Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of Capital Gains Tax Compliance in the Individuals Market Segment

The objective of the audit was to assess the ATO's administration of CGT compliance in the individuals market segment. The focus of the audit was the ATO's administration of compliance by individuals with respect to the two most common CGT events: real property and share disposals. The Australian National Audit Office (ANAO) identified three key areas for review:

- governance – the corporate planning and reporting arrangements relevant to the administration of CGT compliance in the individuals market segment, including how these are integrated with the ATO's overall approach to managing CGT;

- identifying and assessing compliance risks – the mechanisms and strategies used to identify and assess CGT compliance risks in the individuals market segment; and

- compliance activities – the products and processes used to manage CGT compliance in the individuals market segment.

Summary

Background and Context

Capital gains tax (CGT) refers to the income tax payable on any net capital gain made and included in an annual tax return.1 It is not a separate tax, but forms a component of income tax.

A CGT regime was introduced in Australia on 20 September 1985, through amendments to the Income Tax Assessment Act 1936. The Tax Law Improvement Project established in 1994 aimed to address the complexity of the original CGT provisions. Following this project, CGT law was rewritten to include events, each with its own provisions for identifying and calculating capital gains and losses.2 These changes were incorporated into the Income Tax Assessment Act 1997. A key change from the 1999 Review of Business Taxation was the introduction of a discount in CGT payable for certain assets held for over a year.3 In addition, indexation was frozen at 30 September 1999.4 The Australian Taxation Office (ATO) has identified that the evolving and complex nature of CGT legislation, with its extensive record keeping requirements and calculations, means many individuals find compliance with their legislative obligations difficult.

Context: capital gains tax for individuals

In 2003–04, 813 755 individuals reporting net capital gains were classified as being taxable (that is, have net tax payable of more than $0). This number of taxable individuals reporting net capital gains increased by 19 per cent from 2002–03, while the amount of net capital gains reported increased by 45 per cent over the same period. The trend for the number of taxable individuals reporting net capital gains, and the value of these gains is shown in Figure 1. The decline in the number of individuals reporting net capital gains from 2000–01 to 2002–03 shown in Figure 1 was identified by the ATO as a major risk to the CGT system, and was a key driver behind the introduction of the CGT Project, designed to improve the ATO's administration of CGT compliance by individual taxpayers.

Figure 1 Number of Taxable Individuals reporting net capital gains and value of net capital gains 2000-01 to 2003-04

Source: ANAO analysis of Taxation Statistics 2003–04, Table 9.12.

The Reserve Bank of Australia reports that Australia has a strong tradition of home ownership, with ownership of other residential property (primarily for investment) increasing over the past decade. In 2002, 17 per cent of Australian households owned residential property which was not their principal place of residence, and over half of these received rental income from the property.

As with almost all OECD countries, Australia experienced a significant increase in housing prices since the mid-1990s. In particular, the property boom in Australia peaked on the eastern seaboard around 2003, with what the Commonwealth Bank referred to as a ‘home buying frenzy in 2003'. At this time, approximately 30 per cent of all housing loans were for investment properties.

In addition, the Australian Stock Exchange has reported that in 2004, approximately eight million Australians (55 per cent of the adult population) owned shares. Share ownership is currently the highest it has been since 1999. This strong growth in both the real property and share markets has also increased the likelihood of large capital gains being made.

Audit objective

The objective of the audit was to assess the ATO's administration of CGT compliance in the individuals market segment. The focus of the audit was the ATO's administration of compliance by individuals with respect to the two most common CGT events: real property and share disposals. The Australian National Audit Office (ANAO) identified three key areas for review:

- governance – the corporate planning and reporting arrangements relevant to the administration of CGT compliance in the individuals market segment, including how these are integrated with the ATO's overall approach to managing CGT;

- identifying and assessing compliance risks – the mechanisms and strategies used to identify and assess CGT compliance risks in the individuals market segment; and

- compliance activities – the products and processes used to manage CGT compliance in the individuals market segment.

Governance Arrangements

Recent history of CGT administration for individual taxpayers

During the first 12 years of Australia's CGT regime, the ATO did not have a comprehensive approach to identifying and treating CGT compliance risks. Between 1997 and 2003 it made isolated attempts to better comprehend or quantify CGT compliance in geographical areas or for large events. These did not progress for reasons ranging from funding, resourcing, and skilling to prioritisation of perceived higher risks.

In 2003 the ATO sought additional funding, and in the 2004 Budget was allocated $7.3 million to address its CGT compliance challenges. There was also a substantial increase in the business-as-usual funding made available to administer CGT compliance by individual taxpayers (from $0.3 million in 2003–04 to approximately $4.37 million over four years). A total of $11.67 million has been allocated to improve the ATO's dedicated CGT capability for the individuals market segment (the CGT Project). At the time of the audit (two years into the project) just over $7 million of this funding had been spent by the ATO.

The CGT Project

The CGT Project commenced in July 2004 and is a four-year project focusing on capital gains arising from real property and share disposals. A key feature is the systematic use of external data to develop the ATO's understanding of the real property and share markets.

In addition to ensuring that the ATO meets its overall revenue and coverage commitments for CGT, the project intends to position the ATO to effectively measure levels of CGT compliance and make informed decisions about risk treatment strategies. A series of integrated strategies have been initiated to build capability across key areas and to embed improvements to the point that they are considered business-as-usual by the end of the project.

The ATO has established monitoring and reporting arrangements that support the ongoing management of the CGT Project. Although the comprehensiveness of, and links between, higher level strategic planning documentation was adequate, the ANAO concluded that there is a need to improve relevant planning documentation to provide assurance that the CGT Project is being undertaken in a coordinated and consistent way at the operational level. The ANAO also considers that there is scope for the ATO to introduce additional performance measures that enable the assessment of progress against the projects' intended outcomes.

The ANAO examined the relationship between the CGT Project and the ATO's Capital Gains Compliance Committee and found that the Project was integrated with the ATO's overall approach to managing CGT.

CGT Compliance Risks

During the initial stages of the CGT Project a CGT risk management framework was developed in line with the ATO's corporate requirements. As part of the audit, the ANAO examined progress made by the project to inform the ATO's understanding of the compliance risks relating to non-disclosure of real property and share capital gains by individual taxpayers.

Research and intelligence

The ATO has initiated research and intelligence activities designed to support systemic risk identification and assessment and inform its CGT compliance strategies. The ANAO recognises the ongoing challenge faced by the ATO in balancing client costs with administrative requirements. However, in the absence of other information sources, the ANAO considers that the limited capital gains or losses information that an individual must report on their annual income tax return impedes the ATO's ability to obtain a good understanding of CGT compliance risks.

Data management

At the time of the audit, the ATO had sought external data relating to real property and share transactions. However, it had not yet finalised its acquisition of relevant share trading data from the Australian Stock Exchange and selected share registers.

Commencing in August 2004 the ATO approached state and territory Government Revenue and Land Titles offices to explore opportunities for acquiring bulk real property data. The data related to title transfers in all states and territories, from 1 July 1999 to 30 June 2004 (including available historical data required to establish a CGT liability). The ANAO noted that the acquisition process for this data satisfied the ATO's corporate requirements for external data matching, which includes ensuring that the Federal Privacy Commissioner's guidelines for data matching in Commonwealth administration have been met.

During 2004–05 the ATO employed manual techniques to identify real property disposals. The ATO began receiving bulk real property data in March 2005. Due to variations in the content, quality and formatting between agencies, significant time and effort was spent analysing the data structures and holdings. Using insights gained from this work, the ATO adopted a systematic approach to develop a data model to convert all real property data into a common format. The ATO advised that delays in acquiring external data meant that one State Revenue Office was the main source used to identify real property disposals for administrative action during 2005–06.

The ANAO noted that as each data set was progressively analysed quality shortcomings were identified. Where data has been acquired from an Office of State Revenue, a requirement of the Memorandum of Understanding is to notify the source agency as soon as practicable where possible errors or defects are identified. At the time of the audit limited feedback had been provided on identified shortcomings to Offices of State Revenue.

During 2005–06 approximately 70 per cent of individuals, within the data sample of those who disposed of property, had their identity partially matched with taxpayer information held by the ATO and were consequently available for analysis and case selection. Consistent with 2004–05, identity matching was only partial and considered to only be successful to a low or medium level of confidence. The major reason for these lower grade identity matching outcomes is that external real property data does not generally contain key identifiers relied on when using external data in other areas of tax administration.5

The ANAO noted that one of the original deliverables identified by the ATO for the CGT Project was to report on the feasibility of automated data matching and case actioning for CGT compliance in the individuals market segment. The ANAO considers that given the delays in acquiring and converting all relevant data, it is too early to make an overall assessment of the long-term feasibility of the data management activities initiated by the ATO.6 However, based on the outcomes of activities to date, it is clear the absence of key identification data significantly reduces the proportion of individuals disposing of real property that can be readily matched to the ATO taxpayer database.

The ANAO considers that given the project's focus on data management to enable it to better understand CGT compliance risks, it is important that the ATO assess, prior to the project's end date of 30 June 2008, whether automated data matching and case actioning is the most appropriate strategy for CGT compliance in the individuals market segment. This could include exploring other solutions with relevant state and territory Government Revenue and Land Titles offices that may support the quotation by individual taxpayers of key identifiers at the time of real property disposal or acquisition. Such enhanced data from source entities would enable an increased proportion of real property disposals to be readily identified and assessed for administrative action.

Assessing identified CGT compliance risks for active compliance activities

Once an individual's identity has been matched with taxpayer information held by the ATO, the ATO compares disposal details with information reported in the individual's income tax return, to determine the risk of non-compliance with CGT obligations. As part of the CGT Project the ATO developed risk criteria to prioritise and plan treatment of identified real property disposals. Figure 2 summarises the real property disposal risk assessments undertaken during 2005–06.

Figure 2 Real property disposal risk assessments during 2005-06

Source: ANAO analysis of ATO data

The ATO conducted audits on high risk cases, and risk reviews on low/medium risk cases. The ATO advised that ‘No Further Action Required' relates to individuals that may have been eliminated due to the main residence exemption, or sufficient CGT had been disclosed, or the transactions associated with the individual could not be verified.

During 2005–06, the ATO attempted to estimate a potential CGT population using aggregate real property sales data published by the Real Estate Institute of Australia. The ANAO recognises the effort by the ATO to provide assurance that it is reviewing an acceptable proportion of real property disposals as part of its active compliance interactions. In the absence of a complete set of useable data from its data management activities, it is appropriate to use industry data such as that published by the Real Estate Institute. However, there is scope to improve the transparency and calculation of any sales population used to support real property compliance interactions for the CGT Project.

To partly address compliance risks relating to the potential non-disclosure of share-related capital gains, the ATO initiated a pilot project in 2005–06 using dividend information from the Annual Investment Income Report (AIIR). This project was labour-intensive and produced limited returns. The ANAO identified opportunities for the ATO to improve its use of relevant AIIR data to assess CGT compliance risks associated with the capital gains paid to individuals by unit trusts.

Activities to Facilitate and Enforce Compliance with CGT Obligations

Compliance assistance

As part of the CGT Project, the ATO developed an investor pathway for real property and at the time of the audit was developing a shares investor pathway. The pathways are diagrammatic representations of taxpayers' interactions with the revenue system for specific CGT assets. The ANAO considers the development of the pathways to be innovative and effective mechanisms to improve the ATO's understanding of a taxpayers experience in relation to CGT, including the role of intermediaries.

The ANAO found that the ATO also used a range of compliance assistance products to treat identified CGT compliance risks in the individuals market segment. The ANAO observed that the numbers and types of products developed increased following receipt of compliance challenges funding and the inception of the CGT Project. At the time of the audit the focus had been on real property disposals.

Active compliance

The ATO's Active Compliance stream is responsible for managing, measuring and generally improving taxpayer compliance. The ATO identified obtaining staff and developing staff capability (particularly for Active Compliance) as key issues in the first year of the CGT Project. The ANAO noted that procedural guidance documentation supports active compliance activities, and some capability training has been provided. Staffing and staff capability are issues the ATO will need to closely monitor and address as the focus of its active compliance activities shifts to capital gains made on the disposal of shares by individuals. Embedding this capability is critical to the long-term success of the CGT Project.

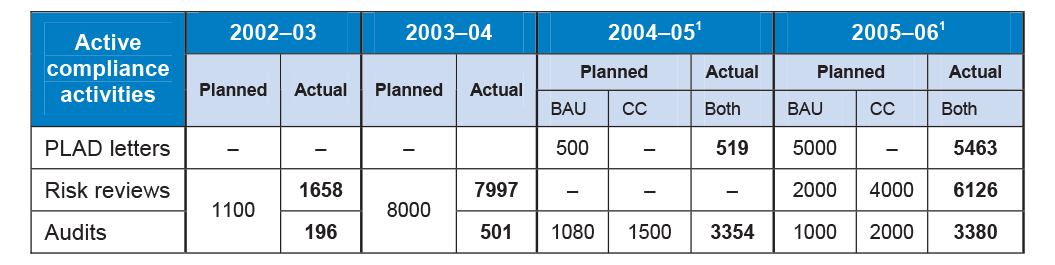

The ATO's key active compliance activities for CGT are letters,7 risk reviews and audits. Table 1 details active compliance activities from 2002–03 to 2005–06. The ANAO noted that inconsistent reporting of active compliance activity types over time and across types of reports, makes analysis of performance difficult. In particular, the classification of risk identification/data matching reviews, risk reviews and audits was not constant.

Table 1 Coverage: planned and actual CGT active compliance activities in the individuals market segment 2002–03 to 2005–06

Note 1: From 2004–05 the ATO received additional funding to undertake CGT active compliance activities in the individuals market segment. These planned activities are identified as business-as-usual (BAU) or compliance challenges (CC) funding.

Source: ANAO analysis of ATO information.

Table 1 indicates that the ATO met or exceeded the active compliance coverage commitments made under compliance challenges and the Output Pricing Agreement 2002–05 during the last four years. The ANAO observed that the 2005–06 target for liabilities raised by active compliance activities was adjusted twice during the financial year. The target directly impacts the level and nature of activities the CGT active compliance team undertakes. The Improving Active Compliance Reporting project is reviewing calculation of collection rates, and their consistent application to liabilities raised. The ANAO notes that to meet cash collection commitments made under compliance challenges, the ATO will need to monitor the collection rates throughout the CGT Project. A consistent and documented methodology for applying collection rates is essential to inform compliance planning and for accurate reporting of active compliance activities.

Compliance evaluation

During the audit the ATO was in the process of evaluating the effectiveness of compliance assistance activities initiated as part of the CGT Project. The ATO undertakes analysis of active compliance activities to inform risk identification and future compliance planning.

Overall Audit Conclusion

An increasing proportion of Australians have invested in potential CGT assets such as real property and shares during the last decade. Prior to 2003, there were limited resources allocated to support the ATO's administration of CGT compliance in the individuals market segment. With the benefit of additional budget funding, the ATO initiated a four-year CGT Project with a particular focus on assessing the levels of compliance relating to gains arising from real property and share disposals.

The governance arrangements established as part of the CGT Project support the administration of CGT compliance in the individuals market segment. However, there is a need to improve relevant planning documentation to provide assurance that the project is being undertaken in a consistent and coordinated way at the operational level.

A CGT risk management framework has been implemented, focusing on the use of data from a range of external sources to better identify the compliance risks associated with the non-disclosure of capital gains. The ANAO recognises the ongoing challenge faced by the ATO in balancing client costs with administrative requirements. However, the ANAO considers that in the absence of other information sources, the ATO's understanding of CGT compliance risks would be enhanced by increasing the disclosure requirements for asset disposals reported by individual taxpayers in their income tax returns.

The current lack of key identifiers for external real property data also significantly reduces the proportion of individuals, who have disposed of real property, that can be readily identified and risk assessed for compliance by the ATO. In addition, there have been delays in the ATO acquiring the external data, which has resulted in it not yet being in a position to effectively measure levels of CGT compliance across the total taxpayer population. This has also impacted on the ATO's ability to make informed decisions about risk treatment strategies for the individuals market segment.

The ANAO considers it important that the ATO assess, prior to the project's end, whether of the options available, automated data matching and case actioning is the most appropriate strategy to achieve CGT compliance in the individuals market segment. There are also opportunities for the ATO to improve its use of measures that provide assurance that its active compliance activities are covering an acceptable proportion of real property disposals across Australia.

Similarly, there are opportunities for expanding the use of relevant AIIR data to assess CGT compliance risks associated with the capital gain components paid to individuals by unit trusts.

The ANAO observed that the ATO used a range of compliance assistance and active compliance activities to treat CGT compliance risks in the individuals market segment. The ATO met or exceeded the active compliance coverage and revenue commitments made under compliance challenges, the Output Pricing Agreement 2002–05 and in the last four Compliance Programs. To date, the main focus of compliance activities has been on real property disposals.

Recommendations

The ANAO made seven recommendations aimed at improving the ATO's administration of CGT compliance in the individuals market segment. These recommendations are intended to complement the ATO's aim, as part of its CGT Project, of embedding CGT capability improvements into its business-as-usual practices.

Summary of ATO's Response

The Tax Office welcomes the ANAO's recommendations in relation to the administration of Capital Gains Tax compliance in the individuals' market segment. It is encouraging to note that although the ANAO identified areas for improvement, it was broadly supportive of the approach adopted and the achievements the Tax Office has made since the Capital Gains Tax project began in July 2004.

Results of the project to date include:

- 32 new educational products for investors;

- in the year ended 30 June 2006, the Tax Office reviewed or audited 9 500 returns where taxpayers had failed to fully disclose capital gains tax liabilities, resulting in revenue adjustments of $40 million;

- the translation of key educational products into six languages; and

- the year ended 30 June 2006, the Tax Office wrote to over 23 000 taxpayers who had purchased investment properties to help them better understand their future Capital Gains Tax obligations.

Capital Gains Tax continues to be a focus area for the Tax Office. The Tax Office will adopt in full, the seven recommendations made by the ANAO.

The Tax office will continue to work with the community to optimise voluntary compliance with Capital Gains Tax laws through a range of integrated strategies including:

- improving the understanding of taxpayers' and intermediaries' experiences interacting with the Capital Gains Tax system;

- supporting systemic risk assessment and identification strategies;

- making more efficient use of external data to better identify Capital Gains Tax risks;

- delivering a range of Capital Gains Tax educational products to better educate and inform the community; and

- expanding Tax Office active compliance activities to address non-compliance.

Footnotes

1 A net capital gain is the difference between total capital gains for the year and total capital losses (including capital losses from prior years).

2 There are currently 52 CGT events. The most common is disposal of an asset (e.g. sold or given away).

3 This is 50 per cent for individuals and trusts, 33.3 per cent for super funds and is not available to most companies.

4 There are three methods for calculating CGT. The indexation method is now only applicable for assets acquired pre-21 September 1999. It allows an increase to the assets' cost base by applying an indexation factor based on CPI up to September 1999; the discount method allows a discount on capital gains on assets held for over 12 months; and the other method involves subtracting the cost base from the capital proceeds.

5 Key identifiers for the ATO are the individual's TFN and date of birth.

6 This is particularly so, given that the conversion of share trading data has yet to begin.

7 The ATO issues two types of letters; education and pre-lodgement advisory determinations (PLADs).