Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of the 30 Per Cent Private Health Insurance Rebate Follow-up Audit

The follow-up audit assessed the extent to which the Australian Taxation Office (ATO), Department of Health and Ageing (Health), and Medicare Australia had implemented the six recommendations from Audit Report No.47 2001–02, Administration of the 30 Per Cent Private Health Insurance Rebate. The audit also looked at: the implementation of some of the major suggestions for improvement in the original audit; and the current validity of some of the positive major findings from that audit. The audit found that the ATO, Health and Medicare Australia have acted upon the recommendations contained in Audit Report No.47 2001–02 and, overall, the administration of the Rebate is currently being undertaken effectively.

Summary

Background

The Australian Government subsidises the cost of private health insurance premiums for Australians. The subsidy is a financial incentive designed to make private health insurance more affordable and support the mix of public and private health care that makes up Australia's health care system.

The Government introduced a 30 Per Cent Private Health Insurance Rebate (the Rebate) on 1 January 19991. The Rebate provides for a reimbursement, or discount, of 30 per cent of the cost of private health insurance cover, and is available to all Australians who are eligible for Medicare and who are members of a registered 2 health benefits organisation (health fund)—regardless of their level of private health insurance cover, income or type of membership.

The 31 March 2006 quarterly figures from the Private Health Insurance Administration Council reported that Australia's 38 health funds provided over 10 million Australians with private health insurance cover (43.1 per cent with hospital cover). In the first few years after 1 January 1999, the proportion of the Australian population with private health insurance (hospital cover) increased by more than ten percentage points, but has remained relatively stable in recent years.

The Government's investment in the Rebate since 1999–2000 has almost doubled, with government agencies involved in administering the Rebate expecting expenditure to exceed $3 billion in 2005–06.

Three Australian Government agencies are involved in the administration of the Rebate. The Department of Health and Ageing (Health) determines private health insurance policy and the Australian Taxation Office (ATO) and Medicare Australia administer the Rebate in accordance with the Income Tax Assessment Act 1997 and the Private Health Insurance Incentives Act 1998, respectively. In 2004–05, Medicare Australia made over 94 per cent of the total Rebate payments (amounting to approximately $2.7 billion).

The Australian National Audit Office (ANAO) audited the administration of the Rebate in 2001–02 in order to assess the effectiveness of Australian Government agencies' administration of the Rebate. Audit Report No.47 2001–02, Administration of the 30 Per Cent Private Health Insurance Rebate, made six recommendations addressing: Federal Budget estimates; financial controls; and performance information for the Rebate. Agencies agreed with all of the recommendations with the exception of Recommendation No.6, which Health agreed to with qualification.

Given the magnitude of the Australian Government's expenditure under the Rebate, and the widespread access to the Rebate in the Australian community, the ANAO conducted a follow-up on agencies' implementation of the 2001–02 audit report recommendations.

Follow-up audit objective

The follow-up audit assessed the extent to which the ATO, Health and Medicare Australia had implemented the six recommendations from the 2002 audit. The audit also looked at:

- the implementation of some of the major suggestions for improvement in the original audit; and

- the current validity of some of the positive major findings from the original audit.

The ANAO wrote to the ATO, Health and Medicare Australia when the follow-up audit started, requesting their initial assessment of the implementation status of the original audit recommendations, and evidence supporting those assessments.

The ANAO's methodology for the audit then involved the audit team interviewing relevant staff in the three agencies and analysing relevant agency files and documents. The ANAO met with the Private Health Insurance Administration Council, the Private Health Insurance Ombudsman, and the Australian Health Insurance Association (industry representative body). The ANAO also conducted telephone interviews with three health funds. The majority of the audit fieldwork was carried out between September and December 2005.

Overall conclusion

The ANAO concluded that the ATO, Health and Medicare Australia have acted upon the recommendations contained in Audit Report No.47 2001–02 and, overall, the administration of the Rebate is currently being undertaken effectively.

The ANAO was informed that, in 2003, Medicare Australia spent $501 000 on a seven month project to address the recommendations of the previous ANAO audit and worked with the ATO and Health on implementing the joint recommendations.

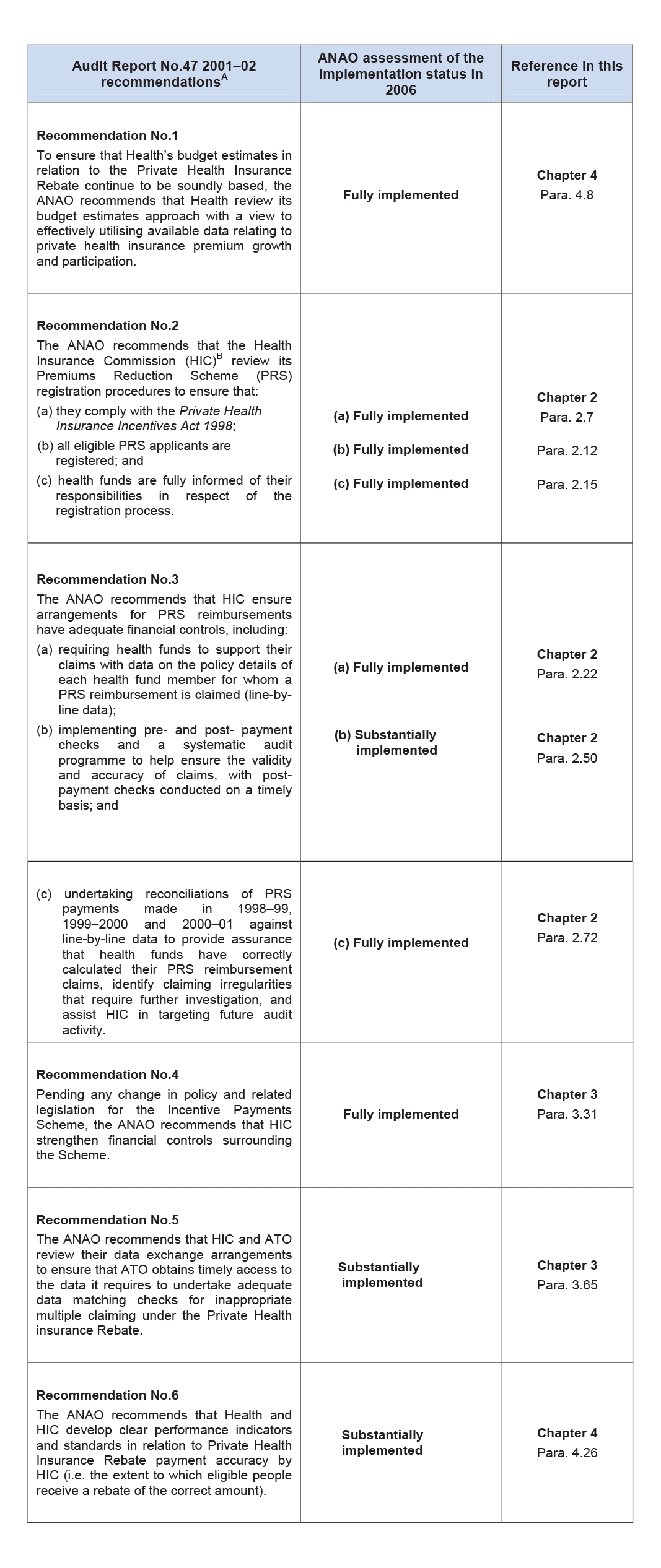

Table 1 summarises the ANAO's assessment of agencies' progress in implementing the six recommendations made in 2002. The ANAO found that three of the recommendations have been fully implemented, and the other three substantially completed. The relevant agencies are continuing to work towards full implementation of the three recommendations that have been substantially completed.

Table 1 Summary of ANAO's 2006 assessment of agencies' progress in implementing recommendations from Audit Report No. 47 2001-02

Key findings

Premiums Reduction Scheme Administration (Chapter 2)

Premiums Reduction Scheme registration procedures (Original Recommendation No.2)

The original audit found that Medicare Australia was not complying with some parts of the Private Health Insurance Incentives Act 1998 (PHIIA) for Premiums Reduction Scheme (PRS) registration notifications and variations3. This meant that Medicare Australia was not able to enforce the Rebate eligibility criteria set out in the PHIIA. The ANAO concluded, however, that given the broad nature of the eligibility criteria, the total payment to ineligible persons was unlikely to have been material in financial statement terms.

The ANAO's follow-up audit in 2005–06 found that Medicare Australia has fully implemented Recommendation No.2 of the original audit as:

- the agency's current PRS registration processes comply with relevant sections of the PHIIA;

- eligible PRS applicants are being registered; and

- health funds are fully informed of their responsibilities in respect of the registration process.

Premiums Reduction Scheme reimbursements to health funds (Original Recommendation No.3)

The ANAO found in the 2001–02 audit that a number of weaknesses existed with Medicare Australia's pre-payment checks and only very limited post-payment reconciliation checks were in place for PRS reimbursements to health funds. This finding gave little assurance that health funds were correctly calculating their PRS claims for reimbursement. The ANAO concluded that the shortcomings with the PRS registration processes and database affected Medicare Australia's financial controls for the PRS pre- and post-payment checks and audit and compliance activity. 4

The ANAO's follow-up audit in 2005–06 found that Medicare Australia now has generally adequate financial controls for PRS reimbursements, as Medicare Australia:

- requires health funds to support their Rebate claims for each health fund member with line-by-line data;

- has implemented a range of pre- and post-payment checks and a systematic audit programme; and

- undertook adequate reconciliations of PRS payments made in the period January to June 1999, and the 1999–2000 and 2000–01 financial years against line-by-line data. In addition, the monthly reconciliations of PRS payments against line-by-line data Medicare Australia introduced for subsequent financial years have strengthened the financial control framework for PRS payments.

However, the ANAO has also identified a number of areas within the PRS reimbursement process where Medicare Australia could further improve its financial controls. In particular, the ANAO recommends that Medicare Australia should further treat the risk of overpayments to health funds, resulting from health fund members' dishonoured premium payments, by reviewing and updating a number of the current control mechanisms (see Recommendation No.1, paragraph 2.38).

Overall, the ANAO considers that Medicare Australia has substantially completed implementing Recommendation No.3 of the original audit.

Incentive Payments Scheme and Tax Offset Administration (Chapter 3)

Incentive Payments Scheme administration (Original Recommendation No.4)

The 2001–02 audit found that Medicare Australia assessed the risks5 and adequacy of the financial controls for the Incentive Payments Scheme (IPS), but did not take action for some time to address these issues because of the relatively low total value of the IPS payments and the possibility that the IPS option would be abolished on cost-benefit grounds. However, in 2000 Medicare Australia did recover funds from individuals for incorrect IPS payments. At the time, the ANAO concluded that the financial controls for the IPS could be further strengthened by Medicare Australia.

The ANAO's follow-up audit in 2005–06 found that Medicare Australia adequately administers the IPS, as it:

- has introduced a pre-payment control linking the IPS claims system to PRS data held in the same system;

- has revised the format and introduced a certification process for health funds' IPS receipts; and

- is providing adequate training to Medicare operators processing IPS payments.

Therefore, the ANAO considers that Medicare Australia has fully implemented Recommendation No.4 of the original audit.

Data matching between Medicare Australia and the ATO (Original Recommendation No.5)

The ATO relies on data provided by Medicare Australia and the health funds to identify incorrect Rebate Tax Offset claims. Medicare Australia is required to provide annual line-by-line data to the ATO by 28 September each year. The ATO requires health funds to provide line-by-line data for each financial year by 30 November.

The original audit found that Medicare Australia did not comply with s. 19–15 of the PHIIA, which required it to provide the ATO with the data necessary for the ATO to conduct adequate data matching checks6. Initially, this was because the legislation did not permit Medicare Australia to obtain relevant data from health funds in order for Medicare Australia to comply with s. 19–15. After December 1999, the legislation was amended to require health funds to provide this data. However, Medicare Australia decided not to implement the systems necessary to provide the ATO with the data prescribed in s. 19–15. An effect was that for the Rebate's first two and a half years, arrangements were not adequate to detect people inappropriately claiming the Rebate through more than one delivery channel.

The original audit suggested that Medicare Australia and the ATO should investigate the scope for streamlining the exchange of data between health funds and Australian Government agencies to reduce the administrative burden on health funds.

The ANAO considers that Medicare Australia and the ATO have substantially completed implementing Recommendation No.5 of the original audit. The two agencies have agreed data exchange protocols that provide the ATO with access to the data necessary to detect inappropriate Rebate claims.

However, the data exchange protocols require health funds to provide data to both Medicare Australia and the ATO, but this might not be providing a net benefit to the Australian Government. Furthermore, the ATO's main compliance tool used to identify potential overpayments associated with the Rebate excluded many potential audit cases in 2002–03 because the data supplied to the ATO by Medicare Australia was different to the data provided to the ATO by the health funds.

The ANAO also considers that it is important that the ATO proceeds with planned refinements of the business rules affecting its compliance processing of the Rebate to improve debt identification in subsequent years. Consequently, the ANAO recommends that Medicare Australia and the ATO resume discussions about streamlining data collection (see Recommendation No.2, paragraph 3.59).

Budget Estimates and Performance Information for the Rebate (Chapter 4)

Budget estimates of the Rebate (Original Recommendation No.1)

The original audit found that Health adopted a reasonable approach to preparing Rebate Federal Budget estimates. Health's assumptions were reasonable and based on an adequate level of analysis. 7

However, the audit noted that with the accumulation of data on the impact of Lifetime Health Cover8, Health was in a position to enhance its estimates model through an analysis of the factors underlying private health insurance premium growth (including health funds' income and costs and Medicare hospital statistics), trends in private health insurance participation among different demographic groups post-Lifetime Health Cover, and the relationship between private health insurance premium growth and participation rates.

The ANAO considers that Health has fully implemented Recommendation No.1 of the original audit given that Health has extensively reviewed its Budget estimates methodology, trialling various models that included the available private health insurance data. However, in the end, the existing model proved more accurate than the revised models and was retained by Health. This model proved to be reasonably accurate for most years since the original audit, but considerably underestimated Rebate costs in 2004–05. Health is continuing to work with Finance to improve the accuracy of the model.

Performance indicators of Rebate payment accuracy (Original Recommendation No.6)

The original audit assessed the adequacy of performance information for the Rebate. It found that Health developed a sound basis for assessing Medicare Australia's, and the ATO's, overall administrative performance for both internal management and external reporting purposes. 9

While overall performance information was considered sound, the original audit found that the claim processing accuracy indicator for Medicare Australia did not appropriately address accuracy. Above all, the Schedule for the Rebate under the Strategic Partnership Agreement did not provide clear standards in relation to the accuracy of processing by Medicare Australia (that is, paying the correct person the correct amount).

The original audit also noted that the performance indicators in the Health-ATO agreement were adequate given the respective roles and responsibilities of the agencies. As reported in the original audit, the ATO indicators were, however, inadvertently omitted from Health's 2001–02 Portfolio Budget Statements (PBS). Health intended to include broad agency performance measures, consistent with measures set out in Health's Service Level Agreement with the ATO, in the next Health Annual Report and PBS.

The ANAO's follow-up audit in 2005–06 found that Health and Medicare Australia have substantially completed Recommendation No.6 of the original audit.

Recommendations

The ANAO identified further opportunities for improvement in agencies' administration of the Rebate and made two recommendations that address improving:

- the ATO's and Medicare Australia's data exchange arrangements; and

- Medicare Australia's risk management and audit programme for the Rebate.

Agency responses

Australian Taxation Office

The Second Commissioner of Taxation provided the following summary response to the audit findings.

The Tax Office agrees with the recommendation.

Recent work with Medicare Australia, regarding data exchange requirements for the Private Health Insurance Rebate, indicates that the need for health funds to provide data to both the Tax Office and Medicare Australia could be removed with effect from the 2006–07 year.

Subject to Medicare Australia including some additional information currently provided by the health funds and the health funds agreeing to this process, the requirement for health funds to provide the information to the Tax Office will be removed.

Department of Health and Ageing

The Secretary of the Department of Health and Ageing provided the following summary response to the audit findings.

The Department of Health and Ageing welcomes the findings of the ANAO follow-up audit, in particular the overall finding that the administration of the rebate is currently being undertaken effectively.

The report confirms that the recommendation from the earlier audit report, Administration of the 30 Per Cent Private Health Insurance Rebate (Audit Report No.47, 2001–02), that the Department review its budget estimates approach for the rebate, has been fully implemented.

The earlier audit report recommended that the Department and the HIC (now Medicare Australia) develop clear performance indicators and standards in relation to the rebate payment accuracy. The Department agrees with the current report's finding that the performance indicator agreed between the Department and Medicare Australia, as part of the Business Practice Agreement (BPA), has the potential to enable both agencies to better track payment accuracy. It is anticipated that the BPA will be in place by 1 July 2006 which will then render the recommendation from the earlier report fully implemented.

Medicare Australia

The Chief Executive Officer of Medicare Australia provided the following summary response to the audit findings.

Medicare Australia welcomes the assurance provided by the ANAO that Medicare Australia has acted upon the recommendations contained in the original report and, overall, the administration of the rebate is currently being undertaken effectively. Medicare Australia agrees with the two ANAO recommendations and has taken action in response to each.

Footnotes

1 Changes to the Private Health Insurance Incentives Act 1998, introduced from 1 April 2005, increase the Rebate from 30 per cent to 35 per cent for people aged 65 to 69 years, and to 40 per cent for people aged 70 years and over.

2 A fund registered under Part IV of the National Health Act 1953.

3 Australian National Audit Office 2002, Administration of the 30 Per Cent Private Health Insurance Rebate, Audit Report No.47 2001–02, ANAO, Canberra, p. 14. This report is referred to as the ‘original audit' in the current audit.

4 Australian National Audit Office, op. cit., p. 41 and pp. 50–51.

5 A December 1998 Medicare Australia risk assessment concluded that there was a high/very high risk of forged health fund receipts; multiple payments; and payments for ineligible policies. There was also a risk that double dipping would occur by claiming through the IPS and the Tax Offset or PRS Rebate options. Australian National Audit Office, op, cit., p. 54.

6 Australian National Audit Office, op. cit., p. 19.

7 Australian National Audit Office, op. cit., pp. 16–17.

8 Lifetime Health Cover is an Australian Government initiative that started on 1 July 2000 and was designed to encourage people to take out hospital insurance earlier in life, and to maintain their cover. People who delay taking out hospital cover will pay a two per cent loading on top of their private health insurance premium for every year they are aged over 30 when they first take out hospital cover. See the Department of Health and Ageing website for more details at http://www.health.gov.au.

9 Australian National Audit Office, op. cit., p. 21.