Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Accuracy and Timeliness of Welfare Payments

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- A bilateral partnership arrangement has been in place between the Department of Social Services (the department) and Services Australia since the establishment of Centrelink in 1997.

- Effective management of welfare payments to ensure recipients receive ‘the right payment at the right time’ is central to the bilateral arrangement. It also supports proper use and management of public resources.

- This audit was conducted to provide assurance to Parliament on the department and Services Australia’s processes for monitoring, reporting and continuously improving welfare payment accuracy and timeliness.

Key facts

- In 2021–22 Services Australia was responsible for delivering $124.7 billion in welfare payments on behalf of the department to eligible families, parents, seniors, people with a disability, carers, job seekers and students (representing around 20 per cent of all Australian Government spending).

What did we find?

- The department's and Services Australia’s management of welfare payment accuracy and timeliness has been partly effective.

- The department’s oversight has been partly effective due to weaknesses in bilateral agreements, assurance arrangements and shared risk management.

- Monitoring and reporting of payment accuracy was partly effective. The methodology for measuring accuracy is largely robust. Data collection does not adequately support continuous improvement.

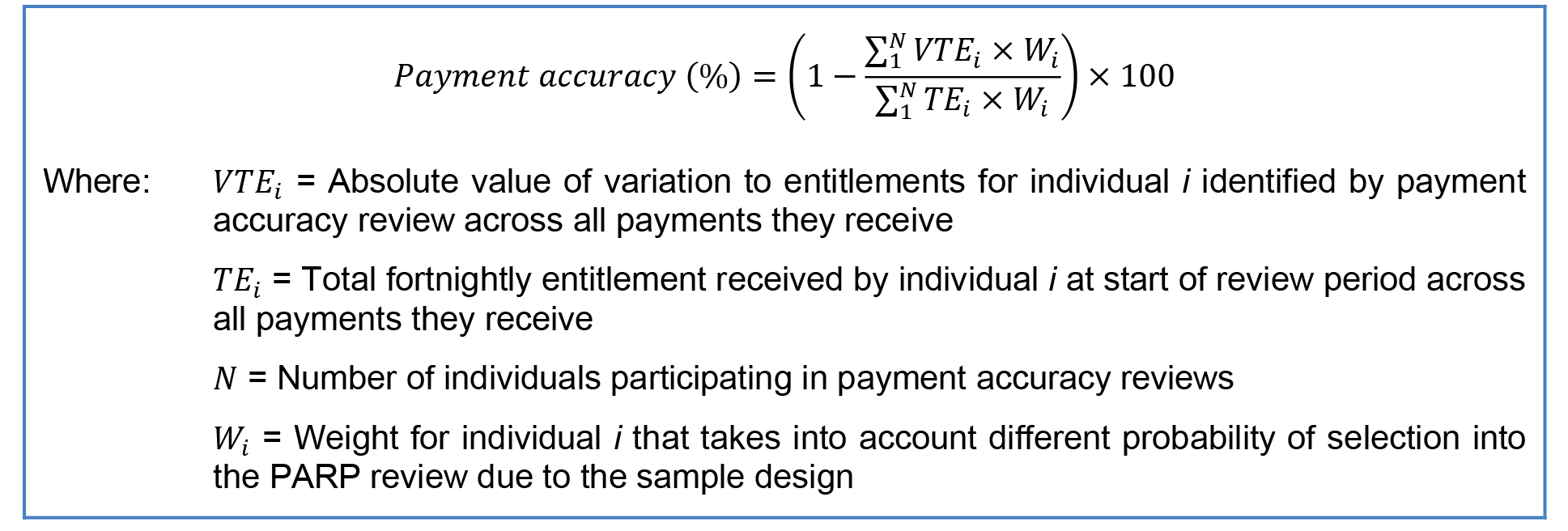

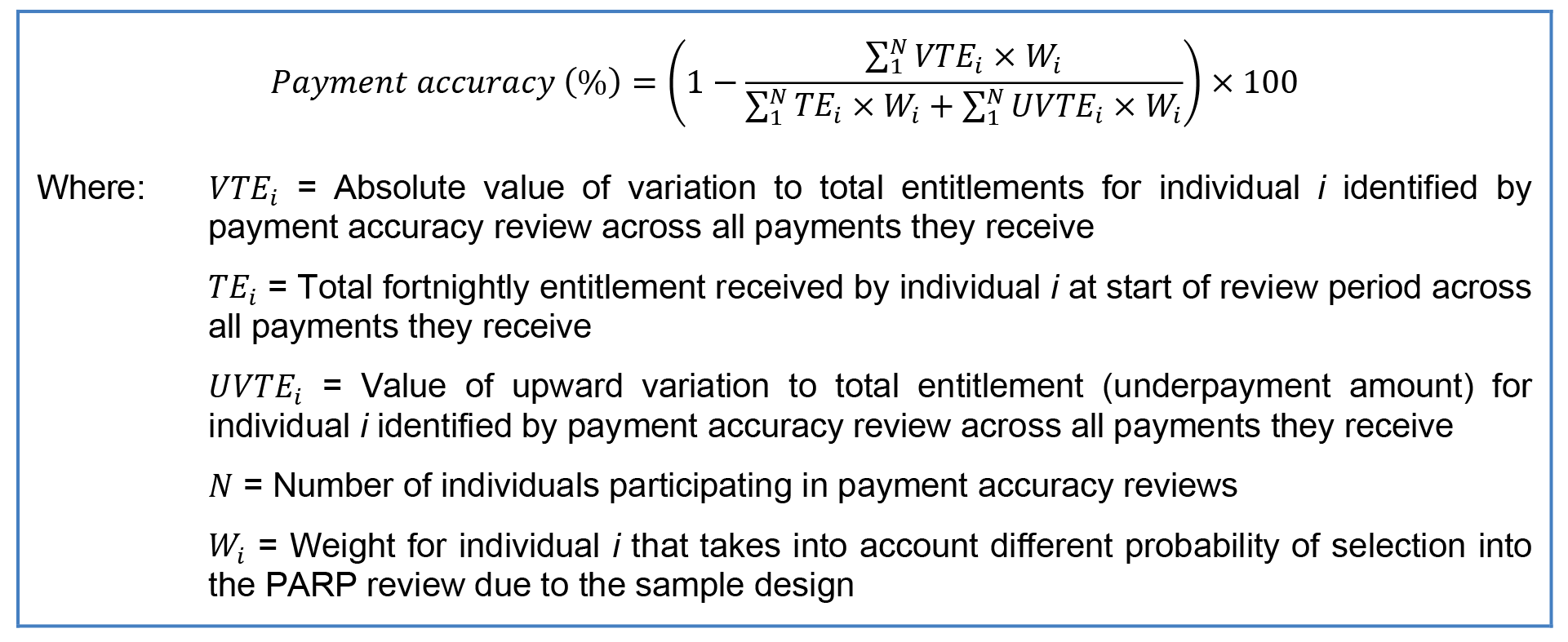

- Monitoring and reporting of payment timeliness was partly effective. The methodology for measuring timeliness is not robust and reporting has been biased.

What did we recommend?

- There were 14 recommendations to the department and Services Australia.

- 11 were agreed, one was partially agreed, and two were not agreed.

$8.0b

ANAO estimate of welfare overpayments in 2021–22 (6.71% of total payments)

81.4%

ANAO estimate of proportion of welfare recipients receiving correct payments in 2021–22

76.9%

ANAO estimate of proportion of welfare claims processed within bilateral timeliness standards in 2021–22

Summary and recommendations

Background

1. The Department of Social Services (the department) is responsible for providing targeted welfare payments and other assistance to ‘people who cannot fully support themselves’.1 Services Australia, an executive agency within the social services portfolio, has a purpose to ‘support Australians by efficiently delivering high-quality, accessible services and payments on behalf of the Government’.2 The Secretary of the department has delegated responsibility for delivering and managing the department’s welfare payments to the Chief Executive Officer of Services Australia. In 2021–22 Services Australia delivered welfare payments totalling $124.7 billion on the department’s behalf (representing around 20 per cent of all Australian Government spending).

2. A bilateral partnership arrangement has been in place between the department and Services Australia since the establishment of Centrelink in 1997.3 The arrangement is supported by bilateral agreements, which include bilateral performance measures for the accuracy and timeliness of welfare payments Services Australia delivers on the department’s behalf.4 Services Australia also reports on a measure it calls ‘payment correctness’ in its annual report.5

Rationale for undertaking the audit

3. Effective management of welfare payment processing to ensure recipients receive ‘the right payment at the right time’ is central to the bilateral arrangement between the department and Services Australia. Accuracy and occurrence of personal benefits is a key audit matter for the ANAO’s financial statements audit program and a key area of financial statements risk for the department due to: the high volume and varying complexity of payments processed by Services Australia on complex IT systems; and the reliance on correct disclosure of personal circumstance information by a large number of recipients across diverse socioeconomic groups. This audit was conducted to provide assurance to Parliament on the department’s and Services Australia’s processes for monitoring, reporting and continuously improving welfare payment accuracy and timeliness.

Audit objective and criteria

4. The objective of the audit was to assess the effectiveness of Department of Social Services’ and Services Australia’s management of the accuracy and timeliness of welfare payments.

5. To form a conclusion against the objective, the following high-level criteria were adopted:

- Has the department established effective oversight arrangements for the accuracy and timeliness of Services Australia’s payment delivery?

- Have the department and Services Australia established effective processes for monitoring, reporting and continuously improving payment accuracy?

- Have the department and Services Australia established effective processes for monitoring, reporting and continuously improving payment timeliness?

Conclusion

6. The department’s and Services Australia’s management of the accuracy and timeliness of welfare payments has been partly effective.

7. The department’s oversight arrangements for the accuracy and timeliness of welfare payments have been partly effective. Current bilateral agreements do not adequately support oversight of payment accuracy and timeliness, and attempts to update relevant agreements have been unsuccessful to date. The department’s oversight of payment accuracy and timeliness has not been proactive and strategic. Assurance arrangements for payment accuracy and timeliness are not sufficiently objective and independent, and shared risks relating to payment accuracy and timeliness are not being managed collaboratively.

8. The department’s and Services Australia’s processes for monitoring, reporting and continuously improving payment accuracy are partly effective. A largely robust methodology and largely effective operational processes have been established for monitoring payment accuracy, and the entities have started using data to attempt to drive payment accuracy improvements. Weaknesses were found in relation to setting bilateral performance targets, identifying underlying causes of payment inaccuracies, ensuring data accuracy and completeness, and quality assuring reported results. Services Australia’s payment correctness performance measure is biased, and changes to the treatment of Disability Support Pension inaccuracies have introduced bias to payment accuracy reporting.

9. The department’s and Services Australia’s processes for monitoring, reporting and continuously improving payment timeliness are partly effective. The methodology for measuring welfare claim processing timeliness is not robust. Recent changes to bilateral performance measures have not been based on sound rationales. Claim processing timeliness reporting has been partly reliable and verifiable, but a 2020 methodological change introduced bias. The timeliness of Services Australia’s claim processing has largely been driven by resourcing decisions.

Supporting findings

Oversight arrangements

10. Current bilateral agreements between the department and Services Australia do not adequately support the department’s oversight of payment accuracy and timeliness. While accuracy and timeliness are core components of current agreements, relevant content is incomplete and out of date. The department and Services Australia renegotiated the head agreement in April 2023 and the entities plan to update other aspects of the bilateral framework by October 2023. Previous attempts to update agreements over the last seven years were unsuccessful. (See paragraphs 2.3 to 2.12)

11. Reporting on payment accuracy and timeliness has been monitored by senior executive-level bilateral committees. The department’s oversight has generally focussed on performance results, rather than strategic consideration of underlying causal factors. Since 2021 there has been increased oversight of payment accuracy and timeliness at the accountable authority level, focusing on remedial action to address declining performance results. (See paragraphs 2.14 to 2.24)

12. Current bilateral arrangements do not provide the department with an objective and independent assessment of governance, risk management and control processes for payment accuracy and timeliness. The department and Services Australia have separately identified deficiencies in payment assurance arrangements, but progress in addressing these issues has been limited. (See paragraphs 2.25 to 2.40)

13. The department and Services Australia use a quarterly performance assurance report and annual payment accuracy risk management plans to manage shared risks. These processes do not provide effective mechanisms to support the department in proactively and strategically managing shared risks relating to payment accuracy and timeliness. (See paragraphs 2.42 to 2.53)

Payment accuracy

14. The methodology for monitoring payment accuracy via the Payment Accuracy Review Program is largely robust. It produces largely reliable statistical estimates of underpayments, overpayments and the resulting effect on the accuracy of welfare payments. However, it does not allow for robust analysis of the effectiveness of Services Australia’s payment accuracy controls or the underlying causes of inaccuracies, particularly regarding the relative impact of administrative error, recipient non-compliance and fraud. The department has no established rationale for its 95 per cent benchmark target for payment accuracy. (See paragraphs 3.2 to 3.39)

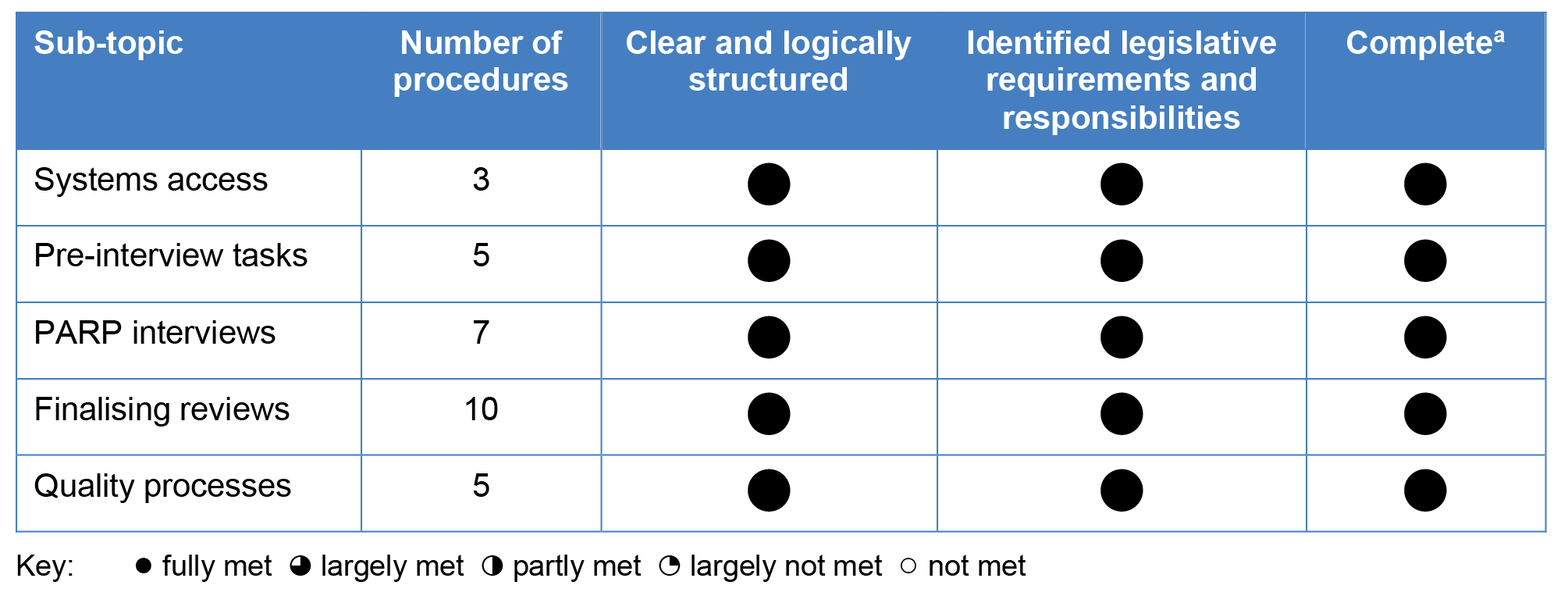

15. The department and Services Australia have developed largely effective operational processes for conducting payment accuracy reviews. Services Australia’s procedural documentation is clear, comprehensive and identifies legislative requirements and responsibilities. Quality assurance processes established by Services Australia and the department were partly effective. While comprehensive quality assurance processes have been established, processes for ensuring the accuracy and completeness of data could be strengthened to enable more robust analysis of underlying payment inaccuracy causes. (See paragraphs 3.40 to 3.60)

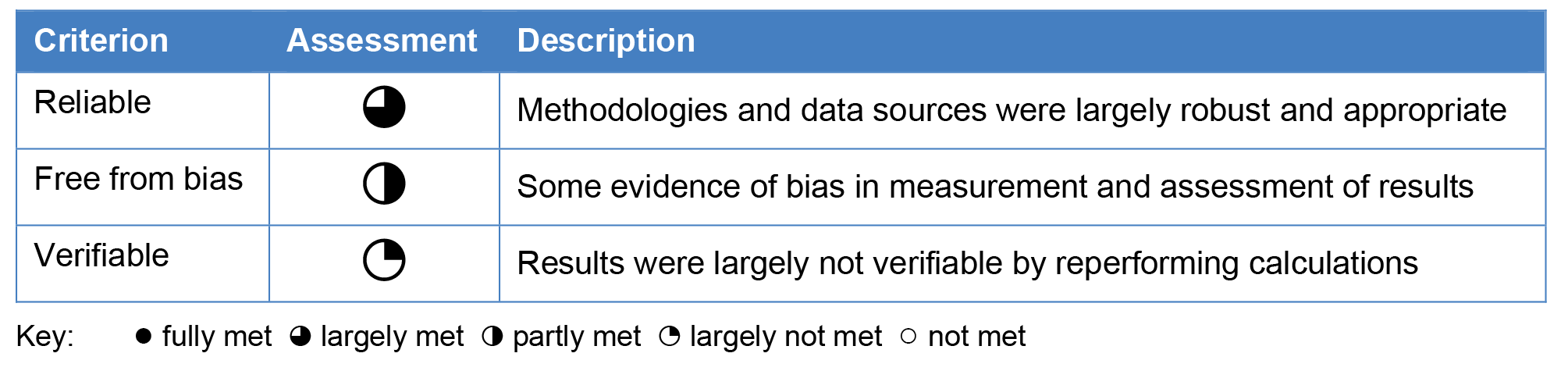

16. Reporting of payment accuracy results has been based on largely reliable methodologies and data sources. Reporting has been partly free from bias, as Disability Support Pension reporting has excluded certain inaccuracies since 2019–20 which has improved reported accuracy results. Payment accuracy reporting has been largely unverifiable. The ANAO was only able to replicate 33.5 per cent of results reported from 2018–19 to 2021–22 due to calculation errors and ad hoc deviations from the methodology that were not adequately documented. (See paragraphs 3.61 to 3.83)

17. Services Australia’s reporting of payment correctness results has been partly reliable and largely verifiable. However, its reporting has been biased as its payment correctness performance measure excludes most incorrect payments. (See paragraphs 3.84 to 3.103)

18. In 2021 the department and Services Australia started using payment accuracy performance information to identify improvement opportunities and monitor the impact of initiatives. Various high-level strategies have been developed, but there is limited evidence of outcomes being achieved. Data quality issues with Payment Accuracy Review Program data limit the ability to drill deeper into payment inaccuracy causes, which means Services Australia may not be effectively targeting its payment accuracy improvement initiatives. (See paragraphs 3.104 to 3.118)

Payment timeliness

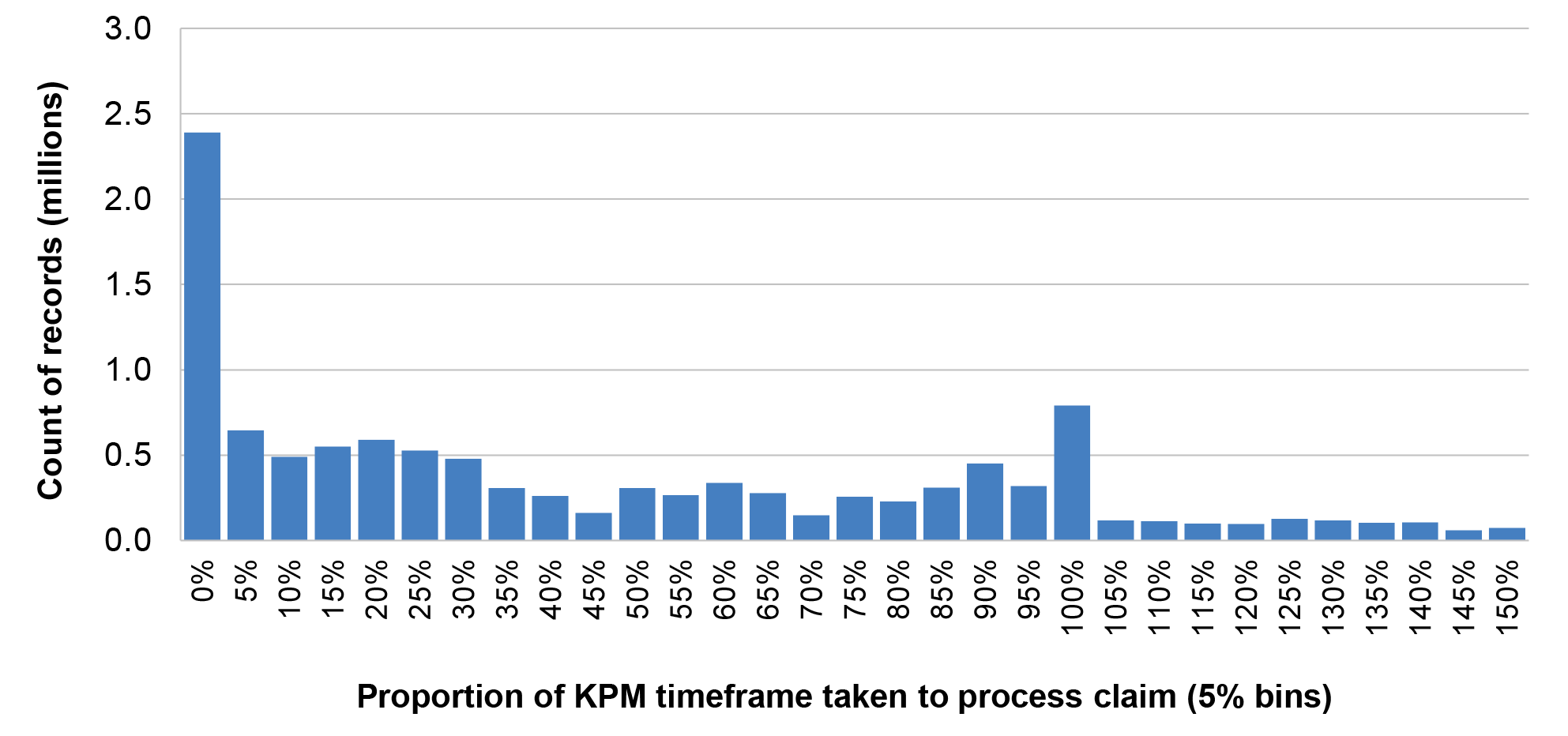

19. The current methodology for monitoring payment timeliness is not robust. The department and Services Australia have engaged in a protracted review process since 2017 but changes to bilateral timeliness performance measures made through this process have largely not been based on robust rationales. In addition, the entities have not adequately considered the business rules for calculating claim processing timeliness at a bilateral level. (See paragraphs 4.2 to 4.28)

20. Reporting of payment timeliness results has been biased and partly reliable and verifiable. A 2020 methodology change provided a significant increase in Services Australia’s timeliness results that was not reflective of improved performance, introducing bias to its reporting. This change also reduced the reliability of the methodology. The ANAO was only able to replicate 72.6 per cent of reported bilateral timeliness results from 2018–19 to 2021–22 using the entities’ documented business rules. (See paragraphs 4.29 to 4.56)

21. Since the late 1990s, when Centrelink was established, payment timeliness performance measures have remained the same or become longer, in the context of changes to welfare claim processing that should have made it easier to meet targets. Services Australia has used performance information on claim processing timeliness primarily to manage its workforce and prioritise work items. The department informed the ANAO it has limited levers to drive improvements in Services Australia’s payment timeliness. (See paragraphs 4.57 to 4.64)

Recommendations

Recommendation no. 1

Paragraph 2.10

Department of Social Services and Services Australia complete the current bilateral arrangement refresh process by October 2023, ensuring revised service arrangements for welfare payments include effective mechanisms to support the department’s oversight of welfare payment accuracy and timeliness.

Department of Social Services response: Agreed.

Services Australia response: Agreed.

Recommendation no. 2

Paragraph 2.38

Department of Social Services and Services Australia establish by October 2023:

- processes to exchange relevant internal audit and management assurance reports; and

- a robust bilateral assurance framework that facilitates independent and objective assessment of welfare payment control effectiveness.

Department of Social Services response: Agreed.

Services Australia response: Agreed.

Recommendation no. 3

Paragraph 2.51

Department of Social Services and Services Australia implement robust bilateral processes by October 2023 to manage shared risks relating to welfare payment accuracy and timeliness, including establishing and maintaining joint risk management plans and/or registers.

Department of Social Services response: Agreed.

Services Australia response: Agreed.

Recommendation no. 4

Paragraph 3.21

Department of Social Services, in consultation with Services Australia, review key performance measure benchmark targets for the accuracy of welfare payment giving due consideration to payment inaccuracy risk tolerance.

Department of Social Services response: Agreed.

Recommendation no. 5

Paragraph 3.33

Department of Social Services, in consultation with Services Australia, amend the methodology for the Payment Accuracy Review Program to enable assessments to be made of:

- the dollar impact of potential fraud, opportunistic and inadvertent non-compliance and administrative error on welfare payments; and

- the effectiveness of Services Australia’s control framework.

Department of Social Services response: Partially agreed.

Recommendation no. 6

Paragraph 3.55

Services Australia establish processes to ensure:

- quality checking and quality assurance processes are undertaken and appropriately documented; and

- data captured through the Payment Accuracy Review Program is accurate and complete.

Services Australia response: Agreed.

Recommendation no. 7

Paragraph 3.67

Department of Social Services:

- review any payments that are not currently captured by the Payment Accuracy Review Program to assess the impact of exclusion on the assessment of payment accuracy for all welfare payments and whether any or all of the currently excluded payments should be included; and

- list any payments excluded from the Payment Accuracy Review Program in external reporting, including the rationale for exclusion.

Department of Social Services response: Agreed.

Recommendation no. 8

Paragraph 3.75

Department of Social Services ensure reporting on payment accuracy is unbiased by:

- assessing the impact of changes in medical eligibility on the accuracy of Disability Support Pension payments either through conducting medical reviews under the Payment Accuracy Review Program or some other mechanism; and

- not excluding any identified inaccuracies from reported results, including cancellations due to changes in medical eligibility and recipients transferring to another payment.

Department of Social Services response: Not agreed.

Recommendation no. 9

Paragraph 3.82

Department of Social Services ensure reporting on payment accuracy is verifiable by:

- establishing a register to document any deviations from the Payment Accuracy Review Program methodology and the rationale for the deviations; and

- conducting and documenting additional quality assurance over weighting calculations.

Department of Social Services response: Agreed.

Recommendation no. 10

Paragraph 3.93

Services Australia develop a reliable and unbiased external performance measure for welfare payment correctness that includes recipient errors or adopt payment accuracy as a performance measure.

Services Australia response: Not agreed.

Recommendation no. 11

Paragraph 4.24

Department of Social Services, in consultation with Services Australia, revise existing bilateral key performance measures for claim processing timeliness based on consideration of:

- claim processing stages and reasonable timeframes for each stage;

- claimants’ needs for timely support;

- Services Australia’s claim processing capacity;

- where payments involve different processing pathways (such as manual and automatic processing), the potential need for separate measures for each pathway;

- the potential need for separate measures for different work items (such as new claims, claims reopened on appeal, and non-claim work items); and

- business rules that should be applied in calculating results.

Department of Social Services response: Agreed.

Recommendation no. 12

Paragraph 4.41

Department of Social Services, in consultation with Services Australia, ensure:

- bilateral timeliness key performance measures are developed for all welfare payments;

- business rules for claim processing timeliness key performance measures are free from bias; and

- any methodology changes that impact on reported results and the rationales for the changes are explained in reporting.

Department of Social Services response: Agreed.

Recommendation no. 13

Paragraph 4.47

Department of Social Services complete the following steps when developing or revising bilateral key performance measures for claim processing timeliness:

- conduct analysis of any potential unintended incentives for prioritising certain types of claims that may be created by proposed key performance measures;

- assess the merit and viability of developing additional key performance measures for the timeliness of non-claim work items; and

- design key performance measures to ensure claims are effectively prioritised after they fall outside timeliness standards.

Department of Social Services response: Agreed.

Recommendation no. 14

Paragraph 4.54

Services Australia ensure that:

- the business rules for calculating claim processing timeliness key performance measures are complete and accurate; and

- appropriate bilateral quality assurance processes are established to verify reported claim processing timeliness results.

Services Australia response: Agreed.

Summary of entity response

22. The proposed audit report was provided to the department and Services Australia. The entities’ summary responses are reproduced below. Their full responses are included at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed at Appendix 2.

Department of Social Services

The department welcomes the Australian National Audit Office (ANAO) report Accuracy and Timeliness of Welfare Payments.

The department acknowledges the audit findings and agrees with all the recommendations, with the exception of one. The department is committed to ensuring social security payments are delivered accurately, consistent with the legislation, and in a timely manner. The department is currently working with Services Australia to update Bilateral Management Protocols to ensure appropriate service delivery standards are met. This audit provides added impetus to ensure these protocols are effective.

The department does not agree with Recommendation 8 on medical checks for Disability Support Pension (DSP) recipients. The imposition of medical reviews as part of the Payment Accuracy Review Program would have an inequitable impact on some DSP recipients. The Recommendation, if implemented, would mean DSP recipients undergoing a Payment Accuracy Review Program review would require medical checks, thereby placing additional burdens on those randomly selected for review, when compared to the wider payment population.

Services Australia

Services Australia (the Agency) notes the findings of the report that the Agency’s arrangements for managing welfare payment accuracy and timeliness are partly effective, with regard to a largely robust methodology and largely effective operational processes for monitoring payment accuracy, driving payment accuracy improvements with the use of data, and processes to continuously improve payment timeliness.

The Agency’s focus is on ensuring the right payment, to the right person, at the right time. To that end, the Agency will continue to work collaboratively with the Department of Social Services to further strengthen our joint processes for governance, risk management, performance monitoring and reporting, and quality assurance, which will together improve the accuracy and the timeliness of the welfare payments we deliver.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Performance and impact measurement

1. Background

Introduction

1.1 The Department of Social Services (the department or DSS) has responsibility for delivering:

A sustainable social security system that incentivises self-reliance and supports people who cannot fully support themselves by providing targeted payments and assistance.6

1.2 In 2021–22 the department was responsible for welfare payments totalling $124.7 billion, representing around 20 per cent of all Australian Government spending. These payments are made under unlimited special appropriations established by legislation (see Table 1.1).7

Table 1.1: Special appropriations for welfare payments, 2021–22

|

Special appropriation (authorising legislation) |

Type |

Purpose |

2021–22 payments ($m) |

|

Social Security (Administration) Act 1999 |

Unlimited |

To enable the payment of income support payments. |

104,692 |

|

A New Tax System (Family Assistance) (Administration) Act 1999 |

Unlimited |

To enable the payment of family income support payments. |

16,967 |

|

Paid Parental Leave Act 2010 |

Unlimited |

To enable payments to working parents to enhance maternal and child health and shared caring responsibilities. |

2,644 |

|

Student Assistance Act 1973 |

Unlimited |

To enable payment of student assistance benefits for Isolated Children and the Aboriginal Study Assistance Scheme. |

413 |

|

Totala |

124,717 |

||

Note a: Payments do not add to total due to rounding.

Source: DSS, Annual Report 2021–22, Commonwealth of Australia, 2022, pp. 214–215.

1.3 Services Australia was established as an executive agency within the social services portfolio in February 2020. Its purpose is to ‘support Australians by efficiently delivering high-quality, accessible services and payments on behalf of the Government’.8 Through a longstanding bilateral arrangement, Services Australia is responsible for delivering welfare payments on the department’s behalf through its Social Security and Welfare program.9 To facilitate this, the Secretary of the department has delegated powers to assess, determine and make welfare payments to the Chief Executive Officer of Services Australia.10

1.4 Table 1.2 shows 2021–22 payment expenditure and recipient numbers for the department’s top ten welfare payments. Collectively these ten payments represented around 95 per cent of the department’s total welfare payments in 2021–22. A full list of the department’s welfare payments delivered by Services Australia is at Appendix 3, including coverage of these payments by bilateral key performance measures (KPMs) relating to payment accuracy and timeliness.11

Table 1.2: Top ten welfare payments by expenditure, 2021–22

|

Payment |

PBS Program |

Special appropriation |

Payments ($m) |

Number of recipients |

|

Age Pension |

1.2 – Support for Seniors |

Social Security (Administration) Act 1999 |

51,132 |

2,557,691 |

|

Disability Support Pension |

1.3 – Financial Support for People with Disability |

Social Security (Administration) Act 1999 |

18,334 |

764,967 |

|

JobSeeker Payment |

1.5 – Working Age Payments |

Social Security (Administration) Act 1999 |

14,844 |

831,601 |

|

Family Tax Benefit A |

1.1 – Family Assistance |

A New Tax System (Family Assistance) (Administration) Act 1999 |

12,334 |

N/Aa |

|

Carer Payment |

1.4 – Financial Support for Carers |

Social Security (Administration) Act 1999 |

6,573 |

301,217 |

|

Parenting Payment Single |

1.5 – Working Age Payments |

Social Security (Administration) Act 1999 |

4,915 |

231,999 |

|

Family Tax Benefit B |

1.1 – Family Assistance |

A New Tax System (Family Assistance) (Administration) Act 1999 |

3,432 |

N/Aa |

|

Parental Leave Pay |

1.1 – Family Assistance |

Paid Parental Leave Act 2010 |

2,511 |

178,778b |

|

Carer Allowance |

1.4 – Financial Support for Carers |

Social Security (Administration) Act 1999 |

2,462 |

622,765 |

|

Youth Allowance (Student) |

1.6 – Student Payments |

Social Security (Administration) Act 1999 |

1,884 |

77,237 |

Note a: Family Tax Benefit recipient information is reported with a two-year lag, so 2021–22 figures were not available.

Note b: Number of individuals and families that started receiving Parental Leave Pay in the financial year.

Source: DSS, Annual Report 2021–22, Commonwealth of Australia, 2022, pp. 46–47 and 243–244.

Bilateral arrangement between the department and Services Australia

1.5 The bilateral arrangement between the department and Services Australia began as a ‘purchaser-provider’ arrangement established in 1997 between the newly created Centrelink and the Department of Social Security. Under a ‘purchaser-provider’ arrangement, one entity purchases services from another entity, with agreed expectations and service levels set out in bilateral agreements. From 1997–98 Centrelink began reporting to the department against bilateral KPMs for the accuracy and timeliness of welfare payments it made on the department’s behalf.

1.6 In 2011 the bilateral relationship changed from a ‘purchaser-provider’ arrangement to an ‘appropriated partnership’ arrangement (when Centrelink became part of the Department of Human Services). Under an ‘appropriated partnership’ arrangement, one entity is accountable for delivering services and prioritising service delivery within its funding budget (appropriation); and the other entity retains policy responsibility for those services.

1.7 For welfare payments, the Secretary of the department is accountable for delivery of welfare payment outcomes and all payment-related functions that have been delegated to Services Australia, including payment accuracy and timeliness.12 The Chief Executive Officer (CEO) of Services Australia is accountable for whole-of-government service and payment delivery and Services Australia receives direct funding to manage these functions through a departmental appropriation ($4.6 billion in 2022–23).13 Services Australia has bilateral arrangements with the department and other entities (such as with the Department of Health and Aged Care for delivery of Medicare services) and needs to prioritise service and payment delivery across these arrangements within its allocated funding. Accordingly, to ensure that welfare payment delivery achieves its policy objectives, the department must establish a robust bilateral arrangement with Services Australia that enables it to effectively oversee the delivery of its delegated functions and resolve competing risk priorities.

1.8 The current Bilateral Management Arrangement (BMA) between the department and Services Australia comprises: a high-level Head Agreement; and a series of subordinate bilateral agreements (called ‘protocols’ and ‘service schedules/arrangements’) outlining how the entities will work together to achieve desired outcomes.14 Reporting against KPMs for the accuracy and timeliness of welfare payments still forms a central component of the BMA. The current Payment Assurance Service Arrangement (dated April 2016) sets out that: Services Australia is responsible for implementing payment assurance activities, monitoring their effectiveness and providing feedback to the department; and the department is responsible for reporting to government on outcomes and issues.

1.9 Under the BMA, the department reports on welfare payment accuracy in its annual report, Services Australia reports on payment accuracy and timeliness to the Secretary of the department through an annual assurance statement, and Services Australia reports on payment correctness and timeliness in its annual report.15 In addition, the department and Services Australia provide quarterly performance reporting to bilateral governance bodies comprised of senior executives from both entities.

Payment accuracy

1.10 Welfare payments are considered ‘accurate’ if Services Australia pays ‘the right person the right amount through the right program at the right time’.16 Inaccurate payments can be either overpayments or underpayments, and can result from fraud, corruption, recipient error (such as inadvertent non-compliance with requirements to report changes in circumstances17) and/or administrative error (such as errors in Services Australia’s payment processing).

1.11 From July 2002 Centrelink, on behalf of the department, began using the results of a random sample survey of welfare recipients to assess the accuracy of welfare payments. As of June 2023, this survey-based approach, now called the Payment Accuracy Review Program (PARP), was still the primary mechanism for assessing the accuracy of the department’s payments. Broadly, the PARP involves:

- identifying a random sample of welfare payment recipients;

- undertaking reviews of their eligibility and circumstances (PARP reviews) to determine if they are receiving the right payment for the right amount on a particular fortnight; and

- using PARP review results to estimate payment accuracy (also referred to as ‘payment integrity’ or ‘integrity of payment outlays’) for the population of welfare recipients.

1.12 The department and Services Australia use data generated through the PARP to report to bilateral governance bodies on a trimester basis on performance against KPMs for the accuracy of individual welfare payments. Services Australia uses the same data to report on accuracy KPM performance to the Secretary of the department annually through its annual assurance statement. The department also reports on welfare payment accuracy in its annual report using the results of the PARP.

1.13 As shown in Figure 1.1, the overall payment inaccuracy rate for the department’s welfare payments, as measured through the PARP, has increased since 2013–14. The inaccuracy rate went above five per cent (representing the department’s payment accuracy target of 95 per cent) for the first time in 2018–19 and was above the target in 2020–21 and 2021–22. In 2021–22 the department estimated that the total value of overpayments was $7.174 billion (6.0 per cent of total payments), and the total value of underpayments was $514 million (0.4 per cent of total payments). Individual payment accuracy KPMs and reported results from 2018–19 to 2021–22 are reproduced at Appendix 4.

Figure 1.1: Payment inaccuracy rate, 2013–14 to 2021–22

Source: ANAO analysis of DSS annual reports from 2013–14 to 2021–22. DSS did not report an overall accuracy rate in its 2020–21 annual report, so the result for that year is sourced from internal reporting.

1.14 In 2022–23 Services Australia had 150 operational staff working on the PARP (excluding support staff and managers).18 Figure 1.2 shows Services Australia has conducted an average of around 21,000 PARP reviews of individual welfare recipients per year since 2013–14. In 2019–20 PARP reviews were suspended for trimester three (1 March to 30 June 2020) due to Services Australia’s COVID-19 pandemic response.19 The department and Services Australia further agreed that three payments (Disability Support Payment, Parenting Payment Partnered and Parenting Payment Single) would not be reviewed in trimester three 2021–22 (1 March to 30 June 2022) due to the diversion of PARP staff to priority activities in response to the continuing COVID-19 pandemic and natural disaster events (particularly, New South Wales and Queensland floods in early 2022).

Figure 1.2: Number of PARP reviews conducted, 2013–14 to 2021–22

Source: DSS annual reports from 2013–14 to 2021–22.

Payment correctness

1.15 Services Australia has also used PARP data to report on welfare payment correctness in its annual report. Centrelink first publicly reported a correctness result based on PARP data in 2004–05, and the calculation method has not changed since then. Services Australia has defined payment correctness as ‘the percentage of [PARP] reviews without a dollar impact error based on information provided by the customer’20, and it has used this performance measure to assess the correctness of its administrative decision making and processing.21 As shown in Figure 1.3, the percentage of PARP reviews identifying dollar impact administrative errors has steadily decreased since 2009–10, and has been consistently below five per cent (representing Services Australia’s payment correctness target of 95 per cent).

Figure 1.3: Percentage of PARP reviews with dollar impact administrative errors, 2004–05 to 2021–22

Source: ANAO analysis of Centrelink annual reports from 2004–05 to 2010–11, DHS annual reports from 2011–12 to 2017–18, and Services Australia annual reports from 2018–19 to 2021–22.

Payment timeliness

1.16 Individuals can claim most welfare payments online using a ‘Centrelink online account’ through the myGov platform. In 2021–22 Services Australia reported that it processed more than 4.5 million welfare claims for the department, of which around 3 million were granted and 1.5 million rejected.22

1.17 ‘Payment timeliness’ is a measure of the time it takes Services Australia to process claims for welfare payments. The department and Services Australia have agreed KPM benchmarks for the timeliness of specific payments — for example, the benchmark for the Crisis Payment is the completion of 90 per cent of claims within two calendar days, whereas for the Disability Support Pension it is completion of 80 per cent of claims within 84 calendar days.

1.18 Services Australia has reported against an aggregate welfare payment timeliness performance measure in its annual report since 2015–16 with a performance target of 82 per cent of claims processed within agreed KPM benchmark standards.23 Figure 1.4 shows Services Australia’s performance has been variable, achieving the target in four of the past seven years.

Figure 1.4: Welfare claim processing timeliness, 2015–16 to 2021–22

Source: ANAO analysis of DHS annual reports from 2015–16 to 2017–18 and Services Australia annual reports from 2018–19 to 2021–22.

1.19 The department and Services Australia report on timeliness KPMs for individual welfare payments to bilateral governance bodies on a quarterly basis, and Services Australia reports on timeliness KPM performance to the Secretary of the department annually through its annual assurance statement. Payment timeliness KPMs and results from 2018–19 to 2021–22 are reproduced at Appendix 5.

Rationale for undertaking the audit

1.20 Effective management of welfare payment processing to ensure recipients receive ‘the right payment at the right time’ is central to the bilateral arrangement between the department and Services Australia. Accuracy and occurrence of personal benefits is a key audit matter for the ANAO’s financial statements audit program and a key area of financial statements risk for the department due to: the high volume and varying complexity of payments processed by Services Australia on complex IT systems; and the reliance on correct disclosure of personal circumstance information by a large number of recipients across diverse socioeconomic groups.24 This audit was conducted to provide assurance to Parliament on the department’s and Services Australia’s processes for monitoring, reporting and continuously improving welfare payment accuracy and timeliness.

Audit approach

Audit objective, criteria and scope

1.21 The objective of the audit was to assess the effectiveness of Department of Social Services’ and Services Australia’s management of the accuracy and timeliness of welfare payments.

1.22 To form a conclusion against the objective, the following high-level criteria were adopted:

- Has the department established effective oversight arrangements for the accuracy and timeliness of Services Australia’s payment delivery?

- Have the department and Services Australia established effective processes for monitoring, reporting and continuously improving payment accuracy?

- Have the department and Services Australia established effective processes for monitoring, reporting and continuously improving payment timeliness?

1.23 The ANAO’s analysis of payment accuracy and timeliness reporting examined the period of July 2018 to June 2022 and, where relevant, the ANAO examined key events up to and including June 2023.25 The ANAO did not directly examine Services Australia’s fraud and corruption control or debt management activities (including the Online Compliance Intervention System for Debt Raising and Recovery, colloquially known as Robodebt).26 Debt management was the subject of a separate performance audit, which was presented to Parliament in May 2023.27

Audit methodology

1.24 To address the audit objective and criteria, the ANAO:

- examined documentation held by the department and Services Australia, including governance body papers and minutes, internal and external reporting, and email records;

- conducted process reviews for payment accuracy and timeliness monitoring activities, including reviewing procedural documentation and quality assurance processes;

- extracted and analysed monitoring data from 2018–19 to 2021–22 to verify reporting on payment accuracy and timeliness;

- held meetings with staff of the department and Services Australia; and

- invited input from external stakeholders (three contributions were received from two individuals).

1.25 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $614,000.

1.26 The team members for this audit were Daniel Whyte, Anne Kent, Ewan McPherson, James Carrington, Magdalena Carrasco, Nathan Daley, Qing Xue, Zhuo Li, Xiaoyan Lu and Alexandra Collins.

1.27 The ANAO has co-operative evidence gathering arrangements in operation with entities. On 3 February 2023 Services Australia advised the ANAO that it was unable to voluntarily provide certain information requested by the ANAO due to legislative restrictions on the disclosure of requested information. On 9 February 2023 the Acting Auditor-General issued Services Australia with a notice to provide information and produce documents pursuant to section 32 of the Auditor-General Act 1997 to enable it to provide the requested information taking account of legislative requirements. Services Australia provided the information requested within the specified time, following receipt of the notice.

2. Oversight arrangements

Areas examined

This chapter examines whether the Department of Social Services (the department or DSS) has established effective oversight arrangements for the accuracy and timeliness of welfare payments that Services Australia delivers on its behalf.

Conclusion

The department’s oversight arrangements for the accuracy and timeliness of welfare payments have been partly effective. Current bilateral agreements do not adequately support oversight of payment accuracy and timeliness, and attempts to update relevant agreements have been unsuccessful to date. The department’s oversight of payment accuracy and timeliness has not been proactive and strategic. Assurance arrangements for payment accuracy and timeliness are not sufficiently objective and independent, and shared risks relating to payment accuracy and timeliness are not being managed collaboratively.

Areas for improvement

The ANAO made three recommendations aimed at: ensuring bilateral arrangements support the department’s oversight of payment accuracy and timeliness; establishing a robust bilateral assurance framework; and implementing robust bilateral risk management processes.

2.1 As noted at paragraphs 1.6 and 1.7, the department and Services Australia have an ‘appropriated partnership’ bilateral arrangement.

- The department is responsible for welfare payment policy and for administration of special appropriations established for welfare payments (see paragraph 1.1). The Secretary has delegated authority for delivering and managing welfare payments to the Services Australia Chief Executive Officer (CEO). The Secretary of the department is accountable for delivery of welfare payment outcomes and all functions delegated to Services Australia, including payment accuracy and timeliness.

- Services Australia receives a direct appropriation for delivering government services and payments. The CEO of Services Australia is accountable for prioritising service and payment delivery within this allocation.

2.2 To support effective oversight of an appropriated partnership, the entity accountable for the services needs to establish robust bilateral agreements with the delivery entity, which should include clear objectives, defined roles and responsibilities, and effective processes for issue identification and dispute resolution. Bilateral governance bodies should be established at appropriate levels to ensure proactive and strategic management and oversight of the services being delivered. Bilateral arrangements should include appropriate assurance processes that provide the accountable entity with an objective and independent assessment of delivery mechanisms.28 Robust processes for identifying, communicating and managing shared risks are also important, particularly when the accountable entity’s and delivery entity’s risk tolerances differ.29 This chapter examines whether the department has established an effective bilateral arrangement with Services Australia that supports its oversight of welfare payment accuracy and timeliness and includes appropriate processes for assurance and shared risk management.

Do bilateral agreements adequately support the department’s oversight of payment accuracy and timeliness?

Current bilateral agreements between the department and Services Australia do not adequately support the department’s oversight of payment accuracy and timeliness. While accuracy and timeliness are core components of current agreements, relevant content is incomplete and out of date. The department and Services Australia renegotiated the head agreement in April 2023 and the entities plan to update other aspects of the bilateral framework by October 2023. Previous attempts to update agreements over the last seven years were unsuccessful.

Structure of the Bilateral Management Arrangement

2.3 A machinery-of-government change in September 2013 brought responsibility for welfare payments together within the department.30 In October 2014 the department established a Bilateral Management Arrangement (BMA) with Services Australia31, comprising:

- a head agreement — which outlined the purpose, outcomes and principles of the BMA, defined each entity’s roles and responsibilities, established governance and operational arrangements for managing the BMA, and included a bilateral assurance framework;

- protocols — subordinate agreements outlining processes, frameworks and guidelines to support operational arrangements; and

- service schedules/arrangements — subordinate agreements relating to the payments, programs and services that Services Australia delivered on the department’s behalf.

2.4 In April 2018 the accountable authorities of the department and Services Australia signed a Statement of Intent, which replaced the 2014 BMA Head Agreement. In April 2023 the accountable authorities signed a new BMA head agreement, which superseded the two previous agreements. The 2023 Head Agreement stated that subordinate agreements entered into under the previous agreements remained in effect and bilateral protocols would be revised over the first three to six months of the new agreement (by July to October 2023). BMA agreements in effect as of June 2023 are outlined in Appendix 6.

Bilateral agreement coverage of payment accuracy and timeliness

2.5 As of June 2023 four service arrangements (pre-dating the 2023 Head Agreement) included content related to the accuracy and timeliness of welfare payments. In addition, the 2016 Payment Assurance Service Arrangement includes reference to an additional subordinate agreement with related content — the Random Sample Surveys Standing Operational Statement, which was last updated in May 2019. Table 2.1 outlines the ANAO’s assessment of the completeness and currency of this content. In summary:

- all relevant subordinate bilateral agreements were out of date, with commitments to annual reviews included within the agreements not having been met; and

- content related to payment accuracy and timeliness was incomplete and out of date (all agreements included references to ceased payments and/or did not include all current payments and revised key performance measures, and some agreements did not include entity roles and responsibilities or had outdated references to issues resolution processes).

Table 2.1: ANAO assessment of completeness and currency of BMA subordinate agreement content related to welfare payment accuracy and timeliness

|

Agreement |

Related content |

Completea |

Currentb |

|

Age, Disability and Carer Service Arrangement (October 2014) |

|

✘ |

✘ |

|

Family Assistance and Child Support Service Arrangement (April 2016) |

|

✘ |

✘ |

|

Labour Market Policy and Student Payments Service Arrangement (April 2016) |

|

✘ |

✘ |

|

Payment Assurance Service Arrangement (April 2016) |

|

✘ |

✘ |

|

Random Sample Surveys Standing Operational Statement (May 2019) |

|

✔ |

✘ |

Key: ✔ yes ✘ no

Note a: Agreements were assessed to be incomplete if there was relevant content that was not included (such as new or updated KPMs for welfare payments, entity roles and responsibilities, or issues resolution processes).

Note b: Agreements were assessed to be not current if there was relevant content that was out of date (such as payments or processes that had ceased) or they had not been updated in accordance with the review period defined within the agreement.

Source: ANAO analysis of DSS and Services Australia documentation.

Attempts to refresh the bilateral arrangement

2.6 In 2016 the department commissioned a review of entity accountabilities and the operation of the BMA (‘Review of Accountabilities — The Bilateral Management Arrangement’), led by Ms Peta Winzar.32 The review was finalised in August 2016 and made 22 recommendations for reforming the BMA, including an overarching recommendation that:

DSS and [Services Australia] develop a new, transformative partnership agreement which:

- explicitly aims to transform policy and delivery by collaborating,

- reflects the separate, shared and reciprocal accountabilities of both departments, and

- which uses a control-assure-improve model of accountability to design a performance framework which aligns with the outcomes set out in the DSS Portfolio Budget Statement, and employs a risk-based and proportionate suite of assurance mechanisms.

2.7 The department and Services Australia did not document their responses to the recommendations. Following the Review of Accountabilities, the department and Services Australia initiated a BMA review project in late 2016 with the aim of having revised arrangements in place for 2017–18. In November 2016 the department told the Joint Committee of Public Accounts and Audit that the BMA review would be completed in early 2017.33 The project was subsequently delayed due to the entities prioritising other activities (such as developing Budget proposals and revising the annual assurance statement process), and a revised timeline was agreed in April 2018 that committed to bilateral agreements being finalised between June 2018 and February 2019. The Statement of Intent (see paragraph 2.4) and some bilateral protocols were finalised in 2018 and early 2019. Core elements of the BMA review project relevant to welfare payment timeliness and accuracy (such as an independent review of bilateral KPMs and a revised assurance framework) were not progressed.

2.8 A November 2019 internal audit of welfare payment processing undertaken by the department found there was limited evidence that the department had accepted or rejected the recommendations of the 2016 Review of Accountabilities or put in place management actions to address them. The internal audit included a recommendation, agreed by management, that the department redesign the existing BMA in consultation with Services Australia, including updating the Statement of Intent and reshaping arrangements and protocols. Implementation of the recommendation has been delayed, with reporting to the department’s audit committee from 2020 to 2022 citing reasons such as: the establishment of Services Australia; the COVID-19 response; prioritising work on addressing payment inaccuracy; and implementing recommendations from an Australian National University review of the methodology for measuring payment accuracy (discussed in paragraphs 3.5 to 3.10).

2.9 A renewed BMA project was initiated in 2022 with the aim of developing a revised suite of bilateral agreements by the end of 2022. The renewed project has also been delayed. As of June 2023, the only output of the project was the April 2023 Head Agreement, which includes a revised governance structure for the refreshed BMA (discussed at paragraph 2.16). None of the proposed subordinate agreements relating to payment accuracy and timeliness had been finalised.

Recommendation no.1

2.10 Department of Social Services and Services Australia complete the current bilateral arrangement refresh process by October 2023, ensuring revised service arrangements for welfare payments include effective mechanisms to support the department’s oversight of welfare payment accuracy and timeliness.

Department of Social Services response: Agreed.

2.11 An updated Bilateral Management Arrangement Head Agreement was signed by department’s Secretary, Mr Ray Griggs AO CSC, and the Services Australia CEO, Ms Rebecca Skinner PSM, in April 2023. Subordinate Protocols and Service Arrangements are being updated.

Services Australia response: Agreed.

2.12 The Head Agreement was executed by the Entity Heads on 25 April 2023, and the underpinning Protocols will be finalised by October 2023 as outlined in the Bilateral Management Arrangement (BMA). Subordinate documents will be reviewed and finalised in the first half of 2024, after the Protocols are executed.

ANAO comment on Services Australia’s response:

2.13 While Services Australia agreed to this recommendation, its comment indicates that it does not intend to complete the current bilateral arrangement refresh process by October 2023.

Has the department had adequate oversight of payment accuracy and timeliness?

Reporting on payment accuracy and timeliness has been monitored by senior executive-level bilateral committees. The department’s oversight has generally focussed on performance results, rather than strategic consideration of underlying causal factors. Since 2021 there has been increased oversight of payment accuracy and timeliness at the accountable authority level, focusing on remedial action to address declining performance results.

Bilateral governance structure

Bilateral governance bodies

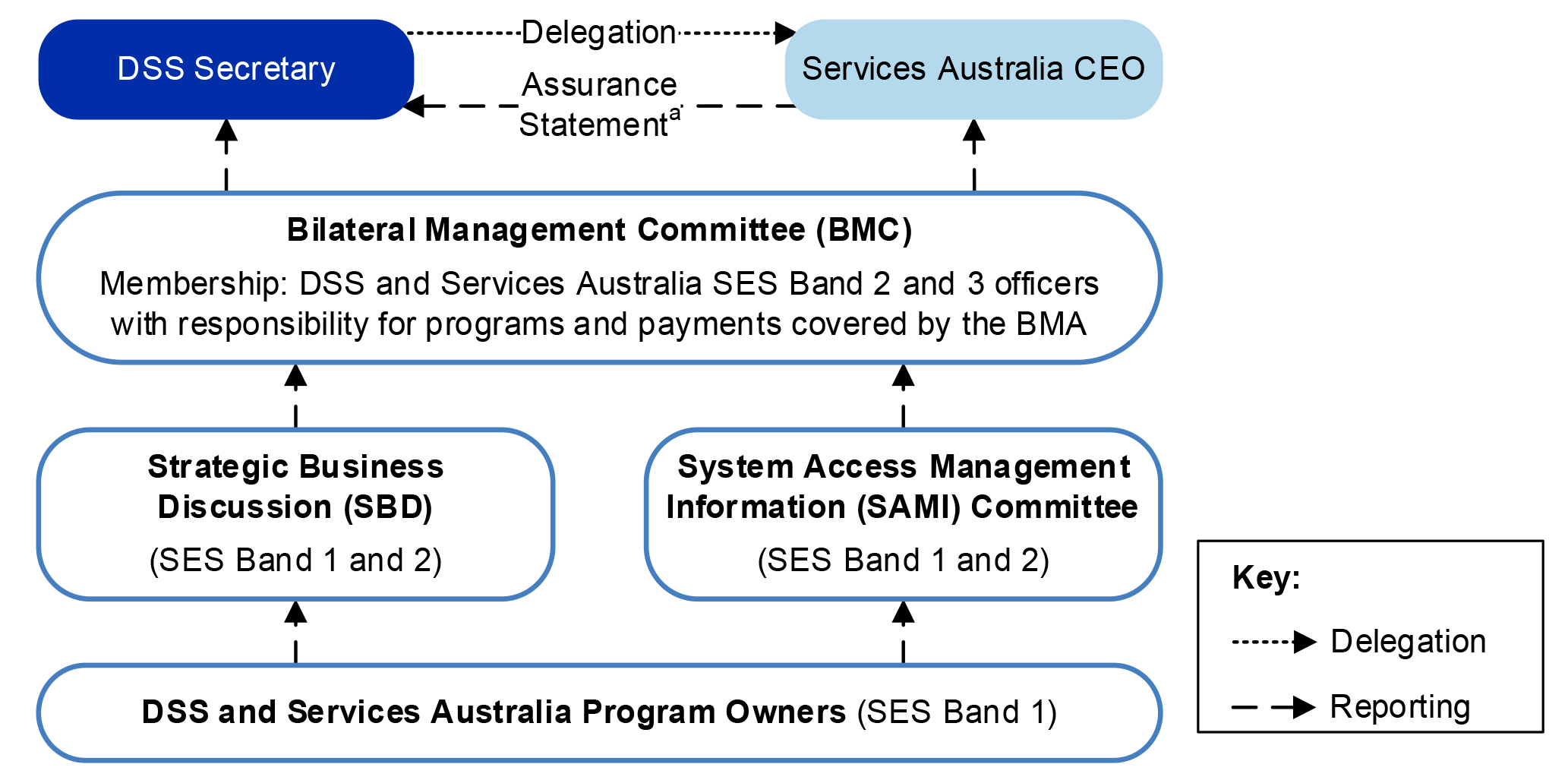

2.14 As described at paragraph 2.1, the Secretary of the department is accountable for welfare payment outcomes and the CEO of Services Australia is accountable for whole-of-government service and payment delivery. Beneath the accountable authorities, the 2014 Head Agreement established a governance structure centred around a Senior Executive Service (SES) Band 3 level Bilateral Management Committee (BMC). Reporting to BMC were six SES Band 2 level Strategic Business Discussion (SBD) committees34 and a Systems Access and Management Information (SAMI) Committee. In December 2016 the department and Services Australia reduced the number of BMA governance bodies to three, retaining BMC, a single SBD and SAMI. This was originally intended as an interim measure, pending the outcomes of a review of BMA governance arrangements (which was not completed).

2.15 The interim structure was subsequently incorporated into the 2018 Statement of Intent. Under the Statement of Intent, BMC and SBD were responsible for oversight of payment accuracy and timeliness, with the agreement stating that BMC ‘monitors program and payment performance’ and SBD ‘provides oversight of program performance and payment outcomes’. This governance structure, which remained in place until March 2023, is depicted in Figure 2.1.

Figure 2.1: BMA governance structure, as of March 2023

Note a: While not a requirement of the Bilateral Management Arrangement (BMA) until it was included in the 2023 BMA Head Agreement, by convention the Services Australia CEO has provided an annual assurance statement to the Secretary reporting against ‘bilateral assurance areas’ outlined in the 2014 BMA Head Agreement. The five bilateral assurance areas were: 1. Integration of policy and service delivery; 2. Shared understanding of policy and delivery outcomes sought; 3. Systems, data and management information continuity and interoperability; 4. Effective relationship management; and 5. Payment assurance.

Source: ANAO analysis of DSS and Services Australia documentation.

2.16 The April 2023 BMA Head Agreement outlines a new governance structure, which as of June 2023 was in the process of being established, that involves:

- meetings between the Secretary of the department and Services Australia CEO at least twice a year;

- three SES Band 3 level meetings occurring twice yearly covering social security and family payment integrity, community and disability policy and program delivery, and whole of portfolio matters;

- three SES Band 2 level SBD meetings and one SES Band 2 level data forum occurring quarterly35; and

- a series of other ad hoc and scheduled working group and committee meetings at an SES Band 1 level.

Bilateral governance body oversight

2.17 The ANAO examined BMC and SBD meeting papers and minutes from 2018–19 to 2021–22 to assess the adequacy of these bodies’ oversight of payment accuracy and timeliness. BMC and SBD generally met quarterly over this period, except for a ‘pause’ from late 2019 to late 2020 attributed to the establishment of Services Australia and the COVID-19 response.

2.18 As shown in Figure 2.2, all BMC and SBD meetings held over the four years included discussion of payment accuracy and/or timeliness matters. Discussion generally focussed on changes in the quarterly KPM results. Limited progress was made over this period on strategic projects, such as the BMA refresh and development of a revised assurance framework.

- During 2018–19 BMC and SBD discussed both payment accuracy and timeliness issues. In that year most payments fell short of timeliness KPM targets36, and aggregate payment accuracy results failed to meet the department’s 95 per cent target for the first time.

- After bilateral meetings resumed in 2020–21 discussion focused on topics relating to the measurement methodologies (such as reviewing the payment accuracy methodology and timeliness KPMs), particularly at SBD meetings. In addition, there was increased focus on payment accuracy during 2020–21 and 2021–22 as KPM results deteriorated.

Figure 2.2: BMC and SBD discussion topicsa, quarter one 2018–19 to quarter four 2021–22b

Note a: BMC and SBD discussion topics were determined through analysis of meeting minutes. Agenda items were assessed as having multiple discussion topics when separate topics were discussed under a single item. Topics were classified based on whether they related to: payment timeliness performance; payment accuracy performance; methodologies for measuring payment timeliness or accuracy; BMA matters (for example, the BMA review project); and other matters (for example, policy matters, upgrades to payment processing systems, etc.).

Note b: Quarter in which meeting was held, rather than for which performance reporting was presented. BMC meetings were paused from Q2 to Q4 2019–20 and no BMC meeting was held in Q3 2021–22. No SBD meeting was held in Q1 2018–19 and SBD meetings were paused from Q3 2019–20 to Q1 2020–21.

Source: ANAO analysis of DSS and Services Australia documentation.

Reporting to SBD and BMC

2.19 The department’s 2019 internal audit of welfare payment processing (discussed at paragraph 2.8) found that:

- BMC and SBD had not clearly defined their expectations for reporting; and

- information being provided was not transparent and was insufficient to inform strategic decision-making and demonstrate their responsibilities had been acquitted.

2.20 The audit made a recommendation to clearly outline the information and reporting expectations for each committee. While the terms of reference for BMC and SBD were updated in December 2021 in response to this recommendation, the revisions were superficial and did not address the substance of the recommendation relating to information and reporting expectations.

2.21 The ANAO’s analysis of papers presented to BMC and SBD from 2018–19 to 2021–22 found that the committees received regular reporting on KPM performance. Less frequently, papers were presented that provided detailed analysis of the drivers of accuracy and timeliness performance.

- The department and Services Australia prepare a quarterly performance assurance report, which includes reporting against accuracy and timeliness KPMs and commentary from Services Australia on KPMs not achieving benchmark targets. The report was provided to most SBD meetings and two thirds of BMC meetings held from 2018–19 to 2021–22 (although BMC only received an executive summary in 2018–19).

- One paper was presented over the period on payment timeliness performance. In April and May 2019 the department and Services Australia presented a paper to SBD and BMC that provided quantitative analysis of Newstart Allowance claim processing timeliness, following a rise in the number of unfinalised claims.

- Papers on payment accuracy performance were more frequent, starting from the beginning of 2021 as KPM performance declined. These papers noted a high level of payment inaccuracy risk associated with JobSeeker Payment recipients incorrectly reporting their earned income, and discussed remediation actions being taken by Services Australia.

Accountable authority oversight

2.22 In addition to the regular oversight of payment accuracy and timeliness through bilateral governance bodies, there has been engagement at the accountable authority level. The Secretary of the department has written to the Services Australia CEO on three occasions since 2019 raising concerns about payment accuracy and timeliness results.

- In October 2019 the Secretary expressed concern that Services Australia’s 2018–19 Annual Assurance Statement did not include detail on claim processing timeliness and requested such information be included in future. Services Australia’s subsequent annual assurance statements in 2019–20, 2020–21 and 2021–22 included reporting on payment timeliness KPM performance.

- In April 2021 the Secretary expressed concern about payment accuracy results and requested detailed analysis of factors driving inaccuracy and a remediation plan. The Services Australia CEO responded in May 2021 identifying the key drivers of inaccuracy as: recipients failing to report changes in their circumstances; and a large cohort of new welfare recipients during COVID-19 who were unfamiliar with the welfare system. The CEO’s letter also noted actions being taken to address the deficiencies, including obtaining assurance and advice from KPMG on COVID-19 activities and factors contributing to inaccuracy and using Single Touch Payroll (STP) data to pre-fill recipients’ employment reporting forms.37

- The Secretary wrote to the CEO again in November 2022, in response to commentary on STP in Services Australia’s 2021–22 Annual Assurance Statement, requesting ‘an assurance around the role of STP in improving payment accuracy’. The Services Australia CEO responded in December 2022 providing a progress update on payment accuracy initiatives, including STP. After this correspondence, the department and Services Australia began working together at the Senior Executive Service officer level to analyse the impact of STP on payment accuracy through the Payment Accuracy Review Program (PARP) (this work is discussed further in paragraphs 3.115 and 3.116).

2.23 The department informed the ANAO that the Secretary and Services Australia CEO have had more engagement on payment accuracy since mid-2021 but meetings were not well documented. Talking points prepared by the department for the meetings covered topics such as: actions to address payment inaccuracy; analysis of STP impacts on payment accuracy; and progressing the BMA refresh.

2.24 Raising bilateral governance to the accountable authority level and formalising the engagement through maintaining appropriate records of meetings has the potential to improve the department’s oversight of payment accuracy and timeliness. As noted at paragraph 2.16, the governance arrangements outlined in the 2023 BMA Head Agreement involve a biannual meeting between the accountable authorities, as well as establishing more SES Band 3 and Band 2-level bodies.

Have appropriate assurance arrangements been established to support the department’s oversight?

Current bilateral arrangements do not provide the department with an objective and independent assessment of governance, risk management and control processes for payment accuracy and timeliness. The department and Services Australia have separately identified deficiencies in payment assurance arrangements, but progress in addressing these issues has been limited.

Bilateral payment assurance arrangements

2.25 As the department’s welfare payments are delivered by Services Australia, the Secretary of the department needs to obtain sufficient assurance that Services Australia’s control framework for welfare payment processing is operating effectively.38

2.26 The 2018 Statement of Intent included a section on ‘Assurance’ that stated:

DSS and [Services Australia] work cooperatively to provide assurance to each Secretary about the efficiency and effectiveness of social welfare policies and administration.

The assurance framework sets out the specific assurance measures used to demonstrate effective collaboration on payment accuracy and risk identification and management across the bilateral relationship. The assurance process is designed to comply with commonwealth risk management policies and supports corporate requirements and responds to contemporary advice from the ANAO.

The assurance framework is outlined in detail in the assurance addendum to the Special Appropriations Service Arrangement.39

2.27 The Special Appropriations Service Arrangement and ‘assurance addendum’ referenced in the Statement of Intent were not developed, meaning there has been no bilateral assurance framework in place since 2018.

2.28 The 2014 BMA Head Agreement had included a bilateral assurance framework that identified two assurance reporting mechanisms:

- the performance assurance report — which includes reporting on performance against bilateral KPMs (such as the payment accuracy and timeliness KPMs) and commentary on program achievements and issues; and

- Services Australia’s annual assurance statement — which is provided by the Services Australia CEO to the Secretary of the department after the end of each financial year.

2.29 From 2018, in the absence of a current bilateral assurance framework, the assurance reporting mechanisms referenced in the 2014 BMA Head Agreement have continued to operate. As noted in Figure 2.1, Services Australia’s annual assurance statement has continued to include reporting against the ‘bilateral assurance areas’ outlined in the 2014 BMA Head Agreement. Nevertheless, neither assurance mechanism provides sufficient assurance to the Secretary over the effectiveness of Services Australia’s welfare payment controls since neither provides an objective and independent assessment of governance, risk management and control processes.

- Reporting against accuracy and timeliness KPMs informs both the performance assurance report and annual assurance statement. While these KPMs provide useful high-level indicators of program performance, they do not provide a direct assessment of the effectiveness of Services Australia’s control framework. When KPM targets are met, it is possible to infer that controls are operating effectively; but when targets are not met, KPM results alone provide limited information about control weaknesses.40

- Additional information provided in the performance assurance report and annual assurance statement largely consists of Services Australia’s commentary about likely causes of KPM targets not being met and high-level descriptions of actions Services Australia is taking to respond. As this content is prepared by Services Australia in response to identified performance issues, it cannot be considered objective or independent, and does not serve its purpose of providing assurance to the department.

Entity reviews and audits relating to assurance

2.30 Both the department and Services Australia have commissioned internal reviews and audits in recent years that have identified deficiencies in assurance arrangements relating to activities governed by the BMA (see Box 1). Common themes emerging from these reviews and audits and the relevant entity’s response include that:

- the department’ reliance on high-level KPM reporting and assurances from Services Australia does not provide sufficient assurance over welfare payment control effectiveness;

- the department must work collaboratively with Services Australia to gain a deeper understanding of welfare payment controls (such as by conducting assurance mapping) and determine a more robust bilateral assurance framework; and

- findings of reviews and audits have not been adequately considered at a bilateral level, and recommendations have largely not been implemented.

|

Box 1: Findings of entity reviews and audits relating to assurance |

|

Review of Accountabilities (2016) The 2016 Review of Accountabilities (discussed at paragraph 2.6) made several recommendations about improving bilateral assurance arrangements, including that the department and Services Australia:

As noted at paragraph 2.8, the department’s 2019 internal audit of welfare payment processing found limited evidence that the department had accepted or rejected these recommendations or put in place management actions to address them. 2019 and 2020 internal audits of payment processing The department’s 2019 internal audit of welfare payment processing (discussed at paragraphs 2.8 and 2.19) found: the department had limited visibility of assurance activity being undertaken by Services Australia; and the department had not actively considered whether the PARP provides appropriate assurance. The audit included a recommendation that the department:

A November 2020 internal audit of pension payment processing had the same finding and made a comparable recommendation. As of May 2023 implementation of these recommendations remained incomplete. While the department estimated in March 2023 reporting to its audit committee that a new bilateral assurance framework would be implemented by June 2023, it had not approached Services Australia regarding the assurance mapping component of the recommendation. COVID-19 Assurance and Compliance review (2020) During the early response to the COVID-19 pandemic, the department engaged KPMG to provide external assurance of Services Australia’s control framework for streamlined welfare claim processing. This review is the only example the ANAO found of the department obtaining an objective and independent assessment of Services Australia’s governance, risk management and control processes for welfare payments over the period assessed by this audit. The review identified key risks to the integrity of welfare payments and the department’s reputation, including: identify fraud; external fraud (recipients intentionally providing inaccurate information); recipients unintentionally providing incorrect information; internal fraud; and incorrect or poor quality communication with recipients. KPMG noted in its report that the department had ‘a high degree of reliance on assurances provided by [Services Australia] in relation to the operating effectiveness of key systems, controls and programs’. Accordingly, it included a recommendation that the department request regular additional information, updates and assurances related to key risk areas. While the intended scope of the recommendation was broad and ongoing, the department reported to the ANAO in April 2021 that the recommendation had been implemented on the basis that additional assurance had been requested from Services Australia over changes to identity verification controls. No evidence was found that the report was shared with Services Australia. Payment Accuracy Assurance Framework review (2022) In late 2021 Services Australia commissioned advice from Callida Consulting (Callida) on payment accuracy assurance. In January 2022 Callida advised that:

In June 2022 Callida provided a prototype assurance framework to Services Australia. The framework included a detailed controls register identifying gaps in current controls. It also outlined 33 proposed performance measures across the ‘predict-correct continuum’ to enable more holistic assurance monitoring. In February 2023 the ANAO raised with Services Australia that it had not responded to Callida’s findings, which had significant implications for the department’s welfare payments, or shared the prototype framework with the department. In March 2023 Services Australia shared the framework with the department at an SES Band 2 level. |

Note a: Assurance mapping is ‘a mechanism for linking assurances from various sources to the risks that threaten the achievement of an organisation’s outcomes and objectives’. HM Treasury, Assurance Frameworks, December 2012, p. 6.

Exchanging information on welfare payment internal audits

2.31 The 2016 Review of Accountabilities noted that, while the department did not undertake a significant level of internal audits into welfare programs, Services Australia had an extensive internal audit program. It recommended the two entities exchange information on relevant components of their internal audit programs. Following the review, the department and Services Australia began sharing information on their internal audit programs through the BMC in December 2016. However, after June 2018 no evidence was found of internal audits being discussed at BMC meetings.

2.32 In August 2019, after considering Services Australia’s 2018–19 Annual Assurance Statement, the department’s audit committee initiated two action items, requesting that:

- Services Australia acknowledge internal audits performed in future statements; and

- the department’s Head of Internal Audit provide an update to the committee’s next meeting on internal audits agreed between Services Australia and the department under the BMA.

2.33 The first item was closed at the next audit committee meeting in September 2019, with the committee noting that Services Australia’s Branch Manager of Financial Accounting (who had attended the meeting) would ‘take the action on notice’. Subsequently, there was one reference in Services Australia’s 2020–21 Annual Assurance Statement to an internal audit of Paid Parental Leave, and no references to internal audits in either the 2019–20 or 2021–22 statements.

2.34 The ANAO examined internal audits presented to Services Australia’s audit committees between 1 July 2018 and 31 December 2022 to assess their relevance to welfare payment accuracy and timeliness. As shown in Table 2.2, Services Australia undertook 123 internal audits over the period, including 23 that were relevant to payment accuracy and/or timeliness.41

Table 2.2: Services Australia’s internal audits relevant to payment accuracy and/or timeliness, July 2018–December 2022

|

|

2018–19 |

2019–20 |

2020–21 |

2021–22 |

2022–23a |

Total |

|

Number of internal audits completed |

56 |

36 |

15 |

10 |

6 |

123 |

|

Number of internal audits relevant to payment accuracy and/or timeliness |

7 |

10 |

2 |

2 |

2 |

23 |

|

Number of recommendations relevant to payment accuracy |

7 |

16 |

1 |

2 |

3 |

29 |

|

Number of recommendations relevant to payment timeliness |

0 |

1 |

0 |

0 |

9 |

10 |

Note a: Until 31 December 2022.

Source: ANAO analysis of Services Australia information.

2.35 In November 2019 the department’s audit committee agreed to close the second item and move assurance collaboration to be a regular part of the Head of Internal Audit report. No evidence was found of information on Services Australia internal audits or assurance collaboration being presented to the audit committee after that time.42

BMA refresh

2.36 The 2023 BMA Head Agreement has an attachment setting out high-level requirements for Services Australia’s annual assurance statement43, and includes a ‘strategic principle’ on ‘assurance of program performance’, which states:

Both entities acknowledge the importance of the Australian Government’s and customers’ trust in the successful delivery of social services programs and support. This remains a key element of the unique bilateral relationship between the entities. Performance measurement and reporting is a key component of this agreement, and the entities will have a strong focus on ensuring payment correctness, payment accuracy, payment timeliness and the successful administration of social security programs. The entities commit to the establishment and adherence to the Assurance, Delegations and Performance Management Protocol to ensure that the right programs and services are delivered to the right person at the right time.

The entities acknowledge and recognise the importance of regularly monitoring the reporting obligations, including as part of the governance discussions, to ensure assurance activities remain appropriate and fit-for-purpose.44

2.37 The development of the Assurance, Delegations and Performance Management Protocol presents an opportunity for the department to address identified deficiencies in the level of assurance it gains under the bilateral assurance arrangements.

Recommendation no.2

2.38 Department of Social Services and Services Australia establish by October 2023:

- processes to exchange relevant internal audit and management assurance reports; and

- a robust bilateral assurance framework that facilitates independent and objective assessment of welfare payment control effectiveness.

Department of Social Services response: Agreed.

2.39 The department is working with Services Australia to include these matters in the updated Bilateral Management Arrangement documents.

Services Australia response: Agreed.