Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of the Defence Home Ownership Assistance Scheme

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the administration of the Defence Home Ownership Assistance Scheme by the Department of Defence and the Department of Veterans’ Affairs.

Summary

Introduction

1. Members of the Australian Defence Force (ADF) can access a range of housing and accommodation assistance whilst they serve in the Royal Australian Navy, the Australian Army, and the Royal Australian Air Force. This assistance is provided partly in response to the requirement for ADF members and their families to periodically relocate in order to support Defence capability requirements, and also as an incentive to encourage members to remain in active service. The use of initiatives to encourage the retention of serving military personnel is common around the world; as retaining trained, qualified Defence personnel, particularly in areas requiring specialist skills, is an ongoing challenge for governments worldwide.1

2. The Defence Home Ownership Assistance Scheme (DHOAS, or ‘the scheme’) was established by the Australian Government in July 2008 to support ADF members in owning their own homes, as an alternative to occupying rented or service–provided accommodation. DHOAS has multiple objectives, relating to supporting the retention and recruitment of ADF members, increasing private home ownership, and also to support members’ reintegration into civilian life.

3. DHOAS provides eligible members of the ADF—whether serving as a member of the Permanent Forces or the Reserves—with a monthly subsidy on their home loan interest payments for up to 25 years. The scheme provides progressively higher levels of assistance to members who remain in active service and has mechanisms in place to avoid members being disadvantaged as they move between service types.2 In early 2015, maximum monthly subsidies available to eligible members typically ranged between $238 and $476. DHOAS was allocated funding in the 2007–08 Commonwealth Budget of $864 million over 10 years (to 2016–17). The scheme replaced the Defence Home Ownership Scheme3 ‘with a more attractive package of home loan interest payment subsidies designed to encourage retention.’4 In the six and a half years between the commencement of DHOAS and the end of 2014, a total of $395 million in subsidies has been paid to just over 30 000 ADF members.5

4. Defence offers a range of other housing assistance to ADF members, including the Home Purchase Assistance Scheme, which provides a one-off taxable payment of $16 949 to eligible members to assist them to purchase a home. The Home Purchase or Sale Expenses Allowance is also available to members, and assists with some of the costs involved in selling and buying a home which might arise as the result of being posted to a new location. These two schemes can be accessed by members concurrently with DHOAS, as long as the relevant requirements are met.6

5. In the period in which DHOAS was designed and implemented, Defence was seeking to significantly grow the overall size of the ADF. In 2007, there were approximately 53 000 full-time military personnel in the ADF, with Defence seeking to grow this workforce to around 57 000 over the following decade. To support achievement of this growth, in December 2006 the then Government allocated $1 billion for an initial boost to the number of full time personnel. A further $2.1 billion was allocated in the 2007–08 Commonwealth Budget to improve the ability of the ADF to recruit and retain personnel; DHOAS was one part of this funding.7 Together, these two tranches of funding introduced a number of ADF recruitment and retention initiatives (known collectively as the ‘R2’ initiatives), which included retention bonuses and allowances, remuneration structure reform and range of other initiatives.

6. The Defence Home Ownership Assistance Scheme Act 2008 (the Act) and the associated Defence Home Ownership Assistance Scheme Regulations 2008 (the Regulations) provide the legislative basis for the scheme, and guide its administration. Defence is responsible for overall administration of the scheme’s legislative framework, policy and funding. The Department of Veterans’ Affairs (DVA) was appointed by Defence as the ‘Scheme Administrator’—responsible for day-to-day operations of the scheme, including assessing applications submitted by ADF members and paying subsidies into eligible members’ DHOAS-approved home loan accounts. DVA provides these services on a fixed fee and fee for service basis.

7. An important aspect of the scheme is the provision of approved DHOAS home loans—on terms which are expected to be equal or better than other products on the market (particularly in relation to the interest rates applied to the loans).8 Furthermore, to assist in funding the subsidies provided to members, commissions are paid to the Commonwealth by each of the selected home loan providers for the exclusive right to offer DHOAS home loans. The intention of this was to enable the subsidies to be more generous than they otherwise might have been, through using the bargaining power of a considerable bundle of mortgages to a relatively secure type of borrowers. Three home loan providers were selected by Defence to offer DHOAS loans.

Audit objective and scope

8. The objective of the audit was to assess the effectiveness of the administration of the Defence Home Ownership Assistance Scheme by the Department of Defence and the Department of Veterans’ Affairs.

9. To conclude against the audit objective, the Australian National Audit Office’s (ANAO’s) high level criteria considered whether: the operational arrangements of the scheme were well managed; the treatment of members was fair and equitable and accorded with relevant legislative, policy and other requirements; and the performance of the scheme was effectively measured, monitored and reported.

10. The audit scope included the administration of the scheme since its commencement in July 2008.

Overall conclusion

11. Members of the Australian Defence Force (ADF) are often required to relocate as part of their service in the Royal Australian Navy, Australian Army, or Royal Australian Air Force. As a consequence, members and their families often rely on rented or service-provided accommodation and can face difficulties in purchasing their own home. The Defence Home Ownership Assistance Scheme (DHOAS) was established by the Australian Government in 2008 to support members in owning their own homes, and as an incentive to encourage members to remain in active service. The scheme is one form of housing assistance provided to members, and is additional to lump sum payments and allowances which cover some of a member’s costs associated with buying or selling a home.

12. In line with the expectations of the legislation underpinning DHOAS and scheme policy requirements, the Department of Defence (Defence) has established generally satisfactory arrangements to support the effective administration of DHOAS. These arrangements included the appointment and ongoing oversight of a Scheme Administrator (the Department of Veterans’ Affairs (DVA)); and National Australia Bank Limited, Australian Defence Credit Union Limited and Defence Bank Limited as DHOAS-approved home loan providers. In the six and a half years between the commencement of DHOAS and the end of 2014, over 30 000 ADF members have been paid subsidies under the scheme totalling $395 million.9 Through DHOAS, the Commonwealth has received a total of $53.4 million in commissions (over six years) from the home loan providers.

13. Additionally, while DVA has mainly managed the day-to-day service delivery of the scheme effectively, including assessing applicant eligibility in a timely fashion and appropriately managing subsidy payments, there is scope for both Defence and DVA to streamline the scheme’s delivery and adhere to legislative approval mechanisms, strengthen compliance activities, and improve the measurement of the scheme’s specific impacts. Defence’s oversight of the arrangements encompasses a broad range of activities, including performance standards which aim to encourage DVA and the home loan providers to focus on their key responsibilities. However, other than self-reporting and signed declarations by members, there were no processes to actively confirm member compliance with key scheme requirements. DHOAS compliance activities could be strengthened by a periodic review of the various defence housing assistance provided to members. Further, Defence’s efforts to measure the scheme’s success have been complicated by the scheme’s multiple objectives—relating to matters of retention and recruitment, private home ownership, and reintegration into civilian life. While there are some positive signs that the scheme is addressing its retention objective, a lack of data has impeded Defence’s ability to measure the scheme’s specific impacts, relative cost-effectiveness and by extension, its value for money.

14. The agreements between Defence and the home loan providers are due to reach their maximum term limits in 2017. While the providers have consistently met the large majority of their performance measures, the expiry of the agreements provides Defence with an opportunity to test the market with respect to the loan terms provided to members and the commissions received by the Commonwealth.

15. The ANAO has made three recommendations; two recommendations directed towards Defence and DVA to streamline the scheme’s delivery and adhere to legislative approval mechanisms, and one recommendation directed towards Defence strengthening its monitoring and evaluation of the scheme’s performance.

Key findings by chapter

Chapter 2: Scheme Delivery Arrangements

16. DVA effectively manages the day-to-day delivery of the scheme, including correctly assessing applicant eligibility and appropriately managing subsidy payments. In December 2014, monthly subsidies paid to over 19 000 members had a combined value of $6.38 million. Almost 70 per cent of members were paid at the highest level available under the scheme, and received an average tax-free monthly payment of just over $300. The ANAO’s analysis of over 2000 subsidy transactions and more than 100 eligibility decisions identified very few incidences where errors had occurred.10 However, decisions (including eligibility assessments and commencing subsidies) have not been made by staff delegated to do so under the DHOAS Act. Defence advised that in light of the significant volume of activity undertaken by DVA (including hundreds of eligibility and payment decisions every month), Senior Executive Service-level delegations were considered impractical.11 Amendments to the DHOAS Act to lower delegation levels have been planned for some time, and Defence advised that they may be submitted to Parliament for consideration in 2015, subject to Ministerial and Prime Ministerial agreement. Pending any legislative changes, Defence and DVA should explore opportunities for satisfying the current requirements in a streamlined manner, rather than continuing the current practice.

17. The administration of DHOAS involves the use of a number of manual processes, including data entry and the manual calculation of member’s entitlements. To manage the risks of incorrect decisions associated with its manual processing, DVA reviews at least half of all applications and payments processed and has also implemented a quality assurance program. While this illustrates a strong focus on the quality of decision-making, there is considerable scope for Defence and DVA to achieve efficiencies in the delivery of the scheme. A key area to target for efficiencies include the implementation of an online application system, which could offer better service to members, and significantly reduce manual data entry requirements. Although Defence and DVA have advised they are exploring strategies to identify and implement administrative efficiencies, these strategies are in their formative stages and previous attempts (since 2010) to implement similar strategies have not yet been realised.

Chapter 3: Scheme Oversight Arrangements

18. Defence relies on a broad range of activities to manage the delivery of DHOAS. The performance standards included in the respective agreements encourage DVA and the providers to focus their efforts on key elements of their responsibilities and customer service standards, and positive results have been recorded. Surveys are used to assess the satisfaction of members with the scheme. While the response rates to these surveys are quite low12, satisfaction levels among survey respondents are high, particularly in relation to DVA processes. Requests from members for internal reviews and discretionary decisions have also been handled effectively by Defence and DVA, and the lessons of successful appeals considered (in total, just nine appeals have been made to the Administrative Appeals Tribunal since the scheme’s commencement).

19. While there is a range of information used by Defence to manage the scheme, there is a strong reliance on self-reported information by members, DVA and the home loan providers, with generally limited verification of information by Defence. In particular, members’ compliance with scheme requirements was primarily promoted through various forms of communication to members, and self-reporting and signed declarations by members. In addition, there were no processes to actively confirm member compliance with key DHOAS requirements, such as the 12 month occupancy period and the appropriate use of subsidies. Compliance in relation to members inappropriately accessing multiple housing schemes was assessed by a quarterly ‘occupancy audit’ process. However, the occupancy audit was limited in that it only reviewed compliance at a point in time when members first receive a DHOAS subsidy, whereas members are able to receive DHOAS assistance for up to 25 years. There is accordingly scope to strengthen DHOAS compliance activities. Defence has advised that it will work with DVA to examine opportunities to improve the current approach to compliance with the occupancy requirements under DHOAS.

20. The agreements with the home loan providers and DVA are due to expire in 2017 and 2018, respectively. While both parties have consistently met the terms of their respective agreements, the expiry of the agreements will provide an opportunity for Defence to test the market with respect to the quality and efficiency of the services provided under DHOAS. It will also be an opportunity to confirm that the Commonwealth is getting the best deal possible with respect to the loan terms provided to members and commissions paid by home loan providers to the Commonwealth. In this regard, Defence advised that it intends to undertake an open tender process during 2016 for the selection and appointment of home loan providers for the scheme for the period commencing 1 July 2017.

Chapter 4: Monitoring and Evaluating the Performance of the Scheme

21. DHOAS has multiple objectives; however, the scheme’s specific contributions to these objectives have not been clearly established, complicating Defence’s efforts to measure the scheme’s success. Information on the performance of the scheme is provided in Defence’s Annual Reports to Parliament; nonetheless, performance measures could be improved through the use of benchmarks or targets, where relevant. In relation to the take up of the scheme by members, Defence commonly reports that take up is strong, but provides no comparative target.

22. Defence has made a number of attempts to assess the impact of DHOAS. However, despite positive signs, a lack of data and other challenges have impeded Defence’s ability to measure the scheme’s specific impacts and relative cost-effectiveness. Defence’s attempts have also been largely focussed on assessing the scheme’s impacts on retention, to the detriment of other DHOAS objectives. Accordingly, in order to be in a position to provide advice to government on the success of the scheme in achieving its objectives, the ANAO has recommended that Defence act upon the findings of its previous evaluations to develop and implement a program to regularly capture specific data for monitoring and evaluating the scheme’s performance, including in relation to all of the scheme’s objectives.

Summary of entity responses

Response from the Department of Defence

23. Defence welcomes the ANAO audit report on the Administration of the Defence Home Ownership Assistance Scheme. The ANAO’s findings and recommendations provide opportunities to build upon ongoing activities working towards streamlining the administration of the Defence Home Ownership Assistance Scheme (DHOAS).

24. Defence will work with the Department of Veterans’ Affairs (DVA) to meet the current legislative requirements. An amendment to the DHOAS Act is currently being sought to enable the Secretary to delegate to DVA employees below SES.

25. Defence is working towards capturing ongoing details of the impact of DHOAS on retention within the Australian Defence Force (ADF). The recent ADF Reserve Employment Offer Survey and ADF Employment Offer Survey (for Permanent Force members) form part of the Optimising the Defence Employment Offer Project. Questions on DHOAS have been included in these two surveys and a measure of the importance of DHOAS as a retention measure is expected to be gained from the results. This will be first opportunity to measure the effectiveness of the DHOAS and further opportunities will be sought in future surveys.

Response from the Department of Veterans’ Affairs

26. DVA notes the Department of Defence’s intention to prioritise the appropriate legislative amendment to address [the matter of satisfying legislation requirements]. DVA is also currently designing an interim solution to satisfy the current legislative requirements, which will be implemented by the end of June 2015.

27. DVA has commenced a project that will deliver streamlined processes through implementation of ICT functionality. While this project is dependent on overall departmental priorities and resourcing, it is intended to deliver improvements over a 12 to 18 month period (from July 2015).

Recommendations

The ANAO has made three recommendations; two recommendations directed towards Defence and DVA to streamline the scheme’s delivery and adhere to legislative approval mechanisms, and one recommendation directed towards Defence strengthening its monitoring and evaluation of the scheme’s performance.

|

Recommendation No. 1 Para 2.17 |

To satisfy the requirements of the Defence Home Ownership Assistance Act 2008 in relation to the delegation of decisions, the ANAO recommends that the Department of Defence and Department of Veterans’ explore opportunities for satisfying legislative requirements in a streamlined manner. Defence response: Agreed. DVA response: Agreed. |

|

Recommendation No. 2 Para 2.36 |

In order to improve the efficiency of the day-to-day delivery of the scheme, the ANAO recommends that Department of Defence and Department of Veterans’ Affairs prioritise the consideration and implementation of options to streamline the administration of DHOAS’ delivery. Defence response: Agreed. DVA response: Agreed. |

|

Recommendation No. 3 Para 4.21 |

To better advise government and the Parliament on the success of the scheme in achieving its objectives, the ANAO recommends that the Department of Defence act upon the findings of its previous evaluations of Defence Home Ownership Assistance Scheme to develop and implement a program to regularly capture specific data for monitoring and evaluating the scheme’s performance. Defence response: Agreed. |

1. The Defence Home Ownership Assistance Scheme

This chapter introduces the Defence Home Ownership Assistance Scheme, providing information on eligibility and subsidy amounts, the application and payment processes, and the broader ADF workforce context in which the scheme operates.

Background

1.1 Members of the Australian Defence Force (ADF) and their families are periodically required to relocate in order to support Defence capability requirements. To assist members and to encourage them to remain in active service, the Government offers a range of housing and accommodation assistance while serving in the Royal Australian Navy, the Australian Army, and the Royal Australian Air Force in addition to other conditions. The use of initiatives to encourage the retention of serving military personnel is common around the world; as retaining trained, qualified Defence personnel, particularly in areas requiring specialist skills, is an ongoing challenge for governments worldwide.13

1.2 The Defence Home Ownership Assistance Scheme (DHOAS, or ‘the scheme’) was established by the Australian Government in July 2008. The scheme has multiple objectives, relating to supporting the retention and recruitment of ADF members, increasing private home ownership among members, and also to support their reintegration into civilian life. DHOAS provides eligible members of the ADF—whether serving as a member of the Permanent Forces or the Reserves—with a monthly subsidy on their home loan interest payments, as an alternative to occupying rented or service-provided accommodation. The scheme provides progressively higher levels of assistance to members as an incentive to remain in active service and has mechanisms in place to avoid members being disadvantaged when they move between service types.14

1.3 DHOAS was initially allocated funding in the 2007–08 Commonwealth Budget of $864 million over 10 years (to 2016–17). The scheme replaced the Defence Home Ownership Scheme15 ‘with a more attractive package of home loan interest payment subsidies designed to encourage retention.’16 In the six and a half years between the commencement of DHOAS and the end of 2014, a total of $395 million in subsidies has been paid to just over 30 000 ADF members.

1.4 Defence provides members with access to a range of other forms of home purchase assistance which can be accessed by members concurrently with DHOAS, as long as the relevant requirements are met. For example, the Home Purchase Assistance Scheme provides a one-off taxable payment of $16 949 to eligible ADF members to assist them to purchase a home. The Home Purchase or Sale Expenses Allowance seeks to assist ADF members with some of the costs involved in selling and buying a home which might arise as the result of being posted to a new location.17

Australian Defence Force workforce and retention context

1.5 The Department of Defence’s (Defence’s) recruitment and retention policies aim to manage the size of the ADF within its budgeted strength, and to support the training and recruitment of appropriately skilled personnel to replace departing ADF members. Defence has developed and implemented a wide range of strategies and initiatives to support and monitor the achievement of these goals.18 The 2014–15 ANAO report on Recruitment and Retention of Specialist Skills for Navy provides an overview and examination of the Defence (and Navy) workforce strategies.19

1.6 In 2007, there were approximately 53 000 full-time military personnel in the ADF, and Defence was seeking to grow this workforce to around 57 000 by 2017. To support achievement of this growth, in December 2006 the then Australian Government allocated $1 billion for an initial boost to the number of full time members. A further $2.1 billion was allocated in the 2007–08 Commonwealth Budget to improve the ability of the ADF to recruit and retain personnel; DHOAS was one element of this funding.20 Together, these recruitment and retention initiatives (known collectively as the ‘R2’ initiatives), included the payment to members of retention bonuses and allowances21 and remuneration structure reform.

1.7 The ADF permanent force grew significantly between 2007 and 2011. After reaching an average permanent force strength peak of 59 084 in 2010–11, average permanent force strength trended downwards until January 2014. In 2013–14, Defence had an average strength of 56 364 throughout the year. Similarly, the numbers of reservists grew between 2007 and 2011, to a peak of approximately 22 000 reservists. In 2013–14, 19 741 reservists had undertaken paid service during the year.

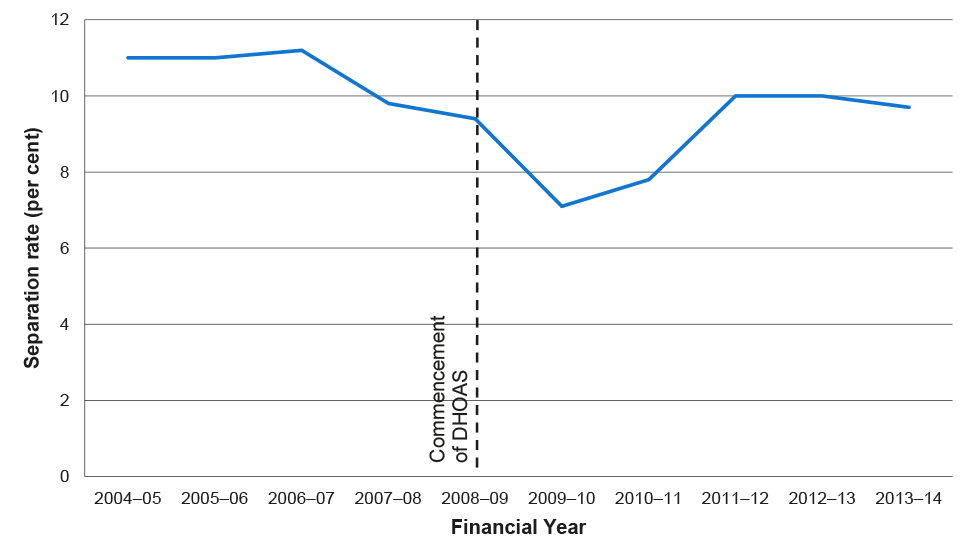

1.8 Defence primarily measures and manages the retention of its personnel through the monitoring of separation rates. The annual rolling separation rates of ADF personnel since 2004–05 are shown in Figure 1.1. As separation rates are heavily influenced by a range of variables including retention activities, financial and labour markets and previous enlistment activity, it is difficult for the department to isolate the individual impact of each variable on annual separation rates. However, initial falls in the separation rate were commonly attributed by Defence to the uncertain global economic conditions experienced at that time, and the introduction of the ‘R2’ retention initiatives (which include DHOAS).22

Figure 1.1: Australian Defence Force ‘12 month rolling’ separation rates

Source: Defence Annual Reports and Final Report of the DHOAS Working Group, 2014.

Governance arrangements

1.9 The Defence Home Ownership Assistance Scheme Act 2008 (the Act) and the associated Defence Home Ownership Assistance Scheme Regulations 2008 (the Regulations) provide the legislative basis for the scheme, and guide its administration. Defence is responsible for overall administration of the scheme’s legislative framework, policy and funding. The Department of Veterans’ Affairs (DVA) was appointed by Defence as the ‘Scheme Administrator’—responsible for the day-to-day operation of the scheme, including assessing applications submitted by ADF members and paying subsidies into eligible members’ DHOAS-approved home loan accounts.23 DVA provides these services on a fixed fee and fee for service basis, underpinned by a Memorandum of Understanding (MOU) between the two departments. Since the commencement of the scheme in 2008 through to 30 June 2014, DVA had been paid almost $29 million for the day-to-day operation of the scheme.

1.10 An important aspect of the scheme is the provision of approved DHOAS home loans—on terms which are expected to be equal or better than other products on the market (particularly in relation to the interest rates applied to the loans).24 Furthermore, to assist in funding the subsidies provided to members, commissions are paid to the Commonwealth by each of the selected home loan providers for the exclusive right to offer DHOAS home loans. The intention of this was to enable the subsidies to be more generous than they otherwise might have been, through using the bargaining power of a considerable bundle of mortgages to a relatively secure type of borrowers. It was originally estimated that commissions payable to the Commonwealth under the scheme would amount to around $170 million over 10 years. Three home loan providers were selected by Defence to offer DHOAS loans.25 As at 30 June 2014, $53.4 million in commissions have been paid by the loan providers. The key DHOAS relationships are shown in Figure 1.2.

Figure 1.2: Key Scheme relationships

Source: ANAO.

Eligibility and subsidy amounts

1.11 To be eligible to receive a subsidy under the scheme, ADF members must have completed specified periods of service. The qualifying periods for entitlement to the scheme are based on the total number of effective service years, either as a permanent member or as a reservist.26 For permanent members, the qualifying period is four years while reservists need to have served for 20 days a year for eight consecutive years.27

1.12 The level of subsidy provided is based on a three-tiered loan limit structure that provides increasing assistance to members the longer they serve. The service periods, subsidised loan limits and maximum monthly subsidy amounts for each of the three tiers, as at December 2014, are shown in Table 1.1. Actual subsidy amounts may fluctuate depending on market factors: interest rates are adjusted each month in accordance with the median interest rate of all Australian home lenders28; and the tiered loan limits, the maximum portion of the home loan that attracts the subsidy, are reviewed annually to reflect changes in Australian house prices.29

Table 1.1: Service periods, loan limits and monthly subsidies, by tier (as at December 2014)

|

Subsidy tier |

Qualifying period (permanent) |

Qualifying period (reserves) |

Subsidised loan limit |

Maximum monthly subsidy |

|

1 |

4 years |

8 years |

$231 794 |

Up to $238 |

|

2 |

8 years |

12 years |

$347 692 |

Up to $357 |

|

3 |

12 years |

16 years |

$463 589 |

Up to $476 |

Source: DHOAS website, available from <http://www.dhoas.gov.au/service-milestones-and-subsidy-tier-level.html> [accessed 10 December 2014].

1.13 The number of months that ADF members can receive the subsidy depends on the amount of ‘service credit’ that they have accrued. In general, the amount of service credit is equal to their total years of ADF service minus the qualifying period and minus any subsidies already provided under DHOAS or its predecessor schemes. Completion of ‘warlike service’30 extends the amount of service credit—for example, members who complete more than nine months of warlike service accrue an additional five years of DHOAS service credit. The maximum period of time that DHOAS assistance can be received without completion of warlike service is 20 years. Completion of warlike service may extend this maximum time to up to 25 years.

1.14 Subsidies continue to be paid as long as a service credit exists, and where members continue to meet the conditions of the scheme. If members separate from the ADF, they can access any remaining entitlement not used prior to their separation. However, subsidies to separated members are paid at Tier 1 levels, unless the member has served in the ADF for more than 20 years (in which case the member is entitled to subsidies at Tier 3 levels). Separation from the ADF also means that the member can only access subsidies for one further home loan, where they make an application within two years of their separation.

1.15 There is also provision for members who had not previously purchased a home while serving in the ADF to be paid accrued subsidy amounts in a one-off lump sum. Lump sums of up to 48 months of subsidy (where sufficient service credit has been accrued) are paid at Tier 1 subsidy levels. Lump sums are paid only after a loan has been drawn down. Subsidies may also be paid to members who are constructing a new home, or who a renovating their home.

Application and payment processes

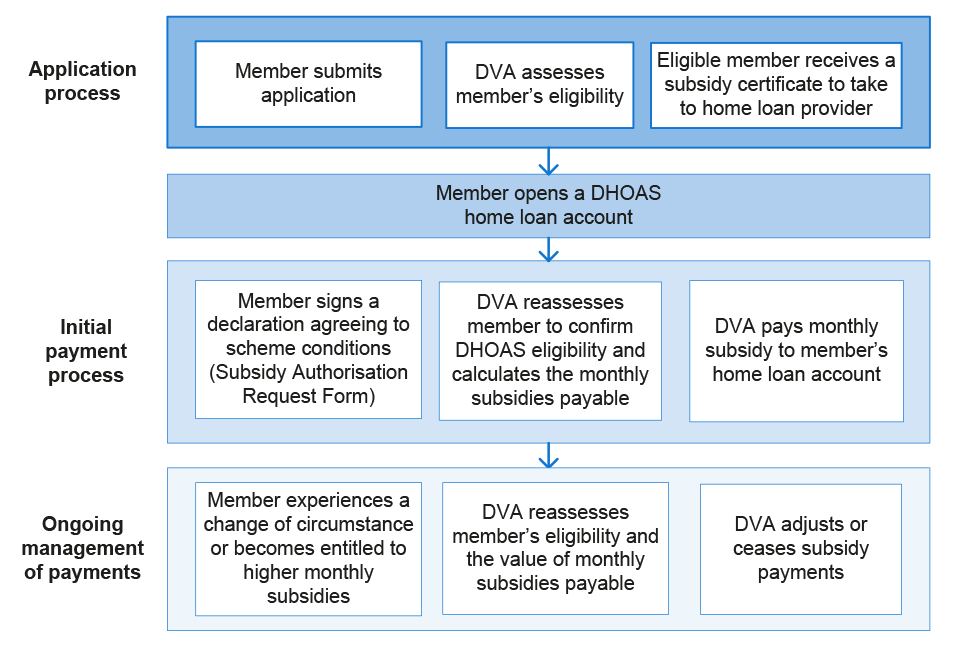

1.16 ADF members can submit an application for DHOAS assistance to DVA via email, post or fax. The application is assessed by DVA to determine the member’s eligibility for a subsidy certificate.31 If they are deemed eligible, members take the certificate to one of the three nominated home loan providers for the scheme—the National Australia Bank Limited, the Australian Defence Credit Union Limited and the Defence Bank Limited.

1.17 Once a DHOAS-approved home loan is drawn down, the loan provider advises DVA of the loan balance and account number so that the subsidy entitlement for the member can be calculated and paid by DVA. At this time the applicant must complete a Subsidy Authorisation Request Form, declaring to DVA that they intend to meet the conditions of the scheme. Conditions include the requirement that DHOAS loans can only be used for buying, constructing a home, or renovating or extending an existing dwelling, and the requirement that members occupy the home for 12 months. At start of each month, DVA pays the subsidy amount into the member’s nominated DHOAS home loan account.

1.18 Each month, DVA is responsible for the ongoing management of subsidy payments, including managing a number of events which may change subsidy amounts or cease payment of subsidies. These include any changes to monthly median interest rates; home loan accounts being paid out, or a member’s service credits being expended. In the case of the death of ADF members in receipt of DHOAS subsidies, there are provisions for surviving partners to continue to receive subsidies.

The audit

Audit objective, criteria and scope

1.19 The objective of the audit was to assess the effectiveness of the administration of the Defence Home Ownership Assistance Scheme by the Department of Defence and the Department of Veterans’ Affairs.

1.20 To conclude against the audit objective, the ANAO’s high level criteria considered whether: the operational arrangements of the scheme were well managed; the treatment of members was fair and equitable and accorded with relevant legislative, policy and other requirements; and the performance of the scheme was effectively measured, monitored and reported.

1.21 The audit examined the administration of the scheme since its implementation in 2008. DVA also provides administrative services to Defence for the scheme which preceded DHOAS—the Defence Home Owner Scheme. As that scheme is now largely closed to new applicants, it was not included in the scope of this audit.

Audit methodology

1.22 Fieldwork was conducted in Defence and DVA’s national offices, as well as DVA’s Brisbane office, between September and December 2014, and involved:

- interviews with relevant Defence and DVA staff and each of the three home loan providers;

- examining relevant Defence and DVA documentation, including a sample of DVA’s records for 105 members who had applied for DHOAS subsidies; and

- analysis of DHOAS data and information, including to gain insight into the volumes of DHOAS activities being undertaken by DVA and Defence.

1.23 The audit was undertaken in accordance with the ANAO’s auditing standards, at a cost of $529 674.

Report Structure

1.24 The remainder of the report consists of:

|

Chapter Title |

Description |

|

2. Scheme Delivery Arrangements |

Examines the processes for assessing the eligibility of ADF members and managing subsidy payments, including commencing the payment of subsidies and adjusting subsidies as required. |

|

3. Scheme Oversight Arrangements |

Examines the effectiveness of the mechanisms used by Defence to manage the delivery of the scheme in accordance with legislative and other requirements. The mechanisms used by Defence to monitor the quality of service to ADF members, and the performance of DVA and the home loan providers, are also examined. |

|

4. Monitoring and Evaluating the Performance of the Scheme |

Examines Defence’s monitoring and evaluation of the performance of the scheme, including assessing whether: DHOAS costs and performance are monitored and reported; and the effectiveness and efficiency of the scheme is measured. |

2. Scheme Delivery Arrangements

This chapter examines the processes for assessing the eligibility of ADF members and managing subsidy payments, including commencing the payment of subsidies and adjusting subsidies as required.

Introduction

2.1 As a scheme established to support ADF members in purchasing their own home and which can pay members for up to 25 years, the accurate eligibility assessment of applicants is a priority. A further priority is the need to ensure that the amount paid—both initially and then as member’s circumstances change—is correct and in keeping with DHOAS legislation. It is also important that eligibility assessments and payments are made in a timely fashion, so as to avoid members missing out on purchasing a property, or defaulting on their home loan. This chapter examines the performance of DVA as Scheme Administrator, against these priorities.

Scheme activity

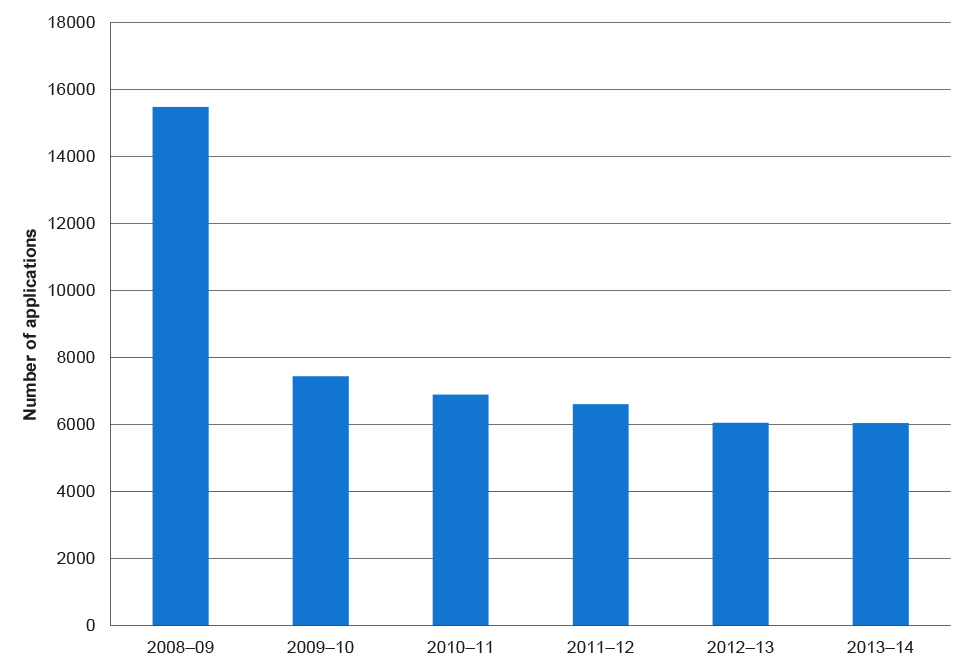

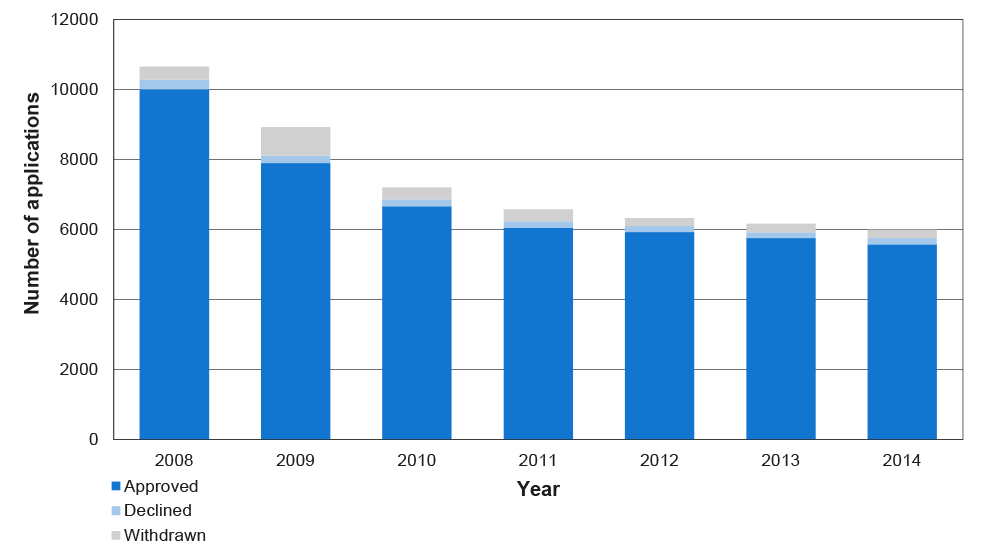

2.2 At the time DHOAS was designed and implemented, Defence was seeking to significantly grow the overall size of the ADF. As noted in paragraph 1.3, DHOAS replaced the former home loan subsidy scheme (the Defence Home Owner Scheme), and is more generous, providing higher levels of subsidies to members that remain in active service. From the commencement of the scheme in July 2008 through to the end of December 2014 a total of 51 650 applications for a DHOAS subsidy were received. Of these, more than 15 000 applications were received in the first year of the scheme (with 11 000 of those received in the first six months), however, this level has since decreased to around 6000 new applications each year. The total number of applications received is shown in Figure 2.1.

Figure 2.1: Total number of applications received each financial year, July 2008 to June 2014

Source: ANAO analysis of Department of Veterans’ Affairs data.

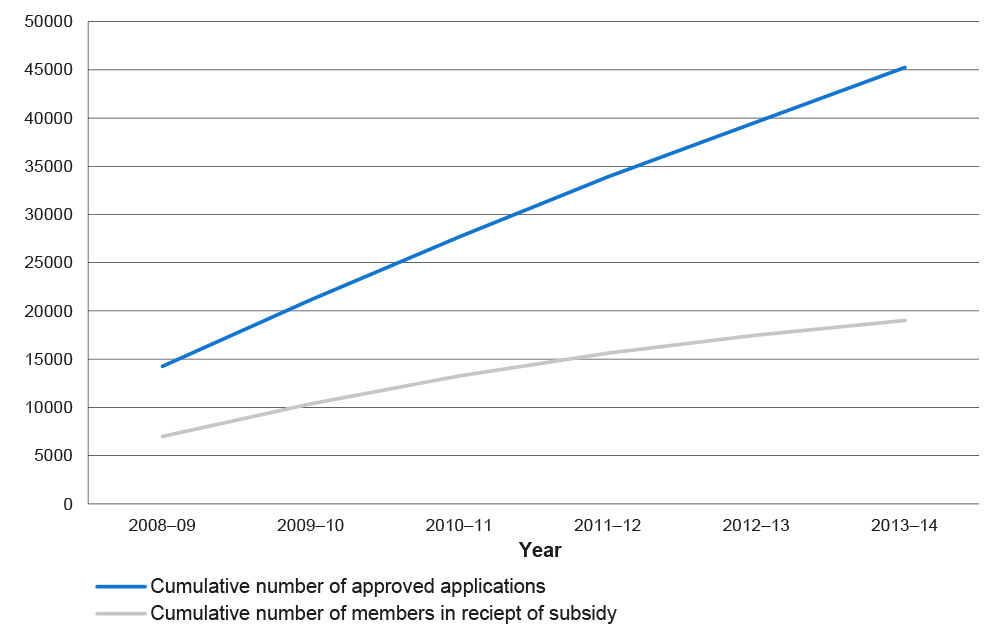

2.3 Not all members who apply for and are found to be eligible for the scheme go on to take up a DHOAS home loan. The reasons for this are varied. Some members may not qualify for a home loan, others may initially test their eligibility for the Scheme, however as eligibility only remains valid for 12 months, may need to re-test their eligibility at a later date. The relationship between overall applications approved and DHOAS loan take up is shown in Figure 2.2.

Figure 2.2: Cumulative numbers of approved applications and the take up of loans by members, July 2008 to December 2014

Source: ANAO, from Department of Defence, Annual Report 2012–13, p. 82, and Annual Report 2013–14, p. 74.

Defence Home Ownership Assistance Scheme day-to-day operations

2.4 To manage the day-to-day operations of DHOAS, DVA assesses ADF members’ eligibility for the scheme, issues subsidy certificates and pays subsidies to members’ where they take up a loan. In addition, DVA adjusts the subsidies when changes occur, including in response to fluctuations in home loan interest rates or when the level of entitlement for an individual member changes. To perform these functions DVA works closely with Defence to make sure that activity is in keeping with legislation and the scheme’s policy intent. DVA also works closely with the three DHOAS home loan providers to obtain the data required to accurately pay subsidies to members, and to determine the commissions payable by providers. A simplified overview of the day-to-day processes is provided in Figure 2.3.

Figure 2.3: Overview of Defence Home Ownership Assistance Scheme application and subsidy processes

Source: ANAO.

2.5 Defence, DVA and the home loan providers jointly contribute to the promotion of DHOAS. Key promotional activities include: maintaining the DHOAS website; providing information to ADF members via phone or email; and loan providers presenting to members on Defence bases.32 The DHOAS website in particular provides a variety of information on the Scheme. Forms (such as the application), fact sheets, a subsidy calculator, and contact methods are provided on the website; as well as links to the approved home loan providers’ websites.

Assessing applications

2.6 For a member to be deemed eligible for DHOAS, DVA must confirm that the member has completed sufficient effective service to meet the applicable qualifying period. Together, the Act and associated Regulations prescribe a range of requirements for DVA to consider when determining whether a member has achieved the relevant qualifying period. These requirements include those which:

- define ‘effective service’ for different types of members33, particularly for permanent members and reservists;34

- prescribe the treatment of ‘combined service members’―for example, members who have performed both permanent and reserve service35; and

- prescribe the treatment of ‘rejoining members’―members who have returned to effective service after having been ‘ineffective’ for 12 months or more, or who had been formally discharged.36

2.7 DVA must also take into account changes to DHOAS policies or processes when they occur. Some of the changes which have occurred over the life of the scheme have included: legislative amendments 37; changes in operational policies; and changes to DHOAS processes.

2.8 To determine eligibility, DVA assessors draw the member’s service records38 and enter the relevant information into manual calculation sheets which assist in identifying and applying relevant legislative and policy requirements. Service periods are counted by entering various start and end dates of effective service in an Internet date calculator39, and the eligibility decision is entered into the DHOAS IT system. Assessors must also enter new member details into the system and any correspondence with the member (including names, rank, contact methods, addresses and partner links).

2.9 The majority of members who apply for DHOAS have their applications for subsidies approved. Since the commencement of the scheme, 92 per cent of DHOAS applications received have been approved, with only three per cent declined and five per cent withdrawn for administrative reasons or at the request of the member. The trends in DHOAS application decisions since 2008 are shown in Figure 2.4.

Figure 2.4: Proportion of Scheme applications approved, declined or withdrawn, since July 2008

Source: ANAO analysis of Department of Veterans’ Affairs data.

Assessing eligibility for the Scheme

2.10 The accurate assessment of a member’s application is important in ensuring that members are not disadvantaged by being incorrectly assessed as ineligible for DHOAS. Accurate processing of applicants contributes to greater efficiency by reducing costs associated with reviews, rework and the pursuit of debts in cases of overpayment.

2.11 A concern in relation to DVA’s eligibility assessments is the reliance on manual processes and the associated risk of error. Highlighting this risk, between May 2013 and February 2015, errors in manual recording and entering mail or email addresses resulted in 83 potential privacy breaches. The breaches occurred despite DVA having in place a privacy management plan for DHOAS. 40DVA had recorded that at least half of these were unlikely to have resulted in an actual breach of privacy—either an email was not delivered, or mail was returned unopened.

2.12 Interviews with DVA staff and managers involved with processing DHOAS applications, indicated a high-level of awareness of the importance of accuracy of eligibility determinations and subsidy payments, and the avoidance of privacy breaches. DVA has a multistage approach to providing assurance over payment accuracy, in recognition of the increased risk of error associated the complexity of eligibility assessments and the level of manual processing which occurs for each assessment. As a first step the assurance approach includes the documentation of eligibility decisions, all calculations and any client contact, and review of (at least half but in some cases all) assessment decisions made, by a reviewer. The frequency of reviews depends on whether the assessor is deemed to be ‘accredited’ on the basis of a high level of accuracy in their previous decisions.41

2.13 In addition DVA has a quality assurance program in place which focuses on the core administration tasks of the scheme: assessing applications; payment accuracy; processing income emails; and processing change events (details of the quality assurance program are at paragraphs 2.28 to 2.30). DVA also conducts the annual reserve audit which focuses on the eligibility of reservists with the requirement to complete at least 20 days of effective service to accrue one year of service credit (details of the reserve audit are discussed at paragraphs 2.31 to 2.32).

2.14 The ANAO’s examination of a sample of 105 applications to determine if DVA had accurately drawn on member service records42 and correctly determined the member’s eligibility43, found that DVA had generally assessed eligibility in accordance with the applicable legislative and policy requirements. However, a number of decisions, including the provision of subsidy certificates, had not been made by decision-makers appropriately delegated to do so.

2.15 The Act provides for the delegation of certain powers of the Secretary of Defence (including the provision of subsidy certificates and the payment of subsidies) to Senior Executive Service employees of both Defence and DVA. 44Defence advised that in light of the very high volume of DHOAS applications (over 15 000 applications were received and processed in the scheme’s first year and about 500 subsidy applications are now regularly received by DVA per month), the delegation levels were impractical. Legislative amendments to lower the delegation levels have been planned for some time (refer to paragraph 3.24 for a list of proposed amendments). However, in early 2015, these amendments were still in development.

2.16 To satisfy the requirements of the Act in relation to the delegation of decisions, Defence and DVA should explore opportunities for satisfying the legislative requirements in a streamlined manner. Defence and DVA should also consider any legal and reporting implications of the current arrangements.

Recommendation No.1

2.17 To satisfy the requirements of the Defence Home Ownership Assistance Act 2008 in relation to the delegation of decisions, the ANAO recommends that the Department of Defence and Department of Veterans’ explore opportunities for satisfying legislative requirements in a streamlined manner.

Defence response:

2.18 Agreed.

DVA response:

2.19 Agreed. DVA notes the Department of Defence’s intention to prioritise the appropriate legislative amendment to address this matter. DVA is also currently designing an interim solution to satisfy the current legislative requirements, which will be implemented by the end of June 2015.

2.20 The ANAO’s examination of the sample also highlighted a number of issues DVA commonly encountered that complicate the processing of applications. These issues related to the lack of service history documentation for some members, or discrepancies within a member’s set of service history documentation; the impacts of changes in policy and processes over time; and challenges in interpreting or applying some legislative requirements.45

2.21 In the ANAO’s sample, it was relatively common for DVA to encounter challenges in accessing comprehensive and consistent service history records from Defence.46 Until January 2010, eligibility assessments required the consideration of service information provided by the member and signed off by their Commanding Officer. After January 2010, members were still required to provide their service details, but were also required to substantiate these details with formal documentation. While the use of formal records likely improved the overall accuracy of eligibility assessments, there were occasions where discrepancies in different service history documentation arose, and DVA was required to contact the member for further documentation and/or make judgements about what documentation was most reliable.

Timeliness of assessments

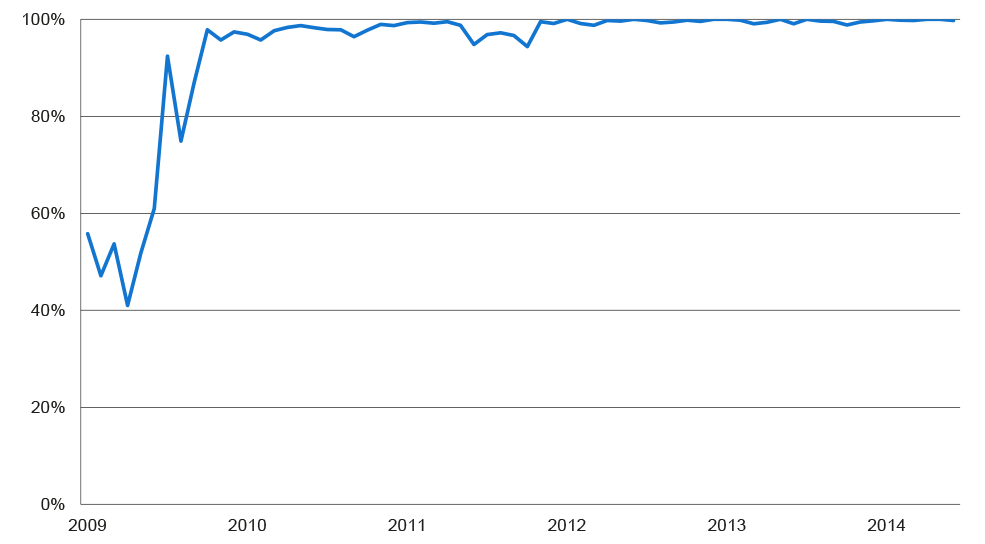

2.22 DVA is required to process at least 95 per cent of applications within five days of receipt (not including any days during which DVA waits for members to provide any outstanding documentation). DVA’s success in meeting the timeframe was initially mixed due to higher than anticipated numbers of applications, but since mid–2009 DVA has consistently met the target (as shown in Figure 2.5).

Figure 2.5: Percentage of applications processed on time, January 2009 to December 2014

Source: ANAO analysis.

Note: Figures for 2008 were not included because DVA advised that during 2008 it measured the indicator in a different manner, which it considers to be less accurate. In March 2011, the target processing timeframe was increased from two to five working days (see Table 3.2).

2.23 The majority of the applications reviewed by the ANAO were processed in a timely manner, although slightly below the timeframes reported more broadly by DVA―of the 105 members, 87 (or 83 per cent) had an application that was processed within DVA’s target of five business days.47

Managing subsidy payments

2.24 In addition to determining member eligibility, DVA also managed the ongoing payment of subsidies—generally members’ subsidies will change over time including due to fluctuations in interest rates. Subsidies may also be affected by changes in individual’s circumstances including when a member experiences changes in service (such as transfers between permanent and reserve service); changes in personal circumstances (such as separation from partner); or when a member’s scheme entitlement is due to change because of a tier progression or exhaustion of service credit. In certain circumstances, members may have options available to them in relation to the calculation of their subsidy payments and when subsidy payments will commence. Options include:

- converting up to 48 months of service credit into a single lump sum payment. To access a lump sum, the member must not have owned a home while serving in the ADF.48 By the end of 2014, over 4000 members have been paid a lump sum;

- electing to use more than one member’s DHOAS entitlements simultaneously. Two DHOAS-eligible borrowers (married or partnered) who share a loan and use their entitlements simultaneously may receive larger subsidy payments. However in some circumstances, there is no financial advantage in doing so; and

- a construction loan, allowing members to progressively increase their loan in line with construction expenses (within a two year period), or elect to commence subsidies after construction is completed.

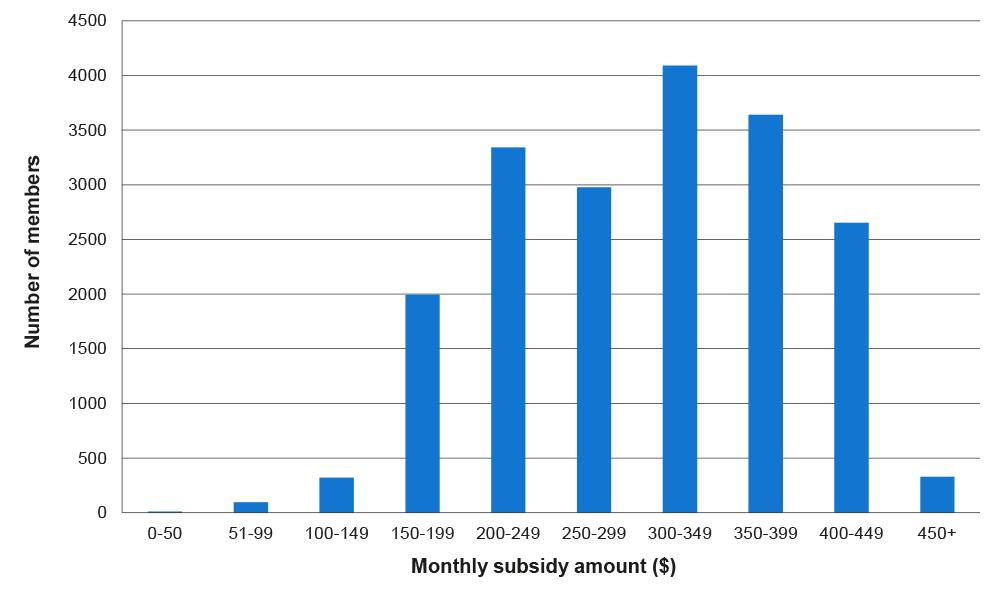

2.25 The total value of monthly subsidies paid to members under the scheme grew in the first four years of the scheme, and then steadied after the 2011–12 financial year.49 In December 2014 for example, DVA paid subsidies worth a total of $6.38 million to the DHOAS home loan accounts of more than 19 400 members. The regular monthly subsidy amounts paid to members in that month (ranged from a minimum regular subsidy amount of $20 to a maximum of $470), are shown in Figure 2.6.50 The average subsidy was just over $300, and almost 70 per cent of members were being paid at the highest tier level (Tier 3).

Figure 2.6: Regular monthly subsidy amounts paid to members, December 2014

Source: ANAO, from Department of Veterans’ Affairs data.

2.26 When a member experiences a change event, DVA assesses whether the subsidy parameters used to calculate the member’s subsidy amounts need to be adjusted.51 In 2014, DVA reviewed over 3000 change events experienced by members. Timely identification of events which may cease a member’s subsidy is important because the DHOAS Act requires DVA to recover overpayments. Examples of events which may cause subsidies to cease are full repayment, closure or refinance of a DHOAS home loan, or the sale of the subsidised property. Members that experience an event that ceases their subsidies are required to apply for a new subsidy certificate in order to have their subsidy payments recommenced. If a member separates from the ADF, the member is only eligible to apply for a final subsidy certificate.

ANAO sample findings—managing payments (initial and ongoing)

2.27 Within the ANAO’s sample, 76 of the 105 members had received DHOAS subsidies and more than 2000 payments had been made to these members, including 13 lump sum payments, between July 2008 and September 2014. Overall, the ANAO found that in all but a few cases DVA had accurately calculated members’ initial subsidies, and had appropriately adjusted ongoing subsidies, as required.52 Similar to the processing of applications (see paragraph 2.14), a number of key decisions in the day-to-day administration of DHOAS had not been made by decision-makers appropriately delegated to do so. These include the decisions to commence and adjust subsidies, make lump sum payments, and cease the payment of subsidies.

Quality Assurance

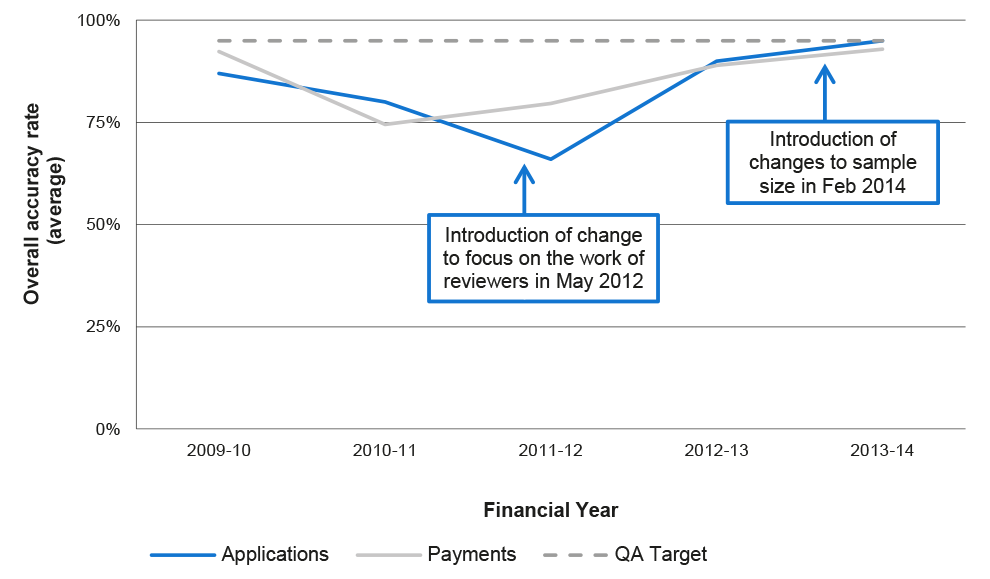

2.28 Quality assurance (QA) systems provide systematic processes for the monitoring of standards and provision of feedback for improvements in the administration of a scheme.53 The current54 DHOAS QA program focuses on the core administrative tasks of the scheme: assessing applications; payment accuracy; processing incoming emails; and processing change events. The QA program is based on a monthly random sample of tasks completed by reviewers.55

2.29 DVA prepares monthly and quarterly reports which detail the findings from the QA program. The average results of the QA program with respect to the accuracy of application and payment processing between 2009–10 to 2013–14, are shown in Figure 2.7. Accuracy rates have been consistently high over the last two financial years, and are meeting, or close to, their respective targets.

Figure 2.7: Average quality assurance results for application and payments processing, 2009–10 to 2013–14

Source: ANAO analysis of Department of Veterans’ Affairs quality assurance spreadsheets.

2.30 DVA advised that it uses the results of the QA process to improve its decision-making. Individual errors identified by the QA process are generally sent back to the relevant reviewer for resolution. More common issues are highlighted with assessors and reviewers in staff guidance and technical training. The ANAO observed instances where certain issues arose as part of QA results, which were then targeted in staff training and guidance, with improvements made in subsequent QA results.

Annual Reserve audit

2.31 Reservists typically must complete at least 20 days of effective service within a financial year to accrue one year of service credit (see paragraph 2.6).56 DVA conducts an ‘annual reserve audit’ to identify members who have not met this requirement, and raise any resulting overpayments.57 The annual reserve audit (costing approximately $63 000 in 2013–1458) requires the examination of records of thousands of reserve members, many of whom may need to be contacted by DVA for further information. DVA identifies reservists at risk of overpayment and advises those members of the situation. Members can then elect to have their subsidy payments immediately reduced to Tier 1 levels if they believe they will not complete sufficient service by the end of the financial year.

2.32 In 2013–14, over 7000 reservists were receiving subsidies under DHOAS. Of these, 1150 members required closer examination as part of the annual reserve audit (as they were recorded in DVA systems as receiving subsidies at a rate other than Tier 1, had served for less than 20 years, and had not yet served 20 days in that year). The annual reserve audit identified a total of 188 members who had been potentially overpaid for one or more months of the financial year. Of these, 32 were subsequently granted an exemption by Defence from completing effective service on the basis of exceptional circumstances.59 Overpayments in 2013–14 totalled approximately $190 000. As at December 2014, over $185 000 had been recovered from members.

Achieving efficiencies in the delivery of the scheme

2.33 As noted in paragraph 2.11, the manual processing of applications and management of payments requires a high level of review and quality assurance to mitigate the risks of human error. The ANAO’s observed DVA collating information from separate databases and reports, to assess and review each members’ eligibility and payment levels the scheme. For example, each time DVA performs an assessment or review of eligibility or payment amounts; three separate databases may need to be searched to check members’ previous subsidy payment history.60 Previous subsidy payments from each database are calculated differently and there are instances where DVA must manually check each subsidy transaction to calculate members’ subsidy payment history. Many members who apply for DHOAS have previously received assistance under the scheme, or its predecessor schemes.61

2.34 As such, there is scope for Defence and DVA to work together to identify and achieve efficiencies in the day-to-day administration of the scheme. Key areas to target for efficiencies include the implementation of an online application system, which could offer better service to members and significantly reduce data entry, and increased automation in the provision of members’ service history information and the generation of letters. Further automation in the calculation of members’ eligibility and service credit may also be possible; however, this may require further legislative amendments to simplify certain DHOAS parameters.

2.35 Defence and DVA advised that they are continuing to explore options to achieve greater administrative efficiencies, including an online application system. Defence and DVA has explored a number of proposed options to improve the administrative efficiency of the scheme since 2010, however most62 have not yet been realised, and the current options are in their formative stages. Accordingly, the ANAO recommends Defence and DVA prioritise the consideration and implementation of options to achieve administrative efficiencies in the delivery of DHOAS, and inform any future developments of the scheme. Such consideration would necessarily include the potential upfront costs of any changes against the expected longer-term benefits.

Recommendation No.2

2.36 In order to improve the efficiency of the day-to-day delivery of the scheme, the ANAO recommends that Department of Defence and Department of Veterans’ Affairs prioritise the consideration and implementation of options to streamline the administration of DHOAS’ delivery.

Defence response:

2.37 Agreed.

DVA response:

2.38 Agreed. DVA has commenced a project that will deliver streamlined processes through implementation of ICT functionality. While this project is dependent on overall departmental priorities and resourcing, it is intended to deliver improvements over a 12 to 18 month period (from July 2015).

Conclusion

2.39 In the six and a half years between the commencement of DHOAS and the end of 2014, over 30 000 ADF members have been paid subsidies under the scheme totalling $395 million.63 As Scheme Administrator, DVA is responsible for the day-to-day operations of DHOAS, including assessing eligibility for the scheme and paying subsidies into home loan accounts. DVA has adjusted subsidies when changes occurred including in response to fluctuations in interest rates or when a member’s entitlement changed. Overall, DVA has generally managed these operations effectively. The ANAO’s analysis of over 2000 monthly subsidy transactions and more than 100 eligibility decisions identified very few incidences where only minor errors had been made by DVA.

2.40 Decisions (including eligibility assessments and commencing subsidies), however, have not been made by staff delegated to do so under the Act. Defence advised that in light of the significant volume of activity undertaken by DVA, Senior Executive Service-level delegations were considered impractical. While amendments to the DHOAS Act to lower delegation levels have been planned for some time, Defence and DVA should explore opportunities for satisfying the legislative requirements in a streamlined manner.

2.41 DVA’s processing of applications and payments for DHOAS relies on manual data entry and calculation of member entitlements. While DVA has in place checks to ensure accuracy, reviewing around half of all applications and payments processed and also implementing a quality assurance program, there is significant scope for Defence and DVA to work together to identify and achieve operational efficiencies. An online application system could offer better service to members, and significantly reduce data entry. In addition, increased automation in the provision of members’ service history information and the generation of letters would improve operational efficiency. Further automation in the calculation of members’ eligibility and service credit may also be possible; however, this may require legislative amendments to simplify certain DHOAS parameters. Although Defence and DVA have advised they are exploring strategies to identify and implement administrative efficiencies, these strategies are in their formative stages and previous attempts (since 2010) to implement similar strategies have not yet been realised.

3. Scheme Oversight Arrangements

This chapter examines the effectiveness of the mechanisms used by Defence to manage the delivery of the scheme in accordance with legislative and other requirements. The mechanisms used by Defence to monitor the quality of service to ADF members, and the performance of DVA and the home loan providers, are also examined.

Introduction

3.1 Initiatives that involve the delivery of services by outside parties can increase the complexity of program management. Generally entities will rely on a broad range of activities to oversight program delivery including mechanisms to encourage service providers to focus their efforts on key elements of their responsibilities and customer service standards. For schemes such as DHOAS, effective communication between relevant parties can contribute to the efficiency of scheme’s operations in accordance with legislative and other relevant requirements. This chapter examines the mechanisms used by Defence to monitor the quality of service to ADF members, and the performance of DVA and the home loan providers.

Quality of service to Australian Defence Force members

3.2 Defence has in place as part of the Memorandum of Understanding (MOU) with DVA and the Deeds of Agreement with the loan providers, a number of avenues to obtain feedback on the efficiency and effectiveness of delivery of DHOAS to members. These include: a monthly satisfaction survey; a complaints handling processes; internal review and appeals processes; and monitoring of non-compliance.

The monthly satisfaction survey

3.3 Under the MOU, DVA is required to survey every three months the satisfaction of a sample of members (who have received their initial DHOAS subsidy payment); regarding the level of service members have received from DVA and their home loan provider. While DVA effectively conducts the survey as a census (all members who started receiving subsidies in the preceding quarter), the response rate to the survey is low—typically between 20 and 25 per cent (approximately 170 to 220 members, each quarter).64 Acknowledging the low response rate, the survey has consistently recorded (since the commencement of the scheme), high satisfaction levels with the service delivery provided by DVA. For example, in each of the four quarters of 2013–14, more than 80 per cent of members who responded to the survey (and mostly around 95 per cent) were satisfied with DVA’s customer service, the timeliness of response, and its handling of any complaints.

3.4 Similarly, satisfaction levels with the service provided by the loan providers have been generally good since the commencement of the scheme (typically around 80 per cent of respondents, although occasionally falling to around 60 per cent); however, one of the providers has commonly recorded lower levels of client satisfaction. Where concerns were raised about the performance of providers, they typically related to the timeliness65 of the processing of loan applications, or dissatisfaction with the customer service provided by during the loan application process. DVA provides a summary of the results of the monthly survey to Defence in a quarterly report which summarises the satisfaction survey results for DVA and the loan providers. Each of the providers also receives an individual quarterly report of their results including any related comments.66

Handling complaints

3.5 Under the MOU, DVA is required to record and handle all complaints received from ADF members in relation to DHOAS. Historically, the number of complaints recorded by DVA has been very low. In the 2012–13 financial year there were 11 recorded complaints, and in 2013–14 there were seven complaints recorded.67 However, the number of members who provided feedback on the quality of DVA’s handling of complaints in satisfaction surveys totalled 170 over the period.68 While the large majority of these respondents indicated that they were satisfied with DVA’s handling of their complaint, the discrepancy suggests that the number of complaints about DHOAS may be under-recorded. DVA advised that it has recorded all complaints from members about its role as Scheme Administrator and Defence has advised that it is satisfied that DVA is correctly recording DHOAS complaints. However, to obtain broader perspective it would be useful to record all member complaints, including those which relate to the home loan providers or DHOAS policies.

3.6 DVA’s management of complaints and other feedback was the focus of a previous ANAO audit (ANAO Audit Report No.32 2011–12 Management of Complaints and Other Feedback by the Department of Veterans’ Affairs. The audit included a recommendation that DVA implement arrangements to assess the under-recording of complaints and other feedback.69 In light of the size of the potential discrepancy in the number of formal complaints recorded and the number of members who suggest they may have made a DHOAS complaint, it would be prudent for DVA to consider the applicability of the previous audit’s findings and suggestions, in the context of DHOAS.

Internal reviews, appeals and other decisions made by Defence

3.7 The DHOAS Act provides for members to request a review of a decision relating to their eligibility for the scheme or the subsidy amount.70 If a member remains dissatisfied with the result of an internal review, they may then appeal the decision to the Administrative Appeals Tribunal (AAT). There are also certain decisions for which Defence and DVA are given limited discretion under the Act to waive or override legislative requirements. These include the discretion to waive the requirements for using a subsidy certificate within two years if the member has a medical condition that precluded them from meeting the requirement, to reduce the occupancy requirement under certain exceptional circumstances and to reduce the requirement for reservists to complete effective service, in exceptional circumstances.

3.8 The numbers of internal reviews, AAT appeals, and requests for discretionary decisions received under the scheme, each financial year since June 2008, are provided in Table 3.1.

Table 3.1: Numbers of internal reviews, appeals and discretionary decisions, since June 2008

|

Financial year |

Requests for Internal reviews |

Appeals to the AAT |

Requests for discretionary decisions |

|

2008–09 |

96 |

0 |

156 |

|

2009–10 |

67 |

1 |

99 |

|

2010–11 |

83 |

3 |

124 |

|

2011–12 |

72 |

2 |

172 |

|

2012–13 |

46 |

2 |

119 |

|

2013–14 |

40 |

1 |

116 |

|

Total |

404 |

9 |

786 |

Source: Department of Veterans’ Affairs.

3.9 The ANAO reviewed a sample of reviews and found that the most common issues that resulted in members seeking internal reviews included requests to reconsider:

- decisions to recalculate/reduce subsidy tier level;

- ineligibility due to a break in service;

- decisions to recover subsidy payments for ineffective reserve service;

- ineligibility due to the receipt of previous housing subsidies;

- calculations of the member’s length of service; and

- the annual requirement for 20 days of reserve service.

3.10 While requests from members for internal reviews are recorded and tracked by DVA, the aggregate results of individual requests have not been collated and analysed. As such, Defence is not in a position to readily monitor the nature of requests for internal reviews or the particular drivers around trends in the review activity (for example, fewer numbers of requests from members for internal reviews have been experienced in more recent years). The reduction in the number of requests for internal reviews may indicate that DHOAS requirements have settled and become better understood over time. In addition, DVA’s decision-making in respect of DHOAS may have improved over time. With respect to discretionary decisions, there were 16 requests for a discretionary decision to be made from members in the ANAO’s sample. In all cases, DVA had documented the evidence used to assess member requests including correspondence with members, medical reports or formal advice from Defence, and the reasons for approval or rejection of requests.

3.11 Since the inception of the scheme in July 2008, there have been a total of nine completed appeals through the AAT. Specific topics of appeals included:

- ineffective reserve service resulting in status as a separated member;

- failure to use the last subsidy certificate issued following separation from the ADF;

- occupancy requirements following the completion of the construction of a house; and

- the definition of a ‘separated member’ under the Act.

3.12 DVA has generally considered the implications of the issues being appealed. Legal advice has been sought, and DVA and Defence have considered the need for adjustments to policy or processes, where relevant. A number of the legislative amendments recommended by the 2014 DHOAS Review (discussed in paragraph 3.25) correspond to the questions and administrative problems highlighted in appeals to the AAT.

Monitoring members’ compliance with scheme and broader Defence housing requirements

3.13 Establishing and monitoring compliance requirements is necessary to support the achievement of scheme objectives and obtain confidence that members are complying with scheme requirements.

3.14 DHOAS loans can only be used for buying, building, renovating or extending a home, or refinancing a loan for one of these purposes. The subsidies provided cannot be used to buy investment properties, cars, boats, holidays or be used for other purposes.71 Within DHOAS, compliance with scheme requirements is encouraged through the use of various forms of communication to members, self-reporting and signed declarations. The DHOAS website clearly communicates the various DHOAS requirements and the need for members to contact DVA to advise of certain changes in circumstances. The application form, and in particular, the Subsidy Authorisation Request Form (which is necessary for subsidies to be paid), requires the member to confirm that they intend to meet the scheme’s conditions.72

3.15 DHOAS is one of a number of forms of assistance offered by Defence (refer to Appendix 2 for more information on other forms of housing-related assistance, including service residences, rent assistance, and other home purchase assistance). Each form of housing assistance has particular objectives, and associated compliance requirements to support achievement of those objectives. In some situations, these requirements are mutually exclusive—for example, an ADF member generally should not be accessing service accommodation or rent assistance in the same location that they receive support to own their own home through DHOAS.73

3.16 To check that members are complying with the occupancy requirements, Defence with the support of DVA and Defence Housing Australia (DHA)—which manages ADF rent assistance and service accommodation—conduct an ‘occupancy audit’. Each quarter, the occupancy audit involves DVA providing the address details of all new DHOAS recipients to DHA, which then checks to see if the members are in receipt of any form of DHA housing assistance. If so, DHA seeks to determine whether the underlying situation is allowable. For example, it may be appropriate for members to be accessing rent assistance while their DHOAS home is being constructed.74

3.17 The ANAO examined reports from the 13 occupancy audits conducted from July 2011 (when the occupancy audit commenced) to the end of September 2014. Typically, less than 10 per cent of members were in receipt of both DHOAS and DHA housing assistance, and as such, were reviewed by DHA. Most of these were subsequently found to meet specific conditions which were considered allowable.

3.18 A key constraint of the occupancy audit process is that it reviews members’ compliance only at a point in time; that being within the first three months that a member accessed a new DHOAS loan. While this timeframe is useful (to confirm that members who were in receipt of DHA assistance prior to accessing DHOAS have appropriately relinquished those other forms of assistance), the process does not identify members who take up rent assistance or service accommodation (in the posting location) at any point after the first three months. Further, the process does not confirm that DHOAS occupancy requirements are being met for the full 12 months required. Lastly, the process is not always relevant for the majority of members who have taken up the option of a DHOAS construction loan—the home is unlikely to have been completed within the first three months.

3.19 The work of the Office of the Inspector General of Defence in examining ADF members’ compliance with the requirements of receiving rent assistance or accessing service residences provides a useful example75 of a more comprehensive process which could be used to strengthen DHOAS compliance processes (see Box 3.1). Defence advised that it will work with DVA to examine opportunities to improve the current checking for compliance with the occupancy requirements under DHOAS.

|

Box 3.1 The Office of the Inspector General’s examination in late 2014 involved the review of all members in receipt of either rent assistance or accessing a service residence at the time, and drew on a broader range of data, particularly in relation to members’ addresses (including DHOAS data, personnel data and publicly available information). The Office of the Inspector General identified approximately 50 ADF members for further investigation by Defence and DHA. Of these, the overwhelming majority were found to have situations which complied with Defence housing policies (for example, that their own home was deemed unsuitable or that the member had been posted to a location away from their dependants).1 |

Note 1: Defence advised that the circumstances of the small number of remaining members had been further investigated by DHA. In April 2015, one instance awaited Defence policy avice, a small number of processing errors were identified, and the remainder required no further action.

Conclusion—Mechanisms used by Defence to monitor the quality of service to ADF members

3.20 Defence has a number of mechanisms in place to obtain feedback from ADF members, including a satisfaction survey, complaints processes and processes for members to request that decisions be reviewed, or a discretionary decision be made. High satisfaction levels have been observed among members, noting relatively low survey response rates. The number of recorded complaints from members about DVA processes is very low; however there would be benefit in recording all DHOAS complaints, including those which might relate to the home loan providers or DHOAS policies. Compliance with scheme requirements is primarily promoted through self-reporting and signed confirmation by members with no processes to actively confirm member compliance with key scheme obligations. However, Defence has advised that it will work with DVA to improve compliance arrangements.

Defence oversight of the Scheme Administrator

3.21 The MOU agreed between Defence and DVA, sets out DVA’s obligations as the Scheme Administrator, and includes a detailed Statement of Work which sets out the services to be provided by DVA, the key performance standards against which DVA’s performance is monitored, reporting and meeting requirements, and arrangements for determining the funding to be paid by Defence to DVA for delivering the scheme. Since being appointed Scheme Administrator in 2008, DVA has been paid a total of almost $29 million in administration costs (refer to Table 4.1 for a breakdown of these costs).

Monitoring performance standards

3.22 DVA reports monthly to Defence against four performance standards and associated targets, however Defence does not verify the results and they are not reported publicly. DVA’s overall reported performance has been consistently high since regular consolidated reporting on the performance standards commenced in mid-2010; with DVA meeting all four performance standards in all months, except one (DVA did not met timeliness performance standard, by just one per cent, in October 2011).76 The performance reported by DVA generally was reflected in the sample of cases examined by the ANAO. Achievements reported against performance standards in 2013–14 are shown in Table 3.2.

Table 3.2: Department of Veterans’ Affairs performance standards

|

Key performance indicators and description |

Target |

2013–14 average |

|

1. Accuracy of subsidy calculations. Number of correctly calculated subsidy payments as a percentage of the total number of subsidy payments. |

≥ 99.9 per cent |

100 per cent |

|

2. Timeliness of application processing. Time between an ADF member submitting a correctly completed application for a subsidy certificate and sending subsidy certificate or notification of ineligibility to be less than or equal to five business days.* |

≥ 95 per cent |

99.7 per cent |

|

3. Accuracy of processing subsidy payments. Number of subsidy payments to the correct subsidised loan account as a percentage of the total subsidy payments. |

≥ 99.9 per cent |

100 per cent |

|

4. Number of complaints received. The number of complaints received relating to DVA’s administration of the scheme as a proportion of the total number of applications received by DVA.* |

≤ 2 per cent |

0.1 per cent |

Source: Defence–DVA Memorandum of Understanding, Attachment B—Statement of Work, p. 13 and monthly DHOAS reports to Defence for 2013–14.