Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of the Export Market Development Grants Scheme

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Trade Commission’s administration of the Export Market Development Grants scheme, in providing incentives to small and medium Australian enterprises for the development of export markets.

Summary

Introduction

1. The Export Market Development Grants (EMDG) scheme was established in 1974, and is the Australian Government’s principal financial assistance program for aspiring and developing exporters. Administered by the Australian Trade Commission (Austrade), the EMDG scheme aims to provide incentives to small and medium Australian enterprises for the development of export markets through reimbursement of up to 50 per cent of expenses incurred on eligible export promotion over $15 000.1 The EMDG scheme is not a grant program for the purposes of the Commonwealth Grant Guidelines, and consequently does not encompass the competitive, merit-based selection process of more traditional grant programs. Rather, the EMDG scheme is a benefit or an entitlement established by legislation2, that assesses an applicant’s eligibility against the Export Market Development Grants Act 1997 (EMDG Act).3 The scheme does, however, use the term ‘grant’ to describe the payments made to eligible applicants.

2. To fulfil the eligibility requirements under the EMDG Act, an EMDG application must involve: an eligible applicant who has incurred an eligible expense; where the expense was in relation to an eligible product. An eligible applicant is any Australian individual, partnership, company, association, cooperative, statutory corporation or trust and approved entities under the Act including joint ventures and approved bodies, who, among other things, has an income of not more than $50 million in the grant year and has not previously received a grant in respect of eight or more previous grant years.4 Eligible expenses are those that relate to specific promotional activities genuinely incurred by the applicant for marketing eligible products in foreign countries. Expenses must be in respect of eligible products, the rationale being that the products are substantially of Australian origin. The types of eligible products are listed in the EMDG Act as: goods; services (tourism and non-tourism); events; intellectual property; and know-how.

Processing of EMDG applications

3. Potential applicants may access the EMDG scheme through: direct application to the scheme; or an EMDG consultant, who lodges an application on their behalf. Since July 2013, with the introduction of a web-based lodgement system, all applications have been lodged electronically. Applications (or claims for reimbursement) are processed through the EMDG Claims Management System (CMS), the scheme’s central electronic processing system.

4. The degree of scrutiny and administrative effort applied by EMDG grant assessors is determined by the assessed level of risk of each application and the key risk that Austrade is seeking to mitigate is that of making payments to ineligible applicants. As a general rule, the CMS assigns applications so that the higher the perceived risk, the greater the level of scrutiny and effort employed by the assessors.5 Assessment activities range from file checks and desk audits, through to site visits. Recommendations made by the EMDG grant assessors, and the CEO of Austrade or delegate determines the EMDG applicant’s entitlement to the grant.6 Applicants who are dissatisfied with the determination of a grant application, including the paid amount, may formally request Austrade to undertake an internal review of the decision.

5. EMDG grant payments are made under a split-payment system whereby grants are paid in two rounds: an initial payment of grant entitlements up to a specified payment ceiling amount; and a second tranche payment of grant entitlements above the initial payment ceiling amount. The initial payment ceiling amount is determined by the Minister for Trade and Investment in June each year.7 The extent to which the total eligible reimbursement will be paid to eligible applicants in the second tranche depends on available funds remaining in the EMDG budget, assessed at the end of each financial year. This split-payment system was designed to ensure that the appropriated funding for the scheme was not exceeded and that applicants were treated in an equitable manner.

Number and profile of EMDG applications

6. Applications for reimbursement under the EMDG scheme are processed by Austrade in subsequent financial years, for example, expenses incurred in 2012–13 will be processed in the 2013–14 financial year. The number of EMDG applications peaked for grant year8 (GY) 2008–09 at 5149 applications, then fell by approximately 41 per cent to 3045 applications for GY2011–12 expenses.9 Between 2007–08 and 2011–12 the profile of EMDG recipients by industry was: services (including ICT, tourism and education and culture) around 60 per cent ; manufacturing (including food and beverage manufacturing) around 30 per cent; and primary industry (less than five per cent). The average grant paid for GY2012–13 (which was paid in 2013–14) was $45 708.

EMDG funding arrangements

7. Expenditure under the scheme is set through annual Appropriation Acts. Since July 1997, a capping mechanism has been in place to ensure that total expenditure under the scheme is limited to appropriated funding. The cost of Austrade’s administration of the scheme must not exceed, in any financial year, five per cent of the appropriated amount.10

8. The EMDG’s appropriation was reduced during 2012–13 from $150.4 million to $125.4 million. In 2013–14, the scheme’s appropriation was increased by $12.5 million, as a result of the new Government providing additional funding of $50 million over four years from 2013–14.11

External reviews of the EMDG scheme

9. Throughout its 40 year life, the EMDG scheme has been the subject of a number of external reviews, including two ANAO performance audits in the 1990s: the ANAO Report The Export Market Development Grants Scheme—Its Efficiency and Effectiveness published in 1994, which focused on Austrade’s administration of the scheme; and a follow-up audit in 1996.

10. The EMDG Act requires that an external review of the scheme is undertaken periodically in order to make recommendations about the EMDG’s continuation.12 The most recent external review was conducted in 2008 by David Mortimer AO (the Mortimer Review).13 The review examined the EMDG scheme and its impact in stimulating export growth and found that the scheme was helpful in introducing smaller Australian businesses and new exporters to the global market, and should be continued. The next legislatively mandated review is to commence no later than 1 January 2015, with the review to be completed by 30 June 2015.14

Audit objective and criteria

11. The objective of the audit was to assess the effectiveness of the Australian Trade Commission’s administration of the Export Market Development Grants scheme, in providing incentives to small and medium Australian enterprises for the development of export markets.

12. To form a conclusion against the audit objective, the ANAO adopted the following high level criteria:

- effective governance arrangements, including appropriate risk management, performance measurements and reporting processes were in place;

- an accessible grant application process to maximise the attraction and selection of high quality applications was established; and

- sound processes for risk assessing, approving and distributing payments, consistent with the EMDG scheme objectives were implemented.

Overall conclusion

13. The Export Market Development Grants (EMDG) scheme provides financial assistance to small and medium Australian enterprises by offering incentives to develop export markets. The Australian Trade Commission (Austrade) is responsible for administering the scheme, which aims to support Australian businesses by encouraging additional promotional activities. In 2013–14, the EMDG scheme’s appropriation was initially set at $125.4 million, but increased by $12.5 million, with the new Government providing additional funding of $50 million over four years from 2013–14 to 2016–17. External reviews of the scheme have found that the EMDG successfully stimulates exports, with the latest review in 2008 estimating that each dollar provided to recipients generates between $13.50 to $27.00 worth of exports.15

14. The EMDG scheme has been in operation since 1974 and, reflecting this maturity, Austrade has well established practices that support the effective administration of the scheme. Overall, the mechanisms employed by Austrade to provide EMDG information and guidance to applicants and consultants are appropriate, including through the entity’s website, information sessions, meetings with the export industry, brochures and the EMDG update e-newsletters. The processing and assessment of applications is underpinned by generally sound program management arrangements, with recently revised key performance indicators providing better insights into overall scheme performance. The distribution of EMDG payments and the controls supporting the payment process are also sound. In addition, clients have reported a generally high level of satisfaction with Austrade’s administration of the EMDG. Nevertheless, there is scope to further strengthen aspects of Austrade’s administration of the scheme, including:

- risk management and fraud risk assessment processes—some implementation risks, particularly in respect of intra-year changes to risk thresholds, were not specifically addressed in the scheme’s risk management plan, and evidence of management considerations and decisions was not retained; and

- application assessment and quality assurance—the rationale for the manual changes to the assessment activities recommended by the CMS, was not consistently recorded. Implementing an EMDG quality assurance program to complement existing assurance mechanisms would also provide additional assurance regarding the integrity of the assessment process.

15. To assist Austrade to further strengthen its administration of the EMDG scheme, the ANAO has made three recommendations designed to: improve risk management processes including fraud risk assessments; clarify arrangements for managing changes to risk thresholds in the Claims Management System; and enhance the transparency of the application assessment process particularly in relation to manual adjustments to assessment activities, supported by the implementation of a quality assurance program to provide additional assurance in relation to the assessment of applications.

Key findings by chapter

Program Management (Chapter 2)

16. Austrade has mature arrangements in place to guide its administration of the EMDG scheme, including planning and risk management frameworks. An EMDG specific business plan was in place for 2013–14 that included the scheme’s: forward work program; strategic direction; and an outline of the challenges of operating within a capped administration budget. There was also appropriate alignment between the objectives of the 2013–14 EMDG business plan and Austrade’s broader corporate plan for the same year. While Austrade’s risk management framework provided entity management with a level of assurance that, in general, key risks with respect to the EMDG scheme were being appropriately identified and treated, there was scope to broaden the coverage of risk assessments. In particular, the inclusion of additional implementation risks, such as intra-year changes to the risk thresholds16 and an ageing and experienced workforce who were predominantly approaching retirement age, would provide management with greater visibility of these risks and assurance in regard to their treatment.

17. Austrade had also prepared EMDG specific fraud risk assessments in 2012 and 201417, which outlined a broad range of fraud risks, their triggers, the current controls and strategies in place, as well as the actions needed to mitigate the risks. However, the extent to which grant assessors were consulted in the development of the assessments, and whether management had formally accepted the fraud risk assessments, including risks identified as having inadequate controls, were not documented.18 The involvement of assessors would provide useful insights into the identification of fraud risks, given their familiarity with the day-to-day delivery of the scheme, while formal endorsement of the assessments would demonstrate management consideration of key fraud risk exposure and treatments.

18. There is a broad range of guidance material and procedural documents available to Austrade staff to inform their administration of the EMDG scheme, including the EMDG Procedures Manual and Administrative Guidelines. These materials generally provide an appropriate level of guidance and support to staff. Austrade has also developed a policy to manage potential and actual Conflicts of Interests (COI), with EMDG staff required to complete COI forms outlining relevant COIs. While Austrade is managing declared conflicts of interest in accordance with the established policy, there would be benefit in providing staff with additional guidance in relation to interactions with EMDG consultants. The involvement of consultants who are former Austrade employees and managers could pose a risk to the perceived fairness and impartiality of decisions taken by EMDG staff who had previous personal and professional relationships with these consultants and, thus these relationships require careful consideration and management.

Registration of Applications and Initial Assessment of Risk (Chapter 3)

19. Austrade has employed a broad range of approaches to build awareness of the EMDG scheme to potential applicants, including conducting information sessions and meetings with the export industry. Notwithstanding the implementation of these initiatives, there has been a steady decline in scheme awareness since 2010. Austrade’s client awareness survey, conducted in 2013, showed that awareness of the scheme had declined from 87 per cent in 2010 to 77 per cent in 2013. Given these results, there would be benefit in Austrade reviewing its current communication strategies and channels for raising scheme awareness.

20. The processes established by Austrade to acknowledge the receipt of applications and register their lodgement were generally sound. The ANAO’s analysis of applications for GYs2011–12 and 2012–13 showed that all applications were recorded as they were received, and that relevant documentation required for each EMDG application was retained on hard copy files or stored in the Claims Management System (CMS) electronic document library. Austrade officers demonstrated a sound understanding of these processes. In addition, the documentation prepared by Austrade for the application process was fit-for-purpose, with the information sought from applicants through the application form enabling EMDG officers to complete eligibility assessments.

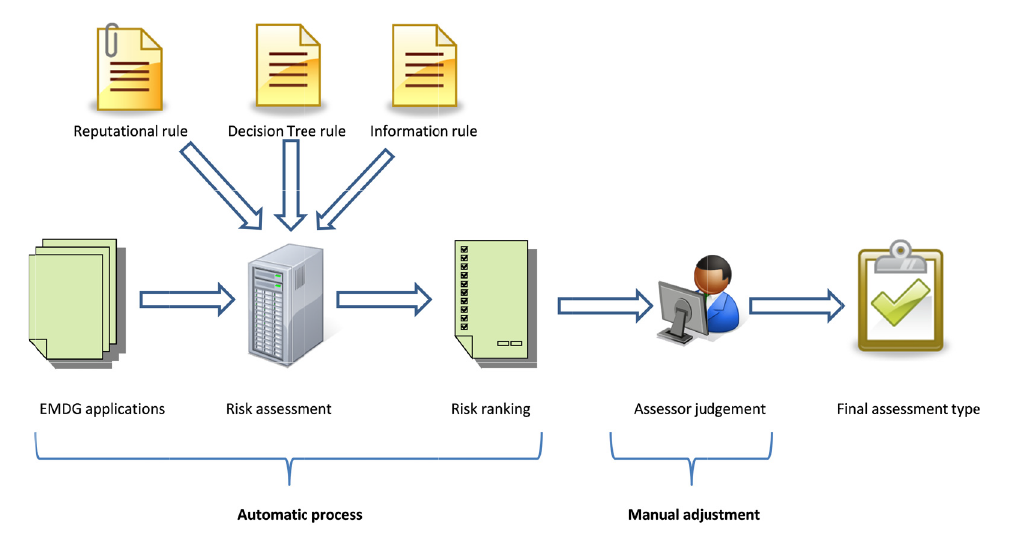

21. Once the lodgement of an application has been registered, it is entered into Austrade’s CMS. An initial risk assessment is automatically generated through the system, with a risk ranking assigned, assessment type determined and assessor allocation completed. The risk ranking and assessment type are based on thresholds (a series of percentile points in a risk continuum), and are designed to mitigate the risk of Austrade making a payment to an ineligible applicant. The thresholds are used by Austrade to derive the recommended assessment activity (for example, a file check, desk review or a site visit). The ANAO’s analysis found that the CMS was correctly assigning risk rankings and that applications were correctly allocated to the appropriate EMDG officers for the years reviewed (GYs2011–12 and 2012–13).

22. Over the course of each year, Austrade adjusts thresholds as a means to balance available resources for assessment activities and the need to complete application processing within established timeframes—essentially reducing the level of scrutiny over the course of the year for some applications as a means of increasing the number of applications to be processed. These adjustments to thresholds do, however, result in applications presenting similar risk profiles being subject to different scrutiny depending on whether the applications are assessed before or after adjustments are made. Given the impact on application scrutiny, any changes to thresholds require careful consideration and appropriate authorisation. Austrade is, however, yet to document the rationale underpinning the adjustment process or the subsequent authorisation process. Further, adjustments to the thresholds are progressively ‘overwritten’ and, as a result, there is no audit trail that records historical changes to thresholds within the CMS, such as the risk ratings assigned to applications, previous percentile points and the reasons for adjustments.

Final Assessment and Distribution of Payments (Chapter 4)

23. Once an application is assigned to an assessor, a final assessment is undertaken and payments are determined. While Austrade has established processes and procedures to guide staff undertaking final assessments, there is scope for additional guidance to staff to reinforce the importance of adequately documenting decisions to manually adjust risk rankings. Within existing procedures, grant assessors are able to adjust the initial recommended assessment activity determined by the risk model in CMS. Approximately 30 per cent of the total applications for GYs2011–12 and 2012–13 involved a manual adjustment to the recommended assessment activity type. In general, the reasons for changes of the recommended assessment activity type were recorded by assessors, however, there was a varying level of detail provided to substantiate the need for an adjustment. Given that these adjustments represent a deviation from the automated risk model’s initial risk assessment, it is important that Austrade systematically assesses the appropriateness of manual adjustments and uses this analysis to further refine its automated risk model.

24. The controls established by Austrade to provide assurance regarding the accuracy of EMDG payments were generally sound, with the ANAO’s analysis confirming that EMDG grant payments for both GYs2011–12 and 2012–13 were accurate (appropriate payment amounts were calculated and paid). In the case of file checks, however, where applications are expected to have the lowest level of risk, a single officer is permitted to complete an end-to-end financial transaction without independent approval. Notwithstanding these applications having the lowest level of risk, having one person assess and approve an application is undesirable. The ANAO’s analysis found that approximately 15 per cent (818 applications) of the 5510 EMDG applications lodged for GYs2011–12 and 2012–13 were assigned to, and processed by, EMDG officers that conducted both the assessment and approval of the application. Assigning end-to-end responsibility to a single officer increases the risks to the integrity of payments. Further, the ability for EMDG assessors to ‘self-select’ an approval officer creates additional risks. Austrade has informed the ANAO that it is considering introducing revised practices that will randomly allocate approval officers, to prevent staff from self-selecting approval officers in the future but that a final decision is yet to be determined.

25. Austrade has implemented several initiatives to provide assurance to management in relation to the quality of assessments undertaken by EMDG assessors. These initiatives include an EMDG Policy and Consistency Committee, random audits and internal audits. Austrade is, however, yet to establish a quality assurance program that involves the regular review of a sample of applications that are analysed (for suggested improvements in the assessment process) and reported to management. Such a program would provide additional assurance that assessments are undertaken in accordance with established policies and procedures, as well as highlighting good practices and areas for improvement.

Monitoring and Reporting on Performance (Chapter 5)

26. Since its establishment, there have been a number of EMDG reviews that have found that the scheme has effectively stimulated exports for small to medium exporters. The reviews have also reported that the EMDG has contributed to additional exports ($1.4 billion in exports based on a 1994 review and $1.69 billion in a 2000 review). The most recent review in 2008 concluded that, although there was a small net positive economy-wide benefit derived from the scheme, the benefit was greater when positive spillover effects were taken into account.19 In the context of export promotion, for example, the benefits of one firm’s pioneering work to secure foreign sales may not accrue exclusively to it (such as in the form of increased revenues) because later entrants may be able to ‘free ride’ on its marketing efforts.20 In other words, some early entrants may have built a reputation for Australian-produced goods or services on which later entrants can capitalise—the Australian wine industry is often cited as an example of this.21

27. In 2014–15, Austrade implemented a revised performance measurement framework, including revised key performance indicators (benchmarks) to better measure the overall effectiveness of the EMDG scheme. For example, one of the revised benchmarks is the proportion of EMDG recipients reporting that the receipt of a grant supported their business to become a more sustainable exporter. Austrade’s annual reports for 2011–12 and 2012–13 have also reported on the scheme’s performance, and on statistical information about the EMDG’s applicants.22

28. EMDG reports internally to management on the percentage of applications processed within established benchmarks. The processing times for all assessment activities for GY2012–13 was, on average, 15 days longer than the established target. Generally speaking, the more complex the assessment activity, the greater the disparity between the benchmark and actual processing times. There would be benefit in Austrade reviewing the reasons for the increasing disparity, and revising its benchmarking approach, as necessary.

Summary of entity response

29. Austrade’s summary response to the proposed report is provided below, with the full response at Appendix 1.

Austrade accepts the ANAO’s recommendations in full with the majority either implemented or currently subject to implementation and those remaining awaiting the completion of the annual grant cycle before implementation. Austrade notes that the ANAO’s observations that EMDG risk management and grant payment mechanisms are generally sound provides assurance to the Government, Austrade management and industry stakeholders and increases public confidence in the scheme.

Recommendations

|

Recommendation No. 1 Paragraph 2.40 |

To strengthen the program management arrangements underpinning the Export Market Development Grants (EMDG) scheme, the ANAO recommends that Austrade: considers a broader range of risks that affect the administration of the scheme in preparing its risk management plan; and documents the involvement of relevant EMDG officers and staff in the development and review of the fraud risk assessments, including the formal acceptance of risks and controls by management. Austrade’s response: Agreed |

|

Recommendation No. 2 Paragraph 3.29 |

To strengthen decision-making under the Export Market Development Grants (EMDG) scheme assessment process, the ANAO recommends that Austrade documents the analysis, review and approval processes for adjusting the risk assessment model thresholds in the Claims Management System. Austrade’s response: Agreed |

|

Recommendation No. 3 Paragraph 4.47 |

To enhance assurance in respect of the assessment and distribution of payments for the Export Market Development Grants (EMDG) scheme, the ANAO recommends that Austrade: systematically assesses the appropriateness of manual adjustments to recommended assessment activities and uses this analysis to refine its automated risk model; and develop and implement a quality assurance program to provide additional assurance that the scheme is being administered consistently, and in accordance with requirements. Austrade’s response: Agreed |

1. Background and Context

This chapter provides an overview of the Export Market Development Grants scheme and sets out the audit objective, scope and criteria.

Introduction

1.1 The Export Market Development Grants (EMDG) scheme was established in 1974, and is the Australian Government’s principal financial assistance program for aspiring and developing exporters. Administered by the Australian Trade Commission (Austrade), the EMDG scheme aims to provide incentives to small and medium Australian enterprises for the development of export markets through reimbursement of up to 50 per cent of expenses incurred on eligible export promotion over $15 000.23 The scheme provides eligible applicants with one grant per year up to a maximum of eight grants.24 Applications open in July of each year and close on the last business day of November.25

1.2 The EMDG scheme is not a grant program for the purposes of the Commonwealth Grant Guidelines, and consequently does not encompass the competitive, merit–based selection process of more traditional grant programs. Rather, the EMDG scheme is a benefit or an entitlement established by legislation26 that assesses an applicant’s eligibility against the Export Market Development Grants Act 1997 (EMDG Act).27 The scheme does, however, use the term ‘grant’ to describe the payments made to eligible applicants.

Export Market Development Grants Act

1.3 The underlying principle for the EMDG scheme is to support Australian businesses in the export of substantially Australian products by encouraging them to undertake additional promotional activities. To fulfil the eligibility requirements under the EMDG Act, an EMDG application must involve: an eligible applicant who has incurred an eligible expense; where the expense was in relation to an eligible product.28

1.4 Under the EMDG Act, an eligible applicant is any Australian individual, partnership, company, association, cooperative, statutory corporation or trust, who, among other things, has an income of not more than $50 million in the grant year and has not previously received a grant in respect of eight or more previous grant years.29 Special approval may also be granted to groups and organisations that are not otherwise eligible under ‘approved joint venture’ or ‘approved body’ status.30

1.5 Eligible expenses are those that relate to specific promotional activities genuinely incurred by the applicant for marketing eligible products in foreign countries. Ineligible expenses are those arising from production or from product development, distribution or certification. The types of expenses that qualify include expenses for overseas representatives, marketing consultants and marketing visits.

1.6 Expenses must be in respect of eligible products, the rationale being that the products are substantially of Australian origin. The types of eligible products are listed in the EMDG Act as: goods, services (tourism and non-tourism), events, intellectual property and know-how. For each eligible product, the EMDG Act requires that a degree of connection between the product and Australia be demonstrated.31

Processing of EMDG applications

Access and registration to the scheme

1.7 Potential applicants may access the EMDG scheme in one of two ways: direct application to the scheme; or through an EMDG consultant, who lodges an application on behalf of the applicant. Since 2013–14, all applications have been lodged electronically with the introduction of a web-based lodgement system in July 2013.32

1.8 Applications (or claims for reimbursement) are processed through the EMDG Claims Management System (CMS), the scheme’s central electronic processing system. The CMS performs: a general eligibility check; an initial risk assessment; and, based on the defined risk parameter, automatically assigns applications to an initial assessment type. There are different grants assessment types that vary in terms of the degree of scrutiny and administrative effort. As a general rule, the CMS assigns applications so that the higher the claim’s perceived risk, the greater the level of scrutiny and effort employed by Austrade. Assessment activities range from file checks and desk audits, to site visits.

Final assessment of EMDG applications

1.9 The CMS also assigns each application to an EMDG officer who is presented with a summary of the risk ranking and recommended assessment activity in a Client Risk Assessment (CRA). The assignment of an EMDG application to the appropriate EMDG officer is a key control in processing EMDG applications for reimbursement. Depending on the risk assessment rankings generated by the system, an EMDG application is assigned to either a senior EMDG officer or a grant assessor. In general, higher risk applications are assigned to senior EMDG officers and low to medium risk applications are assigned to grant assessors.

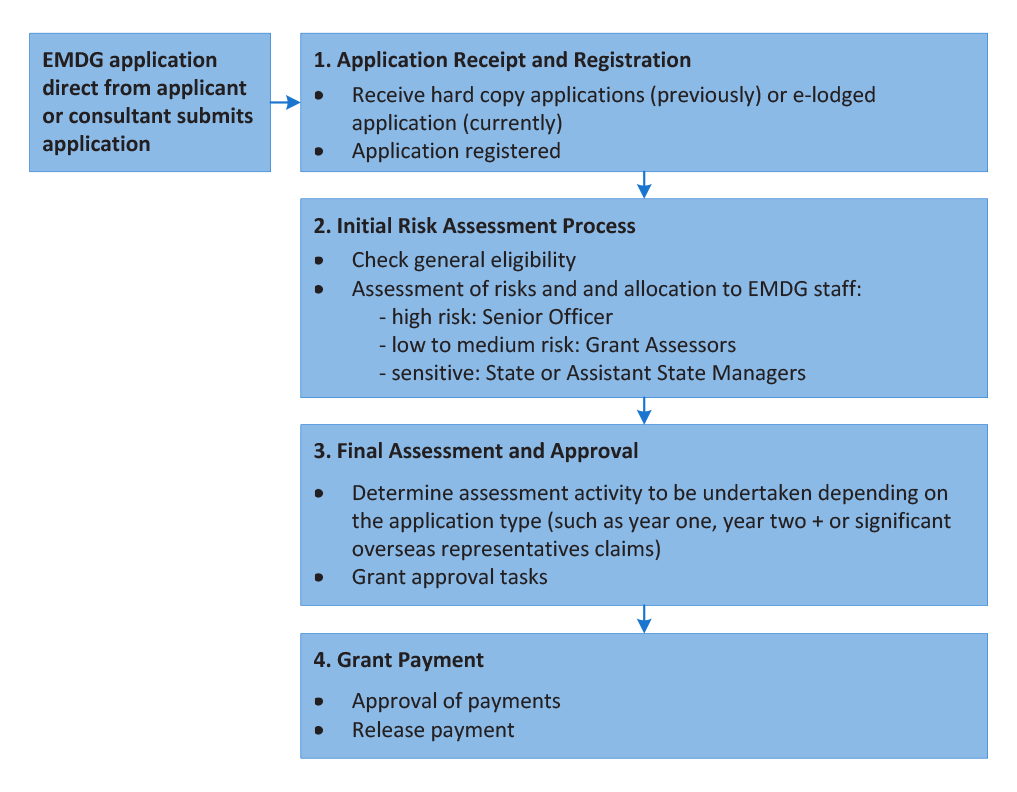

1.10 All completed applications are independently reviewed by an officer with the delegation to approve a recommendation by a grants assessor.33 Approval officers are responsible for the overall accuracy and quality of assessment work. Decisions on assessments are made by the EMDG grant assessors, with the CEO of Austrade to determine the EMDG applicant’s entitlement to the grant.34 A high–level overview of the EMDG process is illustrated in Figure 1.1.

Figure 1.1: High-level overview of the EMDG process

Source: ANAO analysis of Austrade documentation.

Payment of approved grants

1.11 EMDG grant payments are made under a split-payment system, which is intended to ensure that spending under the EMDG is kept within budget. Under the split-payment system, grants are paid in two rounds:

- An initial payment of grant entitlements up to a specified payment ceiling amount; and

- A second tranche payment of grant entitlements above the initial payment ceiling amount.

1.12 The initial payment ceiling amount is a fixed amount decided by the Minister for Trade and Investment in advance of the financial year under s 68 of the EMDG Act. Applications that have been approved at or below the initial payment ceiling amount are eligible to receive the entire grant, once approved. For applications with approved amounts above the initial payment ceiling, applicants are eligible to receive: a preliminary payment at the initial payment ceiling amount when the claim is approved; and all or a proportion of the balance at the end of the financial year. The extent to which the total balance will be paid depends on available funds remaining in the EMDG budget, assessed at the end of the financial year.35

Internal and external review of assessment decisions

1.13 Applicants who are dissatisfied with the determination of a grant application may formally request Austrade to undertake an internal review of the decision.36 An internal review decision may be appealed to the Administrative Appeals Tribunal.37 Other sources of external review are through the Freedom of Information Act 1982, Commonwealth Ombudsman and the Federal Court under the Administrative Decisions (Judicial Review) Act 1979 are also available.

Number and profile of EMDG applications

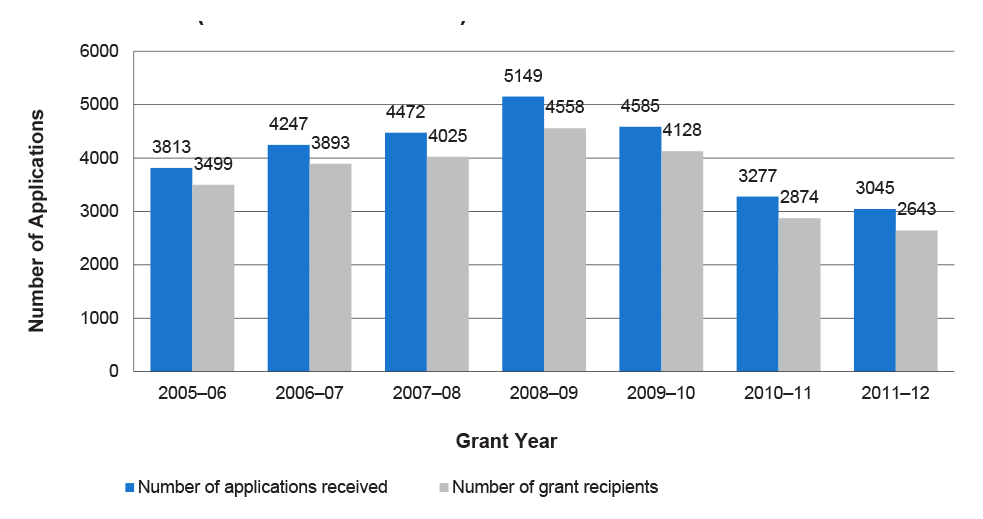

1.14 In recent years, the number of EMDG applicants and recipients has risen and fallen within a relatively narrow band (2643 to 5149). Figure 1.2 shows the number of EMDG applications and recipients by grant year from 2005–06 to 2011–12.

Figure 1.2: Number of EMDG applications and recipients by grant year (2005–06 to 2011–12)

Source: Austrade Annual Reports.

1.15 A grant year (GY) is the 12 month period during which applicants have incurred expenses. Applications for reimbursement under the EMDG scheme are processed by Austrade in subsequent financial years, for example, expenses incurred in 2012–13 are processed in the 2013–14 financial year. Austrade reports that the number of applications peaked for GY2008–09 at 5149 applications due to amendments in the EMDG Act that broadened the scope of potential EMDG applications.38 The number of applications then fell by approximately 41 per cent to 3045 applications for GY2011–12 expenses. Austrade has cited the combined effects of the Global Financial Crisis, as well as the high Australian dollar over the period as the main reasons for the fall in demand for the scheme.

1.16 EMDG recipients comprise a broad range of Australian exporting businesses. Between 2007–08 and 2011–12, the profile of EMDG grant recipients by industry was: services (including ICT, tourism and education and culture) around 60 per cent; manufacturing (including food and beverage manufacturing) around 30 per cent; and primary industry (less than five per cent). The average grant paid for GY 2012–13 (which was paid in 2013–14) was $45 708. Table 1.1 further illustrates the profile of EMDG grant recipients.

Table 1.1: Profile of EMDG grant recipients by grant year (2007–08 to 2011–12)

|

|

2007–08 |

2008–09 |

2009–10 |

2010–11 |

2011–12 |

|

Total value of grants paid ($ million) |

180.7 |

190.4 |

130.2 |

120.2 |

113.5 |

|

Average value of grant ($) |

44 892 |

41 768 |

31 531 |

41 818 |

42 950 |

|

Median grant ($) |

30 678 |

27 828 |

25 050 |

28 421 |

28 182 |

|

Recipients from rural and regional areas (% of recipients) |

23 |

24 |

25 |

22 |

21 |

|

First time applicants (% of recipients) |

27 |

30 |

27 |

23 |

26 |

Source: Austrade Annual Reports.

EMDG funding arrangements

1.17 Expenditure under the scheme is provided for by annual Appropriation Acts. Since July 1997, a capping mechanism has been in place to ensure that total expenditure under the scheme is limited to the appropriated amount. The cost of the administration must not exceed, in any financial year, five per cent of the appropriated amount.39 Table 1.2 outlines the EMDG annual appropriation, administrative budget and reported actual expenses.

Table 1.2: EMDG appropriations and administrative budget per financial year

|

Financial Year |

Appropriation ($ million) |

Total Allowable Administrative Cost Component ($ million) |

Reported Total Expenses(1) ($ million) |

|

2008–09 |

200.4 |

8.4 |

194.3 |

|

2009–10 |

200.4 |

10.0 |

208.1 |

|

2010–11 |

150.4 |

7.5 |

150.6 |

|

2011–12 |

150.4 |

7.5 |

133.1 |

|

2012–13 |

125.4 |

7.5 (2) |

127.9 |

|

2013–14 |

137.9 |

7.3 (3) |

120.9 |

|

2014–15 |

137.9 |

6.9 |

– |

Source: Austrade Portfolio Budget Statements and available Austrade annual reports.

Note 1: Comprises the reported total value of grants paid plus administration costs per financial year.

Note 2: The cap of administration costs in calculated on the appropriated amount. In this year, the EMDG budget was changed during the year. However, the mechanism for this did not change the appropriated amount until after the financial year closed.

Note 3: The amendment to the EMDG Act in 2014 (s 105(2)) provided for additional administrative expenditure from other sources. This enabled Austrade to provide an additional $0.4 million from departmental funds.

1.18 The scheme’s appropriation was reduced during 2012–13 to $125.4 million, following the release of the (then) Government’s Mid–year Economic and Fiscal Outlook. In 2013–14, the scheme’s appropriation was initially maintained at $125.4 million, but was later increased by $12.5 million, as a result of the new Government providing additional funding of $50 million over four years (or $12.5 million per year from 2013–14 to 2016–17).40

1.19 Under s105 of the EMDG Act, administration costs must not exceed five per cent of the funding appropriated by Parliament for the scheme. In March 2014, Austrade became aware that it would exceed the legislative cap on administrative costs for the 2013–14 financial year (in respect of 2012–13 expenses) as a result of an accounting oversight. To address this issue, Austrade sought and obtained approval from government for an amendment to s105 of the Act on 21 March 2014. The EMDG Act currently has the effect that additional administration costs above the five per cent cap may be met from departmental appropriations, but only in respect of the 2013–14 financial year. Subsequent financial years are still subject to the cap on administrative expenses at five per cent of the amount appropriated to the scheme alone.

External reviews of the EMDG scheme

Previous ANAO audits

1.20 Throughout its 40 year life, the EMDG scheme has been subject to a number of external reviews, including two ANAO performance audits in the 1990s. The ANAO Report The Export Market Development Grants Scheme-Its Efficiency and Effectiveness41 published in 1994 focused on Austrade’s administration of the scheme and found, among other things, that improvements could be made in respect of:

- the documentation relating to strategic planning;

- the entity’s fraud control plan;

- the risk assessment of applications; and

- reporting of information on the use and effectiveness of the scheme to Parliament.

1.21 In a follow-up audit in 1996 it was found that of the 20 recommendations in the original report, most (13) had been implemented in full, with four partially implemented.

External reviews

1.22 The EMDG Act requires that an external review of the scheme is undertaken periodically in order to make recommendations about EMDG’s continuation.42 The most recent external review was conducted in 2008 by David Mortimer AO (the Mortimer Review).43 The review examined the EMDG scheme and its impact in stimulating export growth. Using econometric analysis it found, among other things, that: the scheme was helpful in introducing smaller Australian businesses and new exporters to the global market; there was a small positive net benefit based on economy-wide modelling (which was greater when spillover effects were taken into account); and that the funding arrangements for the EMDG caused difficulties for Austrade in administering the scheme as well as for recipients who could not be certain as to the actual grant amount that was to be paid. The next legislatively mandated review is to commence no later than 1 January 2015, with the review completed by 30 June 2015.44

Audit objective, criteria and methodology

Audit objective

1.23 The objective of the audit was to assess the effectiveness of the Australian Trade Commission’s administration of the Export Market Development Grants scheme, in providing incentives to small and medium Australian enterprises for the development of export markets.

Audit criteria

1.24 To form a conclusion against the audit objective, the ANAO adopted the following high level criteria:

- effective governance arrangements, including appropriate risk management, performance measurements and reporting processes were in place;

- an accessible grant application process to maximise the attraction and selection of high quality applications was established; and

- sound processes for risk assessing, approving and distributing payments, consistent with the EMDG scheme objectives were implemented.

Audit methodology

1.25 The focus of the audit was on the program management and administrative arrangements and key elements of the EMDG scheme, from the application phase to the release of payments, including the EMDG Claims Management System (CMS). A stratified sample of 1699 applications from the 2011–12 and 2012–13 grant years were analysed, as well as an automated analysis of all EMDG applications for the two grant years. Interviews were also conducted with relevant staff from Austrade, particularly with selected EMDG State Managers and Grant Assessors. EMDG related performance and customer satisfaction information was also reviewed. Audit fieldwork was undertaken in Austrade’s head office in Sydney, as well as in Melbourne, Adelaide and Canberra.

1.26 The audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of $451 977.

Report structure

1.27 The structure of the report is outlined in Table 1.3.

Table 1.3: Report structure

|

Chapter |

Chapter Overview |

|

2. Program Management |

Examines the program management arrangements underpinning the EMDG scheme. |

|

3. Registration of Applications and Initial Assessment of Risk |

Examines Austrade’s receipt and registration of EMDG applications and its initial assessment of risk. |

|

4. Final Assessment and Distribution of Payments |

Examines the final assessment of EMDG claims, including quality assurance mechanisms and the distribution of payments. |

|

5. Monitoring and Reporting on Performance |

Examines Austrade’s approach to monitoring and reporting on the performance of the EMDG scheme and outcomes of its activities. |

2. Program Management

This chapter examines the program management arrangements underpinning the EMDG scheme.

Introduction

2.1 The management of the EMDG scheme has evolved over the 40 years since it was established. In September 2013, the EMDG was part of Austrade’s Education and Corporations team, under the Programs, Consular and Business Services Division. The Division, headed by the General Manager, had oversight of the administration of the EMDG scheme, as well as Austrade’s consular and business service functions.45 As at September 2013, the EMDG function had four core units46, as outlined in Table 2.1.

Table 2.1: EMDG function (as at September 2013)

|

Unit |

Responsibilities |

|

EMDG Operations |

Managed all operational functions and issues that include: coaching claimants and potential claimants; advice on the claim lodgement system; advice on claim eligibility; receipt of applications; application assessment; appeals and management of AAT cases; day-to-day EMDG consultant issues; implementation of changes and other related functions. |

|

EMDG Policy and Scheme Development |

Responsibilities include: policy setting and interpretation (this would include advice to government on policy options such as policy formulation and framing legislation, regulations and guidelines for government decision); maintenance and development of the EMDG systems; reviews of the scheme and inputs to major and minor reviews; data requests; risk strategy, modelling and reporting; major audit activities; communications and marketing; consultant management and liaison with industry, consultants and allies; and correspondence and reporting. |

|

Special Investigations Unit (SIU) |

Responsible for fraud awareness and deterrent activities within the EMDG scheme; investigations; liaison with the Commonwealth Director of Public Prosecutions; project activities to identify and deter fraud; and assessment of higher risk applications. |

|

Central office management function |

The unit is involved in all of EMDG budgeting and reporting, purchasing and monitoring of financial activities that include credit card use. |

Source: Austrade.

2.2 Austrade’s EMDG senior officers and grant assessors are primarily responsible for undertaking the audit or assessment of grant applications.47 As at June 2014, these staff operated out of the five EMDG state offices: Sydney (for New South Wales and the Australian Capital Territory); Melbourne (for Victoria and Tasmania); Brisbane; Adelaide (for South Australia and Northern Territory); and Perth.

2.3 From 1 July 2014, Austrade advised that responsibility for EMDG moved from the Education and Corporations team to the Tourism Investment Education and Programmes Group. This restructure included the re-engagement of an ongoing Risk Manager and a Communications Officer. EMDG Operations now includes a Central Assessment Team (CAT) reporting to a Manager. Unlike the previous structure, the CAT is assigned applications from anywhere in Australia rather than specific states or territories.48 In addition to the CAT, there are three regional teams that assess, in the main, applications from exporters seeking assistance under the scheme for the first time. The three regional managers are based in Sydney, Melbourne and Brisbane.49

2.4 The roles and responsibilities of the EMDG senior officers and grant assessors are defined in their individual annual Performance Plans. The ANAO interviewed 19 operational staff outposted to four state offices. A number of these officers had many years of experience in their current role, often with an accounting or business background, and demonstrated a sound understanding of their responsibilities.50 Staff are provided with appropriate guidance51 and training. Additional technical support on the interpretation of the EMDG Act is also available to staff from the Legislation and Policy Coordination Section.

2.5 The ANAO’s review of Austrade’s program management arrangements for the EMDG scheme included the examination of: planning and risk management practices; managing fraud risks; and processes for dealing with conflict of interest.

Planning and risk management

2.6 Austrade’s long-term strategic direction was outlined in its 2013–14 corporate plan. The plan detailed: the entity’s key priorities for the year; its primary activities; outcomes; and performance measures in order to meet its strategic goals. The strategic goals included (but were not limited to):

- providing assistance to Australian businesses and education institutions;

- focusing on Asian, growth and emerging markets;

- focusing on established markets, such as North America and Europe;

- aligning foreign direct investment with agreed government priorities in target markets;

- continuing to work with industry and internationally on its branding: Australia Unlimited and Future Unlimited; and

- administering the Asian Century Business Engagement Plan.52

2.7 The ANAO reviewed the 2013–14 EMDG business plan, which included the EMDG work program for the year. The plan outlined the scheme’s strategic direction53, and the challenges faced when working within a capped administration budget. An assessment of some of the entity’s high level risks and its risk management approach were also included. The ANAO observed that there was appropriate alignment between the 2013–14 EMDG business plan and Austrade’s corporate plan for the same year. Overall, Austrade’s strategic and program level (EMDG) planning processes provided a sound foundation for the entity’s operational activities.

2.8 Austrade released its current corporate plan for 2014–15 to 2018–19 in July 2014. The new plan outlined the entity’s strategies and priorities for the four years, which include, that Austrade will:

- continue to help Australian businesses and institutions make the most of international business opportunities and promote Australia as a desirable foreign investment destination;

- strengthen its skills relevant to investment and play a stronger role supporting Australia’s Minister for Trade and Investment;

- continue to promote Australia’s education and training sector, work to strengthen the tourism industry, and use its unique commercial perspective to inform policy development; and

- deliver consular services in a number of locations.54

2.9 The administration of the EMDG scheme is identified in the current corporate plan as one of Austrade’s roles in helping Australian companies grow their business in international markets.55 The effective management of the entity’s risks is central to Austrade achieving this outcome.

Risk management

2.10 Austrade’s risk management arrangements are established through the entity’s Chief Executive Instruction on risk management (CEI 13), its corporate governance framework and risk management plan. These arrangements outline the entity’s overall risk appetite and its approach to managing its key risks, including those relating to the EMDG. An overview of Austrade’s risk management framework is shown in Table 2.2.

Table 2.2: Overview of Austrade’s risk management framework

|

Austrade’s risk management policy comprises the following:

|

|

Other corporate policies and guidelines that support Austrade’s risk management policy include the entity’s:

|

Source: Austrade Chief Executive Instruction 13 on risk management.

2.11 Austrade’s corporate and operational plans are supported by the ‘Agency Risk Management Plan’, which identifies the enterprise wide strategic, transitional and operational risks that may impact on Austrade’s ability to achieve its strategic objectives and priorities. The controls in place to ensure that objectives are met, together with a residual risk rating are also outlined.56 The failure to appropriately administer the EMDG scheme, including its operational improvement initiatives to meet budget requirements is identified as one of Austrade’s operational risks.

2.12 From 2011–12 to 2013–14, Austrade identified the factors influencing the likelihood and consequences of failing to appropriately administer the EMDG scheme. An example of these covering the period 2011–12 to 2013–14 is provided in Table 2.3.

Table 2.3: Factors affecting the likelihood and consequences of failing to effectively administer the EMDG scheme (2011–12 to 2013–14)

|

Factors Influencing Likelihood |

Description of Consequences |

|

|

Source: Austrade Agency Risk Management Plans.

2.13 The 2011–12 to 2013–14 plans outlined a variety of controls at the policy and operational levels to address risks identified for the EMDG scheme, such as ‘monitoring implementation of Austrade’s reforms’ and ‘five-point eligibility check for all new organisations to Austrade’. The residual overall risk rating was ‘High’ in the 2011–12 and ‘Medium’ in the 2012–13 and 2013–14.

2.14 In general, Austrade’s risk management framework provides its Executive with reasonable assurance that key risks with respect to the EMDG scheme will be dealt with effectively, and risk treatments are appropriately implemented and monitored. However, there were specific risks to the administration of the EMDG that have not been included in the program’s risk management plan, and which may warrant closer consideration. These risks include:

- Intra-year changes to risk thresholds may raise the perception of inconsistent or inequitable application of risk treatments. The EMDG risk model is periodically adjusted during the course of the year in light of available resources to process remaining applications. These adjustments can change the way applicants are treated for similar risks depending on when an application is processed. While the risk management plans identified the capped administration budget and pressures of processing increasing claim numbers (as outlined in Table 2.3), the nature of this particular risk was not clearly articulated.

- Loss of experienced officers. The workforce of EMDG Operations comprised senior officers with considerable experience in either EMDG or Austrade. The risks presented by an ageing workforce who were predominantly of retirement age, and the loss of valuable knowledge and expertise on technical aspects of the EMDG Act and its interpretations are not specifically addressed in the program risk plan (as outlined in Table 2.3).

2.15 Austrade has informed the ANAO that it is in the process of revising its risk management plan to take into account the findings of a 2014 internal review with a view to including a broader range of risks in its program risk plan, including those identified by the ANAO.

Managing fraud risks

Fraud against the scheme

2.16 Ensuring that appropriate fraud controls are in place continues to be an important function in Australian Government entities. Notwithstanding the financial and personal cost of fraud, the reputational damage to entities can be direct and longlasting.57 The risk of fraud within the EMDG scheme has been consistently categorised as a high inherent risk for Austrade. There was a total of 53 EMDG fraud related incidents identified by Austrade from 2008–09 to 2012–13 as shown in Table 2.4.

Table 2.4: Identified EMDG fraud related incidents (2008–09 to 2013–14)

|

Financial Year |

Number of Cases |

Case Values (Total Approximate $ Value) |

|

2008–09 |

8 |

364 702 |

|

2009–10 |

11 |

345 167 |

|

2010–11 |

6 |

166 730 |

|

2011–12 |

2 |

111 580 |

|

2012–13 |

5 |

290 418 |

|

2013–14 |

21 |

1 290 000 |

|

Totals |

53 |

2 568 597 |

Source: Austrade information.

2.17 Of the 53 identified fraud incidents, there were six cases of actual losses to the Commonwealth, where grant payments were made to fraudulent EMDG applicants. The first case was in 2008–09 where there was an actual loss to the Commonwealth of $21 300, and the second case was in 2009–10 when the actual loss was $30 613. One case of fraud in 2009–10 for the amount $11 186 has been recovered through the courts. There were four cases of fraud for 2013–14 where the actual loss to the Commonwealth was $88 586.58 The remaining 47 identified cases of fraud were detected prior to the EMDG grants being paid.

2.18 There were no convictions of fraud against the EMDG scheme during 2013–14.59 However, one case was with the Commonwealth Director of Public Prosecutions for consideration as to whether to commence court proceedings.60

Strategies to minimise fraud

2.19 To minimise fraud and abuse within the scheme, Austrade has adopted the following strategies:

- establishing a Special Investigation Unit (SIU) for the EMDG scheme;

- putting in place a Fraud Hotline for reporting suspected fraud under the EMDG scheme, including contact details of the Fraud Hotline being listed on EMDG publications and on the Austrade website;

- requiring applicants to provide documentation at the time of lodgement of applications;

- analysing and assessing applications by SIU on the basis of industry, assessment types, expenditure categories, EMDG consultants, and lodgement patterns (applicants and EMDG consultants are aware that applications may be subject to closer scrutiny);

- making changes to the EMDG Act to incorporate additional deterrents, such as Section 56A claiming of cash payments capped at $10 000, and section 87AA relating to Not Fit and Proper persons;

- developing and implementing an SIU Alert system and analytical tools to identify high risk of fraud or over claiming;

- delivering fraud awareness presentations to the EMDG grant assessors to ensure appropriate internal referrals; and

- advising potential applicants at information sessions of the role and responsibilities of the SIU.

2.20 A key strategy to deter fraud against the EMDG scheme was the establishment of the SIU, which was prompted by an ANAO performance audit in 1995. The SIU is responsible for deterring, detecting and investigating fraud and in meeting Austrade’s responsibilities under the Commonwealth Fraud Guidelines with regards to the EMDG scheme.

2.21 The SIU function is also independent of grant processing operations and is directly responsible to the General Manager of the EMDG scheme. As at June 2014, the SIU team had four full-time staff located in Sydney and Melbourne comprising a Manager, Assistant Manager and two Investigators.61 The SIU conducts investigations and examines cases where there has been an attempt to obtain a grant, or increase the amount of a grant that would not otherwise have been payable.62

Sources of the SIU’s work or investigations

2.22 The SIU’s investigation workload is primarily sourced from:

- external allegations—referrals from parties outside Austrade;

- internal referrals—referrals from the EMDG grant assessors;

- SIU project work—undertaken by the SIU on perceived high risk cases and general audits for which an SIU case is commenced; and

- overseas enquiries—checks conducted by Austrade agents or through EMDG staff overseas visits for which an SIU case is commenced.

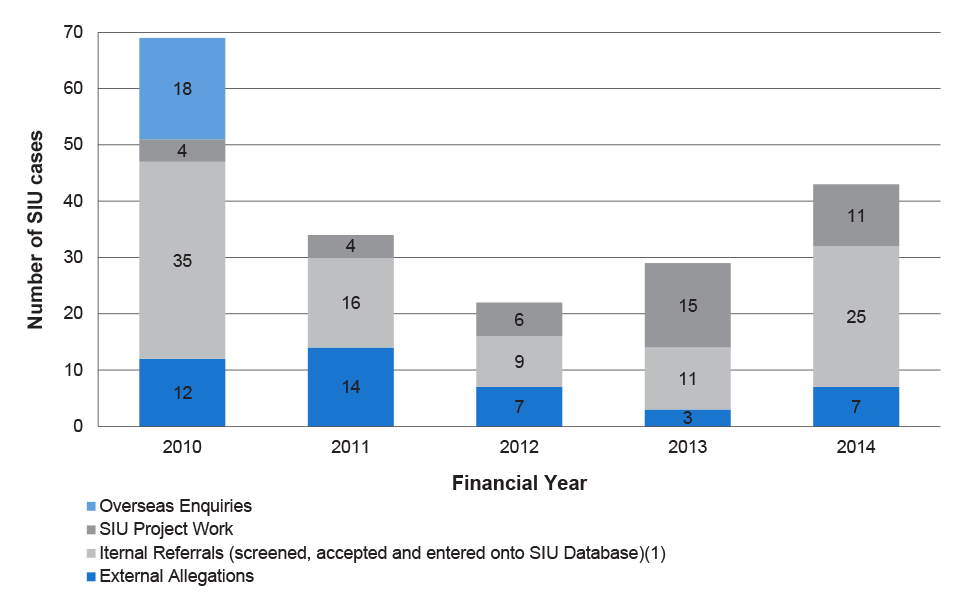

2.23 Figure 2.1 illustrates the number of fraud cases on the SIU database and sources. The number of new fraud cases peaked in 2010 (GY 2008–09), with 69 cases being recorded. Austrade attributed this increase to the large number of applications received in that grant year, as well as new cases from overseas enquiries.

Figure 2.1: Number of cases on the SIU databases and sources (as at 30 June 2014)

Source: ANAO analysis of Austrade data.

Note 1: Excludes cases that have been referred to, but not accepted by, the SIU.

2.24 The total number of new fraud cases decreased by approximately 50 per cent from 2010, but has remained relatively stable over recent years.63 Austrade has also advised that overseas enquiries by SIU staff ceased in 2010 due to funding constraints. Currently, the majority of SIU investigations is sourced from internal referrals.

2.25 Austrade has advised that the number of internal referrals has decreased since 2010 and this reduction has mostly been attributed to the emphasis being given to processing 95 per cent of applications in any given financial year. The SIU indicated that fewer applications are being referred for investigation, as EMDG staff are aware that investigations can be time-consuming and are reluctant to refer instances of potential fraud to SIU. While maintaining a strong focus on processing time is an important consideration, the ANAO considers that this focus should not override the need to conduct investigations where warranted.

EMDG Fraud Risk Assessments

2.26 In June/July 2011, the Manager of the SIU initiated the conduct of yearly fraud risks assessments within the EMDG scheme. The identified risks are based on general risks common to government grants and claimable expenditure items that are specific to the EMDG. These include:

- expenses that are not acquitted;

- overseas representation (Schedule 1A of the application);

- marketing consultants (Schedule 1B);

- marketing visits (Schedule 2);

- free samples (Schedule 4);

- promotional literature and advertising (Schedule 6);

- overseas buyers (Schedule 7);

- IP registration (Schedule 8);

- export earnings (Schedule 9); and

- internal fraud.

2.27 The ANAO reviewed the EMDG’s fraud risk assessments for 2012 and 2014.64 The assessments were appropriately targeted, encompassing a wide range of risks and their triggers, the current controls and potential strategies in place, as well as the actions needed to mitigate the risks. Risk ratings were assigned in relation to the likelihood, consequences and effectiveness of the current controls.

2.28 In its review of the 2012 and 2014 fraud risk assessments, the ANAO noted some fraud risks that were identified by Austrade as having a low level of likelihood, but also an ‘inadequate’ effectiveness of current controls. Austrade has not retained evidence to indicate the steps taken to address the inadequate controls and whether EMDG management has formally accepted the fraud risks identified in the annual fraud risk assessments. In addition, the documentation retained by Austrade does not indicate the extent to which grant assessors were consulted in the development of the risk assessments. The development and review of the fraud risk assessments would benefit from broader involvement of EMDG senior officers and grant assessors. Such involvement would also enhance fraud awareness amongst EMDG staff, and improve the internal monitoring and reporting of fraud (particularly between the grant assessors and the SIU).

Internal and external reporting on fraud

2.29 The internal reporting of SIU fraud risks is through the unit’s reports submitted to the General Manager. SIU reports are on a ‘need to know’ basis, and most recently—from January to May 2014—have been prepared on a monthly basis. The reports include information that relates to cases: at court; referred to the Commonwealth Director of Public Prosecutions (CDPP) and the Australian Federal Police; with the Administrative Appeals Tribunal; under SIU consideration and investigation; and a summary of new cases for the year. Austrade’s Executive is informed of the entity’s fraud issues through the Audit and Risk Committee, which obtains reports on fraud from the EMDG branch. In its annual reports, Austrade also reports on fraud against the EMDG scheme, including the number of: convictions; persons before the courts; and cases with the CDPP for consideration. Fraud reporting provides relevant updates and emerging patterns that inform management and other stakeholders of fraud within the EMDG scheme.

Procedures and guidance to support decision-making

2.30 Austrade EMDG Procedures Manual (as at January 2013) is one of several documents used by Austrade staff to assist them in making decisions regarding the assessment of the EMDG applications. The key components of the manual cover: general information; controls; routine tasks; internal and external reviews; and senior management approvals.65 The manual also includes provisions for the management of Conflict of Interest (COI). It stipulates that EMDG staff who have, directly or indirectly, a pecuniary interest in, or family, social or any other relationship with an (EMDG) applicant, may have a conflict of interest.

Compliance with Austrade’s Conflict of Interest policy

2.31 Austrade advised that under its COI policy, all EMDG staff are required to complete a COI form once per calendar year. Where there is the possibility of potential, perceived or actual COI, an EMDG employee (as well as all Austrade employees) is required to draw the matter to the attention of their supervisor by completing a COI Management Plan.66

2.32 The ANAO reviewed the compliance of EMDG officers with Austrade’s COI policy, for the period 2012 to 2014. The ANAO found that:

- in 2012, all EMDG staff had completed their COI forms, with eight out of 51 EMDG staff declaring a COI;

- in 2013, all EMDG staff had completed their COI forms, with three out of 52 EMDG staff declaring a COI; and

- in 2014, all EMDG staff had completed their COI forms, with six out of 34 EMDG staff declaring a COI. EMDG management’s review of the six COI declarations resulted in three requiring a COI management plan.

2.33 EMDG grant assessors are also required to disclose their work relationships with ex-Austrade EMDG consultants under the current Austrade COI policy if they consider that the prior relationship amounts to personal or private interests that may directly or indirectly influence or benefit the EMDG officer or others. To date, no EMDG staff member has made such a disclosure. Austrade advised the ANAO that there is a significant number of consultants who assist in preparing and lodging EMDG applicants’ claims who are ex-EMDG staff, including some former EMDG State Managers who had oversight of the EMDG functions. At the time of the audit (June 2014), there were EMDG grant assessors employed by Austrade who previously reported to these consultants.

2.34 While Austrade is managing declared conflicts of interest in accordance with the established policy, there would be benefit in providing staff with additional guidance in relation to interactions with EMDG consultants. The ANAO considers that, if not managed carefully and transparently, the involvement of consultants who are former Austrade employees and managers could pose a potential risk to the perceived fairness and impartiality of decisions taken by current Austrade staff who have had previous personal and professional relationships with these consultants.

Approved EMDG consultants

2.35 EMDG consultants are independent of Austrade and assist exporters with lodging applications. For the 2011–12 and 2012–13 grant years, the proportion of applications which were prepared by these consultants was 57 per cent and 61 per cent, respectively. While EMDG consultants are not formally accredited or registered67, some consultants are recognised by Austrade in its Quality Incentive Program (QIP) and are afforded an extended lodgement period of eight months instead of the usual five months.

2.36 The QIP was first introduced in FY2013–14 for GY2012–13 expenses68 and was intended to improve the quality of applications prepared by consultants and reduce the assessment activity needed for these applications. Consultants in the QIP must meet criteria as prescribed in the Export Market Development Grants (Extended Lodgement and Consultant Quality Incentive) Determination 2012.69 A current list of the QIP approved EMDG consultants is published on Austrade’s website and, as at July 2014, there were a total of 55 approved EMDG consultants across all states and the Australian Capital Territory.

Conclusion

2.37 Austrade’s program management arrangements for the EMDG scheme are sound, with welldefined roles, responsibilities and accountability arrangements. The EMDG business plan is also aligned with Austrade’s overall strategic direction as outlined in the entity’s corporate plan. While Austrade’s risk management framework provides its Executive with reasonable assurance that key identified risks with respect to the EMDG scheme will be dealt with effectively, a broader range of risks associated with the administration of the EMDG scheme, such as intrayear changes to risk thresholds and loss of experienced officers, may warrant closer consideration.

2.38 The EMDG’s fraud risk assessments for 2012 and 2014 are appropriately targeted, with fraud risks relevant to the EMDG clearly identified. However, the extent to which EMDG officers and staff were involved in the development and review of the yearly EMDG fraud risk assessments was not documented. In addition, evidence has not been retained to indicate that EMDG management has formally accepted the fraud risk assessments, including for risks identified as having inadequate controls.

2.39 Guidance and procedures for EMDG staff are generally sound, including policies for the identification and management of Conflicts of Interest (COIs). In relation to the management of COIs, EMDG officers and staff have completed the necessary COI forms, with a small number of COIs identified. There would be benefit, however, in providing staff with additional guidance in relation to interactions with EMDG consultants (particularly for those consultants who were previously employed by Austrade to administer aspects of the EMDG scheme).

Recommendation No.1

2.40 To strengthen the program management arrangements underpinning the Export Market Development Grants (EMDG) scheme, the ANAO recommends that Austrade:

- considers a broader range of risks that affect the administration of the scheme in preparing its risk management plan; and

- documents the involvement of relevant EMDG officers and staff in the development and review of the fraud risk assessments, including the formal acceptance of risks and controls by management.

Austrade’s response:

2.41 Agreed.

- Following a management initiated review the EMDG program risk management plan has been expanded to consider a broader range of risks including those identified by the ANAO. This recommendation has been implemented.

- EMDG will commence the documentation of the involvement of relevant staff in the next annual review of fraud risk and document the formal acceptance of risk and controls identified in that review.

3. Registration of Applications and Initial Assessment of Risk

This chapter examines Austrade’s receipt and registration of EMDG applications and its initial assessment of risk.

Introduction

3.1 The effective administration of the EMDG is supported by Austrade adopting application and assessment processes that are accessible, open, transparent and equitable. In this context, the ANAO examined Austrade’s:

- guidance for EMDG applicants and consultants;

- receipt and registration processes; and

- the initial risk assessment of EMDG applications.70

Guidance for the EMDG applicants and consultants

3.2 EMDG is a mature program and, since its establishment, Austrade has put in place various mechanisms to provide EMDG information and guidance to applicants and consultants seeking to participate in the scheme. The information and communication channels used by Austrade are outlined in Table 3.1.

Table 3.1: Mechanisms in place to inform applicants and consultants of the EMDG scheme

|

Mechanism |

Description |

|

Austrade website |

Provides extensive information on the scheme that includes (but is not limited to): who can apply; what can be claimed; how to apply; assessment and payment amounts; information on EMDG consultants; EMDG scheme changes; amendments to the EMDG Act; success stories and other relevant information that is helpful to a prospective EMDG applicant. |

|

Information sessions |

These targeted sessions are designed to assist EMDG applicants in preparing their applications. The sessions are conducted by senior grants staff in major cities around Australia (that is in Sydney, Melbourne, Perth, Adelaide and Brisbane). Some of the topics covered during the sessions include: an introduction to the EMDG; how to plan for EMDG; and how to get the best out of the scheme. |

|

Meetings with the exporting industry, including the EMDG applicants and consultants |

As requested or on a needs basis, EMDG senior grants staff are invited to talk about the EMDG scheme to various exporter groups and associations, that includes the exporters’ consulting industry. |

|

Downloadable brochures and fact sheets |

Brochures cover: general information on the scheme; special approvals information; technical information; Ministerial Determinations, including sanctions and industry specific information. |

|

EMDG Update e-newsletter |

The EMDG Update contains information and updates on the EMDG scheme including key dates, upcoming events, EMDG exporter success stories, and ‘tips’ for intending applicants. A link is provided for interested parties to click on, and subscribe to the newsletter. |

|

Provision of a contact number and email help address |

Austrade has also made available to the general public a contact number and email address for EMDG related or EMDG specific enquiries. |

|

EMDG consultants |

Austrade has advised that it also relies on EMDG consultants to market the scheme to potential applicants. |

Source: ANAO analysis of Austrade’s website and EMDG documentation.

3.3 The scheme’s guidelines and related published material are clear and consistent, and set out the details of the program, as well as the arrangements through which potential applicants are able to access the scheme. Although information on the EMDG scheme is readily available to applicants, Austrade’s telephone survey of its client base in 2012–13 indicated that awareness of the scheme has been declining since 2010 (see Figure 3.1).71

Figure 3.1: Awareness of the EMDG scheme

Source: Austrade.

3.4 Austrade advised that the direct applicability of the findings of its client survey to the EMDG scheme declined due to a number of factors, including the termination of Austrade’s strategy to double the number of exporters (new exporters have traditionally been a key client group of the scheme). Notwithstanding these factors, there would be benefit in Austrade analysing the entity’s client survey and reviewing EMDG’s existing communication and awareness mechanisms so that marketing strategies can be tailored to specific industry groups and exporters that may not be aware of the scheme.

Eligibility criteria and lodgement

3.5 The scheme’s eligibility requirements are set out under the EMDG Act. An eligible applicant generally refers to any Australian individual, partnership, company, association, cooperative, statutory corporation or trust, which:

- has generally carried on a business in Australia during the grant year;

- has an income of not more than $50 million in the grant year;

- has not previously received eight or more EMDG scheme grants in previous grant years; and

- has had no disqualifying conviction under the EMDG Act.72

In addition, some groups and organisations that do not undertake export activity may apply for grants (as approved bodies) for a five year renewable term.

3.6 As outlined earlier, the EMDG Act stipulates the eligible product types under the scheme and these include: goods; services (tourism and non-tourism); events; intellectual property and knowhow. The EMDG Act also provides for various categories of promotional activities that qualify as eligible expenses: overseas representatives; marketing consultants; marketing visits; communications; free samples; trade fairs; seminars; in store promotions; promotional literature and advertising; overseas buyers; and registration and/or insurance of eligible intellectual property. Details on the eligibility requirements are included in Appendix 3.

3.7 An EMDG application must be in a form and manner approved by Austrade73, and lodged with the entity within five months after the end of the grant year, from 1 July to 30 November, or 28 February if lodged through a QIP approved EMDG consultant. The EMDG Act prevents Austrade from considering an application that was not provided to the entity by the closing date.

3.8 EMDG scheme guidelines clearly outline the eligibility criteria that applicants must satisfy in order to be considered for reimbursement, with descriptions and examples provided to assist applicants to determine documentation requirements. In addition, the lodgement dates by which applicants are required to submit their applications are included in all EMDG guidance material, including a statement that applications that are not received within the required timeframe would not be accepted.

Receipt and registration processes

3.9 As previously discussed, Austrade uses an electronic system, the EMDG system, to record and maintain details of applicants, claimed amounts and payments made under the EMDG scheme.74 The EMDG system is located on a standalone technology platform that is independent of the Austrade ICT environment.75 Within the EMDG system are the EMDG claims management system (CMS) and the EMDG risk model, which are central to EMDG operations. The CMS manages the workflow of the EMDG application assessment process, and the risk model identifies the relative risk of individual applications. Since July 2013, the CMS has also included an electronic lodgement system for all EMDG applicants. Previously, Austrade received hard copy applications directly from applicants, with only consultants being able to lodge applications electronically. A high-level overview of the EMDG IT system is illustrated in Figure 3.2.

Figure 3.2: High-level overview of the EMDG system

Source: ANAO analysis of Austrade documentation.

Applying for an EMDG grant

3.10 To apply for an EMDG grant, potential applicants need to ensure that they have an AUSkey76 and are eligible for the EMDG grant. An application is then lodged electronically by completing an online application form and attaching the required documentation. Following registration, applicants and consultants receive an official receipt from the EMDG online application system. The registration process enables the CMS to assign a sequence number to all EMDG applications, to ensure that applications are not misplaced and are considered by Austrade. After registration, the EMDG applications are risk assessed by the risk model and automatically assigned to the relevant EMDG officer.

3.11 The ANAO examined 1699 paper and electronic applications77, constituting 34 per cent of the total population of applications for the 2011–12 and 2012–13 grant years.78 The applications were recorded as they were received. The registration of EMDG applications into the CMS, and the allocation of a registration number was sound.

Introduction of the electronic lodgement system

3.12 To assist applicants and consultants, Austrade established an EMDG hotline to answer queries regarding e-lodgement (introduced in July 2013) during the lodgement period for the 2013–14 financial year (June 2013 to January 2014). The ANAO’s analysis of Austrade’s records showed that of the 837 queries received during the period, at least 90 per cent were technical issues, most of which were addressed on the same day by the EMDG officer answering the query or by referral to another officer. In contrast, around 10 per cent were substantive queries about eligibility to the scheme, generally resolved by internal referral on the same day. The introduction of the CMS electronic lodgement was appropriately managed by Austrade.

Initial checks and key documentation on file

3.13 In addition to completing an EMDG application form, applicants are required to submit relevant documentation and information that includes:

- for first time applicants: financial statements (profit and loss statement and balance sheet for previous GY and the GY for which the applicant wishes to make a claim); information describing the business and product or service (brochure, company profile and other relevant materials); and, if the business made a loss in the GY, information on how the applicant intends to fund his/her future export activities.