Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Interim Report on Key Financial Controls of Major Entities

Please direct enquiries through our contact page.

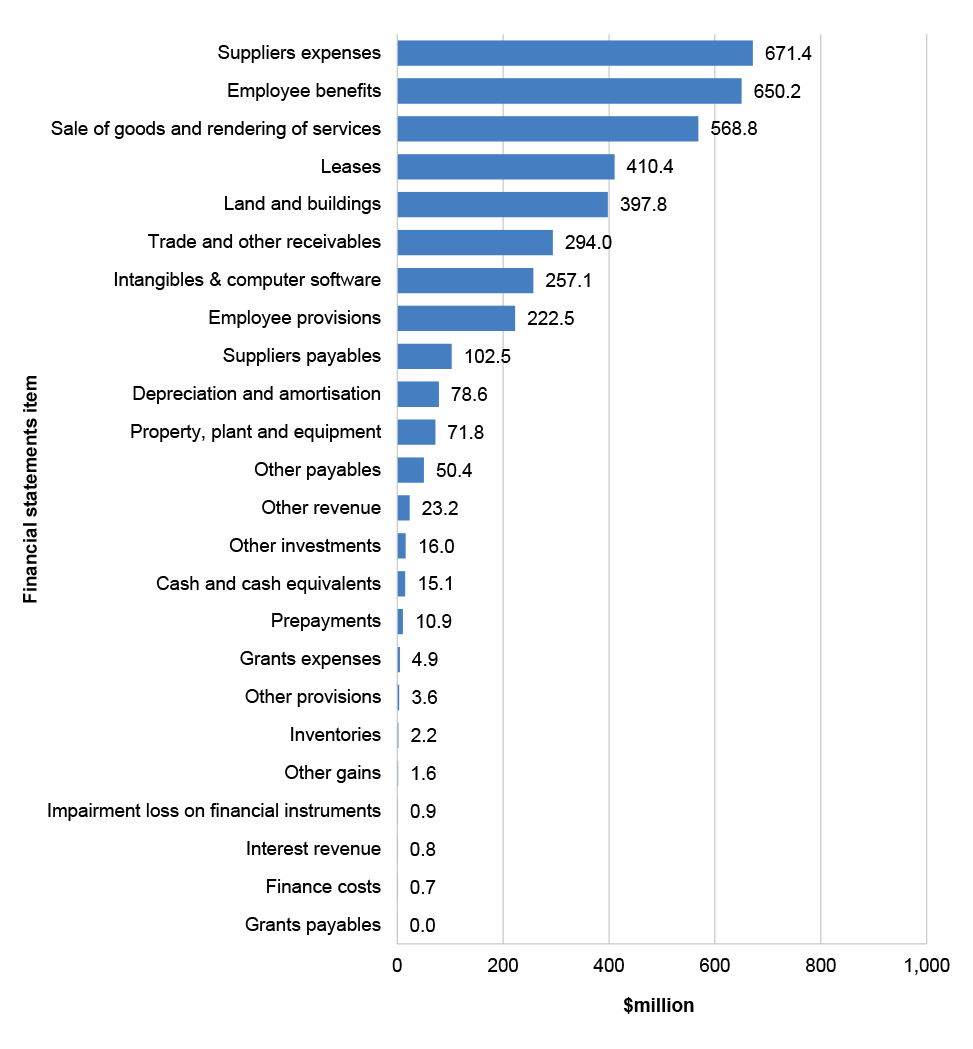

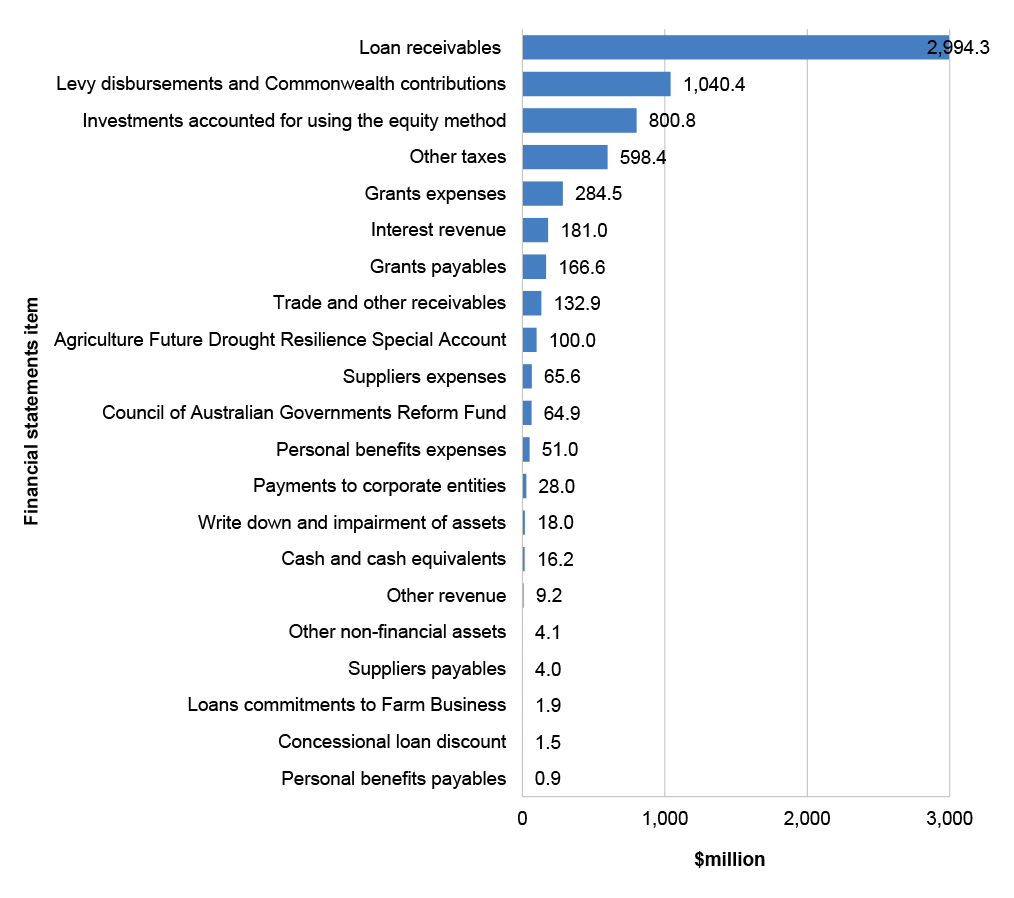

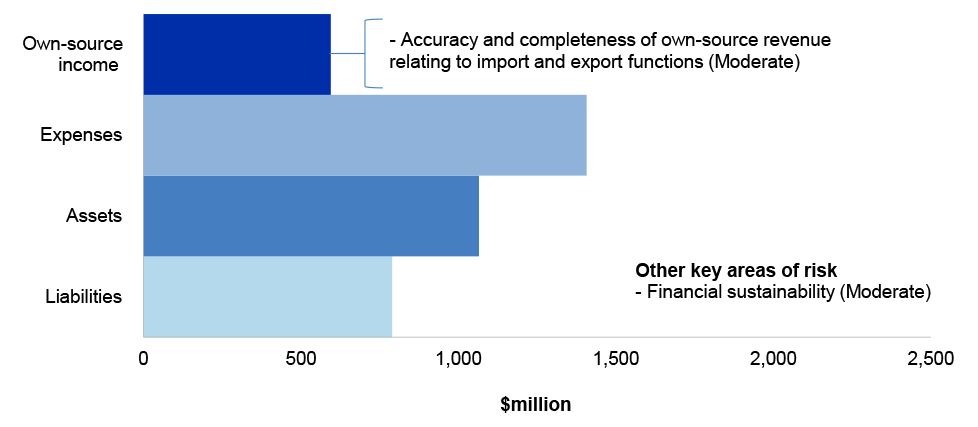

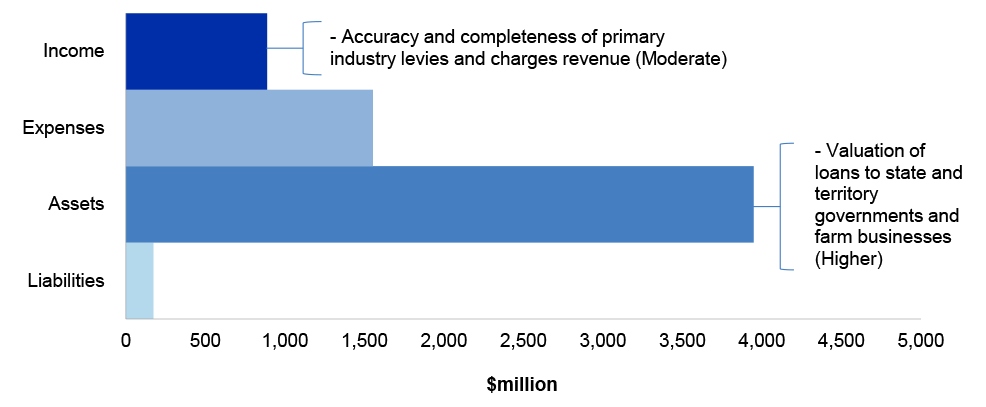

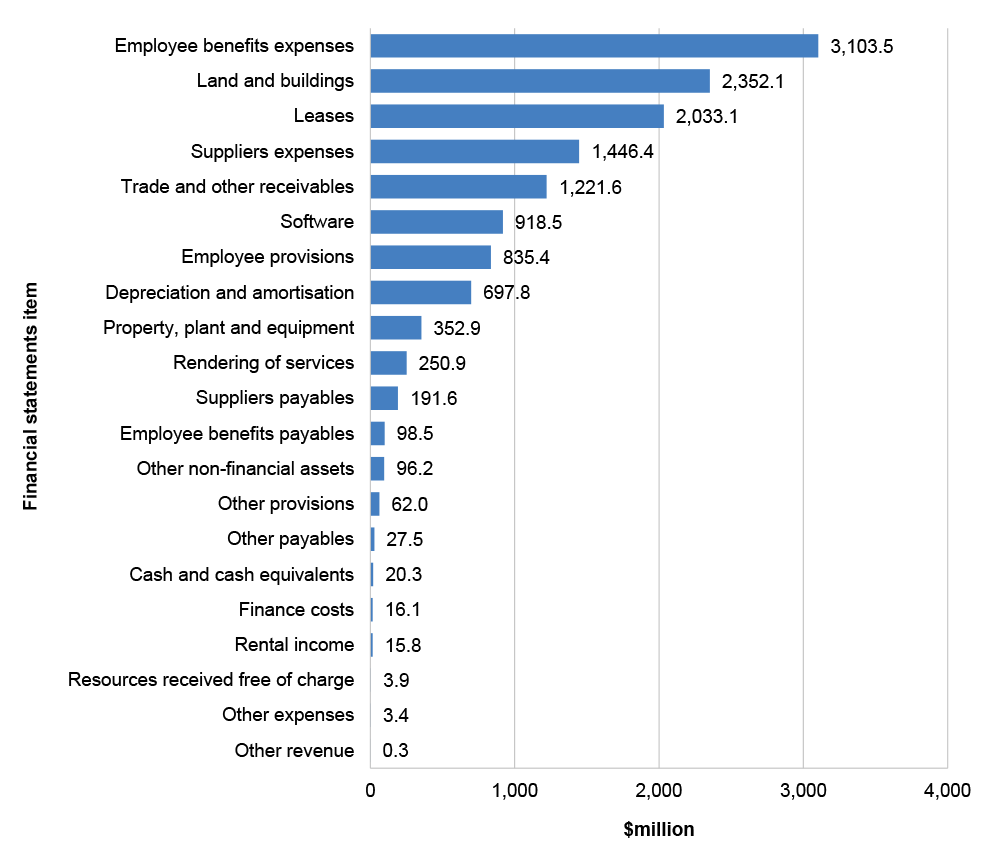

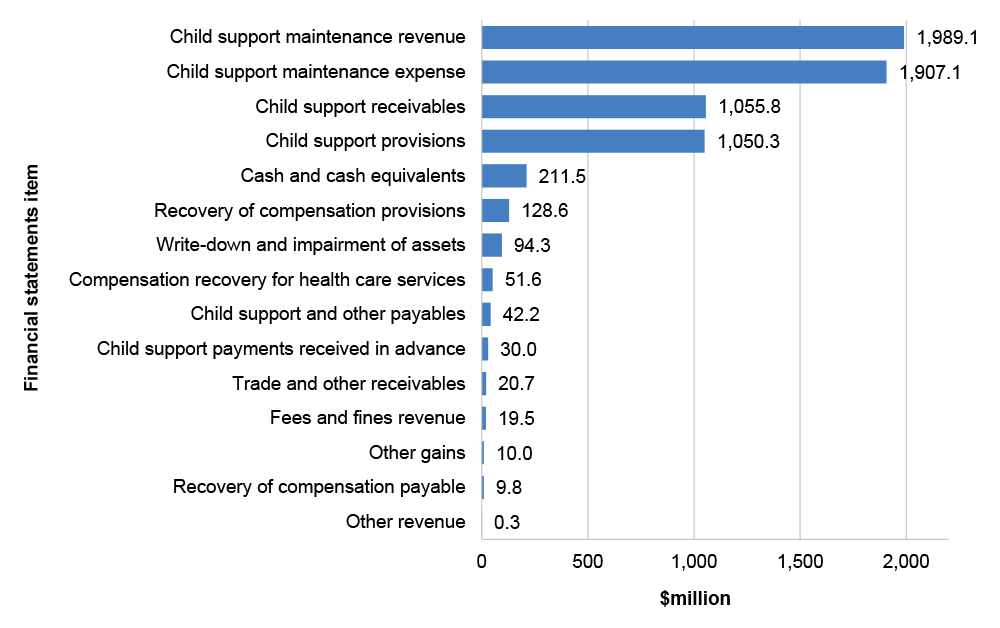

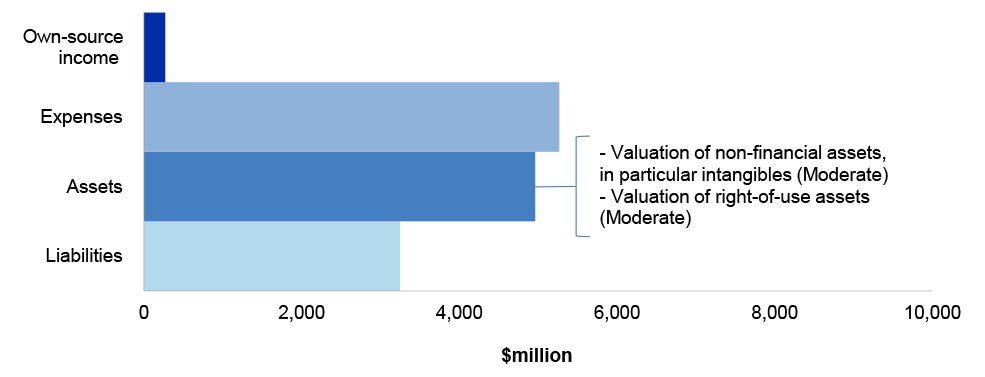

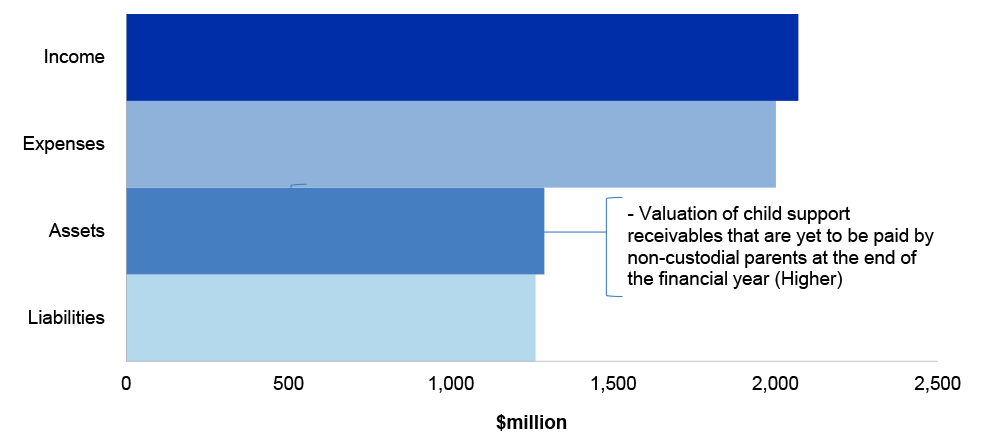

The ANAO prepares two reports annually that provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities, drawing on information collected during our audits.

This report is the first of the two reports and focuses on the results of the interim financial statements audits, including an assessment of entities’ key internal controls, supporting the 2023–24 financial statements audits. This report examines 27 entities, including all: departments of state; the Department of Parliamentary Services; and other Commonwealth entities that significantly contribute to the revenues, expenses, assets and liabilities within the 2022–23 Australian Government Consolidated Financial Statements (CFS). The National Indigenous Australians Agency is also included in this report given the role it plays working across government with indigenous communities and stakeholders.

Executive summary

The ANAO prepares two reports annually that provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities, drawing on information collected during our audits. These reports explain how entities’ internal control frameworks are critical to executing an efficient and effective audit and underpin an entity’s capacity to transparently discharge its duties and obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act). Deficiencies identified during ANAO audits, posing a significant or moderate risk to entities’ ability to prepare financial statements free from material misstatements, are included in these reports.

This report is the first of the two reports and focuses on the results of the interim audits, including an assessment of entities’ key internal controls, supporting the 2023–24 financial statements audits. This report examines 27 entities, including all: departments of state; the Department of Parliamentary Services; and other Commonwealth entities that significantly contribute to the revenues, expenses, assets and liabilities within the 2022–23 Australian Government Consolidated Financial Statements (CFS). The National Indigenous Australians Agency is also included in this report given the role it plays working across government with indigenous communities and stakeholders.

Summary of audit findings and related issues

Interim audit results

1. The interim audit phase includes an assessment of the effectiveness of each entity’s internal controls as they relate to the risk of misstatement in the financial statements. At the completion of interim audits for the 27 entities included in this report, the key elements of internal control were assessed as operating effectively to support the preparation of financial statements free from material misstatement for 14 entities.

2. For 10 entities, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement, except for particular finding/s outlined in Chapter 3 of this report.

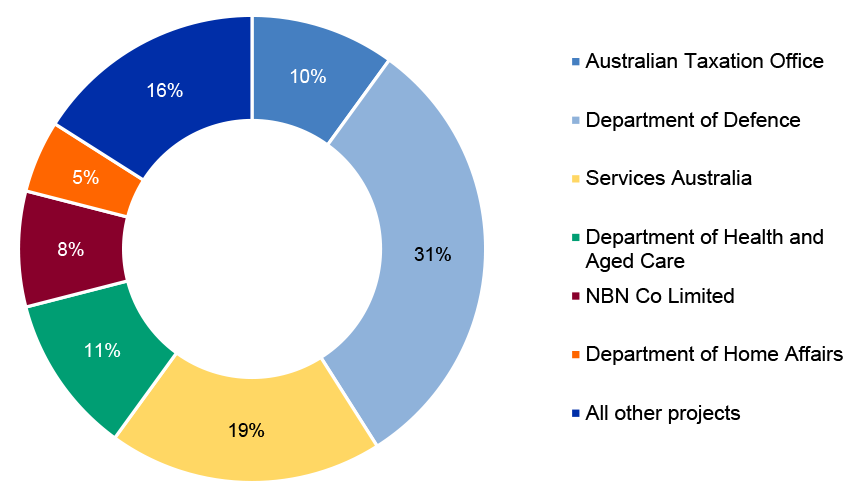

3. In three entities significant audit findings were identified reducing the level of confidence and assurance that could be placed on key elements of internal control. These significant audit findings mainly related to the IT control environment including IT security and change management. These entities were the Australian Taxation Office, Department of Defence and Services Australia (refer to paragraphs 1.9 to 1.15 and Chapter 3).

Interim audit findings

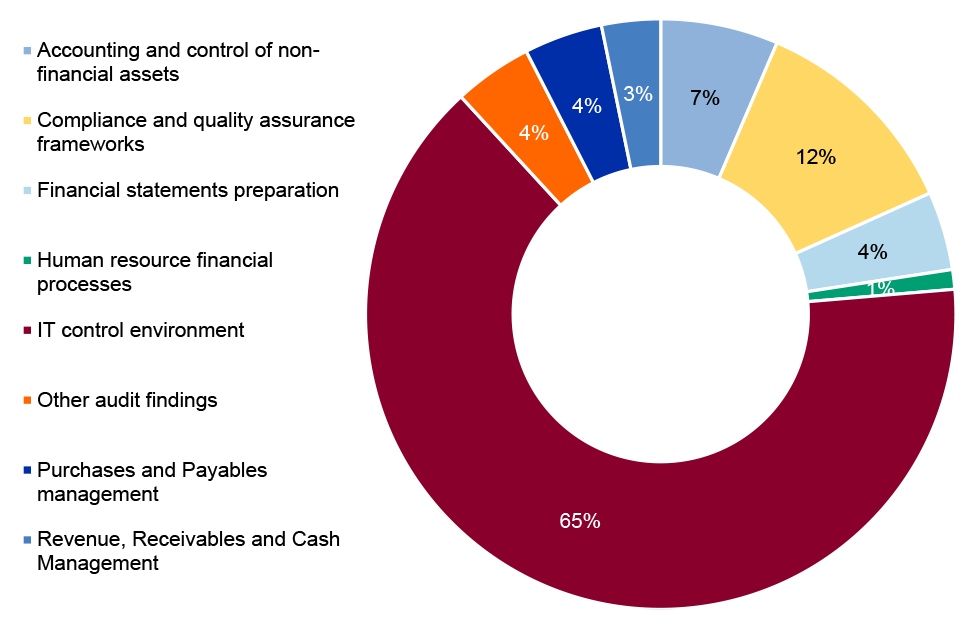

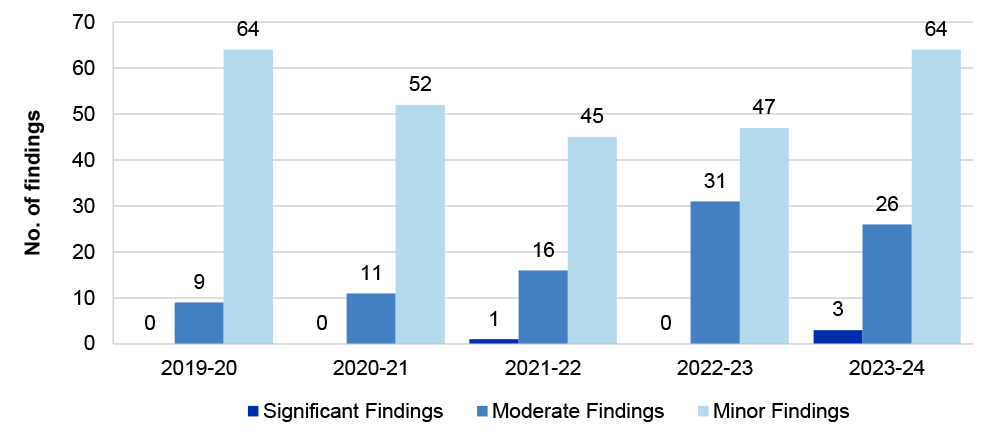

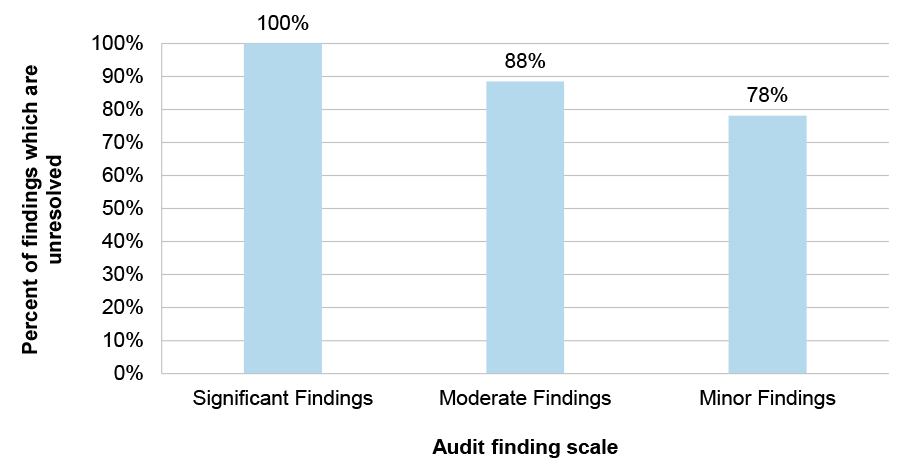

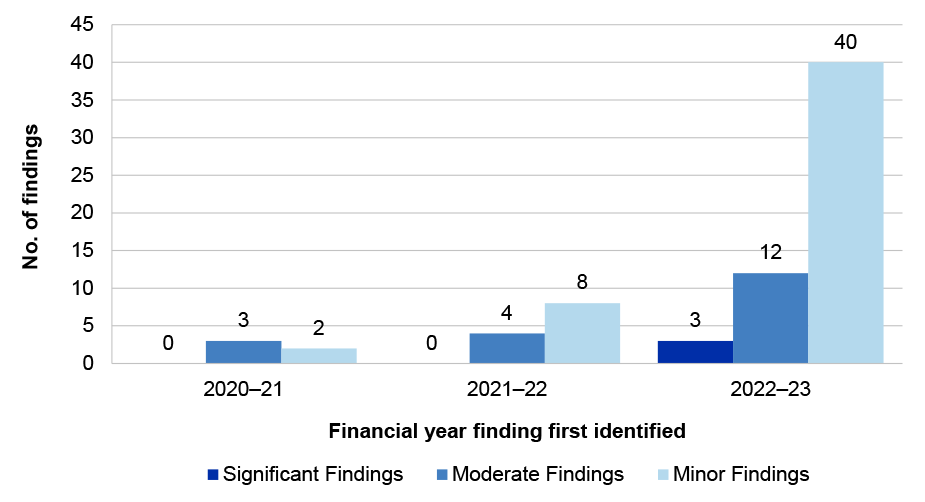

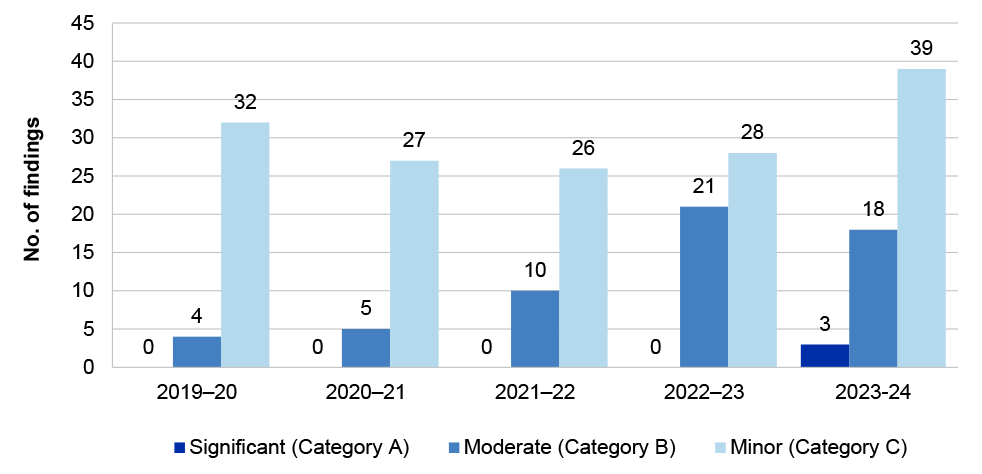

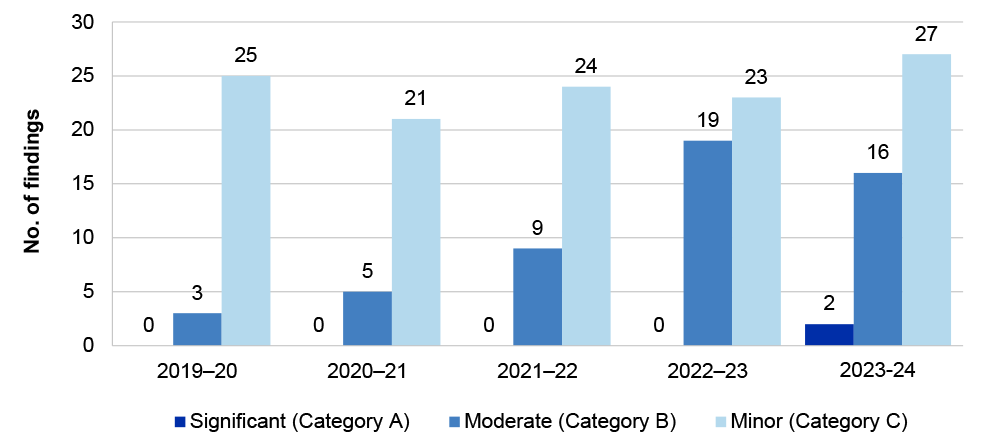

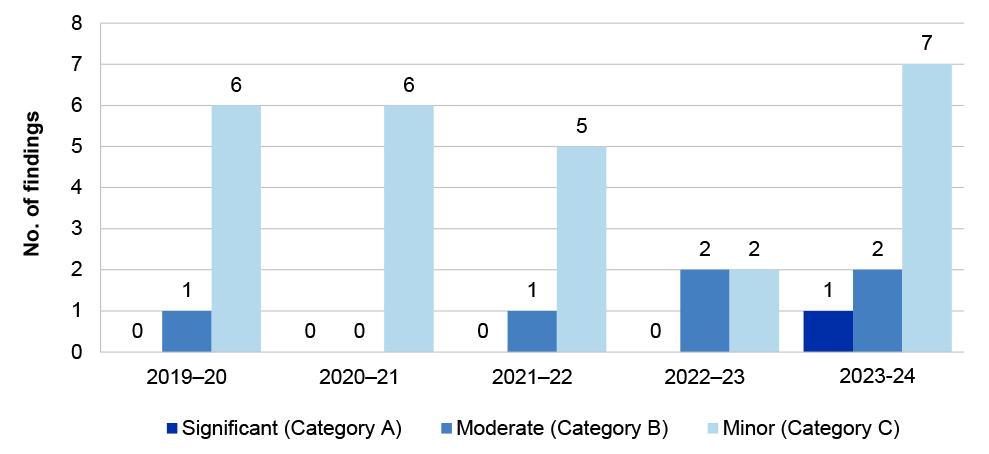

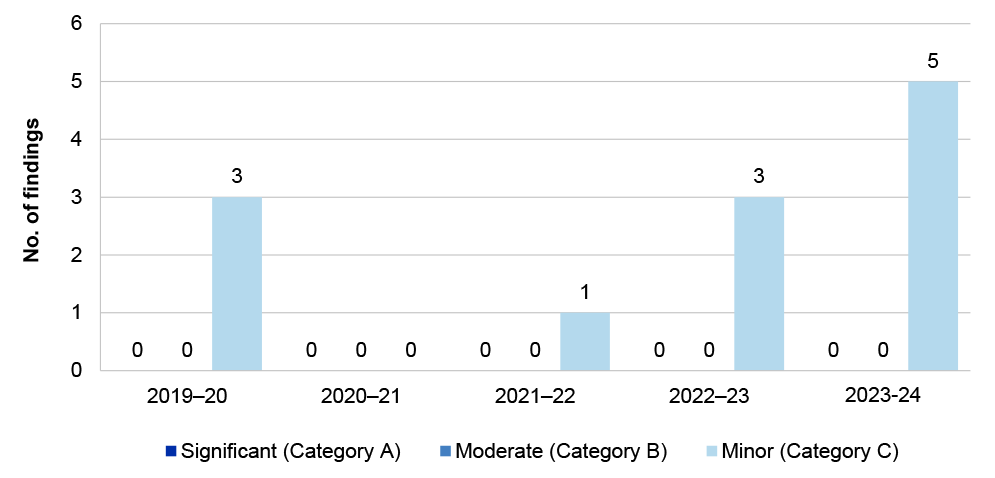

4. Total audit findings have increased compared with the 2022–23 interim audits. A total of 93 findings (2022–23: 76 findings) were reported to the entities included in this report at the conclusion of 2023–24 interim audits, comprising: 3 significant (2022–23: 0), 26 moderate (2022–23: 29), 64 minor (2022–23: 47). Seventy-eight per cent of audit findings reported at the 2023–24 interim phase were unresolved findings from prior audits. Entities should take action to address outstanding audit findings in a manner which is timely and commensurate with the level of risk identified (refer to paragraphs 1.127 to 1.203).

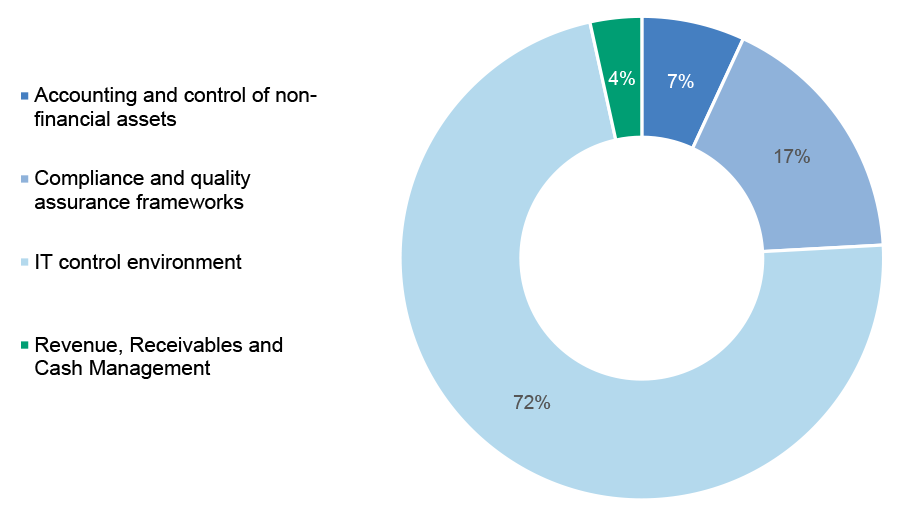

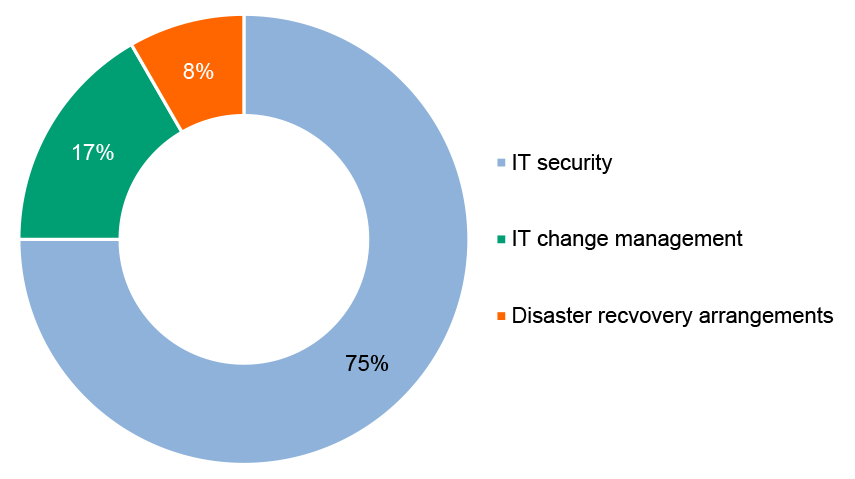

5. The ANAO’s audit findings indicate that entity IT control environments require improvement. Sixty-five per cent of all audit findings identified are related to this area (2022–23: 63 per cent). Seventy-five per cent of all findings related to the IT control environment related to IT security, including the removal of user access on termination, assignment of user access and monitoring of privileged user activities. There remains room for improvement across the sector to enhance governance processes supporting the design, implementation and operating effectiveness of IT security controls, including compliance with the Information Security Manual (refer to paragraphs to 1.141 to 1.173).

Key Management Personnel (KMP) turnover

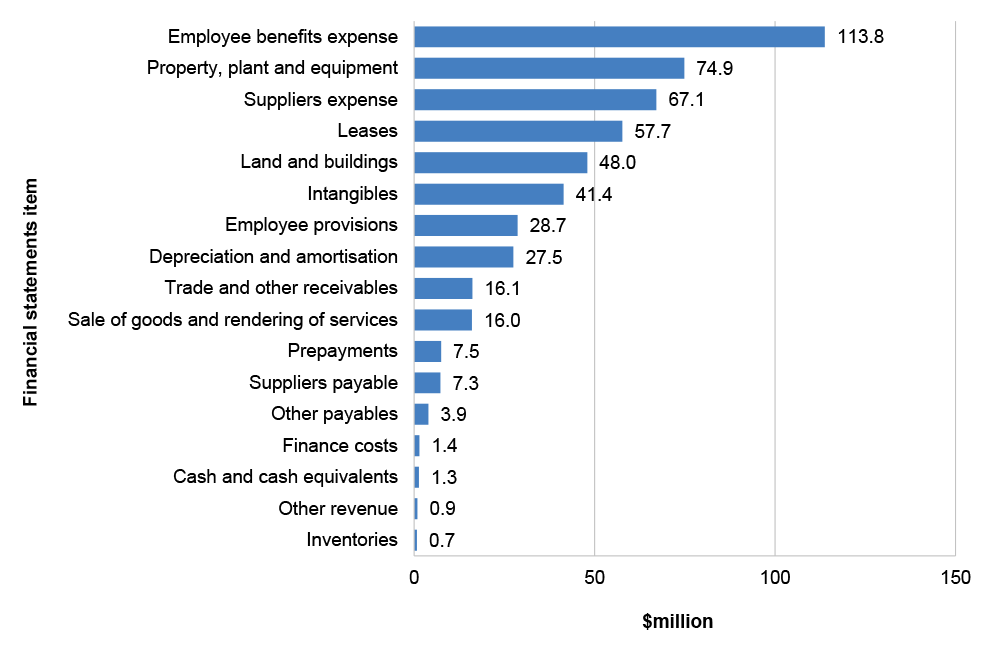

6. From 1 July 2023 to 31 January 2024 there was a turnover of KMP in 85 per cent of entities. The average rate of turnover at these entities was 21 per cent. A higher rate of turnover of KMP could increase risks that can arise from gaps in corporate knowledge, gaps in project management or be indicative of underlying issues in the culture of an entity (refer to paragraphs 1.20 to 1.26).

Audit committee performance

7. Seventy-seven per cent of entities had undertaken a recent review of the effectiveness of their audit committee. These reviews mainly relied on self-assessments of committee performance by audit committee members which may limit their effectiveness. The majority of reviews did not address all of the considerations highlighted in guidance provided by the Department of Finance.

8. Entities could enhance the effectiveness of their review of audit committee performance by adopting a formal process of independently reviewing the performance of audit committees that more comprehensively considers the matters identified in the guidance issued by Finance (refer to paragraphs 1.27 to 1.35).

Fraud control

9. The Commonwealth Fraud Control Framework 2017 encourages entities to conduct fraud risk assessments at least every two years.All 27 entities included in this report had in place a fraud control plan. Twenty-five of the 27 entities had conducted a fraud risk assessment at the enterprise level which informed their plan (refer to paragraphs 1.43 to 1.47).

Internal audit recommendations

10. There were 4,186 internal audit recommendations made to entities included in this report during the period 1 July 2020 to 31 January 2024. At 31 January 2024 24 per cent of these findings remained open. Thirty-three per cent of entities had not established formal policies or procedures for implementing internal audit recommendations. For recommendations where a due date was assigned 69 per cent of internal audit recommendations during the period were addressed past their due date. The average delay in closing recommendations during this period was 91 days.

11. Entities could review and strengthen governance processes and oversight for implementation of internal audit recommendations to ensure that recommendations (and the associated risk identified) are addressed in a timely manner (refer to paragraphs 1.54 to 1.75).

Safeguarding data from cyber threats

12. The Protective Security Policy Framework contains the Essential Eight mitigation strategies and recommends controls intended to strengthen cyber resilience and the capacity of government to mitigate cyber threats. Seventy-seven per cent of entities did not meet all of the relevant requirements although the number of entities reporting compliance with the requirements has improved compared with 2022–23. There continues to be a risk of compromise to information relevant to the preparation of financial statements (refer to paragraphs 1.76 to 1.93).

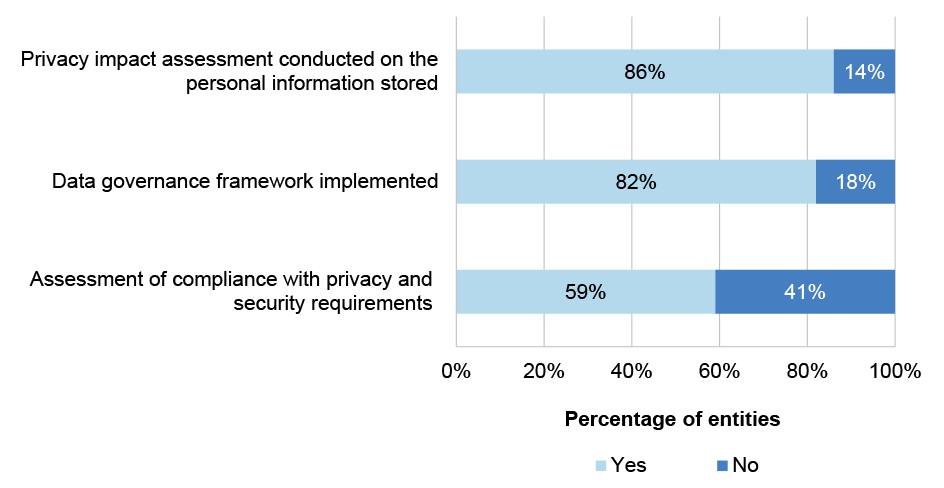

Safeguarding personal information

13. Twenty-two of the 27 entities included in this report indicated that that they collected personal information and complied with requirements of the Privacy Act 1988 and the Australian Privacy Principles (APPs). Forty-one per cent of entities had not assessed their compliance with privacy requirements under the APPs. From July to December 2023 the Australian Government was included in the ‘top 5’ sectors reporting notifiable data breaches to the Australian Information Commissioner. It is important that entities have appropriate governance measures and controls in place supported by clear policies, procedures and practices that comply with the requirements of the principles (refer to paragraphs 1.94 to 1.104).

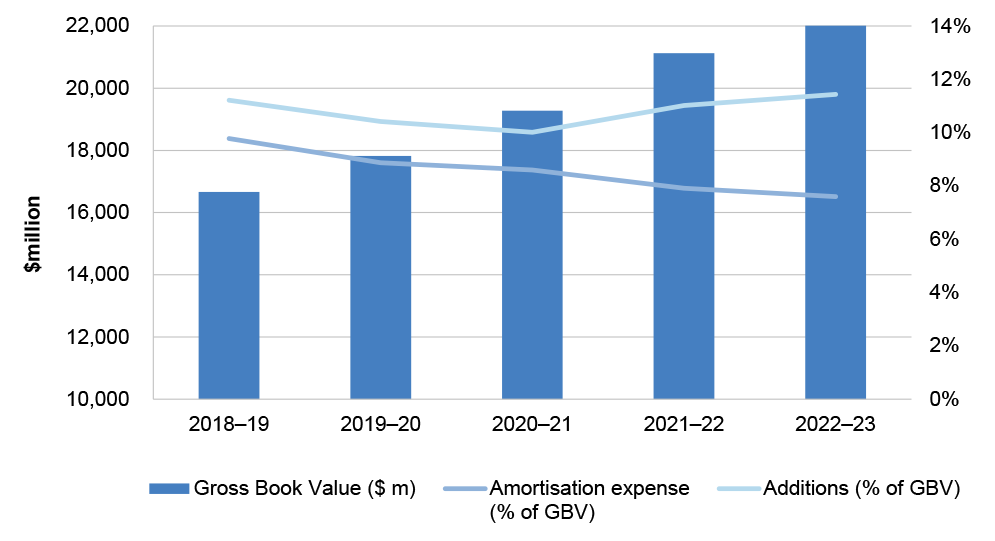

Delivery of computer software projects

14. At 31 January 2024 there were 717 distinct software projects underway at entities included in this report, which had a total budget (including capital and operating expenses) of $10.9 billion.

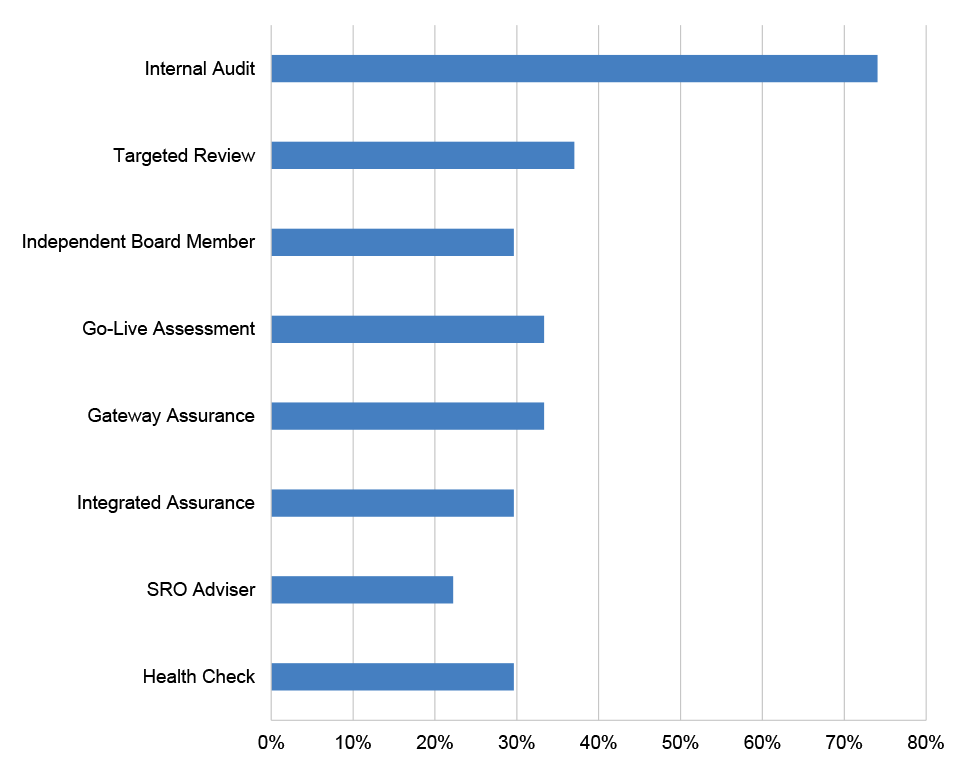

15. Twenty-five of the 27 entities had established a project management framework or policy. All entities had assigned responsibility for monitoring software projects to an executive or other committee embedded in the entity’s organisational structure. Thirteen entities did not provide reports to their audit committees on software projects. All entities has adopted one or more of the eight project assurance processes advised by the Digital Transformation Agency (DTA). One assurance process, internal audit, was adopted by the majority of entities.

16. The significance of the total value of projects under development, and the level of write offs of computer software over the period 2018–19 to 2022–23 create opportunities for entities to consider the effectiveness of governance of delivery of software projects. These include: increasing the oversight from entity audit committees and adopting a broader use of assurance arrangements recommended by the DTA (refer to paragraphs 1.105 to 1.126).

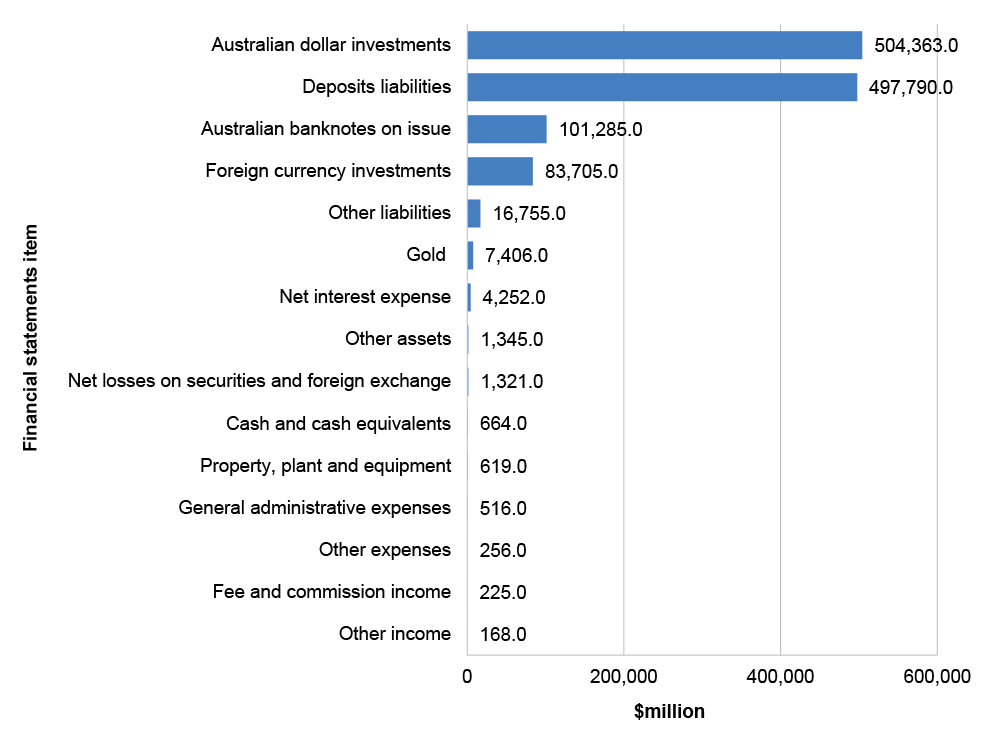

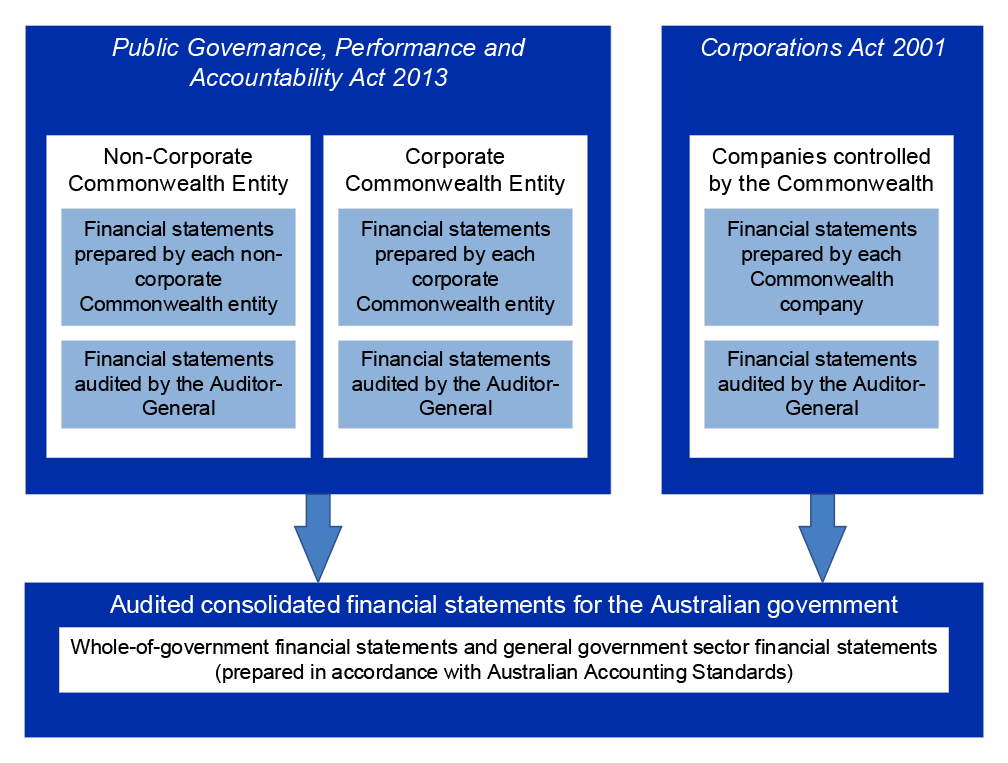

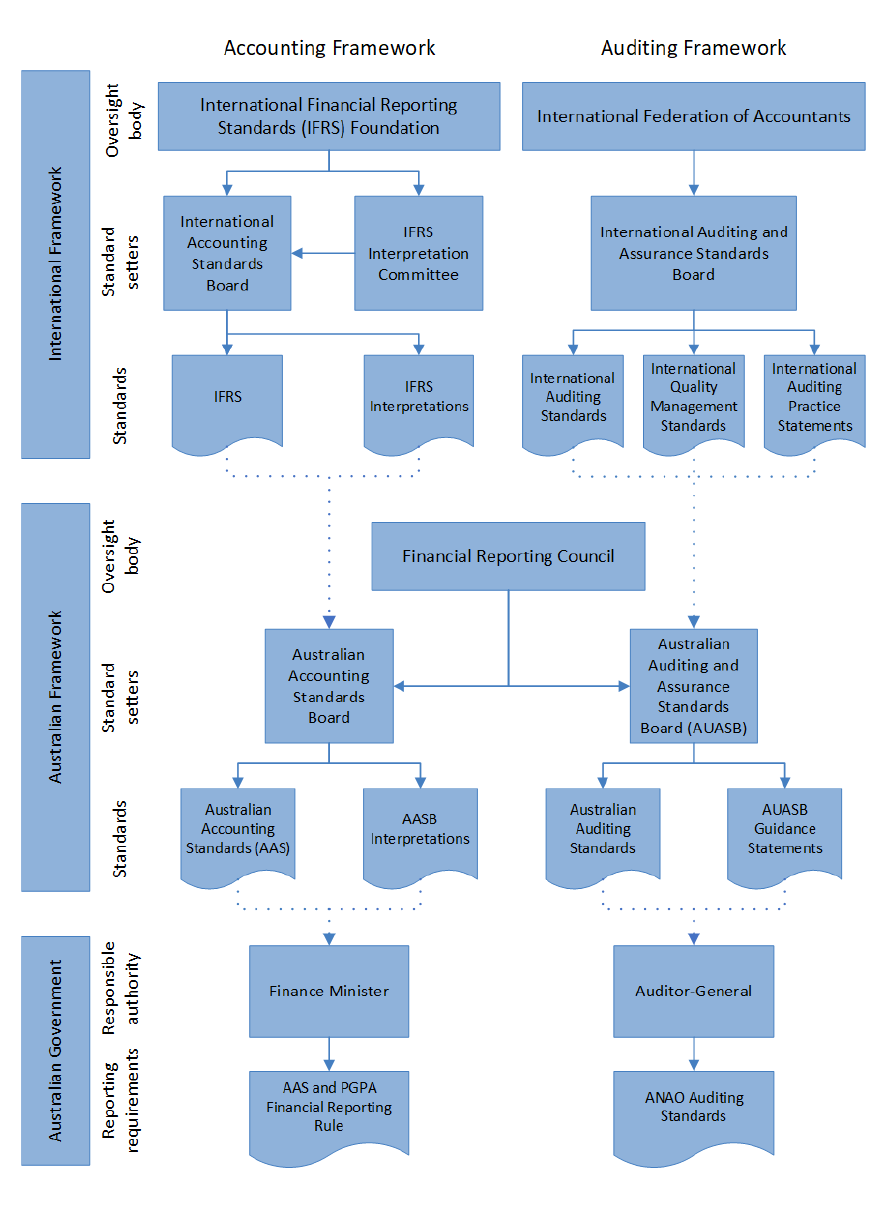

Reporting and auditing frameworks

Summary of developments

17. The development of a climate-related reporting framework and assurance regime in Australia is progressing. The ANAO is working with the Department of Finance (Finance) to establish an assurance regime for the Commonwealth Climate Disclosure (CCD) reform (refer to paragraphs 2.6 to 2.19).

18. Emerging technologies (including artificial intelligence) are increasingly being explored by entities for application in their operations and delivery of services. The ANAO intends to build consideration of risks relating to the use of emerging technologies into audit planning processes to provide Parliament with assurance regarding the efficient, effective, economical and ethical use of emerging technologies (refer to paragraphs 2.20 to 2.27).

Other matters

Completion of outstanding 2022–23 audits

19. The audits of the 2022–23 financial statements for the Bundanon Trust, Royal Australian Navy Central Canteens Board and Wreck Bay Aboriginal Community Council were delayed due to weaknesses in the financial statements preparation process or other internal controls at these entities. These audits have finalised by the ANAO (refer to Chapter 4).

Cost of this report

20. The cost to the ANAO of producing this report is approximately $320,000.

1. Interim audit results and other matters

Chapter coverage

This chapter provides, for the 27 entities included in this report:

- an overview of the ANAO’s audit approach to financial statements audits;

- a summary of observations regarding entity internal control environments;

- observations relating to turnover of key management personnel, audit committee performance, implementation of internal audit recommendations, management of software projects, the safeguarding of financial data from cyber threats and managing personal information; and

- a summary of audit findings identified at the conclusion of the interim audit.

Conclusion

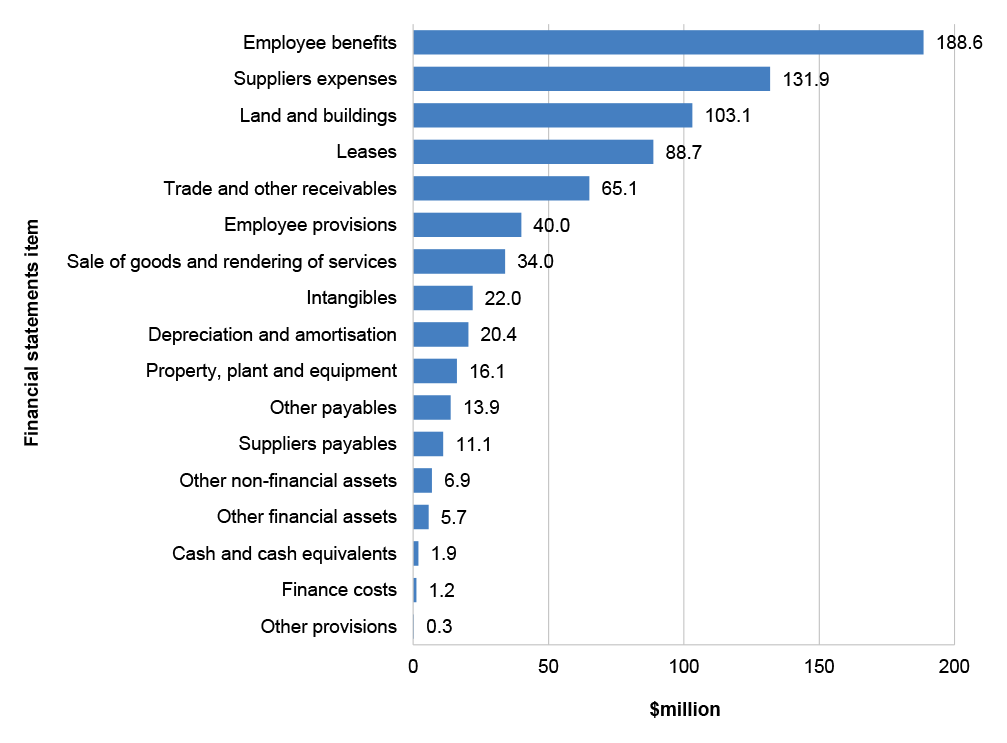

For 14 entities, at the completion of the interim audits, key elements of internal control were operating effectively to provide reasonable assurance that the entities were able to prepare financial statements that were free from material misstatement. For 10 entities, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement, except for particular finding/s outlined in Chapter 3. For three entities where significant audit findings were identified these findings reduced the level of confidence and assurance that could be placed on key elements of internal control. These entities were the Australian Taxation Office, Department of Defence and Services Australia.

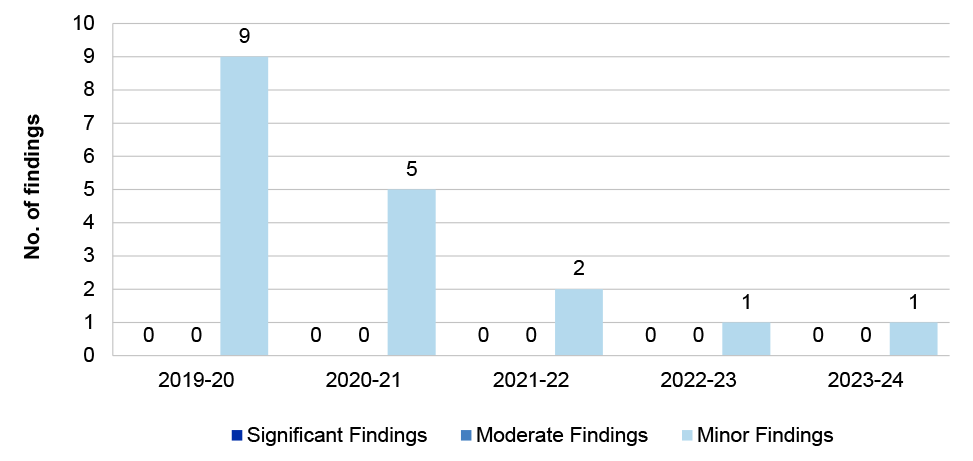

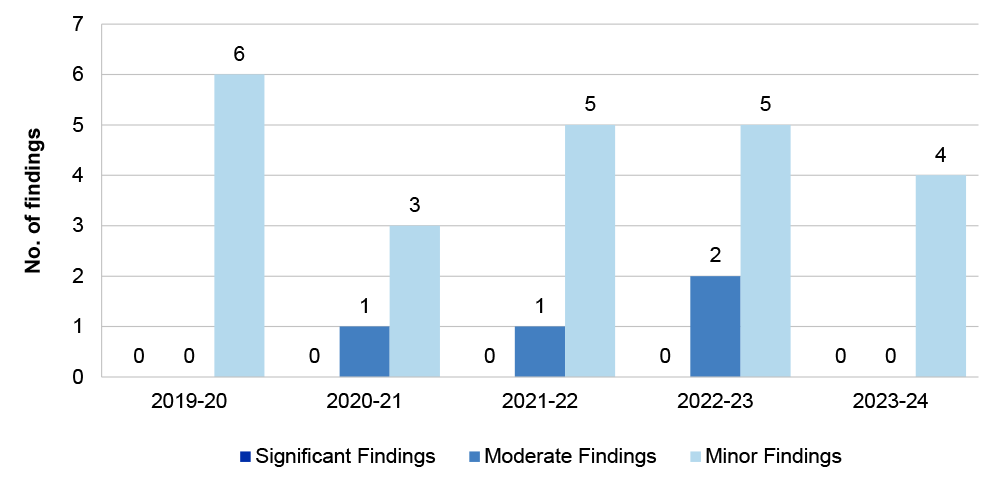

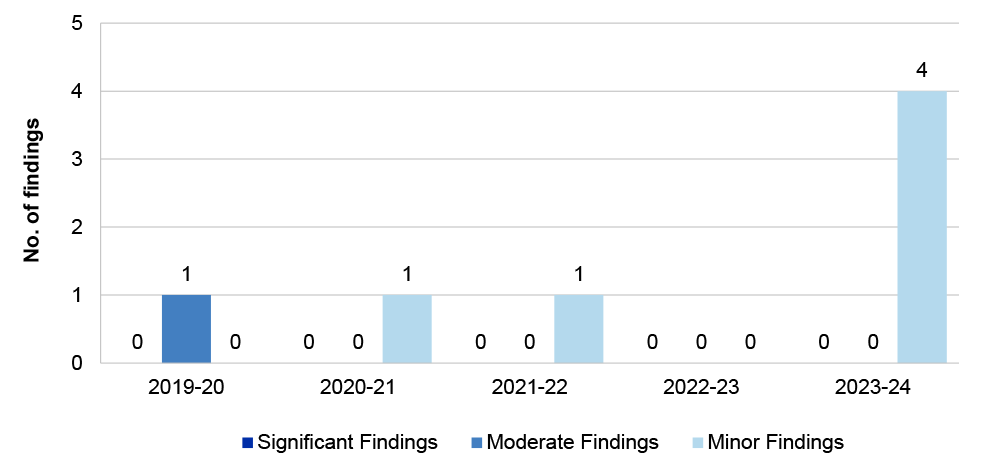

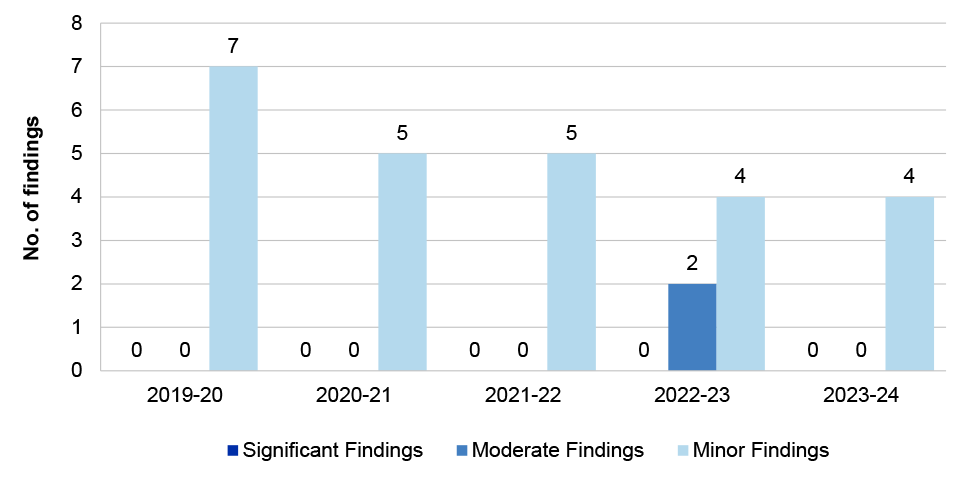

Total audit findings have increased

Ninety-three audit findings (2022–23: 76 findings) were reported at the completion of 2023–24 interim audits, comprising: 3 significant (2022–23: 0); 26 moderate (2022–23: 29); and 64 minor (2022–23: 47). Sixty-five per cent of findings identified relate to the IT control environment (2022–23: 63 per cent).

Most findings identified were unresolved from prior audits

Seventy-eight per cent of audit findings were unresolved findings from prior audits. Entities should take action to address outstanding audit findings in a manner which is timely and commensurate with the level of risk identified.

IT controls require improvement

Seventy-five per cent of findings on the IT control environment related to IT security, including the removal of user access on termination, assignment of user access and monitoring of privileged user activities. The higher number of findings indicate that there remains room for improvement for entities to enhance governance processes supporting the design, implementation and operating effectiveness of IT security controls, including compliance with the Information Security Manual.

Key management personnel turnover can present challenges

From 1 July 2023 to 31 January 2024 there was a turnover of key management personnel (KMP) in 85 per cent of entities included in this report. The average rate of turnover at these entities was 21 per cent. A higher rate of turnover of KMP could increase risks that can arise from gaps in corporate knowledge, gaps in project management or be indicative of underlying issues in the culture of an entity.

Audit committee performance should be regularly reviewed

Seventy-seven per cent of entities had undertaken a recent review of the effectiveness of their audit committee. These reviews mainly relied on self-assessments of committee performance by audit committee members which may limit their effectiveness. The majority of reviews did not address all of the considerations highlighted in guidance issued by the Department of Finance.

Fraud framework requirements are largely in order

The Commonwealth Fraud Control Framework 2017 encourages entities to conduct fraud risk assessments at least every two years. All 27 entities included in this report had in place a fraud control plan. Twenty-five of the 27 entities had conducted a fraud risk assessment at the enterprise level which informed their plan.

Delays in implementing agreed actions from internal audit recommendations in entities

There were 4,186 internal audit recommendations made in 1,469 internal audits performed at the 27 entities included in this report during the period 1 July 2020 to 31 January 2024. At 31 January 2024 24 per cent of these recommendations remained open. Thirty-three per cent of entities had not established formal policies or procedures for implementing internal audit recommendations. Where a due date was assigned 69 per cent of internal audit recommendations during the period were addressed past their due date. The average delay in closing recommendations during this period was 91 days.

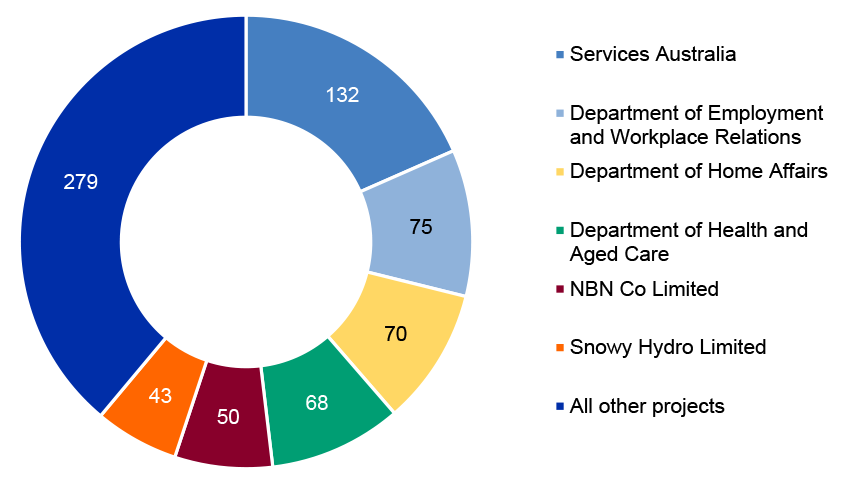

717 software projects with a total budget of $10.9 billion are being delivered by entities

At 31 January 2024 there were 717 distinct software projects reported as underway at 25 of the 27 entities, which had a total budget (including capital and operating expenses) of $10.9 billion.

Twenty-five of the 27 entities had established a project management framework or policy. All entities had assigned responsibility for monitoring software projects to an executive or other committee embedded in the entity’s organisational structure. Thirteen entities did not provide reports to their audit committees on software projects. All entities had adopted one or more of the eight examples of project assurance activities identified by the Digital Transformation Agency (DTA). One of the DTA’s example assurance activities, internal audit, was adopted by the majority of entities.

Safeguarding data from cyber threats

The Protective Security Policy Framework (PSPF) contains the Essential Eight mitigation strategies and recommends controls intended to strengthen cyber resilience and the capacity of government to mitigate cyber threats. Seventy-seven per cent of entities did not meet all of the relevant requirements. The number of entities reporting compliance with the requirements has improved compared with 2022–23. There continues to be a risk of compromise to data relevant to the preparation of financial statements.

Entities could take further steps to assess their compliance with privacy obligations

Twenty-two of the 27 entities included in this report indicated that that they collected personal information. These entities must comply to the provisions of the Privacy Act 1988 and Australian Privacy Principles (APPs). The entities have advised the ANAO that they comply with these requirements, including the requirements to conduct privacy impact assessments and develop a data governance framework. Forty-one per cent of these entities had not assessed their compliance with privacy and security requirements. From July to December 2023 the Australian Government was included in the ‘top 5’ sectors reporting notifiable data breaches to the Office of the Australian Information Commissioner. It is important for entities to implement appropriate governance measures and controls supported by clear policies, procedures and practices that comply with the requirements of the APPs.

Areas for improvement

The ANAO has identified four opportunities for improvement for entities.

- Entities could enhance the effectiveness of their review of audit committee performance by adopting a formal process of independently reviewing the performance of audit committees that more comprehensively considers the matters identified in the guidance issued by Finance.

- Entities could review and strengthen oversight for implementation of internal audit recommendations to ensure that recommendations (and associated risks which they address) are resolved within agreed timeframes.

- The significance of the total value of software projects being delivered, and the level of write offs of computer software over the period 2018–19 to 2022–23 create opportunities for entities to consider the effectiveness of governance of delivery of software projects. These could include: increasing the oversight from entity audit committees of delivery of software projects, particularly where there are increased risks identified with delivery or particular projects; and adopting a broader use of assurance arrangements recommended by the DTA which are consistent with the assurance framework and are performed in a considered and planned manner so that all sources of assurance are coordinated effectively.

- Entities should monitor and evaluate the effectiveness of their controls to ensure risks are successfully managed. In particular, continuous assessment of controls related to change management practices, timely removal of user access and disaster recovery testing would improve the management of IT risks. Having a systematic approach to assessing the design, implementation and operating effectiveness of controls increases the chances of successfully managing IT risks.

Introduction

1.1 The ANAO publishes an Annual Audit Work Program (AAWP) which reflects the ANAO’s strategy and deliverables for the forward year. The purpose of the AAWP is to inform the Parliament, the public and government sector entities of the ANAO’s planned audit coverage by way of financial statements, performance and performance statements audits and other assurance activities.

1.2 The financial statements audit coverage, as outlined in the AAWP, includes presenting two reports to the Parliament addressing the outcomes of the financial statements audits of entities and the Australian Government’s Consolidated Financial Statements (CFS). These reports provide Parliament with an independent examination of the financial accounting and reporting of Australian Government entities.

1.3 This report focuses on the results of the interim audits of 27 entities including an assessment of key internal controls supporting the 2023–24 financial statements. The assessment includes a review of the governance arrangements related to entities’ financial reporting responsibilities and the design and implementation of key internal controls relating to significant business processes. Where the auditor plans to rely upon key controls for assurance that financial statements are free from material misstatement, the controls are tested for operating effectiveness. Testing of controls during the interim audit phase allows us to form a conclusion on the operating effectiveness of those controls for the period up to the date of testing.

1.4 During the final phase of the 2023–24 financial statements audit, the ANAO completes testing over the operating effectiveness of those controls we intend to rely upon, and controls not assessed at interim. The second report presents the final results of the financial statements audits of the CFS and all Australian Government entities.

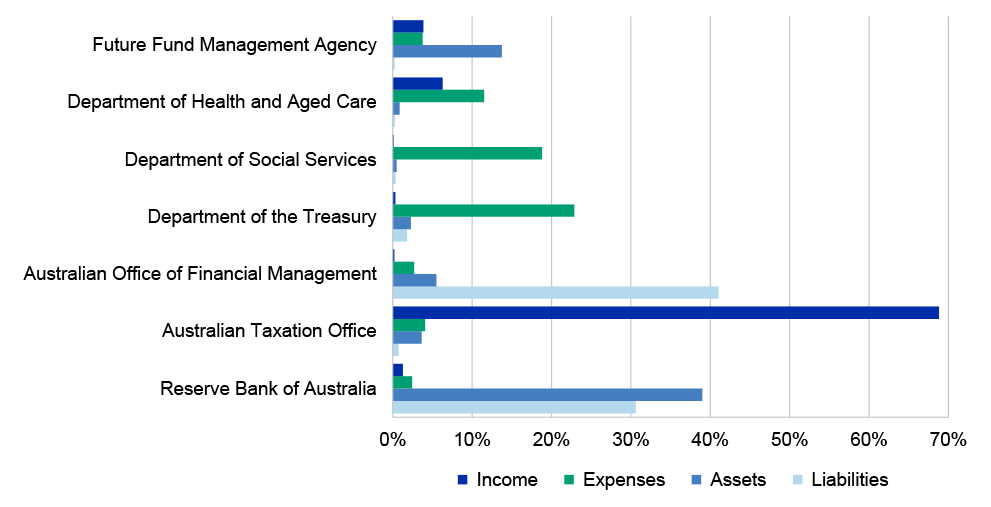

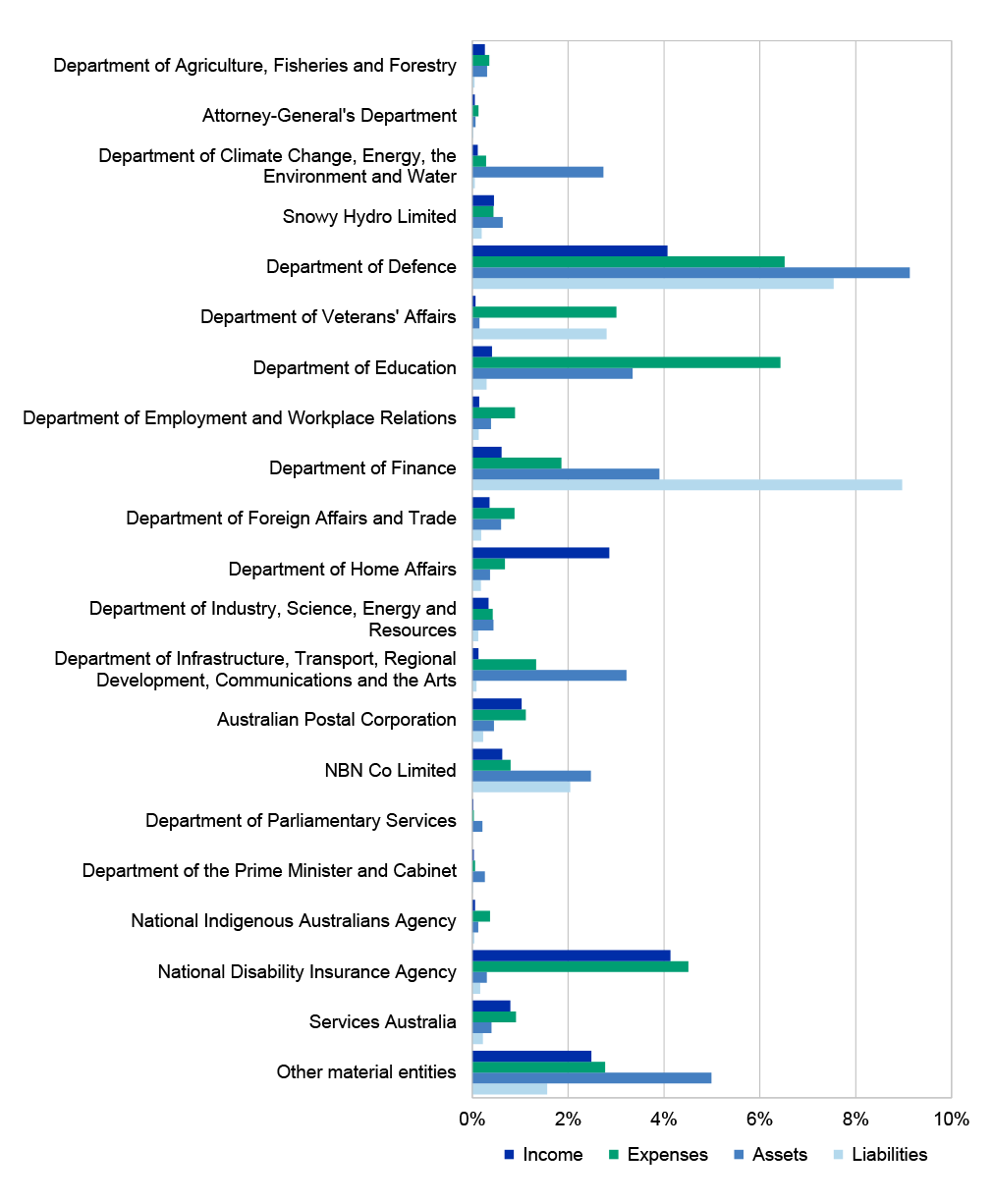

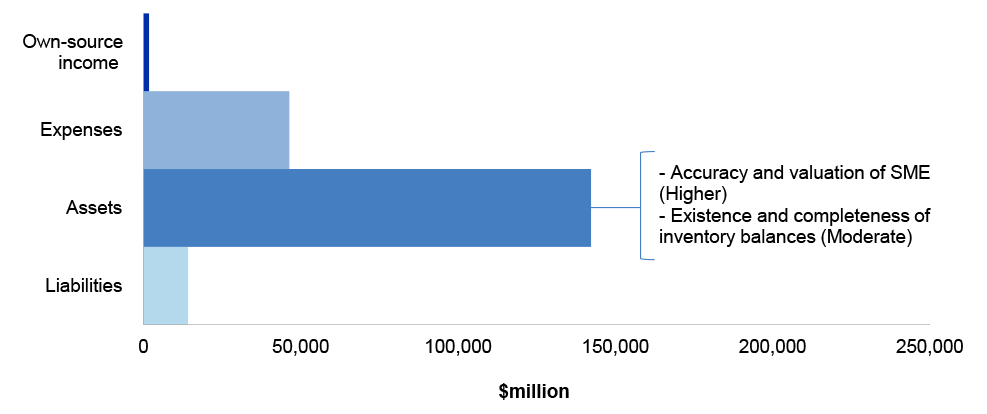

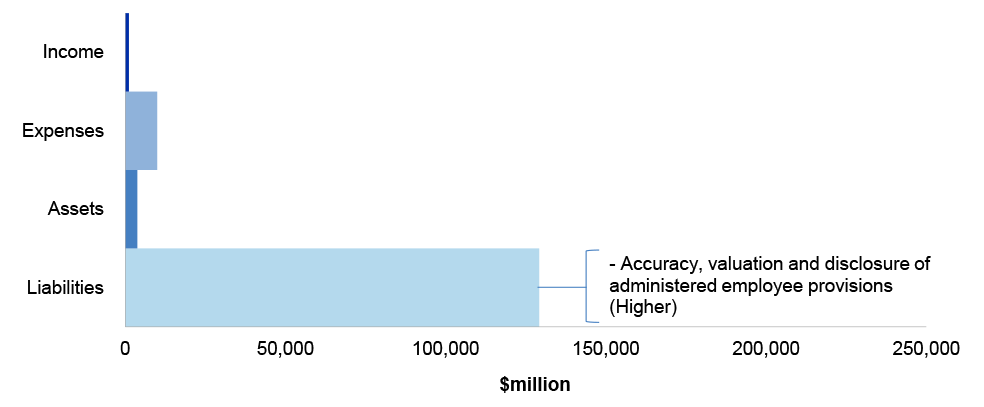

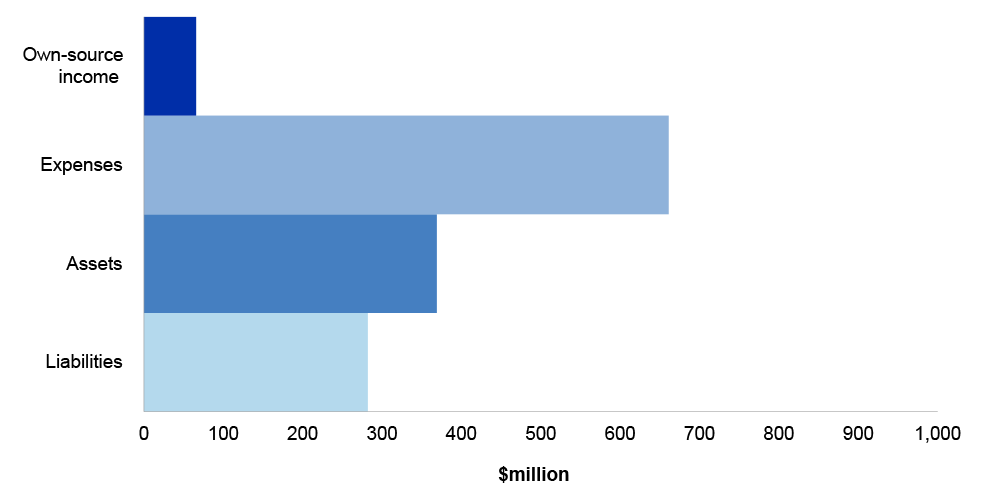

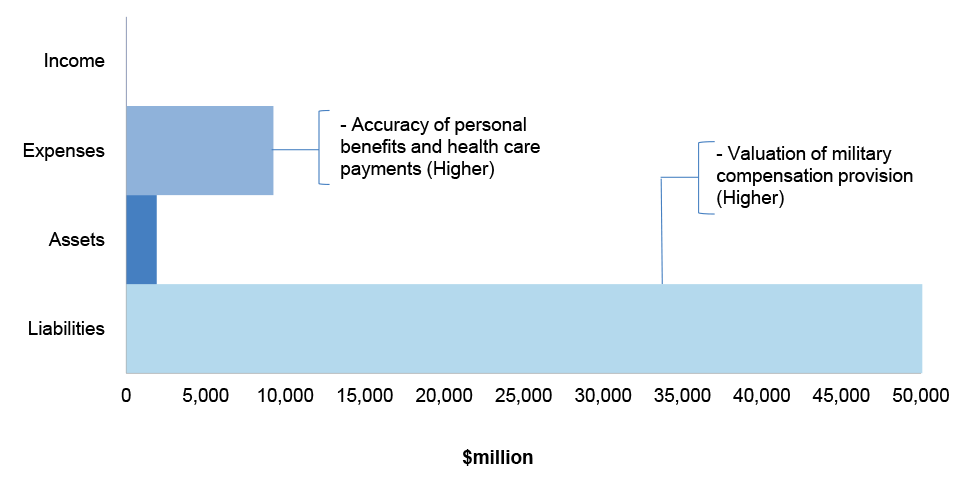

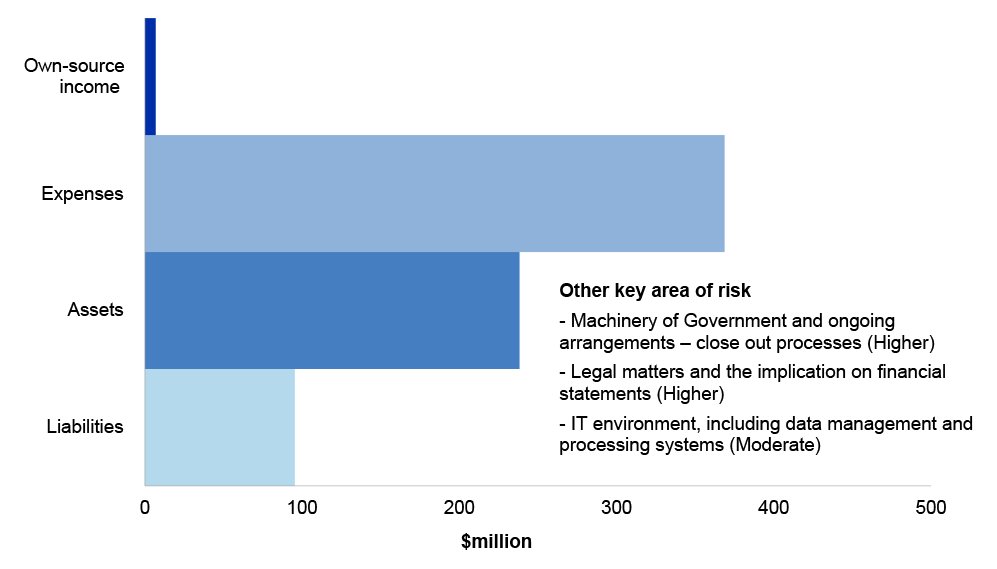

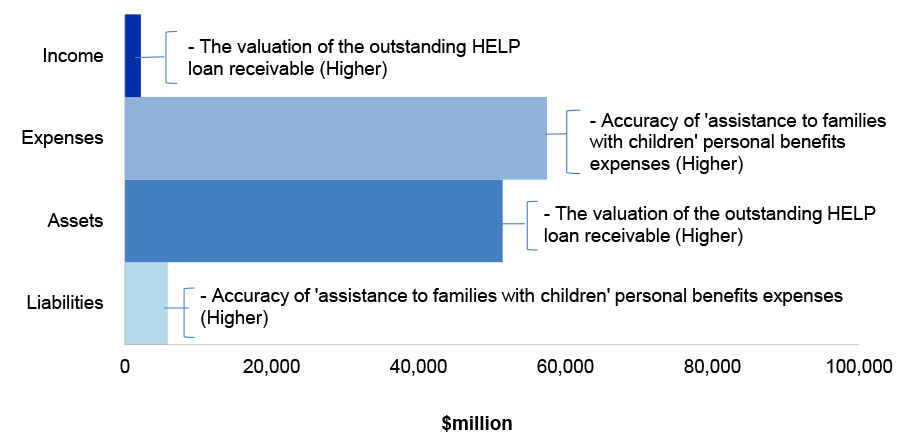

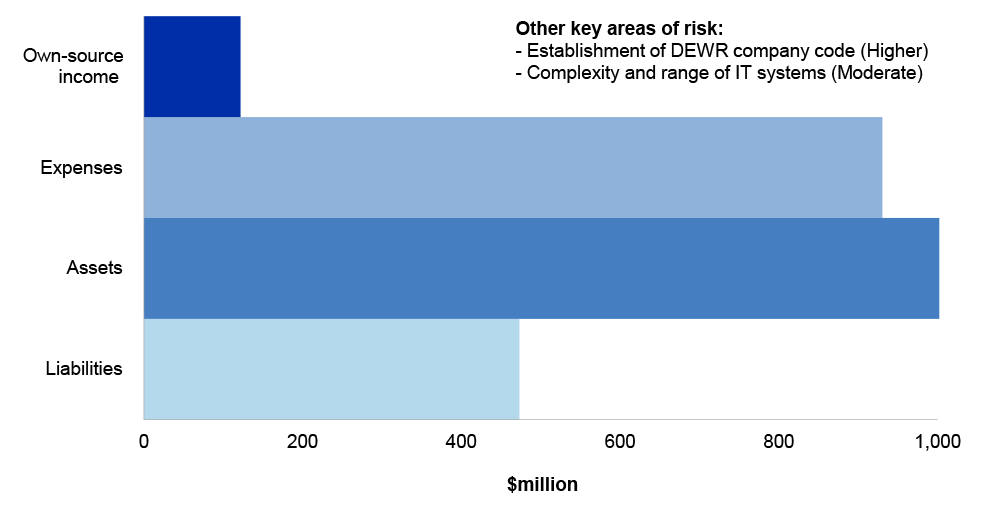

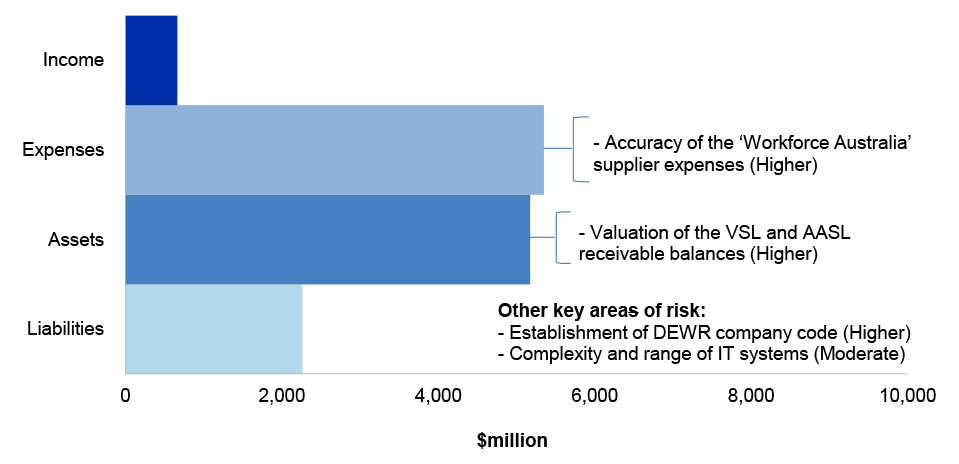

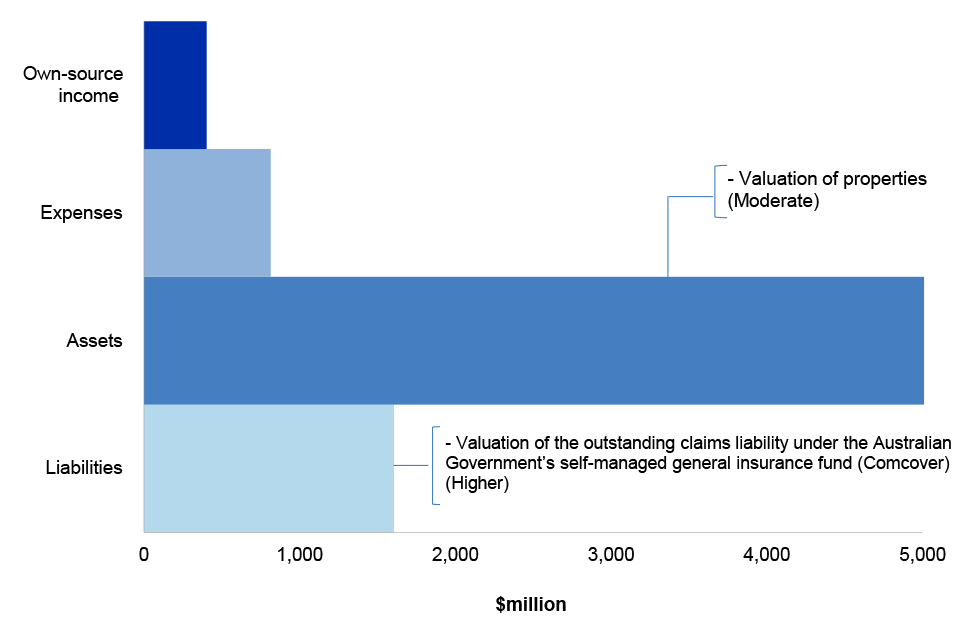

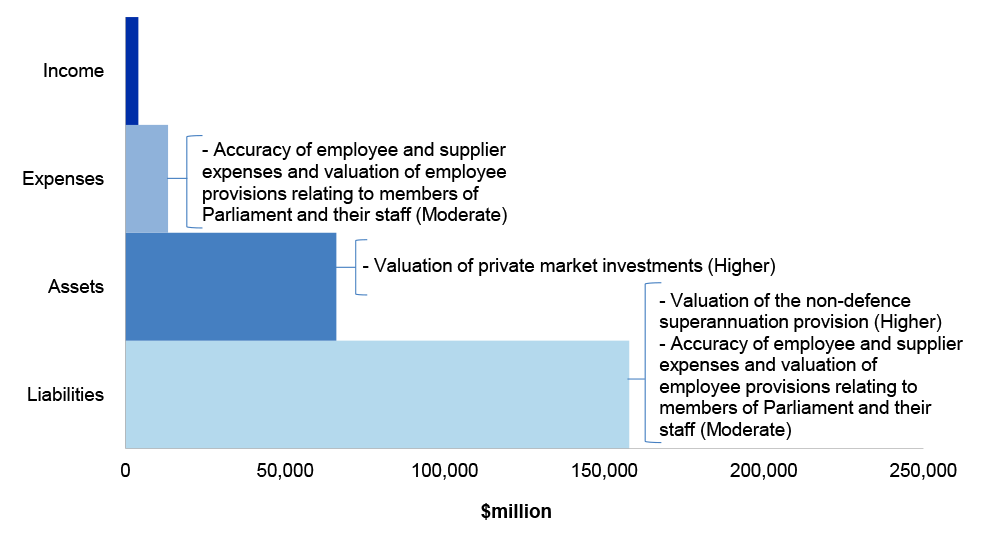

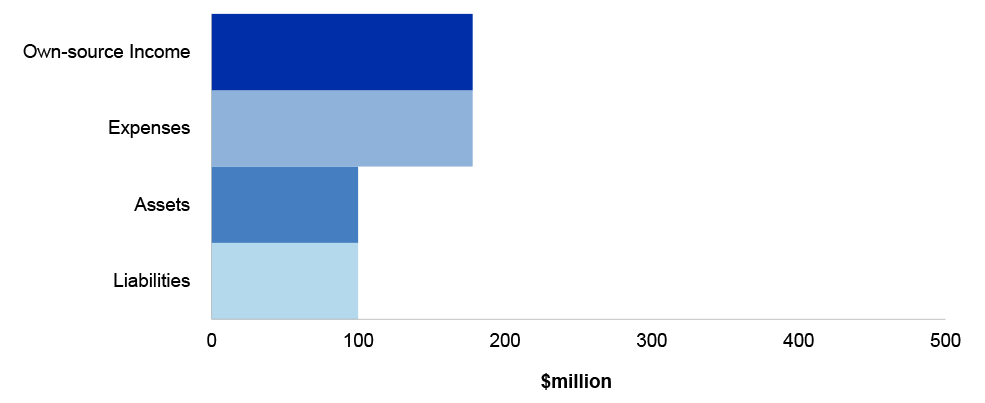

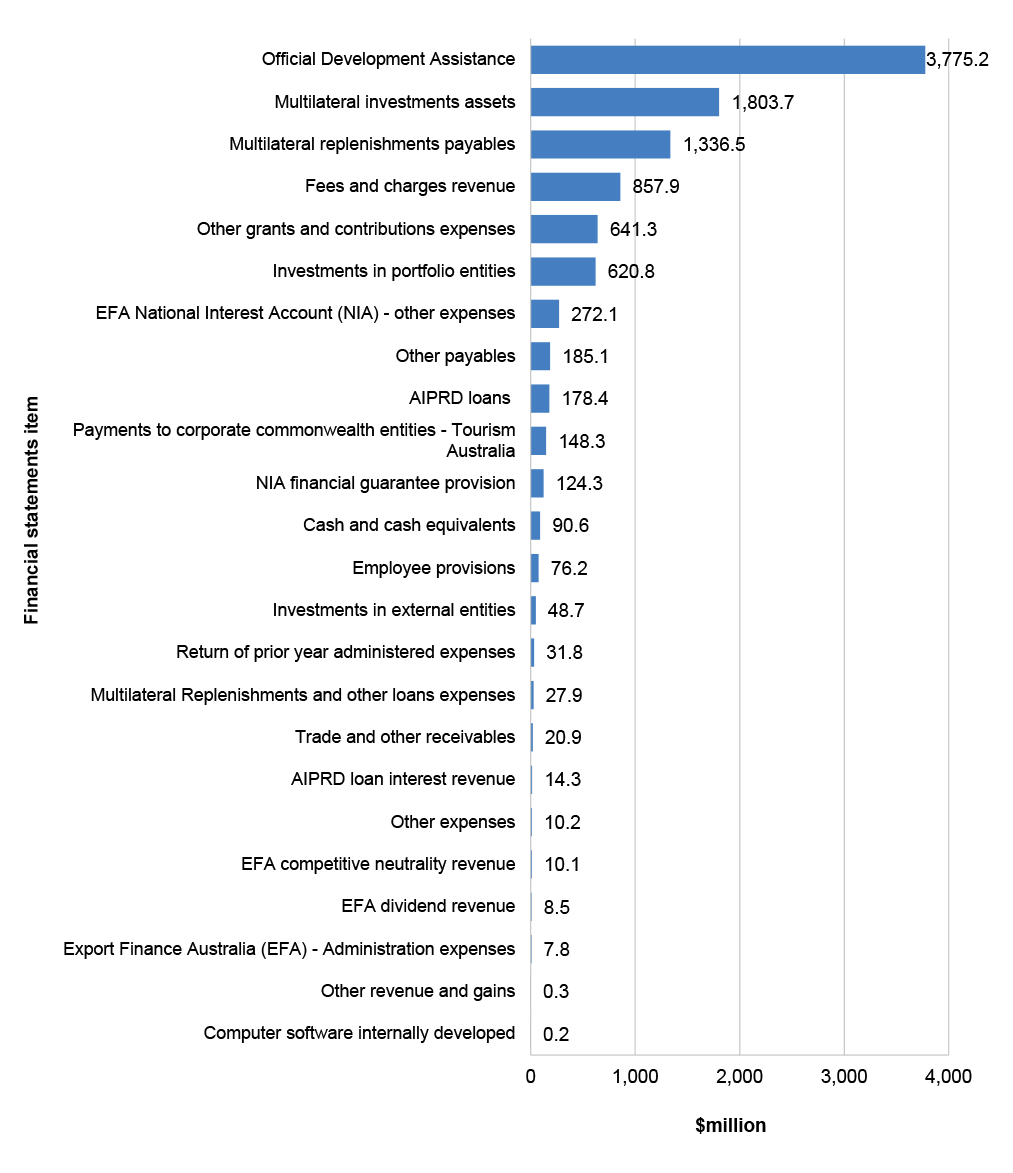

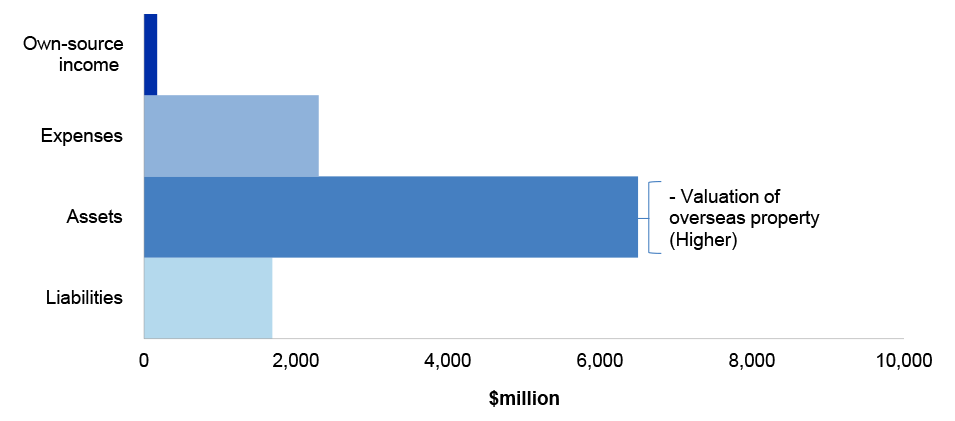

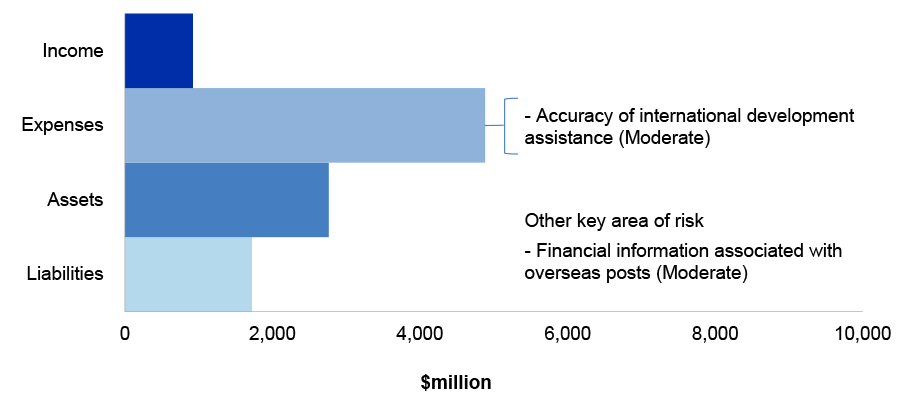

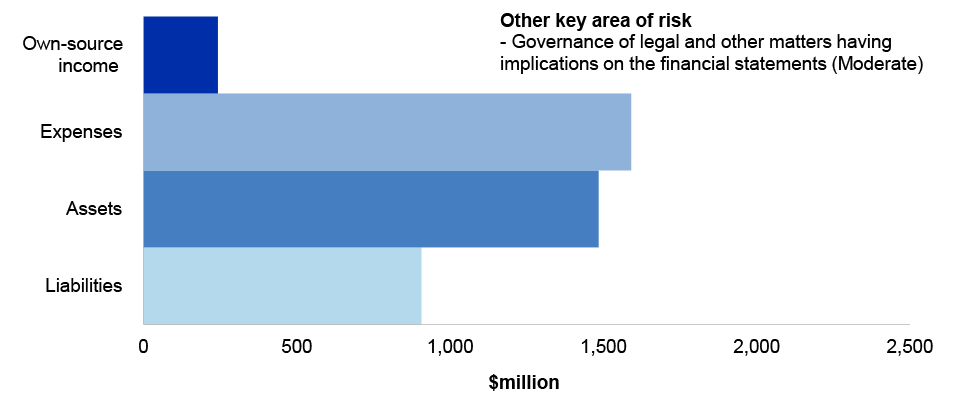

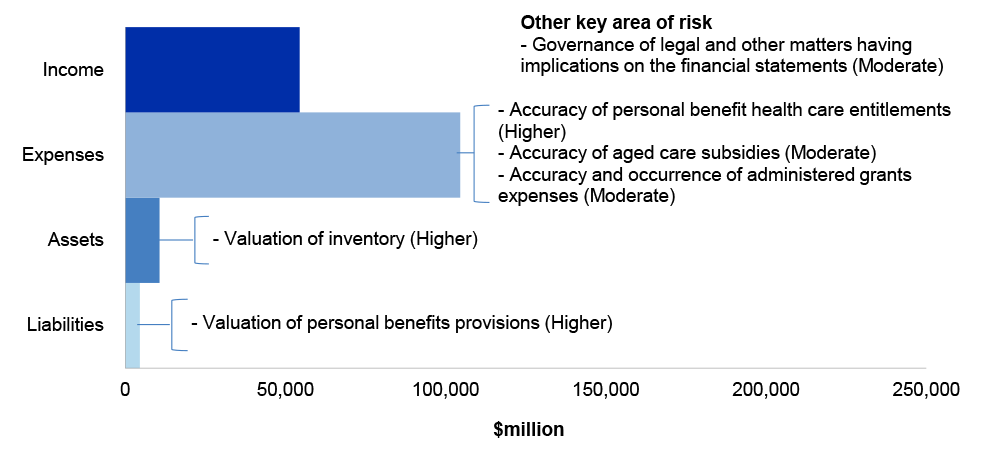

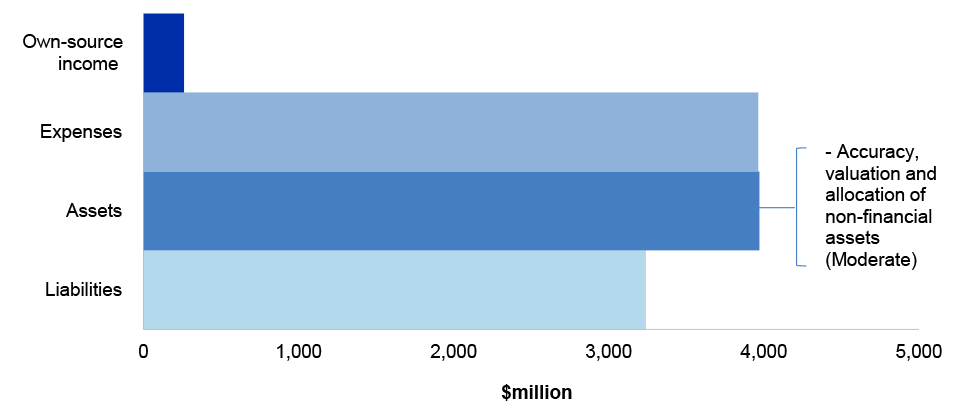

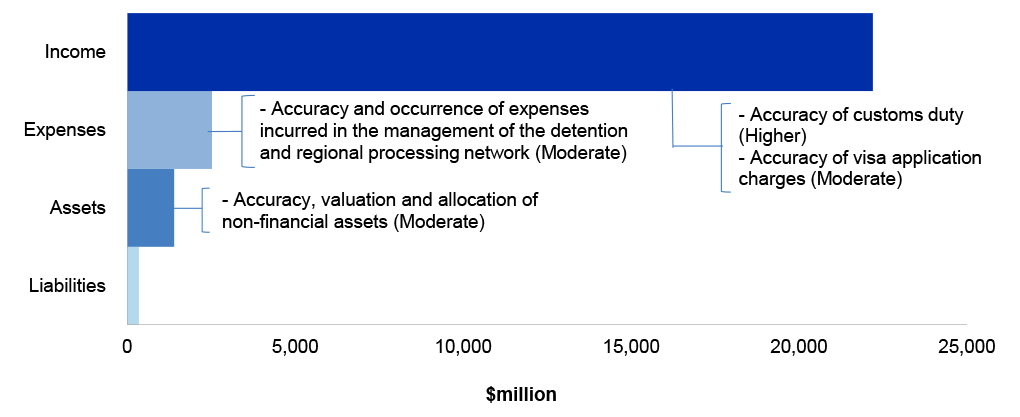

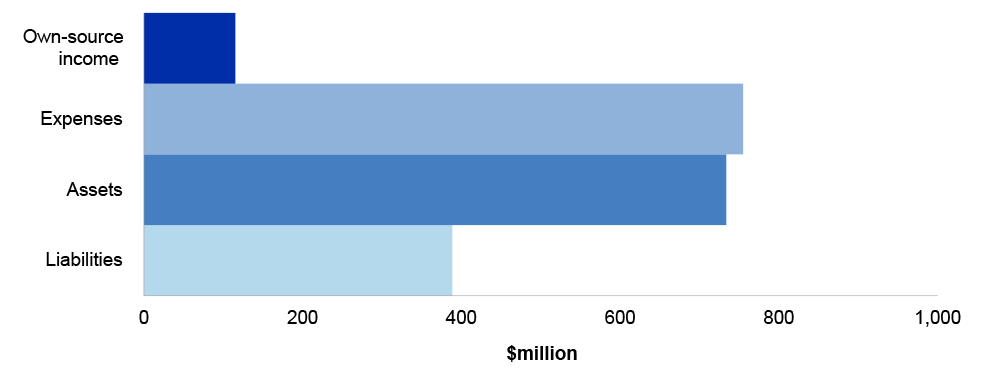

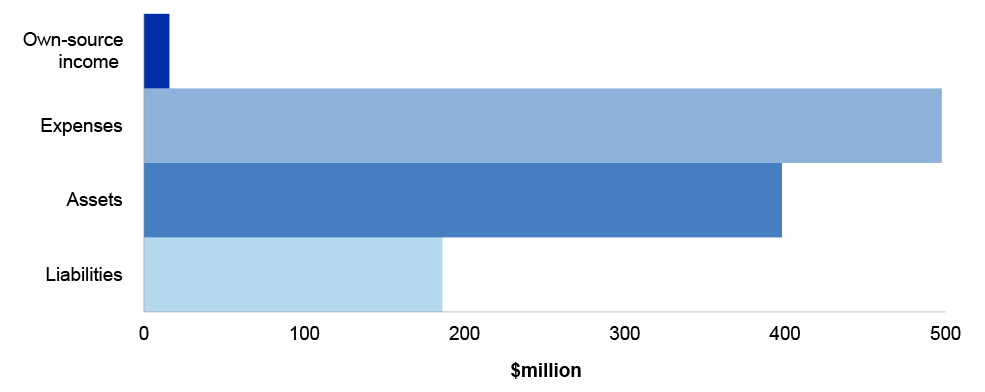

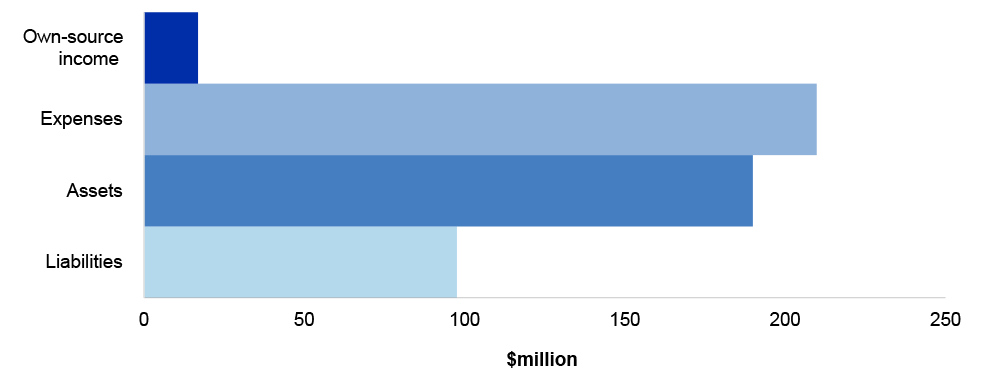

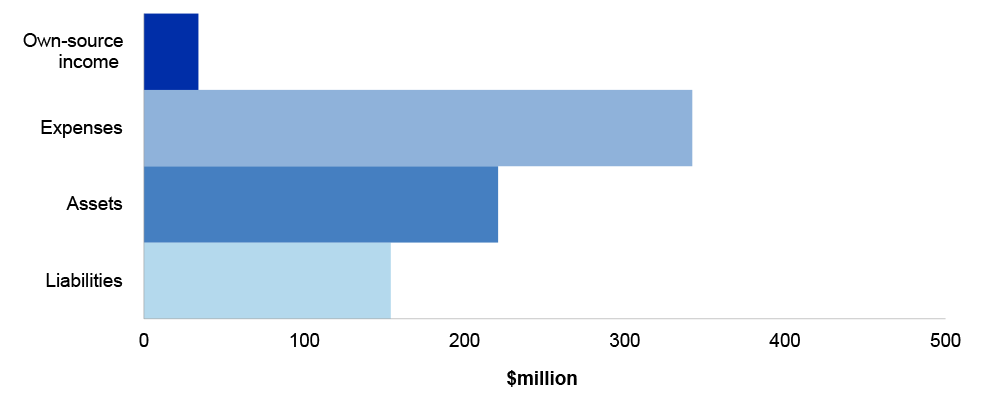

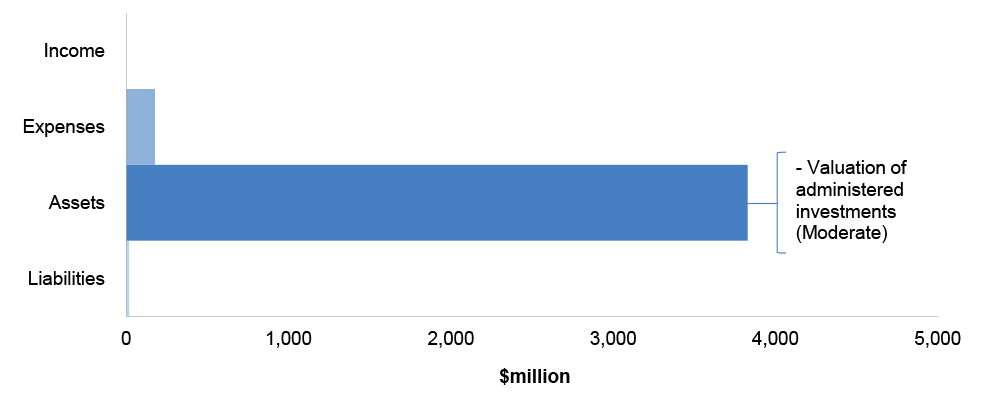

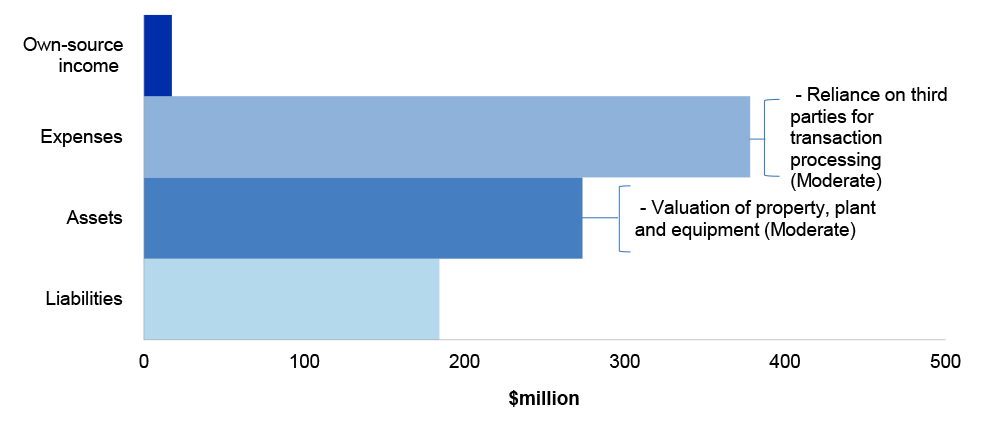

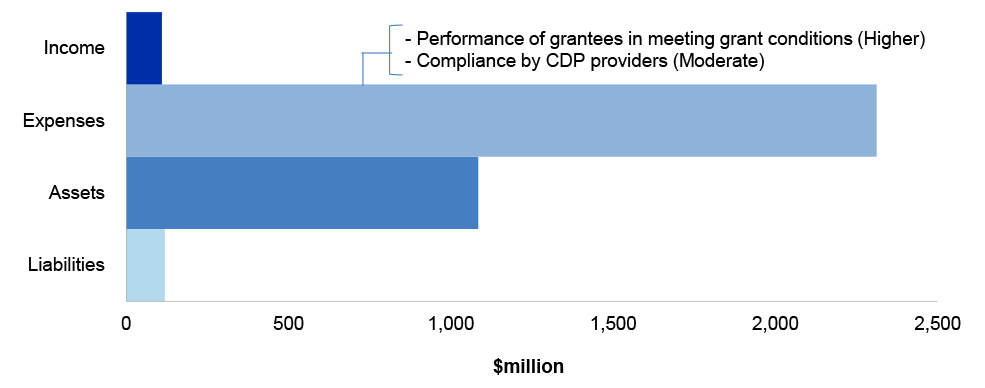

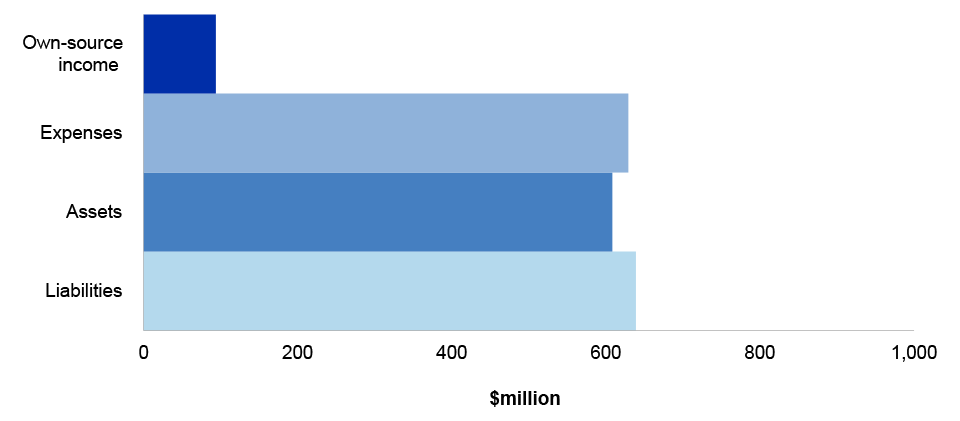

1.5 The entities included in this report are those entities that contribute significantly to the three sectors of the CFS: the General Government Sector (GGS), Public Non-Financial Corporation (PFNC) sector and Public Financial Corporation (PFC) sector. A listing of these entities is provided in Chapter 3.

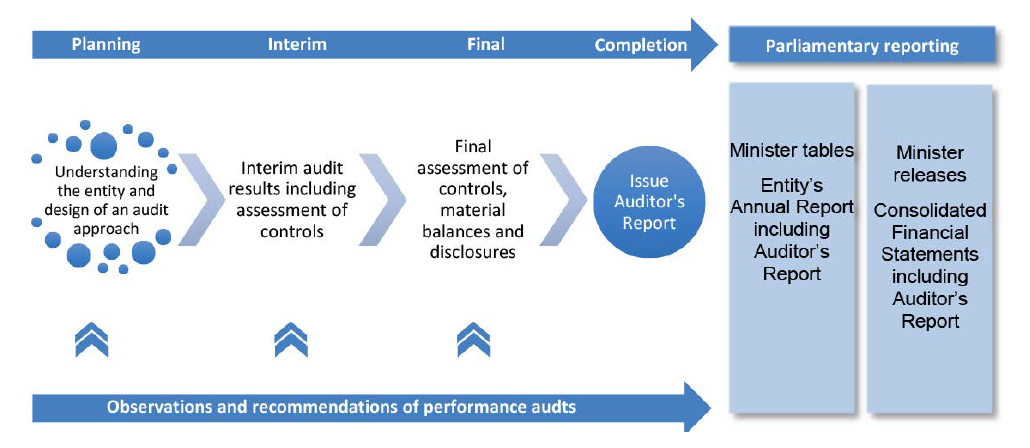

1.6 The ANAO conducts its financial statements audits in four phases: planning; interim; final; and completion. Figure 1.1 outlines the key elements of each phase.

Figure 1.1: ANAO financial statements audit process

Source: ANAO data.

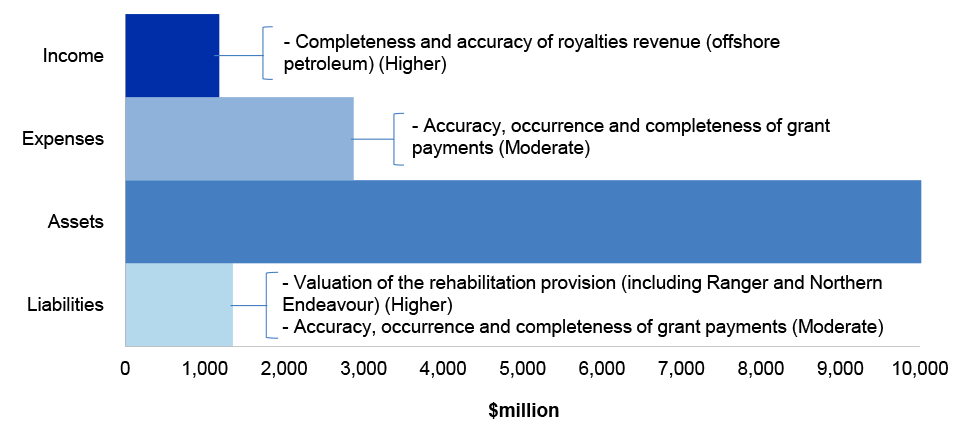

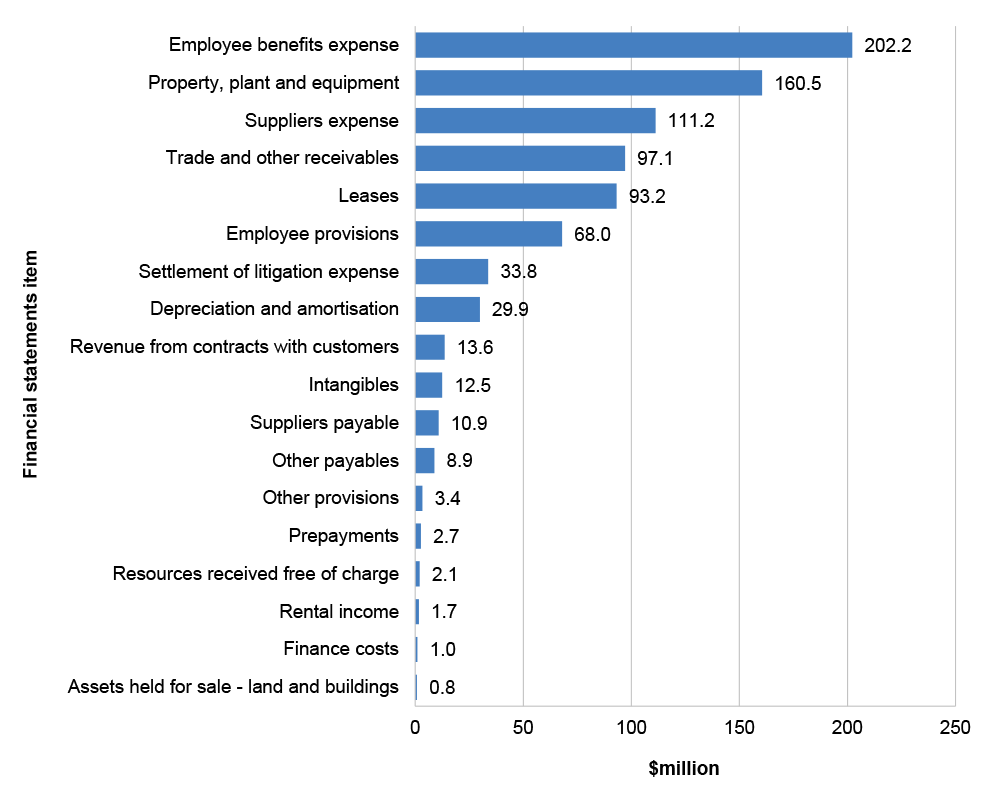

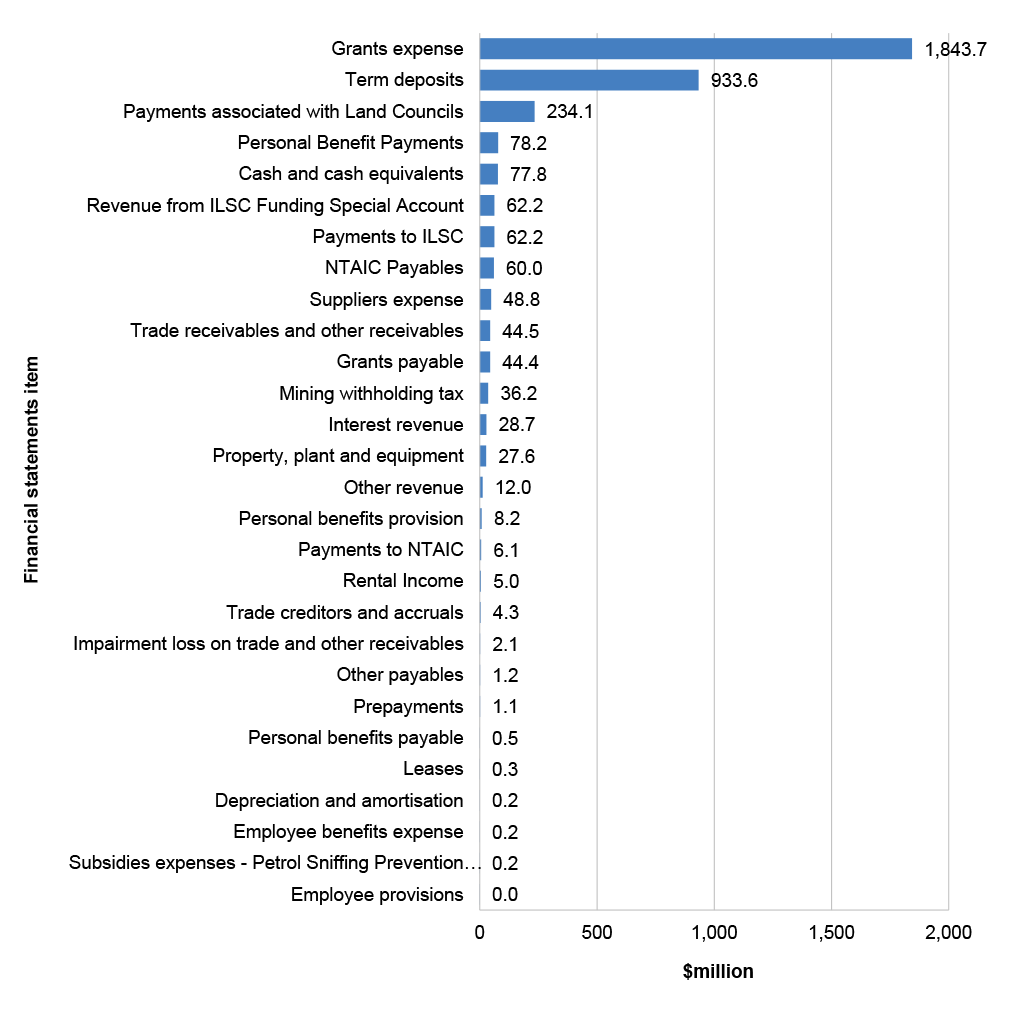

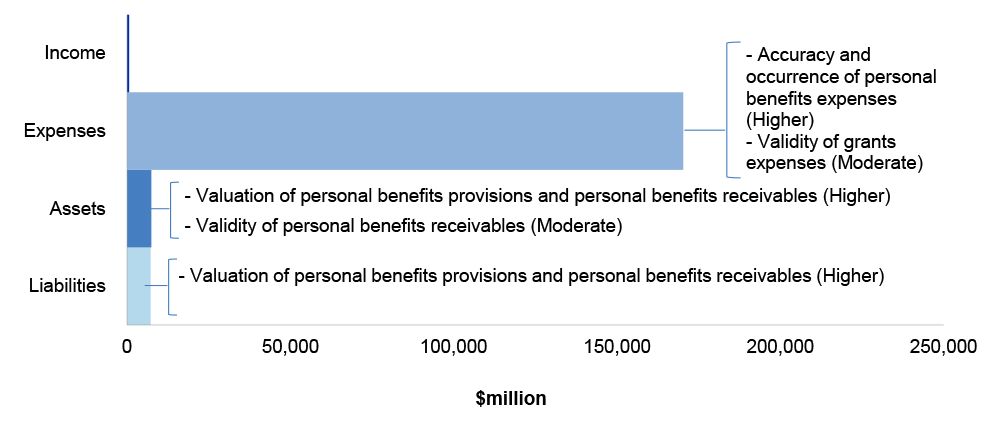

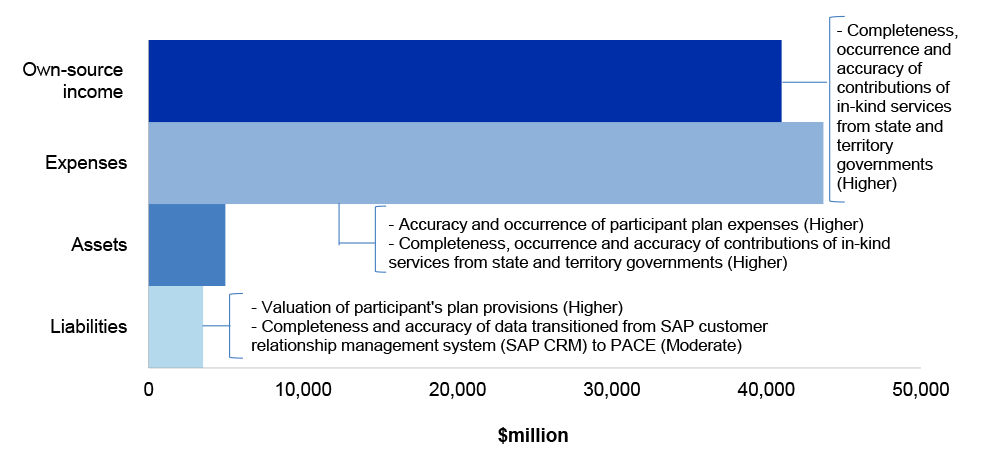

1.7 A central element of the ANAO’s financial statements audit methodology, and the focus of the planning phase of ANAO audits, is a sound understanding of an entity’s environment and internal controls relevant to assessing the risk of material misstatement in the financial statements. This understanding informs the ANAO’s audit approach, including the reliance that may be placed on entity systems to produce financial statements that are free from material misstatement.

1.8 In accordance with generally accepted auditing practice, the ANAO accepts a low level of risk that an audit will fail to detect that the financial statements are materially misstated. This low level of risk is accepted because it is too costly to perform an audit that is predicated on no level of risk. An understanding of the entity, its environment and its controls helps the ANAO design the required work and respond to risks that bear on financial reporting. The key areas of financial statements risks identified through this planning approach are discussed in Chapter 3 for each entity included in this report.

1.9 A key component of understanding the entity and its environment is to understand the governance arrangements established by its accountable authority.1 Accountable authorities of all Commonwealth entities and companies subject to the Public Governance, Performance and Accountability Act 2013 (PGPA Act) are required to govern their entity in a way that promotes the proper use and management of public resources, the achievement of the purposes of the entity and the entity’s financial sustainability.

1.10 The development and implementation of effective corporate governance arrangements and internal controls should be designed to meet the individual circumstances of each entity. These processes also assist in the orderly and efficient conduct of the entity’s business and compliance with applicable legislative requirements, including the preparation of annual financial statements that present fairly the entity’s financial position, financial performance and cash flows.

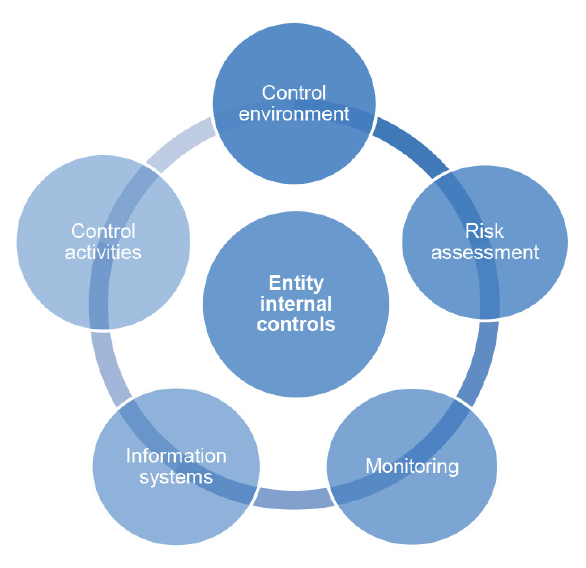

Understanding the entity

1.11 The ANAO uses the framework in the Australian Auditing Standards (ASA) 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment to consider the impact of different elements of an entity’s internal controls that support the preparation of financial statements. This approach provides a basis for designing and implementing the audit work program that reflects the ANAO’s assessment of the risk of material misstatement. Deficiencies in the internal control framework increase the requirement of the ANAO to perform additional audit work in the final audit phase. Figure 1.2 outlines these elements of internal control.

Figure 1.2: Elements of entity internal controls

Source: ASA 315 Identifying and assessing the risk of material misstatement through understanding the entity and its environment, paragraphs 21–26.

1.12 This chapter discusses each of these elements and outlines observations and findings based on the ANAO’s review of aspects of each entity’s internal controls, relevant to the risk of material misstatement to the financial statements, including the detailed results of the interim audits. An effective internal control framework provides a level of assurance that entities are able to prepare financial statements that are free from material misstatement.

What is the ANAO’s assessment of the effectiveness of internal controls supporting financial reporting at these entities?

Internal controls largely support the preparation of financial statements free from material misstatement

For 14 entities, at the completion of the interim audits, key elements of internal control were operating effectively to provide reasonable assurance that the entities were able to prepare financial statements that were free from material misstatement. For 10 entities, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement, except for particular finding/s outlined in Chapter 3. In three entities where significant audit findings were identified, these findings reduced the level of confidence and assurance that could be placed on key elements of internal control. These entities were the Australian Taxation Office, Department of Defence and Services Australia.

Key management personnel turnover can present challenges

A higher rate of turnover of key management personnel (KMP) could increase risks that can arise from gaps in corporate knowledge, gaps in project management or be indicative of underlying issues in culture or performance of an entity. In the period 1 July 2023 to 31 January 2024 there was turnover of KMP in 23 out of 27 entities (85 per cent) included in this report. The average rate of turnover of KMP at these entities was 21 per cent.

Fraud framework requirements are largely in order

The Commonwealth Fraud Control Framework 2017 encourages entities to conduct fraud risk assessments at least every two years and entities responsible for activities with a high fraud risk may assess risk more frequently. All entities had in place a fraud control plan. Twenty-five of the 27 entities had conducted a fraud risk assessment at the enterprise level which informed their plan. Changes to the framework on 1 July 2024 will require entities to expand plans to take account of preventing, detecting and dealing with corruption, as well as periodically examining the effectiveness of internal controls.

Audit committee performance should be regularly reviewed

The Department of Finance (Finance) has indicated that ‘it is good practice for an accountable authority to regularly review the audit committee’s performance and assess its conduct and deliverables against the committee charter’. Seventy-seven per cent of entities had undertaken a recent review of the effectiveness of their audit committee. These reviews mainly relied on self-assessments of committee performance by audit committee members, which may limit their effectiveness. The majority of reviews did not address all of the considerations highlighted in guidance provided by Finance.

Areas for improvement

Entities could enhance the review of audit committee performance by adopting a formal process of independently reviewing the performance of audit committees that more comprehensively considers the matters identified in the guidance issued by Finance.

Assessment of entities’ internal control environment supporting the preparation of financial statements

1.13 Table 1.1 details the assessment of the effectiveness of the elements of internal control at the conclusion of the interim audit for the entities included in this report. Further information on the results of interim audits at each entity is available in Chapter 3.

Table 1.1: Assessment of the effectiveness of the elements of internal control

|

Overall assessment of effectiveness of elements of internal control supporting the preparation of financial statements |

Number of entities |

|

Effective, with no significant or moderate audit findings identified |

14 |

|

Effective, with the exception of particular moderate audit findings identified |

10 |

|

Reduced level of reliance due to significant audit findings identified |

3 |

Source: ANAO analysis.

1.14 At the completion of the 2023–24 interim audits at the 27 entities, the ANAO reported:

- three entities where deficiencies identified by the ANAO reduced the level of confidence in key elements of internal control that support the preparation of financial statements that are free from material misstatement due to the identification of significant audit findings. These entities were the Australian Taxation Office, Department of Defence and Services Australia;

- ten entities where, except for particular finding/s outlined in this chapter, key elements of internal control were operating effectively to provide reasonable assurance that the entities are able to prepare financial statements that are free from material misstatement. These entities are the Departments of: Climate Change, Energy, the Environment and Water; Education; Employment and Workplace Relations; Foreign Affairs and Trade; Health and Aged Care; Infrastructure, Transport, Regional Development, Communications and the Arts; the Prime Minister and Cabinet; Social Services; and Veterans’ Affairs, the National Disability Insurance Agency; and

- fourteen entities where key elements of internal control were operating effectively to provide reasonable assurance that the entities are able to prepare financial statements that are free from material misstatement.

1.15 The key elements of internal control for the full financial year will be assessed in conjunction with additional audit testing during 2023–24 final audits. As a result of the audit findings identified, the ANAO has designed further audit procedures to obtain reasonable assurance that the financial statements balances are not materially misstated.

Control environment

1.16 The PGPA Act sets out the requirements to establish and maintain systems relating to risk and control. Section 16 of the PGPA Act states that:

The accountable authority of a Commonwealth entity must establish and maintain:

(a) an appropriate system of risk oversight and management for the entity; and

(b) an appropriate system of internal control for the entity;

including by implementing measures directed at ensuring officials of the entity comply with finance law.2, 3

1.17 An effective control environment is underpinned by a fit-for-purpose governance structure. Indicators of an effective governance structure include whether management has established frameworks and processes that promote positive attitudes, awareness and actions concerning the entity’s internal controls and their importance in the entity. The main elements reviewed included: governance structures relevant to the preparation of the financial statements; audit committee and assurance arrangements; systems of authorisation; and processes for recording financial transactions.

1.18 Clear lines of accountability and reporting are important in establishing a strong internal control environment for the purposes of preparing the financial statements. The involvement of those charged with governance is an important element of these structures. Just as important is ensuring that staff at all levels in an entity understand their own role in the control framework. This can be achieved through the issuance of accountable authority instructions and delegation instruments.

1.19 During 2023–24 the ANAO has focused on:

- risks arising from the turnover of key management personnel;

- establishment and performance of entity audit committees; and

- assignment and monitoring of responsibilities.

Turnover of key management personnel

1.20 ASA 315 requires that an auditor consider how an entity attracts, retains and develops competent individuals in alignment with its objectives, in order to form a view on the effectiveness of internal control. This includes considering the skills and experience of personnel responsible for leading and governing an entity, including those personnel who are Key Management Personnel (KMP).

1.21 A higher rate of turnover of KMP could increase risks that can arise from gaps in corporate knowledge or management of projects or be indicative of underlying issues in culture or performance of an entity.

1.22 KMP is a concept described in AASB 124 Related Party Disclosures. KMP are those persons having authority and responsibility for planning, directing and controlling the activities of the entity, directly or indirectly, including any director (whether executive or otherwise) of that entity. These individuals generally comprise senior executive management of an entity, and where in place, members of the board of directors. At 30 June 2023, there was an average of nine KMP positions per entity. This average comprised:

- non-corporate entities – 8 positions (with a range of one to 23 positions);

- corporate entities – 16 positions (with a range of eight to 20 positions); and

- companies – 14 positions.

1.23 A consideration in forming an assessment of the level competence, skills and experience of management is to also consider the turnover of personnel during the period. The ANAO analysed the turnover of KMP for the 27 entities included in this report for the period 1 July 2023 to 31 January 2024 and identified that:

- there were changes in KMP in 23 entities (85 per cent of entities);

- the average turnover rate of KMP at entities with turnover was 21 per cent; and

- the range of KMP positions per entity which had turned over was between 1 to 7 individuals.

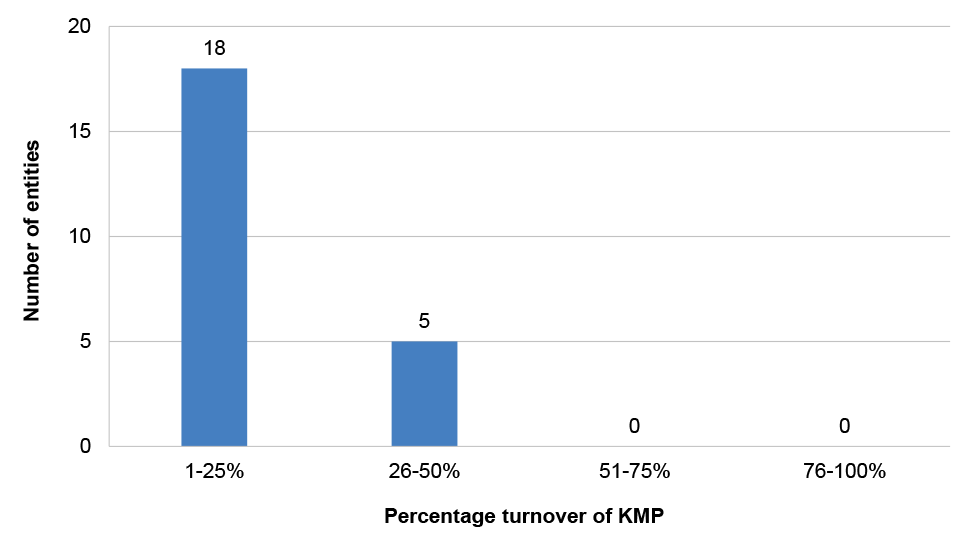

1.24 Figure 1.3 demonstrates the range of turnover in KMP across entities where there were changes during the period 1 July 2023 to 31 January 2024.

Figure 1.3: Range of turnover of KMP from 1 July 2023 to 31 January 2024

Source: ANAO analysis.

1.25 The ANAO has analysed the changes in selected roles that support financial management and the system of internal control within entities: Chief Executive Officer (CEO) or accountable authority, Chief Financial Officer (CFO) and Chief Information Officer (CIO). The ANAO identified that in the period from 1 July 2023 to 31 January 2024 there were:

- eight newly appointed CEOs or accountable authorities (including board chairs). This represents 30 per cent of entities;

- six newly appointed CFOs. This represents 22 per cent of entities; and

- seven newly appointed CIOs. This represents 26 per cent of entities.

1.26 For the Department of Veterans’ Affairs there was a change in the accountable authority, CFO and CIO during the period.

Audit committees

1.27 The Department of Finance’s (Finance) Resource Management Guide (RMG) relating to audit committees, describe a committee’s role as supporting good governance of entities.4 The PGPA Act and Rule prescribe requirements for establishment, membership and functions of these committees. The ANAO’s analysis confirms that for all entities in this report:

- have established audit committees that meet the minimum requirements for audit committees as outlined in PGPA Rule section 175 or 286;

- committees consist of a majority of members which were assessed by the entity to be independent;

- all committee chairs were independent members; and

- an audit committee charter, that is consistent with their obligations under subsection 17(2) of the PGPA Rule, is in place.

1.28 The assessment of the performance of an entity’s audit committee is not mandated. Finance’s RMGs indicates that ‘it is good practice for an accountable authority to regularly review the audit committee’s performance and assess its conduct and deliverables against the committee charter’7. The RMG also indicates that in addition to an assessment by the accountable authority, ‘a well-functioning audit committee would regularly assess its own performance, with the findings reported to the accountable authority’.8

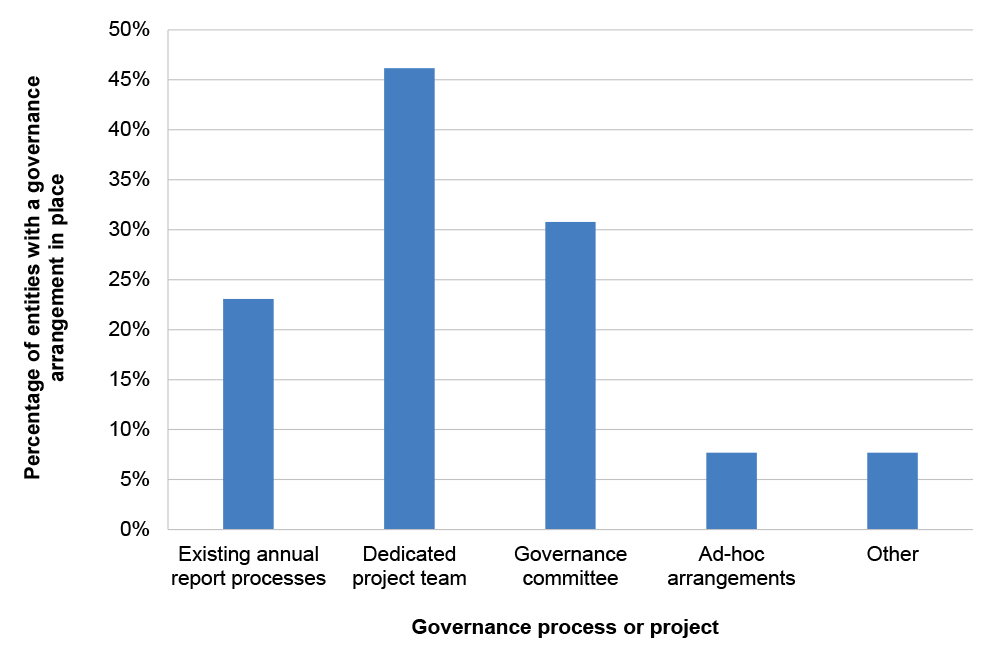

1.29 The ANAO has analysed whether the accountable authority of entities included in this report have conducted a review of audit committee performance and the extent of matters considered in the review. Seventy-seven per cent of entities advised the ANAO that the accountable authority had conducted a review. These reviews were delivered by:

- a self-assessment, such as a survey or questionnaire, being completed by the members of the committee, with the results shared with the accountable authority; or

- a review conducted by the accountable authority.

1.30 Of the entities which conducted a review, less than half (48 per cent) documented the outcomes of the accountable authority’s review in writing.

1.31 The RMG indicates that a self-assessment of performance by audit committee members would be an additional step to any process for an accountable authority to form a view on performance. Reliance on self-assessments by accountable authorities in forming a view on performance of audit committees may limit the objectivity and effectiveness of the review.

1.32 Finance’s RMG does not prescribe the interval at which assessments should be performed, but does indicate that this should be ‘regularly’ performed. Of the entities which completed reviews, 48 per cent were last completed during 2023–24; 43 per cent in 2022–23 and 9 per cent in 2021–22.

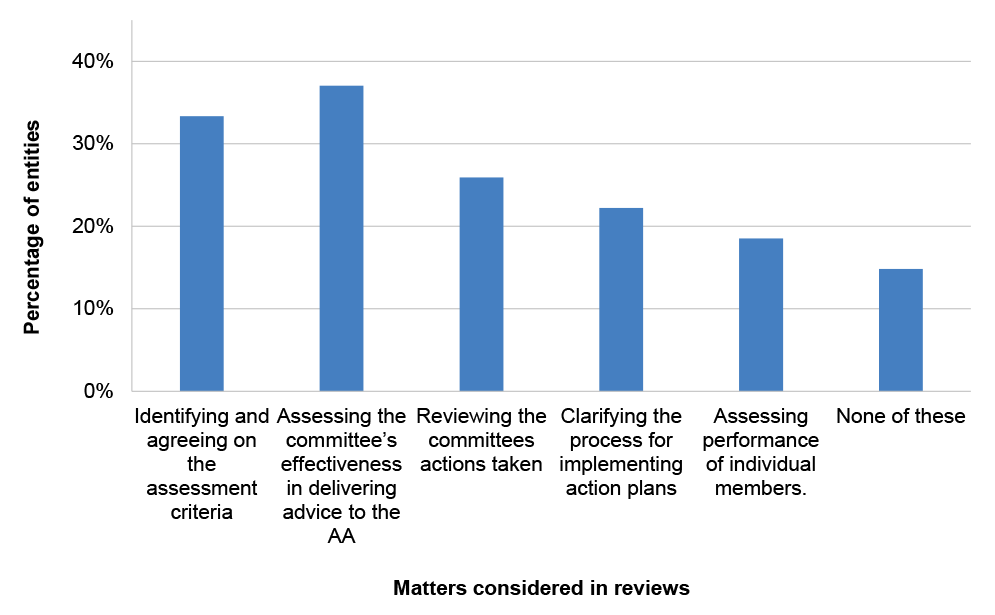

1.33 The RMG indicates that the following matters could be considered by accountable authorities in conducting a review:

- agreeing on criteria to be applied when assessing performance and including them in committee charters;

- effectiveness of advice provided to the accountable authority;

- assessing the performance of individual members;

- clarifying the process for implementing action plans; and

- reviewing the committees actions, including communication with the accountable authority and other stakeholders, preparedness and timeliness of the committee work plan and documentation of deliberations.9

1.34 Figure 1.4 demonstrates the range of matters considered by entities when undertaking these reviews. The majority of entities did not include all of the matters suggested in the RMG.

Figure 1.4: Matters considered in reviews of audit committee effectiveness

Source: ANAO analysis.

|

Opportunity for improvement |

|

1.35 Entities could enhance their review of audit committee performance by:

|

Assignment and monitoring of responsibilities

1.36 All 27 entities included in this report have established executive management committees and/or sub-committees that meet at least monthly, which support financial decision making at the strategic and operational levels.10

1.37 Financial and budgetary performance was included on the agendas of 25 entities’ executive committees. For the Departments of: Climate Change, Energy, the Environment and Water; and Home Affairs, the Chief Finance Officer provided monthly financial reports to the Secretary and other senior executives. The financial information provided to the entities’ executives was supplemented by non-financial operational information for all entities.

1.38 Clear lines of accountability and reporting are important in establishing a strong internal control environment for the purposes of preparing the financial statements. The involvement of those charged with governance is an important element of these structures. It is also important to ensure that staff at all levels understand their own role in the control framework. This can be achieved through the issuance of accountable authority instructions and delegation instruments. All entities have established accountable authority instructions and delegations reflecting current business arrangements.

Risk assessment processes

1.39 Section 16 of the PGPA Act sets out an accountable authority’s responsibilities regarding the establishment of appropriate risk oversight and management in an entity. An understanding of an entity’s process to identify and manage risk is essential to an effective and efficient financial statements audit. A review of this process is done to assist the ANAO to understand how entities identify and manage risks relating to financial statements and assess the risk of material misstatement to an entity’s financial statements.

1.40 In forming a view on the effectiveness of entity control environments, the ANAO has focused on:

- risk management processes; and

- fraud control arrangements.

Risk management

1.41 All entities included in this report have a process to develop and update risk management plans at the organisational and strategic risk levels. In addition, each entity has developed processes for the identification and notification of risks relevant to financial statements preparation either as part of the overall risk management plan, or through a targeted risk identification exercise.

1.42 The monitoring of risks, and the entities’ implementation of risk management strategies, was typically assigned to either an executive committee and/or the audit committee.

Fraud control arrangements

1.43 Section 10 of the PGPA Rule details the minimum standards for accountable authorities of Commonwealth entities for managing the risk and incidence of fraud. The accountable authority of an entity must take all reasonable measures to prevent, detect and deal with fraud relating to the entity. This includes conducting fraud risk assessments regularly and when there is a substantial change in the structure, functions or activities of the entity.11 The Commonwealth Fraud Control Framework 2017, encourages entities to conduct fraud risk assessments at least every two years and entities responsible for activities with a high fraud risk may assess risk more frequently. 12

1.44 The ANAO analysed the extent to which the guidance and requirements of the Commonwealth Fraud Control Framework 2017 has been implemented by entities included in this report and13 identified that:

- all entities have developed and implemented a fraud control plan to prevent and detect fraud; and

- twenty-five entities have a fraud risk assessment at the entity level. For two entities (Department of Finance and Snowy Hydro Limited) fraud risk assessments have been undertaken at the activity level.

1.45 On 1 July 2024 the Commonwealth Fraud and Corruption Control Framework14 will come into effect. In addition to the existing requirements of the 2017 framework, the new framework requires that:

- accountable authorities also take steps to prevent, detect and deal with corrupt conduct, in addition to fraud;

- entities have in place governance structures and processes to oversee and manage risks of fraud and corruption;

- entities have in place officials who are responsible for managing risks of fraud and corruption; and

- entities must periodically review the effectiveness of their fraud and corruption controls.

1.46 Entities should plan and have in place a process to update their existing fraud control plans and risk assessments to take account of the requirements around corruption. It is important that these plans and risk assessments are reviewed and updated by the date of implementation to ensure compliance with the requirements of the framework and to prevent, detect and deal with fraud and corruption.

1.47 To assist entities with the implementation of the Framework, the Attorney-General’s Department’s Commonwealth Fraud Prevention Centre has:

- published a range of guidance for entities on key aspects of the Framework;

- developed a roadmap for entities to demonstrate a step by step approach to implementing the framework; and

- conducted webinars and direct training for entities about the new framework. The Centre offers Counter Fraud Practitioner Training Program for officials engaged in fraud and corruption control.15

Monitoring of controls

1.48 Entities undertake many types of activities as part of their monitoring of control processes, including external reviews, self-assessment processes, post-implementation reviews and internal audits. The level of review of these activities by the ANAO is determined through a risk assessment approach that takes into consideration the nature, extent and timing of each activity and the activities’ application to the preparation of the financial statements. All entities included in this report have an ongoing process for monitoring and evaluating internal controls.

1.49 During 2023–24 the ANAO has focused on the effectiveness of entities in addressing internal audit recommendations. Further information relating to these findings is available in paragraphs 1.54 to 1.75.

Information systems and communication

1.50 The information systems relevant to the preparation of the financial statements consists of activities and policies, and accounting and supporting records, designed and established to initiate, record and process entity transactions (as well as to capture, process and disclose information about events and conditions other than transactions).

1.51 Sixty audit findings have been reported to entities during 2023–24 interim audits relating to the IT control environment, accounting for 65 per cent of audit findings identified by the ANAO during 2023–24 audits. The most common findings identified related to weaknesses in: IT security (primarily removal of user access and management of privileged user access) and change management. Further information relating to these findings is available in paragraphs 1.139 to 1.168.

Control activities

1.52 The control activities component of an entities’ system of internal control are primarily direct controls which are designed to prevent, detect or correct misstatements.16 Auditors are required to evaluate the design of the controls and determine whether the controls have been implemented. Controls include authorisations and approvals, reconciliations, verifications (such as edit and validation checks or automated calculations), segregation of duties, and physical or logical controls, including those addressing safeguarding of assets.

1.53 Where the ANAO identifies one or more control deficiencies, the ANAO assesses whether, individually or in combination, the deficiencies constitute a significant deficiency and reports these to accountable authorities as audit findings. The ANAO applies professional judgement in determining whether a deficiency represents a significant control deficiency. Information relating to the audit findings identified by the ANAO during 2022–23 is available at paragraphs 1.127 to 1.203.

Do entities have robust processes for implementing internal audit recommendations?

4,186 internal audit recommendations from 1,469 internal audits between 1 July 2020 and 31 January 2024

Internal audit recommendations provide advice to entities to strengthen their system of internal control or address identified risks. There were 4,186 internal audit recommendations from 1,469 internal audits made to the 27 entities during the period 1 July 2020 to 31 January 2024. At 31 January 2024 24 per cent of these recommendations were unresolved. Thirty-three per cent of entities had not established formal policies or procedures for implementing internal audit recommendations.

Delays in implementing agreed actions from internal audit recommendations

All entities included in this report established a process for monitoring of the closure of audit recommendations. Internal audit recommendations which are not addressed by agreed timeframes could contribute to increases in business or other risks. For internal audit recommendations with agreed due dates, 69 per cent of audit recommendations during the period 1 July 2020 to 31 January 2024 were resolved past their agreed timeframe. The average delay in closing recommendations with an agreed due date during this period was 91 days. These delays could indicate governance processes in place at entities for monitoring recommendations may not be fully effective.

Opportunities for improvement

Entities could review and strengthen their governance processes and oversight arrangements which support the implementation of internal audit recommendations to ensure that recommendations (and associated risk which they address) are resolved within agreed timeframes.

1.54 The Institute of Internal Auditors (IIA) defines an internal audit function as being:

A department, division, team of consultants, or other practitioner(s) that provides independent, objective assurance and consulting services designed to add value and improve an organization’s operations. The internal audit activity helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and governance processes.17

1.55 An appropriately designed and resourced internal audit can assist the accountable authority of an entity to obtain assurance over the design, implementation and operating effectiveness of the system of risk management and internal control within an entity. All entities included in this report had an internal audit function in place during 2023–24.

1.56 Auditor-General Report No. 9 2023–24 Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2023 focused on the effectiveness and role of internal audit functions within entities, including an analysis of the establishment, design, independence and coverage provided by internal audit across the sector. As a result of this analysis the ANAO identified that there was an opportunity for the Australian Government to consider whether additional guidance relating to the implementation and delivery of internal audit would be beneficial to enhance the Australian Government’s system of internal control.

1.57 In a continuation of this analysis during 2023–24 interim audits the ANAO has analysed the design and implementation of processes with entities relating to internal audit recommendations. The ANAO’s analysis has been undertaken with reference to the standards issued by the IIA18, best practice and guidance issued by other regulators and bodies within Australia. The IIA standards require that an entity’s chief audit executive must communicate the results of internal audit to appropriate parties within an entity to take appropriate action. These communications must include the scope and objective of the engagement, an overall conclusion, recommendations and action plans.19

1.58 The standards issued by the IIA are not mandated for application by entities. The purpose of the IIA standards is to establish principles and practices for internal audit, and a framework within which it can be performed.

1.59 The IIA released the Global Internal Audit Standards in January 2024. These 2024 Standards become effective in January 2025. The main changes in the 2024 Standards are:

- strengthening governance frameworks to improve responsiveness to rapidly changing business environments;

- guidance to assist internal auditors in the public sector and for small internal audit functions; and

- specific guidance and standards on critical areas like cybersecurity and environment, sustainability and governance domains.20,21

Framework for implementing internal audit recommendations

1.60 The IIA standards require that an entity establish and maintain a system to monitor the disposition of results communicated to management, which includes implementing a process to monitor and ensure that recommendations have been effectively implemented or that management has accepted the risks of not taking action.22

Policies and procedures

1.61 The ANAO has assessed entity conformance with this standard through inspection of policies and procedures established by entities. Seventy-seven per cent of entities had established a policy for the monitoring, tracking and resolution of internal audit recommendations. Where a policy was in place, the ANAO reviewed to understand the detail and scope of the policy.

- Thirty-three per cent of entities had developed a separate, comprehensive policy or process that details how internal audit recommendations are tracked and resolved. This included assignment of responsibility for monitoring of internal auditing recommendations and the process that would be undertaken to verify actions taken were implemented.

- Thirty-three per cent of entities had a policy and process established that was referenced in internal audit charters. These policies were briefer in nature and specified higher level requirements.

1.62 Thirteen per cent of entities policies did not establish policies or instructions with the timeframe for implementation of internal audit recommendations.

1.63 Thirty-three per cent of entities did not have a documented policy or procedure on how internal audit recommendations are tracked and resolved. Entities could improve the governance supporting the implementation of internal audit recommendations by establishing formal policies that detail an entity’s process for the closure of internal audit recommendations, that detail:

- the responsibility of management and the internal audit function for closure of these recommendations;

- the requirements for monitoring of internal audit recommendations and their timely resolution.

Audit committee involvement

1.64 The Department of Finance’s (Finance) Resource Management Guides (RMG) relating to audit committees describe the importance of internal audit, particularly: ‘the relationship between the audit committee and the managers of the internal audit function is central to enabling the audit committee to meet its responsibilities’.23 Finance outlines that an audit committee should:

- have input into the internal audit work plan; and

- have access to internal audit reports in order to inform its advice to the accountable authority.24

1.65 For each entity included in this report, the audit committee had an oversight role in relation to the implementation of internal audit recommendations with regular updates on recommendations being provided to the committee.

Closure of internal audit recommendations

1.66 The IIA standards require that an entity implement processes to ensure that recommendations are implemented effectively.25 The ANAO analysed the process established by entities to agree to the closure of audit recommendations. All entities required that evidence to support the closure of the recommendation (that an action had been taken) was provided by the internal audit function.

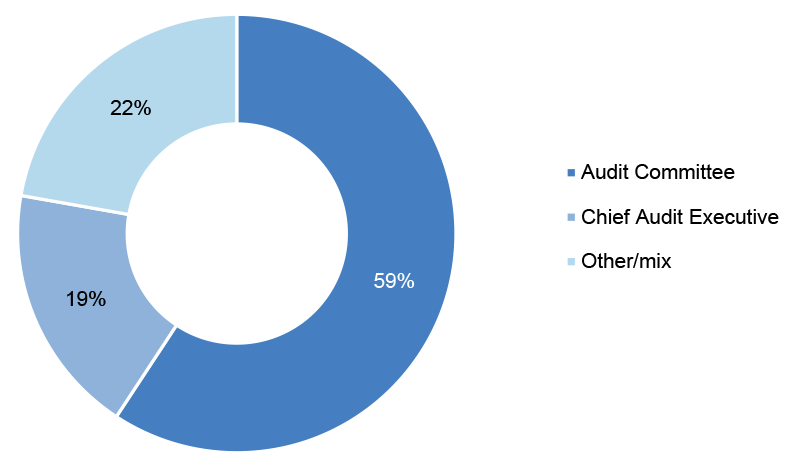

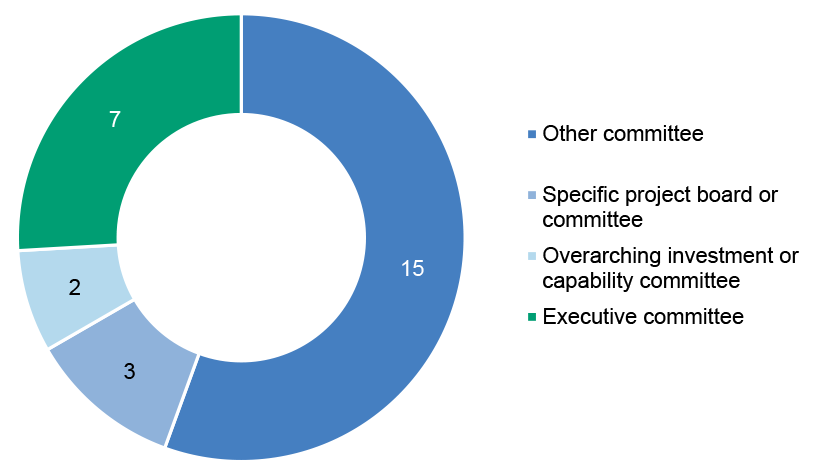

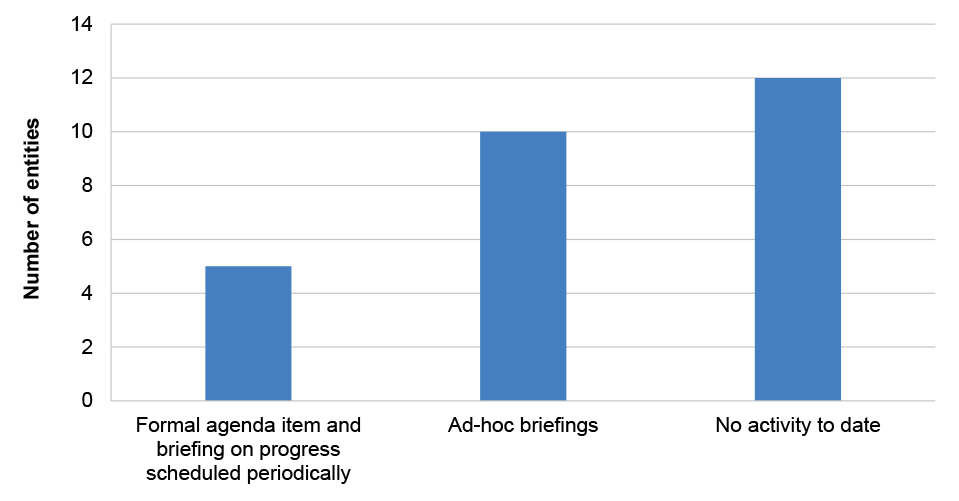

1.67 Figure 1.5 provides an overview of the authority for acceptance of closure of internal audit recommendations in entities. The majority of entities had assigned responsibility for the review of the actions taken for closure of internal audit recommendations to their audit committee (informed by advice from the chief audit executive).

Figure 1.5: Assignment of responsibility to consider closed internal audit recommendations

Source: ANAO analysis.

Audit recommendations

1.68 The ANAO obtained copies of internal audit recommendations registers or monitoring documents used by entities to monitor internal audit recommendation status in order to analyse the number and timeliness of implementation of internal audit recommendations for the period 1 July 2020 to 31 January 2024. This analysis includes audit recommendations that were identified in internal audits that were conducted during the period, as well as recommendations that were unresolved relating to earlier periods.

1.69 There were 4,186 internal audit recommendations made to these entities during the period 1 July 2020 to 31 January 2024 (from 1,469 internal audits). At 31 January 2024, 24 per cent of these recommendations remained open.

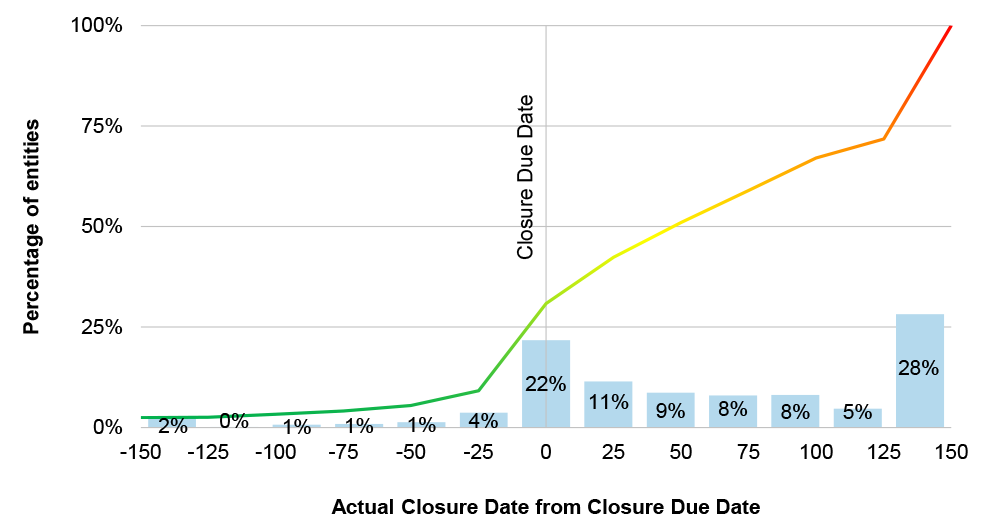

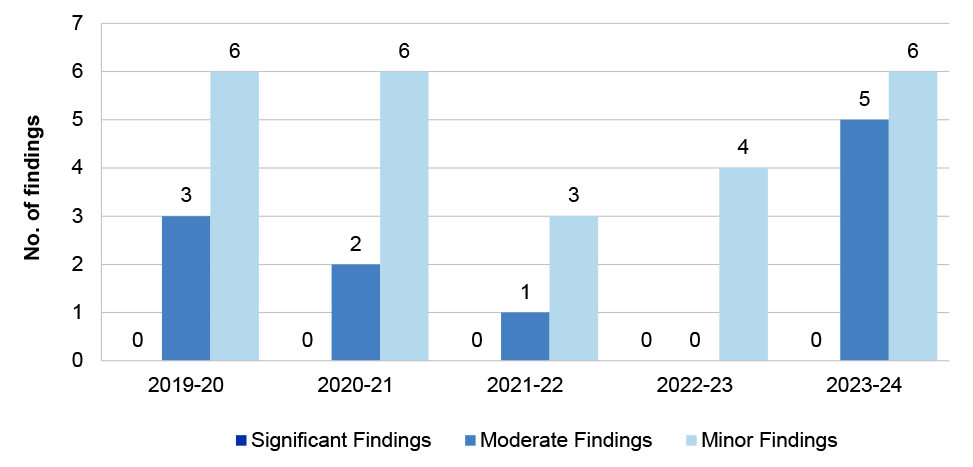

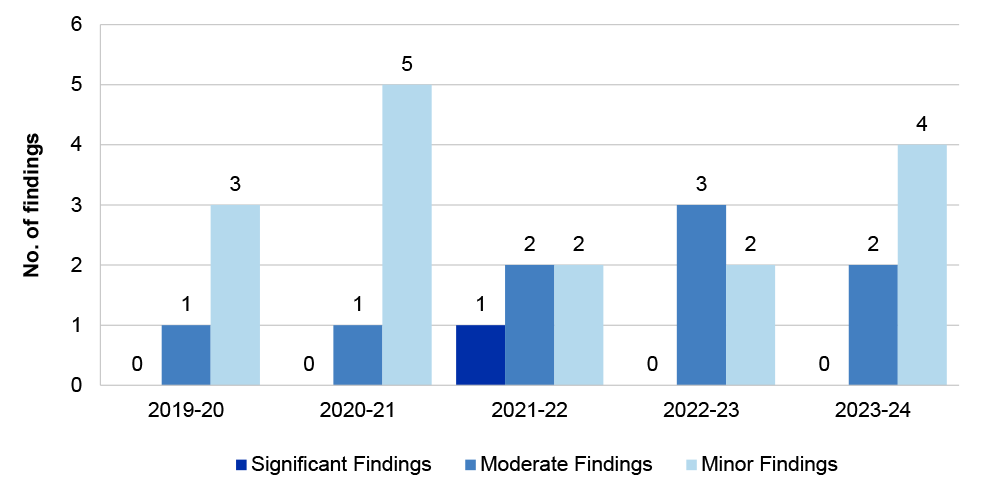

1.70 Where entities agreed a due date for recommendations, 69 per cent of audit recommendations during this period were resolved after the initially agreed due date. Figure 1.6 provides an overview of the range of time taken to resolve internal audit recommendations with agreed due dates compared to the initially agreed due date.

Figure 1.6: Cumulative closure of internal audit recommendations with an agreed due date for the period 1 July 2020 to 31 January 2024

Source: ANAO analysis of entity recommendation closure (where due dates were agreed).

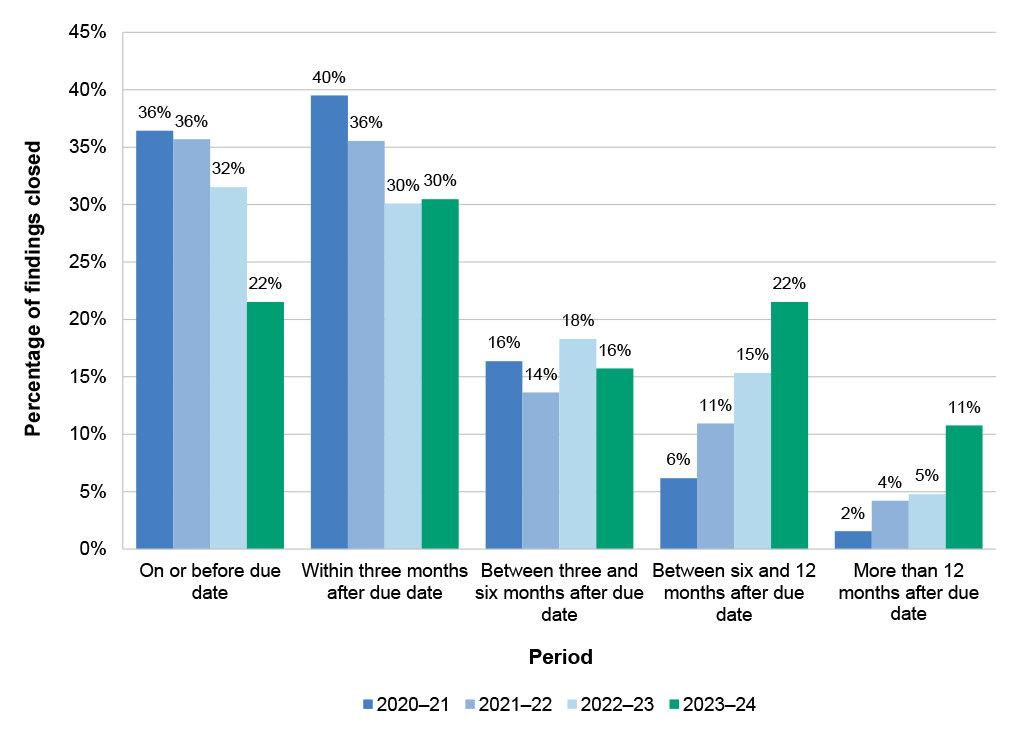

1.71 Figure 1.7 details the trend in the closure of audit recommendations in the period 2020–21 to 2023–24.

Figure 1.7: Trends in timeliness of audit recommendation closure where due dates were agreed 2020–21 to 2023–24

Source: ANAO analysis of entity recommendation closure (where due dates were set).

1.72 There was a decrease in audit recommendations being resolved on or before the due date from 2020–21 to 2023–24 (from 36 to 22 per cent). The average delay between the planned closure date and actual closure date during this period was 91 days, with a range of 1 to 1,538 days.

1.73 There are 11 entities where, on average, the time taken to resolve internal audit recommendations is greater than three months past the original agreed due date. These entities are the Attorney-General’s Department, Department’s of: Agriculture, Fisheries and Forestry; Defence; Foreign Affairs and Trade; Health and Aged Care; Home Affairs; Infrastructure, Transport, Regional Development, Communications and the Arts; the Treasury; and Veterans’ Affairs, the National Indigenous Australians Agency and Services Australia.

1.74 Internal audit recommendations provide advice to the accountable authority and management to strengthen an entity’s system of internal control. Internal audit recommendations which are not resolved within agreed timeframes could contribute to increases in business or other risks.

|

Opportunity for improvement |

|

1.75 Entities could review and strengthen their governance processes and oversight arrangements which support the implementation of internal audit recommendations to ensure that recommendations (and associated risk which they address) are addressed in a timely manner. |

How are entities safeguarding data from cyber security threats?

The Protective Security Policy Framework (PSPF) contains the Essential Eight mitigation strategies and recommends controls intended to strengthen cyber resilience and the capacity of government to mitigate cyber threats. Entities’ reported compliance with PSPF cyber security requirements across each of the Essential Eight mitigation strategies has improved when compared to 2022–23. Entities reported that these improvements were achieved through the establishment of taskforces, cyber investment and uplift programs as well as the commissioning of independent reviews. Seventy-seven per cent (17 of the 22 entities who must comply with Policy 10 requirements) did not meet all of the relevant requirements. There continues to be the risk of compromise to data relevant to the preparation of financial statements.

1.76 The Protective Security Policy Framework (PSPF) requires non-corporate Commonwealth entities (NCE) to consider and implement the Australian Signals Directorate’s (ASD’s) Essential Eight mitigation strategies (Essential Eight). 26 The initial requirements were defined in 2013 and are specified in PSPF Policy 10, “Safeguarding data from cyber threats” (Policy 10).27 The Essential Eight is considered the baseline for cyber resilience within the Australian Government and provides advice on measures that entities can implement to mitigate cyber threats.28

1.77 Policy 10 requires each NCE to:

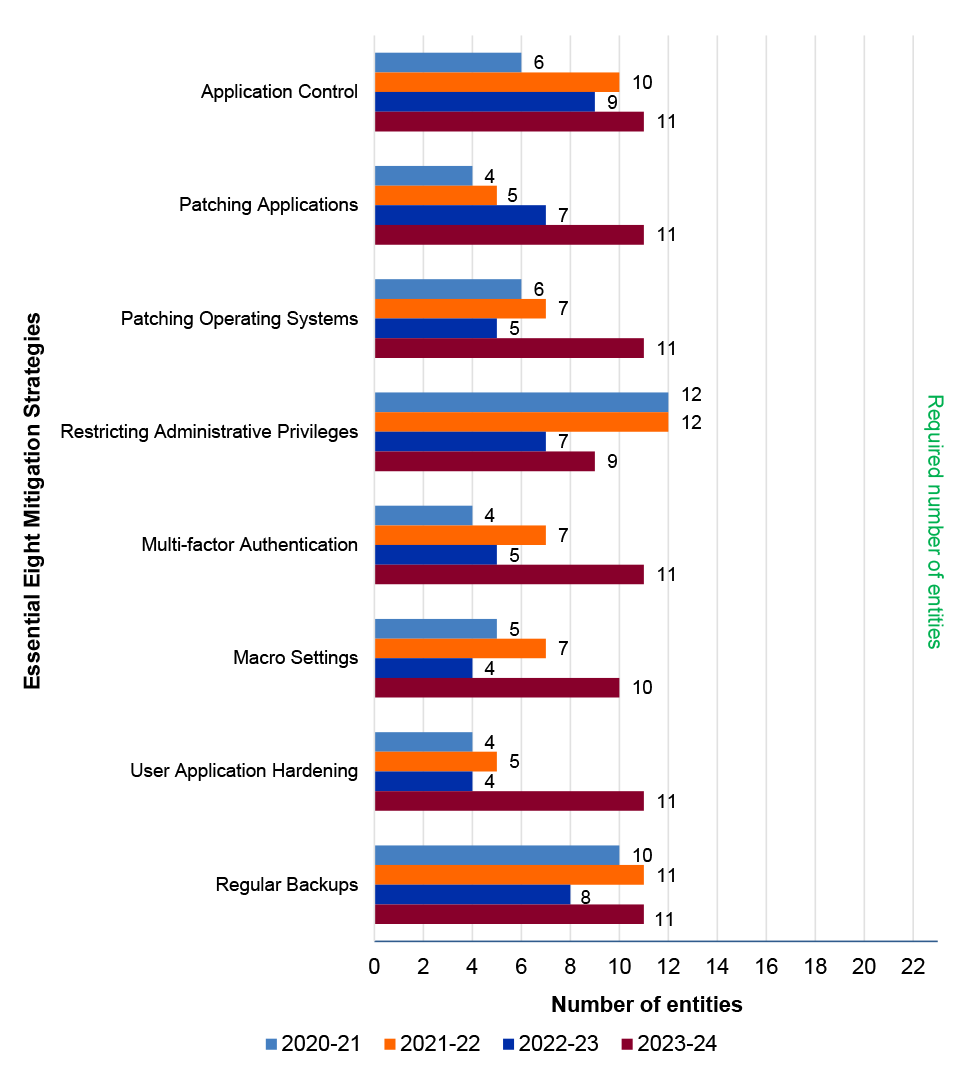

- implement the following ASD Strategies to Mitigate Cyber Security Incidents:29

- consider which of the remaining mitigation Strategies from the Strategies to Mitigate Cyber Security Incidents37 need to be implemented to protect the entity.38

1.78 Since 2013, the ANAO has conducted a series of performance audits focussed on assessing entities’ implementation of the PSPF cyber security requirements. These performance audits continue to identify low levels of compliance with mandatory PSPF cyber security requirements and concerns in annual self-assessments by entities. The ANAO has previously reported concern that there is no evidence that the regulatory framework had driven sufficient improvement in entities mitigating their cyber security risks.

1.79 In 2023–24, the ANAO reviewed and analysed the 2022–23 Policy 10 annual self-assessments prepared by entities. The ANAO’s analysis focused on the protection of information relevant to the preparation of financial statements, specifically the Financial Management Information System (FMIS) and Human Resource Management Information Systems (HRMIS). Twenty-two of the 27 entities included in this report are required to report their compliance annually against the Policy 10 requirements.39 The review was undertaken to assess the evidence supporting the self-assessment and reporting, and to identify cyber security risks that may impact on the preparation of financial statements. The review was based on the March 2022 Policy 10 requirements as these are the requirements that entities were required to implement for the majority of the 2022–23 reporting period.40 The review consisted of analysis of policy and procedural documentation, testing of some Essential Eight mitigation strategies specific to the FMIS and HRMIS, review of results of security assessments and meetings with entity personnel.

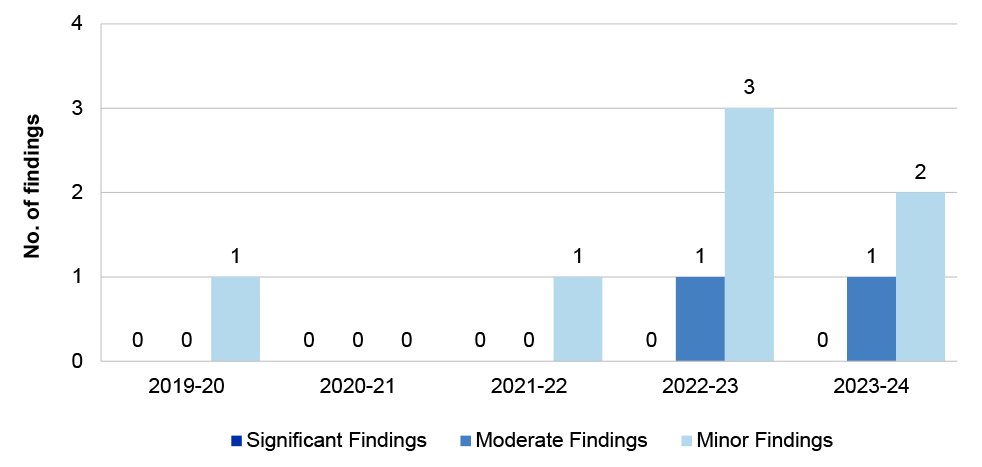

1.80 Figure 1.8 shows ANAO’s analysis of the entities’ reported compliance with the PSPF Policy 10 requirements between 2020–21 and 2023–24. The Essential Eight mitigation strategies were mandatory from 1 July 2022 (the 2022–23 reporting period).

Figure 1.8: Reported compliance with the PSPF Policy 10 Requirements for the period 2021–22 to 2023–24

Source: ANAO data.

1.81 A higher number of entities reported improvements in Essential Eight maturity levels across the Essential Eight mitigation strategies when compared to 2022–23. Five entities met all Policy 10 requirements (23 per cent). The remaining entities were still progressing their development of the Essential Eight mitigation strategies.

1.82 Five of the 22 entities reported lower maturity levels since last year’s assessment. One entity reported that an external review of it’s self-assessment had required it to re-adjust it’s reported maturity level. Nine of the 22 entities reviewed engaged third parties to assist with their assessments and implementation of security controls. Most entities were still planning on achieving a ‘managing’ maturity level for Policy 10 with some entities reporting on the complexity of changes required.

1.83 The ANAO found that the reported maturity levels for some entities were still below the Policy 10 requirements. Of the 22 entities assessed, five (23 per cent) had self-assessed as achieving a Managing maturity level for Policy 10. Only two of the five entities were able to demonstrate evidence to support their self-assessments as required by the PSPF.

1.84 There were improvements this year when compared to 2022–23 across ‘Patching Applications’, ‘Multi-factor Authentication’, ‘Macro Settings’ and ‘User Application Hardening’.

1.85 Whilst there was improvement this year when compared to 2022–23, ‘Restricting Administrative Privileges’ was still reported by entities to be difficult as ICT systems continue to require unique identification, authentication and authorisation. Entities continue to differ in their maturity of addressing the associated risks. Some entities reported the implementation of a single-identity solution to ensure that administration controls would be consistently applied. Entities reported that investments in cyber security uplift programs would be needed to continue to assist in meeting requirements of Policy 10.

1.86 Ten of the 22 entities reviewed had reported achieving the ‘Macro Settings’ requirements, an improvement when compared to 2022–23. Of the ten entities that had reported achieving the requirements, three entities reported that these requirements were still being integrated into business practices. The remaining entities reported not achieving the requirements advised that this is being addressed through educating staff; migrating users to updated desktops; and investing in cyber security uplift programs.

1.87 The PSPF requires entities to identify and protect people, information and assets that are critical to the ongoing operation of their core business.41 Most entities advised the ANAO that they did not view the FMIS and HRMIS applications and financial information as separate critical assets to their computer networks. Those entities reported that their self-assessment was conducted at a system or environment level and did not assess the controls required to minimise cyber risks to their FMIS or HRMIS applications.

1.88 The majority of entities reviewed had advised the ANAO that they had information asset registers that identified critical and high-priority systems and information. One entity specified that the FMIS and HRMIS were assessed as high priority. Entities that had not implemented an information asset register used their disaster recovery plans as the basis for prioritising systems and information. Entities use these mechanisms along with broader business impact level assessments, IT investment priorities and operational requirements to help determine investment in cyber security.

1.89 The ANAO found that the number of assessed entities that reported a Maturity Level 1 or Maturity Level 2 rating had improved since the previous assessment. Compared to 2022–23, the number of entities that had reported as meeting the required Policy 10 Maturity Level 3 from 14 per cent to 23 per cent.

1.90 The PSPF cyber security requirements have been in place since 2013, with the March 2022 update requiring implementation of the Essential Eight mitigation strategies at Maturity Level Two. Since July 2022, the ASD’s Essential Eight Assessment Course has provided technical advice and assistance to entities who have been struggling to implement and maintain strong cyber security controls due to changing requirements.

1.91 Previous ANAO audits of entity compliance with PSPF cyber security requirements have not found a significant improvement over time. The work undertaken as part of this review indicates some improvements, but the trend of non-compliance continues.

1.92 Recommendations to strengthen arrangements for verifying self-assessment results and accountability for the implementation of mandatory cyber security requirements have been made by the Joint Committee of Public Accounts and Audit (JCPAA) and the ANAO in the following reports:

- JCPAA Report 485 Cyber Resilience (2020)42;

- JCPAA Report 497 Inquiry into Commonwealth Financial Statements 2021–2243;

- Auditor-General Report No. 53 2017–18 Cyber Resilience44;

- Auditor-General Report No. 32 2020–21 Cyber Security Strategies of Non-Corporate Commonwealth Entities45; and

- Auditor-General Report No. 9 2022–23 Management of Cyber Security Supply Chain Risks46.

1.93 Entities’ compliance with PSPF cyber security requirements across each of the Essential Eight mitigation strategies has improved when compared to 2022–23. Entities reported that these improvements were achieved through the establishment of taskforces, cyber investment and uplift programs as well as the commissioning of independent reviews. In addition, some entities have recently moved towards adopting a secure-by-design approach. There continues to be a risk of compromise to information relevant to the preparation of financial statements.

How are entities managing personal information?

Twenty-two of the 27 entities included in this report indicated that that they collected personal information for the purposes of delivering public services. These entities must comply to the provisions of the Privacy Act 1988 and Australian Privacy Principles (APPs). These entities have advised the ANAO that they comply with these requirements, including the requirements to conduct privacy impact assessments and develop a data governance framework. Forty-one per cent of these entities had not assessed their compliance with privacy and security requirements. From July to December 2023 the Australian Government was included in the ‘top 5’ sectors reporting notifiable data breaches to the Office of the Australian Information Commissioner. It is important for entities to implement appropriate governance measures and controls supported by clear policies, procedures and practices that comply with the requirements of the APPs.

1.94 The Privacy Act 1988 defines ‘personal information’ as ‘information, or an opinion, about an identified individual, or an individual who is reasonably identifiable’.47Entities48 who are subject to the provisions of the Privacy Act49 are required to manage the personal information they hold by complying with the Australian Privacy Principles50 (APPs) and any other relevant legislation or framework that imposes obligations in relation to personal information security. The APPs are principles-based, technology neutral and form the key privacy protection framework in the Privacy Act 1988.

1.95 The APPs require that entities must manage personal information in an open and transparent way through a ‘privacy by design’ approach and secure personal information throughout all stages of the personal information lifecycle.51 The stages of the personal information lifecycle are as follows: 52

- Part 1 – Consideration of personal information privacy (APPs 1 and 2);

- Part 2 – Collection of personal information (APPs 3, 4 and 5);

- Part 3 – Dealing with personal information (APPs 6, 7, 8 and 9);

- Part 4 – Integrity of personal information (APPs 10 and 11); and

- Part 5 – Access to, and correction of, personal information (APPs 12 and 13).

1.96 The collection and use of personal information is part of most citizen-centred delivery of public services by the Australian Government entities, including in the administration of the taxation and social security programs.

1.97 In the reporting period from July to December 2023 the Australian Government was included in the ‘top 5’ sectors reporting notifiable data breaches to the Office of the Australian Information Commissioner.53 Compliance with the Privacy Act and APPs to build trust, transparency and accountability in the use and security of personal information is an important consideration for entities.

1.98 The ANAO has analysed, for the entities included in this report, how they manage personal information. The ANAO obtained information used in this analysis through a survey of each entity. Twenty-two of the 27 entities included in this report indicated that that they collected personal information for the purposes of delivering public services.

1.99 Figure 1.9 outlines the ANAO’s analysis of how the 22 entities implemented the requirements of the APPs. Eighty-six per cent of these entities had conducted a privacy impact assessment as part of recognising the risks associated with the collection and storage of personal information.

Figure 1.9: Proportion of entities who reported implementing the requirements of the APPs

Source: ANAO analysis.

1.100 Seventy-seven per cent of these entities (17 entities) recognised risks associated with security of personal information or privacy obligations in their entity risk registers.

1.101 A data governance framework is a written document that defines the context for governing data within an entity.54 For those entities which hold personal information, a framework would typically outline the approach for the collection, organisation, storage and use of personal information including any guidance on how the entity maintains or corrects the personal information. Eighty-two per cent of entities reported implementing a data governance framework.55

1.102 Fifty-nine per cent (12 entities) advised the ANAO that they had implemented a centralised data register. The 10 entities that had not implemented a centralised data register advised the ANAO this was due to resource constraints or the process for development of a register was not yet complete, but underway.

- Of the entities that reported implementing a centralised data register, the centralised data register included details about the type of dataset, which contains personal information; a data owner; a data steward; data format; and any other information relevant to the effective management of an entity’s datasets.

- Two entities identified critical information assets and systems in their centralised data register.

1.103 Four entities advised the ANAO that they had reported data breaches to the Office of the Australian Information Commissioner. Two of the four entities reported multiple breaches. These entities have advised the ANAO that they were gaining assurance over the risks associated with data breaches by continuing to review and enhance monitoring controls.

1.104 Entities surveyed for this report indicated that they had implemented the requirements of the APPs, however there continues to be data breaches of personal information caused by malicious action, human error or negligence, or a failure in information handling or security systems. It is important that entities have implemented effective governance measures and controls in place supported by clear policies, procedures and practices that comply with the requirements of the APPs.

How are entities managing the delivery of software projects?

717 software projects with a total budget of $10.9 billion are being delivered by entities

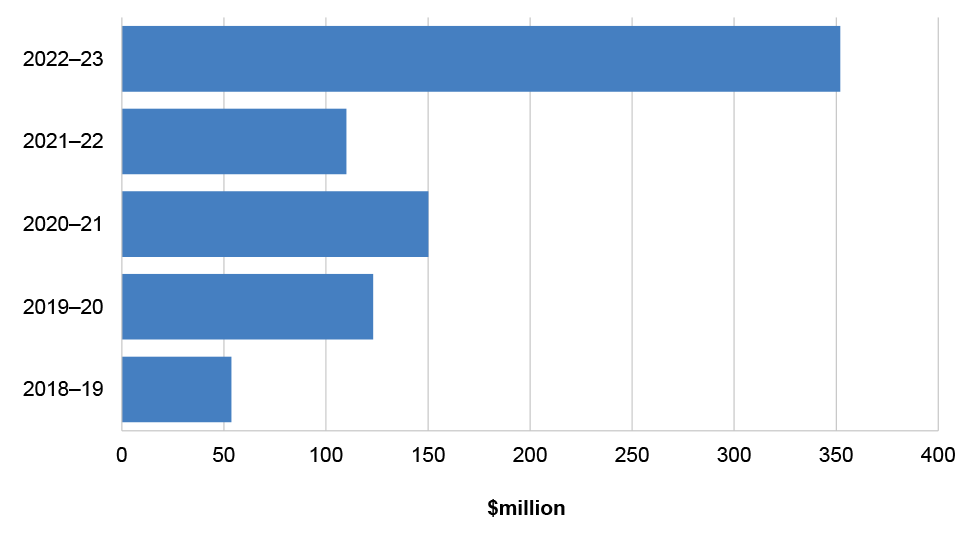

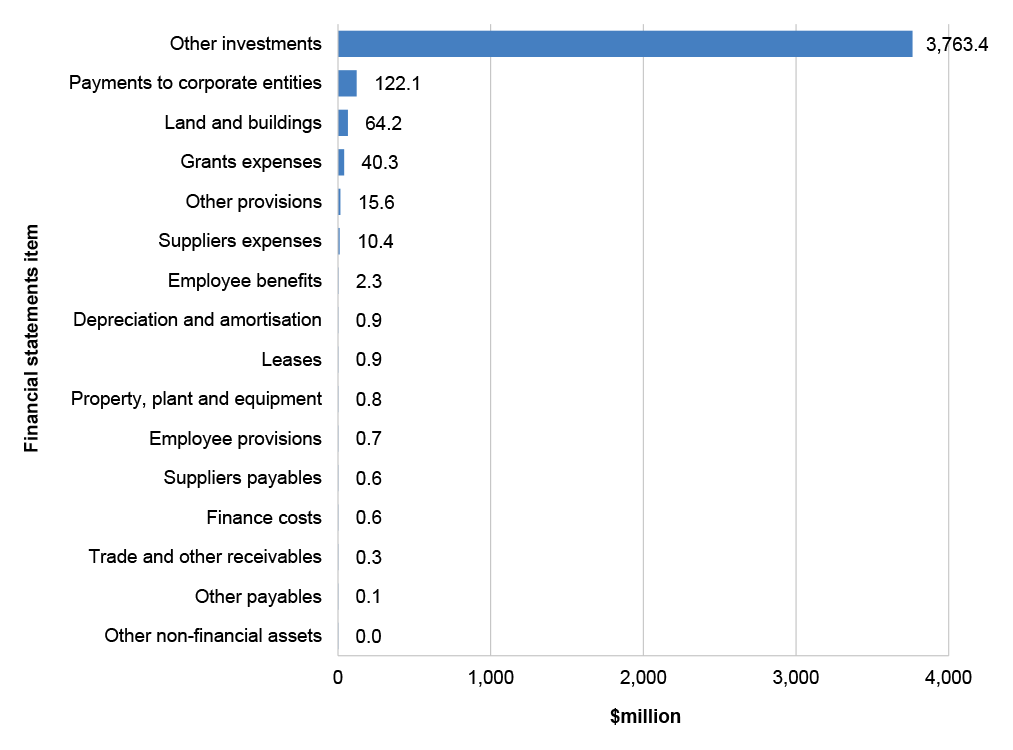

At 30 June 2023 the Australian Government reported computer software of $22.1 billion. For the period 2018–19 to 2022–23 entities wrote off $789.1 million of computer software. At 31 January 2024 there were 717 distinct software projects underway at 25 of the entities included in this report, which had a total budget (including capital and operating expenses) of $10.9 billion.

Entities could consider further assurance processes to support delivery of software projects

Twenty-five of the 27 entities included in this report had established a project management framework or policy. All entities had assigned responsibility for monitoring software projects to an executive or other committee embedded in the entity’s organisational structure. Thirteen entities did not provide reports to their audit committees on software projects. All entities had adopted one or more of the eight examples of project assurance activities identified by the DTA as likely to meet its definition of assurance for digital investments. One of the DTA’s examples of assurance activities, internal audit, was adopted by the majority of entities.

Areas for improvement

The significance of the total value of software projects being delivered, and the level of write-off of computer software over the period 2018–19 to 2022–23 create opportunities for entities to consider the effectiveness of governance of delivery of software projects. These opportunities include: increasing the oversight from entity audit committees of delivery of software projects, particularly where there are increased risks identified with delivery or particular projects; and adopting a broader use of assurance arrangements recommended by the DTA which are consistent with the assurance framework and are performed in a considered and planned manner so that all sources of assurance are coordinated effectively.

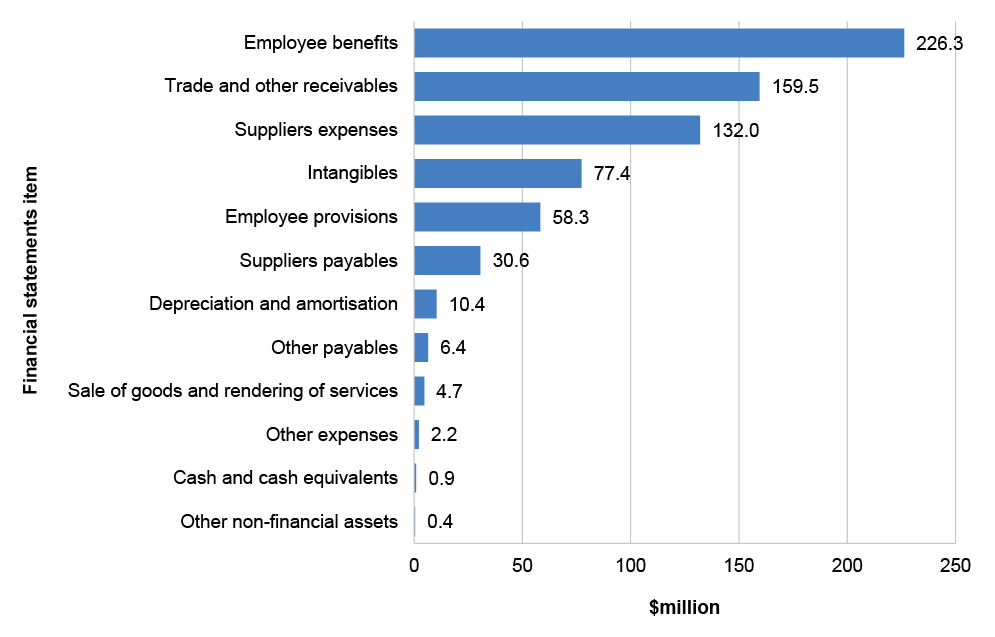

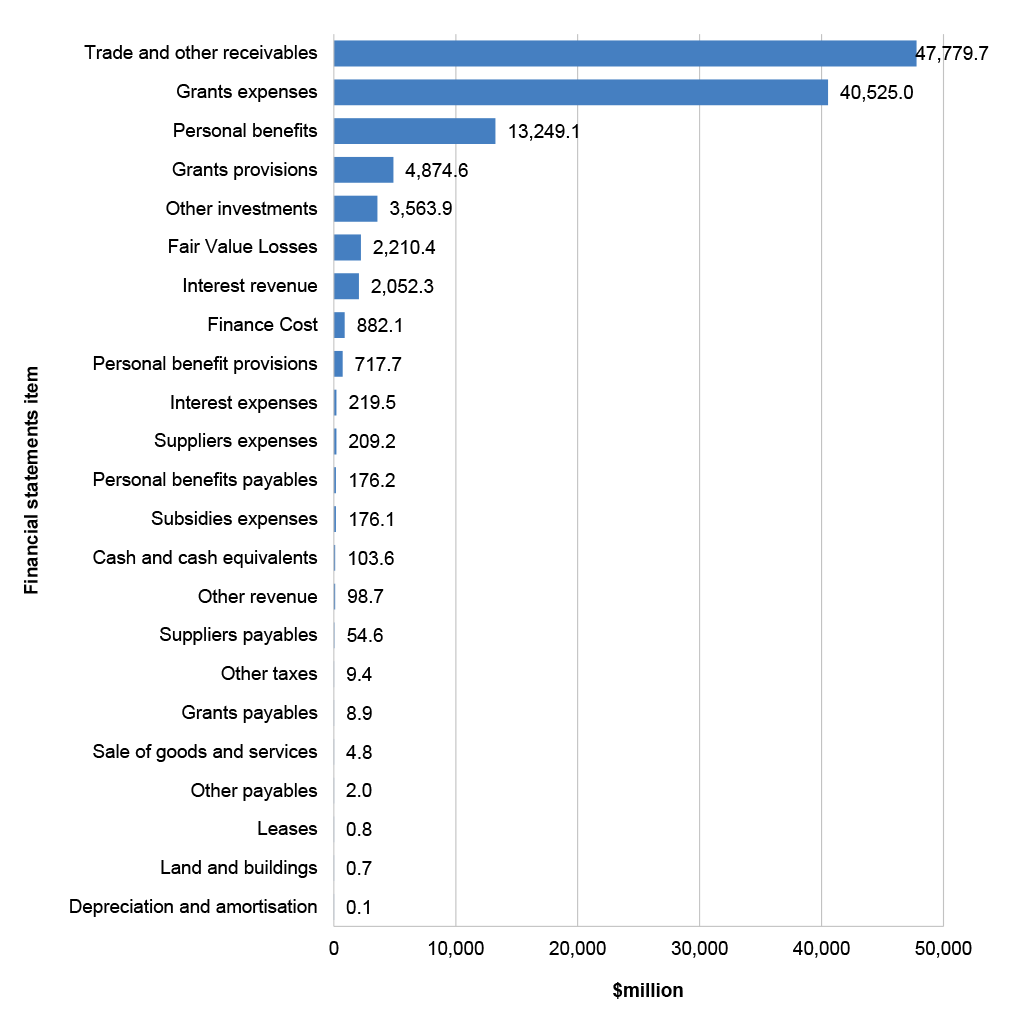

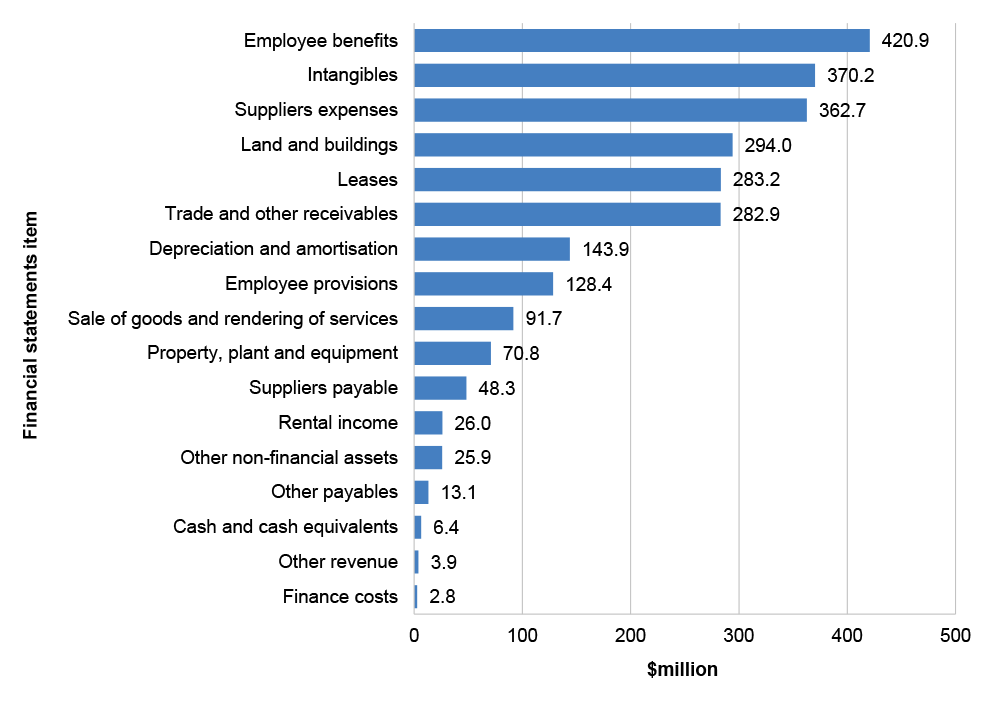

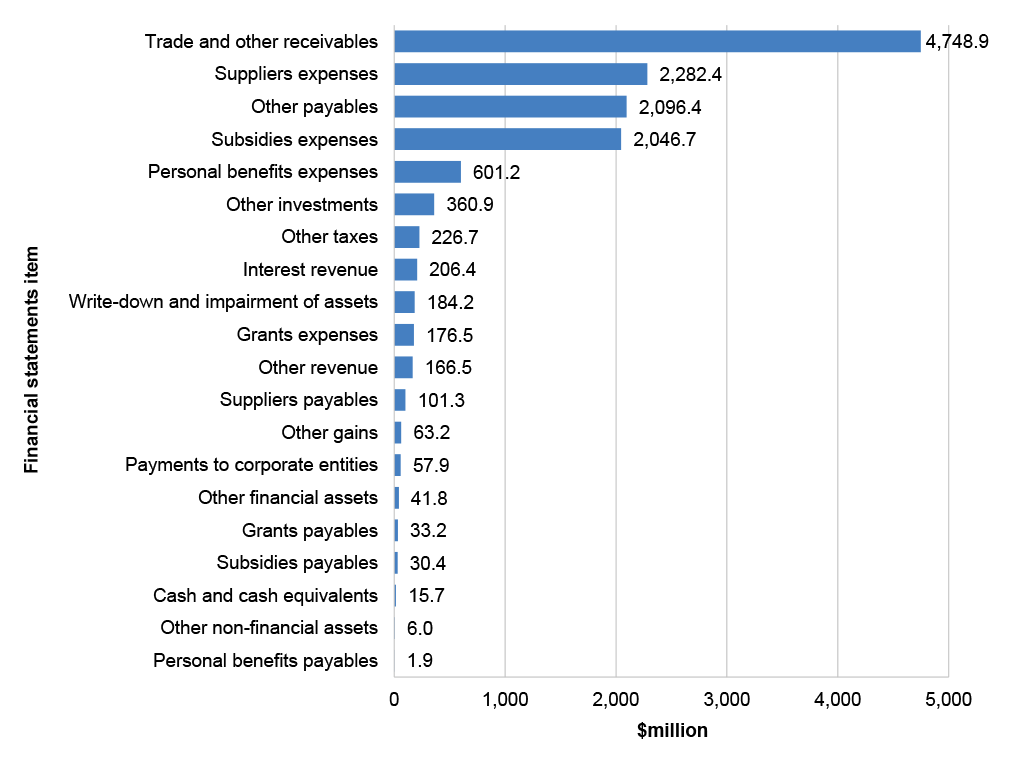

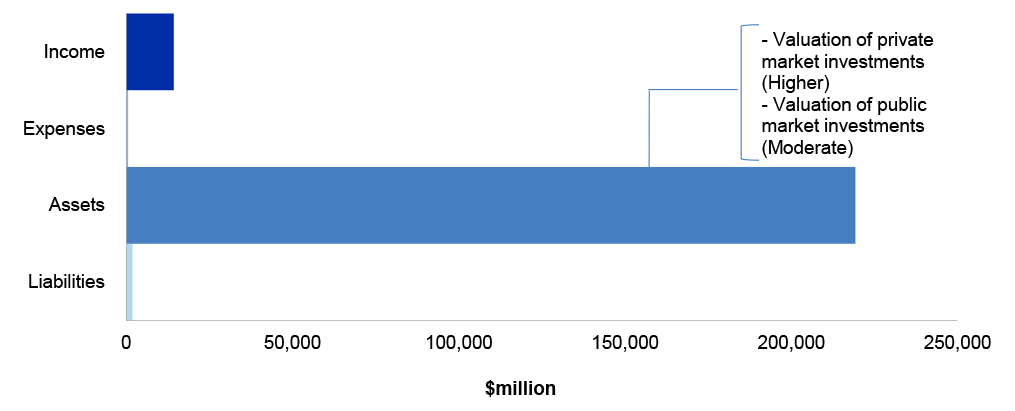

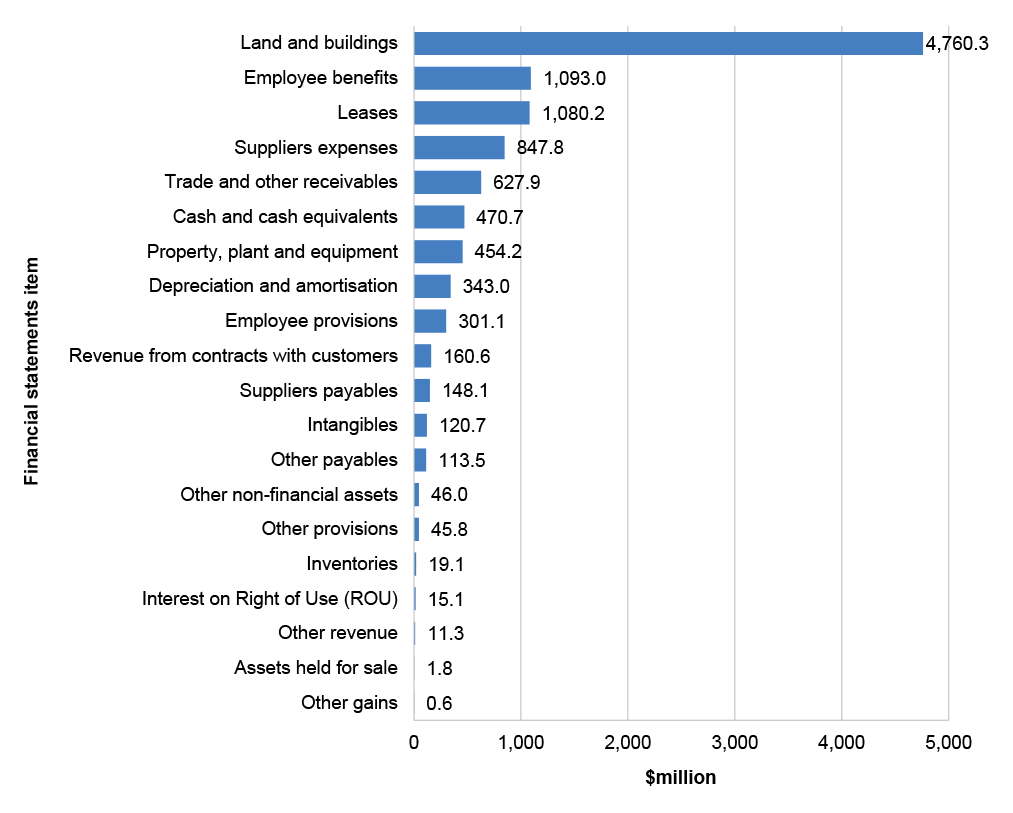

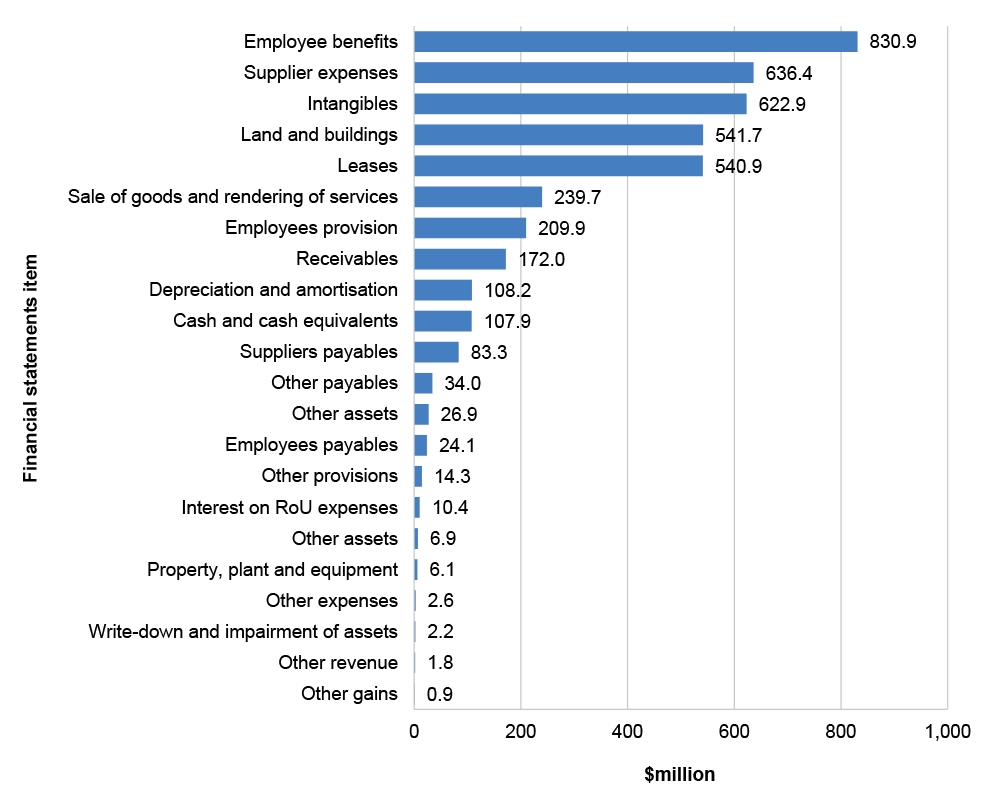

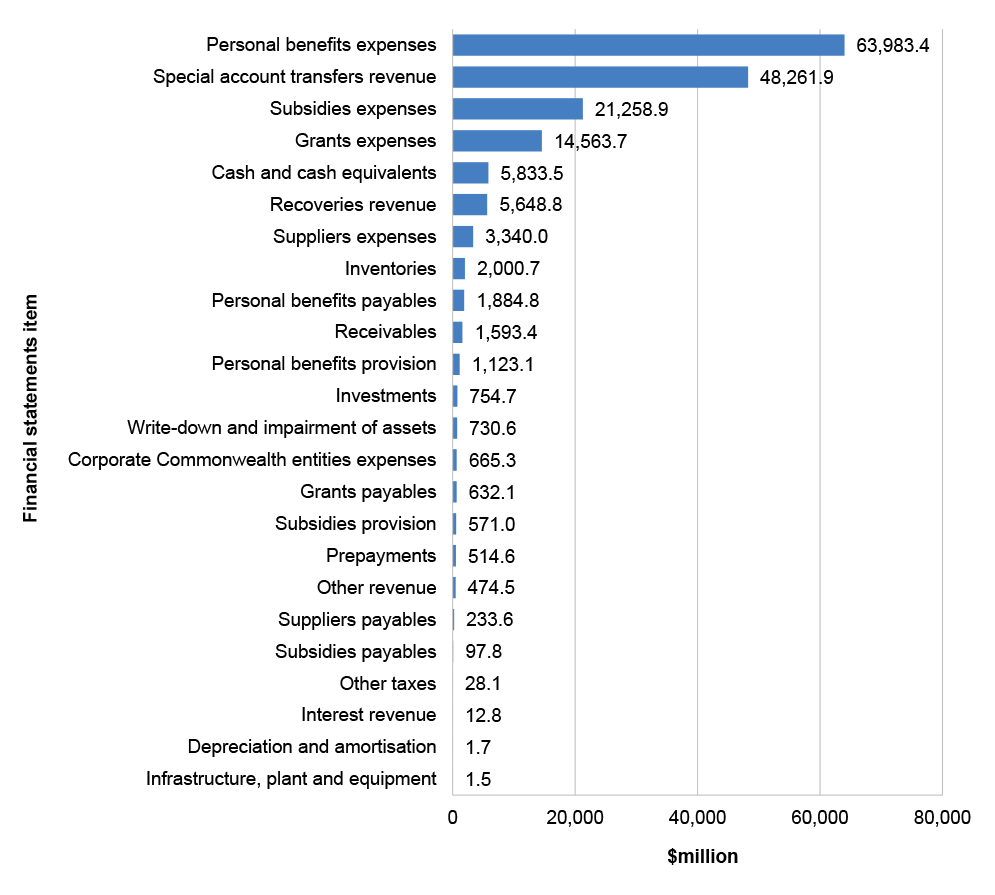

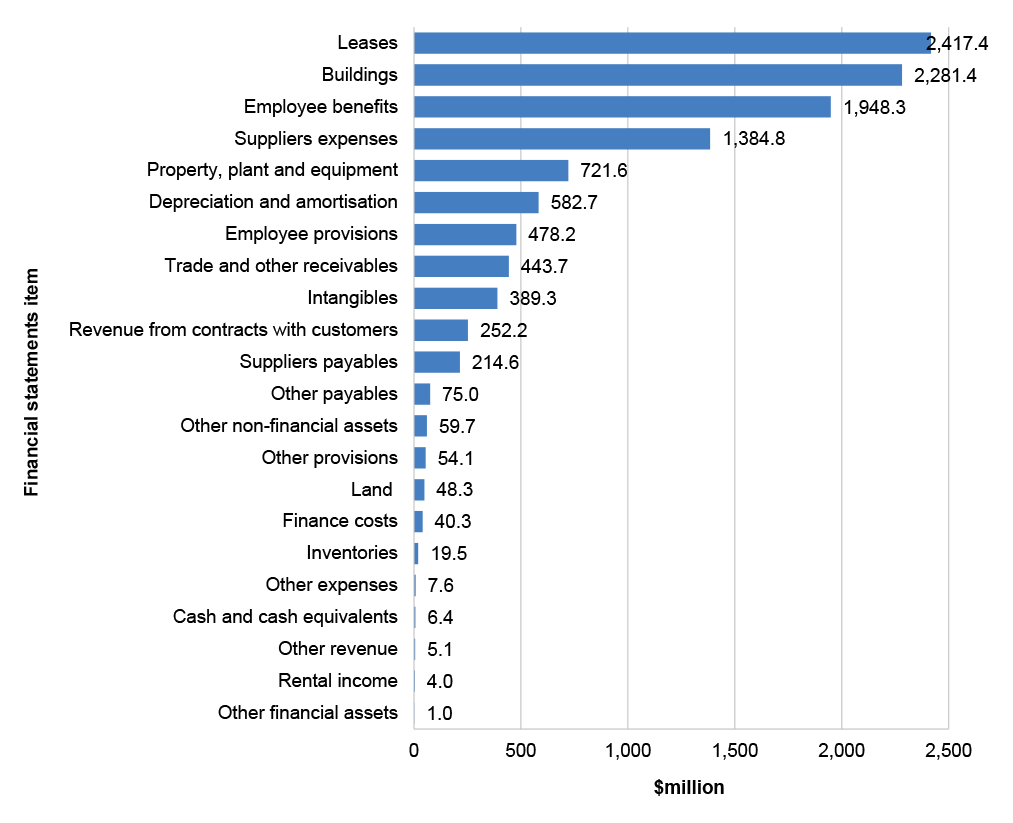

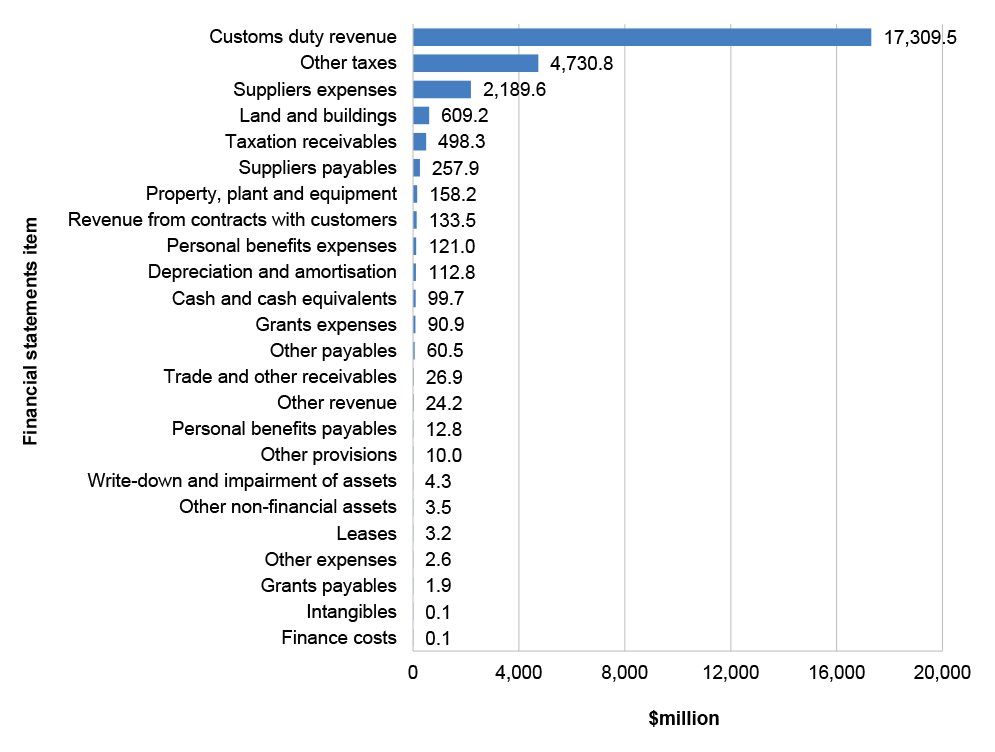

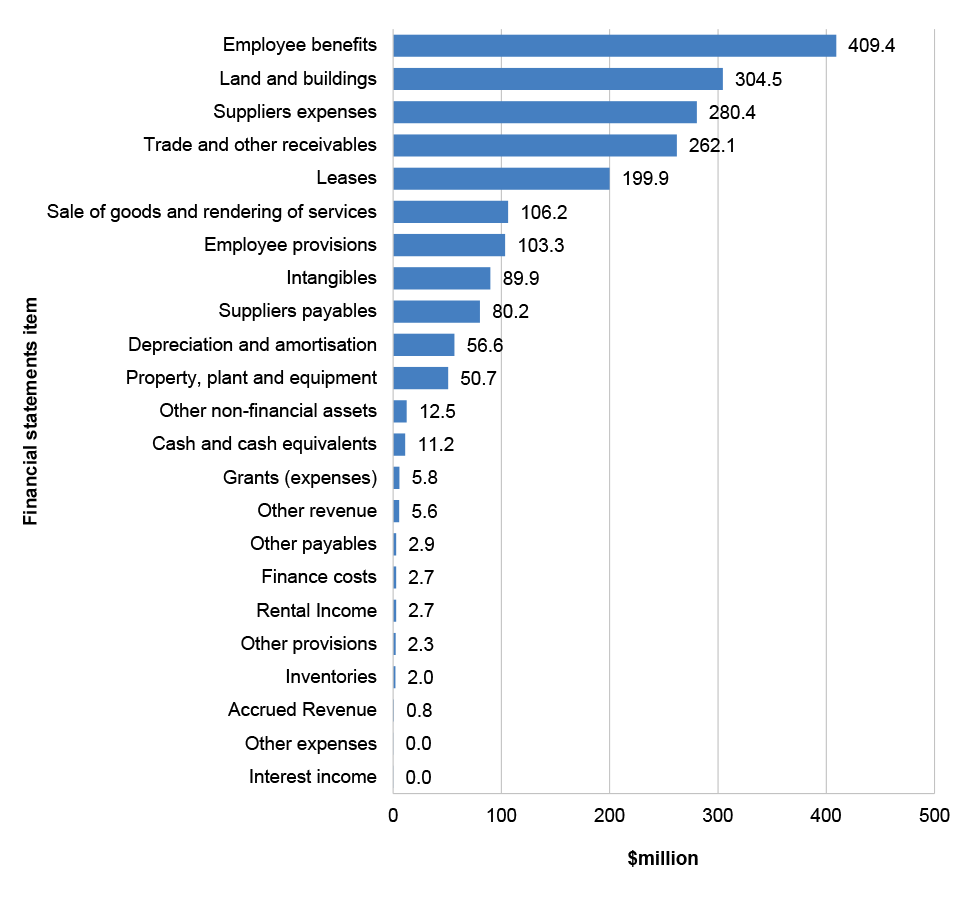

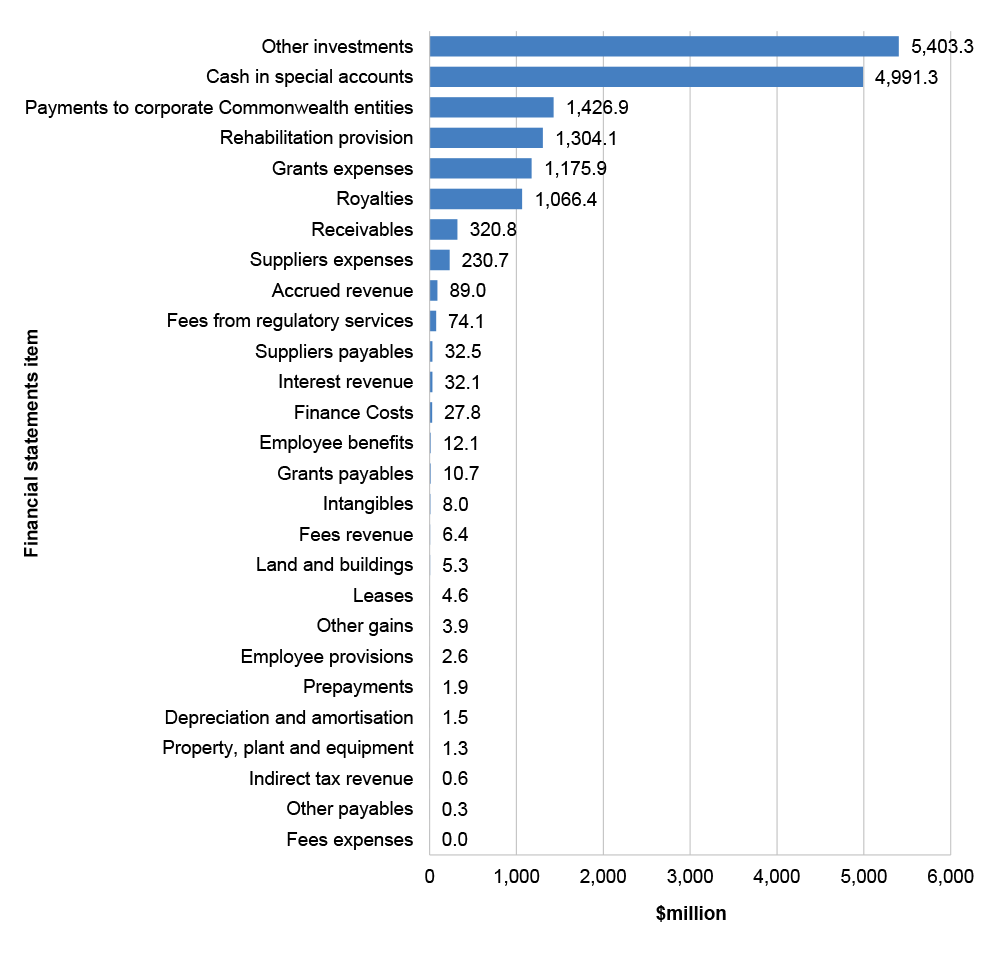

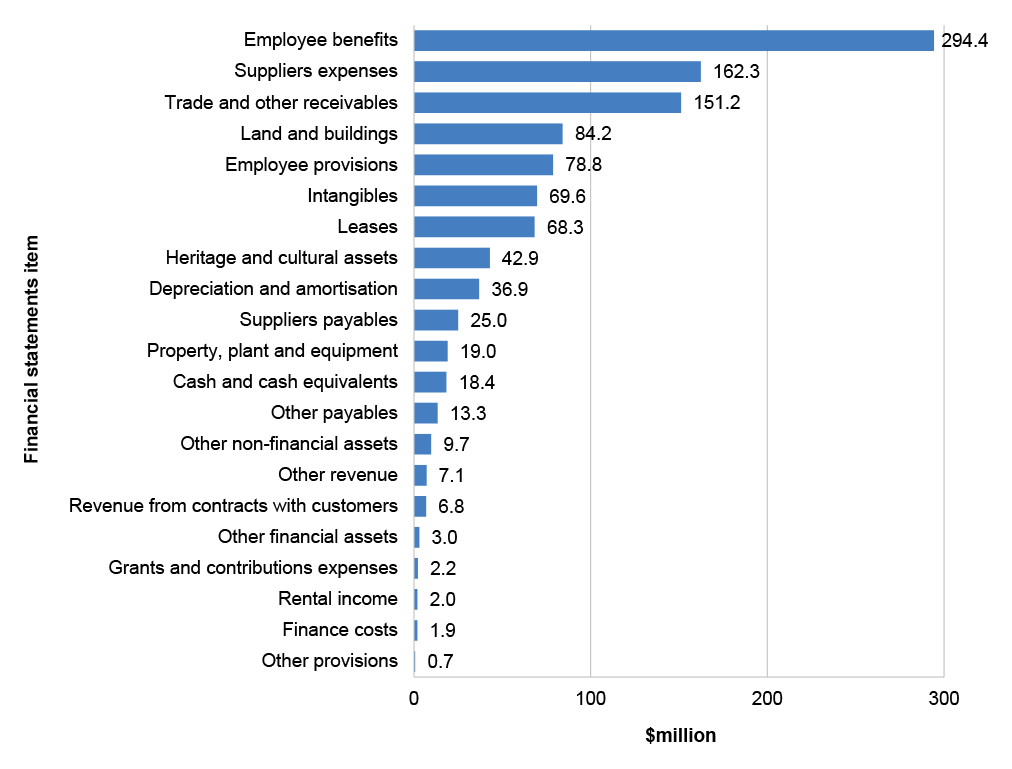

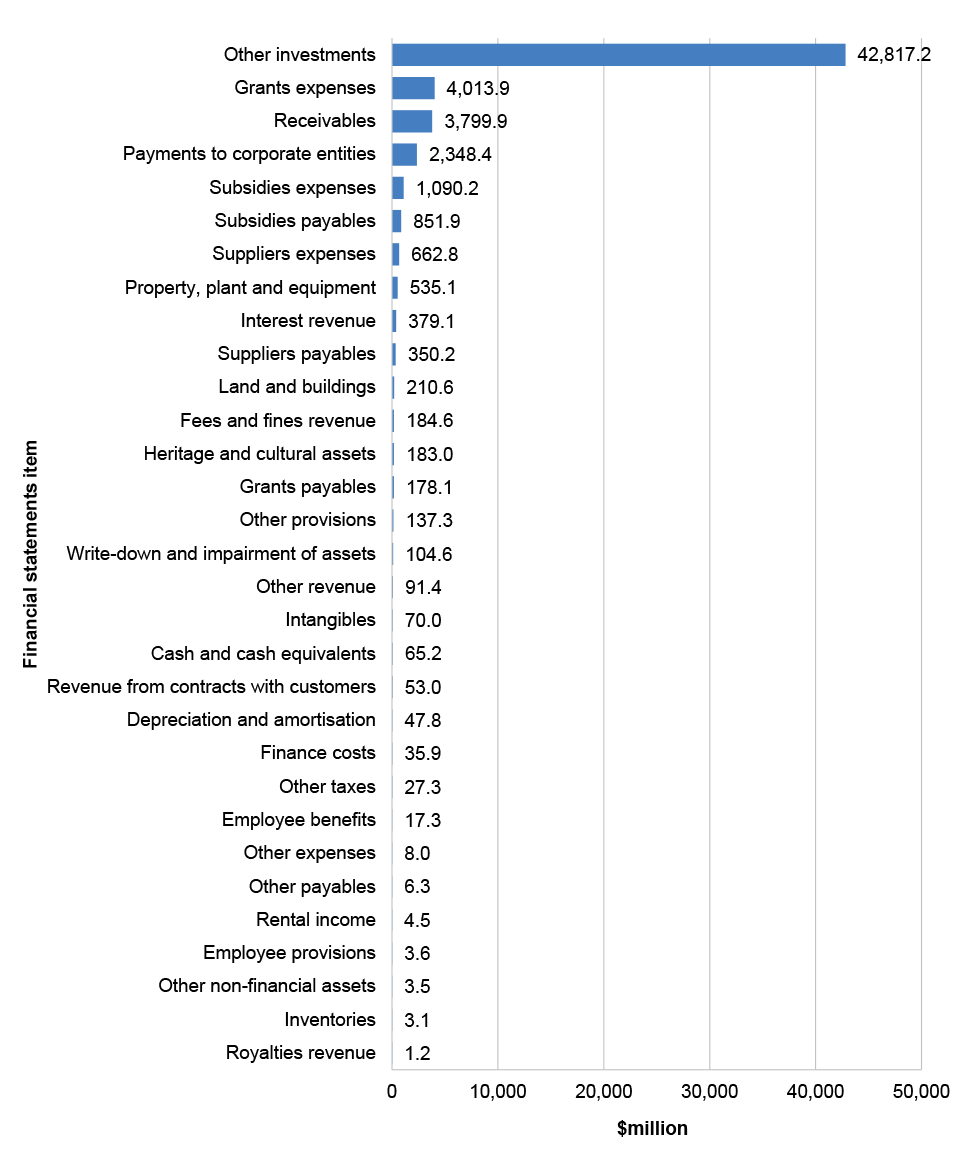

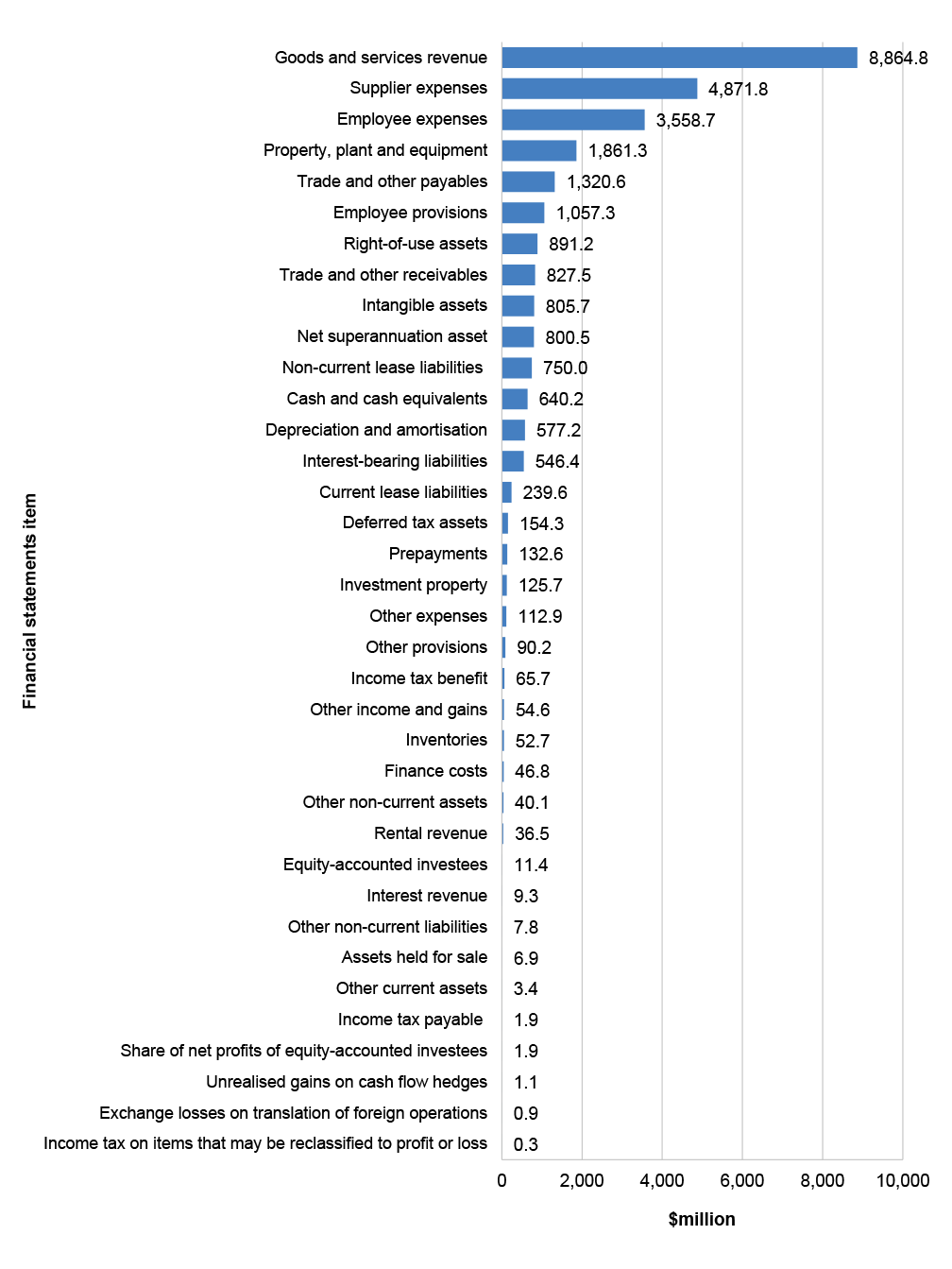

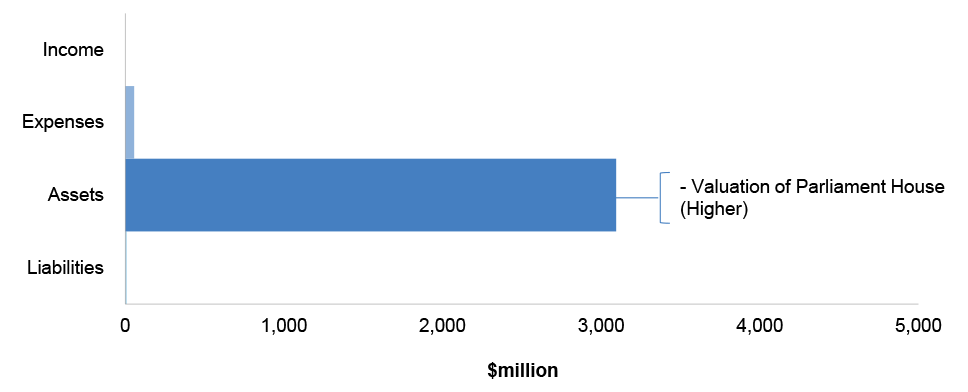

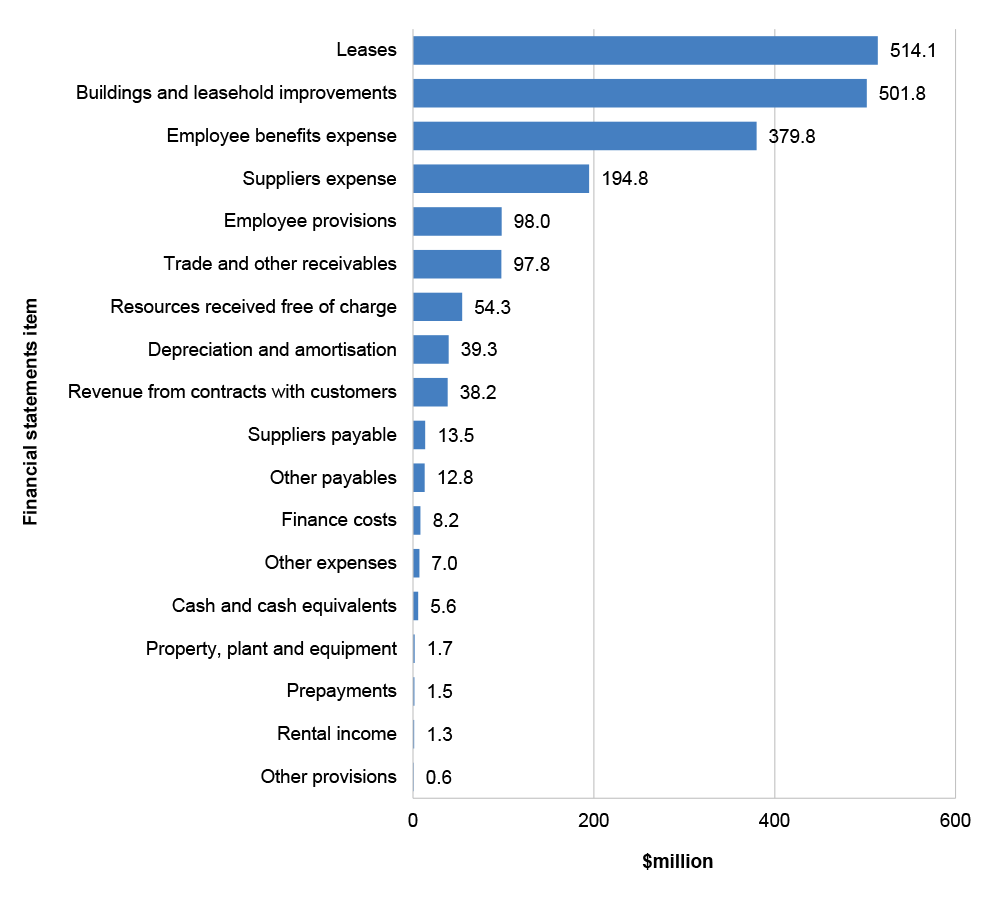

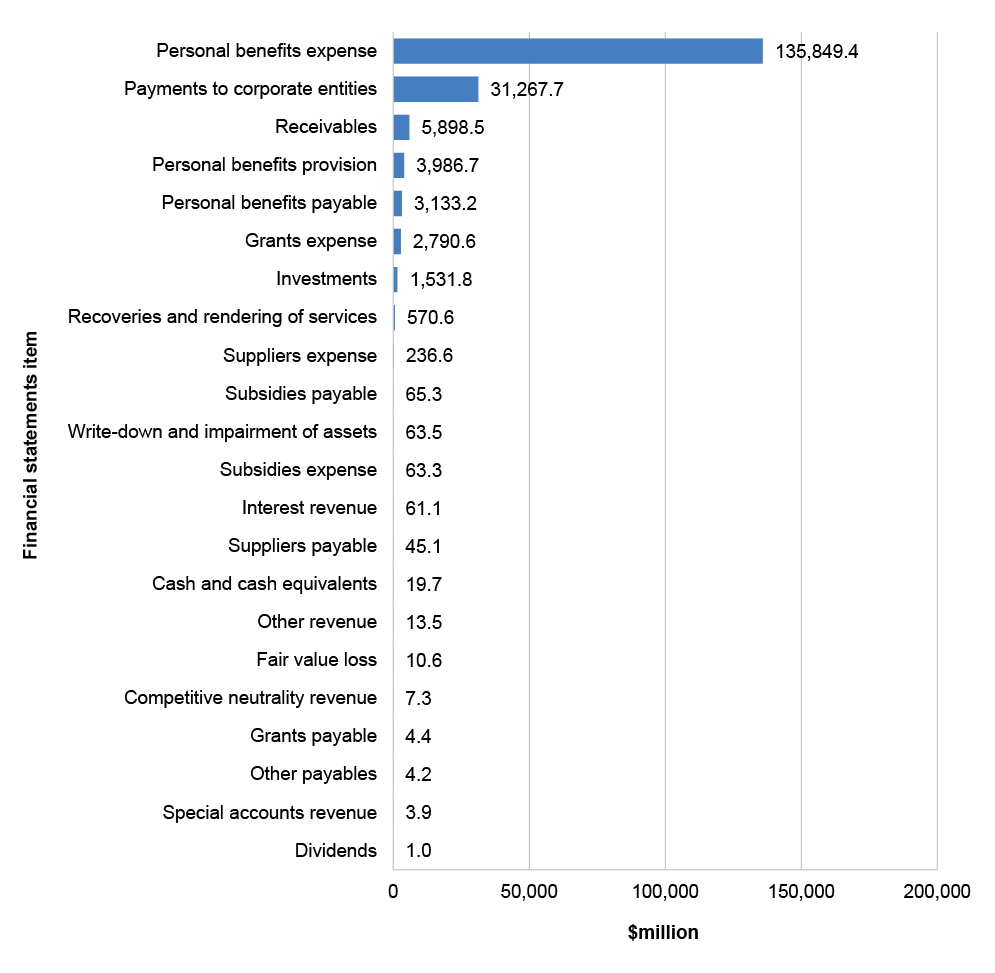

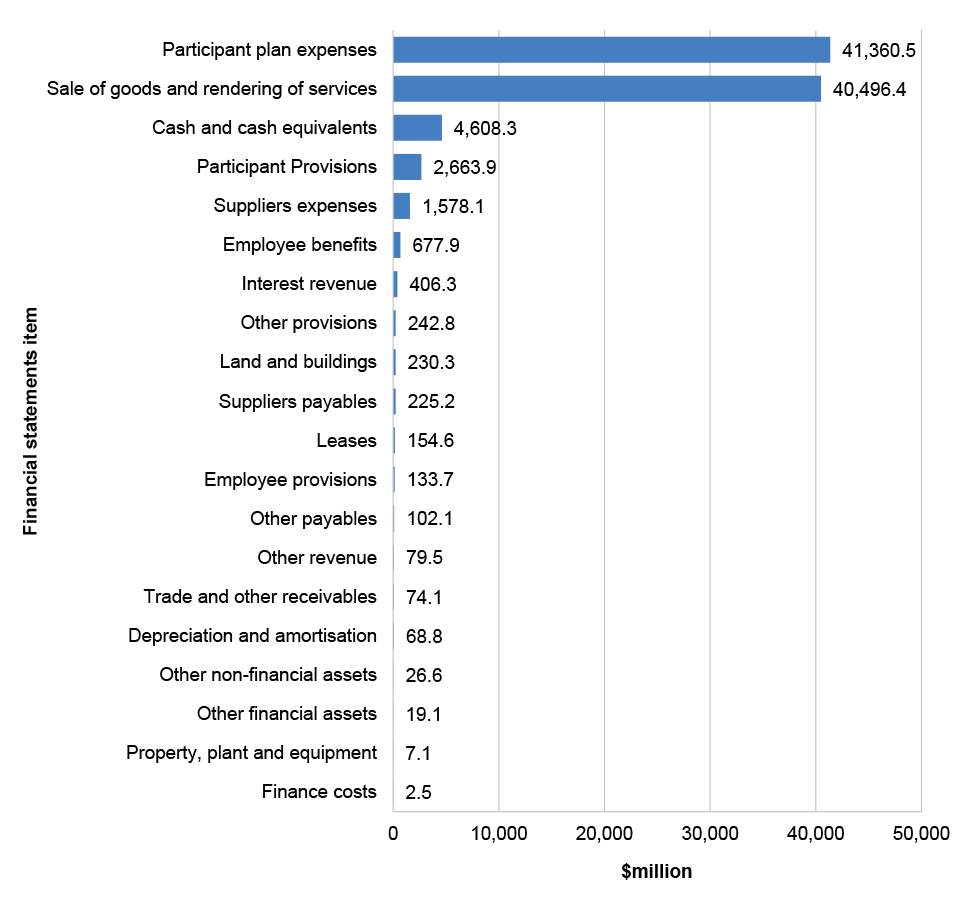

1.105 The Australian Government’s intangible assets comprise mainly internally developed or purchased computer software. As reported in the Australian Government’s Consolidated Financial Statements at 30 June 2023, the gross book value of computer software recognised by the Australian Government totalled $22.1 billion. Figure 1.10 provides an overview of the balance of computer software as reported in the CFS from 2018–19 to 2022–23.

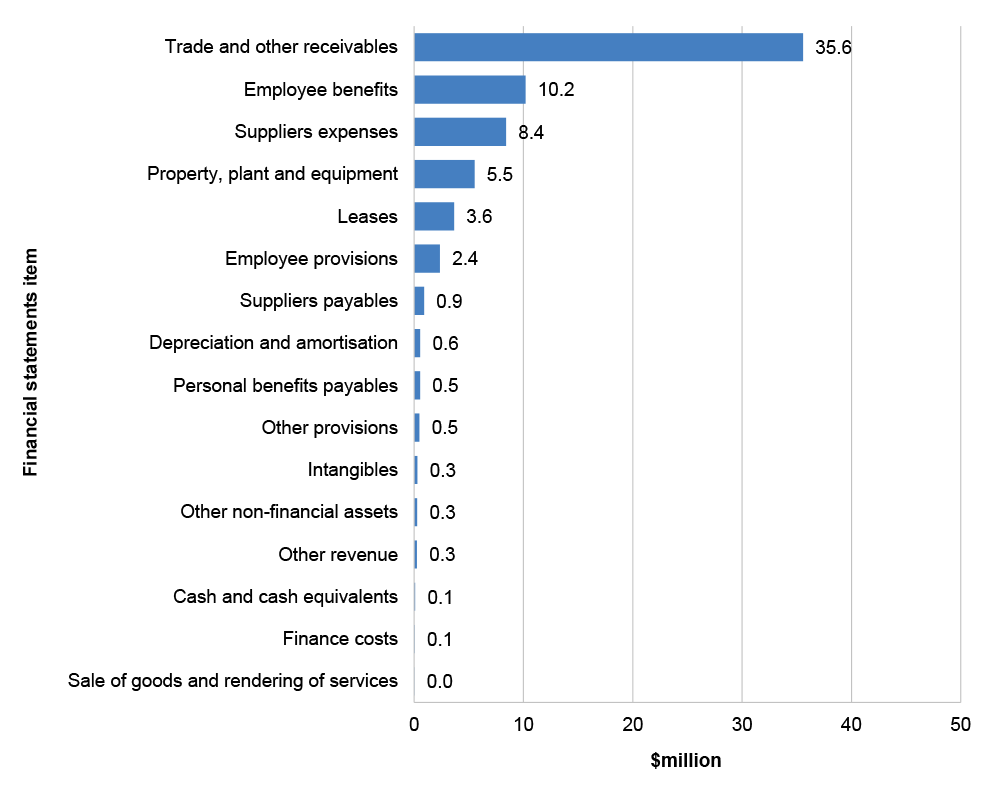

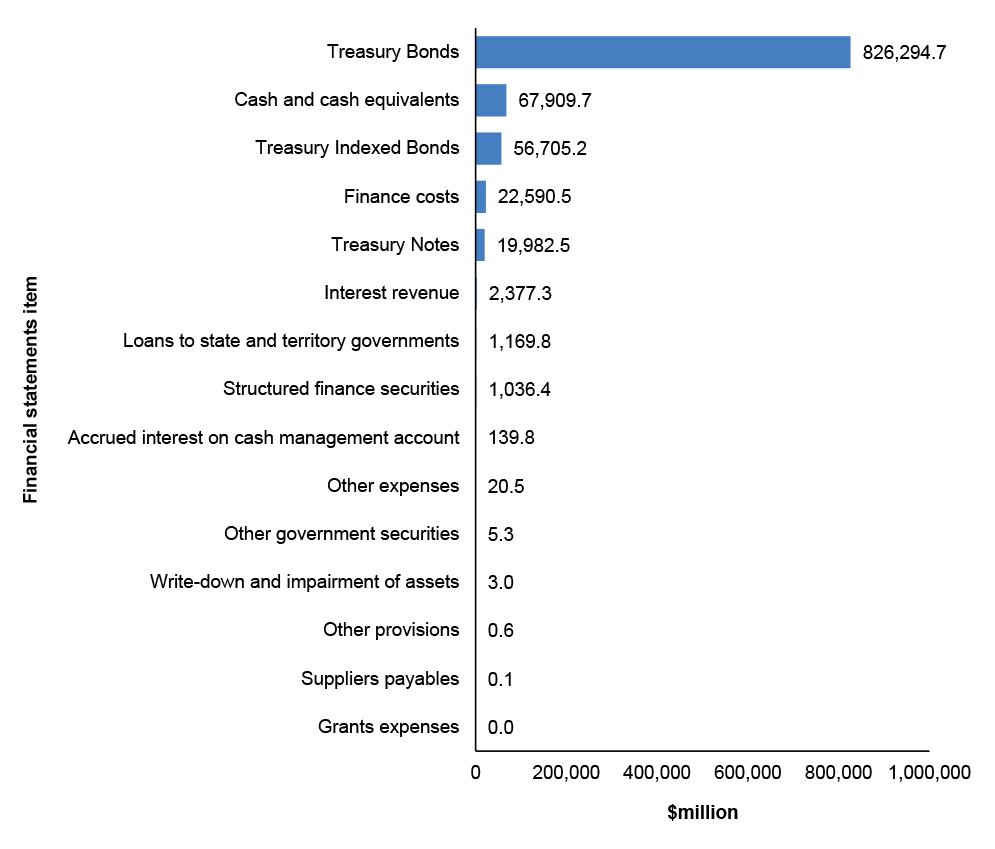

Figure 1.10: Balance of Australian Government computer software for the period 2018–19 to 2022–23

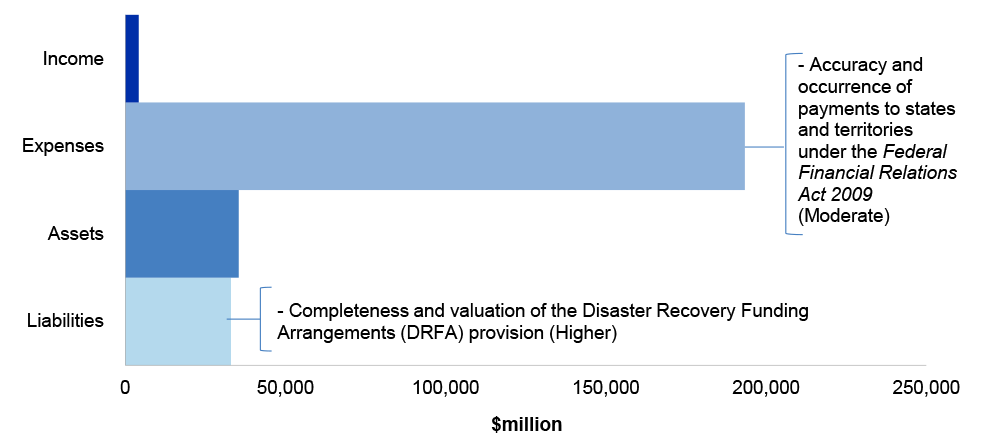

Source: ANAO analysis of the 2018–19 to 2022–23 CFS.