Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of Petroleum and Tobacco Excise Collections: Follow-up Audit

The objective of this follow-up audit was to examine the ATO's implementation of the 20 recommendations in: The Administration of Petroleum Excise Collections (Audit Report No.17, 2001(02); and The Administration of Tobacco Excise (Audit Report No. 55, 2001(02), having regard to any changed circumstances, or new administrative issues, affecting implementation of those recommendations. The audit also aimed to identify scope for improvement in the ATO's administration of petroleum and tobacco excise. Follow-up audits are recognised as an important element of the accountability processes of Commonwealth administration. The Parliament looks to the Auditor-General to report, from time to time, on the extent to which Commonwealth agencies have implemented recommendations of previous audit reports. Follow-up audits keep the Parliament informed of progressive improvements and current challenges in areas of Commonwealth administration that have previously been subject to scrutiny through performance audits.

Summary

Background

Excise duty is levied on certain excisable goods manufactured or produced in Australia. Commodities subject to excise include petroleum, tobacco, alcohol (excluding wine) and crude oil. Excise duty rates for tobacco are increased biannually in line with movements in the consumer price index; however since 2001 indexation provisions have not applied to refined petroleum products, excluding oils and grease.

The Excise Business Line is the division within the Australian Taxation Office (ATO) that administers commodity-based revenue and business payment systems. The Excise Business Line has three key functions: collecting excise; paying certain grants and rebates; and regulating aspects of the industries from which excise is collected. In June 2005 the Excise Business Line employed 425 staff.

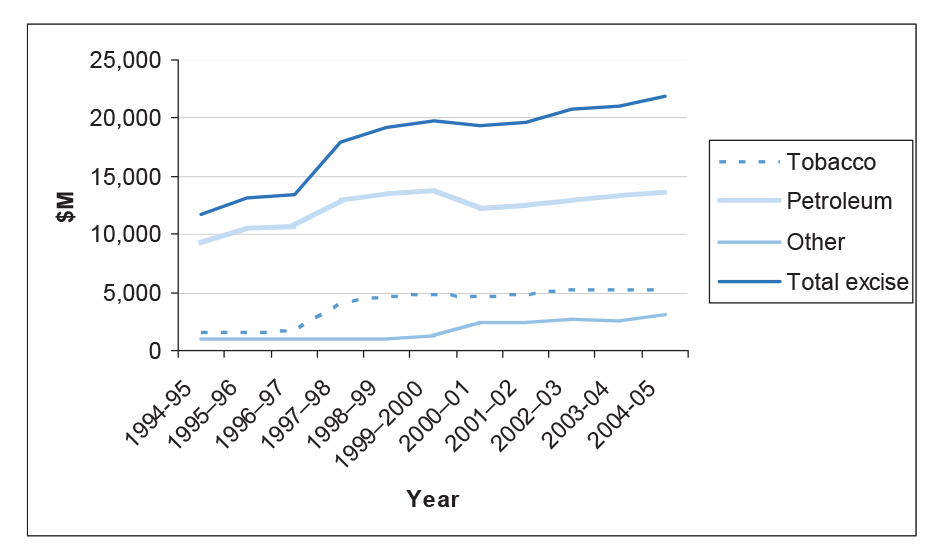

Under the principle of self-assessment, the calculation of excise duty is the responsibility of the manufacturer or dealer in excisable goods. The ATO provides advice and assistance to producers, manufacturers and dealers to calculate and meet their excise obligations. In 2004–05 the ATO collected $21 888 million as excise revenue, accounting for 10 per cent of total revenue collections. Of this, $13 608 million was for petroleum excise, $5 220 million was for tobacco excise, and the remainder was for beer, spirits, and crude oil. Figure 1 shows the amounts of excise collected from 1994–95 to 2004–05.

Figure 1 Excise collections 1994–95 to 2004–05

Note: An excise surcharge on tobacco and petroleum was introduced in 1997 to replace various state business franchise fees. Surcharges were no longer payable following the introduction of GST. Excise collections for 2000–01 include some surcharge payments for clearances made in June 2000.

Source: ANAO analysis of information from Taxation Statistics.

During 2001–02 the Australian National Audit Office (ANAO) completed two separate audits of excise collection: one of petroleum excise and the other of tobacco excise. The audits followed the transfer of the excise function to the ATO from the Australian Customs Service in 1999. Overall, the ANAO concluded that the ATO was implementing effective administrative arrangements for collecting petroleum and tobacco excise. The ANAO also found that there was scope for the ATO to improve its administration of excise in the areas of supporting business systems, risk management and governance.

Audit objective

The objective of this follow-up audit was to examine the ATO's implementation of the 20 recommendations in:

- The Administration of Petroleum Excise Collections (Audit Report No.17, 2001–02); and

- The Administration of Tobacco Excise (Audit Report No. 55, 2001–02),

having regard to any changed circumstances, or new administrative issues, affecting implementation of those recommendations. The audit also aimed to identify scope for improvement in the ATO's administration of petroleum and tobacco excise.

Follow-up audits are recognised as an important element of the accountability processes of Commonwealth administration. The Parliament looks to the Auditor-General to report, from time to time, on the extent to which Commonwealth agencies have implemented recommendations of previous audit reports. Follow-up audits keep the Parliament informed of progressive improvements and current challenges in areas of Commonwealth administration that have previously been subject to scrutiny through performance audits.

Conclusion and key findings

The ANAO concluded that the ATO had made good progress towards implementing the reports' recommendations. Seventeen of the reports' 20 recommendations have been fully implemented, and the remaining three have been substantially implemented. The ANAO noted that the ATO is finalising implementation of the three outstanding recommendations. Table 2 at the end of this brochure presents a summary of the ANAO's assessment of the ATO's implementation of the reports' recommendations.

The ANAO identified several key issues relating to the ATO's administration of petroleum and tobacco excise. These concerned the need to review the memorandum of understanding between the ATO and the Department of the Environment and Heritage; the diversion of significant quantities of tobacco into the illegal market; the apparent involvement of criminal elements in the illegal tobacco market; the effectiveness of tobacco licensing as a compliance tool; the need for improvements in the Excise Collections System; and the development of a strategy directed at the consumers of illegal tobacco. The ANAO made three recommendations to achieve improved excise administration.

Petroleum excise administration

A memorandum of understanding between the ATO and the Department of the Environment and Heritage

Following passage of the Fuel Quality Standards Act 2000 the Department of the Environment and Heritage assumed full responsibility for fuel quality testing. In April 2005 the report of the independent statutory review of the Fuel Quality Standards Act 2000 was tabled in Parliament. This report identified the need for a range of legislative and administrative improvements. The Department of the Environment and Heritage is responsible for advising the Government about the recommendations of the report.

The occurrence of a fuel quality incident may have implications for excise administration; conversely, the ATO's Excise Business Line may have information (of a non-taxation nature) that could help the Department of the Environment and Heritage administer the Fuel Quality Standards Act 2000. The ANAO considers that the ATO and the Department of the Environment and Heritage should review the current memorandum of understanding between the two agencies to improve their sharing of relevant information. Any exchange of information between the agencies would need to take place within the boundaries of the privacy and secrecy legislation governing how the two agencies collect and handle sensitive information.

Tobacco excise administration

Continued diversion of significant quantities of tobacco into the illegal market

The ATO's Compliance Program for 2005–06 identifies illegal tobacco operations as a key priority in the area of evasion and serious fraud. The ANAO concurs with the ATO that the risk of illegal tobacco operations is currently severe. A finding of this audit is that there are reasonable grounds to conclude that each year substantial quantities of tobacco continue to be diverted into the illegal market from Australia's tobacco plantations. Data limitations mean it is not possible to state accurately the precise amount of tobacco that is diverted each year.

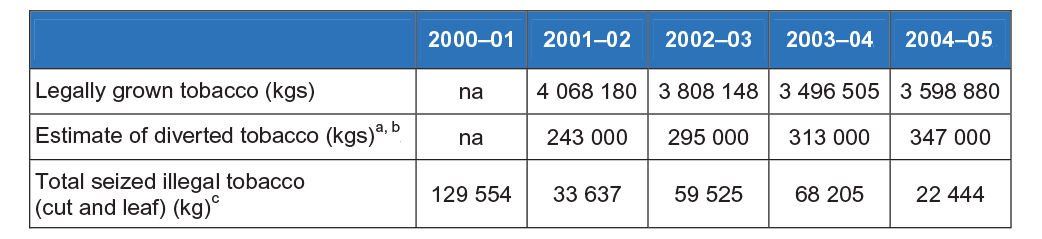

Table 1 details the ATO's estimates of the quantities of tobacco grown, diverted to the illegal market, and seized by the ATO. The ANAO recognises that there is a range of uncertainties inherent in the ATO's estimates of the quantities of tobacco legally grown and illegally diverted. As a result of these uncertainties, the ATO is reluctant to use these estimates to evaluate the impact of its compliance activities on the illegal tobacco market. The ANAO considers that it is important for the ATO to be able to evaluate the effectiveness of its compliance activities. In this light, the ANAO considers that the ATO could develop a suite of indicators, including qualitative ones, that, in conjunction with the quantitative estimates, would give a good guide to the effectiveness of the ATO's compliance strategies for illegal tobacco operations.

Table 1 Estimates of the quantities of tobacco grown, diverted to the illegal market, and seized by the ATO

Note a: There are a range of uncertainties inherent in these estimates. Data limitations mean that is it not possible to accurately state the amount of tobacco diverted each year.

Note b: Estimates of the quantity of diverted tobacco are rounded to the nearest 1 000 kg.

Note c:The ATO advises that the decrease in the amount of tobacco seized from 2003–04 is attributable to the closure of tobacco plantations in north Queensland in 2003–04.

Source: ATO

Criminality in the illegal tobacco market

ATO research suggests that the profit takers, or organisers, in the illegal tobacco market are criminals actively involved in other forms of criminality such as drugs, money laundering, identity fraud, and car rebirthing as well as tobacco smuggling. ATO research shows that this type of highly organised involvement in the illegal tobacco market has intensified over the past three years. This is evidenced by, amongst other things, a degree of ‘vertical integration' by, for example, criminal groups having an associate obtain a licence to grow tobacco.

The consequences of this criminal behaviour are serious. They include an adverse impact on the integrity of the taxation system as well as on the rule of law generally. The linchpin in the illegal tobacco market is the collection of groups that purchase illegal tobacco from farmers, process it into a form suitable for sale and distribute the manufactured product to retailers who sell it illegally.

During the audit, the ATO initiated multi agency approaches, involving state and federal agencies, focussing strategically on the whole of the illegal production and distribution chains. The ATO is also applying a whole-of-ATO approach to the tax affairs of people and entities identified through this operation.

Improving the effectiveness of tobacco licensing as a compliance tool

The ANAO found that since the previous audit, there has been an increased focus on using licensing as a compliance management tool. In 2001, the Excise Business Line decentralised the licensing function to the Industry Groups. As a result, the Fuel and Energy and Tobacco Industry Groups established dedicated licensing functions specific to their industries. The ANAO considers that developing a licensing framework will provide greater consistency across the Industry Groups when dealing with and developing excise licensing policy and strategies, and cross-promote efficiencies between the Industry Groups.

Need for improvement to the Excise Collection System

Audit Report No.55 of 2001–02 noted that the ATO used the Australian Customs Service's Licensing and Permissions System to administer excise collections, however it intended to develop its own Excise Collections System. In 2005 the ATO undertook a post implementation review of the new system. The report of this review found a significant budget overrun against the original business case. The review also found that the system deployment ran significantly over schedule, and did not include all of the original functionality. The ANAO found that this system could be improved in some important areas, however, the ATO intends to replace it by January 2008 as part of the Easier, cheaper and more personalised program.

Scope for the development of a strategy directed at the consumers of illegal tobacco

The Australian Institute of Health and Welfare estimates there are currently 290 000 Australian smokers who occasionally or regularly use illegal tobacco. The Department of Health and Ageing advise that the proportion of smokers in Australia who use illegal tobacco is estimated to be fairly small. Unpublished data from the 2003 National Tobacco Campaign Evaluation Survey estimated that less than 5 per cent of smokers/recent quitters smoke illegal tobacco. Anecdotal evidence indicates that many consumers purchase illegal tobacco because it is cheaper than legal tobacco and/or because they believe it is ‘natural', unadulterated and therefore a less harmful product than legal tobacco. The ANAO understands that a 100 gram pouch of illegal tobacco costs approximately $13, whereas the equivalent amount of legal tobacco costs approximately $36.

Expert advice commissioned by the Department of Health and Ageing showed that illegal tobacco grown in Australia presents serious additional health risks to those of legal tobacco, as it typically contains a number of contaminants. Illegal tobacco is often wet, sometimes to the extent that excess water has to be poured off. Twigs and pulp from raw cotton, hay, cabbage leaves and grass clippings are some of the vegetable matter that may be added to illegal tobacco in order to bulk up the weight for sale. The research reported a dense volume of fungal contamination in the samples examined. The illnesses caused by the fungal agents may range from allergic reactions, chronic bronchitis, asthma, aspergillosis, alveolitis, pneumonitis and lung cancer to Legionnaire's disease.

ATO compliance activity is currently directed at the supply side of the illegal tobacco market as consumers may not breach any law by purchasing illegal tobacco. Currently there are no initiatives directed at the demand side, with the exception of a fact sheet published by the Department of Health and Ageing. The ANAO considers that the ATO should engage with the Department of Health and Ageing so that a strategy directed at consumers of illegal tobacco might be developed. A targeted health education campaign directed at current and potential consumers of illegal tobacco may be warranted. Amongst other things, such a campaign could reduce the demand for illegal tobacco. Department of Health and Ageing advised that the underlying principle upon which the Australian Government's current tobacco control policy is based is ‘there is no such thing as a safe cigarette'. The ANAO notes that the goal of the National Tobacco Strategy 2004–2009 is ‘to significantly improve health and to reduce the social costs caused by, and the inequity exacerbated by, tobacco in all its forms' and that this includes illegal tobacco.

Table 2 Summary of the ANAO's assessment of the ATO's implementation of the recommendations

ATO Response

The Report recognises the ongoing challenges in the administration of excise with particular regard to those operating outside the system. The ATO appreciates that the report positively acknowledges the advances made in relation to improved intelligence systems, the establishment of the Serious Non Compliance Business Line to develop strategies around serious fraud and evasion and a shift to working across agencies in the administration of various acts and in investigating and tracing networks involved in illicit markets.

The report confirms 17 of the 20 recommendations from two earlier audits The Administration of Petroleum Excise Collections (Audit Report No.17, 2001–02) and The Administration of Tobacco Excise (Audit Report No.55, 2001–02) have been completed and that progress of the three remaining is well progressed.

The report recommendations give guidance with respect to improvement in strategies. The ATO has agreed to these recommendations and has proceeded with implementation.