Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of Goods and Service Tax Compliance in the Large Business Market Segment

The objective of the audit was to assess the administrative effectiveness of the ATO's management of GST compliance in the large business market segment. In conducting the audit the ANAO examined three key areas: governance - ILEC's corporate planning and reporting arrangements relevant to the management of GST compliance in the large business market segment; assessing and identifying compliance risks- how ILEC collects information relating to the large business market segment and how it uses this information to support risk identification and assessment; and managing compliance- compliance planning and the products and processes used by ILEC to manage GST compliance in the large business market segment and evaluating compliance outcomes to support future compliance planning and the targeting of GST compliance risks. In undertaking the audit, the ANAO took account of the findings of previous reviews, in particular the LCCP Review.

Summary

Background and Context

The Goods and Services Tax (GST) came into effect in Australia on 1 July 2000. The GST is an indirect, broad-based, consumption tax of 10 per cent, levied on most goods and services in Australia. The GST is governed by the A New Tax System (Goods and Services Tax) Act 1999.

The Australian Taxation Office (ATO) is responsible for the collection of GST. Administration of the GST is outlined in the GST Administration Performance Agreement between the Australian Taxation Office and the States and Territories (GST Performance Agreement). The outcome to be achieved under the GST Performance Agreement is to collect GST revenue effectively through maintaining compliance and a cost-effective GST administration.1 The ATO's GST Line is the primary provider of services for this outcome. Within the GST Line, the Interpretation and Large Enterprise Compliance Business Unit (ILEC) is responsible for managing GST compliance in the large business market segment. 2

Large business market segment

The ATO defines the large business market segment as consisting of businesses with a turnover of $100 million or more. The GST large business market segment consists of approximately 1 000 large economic groups. These represent a total of approximately 18 000 business entities and 6 000 Business Activity Statement (BAS) lodgers. The large business market segment makes a major contribution to Australia's revenue through the tax system.

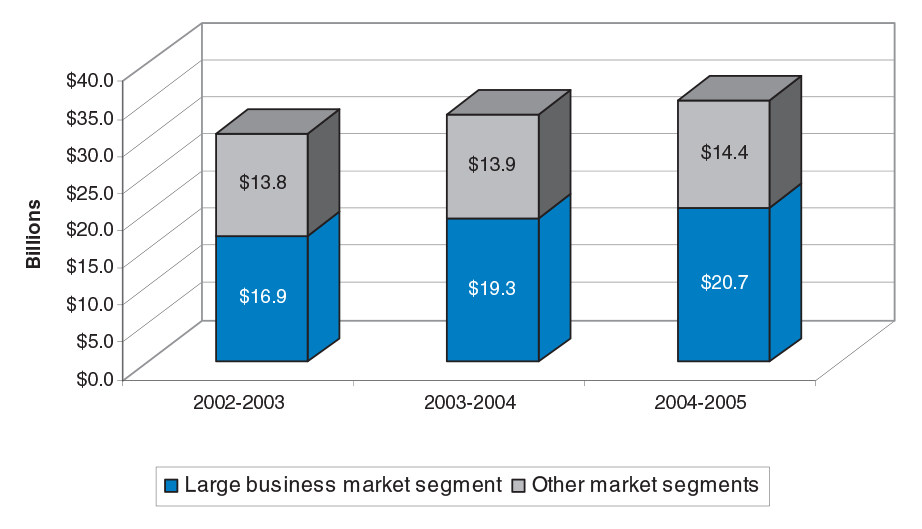

Between 2002–2003 and 2004–2005 large business GST revenue collections were approximately $56.9 billion. This accounted for more than half of the GST collected. Figure 1 depicts total GST revenue collected by the ATO between 2002–2003 and 2004–2005 and the GST large business market segments' contribution. In 2004–2005, the ATO also raised approximately $425 million in additional GST and related penalties from large businesses. The additional GST is attributed to the ATO's active compliance, audit and verification activities. This result represented a 25 percent increase in the value of GST adjustments made in 2003–2004.

Figure 1: GST revenue collections 2002–2003 to 2004–2005

Source: Australian Taxation Office (data based on percent market share of total GST cash collections)

Interpretation and Large Enterprise Compliance Business Unit

To support the administration of GST compliance in the large business market segment, ILEC has been divided into five assurance programs. Each of the assurance programs is responsible for a range of clients grouped by industry, geographic location, or risk profile. In late 2004–2005 ILEC revised its assurance program structure. 3

In addition to managing GST compliance in the large business market segment, ILEC also has a shared responsibility for managing aspects of GST compliance in the small to medium enterprise and micro markets. For example, the Aggressive Tax Planning, and Financial Supplies and Insurance assurance programs reside within ILEC, but have a whole of GST, cross–market scope.

Recent reviews and initiatives

Aspects of the ATO's administration of GST compliance in the large business market segment have been considered in the conduct of several recent reviews. These have included reviews by the Inspector General of Taxation and the ATO's review of its GST Large Corporate Compliance Program (LCCP Review).

Audit objective and scope

The objective of the audit was to assess the administrative effectiveness of the ATO's management of GST compliance in the large business market segment. In conducting the audit the ANAO examined three key areas:

- governance – ILEC's corporate planning and reporting arrangements relevant to the management of GST compliance in the large business market segment;

- assessing and identifying compliance risks – how ILEC collects information relating to the large business market segment and how it uses this information to support risk identification and assessment; and

- managing compliance – compliance planning and the products and processes used by ILEC to manage GST compliance in the large business market segment and evaluating compliance outcomes to support future compliance planning and the targeting of GST compliance risks.

In undertaking the audit, the ANAO took account of the findings of previous reviews, in particular the LCCP Review.

Aspects of Governance

Good governance includes a broad range of activities that assist an organisation achieve its corporate and business goals. As part of this audit the ANAO examined whether ILEC's governance arrangements support the management of GST compliance in the large business market segment. In carrying out this examination, the ANAO reviewed ILEC's planning framework and the monitoring and reporting of its performance.

Planning framework

The ANAO found that ILEC's plans are in the main aligned with the ATO's higher level planning 4 documents. However, including the GST Performance Agreement outcome measures in the ILEC Business Plan for 2005–2006 and future years would assist the ILEC Executive in assessing the Business Unit's overall performance. The ANAO considers that ILEC should more clearly specify its output targets including the number of audits to be completed, the number of industry partnership meetings expected to be held and direct client contact made by client relationship managers.

The ANAO observed that ILEC's 2005–2006 Business Plan clearly documents identified GST compliance risks in the large business market segment, outlines proposed mitigation strategies (the mix and number of compliance activities to be completed) and performance measures. The performance measures include the GST Performance Agreement outcome measures. The ANAO found that ILEC's 2005–2006 Business Plan provides clear direction to the Assurance Programs, which are responsible for completing audits and other compliance activities.

Monitoring and reporting performance

The ANAO found that overall, the monitoring and reporting of ILEC's performance was sound. Reporting on ILEC's performance occurs at various levels. To support more informed management decision making and resource allocation, the ANAO considers that the content of some of the reports could be aligned better with ILEC's planned outputs. The monitoring and reporting of ILEC's performance would be enhanced if ILEC:

- reviewed its existing performance measures and developed a standard set of measures to be applied across the Business Unit. These measures should focus on assessing a combination of activity, revenue and the effectiveness of ILEC's compliance strategies in treating potential GST compliance risks in the large business market segment;

- assessed its performance consistently across the Business Unit, by applying a sub-set of aligned performance measures at the assurance program level; and

- streamlined current reporting arrangements with a view to providing relevant, accurate and timely information to the ILEC Executive.

ILEC advised the ANAO that as part of its business planning process for 2005–2006, it has aligned its risks and risk mitigation strategies with its outputs. ILEC also advised that a new of set of management reports is being developed. These reports will support monthly reporting on each of its outputs to the ILEC Executive. The assurance programs' business plans are also to articulate the same performance measures as the ILEC Business Plan.

Compliance Risk

The ATO's Business Model states that it uses a risk management approach to verify tax compliance. The ATO aims to optimise revenue collections through responding to changing circumstances and managing compliance risks. In doing so the ATO aims to make informed choices about how it uses its resources.

Compliance risk management is a structured process for the systematic identification, assessment, ranking and treatment of tax compliance risks.5 Compliance risk management in the ATO takes place within the context of ATO-wide risk management. The ANAO reviewed the ATO's broader framework for managing compliance risks, including recent developments in this area. In particular, the ANAO reviewed the first four processes in the ATO's compliance risk management model. These processes are: establishing the operating context, identifying compliance risks, assessing and prioritising compliance risks and analysing compliance behaviour.

Compliance risk management within the ATO is an evolving process. The ANAO found that both the ATO as an organisation and ILEC as a Business Unit, are continually improving their risk management activities. In response to the LCCP Review recommendations, the GST Line has implemented a GST Risk Management Framework. ILEC advised that the GST Risk Management Framework replaced the existing risk management structure and processes within ILEC and focuses on risk from a whole of GST perspective. The ANAO did not audit the GST Risk Management Framework, as it was implemented from July 2005.

Establishing the operating context

The ANAO observed that the ATO uses segmentation to understand its operating environment and facilitate management of compliance risks. Segmentation sorts businesses into different groups and sub groups with similar features in order to better understand common behaviours. The ATO's segmentation at a high level includes market segments, tax issues and industries, while lower level segmentation relates to economic groups, business entities and transactions. 6 The OECD recommends the use of segmentation as good practice.

The ANAO found that several business areas within the ATO have profiled large business market segment clients and undertaken environmental scanning for the large business market segment. Environmental scanning supports the identification of changes in the large market segment that may impact on tax compliance.

To support a more coordinated approach and the systematic sharing of information and intelligence, the ANAO considered that the responsibilities and timeframes for undertaking large business profiling and environmental scanning could be more clearly defined. To achieve this, the ATO should determine who is responsible for completing these activities, the frequency with which risk information should be formally reported and to whom this information should be reported. ILEC advised that implementation of the GST Risk Management Framework should provide further clarity on the sharing of risks and intelligence across the whole of GST and with other ATO business and service lines.

Compliance risk identification

The ANAO found that at the time of undertaking fieldwork, ILEC had focused on identifying operational level risks, as opposed to systematically identifying GST compliance risks across the large business market segment. The LCCP Review outlined similar findings.

The ANAO considers that to improve risk identification, ILEC should establish a clear structure for categorising compliance risks and document the requirements for undertaking risk identification activities at each segmentation level. Developing standard tools or techniques for systematically identifying GST compliance risks would also be a sound initiative. The ANAO further considers that ILEC should periodically review the risks that have previously been recorded. This is to ensure that all relevant GST compliance risks in the large business market segment have been recorded and that the information recorded is up to date and complete. The ANAO notes that this issue is expected to be addressed as part of the GST Risk Management Framework.

Assessing and prioritising compliance risks

During audit fieldwork, the ANAO found that ILEC did not have adequate processes in place for prioritising and/or ranking compliance risks within or across the assurance programs. However, ILEC has subsequently initiated processes for assessing, prioritising and ranking GST compliance risks across the large business market segment.

The ANAO noted that a number of the GST compliance risks identified as part of ILEC's business planning process are articulated in the ATO's published Compliance Program for 2005–2006. The Compliance Program states that the ATO's major GST compliance focus in the large market for 2005–2006, relates to the following focus areas: margin scheme property valuations, GST aggressive tax planning, Division 129 transactions, securitisation, GST international issues, the motor vehicle industry, security deposits, GST consolidations and the integrity of business systems. 7

The ANAO considers that in addition to implementing an annual process for risk analysis at the large business market segment level, ILEC should also ensure it has processes in place for analysing and prioritising emerging risks. This analysis and prioritisation should occur both within the assurance programs and at the whole of large business market segment level. The ANAO was advised in June 2005 that the Business Management Group 8 has implemented a process for reviewing and analysing emerging risks. These risks are to be rated using the ATO Risk Matrix, from a GST large business market segment perspective.

Analysis of compliance behaviour

The analysis of compliance behaviour supports the development of appropriate compliance risk treatment strategies. The ANAO noted that ILEC uses the BISEPS 9 model to understand drivers of compliance behaviour. The LCCP Review found that this model is underutilised by ILEC. The ANAO supports the Review sub recommendation that ILEC fully adopt the BISEPS principles when analysing behaviour that creates compliance risks.

Managing Compliance

Australia's GST system relies on self-assessment, where taxpayers are required to assess their liabilities under the law and pay the correct amount of taxation. The system of self-assessment has inherent risks, which the ATO aims to manage through its compliance program of education and enforcement activities. As part of this audit, the ANAO examined ILEC's approach to managing GST compliance in the large business market segment.

ILEC's compliance planning

The ANAO found that ILEC, through its business planning process, aims to identify compliance risks and determine the mix of activities required to treat identified risks. As noted earlier, the ANAO also found ILEC had focused on identifying GST compliance risks at the economic group, entity and transactions levels. This limited ILEC's ability to methodically plan for the treatment of its highest level GST compliance risks through its business planning processes. The ANAO considers that by more closely integrating risk management and compliance planning processes, ILEC could better target its highest level compliance risks. ILEC advised that for 2005–2006 it has implemented a revised planning framework through which it has identified, assessed and ranked its highest level compliance risk.

Compliance products and processes

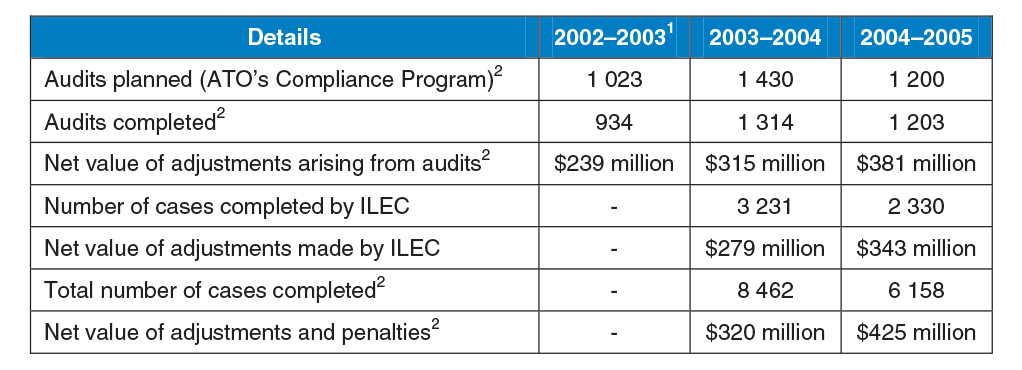

The ANAO considers that overall, ILEC's compliance products and processes for managing GST compliance in the large business market segment are sound. The ANAO found that ILEC had developed and implemented a range of compliance products and processes. These include education and advice products, such as GST fact sheets and GST public rulings, through to active compliance audit products. Application of these products was outlined in the ATO's Compliance Program and ILEC's Business Plan. ILEC's compliance program covered a broad range of activities, but largely focused on active compliance (audit and verification) activities. These are activities that would generally result in an adjustment to the GST payable. Table 1 outlines the outcomes of the ATO's active compliance program in the large business market segment between 2002–2003 and 2004–2005. The total value of GST adjustments from all active compliance activities in the large business market segment is also detailed.

Table 1: Details of completed GST audit and verification activities in the large business market segment 2002-2003 to 2004-2005

Private sector stakeholder consultation

During the audit the ANAO consulted with a range of large business representatives and professional associations about the ATO's management of GST compliance in the large business market segment. Generally stakeholders indicated support for the ATO's approach to GST compliance in the large business market segment. Notwithstanding, the consultation process identified a number of issues including the:

- number of ATO audit staff participating in industry partnership meetings and perceptions that ILEC uses information from these meetings to select clients for review and/or in conducting audits;

- timeliness of private binding rulings and the limited opportunity to liaise directly with the ATO's interpretations' staff in resolving complex technical issue;

- time taken to complete audits; and

- work associated with entering into a Cooperative Compliance Advance Agreement with the ATO. 11

The ANAO noted that the ATO received similar feedback as part of the LCCP Review and is working towards resolving these issues. ILEC advised that the aim of the industry partnerships is to provide senior industry representatives and the ATO with a forum to discuss relevant aspects in the administration of the tax system, consult on any issues of concern or interest and where possible resolve such issues. ILEC further advised that the ATO does not use the industry partnership forums as a means of selecting clients for audit.

Analysing compliance outcomes

The ANAO considers that recording and assessing compliance outcomes is important to inform future compliance planning and the targeting of compliance risks. In reviewing ILEC's management of GST compliance in the large business market segment the ANAO considered that ILEC inconsistently used compliance case results to inform future compliance planning and case selection. High-level information such as return on investment has been used to assess the effectiveness of audit products. However, compliance outcome data was not consistently used to assess the effectiveness of compliance risk treatments.

The ANAO also considers that ILEC's outcome measures should extend beyond revenue assessment as not all compliance activities result in a direct revenue return. The ability to assess the outcomes of non audit activities is important in demonstrating the effectiveness of these approaches in managing GST compliance risks.

Audit Conclusion

The ANAO found that the ATO has developed and implemented governance and risk management processes that support the management of GST compliance in the large business market segment. The ANAO also found that the ATO has implemented a compliance program to treat identified GST compliance risks. Over the three-year period 2002–2003 to 2004–2005, GST cash collections and adjustments resulting from the ATO's compliance activities, have exceeded estimated revenue targets in the large business market segment.

During the audit, the ATO commenced a number of initiatives to improve its systems and processes that support the management of GST compliance. Measures have also been put in place to resolve issues raised by stakeholders. The ANAO considers that collectively these initiatives will enhance the ATO's administrative effectiveness in managing GST compliance in the large business market segment. The ANAO also identified several areas where the ATO's systems and processes for managing GST compliance in the large business market segment could be strengthened. These include the ATO's Interpretation and Large Enterprise Compliance Business Unit:

- enhancing its performance monitoring and reporting by developing and defining a set of standard performance measures, consistently assessing performance across the Business Unit and streamlining reporting arrangements;

- further developing its risk management framework, to support the coordinated and systematic identification, recording and assessment of GST compliance risks in the large business market segment;

- developing stronger linkages between compliance planning and risk management, in order to demonstrate that the highest level GST compliance risks in the large business market segment are being effectively targeted; and

- systematically analysing its compliance results and using this information to inform future compliance planning and case selection.

Recommendations

The ANAO has made four recommendations to improve the administrative effectiveness of the ATO's management of GST compliance in the large business market segment. The recommendations are intended to complement the ATO's initiatives commenced in response to the ATO's review of its GST large corporate compliance program.

ATO's Response

The ATO recognise the important role played by large businesses in the operation of the GST system and the impact that their compliance behaviour can have on industry, revenue and community confidence. This segment contributes around 59 per cent of all GST collected. We acknowledge the generally good compliance record of large businesses, but also note that our GST compliance activities in the large business market segment resulted in liabilities of $425m plus collections of $381m in 2004–2005. Consequently it is of critical importance that we continue to build our capability in administering GST compliance of this segment.

In September 2004 the Tax Office commissioned a review of the GST Large Corporate Compliance Program (LCCP). One of the major initiatives implemented as a result of this review, is a new GST Risk Management Framework. The ANAO performance audit has recognised the LCCP review, and we are pleased that the ANAO report recommendations complement the initiatives that have commenced.

The Tax Office supports the recommendations contained in your report and will proactively work towards delivering on them as we implement the improvements flowing from the LCCP review.

Footnotes

1 GST Administration Performance Agreement between the Australian Taxation Office and the States and Territories, Part 3, clause 10.

2 The Large Business and International Line (LB&I) is responsible for managing income taxation compliance in the large market segment. LB&I has a similar client base to ILEC, however, differences occur in respect of the grouping and structural arrangement of business entities for GST and income taxation purposes. Different consolidation rules apply to businesses for GST and income taxation purposes.

3 ILEC's assurance programs as outlined in its 2005–2006 Business Plan are: Financial Supplies and Insurance; Aggressive Tax Planning; Client Assurance Program North/Technology, Information, Communication, and Events; Client Assurance Program South/Resources and Energy; and Property and Construction.

4 As part of the audit the ANAO reviewed ATO planning documents relating to 2004–2005.

5 Organisation for Economic Co Operation and Development, 2004. Compliance Risk Management: Managing and Improving Tax Compliance, Centre for Tax Policy and Administration Guidance Note, p. 8.

6 Tax issues are specific tax matters that may relate to a cross section of a market segment, for example, GST aggressive tax planning.

7 Paragraph 3.37 of the Audit Report outlines in more detail the GST large market focus areas identified in the ATO's Compliance Program for 2005–2006.

8 The Business Management Group is an operational decision making body whose prime objective is to support the ILEC Executive by focusing on the management of operational issues that affect ILEC.

9 The BISEPS model is defined as: (B) business, (I) industry, (S) sociology, (E) economy, (P) psychology and (S) systems. These are considered to be broad areas, which reflect the fact that taxpayer compliance decisions are affected by a wide set of related factors.

10 For example, GST General Compliance is responsible for undertaking the review of deferred GST for all clients including those in the large market.

11 Cooperative Compliance Advance Agreements are directed at delivering greater certainty, reduced costs and improved administration for both the ATO and the large businesses in their GST dealings. The agreements involve the ATO assessing the integrity of a client's systems for managing GST. If satisfied with the systems' controls the ATO commits to reduced audit activity.