Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of Parliamentarians' Entitlements by the Department of Finance and Deregulation

The focus of this audit was on those entitlements administered by Finance. Similar to the 2001-02 Audit Report, the audit scope did not include entitlements provided to persons employed under the Members of Parliament (Staff) Act 1984 (MOP(S) Act). It also did not examine the administration of entitlements provided through other agencies (such as Parliamentarians' salary and electorate allowance, which are paid by the Chamber Departments, and entitlements provided to Ministers by their home department).

Summary

Introduction

1. Senators and Members of the Australian Parliament are provided with a range of entitlements to facilitate the carrying out of their duties and responsibilities as elected representatives of the Australian people. Entitlements include office accommodation and related facilities, staff support, travel and various other allowances to assist Parliamentarians service and inform their constituents.

2. The Department of Finance and Deregulation (Finance) is the agency responsible for administering the majority of entitlements provided to Parliamentarians, and the focus of this audit was on those entitlements it administers. The major Acts administered by Finance that relate to the provision of entitlements to current and former Senators and Members are the Parliamentary Allowances Act 1952 and the Parliamentary Entitlements Act 1990 (Parliamentary Entitlements Act). In addition, some entitlements are established under determinations of the Remuneration Tribunal made under the Remuneration Tribunal Act 1973. The Chamber Departments are also involved in the provision of some entitlements.

3. The 2009-10 Portfolio Budget Statements for the Finance and Deregulation portfolio disclosed estimated administered expenses for Parliamentarians' entitlements of some $331 million in 2008-09.1 The amounts paid by Finance do not include salary and electorate allowance, which are paid by the Chamber Departments. After deducting the $169 million paid to or on behalf of Parliamentarians' staff, the cost of entitlements provided by Finance to Parliamentarians was estimated by Finance to be some $162 million.

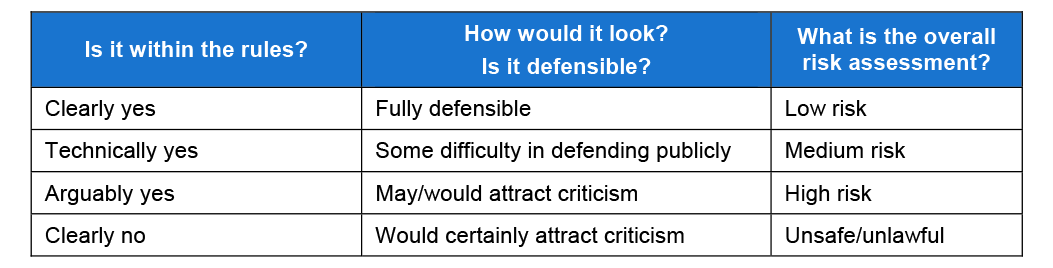

4. As elected officials holding public office, Parliamentarians are expected to act with integrity in accordance with the public trust placed in them.2 Despite the many demands on their time, this requires that Parliamentarians take personal responsibility for ensuring that expenses claimed are properly incurred in discharging their Parliamentary, electorate and/or official duties, and are consistent with applicable legislation, regulations and related guidance that govern the use of entitlements. In this respect, in guiding their decisions as to whether or not to access taxpayer-funded entitlements, Parliamentarians are advised by Finance that it would be advisable for them to adopt a risk-assessment approach, as outlined in Table S 1.

Table S.1 Risk assessment approach for deciding whether to use an entitlement as advised to Parliamentarians by Finance since 2004

Source: Senators and Members Entitlements Handbook, November 2007, p. 8.

Audit objectives and scope

5. The Australian National Audit Office (ANAO) has previously examined some or all aspects of the administration of Parliamentarians' entitlements on four occasions. The two most recent audits involved a comprehensive examination of entitlements provided to Parliamentarians (Audit Report No.5 2001-02, Parliamentarians' Entitlements 1999-2000 3—the

2001-02 Audit Report) and their staff (Audit Report No.15 2003-04, Administration of Staff employed under the Members of Parliament (Staff) Act 19844 —the 2003-04 Audit Report).

6. During consultations on the development of ANAO's 2008 09 Planned Audit Work Program, the Senate Standing Committee on Finance and Public Administration suggested that a follow-up of the 2001-02 audit of Parliamentarians' entitlements warranted the Auditor-General's attention. This audit responds to that request. Its objective was to assess whether:

- the entitlements framework is sound, including whether rules and guidance on entitlements are clear and precise;

- entitlements considered as part of the audit are claimed and administered in a cost-effective manner that is consistent with the entitlements framework underpinning them; and

- accountability arrangements (including internal and public reporting and certifications) are effective and appropriate.

7. The focus of this audit was on those entitlements administered by Finance. Similar to the 2001-02 Audit Report, the audit scope did not include entitlements provided to persons employed under the Members of Parliament (Staff) Act 1984 (MOP(S) Act). It also did not examine the administration of entitlements provided through other agencies (such as Parliamentarians' salary and electorate allowance, which are paid by the Chamber Departments, and entitlements provided to Ministers by their home department).

8. A comprehensive examination was undertaken of the overall entitlements framework. ANAO also examined Finance's administrative controls; analysed Parliamentarians' certification of the use of entitlements included in Management Reports provided to them by Finance; and examined the use of a sample of five entitlements administered by Finance, namely: General Administrative Expenses; Newspapers and Periodicals; Communications Allowance; Car Transportation; and the Printing Entitlement.5 In addition, based on publicly available information, ANAO reviewed the entitlements models used in the United States, Canada, the United Kingdom and New Zealand.

9. The proposed report of the audit was issued in July 2009 to relevant Ministers, Finance and the Department of the Prime Minister and Cabinet (PM&C). Extracts of the proposed report were provided to the three most recent former SMOS', as well as the Attorney-General's Department (AGD) and the Remuneration Tribunal.

10. Also in July 2009, given the nature of the preliminary audit findings in respect to use of the Printing Entitlement, ANAO wrote to Parliamentarians whose use of this entitlement was examined in detail as part of the audit so as to offer them the opportunity to comment on audit analysis of this use, and/or to offer views on the framework for this entitlement, or more generally.6 Any comments provided by Parliamentarians and other stakeholders were taken into account prior to finalisation of this report.

Overall Conclusion

11. The framework for Parliamentarians' entitlements reflects a combination of statute, convention and practice. Over time, the framework has been extended to permit greater flexibility in the use of entitlements. However, this flexibility has not been supported by principles-based legislation that establishes the purposes for which entitlements are provided or subordinate regulations and legislative instruments that provide clear boundaries to guide Parliamentarians in the use of their entitlements and Finance in terms of its administration.

12. To strike a better balance between assisting Parliamentarians and accountability for the public funds spent on providing entitlements to Senators and Members, ANAO's 2001-02 Audit Report on Parliamentarians' entitlements indicated that there would be merit in a comprehensive review of the entitlements framework. No such review was undertaken and, whilst various changes have been made to some individual entitlements, no fundamental changes have been made to the framework in the eight years that have passed since that audit. The result is an entitlements framework that is difficult to understand and manage for both Parliamentarians and Finance.

13. A key shortcoming in the framework is that there is not a consistent approach to specifying the purpose for which entitlements may be used and, where purposes are specified, the meaning of key terms such as Parliamentary business and electorate business has not been articulated. For the sample of entitlements subject to detailed examination by ANAO, this situation was particularly significant for the Printing Entitlement and the related Communications Allowance.7 There is no explicit statement that these (or any other entitlement) are not to be used for election campaigning activities. This is important in this context because public funding is provided through the Australian Electoral Commission (AEC) to assist candidates and parties meet the costs of campaigning. This position allows the capacity for ‘double dipping' in circumstances where Parliamentarians use their entitlements for the primary purpose of attracting votes for themselves and/or their party when the party or candidate8 then receives funding from the AEC to meet the costs of election campaigning activities (the amount paid is calculated by reference to each vote that has been attracted). The Australian approach contrasts with entitlements frameworks in four overseas jurisdictions reviewed by ANAO where it was common to explicitly state that Parliamentary and electorate business does not include Parliamentarians campaigning for themselves, for others or for their party (often referred to as party-political purposes).

14. The shortcomings in the framework establishing Parliamentarians' entitlements have been compounded by a system that involves limited accountability for entitlements use. In particular, Parliamentarians are not required to respond to invitations that they certify their use of entitlements and there is a relatively low level of public reporting of entitlements expenditure.

15. The prime responsibility for ensuring that benefits use is within the terms of the relevant entitlement rests with Parliamentarians, but Finance has a role in exercising an appropriate level of inquiry in order to ensure amounts are properly payable. There have been continuing improvements made to aspects of Finance's administration of Parliamentarians' entitlements, including in the quantity and quality of management reporting to Parliamentarians on their use of entitlements.

16. Shortcomings in the framework have not assisted Finance in its role, and the department has also adopted a relatively gentle approach to entitlements administration. In particular,9 whilst the Printing Entitlement is one of the more financially significant entitlements over which Parliamentarians are able to exercise some discretion within the legislated parameters of the entitlement, the administrative approach that has been adopted has had the effect of ensuring the department is not aware of the substantive nature of the items produced, instead relying on invoice descriptions and certifications from Parliamentarians that the items produced are on the menu of items that may be printed. In this respect, Finance advised ANAO that it had been the intent of successive governments that the department not sight or vet any printed material.

17. The potential for this to result in the printing of material that was outside of entitlement was further increased by Finance's administrative response when presented with invoices that indicated questionable use of the entitlement. In these circumstances, rather than seeking to confirm the substance of the item printed, the department's procedure has been to invite the Senator or Member to provide a re-issued invoice or other advice carrying a descriptor of the printed item that aligns with the menu of approved printable items. Finance has recently changed its approach such that the department now advises Parliamentarians that it is unable to make payment for items that are not consistent with the menu of approved printable items and returns the relevant invoice to the Senator or Member for their personal attention.

18. The Printing Entitlement provided under the Parliamentary Entitlements Regulations is based on a specified menu of approved printable items. Both the form and content of an item must conform to one of the approved categories in order to be considered within entitlement. In this respect, based on the officially endorsed and promulgated framework, ANAO identified a significant number of items at risk of being outside of entitlement both in respect to the form of the items printed and their content. Of a sample of items produced using the Printing Entitlements of 144 Senators and Members in three States, 74 per cent represented items at varying levels of risk of being outside of entitlement.10 For the majority of these, this was primarily due to the content of the material offending the entitlement's principal purpose of facilitating Parliamentarians' capacity to undertake their duties as the elected representative of their constituents (see further at paragraphs 55 to 62). While these results cannot validly be extrapolated to the full population of transactions or to the total cost of the entitlement, the high proportion of transactions examined where there is a question as to whether they are within entitlement underlines the importance of improving the system and its operation. This situation arises from:

- an entitlements framework that is complex11 and overdue for reform;

- some Parliamentarians relying upon a guidance document communicated between the then Government and then Opposition in mid 2003, which was not formally promulgated to all Parliamentarians and Finance was not aware it was being used or relied upon12 ; and

- an administrative approach by Finance that did not enable the department to be adequately informed about the nature of items being produced under the Printing Entitlement.

19. The ANAO has presented its assessment of items produced under the Printing Entitlement on a risk basis as the shortcomings in the entitlements framework meant it was not possible to form a definitive view as to whether individual transactions were outside entitlement. This risk basis is consistent with the approach adopted by the legal adviser to AGD who considered that:

…we are not able to express a clear view as to whether a court would find that a particular document was covered by the benefit. All we are able to do is express the possible outcome in terms of risk.

20. Some Parliamentarians who contacted the ANAO in relation to items produced under the Printing Entitlement did not agree with the audit assessment, generally pointing to the shortcomings in the framework, that their decisions about the use of the Printing Entitlement were made in good faith and/or that their decisions about the use of the Printing Entitlement was considered to be consistent with their understanding of the rules and conventions in place at the time the material was produced.

21. While the audit does recognise that entitlements framework has let down Parliamentarians, it also underlines the importance of individual Senators and Members taking steps to be confident that their use of entitlements is within the officially promulgated framework.

22. During the course of this audit, steps were taken to address shortcomings in the Printing Entitlement and the related Communications Allowance that had been identified by the ANAO. This audit, and the 2001-02 Audit Report, have shown that fundamental reform of the overall entitlements framework is needed, so as to provide appropriate clarity about the purposes for which entitlements are provided; any limits on their use; and allow for a stronger accountability regime over expenditure. In particular, there would be considerable benefit in:

- having a framework that is guided by overarching principles that focus on entitlements supporting Parliamentarians in carrying out their duties and responsibilities as elected representatives of the Australian people;

- each entitlement provided under the framework having a clearly specified purpose so as to better guide Parliamentarians when deciding whether and how to use their entitlements; enable Finance to provide more definitive advice; and facilitate more cost-effective administration of payments made by Finance in respect to entitlements;

- formal arrangements for Parliamentarians to certify that use has been within entitlement; and

- greater reporting on entitlements use in a way that is more publicly accessible.

23. Such an approach would better serve Parliamentarians and instil greater public confidence in the way the entitlements system works, in the longer term. Finance's payment processing procedures for some entitlements would also benefit from the adoption of a more risk-based approach to post-payment checking and a stronger departmental response when there are allegations that expenditure may be outside entitlement.

24. A positive outcome of this audit is that, in July 2009, the Government made some decisions concerning the reform of the Printing Entitlement13, Communications Allowance, Newspapers and Periodicals Entitlement and Office Requisites and Stationery Entitlement. The Government also agreed to a ‘root and branch' review of the entitlements framework (the Terms of Reference for this review include defining key terms in regulations and/or legislative instruments), and that the current protocol for handling allegations of entitlements misuse be referred for consideration as part of this review. The Government further agreed to provide significant additional funding for Finance to improve the administration of entitlements as well as for publishing, online, details of the entitlements framework and expanding the current reporting regime to table and publish on the Finance internet site all entitlements expenditure administered by Finance. The administrative costs associated with implementing these reform measures are to be met from savings resulting from the reduction in the Printing Entitlement.

Key findings by Chapter

Entitlements framework (Chapter 2)

25. Most Parliamentary entitlements are based on legislation, regulations or Determinations of the Remuneration Tribunal. However, the information necessary for interpreting and governing the use of many entitlements is often provided by ‘conventions' or ‘accepted practices'. Decisions relating to conventions and accepted practices may be documented by Ministerial signature to a relevant departmental brief, and/or promulgated to Senators and Members by circular advice and amendments to entitlements handbooks prepared by Finance. These decisions are not made public and they cannot, as a matter of law, determine the extent of entitlements or any limits on their use.

26. There is considerable variation in the extent to which entitlements use is required to be for prescribed purposes.14 Where purposes are prescribed, the meaning of key terms such as ‘Parliamentary', ‘electorate' and ‘party' business has not been articulated such that the purpose to which relevant entitlements may be put remains open to considerable interpretation. In addition, Finance has advised ANAO that the absence of definitions means the department may have no basis on which to undertake post-payment checks of some entitlements.

27. The entitlements framework also does not explicitly address whether entitlements may be used for election campaigning activities and, if so, the extent to which they may be used for this purpose. There is a convention that entitlements may be used by Parliamentarians in support of their own re-election. This convention has, as its basis, recognition of the fact that in carrying out Parliamentary and electorate business it is inevitable that an incidental effect will be to enhance the Parliamentarian's re-election prospects; and that Parliamentarians promoting their own re-election will not be the primary or only purpose of any particular entitlements use.15 However, ANAO found that, in 2007-08, the Printing Entitlement of some Parliamentarians was used principally for the purpose of election campaigning activities involving campaigning:

- for their party, their own re-election or the election of other candidates; and/or

- against the election or re-election of another party or candidate.

28. It is evident that the framework in respect of the Printing Entitlement needs attention. Regulations made under the Parliamentary Entitlements Act establish the Printing Entitlement (as well as a range of other entitlements16). The menu of items that may be produced under the Printing Entitlement has been increased in instruments signed by successive Special Ministers of State (SMOS) which draw their authority from the Regulations. However, there are also a range of conventions that have been applied to the use of the Printing Entitlement, but these have not been codified in the Regulations or the instrument. Finance obtained legal advice on a sub-set of the transactions audited by ANAO, with that advice concluding that, in the majority of cases, there was a real risk that a court would find the material printed by Parliamentarians to be outside entitlement. However, Finance was advised by AGD not to refer the matters for investigation on the basis that the framework establishing the Printing Entitlement was uncertain and that, instead, the priority should lie in clarifying the Regulations, which were considered to be ‘clearly uncertain in scope'. In July 2009, AGD advised PM&C that the issue of the vagueness of the rules warranted immediate attention.

Overseas comparisons

29. The Australian approach to addressing the purposes for which entitlements may be used contrasts with entitlements frameworks in four overseas jurisdictions where definitions have been developed. A common feature of each of these jurisdictions is that they recognise that the entitlements system is not to be used for political parties' publicity (including election campaigning activities). Of particular note was that:

- the United States grants its legislators a high level of flexibility in moving funds between budgets, while at the same time a high level of transparency prevails, which will be further increased when quarterly expenditure reports are made available online. There are also strict controls on the use of public funds for political purposes, and there is no transfer of funds between financial years (which is possible for some of the Australian entitlements); and

- whilst the entitlements provided in the United Kingdom differ in significant respects from those provided to Australian Parliamentarians, there are some common characteristics in the entitlements framework. This is particularly the case in relation to the lack of clarity concerning the legal framework governing the uses to which entitlements may be put and the extent of public accountability and disclosure. A comprehensive review of the United Kingdom framework is currently underway and some recent changes have been made to:

- increase public reporting of entitlements expenditure, with detailed expense data from 2004-05 to 2007-08 being released on 18 June 2009;

- improve the rules concerning the use of entitlements, including addressing the overall principles that are to apply, as well as some guidance on the concept of parliamentary duties (which are stated to exclude ‘anything which is done for personal benefit or for electioneering or for the direct support of a political party');

- supplement the rules with Practice Notes that are approved by a Parliamentary Committee; and

- establish a new system of audit and assurance.

30. In this respect, on 10 July 2009, Finance provided the current SMOS with proposed draft definitions of key terms, including ‘party business', ‘electorate business', ‘official business' and ‘parliamentary business', to aid in the interpretation of all Parliamentary entitlements. Finance advised the SMOS that, to give the definitions maximum weight, they could be included as definitions in the Parliamentary Entitlements Act, and that the Remuneration Tribunal could also be urged to incorporate the definitions verbatim for the purposes of its determinations.

Supplier selection

31. For some entitlements, as a service to Parliamentarians, Finance has entered into centralised contracts for the supply of goods and/or services. For other entitlements, Senators and Members select their own supplier. The Commonwealth Procurement Guidelines do not govern procurement decisions by Parliamentarians and their employees when accessing entitlements. Nevertheless, in such circumstances, adhering to principles such as maximising value for money, non-discrimination in procurement processes and the avoidance of conflicts of interest would clearly be of benefit and not unreasonably expected by the community. Some revision to the current approach is required given that audit analysis shows that the use of the Printing Entitlement and Communications Allowance has, in some instances, been organised by political parties rather than Parliamentarians or their staff. That circumstance is not consistent with ensuring equitable access for suppliers and achieving value for money from the public funds involved.

Finance's administrative control structure (Chapter 3)

32. Finance provides current and former Parliamentarians with entitlements advice, personnel services, assistance with travel arrangements and entitlements processing and reporting. While it is incumbent on Parliamentarians to ensure that any benefit claimed is within the terms of the relevant entitlement17, Finance is obligated to ensure that the amounts paid to, and on behalf of, Parliamentarians are properly payable under the relevant entitlement. To meet its responsibilities, Finance has developed a control structure aimed at promoting accountability in the use of Parliamentarians' entitlements, and adherence to the existing entitlements framework. The key components of this control structure are:

- providing Parliamentarians with guidance on their entitlements (through the issuing of various handbooks and circulars, the availability of Entitlements Managers and a help desk function);

- use of an entitlements management system for processing of payments;

- reporting on entitlements use to Parliamentarians via monthly and End of Financial Year Management Reports, together with some public reporting on the cost of travel entitlements use;

- various certifications requested of Parliamentarians concerning their use of certain entitlements as expenditure is incurred, together with requested certifications of Management Reports;

- pre- and post-payment checking of the use of some entitlements; and

- a protocol for responding to allegations of entitlements misuse.

33. The administration of Parliamentarians' entitlements is resource-intensive. Efforts to introduce greater automation to entitlements processing and reporting have not proven successful, due in part to the high cost of developing Information Technology systems for a complex entitlements framework. Similarly, Finance's ability to provide clear advice to Parliamentarians has been impeded by the difficulties involved in interpreting and applying the framework to individual circumstances.

34. Since the 2001-02 Audit Report, there have been continuing improvements in the quantity and quality of management reports provided by Finance to Parliamentarians on their use of entitlements. However, there have been no significant improvements in transparency arrangements. Greater transparency would be achieved by:

- making the Entitlements Handbooks prepared by Finance publicly available so that there is a better understanding and appreciation of the range of entitlements provided to Parliamentarians; and

- increasing the level and extent of public reporting on entitlements use and the associated costs.

35. In relation to this latter point, in providing advice to the then SMOS, Finance calculated that, of the more than $300 million spent in 2007-0818 on entitlements for Parliamentarians and their staff, less than 10 per cent was included in the reports tabled each six months in the Parliament. In addition, prior to 25 June 200919, the tabled reports were only available in hard copy form, when making them available online would improve their accessibility (and be consistent with the broad Commonwealth policy that public accountability-type documents be made available online).

Certifications

36. The Senators and Members Entitlements Handbook states that, in administering the various entitlements available to Parliamentarians, Finance frequently relies on a certification by the relevant Senator or Member that use is within entitlement as it is often not possible or desirable for departmental officers to make the sort of independent inquiries that would be needed to make an objective assessment about entitlements use. The Handbook further states that, as well as promoting accountability by Senators and Members, certification is an important process by which Finance seeks to comply with its obligations under the Financial Management and Accountability Act 1997.

37. There are a small number of entitlements where certifications are requested to be provided in respect of individual transactions prior to Finance processing the relevant claim. However, the majority of transactions relating to the use of a Parliamentarian's entitlements are not required to be certified by the Senator or Member unless and until they appear in a Monthly Management Report.20 Certification of these reports is viewed by Finance as an integral part of the accountability framework, but Parliamentarians are not required to respond to Finance's request. As a result, a number of Parliamentarians choose not to provide the requested certification.

38. At the time of the 2001-02 Audit Report, Parliamentarians were asked to certify their End of Financial Year Management Reports but not their Monthly Management Reports. The 2001-02 Audit Report found that, two months after certifications were due, only 36 per cent of Parliamentarians had provided the requested certification of their End of Financial Year Management Report for 1999-2000. At the time of the 2003-04 Audit Report, 34 per cent of certifications for 2000-01 and 39 per cent of 2001 02 certifications had not been submitted. At the time of this current audit, there had been some improvement in this area, but a significant proportion of Parliamentarians continue to exercise their discretion not to certify the use of entitlements that has been reported to them. Specifically, by late May 2009, more than seven months after the requested response date, more than 20 per cent21 of Parliamentarians who had been requested to certify their End of Financial Year Management Report for 2007-08 had not done so.

39. Voluntary certification on a monthly basis was introduced from August 2003. This provided a means of reducing the length of time between most transactions occurring and Finance receiving assurance through the provision of a certification. However, whilst Parliamentarians were asked to return the 2007 08 End of Financial Year Management Report certification within 21 days of the report being issued, they were not asked to return Monthly Management Report certifications in any particular timeframe. In the 21 month reporting period between July 2007 and March 2009 examined by ANAO, Finance's records indicated that:

- by late May 2009, Finance had not received a certification in respect to about 14 per cent of Monthly Management Reports provided to Parliamentarians; and

- there were 12 Parliamentarians who did not submit any of the Monthly Management Report and End of Financial Year Management Report certifications requested of them in relation to their use of entitlements.

40. In the absence of a statutory or other obligation to require the timely submission of valid Management Report certifications, Finance has few options for responding when Parliamentarians elect not to certify their use of entitlements. Finance does include in each Monthly Management Report and the End of Financial Year Management Report a table that identifies those certifications that have been received from the relevant Parliamentarian and those that have not been received. However, as outlined above, this process has not been fully effective in promoting the timely receipt of certifications. In August 2009, Finance advised ANAO that the terms of reference for the Government's review of entitlements includes providing advice and recommendations to Government enabling accountability processes to be mandated.

Pre- and post-payment checking and investigation of irregularities

41. Certain travel entitlements are subject to systematic pre-payment checks with payment not proceeding until Finance is satisfied that particular criteria have been met. In addition, in 2005 Finance commenced post-payment checks of the use of a small number of Parliamentarians' entitlements. ANAO's analysis is that Finance's post-payment testing is narrow in scope, is not risk-based and key aspects of entitlements use are not being examined.22 Finance's ‘checking' may also not extend any further than the department writing to the Parliamentarian asking the Senator or Member to certify that use was within entitlement. Finance's post-payment checking has not identified a high level of potential irregularities in entitlements use.

42. Arrangements for responding to indications of entitlements misuse (whether identified from post-payment checks or otherwise) usually involve seeking advice or information from the affected Senator or Member. Where the Parliamentarian responds to such inquiries, there can be long delays and it is uncommon for the explanation to clearly resolve the allegation, or to result in any further investigation or repayments.

43. In July 2009, the Government agreed to provide significant additional funding (offset by savings from a reduced Printing Entitlement) for Finance to improve the administration of entitlements by:

- undertaking pre- and post-payment checking of items produced under the Printing Entitlement;

- publishing details of newspapers and other publications purchased under the Newspapers and Periodicals Entitlement;

- establishing an entitlements advisory function to provide written advice to Senators and Members on entitlements matters;

- establishing a non-exclusive panel of printing providers for use by Senators and Members;

- publishing, online, details of the entitlements framework and expanding the current reporting regime to table and publish on the Finance internet site all expenditure administered by Finance on Senators, Members, former Parliamentarians, family members (including surviving spouses and de facto partners) and employees; and

- establishing an enhanced auditing and checking function within the department.

The use of entitlements for election campaigning activities (Chapter 4)

44. ANAO's 2001-02 Audit Report concluded that a particular need for greater clarity and certainty related to the use of entitlements by Parliamentarians during periods of by-elections and general elections. This situation has not yet been addressed and the risks have been exacerbated by changes to the entitlements framework since 2004 that have:

- resulted in Parliamentarians using their entitlements to attract votes for themselves23 and, accordingly, their political party24, with their party then receiving public funding from the AEC for each vote they have attracted, regardless of whether the Senator or Member was successful in gaining re-election. The result is that there are two sources of public funding for the same types of election campaign expenses and this adversely affects the legislated provisions for financial disclosure of selected revenue and expenditure items incurred by participants in the Federal electoral process (due to some of these costs being met from Parliamentarians' entitlements); and

- allowed the amount available under both the Printing Entitlement and the related Communications Allowance in a financial year in which an election was to be held to be increased, thereby providing further assistance to incumbent Senators and Members in undertaking election campaigning activities.

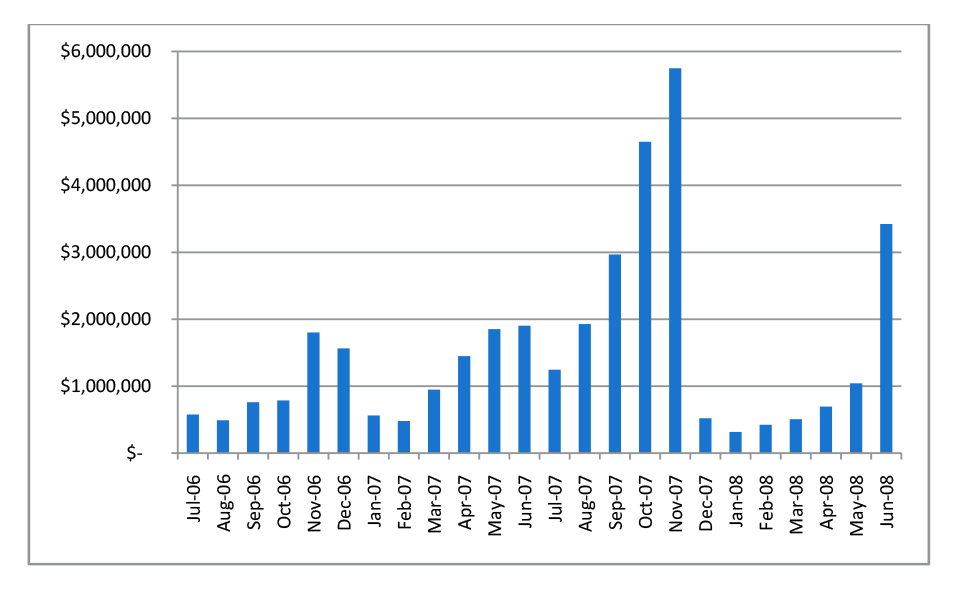

45. The use of the Printing Entitlement for election campaigning activities (for which the Commonwealth Electoral Act 1918 (Electoral Act) already provides public funding) was apparent from both the nature of items printed25 using the entitlement in the period leading up to, and during, the 2007 election campaign (see further at paragraphs 55 to 61), as well as the surge in spending under the Printing Entitlement in the months prior to the November 2007 Federal Election (see Figure S 1).26

Figure S 1 Total Printing Entitlement Expenditure by Month: 2007-08

Source: ANAO analysis of Monthly Management Reports and End of Financial Year Management Reports (Note: date relates to the date of the transaction included in the Management Reports).

46. Some legislative reforms are being considered in this area, including a prohibition on existing members of Parliament claiming electoral expenditure that has been met from their Parliamentary entitlements, allowances and benefits. In addition, in April 2009, the then SMOS agreed that significant reforms should be made to the Printing Entitlement, including some changes to aspects of the entitlements framework that will reduce the capacity for entitlements to be used for election campaigning activities. Finance was to prepare a further brief on options for reform. In June 2009, Finance provided the current SMOS with further advice on options and implementation mechanisms for reform to the Printing Entitlement. In that context, there would be benefits from reforms adopted in this area addressing the various ways in which entitlements have previously been used, and remain available to be used, for election campaigning activities.

47. In July 2009, the Government made decisions (see paragraph 24) that finalised reforms considered by the then SMOS in April 2009 in relation to:

- use of the Printing Entitlement being limited to Parliamentary or electorate business, but not party business or electioneering;

- removing the entitlement to produce How To Vote cards; and

- limiting the number of Postal Vote Applications (PVAs) that may be printed to 50 per cent of the number of enrolled voters in a Senator or Member's electorate27, with further reform of the production of PVAs to be considered as part of the review of the entitlements framework.28

Printing Entitlement (Chapter 5)

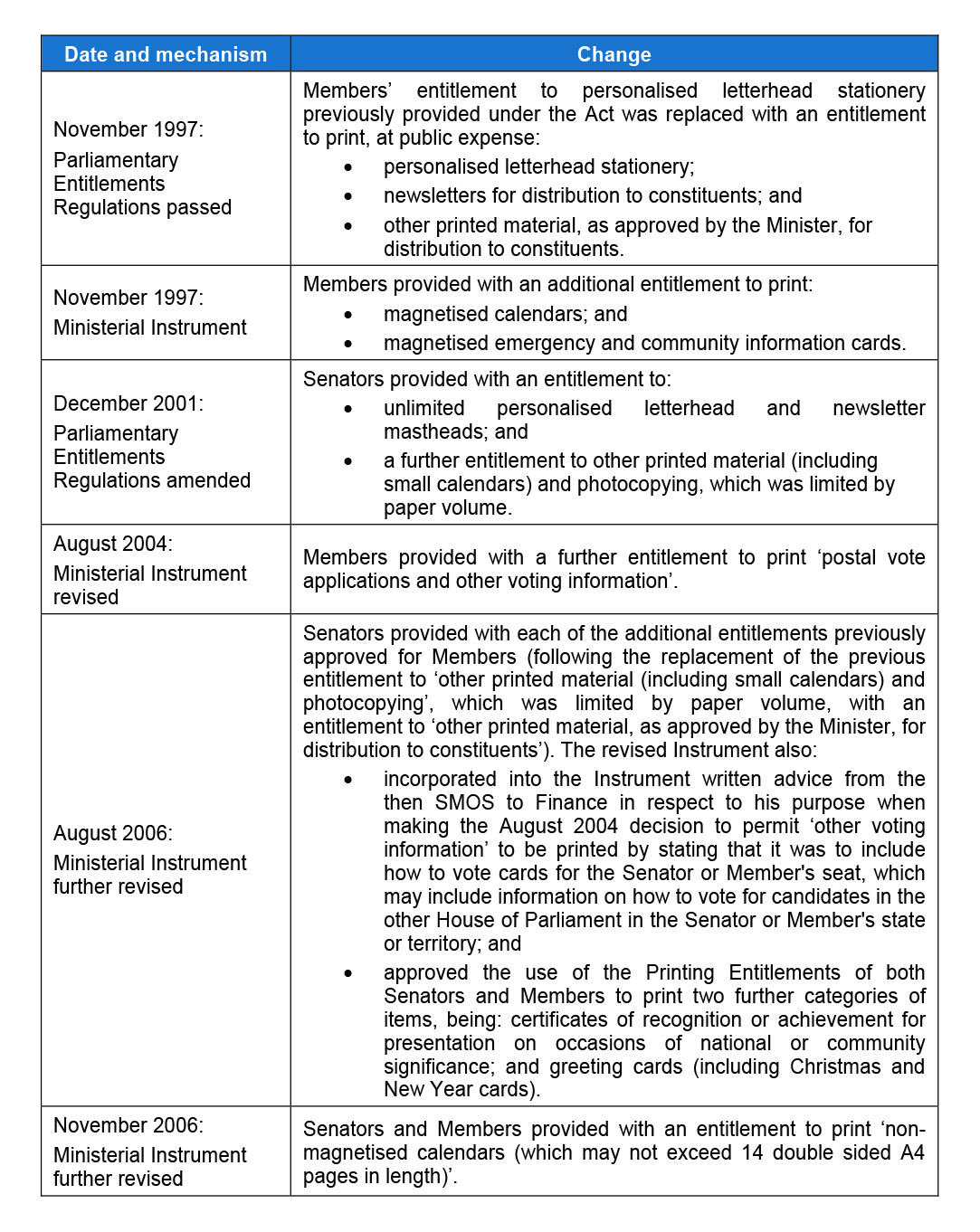

48. Prior to 1990, personalised letterhead stationery for Senators and Members was printed and supplied under an administrative convention by the relevant Chamber department (the Department of the Senate or the Department of the House of Representatives). This primarily involved the use of in-house printing facilities. The commencement of the Parliamentary Entitlements Act formalised Parliamentarians' entitlement to personalised letterhead stationery. This Act, the associated Parliamentary Entitlements Regulations, and various Ministerial Instruments provide the legal foundation for the Printing Entitlement (see Table S 2).

Table S 2 Evolution of items able to be printed under the Printing Entitlement: 1997 to 2006

Source: ANAO analysis.

49. A number of the entitlements provided to Parliamentarians may only be accessed legitimately for a specified purpose, such as the electorate, parliamentary or official business of the relevant Parliamentarian. However, the Parliamentary Entitlements Regulations do not specify the purpose for which the Printing Entitlement provided to Senators and Members is required to be used. A further shortcoming in the framework is that key terms for the purposes of the prescribed entitlement are not defined, including ‘newsletter'. Further, whilst the term ‘constituent' was defined in June 2007 for Members, there is no definition of ‘constituent' in relation to Senators' Printing Entitlement.

50. In the absence of clear parameters governing the use of the Printing Entitlement being articulated in the legislation or regulations, a series of conventions or ‘accepted practices' have evolved in relation to its administration.29 The principal conventions that have been used, in various forms over time, in the administration of the Printing Entitlement are:

- that its proper use should be related to the Parliamentarian's electorate or parliamentary business, but not party business. However, the meaning of the terms ‘electorate business', ‘parliamentary business' and ‘party business' has not been articulated;

- that the electorate business of a Parliamentarian may include the printing of material concerned with his or her own re-election, where this is incidental to the undertaking of electorate or Parliamentary business, but not material concerned with the election or re-election of anyone else;

- a proportional approach to determining the eligibility of newsletter content such that, as long as the majority of content is considered to relate to the Parliamentarian's parliamentary or electorate business, other material may also be included; and

- personalised stationery may include: letterhead paper, envelopes, business cards for the Senator or Member and compliments slips.

51. Each of these ‘conventions'30 has evolved over time and, in many cases, their original premise has become blurred in both intent and implementation. As a result, rather than providing a sound framework within which the Printing Entitlement may be administered, the greater latitude provided over time has contributed to an approach to the use of the entitlement that has deviated from its principal purpose of facilitating Parliamentarians' capacity to undertake their duties as the elected representative of their constituents.

52. The shortcomings in the Printing Entitlement framework have been exacerbated by the approach taken to its administration. In particular, Finance has continued with the approach observed in ANAO's 2001 02 Audit Report of not sighting a copy of the material produced using the entitlement but instead requiring the Parliamentarian to provide it with a tax invoice from the printer and a certification from the Parliamentarian. In this respect, in July 2009 Finance advised ANAO that:

…it was the intent of successive governments that Finance not sight/vet any printed material. When the newsletter entitlement was introduced in 1995 (in preparation for the next federal election) by the then Minister for Administrative Services, a key feature was that Members would deal directly with printers to ensure that officials did not censor content.

53. By way of comparison, in the 2001-02 Audit Report, ANAO reflected favourably on the practice adopted by the Department of the Senate, which was responsible, until 2006, for administering all printing services for Senators. The department required Senators to submit the proposed text of newsletters and other printing requests to it for clearance. Where the text was considered to be outside of the guidelines provided by the Department of the Senate31, the Senator was required to revise the text before the printing would be undertaken.

54. A further feature of the administration of the Printing Entitlement has been that, in circumstances where the item description on an invoice from the printer does not match one of the descriptors of the items that are allowed under the entitlement, Finance's documented procedure was to ask for the Senator or Member to provide a re-issued invoice or other advice carrying a descriptor of the printed item that aligns with the menu of approved printable items, rather than seeking to confirm the substance of the item printed. This procedure was implemented even in situations where the original invoice has indicated that the printed item may not be within entitlement. This aspect of the administration of the entitlement would have benefited from the department also highlighting to the relevant Senator or Member that, if the original invoice had accurately described the item printed, then it was likely to be outside of entitlement and unable to be claimed. After ANAO pointed out that this practice may have encouraged Senators and Members to submit incorrect invoices, Finance has recently changed its approach such that the department now advises Parliamentarians that it is unable to make payment for items that are not consistent with the menu of approved printable items and returns the relevant invoice to the Senator or Member for their personal attention.

55. In concert, an entitlements framework that is complex and overdue for reform, as well as the interpretation by some Parliamentarians of the Printing Entitlement, has led to the printing of a significant number of items at risk of being outside of the Printing Entitlement as formally documented in departmental records and/or officially promulgated to Senators and Members. These instances were identified by ANAO analysis of a large selection of items produced using the Printing Entitlements of 144 Senators and Members in a sample of three States, primarily in the months leading up to, and during, the 2007 election campaign period (which is when the majority of the use of the Printing Entitlement in 2007 08 occurred). Of the sample of items examined, some 26 per cent were either clearly within entitlement, or were likely to be within entitlement. However, 74 per cent of sampled items were at varying levels of risk of being outside of the entitlement.32

56. The eligible category under which an invoice relating to use of the Printing Entitlement is to be paid is generally determined by Finance based on the item description set out on the invoice submitted to the department, together with a completed certification form. In many instances within the sample examined, the item was claimed under a category to which it did not relate and, therefore, for which it was clearly ineligible. In that context, in considering the potential eligibility of invoices under the Printing Entitlement, ANAO had regard for the substance of the items printed under each invoice, together with any further advice provided by the printer in relation to the ordering and production of the item or other services provided and considered whether the item would have been eligible under any of the alternative menu items (so as to provide the maximum opportunity for an item to be assessed as being within one of the allowable items, irrespective of any description relied upon by Finance when processing payments).

57. As the Printing Entitlement is menu-based, with certain prescriptive requirements, ANAO also assessed whether the form of the printed item was in accordance with the entitlement.33 In these respects:

- the majority (56 per cent) of items were in a form that was within entitlement; but

- a high proportion (72 per cent) of sampled items did not include content that was demonstrably within the terms of the entitlement.

58. Thus, the most significant factor in items being assessed as at risk of being outside of the entitlement related to the content of printed material. Examples included items with high levels of material promoting party political interests and/or directly attacking or scorning the views, policies or actions of others, such as the policies and opinions of other parties. Examples where the form of the item printed, or service provided, under an invoice was assessed as at risk of being outside of entitlement included items that were not identifiable as being from the Parliamentarian whose entitlement was used; the use of the Printing Entitlement for the production of direct mail letters and other ineligible distribution-related costs; and the printing of a range of items (including various forms of booklets, posters and charts, bookmarks, shopping or Christmas lists, and songbooks) for distribution to constituents that did not conform to the menu of approved printable items as set out in the Regulations and the Ministerial Instrument made under the Regulations.

59. The ANAO assessment of Printing Entitlement transactions was made against the framework (statute, Ministerial Instruments, guidance and conventions) which had been used to administer this entitlement for many years. The assessment was undertaken on a risk basis having regard to:

- advice provided to Parliamentarians by way of Ministerial Circular;

- advice from Finance to Parliamentarians, including in the Senators and Members Entitlements Handbook and in written advice to incumbent Parliamentarians in 2004 and 2007 concerning the arrangements that apply during the election period; and

- legal advice obtained by Finance during the course of this audit which concluded that, in the majority of cases examined by the legal adviser, there was a real risk that a Court would find the material printed by the relevant Parliamentarians to be outside entitlement.34

60. Due to the shortcomings in the entitlements framework, it was not possible for ANAO to form a definitive view as to whether individual transactions were outside entitlement. Similarly, July 2009 AGD advice was that it is difficult to form a definitive view on the legal position.

61. ANAO recognises that Parliamentarians did not have the benefit of Finance's recent legal advice on the Printing Entitlement. A number of the Parliamentarians that responded to ANAO correspondence concerning their use of the Printing Entitlement indicated to ANAO that their printing of election campaigning material had been organised on their behalf by their political parties' campaign headquarters. In addition, there was evidence of Parliamentarians arranging their printing based on more liberal guidance covering entitlements use communicated between the then Government and then Opposition in mid 2003. Under the terms of that document, which was developed without the benefit of departmental advice and was not formally promulgated to all Parliamentarians35, many of the printed items assessed by ANAO as at risk of being outside entitlement would have been viewed as within entitlement. However, official departmental records attach no authority to this guidance, Finance was not aware it was being used or relied upon, and subsequent guidance issued to Parliamentarians by Finance maintained a more restrictive approach on key aspects. This situation highlights the shortcomings that exist in the current entitlements framework and also raises some issues around the reliance that could be placed on separate communication between the then Government and the then Opposition on entitlements use.

62. A positive outcome of this audit is that the Special Minister of State has informed ANAO that the Government agrees that immediate attention is warranted in clarifying the entitlements framework and providing greater transparency, including in respect of the Printing Entitlement in particular. In this respect, as noted at paragraph 47, decisions have been made to curtail the use of the Printing Entitlement for electioneering purposes. In addition, in July 2009, the Government decided to finalise reforms considered by the then SMOS in April 200936 (see paragraph 46) in relation to:

- reducing the quantum of the Printing Entitlement by 25 per cent from current levels37;

- combining the Printing Entitlement and the related Communications Allowance into a single entitlement;

- changing the Printing Entitlement from a menu-based approach to a purpose-based entitlement (that is, for Parliamentary and electorate business but not for party business or electioneering purposes);

- requiring that material produced under the Printing Entitlement (except for personalised letterhead stationery) carry an acknowledgement in a specified font that: This material has been produced at Australian Government expense by the relevant Senator or Member;

- providing funding to Finance for it to undertaken pre- and post-payment checking of items produced under the Printing Entitlement; and

- the establishment of a non-exclusive panel of printing providers for use by Senators and Members.

Summary of agency response

63. As noted, the proposed report of the audit was issued in July 2009 to relevant Ministers, Finance and PM&C. Extracts of the proposed report were provided to the three most recent former SMOS', as well as the Attorney-General's Department and the Remuneration Tribunal. Formal comments were received from Finance and have been incorporated in the body of the report. Summary comments were also provided, as follows.

Department of Finance and Deregulation

The Department of Finance and Deregulation notes the findings of the audit of the Department's Administration of Parliamentarians' Entitlements. Finance further notes that the ANAO has identified shortcomings in the current overall Parliamentary entitlements framework which the ANAO acknowledges results in it being difficult to understand and manage for both Parliamentarians and Finance. In particular, the ANAO has referred to comments of the Attorney-General's Department on the uncertainties in the legal framework relating to the printing entitlement which is the principal focus of the ANAO report.

With regard to some of the administrative practices this report suggests Finance could have followed in relation to the Printing Entitlement, Finance notes that its administrative practices were based on the preferences of successive Governments that Finance not receive a copy of the printed material either before or after printing had been completed. Finance's guidance to Parliamentarians on, and its administration of, the Printing Entitlement was based on its analysis of the document known as the 31 statements. The document was developed during 2004 by the then Special Minister of State who sought considered advice from Finance on its contents. In preparing its advice to the then Minister, Finance consulted with the Department of the Prime Minister and Cabinet and with the Australian Government Solicitor. The content of the document, as subsequently agreed between the then Special Minister of State and Finance, was incorporated into advice to Senators and Members on entitlements use during an election campaign.

It was only on 22 July 2009 that Finance became aware that another reference point, known as the ‘42 questions and answers' document, was apparently being relied upon by Parliamentarians in guiding their use of entitlements. The document was never endorsed by Finance, nor was it incorporated into advice provided by Finance to Senators and Members on entitlement use during an election campaign. However, if the components of the 42 Questions and Answers document were read separately by Parliamentarians and relied upon, as we now understand has occurred, then the number of printed items that would fall outside of this guidance would represent a very small proportion of the items sampled by the ANAO.

Finance agrees, or agrees in principle, with the five recommendations of the ANAO report.

Footnotes

1 Portfolio Budget Statements 2009-10, Finance and Deregulation portfolio, Budget Related Paper No. 1.8, Budget Initiatives and Explanations, Appropriations Specified by Outcomes and Programs by Agency, 5 May 2009, p. 42. Further detail is shown at Table 1.1 in Chapter 1 of the Audit Report.

2 In this respect, the December 2007 Standards of Ministerial Ethics issued by the Prime Minister outline a Minister's obligations in respect to integrity, fairness, accountability, responsibility and to act in the public interest. In the United Kingdom, the Committee on Standards in Public Life (established in 1994 as an advisory non-departmental public body sponsored by the Cabinet Office) has advocated that seven principles should apply to all in public service, being: selflessness; integrity; objectivity; accountability; openness; honesty; and leadership. In March 2009, the Committee announced that, later in 2009, it would be undertaking a wide-ranging review of allowances provided to Members of Parliament in the United Kingdom. The Committee aims to publish its final report in October 2009 <http://www.public-standards.gov.uk/OurWork/MPs_Allowances_0_1.html> [accessed 29 July 2009].

3 ANAO Audit Report No.5 2001-02, Parliamentarians' Entitlements: 1999 2000, Canberra, 7 August 2001

4 ANAO Audit Report No.15 2003-04, Administration of Staff Employed Under the Members of Parliament (Staff) Act 1984, Canberra, 1 December 2003.

5 The results of this work resulted in ANAO undertaking a more detailed examination of use of the Printing Entitlement.

6 A number of Parliamentarians requested that they be provided with copies of the specific material relating to their use of the Printing Entitlement. This more detailed information was provided to those Parliamentarians that requested it.

7 The Printing Entitlement (provided under the Parliamentary Entitlements Regulations 1997) provides for the production of printed material. The Communications Allowance (provided under Remuneration Tribunal Determination 2006/18) facilitates distribution of this material.

8 Election funding is paid to the party where the candidate or Senate group is endorsed by a registered political party, and in other cases is paid direct to the candidate or Senate group (or their agent).

9 While the more significant issues that arose in the audit related to the administration and use of the Printing Entitlement and related Communications Allowance, anomalies were also identified in relation to some of the other entitlements sampled by ANAO.

10 The transactions involved had an aggregate value of $4.64 million. Appendix 4 to this report illustrates examples of printed items in the sample examined that were assessed as being at risk of being outside of entitlement.

11 For example, it is based on a mix of Acts and Regulations, Remuneration Tribunal Determinations, Ministerial determinations, executive decisions, procedural rules, non-binding conventions and ‘accepted practices'. There are also inconsistencies and ambiguities within and between the Printing Entitlement and the related Communications Allowance.

12 This document was in the form of 42 Questions and Answers. In July 2009, the current SMOS advised ANAO that: ‘The 42 questions contained within this document were formulated by the then Opposition in an attempt to obtain greater clarity around the use of entitlements. The answers to the 42 questions were prepared by the then Government and disseminated to parliamentarians by the then Special Minister of State. I understand these answers were accepted by parliamentarians as providing the definitive guidance on the matters raised therein.' See further at paragraph 61.

13 Including that its use be restricted to Parliamentary or electorate business but not party business or electioneering—see further at paragraph 47.

14 For example, certifications are sought by Finance in relation to 27 entitlements with 12 different purposes referenced, including: official purpose/business (eight entitlements), ‘Parliamentary, electorate or official business' (three entitlements) and ‘Duties as a Member of Parliament but not party political purposes' (one entitlement).

15 See further at paragraph 44.

16 ANAO's analysis of a selection of other entitlements indicated similar shortcomings to those identified in relation to the Printing Entitlement.

17 Senators and Members' Entitlements Handbook, Department of Finance and Administration, November 2001, p. 99.

18 As outlined at paragraph 3, the 2009 10 Portfolio Budget Statements for the Finance and Deregulation portfolio disclosed estimated administered expenses for Parliamentarians' entitlements of some $331 million in 2008 09, of which $169 million was paid to or on behalf of Parliamentarians' staff, with the cost of entitlements provided by Finance to Parliamentarians estimated by Finance to be some $162 million.

19 In August 2009, Finance commented to ANAO that, since 25 June 2009, the tabled reports have been made available online and historic data is being progressively published online.

20 The Management Report is presented in two parts. The Parliamentarian may elect to authorise another person to certify Part B of the Report, which relates to staff use of entitlements. However, Part A of the Report, which relates to expenditure that a Senator or Member or family member incurs personally or expenditure of which he or she could be expected to have knowledge (such as their own and their spouse's travel), may only be certified by the relevant Parliamentarian.

21 57 Parliamentarians.

22 The majority of checked transactions relate to the use of Cabcharge by Parliamentarians or their staff. There has been no post-payment checking of the use of the Printing Entitlement, notwithstanding that this entitlement has been regularly subject to allegations of misuse and Finance's payment processing procedures do not require Parliamentarians to provide the department with a copy of the material that has been produced under the entitlement. Finance advised ANAO that: ‘If we were to require copies of printed material to be provided and were then asked to do some sample based auditing we would be required to determine whether something was outside of entitlement relying on quite subjective criteria, for example the 70/30 convention in which its not clear what the 70/30 relates to. We are in no position to make judgements about such matters and this would place us in a very difficult position. Invoices would need to be paid, regardless of the likelihood of a subsequent challenge as to the legitimacy of the product. Were we then to determine that printed material appeared to be outside of entitlement, we would be obliged to seek recovery from the Senator or Member concerned, in many cases having nothing on which to base our position other than a subjective view against loosely defined criteria.'

23 As noted at paragraph 27, there is a convention that entitlements may be used by Parliamentarians in support of their own re-election. This convention has, as its basis, recognition of the fact that in carrying out Parliamentary and electorate business it is inevitable that an incidental effect will be to enhance the Parliamentarians' re-election prospects, not that Parliamentarians promoting their own re-election will be the primary or only purpose of any particular entitlements use. This situation is complicated by a further convention referred to as the ‘70/30 rule' that requires at least 70 per cent of the material in a newsletter to relate to the Parliamentarian's electorate or parliamentary business, which may involve an incidental promotion of the Parliamentarian's re-election prospects and may cover issues of international, state or local significance, with up to 30 per cent of content able to be other information, such as the Parliamentarian writing about the Parliamentary or electorate contribution of one or more of their colleagues or the activities of their political party. In this latter respect, in considering the application of the 70/30 rule, Finance has advised its Minister that the material that is subject to the 30 per cent of content restriction includes information ‘such as party policies on certain issues'. Parliamentarians have been advised that it is important that any such references fall short of exhorting the reader to vote for the Parliamentarian's colleague or party. As noted at paragraph 25, legal advice to Finance is that conventions cannot, as a matter of law, determine the extent of entitlements or any limits on their use.

24 This is based on a convention that the electorate business of a Parliamentarian may include promoting his or her own re-election (but not the election or re-election of anyone else) where this self-promotion is incidental to the undertaking of electorate or Parliamentary business.

25 For example, the use of Parliamentarians' Printing Entitlements for the production and distribution of Postal Vote Applications (PVAs) and associated material during the 2007 election campaign period was, in large part, a supplementary funding source for the overall campaign strategies of the relevant political parties and of the individual Members and Senators as incumbent party candidates. This was evident from:

- the co-ordinated approach to the use of PVAs by each party, with standardised designs and common printers being generally used within a party; and

- the distribution of PVAs being used by both of the two major parties as a vehicle for the wide-spread distribution of party campaign advertising material, which reflected the key elements of their respective election campaign strategies.

26 More than 70 per cent of total reported annual expenditure for 2007-08 related to transactions in the five months to November 2007, and 44 per cent in October and November 2007 alone. These percentages would have been higher but for an increase in Printing Entitlement expenditure in June 2008 (amendment regulations made on 5 March 2008 removed the provision for Members to rollover unspent funds of up to 45 per cent of their 2007-08 Printing Entitlement into 2008-09).

27 The PVAs printed in the sample examined by ANAO in respect of the 2007 Federal Election each provided the capacity for two voters to apply to make a postal vote.

28 The then SMOS' April 2009 decision had been that Finance provide further advice on options for reform, including the possibility of prohibiting the printing of PVAs.

29 As noted at paragraph 25, conventions and accepted practices cannot, as a matter of law, determine the extent of entitlements or any limits on their use.

30 In addition to these conventions, Finance has advised various SMOS' that the undefined term ‘newsletter' is to be interpreted broadly to include any material that is not a letter, such as surveys, leaflets and other similar material. In this respect, Finance has previously advised some Parliamentarians that letters are not an allowable item under the Printing Entitlement and has declined to pay invoices under that entitlement which described the item produced or service provided as relating to letters. If done for Parliamentary, electorate or official business, Senators and Members are permitted to use the electorate office facilities to print letters on letterhead produced under the Printing Entitlement (and these letters may be distributed using the Communications Allowance, to the extent that they relate to Parliamentary, electorate or official business).

31 The guidelines, issued under authority of the President of the Senate, provided that printing and photocopying services were restricted to the preparation of Parliamentary material associated with Senators' Parliamentary duties, and that material related to political party or election campaign matters could not be accepted. In the course of the 2001-02 Audit, the Department of the Senate advised ANAO that the guidelines were consistent with the Parliamentary Entitlements Act and the requirement to avoid use of appropriations for party political purposes. The guidelines had been considered by the Senate Appropriations and Staffing Committee in April 2000, with no changes resulting.

32 Examples of some of the items assessed as being at risk of being outside of entitlement are illustrated at Appendix 4 of the Audit Report.

33 For example, the Printing Entitlement includes a menu of items that may be printed such as, for example, ‘magnetised emergency and community information cards'. ANAO's assessment of the ‘form' of the items produced addressed whether community information cards were magnetised (legal advice to Finance obtained during the course of the audit was that there is a real risk that non-magnetised emergency and community information cards are not within entitlement). The ‘content' assessment relates to aspects such as whether ‘newsletters for distribution to constituents' (another of the menu of items that may be produced) were devoid of any information about the Parliamentarian as the elected representative of the relevant electorate and instead comprised an appeal for the election or re-election of a party and/or adverse commentary on the policies or candidates of an opposing party.

34 For example, the legal advice stated:

- it would seem generally difficult to treat a document as a ‘newsletter' if it was devoid of any information about a particular parliamentarian or parliamentarians but rather merely contained an appeal for the election or re-election of a party, as the case may be, or merely contained commentary on the policies or candidates of an opposing party; and

- it seems unlikely that it was intended that a parliamentarian's printing entitlement was intended to be used to fund a political party's general campaign material.

35 Subsequent advice from Finance to the then SMOS was that the Financial Management and Accountability Act 1997 (FMA Act) and the Parliamentary Entitlements Act 1990 (PE Act) required that a formal process be followed in order to implement those ‘conventions' which were extensions of the advice currently provided. In addition, the department advised that the principles of ethical administration and the specific arrangements under the FMA Act and the Public Service Act 1999 (PS Act) meant that a change in the conventions relating to any entitlements administered by the department should be conveyed to all Senators and Members affected by the change.

36 In addition, the Government also decided in July 2009 to limit the Printing Entitlement to printing on paper, card up to 700 gsm weight and magnetised material (to allow for the printing of items such as magnetised calendars).

37 Following the 2007 Federal Election, the newly elected Government amended the Parliamentary Entitlements Regulations to: reduce Members' Printing Entitlement from $150 000 to $100 000 per financial year, commencing in 2008-09; remove the capacity for Members to add unspent amounts to their Printing Entitlement for a subsequent financial year; and reduce Senators' Printing Entitlement from $20 000 to $16 667 per financial year.