impact on new affordable housing. |

|

3. Capacity Building |

To provide support for capacity building to assist registered community housing providers to further develop their financial and management capabilities. This support is provided by NHFIC entering into contracts with persons or entities to provide services to registered community housing providers. |

|

4. First Home Loan Deposit Scheme |

To facilitate first home buyers entering into the housing market sooner. To issue up to 10,000 guarantees each financial year for loans to first home buyers with a deposit of between 5 and 20 per cent of the property’s value. |

|

5. Research |

To support the monitoring of housing demand, supply and affordability in Australia. Highlighting current and potential future gaps between housing supply and demand, while also complementing existing housing-related research. |

Source: Investment Mandate.

Rationale for undertaking the audit

4. The primary function of NHFIC is to improve housing outcomes for Australians through increasing the supply of affordable housing. The availability of affordable housing has been of interest to the Parliament. In the 2019–20 financial year, NHFIC expenses were in excess of $101 million of which concessional loan provisions were $74.5 million.2 During this period NHFIC issued bonds to the value of $877 million.3 The audit will provide assurance to the Parliament on the effectiveness of NHFIC’s administration following its first two years of operation.

Audit objective and criteria

5. The audit objective was to assess the effectiveness of the administration of NHFIC. To form a conclusion against this objective, the following high-level criteria were applied:

- Have the design expectations for NHFIC been effectively incorporated into its service delivery arrangements?

- Has NHFIC implemented frameworks to deliver on the Investment Mandate?

- Has NHFIC established appropriate arrangements to measure and report on its impact?

Conclusion

6. The administration of NHFIC is partly effective. While NHFIC has established administrative arrangements for five programs which align to the NHFIC Act and the Investment Mandate, its implementation and reporting does not clearly demonstrate that it is achieving its purpose to ‘improve housing outcomes’. NHFIC’s administration should be improved in relation to: management of its Services Agreement (SA) with Export Finance Australia (EFA); risk management and compliance management; and measuring and presenting its achievements in delivering ‘improved housing outcomes’.

7. The establishment of NHIFC was largely consistent with relevant legislative and policy requirements. There were shortcomings primarily related to its arrangements to monitor and report on performance under its SA with EFA and its implementation of risk management.

8. NHFIC’s management of delivery against the Investment Mandate is partly effective. NHFIC has established mechanisms to monitor its performance and compliance against the Investment Mandate. However, greater assurance is required to meet the obligations set out in NHFIC’s governance charters. The measuring and presenting of NHFIC’s delivery against its legislative object to ‘improve housing outcomes’ was not transparent in corporate plans and was ambiguous in information provided to the NHFIC Board for decision-making.

9. NHFIC’s arrangements for measuring and reporting on its impact are partly appropriate. NHFIC has prepared three corporate plans which identified the overall organisational purpose, aims to achieve its purpose and strategic objectives. NHFIC’s performance framework did not provide an adequate level of insight into the effectiveness and efficiency of NHFIC’s delivery of its legislative object. The performance measures established by NHFIC were not sufficiently reliable and complete.

Supporting findings

Establishment and design expectations

10. NHFIC’s strategies and operating model are consistent with the NHFIC Act and Investment Mandate. Two programs (NHIF and capacity building) fell short of the expectations set out in NHFIC’s business plans and internal budgets.

11. NHFIC was largely effective in establishing the operations of the organisation. The NHFIC Board was established and has an approved charter to govern its operations. In accordance with the charter, the board has established committees to advise or assist in the performance of the board’s functions. Each of these committees has a charter that has been approved by the board. The NHFIC Board and the Audit and Risk Committee did not implement governance arrangements in a way that was intended to fulfil their legislative and charter obligations.

12. NHFIC’s establishment of support functions was largely appropriate. NHFIC has made arrangements for the delivery of establishment services and operational services through a SA with EFA. The performance monitoring that has been undertaken was not documented and focused on inputs. NHFIC acquittal of EFA invoices under the SA is the primary mechanism for monitoring the costs of service delivery. This process should be more rigorous.

13. NHFIC has a range of policy documents that include a requirement to apply risk management techniques at the transaction level. All of these documents have been approved by the Audit and Risk Committee, and are applied in the operation of relevant programs. However, the structure and implementation of organisational risk management in NHFIC is missing elements and is inconsistently applied across the organisation.

Delivery against the Investment Mandate

14. NHFIC has established mechanisms to monitor its performance and compliance against the Investment Mandate. However, NHFIC requires additional measures to give greater assurance that the NHFIC Board is meeting its compliance obligations under the Investment Mandate and its governance charters.

15. NHFIC’s investment decisions are partly effective in demonstrating additionality in outcomes. NHFIC’s corporate plan should provide further information to allow NHFIC to demonstrate whether its performance resulted in ‘improved housing outcomes’. NHFIC’s loan, investment and grant assessment guidelines require specific consideration and assessment of the additionality for projects at the transaction level. However, the level of additionality is not consistently measured or presented in submissions for NHFIC Board approval.

Measuring and reporting on impact

16. NHFIC has established a partly appropriate performance measurement framework. NHFIC has identified a range of performance measures aligned to its strategic and legislative objectives. NHFIC’s performance measures should provide greater insight to the Parliament and public into how NHFIC is achieving its legislative object and an understanding of the efficiency and effectiveness of its operations.

Recommendations

Recommendation no.1

Paragraph 2.76

The National Housing Finance and Investment Corporation implement rigorous monitoring and reporting of performance under the Services Agreement between Export Finance Australia and NHFIC.

National Housing Finance and Investment Corporation response: Agreed.

Recommendation no.2

Paragraph 2.98

The National Housing Finance and Investment Corporation review and update the risk framework and risk assessments to better support the NHFIC Board in the identification and treatment of risks.

National Housing Finance and Investment Corporation response: Agreed.

Recommendation no.3

Paragraph 3.18

The National Housing Finance and Investment Corporation implement additional measures to give greater assurance over the quality of, and compliance with, legislation, policies and procedures.

National Housing Finance and Investment Corporation response: Agreed.

Recommendation no.4

Paragraph 3.34

The National Housing Finance and Investment Corporation present more consistent and transparent information to the NHFIC Board on how it contributes to ‘improved housing outcomes’.

National Housing Finance and Investment Corporation response: Agreed.

Recommendation no.5

Paragraph 4.33

The National Housing Finance and Investment Corporation strengthen its performance measures to address its legislative object ‘to improve housing outcomes’ and to provide a greater understanding of its efficiency and effectiveness in delivering outcomes.

National Housing Finance and Investment Corporation response: Agreed.

Summary of National Housing Finance and Investment Corporation response

17. A summary response from NHFIC is provided below. The full response can be found at Appendix 1.

The National Housing Finance and Investment Corporation (NHFIC) acknowledges the ANAO’s findings and recommendations and welcomes the opportunity to comment on the Audit Report on the effectiveness of the administration of NHFIC.

We agree with the five recommendations noted in the Report and have already made significant progress in responding to the findings. The implementation of the recommendations by the ANAO will be overseen by NHFIC’s Audit and Risk Committee.

NHFIC is only two and a half years old and we welcome the Report highlighting that $1.2 billion of social bonds had been issued between March 2019 and June 2020, that 9,983 First Home Loan Deposit Scheme (FHLDS) guarantees were issued in the first six months of the Scheme’s operation, and that $1.3 billion in loans were made to 26 community housing providers by June 2020.

As a relatively new entity that is still maturing, the timing of the report has been very helpful in highlighting findings that will enhance the existing governance arrangements. NHFIC was established to be operational by 1 July 2018 with two key functions (the Affordable Housing Bond Aggregator (AHBA) and the National Housing Infrastructure Facility (NHIF)). NHFIC was given two additional functions (FHLDS and Research) following the May 2019 Federal election and a further function (the New Home Guarantee (NHG)) following the October 2020 Federal budget. NHFIC is focussed on administering these functions efficiently and effectively.

The Report places appropriate importance on the need for effective monitoring and reporting of governance arrangements. This includes the review of service level agreements and robust risk management policies and compliance practices. We have already enhanced our governance arrangements with the recruitment of specialist staff as part of our commitment to a continuous improvement approach to our policies and practices.

We also welcome the Report’s focus on NHFIC’s primary function of improving housing outcomes for Australians. We are reviewing our internal and external reporting measures to ensure they are consistent and transparent for the Board and to demonstrate to the public and the Parliament how NHFIC is achieving its purpose.

Key messages from this audit for all Australian Government entities

18. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Performance and impact measurement

1. Background

Introduction

1.1 The May 2015 Senate Economic References Committee Inquiry into Affordable Housing identified a range of issues relating to Australian Government interventions to address gaps in both the supply and demand for social and affordable housing.4 In 2017 the Council on Federal Financial Relations (CFFR) noted that the issue of affordable housing was ‘a structural problem in Australia where the demand for affordable housing outstrips its supply, leading to lengthy social housing waitlists and some low-income households facing rental stress or being unable to retain housing at all’.5

1.2 The CFFR identified and commented on the roles of the Commonwealth, state and territory and local governments for affordable housing. The primary responsibility for affordable housing lies with states and territories, with the Commonwealth Government role being largely ‘providing funding assistance for affordable housing rather than delivery.’6 It went on to say ‘different States and Territories have taken different approaches to the way in which they deliver affordable housing. Some states and territories include housing as part of their human services or welfare portfolios, while others have adopted a more commercial/property focus, acting primarily as a developer and/or landlord, with support services provided by other parts of government’.7 Local government also has relevant responsibilities through building approval, urban planning and development processes and may be involved in the provision of public housing directly.8

1.3 On 7 January 2016, the Australian Government announced the establishment of an Affordable Housing Working Group (Working Group) following a request from treasurers at the CFFR meeting in October 2015.9

1.4 In 2016 the Department of the Treasury established the Working Group, which included representatives of the Australian Government and state jurisdictions, as follows.

- Commonwealth Treasury;

- Commonwealth Department of Social Services;

- New South Wales Treasury;

- Victoria Department of Treasury and Finance; and

- Western Australia Department of Treasury.

1.5 The Working Group defined affordable housing as:

that which reduces or eliminates housing stress for low income and disadvantaged families and individuals in order to assist them with meeting other essential basic needs on a sustainable basis, whilst balancing the need for housing to be of a minimum appropriate standard and accessible to employment and services.10

1.6 The Working Group delivered its report, Innovative Financing Models to Improve the Supply of Affordable Housing, to Heads of Treasuries on 3 November 2016. This report concluded that a ‘bond aggregator model … would provide affordable housing providers with access to cheaper and longer tenor11 debt; freeing up capital for the construction of new affordable housing.’12 The CFFR agreed to the recommendations of the report. In the 2017–18 Budget, the Australian Government announced the establishment of the National Housing Finance and Investment Corporation (NHFIC), to operate an affordable housing bond aggregator and administer the National Housing Infrastructure Facility (NHIF).13

1.7 NHFIC was established under the National Housing Finance and Investment Corporation Act 2018 (NHFIC Act). NHFIC was established to ‘improve housing outcomes for Australians, particularly vulnerable Australians who need social and affordable housing’.14 As a corporate Commonwealth entity NHFIC is subject to regulations as set out in the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule).

1.8 NHFIC is part of the Treasury portfolio and reports to the Assistant Treasurer and Minister for Housing (the minister).

Governing legislation

1.9 The objectives and responsibilities of NHFIC are set out in a range of documents including the NHFIC Act and the National Housing Finance and Investment Corporation Investment Mandate Direction 2018 (Investment Mandate).

NHFIC Act

1.10 The object of the NHFIC Act is to establish NHFIC to improve housing outcomes for Australians by:

(a) strengthening efforts to increase the supply of housing; and

(b) encouraging investment in housing (particularly in the social or affordable housing sector); and

(c) providing finance, grants or investments that complement, leverage or support Commonwealth, State or Territory activities relating to housing; and

(d) contributing to the development of the scale, efficiency and effectiveness of the community housing sector in Australia.15

1.11 The object of the NHFIC Act was amended in October 2019 to include:

(e) assisting earlier access to the housing market by first home buyers.

1.12 The NHFIC Act provides that NHFIC performs its functions in accordance with one or more directions given by the minister (the Investment Mandate).16

Investment Mandate

1.13 In performing its functions, NHFIC must take all reasonable steps to comply with the Investment Mandate. The first Investment Mandate, dated 3 July 2018, outlined three activities to be performed by NHFIC:

- establishment and operation of the Affordable Housing Bond Aggregator (AHBA);

- establishment and operation of the National Housing Infrastructure Facility (NHIF); and

- support for capacity building to assist registered community housing providers to further develop their financial and management capabilities.

1.14 On 12 November 2019 the Investment Mandate was amended to include two additional activities:

- establishment and operation of the First Home Loan Deposit Scheme (FHLDS); and

- research into housing affordability in Australia.

1.15 These activities underpin the five programs operated by NHFIC. A high level description of these programs is set out in Table 1.1. The programs are described in detail later in this document.

Table 1.1: Programs administered by NHFIC

|

Program |

Description |

|

1. Affordable Housing Bond Aggregator |

To make loans to registered community housing providers, using money borrowed from the Commonwealth and by raising finance by the issue of bonds on the commercial market. |

|

2. National Housing Infrastructure Facility |

To provide finance for eligible infrastructure projects that would not otherwise have proceeded, or would only have proceeded at a much later date or with a lessor impact on new affordable housing. |

|

3. Capacity Building |

To provide support for capacity building to assist registered community housing providers to further develop their financial and management capabilities. This support is provided by NHFIC entering into contracts with persons or entities to provide services to registered community housing providers. |

|

4. First Home Loan Deposit Scheme |

To facilitate first home buyers entering into the housing market sooner. To issue up to 10,000 guarantees each financial year for loans to first home buyers with a deposit of between 5 and 20 per cent of the property’s value. |

|

5. Research |

To support the monitoring of housing demand, supply and affordability in Australia. Highlighting current and potential future gaps between housing supply and demand, while also complementing existing housing-related research. |

Source: Investment Mandate.

1.16 The Investment Mandate outlines the activities to be performed by NHFIC and the allocation, maintenance and repayment of funds. It also outlines financing mechanisms and eligibility criteria for lending and financing decisions and expectations related to governance, including reasons for decisions, good corporate citizenship and transparency of operations. The Investment Mandate requires NHFIC to have regard to ‘Australian best practice government governance principles, and Australian best practice corporate governance for Commercial Financiers, when performing its functions, including developing and annually reviewing policies with regard to: environmental issues; social issues; and governance issues’.17

Board

1.17 NHFIC is governed by a board. The board consists of a chair and six members. The board is the accountable authority of NHFIC. The functions of the board are: to decide, within the scope of the Investment Mandate, the strategies and policies to be followed by NHFIC; to ensure the proper, efficient and effective performance of NHFIC’s functions; and to perform any other functions conferred on the board by the NHFIC Act. The board must also ensure that NHFIC maintains commercially sound and sufficient levels of capital and reserves.

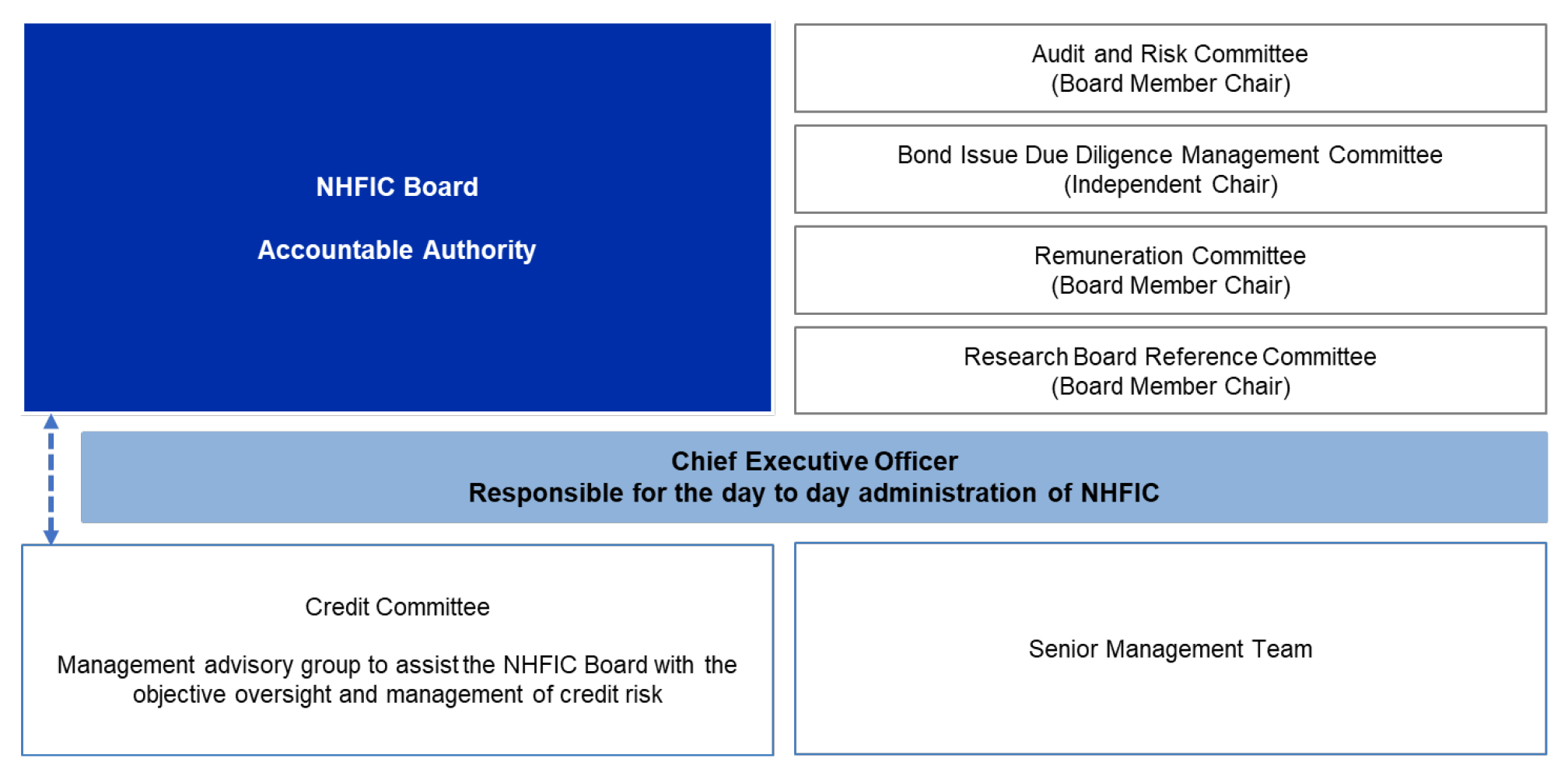

1.18 The NHFIC Board is supported by four committees: the Audit and Risk Committee; the Bond Issue Due Diligence Management Committee; the Remuneration Committee and the Research Board Reference Committee. The Chief Executive Officer (CEO) is responsible for the day-to-day administration of NHFIC. The CEO is required to act in accordance with policies and strategies determined by the board. A management group, known as the Credit Committee, has also been established as a management advisory committee to the board to assist with the oversight and management of credit risks arising from NHFIC’s functions. The CEO attends all board meetings and is invited to, and frequently attends, all committee meetings. Figure 1.1 depicts the NHFIC governance structure.

Figure 1.1: NHFIC governance structure

Source: ANAO analysis of NHFIC’s governance structure.

1.19 In addition to its 28 full time equivalent staff, NHFIC has contracted with Export Finance Australia (EFA) for the delivery of its support functions under a Services Agreement.

Funding and government guarantees

1.20 The Australian Government, through the Department of the Treasury, has provided operating funding for four years to assist with the establishment of NHFIC operations. Operating funding for the four years has been budgeted at approximately $80 million. Operating funds provided during the first two years of NHFIC’s operations was approximately $45 million.

1.21 In addition, the Australian Government has provided $200 million a year over five years ($1 billion between 2018–19 and 2022–23) for NHIF.

1.22 The NHFIC Special Account, established in accordance with section 47A of the NHFIC Act, is operated by the Department of the Treasury. The purpose of the special account is to provide NHFIC with access to loan funding of up to $1 billion as a warehouse facility (see paragraph 2.8) for the operation of the AHBA (the reserve).

1.23 Section 34 of the Investment Mandate states that the board must not enter into a transaction which would result in the sum of the total guaranteed liabilities of NHFIC and the current value of the AHBA reserve to exceed $2 billion.18 As at 30 September 2020 this cap had not been reached. An illustration of NHFIC’s funding flows is shown in Figure 1.2.

Figure 1.2: NHFIC’s funding flows

Source: NHFIC Board Handbook April 2019.

NHFIC and the community housing sector

1.24 The purpose of the AHBA is to engage with, and leverage the work of, the community housing sector. The community housing sector is broadly made up of not-for-profit organisations managed by boards of directors elected by their members. Community housing providers (CHPs) manage a range of housing services including social and affordable housing for people who are on very low to moderate incomes and transitional and crisis accommodation for people who are homeless.19 In Australia, most20 CHPs are regulated through the National Regulatory System for Community Housing (NRSCH). The NRSCH identifies CHPs as Tier 1, Tier 2 or Tier 3 depending on the corporate status, scale and development activities of the CHP. Table 1.2 outlines the categorisation of CHPs in Australia. As at 30 September 2020, there was a total of 359 CHPs registered by the NRSCH and state based regulatory agencies.

Table 1.2: Distribution of registered community housing providers

|

Primary jurisdiction |

Tier 1 |

Tier 2 |

Tier 3 |

Total |

|

Australian Capital Territory |

1 |

3 |

10 |

14 |

|

New South Wales |

23 |

14 |

123 |

160 |

|

Northern Territory |

0 |

3 |

1 |

4 |

|

Queensland |

3 |

9 |

72 |

84 |

|

South Australia |

5 |

10 |

14 |

29 |

|

Tasmania |

2 |

0 |

0 |

2 |

|

Victoriaa |

N/A |

N/A |

N/A |

40 |

|

Western Australia |

4 |

6 |

16 |

26 |

|

Total |

38 |

45 |

236 |

359 |

Note a: At 30 September 2020, Victoria did not classify its CHPs in line with the NRSCH tiers.

Source: ANAO analysis of public information on registered community housing providers.

Rationale for undertaking the audit

1.25 The primary function of NHFIC is to improve housing outcomes for Australians through increasing the supply of affordable housing. The availability of affordable housing has been of interest to the Parliament. In the 2019–20 financial year, NHFIC expenses were in excess of $101 million of which concessional loan provisions were $74.5 million.21 During this period NHFIC issued bonds to the value of $877 million.22 The audit will provide assurance to the Parliament on the effectiveness of NHFIC’s administration following its first two years of operation.

Audit approach

Audit objective, criteria and scope

1.26 The audit objective was to assess the effectiveness of the administration of NHFIC. To form a conclusion against this objective, the following high-level criteria were applied:

- Have the design expectations for NHFIC been effectively incorporated into its service delivery arrangements?

- Has NHFIC implemented frameworks to deliver on the Investment Mandate?

- Has NHFIC established appropriate arrangements to measure and report on its impact?

Audit methodology

1.27 In undertaking the audit the Australian National Audit Office (ANAO):

- examined documentation held by NHFIC (and the Department of the Treasury) including strategies, policies, procedures, frameworks, guidelines, board papers and minutes, and internal reporting;

- reviewed specific documentation relating to individual program set-up, costs and outcomes, loan assessment criteria, credit risk management, risk management and performance monitoring; and

- interviewed relevant entity staff, provider staff and board members.

1.28 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of $236,987.

1.29 Team members for this audit were Mark Rodrigues and Axiom Associates Pty Ltd.

2. Establishment and design expectations

Areas examined

This chapter examines whether NHFIC developed strategies, an operating model, governance arrangements, support functions and an approach to risk management that was consistent with the relevant legislative and policy requirements.

Conclusion

The establishment of NHIFC was largely consistent with relevant legislative and policy requirements. There were shortcomings primarily related to its arrangements to monitor and report on performance under its Services Agreement (SA) with Export Finance Australia (EFA) and its implementation of risk management.

Areas for improvement

The ANAO made two recommendations aimed at addressing the need for NHFIC to:

- implement rigorous monitoring and reporting of performance under the SA between EFA and NHFIC; and

- review and update the risk framework and risk assessments to better support the board in the identification and treatment of risks.

2.1 The National Housing Finance and Investment Corporation Investment Mandate Direction 2018 (Investment Mandate), and its subsequent amendments, required the National Housing Finance and Investment Corporation (NHFIC) to establish, and make operational, five programs. NHFIC is required under the National Housing Finance and Investment Corporation Act 2018 (NHFIC Act) to ensure ‘the proper, efficient and effective performance of its functions’. This includes the development and implementation of strategies, an operating model, governance arrangements, support functions and an approach to risk management.

Are NHFIC’s strategies and operating model consistent with the NHFIC Act and Investment Mandate?

NHFIC’s strategies and operating model are consistent with the NHFIC Act and Investment Mandate. Two programs (NHIF and capacity building) fell short of the expectations set out in NHFIC’s business plans and internal budgets.

2.2 The five programs implemented by NHFIC are delivered through individual service delivery mechanisms that encompass in-house service delivery, partnership arrangements and outsourced functions.

2.3 To assess whether NHFIC’s administration of programs was effective, the ANAO examined whether:

- the operating model used for the program aligned to the Investment Mandate;

- there were operational and financial plans to build capacity and capability into the management and administration of the program;

- there was a clear plan for maturation of the programs that had been approved by the board;

- policies and procedures had been developed to support operations; and

- the programs met the expectations outlined in the Investment Mandate and NHFIC’s internal planning and budget projections.

2.4 The ANAO performed its assessment on each of NHFIC’s programs. Figure 2.1 summarises the results of the assessment. NHFIC results indicate that, in spending and performance, each program is at a different stage of implementation relative to expectations. Each of the five programs is described in detail in this chapter.

Figure 2.1: Analysis of NHFIC’s establishment of programs

Source: ANAO analysis of NHFIC board papers.

Affordable Housing Bond Aggregator (AHBA)

Operating model

2.5 In 2017 the Department of the Treasury commissioned a consultant to provide a plan for the establishment of an Australian affordable housing bond aggregator. The plan proposed that the affordable housing bond aggregator should operate a ‘pass-through’ model where borrowers (community housing providers (CHP)) funding requirements were equally matched to funding sourced from the domestic capital market through the issue of bonds. This would have the effect of providing lower-cost and longer-term loans than were available to CHPs directly. In the report the consultant found that the benefit of an Australian affordable housing bond aggregator could be equivalent to 1.4 per cent per annum in interest costs.

2.6 NHFIC is able to offer AHBA loans at a lower interest rate than can be obtained by CHPs directly. It can do this because it is able to issue bonds at interest rates that reflect the financial support provided by the Australian Government. The Australian Government has guaranteed any money that is payable by NHFIC, other than to the Commonwealth, for contracts and transactions entered into until 30 June 2023.23 As a result of this guarantee, NHFIC has gained a Standard & Poors (S&P) rating as follows.

On Feb. 11, 2019, S&P Global Ratings assigned its ‘AAA’ long-term and ‘A-1+’ short-term issuer credit ratings to Australian government entity National Housing Finance and Investment Corp. (NHFIC). The rating outlook is stable. At the same time, we assigned our ‘AAA’ long-term rating to the proposed senior unsecured notes to be issued under NHFIC’s debt issuance program.

2.7 The importance of the Australian Government guarantee to the rate of interest for NHFIC bonds was referred to in the 1 September 2020 board papers which concluded that ‘if the explicit guarantee is removed NHFIC still may be able to issue non-guaranteed bonds, but the pricing dynamics, quantum of available funding, and the investor base would be very different’.

Operational and financial plans

2.8 The Australian Government agreement to provide up to $1 billion in loans to NHFIC provides it with a reserve warehouse loan facility. NHFIC’s AHBA Reserve Business Plan 2018–19 explained the functioning of the reserve as follows.

NHFIC funds AHBA loans by issuing its own bonds into the wholesale capital market. It can also use the AHBA Reserve for this purpose, including:

- As a warehouse facility for approved AHBA loans prior to refinancing via a bond issuance at a later date. This enables NHFIC to build a portfolio of loans of sufficient scale over several months to support a bond.

- To provide construction funding which directly supports the development of new dwellings. The flexibility of the line of credit enables CHPs to make progressive drawdowns through the construction phase of a project prior to take-out finance at completion and financing of the loan via a bond issuance.

- To fund AHBA loans that will not be refinanced via a bond issuance, in circumstances where it is difficult or costly to match the terms of the loan and bond.

The AHBA Reserve allows NHFIC to offer financing at a competitive price and a range of tenors while giving it the time to build confidence and scale in its bond issuances.

2.9 In December 2018 the NHFIC Board approved the engagement of UBS and ANZ as bond issuance dealers to facilitate NHFIC’s bond issuance by ‘considering marketing and investor options for the NHFIC’s Debut Bond Issuance and bringing the bonds to market in the most efficient and cost-effective manner’.

2.10 The first NHFIC bond was issued on 28 March 2019 for a principal amount of $315 million with an interest rate of 2.38 per cent and a maturity date of 28 March 2029.24 This bond was matched to a pool of nine loans to CHPs varying in size from $3.8 million to $70 million.

Policies and procedures

2.11 The NHFIC Act and Investment Mandate set out the purposes and eligibility criteria for AHBA loans. At a high level, the Investment Mandate requires the board to provide loans to CHPs at the lowest cost and most appropriate tenor possible.

2.12 AHBA loans can be used to:

- acquire or construct new housing stock;

- maintain existing housing stock;

- assist with working capital requirements and/or general corporate requirements; and

- re-finance existing debts.

2.13 In deciding whether to make a particular loan, and in setting its conditions, the board must have regard to the following matters:

(a) the purpose for which the loan is being sought and the extent to which that purpose supports affordable housing outcomes;

(b) the credit-worthiness of the registered community housing provider;

(c) the terms on which any private sector finance would be available to the registered community housing provider;

(d) the likelihood that the NHFIC will receive a return from the loan and the likely extent of that return;

(e) the quality of any security available from the registered community housing provider;

(f) the expected price of funds raised by the NHFIC bonds during the life of the loan;

(g) whether the loan would complement, leverage or support other Commonwealth, State or Territory finance or activities;

(h) the object of the Act and the limits set in the Act.25

2.14 NHFIC has developed guidelines and an Investment Risk Evaluation Process to support the board’s decision-making for AHBA loans that address all the Investment Mandate requirements. The Investment Risk Evaluation Process was provided to the minister in December 2018.

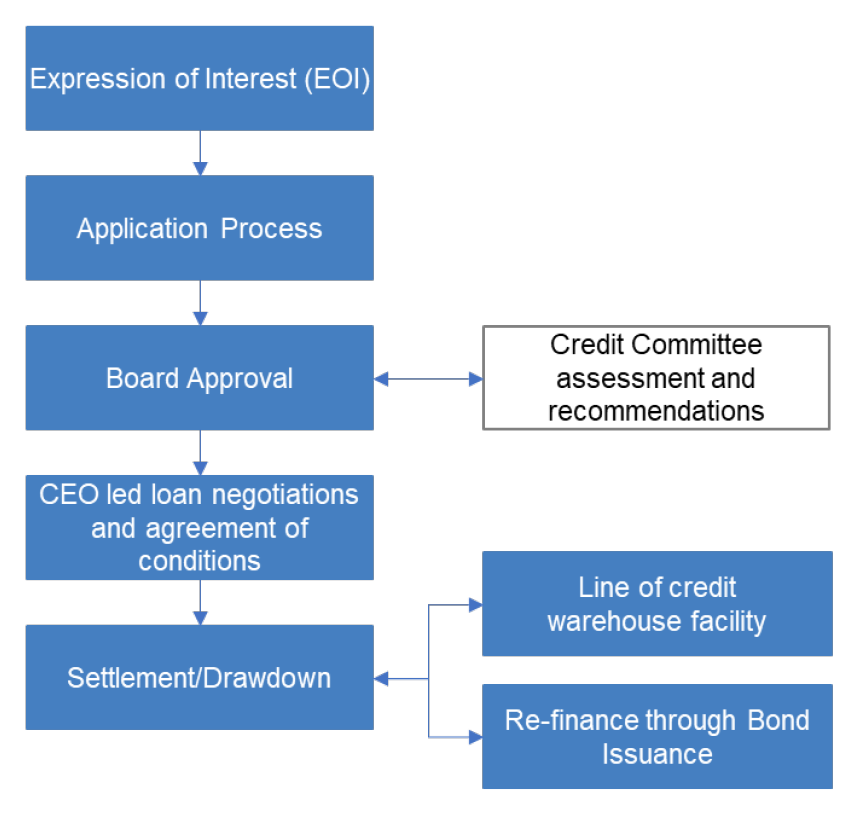

2.15 All AHBA loan applications are subject to an assessment process to determine eligibility and alignment to the requirements of the Investment Mandate. A summary of the process is illustrated in Figure 2.2.

Figure 2.2: AHBA loan assessment process

Source: ANAO analysis of NHFIC Guidelines: For Affordable Housing Bond Aggregator Loans.

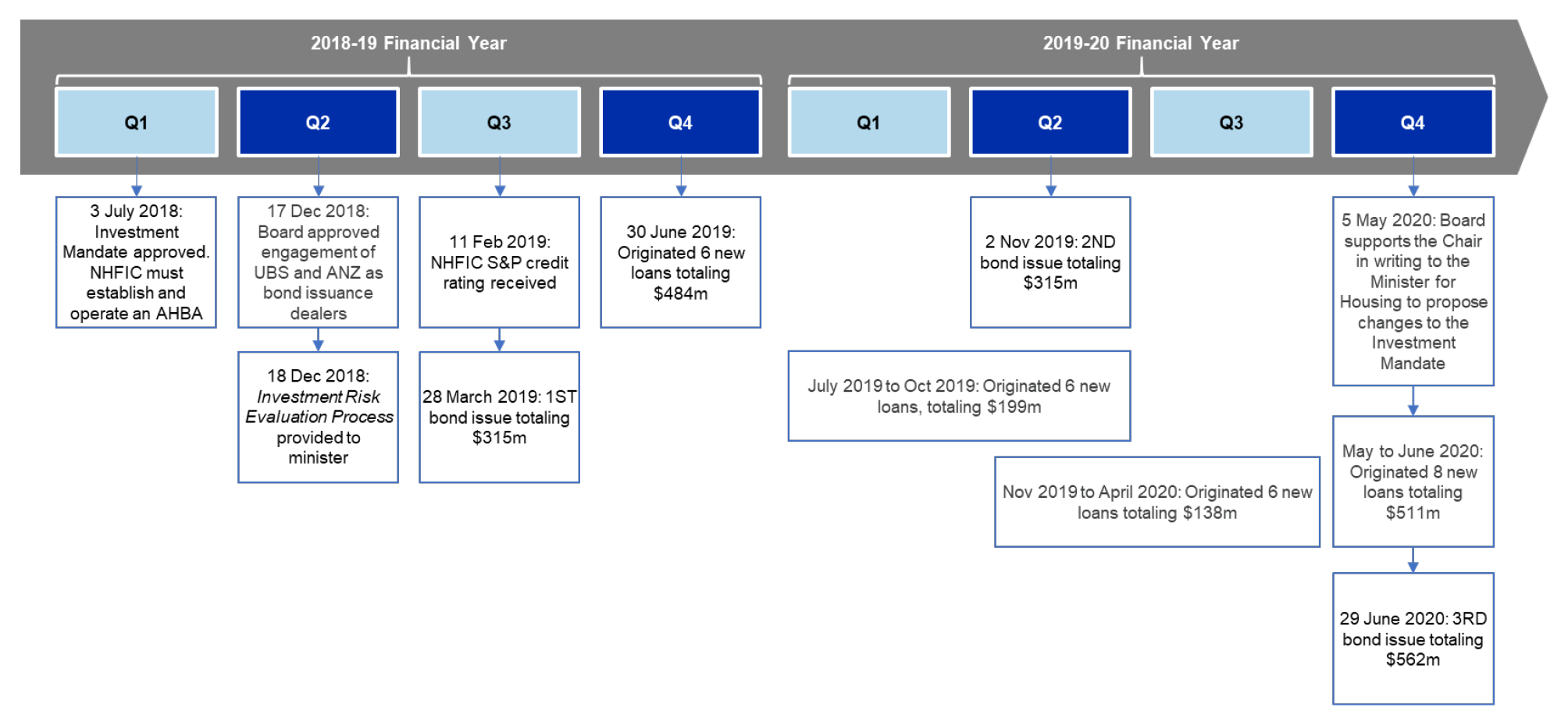

Delivery of program expectations and approach for maturation of the program

2.16 Between July 2018 and June 2020 there were three bond issuances by NHFIC with a total value of approximately $1.2 billion. It also originated26 and gained board approval for 26 loans to Tier 1 CHPs totalling approximately $1.3 billion. A chronology of the AHBA activities is illustrated in Figure 2.3.

Figure 2.3: Chronology of AHBA activities

Source: ANAO analysis of NHFIC board papers.

2.17 In June 2019 NHFIC provided its AHBA Reserve Business Plan 2018–19 to the Treasurer. This business plan forecast the use of the AHBA reserve until the end of financial year 2022–23. The high demand from CHPs for NHFIC loans has meant that NHFIC has exceeded the forecasts set out in this business plan.

2.18 One measure of performance of the AHBA is its ability to reduce the interest rate to CHPs while retaining sufficient margin to meet operational and financing costs. The margin retention by NHFIC is illustrated in Table 2.1.

Table 2.1: NHFIC margin on AHBA loans

|

|

Bond Issue 2 |

Bond Issue 3 |

|

Bond coupon rate |

1.52% |

1.41% |

|

Fixed loan rate to CHPs |

2.07% |

2.06% |

|

NHFIC margin |

0.55% |

0.65% |

Source: ANAO analysis of NHFIC board papers.

2.19 Overall, the implementation of the AHBA program has exceeded the expectations set out in NHFIC’s AHBA Reserve Business Plan 2018–19. This plan estimated that as at 30 June 2020 the total value of NHFIC’s loans would be $580 million. As at 30 June 2020 NHFIC had gained board approval for 26 loans totalling approximately $1.3 billion.

National Housing Infrastructure Facility (NHIF)

Operating model

2.20 The Investment Mandate requires NHFIC to establish and operate the NHIF to make infrastructure loans, investments and grants. The purpose of NHIF is:

[T]o overcome impediments to the provision of housing that are due to the lack of necessary infrastructure. It does this by providing finance for eligible infrastructure projects that would not otherwise have proceeded, or that would only have proceeded at a much later date or with a lesser impact on new affordable housing.27

Policies and procedures

2.21 Under the Investment Mandate the scope for which NHIF loans, investments and grants could be made is for projects that:

(a) would provide critical infrastructure to support new housing, particularly new affordable housing, including (but not limited to):

(i) new or upgraded infrastructure for services such as water, sewerage, electricity, telecommunications or transportation; or

(ii) site remediation works including the removal of hazardous waste or contamination; and

(b) would not itself provide housing; and

(c) would not provide community infrastructure, such as parks, day-care centres or libraries; and

(d) would be unlikely to proceed, or would be likely to proceed only at a much later date, or with a lesser impact on new affordable housing, without finance under the NHIF.28

2.22 These are reflected in the NHFIC Guidelines: For National Housing Infrastructure Facility Loans, Grants and Equity Investments and the NHIF Lending Policy. The NHIF Lending Policy refers to a NHIF Scope Inclusions Table which includes elements intended to provide greater clarity over the meaning of ‘critical infrastructure’ when assessing applications. It includes, for example, provision of gas supply between the mains and the building envelope, external fire protection and subdivision works.

Delivery of expectations

2.23 Between July 2018 and June 2020 the Australian Government provided $400 million for the operation of NHIF. Of this funding, $70 million was provided for loans, investment and grants. As at 30 June 2020, the board had approved one grant application with a value of approximately $3.6 million. The additional funding of $330 million was provided for loans and equity investments/concessional loans. As at 30 June 2020, the board had approved NHIF loans for two projects with a total value of $13.2 million. The forecast settlement for these loans is expected to be in the 2020–21 financial year. Whilst these represent approvals for the use of NHIF funding, the actual NHIF expenditure to 30 June 2020 was approximately $268,000.

2.24 The level of infrastructure loans, investments and grants through NHIF has fallen short of expectations set out in NHFIC’s internal budget projections which included an expected expenditure of $10 million against actual expenditure of approximately $268,000. A chronology of NHIF activities is illustrated in Figure 2.4.

Figure 2.4: Chronology of NHIF activities

Source: ANAO analysis of NHFIC board papers.

Operational and financial plans, including approach to maturation of the program

2.25 In April 2020, NHFIC endeavoured to address the lack of demand for NHIF loans, investments and grants through the negotiation of ‘umbrella agreements’ with state and territory governments.

2.26 The umbrella agreements were designed to provide certainty for the overall level of funding that may be available to a state or territory under NHIF. The availability of this funding requires the state or territory to submit sufficient eligible projects and for these to be approved by NHFIC. The umbrella agreements were also intended to streamline contractual arrangements through the use of a set of common terms and conditions.

2.27 All projects submitted under an umbrella agreement are to be assessed for eligibility against the requirements of the Investment Mandate. In April 2020 the board approved an umbrella agreement of up to $100 million with the New South Wales Land and Housing Corporation. As at 30 September 2020, no projects had been approved under this umbrella agreement. NHFIC is discussing potential umbrella agreements with other jurisdictions.

2.28 In another measure to address the lack of demand for NHIF funding, NHFIC considered proposing a broader eligibility definition for the use of NHIF funding. On 5 May 2020 the board agreed, in principle, to set up the Affordable Housing Fund (AHF) subject to the necessary changes to the Investment Mandate. The AHF proposal involved the re-tasking of unused NHIF funds away from funding only infrastructure to broader construction purposes. The board also approved, prior to any Investment Mandate changes, a budget of $50,000 for AHF set up activities between 1 April 2020 and 30 June 2020.29

Capacity Building

Operating model

2.29 Under the Investment Mandate, NHFIC may provide support to registered CHPs to further develop their financial and management capabilities (capacity building). The Investment Mandate indicates that this ‘support would be provided by the NHFIC entering into contracts with persons or entities to provide services to registered community housing providers’.30

2.30 The total value of the amounts payable by NHFIC under capacity building contracts must not exceed $1.5 million for its initial term (to 30 June 2023 subject to ministerial change).31

Operational and financial plans

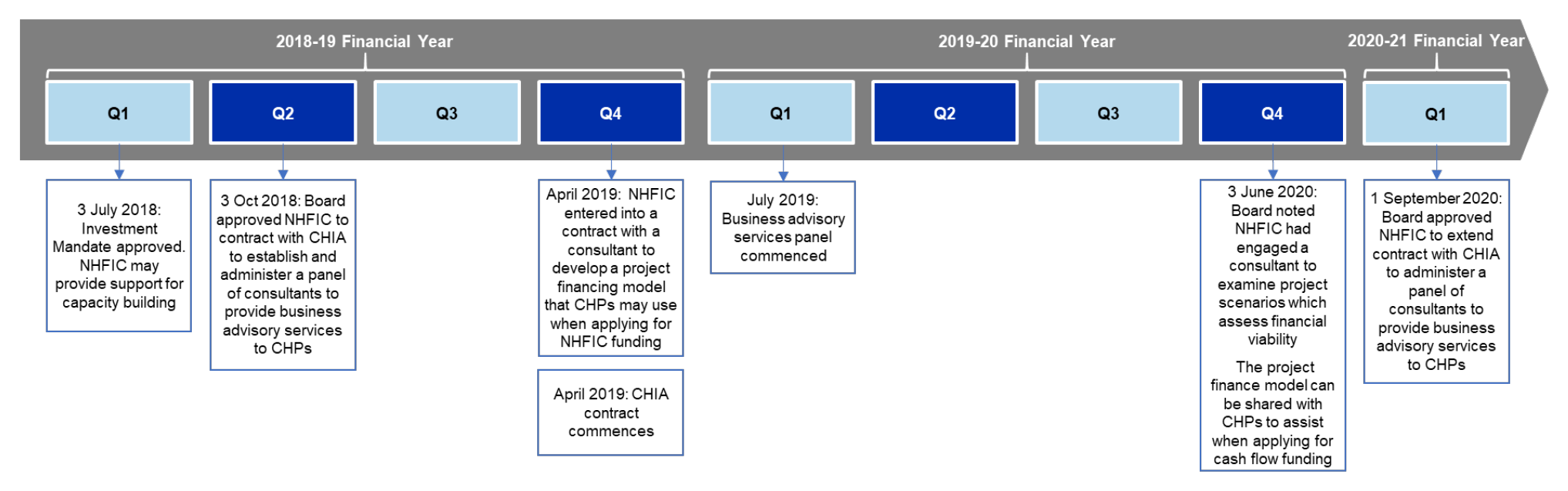

2.31 In October 2018 the board approved the engagement of the Community Housing Industry Association (CHIA) to provide capacity building services primarily through the establishment and administration of a panel of consultants to provide business advisory services to CHPs where their funding applications had been declined by NHFIC. Under this arrangement NHFIC would grant the CHP up to $20,000 for the provision of these business advisory services through the panel arrangement (the grants). In September 2020 the board approved an extension to the CHIA contract for one year.

2.32 In addition to the CHIA panel administration services, NHFIC engaged three consultants to develop financial models that would assist CHPs in their internal financial management and in applying for NHFIC finance. As at 30 June 2020, the total value of the CHIA panel administration services and financial consultancies was $226,000.

2.33 The first application for a business advisory services grant using the panel was referred by NHFIC to CHIA on 24 September 2019. As at September 2020 a total of 12 applications for grants had been referred to CHIA and three grants to CHPs were partially or fully funded. At 30 June 2020, total expenditure on grants was approximately $42,000.

Delivery of expectations and approach to maturation of the program

2.34 As at 30 June 2020, two capacity building grants had been completed, a further six were in progress. The total spending on capacity building grants and contracts was approximately $268,000. NHFIC does not have financial projections for the capacity building program. To assess whether the program was on track, the ANAO assumed that the available funding would be spent evenly throughout the initial funding term of the program. As at 30 June 2020, the notional funding available was $600,000 and expenditure was $268,000, less than half of this available notional funding. A chronology for capacity building activities is illustrated in Figure 2.5.

Figure 2.5: Chronology of capacity building activities

Source: ANAO analysis of NHFIC board papers.

First Home Loan Deposit Scheme

Operating model

2.35 Under the NHFIC Act and Investment Mandate, as amended in October 2019 and November 2019 respectively, NHFIC must establish and operate a scheme to issue guarantees to eligible lenders in relation to eligible loans under the First Home Loan Deposit Scheme (FHLDS). The purpose of FHLDS is to facilitate first home buyers entering into the housing market sooner. NHFIC may issue up to 10,000 guarantees each financial year for loans to first home buyers with a deposit of between 5 and 20 per cent of the property’s value.32

Operational and financial plans

2.36 In August 2019 the NHFIC Board was provided with information about the planning for the implementation of FHLDS. Between August 2019 and October 2019 NHFIC spent $2.1 million33 preparing for the implementation of FHLDS. This spending was primarily for the development of the FHLDS portal and preparation for the procurement of major bank and non-major lenders to administer the program.

2.37 A chronology of the implementation activities for FHLDS is illustrated in Figure 2.6.

Figure 2.6: Chronology of FHLDS activities

Source: ANAO analysis of NHFIC board papers.

Policies and procedures

2.38 The Investment Mandate sets out the eligibility for the FHLDS guarantee. This is determined by an income test, a prior property ownership test, a minimum age test, a citizenship test, a deposit requirement and an owner-occupier requirement. In addition, a property price cap (the maximum property purchase price) is applied. The level of the property price cap is determined by the postcode or suburb of the property.

2.39 The eligibility test and the annual provision of the 10,000 guarantees is through two major bank lenders (5000) and non-major lenders (5000).34 The lenders were selected through a competitive procurement process. Areas for consideration during the evaluation of bids from potential lenders were consideration of loan default rates and the procedures adopted by the potential lenders in relation to managing defaults and customer hardship. For example, a winning lender’s submission showed five year default rates of 1.6 per cent for high loan to valuation ratio (90–95 per cent) loans. This was assessed a being low and a positive attribute of the lender’s submission.

2.40 NHFIC has developed a portal for the administration of the scheme which can be directly accessed by the lenders. When a potential FHLDS applicant applies for a loan with an eligible lender, the eligibility for a FHLDS guarantee is to be assessed by the lender using Scheme Rules. Where the applicant meets the requirements a guarantee place is ‘reserved’ in the NHFIC portal. This reserved guarantee is considered by NHFIC to be ‘issued’ under the Investment Mandate.

Delivery of expectations and approach to maturation of the program

2.41 FHLDS commenced on 1 January 2020. As at 30 June 2020, 9983 of the 10,000 available guarantees had been ‘issued’. A breakdown of the available guarantees was: 6814 were settled or pending settlement; 3169 had been reserved; and 17 guarantees had elapsed or ceased.35 The Investment Mandate expectation for the issue of 10,000 FHLDS guarantees has been met.

Research

Operating model

2.42 The Investment Mandate requires NHFIC to conduct research into housing affordability in Australia. The purpose of NHFIC’s research function is to support the monitoring of housing demand, supply and affordability in Australia by highlighting current and potential future gaps between housing supply and demand, while complementing existing housing related research. The Australian Government agreed to provide $7.1 million in funding over four years for the research activities. Under the Investment Mandate NHFIC must:

(a) conduct comprehensive research into housing demand, supply and affordability in Australia, including current and potential future gaps between housing supply and demand; and

(b) complement existing research, reflecting on the adequacy of construction rates and land supply to meet future needs.36

Operational and financial plans

2.43 In November 2019 the board considered and noted a NHFIC Research Function Work Program which highlighted potential areas of research that NHFIC could undertake. The work program outlined:

- background and context to housing-related policy problems;

- NHFIC’s stakeholder engagement and feedback on the current housing research and data landscape;

- a snapshot of reputable housing research bodies in comparable countries, including the nature and scope of their research, and data and website functions;

- analysis of the resources (including staffing) needed to deliver the work program; and

- potential work focus areas including a flagship publication, core ongoing work, and discrete research projects.

Delivery of expectations and approach to maturation of the program

2.44 In August 2019 the NHFIC Board was provided with information about the planning for the implementation of research activities.

2.45 A chronology of the planning and implementation activities for research is illustrated in Figure 2.7.

Figure 2.7: Chronology of research activities

Source: ANAO analysis of NHFIC board papers.

2.46 As at 30 June 2020 spend on research was approximately $720,000 against a budget of $940,000. One research publication, which does not clearly align to the object of the NHFIC Act, had been released by NHFIC. It was titled Building Jobs: How Residential Construction Drives the Economy. The research program implementation has met the expectations set out in NHFIC’s internal planning and budget projections.

Did NHFIC effectively manage the establishment and operation of the organisation?

NHFIC was largely effective in establishing the operations of the organisation. The NHFIC Board was established and has an approved charter to govern its operations. In accordance with the charter, the board has established committees to advise or assist in the performance of the board’s functions. Each of these committees has a charter that has been approved by the board. The NHFIC Board and the Audit and Risk Committee did not implement governance arrangements in a way that was intended to fulfil their legislative and charter obligations.

2.47 As a corporate Commonwealth entity NHFIC is subject to regulations as set out in the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule).

2.48 To assess whether NHFIC has effectively managed the establishment and operation of the organisation, the ANAO examined whether:

- NHFIC established governance arrangements to support its strategies and operations that reflected best practice; and

- governance arrangements were implemented in line with the PGPA Act, PGPA Rule, NHFIC Act and Investment Mandate.

NHFIC Board

2.49 The NHFIC Act requires the establishment of a board. The board should consist of a chair and at least four, and no more than six, other members.37 The board members collectively should have an appropriate balance of qualifications, skills or experience in social or affordable housing, banking and finance, law, infrastructure planning and financing, local government, and/or public policy. The NHFIC Board comprises a chair and six members with skills and experience consistent with these requirements.

2.50 The NHFIC Board has approved a charter to govern its operations. The charter sets out the board’s role and responsibilities, composition, structure and membership requirements. The charter includes specific roles and responsibilities of the board related to: strategy; risk management and governance; financial management and reporting; and corporate governance and social responsibility. To discharge its responsibilities, the board has held 28 meetings in the last 24 months. Board meeting papers ranged between 150–400 pages. In addition, the board approved 19 out-of-session papers.

2.51 In accordance with the charter, and pursuant to section 47 of the NHFIC Act, the board has established committees to advise or assist in the performance of the board’s functions. The NHFIC Board has established four committees: the Audit and Risk Committee; the Bond Issue Due Diligence Management Committee; the Remuneration Committee; and the Research Board Reference Committee. Each of these committees has a charter that has been approved by the board.

Audit and Risk Committee

2.52 The Audit and Risk Committee was established to provide independent assurance and to review the risk management and engagement practices of NHFIC. In addition, the Audit and Risk Committee was set up to comply with the duty imposed on the board under section 16 of the PGPA Act to establish and maintain a system of risk oversight and management. Pursuant to section 17 of the PGPA Rule, the Audit and Risk Committee’s charter states that its:

primary function is to review the appropriateness of the board’s:

- financial reporting;

- performance reporting;

- system of risk oversight and management; and

- system of internal control for NHFIC.

2.53 The Audit and Risk Committee should also make recommendations to the board on ways in which the risk culture and risk management behaviours across all levels of NHFIC may be improved. The Audit and Risk Committee met 16 times over the last 24 months. The Audit and Risk Committee comprises four board members, it is routinely attended by all board members. The Audit and Risk Committee meeting papers ranged between 10–300 pages.

2.54 The Audit and Risk Committee did not consistently perform all of its functions set out in section 17 of the PGPA Rule and its charter. In particular the Audit and Risk Committee did not:

- review NHFIC’s annual performance statement and recommend acceptance by NHFIC’s Board in 2018–19 and 2019–20;

- review NHFIC’s systems and procedures for assessing and reporting the achievement of the entity’s performance against measures established in the Portfolio Budget Statements and corporate plans in 2018–19, 2019–20 or 2020–21;

- review and consider the performance measures in the corporate plans for 2019–20 and 2020–21;

- review the processes for developing and implementing NHFIC’s fraud control arrangements (Fraud Control Plan/fraud risk assessment); and

- monitor, to a sufficient level, compliance with NHFIC’s obligations under the PGPA Act.38

2.55 The first three of these functions were performed directly by the board rather than on the recommendation of the Audit and Risk Committee as required by the PGPA Rule and as intended by the Audit and Risk Committee charter.

Bond Issue Due Diligence and Management Committee

2.56 The Bond Issue Due Diligence and Management Committee was set up to assist the Board of NHFIC to:

- achieve optimal pricing on bonds issued by NHFIC in the Australian wholesale debt capital market (Bond Issuances);

- conduct due diligence and verification procedures to ensure information contained in the information memorandum and other material provided to investors in connection with offers of any bonds under Bond Issuances (Offering Materials) is correct, accurate and not misleading or deceptive or likely to mislead or deceive (including by omission) as NHFIC and its directors and officers can incur liability under statute and the general law;

- optimise the utilisation of NHFIC’s funding sources for its Affordable Housing Bond Aggregator (AHBA) loans business;

- optimise the investment of NHFIC’s capital and reserves and short-term surplus cash; and

- manage NHFIC’s exposures to interest rate risk and liquidity risk.

2.57 The Bond Issue Due Diligence and Management Committee is chaired by an independent member. The Bond Issue Due Diligence and Management Committee met 14 times over the last 24 months. Meeting papers ranged from 10–50 pages.

Remuneration Committee

2.58 The Remuneration Committee was established to review and make recommendations to the board in relation to the payment of bonuses at NHFIC and the remuneration of the Chief Executive Officer (CEO). The charter requires the Remuneration Committee to meet at least once a year.

Research Board Reference Committee

2.59 The role of the Research Board Reference Committee as set out in its charter is to:

- provide guidance and feedback on NHFIC’s research priorities and agenda;

- provide guidance on aspects of individual research projects, including engagement of contractors or advisers in connection with research projects; and

- assess and make recommendations to the board in relation to NHFIC’s research function consistent with the relevant legislative requirements and NHFIC’s Investment Mandate.

2.60 The committee met five times between 9 June 2020 and 24 July 2020. The charter for the Research Board Reference Committee was approved in August 2020.

2.61 The NHFIC Board and its committees have not reviewed their performance since their establishment. At 30 September 2020 the board has been in operation for more than two years. The Australian Institute of Company Directors has suggested that reviews of boards and committees annually represents better practice and notes that ‘it is now common practice for boards to run an externally facilitated board evaluation every three to four years and to conduct lighter touch internally managed processes in each of the years in between’.39

Has NHFIC established appropriate support functions?

NHFIC’s establishment of support functions was largely appropriate. NHFIC has made arrangements for the delivery of establishment services and operational services through a Services Agreement (SA) with Export Finance Australia (EFA). The performance monitoring that has been undertaken was not documented and focused on inputs. NHFIC acquittal of EFA invoices under the SA is the primary mechanism for monitoring the costs of service delivery. This process should be more rigorous.

2.62 NHFIC has a Services Agreement (SA) for establishment services and operational services with Export Finance Australia (EFA). The agreement covers back office services such as information technology, finance and accommodation, and front office services such as origination and loan/finance management. NHFIC relies on EFA to provide most of its corporate services (these are referred to collectively as ‘support functions’). The value of payments to EFA for support functions is approximately $850,000 per annum. In addition, EFA processes all of NHFIC’s financial transactions such as salaries and invoice payments which are recharged to NHFIC.

2.63 To assess whether NHFIC has established appropriate support functions, the ANAO examined whether:

- the support functions were proportionate to the level of operations for the organisations;

- the board had performed sufficient assessment as to the ongoing use of the SA; and

- NHFIC had satisfied itself that it was getting value for money from the SA.

Support function coverage

2.64 The Department of the Treasury put into place arrangements to facilitate the operation of NHFIC in preparation for the NHFIC Act coming into effect in June 2018. One of the actions taken by the Department of the Treasury was to negotiate and agree a services agreement with EFA (then known as the Export Finance and Insurance Corporation) to provide support functions. This agreement came into effect on 1 June 2018 and was for an initial term of twelve months. The agreement was novated to NHFIC on 26 September 2018.

2.65 The SA covers establishment services and operational services. The services encompass governance support and compliance services, secretariat services, reporting, loan transaction services, loan management services, legal services and marketing services. Corporate services under the SA include the provision of IT systems and services, accommodation, human resource management support and financial support. The SA allows NHFIC to determine the types of services and the quantity of services to be provided by EFA.

Assessment of the ongoing use of the services agreement

2.66 On 5 August 2019 NHFIC and EFA signed an extension to the initial agreement. The extension was for the period 5 August 2019 to 30 June 2020. All other terms and conditions remained unchanged.

2.67 On 17 July 2020 NHFIC and EFA signed a further extension to the SA. The second extension was for the period 1 July 2020 to 30 June 2021. All other terms and conditions remained unchanged.

2.68 The support functions provided under the SA underpin the operations of NHFIC. Extensions to the agreements have not been executed in a timely fashion and this has exposed NHFIC to an unnecessary, albeit small, risk of service disruption.

2.69 In June 2019 KPMG provided a report on its Diagnostic Review which assessed compliance with statutory requirements such as the PGPA Act, NHFIC Act, Investment Mandate and other legal obligations. One area considered was the services agreement with EFA. KPMG concluded that:

When reviewing the option to extend the services … NHFIC should consider institutionalising the appropriate governance arrangements. While the agreement is operating effectively, it is currently reliant on personal relationships. The NHFIC also may wish to consider implementing their own internal framework for monitoring and managing the performance of these arrangements to ensure they are receiving the agreed level of service and assurance.

2.70 As a result of this report, the Audit and Risk Committee agreed on 13 June 2019 to take certain actions. These were:

- a report to be presented to the Audit and Risk Committee annually which benchmarks the fees and charges NHFIC pays to EFA and those which NHFIC could reasonably expect to pay in the open market; and

- to monitor the KPMG action plan which included the following: ‘CFO with the assistance of Legal & Compliance to set up a formal process to monitor and manage performance of all the service agreements, mainly the SA with Export Finance’.

2.71 In response, management indicated that the Chief Finance Officer (CFO) and Legal & Compliance would hold monthly meetings for monitoring and managing the performance of EFA to ensure that NHFIC was receiving the agreed level of service and assurance.

2.72 On 12 August 2019, the CFO reported to the board that the SA with EFA would be finalised and the extension would include performance measures. The SA had already been signed (5 August 2019) and did not include any performance measures.

Value for money

2.73 On 11 February 2020, an internally prepared paper Export Finance Services Agreement was presented to the Audit and Risk Committee. This paper was intended to address the actions identified by the Audit and Risk Committee and to provide a benchmarking of the fees and charges NHFIC pays under the agreement. The paper examined salary levels and on-costs charged under the agreement. It did not consider the level of services provided, the quality of the performance of services, value for money or alternatives for service delivery. At the same meeting, management reiterated its intention to ‘establish a monitoring and performance management report and performance will be assessed on an ongoing basis and formally completed yearly’. Illustrated in Figure 2.8 is a chronology of the implementation of the SA between EFA and NHFIC.

Figure 2.8: Chronology of the implementation of the SA between EFA and NHFIC

Source: ANAO analysis of NHFIC board papers.

2.74 NHFIC has indicated that the acquittal of EFA invoices is the primary mechanism for monitoring costs under the SA. In addition to the services provided directly (refer to paragraph 2.62), EFA processes all of NHFIC’s financial transactions. Each quarter EFA sends an invoice for these services under the agreement. The invoice is supported by a spreadsheet of transactions that represent direct costs under the SA and transactions processed by EFA on behalf of NHFIC. The invoiced services comprise full time staffing costs, part time staffing costs, EFA allocated costs, NHFIC costs, and board costs. For the period October 2019 to June 2020 the three invoices ranged in value between approximately $1 million and $3 million. The number of transactions for direct costs, allocated costs and reimbursements in each supporting spreadsheet was approximately 1500. The details in the spreadsheet are limited, for example the direct salary payments do not show the name of the employee to which they relate.

2.75 The NHFIC Financial Controller reviews the spreadsheet and recommends CEO approval by email. The email and spreadsheet do not indicate what checks, authorisations or analysis has been performed.

Recommendation no.1

2.76 The National Housing Finance and Investment Corporation implement rigorous monitoring and reporting of performance under the Services Agreement between Export Finance Australia and NHFIC.

National Housing Finance and Investment Corporation response: Agreed.

2.77 NHFIC has a Service Agreement (SA) in place with Export Finance Australia (EFA) since its inception in mid-2018 that provides for the delivery of key support services to NHFIC such as finance, information technology, treasury, human resources and accommodation. The SA between NHFIC and EFA is based on a cost recovery charging model. It has been managed by senior staff from both NHFIC and EFA through the ongoing oversight of services provided and the associated costs, which for the more substantive costs has included external benchmarking. This arrangement has enabled NHFIC to effectively establish itself quickly and respond in an agile and cost-effective way to requests from Government in delivering new functions over short timeframes.

2.78 However, NHFIC recognises that there is scope to better formalise these arrangements as noted in the recommendation and will implement more rigorous monitoring and reporting of the SA by:

- Formally scheduling monthly meetings, to complement the existing informal meetings between EFA as service provider and NHFIC as service receiver, to discuss quality of service, efficiency of service and value for money.

- Documenting and minuting all meetings between NHFIC and EFA regarding the SA and report outstanding action items to senior management.

- Implementing KPIs for core, common and strategic functions provided under the SA and report performance against these KPIs to the Board at least semi-annually.

- Engaging the NHFIC Audit and Risk Committee (ARC) to review the SA prior to its expiry and seek formal approval by the ARC to continue the SA arrangements, including periodically reviewing the SA as part of the independent internal audit program.

Did NHFIC develop appropriate risk management arrangements?

NHFIC has a range of policy documents that include a requirement to apply risk management techniques at the transaction level. All of these documents have been approved by the Audit and Risk Committee, and are applied in the operation of relevant programs. However, the structure and implementation of organisational risk management in NHFIC is missing elements and is inconsistently applied across the organisation.

2.79 NHFIC is a corporate Commonwealth entity and is not required to comply with the Commonwealth Risk Management Policy, however Part 6, subsection 31(1) of the Investment Mandate states that NHFIC must have regard to ‘Australian best practice government governance principles … when performing its functions’. NHFIC operates in a risk environment that requires consideration of government objectives, commercial banking objectives and shared risks with the Commonwealth and its lending partners. NHFIC’s Accountable Authority Instructions (AAIs) directs the CEO to have ‘regard to the requirements of the Commonwealth Risk Management Policy and the AS/NZS/ISO 3100:2009 Standard’ (ISO 31000).40 The AAIs also require the CEO ‘to ensure that the risk management framework is integrated with other business processes’.

2.80 To assess whether NHFIC has developed appropriate risk management arrangements, the ANAO examined whether:

- the approach to risk management reflected the requirements of the Investment Mandate and the AAIs;

- the approach to risk management was fit-for-purpose; and

- risk management was appropriately embedded into key business processes.

Approach to risk management

2.81 NHFIC’s risk management framework comprises three documents: the AAIs; the Risk Appetite Statement and the Risk Control Matrix.

2.82 The AAIs provide instructions to all officials on risk management with specific directions to the CEO and to officials. In relation to risk management, the CEO is directed to:

- develop and maintain a written risk management policy that outlines the NHFIC’s risk management framework, which has regard to the requirements of: – the Commonwealth Risk Management Policy; and – the AS/NZS/ISO 3100:2009 Standard;

- ensure that the risk management framework is integrated with other business processes;

- determine and describe in the risk management policy the attributes of the risk culture that the NHFIC seeks to develop;

- implement arrangements to ensure the effective communication and reporting of risk, both within the NHFIC and with relevant external stakeholders;

- assess and maintain sufficient capability and resourcing to both implement the NHFIC’s risk management framework and manage its risks;

- review and update the NHFIC’s risk management framework, the application of its risk management practices, and its risks on a regular basis; and

- establish processes for risk management reviews, which must be effectively documented and endorsed at the appropriate level within the NHFIC.

2.83 Under the direction all officials ‘must refer to and act in accordance with the NHFIC’s risk management framework to ensure that your risk management practices are aligned to the NHFIC’s appetite and tolerance for risk, and consistent with the NHFIC’s methodology to assess and treat risks’.

2.84 The Risk Appetite Statement sets the boundaries for the risks that NHFIC may accept in order to achieve its objectives within risk policies, risk tolerances and operational limits. The Risk Appetite Statement articulates NHFIC’s principles and tolerances for risk management.

2.85 The Risk Control Matrix is:

NHFIC’s internal register of risks facing the organisation. As well as identifying risks to NHFIC, the Risk Control Matrix outlines the controls or risk mitigation in place, assesses the likelihood and consequence of each risk before and after mitigation or controls are applied, and will over time assist in identifying early warning signals.

2.86 The Risk Control Matrix includes a ‘risk heat map’, definitions for likelihood and consequence, specifies the ‘degree of management focus’ to be applied to residual risk levels and includes a risk register containing the top tier risks (a total of sixteen risks across the organisation).

2.87 NHFIC’s risk management framework does not reflect the requirements of the Commonwealth Risk Management Policy and ISO 31000 in the following respects.

2.88 Under Element 2 and Element 7 of the Commonwealth Risk Management Policy entities are required to give specific consideration to shared risks. While NHFIC considers shared risks at the transaction level, for example, it explicitly shares credit risks, NHFIC’s risk framework does not include reference to, or consideration of, shared risks. Given NHFIC’s reliance on third parties to assist with service delivery, NHFIC’s contribution to the management of shared risks should be transparent.

2.89 Paragraph 6.5.2 and 6.5.3 of ISO 31000 require the selection of risk treatment options and the preparation and implementation of risk treatment plans. NHFIC’s risk management framework does not include guidance on the development of risk treatment plans or mechanisms to hold management accountable for the implementation of any risk treatment plans. Of the sixteen top tier risks identified in the Risk Control Matrix, fourteen were rated as ‘moderate’ or ‘high’ which under the Risk Control Matrix guidance require risk reduction strategies to be developed. No risk reduction strategies have been developed and there is no plan or accountability for the reduction of the rating of these risks to tolerable risk levels.

2.90 The top tier risk register identifies risks at a relatively high level, it does not provide an assessment of operational risks. NHFIC has developed an operational risk assessment for the FHLDS program, it has not developed operational risk assessments for AHBA, NHIF, capacity building or research.

2.91 In addition, NHFIC is required to comply with section 10 of the PGPA Rule which, amongst other things, requires the conduct of a fraud risk assessment. As at 30 September 2020, the NHFIC Audit and Risk Committee and Board had not been provided with a fraud risk assessment.